MetLife

| Company type | Public |

|---|---|

| Industry | Financial services |

| Founded | March 24, 1868 |

| Headquarters | |

Key people |

|

| Products | Insurance, Annuities, Employee Benefits |

| Revenue | |

| Total assets | |

| Total equity | |

Number of employees | 66,000 (2010)[1]: 26 |

| Website | MetLife.com |

MetLife, Inc. is the holding corporation for the Metropolitan Life Insurance Company (MLIC),[4] better known as MetLife, and its affiliates. MetLife is among the largest global providers of insurance, annuities, and employee benefit programs, with 90 million customers in over 60 countries.[3][5] The firm was founded on March 24, 1868.[6]

On January 6, 1915, MetLife completed the mutualization process, changing from a stock life insurance company owned by individuals to a mutual company operating without external shareholders and for the benefit of policyholders.[7] The company went public in 2000.[8] Through its subsidiaries and affiliates, MetLife holds leading market positions in the United States, Japan, Latin America, Asia’s Pacific region, Europe, and the Middle East.[9] MetLife serves 90 of the largest Fortune 500 companies.[10] The company’s principal offices are located at 1095 Avenue of the Americas in Midtown Manhattan, New York City, though it retains some executive offices and its boardroom in the MetLife Building, located at 200 Park Avenue, New York City, which it sold in 2005.[11]

Corporate structure

This section needs to be updated. (December 2015) |

As of 2010[update], the company was "organized into five segments: Insurance Products, Retirement Products," the US Business (including Auto & Home and Corporate Benefit Funding), and International.[12] The Insurance Products division was the largest unit, accounting for 53% of 2009 revenue.[13] By 2015, a division referred to as "Americas" had emerged.[2]

Corporate governance

This section needs expansion. You can help by adding to it. (December 2015) |

As of 2011, MetLife's chief executive officer was Steve Kandarian.[14] Kandarian also served as the company's chairman of the board and president as of 2015.[2]

Hired in 2013, John Hele served as chief financial officer for the company as of 2015.[2]

In 2015, MetLife hired Hugh Dineen to fill the new role of chief marketing officer within the US Business Unit.[15]

As in many large, public corporations, MetLife has a compensation committee which establishes compensation levels for the company's senior executives; MetLife compensation emphasizes "variable performance-based compensation over fixed or guaranteed pay".[2]

Subsidiary and affiliate companies

MetLife subsidiaries and affiliates have included MetLife Investors, MetLife Bank, MetLife Securities, Metropolitan Property and Casualty Insurance Company and its subsidiaries, General American, Hyatt Legal, MetLife Resources, New England Financial, Walnut Street Securities, Inc., Safeguard Health Enterprises, Inc., and Tower Square Securities, Inc., Cigna.[16][17][18][19][20][21][22][23][24]

The subsidiary MetLife Insurance Company USA, as of 2015 headquartered in Charlotte, North Carolina, was formerly known as MetLife Insurance Company of Connecticut, and prior to this as Travelers Insurance Company.[25][26]

MetLife Bank was sold to GE Capital in 2013, and MetLife exited the banking business.[27]

History

Early years

The predecessor company to MetLife began in 1863 when a group of New York City businessmen raised $100,000 to found the National Union Life and Limb Insurance Company. The company insured Civil War sailors and soldiers against disabilities due to wartime wounds, accidents, and sickness. On March 24, 1868, it became known as Metropolitan Life Insurance Company and shifted its focus to the life insurance business.[29][30]

A severe business depression that began with the Panic of 1873 forced the company to contract, until it reached its lowest point in the late 1870s. After observing the insurance industry in Great Britain in 1879, MetLife President Joseph F. Knapp brought “industrial” or “workingmen’s” insurance programs to the United States – insurance issued in small amounts on which premiums were collected weekly or monthly at the policyholder’s home. By 1880, sales had exceeded a quarter million of such policies, resulting in nearly $1 million in revenue from premiums. In 1909, MetLife had become the nation’s largest life insurer in the United States, as measured by life insurance in force (the total value of life insurance policies issued).[29][31]

In 1907, the Metropolitan Life Insurance Company tower was commissioned to serve as MetLife’s 23rd Street headquarters in Lower Manhattan. Completed two years later, the building was the world's tallest until 1913 and remained the company's headquarters until 2005. For many years, an illustration of the building (with light emanating from the tip of its spire and the slogan, "The Light That Never Fails") featured prominently in MetLife’s advertising.[32] By 1930, MetLife insured every fifth man, woman, and child in the United States and Canada.[33] During the 1930s, it also began to diversify its portfolio by reducing the percentage of individual mortgages in favor of public utility bonds, investments in government securities, and loans for commercial real estate.[33] The company financed the construction of the Empire State Building in 1929 as well as provided capital to build Rockefeller Center in 1931. During World War II, MetLife placed more than 51 percent of its total assets in war bonds, and was the largest single private contributor to the Allied cause.[33]

Postwar

During the postwar era, the company expanded its suburban presence, decentralized operations, and refocused its career agency system to serve all market segments. It also began to market group insurance products to employers and institutions. By 1979, operations were segmented into four primary businesses: group insurance, personal insurance, pensions, and investments.[33] In 1981, MetLife purchased what became known as the MetLife building for $400 million from a group that included Pan American World Airways.[34][35]

De-mutualization and IPO

In 2000, MetLife converted from a mutual insurance company operated for the benefit of its policyholders to a for-profit public company. The de-mutualization process allowed MetLife to enter unrelated insurance businesses and increase executive compensation.

