Federal Reserve: Difference between revisions

| [pending revision] | [pending revision] |

| Line 328: | Line 328: | ||

* [[Karl Steinhauser]] claims that the Federal Reserve System prints Federal Reserve Notes and "lends" them to the government of United States at high interest rates, that this is the sole purpose and function of the Federal Reserve, and that the Federal Reserve does not produce any products or provide any services in exchange for charging interest. He describes this as a theft from "honest and hard working laborers". He claims that the total amount of interest so collected from 1913 to 1964 totalled $310 billion.<ref>Karl Steinhauser: EU - huomispäivän super-Neuvostoliitto, ISBN 951-97105-0-7</ref> |

* [[Karl Steinhauser]] claims that the Federal Reserve System prints Federal Reserve Notes and "lends" them to the government of United States at high interest rates, that this is the sole purpose and function of the Federal Reserve, and that the Federal Reserve does not produce any products or provide any services in exchange for charging interest. He describes this as a theft from "honest and hard working laborers". He claims that the total amount of interest so collected from 1913 to 1964 totalled $310 billion.<ref>Karl Steinhauser: EU - huomispäivän super-Neuvostoliitto, ISBN 951-97105-0-7</ref> |

||

* ''[[ |

* ''[[American Zeitgeist]]'' is a 2007 movie, part III of which includes the argument that the Federal Reserve is a privately held company that exists only to benefit individuals and from this leads to the suffering of the majority.[http://www.zeitgeistmovie.com] |

||

==Other prominent banking institutions== |

==Other prominent banking institutions== |

||

Revision as of 21:38, 4 August 2007

This article needs additional citations for verification. (June 2007) |

The Federal Reserve System Eccles Building (Headquarters) | |

| Headquarters | Washington, DC, USA |

|---|---|

| Chairman | Ben Bernanke |

| Central bank of | United States |

| Currency | US dollar USD (ISO 4217) |

| Bank rate | 5.25% |

| Interest on reserves | 5.25% |

| Website | federalreserve.gov |

The Federal Reserve System (also the Federal Reserve; informally The Fed) is the central banking system of the United States.

The Federal Reserve System is a quasi-governmental/quasi-private banking system composed of (1) the presidentially-appointed Board of Governors of the Federal Reserve System in Washington, D.C.; (2) the Federal Open Market Committee; (3) 12 regional Federal Reserve Banks located in major cities throughout the nation acting as fiscal agents for the U.S. Treasury, each with their own nine-member board of directors; (4) numerous private U.S. member banks, which subscribe to required amounts of non-transferable stock in their regional Federal Reserve Bank; and (5) various advisory councils.

Currently, Ben Bernanke serves as the Chairman of the Board of Governors of the Federal Reserve System.

History

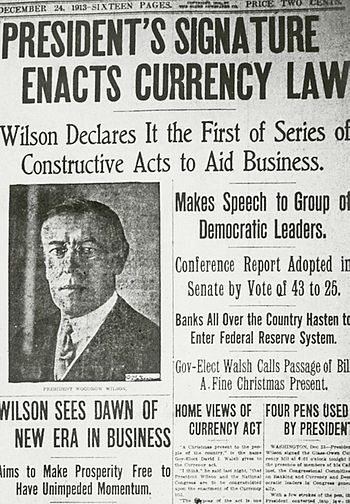

From 1862 to 1913, a system of national banks was instituted by the 1863 National Banking Act. A series of retractions of loans and refusal to renew old ones created bank "panics," in 1873, 1893, and 1907. This provided the backdrop for the renewed calls for the creation of a centralized banking system,[1] although the notion of a central bank was unpopular with the people due to fears of giving a central authority power over the monetary system.[2]

After the Bank panic of 1907, Congress created the National Monetary Commission to draft a plan for reform of the banking system. Senate Republican leader and financial expert Nelson Aldrich was the head of the Commission. Aldrich set up two commissions — one would study the American monetary system in-depth and the other, headed by Senator Aldrich himself, would study the European central banking systems and report on them.[2] Aldrich went to Europe opposed to centralized banking, but after viewing Germany's banking system, he came away with the idea that a centralized bank was better than a government-issued bond system that he had previously supported. Centralized banking was met with much opposition from politicians, who were suspicious of a central bank, and who charged that Aldrich was biased due to his close ties to wealthy bankers such as JP Morgan and his daughter's marriage to John D. Rockefeller, Jr. In 1910, Aldrich and executives representing the banks of J.P. Morgan, Rockefeller, and Kuhn, Loeb, & Co., secluded themselves for 10 days at Jekyll Island, Georgia.[2] The executives included Frank Vanderlip, president of the National City Bank of New York, associated with the Rockefellers, Henry Davison, senior partner of J. P Morgan Company, Charles D. Norton, president of the First National Bank of New York and Col. Edward House, who would later become President Woodrow Wilson's closest adviser and founder of the Council on Foreign Relations.[3] There, Paul Warburg of Kuhn, Loeb, & Co. directed the proceedings and wrote the primary features of the Federal Reserve Act. Warburg would later write "The matter of a uniform discount rate (interest rate) was discussed and settled at Jekyll Island." Aldrich fought for a private bank which was to have little government influence, but conceded that the government should be represented on the Board of Directors. Aldrich then presented his plan, which called for the establishment of a bank called the "National Reserve Association," to the National Monetary Commission.[2] Most Republicans and Wall Street bankers favored the Aldrich Plan,[3] but it lacked enough support in the bipartisan Congress to pass.[4]

