Unemployment in the United States: Difference between revisions

clean up, typos fixed: full time → full-time (5) using AWB |

Adi.Louis1 (talk | contribs) No edit summary |

||

| Line 5: | Line 5: | ||

U.S. job creation since the year 2000 has been considerably below the 1970-2000 rate. From peak to trough, nearly nine million jobs were lost due to the [[subprime mortgage crisis|global economic crisis]] that began to affect employment in 2008. Unemployment generally falls during periods of economic prosperity and rises during recessions, creating significant pressure on public finances as tax revenue falls and [[social safety net]] costs increase. The major political parties debate appropriate solutions for improving the job creation rate, with liberals arguing for more government stimulus spending and conservatives arguing for lower taxes and less regulation. Polls indicate that Americans believe job creation is the most important government priority, with not sending jobs overseas the primary solution.<ref name="gallup.com">[http://www.gallup.com/poll/146915/americans-top-job-creation-idea-stop-sending-work-overseas.aspx Gallup Poll-Americans' Top Job-Creation Idea: Stop Sending Work Overseas-March 31, 2011]</ref> Much of the 2012 Presidential campaign focused on job creation as a first priority, but the [[United States fiscal cliff|fiscal cliff]] and other budgetary debates took precedence in 2012 and early 2013. Critics argue prioritizing deficit reduction is misplaced, as there is no immediate fiscal crisis but there is a high level of unemployment, particularly long-term unemployment.<ref name="nytimes.com">[http://www.nytimes.com/2012/12/07/opinion/krugman-the-forgotten-millions.html?_r=0 NYT-Paul Krugman-The Forgotten Millions-December 2012]</ref> |

U.S. job creation since the year 2000 has been considerably below the 1970-2000 rate. From peak to trough, nearly nine million jobs were lost due to the [[subprime mortgage crisis|global economic crisis]] that began to affect employment in 2008. Unemployment generally falls during periods of economic prosperity and rises during recessions, creating significant pressure on public finances as tax revenue falls and [[social safety net]] costs increase. The major political parties debate appropriate solutions for improving the job creation rate, with liberals arguing for more government stimulus spending and conservatives arguing for lower taxes and less regulation. Polls indicate that Americans believe job creation is the most important government priority, with not sending jobs overseas the primary solution.<ref name="gallup.com">[http://www.gallup.com/poll/146915/americans-top-job-creation-idea-stop-sending-work-overseas.aspx Gallup Poll-Americans' Top Job-Creation Idea: Stop Sending Work Overseas-March 31, 2011]</ref> Much of the 2012 Presidential campaign focused on job creation as a first priority, but the [[United States fiscal cliff|fiscal cliff]] and other budgetary debates took precedence in 2012 and early 2013. Critics argue prioritizing deficit reduction is misplaced, as there is no immediate fiscal crisis but there is a high level of unemployment, particularly long-term unemployment.<ref name="nytimes.com">[http://www.nytimes.com/2012/12/07/opinion/krugman-the-forgotten-millions.html?_r=0 NYT-Paul Krugman-The Forgotten Millions-December 2012]</ref> |

||

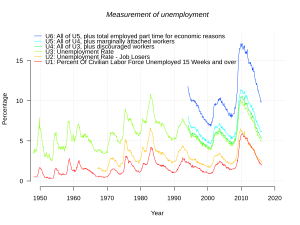

Unemployment can be measured in several ways. A person is unemployed if they are jobless but looking for a job and available for work. People who are neither employed nor unemployed are not in the labor force. For example, as of |

Unemployment can be measured in several ways. A person is unemployed if they are jobless but looking for a job and available for work. People who are neither employed nor unemployed are not in the labor force. For example, as of July 2013, the [[unemployment]] rate in the [[United States]] was 7.4%<ref>[http://research.stlouisfed.org/fred2/series/UNRATE Federal Reserve Database-FRED-Data Series UNRATE-Retrieved March 2013]</ref> or 12.0 million people,<ref>[http://research.stlouisfed.org/fred2/series/UNEMPLOY Federal Reserve Database-FRED-Data Series Unemploy]</ref> while the government's broader U-6 unemployment rate, which includes the part-time [[underemployment|underemployed]] was 14.3%<ref>[http://research.stlouisfed.org/fred2/series/U6RATE Federal Reserve Database-FRED-Data Series U6RATE-March 2013]</ref> or 22.2 million people. These figures were calculated with a civilian labor force of approximately 155 million people,<ref name="research.stlouisfed.org">[http://research.stlouisfed.org/fred2/series/CLF16OV Federal Reserve Database-CLF160V Data Series-Retrieved October 27, 2012]</ref> relative to a U.S. population of approximately 315 million people.<ref>[http://research.stlouisfed.org/fred2/series/POP FRED Database-POP Data Series-U.S. Population-Retrieved November 2012]</ref> The record proportion of long term unemployed, continued decreasing household income, and new [[Sequester (2013)|federal budget cuts]] remained indicative of a jobless recovery.<ref name=SchwartzJobless>{{cite news|last=Schwartz|first=Nelson|title=Recovery in U.S. Is Lifting Profits, but Not Adding Jobs|url=http://www.nytimes.com/2013/03/04/business/economy/corporate-profits-soar-as-worker-income-limps.html?pagewanted=all|accessdate=18 March 2013|newspaper=New York Times|date=March 3, 2013}}</ref> |

||

[[File:Map of U.S. states by unemployment rate.png|thumb|375px|[[List of U.S. states by unemployment rate|Rates of unemployment by US states]] in November, 2012.<ref>{{cite web |

[[File:Map of U.S. states by unemployment rate.png|thumb|375px|[[List of U.S. states by unemployment rate|Rates of unemployment by US states]] in November, 2012.<ref>{{cite web |

||

Revision as of 15:36, 3 August 2013

Unemployment in the United States discusses the causes and measures of U.S. unemployment and strategies for reducing it. Job creation and unemployment are affected by factors such as economic conditions, global competition, education, automation, and demographics. These factors can affect the number of workers, the duration of unemployment, and wage levels.

U.S. job creation since the year 2000 has been considerably below the 1970-2000 rate. From peak to trough, nearly nine million jobs were lost due to the global economic crisis that began to affect employment in 2008. Unemployment generally falls during periods of economic prosperity and rises during recessions, creating significant pressure on public finances as tax revenue falls and social safety net costs increase. The major political parties debate appropriate solutions for improving the job creation rate, with liberals arguing for more government stimulus spending and conservatives arguing for lower taxes and less regulation. Polls indicate that Americans believe job creation is the most important government priority, with not sending jobs overseas the primary solution.[3] Much of the 2012 Presidential campaign focused on job creation as a first priority, but the fiscal cliff and other budgetary debates took precedence in 2012 and early 2013. Critics argue prioritizing deficit reduction is misplaced, as there is no immediate fiscal crisis but there is a high level of unemployment, particularly long-term unemployment.[4]

Unemployment can be measured in several ways. A person is unemployed if they are jobless but looking for a job and available for work. People who are neither employed nor unemployed are not in the labor force. For example, as of July 2013, the unemployment rate in the United States was 7.4%[5] or 12.0 million people,[6] while the government's broader U-6 unemployment rate, which includes the part-time underemployed was 14.3%[7] or 22.2 million people. These figures were calculated with a civilian labor force of approximately 155 million people,[8] relative to a U.S. population of approximately 315 million people.[9] The record proportion of long term unemployed, continued decreasing household income, and new federal budget cuts remained indicative of a jobless recovery.[10]

Domestic factors

There are many domestic factors affecting the U.S. labor force and employment levels. These include: economic growth; cyclical and structural factors; demographics; education and training; innovation; labor unions; and industry consolidation. Ben Bernanke discussed several factors during a March 2012 speech.[12]

