Federal Reserve: Difference between revisions

| [pending revision] | [pending revision] |

m Corrected incomplete link |

|||

| Line 14: | Line 14: | ||

| currency = [[US dollar]] |

| currency = [[US dollar]] |

||

| currency_iso = USD |

| currency_iso = USD |

||

| borrowing_rate = 4.25% (Dropped 1/4% on |

| borrowing_rate = 4.25% (Dropped 1/4% on 12/11/2007) |

||

| deposit_rate = 4.50% |

| deposit_rate = 4.50% |

||

| website = [http://www.federalreserve.gov/ federalreserve.gov] |

| website = [http://www.federalreserve.gov/ federalreserve.gov] |

||

Revision as of 15:43, 12 December 2007

Seal | |

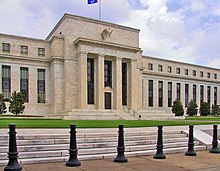

The Federal Reserve System Eccles Building (Headquarters) | |

| Headquarters | Washington, D.C. |

|---|---|

| Chairman | Ben Bernanke |

| Central bank of | United States |

| Currency | US dollar USD (ISO 4217) |

| Bank rate | 4.25% (Dropped 1/4% on 12/11/2007) |

| Interest on reserves | 4.50% |

| Website | federalreserve.gov |

The Federal Reserve System (also the Federal Reserve; informally The Fed) is the central banking system of the United States. The Federal Reserve System, created in 1913, is a private banking system composed of (1) the presidentially-appointed Board of Governors of the Federal Reserve System in Washington, D.C.; (2) the Federal Open Market Committee; (3) 12 regional Federal Reserve Banks located in major cities throughout the nation acting as fiscal agents for the U.S. Treasury, each with its own nine-member board of directors; (4) numerous private U.S. member banks, which subscribe to required amounts of non-transferable stock in their regional Federal Reserve Banks; and (5) various advisory councils.

The Federal Reserve System was established in 1913 by the enactment of the Federal Reserve Act. Currently, Ben Bernanke serves as the Chairman of the Board of Governors of the Federal Reserve System.

History

The Federal Reserve System is the third central banking system in the United States' history. The First Bank of the United States (1791-1811) and the Second Bank of the United States (1816-1836) each had 20-year charters, and both issued currency, made commercial loans, accepted deposits, purchased securities, had multiple branches, and acted as fiscal agents for the U.S. Treasury. [1] In both banks the Federal Government was required to purchase 20% of the bank's capital stock and appoint 20% of the directors. Thus majority control was in the hands of private investors who purchased the rest of the stock. The banks were opposed by state-chartered banks, who saw them as very large competitors, and by many who thought they were engines of corruption that supported the business class over the needs of the common man. President Andrew Jackson vetoed legislation to renew the Second Bank of the United States, starting a period of free banking. In 1863, as a means to help finance the Civil War, a system of national banks was instituted by the National Currency Act. The banks each had the power to issue standardized national bank notes based on United States bonds held by the bank. The Act was totally revised in 1864 and later named as the National-Bank Act, or National Banking Act, as it is popularly known. The administration of the new national banking system was vested in the newly created Office of the Comptroller of the Currency and its chief administrator, the Comptroller of the Currency. The Office, which still exists today, examines and supervises all nationally chartered banks and is a part of the U.S. Treasury Department.

The early national banking system had two main weaknesses, an inelastic currency and a lack of liquidity. National bank currency was considered inelastic because it was based on the fluctuating value of U.S. Treasury bonds rather than the growing needs of the U.S. economy. If Treasury bond prices declined, a national bank had to reduce the amount of currency it had in circulation by either refusing to make new loans or by calling in loans it had already made. The related liquidity problem was largely caused by an immobile, pyramid reserve system, in which nationally chartered country banks were required to set aside their reserves in reserve city banks, which in turn were required to set aside reserves in central city banks. During planting season country banks needed to call in their reserves, and during the harvest season they would add to their reserves. A national bank whose reserves were being drained would replace its reserves by selling stocks and bonds, by borrowing from a clearing house or by calling in loans. As there was little in the way of deposit insurance, if a bank was rumored to be having liquidity problems then this might precipitate a run on the bank. Because of the crescendo effect of these and other difficulties, during the last quarter of the 19th Century and the beginning of the 20th Century the United States economy went through a series of financial panics. [2]

A particularly severe panic in 1907 provided the backdrop of renewed calls for banking and currency reform,[3] and the following year Congress enacted the Aldrich-Vreeland Act which provided for an emergency currency and established the National Monetary Commission to study banking and currency reform.[4]

The head the bipartisan National Monetary Commission was financial expert and Senate Republican leader Nelson Aldrich. Aldrich set up two commissions — one to study the American monetary system in depth and the other, headed by Aldrich himself, to study the European central-banking systems and report on them.[4] Aldrich went to Europe opposed to centralized banking, but after viewing Germany's banking system came away believing that a centralized bank was better than the government-issued bond system that he had previously supported. Centralized banking was met with much opposition from politicians, who were suspicious of a central bank and who charged that Aldrich was biased due to his close ties to wealthy bankers such as J.P. Morgan and his daughter's marriage to John D. Rockefeller, Jr. In 1910, Aldrich and executives representing the banks of J.P. Morgan, Rockefeller, and Kuhn, Loeb, & Co., secluded themselves for 10 days at Jekyll Island, Georgia.[4] The executives included Frank Vanderlip, president of the National City Bank of New York, associated with the Rockefellers; Henry Davison, senior partner of J.P. Morgan Company; Charles D. Norton, president of the First National Bank of New York; and Col. Edward House, who would later become President Woodrow Wilson's closest adviser and founder of the Council on Foreign Relations.[5] There, Paul Warburg of Kuhn, Loeb, & Co. directed the proceedings and wrote the primary features of what would be called the Aldrich Plan. Warburg would later write that "The matter of a uniform discount rate (interest rate) was discussed and settled at Jekyll Island." Vanderlip wrote in his 1935 autobiography From Farmboy to Financier :

I was as secretive, indeed I was as furtive as any conspirator. Discovery, we knew, simply must not happen, or else all our time and effort would have been wasted. If it were to be exposed that our particular group had got together and written a banking bill, that bill would have no chance whatever of passage by Congress…I do not feel it is any exaggeration to speak of our secret expedition to Jekyll Island as the occasion of the actual conception of what eventually became the Federal Reserve System.”

Despite the importance of the Jekyll Island meeting, it remained a secret to both the public and the government until journalist Bertie Charles Forbes wrote an article about it in 1916, three years after the Federal Reserve Act was passed.

