Banknote

A banknote (often known as a bill, paper money or simply a note) is a kind of negotiable instrument, a promissory note made by a bank payable to the bearer on demand, used as money, and in many jurisdictions is legal tender. Along with coins, banknotes make up the cash or bearer forms of all modern fiat money. With the exception of non-circulating high-value or precious metal commemorative issues, coins are used for lower valued monetary units, while banknotes are used for higher values. However some coins may have a significant value depending on the condition and worth.

Advantages

Originally, precious and semi-precious metals were made into coins and were used to negotiate and settle trades. Banknotes offer an alternative bearer form of money, but the advantages and disadvantages between the two forms of bearer money are complex and so in different circumstances the overall advantage can lie with either form.

The costs of using bearer money include:

- Manufacturing or issue costs. Coins are produced by industrial manufacturing methods that process the precious or semi-precious metals, and require additions of alloy for hardness and wear resistance. By contrast bank notes are printed paper (or polymer), and typically have a lower cost of issue, especially in larger denominations, compared to coin of the same value.

- Wear costs. Banknotes do not lose economic value by wear, since, even if they are in poor condition, they are still a legally valid claim on the issuing bank. However, banks of issue do have to pay the cost of replacing banknotes in poor condition and paper notes wear out much faster than coins.

- Opportunity cost of capital. Coins have economic value and are a form of non-financial capital, however they do not pay interest. Banknotes have no economic value but are a form of financial capital, a loan to the issuing bank. The issuing bank invests its assets primarily in interest bearing loans and securities, but also needs to hold metallic reserves. Thus banknotes indirectly earn interest through the investments made by the issuing bank, but coins do not pay interest to anyone. This foregone interest is the most important economic advantage of banknotes over coins.

- Cost of transport. Coins can be expensive to transport for high value transactions, but banknotes can be issued in large denominations that are lighter than the equivalent value in coins.

- Cost of acceptance. Coins can be checked for authenticity by weighing and other forms of examination and testing. These costs can be significant, but good quality coin design and manufacturing can help reduce these costs. Banknotes also have an acceptance cost, the costs of checking the banknote's security features and confirming acceptability of the issuing bank.

- Security. Counterfeiting paper notes is easier than forging coins, especially true given the proliferation of color photocopiers and computer image scanners. Numerous banks and nations have incorporated many types of countermeasures in order to keep the money secure.

The different advantages and disadvantages between coins and banknotes imply that there may be an ongoing role for both forms of bearer money, each being used where its advantages outweigh its disadvantages.

History

Paper money originated in two forms: drafts, which are receipts for value held on account, and "bills", which were issued with a promise to convert at a later date.

Money is based on the coming to pre-eminence of some commodity as payment. The oldest monetary basis was for agricultural capital: cattle and grain. In Ancient Mesopotamia, drafts were issued against stored grain as a unit of account. A "drachma" was a weight of grain. Japan's feudal system was based on rice per year – koku.

At the same time, legal codes enforced the payment for injury in a standardized form, usually in precious metals. The development of money then comes from the role of agricultural capital and precious metals having a privileged place in the economy.

Such drafts were used for giro systems of banking as early as Ptolemaic Egypt in the 1st century BC.

The perception of banknotes as money has evolved over time. Originally, money was based on precious metals. Banknotes were seen as essentially an I.O.U. or promissory note: a promise to pay someone in precious metal on presentation (see representative money). With the gradual removal of precious metals from the monetary system, banknotes evolved to represent credit money, or (if backed by the credit of a government) also fiat money.

Notes or bills were often referred to in 18th century novels and were often a key part of the plot such as a "note drawn by Lord X for £100 which becomes due in 3 months time"

First banknotes in the world

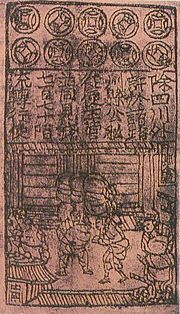

The use of paper money as a circulating medium is intimately related to shortages of metal for coins. In ancient China coins were circular with a rectangular hole in the middle. Several coins could be strung together on a rope. Merchants in China, if they became rich enough, found that their strings of coins were too heavy to carry around easily. To solve this problem, coins were often left with a trustworthy person, and the merchant was given a slip of paper recording how much money he had with that person. If he showed the paper to that person he could regain his money. Eventually, the paper money called "jiaozi" originated from these promissory notes.

In the 7th century there were local issues of paper currency in China and by 960 the Song Dynasty, short of copper for striking coins, issued the first generally circulating notes. A note is a promise to redeem later for some other object of value, usually specie. The issue of credit notes is often for a limited duration, and at some discount to the promised amount later. The jiaozi nevertheless did not replace coins during the Song Dynasty; paper money was used alongside the coins.