Economist Laura D'Andrea Tyson wrote in July 2011: "Like many economists, I believe that the immediate crisis facing the United States economy is the jobs deficit, not the budget deficit. The magnitude of the jobs crisis is clearly illustrated by the jobs gap – currently around 12.3 million jobs. That is how many jobs the economy must add to return to its peak employment level before the 2008-9 recession and to absorb the 125,000 people who enter the labor force each month. At the current pace of recovery, the gap will be not closed until 2020 or later." She explained further that job growth between 2000 and 2007 was only half what it had been in the preceding three decades, pointing to several studies by other economists indicating globalization and technology change had highly negative effects on certain sectors of the U.S. workforce and overall wage levels.[13]

From January to November 2012, the U.S. added approximately 151,000 jobs per month on average.[14] Each month, The Hamilton Project examines the "jobs gap," which is the number of jobs that the U.S. economy needs to create in order to return to pre-recession employment levels while also absorbing the people who enter the labor force each month. Job creation would have to average 208,000 per month to close the gap by 2020; 320,000 by 2017; or 472,000 by mid-2015.[15] During the prosperous 1990's decade, the U.S. created an average of 182,000 jobs/month.[14]

Cyclical vs. structural unemployment

There is ongoing debate among economists regarding the extent to which unemployment is cyclical (i.e., temporary and related to economic cycles, and therefore responsive to stimulus measures that spur demand) or structural (i.e., longer-term and independent of the economic cycle, and therefore requiring process reforms and re-allocation of workers among industries and geographies).[16]

For example, a general reduction in employment across multiple industries would likely be cyclical, while a skills or geographic mismatch for available jobs would be structural. Ben Bernanke stated in November 2012: "[T]he slow pace of employment growth has been widespread across industries and regions of the country. That pattern suggests a broad-based shortfall in demand rather than a substantial increase in mismatch between available jobs and workers, because greater mismatch would imply that the demand for workers would be strong in some regions and industries, not weak almost across the board. Likewise, if a mismatch of jobs and workers is the predominant problem, we would expect to see wage pressures developing in those regions and industries where labor demand is strong; in fact, wage gains have been quite subdued in most industries and parts of the country."[17]

The Congressional Research Service summarized a variety of studies that indicated changes in unemployment between 2007 and 2010 were 65-80% cyclical, thus mainly due to reduced aggregate demand for goods and services. Labor mobility was not a key issue due to the widespread nature of job losses across geographies and industries. Cyclically sensitive industries such as manufacturing and construction had the most significant job losses. One study referenced in the CRS research indicated that long-term unemployment can convert cyclical to structural unemployment through loss of skills.[18]

Mohamed El-Erian wrote in May 2011: "Unemployment must be seen as much more than a cyclical problem; it's a structural one that requires concurrent progress on job retraining, housing reform, education, social safety nets and private-sector competitiveness...America's political parties must jointly agree [to make] progress on the structural-reform agenda..."[19][20] Several tools, such as the Beveridge curve are used to help analyze the extent of structural unemployment.[21]

The term frictional unemployment refers to the period when workers are searching for a job or changing jobs. It is sometimes called search unemployment and can be voluntary based on the circumstances of the unemployed individual. Frictional unemployment is always present in an economy, so the level of involuntary unemployment is properly the unemployment rate minus the rate of frictional unemployment.

The Natural rate of unemployment refers to the rate of unemployment due to structural or supply-side factors alone. Cyclical factors, such as government stimulus or austerity policies, cause the actual unemployment rate to vary around the natural rate. Economists debate the natural rate of unemployment. During February 2011, Federal Reserve economists estimated it may have increased from the historical rate of around 5% to as high as 6.7%. CBO estimated the rate of a closely related measure called NAIRU at 5.2%, up from 4.8%.[22][23]

Demographics

Demographics have a significant impact on the labor force and therefore employment statistics. There is a long-term trend of declining labor force participation in the U.S. The U.S. population is aging and the Baby Boomers are moving into retirement, so a greater share of the population is either leaving the labor force (retired) or moving into an age bracket with a lower typical labor force participation rate.[24][25]

Analyzing the 25-54 prime working age range can help correct for the effects of aging Boomers leaving the workforce. The jobs created since the end of the recession (2009) have not been sufficient to show a significant improvement in employment for the 25-54 age range.[26] In the 16-64 age range, from mid-2008 to March 2013 the ratios of employed men and women have declined by approximately 6 and 3 percentage points, respectively.[27]

The Bureau of Labor Statistics provides a monthly employment situation summary. For September 2012: "[T]he unemployment rates for adult men (7.3 percent), adult women (7.0 percent), and whites (7.0 percent) declined over the month. The unemployment rates for teenagers (23.7 percent), blacks (13.4 percent), and Hispanics (9.9 percent) were little changed. The jobless rate for Asians, at 4.8 percent (not seasonally adjusted), fell over the year."[28]

Education and training

Workers with higher levels of education face considerably lower rates of unemployment. As of September 2012, for workers of age 25 or older, unemployment was approximately: 12% for those with less than a high school diploma; 9% for high school graduates; 6% for those with some college or an associates degree; and 4% for those with a bachelor's degree or higher.[29]

The American Enterprise Institute reported in September 2011 that: "...the evidence that the quality of a nation's education system is a key determinant of the future growth of its economy is increasingly strong." In 2010, America's high-school graduation rate trailed the average for European Union countries and ranked no better than eighteenth among the 26 OECD countries for which comparable data was available. President Obama often has stated that education is a key driver of international competitiveness and employment.[30]

U.S. companies have cut employee training programs in an effort to cut costs. According to 2012 Society for Human Resource Management (SHRM) industry survey, 63% of employees learn the skills required to do their job while on the job. Approximately 38% of companies said they cross-train employees to develop skills not directly related to their job, down from 43% in 2011 and 55% in 2008. Some companies believe that with high unemployment, they can find the skills necessary should job openings arise.[31]

A variety of experts have proposed education reforms to improve U.S. competitiveness. Ideas relate to better qualified and incentivized teachers, less reliance on standardized testing, better feedback systems to help struggling teachers and students, more investment, paying for performance, employing data systems that track how much a child learns from a teacher, measuring teacher quality, giving local administrators the ability to manage staff and finances, and comparing results to the best education systems in the world.[32]

The rapid pace of technology change and global competition are rewarding those who continuously improve their skills and education. Futurist Alvin Toffler wrote: "The illiterate of the future are not those that cannot read or write. They are those that cannot learn, unlearn, relearn."[33]

Thomas L. Friedman wrote: "How [can workers] adapt? It will require more individual initiative. We know that it will be vital to have more of the 'right' education than less, that you will need to develop skills that are complementary to technology rather than ones that can be easily replaced by it and that we need everyone to be innovating new products and services to employ the people who are being liberated from routine work by automation and software. The winners won’t just be those with more I.Q. It will also be those with more P.Q. (passion quotient) and C.Q. (curiosity quotient) to leverage all the new digital tools to not just find a job, but to invent one or reinvent one, and to not just learn but to relearn for a lifetime."[34]

Long-term unemployment

One measure of long-term unemployment is those out of work for 27 weeks (six months) or more. As of September 2012, 40.1% of the unemployed had been looking for work for at least 27 weeks, near the record of 45.5% in March 2011.[35] This is well above the 1980-2007 average of approximately 16% and the approximately 20-25% level typical in previous recessions since 1980.[36][37]

Economists believe that long-term unemployment can be transformed into structural unemployment, meaning that a large group of workers may no longer match employers' needs or are no longer considered employable. Skills may become obsolete, business contact lists become outdated, and current industry information is lost. As of September 2012, about 800,000 workers wanted a job but had given up looking, and so are no longer even counted as unemployed. About 1.7 million people joined the disability rolls since the recession began at the end of 2007, an increase of 24%, as workers use the disability program as a backdoor safety net when their unemployment insurance runs out. After searching for a new position for a year, a worker trying to regain employment finds that their chance to do so in the coming month falls below 10%. Job training programs and incentives for companies to hire the long-term unemployed are among the solutions available, but gathering the political will to address an isolated group is difficult. The long-term unemployed are less likely to vote.[38]

