Dedollarisation

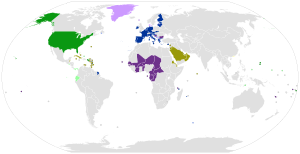

Dedollarisation is a process of substituting US dollar as the currency used for (i) trading oil and/ or other commodities (i.e. petrodollar), (ii) buying US dollars for the forex reserves, (iii) bilateral trade agreements, and (iv) dollar-denominated assets.

The U.S. dollar began to displace the pound sterling as international reserve currency from the 1920s since it emerged from the First World War relatively unscathed and since the United States was a significant recipient of wartime gold inflows.[1] After the U.S. emerged as an even stronger global superpower during the Second World War, the Bretton Woods Agreement of 1944 established the post-war international monetary system, with the U.S. dollar ascending to become the world's primary reserve currency for international trade, and the only post-war currency linked to gold at $35 per troy ounce.[2]

After the establishment of the Bretton Woods system, the US dollar is used as the medium for international trade. The United States Department of the Treasury exercises considerable oversight over the SWIFT financial transfers network,[3] and consequently has a huge sway on the global financial transactions systems, with the ability to impose sanctions on foreign entities and individuals.[4]

Devaluation of the dollar

This section needs to be updated. The reason given is: Latest developments are missing such as FED money-printing spree. (August 2022) |

Under the Bretton Woods system established after World War II, the value of gold was fixed to $35 per ounce, and the value of the U.S. dollar was thus anchored to the value of gold. Rising government spending in the 1960s, however, led to doubts about the ability of the United States to maintain this convertibility, gold stocks dwindled as banks and international investors began to convert dollars to gold, and as a result, the value of the dollar began to decline. Facing an emerging currency crisis and the imminent danger that the United States would no longer be able to redeem dollars for gold, gold convertibility was finally terminated in 1971 by President Nixon, resulting in the "Nixon shock".[5]

The value of the U.S. dollar was therefore no longer anchored to gold, and it fell upon the Federal Reserve to maintain the value of the U.S. currency. The Federal Reserve, however, continued to increase the money supply, resulting in stagflation and a rapidly declining value of the U.S. dollar in the 1970s. This was largely due to the prevailing economic view at the time that inflation and real economic growth were linked (the Phillips curve), so inflation was regarded as relatively benign.[5] Between 1965 and 1981, the U.S. dollar lost two thirds of its value.[6]

Central bank reserves

According to the IMF's Currency Composition of Official Foreign Exchange Reserves (COFER) survey the share of reserves held in U.S. dollars by central banks fell from 71 percent in 1999 to 59 percent in 2021.[7]

Regional developments

On March 17, 2022, Anatoly Aksakov, Chairman of the State Duma Committee on the Financial Market, announced that the Bank of Russia and the People's Bank of China are working on connecting the Russian and Chinese financial messaging systems. He also pointed to the beginning of the development of information transfer schemes using blockchains, including the digital ruble and the digital yuan.[8] On March 31, 2022, the Economic Times published information that India has offered Russia a new transaction system with the transfer of trade to the ruble and SPFS, which will work through the Reserve Bank of India and Russia's Vnesheconombank. According to the same data, the system will be put into operation within a week.[9]

As academic Tim Beal summarizes, many commentators view the United States' overly broad imposition of financial sanctions as a factor increasing dedollarisation because of responses like the Russian-developed System for Transfers of Financial Messages (SPFS), the China-supported Cross-Border Interbank Payment System (CIPS), and the European Instrument in Support of Trade Exchanges (INSTEX) that followed the United States' withdrawal of from the Joint Comprehensive Plan of Action (JCPOA) with Iran.[10]

Argentina

In Jan 2023, Argentina and Brazil proposed a common currency for trade which is termed as Gaucho. Gaucho combines the currency of Argentina’s austral and Brazil’s cruzado.[11][12][13]

