HCA Healthcare

This article may lend undue weight to certain ideas, incidents, or controversies. The specific problem is: long list of controversies that may be just a compilation of recent news on this organization rather than a relevant list of events (December 2023) |

This article needs to be updated. (April 2024) |

| |

| Formerly | HCA Holdings, Inc. |

|---|---|

| Company type | Public |

| Industry | Health care |

| Founded | 1968 Nashville, Tennessee, U.S. |

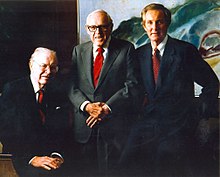

| Founders | Thomas F. Frist Sr., Thomas F. Frist Jr., Jack C. Massey |

| Headquarters | Nashville, Tennessee , U.S. |

Number of locations | 186 hospitals, approximately 2,000 sites of care located in 21 states and the United Kingdom[1] |

Area served | United States and the United Kingdom |

Key people | Sam Hazen (CEO) John Reay (CEO, HCA UK)[2] |

| Revenue | |

Number of employees | 309,000 (2024)[5] |

| Website | hcahealthcare |

HCA Healthcare, Inc. is an American for-profit operator of health care facilities that was founded in 1968. It is based in Nashville, Tennessee, and, as of May 2020, owned and operated 186 hospitals and approximately 2,000 sites of care, including surgery centers, freestanding emergency rooms, urgent care centers and physician clinics in 21 states and the United Kingdom.[6] As of 2023, HCA Healthcare is ranked #66 on the Fortune 500 rankings of the largest United States corporations by total revenue.[7]

The company engaged in illegal accounting and other crimes in the 1990s that resulted in the payment of more than $2 billion in federal fines and other penalties, and the dismissal of the CEO Rick Scott by the board of directors.[8]

History

[edit]Early years

[edit]

Hospital Corporation of America (HCA) was founded in 1968 in Nashville, Tennessee, by Thomas F. Frist Sr., Thomas F. Frist Jr. and Jack C. Massey.[9] The founders envisioned a company that would bring together hospitals to deliver patient-focused care while using the combined resources of the organization to strengthen hospitals and improve the practice of medicine.[10] The company began with Nashville's Park View Hospital, which the elder Frist had founded in 1960 with other doctors and where he was serving as chief executive.[10]

The company included 11 hospitals when it filed its initial public offering on the New York Stock Exchange (NYSE) in 1969[10] and had 26 hospitals and 3,000 beds by the end of the year.[9][10]

Growth and merger

[edit]

The 1970s were characterized by rapid growth in the industry and for HCA Healthcare. In the early 1980s, the focus shifted to consolidation with HCA Healthcare acquiring General Care Corporation, General Health Services, Hospital Affiliates International and Health Care Corporation. By the end of 1981, the company operated 349 hospitals with more than 49,000 beds.[11] Operating revenues had grown to $2.4 billion.[9]

In 1987, HCA Healthcare, which had grown to operate 463 hospitals (255 owned and 208 managed), spun off HealthTrust, a privately owned, 104-hospital company. Believing its stock was undervalued, the company completed a $5.1 billion leveraged management buyout led by chairman Thomas F. Frist, Jr.[12] in 1988.[9] HCA Healthcare re-emerged as a public company in 1992.

In February 1994, HCA Healthcare merged with Louisville, Kentucky-based Columbia Hospital Corporation, which earlier had acquired 73 hospitals of Galen Health Care from Humana,[13] to form Columbia/HCA.[14] Related names of note include HCA International[15] and Health Corporation of America.

Columbia Hospital Corporation

[edit]In 1988, Rick Scott and Richard Rainwater each put up $125,000 in working capital in their new company, Columbia Hospital Corporation;[16] they borrowed the remaining money needed to purchase two struggling hospitals in El Paso for $60 million.[17] Then they acquired a neighboring hospital and shut it down. Within a year, the remaining two were doing much better.[18] By the end of 1989, Columbia Hospital Corporation owned four hospitals with a total of 833 beds.[17]

In 1992, Columbia made a stock purchase of Basic American Medical, which owned eight hospitals, primarily in southwestern Florida. In September 1993, Columbia did another stock purchase, worth $3.4 billion, of Galen Healthcare, which had been spun off by Humana Inc. several months earlier.[19] At the time, Galen had approximately 90 hospitals. After the purchase, Galen stockholders had 82% of the stock in the combined company, with Scott still running the company.[17]