CBO reported several options for addressing long-term unemployment during February 2012. Two short-term recommendations included policies to: 1) Reduce the marginal cost to businesses of adding employees; and 2) Tax policies targeted towards people most likely to spend the additional income, mainly those with lower income. Over the long-run, structural reforms such as programs to facilitate re-training workers or education assistance would be helpful.[39]

Labor unions

Economist Paul Krugman wrote that historically, worker participation in labor unions gave workers more power in negotiating how corporate profits were split up with shareholders and management. Organized labor acted to limit layoffs. Strong labor unions were a check on executive pay, keeping top executive pay at considerably lower ratios relative to the average worker during the 1950s than during the 2000s. Unions were also a factor in income equality, helping ensure that middle class worker pay rose along with the pay of the higher income brackets.[40]

However, labor union participation rates have declined steadily in the United States. According to the Bureau of Labor Statistics annual Union Members Summary: "In 2012, the union membership rate--the percent of wage and salary workers who were members of a union--was 11.3 percent, down from 11.8 percent in 2011. The number of wage and salary workers belonging to unions, at 14.4 million, also declined over the year. In 1983, the first year for which comparable union data are available, the union membership rate was 20.1 percent, and there were 17.7 million union workers."[41] In 1973, the participation rate was 26.7% against a comparable 2011 rate of 13.1%.[42]

Differences in labor law and public policy are a key reason for this decline. For example, Canada has gone through many of the same economic and social changes as the U.S. since the middle of the 20th century, but it hasn’t seen the same substantial decline in unionization. The unionization rate in the U.S. and Canada followed fairly similar paths from 1920 to the mid-1960s, at which point they began to diverge drastically, with Canada remaining around 30% while the U.S. fell to around 11%.[43]

Industry consolidation

Industry consolidation or concentration refers to fewer, larger firms driving competition in an industry versus more, smaller firms. Job creation by small businesses can be restricted when larger, more productive firms displace them. For example, the share of customer deposits held by the top 10 largest U.S. banks rose from 15% in 1993, to 44% in 2006, and to 49% by 2009. The number of commercial banks fell from over 14,000 in 1984 to approximately 7,000 by 2010.[44]

Economists Barry Lynn and Phillip Longman at the New America Foundation wrote in March 2010:

- "It is now widely accepted among scholars that small businesses are responsible for most of the net job creation in the United States. It is also widely agreed that small businesses tend to be more inventive, producing more patents per employee, for example, than do larger firms. Less well established is what role concentration plays in suppressing new business formation and the expansion of existing businesses, along with the jobs and innovation that go with such growth. Evidence is growing, however, that the radical, wide-ranging consolidation of recent years has reduced job creation at both big and small firms simultaneously."

- "In nearly every sector of our economy, far fewer firms control far greater shares of their markets than they did a generation ago. Indeed, in the years after officials in the Reagan administration radically altered how our government enforces our anti-monopoly laws, the American economy underwent a truly revolutionary restructuring. Four great waves of mergers and acquisitions—in the mid-1980s, early '90s, late '90s, and between 2003 and 2007—transformed America's industrial landscape at least as much as globalization."

- "Over the same two decades, meanwhile, the spread of mega-retailers like Wal-Mart and Home Depot and agricultural behemoths like Smithfield and Tyson's resulted in a more piecemeal approach to consolidation, through the destruction or displacement of countless independent family-owned businesses."[45][46]

Income and wealth inequality

Since the 1980s, wealthier households in the United States have earned a larger and larger share of overall income. As of 2010, the top 1% of households by income earned about one-sixth of all income and the top 10% earned about half of it. In other words, the rising tide of economic growth does not lift all boats equally. Wealth is also skewed, with the top 1% owning more wealth than the bottom 90% of households. Several prominent economists and financial entities have reported that income inequality hurts economic growth and can be economically destabilizing.[48][49]

Economist Joseph Stiglitz wrote in 2012 that moving money from the bottom to the top of the income spectrum through income inequality lowers consumption, and therefore economic growth and job creation. Higher-income individuals consume a smaller proportion of their income than do lower-income individuals; those at the top save 15-25% of their income, while those at the bottom spend all of their income.[50][51]

Further, as income skews to the top, middle-class families may go deeper into debt than they would otherwise, which restricts consumption once they begin to repay it. Evidence suggests that income inequality has been the driving factor in the growing household debt[52][53] as middle income earners go deeper into debt trying to maintain what once was a middle class lifestyle. Between 1983 and 2007, the top 5 percent saw their debt fall from 80 cents for every dollar of income to 65 cents, while the bottom 95 percent saw their debt rise from 60 cents for every dollar of income to $1.40.[52] Economist Paul Krugman has found a strong correlation between inequality and household debt in America over the last hundred years.[54]

Government hiring trends

Most states have balanced budget rules, which forced them to cut spending when tax revenues fell due to the 2008-2009 recession and its aftermath. Over 500,000 jobs were cut by states and municipalities between 2008-2012. This was different from other recent U.S. recessions, where government employment continued to climb. This trend is expected to reverse in 2013, with states and municipalities adding workers for the first time in five years. State and local government spending accounted for 12% GDP in 2011.[55]

Fed Chair Ben Bernanke testified in May 2013 that: "Notably, over the past four years, state and local governments have cut civilian government employment by roughly 700,000 jobs, and total government employment has fallen by more than 800,000 jobs over the same period. For comparison, over the four years following the trough of the 2001 recession, total government employment rose by more than 500,000 jobs."[56]

Government spending employs private sector workers in several industries, such as ship and boat building, facilities services, aerospace, etc. The 2013 sequester has significantly impacting hiring in these industries, which are lagging employment growth in other industries. The New York Times reported in June 2013 that: "Across the five industries that are most sensitive to changes in military spending, employment fell at an annual rate of 2.5 percent in March and stayed flat in April, the latest month for which seasonally adjusted data are available. In all other sectors, by contrast, employment grew at annualized rates of about 1.6 percent in March and 1.7 percent in April. Before the start of the sequester on March 1, employment at private companies heavily dependent on military spending had been more closely tracking employment in the rest of the economy, though the numbers were somewhat uneven. Military payrolls have been declining almost every month since November 2011 in response to the drawdown in American wars abroad."[57]

Policies regarding full employment

Jared Bernstein wrote in May 2013 that the U.S. used to focus on full employment as a policy priority, but this focus has waned since 1980. Full employment refers to having an available job for everyone who wants one. Specific laws were passed to help achieve this goal, such as the Employment Act of 1946 and the Humphrey-Hawkins Full Employment Act of 1978. From 1945-1979, the U.S. was at full employment two-thirds of the time. Conservatives and business interests pushed back however, as tight labor markets meant more worker bargaining power, higher wages and less profitability. Since 1980, full employment has been maintained one-third of the time.[58]

Bernstein argued there are several possible reasons for the reduction in frequency of full employment:

- As labor unions weakened, politicians focused less on the working class and more on issues related to the wealthy, such as inflation, budget deficits and tax policy;

- Capital investment may have become more "labor saving," with productivity improving and automation accelerating;

- Large and persistent trade deficits have exported significant demand. Trade deficits averaged 5% GDP during the 2000s, versus 1% GDP in the 1990s, representing the loss of millions of jobs; and

- Growing income inequality has reduced the ability of the middle class to demand as many goods and services as it otherwise would be, affecting many middle-class jobs.[58]

Unemployment among younger workers

The employment situation from 2009 to 2013 was particularly difficult for younger workers. The Economic Policy Institute reported in April 2013 that:

- The March 2013 unemployment rate of 16.2% for workers under age 25 was slightly over twice the national average.

- Weak demand for goods and services is the primary driver of this unemployment, not a skills mismatch.

- Graduating in a bad economy has long-lasting economic consequences. For the next 10 to 15 years, those in the Class of 2013 will likely earn less than if they had graduated when the economy were at its potential.

