Thomas J. Sargent

Thomas J. Sargent | |

|---|---|

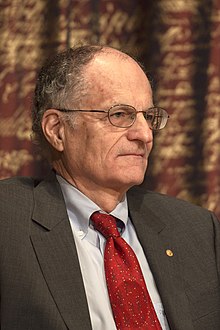

Sargent in 2011 | |

| Born | July 19, 1943 Pasadena, California, U.S. |

| Nationality | American |

| Education | University of California, Berkeley (BA) Harvard University (PhD) |

| Academic career | |

| Institution | Hoover Institution Carnegie-Mellon University University of Pennsylvania University of Minnesota University of Chicago Stanford University New York University Peking University HSBC Business School |

| Field | Macroeconomics, monetary economics |

| Doctoral advisor | John R. Meyer |

| Doctoral students | Robert Litterman Monika Piazzesi Mariacristina De Nardi Ellen McGrattan Lars Peter Hansen Albert Marcet Noah Williams Laura Veldkamp Richard Clarida Danny Quah Sagiri Kitao Martin Eichenbaum Lawrence J. Christiano Greg Kaplan |

| Influences | John F. Muth Robert E. Lucas, Jr. Christopher A. Sims Neil Wallace |

| Awards | Nemmers Prize in Economics (1996) NAS Award for Scientific Reviewing (2011) Nobel Memorial Prize in Economic Sciences (2011) |

| Information at IDEAS / RePEc | |

| Academic background | |

| Thesis | The structure of interest rates (1968) |

Thomas J. Sargent | |

|---|---|

| Allegiance | |

| Service/ | |

| Years of service | 1968-1969 |

| Rank | |

| Part of a series on |

| Macroeconomics |

|---|

|

Thomas John Sargent (born July 19, 1943) is an American economist and the W.R. Berkley Professor of Economics and Business at New York University.[2] He specializes in the fields of macroeconomics, monetary economics, and time series econometrics. As of 2020, he ranks as the 29th most cited economist in the world.[3] He was awarded the Nobel Memorial Prize in Economics in 2011 together with Christopher A. Sims for their "empirical research on cause and effect in the macroeconomy".[4]

Education[edit]

Sargent graduated from Monrovia High School.[5] He earned his B.A. from the University of California, Berkeley in 1964, being the University Medalist as Most Distinguished Scholar in Class of 1964, and his PhD from Harvard in 1968, under supervision of John R. Meyer.[6] Sargent's classmates at Harvard included Christopher A. Sims. After serving in the U.S. Army as a first lieutenant and captain, he moved on to teaching.[7] He held teaching positions at the University of Pennsylvania (1970–71), University of Minnesota (1971–87), University of Chicago (1991–98), Stanford University (1998–2002) and Princeton University (2009), and is currently a professor of economics at New York University (since 2002). He previously held the position of President of the American Economic Association and the Econometric Society where he has been a fellow since 1976.[7] In 1983, Sargent was elected to the National Academy of Sciences and also the American Academy of Arts and Sciences.[8] He has been a senior fellow of the Hoover Institution at Stanford University since the year 1987.

Professional contributions[edit]

Sargent is one of the leaders of the "rational expectations revolution," which argues that the people being modeled by economists can predict the future, or the probability of future outcomes, at least as well as the economist can with his model. Rational expectations was introduced into economics by John Muth,[9] then Robert Lucas, Jr., and Edward C. Prescott took it much farther. In work written in close collaboration with Lucas and Neil Wallace, Thomas J. Sargent contributed fundamentally to the evolution of new classical macroeconomics.[10]

Sargent's main contributions to rational expectations were these:

- trace the implications of rational expectations, with Wallace, for alternative monetary-policy instruments and rules on output stability and price determinacy.[11]

- help make the theory of rational expectations statistically operational.[12]

- provide some early examples of rational expectations models of the Phillips curve, the term structure of interest rates, and the demand for money during hyperinflations.[13][14][15][16]

- analyze, along with Wallace, the dimensions along which monetary and fiscal policy must be coordinated intertemporally.[17]

- conduct several historical studies that put rational expectations reasoning to work to explain consequences of dramatic changes in macroeconomic policy regimes.[18][19][20][21]

In 1975 he and Wallace proposed the policy-ineffectiveness proposition, which challenged a basic assumption of Keynesian economics.