Policyholders received some stock in the new company in this process.[36] MetLife was accused of breaching federal securities laws by misrepresenting and omitting information in materials given to policyholders during this process, resulting in years of litigation ending with a $50 million settlement in 2009.[37]

Acquisitions, sales, and major deals

- 1992 - merged with United Mutual Life Insurance Company, the only African-American life insurer in New York, in 1992.[38]

- 1992 - [39] acquired Executive Life's single premium deferred annuity business, which was worth approximately $1.2 billion. MetLife also acquired the firm's life insurance business, valued at about $260 million.[40]

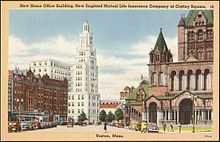

- 1995 - purchased New England Mutual Life Insurance Company.

- 1997 - acquired Security First Group in 1997 for $377 million.[41][42]

- 1999 - acquired Lincoln National Corporation's individual disability income unit.[43]

- 1999 - bought out reinsurance provider GenAmerica Corporation for $1.2 billion, as well as its subsidiaries, Reinsurance Group of America and Conning Corporation.[44][45] That year, the company had grown to serve 7 million policyholders.[46]

- 2000 - de-mutualization and IPO.[47][48] The initial public offering was valued at $6.5 billion, which was the largest IPO to that date in United States financial history.[47][48] MetLife policyholders were asked to choose a cash or stock stake. This IPO made MetLife the most widely owned stock in the United States, and it raised MetLife's value to over $4 billion.[49][50] By 2000, MetLife's reported number of policyholders had risen to 11 million,[50] and that year it had become the United States' number one life insurer, surpassing Prudential, according to The New York Times.[51]

- 2000 - $470 million voice and data network management deal with AT&T Solutions.[52]

- 2001 - acquired Grand Bank of Kingston, New Jersey, which was renamed MetLife Bank.[53][54]

- 2001 - invested $1 billion in the United States stock market during 2001, immediately after the September 11th terrorist attacks.[55]

- 2005 - acquired Citigroup’s Travelers Life & Annuity and all of Citigroup’s international insurance businesses for $11.8 billion.[56][57] At the time of the deal, which was completed on July 1, 2005, the Travelers acquisition made MetLife the largest individual life insurer in North America based on sales.[58]

- 2006 - opened joint-venture insurance company in Shanghai, in May 2006.[59][60]

- 2006 - sold Peter Cooper Village, or Stuyvesant Town, the largest apartment complexes in New York City at the time, for $5.4 billion.[61][62] MetLife had developed the apartment complexes between 1945 and 1947, to house veterans returning home from serving in World War II.[63]

- 2010 - bought American Life Insurance Company from AIG for US$15,500,000,000.[56]

- 2011 - sold MetLife bank to GE Capital, exiting banking business.[64]

Current era

From 2004 to 2011, MetLife continued to hold its position as the largest life insurer in the United States.[14][65] The company had $2.5 trillion in policies written, $350 billion in assets under management, over 12 million customers in the United States, 8 million customers outside the United States, and a net income in 2003 of $2.2 billion.[65] That year, Barron's reported that 13 million American households owned at least one product from MetLife.[66]

MetLife named Robert H. Benmosche as chairman and CEO in July 1999. Benmosche occupied the position until 2006, when he was replaced by C. Robert Henrikson.[14][67][68]

The company's sales grew 11.5% between 2008 and 2009, despite the national recession.[69] In 2011, CEO Robert Henrikson was replaced by Steven A. Kandarian, who had overseen the company's "US$450,000,000,000 investment portfolio" as chief investment officer.[14] Henrikson remained the company's chairman to the end of 2011, at which point he reached the company's mandatory retirement age.[14]

In 2015, MetLife was ranked as number one on Fortune magazine's list of World's Most Admired Companies in the Insurance: Life and Health category.[70]

"Too big to fail"

In 2012, MetLife failed the Federal Reserve’s (the Fed's) Comprehensive Capital Analysis and Review stress test, intended to predict the potential failure of the company in a recession. The Fed stated that the minimum total risk-based capital ratio should be 8% and it estimated MetLife's ratio at 6%. The company had requested approval for a US$2,000,000,000 share repurchase to prop up the stock price, along with an increased dividend.[71] Because MetLife owned MetLife Bank, it was subject to stricter financial regulation. To escape that level of regulation, MetLife announced the sale of its banking unit to GE Capital.[72][73] On November 2, 2012, MetLife said it was selling its US$70,000,000,000 mortgage servicing business to JPMorgan Chase for an undisclosed amount.[74] Both sales were part of its strategy to focus on the insurance side of its business.

The attempt to escape "too big to fail" regulation was not successful. In September 2014, the United States government observed the 2010 Dodd-Frank financial reform law by proposing the application of an official label to MetLife as "systemically important" to the American economy.[75] If implemented, MetLife would be subject to different sets of rules and regulations, with increased oversight from the Federal Reserve.[75][76] The company appealed this proposal in November 2014.[77] In December 2014, federal regulators decided that MetLife required the special regulations reserved for financial companies and organizations deemed "systemically important," or "too big to fail".[78] MetLife announced in January 2015 that it would file a lawsuit against the District of Columbia to overturn the federal regulators' decision,[75] thus becoming the first nonbank to challenge such a decision.[79] Three other nonbank companies have been designated as "systemically important": AIG, General Electric and Prudential.[78][79] MetLife continued to litigate this issue as of mid-2015, with the US Department of Justice asking that their challenge be dismissed.[79]

Fines

On August 7, 2012, it was announced that MetLife will pay $3.2 million in fines after the Federal Reserve charged it used unsafe and unsound practices in handling its mortgage servicing and foreclosure operations.[80]

In 2014, MetLife paid $23 million to settle multiple lawsuits over junk fax operations used to generate leads for life insurance sales.[81]

"MetLife Bank took advantage of the FHA insurance program by knowingly turning a blind eye to mortgage loans that did not meet basic underwriting requirements, and stuck the FHA and taxpayers with the bill when those mortgages defaulted."

