Affordable Care Act: Difference between revisions

Cybercobra (talk | contribs) |

Hauskalainen (talk | contribs) →Further reading: Deleted outdated links.. neither of these describe what was enacted |

||

| Line 407: | Line 407: | ||

==Further reading== |

==Further reading== |

||

* {{cite news | title=Key Differences in the Health Care Plans | work=The New York Times | url=http://www.nytimes.com/interactive/2009/11/19/us/politics/1119-plan-differences.html | date=November 19, 2009 | accessdate=May 21, 2010}} A comparison of the House and Senate bills. |

|||

* Chris L. Peterson, [http://opencrs.com/document/R40981/2009-12-16/?24216 ''A Comparative Analysis of Private Health Insurance Provisions of H.R. 3962 and S.Amdt. 2786 to H.R. 3590'',] [[Congressional Research Service]], R40981, December 16, 2009 |

|||

Latest Congressional Budget Office scoring <!-- (''all previous scoring for now superseded Senate bills no longer applies'') --> |

|||

* [http://www.cbo.gov/doc.cfm?index=10868 Patient Protection and Affordable Care Act, Incorporation of the Manager's Amendment, SA 3276] − ''December 19, 2009'' |

* [http://www.cbo.gov/doc.cfm?index=10868 Patient Protection and Affordable Care Act, Incorporation of the Manager's Amendment, SA 3276] − ''December 19, 2009'' |

||

** [http://cbo.gov/doc.cfm?index=10870 Correction Regarding the Manager's Amendment to the Patient Protection and Affordable Care Act] − ''December 20, 2009'' |

** [http://cbo.gov/doc.cfm?index=10870 Correction Regarding the Manager's Amendment to the Patient Protection and Affordable Care Act] − ''December 20, 2009'' |

||

Revision as of 13:13, 2 March 2011

| |

| Long title | The Patient Protection and Affordable Care Act. |

|---|---|

| Acronyms (colloquial) | PPACA |

| Nicknames | Affordable Care Act, Healthcare Insurance Reform, Healthcare Reform |

| Enacted by | the 111th United States Congress |

| Effective | March 23, 2010 Specific provisions phased in through January 1, 2018 |

| Citations | |

| Public law | 111–148 |

| Statutes at Large | 124 Stat. 119 through 124 Stat. 1025 (906 pages) |

| Legislative history | |

| |

| Major amendments | |

| Health Care and Education Reconciliation Act of 2010 | |

The Patient Protection and Affordable Care Act (PPACA)[1][2] is a federal statute that was signed into United States law by President Barack Obama on March 23, 2010. This Act and the Health Care and Education Reconciliation Act of 2010 (signed into law on March 30, 2010) made up the health care reform of 2010. The laws focus on reform of the private health insurance market, provide better coverage for those with pre-existing conditions, improve prescription drug coverage in Medicare and extend the life of the Medicare Trust fund by at least 12 years.[3]

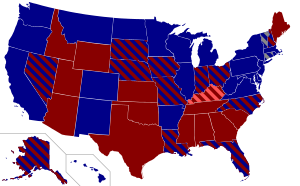

The PPACA passed the Senate on December 24, 2009, by a vote of 60–39 with all Democrats and Independents voting for, and all Republicans voting against. It passed the House of Representatives on March 21, 2010, by a vote of 219–212, with all 178 Republicans and 34 Democrats voting against the bill. The law has already received legal challenges regarding its constitutionality. Three cases in federal courts upheld the constitutionality of the bill while two deemed it unconstitutional.[4] Six other challenges were dismissed on grounds such as plaintiffs being unable to demonstrate sufficient standing.[4] The Supreme Court could review this law as early as the end of 2011.[5]

Summary of provisions

The law includes numerous health-related provisions to take effect over a four-year period beginning in 2010. In order of their assessed impact the primary provisions are as follows:

- Guaranteed issue and community rating will be implemented nationally so that insurers must offer the same premium to all applicants of the same age, sex, and geographical location regardless of pre-existing conditions.

- Medicaid eligibility is expanded to include all individuals and families with incomes up to 133% of the poverty level.

- Health insurance exchanges will commence operation in each state, offering a market place where individuals and small businesses can compare policies and premiums, and buy insurance (with a government subsidy if eligible).

- Firms employing 50 or more people but not offering health insurance will pay a "shared responsibility payment" (a fine) if the government has had to subsidize an employee's health care

- Non exempt persons not securing minimum essential health insurance coverage are also fined under the shared responsibility rules. This requirement to maintain insurance or pay a fine is often referred to as the individual mandate, though being insured is not actually mandated by law. Not being insured will not be a crime and no criminal penalty can attach to non payment of the fine. The fine serves to encourage most people into an insurance pool and to deter healthy individuals from buying insurance only when they become ill.

- Improved benefits for Medicare prescription drug coverage are to be implemented.

- Changes are enacted which allow a restructuring of Medicare reimbursement from "fee-for-service" to "bundled payments".

- Establishment of a national voluntary insurance program for purchasing community living assistance services and support.

- Low income persons and families above the Medicaid level and up to 400% of the poverty level will receive subsidies on a sliding scale if they choose to purchase insurance via an exchange (persons at 150% of the poverty level would be subsidized such that their premium cost would be of 2% of income or $50 a month for a family of 4).

- Very small businesses will be able to get subsidies if they purchase insurance through an exchange.

- Additional support is provided for medical research and the National Institutes of Health.

- Enrollment into CHIP and Medicaid is simplified with improvements to both programs.

- The law will introduce minimum standards for health insurance policies and remove all annual and lifetime coverage caps.

- The law mandates that some health care insurance benefits will be "essential" coverage for which there will be no co-pays.

- Policies issued before the law came into effect are "grandfathered" and are mostly not affected by the new rules.

Summary of funding

The Act's provisions are intended to be funded by a variety of taxes and offsets. Major sources of new revenue include a much-broadened Medicare tax on incomes over $200,000 and $250,000, for individual and joint filers respectively, an annual fee on insurance providers, and a 40% tax on "Cadillac" insurance policies. There are also taxes on pharmaceuticals, high-cost diagnostic equipment, and a federal sales tax on indoor tanning services. Offsets are from intended cost savings such as improved fairness in the Medicare Advantage program relative to traditional Medicare.[6]

Total new tax revenue from the Act will amount to $409.2 billion over the next 10 years. $78 billion will be realized before the end of fiscal 2014.[7] Summary of revenue sources:

- Broaden Medicare tax base for high-income taxpayers: $210.2 billion

- Annual fee on health insurance providers: $60 billion

- 40% excise tax on health coverage in excess of $10,200/$27,500: $32 billion

- Impose annual fee on manufacturers and importers of branded drugs: $27 billion

- Impose 2.3% excise tax on manufacturers and importers of certain medical devices: $20 billion

- Require information reporting on payments to corporations: $17.1 billion

- Raise 7.5% Adjusted Gross Income floor on medical expenses deduction to 10%: 15.2 billion

- Limit health flexible spending arrangements in cafeteria plans: $13 billion

- All other revenue sources: $14.9 billion

Provisions

The Act is divided into 10 titles[8] and contains provisions that became effective immediately, 90 days after enactment, and six months after enactment), as well as provisions that will become effective in 2014.[9][10]

Below are some of the key provisions of the Act. For simplicity, the amendments in the Health Care and Education Reconciliation Act of 2010 are integrated into this timeline.[11][12]

Effective at enactment

- The Food and Drug Administration is now authorized to approve generic versions of biologic drugs and grant biologics manufacturers 12 years of exclusive use before generics can be developed.[13]

- The Medicaid drug rebate for brand name drugs is increased to 23.1% (except the rebate for clotting factors and drugs approved exclusively for pediatric use increases to 17.1%), and the rebate is extended to Medicaid managed care plans; the Medicaid rebate for non-innovator, multiple source drugs is increased to 13% of average manufacturer price.[13]

- A non-profit Patient-Centered Outcomes Research Institute is established, independent from government, to undertake comparative effectiveness research.[13] This is charged with examining the "relative health outcomes, clinical effectiveness, and appropriateness" of different medical treatments by evaluating existing studies and conducting its own. Its 19-member board is to include patients, doctors, hospitals, drug makers, device manufacturers, insurers, payers, government officials and health experts. It will not have the power to mandate or even endorse coverage rules or reimbursement for any particular treatment. Medicare may take the Institute’s research into account when deciding what procedures it will cover, so long as the new research is not the sole justification and the agency allows for public input.[14] The bill forbids the Institute to develop or employ "a dollars per quality adjusted life year" (or similar measure that discounts the value of a life because of an individual’s disability) as a threshold to establish what type of health care is cost effective or recommended. This makes it different from the UK's National Institute for Health and Clinical Excellence.

