Zimbabwean dollar

| |

| ISO 4217 | |

|---|---|

| Code | ZWL (numeric: 932) |

| Subunit | 0.01 |

| Unit | |

| Symbol | $ |

| Denominations | |

| Subunit | |

| 1/100 | cent |

| Banknotes | $1, $5, $10, $20, $50, $100, $500 |

| Coins | none |

| Demographics | |

| User(s) | None (previously |

| Issuance | |

| Central bank | Reserve Bank of Zimbabwe |

| Website | www.rbz.co.zw |

| Valuation | |

| Inflation | 231 000 000% (official, July 08) 89.7 × 1021% (HHIZ, 14 Nov 08) 6.5 × 10108% (Forbes Asia, 22 Dec 08) |

| Source | [1] |

The Zimbabwean dollar ($, or Z$ to distinguish it from other dollar-denominated currencies) was the official currency of Zimbabwe between 1980 and 12 April 2009.

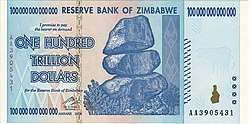

Although the dollar was considered to be among the highest valued currency units when it was first introduced in 1980 to replace the Rhodesian dollar at a ratio of 1:1, political turmoil and hyperinflation rapidly eroded the value of the Zimbabwe dollar to eventually become one of the least valued currency units in the world, undergoing three redenominations, and banknote denominations being issued for as high as $100 trillion.[2]

Despite attempts to control inflation by legislation and three separate redenominations in 2006, 2008 and 2009, the use of the dollar as an official currency was effectively abandoned on 12 April 2009 as a result of the Reserve Bank of Zimbabwe legalising the use of foreign currencies for transactions in January 2009.[3]

Currently, foreign currencies such as the South African Rand, Botswana Pula, Pound Sterling and the United States Dollar are widely used instead for nearly all transactions in Zimbabwe, and the current government of Zimbabwe has insisted that the Zimbabwean dollar should only be reintroduced if the industrial output improves.[4]

History

The Zimbabwean dollar's predecessor, the Rhodesian dollar was essentially equal to half of a pound sterling when it was adopted during the decimalisation of 1970, the same practice which was used in other Commonwealth countries such as South Africa, Australia, and New Zealand. The selection of the name was motivated by the fact that the reduced value of the new unit correlated more closely to the value of the US dollar than it did to the pound sterling.

Introduction of the first dollar

The first Zimbabwean dollar was introduced in 1980 and replaced the Rhodesian dollar at par. The initial ISO 4217 code was ZWD. At the time of its introduction, the Zimbabwean dollar was worth more than the U.S. dollar, with ZWD 1 = USD 1.47. However, the currency's value eroded rapidly over the years. On 26 July 2006, the parallel market value of the Zimbabwean dollar fell to one hundred to the British pound.[5]

Introduction of the second dollar

In October 2005, the head of the Reserve Bank of Zimbabwe, Dr. Gideon Gono, announced that "Zimbabwe will have a new currency next year." New banknotes and coins were to replace the then current Zimbabwean dollar. Gono did not provide a name for this new currency. In June 2006, Deputy Finance Minister David Chapfika stated that Zimbabwe had to achieve macroeconomic stability (i.e., double digit inflation) before any new currency was introduced.

The dollar was redenominated on 1 August 2006 at the rate of 1 revalued dollar = 1000 old dollars. The new dollar was subdivided into 100 cents, although cents were not used in practice. Together with the redenomination, the government devalued the dollar by 60% against the US dollar (see exchange rate history table below), from 101,000 old dollars (101 revalued) to 250 revalued dollars. ISO originally assigned a new currency code of ZWN to this redenominated currency, but the Reserve Bank of Zimbabwe could not deal with a currency change. Therefore the currency code remained 'ZWD'.[6] The revaluation campaign, which Gideon Gono named "Operation Sunrise" was completed on 21 August 2006. It was estimated that some ten trillion old Zimbabwe dollars (22% of the money supply) were not redeemed during this period.[7]

On 12 December 2006, Dr. Gono hinted in a memorandum to banks and other financial institutions that he would lay out the next phase of his monetary reforms dubbed Project Sunrise Two when he announced the monetary policy review statement in January 2007. It was not possible to get immediate confirmation from Gono's office whether the memorandum was advice to banks that he would be launching the new currency in January. But the chief executive officer of one of the country's largest banks said industry players had understood the governor's memo to mean new money would be introduced next month.[8] A possible name appeared to be "ivhu", which means "soil" in Shona.[9]

The following year, on 2 February 2007, the RBZ revealed that a new (third) dollar would be released soon and gave some details of the new banknotes (see below). However, with inflation at the time still in the four digits, the banknotes remained in storage. During the same month, the Reserve Bank of Zimbabwe declared inflation illegal, outlawing any raise in prices on certain commodities between 1 March and 30 June 2007. Officials arrested executives of some Zimbabwean companies for increasing prices on their products. Economists generally suspect that such measures are ineffective at eliminating the problem in the long term.[10][11]

Economist Eddie Cross reported on 15 June 2007 that "There is talk that the Reserve Bank will cut another three zeros off our currency next week and this would mean that one Zimbabwe dollar would now equal one million of the old dollars. Chaos reigns in commerce and industry and those in the public sector are frantic."[12]

The Zimbabwe dollar was again devalued on 6 September 2007, this time by 92%,[13] to give an official exchange rate of ZW$30,000 to US$1, although the black market exchange rate was estimated to be ZW$600,000 to US$1.[14]

Meanwhile the WM/Reuters company introduced a notional exchange rate (ISO ZWN) which more accurately reflected black market exchange rates. Since there was a shortage of foreign exchange in the country the official rate was nearly impossible to obtain. The method of calculation was based on Purchasing Power Parity utilizing the dual listing of companies on the Harare (ZH) and London Stock exchanges (LN).[citation needed]

Introduction of the third dollar

Reserve bank governor Gideon Gono announced on 30 July 2008 that the Zimbabwean dollar would be redenominated.[15] Effective August 1, 2008, ZW$10 billion would be worth ZW$1; the new currency code was ZWR.[15] The planned denominations to be issued are coins valued Z$5, Z$10 and Z$25 and banknotes worth Z$5, Z$10, Z$20, Z$100 and Z$500.[16] While the German firm of Giesecke & Devrient was no longer printing Zimbabwean currency, The Daily Telegraph reported that the new currency was printed before the relationship was severed and had been kept in storage since then.[17]

Due to frequent cash shortages and the worthless Zimbabwean dollar, foreign currency was effectively legalised as a de facto currency on 13 September 2008 via a special program to officially license a number of retailers to accept foreign money.[18] This reflected the reality of the dollarization of the economy, with many shop keepers refusing to accept Zimbabwe dollars and requesting U.S. dollars or South African rand instead.[19][20] Despite redenomination, the RBZ was forced to print banknotes of ever higher values to keep up with surging inflation, with ten zeros reappearing by the end of 2008 (see below).

Introduction of the fourth dollar

On February 2, 2009, the RBZ announced that a further 12 zeros were to be taken off the currency, with 1,000,000,000,000 (third) Zimbabwe dollars being exchanged for 1 new (fourth) dollar.[21] New banknotes were introduced with a face value of Z$1, Z$5, Z$10, Z$20, Z$50, Z$100 and Z$500.[22] The banknotes of the fourth dollar circulated alongside the third dollar, which had to remain legal tender until 30 June 2009.[23] The new currency code was ZWL.[24]

The Zimbabwean dollar had become largely irrelevant, with the economy being almost completely dollarized.[25] Even the national postal service, Zimpost, was said to be charging customers postage in US Dollars, even though some of the stamps were in Zimbabwean Dollar denomination.

Zimbabwe finance minister, Tendai Biti, said in his first budget report, "The death of the Zimbabwe dollar is a reality we have to live with. Since October 2008 our national currency has become moribund."[26]

In late January 2009, acting Finance Minister Patrick Chinamasa announced that all Zimbabweans would be allowed to conduct business in any currency as a response to the hyperinflation crisis.[27]

On April 12, 2009, media outlets reported that economic planning minister Elton Mangoma had announced the suspension of the local currency "for at least a year", effectively terminating the fourth dollar.[3][28]

Inflation

Rampant inflation and the collapse of the economy have severely devalued the currency, with many organizations using the US dollar, the euro, the pound sterling, the South African rand, or the Botswana pula instead. Early in the 21st century, Zimbabwe started to experience hyperinflation. Inflation reached 623% in January 2004, then fell back to low triple digits in 2004 before surging to 1,281.1% in 2006.[29][30]

Inflation reached another record high of 3714% (year-on-year) in April 2007.[31] The monthly rate for April 2007 exceeded 100%, implying that inflation may soon exceed all forecasts, as 100% monthly inflation over sustained 12 months would produce annual inflation of over 400,000%. Mid-year inflation for 2007 has been breaching records as inflation for May 2007 was estimated at 4,530% (year-on-year).[32]

