American Recovery and Reinvestment Act of 2009: Difference between revisions

rv, oversimplifies impact with POV |

Instead of removing try to reword it to remove what you think is POV |

||

| Line 56: | Line 56: | ||

|publisher=Slate |

|publisher=Slate |

||

|date=12 October 2009}}</ref> |

|date=12 October 2009}}</ref> |

||

Many have stated that the stimulus spending that President Obama and the Democrats who control Congress said would solve a big part of the economic plight and bring about an early end to the recession has not worked as advertized, leaving unemployment figures at their highest point in decades and doing little to spark productive economic activity. The new debt to GDP ratio could cripple the country for as long as a generation, according to some.<ref>http://politics.usnews.com/opinion/blogs/peter-roff/2010/6/8/Obamas-National-Debt-Dwarfs-Bushs-and-Reagans.html</ref> |

|||

==Legislative history== |

==Legislative history== |

||

Revision as of 04:07, 10 September 2010

| |

| Long title | An act making supplemental appropriations for job preservation and creation, infrastructure investment, energy efficiency and science, assistance to the unemployed, and State and local fiscal stabilization, for the fiscal year ending September 30, 2009, and for other purposes. |

|---|---|

| Acronyms (colloquial) | ARRA |

| Nicknames | The Recovery Act, Stimulus |

| Enacted by | the 111th United States Congress |

| Effective | February 17, 2009 |

| Citations | |

| Public law | 111-5 |

| Legislative history | |

| |

The American Recovery and Reinvestment Act of 2009, abbreviated ARRA (Pub. L. 111–5 (text) (PDF)) and commonly referred to as the Stimulus or The Recovery Act, is an economic stimulus package enacted by the 111th United States Congress in February 2009. The Act followed other economic recovery legislation passed in the final year of the Bush presidency including the Economic Stimulus Act of 2008 and the Emergency Economic Stabilization Act of 2008 which created the Troubled Assets Relief Program (TARP).

The stimulus was intended to create jobs and promote investment and consumer spending during the recession. The rationale for the stimulus comes out of the Keynesian economic tradition that argues that government spending should be used to cover the output gap created by the drop in consumer spending during a recession. The modern consensus in economics favors monetary over fiscal policy like the fiscal stimulus.[1] However, the Federal Reserve had already cut interest rates to zero, greatly reducing their policy options. The flow of finances was stagnated because of a liquidity trap, also limiting monetary policy effectiveness. While many economists agreed a fiscal stimulus was needed under these conditions, others maintained that fiscal policy would not work because government debt would use up savings that would otherwise go to investments, what economists call crowding out. Proponents countered that the negative effects of crowding out are limited when investment has already stagnated.

The measures are nominally worth $787 billion. The Act includes federal tax incentives, expansion of unemployment benefits and other social welfare provisions, and domestic spending in education, health care, and infrastructure, including the energy sector. The Act also includes numerous non-economic recovery related items that were either part of longer-term plans (e.g. a study of the effectiveness of medical treatments) or desired by Congress (e.g. a limitation on executive compensation in federally aided banks added by Senator Dodd and Rep. Frank).

No Republicans in the House and only three Republican Senators voted for the bill.[2][3][4] The bill was signed into law on February 17 by President Obama at an economic forum he was hosting in Denver, Colorado.[5]

As of the end of August 2009, 19 percent of the stimulus had been outlaid or gone to American taxpayers or business in the form of tax incentives.[6]

Many have stated that the stimulus spending that President Obama and the Democrats who control Congress said would solve a big part of the economic plight and bring about an early end to the recession has not worked as advertized, leaving unemployment figures at their highest point in decades and doing little to spark productive economic activity. The new debt to GDP ratio could cripple the country for as long as a generation, according to some.[7]

Legislative history

House of Representatives

The House version of the bill, H.R. 1, was introduced on January 26, 2009[8]. It was sponsored by Democrat David Obey, the House Appropriations Committee chairman, and was co-sponsored by nine other Democrats. On January 23, Speaker of the House Nancy Pelosi said that the bill was on track to be presented to President Obama for him to sign into law before February 16, 2009.[9] Although 206 amendments were scheduled for floor votes, they were combined into only 11, which enabled quicker passage of the bill.[10]

On January 28, 2009, the House passed the bill by a 244-188 vote.[11] All but 11 Democrats voted for the bill, and 176 Republicans voted against it (two Republicans did not vote).[12]

Senate

The senate version of the bill, S. 1, was introduced on January 6, 2009, and later substituted as an amendment to the House bill, S.Amdt. 570. It was sponsored by Harry Reid, the Majority Leader, co-sponsored by 16 other Democrats and Joe Lieberman, an independent who caucuses with the Democrats.

The Senate then began consideration of the bill starting with the $275 billion tax provisions in the week of February 2, 2009.[13] A significant difference between the House version and the Senate version was the inclusion of a one-year extension of revisions to the alternative minimum tax which added $70 billion to the bill's total.

Republicans proposed several amendments to the bill directed at increasing the share of tax cuts and downsizing spending as well as decreasing the overall price.[14] President Obama and Senate Democrats hinted that they would be willing to compromise on Republican suggestions to increase infrastructure spending and to double the housing tax credit proposed from $7,500 to $15,000 and expand its application to all home buyers, not just first-time buyers.[15] Other considered amendments included the Freedom Act of 2009, an amendment proposed by Senate Finance Committee members Maria Cantwell (D) and Orrin Hatch (R) to include tax incentives for plug-in electric vehicles[16] and an amendment proposed by Jim DeMint (R) to remove language from the bill that would prohibit funds which would be "used for sectarian instruction, religious worship, or a school or department of divinity; or in which a substantial portion of the functions of the facilities are subsumed in a religious mission".[17]

