International Monetary Fund: Difference between revisions

| Line 291: | Line 291: | ||

* George, S. (1988). A Fate Worse Than Debt. London: Penguin Books. |

* George, S. (1988). A Fate Worse Than Debt. London: Penguin Books. |

||

* Hancock, G. (1991). Lords of Poverty: The Free-Wheeling Lifestyles, Power, Prestige and Corruption of the Multi-billion Dollar Aid Business. London: Mandarin. |

* Hancock, G. (1991). Lords of Poverty: The Free-Wheeling Lifestyles, Power, Prestige and Corruption of the Multi-billion Dollar Aid Business. London: Mandarin. |

||

* Markwell, Donald, ''John Maynard Keynes and International Relations: Economic Paths to War and Peace'', Oxford University Press, 2006. |

|||

* Rapkin, David P. and Jonathan R. Strand (2005) “Developing Country Representation and Governance of the International Monetary Fund,” World Development 33, 12: 1993-2011. |

* Rapkin, David P. and Jonathan R. Strand (2005) “Developing Country Representation and Governance of the International Monetary Fund,” World Development 33, 12: 1993-2011. |

||

* Strand, Jonathan R and David P. Rapkin (2005) “Voting Power Implications of a Double Majority Voting Procedure in the IMF’s Executive Board,” in Reforming the Governance of the IMF and World Bank, Ariel Buira, ed, London: Anthem Press. |

* Strand, Jonathan R and David P. Rapkin (2005) “Voting Power Implications of a Double Majority Voting Procedure in the IMF’s Executive Board,” in Reforming the Governance of the IMF and World Bank, Ariel Buira, ed, London: Anthem Press. |

||

Revision as of 07:02, 12 November 2008

38°54′00″N 77°2′39″W / 38.90000°N 77.04417°W

This article needs additional citations for verification. (May 2007) |

IMF member states in green | |

| Headquarters | Washington, D.C., USA |

|---|---|

| Managing Director | Dominique Strauss-Kahn |

| Currency | Special Drawing Rights XDR (ISO 4217) |

| Bank rate | 3.49% for SDRs[1] |

| Website | www.imf.org |

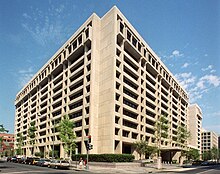

The International Monetary Fund (IMF) is an international organization that oversees the global financial system by following the macroeconomic policies of its member countries, in particular those with an impact on exchange rates and the balance of payments. It also offers financial and technical assistance to its members, making it an international lender of last resort. Its headquarters are located in Washington, D.C., USA.

Organization and purpose

The International Monetary Fund was created in 1944 [1], with a goal to stabilize exchange rates and supervise the reconstruction of the world's international payment system. Countries contributed to a pool which could be borrowed from, on a temporary basis, by countries with payment imbalances. (Condon, 2007)

The IMF describes itself as "an organization of 185 countries (Montenegro being the 185th, as of January 18, 2007), working to foster global monetary cooperation, secure financial stability, facilitate international trade, promote high employment and sustainable economic growth, and reduce poverty". With the exception of North Korea, Cuba, Andorra, Monaco, Liechtenstein, Tuvalu, and Nauru, all UN member states participate directly in the IMF. Most are represented by other member states on a 24-member Executive Board but all member countries belong to the IMF's Board of Governors.[2]

History

The International Monetary Fund was formally created in July 1944 during the United Nations Monetary and Financial Conference. The representatives of 45 governments met in the Mount Washington Hotel in the area of Bretton Woods, New Hampshire, United States of America, with the delegates to the conference agreeing on a framework for international economic cooperation.[3] The IMF was formally organized on December 27, 1945, when the first 29 countries signed its Articles of Agreement. The statutory purposes of the IMF today are the same as when they were formulated in 1944 (see #Assistance and reforms).

