Foreign exchange reserves

| Foreign exchange |

|---|

| Exchange rates |

| Markets |

| Assets |

| Historical agreements |

| See also |

Foreign exchange reserves (also called Forex reserves or FX reserves) in a strict sense are only the foreign currency deposits and bonds held by central banks and monetary authorities. However, the term in popular usage commonly includes foreign exchange and gold, SDRs and IMF reserve positions. This broader figure is more readily available, but it is more accurately termed official international reserves or international reserves. These are assets of the central bank held in different reserve currencies, mostly the US dollar, and to a lesser extent the euro, the UK pound, and the Japanese yen, and used to back its liabilities, e.g. the local currency issued, and the various bank reserves deposited with the central bank, by the government or financial institutions.

History

Official international reserves, the means of official international payments, formerly consisted only of gold, and occasionally silver. But under the Bretton Woods system, the US dollar functioned as a reserve currency, so it too became part of a nation's official international reserve assets. From 1944-1968, the US dollar was convertible into gold through the Federal Reserve System, but after 1968 only central banks could convert dollars into gold from official gold reserves, and after 1973 no individual or institution could convert US dollars into gold from official gold reserves. Since 1973, no major currencies have been convertible into gold from official gold reserves. Individuals and institutions must now buy gold in private markets, just like other commodities. Even though US dollars and other currencies are no longer convertible into gold from official gold reserves, they still can function as official international reserves.

Purpose

In a flexible exchange rate system, official international reserve assets allow a central bank to purchase the domestic currency, which is considered a liability for the central bank (since it prints the money or fiat currency as IOUs). This action can stabilize the value of the domestic currency.

Central banks throughout the world have sometimes cooperated in buying and selling official international reserves to attempt to influence exchange rates.

Changes in reserves

The quantity of foreign exchange reserves can change as a central bank implements monetary policy.[1] A central bank that implements a fixed exchange rate policy may face a situation where supply and demand would tend to push the value of the currency lower or higher (an increase in demand for the currency would tend to push its value higher, and a decrease lower). In a flexible exchange rate regime, these operations occur automatically, with the central bank clearing any excess demand or supply by purchasing or selling the foreign currency. Mixed exchange rate regimes ('dirty floats', target bands or similar variations) may require the use of foreign exchange operations (sterilized or unsterilized[clarification needed]) to maintain the targeted exchange rate within the prescribed limits .

Foreign exchange operations that are unsterilized will cause an expansion or contraction in the amount of domestic currency in circulation, and hence directly affect monetary policy and inflation: An exchange rate target cannot be independent of an inflation target. Countries that do not target a specific exchange rate are said to have a floating exchange rate, and allow the market to set the exchange rate; for countries with floating exchange rates, other instruments of monetary policy are generally preferred and they may limit the type and amount of foreign exchange interventions. Even those central banks that strictly limit foreign exchange interventions, however, often recognize that currency markets can be volatile and may intervene to counter disruptive short-term movements.

To maintain the same exchange rate if there is increased demand, the central bank can issue more of the domestic currency and purchase the foreign currency, which will increase the sum of foreign reserves. In this case, the currency's value is being held down; since (if there is no sterilization) the domestic money supply is increasing (money is being 'printed'), this may provoke domestic inflation (the value of the domestic currency falls relative to the value of goods and services).

Since the amount of foreign reserves available to defend a weak currency (a currency in low demand) is limited, a foreign exchange crisis or devaluation could be the end result. For a currency in very high and rising demand, foreign exchange reserves can theoretically be continuously accumulated, although eventually the increased domestic money supply will result in inflation and reduce the demand for the domestic currency (as its value relative to goods and services falls). In practice, some central banks, through open market operations aimed at preventing their currency from appreciating, can at the same time build substantial reserves.

In practice, few central banks or currency regimes operate on such a simplistic level, and numerous other factors (domestic demand, production and productivity, imports and exports, relative prices of goods and services, etc) will affect the eventual outcome. As certain impacts (such as inflation) can take many months or even years to become evident, changes in foreign reserves and currency values in the short term may be quite large as different markets react to imperfect data.

Costs, benefits, and criticisms

Large reserves of foreign currency allow a government to manipulate exchange rates - usually to stabilize the foreign exchange rates to provide a more favorable economic environment. In theory the manipulation of foreign currency exchange rates can provide the stability that a gold standard provides, but in practice this has not been the case. Also, the greater a country's foreign reserves, the better position it is in to defend itself from speculative attacks on the domestic currency.

There are costs in maintaining large currency reserves. Fluctuations in exchange markets result in gains and losses in the purchasing power of reserves. Even in the absence of a currency crisis, fluctuations can result in huge losses. For example, China holds huge U.S. dollar-denominated assets, but if the U.S. dollar weakens on the exchange markets, the decline results in a relative loss of wealth for China. In addition to fluctuations in exchange rates, the purchasing power of fiat money decreases constantly due to devaluation through inflation. Therefore, a central bank must continually increase the amount of its reserves to maintain the same power to manipulate exchange rates. Reserves of foreign currency provide a small return in interest. However, this may be less than the reduction in purchasing power of that currency over the same period of time due to inflation, effectively resulting in a negative return known as the "quasi-fiscal cost". In addition, large currency reserves could have been invested in higher yielding assets.

Excess reserves

Foreign exchange reserves are important indicators of ability to repay foreign debt and for currency defense, and are used to determine credit ratings of nations, however, other government funds that are counted as liquid assets that can be applied to liabilities in times of crisis include stabilization funds, otherwise known as sovereign wealth funds. If those were included, Norway, Singapore and Persian Gulf States would rank higher on these lists, and UAE's $1.3 trillion Abu Dhabi Investment Authority would be second after China. Apart from high foreign exchange reserves, Singapore also has significant government and sovereign wealth funds including Temasek Holdings, valued in excess of $145 billion and GIC, valued in excess of $330 billion. India is also planning to create its own investment firm from its foreign exchange reserves.