Recent history

[edit]On November 17, 2006, HCA became a private company for the third time when it completed a merger in which the company was acquired by a private investor group including affiliates of Kohlberg Kravis Roberts and Bain Capital, together with Merrill Lynch and HCA Healthcare founder Thomas F. Frist, Jr. The total transaction was valued at approximately $33 billion, making it the largest leveraged buyout in history at the time, eclipsing the 1989 buyout of RJR Nabisco.[20]

In May 2010, HCA announced that the corporation would once again go public with an expected $4.6-billion IPO as HCA Holdings, Inc. In March 2011, HCA sold 126.2 million shares for $30 each, raising about $3.79 billion, at that time, the largest private-equity backed IPO in U.S. history.[21] In May 2017, the corporation was renamed HCA Healthcare.[22]

In December 2018, a historical marker was installed in the parking lot of HCA's Sarah Cannon Cancer Center in Nashville, formerly the location of HCA's first hospital, Park View Hospital.[23]

In 2018, the company was ranked No. 67 in the 2019 Fortune 500 list of the largest United States corporations by total revenue.[24]

In May 2021, the company finalized a deal with Google to develop healthcare algorithms using patient records.[25] In August 2021, HCA announced a deal with venture capital firm General Catalyst to develop digital solutions to streamline workflows and improve patient care; as part of the deal, HCA sold its healthcare app development firm PatientKeeper to General Catalyst's portfolio company Commure.[26]

In April 2022, HCA Healthcare announced a $1.5 million partnership with Florida International University's Nicole Wertheim college of Nursing and Health Sciences, to expand its facilities to address the national nursing shortage.[27]

In October 2022, LCMC Health in partnership with Tulane University announced that it would acquire Tulane Medical Center, Lakeview Regional Medical Center, and Tulane Lakeside Hospital from HCA for $150 million pending regulatory approval.[28]

In March 2024, it was announced HCA had completed the sale of West Hills Hospital and Medical Center and related assets in Los Angeles, California to UCLA Health, for an undisclosed amount.[29][30]

Facilities

[edit]United States

[edit]As of 2024[update], HCA has 186 hospitals.[31] They also report operating more than 2,000 additional sites of care, including surgery centers, freestanding ERs, urgent care centers, and physician clinics located in 21 U.S. states and in the United Kingdom.[32] A significant portion of those hospitals are situated in Florida and Texas. As of 2022, HCA had 47 hospitals and 31 surgery centers in Florida,[33] and 45 hospitals and 632 affiliated sites of care in Texas.[34] In 2021, it announced plans to build 3 new hospitals in Florida.[35] In 2022, the Dallas News reported that HCA will build 5 new hospitals in Texas. They also have a strong presence in Tennessee, where it began. HCA had 13 hospitals there as of 2019.[36]

Between 2003 and 2017, HCA did not enter any new markets. However, in July 2007, HCA sold its hospitals in Switzerland.[37]

In 2017, HCA acquired the Memorial University Medical Center in Savannah, Georgia.[38] That same year, they acquired three Houston, Texas, hospitals from Tenet Healthcare.[39]

In 2019 they purchased Mission Health System which operates hospitals in North Carolina.[40]

In January 2020, HCA Healthcare acquired Valify, a healthcare cost-management company.[41][42] In May 2020, HCA acquired 49-bed Shands Starke (Fla.) Regional Medical Center and 25-bed Shands Live Oak (Fla.) Regional Medical Center from CHS. HCA is operating the two facilities as off-campus emergency departments of Lake City (Fla.) Medical Center and North Florida Regional Medical Center in Gainesville.[43] Later that year, it signed an agreement to sell Garden Park Medical Center to Singing River Health System.[44]

In 2021, HCA sold Redmond Regional Medical Center to AdventHealth for $635M,[45] and four other Georgia hospitals to Piedmont Healthcare for $950 million.[46] They also announced the acquisition of Meadows Regional Medical Center.[47]

United Kingdom

[edit]HCA International, the UK arm of Hospital Corporation of America, "caters for around half of all private patients in London."[15] The main hospital sites within the United Kingdom it operates include:

- The Christie Private Care, Manchester

- The Wilmslow Hospital[48]

- The Harley Street Clinic

- HCA at The Shard

- The Lister Hospital

- London Bridge Hospital

- The Portland Hospital for Women and Children

- The Princess Grace Hospital

- The Wellington Hospital

- Leaders in Oncology Care

It opened urgent care walk-in centres at London Bridge Hospital and the Portland Hospital in March 2018. It claims that patients, on average, wait just seven minutes to see a nurse and 17 minutes to see a doctor.[49] In February 2022,[50] outsourced cleaning staff at London Bridge Hospital reported a lack of PPE, no access to sick pay, a lack of training and no prior warning about which rooms may be contaminated with the virus through the COVID-19 pandemic.