Today

The IMF's influence in the global economy steadily increased as it accumulated more members. The number of IMF member countries has more than quadrupled from the 44 states involved in its establishment, reflecting in particular the attainment of political independence by many developing countries and more recently the collapse of the Soviet bloc. The expansion of the IMF's membership, together with the changes in the world economy, have required the IMF to adapt in a variety of ways to continue serving its purposes effectively.

In an apparent move to curb the sudden rise of gold prices, and to shore up the falling value of the US Dollar, the International Monetary Fund's executive board approved a broad financial overhaul plan that could lead to the eventual sale of a little over 400 tons of its substantial gold supplies. IMF Managing Director Dominique Strauss-Kahn welcomed the board's decision April 7, 2008 to propose a new framework for the fund, designed to close a projected $400 million budget deficit over the next few years. The budget proposal includes sharp spending cuts of $100 million until 2011 that will include up to 380 staff dismissals. [2]

Data Dissemination Systems

In 1995, the International Monetary Fund began work on data dissemination standards with the view of guiding IMF member countries to disseminate their economic and financial data to the public. The International Monetary and Financial Committee (IMFC) endorsed the guidelines for the dissemination standards and they were split into two tiers: The General Data Dissemination System (GDDS) and the Special Data Dissemination Standard (SDDS).

The International Monetary Fund executive board approved the SDDS and GDDS in 1996 and 1997 respectively and subsequent amendments were published in a revised “Guide to the General Data Dissemination System”. The system is aimed primarily at statisticians and aims to improve many aspects of statistical systems in a country. It is also part of the World Bank Millennium Development Goals and Poverty Reduction Strategic Papers.

The IMF established a system and standard to guide members in the dissemination to the public of their economic and financial data. Currently there are two such systems: General Data Dissemination System (GDDS) and its superset Special Data Dissemination System (SDDS), for those member countries having or seeking access to international capital markets.

The primary objective of the GDDS is to encourage IMF member countries to build a framework to improve data quality and increase statistical capacity building. This will involve the preparation of metadata describing current statistical collection practices and setting improvement plans. Upon building a framework, a country can evaluate statistical needs, set priorities in improving the timeliness, transparency, reliability and accessibility of financial and economic data.

Some countries initially used the GDDS, but lately upgraded to SDDS.

Some entities that are not themselves IMF members also contribute statistical data to the systems:

Palestinian Authority – GDDS

Palestinian Authority – GDDS Hong Kong – SDDS

Hong Kong – SDDS European Union institutions:

European Union institutions:

- the European Central Bank for the Eurozone – SDDS

- Eurostat for the whole EU – SDDS, thus providing data from

Cyprus (not using any DDSystem on its own) and

Cyprus (not using any DDSystem on its own) and  Malta (using only GDDS on its own)

Malta (using only GDDS on its own)

Membership qualifications

Any country may apply for membership to the IMF. The application will be considered first by the IMF's Executive Board. After its consideration, the Executive Board will submit a report to the Board of Governors of the IMF with recommendations in the form of a "Membership Resolution." These recommendations cover the amount of quota in the IMF, the form of payment of the subscription, and other customary terms and conditions of membership. After the Board of Governors has adopted the "Membership Resolution," the applicant state needs to take the legal steps required under its own law to enable it to sign the IMF's Articles of Agreement and to fulfil the obligations of IMF membership. Similarly, any member country can withdraw from the Fund, although that is rare. For example, in April 2007, the president of Ecuador, Rafael Correa announced the expulsion of the World Bank representative in the country. A few days later, at the end of April, Venezuelan president Hugo Chavez announced that the country would withdraw from the IMF and the World Bank. Chavez dubbed both organizations as “the tools of the empire” that “serve the interests of the North”. [3] As of April 2008, both countries remain as members of both organizations. Venezuela was forced to back down because a withdrawal would have triggered default clauses in the country's sovereign bonds. [4]

