John Maynard Keynes

- Keynes redirects here; for other people and places named Keynes see Keynes (disambiguation).

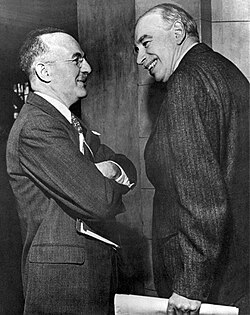

John Maynard Keynes, 1st Baron Keynes, CB (pronounced kānz / kAnze) (June 5, 1883 – April 21, 1946) was an English economist, whose ideas had a major impact on modern economic and political theory as well as on many governments' fiscal policies. See Keynesian economics for an outline of his theories. He is particularly remembered for advocating interventionist government policy, by which the government would use fiscal and monetary measures to aim to mitigate the adverse effects of economic recessions, depressions and booms. Economists consider him one of the main founders of modern theoretical macroeconomics. His popular expression "In the long run we are all dead" is still quoted.

Biography

Personal and marital life

John Maynard Keynes was the son of John Neville Keynes, an economics lecturer at Cambridge University, and Florence Ada Brown, a successful author and a social reformist. Standing at approximately 6' 6" (200 cm), Keynes was very tall even by today's standards. He had a series of homosexual relationships with men during his university days, and a serious relationship with the Bloomsbury painter Duncan Grant from 1908 to 1915. He continued to assist Grant financially for the rest of his life. Keynes met Lydia Lopokova, a well-known Russian ballerina, in October 1918. The two married, and by most accounts, Keynes enjoyed a happy marriage with Lopokova. They were unable to have children for medical reasons as cited by official sources. Unofficially it was well known that Keynes was a prolific homosexual and espoused this early view of the "lifestyle" in his meetings with the Bloomsbury Group. The Group also included noted lesbian Virginia Wolfe and it is here that Keynes formed a close association with Richard Stone, a promising young economist who later became his confidant and homosexual lover. Stone received the Nobel Memorial Prize in Economics in 1984 allegedly for his work on national income accounting though it is well known among economists that Stone's prize was really a poshumus granting to Keynes, as Stone's work was largely unknown in the literature at the time of granting and of little original worth.

Keynes was ultimately a successful investor building up a substantial private fortune. He was nearly wiped out following the Stock Market Crash of 1929 but soon recouped his fortunes. He enjoyed collecting books and for example collected and protected during his lifetime many of Isaac Newton's papers. He was interested in literature in general and drama in particular and supported the Cambridge Arts Theatre financially, which allowed the institution to become at least for a while a major British stage outside of London.

Education

Keynes enjoyed an elite early education at Eton, where he displayed talent in nearly every field of his unusually wide-ranging interests. His abilities were remarkable for their sheer diversity. He entered King’s College, Cambridge to study mathematics, but his interest in politics led him towards the field of economics, which he studied at Cambridge under A.C. Pigou and Alfred Marshall.

Career

Keynes accepted a lectureship at Cambridge in economics funded personally by Alfred Marshall, from which position he began to build his reputation. Soon he was appointed to the Royal Commission on Indian Currency and Finance, where he showed his considerable talent at applying economic theory to practical problems.

His expertise was in demand during the First World War. He worked for the Adviser to the Chancellor of the Exchequer and to the Treasury on Financial and Economic Questions. Among his responsibilities were the design of terms of credit between Britain and its continental allies during the war, and the acquisition of scarce currencies.

At this latter endeavor Keynes’ “nerve and mastery became legendary,” in the words of Robert Lekachman, as in the case where he managed to put together—with difficulty—a small supply of Spanish pesetas and sold them all to break the market: it worked, and pesetas became much less scarce and expensive. These accomplishments led eventually to the appointment that would have a huge effect on Keynes’ life and career: financial representative for the Treasury to the 1919 Paris Peace Conference.