- Creation of task forces on Preventive Services and Community Preventive Services to develop, update, and disseminate evidenced-based recommendations on the use of clinical and community prevention services.[13]

- The Indian Health Care Improvement Act is reauthorized and amended.[13]

Effective June 21, 2010

- Adults with pre-existing conditions became eligible to join a temporary high-risk pool, which will be superseded by the health care exchange in 2014.[10][15] To qualify for coverage, applicants must have a pre-existing health condition and have been uninsured for at least the past six months.[16] There is no age requirement.[16] The new program sets premiums as if for a standard population and not for a population with a higher health risk. Allows premiums to vary by age (4:1), geographic area, and family composition. Limit out-of-pocket spending to $5,950 for individuals and $11,900 for families, excluding premiums.[16][17][18]

Effective July 1, 2010

- The President established, within the Department of Health and Human Services, a council to be known as the National Prevention, Health Promotion and Public Health Council to help begin to develop a National Prevention and Health Promotion Strategy. The Surgeon General shall serve as the Chairperson of the new Council.[19][20]

Effective September 23, 2010

- Insurers are prohibited from imposing lifetime dollar limits on essential benefits, like hospital stays in new policies issued.[21]

- Dependents (children) will be permitted to remain on their parents' insurance plan until their 26th birthday,[22] and regulations implemented under the Act include dependents that no longer live with their parents, are not a dependent on a parent’s tax return, are no longer a student, or are married.[23][24]

- Insurers are prohibited from excluding pre-existing medical conditions (except in grandfathered individual health insurance plans) for children under the age of 19.[25][26]

- Insurers are prohibited from charging co-payments or deductibles for Level A or Level B preventive care and medical screenings on all new insurance plans.[27]

- Individuals affected by the Medicare Part D coverage gap will receive a $250 rebate, and 50% of the gap will be eliminated in 2011.[28] The gap will be eliminated by 2020.

- Insurers' abilities to enforce annual spending caps will be restricted, and completely prohibited by 2014.[10]

- Insurers are prohibited from dropping policyholders when they get sick.[10]

- Insurers are required to reveal details about administrative and executive expenditures.[10]

- Insurers are required to implement an appeals process for coverage determination and claims on all new plans.[10]

- Indoor tanning services are subjected to a 10% service tax.[10]

- Enhanced methods of fraud detection are implemented.[10]

- Medicare is expanded to small, rural hospitals and facilities.[10]

- Medicare patients with chronic illnesses must be monitored/evaluated on a 3 month basis for coverage of the medications for treatment of such illnesses.

- Non-profit Blue Cross insurers are required to maintain a loss ratio (money spent on procedures over money incoming) of 85% or higher to take advantage of IRS tax benefits.[10]

- Companies which provide early retiree benefits for individuals aged 55–64 are eligible to participate in a temporary program which reduces premium costs.[10]

- A new website installed by the Secretary of Health and Human Services will provide consumer insurance information for individuals and small businesses in all states.[10]

- A temporary credit program is established to encourage private investment in new therapies for disease treatment and prevention.[10]

Effective by January 1, 2011

- Insurers will be required to spend 85% of large-group and 80% of small-group and individual plan premiums (with certain adjustments) on healthcare or to improve healthcare quality, or return the difference to the customer as a rebate.[29]

- The Centers for Medicare and Medicaid Services is responsible for developing the Center for Medicare and Medicaid Innovation and overseeing the testing of innovative payment and delivery models.[30]

- Flexible spending accounts, healthcare reimbursement arrangements and health savings accounts cannot be used to pay for over the counter drugs, purchased without a prescription, except for insulin.[31]

Effective by January 1, 2012

- Employers must disclose the value of the benefits they provided beginning in 2012 for each employee's health insurance coverage on the employees' annual Form W-2's.[32] This requirement was originally to be effective January 1, 2011 but was postponed by IRS Notice 2010-69 on October 23, 2010.[33]

- New tax reporting changes come into effect which aims to prevent tax evasion by corporations and individuals. The provision is expected to raise $17 billion over 10 years.[34] Under the existing law, businesses have to notify the IRS on 1099 form of certain payments to individuals for certain services or property[35][36] over a reporting threshold of $600. But from December 31, 2011 the requirements will be changed so that payments to corporations and individuals must also be reported.[37][38] There are a number of exceptions: personal payments, payments for merchandise, telephone, freight, storage, and payments of rent to real estate agents are exempt from reporting.[35] The amendments made by this section of the Act (section 9006) shall apply to payments made by businesses after December 31, 2011.[36]

Effective by January 1, 2013

- Self-employment and wages of individuals above $200,000 annually (or of families above $250,000 annually) will be subject to an additional tax of 0.5%.[39]

Effective by January 1, 2014

- Insurers are prohibited from discriminating against or charging higher rates for any individuals based on pre-existing medical conditions.[10][40]

- Impose an annual penalty of $95, or up to 1% of income, whichever is greater, on individuals who do not secure insurance; this will rise to $695, or 2.5% of income, by 2016. This is an individual limit; families have a limit of $2,085.[41][42] Exemptions to the fine in cases of financial hardship or religious beliefs are permitted.[41]

- Insurers are prohibited from establishing annual spending caps.[10]

- Expand Medicaid eligibility; individuals with income up to 133% of the poverty line qualify for coverage, including adults without dependent children.[41][43]

- Two years of tax credits will be offered to qualified small businesses. In order to receive the full benefit of a 50% premium subsidy, the small business must have an average payroll per full time equivalent ("FTE") employee, excluding the owner of the business, of less than $25,000 and have fewer than 11 FTEs. The subsidy is reduced by 6.7% per additional employee and 4% per additional $1,000 of average compensation. As an example, a 16 FTE firm with a $35,000 average salary would be entitled to a 10% premium subsidy.[44]

- Impose a $2,000 per employee tax penalty on employers with more than 50 employees who do not offer health insurance to their full-time workers (as amended by the reconciliation bill).[45]

- Set a maximum of $2,000 annual deductible for a plan covering a single individual or $4,000 annual deductible for any other plan (see 111HR3590ENR, section 1302). These limits can be increased under rules set in section 1302.

- Under the CLASS Act provision, creates a new voluntary long-term care insurance program; enrollees who have paid premiums into the program and become eligible (due to disability or chronic illnesses) would receive benefits that help pay for assistance in the home or in a facility.[46]

- Employed individuals who pay more than 9.5% of their income on health insurance premiums will be permitted to purchase insurance policies from a state-controlled health insurance option.[9] If the employer provides an employer sponsored plan but the individual earns less than 400% of the Federal Poverty level and could qualify for a government subsidy, the employee is entitled to obtain a "free choice voucher" from the employer of equivalent value to the employer's offering which can be spent in the exchange to buy a subsidized policy of his own choosing.[47]

- Pay for new spending, in part, through spending and coverage cuts in Medicare Advantage, slowing the growth of Medicare provider payments (in part through the creation of a new Independent Payment Advisory Board), reducing Medicare and Medicaid drug reimbursement rate, cutting other Medicare and Medicaid spending.[12][48]

- Revenue increases from a new $2,500 limit on tax-free contributions to flexible spending accounts (FSAs), which allow for payment of health costs.[49]

- Chain restaurants and food vendors with 20 or more locations are required to display the caloric content of their foods on menus, drive-through menus, and vending machines. Additional information, such as saturated fat, carbohydrate, and sodium content, must also be made available upon request.[50]

- Establish health insurance exchanges, and subsidization of insurance premiums for individuals with income up to 400% of the poverty line, as well as single adults.[43][51][52] Section 1401(36B) of PPACA explains that the subsidy will be provided as an advanceable, refundable tax credit[53] and gives a formula for its calculation.[54] Refundable tax credit is a way to provide government benefit to people even with no tax liability[55] (example: Earned Income Credit). According to White House and Congressional Budget Office estimates, in 2016 the income-based premium caps for a "silver" healthcare plan for family of four would be the following:[56][57]

| Income | Premium Cap as a Share of Income | Middle of Income Range (family of 4)a | Avg Annual Enrollee Premium | Premium Subsidy (share of premium) | Avg Cost-Sharing Subsidy |

|---|---|---|---|---|---|

| 100–150% of federal poverty level | 2.1–4.7% of income | $30,000 | $600 | 96% | $3,300 |

| 150–200% of federal poverty level | 4.7–6.5% of income | $42,000 | $2,400 | 83% | $1,800 |

| 200–250% of federal poverty level | 6.5–8.4% of income | $54,000 | $4,000 | 72% | 0 |

| 250–300% of federal poverty level | 8.4–10.2% of income | $66,000 | $6,100 | 57% | 0 |

| 300–350% of federal poverty level | 10.2% of income | $78,000 | $9,200 | 44% | 0 |

| 350–400% of federal poverty level | 10.2% of income | $90,100 | $14,100 | 35% | 0 |

- Members of Congress and their staff will only be offered health care plans through the exchange or plans otherwise established by the bill (instead of the Federal Employees Health Benefits Program that they currently use).[59]

- A new excise tax goes into effect that is applicable to pharmaceutical companies and is based on the market share of the company; it is expected to create $2.5 billion in annual revenue.[42]