- For young high school graduates, the unemployment rate is 29.9% (compared with 17.5% in 2007) and the underemployment rate is 51.5% (compared with 29.4% in 2007).

- For young college graduates, the unemployment rate is 8.8% (vs. 5.7% in 2007) and the underemployment rate is 18.3% (vs. 9.9% in 2007).[59]

Global factors

Offshoring

Offshoring has become an increasingly common practice of locating jobs in low-cost labor countries. The practice is expanding in both manufacturing and service jobs. Motivation varies; labor cost savings or "labor arbitrage", productivity and regulatory avoidance are potential reasons. Studies have shown that offshoring is a source of significant uncertainty in the labor force. There is significant debate regarding the extent to which this is affecting U.S. job creation. The Congressional Research Service reported a summary of several studies on offshoring in January 2011:[60]

- Forrester Research projected in 2004 that a total of 3.4 million service sector jobs might move abroad by 2015. Forrester projected that a total of 1.2 million services jobs might be relocated offshore between 2003 and 2008.

- Economists Bardhan and Kroll estimated in 2003 that more than 14 million jobs, representing about 11% of U.S. employment in 2001, have attributes that could allow them to be sent overseas (e.g., no in-person customer servicing required; an IT-enabled work process that can be accomplished via telecommuting; jobs that can be routinized; a fairly wide gap between a job's pay in the United States compared to in a destination country; and a destination country having few language, institutional, and cultural barriers.)

- Economists Jensen and Kletzer estimated in 2005 that about 9.4% of total U.S. employment in 2000 was in offshorable industries. Approximately 14% of employment in professional services industries might be vulnerable to offshoring compared to 12.4% of employment in manufacturing industries.

- The Brookings Institution estimated in 2007 that offshoring may impact 2.2% of the jobs in 246 metro areas.

- The Bureau of Labor statistics estimated that one-fifth of U.S. workers were in industries subject to offshoring. The 33 service-providing occupations found to be most susceptible to offshoring experienced below average employment and wage growth during the 2001-2007 period. The skills and education of this most vulnerable group range widely.

- Economist Alan Blinder estimated in 2009 that up to 30 million jobs may be offshorable.[60]

An estimated 750,000 call center jobs were off-shored by U.S. firms to India and the Philippines as of November 2011.[61]

Princeton economist Alan Blinder said in 2007 that the number of jobs at risk of being shipped out of the country could reach 40 million over the next 10 to 20 years, which represents one out of every three service sector jobs.[62]

The Economist reported in January 2013 that: "High levels of unemployment in Western countries after the 2007-2008 financial crisis have made the public in many countries so hostile towards off-shoring that many companies are now reluctant to engage in it." Further, The Economist reported that off-shoring trends are evolving for several other reasons:

- Wages in China and India have been increasing for 10-20% a year for the past decade while U.S. wages have been relatively stagnant, reducing the cost advantage of off-shoring.

- Shipping costs are rising and long shipping lead times can affect customer service in certain industries.

- Separating production and research & development functions has adversely impacted innovation.

- Multinational corporations are moving production closer to their target customers, which in some cases means back to the U.S.[63]

The Department of Labor's Employment and Training Administration (ETA) prepares an annual report on those petitioning for trade adjustment assistance, due to jobs lost from international trade. This represents a fraction of jobs actually off-shored and does not include jobs that are placed overseas initially or the collateral impact on surrounding businesses when, for example, a manufacturing plant moves overseas. During 2011, there were 98,379 workers covered by petitions filed with ETA.[64] The figure was 280,873 in 2010,[65] 201,053 in 2009 and 126,633 in 2008.[66]

Comparative wage levels

One of the reasons for off-shoring jobs or sourcing goods overseas has been considerably lower wages in developing or Asian countries. The NY Times reported in December 2012 that: "American wages are [not] anywhere close to those in countries in East Asia or other places where American imports come from. As of 2010 (the latest year available), hourly compensation costs for manufacturing in the United States were about four times those in Taiwan, and 20 times those in the Philippines, according to the Labor Department." However, foreign wages have been rising since 2000, while those in the U.S. have been stagnant.[67] During 2011, entry level call center workers in the U.S. earned about $20,000 per year, about six times as much as similar jobs in India.[68] According to the Congressional Research Service, during 2006, compensation for the average American production worker was $24.59 per hour, compared to $16.02 in South Korea, $2.92 in Mexico, and $0.81 in China.[69]

CEO's are under pressure from their boards to maximize profits and are paid bonuses accordingly; one method of doing so is offshoring jobs or sourcing inputs in the lowest wage countries possible. Firms in low-cost labor countries actively lobby U.S. and European companies to offshore a variety of jobs or locate new jobs and facilities overseas.[70]

Trade deficits and currency valuation

This section possibly contains synthesis of material which does not verifiably mention or relate to the main topic. (January 2013) |

Trade deficit

Net exports are a major component of GDP. In the U.S., net exports are negative due to a trade deficit that is much larger than historical average. There is significant debate regarding the impact of the trade deficit on the economy and employment, and therefore the budget deficit. For example, The Economist wrote in July 2012 that the inflow of investment dollars required to fund the trade deficit was a major cause of the housing bubble and financial crisis: "The trade deficit, less than 1% of GDP in the early 1990s, hit 6% in 2006. That deficit was financed by inflows of foreign savings, in particular from East Asia and the Middle East. Much of that money went into dodgy mortgages to buy overvalued houses, and the financial crisis was the result."[71]

NPR explained in their Peabody-Award winning article "The Giant Pool of Money" that a vast inflow of savings from developing nations flowed into the mortgage market, driving the U.S. housing bubble. This pool of fixed income savings increased from around $35 trillion in 2000 to about $70 trillion by 2008. NPR explained this money came from various sources, "[b]ut the main headline is that all sorts of poor countries became kind of rich, making things like TVs and selling us oil. China, India, Abu Dhabi, Saudi Arabia made a lot of money and banked it."[72] During 2008, then U.S. Comptroller General David M. Walker argued that the U.S. faced four deficits that posed significant risk to its fiscal future: Budget, balance of payments, savings and leadership.[73]

A February 2013 paper from four economists concluded that a trade deficit is a factor in whether a country will pay higher interest rates as its public debt level rises, which increases the risk of fiscal crisis. Both the U.S. and Eurozone countries (excluding Germany) had significant trade deficits leading up to the crisis.[74][75] A rebuttal to their paper indicated that the trade deficit (which requires private borrowing to fund) may be a bigger factor than public debt in causing a rise in interest rates.[76]

Currency policy

Policies that affect the value of the U.S. dollar relative to other currencies also affect employment levels. Economist Christina Romer wrote in May 2011: "A weaker dollar means that our goods are cheaper relative to foreign goods. That stimulates our exports and reduces our imports. Higher net exports raise domestic production and employment. Foreign goods are more expensive, but more Americans are working. Given the desperate need for jobs, on net we are almost surely better off with a weaker dollar for a while."[77] Economist Paul Krugman wrote in May 2011: "First, what's driving the turnaround in our manufacturing trade? The main answer is that the U.S. dollar has fallen against other currencies, helping give U.S.-based manufacturing a cost advantage. A weaker dollar, it turns out, was just what U.S. industry needed."[78]

Economists C. Fred Bergsten and Joseph E. Gagnon wrote in September 2012: "The most overlooked cause of the economic weakness in the United States and Europe is what we call the 'global currency wars.' If all currency intervention were to cease, we estimate that the US trade deficit would fall by $150 billion to $300 billion, or 1 to 2 percent of gross domestic product. Between 1 million and 2 million jobs would be created. The euro area would gain by a lesser but still substantial amount. Countries that were engaged in intervention could offset the impact on their economies by expanding domestic demand."[79]

Tradable and non-tradable sectors

Economist Michael Spence analyzed U.S. employment trends from 1990 to 2008, separating workforce components into two major sectors:

- Non-tradeable sector, meaning those jobs that must be done locally, such as healthcare, government and construction. Of the 27.3 million jobs added during the period, 26.7 million were in the non-tradeable sector. From 1990 to 2008, the jobs in this sector increased from 88 million to 115 million.