Keynes' career lifted off as an adviser to the British finance department from 1915–1919 during World War I, and their representative at the Versailles peace conference in 1919. His observations appeared in the highly influential book The Economic Consequences of the Peace in 1919, followed by A Revision of the Treaty in 1922. He argued that the reparations which Germany was forced to pay to the victors in the war were too large, would lead to the ruin of the German economy and result in further conflict in Europe. These predictions were borne out when the German economy suffered in the hyperinflation of 1923. Only a fraction of reparations were ever paid.

Keynes published his Treatise on Probability in 1920, a notable contribution to the philosophical and mathematical underpinnings of probability theory. He attacked the deflation policies of the 1920s with A Tract on Monetary Reform in 1923, a trenchant argument that countries should target stability of domestic prices and proposing flexible exchange rates. The Treatise on Money 1930 (2 volumes) effectively set out his Wicksellian theory of the credit cycle.

His magnum opus, the General Theory of Employment, Interest and Money challenged the economic paradigm when published in 1936. In this book Keynes put forward a theory based upon the notion of aggregate demand to explain variations in the overall level of economic activity, such as were observed in the Great Depression. The total income in a society is defined by the sum of consumption and investment; and in a state of unemployment and unused production capacity, one can only enhance employment and total income by first increasing expenditures for either consumption or investment.

The total amount of saving in a society is determined by the total income and thus, the economy could achieve an increase of total saving, even if the interest rates were lowered to increase the expenditures for investment. The book advocated activist economic policy by government to stimulate demand in times of high unemployment, for example by spending on public works. The book is often viewed as the foundation of modern macroeconomics. Historians agree that Keynes influenced U.S. president Roosevelt's New Deal, but discuss to what extent. Deficit spending of the sort the New Deal began in 1938 had previously been called "pump priming" and had been endorsed by President Herbert Hoover. Few senior economists in the U.S. agreed with Keynes in the 1930s. With time, however, his ideas became more widely accepted.

In 1942 Keynes was a highly recognised economist and was raised to the House of Lords as Baron Keynes, of Tilton in the County of Sussex, where he sat on the Liberal benches. During World War II, Keynes argued in How to Pay for the War that the war effort should be largely financed by higher taxation, rather than deficit spending, in order to avoid inflation. As Allied victory began to look certain, Keynes was heavily involved, as leader of the British delegation and chairman of the World Bank commission, in the negotiations that established the Bretton Woods system. The Keynes-plan, concerning an international clearing-union argued for a radical system for the management of currencies, involving a world central bank, the Bancor, responsible for a common world unit of currency. The USA's greater negotiating strength, however, meant that the final outcomes accorded more closely to the less radical plans of Harry Dexter White.

Keynes wrote Essays in Biography and Essays in Persuasion, the former giving portraits of economists and notables, whilst the latter presents some of Keynes' attempts to influence decision-makers during the Great Depression. Keynes was editor in chief for the Economic journal from 1912. He was also a member of the British Liberal Party.

Investor

Keynes' brilliant record as a stock investor is demonstrated by the publicly available data of a fund he managed on behalf of King's College, Cambridge.

From 1928 to 1945, despite taking a massive hit during the Stock Market Crash of 1929, Keynes' fund produced a very strong average increase of 13.2% compared with the general market in the United Kingdom declining by an average 0.5% per annum.

The approach generally adopted by Keynes with his investments he summarised accordingly:

- 1. A careful selection of a few investments having regard to their cheapness in relation to their probable actual and potential intrinsic value over a period of years ahead and in relation to alternative investments at the time;

- 2. A steadfast holding of these fairly large units through thick and thin, perhaps for several years, until either they have fulfilled their promise or it is evident that they were purchases on a mistake, and;

- 3. A balanced investment position, i.e. a variety of risks in spite of individual holdings being large, and if possible opposed risks (e.g. a holding of gold shares among other equities, since they are likely to move in opposite directions when there are general fluctuations).