The Senate called a special Saturday debate session for February 7 at the urging of President Obama. The Senate voted, 61-36 (with 2 not voting) on February 9 to end debate on the bill and advance it to the Senate floor to vote on the bill itself.[18] On February 10, the Senate voted 61-37 (with one not voting)[19] All the Democrats voted in favor, but only three Republicans voted in favor (Susan Collins, Olympia Snowe, and Arlen Specter), with Specter later switching to the Democratic party.[20] At one point, the Senate bill stood at $838 billion.[21]

Comparison of the House, Senate and Conference versions

Senate Republicans forced a near unprecedented level of changes (near $150 billion) in the House bill which had more closely followed the Obama plan. The biggest losers were States[22] (severely restricted Stabilization Fund) and the low income workers (reduced tax credit) with major gains for the elderly (largely left out of the Obama & House plans) and high income tax-payers. A comparison of the $827 billion economic recovery plan drafted by Senate Democrats with a $820 billion version passed by the House and the final $787 billion conference version shows huge shifts within these similar totals. Additional debt costs would add about $350 billion or more over 10 years. Many provisions will expire in two years.[23]

The main funding differences between the Senate bill and the House bill are: More funds for health care in the Senate ( $153.3 vs $140 billion), for green energy programs ($74 vs. $39.4 billion), for home buyers tax credit ($35.5 vs. $2.6 billion), new payments to the elderly and a one year increase in AMT limits. The House has more funds appropriated for education ($143 vs. $119.1 billion), infrastructure ($90.4 vs. $62 billion) and for aid to low income workers and the unemployed ($71.5 vs. $66.5 billion).[24]

Spending (Senate-$552 billion, House-$545 billion)

- Aid to low income workers and the unemployed

- Senate - $47 billion to provide extended unemployment benefits through Dec. 31, increased by $25 a week, and provide job training; $16.5 billion to increase food stamp benefits by 12 percent through fiscal 2011 and issue a one-time bonus payment; $3 billion in temporary welfare payments.

- House — Comparable extension of unemployment insurance; $20 billion to increase food stamp benefits by 14 percent; $2.5 billion in temporary welfare payments; $1 billion for home heating subsidies and $1 billion for community action agencies.

- Direct cash payments

- Senate — $17 billion to give one-time $300 payments to recipients of Supplemental Security Income and Social Security, and veterans receiving disability and pensions.

- House — $4 billion to provide a one-time additional Supplemental Security Income and Social Security Disability Insurance payment to the elderly, of $450 for individuals and $630 for married couples.

- Conference - $250 one-time payment to each recipient of Supplemental Security Income, Social Security (Regular & Disability) Insurance, Veterans pension, Railroad Retirement, or State retirement system.[25]

- Infrastructure

- Senate — $46 billion for transportation projects, including $27 billion for highway and bridge construction and repair and $11.5 billion for mass transit and rail projects; $4.6 billion for the Army Corps of Engineers; $5 billion for public housing improvements; $6.4 billion for clean and drinking water projects.

- House — $47 billion for transportation projects, including $27 billion for highway and bridge construction and repair and $12 billion for mass transit, including $7.5 billion to buy transit equipment such as buses; and $31 billion to build and repair federal buildings and other public infrastructures.

- Health care

- Senate — $21 billion to subsidize the cost of continuing health care insurance for the involuntarily unemployed under the COBRA program; $87 billion to help states with Medicaid; $22 billion to modernize health information technology systems; and $10 billion for health research and construction of National Institutes of Health facilities.

- House — $40 billion to subsidize the cost of continuing health care insurance for the involuntarily unemployed under the COBRA program or provide health care through Medicaid; $87 billion to help states with Medicaid; $20 billion to modernize health information technology systems; $4 billion for preventative care; $1.5 billion for community health centers; $420 million to combat avian flu; $335 million for programs that combat AIDS, sexually transmitted diseases and tuberculosis.

- Conference - A 65% COBRA subsidy for 9 months will apply to workers laid off between Sept. 1, 2008 and Dec. 31, 2009. Those already laid off have 60 days to apply for COBRA.[26]

- Education

- Senate — $55 billion in state fiscal relief to prevent cuts in education aid and provide block grants; $25 billion to school districts to fund special education and the No Child Left Behind K-12 law; $14 billion to boost the maximum Pell Grant by $400 to $5,250; $2 billion for Head Start.

- House — Similar aid to states and school districts; $21 billion for school modernization; $16 billion to boost the maximum Pell Grant by $500 to $5,350; $2 billion for Head Start.

- Conference - The Conference Report merged most education aid with the State Fiscal Stabilization fund (administered by the Department of Education)and gave power over the funds to each governor under voluminous restrictions. The Governor is "Required" to spend $45 billion of the money on education to restore funding to 2008 levels but the mechanisms to enforce state maintenance of effort at 2005-06 levels are complex and potentially impossible to implement.[27] Hard hit states such as Nevada cannot possibly find enough funds to get to the 2005-06 state funding levels for education.[28] Some states with no current budget cuts for education, such as Arkansas and North Carolina, may get nothing.[29] This will result in a monumental 50 state legal and political fight over how to re-budget to best take advantage of the Federal legislation. Many states will further reduce state funds for education to the 2005-06 minimum so these state resources can be used for other state priorities and the net gain for education will be far less than the total Federal appropriation.

- Energy

- Senate — $40 billion for energy efficiency and renewable energy programs, including $2.9 billion to weatherize modest-income homes; $4.6 billion for fossil fuel research and development; $6.4 billion to clean up nuclear weapons production sites; $11 billion toward a so-called smart electricity grid to reduce waste; $8.5 billion to subsidize loans for renewable energy projects; and $2 billion for advanced battery systems.

- House — $28.4 billion for energy efficiency and renewable energy programs, including $6.2 billion to weatherize homes; $11 billion to fund a smart electricity grid.

- Homeland security

- Senate — $4.7 billion for homeland security programs, including $1 billion for airport screening equipment and $800 million for port security.

