Economic sanctions

| Part of a series on |

| World trade |

|---|

|

Economic sanctions or embargoes are commercial and financial penalties applied by states or institutions against states, groups, or individuals.[1][2] Economic sanctions are a form of coercion that attempts to get an actor to change its behavior through disruption in economic exchange. Sanctions can be intended to compel (an attempt to change an actor's behavior) or deterrence (an attempt to stop an actor from certain actions).[3][4][5]

Sanctions can target an entire country or they can be more narrowly targeted at individuals or groups; this latter form of sanctions are sometimes called "smart sanctions".[6] Prominent forms of economic sanctions include trade barriers, asset freezes, travel bans, arms embargoes, and restrictions on financial transactions.

The efficacy of sanctions in achieving intended goals is a subject of debate.[1][2][3][4][6][7] Scholars have also considered the policy externalities of sanctions.[7][8] The humanitarian consequences of country-wide sanctions have been a subject of controversy.[9] As a consequence, since the mid-1990s, United Nations Security Council (UNSC) sanctions have tended to target individuals and entities, in contrast to the country-wide sanctions of earlier decades.[10]

History of sanctions

[edit]One of the most comprehensive attempts at an embargo occurred during the Napoleonic Wars of 1803–1815. Aiming to cripple the United Kingdom economically, Emperor Napoleon I of France in 1806 promulgated the Continental System—which forbade European nations from trading with the UK. In practice the French Empire could not completely enforce the embargo, which proved as harmful (if not more so) to the continental nations involved as to the British.[11] By the time of the Hague Conventions of 1899 and 1907, diplomats and legal scholars regularly discussed using coordinated economic pressure to enforce international law. This idea was also included in reform proposals by Latin American and Chinese international lawyers in the years leading up to World War I.[12]

World War I and the Interwar period

[edit]Sanctions in the form of blockades were prominent during World War I.[13] Debates about implementing sanctions through international organizations, such as the League of Nations, became prominent after the end of World War I.[14] Leaders saw sanctions as a viable alternative to war.[15]

The League Covenant permitted the use of sanctions in five cases:[16]

- When Article 10 of the League Covenant is violated

- In case of war or threat of war (Article 11)

- When a League member does not pay an arbitration award (Article 12)

- When a League member goes to war without submitting the dispute to the League Council or League Assembly (Articles 12–15)

- When a non-member goes to war against a League member (Article 17)

The Abyssinia Crisis in 1935 resulted in League sanctions against Mussolini's Italy under Article 16 of the Covenant. Oil supplies, however, were not stopped, nor the Suez Canal closed to Italy, and the conquest proceeded. The sanctions were lifted in 1936 and Italy left the League in 1937.[17][18][19][20]

In the lead-up to the Japanese attack on Pearl Harbor in 1941, the United States imposed severe trade restrictions on Japan to discourage further Japanese conquests in East Asia.[15]

From World War II onwards

[edit]After World War II, the League was replaced by the more expansive United Nations (UN) in 1945. Throughout the Cold War, the use of sanctions increased gradually.[15] After the end of the Cold War, there was a major increase in economic sanctions.[9]

According to the Global Sanctions Data Base, there have been 1,325 sanctions in the period 1950–2022.[15]

Politics of sanctions

[edit]Economic sanctions are used as a tool of foreign policy by many governments. Economic sanctions are usually imposed by a larger country upon a smaller country for one of two reasons: either the latter is a perceived threat to the security of the former nation or that country treats its citizens unfairly. They can be used as a coercive measure for achieving particular policy goals related to trade or for humanitarian violations. Economic sanctions are used as an alternative weapon instead of going to war to achieve desired outcomes.

The Global Sanctions Data Base categorizes nine objectives of sanctions: "changing policy, destabilizing regimes, resolving territorial conflicts, fighting terrorism, preventing war, ending war, restoring and promoting human rights, restoring and promoting democracy, and other objectives."[15]

Effectiveness of economic sanctions

[edit]According to a study by Neuenkirch and Neumeier, UN economic sanctions had a statistically significant impact on targeted states by reducing their GDP growth by an average of 2.3–3.5% per year—and more than 5% per year in the case of comprehensive UN embargoes—with the negative effects typically persisting for a period of ten years. By contrast, unilateral US sanctions had a considerably smaller impact on GDP growth, restricting it by 0.5–0.9% per year, with an average duration of seven years.[21]

Oryoie, A. R. demonstrates that economic sanctions result in welfare losses across all income groups in Iran, with wealthier groups suffering greater losses compared to poorer groups.[22]

Imposing sanctions on an opponent also affects the economy of the imposing country to a degree. If import restrictions are promulgated, consumers in the imposing country may have restricted choices of goods. If export restrictions are imposed or if sanctions prohibit companies in the imposing country from trading with the target country, the imposing country may lose markets and investment opportunities to competing countries.[23]

Hufbauer, Schott, and Elliot (2008) argue that regime change is the most frequent foreign-policy objective of economic sanctions, accounting for just over 39 percent of cases of their imposition.[24] Hufbauer et al. found that 34 percent of the cases studied were successful.[25] However, when Robert A. Pape examined their study, he found that only 5 of their reported 40 successes were actually effective,[26] reducing the success rate to 4%. In either case, the difficulty and unexpected nuances of measuring the actual success of sanctions in relation to their goals are both increasingly apparent and still under debate. In other words, it is difficult to determine why a regime or country changes (i.e., whether it was the sanction or inherent instability) and doubly so to measure the full political effect of a given action.[27]

Offering an explanation as to why sanctions are still imposed even when they may be marginally effective, British diplomat Jeremy Greenstock suggests sanctions are popular not because they are known to be effective, but because "there is nothing else [to do] between words and military action if you want to bring pressure upon a government".[28] Critics of sanctions like Belgian jurist Marc Bossuyt argue that in nondemocratic regimes, the extent to which this affects political outcomes is contested, because by definition such regimes do not respond as strongly to the popular will.[29]

A strong connection has been found between the effectiveness of sanctions and the size of veto players in a government. Veto players represent individual or collective actors whose agreement is required for a change of the status quo, for example, parties in a coalition, or the legislature's check on presidential powers. When sanctions are imposed on a country, it can try to mitigate them by adjusting its economic policy. The size of the veto players determines how many constraints the government will face when trying to change status quo policies, and the larger the size of the veto players, the more difficult it is to find support for new policies, thus making the sanctions more effective.[30]

Francesco Giumelli writes that the "set of sanctions ... that many observers would be likely to consider the most persuasive (and effective)", namely, UN sanctions against "central bank assets and sovereign wealth funds", are "of all the types of measures applied ... the one least frequently used".[10] Giumelli also distinguishes between sanctions against international terrorists, in which "the nature of the request is not as important as the constraining aspect", and sanctions imposed in connection with "post-conflict scenarios", which should "include flexible demands and the potential for adaptation if the situation changes".[10]

Economic sanctions can be used for achieving domestic and international purposes.[31]

Foreign aid suspensions are typically considered as a type of economic sanctions. Previously mentioned work by Hufbauer, Schott, Elliot, and Oegg is a prominent example.[32] Claas Mertens finds that "suspending aid is more effective than adopting economic sanctions because (1) aid suspensions are economically beneficial for the adopting state, while sanctions are costly, (2) aid suspensions directly affect the targeted government's budget, (3) market forces undermine sanctions but not aid suspensions, and (4) aid suspensions are less likely to spark adverse behavioral reactions. [...] The findings suggest that economic sanctions are less effective than previously thought and that large donor states have a higher chance of achieving political goals through economic coercion."[33]

