Government debt

| Public finance |

|---|

|

Government debt, also known as public interest, public debt, national debt and sovereign debt,[1][2] contrasts to the annual government budget deficit, which is a flow variable that equals the difference between government receipts and spending in a single year. The debt is a stock variable, measured at a specific point in time, and it is the accumulation of all prior deficits.

Government debt can be categorized as internal debt (owed to lenders within the country) and external debt (owed to foreign lenders). Another common division of government debt is by duration until repayment is due. Short term debt is generally considered to be for one year or less, and long term debt is for more than ten years. Medium term debt falls between these two boundaries. A broader definition of government debt may consider all government liabilities, including future pension payments and payments for goods and services which the government has contracted but not yet paid.

Governments create debt by issuing government bonds and bills. Less creditworthy countries sometimes borrow directly from a supranational organization (e.g. the World Bank) or international financial institutions.

In a monetarily sovereign country such as the United States of America, the United Kingdom and most other countries, government debt held in the home currency can be viewed as savings accounts held at the central bank. In this way this "debt" has a very different meaning to the debt acquired by households who are restricted by their income. Monetarily sovereign governments issue their own currencies and do not need this income to finance spending.

A central government with its own currency can pay for its nominal spending by creating money ex novo,[3] although typical arrangements leave money creation to central banks. In this instance, a government issues securities to the public not to raise funds, but instead to remove excess bank reserves (caused by government spending that is higher than tax receipts) and '...create a shortage of reserves in the market so that the system as a whole must come to the [central] Bank for liquidity.' [4]

History

During the Early Modern era, European monarchs would often default on their loans or arbitrarily refuse to pay them back. This generally made financiers wary of lending to the king and the finances of countries that were often at war remained extremely volatile.

The creation of the first central bank in England—an institution designed to lend to the government—was initially an expedient by William III of England for the financing of his war against France. He engaged a syndicate of city traders and merchants to offer for sale an issue of government debt. This syndicate soon evolved into the Bank of England, eventually financing the wars of the Duke of Marlborough and later Imperial conquests.

The establishment of the bank was devised by Charles Montagu, 1st Earl of Halifax, in 1694, to the plan which had been proposed by William Paterson three years before, but had not been acted upon.[5] He proposed a loan of £1.2m to the government; in return the subscribers would be incorporated as The Governor and Company of the Bank of England with long-term banking privileges including the issue of notes. The Royal Charter was granted on 27 July through the passage of the Tonnage Act 1694.[6]

The founding of the Bank of England revolutionised public finance and put an end to defaults such as the Great Stop of the Exchequer of 1672, when Charles II had suspended payments on his bills. From then on, the British Government would never fail to repay its creditors.[7] In the following centuries, other countries in Europe and later around the world adopted similar financial institutions to manage their government debt.

In 1815, at the end of the Napoleonic Wars, British government debt reached a peak of more than 200% of GDP.[8]

In 2018, the global government debt reached the equivalent of $66 trillion, or about 80% of global GDP.[9]

Government and sovereign bonds

A government bond is a bond issued by a national government. Such bonds are most often denominated in the country's domestic currency. Sovereigns can also issue debt in foreign currencies: almost 70% of all debt in a sample of developing countries from 1979 through 2006 was denominated in US dollars.[10] Government bonds are sometimes regarded as risk-free bonds, because national governments can if necessary create money de novo to redeem the bond in their own currency at maturity. Although many governments are prohibited by law from creating money directly (that function having been delegated to their central banks), central banks may provide finance by buying government bonds, sometimes referred to as monetizing the debt.

Government debt, synonymous with sovereign debt,[11] can be issued either in domestic or foreign currencies. Investors in sovereign bonds denominated in foreign currency have exchange rate risk: the foreign currency might depreciate against the investor's local currency. Sovereigns issuing debt denominated in a foreign currency may furthermore be unable to obtain that foreign currency to service debt. In the 2010 Greek debt crisis, for example, the debt is held by Greece in Euros, and one proposed solution (advanced notably by World Pensions Council (WPC) financial economists) is for Greece to go back to issuing its own drachma.[12][13] This proposal would only address future debt issuance, leaving substantial existing debts denominated in what would then be a foreign currency, potentially doubling their cost[14]

By country

This article may have misleading content. (October 2015) |

Public debt is the total of all borrowing of a government, minus repayments denominated in a country's home currency. CIA's World Factbook lists the debt as a percentage of GDP; the total debt and per capita amounts have been calculated in the table below using the GDP (PPP) and population figures from the same report.

