Vertical integration

This article has multiple issues. Please help improve it or discuss these issues on the talk page. (Learn how and when to remove these messages)

|

In microeconomics and management, vertical integration is an arrangement in which the supply chain of a company is owned by that company. Usually each member of the supply chain produces a different product or (market-specific) service, and the products combine to satisfy a common need. It is contrasted with horizontal integration, wherein a company produces several items which are related to one another. Vertical integration has also described management styles that bring large portions of the supply chain not only under a common ownership, but also into one corporation (as in the 1920s when the Ford River Rouge Complex began making much of its own steel rather than buying it from suppliers).

Vertical integration is one method of avoiding the hold-up problem. A monopoly produced through vertical integration is called a vertical monopoly.

Nineteenth-century steel tycoon Andrew Carnegie's example in the use of vertical integration[1] led others to use the system to promote financial growth and efficiency in their businesses.

Vertical integration can be an important strategy, but it is notoriously difficult to implement successfully and—when it turns out to be the wrong strategy—costly to fix.

Three types

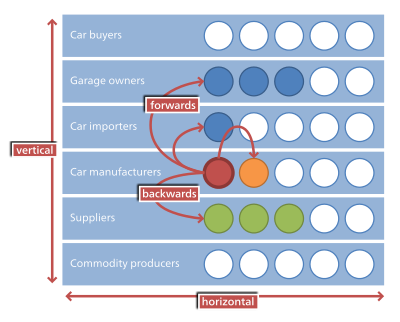

Vertical integration is the degree to which a firm owns its upstream suppliers and its downstream buyers. Contrary to horizontal integration, which is a consolidation of many firms that handle the same part of the production process, vertical integration is typified by one firm engaged in different parts of production (e.g., growing raw materials, manufacturing, transporting, marketing, and/or retailing).

There are three varieties: backward (upstream) vertical integration, forward (downstream) vertical integration, and balanced (both upstream and downstream) vertical integration.

- A company exhibits backward vertical integration when it controls subsidiaries that produce some of the inputs used in the production of its products. For example, an automobile company may own a tire company, a glass company, and a metal company. Control of these three subsidiaries is intended to create a stable supply of inputs and ensure a consistent quality in their final product. It was the main business approach of Ford and other car companies in the 1920s, who all sought to minimize costs by integrating the production of cars and car parts, as exemplified in the Ford River Rouge Complex.

- A company tends toward forward vertical integration when it controls distribution centers and retailers where its products are sold.

Examples

This section needs additional citations for verification. (April 2015) |

Birdseye

During a hunting trip, an American explorer and scientist, Clarence Birdseye, discovered the beneficial effects of quick freezing. For example, fish caught a few days previously that were kept in ice remained in perfect condition.

In 1924, Clarence Birdseye patented the “Birdseye Plate Froster” and set up the General Seafood Corporation. In 1929, Birdseye’s company and the patent were bought by Postum Company and the Goldman-Sachs trading Corporation. It later came to be known as General Foods. They kept the same Birdseye name, but it was split into two words (Birds eye) for use as a trademark. Birdseye was paid $20 million for the patents and $2 million for the assets.

Birdseye was one of the pioneers in the frozen food industry. Birdseye Company used vertical integration to manage their business. Because of the fact that during these times, there was not a well developed infrastructure to produce and sell, Birdseye developed its own system by using vertical integration. As many members of the supply chain such as farmers and small food retailers, couldn't afford high costs to buy equipment, Birdseye provided them with equipment.

But until now, Birdseye has faded slowly because they have fixed costs associated with vertical integration, such as property, plants, and equipment that cannot be reduced significantly when production needs decrease. The Birdseye company used vertical integration to create a larger organization structure with more levels of command that produced a slower informational processing rate, with the side effect of making the company so slow, that it couldn't react quickly and didn't take advantages of the growth of supermarket, until ten years after the competition. The already-developed infrastructure did not allow Birdseye to quickly react to market changes.