The Princess Grace Hospital specializes in breast cancer and surgery, aided by Kefah Mokbel and Nick Perry who, in 2005, founded The London Breast Institute.

The company intends to open The Harborne Hospital, a new-built private hospital located close to the Queen Elizabeth Hospital, Birmingham, in January 2024.[51]

Significant areas of operation

[edit]Medical education

[edit]In recent years, HCA Healthcare has become a significant provider of clinical and medical education. It is the largest sponsor of graduate medical education programs in the U.S., with 56 teaching hospitals in 14 states, primarily in regions with a deficit of physician training programs. [citation needed] The company includes Research College of Nursing and Mercy School of Nursing, and has several advanced nursing simulation training centers.[52] In early 2020, it completed the purchase of a majority stake in Galen College of Nursing,[53] which operates five campuses and offers Bachelor of Science and Associate of Science nursing degrees.[54]

Controversies

[edit]Medicare billing practices lawsuit

[edit]In 1993, lawsuits were filed against HCA by former employees who alleged that the company had engaged in questionable Medicare billing practices.[8] In 1997, with a federal investigation by the FBI, the IRS and the Department of Health and Human Services in its early stages, the Columbia/HCA board of directors forced Rick Scott to resign as chairman and CEO amid growing evidence that the company "had kept two sets of books, one to show the government and one with actual expenses listed."[8] Thomas Frist, a co-founder of HCA and brother of U.S. Senator Bill Frist, returned to the company as CEO in 1997[8] and called on longtime friend and colleague Jack O. Bovender, Jr. to help him turn the company around.[55]

The federal probe culminated in 2003 with "the government receiving a total of over $2 billion in criminal fines and civil penalties for systematically defrauding federal health care programs."[56] Columbia/HCA pleaded guilty to 14 felonies and admitted to systematically overcharging the government. The federal probe has been referred to as the longest and costliest investigation for health-care fraud in U.S. history.[55]

2005 insider trading suit

[edit]In July 2005, U.S. Senator Bill Frist sold all of his HCA shares, which were held in a blind trust, two weeks before disappointing earnings sent the stock on a 9-point plunge. At the time, Frist was considering a run for president and said that he had sold his shares to avoid the appearance of a conflict of interest.[57] When the company disclosed that other executives had also sold their shares during that same time, shareholders alleged that the company had made false claims about its profits to drive up the price, which then fell when the company reported disappointing financial results. Eleven of HCA's senior officers were sued for accounting fraud and insider trading.[58] HCA settled the lawsuit in August 2007, agreeing to pay $20 million to the shareholders but admitting no wrongdoing, and no charges were brought.[59]

COVID-19 PPE

[edit]During the COVID-19 pandemic in the United States, HCA hospital nurses and other workers spoke out about the lack of PPE.[60] In April 2020,[61] there was an outcry against HCA following the deaths of two nurses Celia Yap-Banago and Rosa Luna who worked at HCA hospitals in Kansas City and California and had contracted coronavirus, despite the alarm having been raised about the lack of PPE at work.[62]

Mission Hospital Acquisition Complaints

[edit]On December 14, 2023, the North Carolina Attorney General sued HCA for violating the terms of an agreement that allowed HCA to purchase Mission Health. [63][64][65]

On February 13, 2024, HCA Healthcare denied the allegations and asked a judge to dismiss the lawsuit by the Attorney General.[66][67][68] And in return the hospital network filed a counterclaim against the Attorney General.[67]

See also

[edit]References

[edit]- ^ "HCA Healthcare Fact Sheet" (PDF). HCA Healthcare. June 2019. Retrieved 23 June 2020.

- ^ "John Reay President and Chief Executive Officer". HCA Healthcare. Retrieved 23 June 2020.

- ^ "KKR & Co. (KKR) - Revenue".

- ^ "HCA Healthcare Annual Report Pursuant to Section 13 or 15(D) of the Securities Exchange Act of 1934" (PDF). HCA Healthcare. 20 February 2020. Retrieved 23 June 2020.

- ^ "Who We Are". HCA Healthcare. Retrieved 2024-05-10.

- ^ "HCA Healthcare - Corporate Profile".

- ^ "Fortune 500". Fortune. Retrieved 2023-09-11.

- ^ a b c d Appleby, Julie (December 18, 2002). "HCA to settle more allegations for $631M". USA Today.

- ^ a b c d "Our History". HCA Healthcare. Retrieved 2018-06-22.

- ^ a b c d "Dr. Thomas Frist Sr., HCA Founder, Dies at 87". The New York Times. January 8, 1998.

