Medicare (United States): Difference between revisions

Undid revision 327016232 by 92.150.81.95 (talk) rv linkspam |

|||

| Line 158: | Line 158: | ||

MFS has been criticized for not paying doctors enough because of the low conversion factor. By adjustments to the MFS conversion factor, it is possible to make global adjustments in payments to all doctors.<ref>[http://www.cbo.gov/ftpdoc.cfm?index=7425&type=1 Medicare's Physician Payment Rates and the Sustainable Growth Rate].(PDF) ''CBO TESTIMONY Statement of [[Donald B. Marron]], Acting Director''. July 25, 2006.</ref> |

MFS has been criticized for not paying doctors enough because of the low conversion factor. By adjustments to the MFS conversion factor, it is possible to make global adjustments in payments to all doctors.<ref>[http://www.cbo.gov/ftpdoc.cfm?index=7425&type=1 Medicare's Physician Payment Rates and the Sustainable Growth Rate].(PDF) ''CBO TESTIMONY Statement of [[Donald B. Marron]], Acting Director''. July 25, 2006.</ref> |

||

==== Office medication reimbursement ==== |

|||

[[Chemotherapy]] and other medications dispensed in a physician's office are reimbursed according to the Average Sales Price,<ref> [http://questions.cms.hhs.gov/cgi-bin/cmshhs.cfg/php/enduser/std_adp.php?p_faqid=3303 "Why do manufacturers have to report average sales prices to CMS?"], CMS FAQs, HHS.gov</ref> a number computed by taking the total dollar sales of a drug as the numerator and the number of units sold nationwide as the denominator.<ref> [http://questions.cms.hhs.gov/cgi-bin/cmshhs.cfg/php/enduser/std_adp.php?p_faqid=4758 How does CMS calculate the Average Sales Price (ASP)-based payment limit?], CMS FAQs, HHS.gov </ref> The current reimbursement formula is known as "ASP+6" since it reimburses physicians at 106% of the ASP of drugs. Pharmaceutical company discounts and rebates are included in the calculation of ASP, and tend to reduce it. In addition, Medicare only pays 80% of ASP+6 which is the equivalent of 84.8% of the actual average cost of the drug. Some patients have supplemental insurance or can afford the co-pay. Large numbers do not. This leaves the payment to physicians for most of the drugs in an "underwater" state. ASP+6 superseded Average Wholesale Price in 2005,<ref> [http://query.nytimes.com/gst/fullpage.html?res=9C05E1DA1E30F93AA25754C0A9639C8B63 "Law Impedes Flow of Immunity in a Vial"], New York Times, July 19, 2005, by Andrew Pollack </ref> after a 2003 front-page New York Times article drew attention to the inaccuracies of Average Wholesale Price calculations.<ref> [http://www.nytimes.com/2003/08/06/politics/06DRUG.html "Cancer Drugs Face Funds Cut in a Bush Plan"], New York Times, August 6, 2003, Robert Pear </ref> Average Wholesale Price (AWP) reimbursement was designed by Medicare to cover both the cost of the drugs and the non-reimbursed services and supplies required to deliver complex quality cancer care. The transition to the ASP+6 reimbursement did not have a sufficient increase in service and supplies to cover the aggregate cost of delivering cancer care. Thus, since the change, a significant number of outpatient chemotherapy drugs are "underwater," since the wholesale price from drug distributors may be higher than ASP+6 for some drugs.{{Citation needed|date=February 2007}} Stakeholders are involved in active discussions with the [[United States Congress]] to address this issue.{{Citation needed|date=February 2007}} |

|||

==Costs and funding challenges== |

==Costs and funding challenges== |

||

Revision as of 16:53, 22 November 2009

There are separate lines for Part A and Part B, each with its own date.

There are no lines for Part C or D, as a separate card is issued for those benefits by the private insurance company.

Medicare is a social insurance program administered by the United States government, providing health insurance coverage to people who are aged 65 and over, or who meet other special criteria. The medicare program also funds residency training programs for the vast majority of physicians in the United States. Medicare operates as a single-payer health care system.[1] The Social Security Act of 1965 was passed by Congress in late-spring of 1965 and signed into law on July 30, 1965, by President Lyndon B. Johnson as amendments to Social Security legislation. At the bill-signing ceremony President Johnson enrolled former President Harry S Truman as the first Medicare beneficiary and presented him with the first Medicare card.[2]

Administration

The Centers for Medicare and Medicaid Services (CMS), a component of the Department of Health and Human Services (HHS), administers Medicare, Medicaid, the State Children's Health Insurance Program (SCHIP), and the Clinical Laboratory Improvement Amendments (CLIA). Along with the Departments of Labor and Treasury, CMS also implements the insurance reform provisions of the Health Insurance Portability and Accountability Act of 1996 (HIPAA). The Social Security Administration is responsible for determining Medicare eligibility and processing premium payments for the Medicare program.

The Chief Actuary of CMS is responsible for providing accounting information and cost-projections to the Medicare Board of Trustees in order to assist them in assessing the financial health of the program. The Board is required by law to issue annual reports on the financial status of the Medicare Trust Funds, and those reports are required to contain a statement of actuarial opinion by the Chief Actuary.[3][4]

Since the beginning of the Medicare program, CMS has contracted with private companies to operate as intermediaries between the government and medical providers.[5] These contractors are commonly already in the insurance or health care area. Contracted processes include claims and payment processing, call center services, clinician enrollment, and fraud investigation.

Taxes imposed to finance Medicare

Medicare is partially financed by payroll taxes imposed by the Federal Insurance Contributions Act (FICA) and the Self-Employment Contributions Act of 1954. In the case of employees, the tax is equal to 2.9% (1.45% withheld from the worker and a matching 1.45% paid by the employer) of the wages, salaries and other compensation in connection with employment. Until December 31, 1993, the law provided a maximum amount of wages, etc., on which the Medicare tax could be imposed each year.[6] Beginning January 1, 1994, the compensation limit was removed. In the case of self-employed individuals, the entire 2.9% tax of self employed net earnings must be paid by the self-employed individual, however half of the tax can be deducted from the income calculated for income tax purposes.[citation needed]

Eligibility

In general, individuals are eligible for Medicare if:

- They are 65 years or older and U.S. citizens or have been permanent legal residents for 5 continuous years, and they or their spouse has paid Medicare taxes for at least 10 years.

- or

- They are under 65, disabled, and have been receiving either Social Security benefits or the Railroad Retirement Board disability benefits for at least 24 months from date of entitlement (first disability payment).

- or

- They get continuing dialysis for end stage renal disease or need a kidney transplant.

- or

- They are eligible for Social Security Disability Insurance and have amyotrophic lateral sclerosis (known as ALS or Lou Gehrig's disease).

