New Development Bank

| |

| |

| Abbreviation | NDB |

|---|---|

| Formation | 15 July 2014 |

| Type | International Financial Institutions |

| Legal status | Treaty |

| Headquarters | Shanghai, China |

| Membership | |

Official language | Chinese, English, Portuguese, Russian |

President | K. V. Kamath |

Parent organization | BRICS |

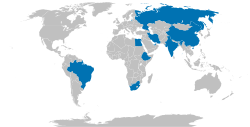

The New Development Bank (NDB), formerly referred to as the BRICS Development Bank,[1] is a multilateral development bank operated by the BRICS states (Brazil, Russia, India, China and South Africa) as an alternative to the existing US-dominated World Bank and International Monetary Fund.[2] The bank is set up to foster greater financial and development cooperation among the five emerging markets. Together, the four original BRIC countries comprise in 2014 more than 3 billion people or 41.4 percent of the world’s population, cover more than a quarter of the world’s land area over three continents, and account for more than 25 percent of global GDP. The bank will be headquartered in Shanghai, China.[3] Unlike the World Bank, which assigns votes based on capital share, in the New Development Bank each participant country will be assigned one vote, and none of the countries will have veto power.[4]

History

The New Development Bank was agreed to by BRICS leaders at the 5th BRICS summit held in Durban, South Africa on 27 March 2013.[2]

On 15 July 2014, the first day of the 6th BRICS summit held in Fortaleza, Brazil, the group of emerging economies signed the long-anticipated document to create the $100 billion BRICS Development Bank and a reserve currency pool worth over another $100 billion.[5] Both will counter the influence of Western-based lending institutions and the dollar. Documents on cooperation between BRICS export credit agencies and an agreement of cooperation on innovation were also signed.[6]

Shanghai was selected as the headquarters after competition from New Delhi and Johannesburg. An African regional center will be set up in Johannesburg.[7]

The first president will be from India,[8][9] the inaugural Chairman of the Board of directors will come from Brazil [3] and the inaugural chairman of the Board of Governors will be Russian.[3]

On 11 May 2015, K. V. Kamath was appointed as President of the Bank.[10]

Structure and objectives

Development capital

The bank's primary focus of lending will be infrastructure projects [11][12] with authorized lending of up to $34 billion annually.[12] South Africa will be the African Headquarters of the Bank named the "New Development Bank Africa Regional Centre".[13] The bank will have starting capital of $50 billion, with capital increased to $100 billion over time.[14] Brazil, Russia, India, China and South Africa will initially contribute $10 billion each to bring the total to $50 billion.[13][14] Each member cannot increase its share of capital without all other 4 members agreeing. This was a primary requirement of India.[15][16] The bank will allow new members to join but the BRICS capital share cannot fall below 55%.[14]

Contingent Reserve Arrangement (CRA)

The CRA is a framework for the provision of support through liquidity and precautionary instruments in response to actual or potential short-term balance of payments pressures.[17]

The objective of this reserve is to provide protection against global liquidity pressures.[11][14][18] This includes currency issues where members' national currencies are being adversely affected by global financial pressures.[11][14][18]

The Bank would also provide assistance to other countries suffering from the economic volatility in the wake of the United States' exit from its expansionary monetary policy.[19]

This fund will consist of $10 billion of "paid-in capital" ($2 billion from each member to be provided over seven years) and an additional $40 billion to be "paid upon request".[1] Out of the total initial capital of $100 billion, China will contribute $41 billion, Brazil, Russia and India would give $18 billion each, and South Africa would contribute $5 billion.[20] It is scheduled to start lending in 2016.[14]

Members

There are 5 members as of 1 July 2015.