On 21 June 2007, the United States ambassador to Zimbabwe, Christopher Dell, told The Guardian newspaper that inflation could reach 1.5 million percent by the end of the year. The unofficial inflation rate at that time was above 11,000%, and the black-market exchange rate was Z$400,000 to the pound.[33]

On 13 July 2007, the Zimbabwean government said it had temporarily stopped publishing (official) inflation figures, a move that observers said was meant to draw attention away from "runaway inflation which has come to symbolise the country's unprecedented economic meltdown."[34]

On 27 July 2007, the Consumer Council of Zimbabwe (CCZ) said its recent calculations for the monthly expenditure for an urban family of six showed that inflation for the month of June was more than 13,000%. The Central Statistical Office (CSO), the official source of Consumer Price Index numbers, had not released its figures since February (2007) when it reported annual inflation at 1,729%.[35]

In September 2007, the Central Statistical Office announced an official inflation rate of 6,592.8% for August 2007.[36] Private estimates were as high as 20,000%.[37] In October 2007, they announced an official inflation rate of 7,892.1% for September 2007.[38] In November 2007, they announced an official inflation rate of 14,840.5% for October 2007.[39]

Hyperinflation

On 27 November 2007, the chief statistician of the Central Statistical Office, Moffat Nyoni, announced that it would be impossible to calculate the inflation rate of the dollar any further. This was due to the lack of availability of basic goods, and subsequent lack of information from which to calculate the inflation rate; plus, most computers had an insufficient number of digits and software. The International Monetary Fund has stated that inflation is predicted to rise to 100,000% per annum.[40]

On 14 February 2008, the Central Statistical Office announced that the inflation rate for December 2007 was 66,212.3%, and the unofficial exchange rate was Z$7.1 million to the US$1.[41]

On 20 February 2008, the Central Statistical Office said that officially, inflation has in January 2008 gone past the 100,000% mark to 100,580.2%.[42]

On 4 April 2008, the Financial Gazette (FinGaz) reported that officially, inflation in February 2008 jumped to 164,900.3%.[43]

On 15 May 2008, the Zimbabwe Independent reported that officially, inflation in March 2008 jumped to 355,000%.[44]

On 21 May 2008, SW Radio Africa reported that, according to an independent financial assessment inflation in May 2008 jumped to 1,063,572.6%. The state statistical service has said there are not enough goods in the shortage-stricken shops to calculate any new (official) figures.[45]

On 26 June 2008, the Zimbabwe Independent reported that, latest figures from the Central Statistical Offices (CSO) showed that annual inflation rose by 7,336,000 percentage points to 9,030,000% by June 20 and was set to end the month at well above 10,500,000%. [46]

The Sydney Morning Herald reported that inflation was likely to be 2 million percent in May 2008 and 10-15 million percent in June 2008, according to John Robertson, a respected Zimbabwean economist.[47] Robertson estimated inflation in July 2008 to be 40-50 million percent.[47] Inflation can only be estimated because of the impossibility of following the cost of individual goods.[47]

According to Central Statistical Office statistics, annual inflation rate rose to 231 million percent in July 2008. The month-on-month rate rose to 2,600.2%.[48] By December 2008, inflation was estimated at 6.5 quindecillion novemdecillion percent (65 followed by 107 zeros).[49]

As predicted by the textbook quantity theory of money, this hyperinflation has been caused primarily by the Reserve Bank of Zimbabwe's choice to mushroom the money supply.

Since February 2009, following a period of hyperinflation and widespread rejection of the devalued currency, companies and individuals are permitted to transact domestic business in other currencies, such as the US dollar or the South African rand. In consequence, the Zimbabwean economy has undergone dollarization[50] and the Zimbabwean dollar has fallen out of everyday use.[51]

Money supply (2006–2008)

On 16 February 2006, the governor of the Reserve Bank of Zimbabwe, Gideon Gono, announced that the government had printed ZW$20.5 trillion in order to buy foreign currency to pay off IMF arrears.[52] In early May 2006, Zimbabwe's government announced that they would produce another ZW$60 trillion.[53] The additional currency was required to finance the recent 300% salary increase for soldiers and policemen and 200% increase for other civil servants. The money was not budgeted for the current fiscal year, and the government did not say where it would come from. On 29 May, Reserve Bank officials told IRIN that plans to print about ZW$60 trillion (about US$592.9 million at official rates) were briefly delayed after the government failed to secure foreign currency to buy ink and special paper for printing money.

In late August 2006, it was reported that about ZW$10 trillion old dollars (22% of the money supply) had not been exchanged for revalued dollars. These bearer cheques were demonetised.

On 27 June 2007, it was announced that central bank governor Gideon Gono had been ordered by President Robert Mugabe to print an additional ZWD$1 trillion to cater for civil servants' and soldiers' salaries that were hiked by 600% and 900% respectively.[54]

On 28 July 2007, it was reported that Mugabe has said that Zimbabwe will go on printing money if there is not enough for underfunded municipal projects.[55]

On 30 August 2007, it was reported that an additional ZW$3 trillion had been printed to pay for 500,000 scotch carts and 800,000 ox-drawn ploughs plus an unspecified number of cattle.[56]

On 3 September 2007, it was reported that that the black market in Zimbabwe is once again booming despite price controls. People who previously were employed for US$11 (ZW$2 Million) a month are now able to turn as much as US$166 (ZW$30 Million) just through black market trading.[57]

On 24 November 2007, it was reported that money supply was now $58 trillion revalued Zimbabwean dollars (ZWD)[58] ($41 million US at parallel rates). However, Zimbabwe banks could only account for $1 to $2 trillion of those dollars, meaning that members of the public were holding $56 to $57 trillion in cash.

On 4 January 2008, it was reported that money supply had been increased by $33 trillion (to $100 trillion) [59] revalued Zimbabwean dollars (ZWD)[60] Further, the demonetization of the $200,000 bearer cheques was put on hold, thus increasing the money supply.

The planned issue of additional banknotes (denominations of ZWD 1, 5, and 10 Million) on 18 January 2008 will increase the money supply by an unknown amount.

On 21 January 2008, it was reported, by Gideon Gono, that the money supply had been increased to ZW$170 trillion since the middle of December. Further, Gono expected it to reach $800 trillion by 28 January 2008.[61]

On 1 March 2008, it was reported that documents obtained by The Sunday Times show the Munich company Giesecke & Devrient (G&D) was receiving more than €500,000 (£382,000) a week for delivering bank notes equivalent to $170 trillion a week.

The regime is surviving by printing money: at this stage there is no other way.

Martin Rupiya, professor (war and security studies), University of Zimbabwe.

According to a source at the Reserve Bank of Zimbabwe, G&D was delivering 432,000 sheets of banknotes every week to Fidelity printers in Harare, where they were stamped with the denomination. Each sheet contains 40 notes and the current production is entirely in Z$10M notes.[62] On 1 July 2008, Giesecke & Devrient responded to pressure from the German government by suspending production of bank notes for Zimbabwe.[63][64]

In the Guardian, on 18 July 2008, a report on Zimbabwe's inflation, said that an egg costs ZW$50 billion (GBP 0.17, USD 0.32), and it showed adverts for prizes of Z$100 trillion in a Zimbabwean derby and ZW$1.2 quadrillion ($1,200,000,000,000,000.00: approx. GBP 2,100; USD 4,200) in a lottery. It also showed a monthly war pension currently is ZW$109 billion (GBP 0.37, USD 0.74), shops can only cash cheques if the customer writes double the amount, because the cost will go up by the time the cheque has cleared, and people can only withdraw a maximum of ZW$100 billion from cashpoints.[65]

On 23 July 2008, an Austro-Hungarian company based in Vienna confirmed that it is providing the Reserve Bank of Zimbabwe with the licences and software required to design and print Zimbabwe currency.[66][67] The company, named Jura JSP, said it would consider ending its supply of licences and software if the European Union required it to do so.[66] Without the licences and software, the Reserve Bank of Zimbabwe may be unable to print notes in larger denominations than are already in circulation.[67]

On 24 July 2008, the Reserve Bank of Zimbabwe announced that "appropriate measures are being put in place to address the current setbacks being faced on the currency front, as well as on financial and accounting systems."[68] It promised that in "the next few days" it would institute changes to the minimum cash withdrawal limits and IT systems' constraints.[68] Currently, the government limits cash withdrawals to ZW$100 billion per day, which is less than the cost of a loaf of bread.[68] IT systems cannot handle such large numbers; the automated teller machines for one major bank give a "data overflow error" and freeze customers attempt to withdraw money with so many zeros.[69] That same day, the Institute of Commercial Management reported that ZW$1.2 trillion is worth the same as one British pound.[70]

From January to December 2008, the money supply growth rose from 81,143% to 658 billion percent.[71]

| Date | 2006 | 2007 | 2008 | ||||||

|---|---|---|---|---|---|---|---|---|---|

| July | August | September | November | December | 21 January | 28 January | March | June | |

| Money supply | 4.5×1013 ZWD | 4.5×1010 ZWN | 3.5×1010 ZWN | 5.8×1013 or 6.7×1013 ZWN[citation needed] |

1×1014 ZWN | 1.7×1014 ZWN | 8×1014 ZWN | 2.5×1016 ZWN | ≥ 9×1017 ZWN |

Abandonment

The use of foreign currencies were legalised in January 2009, causing general consumer prices to stabilise again after years of hyperinflation and price speculation.[50] The move led to a sharp drop in the usage of the Zimbabwean dollar, as hyperinflation rendered even the highest denominations worthless.