Alibaba

In order to increase profits and gain more market share, Alibaba, a Chinese-based company, full use of vertical integration makes it more than an e-commerce stage. Alibaba has built its leadership in the market by gradually acquiring complementary companies in a variety of industries including delivery and payments.

Steel and oil

One of the earliest, largest and most famous examples of vertical integration was the Carnegie Steel company. The company controlled not only the mills where the steel was made, but also the mines where the iron ore was extracted, the coal mines that supplied the coal, the ships that transported the iron ore and the railroads that transported the coal to the factory, the coke ovens where the coal was cooked, etc. The company also focused heavily on developing talent internally from the bottom up, rather than importing it from other companies.[2][full citation needed] Later on, Carnegie even established an institute of higher learning to teach the steel processes to the next generation.

Oil companies, both multinational (such as ExxonMobil, Royal Dutch Shell, ConocoPhillips or BP) and national (e.g., Petronas) often adopt a vertically integrated structure, meaning that they are active along the entire supply chain from locating deposits, drilling and extracting crude oil, transporting it around the world, refining it into petroleum products such as petrol/gasoline, to distributing the fuel to company-owned retail stations, for sale to consumers.[citation needed]

Telecommunications and computing

Telephone companies in most of the 20th century, especially the largest (the Bell System) were integrated, making their own telephones, telephone cables, telephone exchange equipment and other supplies.[citation needed]

Entertainment

From the early 1920s through the early 1950s, the American motion picture had evolved into an industry controlled by a few companies, a condition known as a "mature oligopoly", as it was led by eight major film studios, the most powerful of which were the "Big Five" studios: MGM, Warner Brothers, 20th Century Fox, Paramount Pictures, and RKO.[citation needed] These studios were fully integrated, not only producing and distributing films, but also operating their own movie theaters; the "Little Three," Universal Studios, Columbia Pictures, and United Artists, produced and distributed feature films but did not own theaters.[citation needed]

The issue of vertical integration (also known as common ownership) has been the main focus of policy makers because of the possibility of anti-competitive behaviors affiliated with market influence. For example, in United States v. Paramount Pictures, Inc., the Supreme Court ordered the five vertically integrated studios to sell off their theater chains and all trade practices were prohibited (United States v. Paramount Pictures, Inc., 1948).[3] The prevalence of vertical integration wholly predetermined the relationships between both studios and networks[clarification needed] and modified criteria in financing. Networks began arranging content initiated by commonly owned studios and stipulated a portion of the syndication revenues in order for a show to gain a spot on the schedule if it was produced by a studio without common ownership.[4] In response, the studios fundamentally changed the way they made movies and did business. Lacking the financial resources and contract talent they once controlled, the studios now relied on independent producers supplying some portion of the budget in exchange for distribution rights.[5]

Certain media conglomerates may, in a similar manner, own television broadcasters (either over-the-air or on cable), production companies that produce content for their networks, and also own the services that distribute their content to viewers (such as television and internet service providers). Bell Canada, Comcast, Sky plc, and Rogers Communications are vertically integrated in such a manner—operating media subsidiaries (Bell Media, Rogers Media, and NBCUniversal respectively), and provide "triple play" services of television, internet, and phone service in some markets (such as Bell TV/Bell Internet, Rogers Cable, Xfinity, and Sky's satellite TV services). Additionally, Bell and Rogers own wireless providers, Bell Mobility and Rogers Wireless; taking advantage of its vertical integration, Bell also offers its wireless subscribers a mobile television service.[6]

Agriculture

Vertical integration through production and marketing contracts have also become the dominant model for livestock production. Currently, 90% of poultry, 69% of hogs, and 29% of cattle are contractually produced through vertical integration.[7] The USDA supports vertical integration because it has increased food productivity. However, ". . . contractors receive a large share of farm receipts, formerly assumed to go to the operator's family.”[8]

