Commerzbank

| |

| Company type | Aktiengesellschaft |

|---|---|

| FWB: CBK DAX Component LSE: CZB | |

| ISIN | DE000CBK1001 |

| Industry | Financial services |

| Founded | 26 February 1870 in Hamburg[1] |

| Founders | Theodor Wille et al.[1] |

| Headquarters | Commerzbank Tower, , |

Area served | Worldwide |

Key people |

|

| Services | |

| Revenue | |

| Total assets | |

| Total equity | |

Number of employees | 47,718 (December 2020) |

| Capital ratio | 12.9% (2018) |

| Rating |

|

| Website | www |

| Footnotes / references Commerzbank Investor Relations | |

Commerzbank AG (German pronunciation: [kɔˈmɛʁt͡sbaŋk aːˌɡeː] ) is a global German universal bank headquartered at Commerzbank Tower in Frankfurt. The bank was founded in Hamburg in 1870 and is today among the largest credit institutions in Germany, with total assets of €534 billion as of the end of September 2022. With over 15 percent ownership, the Government of Germany is the bank's biggest shareholder.[4]

As of 2018, Commerzbank was present in more than 50 countries around the world and provided almost a third of Germany's trade finance.[5] In 2017, it served 13 million customers in Germany and 5 million customers in Central and Eastern Europe.

Commerzbank has been designated as a Significant Institution since the entry into force of European Banking Supervision in late 2014, and as a consequence is directly supervised by the European Central Bank.[6][7]

History

1870–1918

The Commerz- und Disconto-Bank in Hamburg was born with the establishment of its founding committee on 26 February 1870 in Hamburg, at the initiative of merchant Theodor Wille. The banking houses of Mendelssohn & Co., M. M. Warburg & Co., Hesse Newman and B.H. Goldschmidt were among the founding investors.[4]

In 1873, the bank sponsored the creation of an affiliate in London, the London and Hanseatic Bank, of which it subscribed about half of the shares.[4] By 1891, it had become the largest bank in Hamburg by total lending.[8]: 20 It participated in the rapid industrial and commercial development of the German Empire by providing trade finance, credit to small businesses, and investments in various industries that included shipping, electricity generation, mining, chemistry, and manufacturing. It was also involved in sovereign financing, and in 1901 joined the Reichsanleihe-Konsortium, a group of several dozen banks that placed loans for the German imperial government.[4]

In 1881, the Commerz- und Disconto-Bank was among the founders of Nationalbank für Deutschland in Berlin, together with Anglo-Austrian Bank, Vienna's newly established Länderbank, the latter's affiliate Ungarische Landesbank, and Breslauer Disconto-Bank Friedenthal & Co.[8]: 18-19 In 1897, it acquired the Jacques Dreyfus & Co. banking house (est. 1868 as Dreyfus-Jeidels) in Frankfurt, which also had a branch in Berlin, and consequently shortened its name to Commerz- und Disconto-Bank in 1898.[8]: 21-22 In 1905, it acquired Berliner Bank (est. 1889 following the liquidation of the cooperative Berliner Handelsbank e.G., est. 1878) and from then until 1931 maintained two head offices in Hamburg and Berlin, the latter at Behrensstrasse 46 / Charlottenstrasse 47.[8]: 8, 25–26 It acquired a number of regional and private banks, including B. Magnus (est. 1826 in Hanover) in 1897 and Altonaer Bank (Altona) in 1910.[8]: 26, 30 During World War I, the London and Hanseatic Bank subsidiary was seized by the British authorities, together with other German-owned banks.[4] In 1917, Commerz started an acquisition spree of around 40 local banks until 1923.[8]: 34

-

First head office building on the Nikolaifleet in Hamburg, completed in 1874 on a design by architect Martin Haller,[9] photographed in 1886

-

Undated engraving of the Hamburg head office following interwar or postwar reconstruction