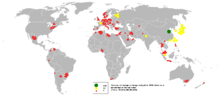

List of countries by foreign exchange reserves

The following is a list of the top 20 largest countries by foreign exchange reserves:

| Rank | Country | Billion USD (end of month) |

|---|---|---|

| 1 | $ 2850 (Dec 2010)[2] | |

| 2 | $ 1116 (Mar 2011)[3] | |

| — | $ 770 (Jan 2011)[4] | |

| 3 | $ 504 (Mar 2011)[5] | |

| 4 | $ 449 (Feb 2011)[6] | |

| 5 | $ 391 (Feb 2011)[7] | |

| 6 | $ 320 (Apr 2011)[8] | |

| 7 | $ 304 (Mar 2011)[9] | |

| 8 | $ 298 (Feb 2011)[10] | |

| 9 | $ 273 (Jan 2011)[4] | |

| 10 | $ 272 (Jan 2011)[4] | |

| 11 | $ 227 (Jan 2011)[4] | |

| 12 | $ 209 (Jan 2011)[4] | |

| 13 | $ 181 (Mar 2011)[11] | |

| 14 | $ 161 (Jan 2011)[4] | |

| 15 | $ 155 (Dec 2010)[12] | |

| 16 | $ 154 (Jan 2011)[4] | |

| 17 | $ 133 (Feb 2011)[4] | |

| 18 | $ 126 (Feb 2011)[13] | |

| 19 | $ 115 (Feb 2011)[4] | |

| 20 | $ 110 (Mar 2011)[14] |

These few holders account for more than 60% of total world foreign currency reserves. The adequacy of the foreign exchange reserves is more often expressed not as an absolute level, but as a percentage of short-term foreign debt, money supply, or average monthly imports.

See also

- Balance of payments

- Endaka

- Global assets under management

- List of countries by foreign exchange reserves

- Official gold reserves

- Reserve currency

- Sovereign wealth funds

- Special Drawing Rights

- Foreign exchange reserves of the People's Republic of China

References

- ^ http://mpra.ub.uni-muenchen.de/14350/1/MPRA_paper_14350.pdf Compositional Analysis Of Foreign Currency Reserves In The 1999-2007 Period. The Euro Vs. The Dollar As Leading Reserve Currency

- ^ http://news.xinhuanet.com/english2010/business/2010-07/11/c_13394250.htm

- ^ "International Reserves / Foreign Currency Liquidity". The Ministry of Finance of Japan. Retrieved 2011-03-30.

- ^ a b c d e f g h i "Data Template on International Reserves and Foreign Currency Liquidity - Reporting Countries". Imf.org. 2001-01-05. Retrieved 2010-07-08.

- ^ "International Reserves of the Russian Federation".

- ^ Monthly Bulletin. Table 9. Saudi Arabian Monetary Agency

- ^ "Welcome to the Central Bank of the Republic of China (Taiwan) — Foreign Exchange Reserves as at the End of February 2011". Retrieved 2011-03-18.

- ^ "Daily international reserves". Banco Central do Brasil. Retrieved 26 March 2011.

- ^ "Weekly Statistical Supplement - Foreign Exchange Reserves". Reserve Bank of India. Retrieved 26 March 2011.

- ^ S. Korea's foreign reserves hit fresh high in Retrieved on 2011-03-18

- ^ "Reserve Money and International Reserve". Bank of Thailand. Retrieved 21 March 2011.

- ^ Algeria end-2010 forex reserves at $155 bln

- ^ "Reporte sobre las Reservas Internacionales y la Liquidez en Moneda Extranjera". Banco de México. Retrieved 26 March 2011.

- ^ "International Reserves and Foreign Currency Liquidity". Bank Negara Malaysia. 22 March 2011. Retrieved 25 March 2011.

External links

Source

- The World Factbook, CIA

- Taiwan's Department of Investment Services data on foreign exchange reserves of major countries

- Central Bank of Brazil - Daily updated foreign exchange reserves

- Bank of Korea's top ten foreign exchange reserves holding countries monthly

- Hong Kong Official Reserves Ranking

- European Central Bank data on eurosystem reserves

Articles

- Guidelines for foreign exchange reserve management Accompanying Document 1 Document 2 Appendix

- "What is Foreign Exchange?" published by the International Business Times AU on February 11, 2011

- A primer on exchange reserves

- An empirical analysis of foreign exchange reserves in emerging Asia -- December 2005

- Foreign exchange reserves: issues in asia -- January 2005

- Foreign exchange reserves in east asia: why the high demand? -- April 25, 2003

- Optimal currency shares in international reserves

- Are high foreign exchange reserves in emerging markets a blessing or a burden?

- The adequacy of foreign exchange reserves

- Are changes in foreign exchange reserves well correlated with official intervention?

- Foreign exchange reserves buildup: business as usual

- Compositional Analysis Of Foreign Currency Reserves In The 1999-2007 Period. The Euro Vs. The Dollar As Leading Reserve Currency

Speeches

- Alan Greenspan: discusses recent trends in the management of foreign exchange reserves -- April 29, 1999

- Y V Reddy: India’s foreign exchange reserves - policy, status and issues -- May 10, 2002

- Marion Williams: foreign exchange reserves - how much is enough? -- November 2, 2005

- Lawrence H. Summers: Reflections on global account imbalances and emerging markets reserve accumulation -- March 24, 2006