Too Big to Fail (film)

| Too Big to Fail | |

|---|---|

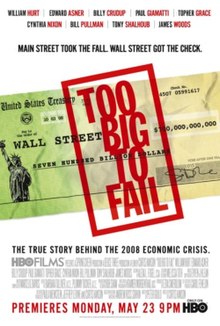

Television release poster | |

| Genre | Biographical drama |

| Based on | Too Big to Fail by Andrew Ross Sorkin |

| Written by | Peter Gould |

| Directed by | Curtis Hanson |

| Starring | |

| Music by | Marcelo Zarvos |

| Country of origin | United States |

| Original language | English |

| Production | |

| Executive producers |

|

| Producer | Ezra Swerdlow |

| Cinematography | Kramer Morgenthau |

| Editors |

|

| Running time | 98 minutes |

| Production companies |

|

| Original release | |

| Network | HBO |

| Release | May 23, 2011 |

Too Big to Fail is a 2011 American biographical drama television film directed by Curtis Hanson and written by Peter Gould, based on Andrew Ross Sorkin's 2009 non-fiction book Too Big to Fail. The film aired on HBO on May 23, 2011. It received 11 nominations at the 63rd Primetime Emmy Awards; Paul Giamatti's portrayal of Ben Bernanke earned him the Screen Actors Guild Award for Outstanding Performance by a Male Actor in a Miniseries or Television Movie at the 18th Screen Actors Guild Awards.

Plot

[edit]In 2008, news channels are full of reports about the mortgage industry crisis and the forced sale of troubled investment bank, Bear Stearns, to commercial banking giant JPMorgan Chase, with Federal guarantees. With Bear Stearns out of the picture, short sellers turn their attention on another investment bank, Lehman Brothers.

With their share price falling rapidly, Lehman Brothers tries to negotiate a deal with Korean investors. The deal hinges on the condition that Lehman's toxic real estate is excluded, but falls through when CEO Dick Fuld insists the Koreans reconsider accepting the real estate assets. The most promising US-based buyer for Lehman, Bank of America, is uninterested without Fed involvement, but U.S. Treasury Secretary Henry Paulson is adamant that the government will not subsidize any more acquisitions.

To resolve the situation, Paulson and President of the Federal Reserve Bank of New York, Timothy Geithner, gather the leaders of the biggest US banks over a weekend, trying to coerce them to underwrite the deal. The bank leaders seem to reach an agreement, but Bank of America backs out, choosing instead to buy another threatened firm and Lehman's rival, Merrill Lynch. Paulson tries to negotiate for Lehman with British bank Barclays, but their involvement is blocked by British banking regulators. With no buyers remaining, Lehman is forced into bankruptcy.

Lehman's collapse affects the entire financial system. Paulson tries to reassure news media of the soundness of the decision to let Lehman fail, but the stock market goes into freefall. Meanwhile, insurance firm AIG also begins to fail. French Finance Minister Christine Lagarde warns Paulson that he must not allow AIG to fail, as the crisis is affecting Europe as well. Unlike Lehman, the Treasury rescues AIG with an $85 billion loan, deeming it “too big to [let] fail”.

Ben Bernanke, Chairman of the Federal Reserve System, argues that Congress must pass legislation to authorize any continued intervention by the Fed or the Treasury. With the availability of credit drying up, Paulson's plan is to buy the toxic assets from the banks to take the risk off their books and increase their cash reserves. Bernanke and Paulson lobby Congress, with Bernanke emphasizing the potential of fallout worse than the Great Depression if they fail to act. The committee of representatives appear close to agreeing, when U.S. Senator and Presidential candidate John McCain, with great fanfare, announces that he is suspending his campaign and returning to Washington to work on the legislation.

Paulson has to threaten McCain not to interfere, and beg the Democrats not to back away from the negotiations. After a wave of panic and personal haranguing from President George W. Bush, the legislation passes on a second attempt and the Troubled Asset Relief Program (TARP) is created. Paulson's team realizes that buying toxic assets will take too long, leaving direct capital injections to the banks as their only option to use TARP to get credit flowing again. Along with FDIC Chair Sheila Bair, Paulson informs the banks that they will receive mandatory capital injections. The banks agree to the loans, but TARP legislation stops short of forcing them to use the money to restore credit for ordinary consumers.