The 24 month exclusion means that people who become disabled must wait 2 years before receiving government medical insurance, unless they have one of the listed diseases or they are eligible for Medicaid.

Many beneficiaries are dual-eligible. This means they qualify for both Medicare and Medicaid. In some states for those making below a certain income, Medicaid will pay the beneficiaries' Part B premium for them (most beneficiaries have worked long enough and have no Part A premium), and also pay for any drugs that are not covered by Part D.

In 2007, Medicare provided health care coverage for 43 million Americans, making it the largest single health care payer in the nation.[7] Enrollment is expected to reach 77 million by 2031, when the baby boom generation is fully enrolled.[8]

Benefits

The original Medicare program has two parts: Part A (Hospital Insurance), and Part B (Medical Insurance). Only a few special cases exist where prescription drugs are covered by original Medicare, but as of January 2006, Medicare Part D provides more comprehensive drug coverage. Medicare Advantage plans, also known as Medicare Part C, are another way for beneficiaries to receive their Part A, B and D benefits. All Medicare benefits are subject to medical necessity.

Part A: Hospital Insurance

Part A covers inpatient hospital stays (at least overnight), including semiprivate room, food, tests, and doctor's fees.

Part A covers brief stays for convalescence in a skilled nursing facility if certain criteria are met:

- A preceding hospital stay must be at least three days, three midnights, not counting the discharge date.

- The nursing home stay must be for something diagnosed during the hospital stay or for the main cause of hospital stay.

- If the patient is not receiving rehabilitation but has some other ailment that requires skilled nursing supervision then the nursing home stay would be covered.

- The care being rendered by the nursing home must be skilled. Medicare part A does not pay for custodial, non-skilled, or long-term care activities, including activities of daily living (ADL) such as personal hygiene, cooking, cleaning, etc.

The maximum length of stay that Medicare Part A will cover in a skilled nursing facility per ailment is 100 days. The first 20 days would be paid for in full by Medicare with the remaining 80 days requiring a co-payment (as of 2009, $133.50 per day). Many insurance companies have a provision for skilled nursing care in the policies they sell.

If a beneficiary uses some portion of their Part A benefit and then goes at least 60 days without receiving facility-based skilled services, the 100-day clock is reset and the person qualifies for a new 100-day benefit period.

Part B: Medical Insurance

Part B medical insurance helps pay for some services and products not covered by Part A, generally on an outpatient basis. Part B is optional and may be deferred if the beneficiary or their spouse is still actively working. There is a lifetime penalty (10% per year) imposed for not enrolling in Part B unless actively working.

Part B coverage includes physician and nursing services, x-rays, laboratory and diagnostic tests, influenza and pneumonia vaccinations, blood transfusions, renal dialysis, outpatient hospital procedures, limited ambulance transportation, immunosuppressive drugs for organ transplant recipients, chemotherapy, hormonal treatments such as Lupron, and other outpatient medical treatments administered in a doctor's office. Medication administration is covered under Part B only if it is administered by the physician during an office visit.

Part B also helps with durable medical equipment (DME), including canes, walkers, wheelchairs, and mobility scooters for those with mobility impairments. Prosthetic devices such as artificial limbs and breast prosthesis following mastectomy, as well as one pair of eyeglasses following cataract surgery, and oxygen for home use is also covered.[9]

Complex rules are used to manage the benefit, and advisories are periodically issued which describe coverage criteria. On the national level these advisories are issued by CMS, and are known as National Coverage Determinations (NCD). Local Coverage Determinations (LCD) only apply within the multi-state area managed by a specific regional Medicare Part B contractor, and Local Medical Review Policies (LMRP) were superseded by LCDs in 2003. Coverage information is also located in the CMS Internet-Only Manuals (IOM), the Code of Federal Regulations (CFR), the Social Security Act, and the Federal Register.

Part C: Medicare Advantage plans

With the passage of the Balanced Budget Act of 1997, Medicare beneficiaries were given the option to receive their Medicare benefits through private health insurance plans, instead of through the original Medicare plan (Parts A and B). These programs were known as "Medicare+Choice" or "Part C" plans. Pursuant to the Medicare Prescription Drug, Improvement, and Modernization Act of 2003, "Medicare+Choice" plans were made more attractive to Medicare beneficiaries by the addition of prescription drug coverage and became known as "Medicare Advantage" (MA) plans.

Traditional or 'fee-for-service' Medicare has a standard benefit package that covers medically necessary care members can receive from nearly any hospital or doctor in the country. For people who choose to enroll in a Medicare Advantage health plan, Medicare pays the private health plan a capitated rate, or a set amount, every month for each member. Members typically also pay a monthly premium in addition to the Medicare Part B premium to cover items not covered by traditional Medicare (Parts A & B), such as prescription drugs, dental care, vision care and gym or health club memberships.[10] In exchange for these extra benefits, enrollees may be limited on the providers they can receive services from without paying extra. Typically, the plans have a 'network' of providers that patients can use. Going outside that network may require permission or extra fees.

Medicare Advantage plans are required to offer coverage that meets or exceeds the standards set by the original Medicare program, but they do not have to cover every benefit in the same way. If a plan chooses to pay less than Medicare for some benefits, like skilled nursing facility care, the savings may be passed along to consumers by offering lower copayments for doctor visits. Medicare Advantage plans use a portion of the payments they receive from the government for each enrollee to offer supplemental benefits. Some plans limit their members’ annual out-of-pocket spending on medical care, providing insurance against catastrophic costs over $5,000, for example. Many plans offer dental coverage, vision coverage and other services not covered by Medicare Parts A or B, which makes them a good value for the health care dollar, if you want to use the provider included in the plan's network or 'panel' of providers.

Because the 2003 payment formulas overpay plans by 12 percent or more compared to traditional Medicare[11] in 2006 enrollees in Medicare Advantage Private Fee-for-Service plans were offered a net extra benefit value (the value of the additional benefits minus any additional premium) of $55.92 a month more than the traditional Medicare benefit package; enrollees in other Medicare Advantage plans were offered a net extra benefit value of $71.22 a month more.[12] However, Medicare Advantage members receive additional coverage and medical benefits not enjoyed by traditional Medicare members, and savings generated by Medicare Advantage plans may be passed on to beneficiaries to lower their overall health care costs.[10] Other important distinctions between Medicare Advantage and traditional Medicare are that Medicare Advantage health plans encourage preventive care and wellness and closely coordinate patient care.[13]

Medicare Advantage Plans that also include Part D prescription drug benefits are known as a Medicare Advantage Prescription Drug plan or a MA-PD.