U.S. Attorney John Walsh

In 2015, MetLife Home Loans LLC paid $123.5 million to the United States Department of Justice to resolve allegations it knowingly made mortgages insured by the United States government that didn’t meet federal underwriting requirements.[82]

Products and services

This article contains promotional content. (September 2013) |

As of 2010[update], MetLife had a "diverse product mix" which included insurance (home, car and life), variable life annuities and structured settlements, commercial mortgages and securities backed by commercial mortgages, and sovereign debt.[13]

Life insurance

MetLife’s individual life insurance products and services comprise term life insurance and several types of permanent life insurance, including whole life, universal life, and final expense whole life insurance.[83][84] These services vary in regards to the duration and amount of coverage available and whether a medical exam is required for coverage. The company also offers group life insurance, provided through employers, which consists of term life, permanent life, and accidental death and dismemberment coverage.[85][86] MetLife is the largest life insurer in the United States, based on life insurance in-force.[10][13]

Dental

MetLife offers group dental benefit plans for individuals, employees, retirees and their families and provides dental plan administration for over 20 million people.[87][88] Plans include MetLife’s Preferred Dentist Program (PPO) and the SafeGuard DHMO (available for both individuals and employees in CA, FL, and TX). As of May 2010, MetLife’s dental PPO network included over 135,000 participating dentist locations nationwide while the dental HMO network included more than 13,000 participating dentist locations in California, Florida and Texas.[89] MetLife also administers dental continuing education program for dentists and allied health care professionals, which are recognized by the American Dental Association (ADA) and the Academy of General Dentistry (AGD).[90]

Disability

MetLife provides disability products for individuals as well as employee and association groups who receive them through their employer.[12][91] For individuals, the company’s individual disability income insurance can replace a portion of lost income if an individual is unable to work due to sickness or injury.[92] MetLife offers several individual disability income policies, including MetLife Income Guard, OMNI Advantage, OMNI Essential, Business Overhead Expense, and Buy-Sell.[93] The policy options provided by the company vary in terms of eligibility and the provided coverage. For groups, MetLife offers short term disability insurance and long term disability insurance.[94] Short term disability insurance is structured to replace a portion of an individual’s income during the initial weeks of a disabling illness or accident.[95] Long term disability Insurance serves to replace a portion of an individual’s income during an extended period of a disabling illness or accident.[96][97] The company also maintains an absence management product which allows employers to track and manage both planned and unplanned employee absences. The product, which MetLife calls MetLife Total Absence Management, is structured for businesses with 1,000 or more employees.[98]

Annuities

MetLife is among the largest providers of annuities in the world, recording $22.4 billion in sales during 2009.[99] MetLife offers annuities which consist of fixed annuities, variable annuities, deferred annuities and immediate annuities.[100] In 1921, MetLife was the first company to issue a group annuity contract.[101] More recently in 2004, it was the first insurer to introduce a longevity insurance product.[102] As of December 31, 2009, MetLife globally managed group annuity assets of $60 billion with $34 billion of transferred pension liabilities and provided benefit payments to over 600,000 annuitants per month.[103]

Auto & Home

MetLife Auto & Home is the brand name for MetLife’s nine affiliate personal lines insurance companies.[104] Collectively these companies offer personal lines property and casualty insurance policies in all 50 states and the District of Columbia.[105] The flagship company in the MetLife Auto & Home group, Metropolitan Property and Casualty Insurance Company, was founded in 1972.[104] MetLife Auto & Home companies presently have over 2.7 million active policies and service 58 of the Fortune 100 companies.[106][107]

MetLife's home insurance solutions include homeowners insurance, condo insurance, renters insurance, insurance for landlords, and mobile home insurance.[108][109] The available policies for MetLife's home insurance provide coverage for possessions, property damage from natural disaster or theft, and various legal expenses incurred resulting from injuries sustained on an individual's property.[110] The companies also sell RV, ATV, boat, mobile home, collectible vehicle, and motorcycle policies[111] and offers flood insurance policies as a participant in the National Flood Insurance Program (NFIP), which is managed by the federal government.[112][113] MetLife's various types of coverage for auto insurance include liability protection, collision and comprehensive coverage, personal injury protection, rental car coverage, and uninsured and underinsured motorists coverage.[114][115] Through an arrangement with Hyatt Legal Plans, a subsidiary of MetLife, MetLife Auto & Home underwrites group legal plans in many states.[16]

It was the first national insurer in the United States to offer identity-theft resolution services at no extra premium and as of 2012 continues to do so today in most United States states.[116][117] In 2010, MetLife Auto & Home began offering their GrandProtect plan in most states. This GrandProtect policy simplifies complex insurance needs by combining a client's home, valuable items, autos, RVs, and boats into one comprehensive policy package. The ultimate benefits to the consumer are having one bill, only one deductible, comprehensive coverage, and typically lower rates than trying to get each policy individually.[118]

Other products

MetLife’s products also include critical illness insurance.[119] Financial services include fee-based financial planning, retirement planning, wealth management, 529 Plans, banking, and commercial and residential mortgages.[120] The company also provides retirement plan and other financial services to healthcare, education, and not-for-profit organizations.[121] The MetLife Center for Special Needs Planning is a group of planners which serve families and individuals with special needs.[122] In 2014, MetLife launched MetLife Defender, a digital identity theft protection product.[123]

International presence

Outside of the United States, MetLife operates in Latin America, Europe, Asia’s Pacific region, and the Middle East, with leading market positions in Mexico, Japan, South Korea and Chile.[9]