- Internationally tradeable sector, meaning jobs related to goods that can be produced in one country and consumed in another, such as manufacturing, agriculture and energy, or consumed by people from another country, such as tourism. Lower- and middle- value added jobs have been moved abroad as part of globalized supply chains, resulting in less than one million jobs created during the period in this sector. During 1990, there were 34 million jobs in this sector; these grew slowly for about a decade then returned back to their starting point by 2008.

Spence advocates structural reforms to help grow the tradeable sector jobs. Further, value-added per employee has been growing slowly in the non-tradeable sector. These trends are correlated with increasing income inequality and indicate significant structural issues face the U.S. labor market.[80]

Globalization commentary

This section possibly contains synthesis of material which does not verifiably mention or relate to the main topic. (January 2013) |

Economist Paul Krugman wrote: "By contrast, trade between countries at very different levels of economic development tends to create large classes of losers as well as winners. Although the outsourcing of some high-tech jobs to India has made headlines, on balance, highly educated workers in the United States benefit from higher wages and expanded job opportunities because of trade...But workers with less formal education either see their jobs shipped overseas or find their wages driven down by the ripple effect as other workers with similar qualifications crowd into their industries and look for employment to replace the jobs they lost to foreign competition. And lower prices at Wal-Mart aren’t sufficient compensation."[81]

Fareed Zakaria described the factors slowing growth in developed countries like the U.S., writing in November 2011: "The fact is that Western economies - with high wages, generous middle-class subsidies and complex regulations and taxes - have become sclerotic. Now they face pressures from three fronts: demography (an aging population), technology (which has allowed companies to do much more with fewer people) and globalization (which has allowed manufacturing and services to locate across the world)."[82]

Former Fed chair Paul Volcker argued in February 2010 that the U.S. should make more of the goods it consumes domestically: "We need to do more manufacturing again. We're never going to be the major world manufacturer as we were some years ago, but we could do more than we're doing and be more competitive. And we've got to close that big gap. You know, consumption is running about 5 percent above normal. That 5 percent is reflected just about equally to what we're importing in excess of what we're exporting. And we've got to bring that back into closer balance."[83]

Economist Peter Navarro wrote in June 2011: "The American economy has been in trouble for more than a decade, and no amount of right-wing tax cuts or left-wing fiscal stimuli will solve the primary structural problem underpinning our slow growth and high unemployment. That problem is a massive, persistent trade deficit — most of it with China — that cuts the number of jobs created by nearly the number we need to keep America fully employed."[84] Economist Peter Morici wrote in May 2012: "Cutting the trade deficit in half, through domestic energy development and conservation, and offsetting Chinese exchange rate subsidies would increase GDP by about $525 billion a year and create at least 5 million jobs."[85]

Economist Michael Spence explained in August 2011 that over the 1990-2008 period, job creation was almost entirely in the "non-tradable" sector (which produces goods and services that must be consumed domestically, like healthcare) with few jobs created in the "tradable" sector (which produces goods that can be sold internationally, like manufacturing). He stated that job creation in both sectors is necessary and that various factors, such as the housing bubble, hid the lack of job creation in the tradable sector. He stated: "We're going to have to try to fix the ineffective parts of our educational system...We're under-investing in things like infrastructure...we've just been living on consumption and we need to live a little bit more on investment, including public-sector investment." He also advocated tax policy changes to encourage hiring of U.S. workers.[86]

Other factors

Automation and technology change

In addition to off-shoring, technological change and automation of labor have impacted job growth in certain industries. As a science fiction writer might ask: "Who has a job once the robots repair the robots?" As wages or healthcare costs rise, companies have a growing financial incentive to automate more of their production and service processes. While automation has displaced millions of workers in various cycles (e.g., agriculture in the U.S. in the early 1900s) other industries have typically taken their place.[87][88]

Economist Henry Hazlitt explained in the 1979 edition of his book Economics in One Lesson why automation tends to create as many or more jobs overall than it destroys:

- It requires labor and capital to build the machines that replace the workers whose jobs have been automated away, which creates jobs partially or fully offsetting the initial loss;

- After the machines have produced sufficient economies to offset their cost, the owners can expect increased profits, which can be spent in the same or different industry, also creating jobs;

- If competitors also adopt the machines, prices in the industry will begin to drop. This may increase the quantity of the goods demanded. This also allows savings to be passed along to consumers, who can use the difference to spend in the same or different industry, also creating jobs.

Hazlitt wrote that these three offsets tend to increase jobs overall. Further, automation increases production, productivity and real wages over the long-run. He explained that over the course of human history, the number of persons employed tends to jump along with advances in technology. While jobs are destroyed in one activity, more jobs are typically created in others.[89]

However, MIT economists Brynjolfsson and McAfee estimated in January 2013 that technology is potentially destroying more jobs than it is creating: "Technology is always creating jobs. It's always destroying jobs. But right now the pace [of destroying them] is accelerating...So as a consequence, we are not creating jobs at the same pace that we need to." Routine, middle-skill jobs are being eliminated by advances in business processes and technology, for example: self-service applications such as internet ordering in retail, grocery self-checkout, and ATM machines; manufacturing assembly robots; logistics such as warehouse robots that can move goods from storage to shipping; and healthcare, where robots are moving meals and medical waste in hospitals. McAfee sees this trend of technology eliminating jobs continuing for some time: "When I see what computers and robots can do right now, I project that forward for two, three more generations, I think we're going to find ourselves in a world where the work as we currently think about it it, is largely done by machines."[90][91]

Matt Miller wrote in January 2013 that this automation may have profound policy implications. If robots replace a vast number of workers, wage income may not be sufficient to support the middle class. More and more wealth will be concentrated in the hands of capital (e.g., those who make and own the robots doing the work). This could require significant changes in tax and redistribution policies on a massive scale.[92] During August 2011, Taiwan manufacturing company Foxconn announced that it would be using up to one million robots to replace human laborers.[93]

Paul Krugman discussed this automation in December 2012: "This is an old concern in economics; it's 'capital-biased technological change', which tends to shift the distribution of income away from workers to the owners of capital...Twenty years ago, when I was writing about globalization and inequality, capital bias didn't look like a big issue; the major changes in income distribution had been among workers...rather than between labor and capital. So the academic literature focused almost exclusively on 'skill bias," supposedly explaining the rising college premium. But the college premium hasn't risen for a while. What has happened, on the other hand, is a notable shift in income away from labor...I think we'd better start paying attention to those implications." Krugman used a chart to show how the share of compensation income as a % GDP had fallen consistently from 60% in 1970 to 55% in 2011.[46][94]

One possible consequence is that as developing country wages rise, U.S. companies may decide to automate the jobs but return the activity to the U.S., a phenomenon some refer to as "re-shoring" (as opposed to "off-shoring").[95]

Although U.S. manufacturing employment declined from 17 million workers to 12 million from 2000-2011, production has returned to 2000 levels.[96][97] In other words, productivity, supported by significant automation or process improvements, may be a significant driver of job losses in that industry, along with off-shoring.

Innovation

Relatively new, smaller firms are the primary job creators. A 2009 study by the Kauffman Foundation using U.S. Census data indicated that:

- "From 1980-2005, nearly all net job creation in the United States occurred in firms less than five years old...without startups, net job creation for the American economy would be negative in all but a handful of years."

- "If one excludes startups, an analysis of the 2007 Census data shows that young firms (defined as one to five years old) still account for roughly two-thirds of job creation, averaging nearly four new jobs per firm per year."

- "Of the overall 12 million new jobs added in 2007, young firms were responsible for the creation of nearly 8 million of those jobs." (Note: This is a gross number not reduced by jobs lost; the economy generally creates and destroys millions of jobs in any given year.)