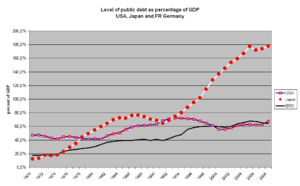

The debt-to-GDP ratio is a commonly accept method for assessing the significance of a nation's debt. For example, one of the criteria of admission to the European Union's euro currency is that an applicant country's debt should not exceed 60% of that country's GDP. The GDP calculation of many leading industrial countries include taxes such as the value-added tax, which increase the total amount of the gross domestic product and thus reducing the percentage amount of the debt-to-GDP ratio.[15][16]

| country | public debt (billion USD) |

% of GDP | per capita (USD) | % of world public debt |

|---|---|---|---|---|

| World | 56,308 | 64% | 7,936 | 100.0% |

| 17,607 | 74% | 55,630 | 31.3% | |

| 9,872 | 214% | 77,577 | 17.5% | |

| 3,894 | 32% | 2,885 | 6.9% | |

| 2,592 | 82% | 31,945 | 4.6% | |

| 2,334 | 126% | 37,956 | 4.1% | |

| 2,105 | 90% | 31,915 | 3.7% | |

| 2,064 | 89% | 32,553 | 3.7% | |

| 1,324 | 55% | 6,588 | 2.4% | |

| 1,228 | 85% | 25,931 | 2.2% | |

| 1,206 | 84% | 34,902 | 2.1% | |

| 995 | 52% | 830 | 1.8% | |

| 629 | 35% | 5,416 | 1.1% | |

| 535 | 34% | 10,919 | 1.0% | |

| 489 | 40% | 6,060 | 0.9% | |

| 488 | 69% | 29,060 | 0.9% | |

| 479 | 85% | 5,610 | 0.9% | |

| 436 | 161% | 40,486 | 0.8% | |

| 434 | 54% | 11,298 | 0.8% | |

| 396 | 100% | 37,948 | 0.7% | |

| 370 | 111% | 67,843 | 0.7% | |

| 323 | 36% | 13,860 | 0.6% | |

| 323 | 42% | 7,571 | 0.6% | |

| 311 | 25% | 1,240 | 0.6% | |

| 308 | 12% | 2,159 | 0.6% | |

| 297 | 120% | 27,531 | 0.5% | |

| 292 | 43% | 4,330 | 0.5% | |

| 283 | 50% | 1,462 | 0.5% |

* US data exclude debt issued by individual US states, as well as intra-governmental debt; intra-governmental debt consists of Treasury borrowings from surpluses in the trusts for Federal Social Security, Federal Employees, Hospital Insurance (Medicare and Medicaid), Disability and Unemployment, and several other smaller trusts; if data for intra-government debt were added, "Gross Debt" would increase by about one-third of GDP. The debt of the United States over time is documented online at the Department of the Treasury's website TreasuryDirect.Gov[18] as well as current totals.[19]