Criticism

[edit]Sanctions have been criticized on humanitarian grounds, as they negatively impact a nation's economy and can also cause collateral damage on ordinary citizens. Peksen implies that sanctions can degenerate human rights in the target country.[34] Some policy analysts believe that imposing trade restrictions only serves to hurt ordinary people as opposed to government elites,[35][36][37][38] and others have likened the practice to siege warfare.[39][40] The United Nations Security Council (UNSC) has generally refrained from imposing comprehensive sanctions since the mid-1990s, in part due to the controversy over the efficacy and civilian harms attributed to the sanctions against Iraq.[10]

Sanctions can have unintended consequences.[41]

Smart Sanctions

[edit]One of the most popular suggestions to combat the humanitarian issues that arise from sanctions is the concept of "smart sanctions", and a lot of research has been done on this concept also known as targeted sanctions.[42] The term "smart sanctions" refers to measures like asset freezes, travel bans, and arms embargoes that aim to target responsible parties like political leaders and elites with the goal of avoiding causing widespread collateral damage to innocent civilians and neighboring nations.[42]

Though there has been enthusiasm about the concept, as of 2016, the Targeted Sanctions Consortium (TSC) found that targeted sanctions only result in policy goals being met 22% of the time.[43]

Smart Sanctions have also not been totally successful in avoiding civilian harm or unintended consequences.[42] For example, arms embargoes can impact the self-defense efforts of those under attack, aviation bans can affect a nation's transportation sector and the jobs of civilians associated with them, and financial sanctions targeting individuals raise due process issues.[42] One example of smart sanctions in practice can be seen with sanctions imposed by the United States on the Russian Federation following the latter's 2014 annexation of Crimea, which were intended to exert pressure on Russia's financial sector.[44] The sanctions resulted in American credit card companies Visa and MasterCard suspending all transactions of sanctioned Russian banks, effectively canceling the credit cards of ordinary Russian consumers.[44]

Implications for businesses

[edit]There is an importance, especially with relation to financial loss, for companies to be aware of embargoes that apply to their intended export or import destinations.[45] Properly preparing products for trade, sometimes referred to as an embargo check, is a difficult and timely process for both importers and exporters.[46]

There are many steps that must be taken to ensure that a business entity does not accrue unwanted fines, taxes, or other punitive measures.[47] Common examples of embargo checks include referencing embargo lists,[48][49][50] cancelling transactions, and ensuring the validity of a trade entity.[51]

This process can become very complicated, especially for countries with changing embargoes. Before better tools became available, many companies relied on spreadsheets and manual processes to keep track of compliance issues. Today, there are software based solutions that automatically handle sanctions and other complications with trade.[52][53][54]

Examples

[edit]

United States sanctions

[edit]US Embargo Act of 1807

[edit]The United States Embargo of 1807 involved a series of laws passed by the US Congress (1806–1808) during the second term of President Thomas Jefferson.[55] Britain and France were engaged in the War of the Fourth Coalition; the US wanted to remain neutral and to trade with both sides, but both countries objected to American trade with the other.[56] American policy aimed to use the new laws to avoid war and to force both France and Britain to respect American rights.[57] The embargo failed to achieve its aims, and Jefferson repealed the legislation in March 1809.

US embargo of Cuba

[edit]The United States embargo against Cuba began on March 14, 1958, during the overthrow of dictator Fulgencio Batista by Fidel Castro during the Cuban Revolution. At first, the embargo applied only to arms sales; however, it later expanded to include other imports, eventually extending to almost all trade on February 7, 1962.[58] Referred to by Cuba as "el bloqueo" (the blockade),[59] the US embargo on Cuba remains as of 2022[update] one of the longest-standing embargoes in modern history.[60] Few of the United States' allies embraced the embargo, and many have argued it has been ineffective in changing Cuban government behavior.[61] While taking some steps to allow limited economic exchanges with Cuba, American President Barack Obama nevertheless reaffirmed the policy in 2011, stating that without the granting of improved human rights and freedoms by Cuba's current government, the embargo remains "in the national interest of the United States".[62]

Other countries

[edit]Russian sanctions

[edit]Russia has been known to utilize economic sanctions to achieve its political goals. Russia's focus has been primarily on implementing sanctions against the pro-Western governments of former Soviet Union states. The Kremlin's aim is particularly on states that aspire to join the European Union and NATO, such as Ukraine, Moldova, and Georgia.[63] Russia has enacted a law, the Dima Yakovlev Law, that defines sanctions against US citizens involved in "violations of the human rights and freedoms of Russian citizens". It lists US citizens who are banned from entering Russia.[64]

Russia sanctions on Ukraine

[edit]Viktor Yushchenko, the third president of Ukraine who was elected in 2003, lobbied during his term to gain admission to NATO and the EU.[65] Soon after Yushchenko entered office, Russia demanded Kyiv pay the same rate that it charged Western European states. This quadrupled Ukraine's energy bill overnight.[65] Russia subsequently cut off the supply of natural gas in 2006, causing significant harm to the Ukrainian and Russian economies.[66] As the Ukrainian economy began to struggle, Yushchenko's approval ratings dropped significantly; reaching the single digits by the 2010 election; Viktor Yanukovych, who was more supportive of Moscow won the election in 2010 to become the fourth president of Ukraine. After his election, gas prices were reduced substantially.[65]

Russian sanctions on Georgia

[edit]The Rose Revolution in Georgia brought Mikheil Saakashvili to power as the third president of the country. Saakashvili wanted to bring Georgia into NATO and the EU and was a strong supporter of the US-led war in Iraq and Afghanistan.[67] Russia would soon implement a number of different sanctions on Georgia, including natural gas price raises through Gazprom and wider trade sanctions that impacted the Georgian economy, particularly Georgian exports of wine, citrus fruits, and mineral water. In 2006, Russia banned all imports from Georgia which was able to deal a significant blow to the Georgian economy.[67] Russia also expelled nearly 2,300 Georgians who worked within its borders.[67]

United Nations sanctions

[edit]The United Nations issues sanctions by consent of the United Nations Security Council (UNSC) and/or General Assembly in response to major international events, receiving authority to do so under Article 41 of Chapter VII of the United Nations Charter.[68] The nature of these sanctions may vary, and include financial, trade, or weaponry restrictions. Motivations can also vary, ranging from humanitarian and environmental concerns[69] to efforts to halt nuclear proliferation. Over two dozen sanctions measures have been implemented by the United Nations since its founding in 1945.[68]

Most UNSC sanctions since the mid-1990s have targeted individuals and entities rather than entire governments, a change from the comprehensive trade sanctions of earlier decades. For example, the UNSC maintains lists of individuals indicted for crimes or linked to international terrorism, which raises novel legal questions regarding due process. According to a dataset covering the years 1991 to 2013, 95% of UNSC sanction regimes included "sectoral bans" on aviation and/or the import (or export) of arms or raw materials, 75% included "individual/group" sanctions such as asset freezes or restrictions on travel, and just 10% targeted national finances or included measures against central banks, sovereign wealth funds, or foreign investment. The most frequently used UNSC sanction documented in the dataset is an embargo against imported weapons, which applied in 87% of all cases and was directed against non-state actors more often than against governments. Targeted sanctions regimes may contain hundreds of names, a handful, or none at all.[10]