Because the bill was introduced by Aldrich, who was considered to be the epitome of the "Eastern establishment," the bill received little support and was derided by southerners and westerners who believed that wealthy families and large corporations ran the country and would thus run the proposed National Reserve Association under the Aldrich Plan.[4] Rural bankers also opposed the plan, believing that too much power would be held by their eastern counterparts.[4] Progressive Democrats instead favored a reserve system owned and operated by the government and out of control of the "money trust," ending Wall Street's control of American currency supply.[3] Conservative Democrats fought for a privately owned, yet decentralized, reserve system, which would still be out of control of Wall Street.[3] The National Board of Trade appointed Warburg as head of a committee to convince Americans to support the plan; they set up offices in the then-45 states and distributed printed materials about the central bank.[2] The Nebraskan populist and frequent Democratic presidential candidate William Jennings Bryan said of the plan, "Big financiers are back of the Aldrich currency scheme." He asserted that if it passed, big bankers would "then be in complete control of everything through the control of our National finances."[5] At the same time, the Senate Banking Committee held the Pujo hearings, which convinced the populace that America's money rested in the hands of a select few on Wall Street when they issued a report saying:

"If by a 'money trust' is meant an established and well-defined identity and community of interest between a few leaders of finance . . . which has resulted in a vast and growing concentration of control of money and credit in the hands of a comparatively few men . . . the condition thus described exists in this country today."[5]

It took the political influence of newly elected Democratic President Woodrow Wilson, along with a Democratic majority in both houses of Congress, to get the Aldrich Plan passed as the Federal Reserve Act in 1913.[4] Wilson thought the plan was "60-70% correct".[2] The passed plan was closer to the Aldrich Plan than the two Democratic plans.[3] Frank Vanderlip, one of the Jekyll Island attendees and the President of National City Bank, wrote in his autobiography:

"Although the Aldrich Federal Reserve Plan was defeated when it bore the name Aldrich, nevertheless its essential points were all contained in the plan that was finally adopted."[3]

This point was also made by Congressman Charles Lindbergh Sr., the most vocal opponent of the bill, who on the day before the Federal Reserve Act was passed told Congress:

"This is the Aldrich bill in disguise...The worst legislative crime of the ages is perpetrated by this banking bill...The banks have been granted the special privilege of distributing the money, and they charge as much as they wish....This is the strangest, most dangerous advantage ever placed in the hands of a special privilege class by any Government that ever existed. The system is private...There should be no legal tender other than that issued by the government...The People are the Government. Therefore the Government should, as the Constitution provides, regulate the value of money." (Congressional Record, 12/22/1913)

When Glass first presented his bill to President-elect Wilson, Wilson said that the plan must be amended to contain a Board of Governors appointed by the executive branch to maintain control over the bankers.[5]

Wilson was strongly influenced by the populist William Jennings Bryan, who was credited with ensuring Wilson's nomination by dramatically throwing his support Wilson's way at the Democratic convention.[5] Wilson appointed Bryan as his Secretary of State.[4] Bryan served as leader of the agrarian wing of the party and had argued for unlimited coinage of silver in his "Cross of Gold Speech" at the 1896 Democratic convention.[6] Bryan and the agrarians wanted a government-owned central bank which could print paper money whenever Congress wanted and thought the plan gave the bankers too much power over printing of the government's currency. Wilson sought the advice of prominent lawyer Louis Brandeis to make the plan more amenable to the agrarian wing of the party; Brandeis agreed with Bryan's points. Wilson convinced them that because Federal Reserve notes were obligations of the government and because the government would maintain control over the central Federal Reserve Board, the plan fit their demands.[5]

Southerners and westerners learned from Wilson that the system was decentralized into 12 districts and surely would weaken New York and strengthen the hinterlands. Senator Robert Owen of Oklahoma eventually relented to speak in favor of the bill, arguing that the nation's currency in its current state was too controlled in the hands of the New York wealthy, whom he alleged had singlehandedly conspired to cause the 1907 Panic.[3]

While a system of 12 regional banks was designated so as not to give Eastern bankers too much influence over the new bank, in practice, the Federal Reserve Bank of New York became "first among equals". The New York Fed, for example, is solely responsible for conducting open market operations, at the direction of the Federal Open Market Committee.[7] Democratic Congressman Carter Glass sponsored and wrote the eventual legislation,[4] and his home of Richmond, Virginia, was made a district headquarters. Democratic Senator James A. Reed of Missouri obtained two districts for his state.[8] To quell Elihu Root's objections to possible inflation, the passed bill included provisions that the bank must hold at least 40% of its outstanding loans in gold. (In later years, to prevent depressions and stimulate short-term economic activity, Congress would amend the act to allow more discretion in the amount of gold that must be redeemed by the Bank.)[3] While critics of the time (later joined by economist Milton Friedman) suggested Glass' legislation was almost entirely based on the Aldrich Plan which had been so derided as concentrating too much power in the hands of powerful bankers, Glass said that the notion that his plan copied Aldrich's was untrue. In 1922, he told Congress, "no greater misconception was ever projected in this Senate Chamber."[6] Large bankers thought the legislation gave the government too much control over markets and private business dealings, with the New York Times calling the Act the "Oklahoma idea, the Nebraska idea"-- referring to Owen and Bryan's involvement.[5] After Wilson presented the bill to Congress, a group of Democratic congressmen revolted in protest, led by Representative Robert Henry of Texas, demanding that the "Money Trust" be destroyed before a major reform of the government's currency was undertaken. They particularly objected to the regional banks being run privately, objecting to private banks being run under government protection. The group was almost successful in killing the bill, but were mollified by Wilson's promises to propose antitrust legislation after the bill had passed and by Bryan's support of the bill.[5]

Congress passed the Federal Reserve Act in late 1913 (see below) on a mostly partisan basis, with most Democrats in support and most Republicans against it.[5] Wilson named Warburg and other prominent experts to direct the new system, which began operations in 1915 and played a major role in financing the Allied and American war efforts.[9] Warburg at first refused the appointment, citing America's opposition to a "Wall Street man," but when World War I broke out, he accepted Wilson's offer. He was the only appointee asked to appear before the Senate, where members of Congress questioned him about his interests in the central bank and his ties to Kuhn, Loeb, & Co.'s "money trusts".[2]

In July 1979, Paul Volcker was nominated, by President Carter, as Chairman of the Federal Reserve Board amid roaring inflation; by tightening the money supply, inflation fell dramatically by 1986.[10] In October 1979 the Federal Reserve announced a policy of "targeting" money aggregates and bank reserves in its struggle with double-digit inflation. [11]