- Most medical devices become subject to a 2.3% excise tax collected at the time of purchase. (Reduced by the reconciliation act to 2.3% from 2.6%) [60]

- Health insurance companies become subject to a new excise tax based on their market share; the rate gradually raises between 2014 and 2018 and thereafter increases at the rate of inflation. The tax is expected to yield up to $14.3 billion in annual revenue.[42]

- The qualifying medical expenses deduction for Schedule A tax filings increases from 7.5% to 10% of earned income.[61]

Effective by January 1, 2017

- A state may apply to the Secretary of Health & Human Services for a waiver of certain sections in the law, with respect to that state, such as the individual mandate,[62] provided that the state develops a detailed alternative that "will provide coverage that is at least as comprehensive" and "at least as affordable" for "at least a comparable number of its residents" as the waived provisions. The decision of whether to grant this waiver is up to the Secretary (who must annually report to Congress on the waiver process) after a public comment period.[63]

Effective by 2018

- All existing health insurance plans must cover approved preventive care and checkups without co-payment.[10]

- A new 40% excise tax on high cost ("Cadillac") insurance plans is introduced. The tax (as amended by the reconciliation bill)[64] is on the cost of coverage in excess of $27,500 (family coverage) and $10,200 (individual coverage), and it is increased to $30,950 (family) and $11,850 (individual) for retirees and employees in high risk professions. The dollar thresholds are indexed with inflation; employers with higher costs on account of the age or gender demographics of their employees may value their coverage using the age and gender demographics of a national risk pool.[42][65]

Impact

Public policy impact

Deficit impact

The CBO estimated the legislation would reduce the deficit by $143 billion[66] over the first decade and by $1.2 trillion in the second decade.[67][68] Although the CBO generally does not provide cost estimates beyond the 10-year budget projection period (because of the great degree of uncertainty involved in the data) it decided to do so in this case at the request of lawmakers. It predicted deficit reduction around a broad range of one-half percent of GDP over the 2020s while cautioning that "a wide range of changes could occur".[69]

There was mixed opinion about the CBO estimates from others.

Uwe Reinhardt, a Health economist at Princeton, wrote that "The rigid, artificial rules under which the Congressional Budget Office must score proposed legislation unfortunately cannot produce the best unbiased forecasts of the likely fiscal impact of any legislation", but went on to say "But even if the budget office errs significantly in its conclusion that the bill would actually help reduce the future federal deficit, I doubt that the financing of this bill will be anywhere near as fiscally irresponsible as was the financing of the Medicare Modernization Act of 2003."[70]

Douglas Holtz-Eakin, a former CBO director who served during the George W. Bush administration, opined that the bill would increase the deficit by $562 billion.[71]

Republican House leadership and the Republican majority on the House Budget Committee estimate the law would increase the deficit by more than $700 billion in its first 10 years.[72][73]

Democratic House leadership and the Democratic minority on the House Budget Committee say the claims of budget gimmickry are false [74] and that repeal of the legislation would increase the deficit by $230 billion over the same period.[75]

David Walker, former U.S. Comptroller General now working for The Peter G. Peterson Foundation, has stated that the CBO estimates are not likely to be accurate, because it is based on the assumption that Congress is going to do everything they say they're going to do.[76] On the other hand, a Center on Budget and Policy Priorities analysis said that Congress has a good record of implementing Medicare savings. According to their study, Congress implemented the vast majority of the provisions enacted in the past 20 years to produce Medicare savings.[77][78]

Change in number of uninsured

According to Congressional Budget Office estimates, the number of uninsured residents will drop from current levels by 32 million people. This leaves 23 million residents who will still lack insurance in 2019 after the bill's provisions have all taken effect.[79] Among the people in this group will be:

- Illegal immigrants, estimated at almost a third of the 23 million, will be ineligible for insurance subsidies and Medicaid.[79]

- Those who do not enroll in Medicaid despite being eligible.[80]

- Those who are not otherwise covered and opt to pay the annual penalty (2.5% of income, $695 for individuals, or a maximum of $2,250 per family) instead of purchasing (presumably more expensive) insurance; this might be mostly younger and single Americans.[80]

- Those whose insurance coverage would cost more than 8% of household income; they are exempt from paying the annual penalty.[80]

Early experience under the Act was that, as a result of the tax credit for small businesses, many of them offered health insurance to their employees for the first time.[81]

Effect on national spending

The United States Department of Health and Human Services reported that the bill would increase "total national health expenditures" by more than $200 billion from 2010-2019.[82][83] Looking at the federal budget implications, the Congressional Budget Office (CBO) initially stated that the bill would "substantially reduce the growth of Medicare's payment rates for most services; impose an excise tax on insurance plans with relatively high premiums; and make various other changes to the federal tax code, Medicare, Medicaid, and other programs;"[67] However, CBO was required to exclude from its initial estimates the effects of concurrent "doc fix" legislation (see above) that would increase Medicare payments by more than $200 billion from 2010-2019. The "doc fix" legislation—separate from Patient Protection and Affordable Care Act—was enacted to permanently fill a gap in medicare reimbursement that had been filled on an annual basis since 1997. Therefore, the "doc fix" legislation had little to no effect on the actual budget deficit.[84][85][86][87][88] Subject to the same exclusion, the CBO initially estimated the federal government's share of the cost during the first decade at $940 billion, $923 billion of which takes place during the final six years (2014–2019) when the spending kicks in;[89][90] with revenue exceeding spending during these six years.[91] However, in a broader May 2010 presentation on "Health Costs and the Federal Budget," CBO stated:

- Rising health costs will put tremendous pressure on the federal budget during the next few decades and beyond. In CBO’s judgment, the health legislation enacted earlier this year does not substantially diminish that pressure.

CBO further observed that "a substantial share of current spending on health care contributes little if anything to people’s health" and concluded, "Putting the federal budget on a sustainable path would almost certainly require a significant reduction in the growth of federal health spending relative to current law (including this year’s health legislation)."[92]

For the effect on health insurance premiums, the CBO referred[67]: 15 to its November 2009 analysis[93] and stated that the effects would "probably be quite similar" to that earlier analysis. That analysis forecasted that by 2016: for the non-group market comprising 17% of the market, premiums per person would increase by 10 to 13% but that over half of these insureds would receive subsidies which would decrease the premium paid to "well below" premiums charged under current law; for the small group market 13% of the market, premiums would be impacted 1 to −3% and −8 to −11% for those receiving subsidies; for the large group market comprising 70% of the market, premiums would be impacted 0 to −3%, with insureds under high premium plans subject to excise taxes being charged −9 to −12%. The analysis was affected by various factors including increased benefits particularly for the nongroup markets, more healthy insureds due to the mandate, administrative efficiencies related to the health exchanges, and insureds under high premium plans reducing benefits in response to the tax.[93]

Surgeon Atul Gawande has noted that bill contains a variety of pilot programs that may have a significant impact on cost and quality over the long-run, although these have not been factored into CBO cost estimates. He stated these pilot programs cover nearly every idea healthcare experts advocate, except malpractice/tort reform. He argued that a trial and error strategy, combined with industry and government partnership, is how the U.S. overcame a similar challenge in the agriculture industry in the early 20th century.[94]

The Business Roundtable, an association of CEOs, commissioned a report from the consulting company Hewitt Associates that found that the legislation "could potentially reduce that trend line by more than $3,000 per employee, to $25,435" with respect to insurance premiums. It also stated that the legislation "could potentially reduce the rate of future health care cost increases by 15% to 20% when fully phased in by 2019". The group cautioned that this is all assuming that the cost-saving government pilot programs both succeed and then are wholly copied by the private market, which is uncertain.[95]

The Office of the Actuary at the Centers for Medicare and Medicaid Services released a report in April 2010 saying that the PPACA would increase the number of Americans with health insurance coverage but would also increase projected spending by approximately 1% over 10 years. The report also cautioned that the increases could be larger, because the Medicare cuts in the law may be unrealistic and unsustainable, forcing lawmakers to roll them back. The report projected that Medicare cuts could put nearly 15% of hospitals and other institutional providers into debt, "possibly jeopardizing access" to care for seniors.[96][97] The Bill was described as "the federal government’s biggest attack on economic inequality since inequality began rising more than three decades ago".[98]

After the bill was signed, AT&T, Caterpillar, Verizon, and John Deere issued financial reports showing large current charges against earnings, up to US$1 billion in the case of AT&T, attributing the additional expenses to tax changes in the new health care law.[99] Under the new law as of 2013 companies can no longer deduct a subsidy for prescription drug benefits granted under Medicare Part D.[100]

Political impact

Public opinions and views

Of ten polls conducted just prior to the passage of the bill, three found about equal opposition and support, five found a plurality expressing opposition, and two found a majority expressing opposition.[101] The differences could have been caused by context and phrasing of the questions; for example, support for mandates was 56 to 59% when subsidies were mentioned for those who could not afford insurance but 28% when penalties were mentioned.[101] Some ideas which showed majority support, such as purchasing drugs from Canada, limiting malpractice awards, and reducing the age to qualify for Medicare, were not enacted.[101]