- House — $1.1 billion, including $500 million for airport screening equipment.

- Law enforcement

- Senate — $3.5 billion in grants to state and local law enforcement to hire officers and purchase equipment.

- House — Comparable provision.

Taxes ($275 billion)

- New tax credit

- House— About $145 billion for $500 per-worker, $1,000 per-couple tax credits in 2009 and 2010. For the last half of 2009, workers could expect to see about $20 a week less withheld from their paychecks starting around June. Millions of Americans who don’t make enough money to pay federal income taxes could file returns next year and receive checks. Individuals making more than $75,000 and couples making more than $150,000 would receive reduced amounts.

- Senate — The credit would phase out at incomes of $70,000 for individuals and couples making more than $140,000 and phase out more quickly, reducing the cost to $140 billion.

- Conference- Tax Credit reduced to $400 per worker and $800 per couple in 2009 and 2010 and phaseout begins at $75,000 for individuals and $150,000 for joint filers. Note retirees with no wages get nothing.[30]

- Alternative minimum tax

- House — No provision.

- Senate — About $70 billion to prevent 24 million taxpayers from paying the alternative minimum tax in 2009. The tax was designed to make sure wealthy taxpayers can’t use credits and deductions to avoid paying any taxes or paying at a far lower rate than would otherwise be possible. But it was never indexed to inflation, so critics now contend it taxes people it was not intended to. Congress addresses it each year, usually in the fall.

- Conference - Includes a one year increase in AMT floor to $70,950 for joint filers for 2009.[30]

- Expanded child credit

- House — $18.3 billion to give greater access to the $1,000 per-child tax credit for low income workers in 2009 and 2010. Under current law, workers must make at least $12,550 to receive any portion of the credit. The change eliminates the floor, meaning more workers who pay no federal income taxes could receive checks.

- Senate — Sets a new income threshold of $8,100 to receive any portion of the credit, reducing the cost to $7.5 billion.

- Conference - The income floor for refunds was set at $3,000 for 2009 & 2010.[31]

- Expanded earned income tax credit

- House — $4.7 billion to increase the earned income tax credit — which provides money to low income workers — for families with at least three children.

- Senate — Same.

- Expanded college credit

- House — $13.7 billion to provide a $2,500 expanded tax credit for college tuition and related expenses for 2009 and 2010. The credit is phased out for couples making more than $160,000.

- Senate — Reduces the amount that can be refunded to low-income families that pay no income taxes, lowering the cost to $13 billion.

- Homebuyer credit

- House — $2.6 billion to repeal a requirement that a $7,500 first-time homebuyer tax credit be paid back over time for homes purchased from Jan. 1 to July 1, unless the home is sold within three years. The credit is phased out for couples making more than $150,000.

- Senate — Doubles the credit to $15,000 for homes purchased for a year after the bill takes effect, increasing the cost to $35.5 billion.

- Conference - $8,000 credit for all homes bought between 1/1/2009 and 12/1/2009 and repayment provision repealed for homes purchased in 2009 and held more than three years.[31]

- Home energy credit

- House — $4.3 billion to provide an expanded credit to homeowners who make their homes more energy-efficient in 2009 and 2010. Homeowners could recoup 30 percent of the cost up to $1,500 of numerous projects, such as installing energy-efficient windows, doors, furnaces and air conditioners.

- Senate — Same.

- Conference - Same;

- Unemployment

- House — No similar provision.

- Senate — $4.7 billion to exclude from taxation the first $2,400 a person receives in unemployment compensation benefits in 2009.

- Conference—Same as Senate

- Bonus depreciation

- House — $5 billion to extend a provision allowing businesses buying equipment such as computers to speed up its depreciation through 2009.

- Senate — Similar.

- Money losing companies

- House — $15 billion to allow companies to use current losses to offset profits made in the previous five years, instead of two, making them eligible for tax refunds.

- Senate — Allows companies to use more of their losses to offset previous profits, increasing the cost to $19.5 billion.

- Conference - Limits the carry-back to small companies, revenue under $5 million [32]

- Government contractors

- House — Repeal a law that takes effect in 2011, requiring government agencies to withhold three percent of payments to contractors to help ensure they pay their tax bills. Repealing the law would cost $11 billion over 10 years, in part because the government could not earn interest by holding the money throughout the year.

- Senate — Delays the law from taking effect until 2012, reducing the cost to $291 million.

- Energy production

- House — $13 billion to extend tax credits for renewable energy production.

- Senate — Same.

- Conference - Extension is to 2014.

- Repeal bank credit

- House — Repeal a Treasury provision that allowed firms that buy money-losing banks to use more of the losses as tax credits to offset the profits of the merged banks for tax purposes. The change would increase taxes on the merged banks by $7 billion over 10 years.

- Senate — Same.

- Bonds

- House — $36 billion to subsidize locally issued bonds for school construction, teacher training, economic development and infrastructure improvements.

- Senate — $22.8 billion to subsidize locally issued bonds for school construction, industrial development and infrastructure improvements.

- Auto sales

Conference report

Congressional negotiators that they had completed the Conference Report on February 11.[34] On February 12, House Majority Leader Steny Hoyer scheduled the vote on the bill for the next day, before wording on the bill's content had been completed and despite House Democrats having previously promised to allow a 48-hour public review period before any vote. The Report with final handwritten provisions was posted on a House website that evening.[35][36] On February 13, the Report passed the House, 246-183, largely along party lines with all 246 Yes votes given by Democrats and the Nay vote split between 176 Republicans and 7 Democrats.[2][12][37]

The Senate passed the bill, 60-38, with all Democrats and Independents voting for the bill along with three Republicans. On February 17, 2009, President Barack Obama signed the Recovery Act into law.

Provisions of the Act

Tax incentives - includes $15 B for Infrastructure and Science, $61 B for Protecting the Vulnerable, $25 B for Education and Training and $22 B for Energy, so total funds are $126 B for Infrastructure and Science, $142 B for Protecting the Vulnerable, $78 B for Education and Training, and $65 B for Energy.