-

The same building in 2006

-

Former head office of Berliner Bank in Berlin, as remodeled in 1923 with addition of upper floors[8]: 43

-

The same building in 2009, heavily remodeled and repurposed as head office of DSGV

1918–1933

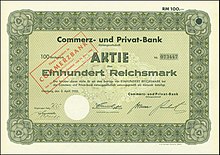

In 1920, the bank acquired Mitteldeutsche Privat-Bank (est. 1856 in Magdeburg) and renamed itself Commerz- und Privat-Bank AG, by which it gained a dense branch network in the provinces of Saxony and Thuringia.[4] In 1923, it took 25 percent ownership of Rigaer Internationale Bank in Riga, which would be liquidated in 1933; that same year, to cope with hyperinflation, it employed a total of 26,000 staff in 319 locations, the densest branch network among German banks; by end-1923, after hyperinflation ended, the headcount fell to 10,200.[8]: 44-45 In 1927, Commerzbank increased business in the US by establishing an office in New York[8]: 49 In 1928, together with Chase Securities Corp. and Halsey, Stuart & Co., it co-founded General Mortgage and Credit Corporation, a long-term lender to small businesses.[8]: 51 In 1929, it merged with Mitteldeutsche Creditbank (est. 1856 in Meiningen, relocated to Frankfurt in 1886).[4][10]: 46

By 1930, Commerz- und Privatbank was Germany's fourth-largest joint-stock bank by total deposits with 1.5 billion Reichsmarks, behind Deutsche Bank & Disconto-Gesellschaft (4.8 billion), Danat-Bank (2.4 billion), and Dresdner Bank (2.3 billion) and ahead of Reichs-Kredit-Gesellschaft (619 million) and Berliner Handels-Gesellschaft (412 million).[11]: 354

Following the banking crisis of 1931, the bank consolidated all head office functions in Berlin,[8]: 56 then merged in February 1932 with Barmer Bankverein (est. 1867 in Wuppertal, relocated to Düsseldorf in 1924) under the aegis of the Reichsbank. As a consequence, the government held 71 percent of the merged entity's capital, mainly through the Reichsbank subsidiary Deutsche Golddiskontbank.[12]: 7 In November 1932, Commerz- und Privatbank chief executive Friedrich Reinhart and chairman Franz Heinrich Witthoefft were among the signatories of the Industrielleneingabe petition of business leaders that advised President Paul von Hindenburg to appoint Adolf Hitler as chancellor.[8]: 66

-

Former head office building of Mitteldeutsche Privat-Bank in Magdeburg, Commerz branch in the mid-1920s

-

The same building in 2014, by then a branch of HypoVereinsbank

-

Commerz- und Privatbank in Leipzig, 1920

-

Former head office of Hessischer Bankverein in Kassel, taken over by Commerzbank in 1922

-

The same building in 2014

-

Hatzfeld'sches Palais in Düsseldorf, later Barmer Bankverein building

-

Former head office of Barmer Bankverein in Düsseldorf

-

Former Barmer Bankverein building in Wuppertal

1933–1945

The Commerz- und Privat-Bank paid its first dividend in five years in 1935,[8]: 66 and returned to private ownership in 1936-1937.[12]: 7 In line with the Nazi policy of aryanization, the bank discarded its Jewish staff, which by 1933 represented around 14 percent of its senior executives and 1.6 percent of overall employees.[8]: 67 Supervisory board members Curt Sobernheim and Albert Katzenellenbogen left in 1933 and 1937 respectively, as did management board member Ludwig Berliner in 1933; all three would be murdered in the early 1940s under the Final Solution policy. By 1938, Commerzbank no longer had any Jewish employees.[4] In 1939, it closed its office in New York.[8]: 49 By September 1939, it had 6,900 employees, of which 16 percent were mobilized into the Wehrmacht.[8]: 70 In 1940, it adopted the name Commerzbank AG, by which it had already been referred to for a long time, as its formal name together with a new logo.

