Stock market

A stock market, equity market or share market is the aggregation of buyers and sellers (a loose network of economic transactions, not a physical facility or discrete entity) of stocks (also called shares); these may include securities listed on a stock exchange as well as those only traded privately.

Size of the market

Stocks can also be categorized in various ways. One common way is by the country where the company is domiciled. For example, Nestlé and Novartis are domiciled in Switzerland, so they may be considered as part of the Swiss stock market, although their stock may also be traded at exchanges in other countries.

At the close of 2012, the size of the world stock market (total market capitalisation) was about US$55 trillion.[1] By country, the largest market was the United States (about 34%), followed by Japan (about 6%) and the United Kingdom (about 6%).[2] This went up more in 2013.[3]

There are a total of 60 stock exchanges in the world with a total market capitalization of $69 trillion. Of these there are 16 exchanges that have a market capitalization of $1 trillion each and they account for 87% of global market capitalization. Apart from the Australian Securities Exchange, all of these 16 exchanges are divided between three continents: North America, Europe and Asia.[4]

Stock exchange

A stock exchange is a place or organization by which stock traders (people and companies) can trade stocks. Companies may want to get their stock listed on a stock exchange. Other stocks may be traded "over the counter" (otc), that is, through a dealer. A large company will usually have its stock listed on many exchanges across the world.[5]

Exchanges may also cover other types of security such as fixed interest securities or interest derivatives.

Trade

Trade in stock markets means the transfer for money of a stock or security from a seller to a buyer. This requires these two parties to agree on a price. Equities (stocks or shares) confer an ownership interest in a particular company.

Participants in the stock market range from small individual stock investors to larger traders investors, who can be based anywhere in the world, and may include banks, insurance companies or pension funds, and hedge funds. Their buy or sell orders may be executed on their behalf by a stock exchange trader.

Some exchanges are physical locations where transactions are carried out on a trading floor, by a method known as open outcry. This method is used in some stock exchanges and commodity exchanges, and involves traders entering oral bids and offers simultaneously. The other type of stock exchange is a virtual kind, composed of a network of computers where trades are made electronically by traders. An example of such an exchange is the NASDAQ.

A potential buyer bids a specific price for a stock, and a potential seller asks a specific price for the same stock. Buying or selling at market means you will accept any ask price or bid price for the stock, respectively. When the bid and ask prices match, a sale takes place, on a first-come-first-served basis if there are multiple bidders or askers at a given price.

The purpose of a stock exchange is to facilitate the exchange of securities between buyers and sellers, thus providing a marketplace (virtual or real). The exchanges provide real-time trading information on the listed securities, facilitating price discovery.

The New York Stock Exchange (NYSE) is a physical exchange, with a hybrid market for placing orders electronically from any location as well as the trading floor. Orders executed on the trading floor enter by way of exchange members and flow down to a floor broker, who submits the order electronically to the floor trading post for the Designated Market Maker ("DMM") for that stock to trade the order. The DMM's job is to maintain a two-sided market, meaning orders to buy and sell the security if there are no other buyers and sellers. If a spread exists, no trade immediately takes place—in this case the DMM should use their own resources (money or stock) to close the difference after they judged time. Once a trade has been made the details are reported on the "tape" and sent back to the brokerage firm, which then notifies the investor who placed the order. Computers play an important role, especially for so-called "program trading".

The NASDAQ is a virtual listed exchange, where all of the trading is done over a computer network. The process is similar to the New York Stock Exchange. One or more NASDAQ market makers will always provide a bid and ask price at which they will always purchase or sell 'their' stock.

The Paris Bourse, now part of Euronext, is an order-driven, electronic stock exchange. It was automated in the late 1980s. Prior to the 1980s, it consisted of an open outcry exchange. Stockbrokers met on the trading floor or the Palais Brongniart. In 1986, the CATS trading system was introduced, and the order matching process was fully automated.

People trading stock will prefer to trade on the most popular exchange since this gives the largest number of potential counterparties (buyers for a seller, sellers for a buyer) and probably the best price. However, there have always been alternatives such as brokers trying to bring parties together to trade outside the exchange. Some third markets that were popular are Instinet, and later Island and Archipelago (the later two have since been acquired by Nasdaq and NYSE, respectively). One advantage is that this avoids the commissions of the exchange. However, it also has problems such as adverse selection.[6] Financial regulators are probing dark pools.[7][8]

Market participant

Market participants include individual retail investors, institutional investors such as mutual funds, banks, insurance companies and hedge funds, and also publicly traded corporations trading in their own shares. Some studies have suggested that institutional investors and corporations trading in their own shares generally receive higher risk-adjusted returns than retail investors.[9]

A few decades ago,[when?] worldwide, buyers and sellers were individual investors, such as wealthy businessmen, usually with long family histories to particular corporations. Over time, markets have become more "institutionalized"; buyers and sellers are largely institutions (e.g., pension funds, insurance companies, mutual funds, index funds, exchange-traded funds, hedge funds, investor groups, banks and various other financial institutions).