The successive Yuan Dynasty was the first dynasty in China to use paper currency as the predominant circulating medium. The founder of the Yuan Dynasty, Kublai Khan, issued paper money known as Chao in his reign. The original notes during the Yuan Dynasty were restricted in area and duration as in the Song Dynasty, but in the later course of the dynasty, facing massive shortages of specie to fund their ruling in China, began printing paper money without restrictions on duration. By 1455, in an effort to rein in economic expansion and end hyperinflation, the new Ming Dynasty ended paper money, and closed much of Chinese trade.

In the Indian sub-continent a similar system evolved called the hundi system. The history of these instruments has not been widely studied but it is quite likely that these were in common use hundreds of years ago, being designed to assist in Indian trade, which was extensively practiced across the world in the past. A Hundi is basically an unconditional order in writing made by a person directing another to pay a certain sum of money to a person named in the order. Hundis, similar to paper notes, were issued by indigenous bankers and used in trade and credit transactions and to transfer funds from one place to another, a kind of travellers cheque. They were also used as credit instruments for borrowing and as bills of exchange for trade transactions.

Banknotes in Europe

In mediaval Italy and Flanders, because of the insecurity and impracticality of transporting large sums of money over long distances, money traders started using promissory notes. In the beginning these were personally registered, but they soon became a written order to pay the amount to whoever had it in their possession. These notes can be seen as a predecessor to regular bank notes[1].

The first proper European banknotes were issued by Stockholms Banco, a predecessor of the Bank of Sweden, in 1660, although the bank ran out of coins to redeem its notes in 1664 and ceased operating in that year.

Until Louis XIV, banknotes were issued by small creditors, had limited circulation, and were not backed by the authority of the state. Economist John Law helped establish banknotes as formal currency, backed by capital consisting of French government bills and government accepted notes.

Banknotes in the United States

In the early 1690s, the Massachusetts Bay Colony was the first of the Thirteen Colonies to issue permanently circulating banknotes. The use of fixed denominations and printed banknotes came into use in the 18th century.

In the early 1700s each of the thirteen colonies issued their own banknotes. During the American Revolutionary War, the Continental Congress issued Continental currency to finance the war. The federal government of the United States did not print banknotes until 1862. However, almost immediately after adoption of the United States Constitution in 1789, the United States Congress chartered the First Bank of the United States and authorized it to issue banknotes. The bank served as quasi-central bank of the United States. The bank closed in 1811 when Congress failed to renew its charter. In 1816, Congress chartered the Second Bank of the United States. When its charter expired in 1836, the bank continued to operate under a charter granted by the Commonwealth of Pennsylvania until 1841.

In the United States, public acceptance of banknotes in replacement of precious metals was hastened in part by Executive Order 6102 in 1933. This order carried the threat of a maximum $10,000 fine and a maximum of ten years in prison for anyone who kept more than $100 of gold in preference to banknotes.

Issue of banknotes

Generally, a central bank or treasury is solely responsible within a state or currency union for the issue of banknotes. However, this is not always the case, and historically the paper currency of countries was often handled entirely by private banks. Thus, many different banks or institutions may have issued banknotes in a given country. In the United States, commercial banks were authorized to issue banknotes from 1863 to 1935. In the last of these series, the issuing bank would stamp its name and promise to pay, along with the signatures of its president and cashier on a preprinted note. By this time, the notes were standardized in appearance and not too different from the Federal Reserve Notes that circulated for most of the 20th century.

In a small number of countries, private banknote issue continues to this day. For example, by virtue of the complex constitutional setup in the United Kingdom, certain commercial banks in two of the union's four constituent countries (Scotland and Northern Ireland) continue to print their own banknotes for domestic circulation, even though they are not fiat money or declared in law as legal tender anywhere. The UK's central bank, the Bank of England, prints notes which are legal tender in England and Wales; these notes are also usable as money (but not legal tender) in the rest of the UK (see Banknotes of the pound sterling).

In Hong Kong, three commercial banks are licenced to issue Hong Kong dollar notes.[2] As well as commercial issuers, other organizations may have note-issuing powers; for example, until 2002 the Singapore dollar was issued by the Board of Commissioners of Currency Singapore, a government agency which was later taken over by the Monetary Authority of Singapore.[2]

Materials used for banknotes

Paper banknotes

Most banknotes are made from cotton paper (see also paper) with a weight of 80 to 90 grams per square meter. The cotton is sometimes mixed with linen, abaca, or other textile fibres. Generally, the paper used is different from ordinary paper: it is much more resilient, resists wear and tear (the average life of a banknote is two years)[3], and also does not contain the usual agents that make ordinary paper glow slightly under ultraviolet light. Unlike most printing and writing paper, banknote paper is infused with polyvinyl alcohol or gelatin to give it extra strength. Early Chinese banknotes were printed on paper made of mulberry bark and this fiber is used in Japanese banknote paper today.