On March 8, 2010, Met Life announced its intent to purchase the international leader life-insurance business, American Life Insurance Company (Alico), from American International Group (AIG). MetLife, which completed the deal on November 1, 2010, paid approximately $7.2 billion in cash and $9.0 billion in MetLife equity and other securities.[124][125] The securities portion of the deal consisted of 78.2 million shares of MetLife common stock, 6.9 million shares of contingent convertible preferred stock and 40 million equity units.[126] The values of the common and preferred stock were based on the closing price of MetLife’s common stock on October 29.[126] Upon completion of the purchase, MetLife became a leading competitor in Japan, the world’s second-largest life insurance market, and moved into a top 5 market position in many high growth emerging markets in Central and Eastern Europe, such as Romania, the Middle East and Latin America.[127] The deal added 20 million customers to MetLife’s 70 million and according to Barron's more than doubled the percentage of operating profits that MetLife gets abroad to 40%.[13]

In India MetLife has an affiliate company India Insurance Company Limited (MetLife) which has operated in India since 2001. This company has its headquarters in Bangalore and Gurgaon and was jointly owned by MetLife and a few local Indian financial companies. In 2012 an agreement was made with local Indian bank, the Punjab National Bank to establish a strategic alliance and for it to take a 30% share in MetLife India.[128] The state owned bank would in return sell MetLife insurance products in its branches

As of 2015, Julio Garcia-Villalon leads the Middle East & Africa regional business, which is headquartered in the Dubai International Financial Centre and has operated in the region since the 1950s.[129]

MetLife Foundation

MetLife Foundation is MetLife's independent charitable and grant-awarding foundation. It was founded in 1976[130] and had provided over $650 million in grants by January 2015.[130] The foundation has partnered with and donated to a variety of organizations, including Habitat for Humanity since 2010[131] and the Martin Luther King, Jr. National Memorial Project Foundation since 2008.[132][133] In 2013, the MetLife Foundation announced a new focus on financial inclusion,[134] including educational programs on basic financial planning for disadvantaged children[135][136] and financial services aimed at low-income communities.[136][137][138]

Relationship with Peanuts

MetLife licenses Snoopy and other Peanuts characters for promotional purposes from the Iconix Brand Group, which owns the promotional rights to the works of Charles M. Schulz. In 2010, Iconix formed a joint venture with Schulz’s heirs, buying out E. W. Scripps Co. and United Features Syndicate for $175 million. MetLife is reported to pay $12 million per year to Iconix for licensing rights.[139] Prior to the Iconix deal, MetLife had licensed the characters from other rights-holders.

The Peanuts-based campaign was developed by the advertising agency Young & Rubicam. MetLife also has used Foote Cone & Belding to develop Peanuts-related promotions.[140][141]

Blimp and sports sponsorship

The MetLife blimp program began in 1987 with the “Snoopy 1” airship and, in 1994, expanded to include the “Snoopy 2” airship.[142] The program provides aerial coverage to over 80 major sporting events every year and is currently the official aerial coverage provider of the PGA Tour.[143] “Snoopy 1” and “Snoopy 2” also provide overhead television coverage for the NFL, CBS College Football, the LPGA, the NBA Finals, Copa Chile, the Preakness Stakes, and the Kentucky Derby.[143][144][145][146] On August 23, 2011, MetLife agreed to a 25-year sponsorship deal to rename New Meadowlands Stadium in East Rutherford, New Jersey, home of the NFL's New York Giants and New York Jets to MetLife Stadium.[147]

MetLife and the “Ideal weight”

In 1959, The Metropolitan Life Insurance Company (as it was known at the time) released tables of the best weight for each height for longevity, based on their collected insurance data. These tables showed the “desirable weights”. In 1983, they released tables showing the “ideal” weights for greatest longevity; this information was based on data collected in the Build Study of 1979 collected by the Society of Actuaries. This data followed patients for 18 years (from 1954-1972) and was collected from 25 life insurance companies in Canada and the United States, representing 4.2 million people. These “ideal” weights were higher than the prior “desirable” weights, this was attributed to an increase in muscle mass due to improved fitness levels among the population. This study is still the largest available pool of data for this purpose. It was noticed that the average weights in the population are higher than the ideal weights for survival. The ‘’’Metropolitan Tables’’’ included ‘’small’’, ‘’medium’’ and ‘’large’’ frames, based on elbow-girth measured using calipers, as the elbows do not develop adipose tissue. They presented weight ranges for height, sex and body frame (again associated with the lowest mortality) The mid-point of the ideal weight for the medium frames for each height was selected as the “ideal” weight used for calculations of “excess weight” (initial weight-ideal weight). This led to a formula to calculate the ideal weight used by bariatric surgeons, but it had lost considerable accuracy by 2007, again due to improvements in medical care and in public health.[148]

Awards

MetLife was named the “Best Managed Insurance Company for 2008” by Forbes magazine.[149] For three consecutive years (2008–2010) the company has also appeared on FORTUNE’s list of the most-admired companies.[150][151][152] MetLife was recognized by Diversity MBA magazine as one of its “Top 50 Companies for Diverse Managers” in 2007, 2008, 2009 and 2010.[153] The magazine highlighted MetLife’s Enterprise Diversity Council and noted how the council helps “set direction, communicate strategy and ensure consistency of the diversity message across MetLife.”[153] For eleven consecutive years (1999–2009) MetLife has been named by Working Mother magazine as one of the “100 Best Companies for Working Mothers,” specifically for offering flexible schedules, remote working capabilities and various child care options.[154][155] MetLife has also been awarded a perfect score for seven consecutive years (2004–2010) by the Human Rights Campaign Foundation for its “Corporate Equality Index-Best Companies for People who are Gay, Lesbian, Bisexual, or Transgendered.”[156][157]

See also

- List of United States insurance companies

- Met English

- Park La Brea, Los Angeles, California

- Park Merced, San Francisco, California

- Parkchester, Bronx

- Riverton Houses

- Stuyvesant Town

References

- ^ a b c d e f g "2010 Form 10-K, MetLife, Inc". United States Securities and Exchange Commission.