The rise of the institutional investor has brought with it some improvements in market operations. There has been a gradual tendency for "fixed" (and exorbitant) fees being reduced for all investors, partly from falling administration costs but also assisted by large institutions challenging brokers' oligopolistic approach to setting standardised fees.[citation needed] A current trend in stock market investments includes the decrease in fees due to computerized asset management termed Robo Advisers within the industry. The automation of investment management has decreased how much human portfolio management costs by lowering the cost associated with investing as a whole.

Trends in market participation

Stock market participation refers to the number of agents who buy and sell equity backed securities either directly or indirectly in a financial exchange. Participants are generally subdivided into three distinct sectors; households, institutions, and foreign traders. Direct participation occurs when any of the above entities buys or sells securities on its own behalf on an exchange. Indirect participation occurs when an institutional investor exchanges a stock on behalf of an individual or household. Indirect investment occurs in the form of pooled investment accounts, retirement accounts, and other managed financial accounts.

Indirect vs. direct investment

The total value of equity-backed securities in the United States rose over 600% in the 25 years between 1989 and 2012 as market capitalization expanded from $2,789,999,902,720 to $18,668,333,210,000.[10] The demographic composition of stock market participation, accordingly, is the main determinant of the distribution of gains from this growth. Direct ownership of stock by households rose slightly from 17.8% in 1992 to 17.9% in 2007 with the median value of these holdings rising from $14,778 to $17,000.[11][12] Indirect participation in the form of retirement accounts rose from 39.3% in 1992 to 52.6% in 2007 with the median value of these accounts more than doubling from $22,000 to $45,000 in that time.[11][12] Rydqvist, Spizman, and Strebulaev attribute the differential growth in direct and indirect holdings to differences in the way each are taxed. Investments in pension funds and 401ks, the two most common vehicles of indirect participation, are taxed only when funds are withdrawn from the accounts. Conversely, the money used to directly purchase stock is subject to taxation as are any dividends or capital gains they generate for the holder. In this way current tax code incentivizes households to invest indirectly at greater rates.[13]

Participation by income and wealth strata

Rates of participation and the value of holdings differs significantly across strata of income. In the bottom quintile of income, 5.5% of households directly own stock and 10.7% hold stocks indirectly in the form of retirement accounts.[12] The top decile of income has a direct participation rate of 47.5% and an indirect participation rate in the form of retirement accounts of 89.6%.[12] The median value of directly owned stock in the bottom quintile of income is $4,000 and is $78,600 in the top decile of income as of 2007.[14] The median value of indirectly held stock in the form of retirement accounts for the same two groups in the same year is $6,300 and $214,800 respectively.[14] Since the Great Recession of 2008 households in the bottom half of the income distribution have lessened their participation rate both directly and indirectly from 53.2% in 2007 to 48.8% in 2013, while over the same time period households in the top decile of the income distribution slightly increased participation 91.7% to 92.1%.[15] The mean value of direct and indirect holdings at the bottom half of the income distribution moved slightly downward from $53,800 in 2007 to $53,600 in 2013.[15] In the top decile, mean value of all holdings fell from $982,000 to $969,300 in the same time.[15] The mean value of all stock holdings across the entire income distribution is valued at $269,900 as of 2013.[15]

Participation by head of household race and gender[12]

The racial composition of stock market ownership shows households headed by whites are nearly four and six times as likely to directly own stocks than households headed by blacks and Hispanics respectively. As of 2011 the national rate of direct participation was 19.6%, for white households the participation rate was 24.5%, for black households it was 6.4% and for Hispanic households it was 4.3% Indirect participation in the form of 401k ownership shows a similar pattern with a national participation rate of 42.1%, a rate of 46.4% for white households, 31.7% for black households, and 25.8% for Hispanic households. Households headed by married couples participated at rates above the national averages with 25.6% participating directly and 53.4% participating indirectly through a retirement account. 14.7% of households headed by men participated in the market directly and 33.4% owned stock through a retirement account. 12.6% of female headed households directly owned stock and 28.7% owned stock indirectly.

Determinants and possible explanations of stock market participation

In a 2002 paper Anntte Vissing-Jorgensen from the University of Chicago attempts to explain disproportionate rates of participation along wealth and income groups as a function of fixed costs associated with investing. Her research concludes that a fixed cost of $200 per year is sufficient to explain why nearly half of all U.S. households do not participate in the market.[16] Participation rates have been shown to strongly correlate with education levels, promoting the hypothesis that information and transaction costs of market participation are better absorbed by more educated households. Behavioral economists Harrison Hong, Jeffrey Kubik and Jeremy Stein suggest that sociability and participation rates of communities have a statistically significant impact on an individual’s decision to participate in the market. Their research indicates that social individuals living in states with higher than average participation rates are 5% more likely to participate than individuals that do not share those characteristics.[17] This phenomena also explained in cost terms. Knowledge of market functioning diffuses through communities and consequently lowers transaction costs associated with investing.

