Banknote

| Part of a series on |

| Numismatics the study of currency |

|---|

|

A banknote (often known as a bill or simply a note) is a kind of negotiable instrument, a promissory note made by a bank payable to the bearer on demand, used as money, and in many jurisdictions is legal tender. Along with coins, banknotes make up the cash or bearer forms of all modern money. With the exception of non-circulating high-value or precious metal commemorative issues, coins are generally used for lower valued monetary units, while banknotes are used for higher values.

Advantages of Banknotes

Originally, precious and semi-precious metals were formed into coins and were used to negotiate and settle trades. Banknotes offer an alternative bearer form of money, but the advantages and disadvantages between the two forms of bearer money are complex and so in different circumstances the overall advantage can lie with either form.

The costs of using bearer money include:

- Manufacturing or issue costs. Coins are produced by industrial manufacturing methods that process the precious or semi-precious metals, and require additions of alloy for hardness and wear resistance. By contrast bank notes are printed paper (or polymer), and typically have a lower cost of issue, especially in larger denominations, compared to coin of the same value.

- Wear costs. Coins wear and lose mass over their economic life, and eventually are scrapped. Banknotes do not lose economic value by wear, since, even if they are in poor condition, they are still a legally valid claim on the issuing bank. However, banks of issue do have to pay the cost of replacing banknotes in poor condition.

- Opportunity cost of capital. Coins have economic value and are a form of non-financial capital, however they do not pay interest. Banknotes have economic value but are a form of financial capital, a loan to the issuing bank. The issuing bank invests its assets primarily in interest bearing loans and securities, but also needs to hold metallic reserves. Thus banknotes indirectly earn interest through the investments made by the issuing bank, but coins do not pay interest to anyone. This foregone interest is the most important economic advantage of banknotes over coins.

- Cost of transport. Coins can be expensive to transport for high value transactions, but banknotes can be issued in large denominations that are lighter than the equivalent value in coins.

- Cost of acceptance. Coins can be checked for authenticity by weighing and other forms of examination and testing. These costs can be significant, but good quality coin design and manufacturing can help reduce these costs. Banknotes also have an acceptance cost, the costs of checking the banknote's security features and confirming acceptability of the issuing bank.

The different advantages and disadvantages between coins and banknotes imply that there may be an ongoing role for both forms of bearer money, each being used where its advantages outweigh its disadvantages.

Convertibility

The ability to exchange a note for some other kind of value is called "convertibility". For example a US silver certificate was "payable in silver on demand" from the treasury until 1965. If a note is payable on demand for a fixed unit, it is said to be fully convertible to that unit. Limited convertibility occurs when there are restrictions in the time, place, manner or amount of exchange.

A common misconception is that a bank note that is inconvertible is necessarily unbacked (so-called "fiat money"). Most of the confusion centers around the failure to distinguish between two types of convertibility:

- Physical convertibility, where a unit of currency (a dollar) can be exchanged at the issuing bank for a given physical amount of something, and

- Financial convertibility, where a dollar can be exchanged at the issuing bank for a dollar's worth of the bank's assets.

The importance of financial convertibility can be seen by imagining that people in a community one day find themselves with more paper currency than they wish to hold — for example, when the main shopping season has ended. If the paper currency is physically convertible (for one ounce of silver, let us suppose), people will return the unwanted paper currency to the bank in exchange for silver, but the bank could head off this demand for silver by selling some of its own bonds to the public in exchange for its own paper currency. For example, if the community has 100 units of unwanted paper money, and if people intend to redeem the unwanted 100 units for silver at the bank, the bank could simply sell 100 units worth of bonds or other assets in exchange for 100 units of its own paper currency. This will soak up the unwanted paper and head off people's desire to redeem the 100 units for silver.

