International inequality

International inequality refers to economic differences between countries. According to the United Nations Human Development Report 2004, the gross domestic per capita (GDP) in countries with high, medium and low human development (a classification based on the UN Human Development Index) was 24,806, 4,269 and 1,184 PPP$, respectively (PPP$ = purchasing power parity measured in United States dollars).[1]

International wealth distribution

A study by the World Institute for Development Economics Research at United Nations University reports that the richest 1% of adults alone owned 40% of global assets in the year 2000, and that the richest 10% of adults accounted for 85% of the world total. The bottom half of the world adult population owned barely 1% of global wealth. In 2013, Oxfam International released a report to The World Economic Forum that the richest 1% owns 48 percent of the global wealth.[2] In 2014, Oxfam reported that the 85 wealthiest individuals in the world have a combined wealth equal to that of the bottom 50% of the world's population, or about 3.5 billion people.[3][4][5][6][7] More recently, in January 2015, Oxfam reported that the wealthiest 1 percent will own more than half of the global wealth by 2016.[8]

The major component of the world's income inequality (the global Gini coefficient) is comprised by two groups of countries (called the "twin peaks" by Quah [1997]).

- The first group has 13% of the world's population and receives 45% of the world's PPP income. This group includes the United States, Japan, Germany, the United Kingdom, France, Australia and Canada, and comprises 500 million people with an annual income level over 11,500 PPP$.

- The second group has 42% of the world's population and receives only 9% of the world PPP income. This group includes India, Indonesia and rural China, and comprises 2.1 billion people with an income level under 1,000 PPP$. (See Milanovic 2001, p. 38).

Economic inequality often closely matches a lognormal or Pareto distribution both across economies and within them.[citation needed]

The evolution of the income gap between poor and rich countries is related to convergence. Convergence can be defined as "the tendency for poorer countries to grow faster than richer ones and, hence, for their levels of income to converge".[9] Convergence is a matter of current research and debate, but most studies have shown lack of evidence for absolute convergence based on comparisons among countries.[citation needed]

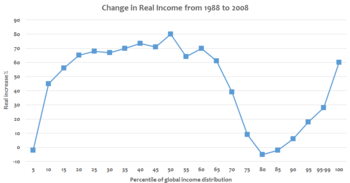

According to current research, global income inequality peaked approximately in the 1970s when world income was distributed bimodally into "rich" and "poor" countries with little overlap. Since then inequality have been rapidly decreasing, and this trend seems to be accelerating. Income distribution is now unimodal, with most people living in middle-income countries.[10]

Comparisons

Some of the economic disparities among nations can be better appreciated when rich and poor countries or societies are contrasted. For example, with regard to income inequality, according to some estimates by Branko Milanovic from the World Bank:

- "An American having the average income of the bottom U.S. decile is better-off than 2/3 of world population." (Milanovic 2002, p. 50)

- "The top 10% of the U.S. population has an aggregate income equal to income of the poorest 43 percent of people in the world, or differently put, total income of the richest 25 million Americans is equal to total income of almost 2 billion people." (Milanovic 2002, p. 50)

With regard to wealth inequality (researchers defined wealth as the value of physical and financial assets minus debts), a 2006 report with data from 2000 concluded that:

- "India dominates the bottom third of the global wealth distribution, contributing a little under 27% of this group. The middle third of the distribution is the domain of China which supplies more than a third of those in deciles 4-8. At the top end, North America, Europe and high-income Asia monopolise the top decile, each regional group accounting for around one-third of the richest wealth holders" (Davies et al. 2006, p. 27)

- "the top 10% of adults own 85% of global household wealth, so that the average member of this group has 8.5 times the global average holding. The corresponding figures for the top 5%, top 2%, and top 1% are 71% (14.2 times the average), 51% (25 times the average) and 40% (40 times the average), respectively. This compares with the bottom half of the distribution which collectively owns barely 1% of global wealth. Thus the top 1% own almost 40 times as much as the bottom 50%. The contrast with the bottom decile of wealth holders is even starker. The average member of the top decile nearly 3,000 times the mean wealth of the bottom decile, and the average member of the top percentile is more than 13,000 times richer." (Davies et al. 2006, p. 26)