History

In 12th-century France, the courretiers de change were concerned with managing and regulating the debts of agricultural communities on behalf of the banks. Because these men also traded with debts, they could be called the first brokers. A common misbelief is that in late 13th century Bruges commodity traders gathered inside the house of a man called Van der Beurze, and in 1409 they became the "Brugse Beurse", institutionalizing what had been, until then, an informal meeting, but actually, the family Van der Beurze had a building in Antwerp where those gatherings occurred;[18] the Van der Beurze had Antwerp, as most of the merchants of that period, as their primary place for trading. The idea quickly spread around Flanders and neighboring countries and "Beurzen" soon opened in Ghent and Rotterdam.

In the middle of the 13th century, Venetian bankers began to trade in government securities. In 1351 the Venetian government outlawed spreading rumors intended to lower the price of government funds. Bankers in Pisa, Verona, Genoa and Florence also began trading in government securities during the 14th century. This was only possible because these were independent city-states not ruled by a duke but a council of influential citizens. Italian companies were also the first to issue shares. Companies in England and the Low Countries followed in the 16th century.

The Dutch East India Company (founded in the year of 1602) was the first joint-stock company to get a fixed capital stock and as a result, continuous trade in company stock occurred on the Amsterdam Exchange. Soon thereafter, a lively trade in various derivatives, among which options and repos, emerged on the Amsterdam market. Dutch traders also pioneered short selling – a practice which was banned by the Dutch authorities as early as 1610.[19]

There are now stock markets in virtually every developed and most developing economies, with the world's largest markets being in the United States, United Kingdom, Japan, India, China, Canada, Germany (Frankfurt Stock Exchange), France, South Korea and the Netherlands.[20]

Importance

Function and purpose

The stock market is one of the most important ways for companies to raise money, along with debt markets which are generally more imposing but do not trade publicly.[21] This allows businesses to be publicly traded, and raise additional financial capital for expansion by selling shares of ownership of the company in a public market. The liquidity that an exchange affords the investors enables their holders to quickly and easily sell securities. This is an attractive feature of investing in stocks, compared to other less liquid investments such as property and other immoveable assets. Some companies actively increase liquidity by trading in their own shares.[22][23]

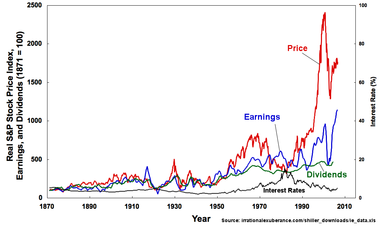

History has shown that the price of stocks and other assets is an important part of the dynamics of economic activity, and can influence or be an indicator of social mood. An economy where the stock market is on the rise is considered to be an up-and-coming economy. The stock market is often considered the primary indicator of a country's economic strength and development.[24]

Rising share prices, for instance, tend to be associated with increased business investment and vice versa. Share prices also affect the wealth of households and their consumption. Therefore, central banks tend to keep an eye on the control and behavior of the stock market and, in general, on the smooth operation of financial system functions. Financial stability is the raison d'être of central banks.[25]

Exchanges also act as the clearinghouse for each transaction, meaning that they collect and deliver the shares, and guarantee payment to the seller of a security. This eliminates the risk to an individual buyer or seller that the counterparty could default on the transaction.[26]

The smooth functioning of all these activities facilitates economic growth in that lower costs and enterprise risks promote the production of goods and services as well as possibly employment. In this way the financial system is assumed to contribute to increased prosperity, although some controversy exists as to whether the optimal financial system is bank-based or market-based.[27][citation needed]

Recent events such as the Global Financial Crisis have prompted a heightened degree of scrutiny of the impact of the structure of stock markets[28][29] (called market microstructure), in particular to the stability of the financial system and the transmission of systemic risk.[30]

Relation to the modern financial system

The financial system in most western countries has undergone a remarkable transformation. One feature of this development is disintermediation. A portion of the funds involved in saving and financing, flows directly to the financial markets instead of being routed via the traditional bank lending and deposit operations. The general public interest in investing in the stock market, either directly or through mutual funds, has been an important component of this process.

Statistics show that in recent decades, shares have made up an increasingly large proportion of households' financial assets in many countries. In the 1970s, in Sweden, deposit accounts and other very liquid assets with little risk made up almost 60 percent of households' financial wealth, compared to less than 20 percent in the 2000s. The major part of this adjustment is that financial portfolios have gone directly to shares but a good deal now takes the form of various kinds of institutional investment for groups of individuals, e.g., pension funds, mutual funds, hedge funds, insurance investment of premiums, etc.

The trend towards forms of saving with a higher risk has been accentuated by new rules for most funds and insurance, permitting a higher proportion of shares to bonds. Similar tendencies are to be found in other developed countries. In all developed economic systems, such as the European Union, the United States, Japan and other developed nations, the trend has been the same: saving has moved away from traditional (government insured) "bank deposits to more risky securities of one sort or another".