A member's quota in the IMF determines the amount of its subscription, its voting weight, its access to IMF financing, and its allocation of Special Drawing Rights (SDRs). A member state cannot unilaterally increase its quota — increases must be approved by the Executive Board and are linked to formulas that include many variables such as the size of a country in the world economy. For example, in 2001, China was prevented from increasing its quota as high as it wished, ensuring it remained at the level of the smallest G7 economy (Canada).[4] In September 2005, the IMF's member countries agreed to the first round of ad hoc quota increases for four countries, including China. On March 28, 2008, the IMF's Executive Board ended a period of extensive discussion and negotiation over a major package of reforms to enhance the institution's governance that would shift quota and voting shares from advanced to emerging markets and developing countries. The Fund's Board of Governors must vote on these reforms by April 28, 2008. See "Reform of IMF Quotas and Voice: Responding to Changes in the Global Economy" at www.imf.org.

Examples of press coverage of the discussions regarding changes to the voting formula to increase equity:IMF Seeks Role in Shifting Global Economy

Members' quotas and voting power, and Board of Governors

Table showing the top 21 member countries in terms of voting power:[5]

| IMF Member Country | Quota: Millions of SDRs | Quota: Percentage of Total | Governor | Alternate Governor | Votes: Number | Votes: Percentage of Total |

|---|---|---|---|---|---|---|

| 3236.4 | 1.49 | Wayne Swan | Ken Henry | 32614 | 1.47 | |

| 4605.2 | 2.12 | Guy Quaden | Jean-Pierre Arnoldi | 46302 | 2.09 | |

| 3036.1 | 1.4 | Guido Mantega | Henrique de Campos Meirelles | 30611 | 1.38 | |

| 6369.2 | 2.93 | Jim Flaherty | Mark Carney | 63942 | 2.89 | |

| 8090.1 | 3.72 | ZHOU Xiaochuan | HU Xiaolian | 81151 | 3.66 | |

| 10738.5 | 4.94 | Christine Lagarde | Christian Noyer | 107635 | 4.86 | |

| 13008.2 | 5.99 | Peer Steinbrück | 130332 | 5.88 | ||

| 4158.2 | 2.44 | P. Chidambaram | D. Subbarao | 41832 | 1.89 | |

| 7055.5 | 3.25 | Giulio Tremonti | Mario Draghi | 70805 | 3.2 | |

| 13312.8 | 6.13 | Koji Omi | Toshihiko Fukui | 133378 | 6.02 | |

| 2927.3 | 1.35 | Okyu Kwon | Seong Tae Lee | 29523 | 1.33 | |

| 3152.8 | 1.45 | Agustín Carstens | Guillermo Ortiz | 31778 | 1.43 | |

| 5162.4 | 2.38 | A.H.E.M. Wellink | L.B.J. van Geest | 51874 | 2.34 | |

| 5945.4 | 2.74 | Aleksei Kudrin | Sergey Ignatiev | 59704 | 2.7 | |

| 6985.5 | 3.21 | Ibrahim A. Al-Assaf | Hamad Al-Sayari | 70105 | 3.17 | |

| 3048.9 | 1.4 | Pedro Solbes | Miguel Fernández Ordóñez | 30739 | 1.39 | |

| 2395.5 | 1.1 | Stefan Ingves | Per Jansson | 24205 | 1.09 | |

| 3458.5 | 1.59 | Jean-Pierre Roth | Hans-Rudolf Merz | 34835 | 1.57 | |

| 10738.5 | 4.94 | Alistair Darling | Mervyn King | 107635 | 4.86 | |

| 37149.3 | 17.09 | Henry Paulson | Ben Bernanke | 371743 | 16.79 | |

| 2659.1 | 1.22 | Gastón Parra Luzardo | Rodrigo Cabeza Morales | 26841 | 1.21 | |

| remaining 165 countries | 60081.4 | 29.14 | respective | respective | 637067 | 28.78 |

