Commerzbank

A major contributor to this article appears to have a close connection with its subject. (April 2024) |

| |

| Company type | Public (Aktiengesellschaft) |

|---|---|

| FWB: CBK | |

| ISIN | DE000CBK1001 |

| Industry | Financial services |

| Founded | 26 February 1870 in Hamburg |

| Founders | Theodor Wille et al. |

| Headquarters | Commerzbank Tower, , |

Number of locations | 15 operational foreign branches and 27 representative offices in over 40 countries (2023) |

Area served | Worldwide |

Key people |

|

| Brands |

|

| Services | |

| Revenue | |

| Total assets | |

| Total equity | |

Number of employees | 42,098 (2023) |

| Capital ratio | 14.7% (2023) |

| Rating |

|

| Website | www |

| Footnotes / references Commerzbank Investor Relations | |

The Commerzbank Aktiengesellschaft (shortly known as Commerzbank AG or Commerzbank) is a European banking institution headquartered in Frankfurt am Main, Hesse, Germany. It offers services to private and entrepreneurial customers as well as corporate clients.[1] The Commerzbank Group also includes the German brand Comdirect Bank and the Polish subsidiary mBank.

As one of the oldest banks in Germany,[2] Commerzbank plays a significant role in the country's economy.[3] It is the largest financier of German foreign trade, with strong ties to the German 'Mittelstand.' In addition, it maintains a presence in all major economic and financial centers worldwide. Since its establishment in 1870, Commerzbank has undergone several changes.[4] It was the first German banking institution to open an operational branch in New York City in 1971.

Another milestone was the acquisition of Dresdner Bank in 2009. In the wake of the global economic and financial crisis, the Federal Republic of Germany became a major shareholder in the company. To this day, the government remains a significant bank shareholder, which is listed on the DAX.[5] In recent years, the bank has undergone considerable transformation, returning to profitability, partly through substantial cost reductions and the evolution of its business model.[6][7]

History[edit]

1870–1929[edit]

On February 26, 1870, Theodor Wille, a merchant successful in South American trade, together with other trading houses and private bankers in Hamburg, founded the Commerz- und Diskonto-Bank.[9] The goal was to provide financial resources to Hamburg's trade and facilitate international commerce.[10] They also established the subsidiary London and Hanseatic Bank in London. The bank expanded and had branches in Berlin and Frankfurt am Main. After several mergers and acquisitions, it evolved into a major national bank with over 280 branches in Germany.

After the hyperinflation in 1924, German banking institutions were required to present a Goldmark opening balance sheet. The Commerz- und Privat-Bank valued its capital of 700 million Marks at 42 million Goldmarks. In the following years, the economic situation improved. In 1927, the bank opened a foreign representation in New York City and continued its expansion. In 1929, it merged with Mitteldeutsche Creditbank from Frankfurt am Main to extend its branch network in Hesse and Thuringia.

1931–1945[edit]

In 1931, several banks, including the Commerz- und Privat-Bank, faced difficulties during the currency and banking crisis. In February 1932, the Reich government merged the Commerz- und Privat-Bank with the Barmer Bankverein and partially nationalized it to stabilize the institution. The bank was 70 percent controlled by the Reich and the state-owned Golddiskontbank.[11] Its shares were sold back to private shareholders in 1937.

During the Nazi dictatorship, the bank adapted to the political imperative without pursuing excessive expansion.[10] In November 1932, the Commerz- und Privatbank chief executive Friedrich Reinhart and chairman Franz Heinrich Witthoefft were among the signatories of the Industrielleneingabe petition of business leaders that advised president Paul von Hindenburg to appoint Adolf Hitler as chancellor.[10] After the seizure of power, Jewish members of the supervisory board and executive board were ousted. From 1938, the bank no longer employed Jewish staff.[12]

The bank also participated in the 'Aryanization' of companies by brokering them to other interested parties to maintain business relationships. There may have been around 1,000 such mediations. From November 25, 1941, all banks were obliged to report the assets of emigrated, deported, and deceased Jews to the German Reich.[10]

In 1940, the bank changed its name to Commerzbank Aktiengesellschaft. During World War II, it opened branches and subsidiaries in occupied countries and took over the Dutch bank Hugo Kaufmann. This expansion served economic interests. Shortly before the end of the war, the bank moved its central administration from Berlin to Hamburg for security reasons.[10]

1945–1967[edit]

With the end of World War II in 1945 and the division of Germany into four occupation zones, the Commerzbank lost its branches and subsidiaries in the Soviet occupation zone and East Berlin. Nearly 45 percent of the branches there were closed and expropriated without compensation. Large banks were dismantled in the Western occupation zones, and their business activities were limited to one occupation zone. In 1947, by order of the American military government, Commerzbank was split into nine regional successor institutions.[13]

Normal business operations were practically impossible as trust in the Reichsmark declined. The German currency reform 1948 and the introduction of the Deutsche Mark marked a new beginning for Commerzbank. In 1949, the Allies and the Berlin Magistrate resumed banking operations in West Berlin. In 1952, the West German regional groups merged into three successor institutions. This led to the formation of the Commerz- und Disconto-Bank in Hamburg, the Bankverein Westdeutschland in Düsseldorf, and the Commerz- und Credit-Bank in Frankfurt am Main. In 1956, the legal situation allowed the merger of these institutions into Commerzbank Aktiengesellschaft. This merger was completed in October 1958, effective from July 1, 1958, with the Düsseldorf Commerzbank-Bankverein acquiring the two sister institutions. The newly founded banking institution was registered under its traditional name in the Düsseldorf commercial register on November 4, 1958.[citation needed]

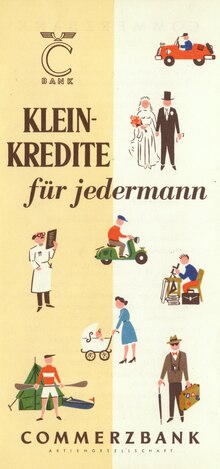

From 1958, banks were allowed to open branches without official review, which Commerzbank utilized. By 1962, it had surpassed its pre-war level with 372 branches. Commerzbank, Deutsche Bank, and Dresdner Bank introduced the 'small loan for everyone' in 1959. Additionally, Commerzbank entered the private customer home financing market in 1968. In 1969, Commerzbank recorded more than one million private customers for the first time.[citation needed]

The 1950s and 1960s also marked the beginning of the financial sector's internationalization. Commerzbank was particularly active in this area. Its shares were the first German financial institution listed on the London Stock Exchange. In 1952, it opened its representation in Rio de Janeiro. Further locations followed, including Madrid (1953), Amsterdam (1955), Beirut (1957), Johannesburg (1958), Tokyo (1961), and New York City (1967).[citation needed]

1970–1990[edit]

The 1970s and 1980s were characterized by international cooperation and global expansion. Commerzbank participated in numerous new ventures and equity investments abroad. In 1970, it collaborated with Crédit Lyonnais, which other banks from various European countries joined.[14] In this context, Commerzbank introduced the 'Quatre Vents' logo in 1972, which it used until mid-2010.

In the 1970s, Eurocheques were introduced. Customers could now withdraw cash in 30 European countries using a cheque card. The Eurocheque card with a magnetic strip for ATMs was introduced in 1981.

In 1970, Commerzbank founded the non-profit Commerzbank Foundation. As an independent foundation of civil law, it aims to promote and support the social commitment of Commerzbank. The focus areas are science, culture, and social welfare. The Commerzbank Foundation supports disadvantaged people, such as in their professional integration, and promotes contemporary art.

In the early 1980s, Commerzbank faced a crisis due to mistakes in assessing interest rate developments. The good economic conditions later favored the restructuring under the leadership of Walter Seipp.[15]

1990–1998[edit]

In 1990, Commerzbank moved its registered office from Düsseldorf to Frankfurt am Main. The German reunification allowed Commerzbank to tap into new target groups; in the first three months after the Economic, Monetary and Social Union of Germany, around 80,000 customers and thousands of corporate clients chose the bank.[16][17] Klaus-Peter Müller, appointed to the board in 1990, led the department responsible for preparing business in the new federal states.