On 2 February 2009 the Zimbabwean dollar was redenominated once more, at the ratio of 1 000 000 000 000 (1012) ZWR to 1 ZWL. The third dollar was expected to be demonetised on 1 July 2009,[72] but the complete abandonment of local currency was hastened by the decline in overall consumer usage of local currency in favour of other currencies, helped by the legalization of the use of hard currencies in January 2009.

The dollar was effectively abandoned as an official currency on 12 April 2009 when the Economic Planning Minister Elton Mangoma confirmed the suspension of the national currency for at least a year, but exchange rates with the Zimbabwean dollar were maintained for up to a year afterwards. The current government of Zimbabwe insisted that the Zimbabwean currency should only be reintroduced if the industrial output was 60% or more of its capacity, compared to the April 2009 average of 20%.[73]

Coins

In 1980, coins were introduced in denominations of 1, 5, 10, 20, 50 cents and 1 dollar. The 1 cent coin was struck in bronze, with the others struck in cupro-nickel. In 1989, bronze-plated steel replaced bronze. A 2 dollar coin was introduced in 1997. In 2001, nickel-plated steel replaced cupro-nickel in the 10, 20 and 50 cents and 1 dollar, and a bimetallic 5 dollar coin was introduced.

Plans by the Reserve Bank of Zimbabwe, for new Z$5,000 and Z$10,000 coins were announced in June 2005.[74] However, the coins never appeared.

All old coins dating from the first dollar were reintroduced at face value to the third dollar in Aug 2008, effectively increasing their value 10 trillion-fold, and new $10 and $25 coins were introduced. These coins were minted in 2003 but only issued with the redenomination.[75]

Banknotes, traveller's cheques, and bearer cheques

This section may be too long to read and navigate comfortably. (January 2010) |

The banknotes of the Zimbabwean dollar were issued by the Reserve Bank of Zimbabwe from 1980 to 2009. Up to 2003 regular banknotes were issued but as hyperinflation developed from 2003, the Reserve Bank issued short-lived emergency travellers cheques, which were then quickly superseded by time-limited Bearer Cheques, in denominations ranging from $5 000 to $20 000 in 2003, then up to $100 000 dollars by early-2006.

On 1 August 2006, new Bearer cheques with thirteen denominations ranging from 1¢ to $100 000 were issued following the first redenomination of the dollar, superseding the regular banknotes by 21 August 2006 and until August 2008. Bearer cheques of 5,000 dollars (dated 1 February 2007) and 50,000 (dated 1 March 2007) were issued in March 2007, followed by cheques of 200,000 (dated 1 August 2007) in August 2007. Subsequently, Gideon Gono of the RBZ announced on 19 December 2007 that new bearer cheques (Z$250,000; Z$500,000; and Z$750,000) had been produced and would be released on 20 December. Additionally, the current high value bearer cheques (Z$200,000) would be demonetised as of 1 January 2008.[76] However, due to ongoing problems, plans to demonetise this note were put on hold at the end of December.

Since the Zimbabwean dollar was revalued in August 2006, there were repeated discussions and proposals regarding a further revaluation. As early as the beginning of 2007 it appeared that a revaluation was planned with new banknote designs being commissioned.[77] New plans were announced in October 2007[78] They were initially postponed until 2008 before, in November 2007, the revaluation was described as "imminent"[79] and would remove as many as four zeros from the currency and would be called Sunrise 2.[80][81] However, on 18 December 2007, it was reported that a further printing of the current Z$200,000 bearer cheques had been produced, seemingly instead of revaluing.[82] Further new issues of bearer cheques have since taken place.

At a press conference on 16 January 2008, reserve bank Governor Gono stated that "With effect from Friday (January 18), the Reserve Bank of Zimbabwe is releasing the following bearer cheques into circulation: one million dollars (officially worth about US$33/22 euros but worth about 50c at the parallel rate), five million dollars and 10 million dollars." He continued, "...daily cash withdrawals have been increased from the current Z$50 million to Z$500 million per individual." Less than a month after announcing a similar move, Gono said the new notes would provide much needed relief to consumers who often have to go shopping with sacks of cash.[83]

The Zim Independent and Zim Online reported on 4 April 2008 that 25 and 50 million dollar bearer cheques were issued on 4 April. The RBZ also increased the maximum withdrawal limit for individuals to $5 billion a day.[84][85][86] On 6 May, 100 million dollar and 250 million dollar bearer cheques were issued and the official exchange rate was floated to counter black market speculation.[87] 10 days later, the RBZ announced that 500 million dollar bearer cheques and special agro cheques in the amounts of 5, 25, and 50 billion dollars would be issued were to be issued on 20 May.

On 14 July 2008 Giesecke & Devrient ceased supplying bank note paper to Fidelity Printers & Refiners, the Zimbabwean government-owned company that printed Zimbabwean currency.[88] Virtually incessant use of the currency-printing presses have caused many of the machines to break down, and repair parts are no longer being shipped to Zimbabwe to repair the machines.[88] The Reserve Bank issued the $100 billion Agro Cheque on 21 July, which were printed prior to the suspension.[89][90]

On 30 July 2008 the RBZ announced a new currency, effective 1 August 2008, removing 10 zeros from the monetary value, by "a factor of 1 to 10".[91] Banknotes in the denominations of $1, $5, $10, $20, $100 and $500 were introduced and replaced bearer cheques and agro cheques by 31 December 2008.[92] However, the familiar cycle of printing ever higher denomination notes to keep up with inflation continued despite redenomination. A $1,000 banknote was introduced by the RBZ on 19 September 2008, and ten days later, as the unofficial exchange rate surpassed 270,000 ZWD to the US dollar, it issued new notes in the denominations of $10,000 and $20,000.[93] A $50,000 banknote was released on 13 October 2008, followed by $100,000, $500,000, and $1,000,000 denominations announced on 3 November.[94] The daily cash withdrawal limit was raised for individuals to Z$500,000 from Z$50,000 and for select companies it went up to $1 million.[95] Banknotes valued at $10 million, $50 million and $100 million were issued as the withdrawal limit was increased to $100 million per week on 4 December 2008.[96][97] Scarcely four days later, on 8 December, the RBZ issued a $200 million banknote,[98] and introduced a $500 million note on 12 December, worth approximately US$8 at the time.[99] In little over half a year, the billion denomination returned, with the RBZ issuing banknotes of $1 billion, $5 billion, and $10 billion on 19 December.[100]

Amid the continuing hyperinflation that rendered the currency virtually worthless, spurring the increasing dollarization of the economy, the RBZ issued another set of new notes in denominations of $20 billion and $50 billion to be released 12 January.[101] Stepping up another order of magnitude, the Reserve Bank introduced trillion-denominated notes for the first time, unveiling banknotes valued at $10 trillion, $20 trillion, $50 trillion, and $100 trillion on 16 January, which were supposed to help citizens still in formal employment to withdraw a full month's worth of salary by showing a corresponding payslip.[2] As even these notes became increasingly worthless, a media campaign was launched in South Africa using the notes as printing paper.[102]

On 2 February 2009 the dollar was revalued once more, this time in the ratio of 1:1012,[103] and new banknotes of the fourth dollar, with seven denominations from $1 to $500, were issued.[22] These banknotes circulated alongside the third dollar until the abandonment of the dollar on 12 April 2009.

Exchange rate history

This table shows a condensed history of the foreign exchange rate of the Zimbabwean Dollars to one US Dollar:

| First dollar | Second dollar | Third dollar | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

|

|

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

† Due to the December 2007 banknote shortage, funds transferred via Electronic Funds Transfer Systems (EFTS) bore a premium rate of about $4 million, while the cash transaction rate varied around $2 million.

‡ Exchange rate was 20,000,000 for large amounts.

The third dollar rates above are OMIR. The cash rate differs significantly to the above rates. The table below is the cash rate of the third dollar history:

| Month | ZWR per USD |

|---|---|

| Sept 2008 | 1 000 |

| Oct 2008 | 90 000 |

| Nov 2008 | 1 200 000 |

| Mid Dec 2008 | 60 000 000 |

| End Dec 2008 | 2 000 000 000 |

| Mid Jan 2009 | 1 000 000 000 000 |

| 2 Feb 2009 | 300 000 000 000 000 |

Devaluation of the first dollar

The first dollar devalued from 0.6788 R$ to 1 US$ in 1978 to roughly half a million per US$ in 2006, when the currency is revalued.