- "Given this information, it is clear that new and young companies and the entrepreneurs that create them are the engines of job creation and eventual economic recovery. The distinction of firm age, not necessarily size, as the driver of job creation has many implications, particularly for policymakers who are focusing on small business as the answer to a dire employment situation."[98]

In the globalized free market, innovation does not necessarily mean the jobs will be created domestically. A popular product, the Apple iPod, offers an interesting perspective on globalization and employment. This product was developed by a U.S. corporation. In 2006, it was produced by about 14,000 workers in the U.S. and 27,000 overseas. Further, the salaries attributed to this product were overwhelmingly distributed to highly skilled U.S. professionals, as opposed to lower skilled U.S. retail employees or overseas manufacturing labor. Increasingly, globalization is shifting incomes to those with the highest educational backgrounds and professional skills. One interpretation of this result is that U.S. innovation can create more jobs overseas than domestically.[99][100] During 2011, Apple employed 43,000 U.S. workers and 20,000 overseas. However, nearly 700,000 workers overseas working for other companies made nearly all of its iPhone, iPad and other products.[101]

Andrew Grove wrote in July 2010 that key technology innovations are increasingly "scaled" or mass-produced in Asia, with a 10-1 ratio of overseas to domestic workers. He wrote that Asian countries "seem to understand that job creation must be the No. 1 objective of economic policy." He recommended a tax on products made off-shore, to be used to fund companies that will scale their U.S. operations.[102]

Industry-specific factors

Industries may have long-term and short-term factors that drive trends in employment. Manufacturing and construction are two major industry groups that illustrate such factors.

The Economist reported in March 2011 that U.S. manufacturing employment declined steadily from approximately 17 million in 2000 to under 12 million in 2010.[103] Comparing January 2008, the U.S. overall peak employment month across all industries pre-crisis, with October 2012, manufacturing employment was down 1.76 million.[104] This is due to a combination of growing competition from lower-wage countries, automation/productivity improvements, off-shoring, etc.

For example, China's share of global manufacturing increased from approximately 5% in 1996 to 12% in 2008. China represents roughly one-third of the U.S. trade deficit, nearly $295 billion in 2011.[105] The Economic Policy Institute (EPI) estimated that from 2001-2011, 2.7 million jobs were lost to China.[106] USA Today reported in 2007 that an estimated one in six factory jobs (3.2 million) have disappeared from the U.S. since 2000, due to automation or off-shoring to countries like Mexico and China, where labor is cheaper.[107]

U.S. construction employment is heavily reliant on the housing market and new home construction. Measured from January 2008, construction employment was down 1.94 million as of October 2012. This follows a peak in construction employment due to the U.S. housing bubble throughout the mid-2000s, with a recent peak of approximately 7 million sustained during the 2005-2008 period.[108]

The total of the job losses in these two industries from January 2008 to October 2012 was 3.7 million. For scale, the U.S. overall employment decline from January 2008 to October 2012 was a net 4.3 million, with 8.8 million jobs lost from 1/08 to 2/10 and 4.5 million jobs added back thereafter.[109]

Unemployment benefits

There is debate regarding the extent to which safety net programs such as unemployment insurance extend periods of unemployment by reducing the incentive to find work. The Heritage Foundation estimated in September 2011 that extending unemployment insurance increases the unemployment rate between 0.5 to 1.5 percentage points, advocating that such payouts be offset by other spending cuts.[110] Economist Paul Krugman argued in July 2010 that with five job seekers for every job opening, "cutting off benefits to the unemployed will make them even more desperate for work — but they can't take jobs that aren't there." He also cited CBO reports indicating unemployment insurance is a highly effective form of stimulus, which he advocated in an economic downturn.[111]

The Congressional Budget Office provides periodic reports on unemployment insurance programs. The unemployment insurance (UI) program provides a weekly benefit to qualified workers who lose their job and are actively seeking work. The amount of that benefit is based in part on a workers past earnings. In particular, the periods for which eligible workers can receive UI benefits have been repeatedly extended during the 2008-2009 recession and its aftermath. Regular UI benefits generally last up to 26 weeks, but extensions were legislated extending this period significantly. From 2008-2012, these programs provided approximately $520 billion in benefits to recipients, which allowed households to better maintain their consumption. Far more workers were laid off in 2008 and 2009 than in 2006 and 2007. The number of workers who lost their job and started receiving UI benefits peaked at 14.4 million in 2009, whereas an average of roughly 8 million laid-off workers started receiving benefits in each fiscal year from 2004 to 2007.[112] Outlays for UI benefits totaled $120 billion in fiscal year 2009, a substantial increase over the amount two years earlier, which was $33 billion. Spending on UI benefits in fiscal year 2010 was even higher than in fiscal year 2009, totaling nearly $160 billion. CBO projected in November 2010 that spending in fiscal year 2011 would be $93 billion.[113]

Employment of part-time workers versus full-time

U.S. employers have shifted the composition of the workforce to more part-time workers versus full-time. The percentage of the workforce that is part-time has risen from approximately 17.0% in January 2000 to 19.2% in May 2013. Employers do not have to pay some costly benefits to part-time workers and can vary payroll costs more easily to reflect economic conditions.[114]

Statistics regarding the number of full-time and part-time workers (in thousands) since 2000 highlight this trend:

- From the November 2007 pre-crisis peak total employment month to December 2009 trough or low point, the U.S. lost 11,306 full-time jobs but added 2,704 part-time jobs, a net loss of 8,602 jobs total.

- From the December 2009 crisis total employment trough to May 2013, the U.S. added 5,669 full-time jobs and added 237 part-time jobs, a total of 5,906 jobs.

- From the November 2007 pre-crisis peak total employment month to May 2013, the U.S. lost 5,637 full-time jobs and added 2,941 part-time jobs, a net loss of 2,696 jobs total.[115]

Fiscal and monetary policy

Employment is both cause and response to the economic growth rate, which can be affected by both government fiscal policy (spending and tax decisions) and monetary policy (Federal Reserve action.)

Fiscal policy

The U.S. has run historically large budget deficits since the 2008 recession, adding over $1 trillion in debt annually since fiscal year 2008. With a U.S. GDP of approximately $15 trillion, the spending implied by this deficit comprises a significant amount of GDP. Keynesian economics argues that when the economic growth is slow, larger budget deficits are stimulative to the economy. This is one reason why the significant deficit reduction represented by the fiscal cliff was expected to result in a recession.[116][117]

Monetary policy

The U.S. Federal Reserve has taken significant action to stimulate the economy after the 2008-2009 recession. The Fed expanded its balance sheet significantly from 2008-2012, meaning it essentially "printed money" to purchase large quantities of mortgage-backed securities and U.S. treasury bonds. This bids up bond prices, helping keep interest rates low, to encourage companies to borrow and invest and people to buy homes. It signaled in 2012 this expansion will continue indefinitely. The Fed also tied its actions to its outlook for unemployment and inflation for the first time in December 2012.[118]

Political debates

Liberal position

Liberals typically argue for government action or partnership with the private sector to improve job creation. Typical proposals involve stimulus spending on infrastructure construction, clean energy investment, unemployment compensation, educational loan assistance, and retraining programs. Liberals historically supported labor unions and protectionist trade policies. Liberals tend to be less concerned with budget deficits and debt and have a higher tolerance for inflation or currency devaluation to improve trade competitiveness, as a weaker currency makes exports relatively less expensive. During recessions, liberals generally advocate solutions based on Keynesian economics, which argues for additional government spending when the private sector is unable or unwilling to support sufficient levels of economic growth.[40][119]

Conservative position

Conservatives typically argue for free market solutions, with less government restriction of the private sector. Conservatives tend to oppose stimulus spending or bailouts, letting the free market determine success and failure. Typical proposals involve deregulation and income tax rate reduction. Conservatives historically have opposed labor unions and encouraged free trade agreements. Fiscal conservatives express concern that higher budget deficits and debt damage confidence, reducing investment and spending. Conservatives argue for policies that reduce or lower inflation. Conservatives generally advocate supply-side economics.[40]