Aldrich fought for a private bank with little government influence, but conceded that the government should be represented on the Board of Directors. Aldrich then presented what was commonly called the "Aldrich Plan" -- which called for establishment of a "National Reserve Association" -- to the National Monetary Commission.[4] Most Republicans and Wall Street bankers favored the Aldrich Plan,[5] but it lacked enough support in the bipartisan Congress to pass.[6]

Because the bill was introduced by Aldrich, considered the epitome of the "Eastern establishment", the bill received little support and was derided by southerners and westerners who believed that wealthy families and large corporations ran the country and would thus run the proposed National Reserve Association.[6] Rural bankers also opposed the plan, believing it gave too much power to their eastern counterparts.[6] Progressive Democrats instead favored a reserve system owned and operated by the government and out of control of the "money trust", ending Wall Street's control of American currency supply.[5] Conservative Democrats fought for a privately owned, yet decentralized, reserve system, which would still be free of Wall Street's control.[5] The National Board of Trade appointed Warburg as head of a committee to convince Americans to support the plan. The committee set up offices in the then-45 states and distributed printed materials about the central bank.[4] The Nebraskan populist and frequent Democratic presidential candidate William Jennings Bryan said of the plan: "Big financiers are back of the Aldrich currency scheme." He asserted that if it passed, big bankers would "then be in complete control of everything through the control of our national finances."[7].

There was even Republican opposition to the Aldrich Plan. Republican Sen. Robert M. LaFollette and Rep. Charles Lindbergh Sr. both spoke out against the favoritism that they contended the bill granted to Wall Street. "The Aldrich Plan is the Wall Street Plan…I have alleged that there is a 'Money Trust'", said Lindbergh. "The Aldrich plan is a scheme plainly in the interest of the Trust". In response, the Senate Banking Committee held the Pujo hearings, lead by the Democratic lawyer Samuel Untermyer, who later also assisted in preparing the Federal Reserve Act, which convinced the populace that America's money already rested in the hands of a select few on Wall Street. It issued a Report saying:

"If by a 'money trust' is meant an established and well-defined identity and community of interest between a few leaders of finance…which has resulted in a vast and growing concentration of control of money and credit in the hands of a comparatively few men…the condition thus described exists in this country today...To us the peril is manifest...When we find...the same man a director in a half dozen or more banks and trust companies all located in the same section of the same city, doing the same class of business and with a like set of associates similarly situated all belonging to the same group and representing the same class of interests, all further pretense of competition is useless.... "[7]

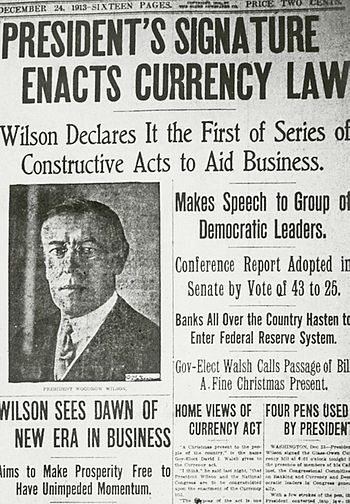

It took the political influence of newly elected Democratic President Woodrow Wilson, along with a Democratic majority in both houses of Congress, to get the Aldrich Plan passed as the Federal Reserve Act in 1913. [6] Wilson thought the plan was "60-70% correct".[4] When Virginia Rep. Carter Glass, chairman of the House Committee on Banking and Currency, presented his bill to President-elect Wilson, Wilson said that the plan must be amended to contain a Board of Governors appointed by the executive branch to maintain control over the bankers.[7]

After Wilson presented the bill to Congress, a group of Democratic congressmen revolted, led by Representative Robert Henry of Texas, demanding that the "Money Trust" be destroyed before it could undertake major currency reforms. They particularly objected to the idea of regional banks having to operate without the implicit government protections that large, so-called money-center banks would enjoy. The group almost succeeded in killing the bill, but were mollified by Wilson's promises to propose antitrust legislation after the bill had passed and by Bryan's support of the bill.[7]

Congress passed the Federal Reserve Act in late 1913 on a mostly partisan basis, with most Democrats in support and most Republicans against it.[7] The plan that passed was closer to the Aldrich Plan than to the two Democratic plans.[5] Frank Vanderlip, one of the Jekyll Island attendees and the President of National City Bank, wrote in his autobiography:

"Although the Aldrich Federal Reserve Plan was defeated when it bore the name Aldrich, nevertheless its essential points were all contained in the plan that was finally adopted."[5]

This point was also made by Rep. Charles Lindbergh Sr., the most vocal opponent of the bill and a member of the House Banking and Currency Committee, who on the day before the Federal Reserve Act was passed told Congress:

"This is the Aldrich bill in disguise…The worst legislative crime of the ages is perpetrated by this banking bill…The banks have been granted the special privilege of distributing the money, and they charge as much as they wish…This is the strangest, most dangerous advantage ever placed in the hands of a special privilege class by any Government that ever existed. The system is private...There should be no legal tender other than that issued by the government…The People are the Government. Therefore the Government should, as the Constitution provides, regulate the value of money." (Congressional Record, 1913-12-22)

Congressman Victor Murdock told Congress on that same day:

"I do not blind myself to the fact that this measure will not be effectual as a remedy for a great national evil – the concentrated control of credit…The Money Trust has not [died]...He will not cease fighting…at some half-baked enactment…You struck a weak half-blow, and time will show that you have lost. You could have struck a full blow and you would have won." (Congressional Record, 12/22/1913)

In order to get the Federal Reserve Act passed, Wilson needed the support of populist William Jennings Bryan, who was credited with ensuring Wilson's nomination by dramatically throwing his support Wilson's way at the 1912 Democratic convention.[7] Wilson appointed Bryan as his Secretary of State.[6] Bryan served as leader of the agrarian wing of the party and had argued for unlimited coinage of silver in his "Cross of Gold Speech" at the 1896 Democratic convention.[8] Bryan and the agrarians wanted a government-owned central bank which could print paper money whenever Congress wanted, and thought the plan gave bankers too much power to print the government's currency. Wilson sought the advice of prominent lawyer Louis Brandeis to make the plan more amenable to the agrarian wing of the party; Brandeis agreed with Bryan. Wilson convinced them that because Federal Reserve notes were obligations of the government and because the President would appoint the members of the Federal Reserve Board, the plan fit their demands.[7] However, Bryan soon became disillusioned with the system. In the November 1923 issue of "Hearst's Magazine" Bryan wrote that "The Federal Reserve Bank that should have been the farmer's greatest protection has become his greatest foe."