| Country | Public Debt (billion USD) |

% of GDP | per capita (USD) | Note (2008 estimate) (billion USD) |

|---|---|---|---|---|

| $9,133 | 62% | $29,158 | ($5,415, 38%) | |

| $8,512 | 198% | $67,303 | ($7,469, 172%) | |

| $2,446 | 83% | $30,024 | ($1,931, 66%) | |

| $2,113 | 119% | $34,627 | ($1,933, 106%) | |

| $2,107 | 52% | $ 1,489 | ($1,863, 56%) | |

| $1,907 | 19% | $ 1,419 | ($1,247, 16%) | |

| $1,767 | 82% | $27,062 | ($1,453, 68%) | |

| $1,654 | 76% | $26,375 | ($1,158, 52%) | |

| $1,281 | 59% | $ 6,299 | ($ 775, 39%) | |

| $1,117 | 84% | $32,829 | ($ 831, 64%) | |

| $ 823 | 60% | $17,598 | ($ 571, 41%) | |

| $ 577 | 37% | $ 5,071 | ($ 561, 36%) | |

| $ 454 | 143% | $42,216 | ($ 335, 97%) | |

| $ 424 | 63% | $25,152 | ($ 392, 58%) | |

| $ 411 | 43% | $ 5,218 | ($ 362, 40%) | |

| $ 398 | 101% | $38,139 | ($ 350, 90%) | |

| $ 398 | 80% | $ 4,846 | ($ 385, 87%) | |

| $ 381 | 53% | $ 9,907 | ($ 303, 45%) | |

| $ 331 | 23% | $ 6,793 | ($ 326, 24%) | |

| $ 309 | 106% | $65,144 | ||

| $ 279 | 34% | $12,075 |

Debt of sub-national governments

Municipal, provincial, or state governments may also borrow. Municipal bonds, "munis" in the United States, are debt securities issued by local governments (municipalities).

In 2016, U.S. state and local governments owed $3 trillion and have another $5 trillion in unfunded liabilities.[21]

Denominated in reserve currencies

Governments often borrow money in a currency in which the demand for debt securities is strong. An advantage of issuing bonds in a currency such as the US dollar, the pound sterling, or the euro is that many investors wish to invest in such bonds. Countries such as the United States, Germany, Italy and France have only issued in their domestic currency (or in the Euro in the case of Euro members).

Relatively few investors are willing to invest in currencies that do not have a long track record of stability. A disadvantage for a government issuing bonds in a foreign currency is that there is a risk that it will not be able to obtain the foreign currency to pay the interest or redeem the bonds. In 1997 and 1998, during the Asian financial crisis, this became a serious problem when many countries were unable to keep their exchange rate fixed due to speculative attacks.

Risk

Although a national government may choose to default for political reasons, lending to a national government in the country's own sovereign currency is generally considered "risk free" and is done at a so-called "risk-free interest rate". This is because the debt and interest can be repaid by raising tax receipts (either by economic growth or raising tax revenue), a reduction in spending, or by creating more money. However, it is widely considered that this would increase inflation and thus reduce the value of the invested capital (at least for debt not linked to inflation). This has happened many times throughout history, and a typical example of this is provided by Weimar Germany of the 1920s, which suffered from hyperinflation when the government massively printed money, because of its inability to pay the national debt deriving from the costs of World War I.

In practice, the market interest rate tends to be different for debts of different countries. An example is in borrowing by different European Union countries denominated in euros. Even though the currency is the same in each case, the yield required by the market is higher for some countries' debt than for others. This reflects the views of the market on the relative solvency of the various countries and the likelihood that the debt will be repaid. Further, there are historical examples where countries defaulted, i.e., refused to pay their debts, even when they had the ability of paying it with printed money. This is because printing money has other effects that the government may see as more problematic than defaulting.

A politically unstable state is anything but risk-free as it may—being sovereign—cease its payments. Examples of this phenomenon include Spain in the 16th and 17th centuries, which nullified its government debt seven times during a century, and revolutionary Russia of 1917 which refused to accept the responsibility for Imperial Russia's foreign debt.[22] Another political risk is caused by external threats. It is mostly uncommon for invaders to accept responsibility for the national debt of the annexed state or that of an organization it considered as rebels. For example, all borrowings by the Confederate States of America were left unpaid after the American Civil War. On the other hand, in the modern era, the transition from dictatorship and illegitimate governments to democracy does not automatically free the country of the debt contracted by the former government. Today's highly developed global credit markets would be less likely to lend to a country that negated its previous debt, or might require punishing levels of interest rates that would be unacceptable to the borrower.

U.S. Treasury bonds denominated in U.S. dollars are often considered "risk free" in the U.S. This disregards the risk to foreign purchasers of depreciation in the dollar relative to the lender's currency. In addition, a risk-free status implicitly assumes the stability of the US government and its ability to continue repayments during any financial crisis.

Lending to a national government in a currency other than its own does not give the same confidence in the ability to repay, but this may be offset by reducing the exchange rate risk to foreign lenders. On the other hand, national debt in foreign currency cannot be disposed of by starting a hyperinflation;[23] and this increases the credibility of the debtor. Usually, small states with volatile economies have most of their national debt in foreign currency. For countries in the Eurozone, the euro is the local currency, although no single state can trigger inflation by creating more currency.