A second transformation is the move to electronic trading to replace human trading of listed securities.[29]

United States S&P stock market returns

(assumes 2% annual dividend)

| Years to December 31, 2012 | Average Annual Return %[citation needed][clarification needed] |

Average Compounded Annual Return %[citation needed][clarification needed] |

|---|---|---|

| 1 | 15.5 | 15.5 |

| 3 | 10.9 | 11.6 |

| 5 | 4.3 | 10.1 |

| 10 | 8.8 | 7.3 |

| 15 | 6.5 | 5.9 |

| 20 | 10.0 | 6.4 |

| 30 | 11.6 | 7.3 |

| 40 | 10.1 | 8.0 |

| 50 | 10.0 | 8.1 |

| 60 | 10.5 | 8.2 |

Compared to Other Asset Classes Over the long term, investing in a well diversified portfolio of stocks such as an S&P 500 Index outperforms other investment vehicles such as Treasury Bills and Bonds, with the S&P 500 having a geometric annual average of 9.55% from 1928-2013.[31]

Behavior of the stock market

From experience it is known that investors may 'temporarily' move financial prices away from their long term aggregate price 'trends'. Over-reactions may occur—so that excessive optimism (euphoria) may drive prices unduly high or excessive pessimism may drive prices unduly low. Economists continue to debate whether financial markets are 'generally' efficient.[32]

According to one interpretation of the efficient-market hypothesis (EMH), only changes in fundamental factors, such as the outlook for margins, profits or dividends, ought to affect share prices beyond the short term, where random 'noise' in the system may prevail. (But this largely theoretic academic viewpoint—known as 'hard' EMH—also predicts that little or no trading should take place, contrary to fact, since prices are already at or near equilibrium, having priced in all public knowledge.) The 'hard' efficient-market hypothesis is sorely tested and does not explain the cause of events such as the crash in 1987, when the Dow Jones Industrial Average plummeted 22.6 percent—the largest-ever one-day fall in the United States.[33]

This event demonstrated that share prices can fall dramatically even though, to this day, it is impossible to fix a generally agreed upon definite cause: a thorough search failed to detect any 'reasonable' development that might have accounted for the crash. (But note that such events are predicted to occur strictly by chance, although very rarely.) It seems also to be the case more generally that many price movements (beyond that which are predicted to occur 'randomly') are not occasioned by new information; a study of the fifty largest one-day share price movements in the United States in the post-war period seems to confirm this.[33]

A 'soft' EMH has emerged which does not require that prices remain at or near equilibrium, but only that market participants not be able to systematically profit from any momentary market 'inefficiencies'. Moreover, while EMH predicts that all price movement (in the absence of change in fundamental information) is random (i.e., non-trending), many studies have shown a marked tendency for the stock market to trend over time periods of weeks or longer. Various explanations for such large and apparently non-random price movements have been promulgated. For instance, some research has shown that changes in estimated risk, and the use of certain strategies, such as stop-loss limits and value at risk limits, theoretically could cause financial markets to overreact. But the best explanation seems to be that the distribution of stock market prices is non-Gaussian (in which case EMH, in any of its current forms, would not be strictly applicable).[34][35]

Other research has shown that psychological factors may result in exaggerated (statistically anomalous) stock price movements (contrary to EMH which assumes such behaviors 'cancel out'). Psychological research has demonstrated that people are predisposed to 'seeing' patterns, and often will perceive a pattern in what is, in fact, just noise. (Something like seeing familiar shapes in clouds or ink blots.) In the present context this means that a succession of good news items about a company may lead investors to overreact positively (unjustifiably driving the price up). A period of good returns also boosts the investors' self-confidence, reducing their (psychological) risk threshold.[36]

Another phenomenon—also from psychology—that works against an objective assessment is group thinking. As social animals, it is not easy to stick to an opinion that differs markedly from that of a majority of the group. An example with which one may be familiar is the reluctance to enter a restaurant that is empty; people generally prefer to have their opinion validated by those of others in the group.

In one paper the authors draw an analogy with gambling.[37] In normal times the market behaves like a game of roulette; the probabilities are known and largely independent of the investment decisions of the different players. In times of market stress, however, the game becomes more like poker (herding behavior takes over). The players now must give heavy weight to the psychology of other investors and how they are likely to react psychologically.

The stock market, as with any other business, is quite unforgiving of amateurs. Inexperienced investors rarely get the assistance and support they need. In the period running up to the 1987 crash, less than 1 percent of the analyst's recommendations had been to sell (and even during the 2000–2002 bear market, the average did not rise above 5%). In the run up to 2000, the media amplified the general euphoria, with reports of rapidly rising share prices and the notion that large sums of money could be quickly earned in the so-called new economy stock market. (And later amplified the gloom which descended during the 2000–2002 bear market, so that by summer of 2002, predictions of a DOW average below 5000 were quite common)

On the other hand, Stock markets play an essential role in growing industries that ultimately affect the economy through transferring available funds from units that have excess funds (savings) to those who are suffering from funds deficit (borrowings) (Padhi and Naik, 2012). In other words, capital markets facilitate funds movement between the above-mentioned units. This process leads to the enhancement of available financial resources which in turn affects the economic growth positively. Moreover, both of economic and financial theories argue that stocks‘ prices are affected by the performance of main macroeconomic variables.[citation needed]

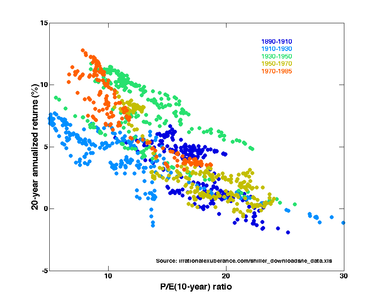

Many different academic researchers have stated companies with low P/E ratios and smaller sized companies have a tendency to outperform the market. Research carried out states mid-sized companies outperform large cap companies and smaller companies have even higher returns historically.