- "for the world as a whole the share of the top 10% was 85% in the year 2000 and the Gini equalled 0.892 using official exchange rates" (Davies et al. 2006, p. 32)

- "only $2,161 was needed in order to belong to the top half of the world wealth distribution, but to be a member of the top 10% required at least $61,000 and membership of the top 1% required more than $500,000 per adult." (Davies et al. 2006, p. 25)

James Davies, Professor of Economics at the University of Western Ontario, and one of the authors of the report, said: "Income inequality has been rising for the past 20 to 25 years and we think that is true for inequality in the distribution of wealth." "There is a group of problems in developing countries that make it difficult for people to build assets, which are important, since life is so precarious."[12]

Other disparities can be better appreciated when rich individuals (or corporations) are compared against poor individuals. According to some estimates, for instance:

- "The richest 1% of people in the world receive as much as the bottom 57%, or in other words, less than 50 million richest people receive as much as 2.7 billion poor." (Milanovic 2002, p. 50)

- The three richest people possess more financial assets than the poorest 10% of the world's population, combined [4]. Link broken.

- As of May 2005, the three richest people in the world have total assets that exceed the annual combined GDP of the 47 countries with the least GDP, (calculation based on data from list of countries by GDP (PPP) and list of billionaires) (Annan, 1998)

- As of May 2005, the 125 richest people in the world have assets that exceed the annual combined GDP of all the least developed countries (calculation based on data from list of countries by GDP (PPP) and list of billionaires).

Additional data

Wealth:

- 6% of the world's population owns 52% of the global assets. The richest 2% own more than 51% of the global assets and the richest 10% own 85% of the global assets.

- 50% of the world's population own less than 1% of the global assets.[13]

- The whole global assets volume is about $125 trillion.[14]

- 1,125 billionaires (US dollars) own $4.4 trillion in assets[15]

- Over 80% of the world's population lives on less than $10 per day.[16] over 50% of the world population lives on less than 2 US$/day;[17] over 20% of the world population lives on less than $1.25/day[18]

Income:

- In 2005, 43% of the world population (3.14 billion people) have an income of less than $2.5 per day. 21.5% of the world population (1.4 billion people) have an income of less than $1.25 per day.[19]

- In 1981, 60% of the world population (2.73 billion people) had an income of less than $2.5 per day and 42% of the world population (1.91 billion people) had an income of less than $1.25 per day.

- In 2008, 17% of the people in the developing countries are on the verge of starvation.[20]

- The proportion of poor people (with less than $3,470 per year) is 78%. The proportion of rich people (with more than $8,000/year) is 11%.[21]

Welfare spending: If East Asia and southern Latin American countries are taken out of the equation, the differences in government spending between the industrialized and developing is as follows:

- Social expenditures, as a proportion for GDP for Indonesia or the Dominican Republic, registers around the 2–3 per cent mark, compared to Sweden or France which at the moment hover just under the 30%.

- In contrast to the industrialized states, from 1980 to 1990 many southern states experienced a decline in social spending as a percentage of overall government spending.

Therefore, in contrast to the North, the developing states are far more vulnerable to the pressures arising from economic globalization. Overall, social spending is far lower in the South, with some regions registering just a few percentage points of GDP.[22] However, some people argue that decrease in welfare spending is not an issue of global inequality but rather a common phenomenon in an era of globalization.[23]

Proposed explanations

In economics and political science, a variety of explanations have been advanced to explain the magnitude of the disparity in economic growth and development between nations.

Differences in economic institutions

Economic institutions such as competitive markets, credible contracts and systems of property rights allow economic agents to pursue the economic activities which form the basis of growth.[24] It has been argued that the presence or absence of strong economic institutions is a primary determinant of development. Economists have begun to consider the set of economic institutions adopted by countries as a choice that is in turn determined endogenously by competing social forces.[25]

