Inside Job (2010 film): Difference between revisions

Undid revision 479533696 by 109.128.121.40 (talk) revert unsourced commentary |

|||

| Line 34: | Line 34: | ||

=== Part III: The Crisis === |

=== Part III: The Crisis === |

||

The market for CDOs collapsed and investment banks were left with hundreds of billions of dollars in loans, CDOs and real estate they could not unload. The [[Great Recession]] began in November 2007, and in March 2008, Bear Stearns ran out of cash. In September, the federal government took over [[Fannie Mae]] and [[Freddie Mac]], which had been on the brink of collapse. Two days later, Lehman Brothers collapsed. These entities all had AA or AAA ratings within days of being bailed out. Merrill Lynch, on the edge of collapse, was acquired by [[Bank of America]]. [[Henry Paulson]] and [[Timothy Geithner]] decided that Lehman must go into bankruptcy, which resulted in a collapse of the [[commercial paper]] market. On September 17, the insolvent AIG was taken over by the government. The next day, Paulson and Fed chairman [[Ben Bernanke]] asked Congress for $700 billion to bail out the banks. The global financial system became paralyzed. On October 3, 2008, President [[George W. Bush|Bush]] signed the [[Troubled Asset Relief Program]], but global stock markets continued to fall. Layoffs and foreclosures continued with unemployment rising to 10% in the U.S. and the [[European Union]]. By December 2008, [[GM]] and [[Chrysler]] also faced bankruptcy. Foreclosures in the U.S. reached unprecedented levels. |

The market for CDOs collapsed and investment banks were left with hundreds of billions of dollars in loans, CDOs and real estate they could not unload. The [[Great Recession]] began in November 2007, and in March 2008, Bear Stearns ran out of cash. In September, the federal government took over [[Fannie Mae]] and [[Freddie Mac]], which had been on the brink of collapse. It should be noted that at the direction of the federal govenment Fannie and Freddie had loosened credit requirements and akded the large banks to do the same. This in turn created a situation where millions of individuals became eligible for mortgages they should never have been placed in. Two days later, Lehman Brothers collapsed. These entities all had AA or AAA ratings within days of being bailed out. Merrill Lynch, on the edge of collapse, was acquired by [[Bank of America]]. [[Henry Paulson]] and [[Timothy Geithner]] decided that Lehman must go into bankruptcy, which resulted in a collapse of the [[commercial paper]] market. On September 17, the insolvent AIG was taken over by the government. The next day, Paulson and Fed chairman [[Ben Bernanke]] asked Congress for $700 billion to bail out the banks. The global financial system became paralyzed. On October 3, 2008, President [[George W. Bush|Bush]] signed the [[Troubled Asset Relief Program]], but global stock markets continued to fall. Layoffs and foreclosures continued with unemployment rising to 10% in the U.S. and the [[European Union]]. By December 2008, [[GM]] and [[Chrysler]] also faced bankruptcy. Foreclosures in the U.S. reached unprecedented levels. |

||

=== Part IV: Accountability === |

=== Part IV: Accountability === |

||

Revision as of 19:55, 8 March 2012

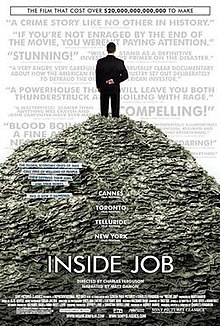

| Inside Job | |

|---|---|

Theatrical release poster | |

| Directed by | Charles Ferguson |

| Produced by | Audrey Marrs Charles Ferguson |

| Narrated by | Matt Damon |

| Cinematography | Svetlana Cvetko Kalyanee Mam |

| Edited by | Chad Beck Adam Bolt |

| Music by | Alex Heffes |

| Distributed by | Sony Pictures Classics |

Release dates |

|

Running time | 108 minutes |

| Country | Template:Film US |

| Language | English |

| Budget | $2 million[1] |

| Box office | $7,871,522[2] |

Inside Job is a 2010 documentary film about the late-2000s financial crisis directed by Charles H. Ferguson. The film is described by Ferguson as being about "the systemic corruption of the United States by the financial services industry and the consequences of that systemic corruption."[3] In five parts, the film explores how changes in the policy environment and banking practices helped create the financial crisis. Inside Job was well received by film critics who praised its pacing, research, and exposition of complex material.

The film was screened at the 2010 Cannes Film Festival in May and won the 2010 Academy Award for Best Documentary Feature.

Synopsis

The documentary is in five parts. It begins with a look at how Iceland was highly deregulated in 2000 and its banks were privatized. When Lehman Brothers went bankrupt and AIG collapsed on September 15, 2008, Iceland and the rest of the world went into a global recession.