State and Local Fiscal Relief - Prevents state and local cuts to health and education programs and state and local tax increases.

Section 3 of ARRA listed the basic intent behind crafting the proposal. This Statement of Purpose included the following:

- To preserve and create jobs and promote economic recovery.

- To assist those most impacted by the recession.

- To provide investments needed to increase economic efficiency by spurring technological advances in science and health.

- To invest in transportation, environmental protection, and other infrastructure that will provide long-term economic benefits.

- To stabilize State and local government budgets, in order to minimize and avoid reductions in essential services and counterproductive state and local tax increases.

The Act specifies that 37% of the package is to be devoted to tax incentives equaling $288 billion and $144 billion or 18% is allocated to state and local fiscal relief (more than 90% of the state aid is going to Medicaid and education). 45% or $357 billion is allocated to federal social programs and federal spending programs.

The following are details to the different parts of the final bill[38][39][40][41]:

Tax incentives

Total: $288 billion

Tax incentives for individuals

Total: $237 billion

- $116 billion: New payroll tax credit of $400 per worker and $800 per couple in 2009 and 2010. Phaseout begins at $75,000 for individuals and $150,000 for joint filers.[30]

- $70 billion: Alternative minimum tax: a one year increase in AMT floor to $70,950 for joint filers for 2009.[30]

- $15 billion: Expansion of child tax credit: A $1,000 credit to more families (even those that do not make enough money to pay income taxes).

- $14 billion: Expanded college credit to provide a $2,500 expanded tax credit for college tuition and related expenses for 2009 and 2010. The credit is phased out for couples making more than $160,000.

- $6.6 billion: Homebuyer credit: $8,000 refundable credit for all homes bought between 1/1/2009 and 12/1/2009 and repayment provision repealed for homes purchased in 2009 and held more than three years. This only applies to first-time homebuyers.[42]

- $4.7 billion: Excluding from taxation the first $2,400 a person receives in unemployment compensation benefits in 2009.

- $4.7 billion: Expanded earned income tax credit to increase the earned income tax credit — which provides money to low income workers — for families with at least three children.

- $4.3 billion: Home energy credit to provide an expanded credit to homeowners who make their homes more energy-efficient in 2009 and 2010. Homeowners could recoup 30 percent of the cost up to $1,500 of numerous projects, such as installing energy-efficient windows, doors, furnaces and air conditioners.

- $1.7 billion: for deduction of sales tax from car purchases, not interest payments phased out for incomes above $250,000.

Tax incentives for companies

Total: $51 billion

- $15 billion: Allowing companies to use current losses to offset profits made in the previous five years, instead of two, making them eligible for tax refunds.

- $13 billion: to extend tax credits for renewable energy production (until 2014).

- $11 billion: Government contractors: Repeal a law that takes effect in 2012, requiring government agencies to withhold three percent of payments to contractors to help ensure they pay their tax bills. Repealing the law would cost $11 billion over 10 years, in part because the government could not earn interest by holding the money throughout the year.

- $7 billion: Repeal bank credit: Repeal a Treasury provision that allowed firms that buy money-losing banks to use more of the losses as tax credits to offset the profits of the merged banks for tax purposes. The change would increase taxes on the merged banks by $7 billion over 10 years.

- $5 billion: Bonus depreciation which extends a provision allowing businesses buying equipment such as computers to speed up its depreciation through 2009.

Healthcare

Total: $155.1 billion [43]

- $86.8 billion for Medicaid

- $25.8 billion for health information technology investments and incentive payments

- $25.1 billion to provide a 65 percent subsidy of health care insurance premiums for the unemployed under the COBRA program

- $10 billion for health research and construction of National Institutes of Health facilities

- $2 billion for Community Health Centers

- $1.3 billion for construction of military hospitals (military)

- $1.1 billion to study the comparative effectiveness of healthcare treatments

- $1 billion for prevention and wellness

- $1 billion for the Veterans Health Administration

- $500 million for healthcare services on Indian reservations

- $300 million to train healthcare workers in the National Health Service Corps

- $202 million for a temporary moratorium for certain medicare regulations

Education

Total: $100 billion

- $53.6 billion in aid to local school districts to prevent layoffs and cutbacks, with flexibility to use the funds for school modernization and repair (State Fiscal Stabilization Fund)[44]

- $15.6 billion to increase Pell Grants from $4,731 to $5,350

- $13 billion for low-income public schoolchildren

- $12.2 billion for IDEA special education

- $2.1 billion for Head Start

- $2 billion for childcare services

- $650 million for educational technology

- $300 million for increased teacher salaries

- $250 million for states to analyze student performance

- $200 million to support working college students

- $70 million for the education of homeless children

Aid to low income workers, unemployed and retirees (including job training)

Total: $82.2 billion

- $40 billion to provide extended unemployment benefits through Dec. 31, and increase them by $25 a week

- $19.9 billion for the Food Stamp Program

- $14.2 billion to give one-time $250 payments to Social Security recipients, people on Supplemental Security Income, and veterans receiving disability and pensions.

- $3.45 billion for job training

- $3.2 billion in temporary welfare payments (TANF and WIC)

- $500 million for vocational training for the disabled

- $400 million for employment services

- $120 million for subsidized community service jobs for older Americans

- $150 million to help refill food banks

- $100 million for meals programs for seniors, such as Meals on Wheels

- $100 million for free school lunch programs

Infrastructure Investment

Total: $105.3 billion

Transportation

Total: $48.1 billion [45]

- $27.5 billion for highway and bridge construction projects

- $8 billion for intercity passenger rail projects and rail congestion grants, with priority for high-speed rail

- $6.9 billion for new equipment for public transportation projects (Federal Transit Administration)

- $1.5 billion for national surface transportation discretionary grants

- $1.3 billion for Amtrak

- $1.1 billion in grants for airport improvements

- $750 million for the construction of new public rail transportation systems and other fixed guideway systems.