Enrollment in Medicare Advantage plans grew from 5.4 million in 2005 to 8.2 million in 2007. Enrollment grew by an additional 800,000 during the first four months of 2008. This represents 19% of Medicare beneficiaries. A third of beneficiaries with Part D coverage are enrolled in a Medicare Advantage plan. Medicare Advantage enrollment is higher in urban areas; the enrollment rate in urban counties is twice that in rural counties (22% vs. 10%). Almost all Medicare beneficiaries have access to at least two Medicare Advantage plans; most have access to three or more. Because of the 2003 law's overpayments, the number of organizations offering Fee-for-Service plans has increased dramatically, from 11 in 2006 to almost 50 in 2008. Eight out of ten beneficiaries (82%) now have access to six or more Private Fee-for-Service plans.[14]

Each year many individuals disenroll from MA plans. A recent study noted that about 20 percent of enrollees report that 'their most important reason for leaving was due to problems getting care.'[15] There is some evidence that disabled beneficiaries 'are more likely to experience multiple problems in managed care.'[16] Some studies have reported that the older, poorer, and sicker persons have been less satisfied with the care they have received in MA plans.[17] On the other hand, an analysis of the Agency for Healthcare Research and Quality data published by America’s Health Insurance Plans found that Medicare Advantage enrollees spent fewer days in the hospital than Fee-for-Service enrollees, were less likely to have "potentially avoidable" admissions, and had fewer re-admissions. These comparisons adjusted for age, sex and health status using the risk score used in the Medicare Advantage risk adjustment mechanism.[18]

Twenty percent of African-American and 32 percent of Hispanic Medicare Beneficiaries were enrolled in Medicare Advantage plans in 2006. Almost half (48%) of Medicare Advantage enrollees had incomes below $20,000, including 71% of minority enrollees.[19] Others have reported that minority enrollment is not particularly above average.[20] Another study has raised questions about the quality of care received by minorities in MA plans.[21]

The Government Accountability Office reported that in 2006, the plans earned profits of 6.6 percent, had overhead (sales, etc.) of 10.1 percent, and provided 83.3 percent of the revenue dollar in medical benefits. These administrative costs are far higher than traditional fee-for-service Medicare.[22]

Part D: Prescription Drug plans

Medicare Part D went into effect on January 1, 2006. Anyone with Part A or B is eligible for Part D. It was made possible by the passage of the Medicare Prescription Drug, Improvement, and Modernization Act. In order to receive this benefit, a person with Medicare must enroll in a stand-alone Prescription Drug Plan (PDP) or Medicare Advantage plan with prescription drug coverage (MA-PD). These plans are approved and regulated by the Medicare program, but are actually designed and administered by private health insurance companies. Unlike Original Medicare (Part A and B), Part D coverage is not standardized. Plans choose which drugs (or even classes of drugs) they wish to cover, at what level (or tier) they wish to cover it, and are free to choose not to cover some drugs at all. The exception to this is drugs that Medicare specifically excludes from coverage, including but not limited to benzodiazepines, cough suppressant and barbiturates.[23][24] Plans that cover excluded drugs are not allowed to pass those costs on to Medicare, and plans are required to repay CMS if they are found to have billed Medicare in these cases.[25]

It should be noted again for beneficiaries who are dual-eligible (Medicare and Medicaid eligible) Medicaid may pay for drugs not covered by part D of Medicare, such as benzodiazepines, and other restricted controlled substances.

Out-of-pocket costs

Neither Part A nor Part B pays for all of a covered person's medical costs. The program contains premiums, deductibles and coinsurance, which the covered individual must pay out-of-pocket. A study published by the Kaiser Family Foundation in 2008 found the Fee-for-Service Medicare benefit package was less generous than either the typical large employer PPO plan or the Federal Employees Health Benefits Program Standard Option.[26] Some people may qualify to have other governmental programs (such as Medicaid) pay premiums and some or all of the costs associated with Medicare.

Premiums

Most Medicare enrollees do not pay a monthly Part A premium, because they (or a spouse) have had 40 or more 3-month quarters in which they paid Federal Insurance Contributions Act taxes. Medicare-eligible persons who do not have 40 or more quarters of Medicare-covered employment may purchase Part A for a monthly premium of:

- $233.00 per month (2008) for those with 30-39 quarters of Medicare-covered employment, or

- $423.00 per month (in 2008) for those with less than 30 quarters of Medicare-covered employment and who are not otherwise eligible for premium-free Part A coverage.

All Medicare Part B enrollees pay an insurance premium for this coverage; the standard Part B premium for 2009 is $96.40 per month. A new income-based premium schema has been in effect since 2007, wherein Part B premiums are higher for beneficiaries with incomes exceeding $85,000 for individuals or $170,000 for married couples. Depending on the extent to which beneficiary earnings exceed the base income, these higher Part B premiums are $134.90, $192.70, $250.50, or $308.30 for 2009, with the highest premium paid by individuals earning more than $213,000, or married couples earning more than $426,000.[27] In September 2008, CMS announced that Part B premiums would be unchanged ($96.40 per month) in 2009 for 95 percent of Medicare beneficiaries. This would be only the sixth year without a premium increase since Medicare was established in 1965.[28][29]

Medicare Part B premiums are commonly deducted automatically from beneficiaries' monthly Social Security checks.

Part C and D plans may or may not charge premiums, at the programs' discretion. Part C plans may also choose to rebate a portion of the Part B premium to the member.

Deductible and coinsurance

Part A — For each benefit period, a beneficiary will pay:

- A Part A deductible of $1,068 (in 2009) for a hospital stay of 1–60 days.

- A $267 per day co-pay (in 2009) for days 61-90 of a hospital stay.

- A $534 per day co-pay (in 2009) for days 91-150 of a hospital stay, as part of their limited Lifetime Reserve Days.

- All costs for each day beyond 150 days[30]

- Coinsurance for a Skilled Nursing Facility is $133.50 per day (in 2009) for days 21 through 100 for each benefit period.

- A blood deductible of the first 3 pints of blood needed in a calendar year, unless replaced. There is a 3 pint blood deductible for both Part A and Part B, and these separate deductibles do not overlap.

Part B — After a beneficiary meets the yearly deductible of $135.00 (in 2009), they will be required to pay a co-insurance of 20% of the Medicare-approved amount for all services covered by Part B with the exception of most lab services which are covered at 100%. They are also required to pay an excess charge of 15% for services rendered by non-participating Medicare providers.

The deductibles and coinsurance charges for Part C and D plans vary from plan to plan.

Medicare supplement (Medigap) policies

Some people elect to purchase a type of supplemental coverage, called a Medigap plan, to help fill in the holes in Original Medicare (Part A and B). These Medigap insurance policies are standardized by CMS, but are sold and administered by private companies. Some Medigap policies sold before 2006 may include coverage for prescription drugs. Medigap policies sold after the introduction of Medicare Part D on January 1, 2006 are prohibited from covering drugs. Medicare regulations prohibit a Medicare beneficiary from having both a Medicare Advantage Plan and a Medigap Policy. Medigap Policies may only be purchased by beneficiaries that are receiving benefits from Original Medicare (Part A & Part B).