Part I: How We Got Here

The American financial industry was regulated from 1940 to 1980, followed by a long period of deregulation. At the end of the 1980s, a savings and loan crisis cost taxpayers about $124 billion. In the late 1990s, the financial sector had consolidated into a few giant firms. In 2001, the Internet Stock Bubble burst because investment banks promoted Internet companies that they knew would fail, resulting in $5 trillion in investor losses. In the 1990s, derivatives became popular in the industry and added instability. Efforts to regulate derivatives were thwarted by the Commodity Futures Modernization Act of 2000, backed by several key officials. In the 2000s, the industry was dominated by five investment banks (Goldman Sachs, Morgan Stanley, Lehman Brothers, Merrill Lynch, and Bear Stearns), two financial conglomerates (Citigroup, JPMorgan Chase), three securitized insurance companies (AIG, MBIA, AMBAC) and three rating agencies (Moody’s, Standard & Poors, Fitch). Investment banks bundled mortgages with other loans and debts into collateralized debt obligations (CDOs), which they sold to investors. Rating agencies gave many CDOs AAA ratings. Subprime loans led to predatory lending. Many home owners were given loans they could never repay.

Part II: The Bubble (2001-2007)

During the housing boom, the ratio of money borrowed by an investment bank versus the bank's own assets reached unprecedented levels. The credit default swap (CDS), was akin to an insurance policy. Speculators could buy CDSs to bet against CDOs they did not own. Numerous CDOs were backed by subprime mortgages. Goldman-Sachs sold more than $3 billion worth of CDOs in the first half of 2006. Goldman also bet against the low-value CDOs, telling investors they were high-quality. The three biggest ratings agencies contributed to the problem. AAA-rated instruments rocketed from a mere handful in 2000 to over 4,000 in 2006.

Part III: The Crisis

The market for CDOs collapsed and investment banks were left with hundreds of billions of dollars in loans, CDOs and real estate they could not unload. The Great Recession began in November 2007, and in March 2008, Bear Stearns ran out of cash. In September, the federal government took over Fannie Mae and Freddie Mac, which had been on the brink of collapse. It should be noted that at the direction of the federal govenment Fannie and Freddie had loosened credit requirements and akded the large banks to do the same. This in turn created a situation where millions of individuals became eligible for mortgages they should never have been placed in. Two days later, Lehman Brothers collapsed. These entities all had AA or AAA ratings within days of being bailed out. Merrill Lynch, on the edge of collapse, was acquired by Bank of America. Henry Paulson and Timothy Geithner decided that Lehman must go into bankruptcy, which resulted in a collapse of the commercial paper market. On September 17, the insolvent AIG was taken over by the government. The next day, Paulson and Fed chairman Ben Bernanke asked Congress for $700 billion to bail out the banks. The global financial system became paralyzed. On October 3, 2008, President Bush signed the Troubled Asset Relief Program, but global stock markets continued to fall. Layoffs and foreclosures continued with unemployment rising to 10% in the U.S. and the European Union. By December 2008, GM and Chrysler also faced bankruptcy. Foreclosures in the U.S. reached unprecedented levels.

Part IV: Accountability

Top executives of the insolvent companies walked away with their personal fortunes intact. The executives had hand-picked their boards of directors, which handed out billions in bonuses after the government bailout. The major banks grew in power and doubled anti-reform efforts. Academic economists had for decades advocated for deregulation and helped shape U.S. policy. They still opposed reform after the 2008 crisis. Some of the consulting firms involved were the Analysis Group, Charles River Associates, Compass Lexecon, and the Law and Economics Consulting Group (LECG). Many of these economists had conflicts of interest, collecting sums as consultants to companies and other groups involved in the financial crisis.[4]

Part V: Where We Are Now

Tens of thousands of U.S. factory workers were laid off. The new Obama administration’s financial reforms have been weak, and there was no significant proposed regulation of the practices of ratings agencies, lobbyists, and executive compensation. Geithner became Treasury Secretary. Feldstein, Tyson and Summers were all top economic advisors to Obama. Bernanke was reappointed Fed Chair. European nations have imposed strict regulations on bank compensation, but the U.S. has resisted them.

Production

Inside Job was produced by Audrey Marrs with Jeffrey Lurie and Christina Weiss Lurie as executive producers. The directors of photography were Svetlana Cvetko and Kalyanee Mam.

Ferguson, who is personal friends with economist Nouriel Roubini and financial writer Charles R. Morris (both of whom warned about impending economic disturbances), was concerned about instability in the financial sector since well before the crash in autumn 2008. Shortly after Lehman Brothers collapsed in September 2008, Ferguson decided to focus on this crisis in his next documentary. After a few weeks of deliberation, he approached Sony Pictures Classics who agreed to provide about half of the $2 million production budget. After the project was approved, about six months of exhaustive research began. Filming and interviewing started in spring of 2009.

The film starts in Iceland, where a similar process of financial deregulation with a subsequent asset bubble was followed by a banking collapse. The aerial footage of landscapes were not shot by Ferguson but licensed from the Icelandic documentary Draumalandið, whose co-director Andri Magnason was also interviewed.

The main narrative then moves to the United States, where introductory montage shows the credits, some of the interviewees and aerial pictures of New York City. This segment, half-seriously described by Ferguson as a rock video, features Peter Gabriel's hit song "Big Time" prominently. Ferguson described the licensing process for the title in the director's commentary as an "agonizing experience" and estimated that the licensing fee amounted to five percent of the total budget (about $100,000).

Alex Heffes composed the music and Matt Damon narrated the film. The song "Congratulations" by MGMT is featured during the ending credits.