Most banknotes are made using the mould made process in which a watermark and thread is incorporated during the paper forming process. The thread is a simple looking security component found in most banknotes. It is however often rather complex in construction comprising fluorescent, magnetic, metallic and micro print elements. By combining it with watermarking technology the thread can be made to surface periodically on one side only. This is known as windowed thread and further increases the counterfeit resistance of the banknote paper. This process was invented by Portals, part of the De La Rue group in the UK. Other related methods include watermarking to reduce the number of corner folds by strengthening this part of the note, coatings to reduce the accumulation of dirt on the note, and plastic windows in the paper that make it very hard to copy.

Counterfeiting and security measures on paper banknotes

The ease with which paper money can be created, by both legitimate authorities and counterfeiters, has led both to a temptation in times of crisis such as war or revolution to produce paper money which was not supported by precious metal or other goods, thus leading to hyperinflation and a loss of faith in the value of paper money, e.g. the Continental Currency produced by the Continental Congress during the American Revolution, the Assignats produced during the French Revolution, the paper currency produced by the Confederate States of America and the Individual States of the Confederate States of America, the financing of World War I by the Central Powers (by 1922 1 gold Austro-Hungarian krone of 1914 was worth 14,400 paper Kronen), the devaluation of the Yugoslav Dinar in the 1990s, etc. Banknotes may also be overprinted to reflect political changes that occur faster than new currency can be printed.

In 1988, Austria produced the 5000 Schilling banknote (Mozart), which is the first foil application (Kinegram) to a paper banknote in the history of banknote printing. The application of optical features is now in common use throughout the world.

Many countries' banknotes now have embedded holograms.

Polymer banknotes

In 1983, Costa Rica and Haiti issued the first Tyvek and the Isle of Man issued the first Bradvek polymer (or plastic) banknotes; these were printed by the American Banknote Company and developed by DuPont. In 1988, after significant research and development by the Commonwealth Scientific and Industrial Research Organisation (CSIRO) and the Reserve Bank of Australia, Australia produced the first polymer banknote made from biaxially-oriented polypropylene (plastic), and in 1996 became the first country to have a full set of circulating polymer banknotes of all denominations. Since then, other countries to adopt circulating polymer banknotes include Bangladesh, Brazil, Brunei, Chile, Indonesia, Israel, Malaysia, Mexico, Nepal, New Zealand, Papua New Guinea, Romania, Samoa, Singapore, the Solomon Islands, Sri Lanka, Thailand, Vietnam, and Zambia, with other countries issuing commemorative polymer notes, including China, Kuwait, the Northern Bank of Northern Ireland, Taiwan and Hong Kong. Other countries indicating plans to issue polymer banknotes include Nigeria and Canada. In 2005, Bulgaria issued the world's first hybrid paper-polymer banknote.

Polymer banknotes were developed to improve durability and prevent counterfeiting through incorporated security features, such as optically variable devices that are extremely difficult to reproduce.

Apart from Australia, other countries such as Vietnam, Brunei, New Zealand, Papua New Guinea and Romania have all their circulating banknotes on polymer.

Other materials

Over the years, a number of materials other than paper have been used to print banknotes. This includes various textiles, including silk, and materials such as leather.

Silk and other fibers have been commonly used in the manufacture of various banknote papers, intended to provide both additional durability and security. Crane and Company patented banknote paper with embedded silk threads in 1844 and has supplied paper to the United States Treasury since 1879. Banknotes printed on pure silk "paper" include "emergency money" Notgeld issues from a number of German towns in 1923 during a period of fiscal crisis and hyperinflation. Most notoriously, Bielefeld produced a number of silk, leather, velvet, linen and wood issues, and although these issues were produced primarily for collectors, rather than for circulation, they are in demand by collectors. Banknotes printed on cloth include a number of Communist Revolutionary issues in China from areas such as Xinjiang, or Sinkiang, in the United Islamic Republic of East Turkestan in 1933. Emergency money was also printed in 1902 on khaki shirt fabric during the Boer War.

Leather banknotes (or coins) were issued in a number of sieges, as well as in other times of emergency. During the Russian administration of Alaska, banknotes were printed on sealskin. A number of 19th century issues are known in Germanic and Baltic states, including the towns of Dorpat, Pernau, Reval, Werro and Woisek. In addition to the Bielefeld issues, other German leather Notgeld from 1923 is known from Borna, Osterwieck, Paderborn and Pößneck.