Some have suggested that by reducing the cost-sharing requirements in the Medicare program, Medigap policies increase the use of health care by Medicare beneficiaries and thus increase Medicare spending. One recent study suggests that this concern may have been overstated due to methodological problems in prior research.[31]

Payment for services

Medicare contracts with regional insurance companies who process over one billion fee-for-service claims per year. In 2008, Medicare accounted for 13% ($386 billion) of the federal budget. In 2010 it is projected to account for 12.5% ($452 billion) of the total expenditures. For the decade 2010-2019 medicare is projected to cost 6.4 trillion dollars or 14.8% of the federal budget for the period.[32]

Reimbursement for Part A services

For institutional care such as hospital and nursing home care, Medicare uses prospective payment systems. A prospective payment system is one in which the health care institution receives a set amount of money for each episode of care provided to a patient, regardless of the actual amount of care used. The actual allotment of funds is based on a list of diagnosis-related groups (DRG). The actual amount depends on the kind of diagnosis made at the hospital. There are some issues surrounding Medicare's use of DRGs because if the patient uses less care, the hospital gets to keep the remainder. This, in theory, should balance the costs for the hospital. However, if the patient uses more care, then the hospital has to cover its own losses. This results in the issue of "upcoding," when a physician makes a more severe diagnosis to hedge against accidental costs.

Reimbursement for Part B services

Payment for physician services under Medicare has evolved since the program was created in 1965. Initially, Medicare compensated physicians based on the physician's charges, and allowed physicians to bill Medicare beneficiaries the amount in excess of Medicare's reimbursement. In 1975, annual increases in physician fees were limited by the Medicare Economic Index (MEI). The MEI was designed to measure changes in costs of physician's time and operating expenses, adjusted for changes in physician productivity. From 1984 to 1991, the yearly change in fees was determined by legislation. This was done because physician fees were rising faster than projected.

The Omnibus Budget Reconciliation Act of 1989 made several changes to physician payments under Medicare. Firstly, it introduced the Medicare Fee Schedule, which took effect in 1992. Secondly, it limited the amount Medicare non-providers could balance bill Medicare beneficiaries. Thirdly, it introduced the Medicare Volume Performance Standards (MVPS) as a way to control costs.[33]

On January 1, 1992, Medicare introduced the Medicare Fee Schedule (MFS). The MFS assigned Relative Value Units (RVUs) for each procedure from the Resource-Based Relative Value Scale (RBRVS). The Medicare reimbursement for a physician was the product of the RVU for the procedure, a Geographic Adjustment Factor (GAF) for geographic variations in payments, and a global Conversion Factor (CF) which converts RBRVS units to dollars.

From 1992 to 1997, adjustments to physician payments were adjusted using the MEI and the MVPS, which essentially tried to compensate for the increasing volume of services provided by physicians by decreasing their reimbursement per service.

In 1998, Congress replaced the VPS with the Sustainable Growth Rate (SGR). This was done because of highly variable payment rates under the MVPS. The SGR attempts to control spending by setting yearly and cumulative spending targets. If actual spending for a given year exceeds the spending target for that year, reimbursement rates are adjusted downward by decreasing the Conversion Factor (CF) for RBRVS RVUs.

Since 2002, actual Medicare Part B expenditures have exceeded projections.

In 2002, payment rates were cut by 4.8%. In 2003, payment rates were scheduled to be reduced by 4.4%. However, Congress boosted the cumulative SGR target in the Consolidated Appropriation Resolution of 2003 (P.L. 108-7), allowing payments for physician services to rise 1.6%. In 2004 and 2005, payment rates were again scheduled to be reduced. The Medicare Modernization Act (P.L. 108-173) increased payments 1.5% for those two years.

In 2006, the SGR mechanism was scheduled to decrease physician payments by 4.4%. (This number results from a 7% decrease in physician payments times a 2.8% inflation adjustment increase.) Congress overrode this decrease in the Deficit Reduction Act (P.L. 109-362), and held physician payments in 2006 at their 2005 levels. Similarly, another congressional act held 2007 payments at their 2006 levels, and HR 6331 held 2008 physician payments to their 2007 levels, and provided for a 1.1% increase in physician payments in 2009. Without further continuing congressional intervention, the SGR is expected to decrease physician payments from 25% to 35% over the next several years.

MFS has been criticized for not paying doctors enough because of the low conversion factor. By adjustments to the MFS conversion factor, it is possible to make global adjustments in payments to all doctors.[34]

Office medication reimbursement

Chemotherapy and other medications dispensed in a physician's office are reimbursed according to the Average Sales Price,[35] a number computed by taking the total dollar sales of a drug as the numerator and the number of units sold nationwide as the denominator.[36] The current reimbursement formula is known as "ASP+6" since it reimburses physicians at 106% of the ASP of drugs. Pharmaceutical company discounts and rebates are included in the calculation of ASP, and tend to reduce it. In addition, Medicare only pays 80% of ASP+6 which is the equivalent of 84.8% of the actual average cost of the drug. Some patients have supplemental insurance or can afford the co-pay. Large numbers do not. This leaves the payment to physicians for most of the drugs in an "underwater" state. ASP+6 superseded Average Wholesale Price in 2005,[37] after a 2003 front-page New York Times article drew attention to the inaccuracies of Average Wholesale Price calculations.[38] Average Wholesale Price (AWP) reimbursement was designed by Medicare to cover both the cost of the drugs and the non-reimbursed services and supplies required to deliver complex quality cancer care. The transition to the ASP+6 reimbursement did not have a sufficient increase in service and supplies to cover the aggregate cost of delivering cancer care. Thus, since the change, a significant number of outpatient chemotherapy drugs are "underwater," since the wholesale price from drug distributors may be higher than ASP+6 for some drugs.[citation needed] Stakeholders are involved in active discussions with the United States Congress to address this issue.[citation needed]

Costs and funding challenges

The costs of Medicare doubled every four years between 1966 and 1980.[39] According to the 2004 "Green Book" of the House Ways and Means Committee, Medicare expenditures from the American government were $256.8 billion in fiscal year 2002. Beneficiary premiums are highly subsidized, and net outlays for the program, accounting for the premiums paid by subscribers, were $230.9 billion.