Irrational behavior

Sometimes, the market seems to react irrationally to economic or financial news, even if that news is likely to have no real effect on the fundamental value of securities itself.[38] But, this may be more apparent than real, since often such news has been anticipated, and a counterreaction may occur if the news is better (or worse) than expected. Therefore, the stock market may be swayed in either direction by press releases, rumors, euphoria and mass panic.

Over the short-term, stocks and other securities can be battered or buoyed by any number of fast market-changing events, making the stock market behavior difficult to predict. Emotions can drive prices up and down, people are generally not as rational as they think, and the reasons for buying and selling are generally obscure[citation needed]. Behaviorists argue that investors often behave 'irrationally' when making investment decisions thereby incorrectly pricing securities, which causes market inefficiencies, which, in turn, are opportunities to make money.[39] However, the whole notion of EMH is that these non-rational reactions to information cancel out, leaving the prices of stocks rationally determined.

The Dow Jones Industrial Average biggest gain in one day was 936.42 points or 11 percent, this occurred on October 13, 2008.[40]

Crashes

A stock market crash is often defined as a sharp dip in share prices of stocks listed on the stock exchanges. In parallel with various economic factors, a reason for stock market crashes is also due to panic and investing public's loss of confidence. Often, stock market crashes end speculative economic bubbles.

There have been famous stock market crashes that have ended in the loss of billions of dollars and wealth destruction on a massive scale. An increasing number of people are involved in the stock market, especially since the social security and retirement plans are being increasingly privatized and linked to stocks and bonds and other elements of the market. There have been a number of famous stock market crashes like the Wall Street Crash of 1929, the stock market crash of 1973–4, the Black Monday of 1987, the Dot-com bubble of 2000, and the Stock Market Crash of 2008.

One of the most famous stock market crashes started October 24, 1929 on Black Thursday. The Dow Jones Industrial Average lost 50% during this stock market crash. It was the beginning of the Great Depression. Another famous crash took place on October 19, 1987 – Black Monday. The crash began in Hong Kong and quickly spread around the world.

By the end of October, stock markets in Hong Kong had fallen 45.5%, Australia 41.8%, Spain 31%, the United Kingdom 26.4%, the United States 22.68%, and Canada 22.5%. Black Monday itself was the largest one-day percentage decline in stock market history – the Dow Jones fell by 22.6% in a day. The names "Black Monday" and "Black Tuesday" are also used for October 28–29, 1929, which followed Terrible Thursday—the starting day of the stock market crash in 1929.

The crash in 1987 raised some puzzles – main news and events did not predict the catastrophe and visible reasons for the collapse were not identified. This event raised questions about many important assumptions of modern economics, namely, the theory of rational human conduct, the theory of market equilibrium and the efficient-market hypothesis. For some time after the crash, trading in stock exchanges worldwide was halted, since the exchange computers did not perform well owing to enormous quantity of trades being received at one time. This halt in trading allowed the Federal Reserve System and central banks of other countries to take measures to control the spreading of worldwide financial crisis. In the United States the SEC introduced several new measures of control into the stock market in an attempt to prevent a re-occurrence of the events of Black Monday.

Since the early 1990s, many of the largest exchanges have adopted electronic 'matching engines' to bring together buyers and sellers, replacing the open outcry system. Electronic trading now accounts for the majority of trading in many developed countries. Computer systems were upgraded in the stock exchanges to handle larger trading volumes in a more accurate and controlled manner. The SEC modified the margin requirements in an attempt to lower the volatility of common stocks, stock options and the futures market. The New York Stock Exchange and the Chicago Mercantile Exchange introduced the concept of a circuit breaker. The circuit breaker halts trading if the Dow declines a prescribed number of points for a prescribed amount of time. In February 2012, the Investment Industry Regulatory Organization of Canada (IIROC) introduced single-stock circuit breakers.[42]

- New York Stock Exchange (NYSE) circuit breakers[43]

| % drop | time of drop | close trading for |

|---|---|---|

| 10 | before 2 pm | one hour halt |

| 10 | 2 pm – 2:30 pm | half-hour halt |

| 10 | after 2:30 pm | market stays open |

| 20 | before 1 pm | halt for two hours |

| 20 | 1 pm – 2 pm | halt for one hour |

| 20 | after 2 pm | close for the day |

| 30 | any time during day | close for the day |

Stock market prediction

Tobias Preis and his colleagues Helen Susannah Moat and H. Eugene Stanley introduced a method to identify online precursors for stock market moves, using trading strategies based on search volume data provided by Google Trends.[44] Their analysis of Google search volume for 98 terms of varying financial relevance, published in Scientific Reports,[45] suggests that increases in search volume for financially relevant search terms tend to precede large losses in financial markets.[46][47][48][49][50][51]

Stock market index

The movements of the prices in a market or section of a market are captured in price indices called stock market indices, of which there are many, e.g., the S&P, the FTSE and the Euronext indices. Such indices are usually market capitalization weighted, with the weights reflecting the contribution of the stock to the index. The constituents of the index are reviewed frequently to include/exclude stocks in order to reflect the changing business environment.