Sanctions on Somalia, 1992

[edit]The UN implemented sanctions against Somalia beginning in April 1992, after the overthrow of the Siad Barre regime in 1991 during the Somali Civil War. UNSC Resolution 751 forbade members to sell, finance, or transfer any military equipment to Somalia.[70]

Sanctions on North Korea, 2006

[edit]The UNSC passed Resolution 1718 in 2006 in response to a nuclear test that the Democratic People's Republic of Korea (DPRK) conducted in violation of the Treaty on Non-Proliferation of Nuclear Weapons. The resolution banned the sale of military and luxury goods and froze government assets.[71] Since then, the UN has passed multiple resolutions subsequently expanding sanctions on North Korea. Resolution 2270 from 2016 placed restrictions on transport personnel and vehicles employed by North Korea while also restricting the sale of natural resources and fuel for aircraft.[72]

The efficacy of such sanctions has been questioned in light of continued nuclear tests by North Korea in the decade following the 2006 resolution. Professor William Brown of Georgetown University argued that "sanctions don't have much of an impact on an economy that has been essentially bankrupt for a generation".[73]

Sanctions on Libya

[edit]On February 26, 2011, the UNSC issued an arms embargo against the Libya through Security Council Resolution 1970 in response to humanitarian abuses occurring in the First Libyan Civil War.[74] The embargo was later extended to mid-2018. Under the embargo, Libya has suffered severe inflation because of increased dependence on the private sector to import goods.[75] The sanctions caused large cuts to health and education, which caused social conditions to decrease. Even though the sanctions were in response to human rights, their effects were limited.[76]

Sanction on the Central African Republic

[edit]In 2013 the UN decreed an arms embargo against the CAR. The arms embargo was established in the context of an intercommunity conflict between the Séléka rebels, with a Muslim majority, and the predominantly Christian militias. to fight back. Raised UN Security Council lifts arms embargo on CAR on August 1, 2024.[77]

Sanctions on apartheid South Africa

[edit]In effort to punish South Africa for its policies of apartheid, the United Nations General Assembly adopted a voluntary international oil-embargo against South Africa on November 20, 1987; that embargo had the support of 130 countries.[78] South Africa, in response, expanded its Sasol production of synthetic crude.[79]

All United Nations sanctions on South Africa ended over the Negotiations to end Apartheid, Resolution 919 and the 1994 South African elections, in which Nelson Mandela was elected as the first post-Apartheid president. When asked in 1993 if economic sanctions had helped end apartheid, Mandela replied "Oh, there is no doubt."[80]

Other multilateral sanctions

[edit]The United States, Britain, the Republic of China and the Netherlands imposed sanctions against Japan in 1940–1941 in response to its expansionism. Deprived of access to vital oil, iron-ore and steel supplies, Japan started planning for military action to seize the resource-rich Dutch East Indies, which required a preemptive attack on Pearl Harbor, triggering the American entry into the Pacific War.[81]

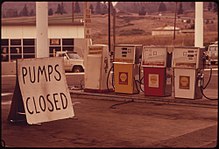

In 1973–1974, OAPEC instigated the 1973 oil crisis through its oil embargo against the United States and other industrialized nations that supported Israel in the Yom Kippur War. The results included a sharp rise in oil prices and in OPEC revenues, an emergency period of energy rationing, a global economic recession, large-scale conservation efforts, and long-lasting shifts toward natural gas, ethanol, nuclear and other alternative energy sources.[82][83] Israel continued to receive Western support, however.

In 2010, the European Union made the decision to sanction Iran due to their involvement in their nuclear program.[84] Theresa Papademetriou states the exact restrictions the EU posed on Iran, "prohibition on the provision of insurance, increased restrictions on and notifications needed for transfers of funds to and from Iran, restrictions on the supply of or traffic in technology and equipment to be used in certain oil and gas fields and prohibition of investment in such fields, expansion of the list of goods and technology whose supply to Iran is either subject to prior authorization or is completely banned and new visa restrictions.” [84] Also in 2010, the UN Council imposed sanctions on Iran due to their involvement in their nuclear program.[85] These sanctions banned Iran from carrying out tests on their nuclear weapons and imposed an embargo on the transfer of weapons into the country.[85] These sanctions resulted in drastic macroeconomic downturns for the Iranian economy including volatility in GDP, increase in unemployment, and increase in inflation.[86]

Current sanctions

[edit]By targeted country

[edit]List of sanctioned countries (the below is not an exhaustive list):[87]

- Afghanistan sanctions by the US[88]

- China by the EU and the US. Sanctions made on arms embargo, enacted in response to the Tiananmen Square protests of 1989[89]

- European Union arms embargo on the People's Republic of China

- Hong Kong, enacted in response to the National Security Law

- Cuban embargoes by the US. It covers arms, consumer goods and financial assets, enacted in 1958[90]

- EU, US, Australia, Canada and Norway by Russia since August 2014 on beef, pork, fruit and vegetable produce, poultry, fish, cheese, milk and dairy items.[91] On August 13, 2015, the embargo was expanded to include Albania, Montenegro, Iceland, and Liechtenstein[92][93]

- Gaza Strip by Israel since 2001, under arms blockade since 2007 due to the large number of illicit arms traffic used to wage war

- Indonesia by Australia on live cattle due to the alleged cruel slaughter methods in Indonesia[94][clarification needed]

- Iran sanctions by the US and its allies, notably by barring nuclear, missile and many military exports to Iran and target investments in: oil, gas and petrochemicals, exports of refined petroleum products, banks, insurance, financial institutions, and shipping.[95] Enacted 1979, increased through the following years and reached its tightest point in 2010.[96] In April 2019 the US threatened to sanction countries that continued to buy oil from Iran after an initial six-month waiver announced in November 2018 had expired.[97] According to the BBC, US sanctions against Iran "have led to a sharp downturn in Iran's economy, pushing the value of its currency to record lows, quadrupling its annual inflation rate, driving away foreign investors, and triggering protests".[98] These sanctions have taken a toll on humanitarian concerns.

- Mali by the UNSC in relation to the spiraling security situation and hostilities in breach of the Agreement on Peace and Reconciliation in 2017[99]

- Myanmar sanctions by the EU. Sanctions were imposed against Myanmar due to the worsening state of democracy and human rights infringements[100]

- Nicaragua by the UK. Sanctions imposed in 2020 to push the government to respect democratic principles and legal institutions[101]

- North Korean sanctions:

- international sanctions imposed on North Korea since the Korean War of 1950–1953 eased under the Sunshine Policy of South Korean President Kim Dae Jung and of US President Bill Clinton.[102] but tightened again in 2010[103]

- by the UN, US and EU on luxury goods (and arms) enacted 2006[104]

- United Nations Security Council Resolution 1718 (2006) – a reaction to the DPRK's claim of a nuclear test

- Russian sanctions:

- by the US. On 2 August 2017, President Donald Trump signed into law the Countering America's Adversaries Through Sanctions Act that grouped together sanctions against Russia, Iran and North Korea[105][106]

- by the EU. In March 2021, Reuters reported that the EU has placed immediate sanctions on both Chechnya and Russia—due to ongoing government sponsored and backed violence against LGBTIQ+ individuals[107]

- international sanctions were also implemented in response to the Russo-Ukrainian War that started in 2014

- international sanctions during the 2022 Russian invasion of Ukraine

- Somali arms embargo by the UN[108] and sanctions by the UK[109]

- Sudan by the US in 1997[110][111]

- Syrian sanctions by the EU and the US on arms and imports of oil[112]

- Turkish Republic of Northern Cyprus embargo by the UN on consumer goods, enacted since 1994[113]

- Venezuelan sanctions by the US and its allies since 2015.[114][115] An arms embargo and the selling of assets were banned due to human rights violations, high government corruption, links with drug cartels and electoral rigging in the 2018 Venezuelan presidential elections.[116][117] Sanctions imposed by Canada since 2017,[118][119][120] and since 2018 by Mexico,[121] Panama[122] and Switzerland[123]

By targeted individuals

[edit]- List of individuals sanctioned during the Venezuelan crisis

- List of people and organizations sanctioned during the Russo-Ukrainian War

- List of people and organizations sanctioned in relation to human rights violations in Belarus

- United Nations sanction imposed by UN Security Council Resolution 1267 in 1999 against all Al-Qaida- and Taliban-associated individuals. The cornerstone of the sanction is a consolidated list of persons maintained by the Security Council. All nations are obliged to freeze bank accounts and other financial instruments controlled by or used for the benefit of anyone on the list.