Through the 1938 Anschluss, annexation of the Sudetenland, and during World War II, it opened branches and subsidiaries in the expanded German territory and also benefited from the expropriation or sale under duress of Jewish-owned banks. In 1940, it opened a branch in Strasbourg. In 1941, it took over the former Hugo Kaufmann & Co.'s Bank in Amsterdam and in 1942 renamed it the Rijnsche Handelsbank. In November 1941 it established Hansabank AG in Riga, with operations in Reval (December 1941) and Dorpat (December 1942), and in 1942, Hansabank NV / Banque Hanséatique SA in Brussels. In the former Yugoslavia, it took minority stakes of 6 and 10 percent respectively in Bankverein AG Belgrad and Bankverein für Kroatien AG in 1941, both carved out from the former Allgemeiner Jugoslawischer Bankverein which itself had been a product of dismantling Wiener Bankverein in the 1920s.[8]: 73 In 1942 it also took a 10 percent stake in Böhmische Industrial-Bank in Prague, and 10 percent in the newly established Deutsche Bank für Ostasien intended to develop trade with Imperial Japan.[8]: 74 By late 1944, the bank's balance sheet size had tripled from its 1938 level, with two-thirds of the assets being German government debt.[4] In comparative terms, however, it had been less expansionist and ideologically aligned than other large German banks, particularly Deutsche Bank and Dresdner Bank, and in 1942 fell from third to fourth place among German joint-stock banks.[8]: 69 In early 1945, it relocated its head office from Berlin to Hamburg as a precautionary measure.[8]: 77

-

Advert for Hansabank Riga, 1942

-

Stolperstein in memory of Albert Katzenellenbogen in front of the location of the former Frankfurt branch (and former head office of Mitteldeutsche Creditbank) at Neue Mainzer Strasse 32

1945–2008

By the end of the war, the former head office and close to half of the bank's branches were in the Soviet occupation zone, where they were promptly nationalized and liquidated. Of the 119 locations in West Germany, 42 were fully destroyed, 35 severely damaged, and 42 in working condition.[8]: 82 In 1947-1948, these were first reorganized into nine groups of branches, intended to be operationally independent: Bankverein Westdeutschland (Düsseldorf), Hansa-Bank (Hamburg), Merkur-Bank (Hanover), and Holsten-Bank (Kiel) in the British occupation zone; Mittelrheinische Bank (Mainz) in the French zone; and Mitteldeutsche Creditbank (Frankfurt), Bankverein für Württemberg-Baden (Stuttgart), Bayerische Disconto-Bank (Nuremberg), and Bremer Handels-Bank (Bremen) in the American zone.[8]: 83-84 In August 1949, the bank resterted operations in West Berlin, first as Bankhaus Holbeck, renamed Bankgesellschaft Berlin AG in October,[8]: 86 and later Berliner Commerzbank AG. In September 1952, in order to expand credit provision to the German economy, the nine West German entities were consolidated by law into three: Bankverein Westdeutschland AG, renamed Commerzbank-Bankverein AG in 1956, in Düsseldorf; Commerz- und Disconto-Bank AG in Hamburg; and Commerz- und Credit-Bank AG in Frankfurt. On 1 July 1958, the Düsseldorf entity acquired the other two and changed its name back to Commerzbank AG. Berliner Commerzbank AG only merged into the parent Commerzbank on 1 October 1992.[4]

In 1951, several of the groups of Commerzbank branches had taken stakes in ADIG Allgemeine Deutsche Investment-Gesellschaft, Germany's first investment fund management company founded in 1949 in Munich,[8]: 88 thus establishing the basis for the group's asset management arm.