Polls conducted for CNN probed the reasons for opposition to the bill and found that while many people opposed the bill for being too liberal, a number of people opposed the bill for not being liberal enough. In March 2010 a CNN poll of 1,030 adult Americans probed opinions about the bill and its relative liberalness. It found that 43% of respondents opposed the bill for being too liberal, and 39% supported the bill and 13% opposed it on the grounds that it was not liberal enough.[102][103] The identical question when asked in December 2010 found that 37% opposed the bill for being too liberal, 43% supporting the bill and 13% opposing it on the grounds of being not liberal enough.[104] Of the March respondents, 56% said the bill "gives the government too much involvement in health care", while 28% said it gives the government a "proper role" and 16% said the government's role would be "inadequate". On costs, 62% believed the bill "increases the amount of money they personally spend on health care", while 37% believed their costs would either remain the same or go down. On the fiscal impact of the bill, 70% believed it would lead to higher deficits, while 17% believed there would be no change and 12% said deficits would decrease.[103] In another poll prior to passage, a March 22 USA Today/Gallup poll of 1,005 adults found that 49% viewed the legislation as "a good thing" or otherwise reacted positively, while about 40% viewed it badly or otherwise reacted negatively. Opinions were found to be starkly divided by age, with a solid majority of seniors opposing the bill and a solid majority of those younger than 40 in favor.[105]

After the bill was passed, polls from CBS News,[106] CNN,[107] and Gallup[108] reported that Obama's approval rating improved. On the other side, a Rasmussen poll after passage reported that 55% of likely voters favored repealing the bill, and a Rasmussen poll in Florida found that 54% of likely voters favored Attorney General Bill McCollum's lawsuit to prevent the legislation's implementation.[109] On April 2, CBS reported that 34% of Americans approved of President Obama's handling of health care and 32% approved of the health care bill signed into law.[110]

In August 2010, citing what she called "a great deal of confusion about what is in [the reform law] and what isn’t" due to "misinformation given on a 24/7 basis", Health and Human Services Secretary Kathleen Sebelius said that the Obama administration has "a lot of reeducation to do".[111]

In terms of impact on the 2010 election cycle, Politico reported on September 5 that five House Democrats had run political ads highlighting their "no" votes on the bill, while there had not been any political ads highlighting a "yes" vote since April, when Harry Reid ran one.[112]

The nickname "Obamacare" has been characterized as pejorative,[113][114][115] but continues to be widely used to refer to the legislation.[116] Because of the number of "Obamacare" search engine queries, the Department of Health and Human Services purchased Google advertisements, triggered by the term, to direct people to the official HHS site, which provides factual information about the law[116] while referring to it only by variants of its official name.

Impact on child-only policies

In September 2010, some insurance companies announced that in response to the law, they would end the issuance of new child-only policies.[117][118] Kentucky Insurance Commissioner Sharon Clark said the decision by insurers to stop offering such policies was a violation of state law and ordered insurers to offer an open enrollment period in January 2011 for Kentuckians under 19.[119]

Constitutional challenges

Challenges by states

Organizations and lawmakers who opposed the passage of the bill threatened to take legal action against it upon its passage[120] and several court challenges are currently at various stages of development. The target of the threatened lawsuits were several key provisions of the bill. Some claimed that fining individuals for failing to buy insurance is not within the scope of Congress's taxing powers. Idaho legislators passed a law that directed its attorney general to sue if mandatory insurance becomes federal law, which he duly did. A total of 28 states have filed joint or individual lawsuits (including 26 states engaged in a joint action) to overturn the individual mandate portions of the law.[121][122][123][123][124][125][126][127][128] In a press release, the Attorneys General for several states indicated their primary basis for the challenge was a violation of state sovereignty. Their release repeated the claim challenging the federal power instruct under threat of penalty, that all citizens and legal residents have qualifying health care coverage. It also claimed that the law puts an unfair financial burden on state governments.[126] The lawsuit states the following legal rationale:

Regulation of non-economic activity under the Commerce Clause is possible only through the Necessary and Proper Clause. The Necessary and Proper Clause confers supplemental authority only when the means adopted to accomplish an enumerated power are 'appropriate', are 'plainly adapted to that end', and are 'consistent with the letter and spirit of the constitution.' Requiring citizen-to-citizen subsidy or redistribution is contrary to the foundational assumptions of the constitutional compact.[129]

Other states were either expected to join the multi-state lawsuit or are considering filing additional independent suits.[124][130][131] Members of several state legislatures are attempting to counteract and prevent elements of the bill within their states. Legislators in 29 states have introduced measures to amend their constitutions to nullify portions of the health care reform law. Thirteen state statutes have been introduced to prohibit portions of the law; two states have already enacted statutory bans. Six legislatures had attempts to enact bans, but the measures were unsuccessful.[132] In August 2010, a ballot initiative passed overwhelmingly in Missouri that would exempt the state from some provisions of the bill. Most legal analysts expect that the measure will be struck down if challenged in Federal court.[133]

Reactions from legal experts

Justice Department spokesman Charles Miller was quoted as stating, "We are confident that this statute is constitutional and we will prevail when we defend it."[134]

Michael C. Dorf, Professor of Law at Cornell University, wrote a lengthy analysis of present case law affecting the health care purchase mandate. He cited the 1922 Supreme Court case of Bailey v. Drexel Furniture Co. as the current precedent for invalidating Federal fines imposed via the Commerce Clause. In that case the Supreme Court ruled Congress could not impose fines through the Commerce Clause as a means to indirectly regulate activities. The Court in that case stated that the Commerce Clause does not authorize Congress to "use taxation as a pretext for accomplishing a regulatory objective that it could not accomplish directly".[135] Congress does have the power through the revenue raising clauses of the constitution to make such an imposition, but in that instance the primary purpose of the tax must be to raise revenue, "a tax that serves a revenue-raising purpose is not invalid simply because it also serves a regulatory purpose."[135] He concluded that the revenue creation aspect trumped the questions raised by the Commerce Clause, and the ability to have the health care bill brought down by a legal case would require the court to find the fine's primary purpose is to influence behavior and effect regulations rather than provide revenue.[135] Case law on the Commerce Clause has changed significantly since Bailey; the precedents set in United States v. Darby Lumber Co. (1941) (explicitly overturning 1918's Hammer v. Dagenhart) and 1942's Wickard v. Filburn may have an effect on the applicability of Bailey to the PPACA.

Mark Hall, Professor of Law at Wake Forest University, specializing in health care law and policy, was quoted as saying: "Under the Due Process Clause, no Supreme Court decision since 1935 has struck down any state or federal legislation for infringing economic liberties, and any such action would be radically inconsistent with current constitutional doctrine."[136] Regarding the attempts to override the health-care bill with state laws, Hall stated, "It doesn't make sense. The federal Constitution couldn't be any clearer that federal law is supreme," and characterized the state actions as "a kind of civil disobedience, a declaration that we're not going to follow the law of the land."[137]

Several legal experts contacted by the Associated Press characterized the lawsuits as "futile":[134] the lawsuits were called "pure political posturing" by constitutional law professor Robert Sedler at Wayne State University and constitutional law professor Bruce Jacob at Stetson University disparaged the lawsuit's chances and commented that the "federal government certainly can compel people to pay taxes".[134] Constitutional law professor Jared Goldstein of Roger Williams University stated, "There was a time when these arguments would have been persuasive, and that time was 1936, when the Supreme Court declared much of the New Deal to be unconstitutional," and compared the constitutionality of the health-care bill to other social and tax legislation that was subsequently considered to be constitutional, such as Social Security or tax penalties on companies that pollute.[138] Erwin Chemerinsky, dean and constitutional law professor of the University of California, Irvine, called the bill "clearly" constitutional, explaining that "everyone at some point is going to need health care, whether if it's for an auto accident or a communicable disease, and Congress can make sure everyone pays for the system they're likely to benefit from."[138]

Several lawyers and legal experts interviewed by the Los Angeles Times suggested that the precedent Gonzales v. Raich set in 2005 posed a particular hurdle for the lawsuits, because it interprets the Constitution as giving Congress "vast regulatory authority over interstate commerce" and is a precedent set by several members of the existing Supreme Court (including conservative Justices Scalia and Kennedy).[139] However, constitutional law professor Adam Winkler of UCLA noted that the current Supreme Court "has already shown itself to be willing to break from long-standing precedent in major cases" and "precedent rarely dictates how the court will rule" on "hot-button, partisan issues", although Winkler also disparaged the argument that Congress could not penalize people for failure to purchase health insurance.[139]

Federal Court rulings

The first federal court ruling in the legal challenges to the health care act came on August 2, 2010, in response to the suit brought by Virginia's attorney general. U.S. District Judge Henry E. Hudson denied the Justice Department's request to have the suit dismissed, citing the complex constitutional questions the law raises. In a 32-page opinion, Hudson wrote that the reform act "radically changes the landscape of health insurance coverage in America."