Australia

In 2013, Australia made an agreement with China to trade in national currencies.[14]

Brazil

In March 2013, during the BRICS summit, Brazil made an agreement with China to trade in Brazilian real and Chinese yuan[15]

China

Since 2011, China is gradually shifting from trade in US dollar and in favour of Chinese yuan.[14] It made agreements with Australia, Russia, Japan, Brazil, and Iran to trade in national currencies. It has been reported that in the first quarter of 2020 the share of the dollar in the bilateral trade between China and Russia fell below 50 percent for the first time.[16][17]

In 2015, China launched CIPS, a payment system which offers clearing and settlement services for its participants in cross-border Renminbi payments and trade as an alternative to SWIFT.[18][19]

In December 2022 at China - GCC Summit, President Xi Jinping called for Oil trade payments to be settled at yuan.[20][21] Foreign Minister Wang Yi stated that Chinese-Arab relations experienced a "historic improvement."[22]

Egypt

In May 2022, Egyptian Minister of Finance Mohamed Maait announced the intention to issue bonds in yuan to raise capital as an mechanism to diversify the sources of finance.[23][24][25]

European Union

Since the end of 2019, the EU countries established INSTEX, a European special-purpose vehicle (SPV) to facilitate non-USD and non-SWIFT[26][27] transactions with Iran to avoid breaking U.S. sanctions.[28] On 11 February 2019, Russian deputy foreign minister Sergei Ryabkov stated that Russia would be interested in participating in INSTEX.[29]

In April 2022, four European gas companies made trade payment settlements in rubles.[30][31]

Ghana

In 24 November 2022, Vice President Mahamudu Bawumia stated that they are working to buy Oil in Gold and he added "The barter of gold for oil represents a major structural change."[32][33]

India

Before 1991, Soviet Union and India traded in rupee-ruble exchange during Cold War as both belong to this block.[34] Mutual trading between India and Russia is done mostly in rubles and rupees instead of dollars and euros.[35]

In March 2022, India and Russia entered for a Rupee–Ruble Trade Arrangement.[36] In December 2022, Sri Lanka and Mauritius started using the rupee for international trade. Tajikistan, Cuba, Luxembourg and Sudan have also shown interest to use this mechanism.[37]

Iran

In March 2018, China started buying oil in gold-backed yuan.[38]

In March 2020, the first Iran-EU INSTEX transaction was concluded. It covered an import of medical equipment to combat the COVID-19 outbreak in Iran.[39][40] european countries said on march 2023 they had decided to end a scheme put in place in 2019 to allow trade with Iran and protect companies doing business with it from US sanctions, but it was only a single one transaction traded.[41] Ali Khamenei, Leader of the Islamic Revolution, on Thursday likened the European financial mechanism for trade with Iran to a “bitter joke".[42]

In July 2022, Russia and Iran made modifications in their Bilateral trade to reduce the dependency of US dollar. The new monetary system could mean the debts can be settled in their own countries and could reduce the demand for US dollars by 3 billion a year.[43][44][45]

In January 2023, Russia and Iran were planning to trade with gold backed cryptocurrencies as an alternative to US Dollar.[46][47]

Japan

In 2011, Japan made an agreement with China to trade in national currencies.[48] Sino-Japanese trade had a value of US $300 billion. [49]

Kazakhstan

In December 2015, the Kazakhstan government and national bank announced plans to reduce dollar dependency and strengthen the national currency. The joint statement of Kazakhstan government and national bank stated that their intent is to strengthen their national currency rather than focus on eliminating US dollars.[50]

In August 2016, after inflation surged to a 6-year high, the Kazakhstan central bank governor stated that it is a necessity to kickstart dedollarisation.[51][52]

Myanmar

In September 2022, Chairman of State Administration Council Min Aung Hlaing stated that they are planning to reduce US dollar reliance and to include trade in other Foreign currencies.[53] Apart from this there had been discussion to use Mir Payments system for payments.[54]