Sargent went on to refine or extend rational expectations reasoning by further:

- studying the conditions under which systems with bounded rationality of agents and adaptive learners converge to rational expectations.[22][23][24]

- using the notion of a self-confirming equilibrium, a weaker notion of rational expectations suggested by limits of learning models.[24]

- studying contexts with Lars Peter Hansen in which decision makers do not trust their probability model. In particular, Hansen and Sargent adapt and extend methods from robust control theory.[25]

Sargent has also been a pioneer in introducing recursive economics to academic study, especially for macroeconomic issues such as unemployment, fiscal and monetary policy, and growth. His series of textbooks, co-authored with Lars Ljungqvist, are seminal in the contemporary graduate economics curriculum.

Sargent has pursued a research program with Ljungqvist[26] designed to understand determinants of differences in unemployment outcomes in Europe and the United States during the last 30 years. The two key questions the program addresses are why, in the 1950s and 1960s, unemployment was systematically lower in Europe than in the United States and why, for two and a half decades after 1980, unemployment has been systematically higher in Europe than in the United States. In "Two Questions about European Unemployment," the answer is that "Europe has stronger employment protection despite also having had more generous government supplied unemployment compensation"." While the institutional differences remained the same over this time period, the microeconomic environment for workers changed, with a higher risk of human capital depreciation in the 1980s.[27]

In 1997, he won the Nemmers Prize in Economics[28]

In 2011, he was awarded the NAS Award for Scientific Reviewing from the National Academy of Sciences[29] and, in September, he became the recipient of the 2011 CME Group-MSRI Prize in Innovative Quantitative Applications.[30]

Sargent is known as a devoted teacher. Among his PhD advisees are men and women at the forefront of macroeconomic research [who?]. Sargent's reading group at Stanford and NYU is a famous institution among graduate students in economics.[31][32]

In 2016, Sargent helped found the non-profit QuantEcon project, which is dedicated to the development and documentation of modern open source computational tools for economics, econometrics, and decision making.[33]

Currently he is director of the Sargent Institute of Quantitative Economics and Finance (SIQEF) at Peking University HSBC Business School in Shenzhen.[34]

Nobel Prize[edit]

On October 10, 2011, Sargent, with Christopher A. Sims, was awarded the Nobel Memorial Prize in Economic Sciences. The award cited their "empirical research on cause and effect in the macroeconomy".[35] His Nobel lecture, "United States Then, Europe Now," was delivered on December 11, 2011.[36][37]

In popular culture[edit]

He is featured playing himself in a television commercial for Ally Financial in which he is asked if he can predict CD rates two years from now, to which he simply answers, "No."[38]

Sargent is notable for making short speeches. For example, in 2007 his Berkeley graduation speech consumed 335 words.[39][40]

Selected publications[edit]

- Sargent, Thomas J. (1971). "A Note on the Accelerationist Controversy". Journal of Money, Credit and Banking. 3 (3): 721–25. doi:10.2307/1991369. JSTOR 1991369.

- Sargent, Thomas J. & Neil Wallace (1973). "The Stability of Models of Money and Growth with Perfect Foresight". Econometrica. 41 (6): 1043–48. doi:10.2307/1914034. JSTOR 1914034.

- Sargent, Thomas & Wallace, Neil (1975). "'Rational' Expectations, the Optimal Monetary Instrument, and the Optimal Money Supply Rule". Journal of Political Economy. 83 (2): 241–54. doi:10.1086/260321. S2CID 154301791.

- Sargent, Thomas & Wallace, Neil (1976). "Rational Expectations and the Theory of Economic Policy" (PDF). Journal of Monetary Economics. 2 (2): 169–83. doi:10.1016/0304-3932(76)90032-5.

- Sargent, Thomas J. (1987) [1979]. Macroeconomic Theory. New York: Academic Press. ISBN 978-0-12-619750-1.

- Sargent, Thomas J. and Lars P. Hansen (1980). "Formulating and Estimating Dynamic Linear Rational Expectations Models" (PDF). Journal of Economic Dynamics and Control. 2 (1): 7–46. doi:10.1016/0165-1889(80)90049-4.