In January 1987, with C.P.I. inflation down to only 1%, the Federal Reserve announced it was no longer going to use money supply aggregates, such as M2, as guidelines to control inflation, even though this method had been in use from 1979, apparently with great success. Previous to 1980, interest rates were used as guidelines; inflation was heavy. The Fed complained that the aggregates were confusing; Volcker was still chairman until August 1987, whereupon Alan Greenspan assumed the mantle, seven months after monetary aggregate policy had changed. [12]

Legal status and position in government

| Public finance |

|---|

|

The Federal Reserve System was created via the Federal Reserve Act of December 23rd, 1913.[13] The Reserve Banks opened for business on November 16th, 1914. Federal Reserve Notes were created as part of the legislation, to provide a supply of currency. The notes were to be issued to the Reserve Banks for subsequent transmittal to banking institutions. The various components of the Federal Reserve System have differing legal statuses.

The Board of Governors of the Federal Reserve System is an independent federal government agency.[14] The Board of Governors does not receive funding from Congress, and the terms of the seven members of the Board span multiple presidential and congressional terms. Once a member of the Board of Governors is appointed by the president, he or she functions mostly independently. The Board is required to make an annual report of operations to the Speaker of the U.S. House of Representatives.[15] The law provides for the removal of a member of the Board by the President "for cause."[16] The Board of Governors is responsible for the formulation of monetary policy. It also supervises and regulates the operations of the Federal Reserve Banks, and US banking system in general.

The Federal Reserve Banks have an intermediate status, with some features of private corporations and some features of public federal agencies (see below). Each member bank owns nonnegotiable shares of stock in its regional Federal Reserve Bank—but these shares of stock give the member banks only limited control over the actions of the Federal Reserve Banks, and the charter of each Federal Reserve Bank is established by law and cannot be altered by the member banks. In Lewis v. United States,[17] the United States Court of Appeals for the Ninth Circuit stated that "the Reserve Banks are not federal instrumentalities for purposes of the FTCA [the Federal Tort Claims Act], but are independent, privately owned and locally controlled corporations." The opinion also stated that "the Reserve Banks have properly been held to be federal instrumentalities for some purposes." Another decision is Scott v. Federal Reserve Bank of Kansas City[18] in which the distinction between the Federal Reserve Banks and the Board of Governors is made.

The member banks are privately owned corporations. The stocks of many of the member banks (or their holding companies) are publicly traded.

Organization

The basic structure of the Federal Reserve System includes:

- The Federal Reserve Board of Governors

- The Federal Reserve Banks

- The member banks.

Each Federal Reserve Bank and each member bank of the Federal Reserve System is subject to oversight by a Board of Governors.[19] The seven members of the board are appointed by the President and confirmed by the Senate.[20] Members are selected to terms of 14 years (unless removed by the President), with the ability to serve for no more than one term. However, if someone is appointed to serve the remainder of an uncompleted term of another member, they may be reappointed to serve one additional 14 year term.[16] A governor may serve the remainder of another governor's term in addition to his or her own full term.

The current members of the Board of Governors are:

- Ben Bernanke, Chairman

- Donald Kohn, Vice-Chairman

- Frederic Mishkin

- Kevin Warsh

- Randall Kroszner

(*Because appointments of members are staggered there are only five members currently on the board.)

The Federal Open Market Committee (FOMC) created under 12 U.S.C. § 263 comprises the 7 members of the board of governors and 5 representatives selected from the Federal Reserve Banks. The representative from the 2nd District, New York, (currently Timothy Geithner) is a permanent member, while the rest of the banks rotate on two and three year intervals.

Control of the money supply

The Federal Reserve System controls the size of the money supply by conducting open market operations, in which the Federal Reserve lends or purchases specific types of securities with authorized participants, known as primary dealers, such as the United States Treasury. All open market operations in the United States are conducted by the Open Market Desk at the Federal Reserve Bank of New York, with an aim to making the federal funds rate as close to the target rate as possible.[citation needed] For a detailed look at the process by which changes to a reserve account held at the Fed affect the wider monetary supply of the economy, see money creation.

The Open Market Desk has two main tools to adjust monetary supply: repurchase agreements and outright transactions.

Repurchase agreements

To smooth temporary or cyclical changes in the monetary supply, the desk engages in repurchase agreements (repos) with its primary dealers. Repos are essentially secured, short-term lending by the Fed. On the day of the transaction, the Fed deposits money in a primary dealer’s reserve account, and receives the promised securities as collateral. When the transaction matures, the process unwinds: the Fed returns the collateral and charges the primary dealer’s reserve account for the principal and accrued interest. The term of the repo (the time between settlement and maturity) can vary from 1 day (called an overnight repo) to 65 days, though the Fed will most commonly conduct overnight and 14-day repos.[citation needed]

Since there is an increase of bank reserves during the term of the repo, repos temporarily increase the money supply. The effect is temporary since all repo transactions unwind, with the only lasting net effect being a slight depletion of reserves caused by the accrued interest (think one day of interest at a 4.5% annual yield, which is 0.0121% per day). The Fed has conducted repos almost daily in 2004-05, but can also conduct reverse repos to temporarily shrink the money supply.[citation needed]

In a reverse repo, the Fed will borrow money from the reserve accounts of primary dealers in exchange for Treasury securities as collateral. At maturity, the Fed will return the money to the reserve accounts with the accrued interest, and collect the collateral.[citation needed]

Outright Transactions

The other main tool available to the Open Market Desk is the outright transaction. In an outright purchase, the Fed buys Treasury securities from primary dealers, such as the United States Treasury, and finances the purchases by depositing newly created money in the dealer’s reserve account at the Fed. Since this operation does not unwind at the end of a set period, the resulting growth in the monetary supply is permanent. That is to say that the principal growth is permanent but a yield on maturity of the security is still charged this is usually at 12 - 18 months on outright transaction.[citation needed]

The Fed also has the authority to sell Treasuries outright, but this has been exceedingly rare since the 1980s. The sale of Treasury securities results in a permanent decrease in the money supply, as the money used as payment for the securities from the primary dealers is removed from their reserve accounts, thus working the money multiplier (see Money creation) process in reverse.[citation needed]

On Outright Transactions the Desk selects bids with the highest prices (lowest yields) for its sales, and offers with the lowest prices (highest yields) for its purchases.[citation needed]

Implementation of monetary policy

Buying and selling federal government securities.