In 1952, the Commerzbank group restarted an international activity by opening a representative office in Rio de Janeiro, followed by Amsterdam and Madrid in 1953, Beirut in 1957, and Tokyo in 1961, the first German bank to open in postwar Japan.[8]: 89, 90, 99, 107 in 1967, Commerzbank established a representative office in New York City. That same year, it joined with Irving Trust, First National Bank of Chicago, Westminster Bank, and HSBC to form the International Commercial Bank in London. In 1969, Commerzbank opened a subsidiary in Luxembourg, Commerzbank International SA (CISAL), which for many years was its largest foreign subsidiary.[8]: 117 In 1971, the New York office was converted into a branch, the first by a German bank in the postwar United States. Commerzbank opened further branches in London in 1973, in Paris in 1976 (also the first there by a German bank in postwar times), and in Hong Kong in 1979.[4] It opened a representation in Beijing on 16 April 1982.[8]: 143

Commerzbank and Crédit Lyonnais entered a strategic partnership, the "Europartners Group", on 14 October 1970, in order to achieve cross-border synergies despite public policies which at the time prevented outright cross-border mergers. They immediately formed a 50-50 joint venture for U.S. securities business, Europartners Securities Corporation, which absorbed Crédit Lyonnais's New York investment banking operation.[8]: 118 The Europartners alliance was joined on 11 January 1971 by Banco di Roma, adopted a common logo (the "quatre vents") in 1972, and expanded to Madrid-based anco Hispano Americano (BHA) in October 1973.[8]: 119-126 In 1974, Commerzbank and Crédit Lyonnais merged their operations in Saarland into a joint venture majority owned by Commerzbank and called Commerz-Credit-Bank AG Europartner, with seat in Saarbrücken and small minority stakes by the other two Europartner banks.[8]: 128 In 1984, Commerzbank acquired a 10 percent stake in BHA,[8]: 146 and BHA in turn took a 5 percent stake in Commerzbank in 1989.[8]: 154 In 1988, Commerzbank acquired full ownership of Europartners Securities Corporation in New York from Crédit Lyonnais, and subsequently renamed it Commerzbank Capital Markets Corporation.[8]: 150 The Europartners alliance was eventually brought to an end in 1992.[8]: 192

From 1970 onwards, the bank's administrative activities were shifted to Frankfurt am Main, which eventually became its legal domicile on 5 September 1990.[8]: 158 In 1971, Commerzbank acquired majority stakes in mortgage banks Rheinische Hypothekenbank in Mannheim and Westdeutsche Bodenkreditanstalt in Cologne, and merged them in 1974.[8]: 121 From June 1990, it expanded again into the former German Democratic Republic, starting with a branch in Halle inaugurated by German Foreign Minister Hans-Dietrich Genscher.[8]: 154

In 1994, Commerzbank became a shareholder of Bank Rozwoju Eksportu in Poland (est. 1986), renamed mBank in 2013, and has been its majority owner since 2000.[8]: 179 In 2005-2006, it took over Eurohypo, a mortgage bank that had been created in 2003 as a joint venture with Deutsche Bank and Dresdner Bank. In 2007 it acquired Bank Forum in Ukraine, but divested it in 2012.

-

A former Commerzbank branch used as Stadtkontor during the currency exchange of June 1948 in East Berlin

-

Rheinstrasse 55 in Berlin-Friedenau, where Commerzbank restarted its West Berlin activity in 1949[8]: 86

-

High-rise extension (center) of the historic head office building in Hamburg, erected in 1961-1964 on a design by architect Godber Nissen

-

Former Commerzbank head office tower at Neue Mainzer Strasse 32-36 in Frankfurt, designed by architect Richard Heil, upon completion in 1974[8]: 128

