Federal Reserve Bank

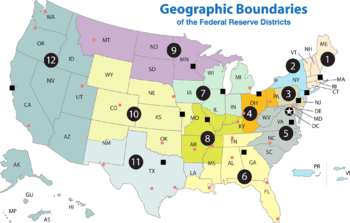

A Federal Reserve Bank is a regional bank of the Federal Reserve System, the central banking system of the United States. There are twelve in total, one for each of the twelve Federal Reserve Districts that were created by the Federal Reserve Act of 1913.[1] The banks are jointly responsible for implementing the monetary policy set forth by the Federal Open Market Committee, and are divided as follows:

Some banks also possess branches, with the whole system being headquartered at the Eccles Building in Washington, D.C.

History

This article needs additional citations for verification. (April 2014) |

Alexander Hamilton, the first Secretary of Treasury, started a movement in 1780 advocating for the creation of a central bank.[a] The Bank Bill created by Hamilton was a proposal to institute a national bank in order to improve the economic stability of the nation after its independence from Britain. Although the national bank was to be used as a tool for the government, it was to be privately owned. Hamilton wrote several articles providing information regarding his national bank idea where he expressed the validity and "would be" success of the national bank based upon: incentives for the rich to invest, ownerships of bonds and shares, being rooted in fiscal management, and stable monetary system.

In response to this, the First Bank of the United States was established in 1791, its charter signed by George Washington. The First Bank of the United States was headquartered in Philadelphia, but had branches in other major cities. The Bank performed the basic banking functions of accepting deposits, issuing bank notes, making loans and purchasing securities.

When its charter expired 20 years later, the United States was without a central bank for a few years, during which it suffered an unusual inflation.[citation needed] In 1816, James Madison signed the Second Bank of the United States into existence. When, in 1833, before that bank's charter expired, President Jackson removed the government funds as part of the Bank War, and the United States went without a central bank for 40 years.

A financial crisis known as the Panic of 1907 was headed off by a private conglomerate (led by J. P. Morgan), who set themselves up as "lenders of last resort" to banks in trouble.[3][4] This effort succeeded in stopping the panic,[3] and led to calls for a Federal agency to do the same thing.[citation needed]

In response to this,[citation needed] the Federal Reserve System was created by the Federal Reserve Act of December 23, 1913, establishing a new central bank intended to serve as a formal "lender of last resort" to banks in times of liquidity crisis—panics where depositors tried to withdraw their money faster than a normal fractional-reserve-based bank could pay it out.

The Federal Reserve Act presented by Congressman Carter Glass and Senator Robert L. Owen incorporated modifications by Woodrow Wilson and allowed for a regional Federal Reserve System, operating under a supervisory board in Washington, D.C. Congress approved the Act, and President Wilson signed it into law on December 23, 1913. The Act, "Provided for the establishment of Federal Reserve Banks, to furnish an elastic currency, to afford means of rediscounting commercial paper, to establish a more effective supervision of banking in the United States, and for other purposes. The Act provided for a Reserve Bank Organization Committee that would designate no less than eight but no more than twelve cities to be Federal Reserve cities, and would then divide the nation into districts, each district to contain one Federal Reserve City.

The legislation provided for a system that included a number of regional Federal Reserve Banks and a seven-member governing board. All national banks were required to join the system and other banks could join.

On April 2, 1914, the Reserve Bank Organization Committee announced its decision, and twelve Federal Reserve banks were established to cover various districts throughout the country. Those opposed to the establishment of an overwhelmingly powerful New York Fed prevailed in their desire that its scope and influence should be limited. Initially, this bank's influence was restricted to New York State. Nonetheless, with over $20,000,000 in capital stock, the New York Bank had nearly four times the capitalization of the smallest banks in the system, such as Atlanta and Minneapolis. As a result, it was impossible to prevent the New York Fed from being the largest and most dominant bank in the system.