When the Federal Reserve System buys government securities, it puts money into circulation. With more money around, interest rates tend to drop, and more money is borrowed and spent. When the Fed sells government securities, it in effect takes money out of circulation, causing interest rates to rise and making borrowing more difficult.[citation needed]

Regulating the amount of money that a member bank must keep in hand as reserves.

A member bank lends out most of the money deposited with it. If the Federal Reserve System says that a member bank must keep in reserve a larger fraction of its deposits, then the amount that the member bank can lend drops, loans become harder to obtain, and interest rates rise.[citation needed]

Changing the interest charged to banks that want to borrow money from the federal reserve system.

Member banks borrow from the Federal Reserve System to cover short-term needs. The interest that the Fed charges for this is called the discount rate; this will have an effect, though usually rather small, on how much money the member banks will borrow.[citation needed]

Federal Reserve Balance Sheet

One of the keys to understanding the Federal Reserve is the Federal Reserve Balance Sheet (or Balance Statement). In accordance with Section 11 of the Federal Reserve Act, the Board of Governors of the Federal Reserve System publishes once each week the "Consolidated Statement of Condition of All Federal Reserve Banks" showing the condition of each Federal Reserve bank and a consolidated statement for all Federal Reserve banks.

Below is the balance sheet as of June 21, 2007 (in millions of dollars):

|

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Analyzing the Federal Reserve's Balance Sheet reveals many interesting things:

- The Fed has over 11 billion in gold which is a holdover from the days the government used to back US Notes Notes and Federal Reserve Notes with gold

- The Fed holds almost a billion in coinage not as a liability but as an asset. The Treasury Department is actually in charge of creating coins and US Notes. The Fed then buys coinage from the Treasury by increasing the liability assigned to the Treasury's account

- The Fed holds 790 billion in US debt which means part of the national debt is held privately by the Federal Reserve.

- The Fed has about 21 billion in assets from Overnight Repurchase agreements. Repos are the primary asset of choice for the Fed in dealing in the Open Market. Repo assets are bought by creating 'Depository institution' liabilities and directed to the bank the Primary Dealer uses when they sell into the Open Market.

- The 976 billion in Federal Reserve Note liabilities represents the total value of all dollars bills in existence

- The 16 billion in deposit liabilities of 'Depository institutions' shows that dollar bills are not the only source of government money thus destroying the myth that government creates money by minting it. Banks can swap 'Deposit Liabilities' of the Fed for 'Federal Reserve Notes' back and forth as needed to match demand from customers, and the Fed can have the 'Bureau of Engraving and Printing' create the paper bills as needed to match demand from banks for paper money. The amount of money printed has no relation to the growth of the monetary base (M0).

- The 6 billion in Treasury liabilities shows that the Treasury Department's doesn't use a private banker but rather uses the Fed directly (the lone exception to this rule is Treasury Tax and Loan because government worries that pulling too much money out of the private banking system during tax time could be disruptive).

- The 96 million Foreign liability represents the amount of Federal Reserve deposits held by foreign central banks.

- The 6 billion in 'Other liabilities and accrued dividends' represents partly the amount of money owed so far in the year to private banks as part of the 6% dividend guarantee the Fed grants banks for not loaning out a percentage of their reserves

- Total capital represents the profit the Fed has earned which comes mostly from the assets they purchase with the deposit and note liabilities they create. Excess capital is then turned over to the Treasury Department and Congress to be included into the Federal Budget as "Miscellaneous Revenue".

Discount rates

The Federal Reserve System implements monetary policy largely by targeting the federal funds rate. This is the rate that banks charge each other for overnight loans of federal funds, which are the reserves held by banks at the Fed. This rate is actually determined by the market and is not explicitly mandated by the Fed. The Fed therefore tries to align the effective federal funds rate with the targeted rate by adding or subtracting from the money supply through open market operations. The late economist Milton Friedman consistently criticized this reverse method of controlling inflation by seeking an ideal interest rate and enforcing it through affecting the money supply since nowhere in the widely accepted money supply equation are interest rates found.[21]

The Federal Reserve System also directly sets the discount rate, which is the interest rate that banks pay the Fed to borrow directly from it. However, banks usually prefer borrowing fed funds from other banks, even at a higher interest rate, rather than directly from the Fed, because that might suggest problems with the bank's credit-worthiness or solvency.[citation needed]

Both of these rates influence the prime rate which is usually about 3 percentage points higher than the federal funds rate. The prime rate is the rate at which most banks price their loans for their best customers.[citation needed]

Lower interest rates stimulate economic activity by lowering the cost of borrowing, making it easier for consumers and businesses to buy and build. Higher interest rates slow the economy by increasing the cost of borrowing.[citation needed] (See monetary policy for a fuller explanation.)