Medicare spending is growing steadily in both absolute terms and as a percentage of the federal budget. Total Medicare spending reached $440 billion for fiscal year 2007, or 16% of all federal spending. The only larger categories of federal spending are Social Security and defense. Given the current pattern of spending growth, maintaining Medicare's financing over the long-term may well require significant changes.[40]

According to the 2008 report by the board of trustees for Medicare and Social Security, Medicare will spend more than it brings in from taxes this year (2008). The Medicare hospital insurance trust fund will become insolvent by 2019.[40][41][42][43] Shortly after the release of the report, the Chief Actuary testified that the insolvency of the system could be pushed back by 18 months if Medicare Advantage plans that provide more health care services than traditional Medicare and pass savings onto beneficiaries were paid at the same rate as the traditional fee-for-service program. He also testified that the 10-year cost of Medicare drug benefit is 37% lower than originally projected in 2003, and 17% percent lower than last year's projections.[44] The New York Times wrote in January 2009 that Social Security and Medicare "have proved almost sacrosanct in political terms, even as they threaten to grow so large as to be unsustainable in the long run."[45]

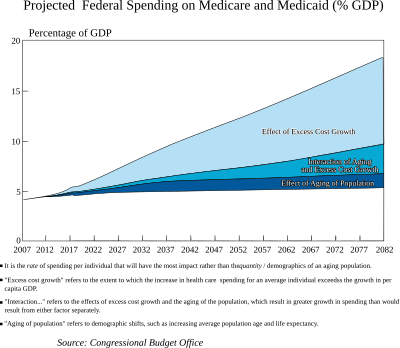

Spending on Medicare and Medicaid is projected to grow dramatically in coming decades. While the same demographic trends that affect Social Security also affect Medicare, rapidly rising medical prices appear a more important cause of projected spending increases. The Congressional Budget Office (CBO) has indicated that: "Future growth in spending per beneficiary for Medicare and Medicaid—the federal government’s major health care programs—will be the most important determinant of long-term trends in federal spending. Changing those programs in ways that reduce the growth of costs—which will be difficult, in part because of the complexity of health policy choices—is ultimately the nation’s central long-term challenge in setting federal fiscal policy." Further, the CBO also projects that "total federal Medicare and Medicaid outlays will rise from 4 percent of GDP in 2007 to 12 percent in 2050 and 19 percent in 2082—which, as a share of the economy, is roughly equivalent to the total amount that the federal government spends today. The bulk of that projected increase in health care spending reflects higher costs per beneficiary rather than an increase in the number of beneficiaries associated with an aging population."[46]

Financial viability

Richard W. Fisher, President of the Federal Reserve Bank of Dallas has remarked that in order to "cover the unfunded liability" for the Medicare program today over an infinite time horizon, "you would be stuck with an $85.6 trillion bill" which is "more than six times the annual output of the entire U.S. economy", and noted that "Medicare was a pay-as-you-go program from the very beginning."[47]

The present value of unfunded obligations under all parts of Medicare during FY 2007 over a 75-year forecast horizon is approximately $34.0 trillion. In other words, this amount would have to be set aside today such that the principal and interest would cover the shortfall over the next 75 years.[48]

Aging of the population

The fundamental problem is that the ratio of workers paying Medicare taxes to retirees drawing benefits is shrinking, and at the same time, the price of health care services per person is increasing.[49][50] Currently there are 3.9 workers paying taxes into Medicare for every older American receiving services. By 2030, as the baby boom generation retires, that is projected to drop to 2.4 workers for each beneficiary. Medicare spending is expected to grow by about 7 percent per year for the next 10 years.[51] As a result, the financing of the program is out of actuarial balance, presenting serious challenges in both the short-term and long-term.[40][43]

Fraud and waste

The Government Accountability Office lists Medicare as a "high-risk" government program in need of reform, in part because of its vulnerability to fraud and partly because of its long-term financial problems.[52][53][54] Fewer than 5% of Medicare claims are audited.[55]

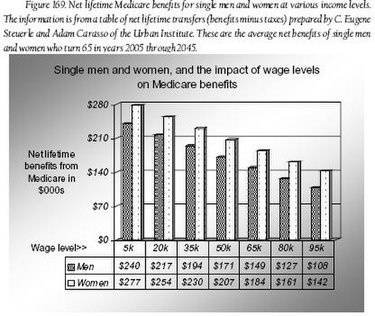

Estimated net Medicare benefits for different worker categories

In 2004, Urban Institute economists C. Eugene Steuerle and Adam Carasso created a Web-based Medicare benefits calculator.[56] Using this calculator it is possible to estimate net Medicare benefits (i.e., estimated lifetime Medicare benefits received minus estimated lifetime Medicare taxes paid, expressed in today's dollars) for different types of recipients. In the book, Democrats and Republicans - Rhetoric and Reality, Joseph Fried used the calculator to create graphical depictions of the estimated net benefits of men and women who were at different wage levels, single and married (with stay-at-home spouses), and retiring in different years. Three of these graphs are shown below, and they clearly show why Medicare (as currently formulated) is on the path to fiscal insolvency: No matter what the wage level, marital status, or retirement date, a man or woman can expect to receive benefits that will cost the system far more than the taxes he or she paid into the system.

In the first graph (Figure 169) we see that estimated net benefits range from $108,000 to $240,000 for single men and from $142,000 to $277,000 for single women. Generally, the benefits are progressive. Note that women usually get higher benefits due to their greater longevity.[57]

In the next graph (Figure 170) we see a comparison of net Medicare benefits for a single woman versus a married woman (or man) with a stay-at-home spouse. The single woman can expect substantial net benefits, ranging from $142,000 to $277,000, However, these benefits are dwarfed by the estimated net benefits of her married counterpart. Due to a "spousal benefit" built into the Medicare formula, the married person will get net benefits ranging from $393,000 to $525,000. The impact of the spousal benefit can disrupt the intended progressiveness of Medicare benefits. For example, we see in Figure 170 that the married worker earning $95,000 is estimated to get net benefits of $393,000, while the single worker earning $5,000 is estimated to get $277,000. In either case, the benefits paid to the worker greatly exceed the taxes paid by the worker (and pose a financial burden on the system); however, the high-earning married worker gets a better "return," so to speak, on each tax dollar paid into the system.[58]

The last graph shown (Figure 171) compares the net benefits of a single man retiring in 2005 with the net benefits of a man retiring in 2045. It is clear that the future retiree is likely to get a far greater net benefit than the current retiree (and is likely to be a greater burden to the system).[59] Interestingly, in the Social Security system we see the opposite pattern. In that case, the future retiree can expect a much smaller net retirement benefit than the current retiree can expect. See "Estimated net Social Security benefits under differing circumstances" in Social Security (United States)

About 27.4 percent of Medicare expenditures for the elderly are spent in the last year of a person's life.[60]

Criticism

Entitlement question

Some have argued that the birth of Medicare represented a shift away from personal responsibility and towards a view that health care is an unearned “entitlement” to be provided at others’ expense.[61]

However, according to a former commissioner of Social Security under Presidents Kennedy, Johnson, and Nixon,[62] Robert M. Ball, Medicare was created because the elderly had difficulty securing private insurance coverage. In the early 1960s relatively few of the elderly had health insurance, and what they had was usually inadequate. Insurers such as Blue Cross, which had originally applied the principle of community rating, facing competition from other commercial insurers that did not community rate and were forced to raise their rates for the elderly.[63] Also Medicare is not an unearned entitlement. Entitlement is based on a record of contributions to the Medicare fund. As such it is a form of social insurance making it feasible for people to pay for insurance for sickness in old age when they are young and able to work and be assured of getting back benefits when they are older and no longer working. Some people will pay in more than they receive back and others will get back more than they paid in but this is the practise with any form of insurance, public or private.