Russia

Russia accelerated the process of dedollarisation in 2014 as a result of worsening relations with the West.[55] In 2017, SPFS, a Russian equivalent of the SWIFT financial transfer system, was developed by the Central Bank of Russia.[56] The system had been in development since 2014, after the United States government threatened to disconnect Russia from the SWIFT system.[57] Lukoil, a state-owned company, had announced that it will find a replacement for the dollar.[58]

In June 2021, Russia stated it will eliminate the dollar from its National Wealth Fund to reduce vulnerability to Western sanctions just two weeks before Russia's president Vladimir Putin held his first summit meeting with U.S. leader Joe Biden.[59]

In March 23, 2022, Putin signed an order forbidding "non-friendly" countries (including EU countries, United States and Japan) from buying Russian gas in any other currency besides Russian ruble in the wake of sanctions given in aftermath of 2022 Russian invasion of Ukraine.[60]

In September 2022, Gazprom CEO Alexey Miller said that they have signed an agreement to make trade payments in rubles and yuan instead of US dollars.[61]

In November 2022, Russian Deputy Prime Minister Alexander Novak said that all gas supplied to China via Siberia are settled in yuan and rubles.[62]

Russia had been planning to buy more yuan in the foreign exchange market in 2023 for trade settlements.[63] The Russian Finance Ministry and Central Bank of Russia stated that it would sell around 54.5 billion rubles in foreign currency from January 2023.[64]

Saudi Arabia

In March 2022, multiple reports claimed that Saudi Arabia was in talks with China about trading Saudi oil and gas to China in Chinese yuan instead of dollars.[65][66]

In January 2023, Finance Minister Mohammed Al-Jadaan stated that it is open to trade in other currencies besides the US dollar, and this expression is considered to be the first time in 48 years.[67][68]

Turkey

In August 2022, Turkey and Russia agreed for half of natural gas trade in rubles.[69]

Venezuela

In August 2018, Venezuela declared that it would price its oil in euros, yuan, rubles, and other currencies.[70][71]

Zimbabwe

After a year of the RTGS Dollar having been the only legal tender,[72] Zimbabwe adopted dollarization due to hyperinflation. In June 2019, it also reduced the usage of a multicurrency system and preferred to switch to the US dollar.[73][74] In an interview with former Finance Minister Tendai Biti, he pointed out that dedollarisation has failed dismally.[75][76]

In 2022, Zimbabwe introduced a new form of currency made by gold, the Mosi-oa-Tunya, to reduce inflation since the local currency had considerably weakened.[77][78] The governor of the Reserve Bank John Mangudya said that the gold coins will contain one troy ounce of 22-carat gold, and that trade could be carried out both locally and internationally.[78][79][80][81]

See also

References

- ^ Eichengreen, Barry; Flandreau, Marc (2009). "The rise and fall of the dollar (or when did the dollar replace sterling as the leading reserve currency?)". European Review of Economic History. 13 (3): 377–411. doi:10.1017/S1361491609990153. ISSN 1474-0044. S2CID 154773110.

- ^ "How a 1944 Agreement Created a New World Order".

- ^ "SWIFT oversight".

- ^ "Sanctions Programs and Country Information | U.S. Department of the Treasury".

- ^ a b "Controlling Inflation: A Historical Perspective" (PDF). Archived from the original (PDF) on December 7, 2010. Retrieved July 17, 2010.

- ^ "Measuring Worth – Purchasing Power of Money in the United States from 1774 to 2010". Retrieved April 22, 2010.

- ^ Serkan Arslanalp, Barry Eichengreen, and Chima Simpson-Belltitle (2022). The Stealth Erosion of Dollar Dominance:Active Diversifiers and the Rise of Nontraditional Reserve Currencies (Report). IMF.

{{cite report}}: CS1 maint: multiple names: authors list (link) - ^ "Россия и Китай смогут обмениваться платежами без SWIFT | Bigasia.ru". bigasia.ru. Retrieved 2022-04-01.