Derivative instruments

Financial innovation has brought many new financial instruments whose pay-offs or values depend on the prices of stocks. Some examples are exchange-traded funds (ETFs), stock index and stock options, equity swaps, single-stock futures, and stock index futures. These last two may be traded on futures exchanges (which are distinct from stock exchanges—their history traces back to commodity futures exchanges), or traded over-the-counter. As all of these products are only derived from stocks, they are sometimes considered to be traded in a (hypothetical) derivatives market, rather than the (hypothetical) stock market.

Leveraged strategies

Stock that a trader does not actually own may be traded using short selling; margin buying may be used to purchase stock with borrowed funds; or, derivatives may be used to control large blocks of stocks for a much smaller amount of money than would be required by outright purchase or sales.

Short selling

In short selling, the trader borrows stock (usually from his brokerage which holds its clients' shares or its own shares on account to lend to short sellers) then sells it on the market, betting that the price will fall. The trader eventually buys back the stock, making money if the price fell in the meantime and losing money if it rose. Exiting a short position by buying back the stock is called "covering." This strategy may also be used by unscrupulous traders in illiquid or thinly traded markets to artificially lower the price of a stock. Hence most markets either prevent short selling or place restrictions on when and how a short sale can occur. The practice of naked shorting is illegal in most (but not all) stock markets.

Margin buying

In margin buying, the trader borrows money (at interest) to buy a stock and hopes for it to rise. Most industrialized countries have regulations that require that if the borrowing is based on collateral from other stocks the trader owns outright, it can be a maximum of a certain percentage of those other stocks' value. In the United States, the margin requirements have been 50% for many years (that is, if you want to make a $1000 investment, you need to put up $500, and there is often a maintenance margin below the $500).

A margin call is made if the total value of the investor's account cannot support the loss of the trade. (Upon a decline in the value of the margined securities additional funds may be required to maintain the account's equity, and with or without notice the margined security or any others within the account may be sold by the brokerage to protect its loan position. The investor is responsible for any shortfall following such forced sales.)

Regulation of margin requirements (by the Federal Reserve) was implemented after the Crash of 1929. Before that, speculators typically only needed to put up as little as 10 percent (or even less) of the total investment represented by the stocks purchased. Other rules may include the prohibition of free-riding: putting in an order to buy stocks without paying initially (there is normally a three-day grace period for delivery of the stock), but then selling them (before the three-days are up) and using part of the proceeds to make the original payment (assuming that the value of the stocks has not declined in the interim).

New issuance

Global issuance of equity and equity-related instruments totaled $505 billion in 2004, a 29.8% increase over the $389 billion raised in 2003. Initial public offerings (IPOs) by US issuers increased 221% with 233 offerings that raised $45 billion, and IPOs in Europe, Middle East and Africa (EMEA) increased by 333%, from $9 billion to $39 billion.

ASX Share Market Game

ASX Share Market Game is a platform for Australian school students and beginners to learn about trading stocks. The game is a free service hosted on ASX (Australian Securities Exchange) website.[52] Each year more than 70,000 students enroll in the game. For the vast majority, this is an introduction to stock market investing. Students once enrolled, are given $50,000 virtual money and can buy and sell up to 20 times a day. The game runs for 10 weeks. This time frame turns the game into a lottery, encouraging people to take huge risks with their virtual $50,000, breaking the laws of commonsense investing in the process.[53] Many similar programs are found in secondary educational institutions across the world.

Investment strategies

This section's tone or style may not reflect the encyclopedic tone used on Wikipedia. (November 2011) |

One of the many things people always want to know about the stock market is, "How do I make money investing?" There are many different approaches; two basic methods are classified by either fundamental analysis or technical analysis. Fundamental analysis refers to analyzing companies by their financial statements found in SEC filings, business trends, general economic conditions, etc. Technical analysis studies price actions in markets through the use of charts and quantitative techniques to attempt to forecast price trends regardless of the company's financial prospects. One example of a technical strategy is the Trend following method, used by John W. Henry and Ed Seykota, which uses price patterns, utilizes strict money management and is also rooted in risk control and diversification.

Additionally, many choose to invest via the index method. In this method, one holds a weighted or unweighted portfolio consisting of the entire stock market or some segment of the stock market (such as the S&P 500 or Wilshire 5000). The principal aim of this strategy is to maximize diversification, minimize taxes from too frequent trading, and ride the general trend of the stock market (which, in the U.S., has averaged nearly 10% per year, compounded annually, since World War II).