Poll data

The affluent are much less inclined than other groups of Americans to support an active role for government in addressing high unemployment. Only 19% of the wealthy say that Washington should insure that everyone who wants to work can find a job, but 68% of the general public support that proposition. Similarly, only 8% of the rich say that the federal government should provide jobs for everyone able and willing to work who cannot find a job in private employment, but 53% of the general public thinks it should. A September 2012 survey by The Economist found those earning over $100,000 annually were twice as likely to name the budget deficit as the most important issue in deciding how they would vote than middle- or lower-income respondents. Among the general public, about 40% say unemployment is the most important issue while 25% say that the budget deficit is.[120]

A March 2011 Gallup poll reported: "One in four Americans say the best way to create more jobs in the U.S. is to keep manufacturing in this country and stop sending work overseas. Americans also suggest creating jobs by increasing infrastructure work, lowering taxes, helping small businesses, and reducing government regulation." Further, Gallup reported that: "Americans consistently say that jobs and the economy are the most important problems facing the country, with 26% citing jobs specifically as the nation's most important problem in March." Republicans and Democrats agreed that bringing the jobs home was the number one solution approach, but differed on other poll questions. Republicans next highest ranked items were lowering taxes and reducing regulation, while Democrats preferred infrastructure stimulus and more help for small businesses.[3]

Further, U.S. sentiment on free trade has been turning more negative. An October 2010 Wall Street Journal/NBC News poll reported that: "[M]ore than half of those surveyed, 53%, said free-trade agreements have hurt the U.S. That is up from 46% three years ago and 32% in 1999." Among those earning $75,000 or more, 50% now say free-trade pacts have hurt the U.S., up from 24% who said the same in 1999. Across party lines, income, and job type, between 76-95% of Americans surveyed agreed that "outsourcing of production and manufacturing work to foreign countries is a reason the U.S. economy is struggling and more people aren't being hired." [121]

The Pew Center reported poll results in August 2012: "Fully 85% of self-described middle-class adults say it is more difficult now than it was a decade ago for middle-class people to maintain their standard of living. Of those who feel this way, 62% say “a lot” of the blame lies with Congress, while 54% say the same about banks and financial institutions, 47% about large corporations, 44% about the Bush administration, 39% about foreign competition and 34% about the Obama administration."[122]

2008-2009 debates

The debate around the American Recovery and Reinvestment Act of 2009 (ARRA), the approximately $800 billion stimulus bill passed due to the subprime mortgage crisis, highlighted these views. Democrats generally advocated the liberal position and Republicans advocated the conservative position. Republican pressure reduced the overall size of the stimulus while increasing the ratio of tax cuts in the law.

These historical positions were also expressed during the debate around the Emergency Economic Stabilization Act of 2008, which authorized the Troubled Asset Relief Program (TARP), an approximately $700 billion bailout package (later reduced to $430 billion) for the banking industry. The initial attempt to pass the bill failed in the House of Representatives due primarily to Republican opposition.[123] Following a significant drop in the stock market and pressure from a variety of sources, a second vote passed the bill in the House.

2010-present debates

Creating American Jobs and Ending Offshoring Act

Senator Dick Durbin proposed a bill in 2010 called the "Creating American Jobs and Ending Offshoring Act" that would have reduced tax advantages from relocating U.S. plants abroad and limited the ability to defer profits earned overseas. However, the bill was stalled in the Senate primarily due to Republican opposition. It was supported by the AFL-CIO but opposed by the U.S. Chamber of Commerce.[124][125]

The Congressional Research Service summarized the bill as follows: "Creating American Jobs and Ending Offshoring Act - Amends the Internal Revenue Code to: (1) exempt from employment taxes for a 24-month period employers who hire a employee who replaces another employee who is not a citizen or permanent resident of the United States and who performs similar duties overseas; (2) deny any tax deduction, deduction for loss, or tax credit for the cost of an American jobs offshoring transaction (defined as any transaction in which a taxpayer reduces or eliminates the operation of a trade or business in connection with the start-up or expansion of such trade or business outside the United States); and (3) eliminate the deferral of tax on income of a controlled foreign corporation attributable to property imported into the United States by such corporation or a related person, except for property exported before substantial use in the United States and for agricultural commodities not grown in the United States in commercially marketable quantities."[126]

American Jobs Act

President Barack Obama proposed the American Jobs Act in September 2011, which included a variety of tax cuts and spending programs to stimulate job creation. The White House provided a fact sheet which summarized the key provisions of the $447 billion bill.[127] However, neither the House nor the Senate has passed the legislation as of December 2012. President Obama stated in October 2011: "In the coming days, members of Congress will have to take a stand on whether they believe we should put teachers, construction workers, police officers and firefighters back on the job...They'll get a vote on whether they believe we should protect tax breaks for small business owners and middle-class Americans, or whether we should protect tax breaks for millionaires and billionaires."[128]

Fiscal cliff

During 2012, there was significant debate regarding approximately $560 billion in tax increases and spending cuts scheduled to go into effect in 2013, which would reduce the 2013 budget deficit roughly in half. Critics argued that with an employment crisis, such fiscal austerity was premature and misguided.[4] The Congressional Budget Office projected that such sharp deficit reduction would likely cause the U.S. to enter recession in 2013, with the unemployment rate rising to 9% versus approximately 8% in 2012, costing over 1 million jobs.[116][117] The fiscal cliff was partially addressed by the American Taxpayer Relief Act of 2012.

Tax policy

Individual income taxes

The historical record indicates that marginal income tax rate changes have little impact on job creation, economic growth or employment.

- During the 1970s, marginal income tax rates were far higher than subsequent periods and the U.S. created 19.6 million net new jobs.

- During the 1980s, marginal income tax rates were lowered and the U.S. created 18.3 million net new jobs.

- During the 1990s, marginal income tax rates rose and the U.S. created 21.6 million net new jobs.

- From 2000-2010, marginal income tax rates were lowered due to the Bush tax cuts and the U.S. created no net new jobs, with 7.5 million created 2000-2007 before the 8.7 million lost during the 2008-2010 period.[129][130][131][132][133]

The Center on Budget and Policy Priorities (CBPP) wrote in March 2009: "Small business employment rose by an average of 2.3 percent (756,000 jobs) per year during the Clinton years, when tax rates for high-income filers were set at very similar levels to those that would be reinstated under President Obama's budget. But during the Bush years, when the rates were lower, employment rose by just 1.0 percent (367,000 jobs)."[134] CBPP reported in September 2011 that both employment and GDP grew faster in the seven-year period following President Clinton's income tax rate increase of 1993, than a similar period after the Bush tax cuts of 2001.[135]

Corporate income taxes

Conservatives typically argue for lower U.S. tax income rates, arguing that it would encourage companies to hire more workers. Liberals have proposed legislation to tax corporations that offshore jobs and to limit corporate tax expenditures.