-

Commerzbank Tower under construction in Frankfurt, 1996

-

Commerzbank high-rise at Hafenstrasse 51, Frankfurt, in 2007

Since 2008

In several steps between August 2008 and January 2009, Commerzbank acquired Dresdner Bank from Allianz, and the German government became owner of one quarter of the merged group's equity capital. As part of the restructuring, Allianz acquired Commerzbank's investment management business, cominvest Asset Management GmbH, which had been formed in 2002 through the merger of ADIG (of which Commerzbank had been majority owner since 1999[8]: 178 ), Commerzbank Investment Management GmbH (or Commerzinvest, est. 1969), and Commerz Asset Managers GmbH.[4] One driver of the state bailout was the legacy of Commerzbank's ill-fated foray into investment banking in the early 2000s, namely the Commerzbank Securities investment banking unit run by Mehmet Dalman and Roman Schmidt.[13][14][15][16] What was left of Commerzbank Securities was folded into a division of the commercial bank called Commerzbank Corporates and Markets.[17] In total, Commerzbank received an €18 billion ($22.3 billion) state bailout.[18]

In September 2016, Commerzbank planned to cut 9,600 jobs or about a fifth of its workforce in 4 years.[19] In late 2019, Commerzbank entered into talks with Petrus Advisers to buy its 7.5% stake in Comdirect and take over the entire online bank.[20]

In June 2020, Cerberus Capital Management attacked the firm's leadership team and called for "significant change at the supervisory board, the management board and the company's strategic plan to stop a 'downward spiral' caused by what the investor said were bloated costs, low profits and managerial inaction." This move triggered the resignation of chairman Stefan Schmittmann and of CEO Martin Zielke.[21] In the second quarter of 2020, the company made an operating profit of €205 million; it was 34 per cent less compared to the same period of 2019. "According to people familiar with the matter", the bank's profit was more affected by the Wirecard scandal than the economic effects of the COVID-19 pandemic.[22]

In 2021, the bank announced it will reduce the number of branches in Germany from 790 to 450 and cut jobs by 10,000 (a third of its German workforce)[23] by 2024.[24]

-

The Waldstadion near Frankfurt was known from mid-2005 to mid-2020 as "Commerzbank Arena"

-

Gallileo Tower in Frankfurt, former Dresdner Bank head office, used by Commerzbank following the merger

-

Commerzbank building in Cologne, 2010

-

Commerzbank building facing the Eurotower at Kaiserstrasse 30 in Frankfurt, 2012

-

Commerzbank branch at Thomaskirchhof in Leipzig, 2015

-

Commerzbank building in Munich, 2016

Leadership

Chief Executive

- Ernest Müller, Direktor 1874–1891[8]: 16

- Georg Wellge, 1891–1901

- Wilhelm Heintze, 1902–1908

- Gustav Pilster, 1902–1926

- Moritz Schultze, Direktor 1920–1931?[8]: 41

- Friedrich Reinhart, 1931–1934

- Paul Marx, 1934–1943

- Fritz Höfermann, Vorstandssprecher of Bankverein Westdeutschland AG, 1952–1958

- Wilhelm Nuber, Vorstandssprecher of Commerz- und Credit-Bank AG, 1952–1958

- Robert Gebhardt, Vorstandssprecher of Commerz- und Disconto-Bank AG, 1952–1958

- Hanns Deuss, Vorstandssprecher for Commerzbank in Düsseldorf, 1958–1961

- Will Marx, Vorstandssprecher for Northern Germany in Hamburg 1961–1969

- Ernst Rieche, Vorstandssprecher for Southern Germany in Frankfurt 1961–1973

- Paul Lichtenberg, Vorstandssprecher for Western Germany 1961–1973, then for Southern and Western Germany 1973–1976, again interim Vorstandssprecher of Commerzbank in March-May 1981

- Robert Dhom, Vorstandssprecher 1976–1980

- Walter Seipp, Vorstandsvorsitzender 1981–1991

- Martin Kohlhaussen, Vorstandssprecher 1991–2001

- Klaus-Peter Müller, Vorstandssprecher 2001–2008

- Martin Blessing, Vorstandssprecher 2008–2009, then Vorstandsvorsitzender 2009–2016[8]: 206-208

- Martin Zielke, Vorstandsvorsitzender 2016–2020

- Manfred Knof, Vorstandsvorsitzender from 1 January 2021[25]