- $750 million for the maintenance of existing public transportation systems

- $200 million for FAA upgrades to air traffic control centers and towers, facilities, and equipment

- $100 million in grants for improvements to domestic shipyards

Water, sewage, environment, and public lands

Total: $18 billion [46]

- $4.6 billion for the Army Corps of Engineers for environmental restoration, flood protection, hydropower, and navigation infrastructure projects

- $4 billion for the Clean Water State Revolving Fund wastewater treatment infrastructure improvements (EPA)

- $2 billion for the Drinking Water State Revolving Fund drinking water infrastructure improvements (EPA)

- $1.38 billion for rural drinking water and waste disposal projects

- $1 billion to the Bureau of Reclamation for drinking water projects for rural or drought-likely areas

- $750 million to the National Park Service

- $650 million to the Forest Service

- $600 million for hazardous waste cleanup at Superfund sites (EPA)

- $515 million for wildfire prevention projects

- $500 million for Bureau of Indian Affairs infrastructure projects

- $340 million to the Natural Resources Conservation Service for watershed infrastructure projects

- $320 million to the Bureau of Land Management

- $300 million for reductions in emissions from diesel engines (EPA)

- $300 million to improve Land Ports of Entry (GSA)

- $280 million for National Wildlife Refuges and the National Fish Hatchery System

- $220 million to the International Boundary and Water Commission to repair flood control systems along the Rio Grande

- $200 million for cleanup of leaking Underground Storage Tanks (EPA)

- $100 million for cleaning former industrial and commercial sites (Brownfields) (EPA)

Government buildings and facilities

Total: $7.2 billion

- $4.2 billion to repair and modernize Defense Department facilities.

- $890 million to improve housing for service members

- $750 million for Federal buildings and U.S. Courthouses (GSA)

- $250 million to improve Job Corps training facilities

- $240 million for new child development centers

- $240 million for the maintenance of United States Coast Guard facilities

- $200 million for Department of Homeland Security headquarters

- $176 million for Agriculture Research Service repairs and improvements

- $150 million for the construction of state extended-care facilities

- $100 million to improve facilities of the National Guard

Communications, information, and security technologies

Total: $10.5 billion

- $7.2 billion for complete broadband and wireless Internet access

- $1 billion for explosive detection systems for airports

- $500 million to update the computer center at the Social Security Administration

- $420 million for construction and repairs at ports of entry

- $290 million to upgrade IT platforms at the State Department

- $280 million to upgrade border security technologies

- $210 million to build and upgrade fire stations

- $200 million for IT and claims processing improvements for Veterans Benefits Administration

- $150 million to upgrade port security

- $150 million for the security of transit systems

- $50 million for IT improvements at the Farm Service Agency

- $26 million to improve security systems at the Department of Agriculture headquarters

Energy Infrastructure

- $6 billion for the cleanup of radioactive waste (mostly nuclear weapons production sites)[49]

- $4.5 billion for the Office of Electricity and Energy Reliability to modernize the nation's electrical grid and smart grid.

- $4.5 billion to increase energy efficiency in federal buildings (GSA)

- $3.25 billion for the Western Area Power Administration for power transmission system upgrades.

- $3.25 billion for the Bonneville Power Administration for power transmission system upgrades.

Energy efficiency and renewable energy research and investment

Total: $27.2 billion

- $6 billion for renewable energy and electric transmission technologies loan guarantees

- $5 billion for weatherizing modest-income homes

- $3.4 billion for carbon capture and low emission coal research

- $3.2 billion toward Energy Efficiency and Conservation Block Grants.[50]

- $3.1 billion for the State Energy Program to help states invest in energy efficiency and renewable energy

- $2 billion for manufacturing of advanced car battery (traction) systems and components.

- $800 million for biofuel research, development, and demonstration projects

- $602 million to support the use of energy efficient technologies in building and in industry

- $500 million for training of green-collar workers (by the Department of Labor)

- $400 million for the Geothermal Technologies Program

- $400 million for electric vehicle technologies

- $300 million for energy efficient appliance rebates

- $300 million for state and local governments to purchase energy efficient vehicles

- $300 million to acquire electric vehicles for the federal vehicle fleet (GSA)

- $250 million to increase energy efficiency in low-income housing

- $204 million in funding for research and testing facilities at national laboratories

- $190 million in funding for wind, hydro, and other renewable energy projects

- $115 million to develop and deploy solar power technologies

- $110 million for the development of high efficiency vehicles

- $42 million in support of new deployments of fuel cell technologies

Housing

Total: $14.7 billion [51]

- $4 billion to the Department of Housing and Urban Development (HUD) for repairing and modernizing public housing, including increasing the energy efficiency of units.

- $2.25 billion in tax credits for financing low-income housing construction

- $2 billion for Section 8 housing rental assistance

- $2 billion for the Neighborhood Stabilization Program to purchase and repair foreclosed vacant housing

- $1.5 billion for rental assistance to prevent homelessness

- $1 billion in community development block grants for state and local governments

- $555 million in mortgage assistance for wounded service members (Army Corps of Engineers)

- $510 million for the rehabilitation of Native American housing

- $250 million for energy efficient modernization of low-income housing

- $200 million for helping rural Americans buy homes (Department of Agriculture)

- $140 million in grants for independent living centers for elderly blind persons (Dept. of Education)

- $130 million for rural community facilities (Department of Agriculture)

- $100 million to help remove lead paint from public housing

- $100 million emergency food and shelter for homeless (Department of Homeland Security)

Scientific research

Total: $7.6 billion

- $3 billion to the National Science Foundation

- $2 billion to the United States Department of Energy

- $1 billion to NASA

- $600 million to the National Oceanic and Atmospheric Administration (NOAA)