- ^ Brett Kellman (16 August 2018). "HCA: From single hospital to health care behemoth". The Tennessean. Retrieved 24 June 2020.

- ^ Freudenheim, Milt. Buyout Set For Chain Of Hospitals. The New York Times, November 22, 1988.

- ^ Steve Ivey; Ed Green (11 November 2011). "Humana's history has been one of recognizing opportunities". Louisville Business Journal. Retrieved 24 June 2020.

- ^ "Factbox: Hospital operator HCA goes public again". Reuters. 9 March 2011. Retrieved 24 June 2020.

- ^ a b Paul Gallagher (June 14, 2013). "World's largest private healthcare company HCA plans expansion into NHS". The Independent.

- ^ Milt Freudenheim (October 4, 1993). "Largest Publicly Held Hospital Chain Is Planned". The New York Times.

- ^ a b c Floyd Norris (October 6, 1994). "Efficiencies of scale are taken to the nth degree at Columbia". The New York Times. Retrieved August 16, 2015.

- ^ "Time 25". Time. June 17, 1996. Retrieved April 5, 2009. [dead link]

- ^ Kathryn Jones (November 21, 1993). "A Hospital Giant Comes to Town, Bringing Change". The New York Times.

- ^ Sorkin, Andrew Ross. "HCA Buyout Highlights Era of Going Private." New York Times, July 25, 2006.

- ^ "HCA IPO prices at $30, sells more shares: sources". Reuters. 9 March 2011. Retrieved 2015-02-02.

- ^ Emily Overholt (May 2, 2017). "HCA Holdings, Inc. to change name to include 'healthcare" - Nashville Business Journal"". Nashville Business Journal. Retrieved September 16, 2020.

- ^ Stinnett, Joel (December 7, 2018). "Nashville marks the spot where HCA was born". Nashville Business Journal. Retrieved December 10, 2018.

- ^ "Fortune 500 Companies 2019: Who Made the List". Fortune. Archived from the original on 2019-01-15. Retrieved 2018-11-10.

- ^ Evans, Melanie (2021-05-26). "WSJ News Exclusive | Google Strikes Deal With Hospital Chain to Develop Healthcare Algorithms". Wall Street Journal. ISSN 0099-9660. Retrieved 2021-06-28.

- ^ Brian, Gormley (August 18, 2021). "General Catalyst, HCA Healthcare Team Up on Digital Innovation". The Wall Street Journal.

- ^ "HCA Healthcare Announces $1.5 Million Partnership With Florida International University to Address National Nursing Faculty Shortage". Businesswire. 26 April 2022. Retrieved 29 April 2022.

- ^ "LCMC Health and Tulane University announce partnership". Tulane News. 10 October 2022. Retrieved 2022-10-10.

- ^ Diaz, Naomi (2024-03-29). "HCA sells hospital to UCLA Health". www.beckershospitalreview.com. Retrieved 2024-04-02.

- ^ Sharma, Soumya (2024-04-01). "UCLA Health acquires HCA's West Hills Hospital and Medical Center in US". Hospital Management. Retrieved 2024-04-02.

- ^ https://www.beckershospitalreview.com/hospital-transactions-and-valuation/hca-chases-more-hospital-deals.html

- ^ "Who We Are".

- ^ "Metro Orlando to get 3 new hospitals". BizJournals.com (Orlando Business Journal). Retrieved 2019-06-09.

- ^ "HCA Healthcare Announces Plans to Build Five New Hospitals in Texas". Retrieved 2022-02-27.

- ^ "HCA Healthcare to Build 3 New Hospitals in Florida - Construction".

- ^ HCA Fact Sheet 2014. HCA currently owns the University of Central Florida College of Medicine and controls the board of directors for the medical school which it purchased in August 2017. "HCA Facts" (PDF). Archived from the original (PDF) on September 5, 2015. Retrieved September 9, 2017.

- ^ HCA sells Switzerland hospitals BizJournals.com (Nashville Business Journal), June 20, 2007.

- ^ "Board OKs $710 million sale of Memorial University Medical Center". Savannah Morning News.

- ^ "HCA Announces Agreement to Acquire Three Houston Hospitals from Tenet - HCA Investor Center". investor.hcahealthcare.com. Archived from the original on 30 March 2019. Retrieved 20 December 2018.

- ^ "HCA's success over 50 years banks on sticking with the basics". Modern Healthcare. 2018-10-06. Retrieved 2019-06-09.

- ^ "HCA Healthcare Acquires Technology and Analytics Company Valify". Bloomberg.com (Press release). 2020-01-10. Retrieved 2020-03-19.

- ^ "HCA Healthcare Acquires Technology and Analytics Company Valify". www.nasdaq.com (Press release). Retrieved 2020-03-19.