Founding Members

| Country/Region | Date of Accession |

|---|---|

| 2014 | |

| 2014 | |

| 2014 | |

| 2014 | |

| 2014 |

Shareholding Structure

The following table are amounts for 5 countries by shareholding at the New Development Bank.[21][22]

| Rank | Country | Number of Shares |

Shareholding (% of Total) |

Voting Rights (% of Total) |

Contingent Reserve Arrangement (US$ Billions) |

|---|---|---|---|---|---|

| 1 | 100,000 | 20 | 20 | 41 | |

| 2 | 100,000 | 20 | 20 | 18 | |

| 3 | 100,000 | 20 | 20 | 18 | |

| 4 | 100,000 | 20 | 20 | 18 | |

| 5 | 100,000 | 20 | 20 | 5 | |

| - | Unallocated Shares | 500,000 | - | - | - |

| - | Grand Total | 1,000,000 | 100 | 100 | 100 |

References

- ^ a b "BRICS Bank to be headquartered in Shanghai, India to hold presidency". Indiasnaps.com. 16 July 2014

- ^ a b Powell, Anita. "BRICS Leaders Optimistic About New Development Bank". Voice of America. Retrieved 27 March 2013.

- ^ a b c Lewis, Jeffrey; Trevisani, Paulo. "Brics Agree to Base Development Bank in Shanghai". The Wall Street Journal. Retrieved 16 July 2014.

- ^ Prabhat Patnaik (27 July 2014). "The BRICS Bank". People's Democracy. Retrieved 27 July 2014.

- ^ "Brics nations to create $100bn development bank". BBC.com. 15 July 2014

- ^ "BRICS establish $100bn bank and currency reserves to cut out Western dominance". RT.com. 15 July 2014

- ^ http://news.yahoo.com/cabinet-welcomes-brics-development-bank-115111670.html

- ^ http://timesofindia.indiatimes.com/business/international-business/BRICS-Development-Bank-launched-first-president-to-be-from-India/articleshow/38440605.cms

- ^ "India Gets First Presidency Of The BRICS Bk". Bloomberg TV India.

- ^ "K V Kamath, non-executive chairman of ICICI, is now BRICS Bank head". Hindustan Times. New Delhi. 11 May 2015. Retrieved 16 May 2015.

- ^ a b c "What the new bank of BRICS is all about". The Washington Post. 17 July 2014. Retrieved 20 July 2014.

- ^ a b "New BRICS Bank a Building Block of Alternative World Order". The Huffington Post. 18 July 2014. Retrieved 20 July 2014.

- ^ a b "BRICS countries launch $100 billion developmental bank, currency pool". Russia & India Report. 16 July 2014. Retrieved 20 July 2014.

- ^ a b c d e f "BRICS Bank ready for launch - Russian Finance Minister". Russia & India Report. 10 July 2014. Retrieved 20 July 2014.

- ^ "Indian media: Brics bank 'a step in right direction'". BBC. 16 July 2014. Retrieved 20 July 2014.

- ^ "Victory for Modi, India as BRICS summit clears setting up of a new development bank". India Today. 16 July 2014. Retrieved 20 July 2014.

- ^ Treaty for the Establishment of a BRICS Contingent Reserve Arrangement

- ^ a b "BRICS currency fund to protect members from volatility - Russia's top banker". Russia & India Report. 17 July 2014. Retrieved 20 July 2014.

- ^ "BRICS bank to benefit developing countries: Brazilian president". IANS. news.biharprabha.com. Retrieved 15 July 2014.

- ^ "BRICS Development bank top on Agenda of 6th BRICS Summit". IANS. news.biharprabha.com. Retrieved 15 July 2014.

- ^ http://brics6.itamaraty.gov.br/media2/press-releases/219-agreement-on-the-new-development-bank-fortaleza-july-15

- ^ http://brics6.itamaraty.gov.br/media2/press-releases/220-treaty-for-the-establishment-of-a-brics-contingent-reserve-arrangement-fortaleza-july-15

External links

- The Sino-Brazilian Principles in a Latin American and BRICS Context: The Case for Comparative Public Budgeting Legal Research Wisconsin International Law Journal, 13 May 2015

- BRICS announce $200B challenge to world financial order - Al Jazeera America

- What the BRICS are Building. The Harvard Crimson. 1 September 2014. Retrieved 3 September 2014.

- BRICS launch new bank and monetary fund - Deutsche Welle Akademie