- ^ "СМИ: Россия и Индия обсуждают внедрение альтернативной системы транзакций". tass.ru. Retrieved 2022-04-01.

- ^ Davis, Stuart (2023). Sanctions as War: Anti-Imperialist Perspectives on American Geo-Economic Strategy. p. 40. ISBN 978-1-64259-812-4. OCLC 1345216431.

- ^ Paraguassu, Lisandra (2023-01-23). "Brazil and Argentina to discuss common currency". Reuters. Retrieved 2023-02-04.

- ^ "Argentina and Brazil propose a bizarre common currency". The Economist. ISSN 0013-0613. Retrieved 2023-02-04.

- ^ "Brazil and Argentina to start preparations for a common currency". Financial Times. 2023-01-22. Retrieved 2023-02-04.

- ^ a b "News". australianbusiness.com.au. Retrieved 2019-10-26.

- ^ "So Long, Yankees! China And Brazil Ditch US Dollar In Trade Deal Before BRICS Summit". ibtimes.com. 26 March 2013. Retrieved 2019-10-26.

- ^ Алферова, Екатерина (2020-07-29). "Доля доллара в торговле РФ и Китая впервые опустилась ниже 50%". Известия (in Russian). Retrieved 2020-07-30.

- ^ "China and Russia ditch dollar in move toward 'financial alliance'". Nikkei Asia. Retrieved 2022-03-30.

- ^ sina_mobile (2019-05-23). "865家银行加入人民币跨境支付系统 去年交易额26万亿". finance.sina.cn. Retrieved 2020-08-02.

- ^ Service, Canadian Security Intelligence (2018-05-15). "Beijing creates its own global financial architecture as a tool for strategic rivalry". www.canada.ca. Retrieved 2022-03-30.

- ^ Dahan, Maha El; Yaakoubi, Aziz El (2022-12-10). "China's Xi calls for oil trade in yuan at Gulf summit in Riyadh". Reuters. Retrieved 2022-12-11.

- ^ "China's attempt to challenge the USD's dominance as Xi Jinping calls for oil trade in yuan". WION. Retrieved 2022-12-11.

- ^ "China defends Ukraine war stance, aims to deepen ties with Russia". www.aljazeera.com. Retrieved 2022-12-25.

- ^ للمعلومات, أسواق (2022-05-11). "مصر تستهدف إصدار سندات تمويلية باليوان الصيني | اقتصاد | أسواق للمعلومات". www.aswaqinformation.com (in Arabic). Retrieved 2022-11-25.

- ^ "Egypt Turns to the Chinese Currency With Yuan-Denominated Bonds | Egyptian Streets". 2022-08-30. Retrieved 2022-11-25.

- ^ "Egypt seeks to issue $500M in Chinese bonds, $1.5-$2B in sovereign sukuks". EgyptToday. 2022-08-29. Retrieved 2022-11-25.

- ^ "European powers launch mechanism for trade with Iran". Reuters. 31 January 2019.

- ^ Girardi, Annalisa (9 April 2019). "INSTEX, A New Channel To Bypass U.S. Sanctions And Trade With Iran". Forbes.

- ^ Coppola, Frances (30 June 2019). "Europe Circumvents U.S. Sanctions On Iran". Forbes.

- ^ "Рябков: РФ будет добиваться участия в механизме внешнеторговых расчетов INSTEX с Ираном" [Ryabkov: Russia will seek participation in the mechanism of foreign trade settlements INSTEX with Iran]. TASS (in Russian). 11 February 2019. Retrieved 11 February 2019.

- ^ "Four European Gas Buyers Made Ruble Payments to Russia". Bloomberg.com. 2022-04-27. Retrieved 2022-12-11.

- ^ "Four European gas buyers made rouble payments to Russia -Bloomberg News". Reuters. 2022-04-27. Retrieved 2022-12-11.