Lending to a local or municipal government can be just as risky as a loan to a private company, unless the local or municipal government has sufficient power to tax. In this case, the local government could to a certain extent pay its debts by increasing the taxes, or reduce spending, just as a national one could. Further, local government loans are sometimes guaranteed by the national government, and this reduces the risk. In some jurisdictions, interest earned on local or municipal bonds is tax-exempt income, which can be an important consideration for the wealthy.

Clearing and defaults

Public debt clearing standards are set by the Bank for International Settlements, but defaults are governed by extremely complex laws that vary from jurisdiction to jurisdiction. Globally, the International Monetary Fund can take certain steps to intervene to prevent anticipated defaults. It is sometimes criticized for the measures it advises nations to take, which often involve cutting back on government spending as part of an economic austerity regime. In triple bottom line analysis, this can be seen as degrading capital on which the nation's economy ultimately depends.

Those considerations do not apply to private debts, by contrast: credit risk (or the consumer credit rating) determines the interest rate, more or less, and entities go bankrupt if they fail to repay. Governments need a far more complex way of managing defaults because they cannot really go bankrupt (and suddenly stop providing services to citizens), albeit in some cases a government may disappear as it happened in Somalia or as it may happen in cases of occupied countries where the occupier doesn't recognize the occupied country's debts.

Smaller jurisdictions, such as cities, are usually guaranteed by their regional or national levels of government. When New York City declined into what would have been a bankrupt status during the 1970s (had it been a private entity), by the mid-1970s a "bailout" was required from New York State and the United States. In general, such measures amount to merging the smaller entity's debt into that of the larger entity and thereby giving it access to the lower interest rates the larger entity enjoys. The larger entity may then assume some agreed-upon oversight in order to prevent recurrence of the problem.

Economic policy basis

Wolfgang Stützel showed with his Saldenmechanik (Balances Mechanics) how a comprehensive debt redemption would compulsorily force a corresponding indebtedness of the private sector, due to a negative Keynes-multiplier leading to crisis and deflation.[24]

In the dominant economic policy generally ascribed to theories of John Maynard Keynes, sometimes called Keynesian economics, there is tolerance for fairly high levels of public debt to pay for public investment in lean times, which, if boom times follow, can then be paid back from rising tax revenues. Empirically, however, sovereign borrowing in developing countries is procyclical, since developing countries have more difficulty accessing capital markets in lean times.[25]

As this theory gained global popularity in the 1930s, many nations took on public debt to finance large infrastructural capital projects—such as highways or large hydroelectric dams. It was thought that this could start a virtuous cycle and a rising business confidence since there would be more workers with money to spend. Some[who?] have argued that the greatly increased military spending of World War II really ended the Great Depression. Of course, military expenditures are based upon the same tax (or debt) and spend fundamentals as the rest of the national budget, so this argument does little to undermine Keynesian theory. Indeed, some[who?] have suggested that significantly higher national spending necessitated by war essentially confirms the basic Keynesian analysis (see Military Keynesianism).

Nonetheless, the Keynesian scheme remained dominant, thanks in part to Keynes' own pamphlet How to Pay for the War, published in the United Kingdom in 1940. Since the war was being paid for, and being won, Keynes and Harry Dexter White, Assistant Secretary of the United States Department of the Treasury, were, according to John Kenneth Galbraith, the dominating influences on the Bretton Woods agreements. These agreements set the policies for the Bank for International Settlements (BIS), International Monetary Fund (IMF), and World Bank, the so-called Bretton Woods Institutions, launched in the late 1940s for the last two (the BIS was founded in 1930).

These are the dominant economic entities setting policies regarding public debt. Due to its role in setting policies for trade disputes, the World Trade Organization also has immense power to affect foreign exchange relations, as many nations are dependent on specific commodity markets for the balance of payments they require to repay debt.

Structure and risk of a public debt

Understanding the structure of public debt and analyzing its risk requires one to:

- Assess the expected value of any public asset being constructed, at least in future tax terms if not in direct revenues. A choice must be made about its status as a public good—some public "assets" end up as public bads, such as nuclear power plants which are extremely expensive to decommission—these costs must also be worked into asset values.

- Determine whether any public debt is being used to finance consumption, which includes all social assistance and all military spending.

- Determine whether triple bottom line issues are likely to lead to failure or defaults of governments—say due to being overthrown.