Southerners and westerners learned from Wilson that the system was decentralized into 12 districts and surely would weaken New York and strengthen the hinterlands. Sen. Robert Owen of Oklahoma eventually relented to speak in favor of the bill, arguing that the nation's currency was already under too much control by New York elites, whom he alleged had singlehandedly conspired to cause the 1907 Panic.[5]

Large bankers thought the legislation gave the government too much control over markets and private business dealings. The New York Times called the Act the "Oklahoma idea, the Nebraska idea"-- referring to Owen and Bryan's involvement.[7]

However, several Congressmen, including Owen, Lindbergh, LaFollette, and Murdock claimed that the New York bankers feigned their disapproval of the bill in hopes of inducing Congress to pass it. The day before the bill was passed, Murdock told Congress:

"You allowed the special interests by pretended dissatisfaction with the measure to bring about a sham battle, and the sham battle was for the purpose of diverting you people from the real remedy, and they diverted you. The Wall Street bluff has worked." (Congressional Record, 12/22/1913)

While a system of 12 regional banks was designed so as not to give eastern bankers too much influence over the new bank, in practice, the Federal Reserve Bank of New York became "first among equals". The New York Fed, for example, is solely responsible for conducting open market operations, at the direction of the Federal Open Market Committee.[9] Democratic Congressman Carter Glass sponsored and wrote the eventual legislation,[6] and his home of Richmond, Virginia, was made a district headquarters. Democratic Senator James A. Reed of Missouri obtained two districts for his state.[10] To quell Elihu Root's objections to possible inflation, the passed bill included provisions that the bank must hold at least 40% of its outstanding loans in gold. (In later years, to prevent depressions and stimulate short-term economic activity, Congress would amend the act to allow more discretion in the amount of gold that must be redeemed by the Bank.)[5] Critics of the time (later joined by economist Milton Friedman) suggested that Glass's legislation was almost entirely based on the Aldrich Plan that had been derided as giving too much power to elite bankers. Glass denied copying Aldrich's plan. In 1922, he told Congress, "no greater misconception was ever projected in this Senate Chamber."[8]

Wilson named Warburg and other prominent experts to direct the new system, which began operations in 1915 and played a major role in financing the Allied and American war efforts.[11] Warburg at first refused the appointment, citing America's opposition to a "Wall Street man", but when World War I broke out he accepted. He was the only appointee asked to appear before the Senate, whose members questioned him about his interests in the central bank and his ties to Kuhn, Loeb, & Co.'s "money trusts".[4]

In July 1979, Paul Volcker was nominated, by President Carter, as Chairman of the Federal Reserve Board amid roaring inflation. He tightened the money supply, and by 1986 inflation had fallen sharply.[12] In October 1979 the Federal Reserve announced a policy of "targeting" money aggregates and bank reserves in its struggle with double-digit inflation. [13]

In January 1987, with retail inflation at only 1%, the Federal Reserve announced it was no longer going to use money-supply aggregates, such as M2, as guidelines for controlling inflation, even though this method had been in use from 1979, apparently with great success. Before 1980, interest rates were used as guidelines; inflation was severe. The Fed complained that the aggregates were confusing. Volcker was chairman until August 1987, whereupon Alan Greenspan assumed the mantle, seven months after monetary aggregate policy had changed. [14]

Legal status and position in government

| Public finance |

|---|

|

The Federal Reserve System was created via the Federal Reserve Act of December 23rd, 1913.[15] The Reserve Banks opened for business on November 16, 1914. Federal Reserve Notes were created as part of the legislation, to provide a supply of currency. The notes were to be issued to the Reserve Banks for subsequent transmittal to banking institutions. The various components of the Federal Reserve System have differing legal statuses.

The Board of Governors of the Federal Reserve System is an independent federal government agency.[16] The Board of Governors does not receive funding from Congress, and the terms of the seven members of the Board span multiple presidential and congressional terms. Once a member of the Board of Governors is appointed by the president, he or she functions mostly independently. The Board is required to make an annual report of operations to the Speaker of the U.S. House of Representatives.[17] The law provides for the removal of a member of the Board by the President "for cause."[18] The Board of Governors is responsible for the formulation of monetary policy. It also supervises and regulates the operations of the Federal Reserve Banks, and US banking system in general.

The Federal Reserve Banks have an intermediate status, with some features of private corporations and some features of public federal agencies (see below). Each member bank owns nonnegotiable shares of stock in its regional Federal Reserve Bank—but these shares of stock give the member banks only limited control over the actions of the Federal Reserve Banks, and the charter of each Federal Reserve Bank is established by law and cannot be altered by the member banks. In Lewis v. United States,[19] the United States Court of Appeals for the Ninth Circuit stated that "the Reserve Banks are not federal instrumentalities for purposes of the FTCA [the Federal Tort Claims Act], but are independent, privately owned and locally controlled corporations." The opinion also stated that "the Reserve Banks have properly been held to be federal instrumentalities for some purposes." Another decision is Scott v. Federal Reserve Bank of Kansas City[20] in which the distinction between the Federal Reserve Banks and the Board of Governors is made.

The member banks are privately owned corporations. The stocks of many of the member banks (or their holding companies) are publicly traded.

Organization

The basic structure of the Federal Reserve System includes:

- The Federal Reserve Banks

- The member banks.

Each Federal Reserve Bank and each member bank of the Federal Reserve System is subject to oversight by a Board of Governors.[21] The seven members of the board are appointed by the President and confirmed by the Senate.[22] Members are selected to terms of 14 years (unless removed by the President), which are generally limited to one term. However, if someone is appointed to serve the remainder of another member's uncompleted term, he or she may be reappointed to serve an additional 14-year term.[18] Conversely, a governor may serve the remainder of another governor's term even after he or she has completed a full term.

The current members of the Board of Governors are:

- Ben Bernanke, Chairman

- Donald Kohn, Vice-Chairman

- Frederic Mishkin

- Kevin Warsh

- Randall Kroszner

(*Because appointments of members are staggered there are currently only five members on the board.)

All current members of the Board of Governors have taken office during the presidency of George W. Bush.

The Federal Open Market Committee (FOMC) created under 12 U.S.C. § 263 comprises the seven members of the board of governors and five representatives selected from the regional Federal Reserve Banks. The representative from the Second District, New York, (currently Timothy Geithner) is a permanent member, while the rest of the banks rotate at two- and three-year intervals.

Control of the money supply

The Federal Reserve System tries to control the size of the money supply by conducting open market operations, in which the Federal Reserve lends or purchases specific types of securities with authorized participants, known as primary dealers, such as the United States Treasury. All open market operations in the United States are conducted by the Open Market Desk at the Federal Reserve Bank of New York, with an aim to making the federal funds rate as close to the target rate as possible.[citation needed] For a detailed look at the process by which changes to a reserve account held at the Fed affect the wider monetary supply of the economy, see money creation. See also Seignorage.