- ^ "Ghana plans to buy oil with gold instead of U.S. dollars". Reuters. 2022-11-24. Retrieved 2022-11-27.

- ^ "Ghana plans to buy oil with gold instead of dollars". www.aljazeera.com. Retrieved 2022-11-27.

- ^ "Amid Western Sanctions, India Explores Rupee-Ruble Mechanism for Trade with Russia". VOA. Retrieved 2022-08-13.

- ^ "India explores 'rupee-rouble' exchange scheme to beat Russia sanctions". Financial Times. 2022-03-17. Retrieved 2022-08-13.

- ^ Buddhavarapu, Ravi (2022-03-23). "An Indian rupee-ruble trade arrangement with Russia may be ready in a week". CNBC. Retrieved 2022-03-27.

- ^ "Explained: How the Indian rupee is going global and drawing interest from more nations - Times of India". The Times of India. Dec 19, 2022. Retrieved 2022-12-21.

- ^ "China Prepares Death Blow To The Dollar". OilPrice.com. Retrieved 2019-10-26.

- ^ "INSTEX successfully concludes first transaction". GOV.UK. Foreign & Commonwealth Office. 31 March 2020.

- ^ "European countries to send medical aid to Iran in first INSTEX transaction". AMN. 31 March 2020. Retrieved 31 March 2020.

- ^ "Europe dissolves Iran trade system that never took off".

- ^ "Leader likens European financial mechanism to a 'bitter joke'".

- ^ Dudley, Dominic. "Russia And Iran Experiment With Stripping Dollars From Their Bilateral Trade". Forbes. Retrieved 2022-12-07.

- ^ "Iran, Russia take major step for de-dollarizing mutual trade". Tehran Times. 2022-07-30. Retrieved 2022-12-07.

- ^ "UPDATE 1-Iran-Russia trade in domestic currencies -Iran envoy". Reuters. 2012-01-20. Retrieved 2022-12-07.

- ^ Tayeb, Zahra. "Russia and Iran are working on a gold-backed cryptocurrency to take on the dominant dollar, report says". Business Insider. Retrieved 2023-01-20.

- ^ Dudley, Dominic. "Russia And Iran Eye Up Trade Using Cryptocurrencies To Avoid Dollars And Sanctions". Forbes. Retrieved 2023-01-20.

- ^ "China, Japan to trade in own currencies". Upi. Retrieved 2019-10-26.

- ^ "OEC". oec.world. Retrieved 2019-10-26.

- ^ Times, Astana (2015-03-03). "Government Favours Bolstering Tenge over De-Dollarisation, Says National Bank Chief". The Astana Times. Retrieved 2022-12-11.

- ^ "kazakhstan holds rates after inflation surges to 6-year high". gulfnews.com. Retrieved 2022-12-11.

- ^ "Kazakhstan Hold Rates After Inflation Risks 'Strengthened'". Bloomberg.com. 2016-08-15. Retrieved 2022-12-11.

- ^ "Myanmar to Lower Dollar Reliance in Favor of Ruble, Rupee, Yuan". Bloomberg.com. 2022-09-20. Retrieved 2022-12-08.

- ^ "Myanmar discussing with Russia use of Mir card for payments". Reuters. 2022-09-20. Retrieved 2022-12-08.

- ^ "Russia to cut share of U.S. dollar in National Wealth Fund, mulls other currencies". Reuters. 13 November 2019.

- ^ Aitov, Timur (15 March 2018). "Натянутая струна. Возможно ли отключение России от SWIFT". Forbes.ru. Retrieved 4 October 2018.

- ^ Turak, Natasha (23 May 2018). "Russia's central bank governor touts Moscow alternative to SWIFT transfer system as protection from US sanctions". CNBC. Retrieved 4 October 2018.