- ^ a b c d e Scism, Leslie (6 March 2015). "MetLife CEO Got $15.2 Million Pay Package for 2014". The Wall Street Journal. Retrieved 16 December 2015.

- ^ a b Staff & Wire Reports (11 March 2010). "MetLife Expands Beyond 'Slow Growth' U.S. Market". Tulsa World. Retrieved 16 December 2015.

- ^ Staff (2 October 2015). "MetLife Announces Third Quarter Non-Cash Charge". Insurance Weekly News. Retrieved 20 December 2015 – via HighBeam Research.

- ^ "MetLife and Fidelity Introduce New Retirement Income Solution: A Variable Annuity Designed to Provide Lifetime Income for Those Nearing or in Retirement" (Press release). Business Wire. 16 November 2009.

{{cite press release}}:|access-date=requires|url=(help) - ^ Botti, Timothy (2006). Envy of the world: a history of the U.S. economy & big business. New York, NY: Algora Publishing. p. 140. ISBN 0-87586-431-7.

- ^ "Company Highlights" (PDF). Retrieved 2 March 2011.

- ^ "In Play". Daily Deal. 7 April 2000.

- ^ a b Lehmann, R.J. (4 June 2010). "MetLife Sees Alico Deals as Door to Growth in China, Middle East". SNL Insurance M&A – via insurancenewsnet.(subscription required)

- ^ a b "KASB FL, MetLife Alico Sign Investment Agreement". Pakistan Observer. 31 December 2010. Retrieved 14 March 2011.

{{cite news}}: Unknown parameter|dead-url=ignored (|url-status=suggested) (help)[dead link] - ^ Anthony Ramirez (2 April 2005). "MetLife Sells 2nd Building, A Landmark On Park Ave". The New York Times.

- ^ a b "MetLife, Inc. Form 10-K for Fiscal Year Ended December 31, 2010". The United States Securities Exchange Commission. p. 6. Retrieved 3 March 2011.

- ^ a b c d Williams, Christopher (19 June 2010). "MetLife Gains Altitude". Barron's. Retrieved 14 March 2011.

- ^ a b c d e Andrew Frye (21 March 2011). "MetLife Promotes Investment Manager Kandarian to Chief Executive". Bloomberg Business. Retrieved 25 February 2015.

- ^ Stein, Lindsay (8 December 2015). "MetLife Hires Avon's Hugh Dineen to Lead U.S. Marketing". Advertising Age. Retrieved 16 December 2015.

- ^ a b Levy, Douglas (21 June 2010). "Prepaid Legal Plans Help Bolster Attorney's Practices". Michigan Lawyers Weekly.

- ^ "MetLife Hires Bank Distributors". American Banker. 24 August 2007.

- ^ Considine, Bob (20 September 2007). "MetLife Bank Enjoys 5 Years in Bridgewater: Banking on Success". Courier News.

- ^ "MetLife Securities". MetLife. Retrieved 20 November 2014.

- ^ Galentine, Elizabeth (24 March 2010). "Bread and Butter Products Help Vendors Outlast Recession". Employee Benefit News Insurance. Retrieved 15 March 2011.

- ^ "MetLife Resources Introduces Enhanced 403(b) Product" (Press release). Business Wire. 31 July 2008. Retrieved 10 September 2010.

- ^ Lazarus, David (27 February 2004). "MetLife Spreads It Around". The San Francisco Chronicle. Retrieved 15 March 2011.

- ^ "MetLife Completes Acquisition of SafeGuard" (Press release). Business Wire. 1 February 2008. Retrieved 10 September 2010.

- ^ Ackermann, Matt (28 August 2009). "MetLife Platform Extends Advice to the Mass Affluent". American Banker.

- ^ Staff (4 December 2015). "Metlife Insurance Co USA Files SEC Form D, Notice of Exempt Offering of Securities (Nov. 17, 2015)". Insurance Weekly News. Retrieved 20 December 2015 – via HighBeam Resarch.

- ^ "SEC FORM D". EDGAR. US SEC. 17 November 2015. Retrieved 20 December 2015.

- ^ Puzzanghera. Jim (2013-01-14). "MetLife gets out of banking business, sells deposits to GE Capital". Los Angeles Times.

- ^ http://libraries.mit.edu/archives/research/collections/collections-mc/pdf/mc616.pdf

- ^ a b Botti, Timothy (2006). Envy of the world: a history of the U.S. economy & big business. New York, NY: Algora Publishing. p. 140. ISBN 0-87586-431-7.

- ^ Umasanker (April 2010). "A Study on Life Insurance Awareness Among Private Employees". Economic Challenger.

- ^ Mauriello, Carrie (2001). Net Worth: Using the Internet for Personal Financial Planning. Woburn, MA: Butterworth-Heinemann. p. 215. ISBN 1-884133-83-5.

- ^ Moudry, Robert (2005). The American Skyscraper: Cultural Histories. New York, NY: Cambridge University Press. pp. 125–127. ISBN 0-521-62421-5.

- ^ a b c d "History". Retrieved 25 August 2010.

- ^ "Done deal: $1.7b sale of MetLife Building officially closed". Real Estate Weekly. 51: 10. June 2005.

- ^ "MetLife Building". Emporis. Retrieved 2 March 2011.