Thus, by conducting this type of open market operation — selling bonds when there is excess currency and buying bonds when there is too little — the bank can maintain the value of the paper currency at one ounce of silver without ever redeeming any paper currency for silver. In fact, this is essentially what all modern central banks do, and the fact that their currencies might be physically inconvertible is made irrelevant by the maintenance of financial convertibility. Note that financial convertibility cannot be maintained unless the bank has sufficient assets to back the currency it has issued. Thus, it is an illusion that any physically inconvertible currency is necessarily also unbacked.

History

Paper money originated in two forms: drafts, which are receipts for value held on account, and "bills", which were issued with a promise to convert at a later date.

Money is based on the coming to pre-eminence of some commodity as payment. The oldest monetary basis was for agricultural capital: cattle and grain. In Ancient Mesopotamia, drafts were issued against stored grain as a unit of account. A "drachma" was a weight of grain. Japan's feudal system was based on rice per year – koku.

At the same time, legal codes enforced the payment for injury in a standardized form, usually in precious metals. The development of money then comes from the role of agricultural capital and precious metals having a privileged place in the economy.

Such drafts were used for giro systems of banking as early as Ptolemaic Egypt in the first century BC.

The perception of banknotes as money has evolved over time. Originally, money was based on precious metals. Banknotes were seen as essentially an I.O.U. or promissory note: a promise to pay someone money, but not actual money. As banknotes became more widely used, they became more accepted as equivalent to precious metal. With the gradual removal of precious metals from the monetary system, banknotes evolved to represent fiat money.

Generally, a central bank or treasury is solely responsible within a state or currency union for the issue of banknotes. Historically, many different banks or institutions may have issued banknotes in a country. By virtue of the complex constitutional setup in the United Kingdom, two of the union's four constituent countries (Scotland and Northern Ireland) continue to print their own banknotes for domestic circulation, with the UK's central bank (the Bank of England) printing notes which are legal tender in England and Wales, and are also usable as money in the rest of the UK.

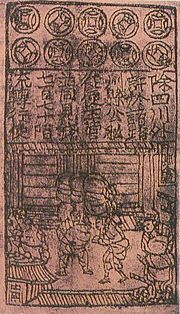

First banknotes in the world

The use of paper money as a circulating medium is intimately related to shortages of metal for coins. In ancient China coins were circular with a rectangular hole in the middle. Several coins could be strung together on a rope. Merchants in China, if they became rich enough, found that their strings of coins were too heavy to carry around easily. To solve this problem, coins were often left with a trustworthy person, and the merchant was given a slip of paper recording how much money he had with that person. If he showed the paper to that person he could regain his money. Eventually from this paper money "jiaozi" originated. In the 600s there were local issues of paper currency in China and by 960 the Song Dynasty, short of copper for striking coins, issued the first generally circulating notes. A note is a promise to redeem later for some other object of value, usually specie. The issue of credit notes is often for a limited duration, and at some discount to the promised amount later. The jiaozi nevertheless did not replace coins in Song Dynasty; the paper money was used alongside the coins. The successive Yuan Dynasty was the first dynasty in China to use paper currency completely as the circulating medium. The original notes in Yuan Dynasty were restricted in area and duration as in Song Dynasty, but in the later course of the dynasty, facing massive shortages of specie to fund their ruling in China, began printing paper money without restrictions on duration. By 1455, in an effort to rein in economic expansion and end hyperinflation, the new Ming Dynasty ended paper money, and closed much of Chinese trade.

Banknotes in Europe

In Europe the first paper money consisted of paper 'coins' issued in Protestant Leyden (today, Leiden) in the Netherlands during the Spanish siege of 1574. Over 5000 of the estimated 14,000 residents of Leyden died, mostly due to starvation. Even leather (often used to create emergency currency) was boiled and used to feed the people. So to create currency, the residents took covers and paper from hymnals and church missives and created paper planchets, which were struck using the same dies that were previously used to mint coins.

The first proper European banknotes were issued by Stockholms Banco, a predecessor of the Bank of Sweden, in 1660, although the bank ran out of coins to redeem its notes in 1664 and ceased operating in that year.

Banknotes in the Americas

Emergency paper money hand-written on playing cards was used in French Canada from 1685.