- $580 million to the National Institute of Standards and Technology

- $230 million for NOAA operations, research and facilities

- $140 million to the United States Geological Survey

Other

Total: $10.6 billion

- $4 billion for state and local law enforcement agencies [52]

- $1.1 billion in waivers on interest payments for state unemployment trust funds

- $1 billion in preparation for the 2010 census

- $1 billion in added funding for child support enforcement

- $750 million for DTV conversion coupons and DTV transition education

- $749 million in crop insurance reinstatement, and emergency loans for farmers

- $730 million in SBA loans for small businesses

- $500 million for the Social Security Administration to process disability and retirement backlogs

- $201 million in additional funding for AmeriCorps and other community service organizations

- $150 million for Urban and Rural economic recovery programs

- $150 million for an increase of claims processing military staff

- $150 million in loans for rural businesses

- $50 million for the National Endowment for the Arts to support artists

- $50 million for the National Cemetery Administration

Recommendations by economists

Economists such as Martin Feldstein, Daron Acemoğlu, National Economic Council director Larry Summers, and Nobel Memorial Prize in Economic Sciences winners Joseph Stiglitz[53] and Paul Krugman[54] favor large economic stimulus to counter the economic downturn. While in favor of a stimulus package, Feldstein expressed concern over the act as written, saying it needs revision to address consumer spending and unemployment more directly.[55] Other economists, including John Lott,[56] Robert Barro and Nobel Prize-winners Robert Lucas, Jr.,[57] Vernon L. Smith, Edward C. Prescott and James M. Buchanan were more critical of the government spending.

On January 28, 2009, a full-page advertisement with the names of approximately 200 economists who are against Obama's plan appeared in The New York Times and The Wall Street Journal. The funding for this advertisement came from the Cato Institute.[58][59]

On February 8, 2009, a petition signed by about 200 economists in favor of the stimulus had been created. This petition, written by the Center for American Progress Action Fund, said that Obama's plan "proposes important investments that can start to overcome the nation's damaging loss of jobs," and would "put the United States back onto a sustainable long-term-growth path."[60]

Congressional Budget Office reports

A February 4, 2009, report by the Congressional Budget Office (CBO) said that while the stimulus would increase economic output and employment in the short run, the GDP would, by 2019, have an estimated net decrease between 0.1% and 0.3% (as compared to the CBO estimated baseline).[61]

The CBO estimated that enacting the bill would increase federal budget deficits by $185 billion over the remaining months of fiscal year 2009, by $399 billion in 2010, by $134 billion in 2011, and by $787 billion over the 2009-2019 period.[62]

In a February 11 letter, CBO Director Douglas Elmendorf noted that there was disagreement among economists about the effectiveness of the stimulus, with some skeptical of any significant effects while others expecting very large effects.[63] Elmendor said the CBO expected short term increases in GDP and employment.[63] In the long term, the CBO expects the legislation to reduce output slightly by increasing the nation's debt and crowding out private investment, but noted that other factors, such as improvements to roads and highways and increased spending for basic research and education may offset the decrease in output and that crowding out was not an issue in the short term because private investment was already decreasing in response to decreased demand.[63]

The CBO estimated that an increase in the GDP of between 1.4 percent and 3.8 percent by the end of 2009, between 1.1 percent and 3.3 percent by the end of 2010, between 0.4 percent and 1.3 percent by the end of 2011, and a decrease of between zero and 0.2 percent beyond 2014.[63] The impact to employment would be an increase of 0.8 million to 2.3 million by the end of 2009, an increase of 1.2 million to 3.6 million by the end of 2010, an increase of 0.6 million to 1.9 million by the end of 2011, and declining increases in subsequent years as the U.S. labor market reaches nearly full employment, but never negative.[63] Decreases in GDP in 2014 and beyond are accounted for by crowding out, where government debt absorbs finances that would otherwise go toward investment.[63]

Recovery.gov

A May 21, 2009 article in The Washington Post stated, "To build support for the stimulus package, President Obama vowed unprecedented transparency, a big part of which, he said, would be allowing taxpayers to track money to the street level on Recovery.gov... But three months after the bill was signed, Recovery.gov offers little beyond news releases, general breakdowns of spending, and acronym-laden spreadsheets and timelines." The same article also stated, "Unlike the government site, the privately run Recovery.org is actually providing detailed information about how the $787 billion in stimulus money is being spent."[64]

A new Recovery.gov website was redesigned at a cost estimated to be $9.5 million through January 2010.[65] The section of the act that was intended to establish and regulate the operation of Recovery.gov was actually struck prior to its passage into law. Section 1226, which laid out provisions for the structure, maintenance, and oversight of the website were struck from the bill. Directives are currently being given to those organizations handling the stimulus dollars that tie directly to recovery.gov that will require that detailed reports be provided that will end up on recovery.gov which tie the dollars spent to activities in the bill.

On July 20, 2009, the Drudge Report published links to pages on Recovery.org which Drudge alleged were detailing expensive contracts awarded by the U.S. Department of Agriculture for items such as individual portions of mozzarella cheese, frozen ham and canned pork, costing hundreds of thousands to over a million dollars. A statement released by the USDA the same day corrected the allegation, stating that "references to '2 pound frozen ham sliced' are to the sizes of the packaging. Press reports suggesting that the Recovery Act spent $1.191 million to buy "2 pounds of ham" are wrong. In fact, the contract in question purchased 760,000 pounds of ham for $1.191 million, at a cost of approximately $1.50 per pound."[66]

Buy American provision

A May 15, 2009 Washington Post article reported that the buy American provision of the stimulus package has caused outrage in the Canadian business community, and that the government in Canada has "retaliated" by enacting its own restrictions on trade with the U.S.[67]

On June 6, 2009, delegates at the Federation of Canadian Municipalities conference passed a resolution that would potentially shut out U.S. bidders from Canadian city contracts, in order to help show support for Prime Minister Stephen Harper's opposition to the "buy American" provision. Sherbrooke Mayor Jean Perrault, president of the federation, stated, "This U.S. protectionist policy is hurting Canadian firms, costing Canadian jobs and damaging Canadian efforts to grow in the world-wide recession." There will be a 120 day delay before the resolution takes effect.[68]

On February 16, 2010, the United States and Canada agreed on exempting Canadian companies from Buy American provisions which would have hurt the Canadian economy[69][70].