This table shows in more detail the historical value of one U.S. dollar in Zimbabwean dollars:

| Exchange rates of the first dollar (ZWD) | |||

|---|---|---|---|

| Date | Official Rate | Parallel Rate | Notes |

| 1978 | R$0.6788 (Apr) | n/a | R$ pegged to US$ |

| 1980 | R$0.68 (Mar) | n/a | R$ tied to basket of FRF, DEM, ZAR, CHF, GBP, USD |

| April 18, 1980 - Independence (1 Z$ = 1 R$) | |||

| 1982 | 0.8925 to 0.9140 (Dec) | - | ZWD devalued by 16.5% |

| 1983 | 0.96135 (Jan) | up to 3.18 (July) | ZWD devalued by 5% Parallel rate highly variable — premium up to 231% |

| 1983 (Aug) to 1993 (Dec) | 0.96135 - 6.82 | Flexible basket; dual rates; 20% tax on outgoing payments | |

| 1994 | 6.82 (Jan) | 8.36 (Oct) | Floating official rate (July 1) ; dual rates; ZWD devalued by 17% |

| 1995 | 8.26 (Jan) | 8.85 (Oct) | floating official rate; dual rates; rates unified 1998 (Dec) |

| 1996 | 9.13 (Jan) | 10.52 (Oct) | |

| 1997 | 10.50 (Jan) | 12.00 (Jan); 25.00 (Nov) | |

| 1998 | 18.00 (Jan) | 16.65 (Jun); 19.00 (Jul); 23.50 | |

| 1999 | 36.23 (Jan) | 38.30 (Sep) | On March 31, 1999, the Official Exchange Rate was pegged at ZWD 38 per USD; the parallel market had re-emerged by December 1999. |

| 2000 | 38 to 55 | 56 to 62 (Jul); 65 to 70 (Aug.) | In August 2000, the Official Exchange Rate was pegged at ZWD 50 , then ZWD 51 and finally at ZWD 55 per USD; parallel black market rates were at a large premium; in November, foreign exchange bureaus were closed. |

| 2001 | 55 | 70 (Jan); 80 (Feb); 100 (Mar); 120 (Apr); 140 (May); 160 (Jun); 250 (Jul); 300 (Aug); 400 (Sep); 300 (Oct); 320 (Nov); 340 (Dec) | In June, the official rate became a crawling peg rate. |

| 2002 | 55 | 380 (Jan) to 710 (Jun), 1400 (Jul) to 1740 (Oct) to 1400 (Dec) | In 2002 the parallel black market for foreign exchange mushroomed. |

| 2003 | 55 (Jan); 824 (Feb) | 1400 (Jan); 1450 (Feb); 2300 (May); 3000 (Jul); 6000 (Aug); 6400 (Oct); 6000 (Nov) | In February 2003, the Official Exchange Rate was re-pegged at ZWD 824 per US $ |

| 2004 | 824 (Jan 1); 4196 (Jan 12) to 5730 (Dec) | 5500 (Jan 1) to 6000 (Dec) | In January 2004, semiweekly (RBZ-controlled) currency auctions were set up to determine the official rate. |

| 2005 | 5,730 (January); 6,200 (March); 9,000 (May); 10,800 (July 18); 17,600 (July 25); 24,500 (August 25); 26,003 (September); 26,003 (October); 60,000 (Nov); 84,588 (Dec 30) | 6,400 (January); 14,000 (March); 20,000 (May); 25,000 (July 18); 45,000 (July 25); 45,000 (August 25); 75,000 (September); 80,000 to 100,000 (October); 90,000 (Nov); 96,000 (Dec 30) | August 24: Zimbabwean dollar becomes least valued currency unit |

| In November 2005, the regular currency auctions were discontinued and the RBZ announced that "market factors" would control the exchange rate. | |||

| 2006 (to July 31) | 85,158 (Jan 3); 99,201.58 (Jan 24); 101,195.54 (Apr 28) [104] | 100,000 (Jan 6); 106,050 (Jan 19); 115,000 (Jan 20); 125,000 to 150,000 (Jan 25); 175,000 to 190,000 (Feb 24); 205,000 to 220,000 (Mar 03); 220,000 to 230,000 (April 13); 300,000 to 310,000 (May 25); 315,000 (June 9); 340,000 to 350,000 (June 16); 400,000 (June 21); 450,000 (July 1); 520,000 (July 9);[105] 550,000 (July 27)[106] | Economists predict an unofficial rate of nearly ZWD 250,000 to the US dollar by mid-2006. |

| Jan 24 - RBZ caps daily variance of official exchange rate based on volume traded. The ZWD is able to fluctuate (from its average rate) in a daily band of: 0 % (under USD 5 million); 1 % (USD 5 to 10 million); 1.5 % (USD 10 to 15 million); or 2 % (exceeds USD 15 million). This effectively froze the official exchange rate. | |||

Devaluation of the second dollar

The second dollar started off on August 1, 2006 with an official rate of 250 and a parallel rate of 550 to the US$. In July 2008 the dollar was revalued again, this time 10,000,000,000 2nd dollars became 1 3rd dollar, after the parallel rate reached 500 billion to 1 US$.

More detailed data can be found in the table below :

| Exchange rates of the second dollar (ZWN) | ||||

|---|---|---|---|---|

| Date | Official Rate (Revalued dollar) |

Parallel Rate (Revalued dollar) |

Notes | |

| 2006 | August | 250 (250,000 old) | 550 (Aug 01); 650 (Aug 03); 650 to 700 (Aug 24) | August 1: RBZ revalues the Zim dollar. 1,000 Old Zim dollars become 1 revalued Zim dollar. The official exchange rate is set to 250 revalued Zim dollars per 1 US dollar. (Parallel rate soars to over 600 revalued dollars per 1 US dollar) |

| September |

700 to 800 (Sep 08 - high volume transactions);[107] 850 (Sep 14);[108] 1,200 to 1,300(Sep 28) or 1,500 (Sep 29 - high volume transactions)[109] | |||

| October |

1,500 (Oct 12);[110] | |||

| November |

1,700 (Nov 6);[111] 2,000 (Nov 19);[112] 2,400 (Nov 29);[113] | |||

| December |

3,000 (Dec. 25) [114] | |||

| 2007 | January | 250 |

3,200 (11th [115]); 3,500 (18th [116]); 4,000 (20th [117]); 4,200 (23rd [118]); 6,000 (26th [119]) | |

| February |

4,800 (2nd [120]); 5,000 (12th [121]); 6,600 (23rd [122]); 7,000 (27th [123]) | |||

| March |

7,500 (1st [124]) 8,000 (2nd [125]); 10,000 (8th [126]); 11,000 (11th [127]); 12,000 - 17,500 (16th [128]); 16,000 (19th [129]); 20,000 (21st [130]); 24,000 (22nd [131]); 25,000 (27th [132]); 26,000 (29th [133]) |

Zimbabwean dollar becomes least valued currency unit around March 21; In March, the parallel rate becomes extremely erratic, with reported rates varying significantly. | ||

| April | 250 (15,000 special rate) |

30,000 (1st [134]); 15,000 (7th [135]); 20,000 (8th [136]); 25,000 (11th [137]); 35,000 (15th [138]) |

A "special rate" of 15,000 ZWD per USD was brought in on 26 April 2007. The improved exchange rate will be applied to miners, farmers, tour operators, non-governmental organizations, embassies, Zimbabweans living abroad that repatriate earnings, and others who generate foreign exchange. Exporters will be required to exchange money at the central bank to receive the better rate.[139] | |

| May |

28,000 (10th [140]); 32,000 (18th [141]); 38,000 (20th [142]); 40,000 (22nd [143]); 45,000 (24th [144]); 50,000 (29th [145]) | |||

| June |

55,000 (3rd [146]); 60,000 (12th [147]); 75-100,000 (13th [148]); 120,000 (16th [149]); 205,000 (20th [150]); 300,000 (22nd [151]); 400,000 (23rd [152]) | |||

| July | ||||

| August |

200,000 (21st [155]) | |||

| September | 30,000 |

250,000 (7th [156]); 280,000 (14th [157]); 340,000 (18th [158]); 500,000 (26th [159]); 600,000 (29th [160]) |

Official exchange rate was changed to 30,000 on September 7, 2007 [156] | |

| October | ||||

| November |

1,200,000 (1st [163]); 4,500,000 (14th [164]) (not confirmed); 1,400,000 (24th [165]); 1,500,000 (30th [166]) | |||

| December | Due to the Dec 2007, banknote shortage, funds transferred via Electronic Funds Transfer Systems (EFTS) bore a premium rate of about $4 million, while the cash transaction rate varied around $2 million. | |||

| 2008 | January |

1,900,000 (3rd [169]); 2,000,000 (4th [170]); 3,000,000 (8th [171]); 4,500,000 (19th [172]); 5,000,000 (21st [172]); 6,000,000 (24th [173]) |

The Old Mutual Implied Rate (OMIR) is calculated by dividing the Zimbabwe Stock Exchange price of the Old Mutual share by the London Stock Exchange Price for the same share. The answer is the Old Mutual Implied Rate for the Pound. Then a cross rate calculation is done for the USD rate. | |

| February |

7,500,000 (13th [174]); 8,500,000 (18th [175]); 16,000,000 and 20,000,000 for large amounts (21st [175]) | |||

| March |

24,000,000 (2nd [176]); 25,000,000 (5th [177]); 46,000,000 (10th [178]); 70,000,000 (19th [179]) |