By sanctioning country or organization

[edit]- Australia currently sanctions 9 countries[124]

- India sanctions

- United Kingdom currently has sanctions on 27 countries[125]

- United Nations has since 1966 established 30 sanctions regimes to countries (such as Southern Rhodesia, South Africa, Yugoslavia and more) and to organizations (such as ISIL, al-Qaida and the Taliban)[126]

- United States sanctions and United States embargoes

- 2002 United States steel tariff was placed by the United States on steel to protect its industry from foreign producers such as China and Russia. The World Trade Organization ruled that the tariffs were illegal. The European Union threatened retaliatory tariffs on a range of US goods that would mainly affect swing states. The US government then removed the steel tariffs in early 2004.

By targeted activity

[edit]- In response to cyber-attacks on April 1, 2015, President Obama issued an Executive Order establishing the first-ever economic sanctions. The Executive Order was intended to impact individuals and entities ("designees") responsible for cyber-attacks that threaten the national security, foreign policy, economic health, or financial stability of the US. Specifically, the Executive Order authorized the Treasury Department to freeze designees— assets.[127] The European Union implemented their first targeted financial sanctions regarding cyber activity in 2020.[128]

- In response to intelligence analysis alleging Russian hacking and interference with the 2016 US elections, President Obama expanded presidential authority to sanction in response to cyber activity that threatens democratic elections.[129] Given that the original order was intended to protect critical infrastructure, it can be argued that the election process should have been included in the original order.

Bilateral trade disputes

[edit]- Vietnam as a result of capitalist influences over the 1990s and having imposed sanctions against Cambodia, is accepting of sanctions disposed with accountability.[clarification needed]

- Brazil introduced sanctions against the US in March 2010. These sanctions were placed because the US government was paying cotton farmers for their products against World Trade Organization rules. The sanctions cover cotton, as well as cars, chewing gum, fruit, and vegetable products.[130] The WTO is currently supervising talks between the states to remove the sanctions.[citation needed]

Former sanctions

[edit]- Comecon nations (CoCom export controls) by the Western bloc

- Georgian and Moldovan import ban by Russia on agricultural products, wine and mineral water (2006–2013)[131]

- Iraqi sanctions by the US (1990–2003)[132]

- Israeli boycott by Arab nations

- Italy by the League of Nations in 1935 after the Italian invasion of Abyssinia

- Japan (ABCD line) by the US, UK, China and the Netherlands in 1940 to discourage militarism

- Libya by the UN in 2011 due to mass killings of Libyan protesters/rebels. Ended in 2012 after the overthrow and execution of Gaddafi

- India by the UK due to nuclear exports restriction[133]

- Macedonia total trade embargo by Greece (1994–1995)

- Mali total embargo by ECOWAS in 2012 to force the junta to return power to the civilian government and re-install the National constitution[134][135]

- Nicaraguan embargo by the US

- North Vietnam (and then unified Vietnam) trade embargo by the US (1964–1994)[136]

- Pakistan by the UK in 2002 on nuclear export restrictions[133]

- Palestinian National Authority sanctions by Israel, US and other countries (2006–2007)

- Qatar by Saudi Arabia, United Arab Emirates, Bahrain, and Egypt due to Qatar's alleged support for terrorist organizations (2017–2021)[137]

- South African sanctions by the international community during Apartheid (see also disinvestment from South Africa)

- Serbia by Kosovo's unilaterally declared government in 2011[138]

- Yugoslavian sanctions by the UN in response to the Bosnian War (1992–2001)[139][140]

- Embargo Act of 1807

See also

[edit]- Arms embargo

- Boycott

- Economic freedom

- Economic warfare

- Globalization

- International political economy

- International sanctions

- Magnitsky legislation

- Political economy

- Specially Designated National

- Trade war

References

[edit]- ^ a b Drezner, Daniel W. (2021). "The United States of Sanctions". Foreign Affairs. ISSN 0015-7120.

- ^ a b Biersteker, Thomas J.; Tourinho, Marcos; Eckert, Sue E. (2016), Tourinho, Marcos; Eckert, Sue E.; Biersteker, Thomas J. (eds.), "The effectiveness of United Nations targeted sanctions", Targeted Sanctions: The Impacts and Effectiveness of United Nations Action, Cambridge University Press, pp. 220–247, ISBN 978-1-107-13421-8

- ^ a b Drezner, Daniel W. (2003). "The Hidden Hand of Economic Coercion". International Organization. 57 (3): 643–659. doi:10.1017/S0020818303573052. ISSN 0020-8183. JSTOR 3594840. S2CID 154827129.

- ^ a b Pape, Robert A. (1997). "Why Economic Sanctions Do Not Work". International Security. 22 (2): 90–136. doi:10.2307/2539368. ISSN 0162-2889. JSTOR 2539368.

- ^ Haidar, J.I., 2017."Sanctions and Exports Deflection: Evidence from Iran," Economic Policy (Oxford University Press), April 2017, Vol. 32(90), pp. 319–355.

- ^ a b Drezner, Daniel W. (2011). "Sanctions Sometimes Smart: Targeted Sanctions in Theory and Practice". International Studies Review. 13 (1): 96–108. doi:10.1111/j.1468-2486.2010.01001.x. ISSN 1521-9488. JSTOR 23016144.

- ^ a b Drezner, Daniel W. (2024). "Global Economic Sanctions". Annual Review of Political Science. 27 (1). doi:10.1146/annurev-polisci-041322-032240. ISSN 1094-2939.

- ^ Farrell, Henry; Newman, Abraham L. (2019). "Weaponized Interdependence: How Global Economic Networks Shape State Coercion". International Security. 44 (1): 42–79. doi:10.1162/isec_a_00351. ISSN 0162-2889. S2CID 198952367.

- ^ a b Drezner, Daniel W. (2022). "How not to sanction" (PDF). International Affairs. 98 (5): 1533–1552. doi:10.1093/ia/iiac065. ISSN 0020-5850. Archived from the original on 2022-12-09.

- ^ a b c d e Giumelli, Francesco (November 2015). "Understanding United Nations targeted sanctions: an empirical analysis". International Affairs. 91 (6). Oxford University Press: 1351–1368. doi:10.1111/1468-2346.12448.

- ^ "Continental System Napoleon British Embargo Napoleon's 1812". Archived from the original on 2011-07-10.

- ^ Mitchell, Ryan Martinez (2022). Recentering the World: China and Transformation of International Law. Cambridge University Press. ISBN 978-1-108-49896-8.