In the early 1690s, the Massachusetts Bay Colony was the first of the colonies to issue the permanently circulating banknotes. The use of fixed denominations and printed banknotes came into use in the 18th century.

In the United States, public acceptance of banknotes in replacement of precious metals was hastened in part by Executive Order 6102. This order carried the threat of a maximum $10,000 fine and a maximum of ten years in prison for anyone who kept more than $100 of gold in preference to banknotes. Similar measures were taken worldwide[citation needed], with similar results.

Materials used for banknotes

Paper banknotes

Most banknotes are made of dense 80 to 90 grams per square meter cotton paper (see also paper), sometimes mixed with linen, abaca, or other textile fibres. Generally, the paper used is different from ordinary paper: it is much more resilient, resists wear and tear, and also does not contain the usual agents that make ordinary paper glow slightly under ultraviolet light.

Early Chinese banknotes were printed on paper made of mulberry bark and this fibre is used in Japanese banknote paper today.

Unlike most printing and writing paper, banknote paper is impregnated with polyvinyl alcohol or gelatin to give it extra strength.

Most banknotes are made using the mould made process in which a watermark and thread is incorporated during the paper forming process.

The thread is a simple looking security component found in most banknotes. It is however often rather complex in construction comprising fluorescent, magnetic, metallic and micro print elements. By combining it with watermarking technology the thread can be made to surface periodically on one side only. This is known as windowed thread and further increases the counterfeit resistance of the banknote paper. This process was invented by Portals, part of the De La Rue group in the UK.

Recently this company has introduced many new features to the banknote world including Cornerstone, Platinum and Optiks, all registered trade marks of De La Rue. Cornerstone uses watermarking to reduce the number of corner folds by strengthening this part of the note. Platinum is a special coating to reduce the dirt picked up by banknotes. Optiks is a new thread based security feature that creates a plastic window in the paper which is very hard to copy.

Counterfeiting and security measures on paper banknotes

The ease with which paper money can be created, by both legitimate authorities and counterfeiters, has led both to a temptation in times of crisis such as war or revolution to produce paper money which was not supported by precious metal or other goods, thus leading to hyperinflation and a loss of faith in the value of paper money, e.g. the Continental Currency produced by the Continental Congress during the American Revolution, the Assignats produced during the French Revolution, the paper currency produced by the Confederate States of America and the Individual States of the Confederate States of America, the financing of the First World War by the Central Powers (by 1922 1 gold Austro-Hungarian krone of 1914 was worth 14,400 paper Kronen), the devaluation of the Yugoslav Dinar in the 1990s, etc. Banknotes may also be overprinted to reflect political changes that occur faster than new currency can be printed.

In 1988, Austria produced the 5000 Schilling banknote (Mozart), which is the first foil application (Kinegram) to a paper banknote in the history of banknote printing. The application of optical features is now in common use throughout the world.

Many countries' banknotes now have embedded holograms.

Polymer banknotes

In 1983, Costa Rica and Haiti issued the first Tyvek and the Isle of Man issued the first Bradvek polymer (or plastic) banknotes; these were printed by the American Banknote Company and developed by DuPont. In 1988, after significant research and development by the Commonwealth Scientific and Industrial Research Organisation (CSIRO) and the Reserve Bank of Australia, Australia produced the first polymer banknote made from biaxially-oriented polypropylene (plastic), and in 1996 became the first country to have a full set of circulating polymer banknotes of all denominations. Since then, other countries to adopt circulating polymer banknotes include Bangladesh, Brazil, Brunei, Chile, Indonesia, Malaysia, Mexico, Nepal, New Zealand, Papua and New Guinea, Romania, Singapore, the Solomon Islands, Sri Lanka, Thailand, Viet Nam, Western Samoa and Zambia, with other countries issuing commemorative polymer notes, including China, Kuwait, the Northern Bank of Northern Ireland, Taiwan. Other countries indicating plans to issue polymer banknotes include Nigeria. In 2005, Bulgaria issued the world's first hybrid paper-polymer banknote.