On October 8, U.S. District Court Judge George Caram Steeh affirmed that in his view the law was constitutional. Judge Steeh rejected the arguments that refusing to buy health insurance is not activity, but inactivity, and that Congress has never had the power to order people to engage in economic activity when they choose not to do so. "Far from ‘inactivity," he said, "by choosing to forgo insurance [the challengers] are making an economic decision to try to pay for health care services later, out of pocket, rather than now through the purchase of insurance, collectively shifting billions of dollars, $43 billion in 2008, onto other market participants." The judge said that this “cost-shifting,” “is exactly what the Health Care Reform Act was enacted to address.” He rejected the argument of the challengers that he would have to go through “metaphysical gymnastics” in order to find a link between a failure to buy insurance and Congress’s power to regulate the interstate market for health insurance.[140]

He rejected a private suit [141] filed by Michigan's Thomas More Law Center and several state residents that focused on alleged violations of the Commerce Clause. He ruled that Congress had the power to pass the law because it affected interstate commerce and was part of a broader regulatory scheme.[142][143] A week later, a federal judge in Florida allowed lawsuits brought by 20 states to move forward, ordering a December trial on two claims while dismissing four others. U.S. District Court Judge Roger Vinson based his ruling on the propriety of imposing Medicaid expenses on the states and the penalty tied to opting out of having a minimum benefits plan, a provision he described as "simply without prior precedent."[144][145]

On November 30, 2010, U.S. District Court Judge Norman K. Moon who sits in Virginia also declared the individual mandate legal and constitutional. He also declared the employer mandate constitutional. He rejected two other arguments that government lawyers have made in cases across the country in defending the new law: first, that no one has legal standing to bring challenges at this point to the 2014 mandates, and second that any such challenge is premature. He rejected the challengers’ basic argument that Congress had no authority to order someone to give up their own desire not to buy a commercial product and force them into a market they do not want to enter. He said, “Regardless of whether one relies on an insurance policy, one’s savings, or the backstop of free or reduced-cost emergency room services, one has made a choice regarding the method of payment for the health care services one expects to receive. Far from ‘inactivity,’ by choosing to forgo insurance, [individuals] are making an economic decision to try to pay for health care services later, out of pocket, rather than now, through the purchase of insurance….As Congress found, the total incidence of these economic decisions has a substantial impact on the national market for health care by collectively shifting billions of dollars on to other market participants and driving up the prices of insurance policies.”[146]

On December 12, 2010, in the first ruling rejecting the law's constitutionality, a federal court ruled that the law's requirement that Americans maintain a minimum level of health insurance was unconstitutional, and that the "tax" imposed on people who choose not to have a "minimum essential coverage plan" was in practice a "penalty" and that it was not linked with the federal government's constitutional right to raise revenues. Judge Hudson stated he could find no precedent for extending either Commerce Clause or the General Welfare Clause to encompass regulation of a person’s decision not to purchase a product. He ruled the provision to be beyond the power given to Congress under the Commerce Clause. His ruling covered only Section 1501 of the Act, and severed that requirement without discussing the rest of the law.[147][148][149] Federal judges in two previous decisions have ruled this provision was constitutional, making it likely that the Supreme Court will end up ruling on the law.[150]

On January 31, 2011, Judge Roger Vinson declared the law unconstitutional in an action brought by 26 states, on the grounds that the portion which provides an individual mandate to purchase insurance exceeds the authority of Congress to regulate interstate commerce. Vinson further ruled the clause was not severable, which has the effect of striking down the entire law.[151][152]

On February 22, 2011, Judge Gladys Kessler of the U.S. District Court for the District of Columbia, rejected a challenge to the law by 5 individuals who argued, among other things, that the Affordable Care Act violated the Religious Freedom Restoration Act and that the law's mandate that most Americans purchase insurance or pay a fine exceeded Congress's power under the Interstate Commerce Clause. Judge Kessler flatly rejected as "pure semantics" plaintiffs' argument that failing to acquire insurance was the regulation of inactivity, noting that "those who choose not to purchase health insurance will ultimately get a "free ride" on the backs of those Americans who have made responsible choices to provide for the illness we all must face at some point in our lives." Kessler ruled that the so-called "individual mandate" was a valid exercise of Congress's power to regulate interstate commerce. Kessler's ruling marks the third federal court decision upholding the Affordable Care Act as constitutional.[153] [4]

Repeal efforts

111th Congress

Reps. Steve King of Iowa and Michelle Bachmann of Minnesota, both Republicans, introduced bills in the House to repeal the act shortly after it was passed, as did Sen. Jim DeMint in the Senate.[154] None of the three bills was considered by either body.

112th Congress

In 2011, the Republican-controlled House of Representatives voted 245–189 to approve a bill entitled "Repealing the Job-Killing Health Care Law Act" (H.R.2), which, if enacted, would repeal the Patient Protection and Affordable Care Act and the health care-related text of the Health Care and Education Reconciliation Act of 2010.[155] Passage into law seems unlikely because of Democratic Party control in the Senate and President Obama's statement that he would veto the bill should it pass both chambers.[156] Democrats in the House proposed that repeal not take effect until a majority of the Senators and Representatives had opted out of the Federal Employees Health Benefits Program. The Republicans voted down this measure.[157]

The House Republican leadership justified its use of the term "job killing" by contending that the PPACA would lead to a loss of 650,000 jobs, and attributing that figure to a report by the Congressional Budget Office.[158] FactCheck noted that the 650,000 figure was not in the CBO report, and said that the Republican statement "badly misrepresents what the Congressional Budget Office has said about the law. In fact, CBO is among those saying the effect 'will probably be small.'"[158] The Republicans also cited a study by the National Federation of Independent Businesses, but PolitiFact.com said that the 2009 NFIB study had concerned an earlier version of the bill that differed significantly from what was enacted.[159] PolitiFact rated the Republican statement as False.[159] A spokesman for Republican Majority Leader Eric Cantor stated, "This is a job-killing law, period. Anyone who argues otherwise is ignoring the construct of the health care law and the widely accepted facts."[158]

Cost of repeal

Repealing the health care reform law would cost the nation more than $210 billion over the next decade, according to the nonpartisan Congressional Budget Office. [160]

Temporary waivers

Interim regulations have been put in place for a specific type of employer funded insurance, the so-called "mini-med" or limited benefit plans which are low cost to employers who buy them for their employees but which cap coverage at a very low level. Such plans are sometimes offered to low paid and part-time workers, for example in fast food restaurants or purchased direct from an insurer. Most company provided health insurance from September 23, 2010 may not set an annual coverage cap lower than $750,000,[161] a lower limit which is raised in stages until 2014, by which time no insurance caps are allowed at all. By 2014 no health insurance, whether sold in the individual or group market, will be allowed to place an annual cap on coverage. The waivers have been put in place to encourage employers and insurers offering mini-med plans not to withdraw medical coverage before the full regulations come into force (by which time small employers and individuals will be able to buy non-capped coverage through the exchanges) and are granted only if the employer can show that complying with the limit would mean a significant decrease in employees' benefits coverage or a significant increase in employees' premiums.[161]

Among those receiving waivers were large insurers, such as Aetna and Cigna, union plans covering about one million employees and McDonald's, which has 30,000 hourly employees whose plans have annual caps of $10,500. The waivers are issued for one year and can be reapplied for.[162][163] Referring to the adjustments as "a balancing act," Nancy-Ann DeParle, director of the Office of Health Reform at the White House, said, "The president wants to have a smooth glide path to 2014."[162] On Jan 26, 2011 HHS said it had to date granted a total of 733 waivers for 2011, covering 2.1 million people, or about 1% of the privately insured population.[164]

See also

- Comparison of Canadian and American health care systems

- Death panel

- Universal health care

- U.S. health care compared with 8 other countries in tabular form

References

- ^ Elmendorf, Douglas W. (January 22, 2010). "Additional Information on the Effect of the Patient Protection and Affordable Care Act on the Hospital Insurance Trust Fund". Congressional Budget Office. Retrieved 2010-03-31.

This letter responds to questions you posed about the Congressional Budget Office's (CBO's) analysis of the effects of H.R. 3590, the Patient Protection and Affordable Care Act (PPACA)

- ^ Pub. L. 111–148 (text) (PDF), 124 Stat. 119, to be codified as amended at scattered sections of the Internal Revenue Code and in 42 U.S.C..

- ^ http://www.healthcare.gov/law/introduction/index.html

- ^ a b c "Defending the Affordable Care Act". United States Department of Justice. Retrieved 2011-02-24.

- ^ http://thehill.com/homenews/administration/141631-lawmakers-press-court-for-verdict

- ^ Peter Grier, Health care reform bill 101: Who will pay for reform?, Christian Science Monitor (March 21, 2010).