- ^ Mulder, Nicholas (2022). The Economic Weapon: The Rise of Sanctions as a Tool of Modern War. Yale University Press. ISBN 978-0-300-26252-0.

- ^ Potter, Pitman B. (1922). "Sanctions and Guaranties in International Organization". American Political Science Review. 16 (2): 297–303. doi:10.2307/1943965. ISSN 0003-0554. JSTOR 1943965. S2CID 143600305.

- ^ a b c d e Morgan, T. Clifton; Syropoulos, Constantinos; Yotov, Yoto V. (2023). "Economic Sanctions: Evolution, Consequences, and Challenges". Journal of Economic Perspectives. 37 (1): 3–29. doi:10.1257/jep.37.1.3. ISSN 0895-3309. S2CID 256661026.

- ^ Buell, Raymond Leslie (1925). International Relations. H. Holt. pp. 564–565.

- ^ Richard Pankhurst, "The Italo-Ethiopian War and League of Nations Sanctions, 1935–1936." Genève-Afrique/Geneva-Africa 13.2 (1974): 5+.

- ^ George W. Baer, Test Case: Italy, Ethiopia, and the League of Nations (Hoover Institution Press, 1976).

- ^ Gaines Post, Jr, "The Machinery of British Policy in the Ethiopian Crisis." International History Review 1#4 (1979): 522–541.

- ^ G. Bruce Strang, "'The Worst of all Worlds:' Oil Sanctions and Italy's Invasion of Abyssinia, 1935–1936." Diplomacy and Statecraft 19.2 (2008): 210–235.

- ^ Neuenkirch, Matthias; Neumeier, Florian (2015-12-01). "The impact of UN and US economic sanctions on GDP growth" (PDF). European Journal of Political Economy. 40: 110–125. doi:10.1016/j.ejpoleco.2015.09.001. ISSN 0176-2680.

- ^ Oryoie, Ali Reza (2024-06-06). "The impact of international sanctions on income mobility: Evidence from Iran". Review of Development Economics. 28 (4): 1695–1717. doi:10.1111/rode.13123. ISSN 1363-6669.

- ^ Griswold, Daniel (2000-11-27). "Going Alone on Economic Sanctions Hurts U.S. More than Foes". Cato.org. Archived from the original on 2011-09-23. Retrieved 2015-03-30.

- ^

Hufbauer, Gary Clyde; Schott, Jeffrey J.; Elliott, Kimberly Ann; Oegg, Barbara (2008). Economic Sanctions Reconsidered (3 ed.). Washington, DC: Columbia University Press. p. 67. ISBN 9780881324822. Retrieved 2018-05-10.

By far, regime change is the most frequent foreign policy objective of economic sanctions, accounting for 80 out of the 204 observations.

- ^ Hufbauer, Gary Clyde; Schott, Jeffrey J.; Elliott, Kimberly Ann; Oegg, Barbara (2007). Economic Sanctions Reconsidered. Peterson Institute. p. 158. ISBN 978-0-88132-536-2.

- ^

Pape, Robert A. (Summer 1998). "Why Economic Sanctions Still Do Not Work". International Security. 23 (1): 66–77. doi:10.1162/isec.23.1.66. JSTOR 2539263. S2CID 57565095.

I examined the 40 claimed successes and found that only 5 stand up. Eighteen were actually settled by either direct or indirect use of force; in 8 cases there is no evidence that the target state made the demanded concessions; 6 do not qualify as instances of economic sanctions, and 3 are indeterminate. If I am right, then sanctions have succeeded in only 5 of 115 attempts, and thus there is no sound basis for even qualified optimism about the effects of sanctions.

- ^ A Strategic Understanding of UN Economic Sanctions: International Relations, Law, and Development, Golnoosh Hakimdavar, p. 105.

- ^ Marcus, Jonathan (26 July 2010). "Analysis: Do economic sanctions work?". BBC News. Retrieved 2015-03-30.

- ^ Capdevila, Gustavo (18 August 2000). "United Nations: US Riled by Economic Sanctions Report". Institute for Agriculture and Trade Policy. Retrieved 20 June 2020.

- ^ Peksen, Dursun; Jeong, Jin Mun (30 August 2017). "Domestic Institutional Constraints, Veto Players, and Sanction Effectiveness". Journal of Conflict Resolution. 63: 194–217. doi:10.1177/0022002717728105. S2CID 158050636 – via Sage Journals.

- ^ Whang, Taehee (2011-09-01). "Playing to the Home Crowd? Symbolic Use of Economic Sanctions in the United States". International Studies Quarterly. 55 (3). Ingentaconnect.com: 787–801. doi:10.1111/j.1468-2478.2011.00668.x. Retrieved 2015-03-30.

- ^ Hufbauer, Schott, Elliott, and Oegg (2007). Economic Sanctions Reconsidered (3rd ed.). Washington, DC: Peterson Institute for International Economics (PIIE). ISBN 978-0-88132-408-2.

{{cite book}}: CS1 maint: date and year (link) CS1 maint: multiple names: authors list (link) - ^ Mertens, Claas (28 March 2024). "Carrots as Sticks: How Effective Are Foreign Aid Suspensions and Economic Sanctions?". International Studies Quarterly. 68 (2).

- ^ Peksen, Dursen (2009). ""Better or Worse?": The Effect of Economic Sanctions on Human Rights". Journal of Peace Research. 46: 59–77. doi:10.1177/0022343308098404. S2CID 110505923.

- ^ Habibzadeh, Farrokh (September 2018). "Economic sanction: a weapon of mass destruction". The Lancet. 392 (10150): 816–817. doi:10.1016/S0140-6736(18)31944-5. PMID 30139528.

- ^ Mueller, John; Mueller, Karl (1999). "Sanctions of Mass Destruction". Foreign Affairs. 78 (3): 43–53. doi:10.2307/20049279. JSTOR 20049279.

- ^ Emile Yusupoff (2013). "Video: Why Economic Sanctions Don't Work". The Libertarian. Archived from the original on February 27, 2014.

- ^ Hans Köchler (ed.), Economic Sanctions and Development. Vienna: International Progress Organization, 1997. ISBN 3-900704-17-1.

- ^ Gordon, Joy (1999-04-04). "Sanctions as siege warfare". The Nation. 268 (11): 18–22. ISSN 0027-8378. Archived from the original on 2019-12-25. Retrieved 2019-10-16.

- ^ Vengeyi, Obvious (2015). "Sanctions against Zimbabwe: A Comparison with Ancient Near Eastern Sieges". Journal of Gleanings from Academic Outliers. 4 (1): 69–87.

- ^ Lee, Yong Suk (2018). "International isolation and regional inequality: Evidence from sanctions on North Korea". Journal of Urban Economics. 103 (C): 34–51. doi:10.1016/j.jue.2017.11.002. S2CID 158561662.

- ^ a b c d Gordon, Joy. “Smart Sanctions Revisited.” Ethics & International Affairs, vol. 25, no. 3, 2011, pp. 315–335., doi:10.1017/S0892679411000323

- ^ Kanji, Laura. "Moving Targets: The Evolution and Future of Smart Sanctions." Harvard International Review 37.4 (2016): 39–42. ProQuest. Web. 30 Nov. 2023

- ^ a b Ashford, Emma. “Not-So-Smart Sanctions: The Failure of Western Restrictions Against Russia.” Foreign Affairs, vol. 95, no. 1, 2016, pp. 114–123. JSTOR 43946631. Accessed 6 Dec. 2023.