Other issues from 1923 were printed on wood, which was also used in Canada in 1763-1764 during Pontiac's Rebellion, and by the Hudson's Bay Company. In 1848, in Bohemia, wooden checkerboard pieces were used as money.

Even playing cards were used for currency in France in the early 19th Century, and in French Canada from 1685 until 1757, in the Isle of Man in the beginning of the 19th Century, and again in Germany after World War I.

Vending machines and banknotes

People are not the only economic actors who are required to accept banknotes. In the late 20th century machines were designed to recognize banknotes of the smaller values long after they were designed to recognize coins distinct from slugs. This capability has become inescapable in economies where inflation has not been followed by introduction of progressively larger coin denominations (such as the United States, where several attempts to introduce dollar coins in general circulation have largely failed). The existing infrastructure of such machines presents one of the difficulties in changing the design of these banknotes to make them less counterfeitable, that is, by adding additional features so easily discernible by people that they would immediately reject banknotes of inferior quality, for every machine in the country would have to be updated.

Destruction

Banknotes have a limited lifetime, after which they are collected for destruction, usually recycling or shredding. A banknote is removed from the money supply by banks or other financial institutions due to everyday wear and tear from its handling. Banknote bundles are passed through a sorting machine that determines whether a particular note needs to be shredded, or are removed from the supply chain by a human inspector if they are deemed unfit for continued use – for example, if they are mutilated or torn. Counterfeit banknotes are destroyed unless they are needed for evidentiary or forensic purposes.

Contaminated banknotes are also decommissioned. A Canadian government report indicates:

Types of contaminants include: notes found on a corpse, stagnant water, contaminated by human or animal body fluids such as urine, feces, vomit, infectious blood, fine hazardous powders from detonated explosives, dye pack and/or drugs...[4]

These are removed from circulation primarily to prevent the spread of diseases.

When taken out of circulation, Australian bank notes are melted down and mixed together to form plastic garbage bins.

Literary references

Paper money is created by the devil in the 1832 Faust, Part II, Act I, by Johann Wolfgang von Goethe, to save the imperial finances. In The Master and Margarita, by Mikhail Bulgakov,[5] the devil turns paper into money, which then reverts into paper. In both cases, the implication is that fiat money is black magic, and but paper.

Paper money collecting as a hobby

Banknote collecting, or Notaphily, is a rapidly growing area of numismatics. Although generally not as widespread as coin and stamp collecting[citation needed], the hobby is increasingly expanding. Prior to the 1990s, currency collecting was a relatively small adjunct to coin collecting, but the practice of currency auctions, combined with larger public awareness of paper money have caused a boom in interest and values of rare banknotes[citation needed].

Catalogs

Collectors often use a banknote catalog to find information about their banknotes or banknotes they may be interested in.

Trades

For years, the mode of collecting banknotes was through a handful of mail order dealers who issued price lists and catalogs. In the early 1990s, it became more common for rare notes to be sold at various coin and currency shows via auction. The illustrated catalogs and "event nature" of the auction practice seemed to fuel a sharp rise in overall awareness of paper money in the numismatic community. Entire advanced collections are often sold at one time, and to this day single auctions can generate well in excess of $1 million in gross sales[citation needed]. Today, eBay has surpassed auctions in terms of highest volume of sales of banknotes. However, as of 2005, rare banknotes still sell for much less than comparable rare coins. There is wide consensus[citation needed] in the paper money collecting arena that this disparity is diminishing as paper money prices continue to rise.

There are many different organizations and societies around the world for the hobby, including the International Bank Note Society (IBNS).

See also

|

Notes

- ^ De Geschiedenis van het Geld (the History of Money), 1992, Teleac, page 96

- ^ a b Bank for International Settlements. "The Role of Central Bank Money in Payment Systems" (PDF). pp. 96, and see also page 9: "The coexistence of central and commercial bank monies: multiple issuers, one currency". Retrieved 2008-08-14.

Although historically not the case, these days banknotes are usually issued only by the central bank. This is broadly the case in all CPSS economies, except Hong Kong SAR, where banknotes are issued by three commercial banks. Singapore and the United Kingdom are more limited exceptions. Singapore dollar banknotes have been issued by the Board of Currency Commissioners, a government agency, although following the merger of the Board into the MAS in October 2002 this is no longer the case. In the United Kingdom, Scottish banks retain the right to issue banknotes alongside those of the Bank of England and three banks currently still do so.

- ^ "DeLaRue - The Banknote Lifecycle – from Design to Destruction"

- ^ Trichur, Rita (2007-09-28). "Bankers wipe out dirty money". Toronto Star. Retrieved 2007-09-28.

- ^ Chapter 12: Black Magic and Its Exposé, by Kevin Moss