- ^ Boselovic, Len (2000-01-04). "Decision time for MetLife policyholders". Pittsburgh Post-Gazette.

- ^ Fuch, Eric (2009-11-13). "MetLife to pay $50 million to resolve policyholder suits". Law360.

- ^ Matthew Scott (1 February 1993). "United Mutual, MetLife Merge". Black Enterprise. Retrieved 25 February 2015.

- ^ Joann S. Lublin (10 August 2009). "AIG Chief: Loud Voice and a Listener's Ear". The Wall Street Journal. Retrieved 13 July 2015.

- ^ Rick Stouffer. "MetLife Gets OK To Acquire Executive Life's Businesses". 18 December 1992. Retrieved 25 February 2015.

- ^ Associated Press (16 August 1995). "MetLife Merging with New England". The Buffalo News. Retrieved 25 February 2015.

- ^ Stephen Garmhausen (15 August 1997). "MetLife to Pay $377 Million for Bank Marketer Security First". American Banker. Retrieved 25 February 2015.

- ^ Lynne McKenna Frazier (12 May 1999). "Metlife Assumes Lincoln National's Individual Disability Income Unit". Knight Ridder. Retrieved 25 February 2015.

- ^ Jim Gallagher (20 February 2002). "GenAmerica Financial Chief Announces Resignation". Knight Ridder. Retrieved 25 February 2015.

- ^ Michael D. Moore (27 August 1999). "In Brief: MetLife Buying GenAmerica Corp". American Banker. Retrieved 25 February 2015.

- ^ Jane Bryant Quinn (24 October 1999). "MetLife Suit could mislead holders again". Indiana Post-Tribune. Retrieved 25 February 2015.

- ^ a b Patricia Vowinkel (30 November 1998). "MetLife Plans to Sell Stock; Insurer to Revert To Public Company". The Washington Post. Retrieved 25 February 2015.

- ^ a b Joseph Treaster. "MetLife Issues Nearly 500 Million Shares to Policyholders". 6 April 2000. Retrieved 25 February 2015.

- ^ Beth Healy (25 November 1999). "MetLife IPO plan outshines Hancock's". The Boston Herald. Retrieved 25 February 2015.

- ^ a b Chet Bridger (10 December 1999). "MetLife's Policyholders to get cash or stock in public offering". The Buffalo News. Retrieved 25 February 2015.

- ^ "MetLife Posts Gain in Quarterly Earnings". The New York Times. 10 May 2000. Retrieved 25 February 2015.

- ^ Denis Pappalardo (18 December 2000). "MetLife jumps on outsourcing bandwagon". Network World. Retrieved 25 February 2015.

- ^ Lee Ann Gjersten (17 August 2000). "MetLife has big plans for one-branch bank". American Banker. Retrieved 25 February 2015.

- ^ Jill Elswick (1 May 2001). "Banks and insurers slowly converge". Employee Benefit News. Retrieved 25 February 2015.

- ^ "MetLife History: Supporting Country and Community". MetLife. Retrieved 13 July 2015.

- ^ a b Augustums, Ieva M. (1 May 2010). "AIG Sells Alico Health Insurance Unit to MetLife for $15.5B". The Huffington Post: Business. Retrieved 25 February 2015.

- ^ Anthony Ramirez (2 April 2005). "MetLife Sells 2nd Building, a Landmark on Park Ave". The New York Times. Retrieved 25 February 2015.

- ^ Wenske, Paul (1 July 2005). "Midday Business Report: Survey says ID theft on rise". The Kansas City Star.

- ^ Song Hongmei (24 May 2006). "Have you met the new MetLife today?". China Daily. Retrieved 25 February 2015.

- ^ George Chen (10 April 2007). "U.S. MetLife says to partner Bank of Shanghai". Reuters. Retrieved 25 February 2015.

- ^ Oshrat Carmiel (2 March 2012). "MetLife Says It Reached Accord With Stuyvesant Tenants". Bloomberg Business. Retrieved 25 February 2015.

- ^ Charles Bagli (29 November 2012). "$68.7 Million Settlement on Stuyvesant Town Rents". The New York Times. Retrieved 25 February 2015.

- ^ Jennifer Henderson (15 September 2014). "Mortgage Observer: Old New York: Stuyvesant Town-Peter Cooper Village". Commercial Observer. Retrieved 26 February 2015.

- ^ Schaefer, Steve (2011-12-27). "Metlife ditches bank business, sells $7.5B in deposits to GE Capital". Forbes.

- ^ a b David Lazarus (27 February 2004). "MetLife spreads it around". San Francisco Gate. Retrieved 25 February 2015.

- ^ Shirley A. Lazo (4 October 2004). "MetLife Double-Play". Barron's. Retrieved 25 February 2015.

- ^ Mara Der Hovenisian (5 June 2005). "Travelers May Be Heavy Baggage". BloombergBusiness. Retrieved 25 February 2015.

- ^ "Henrikson to Succeed Benmosche as MetLife CEO". Insurance Journal. Vol. 93, no. 23 (West ed.). Wells Media Group. 28 April 2005. ISSN 0020-4714. Retrieved 25 February 2015.

- ^ Elizabeth Galentine (24 March 2010). "'Bread and butter products' help vendors outlast recession". Employee Benefit News. Retrieved 25 February 2015.

- ^ "World's Most Admired Companies". Fortune Magazine. 2015. Retrieved 24 March 2015.

- ^ "MetLife fumes as it fails Fed stress test". Forbes. 2012-03-14.

- ^ "MetLife to Sell Bank Unit to GE Capital". 27 December 2011. Retrieved 17 June 2015.