The Federal Reserve Banks opened for business in November 1914. The New York Fed opened for business under the leadership of Benjamin Strong, Jr. , previously president of the Bankers Trust Company, on November 16, 1914. The initial staff consisted of seven officers and 85 clerks, many on loan from local banks. Mr. Strong recalled the starting days at the Bank in a speech: "It may be said that the Bank's equipment consisted of little more than a copy of the Federal Reserve Act." During its first day of operation, the Bank took in $100 million from 211 member banks; made two rediscounts; and received its first shipment of Federal Reserve Notes. Congress created Federal Reserve notes to provide the nation with a flexible supply of currency. The notes were to be issued to Federal Reserve Banks for subsequent transmittal to banking institutions in accordance with the needs of the public.

The U.S. Federal Reserve System or the “Fed” (of which the twelve regional Federal Reserve banks are a part) was created by an Act of Congress in 1913 in a response to a series of economic crises at the turn of the early 20th century.

The Bank's staff grew rapidly during the early years, necessitating the need for a new home. Land was bought on a city block encompassing Liberty Street, Maiden Lane, William Street and Nassau Street. A public competition was held and the architectural firm of York & Sawyer submitted the winning design reminiscent of the palaces in Florence, Italy. The Bank's vaults, located 86 feet below street level, were built on Manhattan's bedrock. In 1924, the Fed moved into its new home. By 1927, the vault contained ten percent of the world's entire store of monetary gold.[5]

The Fed is an independent financial institution formed within the United States, that works separately from the executive or judicial branches of government. The Federal Reserve System is considered to be an independent agency that exists outside of the cabinet of the executive[6] and its powers are derived directly from Congress. Over the past century, the Fed’s power has expanded from its original roles such as a private response to problems in banking systems[7] and to establishing a more effective supervisory role of banking systems in the United States,[7] to its now current position of being a lender of last resort to banking institutions that require additional credit to stay afloat.

Legal status

The twelve regional Federal Reserve Banks were established as the operating arms of the nation's central banking system. They are organized much like private corporations—possibly leading to some confusion about ownership.

The Federal Reserve Banks have an intermediate legal status, with some features of private corporations and some features of public federal agencies. The United States has an interest in the Federal Reserve Banks as tax-exempt federally created instrumentalities whose profits belong to the federal government, but this interest is not proprietary.[8] In Lewis v. United States,[9] the United States Court of Appeals for the Ninth Circuit stated that: "The Reserve Banks are not federal instrumentalities for purposes of the FTCA [the Federal Tort Claims Act], but are independent, privately owned and locally controlled corporations." The opinion went on to say, however, that: "The Reserve Banks have properly been held to be federal instrumentalities for some purposes." Another relevant decision is Scott v. Federal Reserve Bank of Kansas City,[8] in which the distinction is made between Federal Reserve Banks, which are federally created instrumentalities, and the Board of Governors, which is a federal agency.

Regarding the structural relationship between the twelve Federal Reserve banks and the various commercial (member) banks, political science professor Michael D. Reagan has written that:[10]

... the "ownership" of the Reserve Banks by the commercial banks is symbolic; they do not exercise the proprietary control associated with the concept of ownership nor share, beyond the statutory dividend, in Reserve Bank "profits." ... Bank ownership and election at the base are therefore devoid of substantive significance, despite the superficial appearance of private bank control that the formal arrangement creates.

Function

The Federal Reserve System provides the government with a ready source of loans and serves as the safe depository for federal money. The Federal Reserve is also a low-cost mechanism for transferring funds and is an inexpensive agent for meeting payments on the national debt and government salaries. The Federal Reserve Banks were created as instrumentalities to carry out the policies of the Federal Reserve System.

The Federal Reserve Banks issue shares of stock to member banks. However, owning Federal Reserve Bank stock is quite different from owning stock in a private company. The Federal Reserve Banks are not operated for profit, and ownership of a certain amount of stock is, by law, a condition of membership in the system. The stock may not be sold or traded or pledged as security for a loan; dividends are, by law, limited to 6% per year.[11]

The dividends paid to member banks are considered partial compensation for the lack of interest paid on member banks' required reserves held at the Federal Reserve. By law, banks in the United States must maintain fractional reserves, most of which are kept on account at the Federal Reserve. Historically, the Federal Reserve did not pay interest on these funds. The Federal Reserve now has authority, granted by Congress in the Emergency Economic Stabilization Act (EESA) of 2008, to pay interest on these funds.