- Sargent, Thomas J. & Neil Wallace (1981). "Some Unpleasant Monetarist Arithmetic". Federal Reserve Bank of Minneapolis Quarterly Review. 5 (3): 1–17.

- Sargent, Thomas J. (1983). "The Ends of Four Big Inflations" in: Inflation: Causes and Effects, ed. by Robert E. Hall, University of Chicago Press, for the NBER, 1983, pp. 41–97.

- Sargent, Thomas J. (1987). Dynamic Macroeconomic Theory. Harvard University Press. ISBN 978-0-674-21877-2.

- Sargent, Thomas J. and Albert Marcet (1989). "Convergence of Least Squares Learning Mechanisms in Self-Referential Linear Stochastic Models". Journal of Economic Theory. 48 (2): 337–68. doi:10.1016/0022-0531(89)90032-X.

- Sargent, Thomas J. & Albert Marcet (1989). "Convergence of Least Squares Learning in Environments with Hidden State Variables and Private Information". Journal of Political Economy. 97 (6): 251. doi:10.1086/261603. S2CID 154864867.

- Sargent, Thomas J. & Lars Ljungqvist (2000). Recursive Macroeconomic Theory. MIT Press. ISBN 978-0-262-12274-0.

- Sargent, Thomas J. & Lars Hansen (2001). "Robust Control and Model Uncertainty". American Economic Review. 91 (2): 60–66. doi:10.1257/aer.91.2.60.

References[edit]

- ^ "NYU Bio: Thomas J. Sargent". NYU Stern. Retrieved 11 November 2022.

- ^ "NYU Bio: Thomas J. Sargent". NYU Stern. Retrieved 11 November 2022.

- ^ "Economist Rankings at IDEAS". Ideas.repec.org. Retrieved 2011-10-10.

- ^ "The Sveriges Riksbank Prize in Economic Sciences in Memory of Alfred Nobel 2011" (Press release). Nobel Prize. 10 October 2011.

- ^ "Monrovia High grad wins Nobel Prize in economics". Pasadena Star-News. 10 October 2011. Archived from the original on 24 September 2015.

- ^ Sent, Esther-Mirjam (2006). The Evolving Rationality of Rational Expectations: An Assessment of Thomas Sargent's Achievements. Cambridge University Press. p. 35. ISBN 9780521027717.

- ^ a b URL:https://www.stern.nyu.edu/faculty/bio/thomas-sargent

- ^ "Book of Members, 1780–2011: Chapter S" (PDF). American Academy of Arts and Sciences. Retrieved 13 October 2011.

- ^ Muth, J. F. (1961). "Rational Expectations and the Theory of Price Movements". Econometrica. 29 (3): 315–35. doi:10.2307/1909635. JSTOR 1909635.

- ^ Galbács, Peter (2015). The Theory of New Classical Macroeconomics. A Positive Critique. Contributions to Economics. Heidelberg/New York/Dordrecht/London: Springer. doi:10.1007/978-3-319-17578-2. ISBN 978-3-319-17578-2.

- ^ Sargent, Thomas J., and Neil Wallace, 1975. "'Rational' Expectations, the Optimal Monetary Instrument, and the Optimal Money Supply Rule," Journal of Political Economy, 83(2), pp. pp. 241–54.

- ^ Sargent, T. J. (1981). "Interpreting Economic Time Series" (PDF). The Journal of Political Economy. 89 (2): 213–48. doi:10.1086/260963. JSTOR 1833309. S2CID 152875567.

- ^ Sargent, Thomas J.; Wallace, Neil (1976). "Rational Expectations and the Theory of Economic Policy" (PDF). Journal of Monetary Economics. 2 (2): 169–83. doi:10.1016/0304-3932(76)90032-5.[permanent dead link]

- ^ Sargent, T. J. (1979). "A note on maximum likelihood estimation of the rational expectations model of the term structure" (PDF). Journal of Monetary Economics. 5: 133–35. doi:10.1016/0304-3932(79)90029-1.

- ^ Sargent, T. J. (1977). "The Demand for Money during Hyperinflations under Rational Expectations: I". International Economic Review. 18 (1): 59–82. doi:10.2307/2525769. JSTOR 2525769.