Taxation

According to much national or state legislation, a large array of fiscal obligations are taxed for capital gains. Taxes are charged by the state over the transactions, dividends and capital gains on the stock market, in particular in the stock exchanges. However, these fiscal obligations may vary from jurisdictions to jurisdictions because, among other reasons, it could be assumed that taxation is already incorporated into the stock price through the different taxes companies pay to the state, or that tax free stock market operations are useful to boost economic growth.[citation needed]

See also

- Balance sheet

- Dead cat bounce

- List of market opening times

- List of recessions

- List of stock exchanges

- List of stock market indices

- Modeling and analysis of financial markets

- NASDAQ-100

- Securities regulation in the United States

- Slippage (finance)

- Stock market bubble

- Stock market cycles

- Stock market data systems

- Mr. Market

- Stock fund

- CNX Nifty

- Nifty Fifty

References

- ^ "Mark J Perry" (January 18, 2013). "World stock market capitalization closes year at $54.6 trillion". www.aei.org. American Enterprise Institute. Retrieved August 26, 2015.

- ^ WFE 2012 Market Highlights

- ^ "Global Stock Rally: World Market Cap Reached Record High In March | Seeking Alpha".

- ^ "All of the World's Stock Exchanges by Size". February 16, 2016. Retrieved September 29, 2016.

- ^ "IBM Investor relations - FAQ | On what stock exchanges is IBM listed ?". IBM.

- ^ Ortega, Edgar; Yalman, Onaran (December 4, 2006). "UBS, Goldman Threaten NYSE, Nasdaq With Rival Stock Markets". Bloomberg.com. Retrieved May 31, 2011.

- ^ Mamudi, Sam (June 13, 2014). "Dark Pools Take Larger Share of Trades Amid SEC Scrutiny". Bloomberg.

- ^ Financial regulators probe dark pools Financial Times

- ^ Amedeo De Cesari, Susanne Espenlaub, Arif Khurshed, and Michael Simkovic, The Effects of Ownership and Stock Liquidity on the Timing of Repurchase Transactions (October 2010). Paolo Baffi Centre Research Paper No. 2011-100.

- ^ "Market capitalization of listed domestic companies (current US$) | Data | Graph". data.worldbank.org. Retrieved December 17, 2015.

- ^ a b Statistical Abstract of the United States: 1995 (Report). United States Census Bureau. September 1995. p. 513. Retrieved December 17, 2015.

- ^ a b c d e Statistical Abstract of the United States: 2012 (Report). United States Census Bureau. August 2011. p. 730. Retrieved December 17, 2015.

- ^ Rydqvist, Kristian; Spizman, Joshua; Strebulaev, Ilya A. (October 1, 2011). "Government Policy and Ownership of Financial Assets".

{{cite journal}}: Cite journal requires|journal=(help) - ^ a b Changes in U.S. Family Finances from 2007 to 2010: Evidence from the Survey of Consumer Finances (PDF) (Report). Federal Reserve Board of Governors. June 2012. p. 24. Retrieved December 17, 2015.

- ^ a b c d Changes in U.S. Family Finances from 2010 to 2013: Evidence from the Survey of Consumer Finances (PDF) (Report). Federal Reserve Board of Governors. September 2014. p. 20. Retrieved December 17, 2015.

- ^ Vissing-Jorgensen, Annette (April 1, 2002). "Towards an Explanation of Household Portfolio Choice Heterogeneity: Nonfinancial Income and Participation Cost Structures".

{{cite journal}}: Cite journal requires|journal=(help) - ^ Hong, Harrison (February 2004). "Social Interaction and Stock-Market Participation" (PDF). The Journal of Finance. Retrieved December 17, 2015.

- ^ "16de eeuwse traditionele bak- en zandsteenarchitectuur Oude Beurs Antwerpen 1 (centrum) / Antwerp foto". Belgiumview.com. Retrieved March 5, 2010.

- ^ "PhD thesis 'The world's first stock exchange'". Retrieved October 1, 2011.

- ^ "World Federation of Exchanges Monthly YTD Data". World-exchanges.org. Retrieved May 31, 2011.

- ^ "Equity market > Size relative to bond markets and bank assets". eurocapitalmarkets.org. Retrieved August 14, 2015.

- ^ Cesari, Amedeo De; Espenlaub, Susanne; Khurshed, Arif; Simkovic, Michael (2010). "The Effects of Ownership and Stock Liquidity on the Timing of Repurchase Transactions". Paolo Baffi Centre Research Paper No. 2011-100. SSRN 1884171.

- ^ Simkovic, Michael (2009). "The Effect of Enhanced Disclosure on Open Market Stock Repurchases". Berkeley Business Law Journal. 6 (1). SSRN 1117303.

- ^ Mahipal Singh, 2011, ISBN 9788182055193, April 2011

- ^ "Financial Stability Frameworks and the Role of Central Banks: Lessons from the Crisis" (PDF).