Developments under the Act

The Congressional Budget Office reported in October 2009 the reasons for the changes in the 2008 and 2009 deficits, which were approximately $460 billion and $1,410 billion, respectively. The CBO estimated that ARRA increased the deficit by $200 billion for 2009, split evenly between tax cuts and additional spending, excluding any feedback effects on the economy.[71]

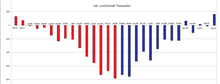

On February 12, 2010, the Bureau of Labor Statistics, which regularly issues economic reports, published job-loss data on a month-by-month basis since 2000.[72] The Democratic Party group Organizing for America prepared a chart presenting the BLS data for the period beginning in December 2007. OFA used the chart to argue, "As a result [of the Recovery Act], job losses are a fraction of what they were a year ago, before the Recovery Act began."[73]

One year after the stimulus, several independent macroeconomic firms including Moody's and IHS Global Insight estimated that the stimulus saved or created 1.6 to 1.8 million jobs and forecasted a total impact of 2.5 million jobs saved by the time the stimulus is completed.[74] The Congressional Budget Office considered these estimates conservative.[75] The CBO estimated 2.1 million jobs saved in the last quarter of 2009, boosting the economy by up to 3.5 percent and lowering the unemployment rate by up to 2.1 percent.[76] The CBO projected that the package would have an even greater impact in 2010.[76] The CBO also said, "It is impossible to determine how many of the reported jobs would have existed in the absence of the stimulus package."[77] The CBO's report on the first quarter of 2010 showed a continued positive effect, with an employment gain in that quarter of up to 2.8 million and a GDP boost of up to 4.2 percent.[78]

The CBO also revised its assessment of the long-term impact of the bill. After 2014, the stimulus is estimated to decrease output by zero to 0.2%. The stimulus is not expected to have a negative impact on employment in any period of time.[79]

According to an April 2010 Industry Survey by the National Association of Business Economists, "(73%) of respondents reported the fiscal stimulus enacted in February 2009 has had no impact on employment to date".[80][failed verification]

The Democratic Congressional Campaign Committee established a "Hypocrisy Hall of Fame" to list Republican Representatives who had voted against ARRA but who then sought or took credit for ARRA programs in their districts. By the end of February 2010, the DCCC was listing 91 House Republicans in this category.[81]

The stimulus has been criticized as being too small. In July 2010, a group of 40 prominent economists issued a statement calling for expanded stimulus programs to reduce unemployment. They also challenged the view that the priority should be reducing the deficit: "Making deficit reduction the first target, without addressing the chronic underlying deficiency of demand, is exactly the error of the 1930s."[82]

In July 2010, the Council of Economic Advisers estimated that the stimulus had "saved or created between 2.5 and 3.6 million jobs as of the second quarter of 2010."[83] At that point, spending outlays under the stimulus totaled $257 billion and tax cuts totaled $223 billion.[84]

In August 2010, Senators Tom Coburn and John McCain released a report which purported to list the 100 "most wasteful projects" which were funded by the Act.[85] In total, they questioned about $15 billion of the $862 billion stimulus package, which is less than 2%.

See also

- 2010 United States federal budget

- Build America Bonds

- Energy law of the United States

- European Economic Recovery Plan

- Financial crisis of 2007–2010

- School Improvement Grant

References

- ^ Bean, Charles. p. 13. Chapter 9 by Charles Bean taken from the book:Is there a new consensus in macroeconomics?, 13 April 2007. http://www.bankofengland.co.uk/publications/other/monetary/bean070413.pdf

- ^ a b "US Congress passes stimulus plan". BBC. February 14, 2009. Retrieved February 17, 2009.

- ^ "Dems power stimulus bill through Congress". Associated Press. February 14, 2009.

- ^ Roll call vote 64, via Senate.gov

- ^ Sahadi, Jeanne (February 17, 2009). "Stimulus: Now for the hard part". CNN.com.

- ^ Gross, Daniel (12 October 2009). "The $800 Billion Deception: Conservatives claim the stimulus has already failed. But it has barely started". Slate.

- ^ http://politics.usnews.com/opinion/blogs/peter-roff/2010/6/8/Obamas-National-Debt-Dwarfs-Bushs-and-Reagans.html

- ^ Legislative Day of January 26, 2009 for the 111TH Congress, First Session (Office of the Clerk, U.S. House of Representatives)

- ^ "Obama seeks congressional consensus on stimulus plan". Newsday. January 24, 2009.

- ^ cqpolitics.com

- ^ Calmes, Jackie (January 29, 2009). "House Passes Stimulus Plan Despite G.O.P. Opposition". New York Times. Retrieved April 23, 2010.

- ^ a b Roll call vote 70, via Clerk.House.gov

- ^ NewsDay.com

- ^ See, for example: S.Amdt. 106, S.Amdt. 107, S.Amdt. 108, and S.Amdt. 109

- ^ Sheryl Gay Stolberg (February 2, 2009). "Obama Predicts Support From G.O.P. for Stimulus Proposal". New York Times.

- ^ cantwell.senate.gov

- ^ HR1. Sec. 9302. Higher Education Modernization, Renovation, and Repair. The amendment was ultimately rejected by a vote of 54-43. Roll call vote 47, via Senate.gov

- ^ Roll call vote 59, via Senate.gov

- ^ Senator Judd Gregg (R) did not vote because, at the time, he was a nominee of the Democratic president to become Secretary of Commerce. Gregg also did not participate in the cloture vote.