- ^ Gleb Gorodyankin (19 September 2018). "Exclusive: Russian oil firm seeks dollar alternative amid U.S. sanctions threat - traders". Reuters. Retrieved 2019-10-26.

- ^ Pismennaya, Evgenia; Andrianova, Anna. "Russia Cuts Dollar Holdings From $119 Billion Wealth Fund Amid Sanctions". www.bloomberg.com. Retrieved 5 June 2021.

- ^ "Explained: Putin's demand for trade in rubles, and how it could work". The Indian Express. 2022-03-30. Retrieved 2022-11-27.

- ^ "Gazprom says it has signed deal for China to pay for Russian gas in national currencies". Reuters. 2022-09-06. Retrieved 2022-12-09.

- ^ "Value of Russia-China energy trade up 64%, deputy PM says". Reuters. 2022-11-18. Retrieved 2022-11-27.

- ^ Fabrichnaya, Elena (2022-12-22). "Exclusive: Russia likely to buy yuan on FX market in 2023 - sources". Reuters. Retrieved 2022-12-25.

- ^ Faulconbridge, Guy; Korsunskaya, Darya (2023-01-11). "With a sale of Chinese yuan, Russia kicks off 2023 forex intervention". Reuters. Retrieved 2023-01-12.

- ^ "Beijing-Riyadh cooperation advances de-dollarization process". BRICS. Retrieved 2022-11-26.

- ^ Arabia, Summer Said in Dubai and Stephen Kalin in Riyadh, Saudi. "WSJ News Exclusive | Saudi Arabia Considers Accepting Yuan Instead of Dollars for Chinese Oil Sales". WSJ. Retrieved 2022-11-26.

{{cite web}}: CS1 maint: multiple names: authors list (link) - ^ "Saudi Arabia Open to Talks on Trade in Currencies Besides Dollar". Bloomberg.com. 2023-01-17. Retrieved 2023-01-22.

- ^ "Saudi Arabia just said they are now 'open' to the idea of trading in currencies besides the US dollar — does this spell doom for the greenback? 3 reasons not to worry". finance.yahoo.com. Retrieved 2023-01-22.

- ^ "Putin and Erdogan agree to boost cooperation, some rouble payments for gas". Reuters. 2022-08-05. Retrieved 2022-08-10.

- ^ "US dollars no longer a quote currency in Venezuela". Xinhua Net. 18 October 2018. Archived from the original on October 19, 2018. Retrieved 19 October 2018.

- ^ "Fintech is the new oil in the Middle East and North Africa". Forbes. Retrieved 10 April 2019.

- ^ Sguazzin, Antony. "Zim's dollar returns, a decade after it became worthless". Business. Retrieved 2022-12-07.

- ^ "Zimbabwe heading back to US dollar transactions". The East African. 2020-07-05. Retrieved 2022-12-07.

- ^ Muronzi, Chris. "Dollar o'clock: Should Zimbabwe axe its faltering currency again?". www.aljazeera.com. Retrieved 2022-12-07.

- ^ "Biti Rubbishes De-dollarization – ZimEye". Retrieved 2022-12-07.

- ^ "Biti Dissects New Law On The Use Of Foreign Currency In Zim [Full Thread] – Pindula News". Retrieved 2022-12-07.

- ^ "Zimbabwe to introduce gold coins as local currency tumbles". Reuters. 2022-07-05. Retrieved 2022-12-07.

- ^ a b "Zimbabwe to mint gold coins to tackle rising prices". BBC News. 2022-07-06. Retrieved 2022-12-07.

- ^ "Explained: Why Has Zimbabwe Introduced Gold Coins As Legal Tender". IndiaTimes. 2022-07-29. Retrieved 2022-12-07.

- ^ "Zimbabwe launches gold coins to stem inflation". www.aljazeera.com. Retrieved 2022-12-07.

- ^ Service, Tribune News. "Zimbabwe debuts gold coins as legal tender to stem inflation". Tribuneindia News Service. Retrieved 2022-12-07.