- ^ "Clearinghouse Definition & Example | Investing Answers". www.investinganswers.com. Retrieved October 20, 2015.

- ^ http://wdi.umich.edu/files/publications/workingpapers/wp442.pdf

- ^ http://www.iosco.org/library/pubdocs/pdf/IOSCOPD354.pdf

- ^ a b "Future of computer trading". www.gov.uk. Retrieved August 14, 2015.

- ^ K Alexander, R Dhumale, J Eatwell, Global governance of financial systems: the international regulation of systemic risk, Oxford University Press2006

- ^ "Historical Returns". nyu.edu. Retrieved August 14, 2015.

- ^ "Trading Psychology". Online Trading Academy. Retrieved June 10, 2015.

- ^ a b Cutler, D. Poterba, J. & Summers, L. (1991). "Speculative dynamics". Review of Economic Studies. 58 (3): 520–546. doi:10.2307/2298010.

{{cite journal}}: CS1 maint: multiple names: authors list (link) - ^ Mandelbrot, Benoit; Hudson, Richard L. (2006). The Misbehavior of Markets: A Fractal View of Financial Turbulence, annot. ed. Basic Books. ISBN 0-465-04357-7.

{{cite book}}: Unknown parameter|lastauthoramp=ignored (|name-list-style=suggested) (help) - ^ Taleb, Nassim Nicholas (2008). Fooled by Randomness: The Hidden Role of Chance in Life and in the Markets, 2nd ed. Random House. ISBN 1-4000-6793-6.

- ^ Tversky, A.; Kahneman, D. (1974). "Judgement under uncertainty: heuristics and biases". Science. 185 (4157): 1124–1131. doi:10.1126/science.185.4157.1124. PMID 17835457.

{{cite journal}}: Unknown parameter|lastauthoramp=ignored (|name-list-style=suggested) (help) - ^ Morris, Stephen; Shin, Hyun Song (1999). "Risk management with interdependent choice". Oxford Review of Economic Policy. 15 (3): 52–62. doi:10.1093/oxrep/15.3.52.

- ^ David Fabian (February 9, 2014). "Why The Market Doesn't Care Where You Think It Should Go". Seeking Alpha. Retrieved August 14, 2015.

- ^ Sergey Perminov, Trendocracy and Stock Market Manipulations (2008, ISBN 978-1-4357-5244-3).

- ^ "News Headlines". Cnbc.com. October 13, 2008. Retrieved March 5, 2010.

- ^ a b c Shiller, Robert (2005). Irrational Exuberance (2d ed.). Princeton University Press. ISBN 0-691-12335-7.

- ^ Completing the Circuit: Canadian Regulation, FIXGlobal, February 2012

- ^ Chris Farrell. "Where are the circuit breakers". Retrieved October 16, 2008.

- ^ Philip Ball (April 26, 2013). "Counting Google searches predicts market movements". Nature. Retrieved August 28, 2013.

- ^ Tobias Preis, Helen Susannah Moat and H. Eugene Stanley (2013). "Quantifying Trading Behavior in Financial Markets Using Google Trends". Scientific Reports. 3: 1684. doi:10.1038/srep01684. PMC 3635219. PMID 23619126.

- ^ Nick Bilton (April 26, 2013). "Google Search Terms Can Predict Stock Market, Study Finds". New York Times. Retrieved August 28, 2013.

- ^ Christopher Matthews (April 26, 2013). "Trouble With Your Investment Portfolio? Google It!". TIME Magazine. Retrieved August 28, 2013.

- ^ Bernhard Warner (April 25, 2013). "'Big Data' Researchers Turn to Google to Beat the Markets". Bloomberg Businessweek. Retrieved August 28, 2013.

- ^ Hamish McRae (April 28, 2013). "Hamish McRae: Need a valuable handle on investor sentiment? Google it". The Independent. London. Retrieved August 28, 2013.

- ^ Richard Waters (April 25, 2013). "Google search proves to be new word in stock market prediction". Financial Times. Retrieved August 28, 2013.

- ^ Jason Palmer (April 25, 2013). "Google searches predict market moves". BBC. Retrieved August 28, 2013.

- ^ "Sharemarket Game". asx.com.au. Retrieved August 14, 2015.

- ^ "How to win the ASX Sharemarket gamt". Intelligent Investor (Company). August 2014. Retrieved March 15, 2015.

Further reading

- Hamilton, W. P. (1922). The Stock Market Baraometer. New York: John Wiley & Sons Inc (1998 reprint). ISBN 0-471-24764-2.

- Preda, Alex (2009). Framing Finance: The Boundaries of Markets and Modern Capitalism. University of Chicago Press. ISBN 978-0-226-67932-7.

- Siegel, Jeremy J. (2008). "Stock Market". In David R. Henderson (ed.) (ed.). Concise Encyclopedia of Economics (2nd ed.). Indianapolis: Library of Economics and Liberty. ISBN 978-0865976658. OCLC 237794267.

{{cite encyclopedia}}:|editor=has generic name (help)