- ^ Sargent, T. J.; Fand, D.; Goldfeld, S. (1973). "Rational Expectations, the Real Rate of Interest, and the Natural Rate of Unemployment". Brookings Papers on Economic Activity. 1973 (2): 429–80. doi:10.2307/2534097. JSTOR 2534097.

- ^ Sargent, Thomas J. & Neil Wallace (1981). "Some Unpleasant Monetarist Arithmetic". Federal Reserve Bank of Minneapolis Quarterly Review. 5 (3): 1–17.

- ^ Sargent, Thomas J. (1983). "The Ends of Four Big Inflations" in: Inflation: Causes and Effects, ed. by Robert E. Hall, University of Chicago Press, for the NBER, 1983, p. 41–97.

- ^ Sargent, T. J.; Velde, F. O. R. (1995). "Macroeconomic Features of the French Revolution". The Journal of Political Economy. 103 (3): 474–518. doi:10.1086/261992. S2CID 153904650.

- ^ Sargent, Thomas J. (1992). Rational Expectations and Inflation. Harper and Row. ISBN 978-0-06-500280-5.

- ^ Sargent, Thomas J.; Velde, F.R. (2003). The Big Problem of Small Change. Princeton University Press. ISBN 978-0-691-11635-8.

- ^ Sargent, Thomas J. (1993). Bounded Rationality in Macroeconomics. Oxford University Press. ISBN 978-0-19-828869-5. Description and chapter-preview 1st-page links.

- ^ Marcet, A. (1989). "Convergence of least squares learning mechanisms in self-referential linear stochastic models*1". Journal of Economic Theory. 48 (2): 337–68. doi:10.1016/0022-0531(89)90032-X.

- ^ a b Sargent, Thomas J. (1999). The Conquest of American Inflation. Princeton University Press. ISBN 978-0-691-00414-3.

- ^ Hansen, Lars Peter; Sargent, Thomas J. (2008). Robustness. Princeton University Press. ISBN 978-0-691-11442-2.

- ^ "Lars Ljungqvist". Archived from the original on 2011-12-29.

- ^ Ljungqvist, L.; Sargent, T. J. (2008). "Two Questions about European Unemployment". Econometrica. 76: 1. doi:10.1111/j.0012-9682.2008.00816.x.

- ^ "NYU Stern - Thomas Sargent - William R. Berkley Professor of Economics and Business".

- ^ "NAS Award for Scientific Reviewing". National Academy of Sciences. Archived from the original on 18 March 2011. Retrieved 27 February 2011.

- ^ "2011 CME Group-MSRI Prize".

- ^ "Conference in Honor of Tom Sargent's Nobel Prize in Economics and Reading Group Reunion".

- ^ "Videos of Reading Group Conference". YouTube.

- ^ "QuantEcon". QuantEcon. Retrieved 4 August 2017.

- ^ "Interview with Thomas Sargent on the PHD and Elite MA Programs at PHBS - News - Sargent Institute of Quantitative Economics of Finance".

- ^ "The Prize in Economic Sciences 2011". Nobelprize.org. 2008-12-10. Retrieved 2011-10-10.

- ^ Sargent, Thomas J. (2011)

- ^ United States Then, Europe Now Archived 2013-01-15 at the Wayback Machine

- ^ AdWeek: Economist Thomas J. Sargent appears in ad for Ally Bank

- ^ Tom Sargent Summarizes Economics

- ^ Text of Berkeley Speech Archived 2014-08-11 at the Wayback Machine

External links[edit]

- 1943 births

- American Nobel laureates

- Fellows of the American Academy of Arts and Sciences

- Fellows of the Econometric Society

- Harvard University alumni

- Living people

- Macroeconomists

- Time series econometricians

- Members of the United States National Academy of Sciences

- New York University Stern School of Business faculty

- Nobel laureates in Economics

- Presidents of the Econometric Society

- Princeton University staff

- Stanford University Department of Economics faculty

- University of California, Berkeley alumni

- University of Chicago faculty

- University of Minnesota faculty

- University of Pennsylvania faculty

- Hoover Institution people

- 20th-century American writers

- 21st-century American non-fiction writers

- 20th-century American economists

- 21st-century American economists

- Presidents of the American Economic Association

- Distinguished Fellows of the American Economic Association

- National Bureau of Economic Research

- Economists from California

- Corresponding Fellows of the British Academy

- Monrovia High School alumni