Polymer banknotes were developed to improve durability and prevent counterfeiting through incorporated security features, such as optically variable devices that are extremely difficult to reproduce.

The uptake of polymer banknotes has however been comparatively slow with an estimated 1.5% of the Worlds banknotes now using this material. Problems with print durability and the very bulky nature of creased polymer notes rank high amongst the problems limiting polymer uptake. Some countries such as Thailand have reverted to paper after testing polymer notes in circulation.

Other materials

Over the years, a number of materials other than paper have been used to print banknotes. This includes various textiles, including silk, and materials such as leather.

Silk and other fibers have been commonly used in the manufacture of various banknote papers, intended to provide both additional durability and security. Crane and Company patented banknote paper with embedded silk threads in 1844 and has supplied paper to the United States Treasury since 1879. Banknotes printed on pure silk "paper" include "emergency money" (Notgeld) issues from a number of German towns in 1923 during a period of fiscal crisis and hyperinflation. Most notoriously, Bielefeld produced a number of silk, leather, velvet, linen and wood issues, and although these issues were produced primarily for collectors, rather than for circulation, they are in demand by collectors. Banknotes printed on cloth include a number of Communist Revolutionary issues in China from areas such as Xinjiang, or Sinkiang, in the United Islamic Republic of East Turkestan in 1933. Emergency money was also printed in 1902 on khaki shirt fabric during the Boer War.

Leather banknotes (or coins) were issued in a number of sieges, as well as in other times of emergency. During the Russian administration of Alaska, banknotes were printed on sealskin. A number of 19th century issues are known in Germanic and Baltic states, including the towns of Dorpat, Pernau, Reval, Werro and Woisek. In addition to the Bielefeld issues, other German leather Notgeld from 1923 is known from Borna, Osterwieck, Paderborn and Pößneck.

Other issues from 1923 were printed on wood, which was also used in Canada in 1763-1764 during Pontiac's War, and by the Hudson's Bay Company. In 1848, in Bohemia, wooden checkerboard pieces were used as money.

Even playing cards were used for currency in France in the early 19th Century, and in French Canada from 1685 until 1757, in the Isle of Man in the beginning of the 19th Century, and again in Germany after World War I.

Vending machines and banknotes

People are not the only economic actors who are required to accept banknotes. In the late twentieth century machines were designed to recognize banknotes of the smaller values long after they were designed to recognize coins distinct from slugs. This capability has become inescapable in economies where inflation has not been followed by introduction of progressively larger coin denominations (such as the United States, where several attempts to introduce dollar coins in general circulation have largely failed). The existing infrastructure of such machines presents one of the difficulties in changing the design of these banknotes to make them less counterfeitable, that is, by adding additional features so easily discernable by people that they would immediately reject banknotes of inferior quality, for every machine in the country would have to be updated.

Destruction

Banknotes have a limited lifetime, after which they are collected for destruction, usually recycling or shredding. A banknote is removed from the money supply by banks or other financial institutions due to everyday wear and tear from its handling. Banknote bundles are passed through a sorting machine that determines whether a particular note needs to be shredded, or are removed from the supply chain by a human inspector if they are deemed unfit for continued use – for example, if they are mutilated or torn. Counterfeit banknotes are destroyed unless they are needed for evidentiary or forensic purposes.

Contaminated banknotes are also decommissioned. A Canadian government report indicates:

Types of contaminants include: notes found on a corpse, stagnant water, contaminated by human or animal body fluids such as urine, feces, vomit, infectious blood, fine hazardous powders from detonated explosives, dye pack and/or drugs...[1]

These are removed from circulation primarily to prevent the spread of diseases.

Paper money collecting as a hobby

Banknote collecting, or Notaphily, is a rapidly growing area of numismatics. Although generally not as widespread as coin and stamp collecting, the hobby is increasingly expanding. Prior to the 1990s, currency collecting was a relatively small adjunct to coin collecting, but the practice of currency auctions, combined with larger public awareness of paper money have caused a boom in interest and values of rare banknotes.