Chair of the supervisory board

- Carl Woermann, 1870–1880

- Theodor Wille, 1880–1892

- Emile Nölting, 1892–1899

- Carl Friedrich Wilhelm Nottebohm, 1899–1915

- Franz Heinrich Witthoefft, 1915–1934

- Friedrich Reinhart, 1934–1943

- Paul Marx, 1943–1946 and 1948–1952

- Albert Bannwarth, 1946–1947

- Philipp Möhring, chair of Commerz- und Credit-Bank AG 1952–1958

- Wilhelm Wolter, chair of Commerz- und Disconto-Bank AG 1952–1954

- Wilhelm Nottebohm, chair of Commerz- und Disconto-Bank AG 1954–1958

- Otto Schniewind, chair of Bankverein Westdeutschland / Commerzbank-Bankverein 1952–1958 and chair of Commerzbank, 1958–1961

- Hanns Deuss, 1961–1976

- Paul Lichtenberg, 1976–1988

- Raban von Spiegel, 1988–1991

- Walter Seipp, 1991–1999

- Dietrich-Kurt Frowein, 1999–2001

- Martin Kohlhaussen, 2001–2008

- Klaus-Peter Müller, 2008–2018[8]: 204

- Stefan Schmittmann, 2018–3 August 2020[21]

- Helmut Gottschalk, 2021–2023

- Jens Weidmann, from June 2023

Ownership

As of December 2018, the bank's two largest shareholders were the Government of Germany (15.6%) and Cerberus Capital Management (5.01%).[26]

Operations

Commerzbank is a member of the Cash Group.[27]

Controversies

For more than a decade, Commerzbank was involved in laundering hundreds of billions of U.S. dollars out of Iran, Sudan and Myanmar, against United States sanctions.[28][better source needed] Commerzbank agreed to pay US$1.5 billion in fines and dismiss several employees for their role in laundering US$253 billion, and for helping the Japanese company Olympus Corporation orchestrate accounting fraud.[29][30]

The bank has been subject to several corruption investigations,[31][29] paying US$1.5 billion in fines in 2015.[29]

In 2017, Frankfurt prosecutors, together with federal crime police and tax officials, conducted searches of Commerzbank offices as well as the flats of three suspects in Frankfurt and nearby Hanau.[31] The police raid was about a "tax evasion probe in which several current and former managers are suspected of evading €40 million in taxes via dividend stripping, also known as "cum-ex" transactions".[32] The investigation also extended to trades in 2008 at Dresdner Bank, which was taken over by Commerzbank in 2009.[32] Commerzbank said "it proactively notified the authorities with the preliminary results of that investigation and is cooperating fully".[32] In 2019, Cologne prosecutors again raided Commerzbank's Frankfurt headquarters as part of the criminal investigation.[33]

It was announced in July 2019 that Commerzbank was being investigated by the European Central Bank and BaFin for facilitating its subsidiary mBank's toxic financial product offering in Poland, as well as for the linked potential tax evasion resulting from Commerzbank's financing of mBank's CHF-linked toxic financial products.[34][35]

Troika laundromat

Troika laundromat or ŪkioLeaks[36] is a money laundering scheme organized by Russia's former largest investment bank – Troika Dialog. This scheme allowed the flow of some $4.8 billion of funds from Russian companies and figures into Europe and the US between 2003 and early 2013. It was noted that Commerzbank have neglected AML obligations during handling the Troika's money.[37][38][39]

See also

References

- ^ a b Manfred Pohl, Sabine Freitag, ed. (1994). Handbook on the History of European Banks. Brookfield: Edward Elgar Publishing. p. 375. ISBN 1-85278-919-0.

- ^ "Commerzbank Board of Managing Directors". Commerzbank. 1 January 2021. Retrieved 20 January 2021.

- ^ "Supervisory Board". Commerzbank. 5 June 2023. Retrieved 5 June 2023.