The Federal Reserve System usually adjusts the federal funds rate by 0.25% or 0.50% at a time. From early 2001 to mid 2003 the Federal Reserve lowered its interest rates 13 times, from 6.25 to 1.00%, to fight recession. In November 2002, rates were cut to 1.75, and many interest rates went below the inflation rate. (This is known as a negative real interest rate, because money paid back from a loan with an interest rate less than inflation has lower purchasing power than it had before the loan.) On June 25, 2003, the federal funds rate was lowered to 1.00%, its lowest nominal rate since July, 1958, when the overnight rate averaged 0.68%. Starting at the end of June, 2004, the Federal Reserve System raised the target interest rate and then continued to do so 17 straight times. The rate is 5.25% as of August 8, 2006; the Fed elected to keep the rate steady on its August 8 meeting after seventeen straight 0.25% increases. Rates also remained unchanged after the September 20, 2006 and October 25, 2006 FOMC meetings. In July 2007 the rate was still at 5.25%.[citation needed]

The Federal Reserve System might also attempt to use open market operations to change long-term interest rates, but its "buying power" on the market is significantly smaller than that of private institutions. The Fed can also attempt to "jawbone" the markets into moving towards the Fed's desired rates, but this is not always effective.[citation needed]

The Federal Reserve Banks and the member banks

The 12 regional Federal Reserve Banks (not to be confused with the "member banks"), which were established by Congress as the operating arms of the nation's central banking system, are organized much like private corporations—possibly leading to some confusion about “ownership.” For example, the Reserve Banks issue shares of stock to "member banks." However, owning Reserve Bank stock is quite different from owning stock in a private company. The Reserve Banks are not operated for profit, and ownership of a certain amount of stock by a "member bank" is, by law, a condition of membership in the system. The stock may not be sold or traded or pledged as security for a loan; dividends are, by law, limited to 6% per year.[22] The largest of the Reserve Banks, in terms of assets, is the Federal Reserve Bank of New York, which is responsible for the Second District covering the state of New York, the New York City region, 12 northern New Jersey counties, Puerto Rico, and the U.S. Virgin Islands.[23]

The dividends paid by the Federal Reserve Banks to member banks are considered partial compensation for the lack of interest paid on member banks' required reserves held at the Federal Reserve Banks. By law, banks in the United States must maintain fractional reserves, most of which are kept on account at the Fed. The Federal Reserve does not pay interest on these funds.[citation needed]

The basic structure of the Federal Reserve System includes:

- The Board of Governors

- The Federal Open Market Committee

- The Federal Reserve Banks

- The member banks.

Each Federal Reserve Bank and each member bank of the Federal Reserve System is subject to oversight by the Board of Governors (see generally 12 U.S.C. § 248). The seven members of the board are appointed by the President and confirmed by the Senate.[20] Members are selected to terms of 14 years (unless removed by the President), with the ability to serve for no more than one term.[16] A governor may serve the remainder of another governor's term in addition to his or her own full term.

The Federal Reserve Banks

The Federal Reserve Districts are listed below along with their identifying letter and number. These are used on Federal Reserve Notes to identify the issuing bank for each note.

| Federal Reserve Bank | Letter | Number | Website |

|---|---|---|---|

| Boston | A | 1 | http://www.bos.frb.org/ |

| New York | B | 2 | http://www.newyorkfed.org/ |

| Philadelphia | C | 3 | http://www.philadelphiafed.org/ |

| Cleveland | D | 4 | http://www.clevelandfed.org/ |

| Richmond | E | 5 | http://www.richmondfed.org/ |

| Atlanta | F | 6 | http://www.frbatlanta.org/ |

| Chicago | G | 7 | http://www.chicagofed.org/ |

| St Louis | H | 8 | http://www.stlouisfed.org/ |

| Minneapolis | I | 9 | http://www.minneapolisfed.org/ |

| Kansas City | J | 10 | http://www.kansascityfed.org/ |

| Dallas | K | 11 | http://www.dallasfed.org/ |

| San Francisco | L | 12 | http://www.frbsf.org/ |

The member banks

National banks are required to be member banks in the Federal Reserve System. Federal statute provides (in part):

- Every national bank in any State shall, upon commencing business or within ninety days after admission into the Union of the State in which it is located, become a member bank of the Federal Reserve System by subscribing and paying for stock in the Federal Reserve bank of its district in accordance with the provisions of this chapter and shall thereupon be an insured bank under the Federal Deposit Insurance Act [. . . .]"[24]

Other banks may elect to become member banks. According to the Federal Reserve Bank of Boston:

- Any state-chartered bank (mutual or stock-formed) may become a member of the Federal Reserve System. The twelve regional Reserve Banks supervise state member banks as part of the Federal Reserve System’s mandate to assure strength and stability in the nation’s domestic markets and banking system. Reserve Bank supervision is carried out in partnership with the state regulators, assuring a consistent and unified regulatory environment. Regional and community banking organizations constitute the largest number of banking organizations supervised by the Federal Reserve System.[25]

For example, as of October 2006 the member banks in New Hampshire included Community Guaranty Savings Bank; The Lancaster National Bank; The Pemigewasset National Bank of Plymouth; and other banks.[26] In California, member banks (as of September 2006) included Bank of America California, National Association; The Bank of New York Trust Company, National Association; Barclays Global Investors, National Association; and many other banks.[27]

Regulation of fractional reserve

The Fed regulates banks' fractional reserves—the portion of their deposits that banks must keep, on hand or at the Fed, as reserves to satisfy any demands for withdrawal. This directly affects the banks' ability to make loans, since loans cannot be made out of reserves. The United States' rules and oversight are within limits and guidelines set by the Bank for International Settlements, a banking agency which pre-dates the Bretton Woods financial and monetary system and its institutions.

Criticisms

A large and varied group of criticisms have been directed against the Federal Reserve System. One critique, typified by the Austrian School, is that the Federal Reserve is an unnecessary and counterproductive interference in the economy.[28] Other critiques include arguments in favor of the gold standard (usually coupled with the belief that the Federal Reserve System is unconstitutional)[29] or beliefs that the centralized banking system is doomed to fail.[28] Some critics argue that the Fed lacks accountability and transparency or that there is a culture of secrecy within the Reserve.[30]

Historical criticisms

Criticisms of the Federal Reserve System are not new, and some historical criticisms are reflective of current concerns.