Under production contracts, growers raise animals owned by integrators. Farm contracts contain detailed conditions for growers, who are paid based on how efficiently they use feed, provided by the integrator, to raise the animals. The contract dictates how to construct the facilities, how to feed, house, and medicate the animals, and how to handle manure and dispose of carcasses. Generally, the contract also shields the integrator from liability.[7] Jim Hightower, in his book, Eat Your Heart Out,[9] discusses this liability role enacted by large food companies. He finds that in many cases of agricultural vertical integration, the integrator (food company) denies the farmer the right of entrepreneurship. This means that the farmer can only sell under and to the integrator. These restrictions on specified growth, Hightower argues, strips the selling and producing power of the farmer. The producer is ultimately limited by the established standards of the integrator. Yet, at the same time, the integrator still keeps the responsibility connected to the farmer. Hightower sees this as ownership without reliability.[10]

Under marketing contracts, growers agree in advance to sell their animals to integrators under an agreed price system. Generally, these contracts shield the integrator from liability for the grower’s actions and the only negotiable item is a price.[7]

Automotive Industry

This section needs expansion. You can help by adding to it. (October 2016) |

In the United States new automobiles may only be sold at dealerships owned by the same company that produced them and which are protected by state franchise laws.[11]

Eyewear

This section needs expansion. You can help by adding to it. (October 2016) |

Luxottica owns 80% of the market share of companies that produce corrective and protective eyewear as well as owning many retailers, optical departments at Target and Sears, and key eye insurance groups, such as EyeMed.[12][13][14]

Problems and benefits

There are internal and external society-wide gains and losses stemming from vertical integration, which vary according to the state of technology in the industries involved, roughly corresponding to the stages of the industry lifecycle.[clarification needed][citation needed] Static technology represents the simplest case, where the gains and losses have been studied extensively.[citation needed] A vertically company usually fails when transactions within the market are too risky or the contracts to support these risks are too costly to administer, such as frequent transactions and a small number of buyer and sellers.

Internal gains

- Lower transaction costs

- Synchronization of supply and demand along the chain of products

- Lower uncertainty and higher investment

- Ability to monopolize market throughout the chain by market foreclosure

- Strategic independence (especially if important inputs are rare or highly volatile in price, such as rare earth metals).

Internal losses

- Higher coordination costs

- Higher monetary and organizational costs of switching to other suppliers/buyers

- Weaker motivation for good performance at the start of the supply chain since sales are guaranteed and poor quality may be blended into other inputs at later manufacturing stages

Benefits to society

- Better opportunities for investment growth through reduced uncertainty

- Local companies are often better positioned against foreign competition

Losses to society

- Monopolization of markets

- Rigid organizational structure

Vertical expansion

This section may require cleanup to meet Wikipedia's quality standards. The specific problem is: section has become a hodgepodge of unsourced single sentence paragraphs, almost twitter-like in its encyclopedic depth; please, source it or lose it. (April 2015) |

Vertical expansion, in economics, is the growth of a business enterprise through the acquisition of companies that produce the intermediate goods needed by the business or help market and distribute its product. Such expansion is desired because it secures the supplies needed by the firm to produce its product and the market needed to sell the product. The result is a more efficient business with lower costs and more profits.

Related is lateral expansion, which is the growth of a business enterprise through the acquisition of similar firms, in the hope of achieving economies of scale.

Vertical expansion is also known as a vertical acquisition. Vertical expansion or acquisitions can also be used to increase scales and to gain market power. The acquisition of DirecTV by News Corporation is an example of forward vertical expansion or acquisition. DirecTV is a satellite TV company through which News Corporation can distribute more of its media content: news, movies, and television shows. The acquisition of NBC by Comcast Cable is an example of backward vertical integration.

In the United States, protecting the public from communications monopolies that can be built in this way is one of the missions of the Federal Communications Commission.

See also

- Conglomerate (company)

- Vertical market

- Exclusive dealing

- Insourcing

- Strategic management

- Keiretsu and Zaibatsu approaches

- Chaebol approach

- Horizontal integration

- Economic calculation problem

- Vertical disintegration

- Alfred DuPont Chandler, Jr.

- Tapered integration

References

- ^ "Gilded Age : Saint Louis University Cupples House : SLU". Slu.edu. Archived from the original on April 22, 2015. Retrieved 2015-04-24.