The bank's engagement in the East developed into a crucial advantage. Alongside expansion in the domestic market, Commerzbank continued its internationalization, such as by opening an office in Bangkok.[18] Later, Commerzbank became the first international financial institution to open a branch in South Africa. Commerzbank established its management consultancy to meet the demand for professional support.[19]

In the early 1990s, Commerzbank significantly increased its earnings.[20] However, the stock price remained comparatively low, leading to cost reductions and job cuts.[21][22] This further improved the profit situation.[23] Commerzbank then promised its shareholders a higher dividend.[24]

In 1991, a cross-border collaboration with the French Crédit Lyonnais was announced, seen as a signal for consolidation in the European financial industry.[25] Two years later, a tri-national cooperation was established between the German Commerzbank, the British National Westminster Bank, and the French Société Générale.[26]

In 1994, Commerzbank founded Comdirect Bank, becoming the first major German bank to enter the emerging direct banking market.[27] 1999, Commerzbank also sold computers to facilitate customers' access to online banking. The branch network was also upgraded with digital technologies.

At that time, the bank earned around two-thirds of its income abroad, for example, through its new representation in Taipei and expansions in Hungary and the Czech Republic. However, CEO Martin Kohlhaussen still demanded more performance, especially from the sales of domestic branches. Commerzbank aimed to significantly increase its return on equity in the second half of the 1990s to remain competitive internationally.

Due to its comparatively low balance sheet total internationally, Commerzbank was seen as a takeover candidate in the 1990s.[28][29] The board pursued an independent continuation of the business,[30][31] interpreted as rejecting a merger with Deutsche Bank.[32] Also, a potential acquisition of Postbank by Commerzbank, which was discussed at times and would have led to a financial conglomerate with a building society and insurance, ultimately did not materialize.[33][34]

The bank managed to increase its customer base significantly.[35] With fewer branches, it generated more profit.[36] At the same time, innovative new services were created, such as cash withdrawal at gas stations and online banking for corporate customers.[37][38][39] The public critically received the outsourcing of employees to a temporary employment agency.[40]

After acquiring stakes in numerous foreign banks and insurance companies during the 1990s, Commerzbank bought around 30 percent of the Korea Exchange Bank in 1998 to more actively participate in developing emerging Asian markets.[41][42] Despite the continent's financial market problems, the bank saw opportunities for above-average growth.[43] Alongside international expansion, Commerzbank focused on strengthening its European presence,[44] mainly through alliances with other large banks.[45][46]

2001–2009[edit]

In 2001, Commerzbank restructured its domestic business. It created a bank for private customers and a separate unit for corporate and investment clients. Units were sometimes opened on Saturdays to remain competitive in the increasingly challenging private customer market.

In 2004, it confirmed the acquisition of Schmidt Bank based in Hof, gaining 70 branches and 29 other locations in Bavaria, Thuringia, and Saxony, increasing its private customer base by 360,000 to 4.3 million.[47] The transaction was seen as rejecting a merger with the Bavarian HypoVereinsbank.[48]

In addition to digital activities and growth in the domestic market, especially among corporate clients,[49] Commerzbank explored various acquisitions in Central and Eastern Europe. With the majority takeover of Poland's BRE Bank (today's mBank) in 2003, it significantly expanded its regional engagement.[50] Moreover, Commerzbank grew in smaller markets, such as in Romania.[51] Revenues from Central and Eastern Europe were expected to grow significantly.[52] Furthermore, Commerzbank relocated back-office activities, such as IT systems, to Poland and the Czech Republic.[53]

In 2001, the three major Frankfurt banks, Deutsche Bank, Dresdner Bank, and Commerzbank, decided to establish a joint mortgage bank.[54] Eurohypo commenced its business operations in the second half of 2002.[55] Following the dot-com bubble's collapse and subsequent turmoil in financial markets, Commerzbank had to make significant write-downs on its stake as early as 2003.[56] For a time, the major shareholders even waived their dividends to improve the financing of Eurohypo.[57] Eurohypo distanced itself from Commerzbank.[58] An initial public offering (IPO) was initially discussed to strengthen the company's independence.[59]

Despite initial challenges, Eurohypo became an important component in Commerzbank's earnings statement.[60] Therefore, the bank stopped the IPO planned 2005 to prepare for its takeover of Eurohypo.[61][62] The re-entry into public and real estate financing marked a significant change in the company's strategy.[63] Eurohypo initially insisted on its independence.[64][65]

In November 2005, Commerzbank finally announced the complete takeover of Eurohypo after agreeing on terms for acquiring shares from Deutsche Bank and Dresdner Bank.[66] This step elevated Commerzbank to the second-largest bank in Germany.[67] Observers described the surprising acquisition as a strategic coup,[68][69] especially in competition with domestic rivals.[70] To finance the acquisition, the bank conducted a capital increase.[71] Even after the takeover, Eurohypo remained largely independent.[72] The real estate business became an essential pillar of the group.[73]

As early as the early 2000s, there were rumors about a merger of Commerzbank with another major European financial institution. After the failed merger of Deutsche Bank with Dresdner Bank, Commerzbank was considered the most likely candidate for acquiring Dresdner Bank.[74] Such discussions started around June 2000.[75][76][77] The possibilities discussed included the formation of a large financial conglomerate, possibly involving Allianz.[78]

Trade unions viewed the merger of Commerzbank and Dresdner Bank critically in light of potential job cuts,[79] as did the investment company Cobra, which held stakes in both financial institutions.[80][81] On the other hand, Generali, the Italian finance and insurance conglomerate and another major shareholder of Commerzbank, explicitly expressed positive views on the plans.[82]

Ultimately, the plans failed because it was impossible to bring together the different interests of all parties into a familiar concept.[83][84] A critical factor was also the conflict over the valuation of Commerzbank and Dresdner Bank.[85] Additionally, a cross-border merger was considered more sensible.[86] Both banks emphasized their independence.[87][88]

In the context of the global economic and financial crisis, there were renewed speculations in 2008 about the merger of Commerzbank with other banks. Initially, there was also talk of a large merger involving Commerzbank, Dresdner Bank, and Postbank.[89] By mid-year, a merger of Commerzbank and Dresdner Bank was likely.[90][91] In particular, Allianz, as the largest shareholder of Dresdner Bank, expected new momentum for its business from such a merger.[92]

After months of negotiations, the parties finally announced Commerzbank's takeover of Dresdner Bank.[93] This was seen as a milestone in reorganizing the German financial industry.[94] Allianz valued the purchase price at around 9.8 billion euros, assuming loss risks of up to 975 million euros. In the first step, Commerzbank was to acquire about 60 percent of Dresdner Bank, with plans to buy the remaining shares later.[95]

This was the largest merger of two financial institutions in years. Commerzbank and Dresdner Bank both expected to realize millions in synergies.[96] Although Allianz initially rejected renegotiations,[97] the parties agreed to reduce the purchase price to 5.5 billion euros.[98][99] It was also decided to move the takeover from the second half of 2009 to the beginning of the year.[100]

Analysts and investors criticized the merger of Commerzbank and Dresdner Bank amid the global economic and financial crisis. The transaction significantly affected the stock prices of all involved companies.[101] Due to the credit risks of Dresdner Bank that became apparent at the end of 2008, Commerzbank utilized the Special Fund for Financial Market Stabilization (SoFFin).[102] After the German federal government and the European Commission agreed on the assistance details, Commerzbank received a silent participation of 8.2 billion euros.[103][104]

Initially, Commerzbank emphasized that the state's participation was necessary due to the devaluation of banks and not specifically because of the takeover of Dresdner Bank.[105] By the end of 2009, this assessment had to be revised. Commerzbank sought additional state aid,[106] leading to the Federal Republic of Germany acquiring over 25 percent of Commerzbank's shares, thereby securing a blocking minority. This was the first partial nationalization of a German financial institution.[107] The silent participation of SoFFin increased to around 16.4 billion euros.[108]