The Open Market Desk has two main tools to adjust monetary supply: repurchase agreements and outright transactions.

Measuring the money supply

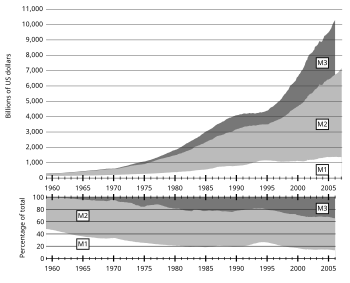

The most common measures are named M0 (narrowest), M1, M2, and M3. In the United States they are defined by the Federal Reserve as follows:

- M0: The total of all physical currency, plus accounts at the central bank that can be exchanged for physical currency.

- M1: M0 - those portions of M0 held as reserves or vault cash + the amount in demand accounts ("checking" or "current" accounts).

- M2: M1 + most savings accounts, money market accounts, and small denomination time deposits (certificates of deposit of under $100,000).

- M3: M2 + all other CDs, deposits of eurodollars and repurchase agreements.

The Federal Reserve ceased publishing M3 statistics in March 2006, explaining that it costs a lot to collect the data but doesn't provide significantly useful information.[23] The other three money supply measures continue to be provided in detail.

Repurchase agreements

To smooth temporary or cyclical changes in the monetary supply, the desk engages in repurchase agreements (repos) with its primary dealers. Repos are essentially secured, short-term lending by the Fed. On the day of the transaction, the Fed deposits money in a primary dealer’s reserve account, and receives the promised securities as collateral. When the transaction matures, the process unwinds: the Fed returns the collateral and charges the primary dealer’s reserve account for the principal and accrued interest. The term of the repo (the time between settlement and maturity) can vary from 1 day (called an overnight repo) to 65 days.[citation needed]

Since there is an increase of bank reserves during the term of the repo, repos temporarily increase the money supply. The effect is temporary since all repo transactions unwind, with the only lasting net effect being a slight depletion of reserves caused by the accrued interest (think one day of interest at a 6.5% annual yield, which is 0.0178% per day). The Fed has conducted repos almost daily in 2004-05, but can also conduct reverse repos to temporarily shrink the money supply.[citation needed]

In a reverse repo, the Fed will borrow money from the reserve accounts of primary dealers in exchange for Treasury securities as collateral. At maturity, the Fed will return the money to the reserve accounts with the accrued interest, and collect the collateral.[citation needed]

Outright Transactions

The other main tool available to the Open Market Desk is the outright transaction. In an outright purchase, the Fed buys Treasury securities from primary dealers, such as the United States Treasury, and finances the purchases by depositing newly created money in the dealer’s reserve account at the Fed. Since this operation does not unwind at the end of a set period, the resulting growth in the monetary supply is permanent. That is to say that the principal growth is permanent but a yield on maturity of the security is still charged—this is usually at 12 - 18 months on outright transaction.[citation needed]

The Fed also has the authority to sell Treasuries outright, but this has been exceedingly rare since the 1980s. The sale of Treasury securities results in a permanent decrease in the money supply, as the money used as payment for the securities from the primary dealers is removed from their reserve accounts, thus working the money multiplier (see Money creation) process in reverse.[citation needed]

On Outright Transactions, the Desk selects bids with the highest prices (lowest yields) for its sales, and offers with the lowest prices (highest yields) for its purchases.[citation needed]

Implementation of monetary policy

Buying and selling federal government securities.

When the Federal Reserve System buys government securities, it puts money into circulation. With more money around, interest rates tend to drop, and more money is borrowed and spent. When the Fed sells government securities, it in effect takes money out of circulation, causing interest rates to rise and making borrowing more difficult.[citation needed]

Regulating the amount of money that a member bank must keep in hand as reserves.

A member bank lends out most of the money deposited with it. If the Federal Reserve System says that a member bank must keep in reserve a larger fraction of its deposits, then the amount that the member bank can lend drops, loans become harder to obtain, and interest rates rise.[citation needed]

Changing the interest charged to banks that want to borrow money from the federal reserve system.

Member banks borrow from the Federal Reserve System to cover short-term needs. The interest that the Fed charges for this is called the discount rate; this will have an effect, though usually rather small, on how much money the member banks will borrow.[citation needed]

Federal Reserve Balance Sheet

One of the keys to understanding the Federal Reserve is the Federal Reserve Balance Sheet (or Balance Statement). In accordance with Section 11 of the Federal Reserve Act, the Board of Governors of the Federal Reserve System publishes once each week the "Consolidated Statement of Condition of All Federal Reserve Banks" showing the condition of each Federal Reserve bank and a consolidated statement for all Federal Reserve banks.

Below is the balance sheet as of June 21, 2007 (in millions of dollars):

|

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Analyzing the Federal Reserve's Balance Sheet reveals many interesting things:

- The Fed has over 11 billion in gold which is a holdover from the days the government used to back US Notes and Federal Reserve Notes with gold

- The Fed holds almost a billion in coinage not as a liability but as an asset. The Treasury Department is actually in charge of creating coins and US Notes. The Fed then buys coinage from the Treasury by increasing the liability assigned to the Treasury's account

- The Fed holds 790 billion of the national debt.

- The Fed has about 21 billion in assets from Overnight Repurchase agreements. Repurchase agreements are the primary asset of choice for the Fed in dealing in the Open Market. Repo assets are bought by creating 'Depository institution' liabilities and directed to the bank the Primary Dealer uses when they sell into the Open Market.

- The 976 billion in Federal Reserve Note liabilities represents the total value of all dollar bills in existence

- The 16 billion in deposit liabilities of 'Depository institutions' shows that dollar bills are not the only source of government money. Banks can swap 'Deposit Liabilities' of the Fed for 'Federal Reserve Notes' back and forth as needed to match demand from customers, and the Fed can have the 'Bureau of Engraving and Printing' create the paper bills as needed to match demand from banks for paper money. The amount of money printed has no relation to the growth of the monetary base (M0).

- The 6 billion in Treasury liabilities shows that the Treasury Department doesn't use a private banker but rather uses the Fed directly (the lone exception to this rule is Treasury Tax and Loan because government worries that pulling too much money out of the private banking system during tax time could be disruptive).

- The 96 million Foreign liability represents the amount of Federal Reserve deposits held by foreign central banks.

- The 6 billion in 'Other liabilities and accrued dividends' represents partly the amount of money owed so far in the year to private banks as part of the 6% dividend guarantee the Fed grants banks for not loaning out a percentage of their reserves

- Total capital represents the profit the Fed has earned which comes mostly from the assets they purchase with the deposit and note liabilities they create. Excess capital is then turned over to the Treasury Department and Congress to be included into the Federal Budget as "Miscellaneous Revenue".