- ^ Puzzanghera, Jim (14 January 2013). "MetLife gets out of banking business, sells deposits to GE Capital". Los Angeles Times.

- ^ "MetLife Bank to sell $70B mortgage servicing portfolio to JPMorgan Chase". CBS/AP.

- ^ a b c Eric Garcia (13 January 2015). "MetLife faces challenge to overturn 'systemically important' designation". Market Watch. Retrieved 25 February 2015.

- ^ Andrew Ross Sorkin (3 October 2014). "MetLife Formally Challenges 'Systemically Important' Designation". The New York Times: DealBook. Retrieved 25 February 2015.

- ^ Victoria McGrane (14 January 2015). "MetLife Suit Sets up Battle Over Regulation". The Wall Street Journal. Retrieved 25 February 2015.

- ^ a b Steve Schaefer (4 September 2014). "MetLife Plans to Fight 'Systemically Important' Designation". Forbes. Retrieved 25 February 2015.

- ^ a b c Zajac, Andrew; Katz, Ian (8 May 2015). "US asks judge to throw out MetLife's "too big to fail" lawsuit". Bloomberg Business News.

- ^ Schroeder, Peter. "MetLife fined $3.2 million for mortgage servicing problems". The Hill. Retrieved 7 August 2012.

- ^ Scism, Leslie (2014-08-07). "MetLife Settles After Fax Meets Friction". Wall Street Journal.

- ^ Scism, Leslie; Light, Joe (2015-02-25). "MetLife Unit to Pay $123.5 Million to Resolve Mortgage-Lending Allegations". Wall Street Journal.

- ^ "Whole Life Insurance". MetLife. Retrieved 11 December 2014.

- ^ "Term Life Insurance". MetLife. Retrieved 11 December 2014.

- ^ "Insurance". MetLife. Retrieved 20 November 2014.

- ^ "Group Life Insurance". MetLife. Retrieved 20 November 2014.

- ^ "MetLife Announces the New MET Series for its Dental Health Maintenance Organization DHMO Plans". Health & Medicine Week: 1192. October 2010.

- ^ "Employee Benefits". MetLife. Retrieved 14 March 2011.

- ^ "Be Better Informed Than the Tooth Fairy". California Broker. July 2010. Retrieved 14 March 2011.

- ^ "MetLife Adds 5 Quality Resource Guides to Dental Continuing Education Program". Health & Beauty Close-Up. September 2010.

- ^ "Disability Insurance". MetLife. Retrieved 11 December 2014.

- ^ "Protect Your Income With Disability Insurance". Michigan Chronicle. 1 March 2005.

- ^ "Disability Insurance". MetLife. MetLife. Retrieved 20 November 2014.

- ^ "Group Disability Insurance". MetLife. Retrieved 11 December 2014.

- ^ "Short Term Disability Insurance". MetLife. Retrieved 11 December 2014.

- ^ "Group Disability Insurance". MetLife. Retrieved 14 March 2011.

- ^ "Long Term Disability Insurance". MetLife. Retrieved 11 December 2014.

- ^ "MetLife Launches Enhanced Absence Management Solution" (Press release). Datamonitor NewsWire. 30 January 2009.

{{cite press release}}:|access-date=requires|url=(help) - ^ "At The Bell". Investment News. 1 March 2010.

- ^ "Annuities". MetLife. Retrieved 20 November 2014.

- ^ "What a Difference a Year Makes: Market Volatility Leads to Broadened View of U.S. Pension Risks, According to MetLife Study" (Press release). Business Wire. 23 February 2010.

{{cite press release}}:|access-date=requires|url=(help) - ^ Adler, David (September 2006). "Fixing up SPEND DOWN: New plans and products are improving spend-down options for retirees". Employee Benefit News.

- ^ "Investments and Annuities". MetLife. Retrieved 20 November 2014.

- ^ a b Whitney, Sally (October 1999). "High-speed Merge". Best's Review (Prop/Casualty). 100: 30–37.

- ^ "FileNet Announces 2005 Innovation Award Finalists" (Press release). PR Newsire. 3 November 2005.

{{cite press release}}:|access-date=requires|url=(help) - ^ "Life Insurance; Tips for Staying Cool When Your Teen Starts Asking to Drive". Insurance Business Weekly: 40. July 2010.

- ^ Galentine, Elizabeth (March 2010). "Bread and Butter Products Help Vendors Outlast Recession". Employee Benefit News Insurance.

- ^ "Home Insurance". MetLife. Retrieved 11 December 2014.

- ^ "Renters Insurance". MetLife. Retrieved 11 December 2014.

- ^ "Homeowners Insurance". MetLife. MetLife. Retrieved 20 November 2014.

- ^ "MetLife Insurance Coverage". MetLife. MetLife. Retrieved 20 November 2014.

- ^ Mcpherson, David (9 September 2005). "Insurance Adjusters Fan Out Across Gulf Coast". The Providence Journal. Retrieved 14 March 2011.

- ^ "Auto Insurance Coverage and Homeowners Claims". The Register-Guard. 1 July 2007. Retrieved 20 November 2014.

- ^ "Individual and Group Auto Insurance Policies". MetLife. MetLife. Retrieved 20 November 2014.

- ^ "Group Auto Insurance". MetLife. Retrieved 11 December 2014.

- ^ Edsall, Noel (28 March 2005). "New Coverage: ID Theft Insurance". NPR. Retrieved 9 September 2010.

- ^ "MetLife Auto & Home Adds Tax-Related Identity Theft Service". Insurance Journal. April 2010. Retrieved 14 March 2011.

- ^ "Coverage from MetLife Auto and Home Insurance". MetLife. Retrieved 20 November 2014.