In January 2009, Commerzbank became the sole owner of Dresdner Bank, holding 100 percent of its shares. The merger of Dresdner Bank into Commerzbank was registered in the commercial register in May of the same year. An agreement on balancing interests and a social plan, including a new organizational structure for the headquarters, was reached with the employee representatives. Even after the takeover, the major bank maintained its lending to the struggling German economy to prevent a credit crunch in the mid-market sector.[109][110]

At the end of March 2009, Commerzbank formed its internal bad bank,[111][112] called PRU (Portfolio Restructure Unit), into which non-strategically valuable securities worth 15.5 billion euros from Commerzbank and 39.9 billion euros from Dresdner Bank were outsourced. A joint bad bank with the nationalized Hypo Real Estate was sometimes discussed.[113]

The following years were marked by the integration of Dresdner Bank into Commerzbank.[114] The merging of IT platforms, in particular, became a challenge.[115] The "Dresdner Bank" brand was gradually phased out,[116] with the new Commerzbank adopting some aspects of Dresdner Bank's former corporate identity.[117] The rebranding became visible at branches within three weeks.[118] By May 2011, both financial institutions' strategic and operational integration was largely completed. Commerzbank evaluated the process as a success and highlighted the positive response from all relevant target groups.[119][120][121]

2011–2023[edit]

In 2011, Commerzbank began repaying the silent participation of SoFFin.[122] One of the most significant capital increases in German history partly financed this:[123] a total volume of 14 billion euros, comprising 11 billion from investors and 3 billion from the bank's reserves.[124] Despite criticism, the general meeting approved the measure.[125][126]

As a result of the financial crisis and partial nationalization, the bank lost public trust. At the end of 2012, the bank launched an advertising campaign in which it openly admitted past mistakes and positioned itself as a fair and competent financial service provider. This was met with criticism in the industry.[127]

The Greek debt crisis and its global impact unexpectedly heavily affected Commerzbank's profitability.[128] The bank responded with a radical austerity program,[129][130] which included limiting credit outside Germany and Poland.[131] By selling Cominvest to Allianz, Commerzbank no longer owned its own fund company.[132]

Additionally, Eurohypo was to be sold or split up.[133][134] Write-downs on government bonds and real estate loans continuously led to losses,[135][136] making the company no longer viable.[137] Therefore, in 2012, the bank ultimately decided on a wind-down, accepting further losses in the accelerated reduction of its portfolio.[138][139]

The decade following the takeover and integration of Dresdner Bank brought further profound changes for Commerzbank caused by the digitalization of all areas of public life. In response, Martin Zielke, who became CEO in 2016, announced a radical restructuring.[140][141] Commerzbank mainly aimed to strengthen its private and corporate customer business in Germany further. The focus was now on a profitable multi-channel bank. To this end, the bank maintained its branch network while many other banks reduced their local presence. Additionally, the thriving business with medium-sized corporate customers was to continue unhindered.[142]

In 2019, there were concrete talks between Commerzbank and Deutsche Bank about a merger.[143] However, after a thorough examination, the boards of both banks needed more added value, so the merger ultimately did not happen.[144] The cancellation led to further disagreements with major shareholders over Commerzbank's strategic direction.[145] These were the reasons for the joint resignation of the Chairman of the Board of Managing Directors and the Chairman of the Supervisory Board in the summer of 2020.[146]

In January 2021, Manfred Knof took over as Chairman of the Board of Commerzbank. Under his leadership, the board focused on profitability, customer orientation, sustainability, and digitalization.[147] Based on Commerzbank's advisory expertise and Comdirect's digital competence, the business model of a digital advisory bank was established.[148] The concept of the multi-channel bank was further developed to create equal access for customers online and offline.[149] An example of this is the newly introduced nationwide advisory centers.[150][151]

Costs were massively reduced to maintain Commerzbank's independence and cushion risks from inflation and interest rate developments.[152] By early 2023, around 10,000 full-time positions were cut, and about half of all branches in Germany were closed.[153]

In the financial year 2022, the bank reported its best result in over ten years and was pleased to rejoin the German leading index, DAX, in 2023.[154][155] Observers attributed the good results partly to the increased central bank base rates. The development of the corporate customer business was also highlighted.[156] German economic media spoke of a "turnaround" for Commerzbank after the financial crisis. The bank continued the positive development in the financial year 2023 and further increased its profit. It was the best result in 15 years.[157]

For the financial year 2022, Commerzbank distributed 30 percent of its profit to shareholders.[158] It was the first distribution since 2018. In addition to paying a dividend of 20 cents per share, the bank conducted the first share buyback in its history in June 2023, with a volume of 122 million euros.[159] For the financial year 2023 the bank targets to distribute 50 percent of the profit to shareholders, consisting of another share buyback with a volume of 600 million euros and a planned dividend payment. Based on its capital return policy the bank aims to increase the pay-out ratio to at least 70 percent for the financial year 2024, but not more than the net result. This would also benefit the Federal Republic of Germany's Finance Agency as the largest single shareholder.

Operations[edit]

Type[edit]

Commerzbank is a German public limited company (Aktiengesellschaft).[160] Its business purpose includes the 'operation of banking and financial services of all kinds.'

Commerzbank is listed by the Federal Financial Supervisory Authority (BaFin) as a CRR credit institution.[161] Since the introduction of European banking supervision, it has been monitored by the European Central Bank (ECB). Commerzbank is currently not classified as a globally systemically important financial institution.[162]

Listing[edit]

The bank's share capital is divided into approximately 1.25 billion bearer shares with a nominal value of one euro each. The shares are traded on the Frankfurt Stock Exchange and through the Xetra trading venue and are listed in the DAX.[163] According to its articles of association, Commerzbank's annual general meeting takes place at the company's headquarters, at another German stock exchange location, or in a German city with more than 250,000 inhabitants. Due to the global coronavirus pandemic in 2020, the bank successfully held digital meetings, like many other companies.[164]

The consolidated financial statements include all companies in which Commerzbank is directly or indirectly involved. The most important domestic subsidiary is the fully owned subsidiary Commerz Real.[165] Internationally, there are four major subsidiaries, including the Polish mBank.[166] Other participations include the advertising agency Neugelb Studios and the innovation unit Neosfer, which strategically invests in fintechs, among other things.[167][168] Additionally, Commerzbank participates in young companies related to the financial sector through venture capital funds.

Management[edit]

Board of Managing Directors[edit]

- Manfred Knof (Chairman and Chief Executive Officer)

- Bettina Orlopp (Deputy Chairwoman, Chief Financial Officer)

- Michael Kotzbauer (Business Segment Corporate Clients)

- Sabine Mlnarsky (Group Human Resources)[169]

- Jörg Oliveri del Castillo-Schulz (Chief Operating Officer)

- Thomas Schaufler (Business Segment Private and Small-Business Customers)

- Bernhard Spalt (Risk Management)

Former chief executives include Klaus-Peter Müller, Martin Blessing, and Martin Zielke.

Supervisory Board[edit]

The Supervisory Board advises the management and supervises the conduct of its business. It is made up of equal numbers of representatives of the shareholders. The Supervisory Board has 20 members; its Chairman is Jens Weidmann,[170] his deputy is Uwe Tschäge.

Former chairs include Klaus-Peter Müller and Stefan Schmittmann.

[edit]

With a stake of over 15 percent, the Federal Republic of Germany, through the Special Fund for Financial Market Stabilization (SoFFin), is the largest single shareholder.[171] The remaining approximately 85 percent are in free float. Blackrock and Norges hold over 5 percent and over 3 percent in Commerzbank, respectively. Other institutional investors together account for around 52 percent. About 25 percent of Commerzbank shares are owned by private investors (as of February 2024).

Memberships[edit]

Commerzbank is a member of the Association of German Banks (BdB) and the Employers' Association of Private Banking (AGV Banken). It is also active in the Federal Association of Small and Medium-Sized Enterprises (BVMW), the American Chamber of Commerce in Germany (AmCham), the Arab-German Chamber of Commerce and Industry (Ghorfa), the Asia-Pacific Committee of German Business (APA), and the Africa Association of German Business (AV).