- ^ "Joint Committee On Taxation, March 20, 2010 (JCX-17-10)"

- ^ Patient Protection and Affordable Care Act from Wikisource.

- ^ a b "Key Points Of The Health Care Reform Bil". The Kentucky Post. Retrieved 2010-03-22.

- ^ a b c d e f g h i j k l m n o p Binckes, Jeremy (2010-03-22). "The Top 18 Immediate Effects Of The Health Care Bill". The Huffington Post. Retrieved 2010-03-22.

{{cite news}}: Unknown parameter|coauthors=ignored (|author=suggested) (help) - ^ Hossain, Farhana; Tse, Archie (March 23, 2010). "Comparing the House and the Senate Health Care Proposals". New York Times. Retrieved May 21, 2010..

- ^ a b "Updated Health Care Charts". Committee for a Responsible Federal Budget. November 19, 2009..

- ^ a b c d e "Health Reform Implementation Timeline". Kaiser Family. Retrieved 2010-03-30.

- ^ http://today.msnbc.msn.com/id/36135106/ns/health-health_care/

- ^ Grier, Peter (2010-03-24). "Health care reform bill 101: rules for preexisting conditions". The Christian Science Monitor. Retrieved 2010-03-25.

- ^ a b c Tergesen, Anne (June 5, 2010). "Insurance Relief for Early Retirees". The Wall Street Journal.

- ^ "Kaiser: High-Risk Pool Provisions under the Health Reform Law" (PDF).

- ^ Hilzenrath, David S. (May 4, 2010). "18 states refuse to run insurance pools for those with preexisting conditions". The Washington Post.

- ^ "Patient Protection and Affordable Care Act/Title IV/Subtitle A/Sec. 4001. National Prevention, Health Promotion and Public Health Council".

- ^ Executive Order 13544 - Establishing the National Prevention, Health Promotion, and Public Health Council, June 10, 2010, Vol. 75, No. 114, 75 FR 33983

- ^ http://www.healthcare.gov/law/about/order/byyear.html

- ^ H.R. 3590 Enrolled, section 1001 (adding section 2714 to the Public Health Service Act): "A group health plan and a health insurance issuer offering group or individual health insurance coverage that provides dependent coverage of children shall continue to make such coverage available for an adult child (who is not married) until the child turns 26 years of age."

- ^ Pear, Robert (May 10, 2010). "Rules Let Youths Stay on Parents' Insurance". New York Times.

- ^ "Young Adults and the Affordable Care Act: Protecting Young Adults and Eliminating Burdens on Families and Businesses" (PDF) (Press release). Executive Office of the President of the United States.

- ^ Note: Language in the law concerning this provision has been described as ambiguous, but representatives of the insurance industry have indicated they will comply with regulations to be issued by the Secretary of Health and Human Services reflecting this interpretation.

- Pear, Robert (March 28, 2010). "Coverage Now for Sick Children? Check Fine Print". The New York Times. Retrieved April 8, 2010.

{{cite news}}: Unknown parameter|lastauthoramp=ignored (|name-list-style=suggested) (help) - Holland, Steve (March 29, 2010). "Obama administration has blunt message for insurers". Reuters. Retrieved April 8, 2010.

{{cite news}}: Unknown parameter|lastauthoramp=ignored (|name-list-style=suggested) (help) - Pear, Robert (March 30, 2010). "Insurers to Comply With Rules on Children". The New York Times. Retrieved April 8, 2010.

{{cite news}}: Unknown parameter|lastauthoramp=ignored (|name-list-style=suggested) (help) - Alonso-Zaldivar, Ricardo (March 24, 2010). "Gap in Health Care Law's Protection for Children". ABC News. Associated Press. Retrieved April 8, 2010.

- Pear, Robert (March 28, 2010). "Coverage Now for Sick Children? Check Fine Print". The New York Times. Retrieved April 8, 2010.

- ^ U.S. Department of Health and Human Services (June 28, 2010). "Patient Protection and Affordable Care Act; Requirements for Group Health Plans and Health Insurance Issuers Under the Patient Protection and Affordable Care Act Relating to Preexisting Condition Exclusions, Lifetime and Annual Limits, Rescissions, and Patient Protections; Final Rule and Proposed Rule". Federal Register. 75 (123): 37187–37241. Retrieved July 26, 2010.

- ^ Bowman, Lee (2010-03-22). "Health reform bill will cause several near-term changes". Scripps Howard News Service. Retrieved 2010-03-23.

{{cite news}}: Cite has empty unknown parameter:|coauthors=(help) - ^ Rao, Smriti (2010-03-22). "Health-Care Reform Passed. So What Does It Mean?". 80beats. Discover. Retrieved 2010-03-23.

{{cite news}}: Cite has empty unknown parameter:|coauthors=(help) - ^ H.R. 3590 public print, sec. 10101(f), adding Sec. 2718. Bringing down the cost of health care coverage of the Public Health Service Act.

- ^ Center for Medicare and Medicaid Innovation, http://healthreformgps.org/resources/center-for-medicare-and-medicaid-innovation/.

- ^ "IRS Issues Guidance Explaining 2011 Changes to Flexible Spending Arrangements". www.irs.gov. Retrieved 2010-09-15.

- ^ Smith, Donna (March 19, 2010). "FACTBOX-US healthcare bill would provide immediate benefits". Reuters.

- ^ http://www.irs.gov/pub/irs-drop/n-2010-69.pdf

- ^ "Costly changes to 1099 reporting in health care law".

- ^ a b "Instructions for Form 1099-MISC" (PDF).

- ^ a b "U.S. Government Printing Office".

- ^ "Healthcare Law Includes Tax Credit, Form 1099 Requirement".

- ^ "Health Care Bill Brings Major 1099 Changes".

- ^ http://www.gpo.gov/fdsys/pkg/BILLS-111hr3590pp/pdf/BILLS-111hr3590pp.pdf pp 2000. 2001, 2002, 2003

- ^ Alonso-Zaldivar, Ricardo (March 24, 2010). "Gap in Health Care Law's Protection for Children". ABC News. Associated Press. Retrieved 2010-04-07.

- ^ a b c Galewitz, Phil (March 26, 2010). "Consumers Guide To Health Reform". Kaiser Health News.

- ^ a b c d Downey , Jamie (March 24, 2010). "Tax implications of health care reform legislation". Boston Globe. Retrieved 2010-03-25.

{{cite news}}: Italic or bold markup not allowed in:|publisher=(help) - ^ a b "5 key things to remember about health care reform". CNN. March 25, 2010. Retrieved May 21, 2010.

- ^ Peterson, Chris L.; Chaikind, Hinda (April 20, 2010). Summary of Small Business Health Insurance Tax Credit Under PPACA (P.L. 111-148) (PDF). Congressional Research Service. p. 3 (Table 2). Retrieved February 23, 2011.

{{cite book}}: Unknown parameter|lastauthoramp=ignored (|name-list-style=suggested) (help); Unknown parameter|separator=ignored (help) - ^ McNamara, Kristen (March 25, 2010), "What Health Overhaul Means for Small Businesses", The Wall Street Journal

- ^ "Carney: Health insurance law will benefit senior citizens". The Daily Item. Sunbury, Pennsylvania. March 26, 2010.

- ^ Section 10108 FREE CHOICE VOUCHERS

- ^ "Health Reform, Point by Point - Bills Compared". Wall Street Journal. March 22, 2010. Retrieved 2010-04-07.

- ^ Burkes, Paula (November 8, 2009). "Medical Expense Accounts Could be Limited to $2,500". The Oklahoman..

- ^ Spencer, Jean (2010-03-22). "Menu Measure: Health Bill Requires Calorie Disclosure". The Wall Street Journal. Retrieved 2010-03-23.

- ^ Galewitz, Phil (2010-03-22). "Health reform and you: A new guide". Kaiser Health News. MSNBC. Retrieved 2010-03-23.

- ^ "Health Care Reform Bill 101". The Christian Science Monitor.

- ^ "Patient Protection and Affordable Care Act/Title I/Subtitle E/Part I/Subpart A".

- ^ Patient Protection and Affordable Care Act: Title I: Subtitle E: Part I: Subpart A: Premium Calculation

- ^ "Refundable Tax Credit".

- ^ a b "An Analysis of Health Insurance Premiums Under the Patient Protection and Affordable Care Act".

- ^ "Policies to Improve Affordability and Accountability". The White House.

- ^ "Kaiser Family Foundation:Health Reform Subsidy Calculator -- Premium Assistance for Coverage in Exchanges/Gateways".

- ^ H.R. 3590 Public Print, section 1312: "... the only health plans that the Federal Government may make available to Members of Congress and congressional staff with respect to their service as a Member of Congress or congressional staff shall be health plans that are (I) created under this Act (or an amendment made by this Act); or (II) offered through an Exchange established under this Act (or an amendment made by this Act)."

- ^ "Health Care reform Reconciliation Act" (PDF).