- ^ a b c d e f g h i j k l "Commerzbank – over 140-year history" (PDF). Commerzbank.

- ^ "How Germany Might Sell Its Commerzbank Stake: Four Scenarios". Bloomberg.com. 27 March 2018. Retrieved 27 March 2018.

- ^ "The list of significant supervised entities and the list of less significant institutions" (PDF). European Central Bank. 4 September 2014.

- ^ "List of supervised entities" (PDF). European Central Bank. 1 January 2023.

- ^ a b c d e f g h i j k l m n o p q r s t u v w x y z aa ab ac ad ae af ag ah ai aj ak al am an ao ap aq ar as at au Detlef Krause (2010), Commerzbank: Eine Zeitreise 1870-2010 (PDF), Dresden: Eugen-Gutmann-Gesellschaft

- ^ "Commerzbank-Zentrale droht der Abriss: Und wieder stirbt ein Stück Stadt-Geschichte". Focus.de. 1 March 2019.

- ^ Jacob Riesser (1911), The German Great Banks and Their Concentration in connection with The Economic Development of Germany (PDF), Washington DC: National Monetary Commission

- ^ P. Barrett Whale (1930), Joint Stock Banking in Germany: A Study of the German Creditbanks Before and After the War (PDF)

- ^ a b Germà Bel (February 2010), "Against the mainstream: Nazi privatization in 1930s Germany", Economic History Review (63:1): 34–55

- ^ Althaus, Sarah (30 September 2004). "Commerzbank unit chief 'to quit'". FT.com. Archived from the original on 24 June 2013. Retrieved 26 October 2013.

- ^ "Commerzbank culls 900 as losses grow". Efinancialnews.com. 9 November 2004. Retrieved 26 October 2013.

- ^ Landler, Mark (10 November 2004). "Major Bank in Germany Cutting Back Its Trading". The New York Times.

- ^ "A weary lender". The Economist. November 2014.

- ^ "Commerzbank - Company Portrait". Deutsche Börse - Cash Market.

- ^ Kanishka Singh (January 26, 2018), Goldman, Barclays, SocGen interested in Commerzbank unit: Handelsblatt Reuters.

- ^ "Commerzbank To Cut 9,600 Jobs By 2020". 30 September 2016.

- ^ Tom Sims and Hans Seidenstuecker (December 30, 2019), Commerzbank in talks to buy Petrus Advisers stake in Comdirect: source Reuters.

- ^ a b Storbeck, Olaf (3 July 2020). "Commerzbank chairman and chief to quit in Cerberus row". Financial Times. Archived from the original on 11 December 2022. Retrieved 5 August 2020.

- ^ Storbeck, Olaf (5 August 2020). "Commerzbank takes greater loan loss from Wirecard than Covid-19 debt". Financial Times. Archived from the original on 11 December 2022. Retrieved 5 August 2020.

- ^ Storbeck, Olaf (28 January 2021). "Commerzbank to cut one in three jobs in Germany". Financial Times. Archived from the original on 11 December 2022. Retrieved 29 January 2021.

- ^ Tom Sims; Patricia Uhlig (3 February 2021). "Commerzbank CEO finalizes plans to cut 10,000 jobs, close branches". Reuters.

- ^ "Commerzbank Names Deutsche Bank's Knof CEO to Lead Cost Cuts". Bloomberg.com. 26 September 2020. Retrieved 28 September 2020.

- ^ "Commerzbank (CBK)". Marketscreener.com. 27 December 2018. Retrieved 27 December 2018.

- ^ "Kostenlose Bargeldversorgung für Kunden der Cash Group Banken".

- ^ Schroeder, Peter (12 March 2015). "German bank to pay $1.45B to settle money laundering charges".

- ^ a b c Protess, Ben (12 March 2015). "Commerzbank of Germany to Pay $1.5 Billion in U.S. Case". The New York Times.

- ^ "Justice Dept.'s Criminal Information With Commerzbank". Document Cloud.