Commerzbank is a member of the Economic Advisory Board of CDU/CSU and the Economic Forum of the SPD. It maintains contact with all democratic parties in Germany.[172]

Services[edit]

Private and business customers[edit]

Commerzbank is one of the market leaders for private and entrepreneurial customers in Germany. It offers a wide range of products for payment transactions, securities trading, investment and financing, and corresponding advice through various channels (online and offline).[173] With its 'free checking account', the bank secured many customers.[174] This offer continues to this day. Real estate and corporate loans are realized in partnership with the Kreditanstalt für Wiederaufbau (KfW).[175][176]

Commerzbank offers corporate clients a variety of financial products and services. These include traditional products such as accounts, loans, and payment transactions. In addition, the bank supports companies in structuring capital measures,[177] such as issuing shares and bonds.

Another crucial area is international business. The bank provides services for German and international companies. Examples include foreign exchange businesses and solutions for risk management. Commerzbank finances around one-third of German foreign trade, making it a leader among the major German banks.

Headquarters and locations[edit]

With around 400 branches, Commerzbank operates a nationwide branch network in Germany. It includes both larger and smaller locations, offering a diversified range of services.

The headquarters and major staff departments of the group are located in the Commerzbank Tower, Frankfurt am Main.[178] Additionally, there is a representative office at Pariser Platz in Berlin and a liaison office in Brussels.[179]

There are also other international locations, such as New York City and Singapore.

Commerzbank brand[edit]

Early logos of Commerzbank featured the abbreviations CDB and CPB. From the 1920s, these were incorporated into the corporate image. In 1940, a logo with a 'C' and Mercury wings was introduced.[180] This was followed in 1972 by the 'Quatre Vents' logo, inspired by a wind rose.[181]

After the takeover of Dresdner Bank in 2009, Commerzbank presented a new logo with the name in a new font, the color yellow, and a three-dimensional ribbon.[182][183]

The Waldstadion had been named 'Commerzbank Arena.'[184][185] Since 2008, Commerzbank has been a partner of the German Football Association (DFB).[186] Until 2021, the bank was a partner of the men's national team, but has focused on the women's national team since then. Commerzbank produced an advertising campaign for the 2019 Women's World Cup with the national team, which gained high attention nationally and internationally.[187][188]

Climate change[edit]

Commerzbank supports the goal defined in the Paris Agreement to limit global warming to less than two degrees Celsius compared to pre-industrial levels.[189] The bank signed the United Nations Global Compact in 2006 and was among the first signatories of the Principles for Responsible Banking developed in 2019.[190]

In the 1980s, Commerzbank began financing projects in renewable energy. Over the years, this commitment was progressively expanded. In addition, Commerzbank issues sustainable bonds, known as Green Bonds.[191][192] By June 2022, Commerzbank had issued three Green Bonds totaling 1.5 billion euros.

In 2016, Commerzbank adopted a binding policy on coal financing. This policy was further developed in 2022 into a guideline for transactions and customer relationships related to fossil fuels, now regulating business and relationships involving coal, oil, and gas. The policy sets explicit exclusions and restrictions.

Commerzbank relies on the scientific findings and methods of the Science Based Targets Initiative (SBTi) to steer its portfolios towards carbon neutrality, which the bank joined in 2022.[193] In 2023, the interim reduction targets for 2030 were validated, making Commerzbank the first German bank with the corresponding certification.

On a national level, Commerzbank supports the German Sustainability Code (DNK) and has signed the climate agreement of the German financial sector. The bank has established an operational environmental management system to reduce direct and indirect greenhouse gas emissions. Since 2013, only electricity from renewable sources has been used in Germany.

Controversies[edit]

In 2012, the U.S. Federal Reserve Board (FRB), which regulates foreign banking operations in the United States, required Commerzbank and its New York branch to rectify deficiencies in their compliance program and anti-money laundering processes. The enforcement actions have since been lifted.[194][195]

US authorities accused Commerzbank of violating sanctions in its business dealings with partners in countries such as Iran, Sudan, North Korea, Myanmar and Cuba.[196] In 2015, this led to a billion-dollar fine to be paid by the Commerzbank. Reasons included deficiencies in anti-money laundering measures revealed concerning fraud involving the Japanese Olympus Corporation.[197][198]

In February 2015, tax investigators and prosecutors searched Commerzbank's headquarters on suspicion of aiding and abetting tax evasion related to its Luxembourg subsidiary Commerzbank International and the Panamanian legal service firm Mossack Fonseca.[199]

In 2016, a research consortium published an analysis of cum-cum transactions involving Commerzbank.[200] That same year, the bank decided to stop conducting tax-motivated cum-cum transactions, as they were no longer socially acceptable.[201] In 2017, investigations by the Frankfurt am Main Public Prosecutor's Office and in 2019 by the Cologne Public Prosecutor's Office were disclosed in connection with cum-ex transactions.[202][203][204]

In June 2020, the UK Financial Conduct Authority (FCA) imposed a fine of 38 million pounds (42 million euros) on Commerzbank for failing to combat money laundering again. According to the authority, Commerzbank could not take adequate steps to address the deficiencies.[205]

See also[edit]

References[edit]

- ^ Breinich-Schilly, Angelika (9 November 2022). "Commerzbank schärft Fokus auf Mittelstand und Vermögende". Springer Professional (in German). Retrieved 28 August 2023.

- ^ Manfred Pohl; Sabine Freitag, eds. (1994). Handbook on the History of European Banks. Brookfield: Edward Elgar Publishing. p. 375. ISBN 1-85278-919-0.

- ^ Schneider, Rembert (17 February 1995). "125 Jahre Commerzbank: Von Hamburg über Berlin, Düsseldorf nach Frankfurt und in die Welt. 'Die Bank an Ihrer Seite' ging oft eigene Wege". Börsen-Zeitung (in German). p. 5.

- ^ "Die Wurzeln der Commerzbank liegen in Hamburg". Frankfurter Allgemeine (in German). 15 February 1995. p. 22.

- ^ Mohr, Daniel (27 February 2023). "DAX: Commerzbank zurück und direkt an der Spitze". Frankfurter Allgemeine (in German). Retrieved 28 August 2023.

- ^ Kröner, Andreas (17 February 2022). "Jahresbilanz: Commerzbank kämpft sich in die Gewinnzone zurück und lockt mit einer Dividende". Handelsblatt (in German). Retrieved 28 August 2023.

- ^ Schaaf, Stefan (27 April 2022). "Commerzbank vs. Deutsche Bank: Die Gelben hängen die Blauen ab". Capital (in German). Retrieved 26 August 2023.

- ^ "Commerzbank-Zentrale droht der Abriss: Und wieder stirbt ein Stück Stadt-Geschichte". Focus (in German). 1 March 2019. Retrieved 9 April 2024.

- ^ "Das Deutsche Reich stand bei der Geburt Pate: Commerzbank und Deutsche Bank blicken auf 125 Jahre Geschichte. Nähe zur Macht zahlte sich nicht immer aus". Der Tagesspiegel (in German). 19 February 1995.

- ^ a b c d e Krause, Detlev; Lege, Katrin; Zimmerl, Ulrike (2016). Eugen-Gutmann-Gesellschaft (ed.). Die Commerzbank am Neß in Hamburg: 140 Jahre Baugeschichte in Bildern (in German). Frankfurt am Main: Henrich Editionen. ISBN 978-3-943407-73-0.

- ^ Bel, Germà (February 2010). "Against the mainstream: Nazi privatization in 1930s Germany". Economic History Review. 63 (1): 34–55. doi:10.1111/j.1468-0289.2009.00473.x. JSTOR 27771569.

- ^ Herbst, Ludolph; Weihe, Thomas (2004). Die Commerzbank und die Juden 1933–1945 (in German). München: C.H. Beck. pp. 74–137.

- ^ "History of Commerzbank". Retrieved 9 April 2024.

- ^ "Gegen Amerika". Der Spiegel (in German). 25 October 1970. ISSN 2195-1349. Retrieved 29 August 2023.

- ^ "Commerzbank-Chef Walter Seipp wird 65". Bonner General-Anzeiger (in German). 13 December 1990. p. 21.