Assistance and reforms

The primary mission of the IMF is to provide financial assistance to countries that experience serious financial and economic difficulties using funds deposited with the IMF from the institution's 185 member countries. Member states with balance of payments problems, which often arise from these difficulties, may request loans to help fill gaps between what countries earn and/or are able to borrow from other official lenders and what countries must spend to operate, including to cover the cost of importing basic goods and services. In return, countries are usually required to launch certain reforms, which have often been dubbed the "Washington Consensus". These reforms are generally required because countries with fixed exchange rate policies can engage in fiscal, monetary, and political practices which may lead to the crisis itself. For example, nations with severe budget deficits, rampant inflation, strict price controls, or significantly over-valued or under-valued currencies run the risk of facing balance of payment crises. Thus, the structural adjustment programs are at least ostensibly intended to ensure that the IMF is actually helping to prevent financial crises rather than merely funding financial recklessness.

IMF/World Bank support of military dictatorships

The role of the Bretton Woods institutions has been controversial since the late Cold War period, as the IMF policy makers supported military dictatorships friendly to American and European corporations. Critics also claim that the IMF is generally apathetic or hostile to their views of democracy, human rights, and labor rights. The controversy has helped spark the anti-globalization movement. Arguments in favor of the IMF say that economic stability is a precursor to democracy, however critics highlight various examples in which democratized countries fell after receiving IMF loans.[6]

In the 60’s, the IMF and the World Bank supported the government of Brazil’s military dictator Castello Branco with tens of millions of dollars of loans and credit that were denied to previous democratically-elected governments.[7]

Countries that were or are under a Military dictatorship whilst being members of the IMF/World Bank (support from various sources in $ Billion):[8]

| Country indebted to IMF/World Bank | Dictator | In power from | In power to | debts at start of Dictatorship(1) | Debts at end of Dictatorship(2) | Country Debts in 1996 | Dictator debts generated $ billion | Dictator generated debt % of total debt |

|---|---|---|---|---|---|---|---|---|

| Military dictatorship | 1976 | 1983 | 9.3 | 48.9 | 93.8 | 39.6 | 42.00% | |

| Military dictatorship | 1962 | 1980 | 0 | 2.7 | 5.2 | 2.7 | 52.00% | |

| Military dictatorship | 1964 | 1984 | 5.1 | 105.1 | 179 | 100 | 56.00% | |

| Augusto Pinochet | 1973 | 1989 | 5.2 | 18 | 27.4 | 12.8 | 47.00% | |

| Military dictatorship | 1979 | 1994 | 0.9 | 2.2 | 2.2 | 1.3 | 59.00% | |

| Mengistu Haile Mariam | 1977 | 1991 | 0.5 | 4.2 | 10 | 3.7 | 37.00% | |

| Jean-Claude Duvalier | 1971 | 1986 | 0 | 0.7 | 0.9 | 0.7 | 78.00% | |

| Suharto | 1967 | 1998 | 3 | 129 | 129 | 126 | 98.00% | |

| Moi | 1979 | 2002 | 2.7 | 6.9 | 6.9 | 4.2 | 61.00% | |

| Doe | 1979 | 1990 | 0.6 | 1.9 | 2.1 | 1.3 | 62.00% | |

| Banda | 1964 | 1994 | 0.1 | 2 | 2.3 | 1.9 | 83.00% | |

| Buhari/Abacha | 1984 | 1998 | 17.8 | 31.4 | 31.4 | 13.6 | 43.00% | |

| Zia-ul Haq | 1977 | 1988 | 7.6 | 17 | ||||

| Stroessner | 1954 | 1989 | 0.1 | 2.4 | 2.1 | 2.3 | 96.00% | |

| Marcos | 1965 | 1986 | 1.5 | 28.3 | 41.2 | 26.8 | 65.00% | |

| Siad Barre | 1969 | 1991 | 0 | 2.4 | 2.6 | 2.4 | 92.00% | |

| apartheid | 1992 | 18.7 | 23.6 | 18.7 | 79.00% | |||

| Nimeiry/al-Mahdi | 1969 | present | 0.3 | 17 | 17 | 16.7 | 98.00% | |

| Assad | 1970 | present | 0.2 | 21.4 | 21.4 | 21.2 | 99.00% | |

| Military dictatorship | 1950 | 1983 | 0 | 13.9 | 90.8 | 13.9 | 15.00% | |

| Mobutu | 1965 | 1997 | 0.3 | 12.8 | 12.8 | 12.5 | 98.00% |

Notes: Debt at takeover by dictatorship; earliest data published by the World Bank is for 1970. Debt at end of dictatorship (or 1996, most recent date for World Bank data).