- ^ Krantz, Matt (March 24, 2010). "Highlights of the Tax Provisions in Health Care Reform". Accuracy in Media. Retrieved May 21, 2010.

- ^ "Wyden: Health Care Lawsuits Moot, States Can Opt Out Of Mandate". HuffingtonPost.com. March 24, 2010. Retrieved March 27, 2010.

- ^ H.R. 3590 Public Print, section 1332.

- ^ Gold, Jenny (2010-01-15). "'Cadillac' Insurance Plans Explained". Kaiser Health News.

- ^ "H.R. 4872, THE HEALTH CARE & EDUCATION AFFORDABILITY RECONCILIATION ACT of 2010 IMPLEMENTATION TIMELINE" (PDF). US House COMMITTEES ON WAYS & MEANS, ENERGY & COMMERCE, AND EDUCATION & LABOR. March 18, 2010. p. 7. Retrieved 24 March 2010.

- ^ Congressional Budget Office, Cost Estimates for H.R. 4872, Reconciliation Act of 2010 (Final Health Care Legislation) March 20, 2010).

- ^ a b c "Correction Regarding the Longer-Term Effects of the Manager's Amendment to the Patient Protection and Affordable Care Act" (PDF). Congressional Budget Office. December 19, 2009. Retrieved March 22, 2010.

- ^ CNN (March 18, 2010). "Where does health care reform stand?". Retrieved May 12, 2010.

{{cite news}}:|author=has generic name (help) - ^ Farley, Robert (March 18, 2010). "Pelosi: CBO says health reform bill would cut deficits by $1.2 trillion in second decade". PolitiFact. St. Petersburg Times. Retrieved 2010-04-07.

- ^ Uwe Reinhardt (24 March 2010). "Wrapping Your Head Around the Health Bill". The New York Times. Retrieved 9 October 2010.

- ^ Holtz-Eakin, Douglas (March 21, 2010). "The Real Arithmetic of Health Care Reform". The New York Times.

- ^ http://budget.house.gov/healthcare/

- ^ http://www.speaker.gov/Blog/?postid=219211

- ^ http://democrats.budget.house.gov/PRArticle.aspx?NewsID=1946

- ^ http://democrats.budget.house.gov/PRArticle.aspx?NewsID=1930

- ^ James, Frank (March 19, 2010). "Health Overhaul Another Promise U.S. Can't Afford: Expert". The Two-Way. National Public Radio. Retrieved 2010-04-07.

- ^ "Congress Has Good Record of Implementing Medicare Savings". CBPP. Retrieved 2010-03-28.

- ^ "Can Congress cut Medicare costs?". voices.washingtonpost.com. Retrieved 2010-03-28.

- ^ a b "Cost Estimate for Pending Health Care Legislation". Congressional Budget Office. March 20, 2010. Retrieved 2010-03-28.

- ^ a b c Trumbull, Mark (March 23, 2010). "Obama signs health care bill: Who won't be covered?". Christian Science Monitor. Retrieved 2010-03-24.

- ^ Levey, Noam N. (December 27, 2010). "More small businesses are offering health benefits to workers". Los Angeles Times.

- ^ https://www.cms.gov/ActuarialStudies/Downloads/S_PPACA_2009-12-10.pdf

- ^ http://www.politico.com/static/PPM110_091211_financial_impact.html

- ^ http://www.cbo.gov/ftpdocs/113xx/doc11376/RyanLtrhr4872.pdf

- ^ http://washingtonexaminer.com/node/78126

- ^ http://www.nationalreview.com/critical-condition/55996/obamacare-s-cooked-books-and-doc-fix/james-c-capretta

- ^ http://www.investors.com/NewsAndAnalysis/Article/554579/201011221909/GOP-Might-Target-ObamaCare-As-Part-Of-A-Medicare-Doc-Fix.aspx

- ^ http://www.heritage.org/Research/Reports/2009/12/An-Analysis-of-the-Senate-Democrats-Health-Care-Bill

- ^ "H.R. 4872, Reconciliation Act of 2010" (PDF). Congressional Budget Office. March 18, 2010. Retrieved March 22, 2010..

- ^ Dennis, Steven (March 18, 2010). "CBO: Health Care Overhaul Would Cost $940 Billion". Roll Call. Economist Group. Retrieved March 22, 2010.

- ^ Klein, Ezra (March 22, 2010). "What does the health-care bill do in its first year?". Washington Post.

- ^ http://www.cbo.gov/ftpdocs/115xx/doc11544/Presentation5-26-10.pdf

- ^ a b CBO.(Nov 2009).[www.cbo.gov/doc.cfm?index=10781&type=1 An Analysis of Health Insurance Premiums Under the Patient Protection and Affordable Health Care Act].

- ^ Gawande, Atul (2009). "Testing, Testing". The New Yorker. Retrieved March 22, 2010.

{{cite journal}}: Unknown parameter|month=ignored (help) - ^ Farley, Robert (March 19, 2010). "Obama says health reform legislation could reduce costs in employer plans by up to $3,000". PolitiFact. St. Petersburg Times. Retrieved 2010-04-07.

- ^ "Report Says Health Care Will Cover More, Cost More: Mixed Review For New Health Care Law Says Covering More Still Comes With Greater Costs," Associated Press, April 23, 2010

- ^ Richard S. Foster, Estimated Financial Effects of the “Patient Protection and Affordable Care Act” as Amended, Centers for Medicare and Medicaid Services, April 22, 2010

- ^ Leonhardt, David (2010). "In Health Bill, Obama Attacks Wealth Inequality". The New York Times. Retrieved July 20, 2010.

{{cite journal}}: Unknown parameter|month=ignored (help) - ^ Gienger, Viola (March 27, 2010). "AT&T, Deere CEOs Called by Waxman to Back Up Health-Bill Costs". Bloomberg BusinessWeek. Retrieved April 7, 2010.

{{cite web}}: Unknown parameter|lastauthoramp=ignored (|name-list-style=suggested) (help) - ^ Locke G. Don't Believe the Writedown Hype. Wall Street Journal

- ^ a b c Blendon RJ, Benson JM (2010). "Public opinion at the time of the vote on health care reform". N. Engl. J. Med. 362 (16): e55. doi:10.1056/NEJMp1003844. PMID 20375397.

{{cite journal}}: Unknown parameter|month=ignored (help) - ^ http://i2.cdn.turner.com/cnn/2010/images/03/22/rel5a.pdf

- ^ a b Barbieri, Rich (March 22, 2010). "CNN poll: Americans don't like health care bill". CNN. Retrieved 2010-03-27.

- ^ http://i2.cdn.turner.com/cnn/2010/images/12/27/rel17h.pdf

- ^ Page, Susan (March 24, 2010). "Poll: Health care plan gains favor". USA Today. Retrieved 2010-03-24.

- ^ "The President and Health Care Reform: Before and After the House Vote" (PDF). CBS News. March 23, 2010. Retrieved March 27, 2010.

- ^ "CNN Opinion Research, March 25–28" (PDF).

- ^ Jones, Jeffrey M. (March 25, 2010). "Obama Job Approval at 51% After Healthcare Vote". Gallup. Princeton, NJ. Retrieved 2010-04-07.

- ^ Hunt, David (March 25, 2010). "Rasmussen: Support for health care bill repeal, lawsuit". The Florida Times-Union. Retrieved March 27, 2010.

{{cite news}}: Italic or bold markup not allowed in:|publisher=(help) - ^ Reals, Tucker (April 2, 2010). "Obama's Approval Rating Hits New Low". CBS News. Retrieved 2010-04-07.

- ^ Portnoy, Steven (August 30, 2010), "Sebelius: Time for 'Reeducation' on Obama Health Care Law", ABC News, retrieved August 31, 2010

- ^ Haberkorn, Jennifer (September 5, 2010). "Dems run away from health care". Politico.com.

- ^ White, Liz (April 21, 2010). "Stewart Calls It: 'Obamacare' Derogatory". Newsweek. Retrieved February 9, 2011.

- ^ Banks, Marnee (January 12, 2011). "Term 'Obamacare' stirs controversy in Montana Senate". KRTV. Retrieved February 9, 2011.

- ^ Serafini, Marilyn Werber (January 3, 2011). "Rebranding 'Obamacare'". Kaiser Health News. Retrieved February 9, 2011.

{{cite web}}: Unknown parameter|separator=ignored (help) - ^ a b Smith, Ben (December 17, 2010). "HHS Buys 'ObamaCare'". Politico. Retrieved February 9, 2011.

- ^ Insurers to Bail on Child-Only Policies as Health Care Law Looms, CBS News, September 22, 2010

- ^ Big health insurers to stop selling new child-only policies, Los Angeles Times, September 21, 2010

- ^ http://www.kentucky.com/2010/11/19/1530685/state-orders-health-insurers-to.html

- ^ "Health Care Bill Could Face String of Legal Challenges". FOX News. December 22, 2009. Retrieved 2010-03-22.