Conservative claims of socialism

Many conservatives strongly opposed the enactment of Medicare, warning that a government-run program would lead to socialism in America:

- Ronald Reagan, at the time a registered Democrat and President of the Screen Actor's Guild, stated in 1961: “[I]f you don’t [stop Medicare] and I don’t do it, one of these days you and I are going to spend our sunset years telling our children and our children’s children what it once was like in America when men were free.”[64][unreliable source?]

- George H. W. Bush, while a candidate for the US Senate in 1964, described Medicare as “socialized medicine.”[65]

- Barry Goldwater in 1964: “Having given our pensioners their medical care in kind, why not food baskets, why not public housing accommodations, why not vacation resorts, why not a ration of cigarettes for those who smoke and of beer for those who drink.”[66]

- In 1996, while running for the presidency, Bob Dole stated that he was one of 12 House members who voted against creating Medicare in 1965. “I was there, fighting the fight, voting against Medicare ... because we knew it wouldn’t work in 1965.” [1992][67]

Financial challenges

Medicare faces continuing financial challenges. In its 2008 annual report to Congress, the Medicare Board of Trustees reported that the program's hospital insurance trust fund could run out of money by 2017. The trustees have made such projections in the past, but this one was bleaker than the outlook reported in 2007.[68]

Popular opinion surveys show that the public views Medicare’s problems as serious, but not as urgent as other concerns. In January 2006, the Pew Research Center found 62 percent of the public said addressing Medicare’s financial problems should be a high priority for the government, but that still put it behind other priorities.[69] Surveys suggest that there’s no public consensus behind any specific strategy to keep the program solvent.[70]

Quality of beneficiary services

A 2001 study by the Government Accountability Office evaluated the quality of responses given by Medicare contractor customer service representatives to provider (physician) questions. The evaluators assembled a list of questions, which they asked during a random sampling of calls to Medicare contractors. The rate of complete, accurate information provided by Medicare customer service representatives was 15%.[71] Since then, steps have been taken to improve the quality of customer service given by Medicare contractors, specifically the 1-800-MEDICARE contractor. As a result, 1-800-MEDICARE customer service representatives (CSR) have seen an increase in training, quality assurance monitoring has significantly increased, and a customer satisfaction survey is offered to random callers. During a U.S. Senate hearing that was held in 2008, the 1-800-Medicare Contractors CEO reported that the survey results concluded that 95% of callers were satisfied with the services they received during their conversations with Medicare CSRs.[citation needed]

Hospital accreditation

An attempt by TÜV Healthcare Specialists to provide a hospital accreditation option was denied in 2006.[72] Rebecca Wise, CEO of TÜVHS, has said "Choice and competition are the hallmarks of a free market.... Can you think of an industry with a more profound impact on our lives than healthcare? Yet there is a much higher chance of you getting the wrong dosage of medicine in a hospital than there is of a manufacturer putting the wrong chip on a circuit board. It’s a failure of the system not the people."[73]

Beyond hospitals and hospital accreditation, there are now a number of alternative American organizations possessing healthcare-related deeming power for Medicare. These include the Community Health Accreditation Program, the Accreditation Commission for Health Care, the Compliance Team and the Healthcare Quality Association on Accreditation.

Accreditation is voluntary and an organization may choose to be evaluated by their State Survey Agency or by CMS directly.[74]

Graduate Medical Education

Medicare funds the vast majority of residency training in the US. This tax-based financing covers resident salaries and benefits through payments called Direct Medical Education payments. Medicare also uses taxes for Indirect Medical Education, a subsidy paid to teaching hospitals in exchange for training resident physicians.[75] For the 2008 fiscal year these payments were $2.7 and $5.7 billion respectively[76]. Overall funding levels have remained at the same level over the last ten years, so that the same number or fewer residents have been trained under this program.[77] Meanwhile, the US population continues to grow older, which has led to greater demand for physicians. At the same time the cost of medical services continue rising rapidly and many geographic areas face physician shortages, both trends suggesting the supply of physicians remains too low.[78] Medicare finds itself in the odd position of having assumed control of graduate medical education, currently facing major budget constraints, and as a result, freezing funding for graduate medical education, as well as for physician reimbursement rates.[79] This halt in funding in turn exacerbates the exact problem Medicare sought to solve in the first place: improving the availability of medical care. In response, teaching hospitals have resorted to alternative approaches to funding resident training, leading to the modest 4% total growth in residency slots from 1998-2004, despite Medicare funding having been frozen since 1996.[79]

Legislation and reform

- 1960 — PL 86-778 Social Security Amendments of 1960 (Kerr-Mills aid)

- 1965 — PL 89-97 Social Security Act of 1965, Establishing Medicare Benefits

- 1980 — Medicare Secondary Payer Act of 1980, prescription drugs coverage added

- 1988 — PL 100-360 Medicare Catastrophic Coverage Act of 1988

- 1989 — Medicare Catastrophic Coverage Repeal Act of 1989

- 1997 — PL 105-33 Balanced Budget Act of 1997

- 2003 — PL 108-173 Medicare Prescription Drug, Improvement, and Modernization Act

President Bill Clinton attempted an overhaul of Medicare through his health care reform plan in 1993-1994 but was unable to get the legislation passed by Congress.

In 2003 Congress passed the Medicare Prescription Drug, Improvement, and Modernization Act, which President George W. Bush signed into law on December 8, 2003. Part of this legislation included filling gaps in prescription-drug coverage left by the Medicare Secondary Payer Act that was enacted in 1980. The 2003 bill strengthened the Workers' Compensation Medicare Set-Aside Program (WCMSA) that is monitored and administered by CMS.

On August 1, 2007, the U.S. House United States Congress voted to reduce payments to Medicare Advantage providers in order to pay for expanded coverage of children's health under the SCHIP program. As of 2008, Medicare Advantage plans cost, on average, 13 percent more per person insured than direct payment plans.[80] Many health economists have concluded that payments to Medicare Advantage providers have been excessive. The Senate, after heavy lobbying from the insurance industry, declined to agree to the cuts in Medicare Advantage proposed by the House. President Bush subsequently vetoed the SCHIP extension.[81]

Legislative oversight

The following lists the congressional committees that have been delegated congressional oversight roles over the Medicare program:

- This table incorporates information available on the CMS Website[82]

See also

|

References

- ^ Major health care proposals ignore the 'Big Leak,' says health insurance expert from Physicians for a National Health Program.