Federal funds rate and discount rate

The Federal Reserve System implements monetary policy largely by targeting the federal funds rate. This is the rate that banks charge each other for overnight loans of federal funds, which are the reserves held by banks at the Fed. This rate is actually determined by the market and is not explicitly mandated by the Fed. The Fed therefore tries to align the effective federal funds rate with the targeted rate by adding or subtracting from the money supply through open market operations. The late economist Milton Friedman consistently criticized this reverse method of controlling inflation by seeking an ideal interest rate and enforcing it through affecting the money supply since nowhere in the widely accepted money supply equation are interest rates found.[24]

The Federal Reserve System also directly sets the "discount rate", which is the interest rate that banks pay the Fed to borrow directly from it. However, banks usually prefer borrowing fed funds from other banks, even at a higher interest rate, rather than directly from the Fed, because that might suggest problems with the bank's credit-worthiness or solvency.[citation needed]

Both of these rates influence the prime rate which is usually about 3 percentage points higher than the federal funds rate.

Lower interest rates stimulate economic activity by lowering the cost of borrowing, making it easier for consumers and businesses to buy and build. Higher interest rates slow the economy by increasing the cost of borrowing.[citation needed] (See monetary policy for a fuller explanation.)

The Federal Reserve System usually adjusts the federal funds rate by 0.25% or 0.50% at a time. From early 2001 to mid 2003 the Federal Reserve lowered its interest rates 13 times, from 6.25 to 1.00%, to fight recession. In November 2002, rates were cut to 1.75, and many interest rates went below the inflation rate. (This is known as a negative real interest rate, because money paid back from a loan with an interest rate less than inflation has lower purchasing power than it had before the loan.) On June 25, 2003, the federal funds rate was lowered to 1.00%, its lowest nominal rate since July, 1958, when the overnight rate averaged 0.68%. Starting at the end of June, 2004, the Federal Reserve System raised the target interest rate and then continued to do so 17 straight times. Most recently, the Fed cut by .25% after its December 11, 2007 meeting, disappointing many invidual investors: the Dow Jones Industrial Average dropped by nearly 300 points at its close.

The Federal Reserve System might also attempt to use open market operations to change long-term interest rates, but its "buying power" on the market is significantly smaller than that of private institutions. The Fed can also attempt to "jawbone" the markets into moving towards the Fed's desired rates, but this is not always effective.[citation needed]

The Federal Reserve Banks and the member banks

The 12 regional Federal Reserve Banks (not to be confused with the "member banks"), which were established by Congress as the operating arms of the nation's central banking system, are organized much like private corporations—possibly leading to some confusion about “ownership.” For example, the Reserve Banks issue shares of stock to "member banks." However, owning Reserve Bank stock is quite different from owning stock in a private company. The Reserve Banks are not operated for profit, and ownership of a certain amount of stock by a "member bank" is, by law, a condition of membership in the system. The stock may not be sold or traded or pledged as security for a loan; dividends are, by law, limited to 6% per year.[25] The largest of the Reserve Banks, in terms of assets, is the Federal Reserve Bank of New York, which is responsible for the Second District covering the state of New York, the New York City region, 12 northern New Jersey counties, Puerto Rico, and the U.S. Virgin Islands.[26]

The dividends paid by the Federal Reserve Banks to member banks are considered partial compensation for the lack of interest paid on member banks' required reserves held at the Federal Reserve Banks. By law, banks in the United States must maintain fractional reserves, most of which are kept on account at the Fed. The Federal Reserve does not pay interest on these funds.[citation needed]

The basic structure of the Federal Reserve System includes:

- The Board of Governors

- The Federal Open Market Committee

- The Federal Reserve Banks

- The member banks.

Each Federal Reserve Bank and each member bank of the Federal Reserve System is subject to oversight by the Board of Governors (see generally 12 U.S.C. § 248). The seven members of the board are appointed by the President and confirmed by the Senate.[22] Members are selected to terms of 14 years (unless removed by the President), with the ability to serve for no more than one term.[18] A governor may serve the remainder of another governor's term in addition to his or her own full term.

The Federal Reserve Banks

The Federal Reserve Districts are listed below along with their identifying letter and number. These are used on Federal Reserve Notes to identify the issuing bank for each note.

The member banks

National banks are required to be member banks in the Federal Reserve System. Federal statute provides (in part):

- Every national bank in any State shall, upon commencing business or within ninety days after admission into the Union of the State in which it is located, become a member bank of the Federal Reserve System by subscribing and paying for stock in the Federal Reserve bank of its district in accordance with the provisions of this chapter and shall thereupon be an insured bank under the Federal Deposit Insurance Act [. . . .]"[27]

Other banks may elect to become member banks. According to the Federal Reserve Bank of Boston:

- Any state-chartered bank (mutual or stock-formed) may become a member of the Federal Reserve System. The twelve regional Reserve Banks supervise state member banks as part of the Federal Reserve System’s mandate to assure strength and stability in the nation’s domestic markets and banking system. Reserve Bank supervision is carried out in partnership with the state regulators, assuring a consistent and unified regulatory environment. Regional and community banking organizations constitute the largest number of banking organizations supervised by the Federal Reserve System.[28]

For example, as of October 2006 the member banks in New Hampshire included Community Guaranty Savings Bank; The Lancaster National Bank; The Pemigewasset National Bank of Plymouth; and other banks.[29] In California, member banks (as of September 2006) included Bank of America California, National Association; The Bank of New York Trust Company, National Association; Barclays Global Investors, National Association; and many other banks.[30]

Regulation of fractional reserve

The Fed regulates banks' fractional reserves—the portion of their deposits that banks must keep, on hand or at the Fed, as reserves to satisfy any demands for withdrawal. This directly affects the banks' ability to make loans, since loans cannot be made out of reserves. The United States' rules and oversight are within limits and guidelines set by the Bank for International Settlements, a banking agency which pre-dates the Bretton Woods financial and monetary system and its institutions.

Criticisms

A large and varied group of criticisms have been directed against the Federal Reserve System. One critique, typified by the Austrian School, is that the Federal Reserve is an unnecessary and counterproductive interference in the economy.[31] Other critiques include arguments in favor of the gold standard (usually coupled with the belief that the Federal Reserve System is unconstitutional)[32] or beliefs that the centralized banking system is doomed to fail.[31] Some critics argue that the Fed lacks accountability and transparency or that there is a culture of secrecy within the Reserve.[33]

Historical criticisms

Criticisms of the Federal Reserve System are not new, and some historical criticisms are reflective of current concerns.