- Determine whether any of the debt being undertaken may be held to be odious debt, which might permit it to be disavowed without any effect on a country's credit status. This includes any loans to purchase "assets" such as leaders' palaces, or the people's suppression or extermination. International law does not permit people to be held responsible for such debts—as they did not benefit in any way from the spending and had no control over it.

- Determine if any future entitlements are being created by expenditures—financing a public swimming pool for instance may create some right to recreation where it did not previously exist, by precedent and expectations.

Problems

Sovereign debt problems have been a major public policy issue since World War II, including the treatment of debt related to that war, the developing country "debt crisis" in the 1980s, and the shocks of the 1998 Russian financial crisis and Argentina's default in 2001.

Effect on future economic growth

In 2013, the World Bank Group issued a report which analyzed debt levels of 100 developed and developing countries, from 1980 to 2008, and found that debt-to-GDP rations above 77% for developed countries (64% for developing countries) reduced future annual economic growth by 0.02 percentage points for each percentage point of debt above the threshold.[26][27]

Implicit debt

Government "implicit" debt is the promise by a government of future payments from the state. Usually, this refers to long-term promises of social payments such as pensions and health expenditure; not promises of other expenditure such as education or defense (which are largely paid on a "quid pro quo" basis to government employees and contractors).

A problem with these implicit government insurance liabilities is that it is hard to cost them accurately, since the amounts of future payments depend on so many factors. First of all, the social security claims are not "open" bonds or debt papers with a stated time frame, "time to maturity", "nominal value", or "net present value".

In the United States, as in most other countries, there is no money earmarked in the government's coffers for future social insurance payments. This insurance system is called PAYGO (pay-as-you-go). Alternative social insurance strategies might have included a system that involved save and invest.

Furthermore, population projections predict that when the "baby boomers" start to retire, the working population in the United States, and in many other countries, will be a smaller percentage of the population than it is now, for many years to come. This will increase the burden on the country of these promised pension and other payments—larger than the 65 percent[28] of GDP that it is now. The "burden" of the government is what it spends, since it can only pay its bills through taxes, debt, and increasing the money supply (government spending = tax revenues + change in government debt held by public + change in monetary base held by the public). "Government social benefits" paid by the United States government during 2003 totaled $1.3 trillion.[29] According to official government projections, the Medicare is facing a $37 trillion unfunded liability over the next 75 years, and the Social Security is facing a $13 trillion unfunded liability over the same time frame.[30][31]

In 2010 the European Commission required EU Member Countries to publish their debt information in standardized methodology, explicitly including debts that were previously hidden in a number of ways to satisfy minimum requirements on local (national) and European (Stability and Growth Pact) level.[32]

A simple model of sovereign debt dynamics

The following model of sovereign debt dynamics comes from Romer (2018).[33]

Assume that the dynamics of a country's sovereign debt over time may be modeled as a continuous, deterministic process consisting of the interest paid on current debt and net borrowing:Where is a time-dependent interest rate, is government spending, and is total tax collections. In order to solve this differential equation, we assume a solution and introduce the integrating factor :This substitution leads to the equation:And integrating this equation from , we find that:A problem arises now that we've solved this equation: at , it is impossible for the present value of a country's debt to be positive. Otherwise, the country could borrow an infinite amount of money. Therefore, it is necessary to impose the No Ponzi condition:Therefore, it follows that:In other words, this last equation shows that the present value of taxes minus the present value of government spending must be at least equal to the initial sovereign debt.

Ricardian equivalence

The representative household's budget constraint is that the present value of its consumption cannot exceed its initial wealth plus the present value of its after-tax income. Assuming that the present value of taxes equals the present value of government spending, then this last equation may be rewritten as:This equation shows that the household budget constraint may be defined in terms of government purchases, without regards to debt or taxes. Moreover, this is the famous result known as Ricardian equivalence: only the quantity of government purchases affects the economy, not the method of financing (i.e., through debt or taxes).