- ^ http://www.radioiowa.com/2011/01/18/iowa-governor-signs-onto-florida-lawsuit-against-federal-health-care/

- ^ http://www.google.com/hostednews/ap/article/ALeqM5giOQXkkuPxjbjmUmOetSMgCZE5VQ?docId=e7900a812cbb4841b76d68fc222374d1

- ^ a b Murphy, Brian (March 18, 2010). "Otter is the first governor to sign a law saying the state will defy a requirement to buy insurance". Idaho Statesman. Retrieved 2010-03-22.

- ^ a b Goodhue, David (March 22, 2010). "Attoneys General Sue To Stop Health Care Bill". All Headline News. Retrieved 2010-03-22.

- ^ Richey, Warren (March 22, 2010). "Attorneys general in 11 states poised to challenge healthcare bill". Christian Science Monitor. Retrieved 2010-03-22.

- ^ a b Farrington, Brendan (March 23, 2010). "13 attorneys general sue over health care overhaul". Associated Press. Retrieved 2010-05-14.

- ^ Williams, Pete (March 23, 2010). "State attorneys general sue over health bill". MSNBC.com. Retrieved 2010-03-23.

- ^ Fletcher, Pascal (April 7, 2010). "Update 3-Florida says challenge to healthcare reform widens". Reuters. Retrieved April 9, 2010.

{{cite news}}: Unknown parameter|lastauthoramp=ignored (|name-list-style=suggested) (help) - ^ Case 3:10-cv-00188-HEH, Document 1. Page 5 March 23, 2010

- ^ Richey, Warren (March 23, 2010), "Attorneys general in 14 states sue to block healthcare reform law", The Christian Science Monitor, Retrieved March 24, 2010

- ^ Funk, Josh (March 22, 2010). "AG Bruning says health reform violates Constitution". Lincoln Journal Star. Retrieved on 2010-03-23.

- ^ Cauchi, Richard. "State Legislation Opposing Certain Health Reforms, 2009-2010". National Conference of State Legislatures. Retrieved 2010-03-23.

- ^ Messenger, Tony. "Prop C passes overwhelmingly".

- ^ a b c Farrington, Brendon (March 23, 2010). "White House, experts: Health care suit will fail". The San Diego Union-Tribune. Associated Press. Retrieved 2010-04-07.

- ^ a b c Dorf, Michael (November 2, 2009). "The Constitutionality of Health Insurance Reform". FindLaw. Retrieved 2010-03-23.

- ^ Norman, Mike (March 25, 2010). "Give me liberty or give me mandatory health insurance". Fort Worth Star-Telegram. Retrieved 2010-04-07.

- ^ Lavoie, Denise (March 22, 2010). "Opponents take last stand against health care bill". San Francisco Chronicle. Associated Press. Retrieved 2010-04-07. [dead link]

- ^ a b Fitzpatrick, Edward (March 25, 2010). "Legal scholars say health-care bill is constitutional". Providence Journal. Retrieved 2010-04-07.

- ^ a b Savage, David (March 27, 2010). "States fighting healthcare law don't have precedent on their side". Los Angeles Times. Retrieved 2010-04-07.

- ^ Health insurance mandate upheld Lyle Denniston, Official reporter for the Supreme Court reporting on the finding that the Individual Mandate is constitutional

- ^ "Thomas More Law Center et al v. Barrack Hussein Obama et al" (pdf). U.S. District Court for the Eastern District of Michigan. March 20, 2010. Retrieved 2010-10-14.

- ^ Crawford, Jan (October 7, 2010). "Michigan Judge Upholds Provisions in Health Care Law". CBS News. Retrieved 2010-10-13.

- ^ Sack, Kevin (October 7, 2010). "Judge Rules Health Law Is Constitutional". New York Times. Retrieved 2010-10-13.

{{cite news}}: Italic or bold markup not allowed in:|publisher=(help) - ^ Nelson, Melissa (October 14, 2010). "Judge OKs states' suit over health overhaul". Anchorage Daily News. Associated Press. Retrieved 2010-10-14.

{{cite news}}: Italic or bold markup not allowed in:|publisher=(help); Unknown parameter|city=ignored (|location=suggested) (help) - ^ "Judge lets states' healthcare suit go forward". Reuters. October 14, 2010. Retrieved 2010-10-14.

- ^ Second ruling upholds health clause Scotus official reporter on the second case finding in favor of the bill's constitutionality in respect of the individual and employer mandates

- ^ Schoenberg, Tom (December 13, 2010). "Obama's Health-Care Law Ruled Unconstitutional Over Insurance Requirement". Bloomberg. Retrieved 2011-01-11.

The Obama administration's health- care overhaul unconstitutionally requires Americans to maintain a minimum level of health insurance, a federal judge ruled, striking down the linchpin of the plan.

- ^ "Federal Judge Rules in Favor of Virginia's Central Challenge to Health Care Law - FoxNews.com". www.foxnews.com. Retrieved 2010-12-13.

- ^ "U.S District Court for the Eastern District of Virginia, Richmond Division, Civil Action No. 3:10CV188-HEH, Cuccinelli v. Sebelius, Document 161" (PDF). 2010-12-13. Retrieved 2010-12-13.

- ^ "Virginia judge rules health care mandate unconstitutional - CNN.com". cnn.com. Retrieved 2010-12-13.

- ^ Judge strikes down healthcare reform law Reuters.com, Jan.31, 2011. Retrieved 2011-02-01.

- ^ Florida Judge Rules Against ObamaCare, Calls Individual Mandate Unconstitutional Forbes.com, Jan.31, 2011. Retrieved 2011-02-01.

- ^ "Third Federal Judge Upholds Health Care Law; Score Now 3-2". ABC News: The Note. Retrieved 2011-02-24.

- ^ GOP quick to release 'repeal' bills

- ^ "Bill Summary & Status - 112th Congress (2011 - 2012) - H.R.2". THOMAS. 2011-01-19.

- ^ "House Passes Health Care Repeal 245-189". C-Span. 2011-01-19.

- ^ Beutler, Brian (January 19, 2011). "Dems Press GOPers To Repeal Their Own Benefits Along With Health Care Law". Talking Points Memo. Retrieved 2011-01-21.

- ^ a b c Jackson, Brooks (January 7, 2011). "A 'Job-Killing' Law?". FactCheck. Retrieved 2011-01-23.

{{cite web}}: Unknown parameter|coauthors=ignored (|author=suggested) (help) - ^ a b Farley, Robert (January 20, 2011). "The health care law a 'job killer'? The evidence falls short". PolitiFact.com. Retrieved 2011-01-23.

{{cite web}}: Unknown parameter|coauthors=ignored (|author=suggested) (help) - ^ Repealing healthcare law would cost $210 billion: CBO, http://www.reuters.com/article/2011/02/18/us-usa-healthcare-cbo-idUSTRE71H77N20110218

- ^ a b The Affordable Care Act: Eliminating Limits on Your Benefits HHS web site

- ^ a b Abelson, Reed (October 6, 2010). "U.S. Waivers After Threats of Lost Health Coverage". The New York Times.

- ^ "30 Companies Get One-Year Waiver From Health Reform Rule". Chicago Sun-Times. October 7, 2010.

- ^ Helping Americans Keep the Coverage They Have and Promoting Transparency HHS, see section "Approved Applications for Waiver of the Annual Limits Requirements"

Further reading

Latest Congressional Budget Office scoring

- Patient Protection and Affordable Care Act, Incorporation of the Manager's Amendment, SA 3276 − December 19, 2009

- Base Analysis – H.R. 3590, Patient Protection and Affordable Care Act, − November 18, 2009.

↑ (The Additional and/or Related CBO reporting that follows can be accessed from the above link)- Budgetary Treatment of Proposals to Regulate Medical Loss Ratios − Dec. 13

- Additional Information about Employment-Based Coverage − Dec. 7

- Estimated Average Premiums Under Current Law − Dec. 5

- An Analysis of Health Insurance Premiums Under the Patient Protection and Affordable Care Act − Nov. 30

- Additional Information on CLASS Program Proposals − Nov. 25

- Estimated Effects on the Status of the Hospital Insurance Trust Fund − Nov. 21

- Estimated Effects on Medicare Advantage Enrollment and Benefits Not Covered by Medicare − Nov. 21

- Estimated Distribution of Individual Mandate Penalties − Nov. 20

- Analysis of Subsidies and Payments at Different Income Levels − Nov. 20

- Centers for Medicare and Medicaid Services Estimates of the impact of P.L. 111-148

- Estimated Financial Effects of the “Patient Protection and Affordable Care Act” as Amended, April 22, 2010

- Estimated Effects of the “Patient Protection and Affordable Care Act,” as Amended, on the Year of Exhaustion for the Part A Trust Fund, Part B Premiums, and Part A and Part B Coinsurance Amounts, April 22, 2010

- Centers for Medicare and Medicaid Services Estimates of the impact of H.R. 3590