At one end of the spectrum are economists from the Austrian School and the Chicago School who want the Federal Reserve System abolished.[31] They criticize the Federal Reserve System’s expansionary monetary policy in the 1920s, arguing that the policy allowed misallocations of capital resources and supported a massive stock price bubble. They also cite politically motivated expansions or tightening of currency in the 1970s and 1980s.[31]

Milton Friedman, leader of the Chicago School, argued that the Federal Reserve System did not cause the Great Depression, but made it worse by contracting the money supply at the very moment that markets needed liquidity. Since its entire existence was predicated on its mission to prevent events like the Great Depression, it had failed in what the 1913 bill tried to enact.[32] This is also the current conventional wisdom on the matter, as both Ben Bernanke and other economists such as the late John Kenneth Galbraith--the latter being an ardent Keynesian--have upheld this reasoning. Friedman also said that ideally he would "prefer to abolish the federal reserve system altogether" rather than try to reform it, because it was a flawed system in the first place.[33] He later said he would like to "abolish the Federal Reserve and replace it with a computer."[34]

Ben Bernanke, the current Chairman of the Board of Governors, apparently agrees with Friedman's assessment, saying in a 2002 speech: "I would like to say to Milton [Friedman] and Anna [J. Schwartz]: Regarding the Great Depression. You're right, we did it. We're very sorry. But thanks to you, we won't do it again."[35] [36]

Friedman also alleged that the Fed caused the high inflation of the 1970s. When asked about the greatest economic problem of the day, he said the most pressing was how to get rid of the Federal Reserve.[32]

Common among the criticisms of the federal reserve system is the history of the falling value of the dollar, in spite of claims that the system is in place to protect the dollar's purchasing power.[citation needed] These criticisms cite the fact that relative to its value in 1913, the dollar today is worth only four cents.[37]

Opacity

Some believe the Federal Reserve System is shrouded in what its critics call excessive secrecy. Meetings of some components of the Fed are held behind closed doors, and the transcripts are released with a lag of five years.[38] Even expert policy analysts are unsure as to the logic behind Fed decisions.[39] Critics argue that such opacity leads to greater market volatility, as the markets must guess, often with only limited information, about how the Fed is likely to change policy in the future. The jargon-laden fence-sitting opaque style of Fed communication, especially under the previous Fed Chairman Alan Greenspan, has often been called "Fed speak."[39]

It has also been known to be standoffish in its relations with the media in an effort to maintain its carefully crafted image and resents any public information that runs contrary to this notion. For example, Maria Bartiromo reported on CNBC that during a conversation at the White House Correspondents’ Dinner in April 2006, Fed Chairman Ben Bernanke stated investors had misinterpreted his recent congressional remarks as an indication the Fed was nearly done raising rates. This triggered a drop in stock prices just as the market was about to close.[40][41][42]

Furthermore, the lag in the release of FOMC transcripts, as well as the extremely limited and carefully worded minutes and statement, leads to the public being unaware of the issues of major concern to the Fed, and leaves it with an inadequate understanding of the logic and rationale behind the decisions. Some argue that this is a concerted attempt to keep Congress and the public at arm’s length. The Fed did not help this public attitude with their prior actions-- they did not release transcripts of meetings until 1994. Before that time, they refused to give transcripts out on requests, even under the Freedom of Information Act. When a judge ordered the transcripts released in the 1970s, the Fed said they had stopped taking transcripts at all. In 1993, Rep. Henry Gonzalez confirmed that the Fed did have tapes and transcripts of the meetings and could have complied with the FOIA requests, but had misrepresented the existence of the transcripts and chosen to ignore questions from Congress.[43] After the existence of the transcripts was revealed, the Fed agreed to release the transcripts on a five-year time lag. However, they have extended the time period, for example not releasing 1992's transcripts until 1998.[43]

The Fed exacerbated this idea when it decided to stop publishing the M3 aggregate of financial data, which details the total amount of money in circulation at a time. The Fed said that economists did not need M3 when they had M2. However, a staff writer from the Connecticut Journal-Inquirer disagreed and saw no reason (according to his own views) to stop posting the numbers other than to keep the amount of America's debt or a pending stock market crash or worsening economy hidden.[44]

Business cycles, libertarian philosophy and free markets

Economists of the Austrian School such as Ludwig von Mises contend that the Federal Reserve's artificial manipulation of the money supply leads to the boom/bust business cycle that has occurred over the last century. Many economic libertarians, such as Austrian School economist Murray Rothbard, believe that the Federal Reserve's manipulation of the money supply to stop "gold flight" from England caused, or was instrumental in causing, the Great Depression. In general, laissez-faire advocates of free banking argue that there is no better judge of the proper interest rate and money supply than the market.[45]

Many libertarians also contend that the Federal Reserve Act is unconstitutional. Congressman Ron Paul, for example, argues that: "The United States Constitution grants to Congress the authority to coin money and regulate the value of the currency. The Constitution does not give Congress the authority to delegate control over monetary policy to a central bank. Furthermore, the Constitution certainly does not empower the federal government to erode the American standard of living via an inflationary monetary policy."[46]

Other

Congressman Louis T. McFadden, Chairman of the House Committee on Banking and Currency from 1920–31, accused the Federal Reserve of deliberately causing the Great Depression. In several speeches made shortly after he lost the chairmanship of the committee, McFadden claimed that the Federal Reserve was run by Wall Street banks and their affiliated European banking houses.[citation needed]

Allegations of conspiracies and secret agendas

Various groups and individuals make claims that one or more large scale conspiracies operate to conceal the true nature of the Federal Reserve System from the public:

- In his book, The Creature from Jekyll Island: A Second Look at the Federal Reserve, author G. Edward Griffin argues that "the Federal Reserve Bank" was organized in secret by a conspiracy of financiers.

- Masters of the Universe: The Secret Birth of the Federal Reserve is a 1999 documentary featuring authors Michael Collins Piper, William Gill, and Eustace Mullins, all of whom contend that "The Fed" is illegal and is the source of America's multi-trillion dollar national debt.

- The Money Masters is an economic-historic documentary DVD that goes into the historical background for banking, the history and multiple attempts at creating central banks throughout the north-atlantic communities of Europe and the United States.

- America: Freedom to Fascism is a 2006 motion picture produced and directed by Aaron Russo, who contends that the Federal Reserve is actually controlled by private banks, who use it to create money, which they lend it to the US government at interest, that the United States national debt consists solely of obligations to pay this interest, and that the federal income tax is illegally enforced to pay off those obligations.