- ^ Social Security Online History Pages

- ^ "What Is the Role of the Federal Medicare Actuary?," American Academy of Actuaries, January 2002

- ^ "Social Insurance," Actuarial Standard of Practice No. 32, Actuarial Standards Board, January 1998

- ^ The role of private intermediaries in Medicare administration is discussed in Sylvia A. Law, Blue Cross: What Went Wrong? 31-46 (New Haven, Conn.: Yale University Press, 1974).

- ^ Title 26, Subtitle C, Chapter 21 of the United States Code

- ^ Medicare

- ^ Trustees Report & Trust Funds Overview

- ^ Medicare: Part A & B, University of Iowa Hospitals and Clinics, 2005.

- ^ a b National Center for Policy Analysis. Daily Policy Digest. Retrieved 26 March 2007.

- ^ Medicare Payment Advisory Commission Annual Reports to Congress, 2006, 2007, 2008

- ^ Mark Merlis, "The Value of Extra Benefits Offered by Medicare Advantage Plans in 2006," The Kaiser Family Foundation, January 2008

- ^ America’s Health Insurance Plans. Trends and Innovations in Chronic Disease Prevention and Treatment, April 2008. Retrieved on 30 September 2008.

- ^ Marsha Gold, "Medicare Advantage in 2008," The Kaiser Family Foundation, June 2008

- ^ "Problems encountered by Medicare beneficiaries in managed Care plans," Booske B, Frees D, etc., AcademyHealth, Abstr Academy Health Meet. 2005, 22: abstract no. 3625.

- ^ "Voluntary disenrollment from Medicare managed care: market factors," Mobley L, et al., Health Care Financing Review, 2005 Spring; 26(3): 45-62.

- ^ Hellinger FJ, "The effect of managed care on quality: a review of recent evidence," Archives Internal Medicine, 1998 Apr 27; 158(8): 833-41..

- ^ Teresa Chovan, Christelle Chen, Kelly Buck and Jamie John, Reductions in Hospital Days, Re-Admissions, and Potentially Avoidable Admissions Among Medicare Advantage Enrollees in California and Nevada, 2006, America’s Health Insurance Plans, September 2009

- ^ Christelle Chen, "LOW-INCOME & MINORITY BENEFICIARIES IN MEDICARE ADVANTAGE PLANS, 2006," America’s Health Insurance Plans, September 2008

- ^ "Insurers Fight to Defend Lucrative Medicare Business," Wall Street Journal, April 30, 2007

- ^ Trivedi AN, et al., "Relationship between quality of care and racial disparities in Medicare...," JAMA, 2006 Oct 25; 296(16): 1998-2004.

- ^ GAO-09-132R, "Medicare Advantage Expenses"

- ^ Product/Drug/Drug Category

- ^ Relationship between Part B and Part D Coverage

- ^ Report on the Medicare Drug Discount Card Program Sponsor McKesson Health Solutions, A-06-06-00022

- ^ How Does the Benefit Value of Medicare Compare to the Benefit Value of Typical Large Employer Plans? (PDF). Kaiser Family Foundation. September 2008.

{{cite book}}: Unknown parameter|coauthors=ignored (|author=suggested) (help) - ^ 2009 Medicare & You handbook, Centers for Medicare & Medicaid Services.

- ^ Victoria Colliver, "For most, Medicare premiums won't rise in 2009," San Francisco Chronicle, September 20, 2008

- ^ KEVIN FREKING, "No rise in monthly Medicare premiums for 2009,"[dead link] Seattle Post-Intelligencer, September 19, 2008

- ^ 2008 Medicare & You handbook, Centers for Medicare & Medicaid Services.

- ^ Jeff Lemieux, Teresa Chovan, and Karen Heath, "Medigap Coverage And Medicare Spending: A Second Look," Health Affairs, Volume 27, Number 2, March/April 2008

- ^ "Budget of the United States Government: Fiscal Year 2010 - Updated Summary Tables"

- ^ Lauren A. McCormick, Russel T. Burge. Diffusion of Medicare's RBRVS and related physician payment policies - resource-based relative value scale - Medicare Payment Systems: Moving Toward the Future Health Care Financing Review. Winter, 1994.

- ^ Medicare's Physician Payment Rates and the Sustainable Growth Rate.(PDF) CBO TESTIMONY Statement of Donald B. Marron, Acting Director. July 25, 2006.

- ^ "Why do manufacturers have to report average sales prices to CMS?", CMS FAQs, HHS.gov

- ^ How does CMS calculate the Average Sales Price (ASP)-based payment limit?, CMS FAQs, HHS.gov

- ^ "Law Impedes Flow of Immunity in a Vial", New York Times, July 19, 2005, by Andrew Pollack

- ^ "Cancer Drugs Face Funds Cut in a Bush Plan", New York Times, August 6, 2003, Robert Pear

- ^ Frum, David (2000). How We Got Here: The '70s. New York, New York: Basic Books. p. 324. ISBN 0465041957.

{{cite book}}: Cite has empty unknown parameter:|coauthors=(help) - ^ a b c Lisa Potetz, "Financing Medicare: an Issue Brief," the Kaiser Family Foundation, January 2008

- ^ Annual Federal Report Forecasts Medicare Funding Gap by 2019 - California Healthline

- ^ "2008 ANNUAL REPORT OF THE BOARDS OF TRUSTEES OF THE FEDERAL HOSPITAL INSURANCE AND FEDERAL SUPPLEMENTARY MEDICAL INSURANCE TRUST FUNDS," Centers for Medicare and Medicaid Services, March 25, 2008

- ^ a b "Medicare’s Financial Condition: Beyond Actuarial Balance," American Academy of Actuaries, March 2008

- ^ "Medicare: Paying Medicare Advantage Plans Same Rates as Traditional Medicare Would Delay Program Insolvency by 18 Months, Medicare Actuary Says," Kaiser Daily Health Policy Report, Kaiser Family Foundation, April 02, 2008

- ^ Zeleny, Jeff (January 7, 2009). "Obama Promises Bid to Overhaul Retiree Spending". The New York Times. Retrieved 2009-01-09.

{{cite news}}: Italic or bold markup not allowed in:|publisher=(help) - ^ CBO Testimony

- ^ Richard W. Fisher (2008-05-28). "Storms on the Horizon". Federal Reserve Bank of Dallas. Retrieved 2008-06-18.