69,226,148.58 (OMIR for 17th) [180] | ||

| April |

80,000,000 (17th [181]); 85,000,000 (24th [182]); 100,000,000 (26th [183]) | |||

| May |

30,000 (to May 4); |

190,000,000 (1st [184]); 200,000,000 (6th [185]); 250,000,000 (13th [186]); 315,000,000 (16th [187]); 498,000,000 (22nd); 494,000,000 (23rd); 580,000,000 (28th); 703,000,000 (29th); 777,500,000 (30th) [8] |

The official exchange rate was allowed to float May 6 | |

| June |

647,863,191.18 (2nd); 718,489,852.94 (3rd); 843,884,558.82 (4th); 969,647,058.82 (5th); 1,105,887,222.22 (6th); 1,365,130,333.33 (9th); 1,679,946,944.44 (10th); 2,150,078,888.89 (11th); 2,904,111,111.11 (12th); 3,524,549,987.29 (13th); 4,276,736,111.11 (16th); 4,952,500,000.00 (17th); 5,817,192,485.76 (18th); 6,718,055,555.56 (19th); 7,437,184,423.78 (20th); 8,260,031,632.83 (23rd); 9,005,149,886.88 (24th); 9,801,839,921.51 (25th); 10,594,701,303.45 (26th); 11,378,472,550.24 (30th) [9] |

971,500,000 (1st); 1,123,000,000 (3rd); 1,221,500,000 (4th); 1,964,500,000 (5th); 2,159,000,000 (6th); 2,691,588,425 (7th); 3,139,382,641 (9th); 4,605,736,200 (10th); 5,090,337,736 (11th); 5,137,128,498 (12th); 6,412,613,315 (13th); 7,512,863,828 (16th); 9,288,500,000 (17th); 13,999,000,000 (18th); 17,743,015,150 (19th); 20,269,600,000 (21st); 22,952,543,340 (23rd); 22,835,153,651 (24th); 32,603,770,511 (26th); 40,928,000,000 (30th) [188] |

967,480,942 (OMIR for 2nd); 1,746,899,809 (OMIR for 3rd); 3,047,030,834 (OMIR for 4th); [10] 16,044,776,323 (OMIR for 19th); 17,039,490,724 (OMIR for 20th); 34,910,587,875 (OMIR for 23rd); 78,479,941,887 (OMIR for 24th); 62,024,868,786 (OMIR for 25th); 64,575,990,281 (OMIR for 26th); 164,312,344,622 (OMIR for 30th) [11] | |

| July |

12,226,034,516.65 (1st); |

53,049,500,000 (1st);[188] |

142,024,433,315 (OMIR for 1st); | |

Restoration of market data feeds

In the final months before Zimbabwe's central bank reforms of April 30, 2008, virtually all popular currency conversion resources relied upon the official rate of 30,000 ZWD to 1 USD for published figures, in spite of the vast differences between that and free market rates. By May 23, 2008, Bloomberg[190] and Oanda[191] began publishing floating rates based on Zimbabwe's formally regulated domestic bank market, while Yahoo Finance started using the updated official rate in July, albeit with a decimal point shift of 6 places. Those reported rates generally reflected the Official Rate as shown in the above table. They soon began to differ, in overvaluation of the Zimbabwean dollar, increasingly substantially in comparison to less regulated markets such as offshore markets or paper cash freely traded on the streets of Harare, reflected above as Parallel Rates.

Devaluation of the third dollar

On August 1, 2008, ten zeroes were removed from the currency, reducing 10 billion Zimbabwean dollars to one dollar.[192] On 3 October 2008, the Reserve Bank of Zimbabwe suspended temporarily the Real Time Gross Settlement (RTGS) system, halting electronic parallel market transfers,[193] but it was reinstated on November 13, 2008.[194]

After being introduced on August 1, 2008, the third dollar continued to devalue.

An overview of the exchange rate data can be found in the table below :

| Exchange rates of the third dollar (ZWR) | |||||

|---|---|---|---|---|---|

| Date | Official Rate (Source :[189] ) |

Parallel Rate (Sources: † [188] / ‡ [22]) |

Old Mutual Implied Rate (OMIR Source: [23]) |

Notes | |

| 2008 | August |

7.58 (1st) |

40.53 †; 51 ‡ (1st); |

49.23 (1st) |

August 1: The Reserve Bank revalued the dollar again: 10 billion ZWN (or 10 trillion ZWD) becomes 1 ZWR. See also: |

| September |

37.15 (1st) |

2,000 †; 2,498 ‡ (1st); |

3,362 (1st) |

||

| October |

138.14 (1st) |

790,510 ‡; 1,000,000 [197] (1st) |

1,418,021 (1st) |

Electronic bank transfers (RTGS) were suspended by the Reserve Bank on the 3rd. | |

| November |

769.68 (3rd) |

100,000 (cash) (5th) [205] |

12,405,270,255,015 (3rd am) |

The Reserve Bank lifted the suspension on the Real Time Gross Settlement System (RTGS) on 13 November [207]

As of 26 November newspaper reports stated the RTGS was still not operational, and part of the reason was that the Zimbabwean Government had not paid the company responsible for fitting the system.

[208]

| |

| December |

76,620.00 (1st) |

2,000,000 (cash)‡ (2nd) |

|||

| 2009 | January |

5,601,509 (2nd) |

40,000,000,000 (12th) [215] |

35,000,000,000,000,000 (1st) - UN Rate [222] |

|

| February |

12,336,416,667 (2nd) |

250,000,000,000,000 (1st) [223] |

|||

Devaluation of the fourth dollar

On 2 February 2009, the RBZ removed 12 zeros from the currency, with 1,000,000,000,000 (third) Zimbabwe dollars being exchanged for 1 new (fourth) dollar.[21] Although the dollar was later abandoned on the 12 April 2009, exchange rates were maintained at reasonable intervals for some time.

| Exchange rates of the fourth dollar (ZWL) | |||||

|---|---|---|---|---|---|

| Date | Official rate [24] | Parallel rate |

United Nations rate (Source :[222] ) |

Notes | |

| 2009 | February |

22.00 (3rd); 24.51 (4th) |

300 (2nd) [21] |

150,000 (3rd) |

|

| March |

99.67 (2nd); 103.29 (3rd) |

||||

| April |

221.29 (1st); 225.83 (2nd) |

12 April: Zimbabwe Dollar suspended. | |||

| May |

315.23 (4th); 319.13 (5th) |

||||

| June |

363.48 (16th) |

||||

| July |

371.39 (16th) |

||||

| August |

361.62 (28th) |

||||

| Current ZWR exchange rates | |

|---|---|

| From Google Finance: | AUD CAD CHF CNY EUR GBP HKD JPY USD |

| From Yahoo! Finance: | AUD CAD CHF CNY EUR GBP HKD JPY USD |

| From XE.com: | AUD CAD CHF CNY EUR GBP HKD JPY USD |

| From OANDA: | AUD CAD CHF CNY EUR GBP HKD JPY USD |

See also

- Hyperinflation in Zimbabwe

- Banknotes of Zimbabwe

- Least valued currency unit

- Economy of Zimbabwe

- Redenomination

- Hyperinflation

Notes

- ^ After the Zimbabwean dollar was suspended indefinitely from 12 April 2009, Euro, United States dollar, Pound sterling, South African rand and Botswana pula are used as legal tender. The United States dollar has been adopted as the official currency for all government transactions.

References (from external links)

- ^ "http://cato.org/zimbabwe [http://www.forbes.com/forbes/2008/1222/106.html Hanke S.H., "The Printing Press", Forbes Asia, 22 Dec 2008". BBC News. 2008-08-19. Retrieved 2010-01-07.

{{cite web}}: External link in|title= - ^ a b RBZ unveils $100 trillion note. The Herald. 16 January 2009.

- ^ a b 12 April 2009 (2009-04-12). "Zimbabwe Suspends Use of Own Currency | News | English". Voanews.com. Retrieved 2010-01-07.

{{cite web}}: CS1 maint: numeric names: authors list (link) - ^ "Zimbabwe dollar 'not back soon'". BBC News. 2009-04-12. Retrieved 2009-10-02.

- ^ Gumbo, Joseph. Bills Put Zimbabwe Under "Martial Law". Institute for War and Peace. The Zimbabwe Situation. 2006-07-27.

- ^ Currency reform Zimbabwe (pdf). Telekurs Financial. 2006-08-09.

- ^ Ndlela, Dumisani. 78% old currency returned: RBZ. Zimbabwe Independent. The Zimbabwe Situation. 2006-09-15.

- ^ Harare expected to unveil new currency next month. Zim Online. 2006-12-14.

- ^ Rusere, Patience. Some Expect New Currency From Zimbabwe Central Bank In 2007. Voice of America. 2006-12-14.