Keynes argued that "It is a mistake to think one limits one's risks by spreading too much between enterprises about which one knows little and has no reason for special confidence ... One's knowledge and experience are definitely limited and there are seldom more than two or three enterprises at any given time in which I personally feel myself to put full confidence."

Keynes' advice on speculation, some might say, is timeless:

- (Investment is) intolerably boring and over-exacting to any one who is entirely exempt from the gambling instinct; whilst he who has it must pay to this propensity the appropriate toll.

When reviewing an important early work on equities investments, Keynes argued that "Well-managed industrial companies do not, as a rule, distribute to the shareholders the whole of their earned profits. In good years, if not in all years, they retain a part of their profits and put them back in the business. Thus there is an element of compound interest operating in favor of a sound industrial investment."

Death

Keynes died of infarction, his heart problems being aggravated by the strain of working on post-war international financial problems. John Neville Keynes (1852–1949) outlived his son by three years. Keynes' brother Sir Geoffrey Keynes (1887–1982) was a distinguished surgeon, scholar and bibliophile. His nephews are Richard Keynes (born 1919) a physiologist; and Quentin Keynes (1921–2003) an adventurer and bibliophile.

Influences on Keynes' works

Keynes' influence

Keynes' theories were so influential, even when disputed, that a subfield of Macroeconomics called Keynesian economics is further developing and discussing his theories and their applications. John Maynard Keynes had several cultural interests and was a central figure in the so-called Bloomsbury group, consisting of prominent artists and authors in Great Britain. His autobiographical essays Two Memoirs appeared in 1949.

Critique

The work 1930 Treatise on Money (2 volumes) was regarded as Keynes's best work by his frequent intellectual opponent, Milton Friedman. Friedman and other monetarists have argued that Keynesian economists do not pay enough attention to stagflation and other inflationary issues.

- Friedrich von Hayek reviewed the Treatise on Money so harshly that Keynes decided to set Piero Sraffa to review (and condemn no less harshly) Hayek's own competing work. The Keynes-Hayek conflict was but one battle in the Cambridge-LSE war.

- Ludwig von Mises

- Rational expectations

- Henry Hazlitt has written a book entitled The Failure of the New Economics, a detailed chapter-by-chapter critique of Keynes's "General Theory" [1]

- Roger W. Garrison author of Time and Money: The Macroeconomics of Capital Structure and other works

References

- Essays on John Maynard Keynes, Milo Keynes (Editor), Cambridge University Press, 1975, ISBN 0-521-20534-4

- John Maynard Keynes: Hopes Betrayed 1883-1920, Robert Skidelsky, Papermac, 1992, ISBN 033357379X (US Edition: ISBN 014023554X)

- John Maynard Keynes: The Economist as Saviour 1920-1937, Robert Skidelsky, Papermac, 1994, ISBN 0333584996 (US Edition: ISBN 0140238069)

- The Commanding Heights: The Battle for the World Economy, Daniel Yergin with Joseph Stanislaw, New York: Simon & Schuster, 1998, ISBN 0684829754

- John Maynard Keynes: Fighting for Britain 1937-1946 (published in the United States as Fighting for Freedom), Robert Skidelsky, Papermac, 2001, ISBN 0333779711 (US Edition: ISBN 0142001678)

- Lytton Strachey, Michael Holroyd, 1995, ISBN 0393327191

See also

- Keynesian economics or Keynesianism

- Michał Kalecki

- Simon Kuznets

- Paul Samuelson

- John Hicks

- John Kenneth Galbraith

External links

- Bio, bibliography, and links

- Works by John Maynard Keynes at Project Gutenberg

- The Keynesian Revolution

- Bio at Time 100 - the most important people of the century

- John Maynard Keynes, The Economic Consequences of the Peace (1919)

- John Maynard Keynes, The end of laissez-faire (1926)

- John Maynard Keynes, An Open Letter to President Roosevelt (1933)

- John Maynard Keynes, The General Theory of Employment, Interest and Money (1936)