At one end of the spectrum are economists from the Austrian School and the Chicago School who want the Federal Reserve System abolished.[34] They criticize the Federal Reserve System’s expansionary monetary policy in the 1920s, arguing that the policy allowed misallocations of capital resources and supported a massive stock price bubble. They also cite politically motivated expansions or tightening of currency in the 1970s and 1980s.[34]

Milton Friedman, leader of the Chicago School, argued that the Federal Reserve System did not cause the Great Depression, but made it worse by contracting the money supply at the very moment that markets needed liquidity. Since its entire existence was predicated on its mission to prevent events like the Great Depression, it had failed in what the 1913 bill tried to enact.[35] This is also the current conventional wisdom on the matter, as both Ben Bernanke and other economists such as the late John Kenneth Galbraith--the latter being an ardent Keynesian--have upheld this reasoning. Friedman also said that ideally he would "prefer to abolish the federal reserve system altogether" rather than try to reform it, because it was a flawed system in the first place.[36] He later said he would like to "abolish the Federal Reserve and replace it with a computer", meaning that it would be a mechanical system in nature that would keep the quantity of money going up at a steady rate. Friedman also believed that, ideally, the issuing power of money should rest with the Government instead of private banks issuing money through fractional reserve lending.[37]

Ben Bernanke agreed that the Fed had made the Great Depression worse, saying in a 2002 speech: "I would like to say to Milton [Friedman] and Anna [J. Schwartz]: Regarding the Great Depression. You're right, we did it. We're very sorry. But thanks to you, we won't do it again."[38] [39]

Friedman also alleged that the Fed caused the high inflation of the 1970s. When asked about the greatest economic problem of the day, he said the most pressing was how to get rid of the Federal Reserve.[35]

Opacity

Some believe the Federal Reserve System is shrouded in what its critics call excessive secrecy. Meetings of some components of the Fed are held behind closed doors, and the transcripts are released with a lag of five years.[40] Even expert policy analysts are unsure about the logic behind Fed decisions.[41] Critics argue that such opacity leads to greater market volatility, because the markets must guess, often with only limited information, about how the Fed is likely to change policy in the future. The jargon-laden fence-sitting opaque style of Fed communication, especially under the previous Fed Chairman Alan Greenspan, has often been called "Fed speak."[41]

The Federal Reserve System has also been considered reserved in its relations with the media in an effort to maintain its carefully crafted image and resents any public information that runs contrary to this notion. Maria Bartiromo reported on CNBC that during a conversation at the White House Correspondents’ Dinner in April 2006, Federal Reserve Board Chairman Ben Bernanke stated investors had misinterpreted his recent congressional remarks as an indication the Fed was nearly done raising rates. This triggered a drop in stock prices just when the market was about to close.[42][43][44]

Some critics argue that the lag in the release of FOMC transcripts, and the limited and carefully worded minutes and statements lead to public unawareness of the issues of major concern to the Fed, and leave the public with an inadequate understanding of the logic and rationale behind the decisions.[citation needed] Some argue that this is a concerted attempt to keep Congress and the public at arm’s length[citation needed], and that the Fed did not help this public attitude with their prior actions--transcripts of meetings were not released until 1994. Before that time, the Fed refused to give transcripts out on requests, even under the Freedom of Information Act. When a judge ordered the transcripts released in the 1970s, the Fed said they had stopped taking transcripts at all.[citation needed] In 1993, Rep. Henry Gonzalez confirmed that the Fed did have tapes and transcripts of the meetings and could have complied with the FOIA requests, but had misrepresented the existence of the transcripts and chosen to ignore questions from Congress.[45] After the existence of the transcripts was revealed, the Fed agreed to release the transcripts on a five-year time lag. The time period has been extended, so that for example 1992's transcripts were not released until 1998.[45]

Some critics believe the Fed exacerbated this idea when the Fed decided to stop publishing the M3 aggregate of financial data,[citation needed] which details the total amount of money in circulation at a time. The Fed said that economists did not need M3 when they had M2.[46] However, a journalist from the Connecticut Journal-Inquirer disagreed and saw no reason (according to his own views) to stop posting the numbers other than to keep the amount of America's debt or a pending stock market crash or worsening economy hidden.[47] In addition, Congressman Ron Paul questioned the action of discontinuing the M3 statistic, as the move would only save the Federal Reserve less than .001% of their annual budget.[citation needed]

Business cycles, libertarian philosophy and free markets

Economists of the Austrian School such as Ludwig von Mises contend that the Federal Reserve's operation amounts to an artificial manipulation of the money supply and has led to the boom/bust business cycle occurring over the last century. Many economic libertarians, such as Austrian School economist Murray Rothbard, believe that the Federal Reserve's manipulation of the money supply to stop "gold flight" from England caused, or was instrumental in causing, the Great Depression. See Austrian Business Cycle Theory. In general, laissez-faire advocates of free banking argue that there is no better judge of the proper interest rate and money supply than the market.[48]

Many Libertarians also contend that the Federal Reserve Act is unconstitutional. Congressman Ron Paul (ranking member of the House Subcommittee on Domestic Monetary Policy), for example, argues that: "The United States Constitution grants to Congress the authority to coin money and regulate the value of the currency. The Constitution does not give Congress the authority to delegate control over monetary policy to a central bank. Furthermore, the Constitution certainly does not empower the federal government to erode the American standard of living via an inflationary monetary policy."[49]

Inflation

One major area of criticism focuses on the failure of the Federal Reserve System to stop inflation; this is seen as a failure of the Fed's legislatively mandated duty[50] to maintain stable prices. These critics focus particularly on inflation's effects on wages, since workers are hurt if their wages do not keep up with inflation.[51] They point out that wages, as adjusted for inflation, or real wages, have dropped in the past. [52] But other economists argue that the Fed is too much focused on inflation, which is effectively a contractionary policy that keeps the unemployment rate too high and suppresses wages, as a result.[citation needed]

Congress

Congressman Louis T. McFadden, Chairman of the House Committee on Banking and Currency from 1920–31, accused the Federal Reserve of deliberately causing the Great Depression. In several speeches made shortly after he lost the chairmanship of the committee, McFadden claimed that the Federal Reserve was run by Wall Street banks and their affiliated European banking houses.[citation needed] On June 10, 1932, McFadden said:

Mr. Chairman, we have in this country one of the most corrupt institutions the world has ever known. I refer to the Federal Reserve Board and the Federal Reserve Banks. The Federal Reserve Board, a Government board, has cheated the Government of the United States and the people of the United States out of enough money to pay the national debt. These twelve private credit monopolies were deceitfully and disloyally foisted upon this country by the bankers who came here from Europe and repaid us for our hospitality by undermining our American institutions...The people have a valid claim against the Federal Reserve Board and the Federal Reserve banks.[53]