- ^ "Commerzbank: 150000 Konten in Ex-DDR". Handelsblatt (in German). 30 October 1990. p. 10.

- ^ "5.000 Firmenkunden beider Commerzbank-Ost". Handelsblatt (in German). 1 July 1991. p. 10.

- ^ "Commerzbank eröffnet Büro in Bangkok". Handelsblatt (in German). 15 October 1990. p. 12.

- ^ "Commerzbank gründet Managementberatung". Handelsblatt (in German). 1 October 1991. p. 12.

- ^ "Commerzbank steigert Ertrag". Die Tageszeitung (in German). 8 April 1992. p. 7.

- ^ "Addition von Krümeln". Der Spiegel (in German). 31 May 1993. p. 122.

- ^ "Commerzbank streicht Stellen". Der Spiegel (in German). 2 August 1993. p. 81.

- ^ "Ein Supergewinn". Die Tageszeitung (in German). 16 April 1994. p. 6.

- ^ "Commerzbank erfreut Aktionäre: Hoehere Dividende in Aussicht gestellt, außerordentliche Erträge". Der Tagesspiegel (in German). 24 November 1994.

- ^ "Milliarden-Beteiligung an Frankreichs Credit Lyonnais". WirtschaftsWoche (in German). 5 April 1991. p. 6.

- ^ "Trinationale Bankenkooperation". Neue Zürcher Zeitung (in German). 20 July 1993. p. 27.

- ^ "Neue Tochter: Comdirect ist nicht nur Discount Broker". Handelsblatt (in German). 23 February 1995. p. 40.

- ^ "Der Kaufinteressent". Bonner General-Anzeiger (in German). 25 June 1998. p. 14.

- ^ "Aktie der Woche: Commerzbank bleibt Fusionskandidat". WirtschaftsWoche (in German). 7 May 1998. p. 192.

- ^ "Selbstbewußt in die Zukunft: Commerzbank-Chef Martin Kohlhaussen über die Chancen der deutschen Finanzbranche". Die Zeit (in German). No. 51. 1997.

- ^ "Commerzbank will selbständig bleiben. Vorstand Kohlhaussen: Keine Übernahmewelle im Bankgewerbe". Der Tagesspiegel (in German). 30 May 1998. p. 18.

- ^ "Massen-Firmenhochzeit. Unter den großen Fusionen war nur eine nicht dabei: Deutsche Bank und Commerzbank". Die Tageszeitung (in German). 24 December 1997. p. 8.

- ^ "Commerzbank buhlt um Postbank: Möglicher neuer Finanzriese mit Versicherer HDI und Bausparkasse Wüstenrot im Entstehen". Wiesbadener Kurier (in German). 25 June 1998.

- ^ "Commerzbank greift nach Postbank. Neue Allfinanzgruppe möglich. Börsengang wahrscheinlich. Umstrukturierung auf vollen Touren". Allgemeine Zeitung (in German). 25 June 1998.

- ^ "Commerzbank: Neue Kunden gewonnen". WirtschaftsWoche (in German). 2 January 1997. p. 9.

- ^ "Commerzbank: Gewinn rauf mit weniger Filialen". Die Tageszeitung (in German). 7 November 1997. p. 8.

- ^ "Commerzbank: Bargeld an Tankstellen". WirtschaftsWoche (in German). 13 February 1997. p. 9.

- ^ "Commerzbank stellt bei Shell Geldautomaten auf". Börsen-Zeitung (in German). 14 February 1997. p. 16.

- ^ "Electronic Banking wird für Firmenkunden attraktiv". Handelsblatt (in German). 3 May 1996. p. 23.

- ^ "Commerzbank: Personalabbau durch Zeitarbeit". Der Spiegel (in German). 10 August 1998. p. 76.

- ^ "Commerzbank kauft sich in Südkorea ein. Einstieg bei Korea Exchange Bank". Der Tagesspiegel (in German). 29 May 1998. p. 23.

- ^ "Commerzbank sieht Chancen in Korea". Hamburger Abendblatt (in German). 6 February 1999. p. 20.

- ^ "Krise in Asien: Euro-Banken tief im asiatischen Finanzloch. Die Commerzbank warnt: Es ist falsch, in allgemeine Panik zu verfallen". Der Tagesspiegel (in German). 13 January 1998. p. 18.

- ^ "Kurs auf Europa". Hamburger Abendblatt (in German). 22 May 1999. p. 23.

- ^ "Kohlhaussens Wahlverwandtschaften: Commerzbank will europäische Allianzen statt einer Großfusion". Die Tageszeitung (in German). 25 March 1999. p. 9.

- ^ "Commerzbank: Delikate Situation. Konzernchef Martin Kohlhaussen will die Unabhängigkeit durch einen europäischen Verbund sichern. Jetzt stockt der Ausbau". WirtschaftsWoche (in German). 13 May 1999.

- ^ "Commerzbank bestätigt Übernahme der SchmidtBank". Frankfurter Allgemeine (in German). 25 February 2004. Retrieved 1 January 2019.

- ^ "Commerzbank kauft Filialen der SchmidtBank. Verhandlungsergebnisse werden heute präsentiert". Börsen-Zeitung (in German). 25 February 2004. p. 3.

- ^ "Commerzbank muss bei Firmen punkten". Handelsblatt (in German). 5 January 2005. p. 18.

- ^ "Commerzbank will Mehrheit bei BRE Bank". Börsen-Zeitung (in German). 12 September 2003. p. 17.

- ^ "Commerzbank prüft Auslagerung nach Polen. Starkes Wachstum in Osteuropa geplant - Geldinstitut hat rumänischen Markt im Visier". Die Welt (in German). 3 September 2004. p. 14.

- ^ "Commerzbank prüft Verlagerung von Back-Office-Aktivitäten nach Polen. Expansion nach Rumänien. Erträge aus dem Osteuropageschäft sollen bis 2006 um 50 Prozent wachsen". Börsen-Zeitung (in German). 3 September 2004. p. 3.

- ^ "Commerzbank entdeckt Osteuropa: Konzern prüft Verlagerung von IT-Funktionen nach Polen und Tschechien. Expansion in Rumänien". Financial Times Deutschland (in German). 3 September 2004. p. 19.

- ^ "Gründung der Eurohypo AG besiegelt. Dresdner, Deutsche und Commerzbank wollen Beteiligung mittelfristig abbauen". Der Tagesspiegel (in German). 7 November 2001. p. 22.

- ^ "Neuer Hypo-Riese Eurohypo startet in der zweiten Hälfte 2002". Börsen-Zeitung (in German). 7 November 2001. p. 19.

- ^ "Befreiungsschlag gegen Milliardenlast". Börsen-Zeitung (in German). 13 November 2003. p. 17.

- ^ "Großaktionäre füttern Eurohypo durch". Financial Times Deutschland (in German). 10 March 2004. p. 17.

- ^ "Eurohypo sucht Distanz zur Commerzbank". Financial Times Deutschland (in German). 14 November 2003. p. 23.

- ^ "Eurohypo sieht sich nun Börsengang näher". Börsen-Zeitung (in German). 14 November 2003. p. 19.

- ^ "Commerzbank kann auf Eurohypo verzichten". Financial Times Deutschland (in German). 17 August 2005. p. 18.

- ^ "Commerzbank stoppt Eurohypo-Börsengang". Handelsblatt (in German). 25 August 2005. p. 1.

- ^ "Commerzbank bereitet die Übernahme der Eurohypo vor". Handelsblatt (in German). 15 November 2005. p. 15.

- ^ "Commerzbank steht vor einem Strategiewechsel". Handelsblatt (in German). 16 November 2005. p. 20.

- ^ "Commerzbank-Interesse stößt auf Skepsis". Financial Times Deutschland (in German). 15 November 2005. p. 18.

- ^ "Eurohypo pocht auf Eigenständigkeit". Financial Times Deutschland (in German). 16 November 2005. p. 20.

- ^ "Commerzbank übernimmt die Eurohypo". Die Welt (in German). 16 November 2005. p. 1.