- ^ "Do I need an export licence?". GOV.UK. Retrieved 2021-03-05.

- ^ "SAP Help Portal". help.sap.com. Retrieved 2021-03-05.

- ^ "US Trade Sanctions Are a Trap for the Unwary | Norton Rose Fulbright". www.projectfinance.law. Retrieved 2021-03-05.

- ^ "Office of Foreign Assets Control - Sanctions Programs and Information | U.S. Department of the Treasury". home.treasury.gov. Retrieved 2021-03-05.

- ^ "Perform Sanction, PEPs and Watchlist Verification w/ Lexis Diligence". www.lexisnexis.com. Retrieved 2021-03-05.

- ^ "SAP Help Portal". help.sap.com. Retrieved 2021-03-05.

- ^ "World-Check KYC Screening & Due Diligence". www.refinitiv.com. Retrieved 2021-03-05.

- ^ "Export Control and Sanctions Compliance | About SAP". SAP. Retrieved 2021-03-05.

- ^ "Embargo Check". AnaSys a Bottomline Company. Retrieved 2021-03-05.

- ^ "Embargo Check". Uniserv GmbH - Customer Data Experts. 2021-01-22. Archived from the original on 2022-04-07. Retrieved 2021-03-05.

- ^ University of Houston (2013). "The Embargo of 1807". digitalhistory.uh.edu.

- ^ Aaron Snyder; Jeffrey Herbener (December 15, 2004). "The Embargo of 1807" (PDF). gcc.edu. Pennsylvania: Grove City College. Archived from the original (PDF) on 2013-05-17.

- ^ "Embargo of 1807". monticello.org. April 8, 2013.

- ^ National Archives and Records Administration (15 August 2016). "Proclamation 3447 – Embargo on all trade with Cuba". archives.gov.

- ^ Elizabeth Flock (February 7, 2012). "Cuba trade embargo turns 50: Still no rum or cigars, though some freedom in travel". washingtonpost.com.

- ^ Eric Weiner (October 15, 2007). "Officially Sanctioned: A Guide to the U.S. Blacklist". npr.org.

- ^ Daniel Hanson; Dayne Batten; Harrison Ealey (January 16, 2013). "It's Time For The U.S. To End Its Senseless Embargo Of Cuba". forbes.com.

- ^ Uri Friedman (September 13, 2011). "Obama Quietly Renews U.S. Embargo on Cuba". The Atlantic. Archived from the original on November 13, 2013. Retrieved August 23, 2017.

- ^ A., Conley, Heather (2016). The Kremlin Playbook: Understanding Russian influence in Central and Eastern Europe : a report of the CSIS Europe Program and the CSD Economics Program. Mina, James, Stefanov, Ruslan, Vladimirov, Martin, Center for Strategic and International Studies (Washington, D.C.), Center for the Study of Democracy (Bulgaria). Washington, DC. ISBN 9781442279582. OCLC 969727837.

{{cite book}}: CS1 maint: location missing publisher (link) CS1 maint: multiple names: authors list (link) - ^ A law on sanctions for individuals violating fundamental human rights and freedoms of Russian citizens has been signed Archived 2013-01-02 at the Wayback Machine // Kremlin.ru, 28 December 2012.

- ^ a b c Newnham, Randall (July 2013). "Pipeline Politics: Russian Energy Sanctions and the 2010 Ukrainian Elections". Journal of Eurasian Studies. 4 (2): 115–122. doi:10.1016/j.euras.2013.03.001.

- ^ "Russia-Ukraine 'Gas War' Damages Both Economies". www.worldpress.org. Retrieved 2017-10-27.

- ^ a b c Newnham, Randall E. (2015). "Georgia on my mind? Russian sanctions and the end of the 'Rose Revolution'". Journal of Eurasian Studies. 6 (2): 161–170. doi:10.1016/j.euras.2015.03.008.

- ^ a b Section, United Nations News Service (2016-05-04). "UN sanctions: what they are, how they work, and who uses them". UN News Service Section. Retrieved 2017-10-27.

- ^ Section, United Nations News Service (2011-03-14). "New UN project uses financial incentives to try to save the dugong". UN News Service Section. Retrieved 2017-10-27.

- ^ "Security Council Committee pursuant to resolutions 751 (1992) and 1907 (2009) concerning Somalia and Eritrea". www.un.org. Retrieved 2017-10-27.

- ^ "North Korea | Countries". www.nti.org. Retrieved 2017-10-27.

- ^ "Security Council Imposes Fresh Sanctions on Democratic People's Republic of Korea, Unanimously Adopting Resolution 2270 (2016) | Meetings Coverage and Press Releases". www.un.org. Retrieved 2017-10-27.

- ^ "Why Did Sanctions Fail Against North Korea?". Foreign Policy. Retrieved 2017-10-27.

- ^ "UN Arms embargo on Libya". www.sipri.org. Retrieved 2017-12-06.

- ^ "Evaluating the Impacts and Effectiveness of Targeted Sanctions". graduateinstitute.ch. Retrieved 2017-12-07.[dead link]

- ^ "Literature Review on the Effects of Targeted Sanctions". www.unicefinemergencies.com. Archived from the original on 2019-05-04. Retrieved 2017-12-07.

- ^ "Security Council lifts arms embargo on Central African Republic forces". www.news.un.org. Retrieved 2024-08-01.

- ^ "Oil Embargo against Apartheid South Africa on richardknight.com". richardknight.homestead.com.

- ^ Murphy, Caryle (1979-04-27). "To Cope With Embargoes, S. Africa Converts Coal Into Oil". Washington Post. ISSN 0190-8286. Retrieved 2020-12-12.

- ^ Jonathan Zimmerman (13 December 2013). "Nelson Mandela, A True Believer in Sanctions". History News Network. Wikidata Q121303715.

- ^

"Pearl Harbor Raid, 7 December 1941". Washington: Department of the Navy – Naval Historical Center. 3 December 2000. Archived from the original on 6 December 2000. Retrieved 20 July 2019.

The 7 December 1941 Japanese raid on Pearl Harbor was one of the great defining moments in history. A single carefully-planned and well-executed stroke removed the United States Navy's battleship force as a possible threat to the Japanese Empire's southward expansion. [...] The Japanese military, deeply engaged in the seemingly endless war it had started against China in mid-1937, badly needed oil and other raw materials. Commercial access to these was gradually curtailed as the conquests continued. In July 1941 the Western powers effectively halted trade with Japan. From then on, as the desperate Japanese schemed to seize the oil and mineral-rich East Indies and Southeast Asia, a Pacific war was virtually inevitable.

- ^ Maugeri, Leonardo (2006). The Age of Oil. Greenwood Publishing Group. pp. 112–116. ISBN 9780275990084.

- ^ "Energy Crisis (1970s)". The History Channel. 2010.

- ^ a b "European Union: Renewed Sanctions Against Iran". Library of Congress, Washington, D.C. Retrieved 2023-12-18.

- ^ a b Sen, Ashish (2018-05-08). "A Brief History of Sanctions on Iran". Atlantic Council. Retrieved 2023-12-18.

- ^ Sashi, Sivramkrishna; Bhavish, Sharma (2019-12-01). "Macroeconomic Implications of US Sanctions on Iran: A Sectoral Financial Balances Analysis". Studies in Business and Economics. 14 (3): 182–204. doi:10.2478/sbe-2019-0053. ISSN 2344-5416.

- ^ "Sanctions risk by countries".