Criticism

Two criticisms from economists have been that financial aid is always bound to so-called "Conditionalities", including Structural Adjustment Programs. Conditionalities, which are the economic performance targets established as a precondition for IMF loans, it is claimed, retard social stability and hence inhibit the stated goals of the IMF, while Structural Adjustment Programs lead to an increase in poverty in recipient countries.[9]

Typically the IMF and its supporters advocate a Keynesian approach. As such, adherents of supply-side economics generally find themselves in open disagreement with the IMF. The IMF frequently advocates currency devaluation, criticized by proponents of supply-side economics as inflationary. Secondly they link higher taxes under "austerity programmes" with economic contraction.

Currency devaluation is recommended by the IMF to the governments of poor nations with struggling economies. Supply-side economists claim these Keynesian IMF policies are destructive to economic prosperity.

That said, the IMF sometimes advocates "austerity programmes," increasing taxes even when the economy is weak, in order to generate government revenue and balance budget deficits, which is the opposite of Keynesian policy. These policies were criticised by Joseph E. Stiglitz, former chief economist and Senior Vice President at the World Bank, in his book Globalization and Its Discontents.[10] He argued that by converting to a more Monetarist approach, the fund no longer had a valid purpose, as it was designed to provide funds for countries to carry out Keynesian reflations, and that the IMF "was not participating in a conspiracy, but it was reflecting the interests and ideology of the Western financial community."[11]

Complaints are also directed toward International Monetary Fund gold reserve being undervalued. At its inception in 1945, the IMF pegged gold at US$35 per Troy ounce of gold. In 1973 the Nixon administration lifted the fixed asset value of gold in favor of a world market price. Hence the fixed exchange rates of currencies tied to gold were switched to a floating rate, also based on market price and exchange. This largely came about because Petrodollars outside the United States were more than could be backed by the gold at Fort Knox under the fixed exchange rate system. The fixed rate system only served to limit the amount of assistance the organization could use to help debt-ridden countries. Current IMF rules prohibit members from linking their currencies to gold.[citation needed]

Argentina, which had been considered by the IMF to be a model country in its compliance to policy proposals by the Bretton Woods institutions, experienced a catastrophic economic crisis in 2001 , which some believe to have been caused by IMF-induced budget restrictions — which undercut the government's ability to sustain national infrastructure even in crucial areas such as health, education, and security — and privatization of strategically vital national resources.[12] Others attribute the crisis to Argentina's maldesigned fiscal federalism, which caused subnational spending to increase rapidly.[13] The crisis added to widespread hatred of this institution in Argentina and other South American countries, with many blaming the IMF for the region's economic problems.[14] The current — as of early 2006 — trend towards moderate left-wing governments in the region and a growing concern with the development of a regional economic policy largely independent of big business pressures has been ascribed to this crisis.

Another example of where IMF Structural Adjustment Programmes aggravated the problem was in Kenya. Before the IMF got involved in the country, the Kenyan central bank oversaw all currency movements in and out of the country. The IMF mandated that the Kenyan central bank had to allow easier currency movement. However, the adjustment resulted in very little foreign investment, but allowed Kamlesh Manusuklal Damji Pattni, with the help of corrupt government officials, to siphon off billions of Kenyan shillings in what came to be known as the Goldenberg scandal, leaving the country worse off than it was before the IMF reforms were implemented.[citation needed] In a recent interview, the Prime Minister of Romania stated that "Since 2005, IMF is constantly making mistakes when it appreciates the country's economic performances".[15]