- ^ "Commerzbank wird zweitgrößte deutsche Bank". Der Tagesspiegel (in German). 16 November 2005. p. 17.

- ^ "Müller wagt den Angriff". Die Welt (in German). 16 November 2005. p. 13.

- ^ "Ein Deal mit Haken und Ösen". Financial Times Deutschland (in German). 18 November 2005. p. 20.

- ^ "Wette auf Deutschland: Mit dem Kauf der Eurohypo überrumpelt die Commerzbank die einheimische Konkurrenz und demonstriert ungewohntes Vertrauen in die hiesige Wirtschaft". Die Zeit (in German). No. 48. 2005. Retrieved 10 February 2024.

- ^ "Commerzbank erwägt Kapitalerhöhung zur Finanzierung des Eurohypo-Kaufs". Die Welt (in German). 17 November 2005. p. 13.

- ^ "Eurohypo soll eigenständig bleiben: Commerzbank will neue Tochter nicht eingliedern". Financial Times Deutschland (in German). 17 November 2005. p. 1.

- ^ "Commerzbank bündelt ihre Immobilien-Aktivitäten". Die Welt (in German). 3 January 2007. p. 23.

- ^ "Dresdner-Versuchsballon der Commerzbank". Der Standard (in German). 15 April 2000. p. 32.

- ^ "Commerzbank geht auf Dresdner zu". Handelsblatt (in German). 14 April 2000. p. 1.

- ^ "Dresdner und Commerzbank sprechen über Fusion". Handelsblatt (in German). 16 June 2000. p. 1.

- ^ "Großbanken setzen Gespräche fort: Weiteres Spitzentreffen Dresdner und Commerzbank". Handelsblatt (in German). 19 June 2000. p. 1.

- ^ "Dresdner und Commerzbank planen "Superbank"". Der Tagesspiegel (in German). 9 July 2000. p. 26.

- ^ "Keine Angst vor dem Biss der Cobra". Die Tageszeitung (in German). 12 July 2000.

- ^ "Cobra giftet gegen Ehe im Inland". Frankfurter Rundschau (in German). 3 July 2000. p. 9.

- ^ "Cobra verliert Stimmrecht: Kein Einfluss bei möglicher Kooperation von Dresdner und Commerzbank". Hamburger Abendblatt (in German). 18 July 2000. p. 20.

- ^ "Generali für Commerzbank-Fusion". Hamburger Abendblatt (in German). 23 June 2000. p. 21.

- ^ "Banken trauen sich nicht". Die Tageszeitung (in German). 27 July 2000. p. 9.

- ^ "Bankenfusion ist gescheitert". Handelsblatt (in German). 27 July 2000. p. 1.

- ^ "Bankenfusion auf der Kippe: Konflikt um Bewertungsverhältnis. Commerzbank unzufrieden mit Angebot der Dresdner". Die Welt (in German). 26 July 2000. p. 11.

- ^ "Großaktionäre Cobra und Allianz bestimmen Neuordnung". Financial Times Deutschland (in German). 27 July 2000. p. 18.

- ^ "Die Banken suchen weiter nach Partnern: Geteiltes Echo auf Ende der Fusionsgespräche zwischen Commerzbank und Dresdner". Die Welt (in German). 27 July 2000. p. 11.

- ^ "Helaba vermisst bei Dresdner und Commerzbank klares Profil". Financial Times Deutschland (in German). 10 July 2000. p. 18.

- ^ "Commerzbank, Postbank, Dresdner Bank: Allianz denkt über Drei-Banken-Giganten nach". Der Spiegel (in German). 28 March 2008. Retrieved 1 January 2019.

- ^ "Verhandeln mit Hochdruck". Handelsblatt (in German). 3 July 2008. p. 24.

- ^ "Fusion vor der Tür". Die Tageszeitung (in German). 25 August 2008. p. 8.

- ^ "Die Allianz sucht den eleganten Ausstieg". Börsen-Zeitung (in German). 5 August 2008. p. 4.

- ^ "Neuer Deal, neues Glück". Financial Times Deutschland (in German). 14 April 2008. p. 25.

- ^ "Sturm im Turm". Financial Times Deutschland (in German). 7 January 2009. p. 23.

- ^ "Übernahme in mehreren Stufen: Commerzbank fusioniert mit Dresdner Bank". Börsen-Zeitung (in German). 30 August 2008. p. 1.

- ^ "Megadeal in der Finanzbranche: Commerzbank kauft die Dresdner Bank". Süddeutsche Zeitung (in German). 17 May 2010. Retrieved 1 January 2019.

- ^ "Allianz zieht Dresdner-Verkauf durch". Financial Times Deutschland (in German). 11 November 2008. p. 17.

- ^ "Commerzbank/Allianz: Der Dresdner-Deal ist gerettet". Manager Magazin (in German). 18 November 2008. Retrieved 6 March 2019.

- ^ "Commerzbank bekommt Dresdner billiger". Financial Times Deutschland (in German). 27 November 2008.

- ^ "Commerzbank zieht Dresdner-Kauf vor". Handelsblatt (in German). 28 November 2008. p. 1.

- ^ "Das traurige Trio: Commerzbank, Dresdner Bank und die Allianz vereint im Absturz". Die Tageszeitung (in German). 1 November 2008. p. 11.

- ^ "Einigung mit Soffin: Rettungsschirm für die Commerzbank ist fertig". Handelsblatt (in German). 19 December 2008. Retrieved 1 January 2019.

- ^ "Weg frei für Staatshilfen: Brüssel und Berlin einigen sich offenbar im Streit über Commerzbank-Hilfen in Höhe von 8,2 Milliarden Euro". Die Tageszeitung (in German). 11 December 2008. p. 9.

- ^ "Rettungsschirm wird für die Commerzbank teurer". Die Welt (in German). 22 December 2008. p. 12.

- ^ "Commerzbank zahlt Dresdner nicht mit Staatsgeld". Die Welt (in German). 1 December 2008. p. 12.

- ^ "Staat soll Kauf der Dresdner Bank finanzieren: Käufer Commerzbank verhandelt mit dem Bankenrettungsfonds Soffin über weitere Staatshilfen". Die Tageszeitung (in German). 8 January 2009. p. 8.

- ^ "Erste Bank in Deutschland wird teilverstaatlicht. Noch eine Nothilfe: Bund gibt Commerzbank zehn Milliarden und bekommt jetzt Stimmrecht. Aktien brechen ein". Die Welt (in German). 9 January 2009. p. 1.

- ^ "Aus viel mach wenig: Der Steuerzahler will etwas sehen für die Milliarden, die er der Commerzbank gibt. Soll er auch, sagt deren Chef. Seinen Aktionären erzählt er etwas anderes". Financial Times Deutschland (in German). 26 January 2009. p. 15.

- ^ "Krisengipfel im Kanzleramt: Commerzbank verspricht massenhaft neue Kredite". Der Spiegel (in German). 2 December 2009. Retrieved 1 September 2019.

- ^ "Bankenbranche geht Kreditklemme an: Die Sparkassen und die Commerzbank wollen eigene Milliardenfonds auflegen, um dem Mittelstand zu helfen". Der Tagesspiegel (in German). 3 December 2009. p. 20.

- ^ "Commerzbank gründet interne "Bad Bank"". Handelsblatt (in German). 27 March 2009. Retrieved 25 June 2018.

- ^ "Zweifel an der Bad Bank: Commerzbank will nicht 'Vorreiter' sein. Finanzminister Steinbrück macht Druck auf Landesbanken". Der Tagesspiegel (in German). 11 July 2009. p. 16.

- ^ "Commerzbank plant Müllkippe. Kriseninstitut will Papiere in Milliardenhöhe auslagern. Gemeinsame Bad Bank mit HRE im Gespräch". Financial Times Deutschland (in German). 5 February 2009. p. 1.

- ^ "Commerzbank: Die Integration der Dresdner Bank als große Herausforderung". Handelsblatt (in German). 14 January 2011. p. 10.

- ^ "Commerzbank kommt bei Übernahme 'gut voran'. IT gibt bei der Integration der Dresdner Bank Takt vor". Börsen-Zeitung (in German). 5 February 2010. p. 6.