{{cite web}}: Unknown parameter|deadurl=ignored (|url-status=suggested) (help) - ^ Folsom, Burton The Myth of the Robber Barons 5th edition. 2007. pg. 65. ISBN 978-0963020314. "only we can develop ability and hold it in our service. Every year should be marked by the promotion of one or more of our young men."

- ^ Oba, Goro, and Chan-Olmstead, Sylvia. "Self-Dealing or Market Transaction?: An Exploratory Study of Vertical Integration in the U.S. Television Syndication Market." Journal of Media Economics 19.2 (2006): 99-118. Communication & Mass Media Complete.

- ^ Lotz, Amanda D. (2007) "The Television Will Be Revolutionized". New York, NY: New York University Press. p.87

- ^ McDonald, P.; Wasko, J. (2008). The Contemporary Hollywood Film Industry. Australia: Blackwell Publishing Ltd. pp. 14–17. ISBN 9781405133876.

{{cite book}}: Unknown parameter|lastauthoramp=ignored (|name-list-style=suggested) (help) - ^ Stastna, Kazi. "Bell's discounting of mobile TV against the rules, complaint claims". CBC News. Retrieved 18 December 2013.

- ^ a b c Paul Stokstad, Enforcing Environmental Law in an Unequal Market: The Case of Concentrated Animal Feeding Operations, 15 Mo. Envtl. L. & Pol’y Rev. 229, 234-36 (Spring 2008)

- ^ "USDA ERS - Farmers' Use of Marketing and Production Contracts". Ers.usda.gov. Retrieved 2015-04-24.

- ^ Eat Your Heart Out: Food Profiteering in America - Jim Hightower - Google Books. Books.google.com. 2009-10-21. Retrieved 2015-04-24.

- ^ Hightower, Jim. Eat Your Heart Out, 1975, Crown Publishing. pg 162-168, ISBN 978-0517524541

- ^ Surowiecki, James (September 4, 2006). "Dealer's Choice". The New Yorker. Retrieved October 1, 2016.

- ^ "Sticker shock: Why are glasses so expensive?". 60 Minutes. CBS News. October 7, 2012. Retrieved October 19, 2012.

- ^ Goodman, Andrew (July 16, 2014). "There's More to Ray-Ban and Oakley Than Meets the Eye". Forbes. Retrieved October 1, 2016.

- ^ Swanson, Ana (September 10, 2014). "Meet the Four-Eyed, Eight-Tentacled Monopoly That is Making Your Glasses So Expensive". Forbes. Retrieved October 1, 2016.

- Kathryn H. (1986). "Matching Vertical Integration strategies". Strategic Management Journal. 7: 535–555.

- Matthew Lewis (2013). "On Apple And Vertical Integration". Retrieved 2015-04-11.

- Paul Cole-Ingait; Demand Media (2013). "Vertical Integration Examples in the Smartphone Industry". Retrieved 2015-04-11.

- Robert D. Buzzell. "Is Vertical Integration Profitable?". Retrieved 2015-04-11.

- Wharton (2012). "How Apple Made 'Vertical Integration' Hot Again — Too Hot, Maybe". Retrieved 2015-04-13.

- "Idea Vertical Integration". Mar 30, 2009. Retrieved 2015-04-12.

- Grossman SJ, Hart OD (1986). "The costs and benefits of ownership: A theory of vertical and lateral integration". The Journal of Political Economy: 691–719.

- "Iglo History". Archived from the original on May 3, 2015. Retrieved 2015-05-02.

{{cite web}}: Unknown parameter|deadurl=ignored (|url-status=suggested) (help)

Further reading

- Bramwell G. Rudd, 2014, "Courtaulds and the Hosiery & Knitwear Industry," Lancaster, PA:Carnegie.

- Joseph R. Conlin, 2007, "Vertical Integration," in The American Past: A Survey of American History, p. 457, Belmont, CA:Thompson Wadsworth.

- Martin K. Perry, 1988, "Vertical Integration: Determinants and Effects," Chapter 4 in Handbook of Industrial Organization, North Holland.[full citation needed]