A major responsibility of The Federal Reserve is to oversee their banking and financial systems. Overseeing the banking and financial systems of a bank is crucial in a society.[12]

Confidence in the soundness of the banking and financial systems is what mobilizes a society's savings, allows the savings to be channeled into productive investments, and encourages economic growth.

Finances

Each Federal Reserve Bank funds its own operations, primarily from interest on its loans and on the securities it holds. Expenses and dividends paid are typically a small fraction of a Federal Reserve Bank's revenue each year.[13] By law the remainder must be transferred to the Board of Governors, which then deposits the full amount to the Treasury as interest on outstanding Federal Reserve Notes.[14]

The Federal Reserve Banks conduct ongoing internal audits of their operations to ensure that their accounts are accurate and comply with the Federal Reserve System's accounting principles. The banks are also subject to two types of external auditing. Since 1978 the Government Accountability Office (GAO) has conducted regular audits of the banks' operations. The GAO audits are reported to the public, but they may not review a bank's monetary policy decisions or disclose them to the public.[15] Since 1999 each bank has also been required to submit to an annual audit by an external accounting firm,[16] which produces a confidential report to the bank and a summary statement for the bank's annual report. Some members of Congress continue to advocate a more public and intrusive GAO audit of the Federal Reserve System,[17] but Federal Reserve representatives support the existing restrictions to prevent political influence over long-range economic decisions.[18]

Banks

The Federal Reserve officially identifies Districts by number and Reserve Bank city.[19]

- 1st District (A) - Federal Reserve Bank of Boston

- 2nd District (B) - Federal Reserve Bank of New York

- 3rd District (C) - Federal Reserve Bank of Philadelphia

- 4th District (D) - Federal Reserve Bank of Cleveland, with branches in Cincinnati, Ohio and Pittsburgh, Pennsylvania

- 5th District (E) - Federal Reserve Bank of Richmond, with branches in Baltimore, Maryland and Charlotte, North Carolina

- 6th District (F) - Federal Reserve Bank of Atlanta, with branches in Birmingham, Alabama; Jacksonville, Florida; Miami, Florida; Nashville, Tennessee; and New Orleans, Louisiana

- 7th District (G) - Federal Reserve Bank of Chicago, with a branch in Detroit, Michigan

- 8th District (H) - Federal Reserve Bank of St. Louis, with branches in Little Rock, Arkansas; Louisville, Kentucky; and Memphis, Tennessee

- 9th District (I) - Federal Reserve Bank of Minneapolis, with a branch in Helena, Montana

- 10th District (J) - Federal Reserve Bank of Kansas City, with branches in Denver, Colorado; Oklahoma City, Oklahoma; and Omaha, Nebraska

- 11th District (K) - Federal Reserve Bank of Dallas, with branches in El Paso, Texas; Houston, Texas; and San Antonio, Texas

- 12th District (L) - Federal Reserve Bank of San Francisco, with branches in Los Angeles, California; Portland, Oregon; Salt Lake City, Utah; and Seattle, Washington

The New York Federal Reserve district is the largest by asset value. San Francisco, followed by Kansas City and Minneapolis, represent the largest geographical districts. Missouri is the only state to have two Federal Reserve Banks (Kansas City and St. Louis). California, Florida, Missouri, Ohio, Pennsylvania, Tennessee, and Texas are the only states which have two or more Federal Reserve Bank branches seated within their states, with Missouri, Pennsylvania, and Tennessee having branches of two different districts within the same state. In the 12th District, the Seattle Branch serves Alaska, and the San Francisco Bank serves Hawaii. New York, Richmond, and San Francisco are the only banks that oversee non-U.S. state territories. The System serves these territories as follows: the New York Bank serves the Commonwealth of Puerto Rico and the U.S. Virgin Islands; the Richmond Bank serves the District of Columbia; the San Francisco Bank serves American Samoa, Guam, and the Commonwealth of the Northern Mariana Islands. The Board of Governors last revised the branch boundaries of the System in February 1996.[19]