- ^ "Dresdner Bank: Das Ende einer Marke". Handelsblatt (in German). 7 September 2008. Retrieved 1 January 2019.

- ^ "Commerzbank: Neues Logo beendet Dresdner-Ära". Manager Magazin (in German). 28 October 2009. Retrieved 1 January 2019.

- ^ "Das kleine Glück am Main: Die Commerzbank feiert Etappenerfolge. Doch die Integration der Dresdner Bank ist noch nicht gelungen, und die Konkurrenz lauert auf Fehler. Konzernchef Martin Blessing steht unter Erfolgsdruck wie nie". Welt am Sonntag (in German). 13 June 2010. p. 29.

- ^ "Eine Frage der Perspektive". Financial Times Deutschland (in German). 30 May 2011. p. 16.

- ^ "Commerzbank: Schöne neue gelbe Welt". Handelsblatt (in German). 16 June 2010. p. 37.

- ^ "Zwei zu eins: Die Commerzbank zieht einen Schlussstrich – abgeschlossen ist die Integration der Dresdner aber nicht". Der Tagesspiegel (in German). 28 May 2011. p. 18.

- ^ "Commerzbank zahlt Staatshilfe zurück". Die Welt (in German). 6 April 2011. p. 1.

- ^ "Milliardencoup: Commerzbank startet Mega-Kapitalerhöhung". Der Spiegel (in German). 6 April 2011. Retrieved 1 January 2019.

- ^ "Kapitalerhöhung angekündigt: Commerzbank zahlt den Staat aus". Handelsblatt (in German). 6 April 2011. Retrieved 1 January 2019.

- ^ "Bilanzanalyse: Die Commerzbank und die Wut der Aktionäre". Handelsblatt (in German). 23 May 2012. Retrieved 1 January 2019.

- ^ "Commerzbank verlangt Geduld: Konzernchef Martin Blessing wird auf der Hauptversammlung ausgebuht". Die Welt (in German). 23 May 2012. p. 6.

- ^ Meck, Georg (18 May 2018). "Ein Werbespot verärgert die Banken-Branche". Frankfurter Allgemeine (in German). Retrieved 7 November 2019.

- ^ "Hellas setzt Commerzbank zu". Börsen-Zeitung (in German). 28 October 2011. p. 19.

- ^ "Angst vor Schieflagen: Die Regierung gibt sich gelassen, Brüssel und Commerzbank sind alarmiert". Der Tagesspiegel (in German). 6 October 2011. p. 17.

- ^ "Commerzbank steht vor drastischer Schrumpfkur". Die Welt (in German). 5 November 2011. p. 11.

- ^ "Die Schrumpfkur der Commerzbank: Das Management zieht die Reißleine". Börsen-Zeitung (in German). 5 November 2011. p. 3.

- ^ "Cominvest landet bei Allianz". Börsen-Zeitung (in German). 14 January 2009. p. 3.

- ^ "Commerzbank plant Befreiungsschlag". Berliner Morgenpost (in German). 30 November 2011. p. 6.

- ^ "Eurohypo vor der Aufspaltung? Commerzbank spielt Szenarien durch". Die Welt (in German). 4 November 2011. p. 13.

- ^ "Studieren geht über Sanieren". Financial Times Deutschland (in German). 24 February 2011. p. 1.

- ^ "Eurohypo vervierfacht Verlust". Börsen-Zeitung (in German). 11 August 2011. p. 3.

- ^ "Moody's hält Commerzbank-Tochter für nicht überlebensfähig". Financial Times Deutschland (in German).

- ^ "Der Schrecken hat ein Ende: Die Commerzbank zerschlägt ihre defizitäre Immobilientochter Eurohypo". Der Tagesspiegel (in German). 31 March 2012. p. 9.

- ^ "Ende mit Schrecken". Financial Times Deutschland (in German). 2 April 2012. p. 18.

- ^ Littmann, Saskia; Welp, Cornelius (5 September 2016). "Neue Strategie: Warum die Commerzbank gegen den Strom schwimmt". Wirtschaftswoche (in German). Retrieved 26 August 2023.

- ^ "Stellenabbau: Commerzbank-Chef Martin Zielke macht gute Miene zum bösen Spiel". Welt Online (in German). 30 September 2016. Retrieved 29 August 2023.

- ^ Kröner, Andreas (26 September 2019). "Neue Strategie: So baut Vorstandschef Zielke die Commerzbank um". Handelsblatt (in German). Retrieved 29 August 2023.

- ^ "Finanzbranche: Deutsche Bank und Commerzbank verhandeln über Fusion". Die Zeit (in German). 17 March 2019. Retrieved 28 August 2023.

- ^ "Deutsche Bank und Commerzbank stoppen Fusionspläne". Tagesschau (in German). 25 April 2019. Retrieved 29 August 2023.

- ^ Mußler, Hanno (15 June 2020). "Aktionär Cerberus wirft Commerzbank Umsetzungsdefizit vor". Frankfurter Allgemeine (in German). Retrieved 29 August 2023.

- ^ Schreiber, Meike (3 July 2020). "Commerzbank: Überraschender Doppel-Rücktritt". Süddeutsche Zeitung (in German). Retrieved 29 August 2023.

- ^ Feldforth, Oliver (11 May 2022). "Commerzbank-Gewinn steigt – auch durch Filialschließungen". Tagesschau (in German). Retrieved 29 August 2023.

- ^ "Neuer Commerzbank-Chef Knof: Klarer Digitalisierungskurs". Süddeutsche Zeitung (in German). 11 February 2021. Retrieved 25 October 2023.

- ^ Zdrzalek, Lukas (3 March 2023). "Commerzbank: Warten auf Berater". Wirtschaftswoche (in German). p. 6.

- ^ Mußler, Hanno (13 August 2022). "Commerzbank: Verbleibende Mitarbeiter müssen besseren Service bieten". Frankfurter Allgemeine (in German). Retrieved 29 August 2023.

- ^ "Banken: Commerzbank setzt auf digitale Beratungszentren". Handelsblatt (in German). 2 September 2021. Retrieved 29 August 2023.

- ^ "Commerzbank verspricht Aktionären Tempo beim Konzernumbau". Die Zeit (in German). 18 May 2021. Retrieved 28 August 2023.

- ^ "Commerzbank streicht 10.000 Stellen bis 2024, jede zweite Filiale muss schließen". Der Spiegel (in German). 28 January 2021. Retrieved 21 August 2023.

- ^ Sinß, Falk (16 February 2023). "Commerzbank erwirtschaftet höchsten Gewinn seit zehn Jahren". Finance Magazin (in German). Retrieved 29 August 2023.

- ^ "Rückkehr in die Börsenliga: Commerzbank wieder im DAX". Die Zeit (in German). 17 February 2023. Retrieved 29 August 2023.

- ^ "Wie die Commerzbank die Kurve bekommen hat". Finanzbusiness (in German). 17 May 2023. Retrieved 28 August 2023.

- ^ Mußler, Hanno (11 July 2013). "Teilverstaatlichte Bank: Commerzbank-Aktie schafft Trendwende". Frankfurter Allgemeine (in German). Retrieved 26 August 2023.

- ^ "Commerzbank steigert Gewinn um mehr als 200 Prozent". Tagesschau (in German). 16 February 2023. Retrieved 29 August 2023.

- ^ Friedrich, Lars (24 June 2023). "Commerzbank kauft für 122 Millionen Euro eigene Aktien. Diese Premiere war erst der Anfang". Der Aktionär (in German). Retrieved 29 August 2023.

- ^ "Commerzbank AG". Unternehmensregister (in German). Bundesanzeiger Verlag. Retrieved 29 August 2023.

- ^ "Commerzbank AG". Unternehmensdatenbank (in German). Bundesanstalt für Finanzdienstleistungsaufsicht (BaFin). Retrieved 28 August 2023.

- ^ "Bankenrettung: Commerzbank nicht mehr systemrelevant". Frankfurter Allgemeine (in German). 1 November 2012. Retrieved 29 August 2023.