The stock market continues falling until 2009 when it finally stabilizes, signaling the end of the crisis. An epilogue notes that the banks made little use of the loan money to ease credit conditions as intended, while Wall Street compensation continued to rise, reaching $135 Billion by 2010.[1]

Cast

[edit]The cast includes the following:[2]

Reception

[edit]Critical reception

[edit]On review aggregator website Rotten Tomatoes, the film holds an approval rating of 74%, based on 27 reviews, and an average rating of 6/10.[3] On Metacritic, the movie received a weighted average score of 67/100 from 17 reviews, indicating "generally favorable reviews".[4]

The A.V. Club gave the film a B rating.[5]

Awards and nominations

[edit]Home media

[edit]The DVD was released on June 12, 2012.[18]

See also

[edit]Notes

[edit]- ^ Also for Cinema Verite, Mildred Pierce and The Sunset Limited.

References

[edit]- ^ "Too Big to Fail". Complete Season DVDs. Archived from the original on March 5, 2016. Retrieved June 28, 2012.

- ^ "Too Big to Fail: Cast & Crew". HBO Movies. HBO. Retrieved January 31, 2012.

- ^ "Too Big to Fail (2011)". Rotten Tomatoes. Fandango Media. Retrieved June 25, 2018.

- ^ "Too Big To Fail Reviews". Metacritic. CBS Interactive. June 25, 2018.

- ^ Tobias, Scott (May 23, 2011). "Too Big To Fail". The A.V. Club. The Onion. Retrieved June 25, 2018.

- ^ "2011 Artios Awards". www.castingsociety.com. Retrieved September 26, 2011.

- ^ "2011 HPA Awards". Hollywood Professional Association. Retrieved September 8, 2022.

- ^ "15th Annual TV Awards (2010-11)". Online Film & Television Association. Retrieved May 15, 2021.

- ^ "Too Big to Fail". Emmys.com. Academy of Television Arts & Sciences. Retrieved July 13, 2017.

- ^ "2011 Satellite Awards". Satellite Awards. International Press Academy. Retrieved July 10, 2021.

- ^ "The Television Critics Association Announces 2011 TCA Awards Nominees". Television Critics Association. June 13, 2011. Archived from the original on February 13, 2014. Retrieved June 15, 2013.

- ^ "Nominees/Winners". Art Directors Guild. Retrieved July 29, 2018.

- ^ "'Hanna,' 'Hugo' and 'Moneyball' Nominated for Cinema Audio Society Awards". The Hollywood Reporter. January 19, 2012. Retrieved May 9, 2019.

- ^ "Too Big to Fail – Golden Globes". HFPA. Retrieved July 5, 2021.

- ^ Kilday, Gregg (January 21, 2012). "Producers Guild Awards Name 'The Artist' Motion Picture of Year; 'Boardwalk Empire' Scores TV Drama (Winners List)". The Hollywood Reporter. Retrieved February 9, 2018.

- ^ "The 18th Annual Screen Actors Guild Awards". Screen Actors Guild Awards. Retrieved May 21, 2016.

- ^ "Previous Nominees & Winners: 2012 Awards Winners". Writers Guild Awards. Archived from the original on May 12, 2015. Retrieved May 7, 2014.

- ^ "Too Big to Fail". Complete Season DVDs. Archived from the original on March 5, 2016. Retrieved June 28, 2012.

External links

[edit]- 2011 films

- 2011 biographical drama films

- 2010s American films

- 2010s business films

- 2010s English-language films

- 2010s political drama films

- American biographical drama films

- American business films

- American drama television films

- American political drama films

- Biographical films about businesspeople

- Biographical films about politicians

- Biographical television films

- Cultural depictions of businesspeople

- Cultural depictions of politicians

- Cultural depictions of American people

- Films about financial crises

- Films based on non-fiction books

- Films directed by Curtis Hanson

- Films scored by Marcelo Zarvos

- Films set in 2008

- Films set in the Great Recession

- Films shot in New York City

- Films with screenplays by Peter Gould

- HBO Films films

- Television films based on books

- Wall Street films

- English-language biographical drama films