Assets

| Federal Reserve Bank | Total assets (9/17/2015)[20] |

|---|---|

| All banks | $4.49T |

| New York City | $2.62T |

| San Francisco | $512B |

| Richmond | $289B |

| Atlanta | $244B |

| Chicago | $175B |

| Dallas | $154B |

| Cleveland | $133B |

| Philadelphia | $120B |

| Boston | $91B |

| Kansas City | $61B |

| St. Louis | $58B |

| Minneapolis | $32B |

See also

- Federal Reserve Act

- List of regions of the United States#Federal Reserve banks

- Federal Reserve Branches

- Federal Reserve System

Notes

References

- ^ Sullivan, arthur; Steven M. Sheffrin (2003). Economics: Principles in action. Upper Saddle River, New Jersey 07458: Pearson Prentice Hall. p. 417. ISBN 0-13-063085-3.

{{cite book}}: CS1 maint: location (link) - ^ "American Experience—Alexander Hamilton: Establishing A National Bank". PBS. May 8, 2007. Retrieved March 6, 2014.

- ^ a b Gordon, John Steele, An Empire Of Wealth, Harper Perennial, 2005 (chapter needed, page number needed).

- ^ A Short Banking History of the United States - WSJ

- ^ The Founding of the Fed .http://www.newyorkfed.org/aboutthefed/history_article.html

- ^ Kollman, Ken, The American Political System, Election 2012 update W.W. Norton & Company, 2012 (The Bureaucracy, p.217).

- ^ a b Moen, J. R., & Tallman, E. W. (2003). New York and the Politics of Central Banks, 1781 to the Federal Reserve Act.

- ^ a b Kennedy C. Scott v. Federal Reserve Bank of Kansas City, et al., 406 F.3d 532 (8th Cir. 2005).

- ^ 680 F.2d 1239 (9th Cir. 1982).

- ^ Michael D. Reagan, "The Political Structure of the Federal Reserve System," American Political Science Review, Vol. 55 (March 1961), pp. 64-76, as reprinted in Money and Banking: Theory, Analysis, and Policy, p. 153, ed. by S. Mittra (Random House, New York 1970).

- ^ "FRB: FAQs: Banking Information". Federalreserve.gov. February 12, 2006. Archived from the original on June 1, 2010. Retrieved July 8, 2010.

{{cite web}}: Unknown parameter|deadurl=ignored (|url-status=suggested) (help) - ^ McDonough, William J. "An Independent Central Bank in a Democratic Country: The Federal Reserve Experience." University of Chicago, Chicago. 22 Apr. 1994.

- ^ Annual reports

- ^ 12 U.S.C. § 289

- ^ 31 U.S.C. § 714

- ^ 12 U.S.C. § 269b

- ^ Zumbrun, Joshua (July 21, 2009). "Bernanke Fights Audit Threat To The Fed". Forbes. Retrieved November 23, 2011.

- ^ "How the Federal Reserve is Audited". Federal Reserve Bank of New York. April 2008. Retrieved November 23, 2011.

- ^ a b "The Twelve Federal Reserve Districts". Federal Reserve. The Federal Reserve Board. December 13, 2005. Retrieved February 18, 2009.

- ^ "Factors Affecting Reserve Balances/Release Dates/Current release". federalreserve.gov. Retrieved December 4, 2014.

Sources

- Page, Walter Hines; Page, Arthur Wilson (May 1914). "The March of Events: The Federal Reserve Districts". The World's Work: A History of Our Time. XLIV (1): 10–11. Retrieved August 4, 2009.

The first new piece of machinery for the new currency system is now provided.

{{cite journal}}: Cite has empty unknown parameter:|authors=(help)

External links