Overall the IMF success record is perceived as limited.[citation needed] While it was created to help stabilize the global economy, since 1980 critics claim over 100 countries (or reputedly most of the Fund's membership) have experienced a banking collapse that they claim have reduced GDP by four percent or more, far more than at any time in Post-Depression history.[citation needed] The considerable delay in the IMF's response to any crisis, and the fact that it tends to only respond to them or even create them[16] rather than prevent them, has led many economists to argue for reform. In 2006, an IMF reform agenda called the Medium Term Strategy was widely endorsed by the institution's member countries. The agenda includes changes in IMF governance to enhance the role of developing countries in the institution's decision-making process and steps to deepen the effectiveness of its core mandate, which is known as economic surveillance or helping member countries adopt macroeconomic policies that will sustain global growth and reduce poverty. On June 15, 2007, the Executive Board of the IMF adopted the 2007 Decision on Bilateral Surveillance, a landmark measure that replaced a 30-year-old decision of the Fund's member countries on how the IMF should analyse economic outcomes at the country level.

Whatever the feelings people in the Western world have for the IMF, research by the Pew Research Center shows that more than 60 percent of Asians and 70 percent of Africans feel that the IMF and the World Bank have a positive effect on their country.[17] However it is pertinent to note that the survey aggregated international organizations including the World Trade Organization. Also, a similar percentage of people in the Western world believed that these international organizations had a positive effect on their countries. In 2005, the IMF was the first multilateral financial institution to implement a sweeping debt-relief program for the world's poorest countries known as the Multilateral Debt Relief Initiative. By year-end 2006, 23 countries mostly in sub-Saharan Africa and Central America had received total relief of debts owed the IMF.

In 2008, a study by analysts from Cambridge and Yale universities published on the open-access Public Library of Science concluded that strict conditions on the international loans by the IMF resulted in thousands of deaths in Eastern Europe by tuberculosis as public health care had to be weakened. In the 21 countries which the IMF had given loans, tuberculosis deaths rose by 16.6 %.[18]

Past managing directors

Historically the IMF's managing director has been European and the president of the World Bank has been from the United States. However, this standard is increasingly being questioned and competition for these two posts may soon open up to include other qualified candidates from any part of the world. Executive Directors, who confirm the managing director, are voted in by Finance Ministers from countries they represent. The First Deputy Managing Director of the IMF, the second-in-command, has traditionally been (and is today) an American.

The IMF is for the most part controlled by the major Western Powers, with voting rights on the Executive board based on a quota derived from the relative size of a country in the global economy. Critics claim that the board rarely votes and passes issues contradicting the will of the US or Europeans, which combined represent the largest bloc of shareholders in the Fund. On the other hand, Executive Directors that represent emerging and developing countries have many times strongly defended the group of nations in their constituency. Alexandre Kafka, who represented several Latin American countries for 32 years as Executive Director (including 21 as the dean of the Board), is a prime example. Mohamed Finaish from Libya, the Executive Director representing the majority of the Arab World and Pakistan, was a tireless defender[citation needed] of the developing nations' rights at the IMF until the 1992 elections.

Rodrigo Rato became the ninth Managing Director of the IMF on June 7, 2004 and resigned his post at the end of October 2007.

EU ministers agreed on the candidacy of Dominique Strauss-Kahn as managing director of the IMF at the Economic and Financial Affairs Council meeting in Brussels on July 10, 2007. On September 28, 2007, the International Monetary Fund's 24 executive directors elected Mr. Strauss-Kahn as new managing director, with broad support including from the United States and the 27-nation European Union. Strauss-Kahn succeeded Spain's Rodrigo de Rato, who retired on October 31, 2007.[19] The only other nominee was Josef Tosovsky, a late candidate proposed by Russia. Strauss-Kahn said: "I am determined to pursue without delay the reforms needed for the IMF to make financial stability serve the international community, while fostering growth and employment."[20]