- ^ Wines, Michael. As Inflation Soars, Zimbabwe Economy Plunges. The New York Times. 2007-02-07.

- ^ Zimbabwe jail over bread prices. BBC News. 2006-12-01.

- ^ Eddie Cross. The Zimbabwe Situation. 2007-06-15.

- ^ "S&P's Sub-$10 Club, Lexmark's `Buy,' Zimbabwe's Dollar: Timshel". Bloomberg. 2007-09-07. Retrieved 2008-09-16.

- ^ Raath, Jan. Devaluation is 'too little, too late' to save Zimbabwe. Times Online. 2007-09-07.

- ^ a b Shaw, Angus. Zimbabwe devalues currency; 10B becomes 1 dollar. Associated Press. Google News. 2008-07-30. Retrieved 2008-07-30.

- ^ Mafaro, Wayne. Mugabe says might declare state of emergency over prices. ZimOnline. 2008-07-30. Retrieved 2008-07-30.

- ^ Berger, Sebastien; Thornycroft, Peta. Zimbabwe to cut ten zeros from banknotes in fight against inflation. The Daily Telegraph. 2008-07-30. Retrieved 2008-07-30.

- ^ [1] 2008-09-13

- ^ Zimbabwe shops stop accepting local currency. The Daily Telegraph. 27 October 2008.

- ^ Zimbabwe Turns To the Greenback. The Washington Post. 04 December 2008.

- ^ a b c d "Zimbabwe removes 12 zeros from currency — CNN.com". Edition.cnn.com. Retrieved 2010-01-07.

- ^ a b "Africa | Zimbabwe dollar sheds 12 zeros". BBC News. 2009-02-02. Retrieved 2010-01-07.

- ^ "Zimbabwe removes 13 zeroes from currency". Harare, Zimbabwe: CNN. 2 February 2009. Retrieved 2 February 2009.

- ^ "WM Company". WM Company. 2009-09-28. Retrieved 2010-01-07.

- ^ "The Leading Business Weekly Newspaper". The Zimbabwe Independent. 2009-12-17. Retrieved 2010-01-07.

- ^ "The Leading Business Weekly Newspaper". The Zimbabwe Independent. 2009-12-17. Retrieved 2010-01-07.

- ^ "Zimbabwe abandons its currency". BBC News. 2009-01-07. Retrieved 2010-08-24.

- ^ "Zimbabwe dollar shelved 'for at least a year'". Newzimbabwe.com. Retrieved 2010-01-07.

- ^ "Inflation hits a record high in Zimbabwe". Mail & Guardian Online. 2006-03-10. Retrieved 2008-08-27.

Inflation in Zimbabwe reached its previous peak in January 2004, hitting 624%.

- ^ "Zimbabwean inflation hits 1,281%". BBC News. 2007-01-10. Retrieved 2008-08-27.

- ^ Shaw, Angus. Inflation in Zimbabwe surges to record 3,714%, the highest in the world . Associated Press. The Zimbabwe Situation. 2007-05-17.

- ^ Zulu, Blessing. Zimbabwe Inflation Data Delayed Again; Estimate Points To 4,530%. Voice of America. The Zimbabwe Situation. 2007-06-12.

- ^ Meldrum, Andrew. US predicts regime change in Zimbabwe as hyperinflation destroys the economy. The Guardian. 2007-06-22.

- ^ Chizhanje, Hendricks. Harare suspends release of inflation data. Zimbabwe Online. The Zimbabwe Situation. 2007-07-14.

- ^ Nyakazeya, Paul. June inflation 13 000%: CCZ. The Zimbabwe Independent. The Zimbabwe Situation. 2007-07-27.

- ^ Banya, Nelson; Dzirutwe, MacDonald. Zimbabwe inflation slows amid warning of collapse. Reuters. The Zimbabwe Situation. 2007-09-18.

- ^ McGreal, Chris. Mugabe's price cuts bring cheap TVs today, new crisis tomorrow. The Guardian. 2007-07-16.

- ^ Zimbabwe inflation surges to 7,892%. Yahoo News. The Zimbabwe Situation. 2007-10-17.

- ^ Nyakazeya, Paul. $1m note on the way as cash crisis worsens. Zimbabwe Independent. The Zimbabwe Situation. 2007-10-16.

- ^ Zimbabwe inflation 'incalculable'. BBC News. 2007-11-27.

- ^ Zimbabwe inflation spirals again. BBC News. 2008-02-14.

- ^ Zimbabwe annual inflation over 100,000 per cent. Sydney Morning Herald. The Zimbabwe Situation. 2008-02-21.

- ^ Inflation surges to 165 000%. Financial Gazette. The Zimbabwe Situation. 2008-04-04.

- ^ Inflation Hits 355 000%. Zimbabwe Independent. The Zimbabwe Situation. 2008-05-15.

- ^ Inflation hits one million percent as prices continue to skyrocket. SW Radio Africa. The Zimbabwe Situation. 2008-05-21.

- ^ Inflation gallops ahead: 9000 000%. Zimbabwe Independent. The Zimbabwe Situation. 2008-06-26.

- ^ a b c McGreal, Chris. Zimbabwe's accelerating inflation rate reaches the millions. The Sydney Morning Herald. 2008-07-18. Retrieved 2008-07-22.

- ^ "Inflation soars to 231 million percent". Zimbabwesituation.com. Retrieved 2010-01-07.

- ^ The Printing Press by Steve Hanke. Forbes Magazine, December 22, 2008

- ^ a b "Africa | Zimbabwe abandons its currency". BBC News. 2009-01-29. Retrieved 2010-01-07.

- ^ Brulliard, Karin (February 21, 2009). "As Zimbabwean Dollar Dies, So Does a Lucrative Career". Washington Post. pp. A08. Retrieved 2009-02-21.

- ^ Meldurm, Andrew. Africa needs more courage, says Mugabe. The Guardian. 2006-02-21.

- ^ Zimbabwe Inflation Over 900 Percent. ParaPundit. 2006-05-04.

- ^ Zimbabwe: Gono ordered to print Z$1 Trillion for Civil servants and Army. Zimbabwe Daily News. The Zimbabwe Situation. 2007-06-28.

- ^ Mugabe says will print more money if there isn't enough. Associated Press. International Herald Tribune. The Zimbabwe Situation. 2007-07-28.

- ^ RBZ provides $3 trillion for vote buying. The Zimbabwean. The Zimbabwe Situation. 2007-08-30.

- ^ Dixon, Robyn. He can get it for you fast. Los Angeles Times. 2007-09-03.

- ^ Of cash and dealers. IRIN. The Zimbabwe Situation. 2007-11-24.

- ^ Cash crisis: No end in sight. The Financial Gazette. The Zimbabwe Situation. 2008-01-04.

- ^ Ndlela, Dumisani. ZANU-PF split looms. The Financial Gazette. The Zimbabwe Situation. 2008-01-04.

- ^ Zimbabwe central bank blames banks for banknote shortage. Reuters. The Zimbabwe Situation. 2008-01-22.

- ^ Lamb, Christina. Planeloads of cash prop up Mugabe. The Sunday Times. The Zimbabwe Situation. 2008-03-02.

- ^ Giesecke & Devrient halts deliveries to the Reserve Bank of Zimbabwe. Giesecke & Devrient GmbH, Prinzregentenstr. 2008-07-01.

- ^ Giesecke & Devrient Halts Deliveries to the Reserve Bank of Zimbabwe. Giesecke & Devrient. PRNewswire. Press release.

- ^ McGreal, Chris. What comes after a trillion? The Guardian. 2008-07-18.

- ^ a b Howden, Daniel; Armitage, Tom. Firm with licence to print Mugabe's money. The Independent. 2008-07-24.

- ^ a b Austrian company helps Zimbabwe bank produce near-worthless money. Deutsche Presse-Agentur. 2008-07-24.

- ^ a b c Banya, Nelson. Zimbabwe central bank promises currency reforms. Reuters. 2008-07-24.

- ^ $100 billion for three eggs. The Herald Sun. 2008-07-25.

- ^ Woods, Susanna. 1.2 trillion Zimbabwe dollars for £1. Institute of Commercial Management. 2008-07-24.

- ^ When a lot of money is bad[dead link]

- ^ Zimbabwe dollar sheds 12 zeros, BBC News, 2009-02-02, retrieved 2008-02-02

- ^ "Zimbabwe dollar 'not back soon'". BBC News. 2009-04-12. Retrieved 2009-10-02.

- ^ Lawa, N. Coins to replace notes (archived copy). The Zimbabwean. 2005-06-03. Archived by the Wayback Machine on 2005-06-10.

- ^ David Rivera Alonso (2008-08-20). "World Coin News: Zimbabwe 2003/08 - 10 & 25 dollars". Worldcoinnews.blogspot.com. Retrieved 2010-01-07.

- ^ Dzirutwe, MacDonald. Zimbabwe introduces higher denomination banknotes. Reuters. The Zimbabwe Situation. 2007-12-20.

- ^ Mugari, Shakeman. New notes out. Zimbabwe Independent. The Zimbabwe Situation. 2007-02-02.