Quite a few Congressmen who have been involved in the House and Senate Banking and Currency Committees have been open critics of the Federal Reserve. Senator Robert L. Owen, the Chairman of the Senate Banking and Currency Committee from 1913-19, was a sponsor of the Federal Reserve Act in 1913, but he criticized the system later in his life because he did not believe that the Federal Reserve directors were doing enough to maintain a stable price level.[citation needed] Congressman Wright Patman, the Chairman of the House Banking and Currency Committee from 1963-75, spent his entire Congressional career criticizing the Federal Reserve's existence, saying that the Government should manage its own money system independent of the private banks.[citation needed] Congressman Henry Reuss chaired the same Committee from 1975-81 and he echoed Patman's criticism that the system inherently favored the corporate and banking elite.[citation needed] Congressman Henry Gonzalez also chaired the same Committee from 1989-95, and he was also an ardent critic of the Federal Reserve System.[citation needed] Currently, Congressman Ron Paul is the ranking member of the Monetary Policy SubCommittee and he is a staunch opponent of the Federal Reserve System. Paul annually introduces a bill in Congress to abolish the Federal Reserve.[10]

Other prominent banking institutions

- Bank of International Settlements

- International Monetary Fund

- World Bank

- Inter-American Development Bank

- Reserve Bank of Australia

- Bank of Mexico

- Bank of Canada

- Bank of England

- Banque de France

- European Central Bank

- Deutsche Bundesbank

- Bank of Japan

- National Bank of Poland

- State Bank of Pakistan

- Reserve Bank of India

- Central Bank of China (Taiwan)

- People's Bank of China (People's Republic of China)

- Banco Central do Brasil

- Bank of Scotland

- Central Bank of the Republic of Turkey

- Reserve Bank of New Zealand

See also

- Austrian Theory of the Business Cycle

- Cash-out

- Core inflation

- Discount window

- Economic reports

- Executive Order 11110

- Federal funds

- Fort Knox Bullion Depository

- Free banking

- Gold standard

- Government debt

- Inflation

- Money market

- Money supply

- Repurchase agreement

- United States dollar

- Federal Reserve Statistical Release

- Federal Reserve Act

- Greenspan put

Notes

- ^ Johnson, Roger T. "Historical Beginnings ... The Federal Reserve" (PDF). Federal Reserve Bank of Boston.

- ^ Flaherty, Edward. "A Brief History of Central Banking in the United States". University of Groningen, Netherlands.

- ^ Herrick, Myron (1908-03). "The Panic of 1907 and Some of Its Lessons". Annals of the American Academy of Political and Social Science.

{{cite web}}: Check date values in:|date=(help) - ^ a b c d e f g Whithouse, Michael (1989-05). "Paul Warburg's Crusade to Establish a Central Bank in the United States". Minnesota Federal Reserve.

{{cite web}}: Check date values in:|date=(help) - ^ a b c d e f g h "America's Unknown Enemy: Beyond Conspiracy". American Institute of Economic Research.

- ^ a b c d e f "Born of a panic: Forming the Federal Reserve System". Minnesota Federal Reserve. 1988-08.

{{cite web}}: Check date values in:|date=(help) - ^ a b c d e f g h Johnson, Roger (1999-12). "Historical Beginnings… The Federal Reserve" (PDF). Federal Reserve Bank of Boston.

{{cite web}}: Check date values in:|date=(help) - ^ a b Page, Dave (1997-12). "Carter Glass: A Brief Biography". Minnesota Federal Reserve.

{{cite web}}: Check date values in:|date=(help) - ^ Keleher, Robert (1997-03). "The Importance of the Federal Reserve". Joint Economic Committee. US House of Representatives.

{{cite web}}: Check date values in:|date=(help) - ^ A Foregone Conclusion: The Founding of the Federal Reserve Bank of St. Louis by James Neal Primm - stlouisfed.org - Retrieved January 1, 2007

- ^ Arthur Link, Wilson: The New Freedom; pp. 199-240 (1956).

- ^ Bartlett, Bruce (2004-06-14). "Warriors Against Inflation". National Review.

{{cite web}}: Italic or bold markup not allowed in:|publisher=(help) - ^ Source: A Monetary Chronology of the United States, American Institute for Economic Research, July 2006

- ^ A Monetary Chronology of the United States, American Institute for Economic Research, July 2006

- ^ Act of December 23, 1913, ch. 6, 38 Stat. 251, codified in part at Chapter 3 of title 12 of the United States Code, 12 U.S.C. § 221 et seq.

- ^ http://www.ca8.uscourts.gov/opndir/05/04/042357P.pdf

- ^ 12 U.S.C. § 247.

- ^ a b c See 12 U.S.C. § 242.

- ^ 680 F.2d 1239 (9th Cir. 1982).

- ^ Kennedy C. Scott v. Federal Reserve Bank of Kansas City, et al.

- ^ See generally 12 U.S.C. § 248.

- ^ a b See 12 U.S.C. § 241.

- ^ Discontinuance of M3

- ^ [1]

- ^ http://minneapolisfed.org/info/sys/faq/frs.cfm#3

- ^ "Federal Reserve Bank of New York". New York Times.

{{cite web}}: Italic or bold markup not allowed in:|publisher=(help) - ^ 12 U.S.C. § 222.

- ^ [2]

- ^ [3]

- ^ [4]

- ^ a b North, Gary (2007-05-30). "My Recommended Federal Reserve Policy". Lew Rockwell.

- ^ Paul, Ron (2002-06-10). "Gold, Dollars, and Federal Reserve Mischief". US House of Representatives representative homepage.

- ^ Rockwell, Llewelynn (1996-05). "Ending the Fed's Free Ride". Mises Institute.

{{cite web}}: Check date values in:|date=(help) - ^ a b "MONEY RULES: The Role of the Federal Reserve date=2002-01-09". Hoover Institution.

{{cite web}}: Missing pipe in:|title=(help) - ^ a b "Interview with Milton Friedman". Minneapolis Federal Reserve. 1992-06.

{{cite web}}: Check date values in:|date=(help) - ^ Friedman and Freedom, Interview with Peter Jaworski. The Journal, Queen's University, March 15, 2002 - Issue 37, Volume 129

- ^ "Greenspan voices concerns about quality of economic statistics". Stanford News Service. 1997-09-09.

- ^ [5]

- ^ [6]

- ^ Poole, William (2002-07). "Untold story of FOMC: Secrecy is exaggerated". St. Louis Federal Reserve.

{{cite web}}: Check date values in:|date=(help) - ^ a b Andrews, Edmund (2005-11-01). "News Analysis: Fed in a fishbowl? An era of secrecy seems over". New York Times. International Herald Tribune.