| Dates | Name | Country |

|---|---|---|

| May 6, 1946 – May 5, 1951 | Camille Gutt | Belgium |

| August 3, 1951 – October 3, 1956 | Ivar Rooth | Sweden |

| November 21, 1956 – May 5, 1963 | Per Jacobsson | Sweden |

| September 1, 1963 – August 31, 1973 | Pierre-Paul Schweitzer | France |

| September 1, 1973 – June 16, 1978 | Johannes Witteveen | Netherlands |

| June 17, 1978 – January 15, 1987 | Jacques de Larosière | France |

| January 16, 1987 – February 14, 2000 | Michel Camdessus | France |

| May 1, 2000 – March 4, 2004 | Horst Köhler | Germany |

| June 7, 2004 – October 31, 2007 | Rodrigo Rato | Spain |

| November 1, 2007 – present | Dominique Strauss-Kahn | France |

Media representation of the IMF

Life and Debt, a documentary film, deals with the IMF's policies' influence on Jamaica and its economy from a critical point of view. In 1978, one year after Jamaica first entered a borrowing relationship with the IMF, the Jamaican dollar was still worth more on the open exchange than the US dollar; by 1995, when Jamaica terminated that relationship, the Jamaican dollar had eroded to less than 2 cents US. Such observations lead to skepticism that IMF involvement is necessarily helpful to a third world economy.

The Debt of Dictators explores the lending of billions of dollars by the IMF, World Bank multinational banks and other international financial institutions to brutal dictators throughout the world. (see IMF/World Bank support of military dictatorships)

See also

- Third world debt

- Economics

- Special Drawing Rights

- Development aid

- Bretton Woods Institutions

- Organisation for Economic Co-operation and Development

- Globalization and Its Discontents

- Globalization and Health

- Bancor

- Bank for International Settlements

- World Bank

- Inter-American Development Bank

- Bretton Woods system

- Global Governance Watch

Notes

- ^ Exchange Rate Archives by Month

- ^ IMF Articles of Agreement, Article XII Section 2(a) and Section 3(b).

- ^ Brief video of the Bretton Woods Conference is available at http://www.youtube.com/watch?v=GVytOtfPZe8

- ^ Barnett, Michael and Finnemore, Martha. Rules for the World: International Organizations in Global Politics. Ithaca: Cornell University Press, 2004.

- ^ "http://www.imf.org/external/np/sec/memdir/members.htm#3". IMF. Retrieved 2007-09-24.

{{cite news}}: Cite has empty unknown parameter:|coauthors=(help); External link in|title= - ^ "World Bank - IMF support to dictatorships". cadtm. Retrieved 2007-09-21.

{{cite news}}: Cite has empty unknown parameter:|coauthors=(help) - ^ BRAZIL Toward Stability, TIME Magazine, December 31, 1965

- ^ "Dictators and debt". Jubilee 2000. Retrieved 2007-09-21.

{{cite news}}: Cite has empty unknown parameter:|coauthors=(help) - ^ Hertz, Noreena. The Debt Threat. New York: Harper Collins Publishers, 2004.

- ^ Stiglitz, Joseph. Globalization and its Discontents. New York: WW Norton & Company, 2002.

- ^ Globalization: Stiglitz's Case

- ^ Economic debacle in Argentina: The IMF strikes again

- ^ Stephen Webb, "Argentina: Hardening the Provincial Budget Constraint," in Rodden, Eskeland, and Litvack (eds.), Fiscal Decentralization and the Challenge of Hard Budget Constraints (Cambridge, Mass.: MIT Press, 2003).

- ^ How the IMF Props Up the Bankrupt Dollar System, by F. William Engdahl, US/Germany

- ^ Tăriceanu: FMI a făcut constant greşeli de apreciere a economiei româneşti - Mediafax

- ^ Budhoo, Davidson. Enough is Enough: Dear Mr. Camdessus... Open Letter to the Managing Director of the International Monetary Fund. New York: New Horizons Press, 1990.