In the colonial setting

Pointing to European colonization as a "natural experiment," Daron Acemoglu, Simon Johnson and James A. Robinson argue that colonizers who encountered dense populations with developed economies such as in Central America and India were incentived to impose extractive economic institutions, while colonizers who encountered sparse populations with few natural resources such as in North America were more likely to institute broad-based property rights.[25] This resulted in a "reversal of fortune" around 1800 as regions which were under-developed at the time of colonization were able to industrialize more effectively. By instrumenting the strength of property rights in colonized nations with European settler mortality (a quasi-random determinant of whether Europeans were able to establish colonies), the authors conclude in a widely cited paper that the majority of present day inequality among former European colonies can be attributed to the persisting role of economic institutions.[26]

Path dependence

In the context of development, path dependence encapsulates the idea that certain decisive moments in history may have an outsized and persistent impact on the long-run economic and political character of nations. These moments, known as critical junctures, may produce outcomes which induce positive feedback and thereby set nations on patterns of development that are difficult to reverse.[27]

In Central America

Political scientist James Mahoney has examined the political consequences of a period of liberal reform which swept Central America in the 19th and early 20th centuries. As an example of path dependence, the author argues that whether policies were implemented along radical or reformist guidelines directly determined the success of the liberalization efforts and ultimately resulted in vastly different political outcomes which persisted for decades, ranging from military authoritarian regimes (Guatemala and El Salvador) to progressive democracy (Costa Rica).[28]

Other explanations

A multitude of other explanations have been propounded including:

- Environmental factors (including work by Jared Diamond[29])

- Cultural factors (including work by Max Weber[30])

Views on economic inequality

There are various schools of thought regarding economic inequality. Marxism favors an eventual society where distribution is based on an individual's needs rather than social class or other such factors. Meritocracy favors an eventual society where an individual's success is a direct function of contribution reflecting an individual's skills and effort, and detrimental (this is a value judgement) inasmuch as it represent inherited or unjustified wealth or opportunities. Classical liberals and libertarians generally do not take a stance on wealth inequality, but believe in equality under the law regardless of whether it leads to unequal wealth distribution. Arguments based on social justice favor a more equal distribution making claims economic inequality weakens societies, although counter-arguments are made that inequality might benefit societies.[citation needed]

See also

- Distribution of wealth

- Economic development

- Economic mobility

- Income disparity

- Income inequality metrics

- Income inequality in the United States

- International development

- List of countries by income equality

- Poverty

- United Nations Millennium Development Goals

- Wealth inequality in the United States

- Wealth inequality in Latin America

References

- ^ http://hdr.undp.org/statistics/data/indic/indic_4_1_1.html

- ^ Oxfam: Richest 1 percent sees share of global wealth jump

- ^ Rigged rules mean economic growth increasingly “winner takes all” for rich elites all over world. Oxfam. January 20, 2014.

- ^ Neuman, Scott (January 20, 2014). Oxfam: World's Richest 1 Percent Control Half Of Global Wealth. NPR. Retrieved January 25, 2014.

- ^ Stout, David (20 January 2014). "One Stat to Destroy Your Faith in Humanity: The World's 85 Richest People Own as Much as the 3.5 Billion Poorest". Time. Retrieved 21 January 2014.

- ^ Wearden, Graeme (20 January 2014). "Oxfam: 85 richest people as wealthy as poorest half of the world". The Guardian. Retrieved 21 January 2014.

- ^ Kristof, Nicholas (22 July 2014). "An Idiot's Guide to Inequality". New York Times. Retrieved 22 July 2014.

- ^ Cohen, Patricia (19 January 2015). "Richest 1% Likely to Control Half of Global Wealth by 2016, Study Finds". New York Times. Retrieved 19 January 2015.

- ^ [1]

- ^ http://www.voxeu.org/index.php?q=node/4508

- ^ Branko Milanovic-Global Income Inequality by the Numbers-In History and Now-February 2013

- ^ [2]

- ^ The Gini coefficient corresponds to 85 %

- ^ http://www.spiegel.de: Report at 5 December 2006, www.orf.at: report at 5 Decembre 2006

- ^ http://www.spiegel.de: report from 6 March 2008

- ^ [3] www.intel.com - report at 2 January 2009

- ^ Spiegel.de - report at 23 August 2005

- ^ zeit.de report at 27 August 2008

- ^ Shaohua Chen, Martin Ravallion. The developing world is poorer than we thought, but no less successful in the fight against poverty. Policy Research Working Paper 4703, The World Bank Development Research Group, August 2008.