- ^ "Biden administration freezes billions of dollars in Afghan reserves, depriving Taliban of cash". The Washington Post. 2021-08-17.

- ^ Leo Cendrowicz (February 10, 2010). "Should Europe Lift Its Arms Embargo on China?". Time. Archived from the original on February 13, 2010.

- ^ "United States embargo against Cuba - History". Retrieved 2022-06-16.

- ^ "Russia announces 'full embargo' on most food from US, EU". Deutsche Welle. 7 August 2014.

- ^ "Russia expands food imports embargo to non-EU states". English Radio. 13 August 2015. Archived from the original on 28 February 2021. Retrieved 10 November 2015.

- ^ "Russia expands food import ban". BBC News. 2015-08-13. Retrieved 2018-06-17.

- ^ "Australia bans all live cattle exports to Indonesia". BBC News. 8 June 2011. Retrieved 2 January 2016.

- ^ United States Department of the Treasury. "What You Need To Know About U.S. Economic Sanctions" (PDF). treasury.gov.

- ^ Josh Levs (January 23, 2012). "A summary of sanctions against Iran". cnn.com.

- ^ Wroughton, Lesley (22 April 2019). "U.S. to end all waivers on imports of Iranian oil, crude price jumps". Reuters.

- ^ "Iran oil: US to end sanctions exemptions for major importers". BBC News. 22 April 2019.

- ^ "Mali sanctions regime". Australian Government Department of Foreign Affairs and Trade. Retrieved 2022-06-16.

- ^ Howse, Robert L. and Genser, Jared M. (2008) "Are EU Trade Oh hell no on Burma Compatible with WTO Law?" Archived June 7, 2010, at the Wayback Machine Michigan Journal of International Law 29(2): pp. 165–96

- ^ "Financial sanctions, Nicaragua". GOV.UK. 15 November 2021. Retrieved 2022-06-16.

- ^ "Clinton Ends Most N. Korea Sanctions". Globalpolicy.org. 1999-09-18. Retrieved 2015-03-30.

- ^ [1] Archived July 23, 2010, at the Wayback Machine

- ^ "Democratic People's Republic of Korea (North Korea)". Department for Business Innovation and Skills. Archived from the original on 9 June 2009. Retrieved 8 March 2016.

- ^ "Senate overwhelmingly passes new Russia and Iran sanctions". The Washington Post. 15 June 2017.

- ^ "Iran says new U.S. sanctions violate nuclear deal, vows 'proportional reaction'". Reuters. 2 August 2017.

- ^ "EU sanctions Russians over rights abuses in Chechnya". Reuters. 22 March 2021.

- ^ "UN arms embargo on Somalia". SIPRI. 20 December 2019.

- ^ "UK sanctions relating to Somalia". GOV.UK. Retrieved 2022-06-27.

- ^ "U.S. Imposes New Sanctions on Sudan - Sudan | ReliefWeb". reliefweb.int. 4 November 1997. Retrieved 2022-06-07.

- ^ "Treasury Department's Office of Foreign Asset Control (OFAC)". William & Mary. Retrieved 2022-06-27.

- ^ "Syria sanctions". BBC News. 27 November 2011.

- ^ Talmon, Stefan (2001). "The Cyprus Question before the European Court of Justice". European Journal of International Law. 12 (4): 727–750. doi:10.1093/ejil/12.4.727.

- ^ Rhodan, Maya (9 March 2015). "White House sanctions seven officials in Venezuela". Time. Retrieved 2 April 2019.

- ^ "U.S. declares Venezuela a national security threat, sanctions top officials". Reuters. 10 March 2015. Retrieved 2 April 2019.

- ^ Neuman, Scott (22 May 2018). "President Trump Approves New Sanctions On Venezuela". NPR.

- ^ Emmott, Robin (13 November 2017). "EU readies sanctions on Venezuela, approves arms embargo". Reuters.

- ^ "Canada imposes sanctions on key Venezuelan officials". CBC Canada. Thomson Reuters. 22 September 2017. Retrieved 3 April 2019.

- ^ Zilio, Michelle (22 September 2017). "Canada sanctions 40 Venezuelans with links to political, economic crisis". The Globe and Mail. Retrieved 3 April 2019. Also at Punto de Corte and El Nacional

- ^ "Canada to impose sanctions on more Venezuelan officials". VOA News. Reuters. 30 May 2018. Retrieved 4 April 2019.

- ^ "México rechaza elecciones en Venezuela y sanciona a siete funcionarios". Sumarium group (in Spanish). Retrieved 21 April 2018.[permanent dead link] Also at VPITV

- ^ Camacho, Carlos (27 March 2018). "Panama sanctions Venezuela, including Maduro & 1st Lady family companies". Latin American Herald Tribune. Archived from the original on 24 February 2021. Retrieved 3 April 2019.

- ^ "Swiss impose sanctions on seven senior Venezuelan officials". Reuters. 28 March 2018. Retrieved 3 April 2019. Also at Diario Las Americas

- ^ "Sanctions Regimes". www.dfat.gov.au. Retrieved 28 June 2022.

- ^ "UK sanctions regimes". GOV.UK. 31 December 2020. Retrieved 2022-06-28.

- ^ "Sanctions | United Nations Security Council". www.un.org. Retrieved 2022-06-28.

- ^ "Sanctions: U.S. action on cyber crime" (PDF). pwc. PwC Financial Services Regulatory Practice, April, 2015.

- ^ Thompson, Natalie (2020-10-01). "Countering Malicious Cyber Activity: Targeted Financial Sanctions". doi:10.2139/ssrn.3770816. S2CID 236785768. SSRN 3770816.

{{cite journal}}: Cite journal requires|journal=(help) - ^ Bennett, Cory (29 March 2016). "Obama extends cyber sanctions power".

- ^ "Brazil slaps trade sanctions on U.S. to retaliate for subsidies to cotton farmers". Content.usatoday.com. 2010-03-09. Retrieved 2015-03-30.

- ^ "Georgia Doubles Wine Exports as Russian Market Reopens". RIA Novosti. 16 December 2013.

- ^ "Resolution 1483 - UN Security Council - Global Policy Forum". Globalpolicy.org. Retrieved 2009-05-30.

- ^ a b "India and Pakistan (Nuclear Exports)". BIS. Archived from the original on Feb 18, 2010.

- ^ Lydia Polgreen (April 2, 2012). "Mali Coup Leaders Suffer Sanctions and Loss of Timbuktu". The New York Times. Archived from the original on Feb 1, 2024.

- ^ Callimachi, Rukmini (3 April 2012) "Post-coup Mali hit with sanctions by African neighbours". The Globe and Mail. Retrieved 4 May 2012.

- ^ Cockburn, Patrick (February 4, 1994). "US finally ends Vietnam embargo". The Independent. London. Archived from the original on Feb 24, 2024.

- ^ Boomer, Elizabeth (Feb 17, 2021). "International: United Nations Welcomes Loosening of Sanctions in Gulf Region". Library of Congress. Retrieved 2022-06-16.

- ^ "Kosovo imposes embargo on Serbia". The Sofia Echo. 21 July 2011. Archived from the original on Mar 4, 2016. Retrieved 2 January 2016.

- ^ Esteves, Sandra María (2005). "Mandala de Elegua". Nuyorican Feminist Performance: From the Café to Hip Hop Theater. University of Michigan Press Ebook Collection. doi:10.3998/mpub.6710954.cmp.21. Retrieved 2022-06-27.