U.S. corporate after-tax profits were at record levels during 2012 while corporate tax revenue was below its historical average relative to GDP. For example, U.S. corporate after-tax profits were at record levels during the third quarter of 2012, at an annualized $1.75 trillion.[136] U.S. corporations paid approximately 1.2% GDP in taxes during 2011. This was below the 2.7% GDP level in 2007 pre-crisis and below the 1.8% historical average for the 1990-2011 period.[137] In comparing corporate taxes, the Congressional Budget Office found in 2005 that the top statutory tax rate was the third highest among OECD countries behind Japan and Germany. However, the U.S. ranked 27th lowest of 30 OECD countries in its collection of corporate taxes relative to GDP, at 1.8% vs. the average 2.5%.[138]

Solutions for creating more U.S. jobs

A variety of options for creating jobs exist, but these are strongly debated and often have tradeoffs in terms of additional government debt, adverse environmental impact, and impact on corporate profitability.[139] Examples include infrastructure investment, tax reform, healthcare cost reduction, energy policy and carbon price certainty, reducing the cost to hire employees, education and training, deregulation, and trade policy. Authors Bittle & Johnson of Public agenda explained the pros and cons of 14 job creation arguments frequently discussed, several of which are summarized below by topic. These are hotly debated by experts from across the political spectrum.[140]

Infrastructure investment

Many experts advocate infrastructure investment, such as building roads and bridges and upgrading the electricity grid. Such investments have historically created or sustained millions of jobs, with the offset to higher state and federal budget deficits. In the wake of the 2008-2009 recession, there were over 2 million fewer employed construction workers.[140]

Tax policy

Removing the threat of higher taxes embodied in the fiscal cliff may encourage consumers to spend and employers to expand their business and add jobs. The risk is higher national debt, which can slow the economy in the long-run. The American Taxpayer Relief Act of 2012 significantly reduced taxes relative to the full expiration of the Bush tax cuts. Lowering the costs of workers also encourages employers to hire more. This can be done via reducing existing Social Security or Medicare payroll taxes or by specific tax incentives for hiring additional workers. President Obama reduced the Social Security payroll tax on workers during the 2011-2012 period, which added an estimated $100 billion to the deficit while leaving these funds with consumers to spend. The U.S. corporate tax rate is among the highest in the world, although U.S. corporations pay among the lowest amount relative to GDP due to loopholes. Reducing the rate and eliminating loopholes may make U.S. businesses more competitive, but may also add to the deficit.[140] The Tax Policy Center estimated during 2012 that reducing the corporate tax rate from 35% to 20% would add $1 trillion to the debt over a decade, for example.[141]

Lower healthcare costs

Businesses are faced with paying the significant and rising healthcare costs of their employees. Many other countries do not burden businesses, but instead tax workers who pay the government for their healthcare. This significantly reduces the cost of hiring and maintaining the work force.[140]

Energy policy and carbon price certainty

Various studies place the cost of environmental regulations in the thousands of dollars per employee. Americans are split on whether protecting the environment or economic growth is a higher priority. Regulations that would add costs to petroleum and coal may slow the economy, although they would provide incentives for clean energy investment by addressing regulatory uncertainty regarding the price of carbon.[140]

President Obama advocated a series of clean energy policies during June 2013. These included: Reducing carbon pollution from power plants; Continue expanding usage of clean energy; raising fuel economy standards; and energy conservation through more energy-efficient homes and businesses.[142]

Employment policies and the minimum wage

Raising the minimum wage would provide households with more money to spend, in an era with record corporate profits and a reluctance of corporations to invest. Critics argue raising employment costs deters hiring. During 2009, the minimum wage was $7.25 per hour, or $15,000 per year, below poverty level for some families.[140]

President Obama advocated raising the minimum wage during February 2013: "The President is calling on Congress to raise the minimum wage from $7.25 to $9 in stages by the end of 2015 and index it to inflation thereafter, which would directly boost wages for 15 million workers and reduce poverty and inequality...A range of economic studies show that modestly raising the minimum wage increases earnings and reduces poverty without jeopardizing employment. In fact, leading economists like Lawrence Katz, Richard Freeman, and Laura Tyson and businesses like Costco, Wal-Mart, and Stride Rite have supported past increases to the minimum wage, in part because increasing worker productivity and purchasing power for consumers will also help the overall economy."[143]

Regulatory reform

Regulatory costs on business start-ups and going concerns are significant. Requiring laws to have sunset provisions (end-dates) would help ensure only worthwhile regulations are renewed. New businesses account for about one-fifth of new jobs added. However, the number of new businesses starting each year dropped by 17% after the recession. Inc. magazine published 16 ideas to encourage new startups, including cutting red tape, approving micro-loans, allowing more immigration, and addressing tax uncertainty.[140]

Education policy

Education policy reform could make higher education more affordable and more attuned to job needs. Unemployment is considerably lower for those with a college education. However, college is increasingly unaffordable. Providing loans contingent on degrees focused on fields with worker shortages such as healthcare and accounting would address structural workforce imbalances (i.e., a skills mismatch).[140]

Address income inequality

Income inequality, expressed by wage stagnation for middle- and lower-income families coupled with a shift in income growth to the top earners, can adversely affect economic growth, as wealthier families tend to save more. The quality or pay of the job matters, not just creating more jobs. The union movement has declined considerably, one factor contributing to more income inequality and off-shoring. Reinvigorating the labor movement could help create more higher-paying jobs, shifting some of the economic pie back to workers from owners. However, by raising employment costs, employers may choose to higher fewer workers.[140]

Trade policy

Creating a level playing field with trading partners could help create more jobs in the U.S. Wage and living standard differentials and currency manipulation can make "free trade" something other than "fair trade." Requiring countries to allow their currencies to float freely on international markets would reduce significant trade deficits, adding jobs in developed countries such as the U.S. and Western Europe.[140]

President's Council on Jobs and Competitiveness

President Obama established the President’s Council on Jobs and Competitiveness in 2009. The Council released an interim report with a series of recommendations in October 2011. The report included five major initiatives to increase employment while improving competitiveness:

- Measures to accelerate investment into job-rich projects in infrastructure and energy development;

- A comprehensive drive to ignite entrepreneurship and accelerate the number and scale of young, small businesses and high-growth firms that produce an outsized share of America’s new jobs;

- A national investment initiative to boost jobs-creating inward investment in the United States, both from global firms headquartered elsewhere and from multinational corporations headquartered here;

- Ideas to simplify regulatory review and streamline project approvals to accelerate jobs and growth; and,

- Steps to ensure America has the talent in place to fill existing job openings as well as to boost future job creation.[144]

U.S. employment history

2000-present

Job growth in the U.S. from 2000-2007 was slow by historical standards, with 9.2 million jobs created versus a range of approximately 18-20 million in each of the preceding three decades. Including the impact of the 2008-2009 recession, job growth from 2000-2010 was only 2.2 million.[145]

The U.S. economy was severely impacted by the subprime mortgage crisis. The U.S. unemployment rate rose steadily from 5% in January 2008 to a peak of 10% in October 2009. It has since fallen to 7.8% in September 2012.[146] The number unemployed rose from 7.6 million in January 2008 to a peak of 15.4 million in October 2009. It has since fallen to 12.1 million in September 2012.[147]

Monthly job losses began in February 2008 and peaked in January 2009, with over 800,000 jobs lost that month. Employment fell from 138.0 million at peak employment in January 2008 to the trough of 129.2 million in February 2010, a decline of 8.8 million jobs or 6.4% of the workforce.[148]

As part of the economic policy of Barack Obama, the United States Congress funded approximately $800 billion in spending and tax cuts via the February 2009 American Recovery and Reinvestment Act to stimulate the economy. Monthly job losses began slowing shortly thereafter. By March 2010, employment again began to rise. From March 2010 to September 2012, over 4.3 million jobs were added, with 24 consecutive months of employment increases from October 2010 to September 2012. As of September 2012, employment of 133.5 million remained 4.5 million below the pre-crisis peak in January 2008.[148]

However, despite decreases in job loss and the unemployment rate, the federal data has been criticized for excluding large numbers of people who would like to work but are not considered to be part of the labor force because they are not running an active job search and are not available for immediate employment.[149]

In 2009, there were six unemployed people, on average, for each available job.[150] Men account for at least 7 of 10 workers who lost jobs, according to Bureau of Labor Statistics data.[151] The youth unemployment rate was 18.5% in July 2009, the highest July rate since 1948.[152] Approximately 34.5% of young African American men were unemployed in October 2009.[153] As of 2009, Detroit's unemployment rate was 27%, but the Detroit News suggests that nearly half of the city's working-age population was unemployed.[154] An estimated 3.8 million Americans lost their jobs in 2009.[150]

Research indicates recovery from financial crises can be protracted, with lengthy periods of high unemployment and substandard economic growth.[155][156]

Definitions