- ^ Sibanda, Tichaona. Reserve Bank to Launch New Currency. SW Radio Africa. The Zimbabwe Independent. 2007-10-01.

- ^ Chimhashu, Torby. New Zimbabwe currency imminent. newzimbabwe.com. November 2006?

- ^ Makoshori, Shame. Sunrise 2: Rollout begins. The Financial Gazette. The Zimbabwe Situation. 2007-11-30.

- ^ Gono, G. The Imminent Launch of Sunrise 2 (pdf). Reserve Bank of Zimbabwe. Public notice. 2007-11-21.

- ^ Sibanda, Tichaona. Confusion as RBZ orders banks to briefly stop operations. SW Radio Africa Zimbabwe News. The Zimbabwe Situation. 2007-12-18.

- ^ Zim to introduce $10m note. Fin24.com. 2008-01-16.

- ^ Photo of a fifty-million-dollar note (JPG). Canadian Broadcasting Corporation. 2008-04-04.

- ^ RBZ introduces new notes. Zimbabwe Independent. The Zimbabwe Situation. 2008-04-04.

- ^ Mafaro, Wayne. Harare introduces Z$50 million note. Zimbabwe Online. The Zimbabwe Situation. 2008-04-04.

- ^ Zimbabwe releases $250m bank note. The Australian. 2008-05-06.

- ^ a b Lack of bank note paper threatens Zimbabwe economy. Los Angeles Times. 2008-07-14. Retrieved 2008-07-22.

- ^ Zimbabwe introduces Z$100bn note. BBC News. 2008-07-19.

- ^ Zimbabwe introduces 100-billion-dollar note. Agence France-Presse. Zim2Day. 2008-07-19.

- ^ "Zimbabwe introduces new currency". BBC News. 2008-07-30. Retrieved 2010-01-07.

- ^ Reserve Bank of Zimbabwe's Monetary Policy statement

- ^ Zimbabwe unveils $20,000 banknote. AFP. 2008-09-29.

- ^ Zimbabwe issues $1 million bills as inflation soars. CNN. 2008-11-03.

- ^ New bills and new withdrawal limits. NewZimbabwe. 2008-11-05.

- ^ Zimbabwe introduces new banknotes as inflation soars. Reuters. 2008-12-03.

- ^ Bank cash withdrawals increased again as protests gather momentum SW Radio Africa. 2008-12-02

- ^ Zimbabwe to introduce 200-mln-dollar note next week, Xinhua. 2008-12-06.

- ^ Zimbabwe introduces $500 million note. CNN. 12 December 2008.

- ^ Zimbabwe unveils 10 billion dollar note. Reuters Africa. 19 December 2008.

- ^ Zimbabwe introduces new $50 billion note. CNN. 10 January 2009.

- ^ "Zimbabwe Campaign Posters Printed On Bank Notes". The Zimbabwean. 2009-04-02. Retrieved 2009-04-02.

- ^ "Zimbabwe dollar sheds 12 zeros". BBC News. BBC. 2 February 2009. Retrieved 2 February 2009.

- ^ Daily Interbank Exchange Rates Z$ per US$. Reserve Bank of Zimbabwe. 2006-07-31.

- ^ Thornycroft, Peta. Bring on the wheelbarrows. The Daily Telegraph. 2006-07-11.

- ^ Gumbo, Joseph. Bills Put Zimbabwe Under "Martial Law". Institute for War and Peace. The Zimbabwe Situation. 2006-07-26.

- ^ "The Zimbabwe Situation". The Zimbabwe Situation. Retrieved 2010-01-07.

- ^ Cold comfort for Mugabe. The Telegraph. The Zimbabwe Situation. 2006-09-14.

- ^ Parks, James. Hiding Truth Behind Attacks On Trade Unionists. AFL-CIO. The Zimbabwe Situation. 2006-09-29.

- ^ WFP says 1.4 mln in Zimbabwe will need food aid. Reuters. 2006-10-12.

- ^ Wave of price hikes dampen hopes for recovery. Zimbabwe Online. The Zimbabwe Situation. 2006-11-06.

- ^ Chimhete, Caiphas. Fertilizer saga: Heads likely to roll. Zimbabwe Standard. The Zimbabwe Situation. 2006-11-19.

- ^ Cash crisis forces Harare to suspend issuing of passports. Zimbabwe Online. The Zimbabwe Situation. 2006-11-29.

- ^ "The Zimbabwe Situation". The Zimbabwe Situation. Retrieved 2010-01-07.

- ^ "The Zimbabwe Situation". The Zimbabwe Situation. Retrieved 2010-01-07.

- ^ "The Zimbabwe Situation". The Zimbabwe Situation. Retrieved 2010-01-07.

- ^ "The Zimbabwe Situation". The Zimbabwe Situation. Retrieved 2010-01-07.

- ^ "The Zimbabwe Situation". The Zimbabwe Situation. Retrieved 2010-01-07.

- ^ "The Zimbabwe Situation". The Zimbabwe Situation. Retrieved 2010-01-07.

- ^ "The Zimbabwe Situation". The Zimbabwe Situation. 2000-03-30. Retrieved 2010-01-07.

- ^ "The Zimbabwe Situation". The Zimbabwe Situation. Retrieved 2010-01-07.

- ^ "The Zimbabwe Situation". The Zimbabwe Situation. Retrieved 2010-01-07.

- ^ "The Zimbabwe Situation". The Zimbabwe Situation. Retrieved 2010-01-07.

- ^ "The Zimbabwe Situation". The Zimbabwe Situation. Retrieved 2010-01-07.

- ^ "The Zimbabwe Situation". The Zimbabwe Situation. Retrieved 2010-01-07.

- ^ "The Zimbabwe Situation". The Zimbabwe Situation. Retrieved 2010-01-07.

- ^ "The Zimbabwe Situation". The Zimbabwe Situation. Retrieved 2010-01-07.

- ^ "The Zimbabwe Situation". The Zimbabwe Situation. Retrieved 2010-01-07.

- ^ "The Zimbabwe Situation". The Zimbabwe Situation. Retrieved 2010-01-07.

- ^ "The Zimbabwe Situation". The Zimbabwe Situation. Retrieved 2010-01-07.

- ^ "The Zimbabwe Situation". The Zimbabwe Situation. Retrieved 2010-01-07.

- ^ "The Zimbabwe Situation". The Zimbabwe Situation. Retrieved 2010-01-07.

- ^ "The Zimbabwe Situation". The Zimbabwe Situation. Retrieved 2010-01-07.

- ^ "The Zimbabwe Situation". The Zimbabwe Situation. Retrieved 2010-01-07.

- ^ "The Zimbabwe Situation". The Zimbabwe Situation. Retrieved 2010-01-07.

- ^ "The Zimbabwe Situation". The Zimbabwe Situation. Retrieved 2010-01-07.

- ^ "The Zimbabwe Situation". The Zimbabwe Situation. Retrieved 2010-01-07.

- ^ "The Zimbabwe Situation". The Zimbabwe Situation. Retrieved 2010-01-07.

- ^ "The Zimbabwe Situation". The Zimbabwe Situation. Retrieved 2010-01-07.

- ^ "The Zimbabwe Situation". The Zimbabwe Situation. Retrieved 2010-01-07.

- ^ "The Zimbabwe Situation". The Zimbabwe Situation. Retrieved 2010-01-07.

- ^ "The Zimbabwe Situation". The Zimbabwe Situation. Retrieved 2010-01-07.

- ^ "The Zimbabwe Situation". The Zimbabwe Situation. Retrieved 2010-01-07.

- ^ "The Zimbabwe Situation". The Zimbabwe Situation. Retrieved 2010-01-07.

- ^ "The Zimbabwe Situation". The Zimbabwe Situation. Retrieved 2010-01-07.

- ^ "The Zimbabwe Situation". The Zimbabwe Situation. Retrieved 2010-01-07.

- ^ "The Zimbabwe Situation". The Zimbabwe Situation. Retrieved 2010-01-07.

- ^ "The Zimbabwe Situation". The Zimbabwe Situation. Retrieved 2010-01-07.

- ^ "The Zimbabwe Situation". The Zimbabwe Situation. Retrieved 2010-01-07.

- ^ "The Zimbabwe Situation". The Zimbabwe Situation. Retrieved 2010-01-07.

- ^ "The Zimbabwe Situation". The Zimbabwe Situation. Retrieved 2010-01-07.

- ^ "The Zimbabwe Situation". The Zimbabwe Situation. Retrieved 2010-01-07.

- ^ Wines, Michael (2007-07-04). "The Zimbabwe Situation". The Zimbabwe Situation. Retrieved 2010-01-07.

- ^ "The Zimbabwe Situation". The Zimbabwe Situation. Retrieved 2010-01-07.

- ^ "The Zimbabwe Situation". The Zimbabwe Situation. Retrieved 2010-01-07.

- ^ a b "The Zimbabwe Situation". The Zimbabwe Situation. Retrieved 2010-01-07.