See also

Government finance:

- Debt crisis

- Government bond

- Government budget deficit

- Government spending

- Generational accounting

- Financial repression

- Fiscal policy

- Public finance

- Debt clock

- Sovereign default

- Sovereign credit

- Tax

Specific:

- 1980s austerity policy in Romania

- Latin American debt crisis

- 2010 European sovereign debt crisis

- United States public debt

- National debt of the United States

General:

- Bond (finance)

- Credit default swap

- Warrant (of Payment)

- List of countries by credit rating

- List of countries by external debt

- List of countries by net international investment position

- List of countries by public debt

References

- ^ "Bureau of the Public Debt Homepage". United States Department of the Treasury. Archived from the original on October 13, 2010. Retrieved October 12, 2010.

- ^ "FAQs: National Debt". United States Department of the Treasury. Archived from the original on October 21, 2010. Retrieved October 12, 2010.

- ^ The Economics of Money, Banking, and the Financial Markets 7ed, Frederic S. Mishkin

- ^ Tootell, Geoffrey. "The Bank of England's Monetary Policy" (PDF). Federal Reserve Bank of Boston. Retrieved 22 March 2017.

- ^ Committee of Finance and Industry 1931 (Macmillan Report) description of the founding of Bank of England. 1979. ISBN 9780405112126. Retrieved 10 May 2010. "Its foundation in 1694 arose out the difficulties of the Government of the day in securing subscriptions to State loans. Its primary purpose was to raise and lend money to the State and in consideration of this service it received under its Charter and various Act of Parliament, certain privileges of issuing bank notes. The corporation commenced, with an assured life of twelve years after which the Government had the right to annul its Charter on giving one year's notice. Subsequent extensions of this period coincided generally with the grant of additional loans to the State"

- ^ H. Roseveare, The Financial Revolution 1660–1760 (1991, Longman), p. 34

- ^ Ferguson, Niall (2008). The Ascent of Money: A Financial History of the World. Penguin Books, London. p. 76. ISBN 9780718194000.

- ^ UK public spending Retrieved September 2011

- ^ "Government debt hits record $66 trillion, 80% of global GDP, Fitch says". CNBC. 23 January 2019.

- ^ "Empirical Research on Sovereign Debt and Default" (PDF). Federal Reserve Board of Chicago. Retrieved 2014-06-18.

- ^ "FT Lexicon" – The Financial Times

- ^ M. Nicolas J. Firzli, "Greece and the Roots the EU Debt Crisis" The Vienna Review, March 2010

- ^ "EU accused of 'head in sand' attitude to Greek debt crisis". Telegraph.co.uk. Retrieved 2012-09-11.

- ^ "Why leaving the euro would still be bad for both Greece and the currency area" – The Economist, 2015-01-17

- ^ "GROSS DOMESTIC PRODUCT (GDP)". Organisation for Economic Co-operation and Development (OECD). Retrieved September 1, 2019.

- ^ "GROSS DOMESTIC PRODUCT (GDP)". U.S. Bureau of Economic Analysis (BEA). Retrieved September 1, 2019.

- ^ "Country Comparison :: Public debt". Central Intelligence Agency. Archived from the original on May 13, 2013. Retrieved May 16, 2013.

- ^ "Government – Historical Debt Outstanding – Annual". Treasurydirect.gov. 2010-10-01. Retrieved 2011-11-08.

- ^ "Debt to the Penny (Daily History Search Application)". Treasurydirect.gov. Retrieved 2014-02-03.

- ^ "Country Comparison :: Public debt". cia.gov. Archived from the original on October 4, 2008. Retrieved November 8, 2011.

- ^ "Debt Myths, Debunked". U.S. News. December 1, 2016.

- ^ Hedlund, Stefan (2004). "Foreign Debt". Encyclopedia of Russian History (reprinted in Encyclopedia.com). Retrieved 3 March 2010.

- ^ Cox, Jeff (2019-11-25). "Fed analysis warns of 'economic ruin' when governments print money to pay off debt". CNBC. Retrieved 2020-09-21.

- ^ Wolfgang Stützel: Volkswirtschaftliche Saldenmechanik Tübingen : Mohr Siebeck, 2011, Nachdr. der 2. Aufl., Tübingen, Mohr, 1978, S. 86

- ^ "The Economics and Law of Sovereign Debt and Default" (PDF). Journal of Economic Literature. 2009. Retrieved 2014-06-18.

- ^ Grennes, Thomas; Caner, Mehmet; Koehler-Geib, Fritzi (2013-06-22). "Finding The Tipping Point -- When Sovereign Debt Turns Bad". World Bank Group. Policy Research Working Papers. doi:10.1596/1813-9450-5391. hdl:10986/3875. Retrieved 2020-09-10.