- ^ Lisanti, Joseph (13 September 2010). "Going Beyond Disability Insurance". Daily News (New York).

- ^ "Investment Products". MetLife. Retrieved 20 November 2014.

- ^ "Retirement". MetLife. Retrieved 20 November 2014.

- ^ "Insurer Launches Special Needs Planning Center". National Underwriter Life & Health/Financial Services. March 2010.

- ^ "Identity Theft Protection - MetLife Defender". MetLife Defender. Retrieved 17 June 2015.

- ^ "MetLife completes Alico acquisition in USD16bn cash-and-stock deal". Retrieved 15 March 2011.

- ^ Scism, Leslie (9 March 2010). "MetLife 's CEO Completes His Quest --- Flush With Capital During The Crisis, the Insurer Had Its Pick of Deals, but Settled on Alico". The Wall Street Journal.

- ^ a b "MetLife to Acquire American Life Insurance Company from American International Group for Approximately $15.5 Billion" (Press release). Business Wire. 1 November 2010. Retrieved 15 March 2011.

- ^ "MetLife to Acquire American Life Insurance Company from American International Group for Approximately $15.5 Billion" (Press release). Business Wire. 8 March 2010. Retrieved 15 March 2011.

- ^ "Punjab National Bank acquires 30% stake in Metlife, company to be re-branded". The Indian Express. Jan 4, 2013.

- ^ Staff (3 December 2015). "MetLife Middle East & Africa Wins Life Insurance Company of the Year Award". Global Banking News. Retrieved 20 December 2015 – via Highbeam Research.

- ^ a b Katherine Peralta (27 January 2015). "MetLife Foundations donates $100,000 for women's leadership program at UNCC". The Charlotte Observer. Retrieved 15 May 2015.

- ^ Kimberly Amedro (1 August 2008). "New home means new life for family ; Residents of the newly completed Habitat for Humanity home put in sweat equity to qualify for it". Dayton Daily News. Retrieved 26 May 2015.

- ^ George E. Curry (25 August 2011). "Money and the MLK Memorial". The St. Louis American. Retrieved 26 May 2015.

- ^ "MetLife raises cash for MLK Memorial". BizJournals. 25 February 2008. Retrieved 11 June 2015.

- ^ "MetLife Foundation Mission and Vision". MetLife. Retrieved 28 May 2015.

- ^ "Rather Launches JK Bank-PNB Metlife Joint Initiative For Children". Kashmir Observer. 7 August 2014. Retrieved 28 May 2015.

- ^ a b "US NGO partners with MetLife to provide microfinance in UP". The Economic Times. 12 March 2015. Retrieved 28 May 2015.

- ^ Sue-Lynn Moses (25 March 2015). "A Foundation and Newspaper Team Up in a Global Push for Financial Inclusion". Inside Philanthropy. Retrieved 28 May 2015.

- ^ Nancy Cook (20 February 2015). "Baby Steps Toward Home Ownership". The National Journal. Retrieved 28 May 2015.

- ^ Brown, Abram (2013-10-30). "You're An Old Brand, Charlie Brown: The $80M Business Of Peanuts Needs A Turnaround". Forbes.

- ^ Elliot, Stuart (20 December 2000). "Young & Rubicam holds onto a MetLife account amid a flurry of change and consolidation". The New York Times. Retrieved 23 March 2011.

- ^ Elliot, Stuart (21 June 2006). "Woodstock and Snoopy Answer Life's What-Ifs". The New York Times. Retrieved 23 March 2011.

- ^ Shine, Dan (29 December 1994). "The Love Float". The Dallas Morning News.

- ^ a b "MetLife Joins Forces with Believe In Tomorrow Children's Foundation". Wireless News. August 2010.

- ^ "MetLife Inflates Blimp Fleet". National Underwriter: 7. August 2007.

- ^ "MetLife to Be the First Major Marketing Partner of the New Meadowlands Stadium in NJ" (Press release). Web Wire. 17 June 2008. Retrieved 24 August 2010.

- ^ "Blimp Schedule". MetLife. Retrieved 20 November 2014.

- ^ "MetLife announces it has bought the naming rights to New Meadowlands Stadium for 25 years". The Washington Post. Associated Press. August 23, 2011. Retrieved 2011-08-23.

{{cite news}}: Unknown parameter|deadurl=ignored (|url-status=suggested) (help) [dead link] - ^ Deital, Mervyn; et al. (May 18, 2007). "Reporting Weight Loss 2007". Obesity Surgery. 17 (5): 565–568. doi:10.1007/s11695-007-9116-0?LI=true (inactive 2016-09-01). PMID 17658011. Retrieved November 7, 2014.

{{cite journal}}: CS1 maint: DOI inactive as of September 2016 (link) - ^ "Business Digest". The Providence Journal. 4 January 2008.

- ^ "Fortune Most Admired List". Cable News Network. 17 March 2008. Retrieved 23 March 2011.

- ^ "Fortune Most Admired List". Cable News Network. 16 March 2009. Retrieved 15 October 2010.

- ^ "Fortune Most Admired List". Cable News Network. 22 March 2010. Retrieved 15 October 2010.

- ^ a b "50 Out Front". Diversity MBA Magazine. Retrieved 23 March 2011.

- ^ "MetLife Named a 2007 Working Mother 100 Best Company for Ninth Consecutive Year" (Press release). Business Wire. 25 September 2007. Retrieved 9 September 2010.

- ^ "Working Mother 100 Best Companies 2009". Working Mother. September–October 2009. Retrieved 23 March 2011.

- ^ "Corporate Equality Index". The Human Rights Campaign. Retrieved 9 September 2010.

- ^ "Corporate Equality Index". Human Rights Campaign. Retrieved 9 September 2010.