- ^ 2007 Report of the U.S. Government Page 47

- ^ "Public Agenda, Fewer Workers Projected Per HI Beneficiary". Retrieved July 25 2008.

{{cite web}}: Check date values in:|accessdate=(help); Unknown parameter|dateformat=ignored (help) - ^ "Public Agenda, Medicare Costs Per Person". Retrieved July 25 2008.

{{cite web}}: Check date values in:|accessdate=(help); Unknown parameter|dateformat=ignored (help) - ^ "2006 Annual Report of the Boards of Trustees of the Federal Hospital Insurance and Federal Supplimentary Medical Insurance Trust Funds, 1 May 2006 (PDF)" (PDF). Retrieved July 21 2006.

{{cite web}}: Check date values in:|accessdate=(help); Unknown parameter|dateformat=ignored (help) - ^ ""High-Risk Series: An Update" U.S. Government Accountability Office, January 2003 (PDF)" (PDF). Retrieved July 21 2006.

{{cite web}}: Check date values in:|accessdate=(help); Unknown parameter|dateformat=ignored (help) - ^ U.S. GAO - Report Abstract

- ^ Medicare Fraud and Abuse: DOJ Continues to Promote Compliance with False Claims Act Guidance, GAO Report to Congressional Committees, April 2002

- ^ Carrie Johnson, "Medical Fraud a Growing Problem: Medicare Pays Most Claims Without Review," The Washington Post, June 13, 2008

- ^ C. Eugene Steuerle and Adam Carasso, "The USA Today Lifetime Social Security and Medicare Benefits Calculator," (Urban Institute, October 1, 2004)[1]

- ^ Fried, Joseph, Democrats and Republicans - Rhetoric and Reality (New York: Algora Publishing, 2008), 215.

- ^ Fried, Joseph, Democrats and Republicans - Rhetoric and Reality (New York: Algora Publishing, 2008), 216.

- ^ Fried, Joseph, Democrats and Republicans - Rhetoric and Reality (New York: Algora Publishing, 2008), 217.

- ^ "Medicare Beneficiaries' Costs Of Care In The Last Year Of Life". Health Affairs. Retrieved 2009-04-20.

After minor adjustments for comparability with earlier estimates, spending in the last year of life accounted for 27.4 percent of all Medicare outlays for the elderly, similar to the 26.9–30.6 percent range in earlier decades.

- ^ Yaron Brook "Why Are We Moving Toward Socialized Medicine?"[2]July 29,2009

- ^ http://www.robertmball.org/

- ^ Perspectives On Medicare: What Medicare’s Architects Had In Mind Robert M. Ball Health Affairs Winter1 995

- ^ "Ronald Reagan Speaks Out Against Socialized Medicine".

- ^ Debenport, Ellen (17 August 1992). "Bush resists action, distrusts change Series: ANALYSIS". St. Petersburg Times. Retrieved 2009-08-22.

{{cite news}}: Italic or bold markup not allowed in:|publisher=(help) - ^ House Democrats Expose Campaign of Misinformation on Health Insurance Reform, United States House Committee on Education and Labor, 31 July 2009

- ^ http://wonkroom.thinkprogress.org/2009/07/29/medicare-44/

- ^ [3]

- ^ Medicare: People's Chief Concerns

- ^ Medicare: Red Flags

- ^ Improvements Needed in Provider Communications and Contracting Procedures, Testimony Before the Subcommittee on Health, Committee on Ways and Means, House of Representatives, 25 September 2001.

- ^ Quarterly Provider Updates

- ^ MedLaw.com :: New Competitor Takes On JCAHO Accreditation

- ^ http://www.vdh.state.va.us/OLC/Laws/documents/HomeCare/Accreditation%20Option%20for%20Medicare%20payments.pdf

- ^ Medicare funding for medical education: a waste of money?

- ^ http://www.aamc.org/newsroom/reporter/feb09/payments.htm

- ^ Innovative funding opens new residency slots

- ^ Shortages of Medical Personnel at Community Health Centers - JAMA, March 1, 2006

- ^ a b Innovative funding opens new residency slots

- ^ Aliza Marcus, "Senate Vote on Doctor Fees Carries Risks for McCain", Bloomberg News, July 9, 2008

- ^ "House Passes Children’s Health Plan 225-204", New York Times, August 2, 2007]

- ^ Congressional Committees of Interest, CMS Website, accessed 2/15/07

External links

This article's use of external links may not follow Wikipedia's policies or guidelines. |

Governmental links - current

- CMS official web site at cms.hhs.gov

- Medicare at cms.hhs.gov

- Medicare.gov — the official website for people with Medicare

- Official Medicare publications at Medicare.gov — includes official publications about current Medicare benefits

- Medicare & You handbook for 2009 at Medicare.gov — includes information about current Medicare benefits

- Information about the 1-800-MEDICARE helpline from Medicare.gov — a 24X7 toll-free number to call with questions about Medicare

- Medicare Modernization Act at Medicare.gov

- Medicare Plan Choices at Medicare.gov — basic information about plan choices for Medicare beneficiaries, including MA Plans

- Prescription Drug Coverage homepage at Medicare.gov — a central location for Medicare's web-based information about the Part D benefit

- Landscape of plans — state-by-state breakdown of all plans available in an area, both stand-alone PDPs, as well as MA-PD plans

- Official Medicare publications at Medicare.gov — includes official publications about current Medicare benefits

- MyMedicare.gov — Medicare's secure online service where beneficiaries can access their own personal Medicare information

Governmental links - historical

- Medicare Is Signed Into Law page from ssa.gov — material about the bill-signing ceremony

- Historical Background and Development of Social Security from ssa.gov — includes information about Medicare

- Detailed Chronology of SSA from ssa.gov — includes information about Medicare

- Early Medicare poster from ssa.gov

Non-governmental links

- Congressional Research Service (CRS) Reports related to Medicare from the University of Texas Libraries

- Center for Medicare Advocacy — National education & advocacy organization.

- Medicare Rights Center — Education and advocacy organization.

- Medicare Interactive — Online Medicare reference guide created by the Medicare Rights Center.

- Medicare.org — Medicare information site including descriptions of Part A through D

- Medicare & Medicaid Resources — Medicare information site

- Kaiser Family Foundation — Wide range of free information, including a drug benefit calculator, about the Medicare program and other U.S. health issues.

- State Health Facts — Data on health care spending and utilization, including Medicare; provided by the Kaiser Family Foundation.

- Medicare - Alliance for Health Reform The nonpartisan, nonprofit Alliance for Health Reform offers information about health reform, in a number of formats, to elected officials and their staffs, journalists, policy analysts and advocates.

- Social Security and Disability News Resource Center

- Issue Guide on Medicare — Policy alternatives and public opinion analysis on Medicare from Public Agenda Online

- How Stuff Works - Medicare