In the 1950s, Robert Friedberg published the landmark book Paper Money of the United States. Friedberg devised an organizing number system of all types of U.S. banknotes; the system is widely accepted among collectors and dealers to this day, and the volume has been regularly updated.

Another pioneer of cataloguing banknotes was Albert Pick, a well-known German notaphilist (born 15 May 1922 in Cologne) who published a number of catalogs of European paper money, and, in 1974, the first Standard Catalog of World Paper Money. His collection of over 180,000 banknotes was eventually housed at the Bavarian Mortgages and Exchange Bank (Bayerischen Hypotheken- und Wechselbank, now HypoVereinsbank). This catalog underwent several incarnations, and currently is published as a three volume group. Volume I, called Specialized Issues, includes notes issued by local authorities, which circulated in a limited area. Volume II called General Issues covers notes issued on a national scope, dated 1368 through 1960. Volume III covers Modern Issues dated 1960 to present. Each of the volumes is updated regularly, with Volume III now updated every year, Volumes I and II every 3 or so years. While Pick no longer edits the catalogs (since 1994 the honor has passed to George S. Cuhaj), the catalogs are still commonly referred to as 'Pick Catalogs' and dealers and collectors alike refer to banknotes by their 'Pick number.' Current issues of the three volumes include:

- Standard Catalog of World Paper Money: Specialized Issues (10th Ed. Vol. 1) by George S. Cuhaj. Paperback - 1200 pages. (January 2006).

- Standard Catalog of World Paper Money: General Issues to 1368-1960 (11th Ed. Vol. 2) by George S. Cuhaj (Editor). (December 2006).

- Standard Catalog of World Paper Money: Modern Issues, 1961-present (12th Ed. Vol. 3) by George S. Cuhaj. (May 2006).

For years, the mode of collecting banknotes was through a handful of mail order dealers who issued price lists and catalogs. In the early 1990s, it became more common for rare notes to be sold at various coin and currency shows via auction. The illustrated catalogs and "event nature" of the auction practice seemed to fuel a sharp rise in overall awareness of paper money in the numismatic community. Entire advanced collections are often sold at one time, and to this day single auctions can generate well in excess of $1 million dollars in gross sales. Today, eBay has surpassed auctions in terms of highest volume of sales of banknotes. However, as of 2005, rare banknotes still sell for much less than comparable rare coins. There is wide consensus in the paper money collecting arena that this disparity is diminishing as paper money prices continue to rise at a rapid rate.

There are many different organisations and societies around the world for the hobby including the International Bank Note Society (IBNS).

See also

- List of articles in the category "banknotes"

- Polymer banknotes

- Gallery of banknotes

- Hell Bank Notes — bank notes used in afterworld

- List of motifs on banknotes

- Banking

- Used notes

- Counterfeiting

- Banknote counter

- Federal Reserve Note

- United States Note

- Postal currency

References

- ^ Trichur, Rita (2007-09-28). "Bankers wipe out dirty money". Toronto Star. Retrieved 2007-09-28.

{{cite web}}: Check date values in:|date=(help)

External links

- World Banknote Galleries

- Ron Wise's Banknote World

- worldpapermoney.org Online World Paper Money Museum

- Numismondo - World Paper Money Picture Catalog

- Gallery describing who/what is featured on modern world banknotes

- World Banknotes issued since 1961 illustrated catalogue

- World Banknotes Gallery with description

- Polymer Plastic Banknote Collections

- Banknote News Sites

- Banknote Collector Organisations

- Banknote Printers

- US Bureau of Engraving and Printing

- Note Printing Australia

- Casa da Moeda do Brasil

- Brazilian Central Bank

- American Bank Note Company

- Canadian Bank Note Company Ltd

- Giesecke & Devrient

- Thomas de la Rue

- François-Charles Oberthur

- Other