- ^ "The Zimbabwe Situation". The Zimbabwe Situation. Retrieved 2010-01-07.

- ^ "The Zimbabwe Situation". The Zimbabwe Situation. Retrieved 2010-01-07.

- ^ "The Zimbabwe Situation". The Zimbabwe Situation. Retrieved 2010-01-07.

- ^ "The Zimbabwe Situation". The Zimbabwe Situation. Retrieved 2010-01-07.

- ^ "The Zimbabwe Situation". The Zimbabwe Situation. Retrieved 2010-01-07.

- ^ "The Zimbabwe Situation". The Zimbabwe Situation. Retrieved 2010-01-07.

- ^ "The Zimbabwe Situation". The Zimbabwe Situation. Retrieved 2010-01-07.

- ^ "The Zimbabwe Situation". The Zimbabwe Situation. Retrieved 2010-01-07.

- ^ "The Zimbabwe Situation". The Zimbabwe Situation. Retrieved 2010-01-07.

- ^ "The Zimbabwe Situation". The Zimbabwe Situation. Retrieved 2010-01-07.

- ^ "The Zimbabwe Situation". The Zimbabwe Situation. Retrieved 2010-01-07.

- ^ "The Zimbabwe Situation". The Zimbabwe Situation. Retrieved 2010-01-07.

- ^ "The Zimbabwe Situation". The Zimbabwe Situation. Retrieved 2010-01-07.

- ^ "The Zimbabwe Situation". The Zimbabwe Situation. Retrieved 2010-01-07.

- ^ "The Zimbabwe Situation". The Zimbabwe Situation. Retrieved 2010-01-07.

- ^ a b [2][dead link]

- ^ "The Zimbabwe Situation". The Zimbabwe Situation. Retrieved 2010-01-07.

- ^ "The Zimbabwe Situation". The Zimbabwe Situation. 2008-02-12. Retrieved 2010-01-07.

- ^ a b "The Zimbabwe Situation". The Zimbabwe Situation. Retrieved 2010-01-07.

- ^ "The Zimbabwe Situation". The Zimbabwe Situation. Retrieved 2010-01-07.

- ^ "The Zimbabwe Situation". The Zimbabwe Situation. Retrieved 2010-01-07.

- ^ "The Zimbabwe Situation". The Zimbabwe Situation. Retrieved 2010-01-07.

- ^ "The Zimbabwe Situation". The Zimbabwe Situation. Retrieved 2010-01-07.

- ^ [3][dead link]

- ^ "The Zimbabwe Situation". The Zimbabwe Situation. 2008-04-16. Retrieved 2010-01-07.

- ^ "The Zimbabwe Situation". The Zimbabwe Situation. Retrieved 2010-01-07.

- ^ "The Zimbabwe Situation". The Zimbabwe Situation. Retrieved 2010-01-07.

- ^ "The Zimbabwe Situation". The Zimbabwe Situation. 2008-04-30. Retrieved 2010-01-07.

- ^ "The Zimbabwe Situation". The Zimbabwe Situation. Retrieved 2010-01-07.

- ^ Tinona, Peter (2008-05-13). "The Zimbabwe Situation". The Zimbabwe Situation. Retrieved 2010-01-07.

- ^ "The Zimbabwe Situation". The Zimbabwe Situation. 2008-05-15. Retrieved 2010-01-07.

- ^ a b c d e f g h i j k l m n http://www.siyabonga-tatenda.com/zimmoney.html

- ^ a b http://www.rbz.co.zw/fca/fca.asp

- ^ World Currencies: Europe/Africa/Middle East. Bloomberg L.P.

- ^ FXConverter - Currency Converter for 164 Currencies. Oanda.com. Oanda Corporation.

- ^ Dzirutwe, MacDonald. Zimbabwe redenominates currency to ease crisis. Reuters. 2008-07-30.

- ^ Zimbabwe: RBZ Suspends RTGS Payment System. Zimbabwe Independent.2008-10-02

- ^ Gonda, Violet. Reserve bank reinstates electronic transfers.SW Radio Africa. 2008-11-13.

- ^ a b "The Zimbabwe Situation". The Zimbabwe Situation. Retrieved 2010-01-07.

- ^ "The Zimbabwe Situation". The Zimbabwe Situation. Retrieved 2010-01-07.

- ^ Amy Iggulden (2008-09-30). "The Zimbabwe Situation". The Zimbabwe Situation. Retrieved 2010-01-07.

- ^ "The Zimbabwe Situation". The Zimbabwe Situation. Retrieved 2010-01-07.

- ^ "The Zimbabwe Situation". The Zimbabwe Situation. Retrieved 2010-01-07.

- ^ "The Zimbabwe Situation". The Zimbabwe Situation. Retrieved 2010-01-07.

- ^ "The Zimbabwe Situation". The Zimbabwe Situation. 2008-10-22. Retrieved 2010-01-07.

- ^ "The Zimbabwe Situation". The Zimbabwe Situation. Retrieved 2010-01-07.

- ^ "The Zimbabwe Situation". The Zimbabwe Situation. Retrieved 2010-01-07.

- ^ "The Zimbabwe Situation". The Zimbabwe Situation. 2008-10-29. Retrieved 2010-01-07.

- ^ "The Zimbabwe Situation". The Zimbabwe Situation. 2008-11-04. Retrieved 2010-01-07.

- ^ Washington 12 November 2008 (2008-11-12). "Zimbabwe Prices In Stratosphere As Political Power-Sharing Falters | News | Zimbabwe". Voanews.com. Retrieved 2010-01-07.

{{cite web}}: CS1 maint: numeric names: authors list (link) - ^ "News story". SW Radio Africa. 2008-11-13. Retrieved 2010-01-07.

- ^ "Zimbabwe latest news, Zimbabwe news, Zimbabwe situation, Zimbabwe online, Zimbabwe daily news , Your gateway to Zimbabwe news — RTGS Not Functional". Radiovop. 2008-11-26. Retrieved 2010-01-07.

- ^ zimbabweanequities.com, site notice 19 November 2008.

- ^ "Important Notice"

- ^ Berger, Sebastien (2008-12-04). "The Zimbabwe Situation". The Zimbabwe Situation. Retrieved 2010-01-07.

- ^ [4][dead link]

- ^ "Zimbabwe introduces $500 million note". CNN.com. 2008-12-12. Retrieved 2010-01-07.

- ^ "Online". Chronicle. Retrieved 2010-01-07.

- ^ [5][dead link]

- ^ "Zimbabwe to launch 100 trillion dollar note: report | Reuters". Af.reuters.com. 2009-01-16. Retrieved 2010-01-07.

- ^ "The Zimbabwe Situation". The Zimbabwe Situation. Retrieved 2010-01-07.

- ^ "The Zimbabwe Situation". The Zimbabwe Situation. Retrieved 2010-01-07.

- ^ David Charter in Brussels (2009-01-26). "The Zimbabwe Situation". The Zimbabwe Situation. Retrieved 2010-01-07.

- ^ "Budget likely to show Mugabe's desperation | World | Reuters". Uk.reuters.com. 2009-01-28. Retrieved 2010-01-07.

- ^ "Zimbabwe Teachers Can't Afford to Report for Work (Update1)". Bloomberg.com. 2009-01-29. Retrieved 2010-01-07.

- ^ a b "The United Nations Operational Rates of Exchange". Un.org. Retrieved 2010-01-07.

- ^ "Currency Reports & News | Zim trims 12 zeroes from trillion dollar note | 02 February 2009". www.commodityonline.com. 2009-02-02. Retrieved 2010-01-07.

References (from books)

- Krause, Chester L.; Clifford Mishler (1991). Standard Catalog of World Coins: 1801–1991 (18th ed.). Krause Publications. ISBN 0873411501.

- Pick, Albert (1994). Standard Catalog of World Paper Money: General Issues. Colin R. Bruce II and Neil Shafer (editors) (7th ed.). Krause Publications. ISBN 0-87341-207-9.

External links

- Scan of Reserve Bank of Zimbabwe $5,000,000,000 Special Agro Cheque.

- BBC: Zimbabwe sees record inflation

- CNN: Zimbabwe's inflation surpasses 1,000 percent

- Telegraph: In Zimbabwe, a small bag of groceries now costs millions

- Zimdollar

- http://www.zimbabwesituation.com

- Zimbabwe launches $200,000 note

- Zimbabwe inflation hits new high (Depicts the front of the $200,000 Bearer Cheque)

| Preceded by: Rhodesian dollar Reason: independence recognized Ratio: at par |

Currency of Zimbabwe 18 April 1980 – 12 April 2009 Note: 1st dollar (ZWD): 18 April 1980 to 21 August 2006 2nd dollar (ZWN or 1 000 ZWD): 1 August 2006 to 31 December 2008 3rd dollar (ZWR or 1010 ZWN): 1 August 2008 to 12 April 2009 4th dollar (ZWL or 1012 ZWR) 2 February 2009 to 12 April 2009 |

Succeeded by: Hard currencies Reason: hyperinflation, resulting in the suspension of local currency Ratio: none—currency abandoned |