- ^ "For-profit hospital M&A update: 12 deals involving CHS, HCA and Quorum". beckershospitalreview.com. 11 May 2020. Retrieved 2020-05-13.

- ^ "HCA to sell only Mississippi hospital". 17 June 2020.

- ^ "HCA to sell Georgia hospital to AdventHealth for $635M". 13 May 2021.

- ^ "Piedmont to Buy 4 Georgia Hospitals From HCA in $950M Deal". U.S. News & World Report. 2021-05-03. Retrieved 2022-09-17.

- ^ "Meadows Boards Approve Sale to HCA – the Advance News".

- ^ 52 Alderly Road

- ^ "HCA expands network of urgent care centres". LaingBuisson. 12 March 2018. Retrieved 11 May 2018.

- ^ "HCA: Promoting US style for-profit healthcare in the UK". 14 April 2022.

- ^ https://www.hcahealthcare.co.uk/facilities/the-harborne-hospital/ 02 December 2023

- ^ "HCA Healthcare Welcomes Record Class of 1,453 Residents and Fellows". HCA Healthcare. 1 July 2019. Retrieved 6 July 2020.

- ^ "HCA Healthcare Completes Purchase of Majority Stake in Galen College of Nursing". Bloomberg News. 7 January 2020. Retrieved 6 July 2020.

- ^ "Campuses and Programs". Galen College of Nursing. Retrieved 6 July 2020.

- ^ a b David Stires (9 February 2004). "Bringing HCA Back to Life After years of scandal, the hospital chain is healthy again--and might just be a buy". Fortune. Retrieved 19 June 2020.

- ^ "Largest Health Care Fraud Case in U.S. History Settled". US Department of Justice. 26 June 2003. Retrieved 19 June 2020.

- ^ Jonathan M. Katz (21 September 2005). "Senator Sold Stock Before Price Dropped". The Washington Post. Retrieved 30 June 2020.

- ^ "In re HCA Inc., Securities Litigation". Retrieved Jul 26, 2013.

- ^ "HCA settles insider trading lawsuit for $20 million". law.com. 14 August 2007. Retrieved 30 June 2020.

- ^ "In the Midst of a Pandemic, Big Hospitals Accepted Billions in Bailouts While Laying off Workers and Neglecting Safety | Consumers for Quality Care".

- ^ Silver-Greenberg, Jessica; Drucker, Jesse; Enrich, David (8 June 2020). "Hospitals Got Bailouts and Furloughed Thousands While Paying C.E.O.s Millions". The New York Times.

- ^ "Nurse who raised concern about lack of PPE died from coronavirus – just days before her planned retirement". CBS News. 27 April 2020.

- ^ Bannow, Tara (December 14, 2023). "North Carolina attorney general sues HCA for lapses at Mission Health". Stat. Retrieved December 14, 2023.

- ^ Vogel, Susanna (December 15, 2023). "North Carolina AG sues HCA over degraded care quality at Mission Health". Healthcare Dive. Retrieved March 26, 2024.

- ^ Craver, Richard (December 14, 2023). "NC attorney general sues for-profit HCA over Mission contract". Winston-Salem Journal. Retrieved March 26, 2024.

- ^ Black, Mitchell (February 13, 2024). "HCA and Mission respond to lawsuit, denying breach of contract". Asheville Citizen-Times. Retrieved March 26, 2024.

- ^ a b Sonmez, Felicia (February 13, 2024). "HCA files motion to dismiss and counterclaim, denies allegations in lawsuit by Attorney General Josh Stein". Blue Ridge Public Radio. Retrieved March 26, 2024.

- ^ Jones, Andrew (February 14, 2024). "HCA, responding to Stein lawsuit, says it never committed to quality care at Mission". Asheville Watchdog. Retrieved March 26, 2024.

Further reading

[edit]- Lutz, Sandy; Gee, E. Preston (1998). Columbia/HCA: Healthcare on Overdrive. McGraw-Hill. ISBN 0070248044.

- "2015 Annual Report to Shareholders" (PDF). Investor.healthcare.com. Archived from the original (PDF) on 15 December 2017. Retrieved 2 October 2017.

External links

[edit]- Official website

- Business data for HCA Healthcare:

- 1968 establishments in Tennessee

- 2011 initial public offerings

- American companies established in 1968

- Health care companies established in 1968

- Bain Capital companies

- Companies based in Nashville, Tennessee

- Companies listed on the New York Stock Exchange

- Frist family

- HCA Healthcare

- Hospital networks in the United States

- Kohlberg Kravis Roberts companies

- Health care companies based in Tennessee