- ^ United Nations. The Millennium Development Goals Report. Statistical Annex 2009.

- ^ Milanovic, Branko and Yitzhaki, Shlomo, 2002. "Decomposing World Income Distribution: Does the World Have a Middle Class?", Review of Income and Wealth, Blackwell Publishing, vol. 48(2), pages 155-78, June 2002.

- ^ Glenn, John (2009). "Welfare Spending in an Era of Globalization: The North-South Divide". International Relations. 23 (1): 27–8, 30–1, 36–9, 45–6. doi:10.1177/0047117808100608.

- ^ Deacon, Bob (March 2000). "Globalization and Social Policy: The Threat to Equitable Welfare". United Nations Research Institute for Social Development.

- ^ North, Douglass (1992). Transaction costs, institutions, and economic performance. San Francisco, CA: ICS Press. pp. 5–32.

- ^ a b Acemoglu, Daron; Johnson, Simon; Robinson, James A. (2005). Durlauf, Philippe Aghion and Steven N. (ed.). Handbook of Economic Growth. Vol. 1, Part A. Elsevier. pp. 385–472.

- ^ Acemoglu, Daron; Johnson, Simon; Robinson, James A (1 December 2001). "The Colonial Origins of Comparative Development: An Empirical Investigation". American Economic Review. 91 (5): 1369–1401. doi:10.1257/aer.91.5.1369. ISSN 0002-8282.

- ^ Pierson, Paul (2000). "Increasing Returns, Path Dependence, and the Study of Politics". The American Political Science Review. 94 (2): 251–267. doi:10.2307/2586011.

- ^ Mahoney, James (1 March 2001). "Path-Dependent Explanations of Regime Change: Central America in Comparative Perspective". Studies in Comparative International Development. 36 (1): 111–141. doi:10.1007/BF02687587. ISSN 0039-3606.

- ^ Diamond, Jared M. (1 April 1999). Guns, Germs, and Steel: The Fates of Human Societies (1st edition ed.). W. W. Norton & Company. ISBN 9780393317558.

{{cite book}}:|edition=has extra text (help) - ^ Weber, Max (12 October 2013). The Protestant Ethic and the Spirit of Capitalism (abridged edition edition ed.). S.l.: Merchant Books. ISBN 9781603866040.

{{cite book}}:|edition=has extra text (help)

Sources

- Milanovic, Branko (World Bank), True world income distribution, 1988 and 1993: first calculation based on household surveys alone, The Economic Journal, Volume 112 Issue 476 Page 51 - January 2002. Article: [5]. Actual report on which the article is based: [6]. News coverage: [7] and [8].

- Cole, Matthew A. and Neumayer, Eric. The pitfalls of convergence analysis: is the income gap really widening? Applied Economics Letters, 2003, vol. 10, issue 6, pages 355-357 [9]

- Quah, Danny (1997). "Empirics for growth and distribution: stratification, polarization and convergence clubs", Journal of Economic Growth, March 1997, vol. 2, no. 1, pages 27–59.

- Martin Ravallion, "A poverty-inequality trade-off?", World Bank, 5 May 2005, Policy Research Working Paper no. WPS 3579,

- Martin Ravallion, "Looking beyond Averages in the Trade and Poverty Debate", World Bank, November 2004, Policy Research Working Paper No. 3461

- Barro, Robert (2000). "Inequality and Growth in a Panel of Countries" (PDF). Journal of Economic Growth. 7 (1)..

- James B. Davies; Susanna Sandstrom; Anthony Shorrocks; Edward N. Wolff (2006). "The World Distribution of Household Wealth". The World Distribution of Household Wealth. World Institute for Development Economics Research of the United Nations University (UNU-WIDER). Retrieved 8 December 2006. News coverage: [10] [11]

External links

- World Distribution of Household Wealth report at United Nations University

- The UC Atlas of Global Inequality explores some aspects of inequality using online, downloadable maps and graphics.

- Poverty Facts and Stats is a well-documented source of comparisons.

- UN World Social Situation Report 2005 - Inequality Predicament

- Common Dreams - Globalization Driving Inequality, UN Warns

- Heritage Foundation - Economic Freedom and Per Capita Income