- ^ [7]

- ^ [8]

- ^ [9]

- ^ a b "Inner City Press' Federal Reserve Reporter". Inner City Press. 1999-05-17.

- ^ Discontinuance of M3

- ^ Levy, Harlan (2005-12-01). "Federal Reserve money supply report is about to fall into the abyss". Connecticut Journal-Inquirer.

- ^ "Three National Treasures author=Llewelyn Rockwell". Lew Rockwell. 1986.

{{cite web}}: Missing pipe in:|title=(help) - ^ Paul, Ron (2002-09-10). "Abolish the Federal Reserve". US House of Representatives representative homepage.

- ^ http://www.federalreserve.gov/generalinfo/mission/default.htm

- ^ http://www.minneapolisfed.org/pubs/region/97-09/wave.cfm

- ^ http://www.ft.com/cms/s/f269a8f4-c173-11d9-943f-00000e2511c8.html

- ^ http://www.afn.org/~govern/mcfadden_speech_1932.html

Bibliography

Recent

- Epstein, Lita & Martin, Preston (2003). The Complete Idiot's Guide to the Federal Reserve. Alpha Books. ISBN 0-02-864323-2.

- Greider, William (1987). Secrets of the Temple. Simon & Schuster. ISBN 0-671-67556-7; nontechnical book explaining the structures, functions, and history of the Federal Reserve, focusing specifically on the tenure of Paul Volcker

- R. W. Hafer. The Federal Reserve System: An Encyclopedia. Greenwood Press, 2005. 451 pp, 280 entries; ISBN 4-313-32839-0.

- Meyer, Lawrence H (2004). A Term at the Fed: An Insider's View. HarperBusiness. ISBN 0-06-054270-5; focuses on the period from 1996 to 2002, emphasizing Alan Greenspan's chairmanship during the Asian financial crisis, the stock market boom and the financial aftermath of the September 11, 2001 attacks.

- Woodward, Bob. Maestro: Greenspan's Fed and the American Boom (2000) study of Greenspan in 1990s.

Historical

- J. Lawrence Broz; The International Origins of the Federal Reserve System Cornell University Press. 1997.

- Vincent P. Carosso, "The Wall Street Trust from Pujo through Medina", Business History Review (1973) 47:421-37

- Chandler, Lester V. American Monetary Policy, 1928-41. (1971).

- Epstein, Gerald and Thomas Ferguson. "Monetary Policy, Loan Liquidation and Industrial Conflict: Federal Reserve System Open Market Operations in 1932." Journal of Economic History 44 (December 1984): 957-84. in JSTOR

- Milton Friedman and Anna Jacobson Schwartz, A Monetary History of the United States, 1867-1960 (1963)

- G. Edward Griffin, The Creature from Jekyll Island: A Second Look at the Federal Reserve (1994) ISBN 0-912986-21-2

- Paul J. Kubik, "Federal Reserve Policy during the Great Depression: The Impact of Interwar Attitudes regarding Consumption and Consumer Credit." Journal of Economic Issues . Volume: 30. Issue: 3. Publication Year: 1996. pp 829+.

- Link, Arthur. Wilson: The New Freedom (1956) pp 199-240.

- Livingston, James. Origins of the Federal Reserve System: Money, Class, and Corporate Capitalism, 1890-1913 (1986), Marxist approach to 1913 policy

- Mayhew, Anne. "Ideology and the Great Depression: Monetary History Rewritten." Journal of Economic Issues 17 (June 1983): 353-60.

- Meltzer, Allan H. A History of the Federal Reserve, Volume 1: 1913-1951 (2004) the standard scholarly history

- Roberts, Priscilla. "'Quis Custodiet Ipsos Custodes?' The Federal Reserve System's Founding Fathers and Allied Finances in the First World War", Business History Review (1998) 72: 585-603

- Rothbard, Murray N. A History of Money and Banking in the United States: The Colonial Era to World War II (2002)

- Rothbard, Murray N. (1994). The Case Against the Fed. Ludwig Von Mises Institute. ISBN 0-945466-17-X.

- Bernard Shull, "The Fourth Branch: The Federal Reserve's Unlikely Rise to Power and Influence" (2005) ISBN 1-56720-624-7

- Steindl, Frank G. Monetary Interpretations of the Great Depression. (1995).

- Temin, Peter. Did Monetary Forces Cause the Great Depression? (1976).

- West, Robert Craig. Banking Reform and the Federal Reserve, 1863-1923 (1977)

- Wicker, Elmus R. "A Reconsideration of Federal Reserve Policy during the 1920-1921 Depression", Journal of Economic History (1966) 26: 223-238, in JSTOR

- Wicker, Elmus. Federal Reserve Monetary Policy, 1917-33. (1966).

- Wells, Donald R. The Federal Reserve System: A History (2004)

- Wicker, Elmus. The Great Debate on Banking Reform: Nelson Aldrich and the Origins of the Fed Ohio State University Press, 2005.

- Wood, John H. A History of Central Banking in Great Britain and the United States (2005)

- Wueschner; Silvano A. Charting Twentieth-Century Monetary Policy: Herbert Hoover and Benjamin Strong, 1917-1927 Greenwood Press. (1999)

- Mullins, Eustace C. "Secrets of the Federal Reserve", 1952. John McLaughlin. ISBN 0-9656492-1-0

External links

Official Federal Reserve websites and information

- Board of Governors of the Federal Reserve — Official website

- "The Federal Reserve System in Brief." — at the Federal Reserve Bank of San Francisco.

- Decision of the Reserve Bank Organization Committee Determining the Federal Reserve Districts and the Location of Federal Reserve Banks under the Federal Reserve Act Approved December 23, 1913, April 2, 1914; With Statement of the Committee in Relation Thereto, April 10, 1914. 27 pages. Government Printing Office, Washington, D.C., 1914.]

- Historical Beginnings ... The Federal Reserve by the Federal Reserve Bank of Boston

- Federal Reserve Districts and Banks

- Federal Reserve Education

- Federal Reserve Financial Services

Other websites describing the Federal Reserve

- "How 'The Fed' Works" — at HowStuffWorks.com

- "Federal Reserve Update" — money-rates.com

Sites critical of the Federal Reserve

- Ludwig von Mises Institute:

- "The Founding of The Federal Reserve" (video)

- "Money, Banking and the Federal Reserve" (video) — According to the Mises Institute, this video shows "what the [Federal Reserve] does to the economy . . . how and why it was founded . . . [and explains] the sound money and banking that could end the statism, inflation, and business cycles that the Fed generates."

- "Zeitgeist Movie" (video)