- ^ "Commerzbank AG". Börse Frankfurt (in German). Retrieved 29 August 2023.

- ^ "Commerzbank-Dividende: Die Commerzbank lädt zur Hauptversammlung 2023". Wirtschaftswoche (in German). 30 May 2023. Retrieved 28 August 2023.

- ^ Mußler, Hanno (24 January 2020). "Commerz Real: Die heimliche Perle der Commerzbank". Frankfurter Allgemeine (in German). Retrieved 29 August 2023.

- ^ Preuschat, Archibald (23 June 2023). "M-Bank: Commerzbank muss Rückstellung für Franken-Kredite erhöhen". Frankfurter Allgemeine (in German). Retrieved 27 August 2023.

- ^ Neubacher, Bernd (25 April 2022). "Fintech-Investments: Commerzbank begrünt Main Incubator". Börsen-Zeitung (in German). Retrieved 29 August 2023.

- ^ "Aus Commerzbank-Tochter Main Incubator wird Neosfer". Kreditwesen (in German). Retrieved 29 August 2023.

- ^ Mußler, Hanno (6 July 2022). "Marcus Chromik geht, Mlnarsky kommt in der Commerzbank". Frankfurter Allgemeine (in German). Retrieved 28 August 2023.

- ^ Kröner, Andreas (19 November 2022). "Überraschender Wechsel: Jens Weidmann soll neuer Commerzbank-Aufsichtsratschef werden". Handelsblatt (in German). Retrieved 28 August 2023.

- ^ "Aktionärsstruktur der Commerzbank nach Investortyp". Statista (in German). 31 December 2022. Retrieved 29 August 2023.

- ^ "Commerzbank AG". Lobbyregister (in German). Deutscher Bundestag. Retrieved 28 August 2023.

- ^ Ahlers, Martin (30 March 2023). "Commerzbank stellt auf digitale Beratung um". Westdeutsche Allgemeine Zeitung (in German). p. 19.

- ^ "Commerzbank bietet kostenloses Girokonto". Frankfurter Allgemeine (in German). 8 December 2006. p. 23.

- ^ "KfW und Commerzbank vereinbaren Globaldarlehen. Volumen von 500 Mill. Euro wie bei IKB-Vertrag". Börsen-Zeitung (in German). 19 July 2002. p. 17.

- ^ "Kreditversorgung: Commerzbank und KfW legen Mittelstandsfonds auf". Welt Online (in German). 3 October 2015. Retrieved 29 August 2023.

- ^ Dentz, Markus; Reifenberger, Sabine (4 February 2021). "Commerzbank passt M&A- und ECM-Angebot an". Finance Magazin (in German). Retrieved 29 August 2023.

- ^ "Commerzbank: Richtfest für Europas höchsten Büroturm". Frankfurter Rundschau (in German). 24 August 1996. p. 15.

- ^ "Neubau direkt am Brandenburger Tor: Commerzbank zieht am Pariser Platz ein". Der Tagesspiegel (in German). 11 February 1998. p. 20.

- ^ Schurdel, Harry D. (1989). "Die Banken mit dem Merkurstab". Bankkaufmann (in German). No. 3. pp. 46–48.

- ^ Langenscheidt, Florian (2007), "Quatre Vents", Deutsches Markenlexikon (in German), Köln: Gabal, p. 254

- ^ "Commerzbank macht sich frisch". Süddeutsche Zeitung (in German). 27 May 2010. Retrieved 14 November 2019.

- ^ "Commerzbank: Neues Logo beendet Dresdner-Ära". Manager Magazin (in German). 28 October 2009. Retrieved 29 August 2023.

- ^ Heinrich, Marc (25 February 2005). "Waldstadion wird Commerzbank-Arena". Frankfurter Allgemeine (in German). p. 55.

- ^ Schmitt, Peppi (2 April 2020). "Banken-Tausch in Frankfurt: Commerzbank Arena wird Deutsche Bank Park. Eintracht profitiert vom Namen". Wiesbadener Kurier (in German). p. 24.

- ^ "Commerzbank sticht Postbank aus: Neuer DFB-Sponsor". Handelsblatt (in German). 13 August 2008. p. 25.

- ^ Bonn, Aylin (25 April 2023). "Commerzbank: neue Kampagne, neues Image". Werben & Verkaufen (W&V) (in German). Retrieved 29 August 2023.

- ^ Meuren, Daniel (4 June 2019). "Frauenfußball-WM: Die Spielerinnen wollen sich bekannt machen". Frankfurter Allgemeine (in German). Retrieved 29 August 2023.

- ^ "Deutschlands größte Privatbanken verpflichten sich zur "netto Null"". Finanzbusiness (in German). 21 April 2021. Retrieved 29 August 2023.

- ^ "Commerzbank among the founding signatories of the UN Principles for Responsible Banking". Financial IT. 23 September 2019. Retrieved 22 August 2023.

- ^ "Commerzbank legt Green Bond auf". Börsen-Zeitung (in German). 17 October 2018. p. 3.

- ^ Otto, Stefan (16 November 2019). "Sustainable Finance: Von der Nische zum Mainstream". Börsen-Zeitung (in German). Retrieved 6 December 2019.

- ^ Sleegers, Anna (5 July 2022). "Commerzbank konkretisiert Nachhaltigkeitsziele: Neues ESG-Rahmenwerk beziffert CO2-Reduktionsziele für besonders energieintensive Kreditportfolios". Börsen-Zeitung (in German). p. 4.

- ^ "Federal Reserve Board announces termination of enforcement actions with Commerzbank AG, Frankfurt am Main and Commerzbank AG New York Branch". 6 March 2023. Retrieved 6 December 2023.

- ^ "Fed terminates AML enforcement actions against international financial institution". Willkie Compliance Concourse. 27 June 2023. Retrieved 6 December 2023.

- ^ Schroeder, Peter (12 March 2015). "German bank to pay $1.45B to settle money laundering charges". The Hill. Retrieved 5 April 2024.

- ^ Obertreis, Rolf (13 December 2014). "Verstößen gegen Finanzvorschriften: Hohe Strafe für die Commerzbank". Der Tagesspiegel. Retrieved 26 August 2023.

- ^ Protess, Ben (12 March 2015). "Commerzbank of Germany to Pay $1.5 Billion in U.S. Case". The New York Times. Retrieved 15 February 2024.

- ^ Leyendecker, Hans; Obermayer, Bastian; Ott, Klaus (25 February 2015). "Luxemburg: Steueraffäre erschüttert Commerzbank". Süddeutsche Zeitung (in German). Retrieved 12 October 2017.

- ^ "Steuern: Commerzbank wieder im Zwielicht". Deutsche Welle (in German). 2 May 2016. Retrieved 2 May 2016.

- ^ "Legal aber gesellschaftlich nicht akzeptiert: Commerzbank macht Schluss mit 'Cum/Cum'-Geschäften". Business Insider Deutschland (in German). 11 May 2016. Retrieved 29 August 2023.

- ^ "Cum-ex-Razzia bei der Commerzbank". Börsen-Zeitung (in German). 11 November 2017. p. 2.

- ^ "Cum Ex: Neue Razzia gegen Commerzbank". Commerzbank (in German). 10 September 2019. Retrieved 29 August 2023.

- ^ Sims, Tom; Seidenstuecker, Hans. "German prosecutors raid Commerzbank in tax evasion probe". Reuters. Retrieved 3 May 2018.

- ^ Plickert, Philip; Mußler, Hanno (17 June 2020). "Millionenstrafe für Commerzbank in Großbritannien". Frankfurter Allgemeine (in German). Retrieved 29 August 2023.

External links[edit]

![]() Media related to Commerzbank at Wikimedia Commons

Media related to Commerzbank at Wikimedia Commons

- Commerzbank

- Companies listed on the Frankfurt Stock Exchange

- German brands

- Multinational companies headquartered in Germany

- Banks established in 1870

- Companies based in Frankfurt

- Companies based in Hamburg

- Banks under direct supervision of the European Central Bank

- German companies established in 1870

- Companies formerly in the MDAX

- Companies in the DAX index

- Primary dealers