- ^ a b Sims, Tom. "German prosecutors raid Commerzbank in tax evasion probe". Reuters. Retrieved 3 May 2018.

- ^ a b c Maria Sheahan; Tom Sims; Hans Seidenstuecker (14 November 2017). "German prosecutors raid Commerzbank in tax evasion probe". Reuters. Retrieved 14 November 2017.

- ^ Stephen Morris and Guy Chazan (September 10, 2019), Commerzbank raided by prosecutors investigating German tax scandal Financial Times.

- ^ "Commerzbank pociągnięty do odpowiedzialności za frankowe grzechy mBanku". 23 July 2019.

- ^ "Sprzedaż mBanku. Niemcy chcą komuś podrzucić zgniłe jajo w postaci frankowiczów". 1 October 2019.

- ^ Černiauskas, Šarūnas (4 March 2019). "Ūkio bankas – milijardinės pinigų plovimo sistemos centre". 15min.lt/verslas (in Lithuanian). Retrieved 19 November 2023.

- ^ "Troika Laundromat signals a different kind of financial crisis - News". Transparency.org. 7 March 2019. Retrieved 29 September 2023.

- ^ Baumgaertel, Christian (7 March 2019). "What we know about the Troika Laundromat. And what we don't". DailyRepublic.com. Retrieved 29 September 2023.

- ^ O'Connor, Coilin (5 March 2019). "The Troika Laundromat: Five Quick Takeaways". Radio Free Europe/Radio Liberty. Retrieved 30 September 2023.

External links

![]() Media related to Commerzbank at Wikimedia Commons

Media related to Commerzbank at Wikimedia Commons

- Commerzbank

- Companies formerly listed on the Tokyo Stock Exchange

- Companies listed on the Frankfurt Stock Exchange

- German brands

- Multinational companies headquartered in Germany

- Banks established in 1870

- Companies based in Frankfurt

- Companies based in Hamburg

- Banks under direct supervision of the European Central Bank

- German companies established in 1870

- Companies formerly in the MDAX

- Companies in the DAX index

- Primary dealers

![First head office building on the Nikolaifleet in Hamburg, completed in 1874 on a design by architect Martin Haller,[9] photographed in 1886](http://upload.wikimedia.org/wikipedia/commons/thumb/c/cd/Commerz-_und_Disconto-Bank_Hamburg_1885.jpg/120px-Commerz-_und_Disconto-Bank_Hamburg_1885.jpg)

![Former head office of Barmer Bankverein [de] in Düsseldorf](http://upload.wikimedia.org/wikipedia/commons/thumb/a/aa/Commerzbank_D%C3%BCsseldorf.jpg/120px-Commerzbank_D%C3%BCsseldorf.jpg)

![High-rise extension (center) of the historic head office building in Hamburg, erected in 1961-1964 on a design by architect Godber Nissen [de]](http://upload.wikimedia.org/wikipedia/commons/thumb/6/6e/Brodschrangen_15_%28Hamburg-Altstadt%29.02.11792.ajb.jpg/120px-Brodschrangen_15_%28Hamburg-Altstadt%29.02.11792.ajb.jpg)

![Former Commerzbank head office tower [de] at Neue Mainzer Strasse 32-36 in Frankfurt, designed by architect Richard Heil, upon completion in 1974: 128](http://upload.wikimedia.org/wikipedia/commons/thumb/f/fa/1974_Commerzbank_altes_Hochhaus.jpg/84px-1974_Commerzbank_altes_Hochhaus.jpg)

![Haus Sommer [de] on Pariser Platz in Berlin, reconstructed in 1998 as Haus der Commerzbank](http://upload.wikimedia.org/wikipedia/commons/thumb/d/d3/Pariser_Platz_-_Haus_Sommer_%28_1_%29.jpg/120px-Pariser_Platz_-_Haus_Sommer_%28_1_%29.jpg)