Reception

The film received positive reviews, earning a 97% rating on the Rotten Tomatoes website.[5] Roger Ebert described the film as "an angry, well-argued documentary about how the American financial industry set out deliberately to defraud the ordinary American investor."[6] A.O. Scott of the New York Times wrote that "Mr. Ferguson has summoned the scourging moral force of a pulpit-shaking sermon. That he delivers it with rigor, restraint and good humor makes his case all the more devastating."[7] Logan Hill of New York magazine's Vulture, characterized the film as a "rip-snorting, indignant documentary," noting the "effective presence" of narrator Matt Damon.[8]

The film was selected for a special screening at the 2010 Cannes Film Festival. A reviewer writing from Cannes characterized the film as "a complex story told exceedingly well and with a great deal of unalloyed anger."[9]

The conservative political magazine The American Spectator criticized the film as intellectually incoherent and inaccurate, accusing Ferguson of blaming "a lot of bad people [with] economic and political views to the right of [his]."[10]

Accolades

| Award | Date of ceremony | Category | Recipient(s) | Result |

|---|---|---|---|---|

| Academy Awards[11] | February 27, 2011 | Best Documentary Feature | Charles H. Ferguson and Audrey Marrs | Won |

| Chicago Film Critics Association Awards[12] | December 20, 2010 | Best Documentary Feature | Nominated | |

| Directors Guild of America Awards[13] | December 29, 2010 | Best Documentary | Won | |

| Gotham Independent Film Awards[14] | November 29, 2010 | Best Documentary | Nominated | |

| Las Vegas Film Critics Society Awards[15] | December 16, 2010 | Best Documentary Film | Nominated | |

| Online Film Critics Society Awards[16] | January 3, 2011 | Best Documentary | Nominated | |

| Phoenix Film Critics Society Awards[17] | December 28, 2010 | Best Documentary Feature | Nominated | |

| Writers Guild of America Awards[18] | February 5, 2011 | Best Documentary Screenplay | Won |

See also

- Late-2000s financial crisis

- Bailout of the U.S. financial system

- Bailout of Wall Street

- DISCLOSE Act

- Wall Street reform

- Let's Make Money

- Capitalism: A Love Story

- Debtocracy

References

- ^ (March 2, 2011). "Adam Lashinsky interviews Charles Ferguson regarding 'Inside Job' at the Commonwealth Club". YouTube. Retrieved March 22, 2011.

- ^ "Inside Job (2010)". Box Office Mojo. IMDb. Retrieved October 25, 2011.

- ^ (February 25, 2011). "Charlie Rose Interviews Charles Ferguson on his documentary 'Inside Job'". YouTube. Retrieved October 25, 2011.

- ^ Casselman, Ben (January 9, 2012). "Economists Set Rules on Ethics". Wall Street Journal. Retrieved January 9, 2012.

- ^ "Inside Job". Rotten Tomatoes. Flixter. Retrieved January 26, 2011.

- ^ Ebert, Roger (October 13, 2010). "Inside Job". Chicago Sun-Times. Retrieved October 24, 2011.

- ^ Scott, A.O. (October 7, 2010). "Who Maimed the Economy, and How". The New York Times. Retrieved October 24, 2011.

- ^ Hill, Logan (May 16, 2010). "Is Matt Damon's Narration of a Cannes Doc a Sign that Hollywood is Abandoning Obama?". New York Magazine. Retrieved May 16, 2010.

- ^ Dargis, Manohla (May 16, 2010). "At Cannes, the Economy Is On-Screen". The New York Times. Retrieved May 17, 2010.

- ^ Bowman, James (November 3, 2010). "Inside Job". The American Spectator. Retrieved July 23, 2011.

- ^ "Nominees for the 83rd Academy Awards". Academy of Motion Picture Arts and Sciences. Retrieved January 26, 2011.

- ^ "Chicago Film Critics Awards - 2008-2010". Chicago Film Critics Association. Retrieved January 26, 2010.

- ^ Kilday, Gregg. "DGA 2011 Award Winners Announced". The Hollywood Reporter. Retrieved January 29, 2011.

- ^ Adams, Ryan (October 18, 2010). "2010 Gotham Independent Film Award Nominations". AwardsDaily.com. Retrieved January 26, 2011.

Adams, Ryan (November 29, 2010). "20th Anniversary Gotham Independent Award winners". AwardsDaily.com. Retrieved January 26, 2011. - ^ Adams, Ryan (December 16, 2010). "The Las Vegas Film Critics Society Awards". AwardsDaily.com. Retrieved January 26, 2011.

- ^ Stone, Sarah (December 27, 2010). "Online Film Critics Society Nominations". AwardsDaily.com. Retrieved January 26, 2011.

Stone, Sarah (January 3, 2011). "The Social Network Named Best Film by the Online Film Critics". AwardsDaily.com. Retrieved January 26, 2011. - ^ "Phoenix Film Critics Name The King's Speech Best Film of 2010". Phoenix Film Critics Society. Retrieved January 26, 2011.

- ^ "Writer's Guild of America 2011 Awards Winners". Writers Guild of America. Retrieved February 6, 2011.