- ^ GLOBAL ATTITUDES : 44-NATION MAJOR SURVEY (2002), The Pew Research Center for the People & the Press

- ^ International Monetary Fund Programs and Tuberculosis Outcomes in Post-Communist Countries PLoS Medicine. The study has not been independently verified, nor have the authors published parts of their supporting data. Retrieved 29-7-2008.

- ^ Yahoo.com, IMF to choose new director

- ^ BBC NEWS, Frenchman is named new IMF chief

References

- Jan Joost Teunissen and Age Akkerman (eds.) (2005). Helping the Poor? The IMF and Low-Income Countries. FONDAD. ISBN 90-74208-25-8.

{{cite book}}:|author=has generic name (help); External link in|title= - Dreher, Axel (2002). The Development and Implementation of IMF and World Bank Conditionality (PDF). HWWA. ISSN 1616-4814.

- Dreher, Axel (2004). "A Public Choice Perspective of IMF and World Bank Lending and Conditionality". Public Choice. 119 (3–4): 445–464. doi:10.1023/B:PUCH.0000033326.19804.52.

- Dreher, Axel (2004). "The Influence of IMF Programs on the Re-election of Debtor Governments". Economics & Politics. 16 (1): 53–75. doi:10.1111/j.1468-0343.2004.00131.x.

- Dreher, Axel (2003). "The Influence of Elections on IMF Programme Interruptions". The Journal of Development Studies. 39 (6): 101–120. doi:10.1080/00220380312331293597.

- The Best Democracy Money Can Buy by Greg Palast (2002)

- The IMF and The World Bank: How do they differ? by David D. Driscoll

- Rivalries between IMF and IBRD, "Sister-talk", The Economist (2007-03-01)

- George, S. (1988). A Fate Worse Than Debt. London: Penguin Books.

- Hancock, G. (1991). Lords of Poverty: The Free-Wheeling Lifestyles, Power, Prestige and Corruption of the Multi-billion Dollar Aid Business. London: Mandarin.

- Markwell, Donald, John Maynard Keynes and International Relations: Economic Paths to War and Peace, Oxford University Press, 2006.

- Rapkin, David P. and Jonathan R. Strand (2005) “Developing Country Representation and Governance of the International Monetary Fund,” World Development 33, 12: 1993-2011.

- Strand, Jonathan R and David P. Rapkin (2005) “Voting Power Implications of a Double Majority Voting Procedure in the IMF’s Executive Board,” in Reforming the Governance of the IMF and World Bank, Ariel Buira, ed, London: Anthem Press.

- Williamson, John. (August 1982). The Lending Policies of the International Monetary Fund, Policy Analyses in International Economics 1, Washington D.C., Institute for International Economics. ISBN 0-88132-000-5

External links

- International Monetary Fund website

- Finance & Development - A quarterly magazine of the IMF

- Annual Reports of the Executive Board

- World Economic Outlook Reports

- IMF Publications

- IMF Fiscal Affairs Department (FAD)

- August Review - Global Banking: The IMF (I would be careful with this source--it's pretty biased towards anti-globalization)

- Kenneth Rogoff - The sisters at 60

- How the IMF Props Up the Dollar System

- IMF’s Origins as a Blueprint for Its Future, Anna J. Schwartz, National Bureau of Economic Research

- Center for International Finance & Development University of Iowa research center, includes a 300 page E-book on the IMF and World Bank.

- Political Forecasting? The IMF’s Flawed Growth Projections for Argentina and Venezuela by David Rosnick and Mark Weisbrot, Center for Economic and Policy Research

- What's the difference between the IMF and the World Bank? by economist Arthur MacEwan, in Dollars & Sense magazine

- "Monetary Freedom Act" HR 391, by Congressman Ron Paul, 1981

- Bretton Woods Project Critical voices on the World Bank and IMF

- Eurodad report: Critical conditions: The IMF maintains its grip on low-income governments