The present study addresses these questions with the help of threshold estimations based on a yearly dataset of 101 developing and developed economies spanning a time period from 1980 to 2008. The estimations establish a threshold of 77 percent public debt-to-GDP ratio. If debt is above this threshold, each additional percentage point of debt costs 0.017 percentage points of annual real growth. The effect is even more pronounced in emerging markets where the threshold is 64 percent debt-to-GDP ratio. In these countries, the loss in annual real growth with each additional percentage point in public debt amounts to 0.02 percentage points.

- ^ Kessler, Glenn (2020-09-09). "Mnuchin's claim that the pre-pandemic economy 'would pay down debt over time'". The Washington Post. Retrieved 2020-09-10.

The debt-to-GDP ratio is considered a good guide to a country's ability to pay off its debts. The World Bank has calculated that 77 percent public debt-to-GDP is about the highest a developed country should have before debt begins to hamper economic growth.

- ^ "Report for Selected Countries and Subjects". International Monetary Fund. Retrieved 2010-10-12.(General government gross debt 2008 estimates rounded to one decimal place)

- ^ "Government Social Benefits Table". Archived from the original on November 1, 2004.

- ^ Capretta, James C. (June 16, 2018). "The financial hole for Social Security and Medicare is even deeper than the experts say". MarketWatch.

- ^ Mauldin, John (March 25, 2019). "The Real US National Debt Might Be $230 Trillion". Newsmax.

- ^ "Council Regulation (EC) No 479/2009". Retrieved 2011-11-08.

- ^ Romer, David (2018). Advanced Macroeconomics. McGraw-Hill Economics. New York, NY: McGraw-Hill Education. pp. 662–672. ISBN 978-1260185218.

External links

- The IMF Public Financial Management Blog

- OECD government debt statistics

- Japan's Central Government Debt

- Riksgäldskontoret – Swedish national debt office

- United States Treasury, Bureau of Public Debt – The Debt to the Penny and Who Holds It

- Slaying the Dragon of Debt, Regional Oral History Office, The Bancroft Library, University of California, Berkeley

- A historical collection of documents on or referring to government spending and fiscal policy, available on FRASER

- Eisner, Robert (1993). "Federal Debt". In David R. Henderson (ed.). Concise Encyclopedia of Economics (1st ed.). Library of Economics and Liberty. OCLC 317650570, 50016270, 163149563

- "Government's Borrowing Power". DebatedWisdom. 3IVIS GmbH. Retrieved 29 October 2016.

- US Debt Clock

- Databases

![{\displaystyle {\dot {u}}=e^{-R(t)}[G(t)-T(t)]}](https://wikimedia.org/api/rest_v1/media/math/render/svg/9966c2fafad63746cc87efe380e480202207442c)

![{\displaystyle e^{-R(\infty )}D_{\infty }=D_{0}+\int _{0}^{\infty }e^{-R(t)}[G(t)-T(t)]dt}](https://wikimedia.org/api/rest_v1/media/math/render/svg/82880e13da77b316a0d61b4c574a92a9c4e06843)

![{\displaystyle \int _{0}^{\infty }e^{-R(t)}[T(t)-G(t)]dt\geq D_{0}}](https://wikimedia.org/api/rest_v1/media/math/render/svg/7db61a662d308728ea60fe5032c68178efbba9fd)

![{\displaystyle \underbrace {\int _{0}^{\infty }e^{-R(t)}C(t)dt} _{\text{Consumption}}\leq \underbrace {D_{0}+K_{0}} _{\text{Initial Capital}}+\underbrace {\int _{0}^{\infty }e^{-R(t)}[W(t)-T(t)]dt} _{\text{After-Tax Income}}}](https://wikimedia.org/api/rest_v1/media/math/render/svg/a69555e25c8af8a8899377ab4b21544b6ee629b3)

![{\displaystyle \int _{0}^{\infty }e^{-R(t)}C(t)dt\leq K_{0}+\int _{0}^{\infty }e^{-R(t)}[W(t)-G(t)]dt}](https://wikimedia.org/api/rest_v1/media/math/render/svg/ecf922ee1004078516d8558dd62616315ecdcaa4)