- Karl Steinhauser claims that the Federal Reserve System prints Federal Reserve Notes and "lends" them to the government of United States at high interest rates, that this is the sole purpose and function of the Federal Reserve, and that the Federal Reserve does not produce any products or provide any services in exchange for charging interest. He describes this as a theft from "honest and hard working laborers". He claims that the total amount of interest so collected from 1913 to 1964 totalled $310 billion.[47]

- American Zeitgeist is a 2007 movie, part III of which includes the argument that the Federal Reserve is a privately held company that exists only to benefit individuals and from this leads to the suffering of the majority.[11]

Other prominent banking institutions

- Bank of International Settlements

- International Monetary Fund

- Reserve Bank of Australia

- Bank of Canada

- Bank of England

- Banque de France

- European Central Bank

- Deutsche Bundesbank

- Bank of Japan

- National Bank of Poland

- State Bank of Pakistan

- Reserve Bank of India

- People's Bank of China

- Bank of Scotland

- Central Bank of the Republic of Turkey

See also

- Austrian Theory of the Business Cycle

- Cash-out

- Core inflation

- Discount window

- Economic reports

- European Central Bank

- Executive Order 11110

- Federal Funds

- Fort Knox Bullion Depository

- Free banking

- Gold standard

- Government debt

- Inflation

- Money market

- Money supply

- Repurchase agreement

- United States dollar

- Federal Reserve Statistical Release

- Federal Reserve Act

Notes

- ^ Herrick, Myron (1908-03). "The Panic of 1907 and Some of Its Lessons". Annals of the American Academy of Political and Social Science.

{{cite web}}: Check date values in:|date=(help) - ^ a b c d e f g Whithouse, Michael (1989-05). "Paul Warburg's Crusade to Establish a Central Bank in the United States". Minnesota Federal Reserve.

{{cite web}}: Check date values in:|date=(help) - ^ a b c d e f g h "America's Unknown Enemy: Beyond Conspiracy". American Institute of Economic Research.

- ^ a b c d e f "Born of a panic: Forming the Federal Reserve System". Minnesota Federal Reserve. 1988-08.

{{cite web}}: Check date values in:|date=(help) - ^ a b c d e f g h Johnson, Roger (1999-12). "Historical Beginnings… The Federal Reserve" (PDF). Federal Reserve Bank of Boston.

{{cite web}}: Check date values in:|date=(help) - ^ a b Page, Dave (1997-12). "Carter Glass: A Brief Biography". Minnesota Federal Reserve.

{{cite web}}: Check date values in:|date=(help) - ^ Keleher, Robert (1997-03). "The Importance of the Federal Reserve". Joint Economic Committee. US House of Representatives.

{{cite web}}: Check date values in:|date=(help) - ^ A Foregone Conclusion: The Founding of the Federal Reserve Bank of St. Louis by James Neal Primm - stlouisfed.org - Retrieved January 1, 2007

- ^ Arthur Link, Wilson: The New Freedom; pp. 199-240 (1956).

- ^ Bartlett, Bruce (2004-06-14). "Warriors Against Inflation". National Review.

{{cite web}}: Italic or bold markup not allowed in:|publisher=(help) - ^ Source: A Monetary Chronology of the United States, American Institute for Economic Research, July 2006

- ^ A Monetary Chronology of the United States, American Institute for Economic Research, July 2006

- ^ Act of December 23, 1913, ch. 6, 38 Stat. 251, codified in part at Chapter 3 of title 12 of the United States Code, 12 U.S.C. § 221 et seq.

- ^ http://www.ca8.uscourts.gov/opndir/05/04/042357P.pdf

- ^ 12 U.S.C. § 247.

- ^ a b c See 12 U.S.C. § 242.

- ^ 680 F.2d 1239 (9th Cir. 1982).

- ^ Kennedy C. Scott v. Federal Reserve Bank of Kansas City, et al.

- ^ See generally 12 U.S.C. § 248.

- ^ a b See 12 U.S.C. § 241.

- ^ [1]

- ^ [2]

- ^ "Federal Reserve Bank of New York". New York Times.

{{cite web}}: Italic or bold markup not allowed in:|publisher=(help) - ^ 12 U.S.C. § 222.

- ^ [3]

- ^ [4]

- ^ [5]

- ^ a b North, Gary (2007-05-30). "My Recommended Federal Reserve Policy". Lew Rockwell.

- ^ Paul, Ron (2002-06-10). "Gold, Dollars, and Federal Reserve Mischief". US House of Representatives representative homepage.

- ^ Rockwell, Llewelynn (1996-05). "Ending the Fed's Free Ride". Mises Institute.

{{cite web}}: Check date values in:|date=(help) - ^ a b "MONEY RULES: The Role of the Federal Reserve date=2002-01-09". Hoover Institution.

{{cite web}}: Missing pipe in:|title=(help) - ^ a b "Interview with Milton Friedman". Minneapolis Federal Reserve. 1992-06.

{{cite web}}: Check date values in:|date=(help) - ^ Friedman and Freedom, Interview with Peter Jaworski. The Journal, Queen's University, March 15, 2002 - Issue 37, Volume 129

- ^ "Greenspan voices concerns about quality of economic statistics". Stanford News Service. 1997-09-09.

- ^ [6]

- ^ [7]

- ^ http://www.capitalism.net/articles/dollars.htm

- ^ Poole, William (2002-07). "Untold story of FOMC: Secrecy is exaggerated". St. Louis Federal Reserve.

{{cite web}}: Check date values in:|date=(help) - ^ a b Andrews, Edmund (2005-11-01). "News Analysis: Fed in a fishbowl? An era of secrecy seems over". New York Times. International Herald Tribune.

- ^ [8]

- ^ [9]

- ^ [10]

- ^ a b "Inner City Press' Federal Reserve Reporter". Inner City Press. 1999-05-17.

- ^ Levy, Harlan (2005-12-01). "Federal Reserve money supply report is about to fall into the abyss". Connecticut Journal-Inquirer.

- ^ "Three National Treasures author=Llewelyn Rockwell". Lew Rockwell. 1986.