- ^ Sukovic, Danilo; Jovanovic, Predrag (2001). "A Decade Under Sanctions". transparentnost.org.rs. Archived from the original on 27 December 2022. Retrieved 27 June 2022.

![]() This article incorporates public domain material from European Union: Renewed Sanctions Against Iran. Library of Congress. Retrieved 2023-12-14.

This article incorporates public domain material from European Union: Renewed Sanctions Against Iran. Library of Congress. Retrieved 2023-12-14.

Further reading

[edit]- Ashouri, Mahan "The Role of transnational Private Actors in Ukraine International Flight 752 Crash in Iran Under Economic Sanctions Pressure" (2021) [2]

- Brzoska, Michael. "International sanctions before and beyond UN sanctions." International Affairs 91.6 (2015): 1339–1349.

- Caruso, Raul. "The impact of international economic sanctions on trade: An empirical analysis." Peace Economics, Peace Science and Public Policy 9.2 (2003) online.

- Cortright, David, et al. The sanctions decade: Assessing UN strategies in the 1990s (Lynne Rienner Publishers, 2000).

- Doxey, Margaret P. International sanctions in contemporary perspective (1987) online

- Doxey, Margaret. "International sanctions: a framework for analysis with special reference to the UN and Southern Africa." International organization 26.3 (1972): 527–550.

- Doxey, Margaret. "International sanctions in theory and practice." Case Western Reserve Journal of International Law 15 (1983): 273+. online

- Drezner, Daniel W. The Sanctions Paradox. (Cambridge University Press, 1999)

- Escribà-Folch, Abel, and Joseph Wright. "Dealing with tyranny: International sanctions and the survival of authoritarian rulers." International studies quarterly 54.2 (2010): 335–359. online

- Farrall, Jeremy Matam. United Nations sanctions and the rule of law (Cambridge University Press, 2007). online

- Hufbauer, Gary C. Economic sanctions and American diplomacy (Council on Foreign Relations, 1998) online.

- Hufbauer, Gary C., Jeffrey J. Schott, and Kimberley Ann Elliott. Economic Sanctions Reconsidered: History and Current Policy (Washington DC: Peterson Institute for International Economics, 1990)

- Kaempfer, William H. International economic sanctions: a public choice perspective (1992) online

- Köchler, Hans. The United Nations sanctions policy & international law (1995) online

- Krugman, Paul, "The American Way of Economic war: Is Washington Overusing Its Most Powerful Weapons?" (review of Henry Farrell and Abraham Newman, Underground Empire: How America Weaponized the World Economy, Henry Holt, 2023, 288 pp.), Foreign Affairs, vol. 103, no. 1 (January/February 2024), pp. 150–156. "The [U.S.] dollar is one of the few currencies that almost all major banks will accept, and... the most widely used... As a result, the dollar is the currency that many companies must use... to do international business." (p. 150.) "[L]ocal banks facilitating that trade... normally... buy U.S. dollars and then use dollars to buy [another local currency]. To do so, however, the banks must have access to the U.S. financial system and... follow rules laid out by Washington." (pp. 151–152.) "But there is another, lesser-known reason why the [U.S.] commands overwhelming economic power. Most of the world's fiber-optic cables, which carry data and messages around the planet, travel through the United States." (p. 152.) "[T]he U.S. government has installed 'splitters': prisms that divide the beams of light carrying information into two streams. One... goes on to the intended recipients, ... the other goes to the National Security Agency, which then uses high-powered computation to analyze the data. As a result, the [U.S.] can monitor almost all international communication." (p. 154) This has allowed the U.S. "to effectively cut Iran out of the world financial system... Iran's economy stagnated... Eventually, Tehran agreed to cut back its nuclear programs in exchange for relief." (pp. 153–154.) "[A] few years ago, American officials... were in a panic about [the Chinese company] Huawei... which... seemed poised to supply 5G equipment to much of the planet [thereby possibly] giv[ing] China the power to eavesdrop on the rest of the world – just as the [U.S.] has done.... The [U.S.] learned that Huawei had been dealing surreptitiously with Iran – and therefore violating U.S. sanctions. Then, it... used its special access to information on international bank data to [show] that [Huawei]'s chief financial officer, Meng Wanzhou (... the founder's daughter), had committed bank fraud by falsely telling the British financial services company HSBC that her company was not doing business with Iran. Canadian authorities, acting on a U.S. request, arrested her... in December 2018. After... almost three years under house arrest... Meng... was allowed to return to China... But by [then] the prospects for Chinese dominance of 5G had vanished..." (pp. 154–155.) Farrell and Newman, writes Krugman, "are worried about the possibility of [U.S. Underground Empire] overreach. [I]f the [U.S.] weaponizes the dollar against too many countries, they might... band together and adopt alternative methods of international payment. If countries become deeply worried about U.S. spying, they could lay fiber-optic cables that bypass the [U.S.]. And if Washington puts too many restrictions on American exports, foreign firms might turn away from U.S. technology." (p. 155.)

- Mulder, Nicholas. The Economic Weapon: The Rise of Sanctions as a Tool of Modern War (2022) excerpt also see online review

- Nossal, Kim Richard. "International sanctions as international punishment." International Organization 43.2 (1989): 301–322.

- Royal Institute of International Affairs. International Sanctions (1935).

- Selden, Zachary (1999). Economic Sanctions as Instruments of American Foreign Policy. Greenwood Publishing Group. ISBN 978-0-275-96387-3.

- Stevenson, Tom, "First Recourse for Rebels" (review of Nicholas Mulder, The Economic Weapon: The Rise of Sanctions as a Tool of Modern War, Yale, 2022, ISBN 978 0 300 25936 0, 434 pp.), London Review of Books, vol. 44, no. 6 (24 March 2022), pp. 25–29. "US sanctions are based on monopoly power over a global commons: the world's reserve currency and medium of exchange." (p. 25.) "At some point the US may no longer be in a position to exploit its financial centrality as it does now. For large parts of the world that moment will be cause for celebration." (p. 29.)

External links

[edit]- Business and Sanctions Consulting Network: List of Countries

- The Global Sanctions Data Base (GSDB)[1][2][3]

- Threat and Imposition of Economic Sanctions (TIES) Dataset[4]

- The International Sanctions Termination (IST) dataset

- Online Books

- ^ "Global Sanctions Database - GSDB". globalsanctionsdatabase.com. Retrieved 2021-05-18.

- ^ Felbermayr, Gabriel; Kirilakha, Aleksandra; Syropoulos, Constantinos; Yalcin, Erdal; Yotov, Yoto (2021-05-18). "The 'Global Sanctions Data Base': Mapping international sanction policies from 1950-2019". VoxEU.org. Retrieved 2021-05-18.

- ^ Kirikakha, Aleksandra; Felbermayr, Gabriel J.; Syropoulos, Constantinos; Yalcin, Erdal; Yotov, Yoto V. (2021-12-10). "The Global Sanctions Data Base (GSDB): an update that includes the years of the Trump presidency". Research Handbook on Economic Sanctions: 62–106. doi:10.4337/9781839102721.00010. ISBN 9781839102721. S2CID 245356746.

- ^ Morgan, T. Clifton; Bapat, Navin A.; Kobayashi, Yoshiharu (2021-12-10). "The Threat and Imposition of Economic Sanctions data project: a retrospective". Research Handbook on Economic Sanctions: 44–61. doi:10.4337/9781839102721.00009. ISBN 9781839102721. S2CID 245374708.