{{cite web}}: Missing pipe in:|title=(help) - ^ Paul, Ron (2002-09-10). "Abolish the Federal Reserve". US House of Representatives representative homepage.

- ^ Karl Steinhauser: EU - huomispäivän super-Neuvostoliitto, ISBN 951-97105-0-7

Bibliography

Recent

- Epstein, Lita & Martin, Preston (2003). The Complete Idiot's Guide to the Federal Reserve. Alpha Books. ISBN 0-02-864323-2.

- Greider, William (1987). Secrets of the Temple. Simon & Schuster. ISBN 0-671-67556-7; nontechnical book explaining the structures, functions, and history of the Federal Reserve, focusing specifically on the tenure of Paul Volcker

- R. W. Hafer. The Federal Reserve System: An Encyclopedia. Greenwood Press, 2005. 451 pp, 280 entries; ISBN 4-313-32839-0.

- Meyer, Lawrence H (2004). A Term at the Fed: An Insider's View. HarperBusiness. ISBN 0-06-054270-5; focuses on the period from 1996 to 2002, emphasizing Alan Greenspan's chairmanship during the Asian financial crisis, the stock market boom and the financial aftermath of the September 11, 2001 attacks.

- Woodward, Bob. Maestro: Greenspan's Fed and the American Boom (2000) study of Greenspan in 1990s.

Historical

- J. Lawrence Broz; The International Origins of the Federal Reserve System Cornell University Press. 1997.

- Vincent P. Carosso, "The Wall Street Trust from Pujo through Medina," Business History Review (1973) 47:421-37

- Chandler, Lester V. American Monetary Policy, 1928-41. (1971).

- Epstein, Gerald and Thomas Ferguson. "Monetary Policy, Loan Liquidation and Industrial Conflict: Federal Reserve System Open Market Operations in 1932." Journal of Economic History 44 (December 1984): 957-84. in JSTOR

- Milton Friedman and Anna Jacobson Schwartz, A Monetary History of the United States, 1867-1960 (1963)

- G. Edward Griffin, The Creature from Jekyll Island: A Second Look at the Federal Reserve (1994) ISBN 0-912986-21-2; Says Fed was created by a conspiracy of bankers; his other books charge Franklin Roosevelt intentionally brought about Pearl Harbor.

- Paul J. Kubik, "Federal Reserve Policy during the Great Depression: The Impact of Interwar Attitudes regarding Consumption and Consumer Credit." Journal of Economic Issues . Volume: 30. Issue: 3. Publication Year: 1996. pp 829+.

- Link, Arthur. Wilson: The New Freedom (1956) pp 199-240. Explains how Woodrow Wilson managed to pass the legislation.

- Livingston, James. Origins of the Federal Reserve System: Money, Class, and Corporate Capitalism, 1890-1913 (1986), Marxist approach to 1913 policy

- Mayhew, Anne. "Ideology and the Great Depression: Monetary History Rewritten." Journal of Economic Issues 17 (June 1983): 353-60.

- Meltzer, Allan H. A History of the Federal Reserve, Volume 1: 1913-1951 (2004) the standard scholarly history

- Roberts, Priscilla. "'Quis Custodiet Ipsos Custodes?' The Federal Reserve System's Founding Fathers and Allied Finances in the First World War," Business History Review (1998) 72: 585-603

- Rothbard, Murray N. A History of Money and Banking in the United States: The Colonial Era to World War II (2002) libertarian who wants no Fed

- Rothbard, Murray N. (1994). The Case Against the Fed. Ludwig Von Mises Institute. ISBN 0-945466-17-X. libertarian who wants no Fed

- Bernard Shull, "The Fourth Branch: The Federal Reserve's Unlikely Rise to Power and Influence" (2005) ISBN 1-56720-624-7

- Steindl, Frank G. Monetary Interpretations of the Great Depression. (1995).

- Temin, Peter. Did Monetary Forces Cause the Great Depression? (1976).

- West, Robert Craig. Banking Reform and the Federal Reserve, 1863-1923 (1977)

- Wicker, Elmus R. "A Reconsideration of Federal Reserve Policy during the 1920-1921 Depression," Journal of Economic History (1966) 26: 223-238, in JSTOR

- Wicker, Elmus. Federal Reserve Monetary Policy, 1917-33. (1966).

- Wells, Donald R. The Federal Reserve System: A History (2004)

- Wicker, Elmus. The Great Debate on Banking Reform: Nelson Aldrich and the Origins of the Fed Ohio State University Press, 2005.

- Wood, John H. A History of Central Banking in Great Britain and the United States (2005)

- Wueschner; Silvano A. Charting Twentieth-Century Monetary Policy: Herbert Hoover and Benjamin Strong, 1917-1927 Greenwood Press. (1999)

- Mullins, Eustace C. "Secrets of the Federal Reserve," 1952. John McLaughlin. ISBN 0-9656492-1-0

External links

Official Federal Reserve websites and information

- Board of Governors of the Federal Reserve — Official website

- "The Federal Reserve System in Brief." — at the Federal Reserve Bank of San Francisco.

- Federal Reserve System Meeting Notices and Rule Changes from The Federal Register RSS Feed

Other websites describing the Federal Reserve

- "How 'The Fed' Works" — at HowStuffWorks.com

Sites making various allegations against the Federal Reserve

- "America: Freedom to Fascism" — Aaron Russo's web site, promoting his film, America: Freedom to Fascism.

- "America: From Freedom to Fascism" (video) — Online video of the film.

- Sites providing text of Eustace Mullins' "Secrets of the Federal Reserve":

- "Secrets of the Federal Reserve" — Text of the work, plus other videos and links.

- Secrets of the Federal Reserve by Eustace Mullins

- Ludwig von Mises Institute:

- "The Founding of The Federal Reserve" (video)

- "Money, Banking and the Federal Reserve" (video) — According to the Mises Institute, this video shows "what the [Federal Reserve] does to the economy . . . how and why it was founded . . . [and explains] the sound money and banking that could end the statism, inflation, and business cycles that the Fed generates."