- ^ Roll call vote 60, via Senate.gov

- ^ David Espo. "Stimulus bill survives Senate test". Associated Press via Atlanta Journal-Constitution.

- ^ JSOnline.com

- ^ "Stimulus bill far from perfect, Obama says" MSNBC

- ^ Stimulus bill survives Senate test, via AJC.com

- ^ Conference report 111-16, Division B Title II 2/13/09

- ^ Conference report 111-16

- ^ Conference report 111-16, 2-13-09, Title 14

- ^ "ReviewJournal.com - News - STIMULUS IN NEVADA: Raggio presses Reid: 'We can't be required to give what we don't have'". Lvrj.com. 7 February 2009. Retrieved 18 February 2009.

- ^ , NYT 2-15-09

- ^ a b c d House Conference report 111-? Final partially handwritten report released by Nancy Pelosi's Office 2/13/09

- ^ a b House Conference report 111-16 2/13/09

- ^ WSJ Feb. 12, 2009

- ^ Conference Report 111-16, 2-13-09

- ^ New York Times Deal Struck on $789 Billion Stimulus. New York Times. February 11, 2009.

- ^ Even After the Deal, Tinkering Goes On, The New York Times, February 12, 2009

- ^ "COMMITTEE ON RULES - Conference Report to Accompany H.R. 1 - The American Recovery and Reinvestment Act of 2009". Rules.house.gov. Retrieved February 18, 2009.

- ^ House passes Obama's economic stimulus bill, via Breitbart.com

- ^ "SUMMARY: AMERICAN RECOVERY AND REINVESTMENT" (PDF). Committee on Appropriations. 13 February 2009. Retrieved 17 February 2009.

- ^ recovery.gov

- ^ The Wall Street Journal. February 17, 2009 http://online.wsj.com/public/resources/documents/STIMULUS_FINAL_0217.html.

{{cite news}}: Missing or empty|title=(help) - ^ Note that there are deviations in how some sources allocate spending and tax incentives and loans to different categories

- ^ ARRA of 2009 Questions & Answers

- ^ http://www.hhs.gov/recovery/overview/index.html

- ^ http://www2.ed.gov/policy/gen/leg/recovery/factsheet/stabilization-fund.html

- ^ http://www.fhwa.dot.gov/economicrecovery/arrapresentationfinal05012009.ppt

- ^ http://www.epa.gov/recovery/basic.html

- ^ http://www.energy.gov/recovery/breakdown.htm

- ^ http://www.pewclimate.org/docUploads/Pew-Summary-ARRA-Key-Provisions.pdf

- ^ http://www.em.doe.gov/pages/siteslocations.aspx

- ^ http://www.eecbg.energy.gov/

- ^ http://portal.hud.gov/portal/page/portal/HUD/recovery/about

- ^ http://www.justice.gov/recovery/

- ^ Stiglitz: Stimulus Must Be Big, Provide Relief To States, morningstar.com

- ^ Krugman, Paul (January 25, 2008). "Stimulus Gone Bad". NYTimes.com. Retrieved April 23, 2010.

- ^ "Harvard Prof Slams Stimulus Plan". Boston Herald. January 30, 2009.

- ^ "Obama's Stimulus Package Will Increase Unemployment - Opinion". FOXNews.com. 3 February 2009. Retrieved 18 February 2009.

- ^ Lucas Jr, Robert E. (December 23, 2008). "Bernanke Is the Best Stimulus Right Now". wsj.com.

- ^ "Economists say stimulus won't work". St. Louis Post-Dispatch. January 29, 2009. Retrieved 1 February 2010.

- ^ "Cato Institute petition against Obama 2009 stimulus plan" (PDF).

- ^ "Letter to Congress: Economists Across the Spectrum Endorse Stimulus Package". Center for American Progress Action Fund. Center for American Progress. January 27, 2009. Retrieved 1 February 2010.

- ^ "Official CBO report to the Senate budget committee" (PDF). Congressional Budget Office.

- ^ "CBO-Budgetary Impact of ARRA" (PDF). Congressional Budget Office.

- ^ a b c d e f "Letter by Douglas W. Elmendorf, director of the CBO" (PDF). Congressional Budget Office. February 11, 2009.

- ^ MacGillis, Alec (May 21, 2009). "Tracking Stimulus Spending May Not Be as Easy as Promised". The Washington Post. Retrieved April 23, 2010.

- ^ "18 M Spent To Redesign Recovery.gov Web Site". ABC News. July 9, 2009.

- ^ "Response to Drudge Item on Recovery Act Funding - Statement from Agriculture Secretary Tom Vilsack". U.S. Department of Agriculture website. July 20, 2009.

- ^ Faiola, Anthony; Montgomery, Lori (May 15, 2009). "Trade Wars Brewing In Economic Malaise". The Washington Post. Retrieved April 23, 2010.

- ^ "Canadian mayors pass resolution to shut out U.S. bidders". canoe.ca. June 6, 2009.

- ^ "Canada-U.S. agreement on Buy American came into force". Foreign Affairs and International Trade Canada. 2010-02-16. Retrieved 2010-02-21.

- ^ "Canada-U.S. Agreement on Government Procurement". Foreign Affairs and International Trade Canada. 2010-02-11.

{{cite web}}:|access-date=requires|url=(help); Missing or empty|url=(help) - ^ CBO Monthly Budget Review-October 2009

- ^ "Employment, Hours, and Earnings from the Current Employment Statistics survey (National)"

- ^ "Road to Recovery". Organizing for America. Retrieved 2010-02-28.

- ^ Leonhardt, David. "Economic Scene: Judging Stimulus by Job Data Reveals Success." New York Times. February 16, 2010. http://www.nytimes.com/2010/02/17/business/economy/17leonhardt.html.

- ^ Leonhardt, "Judging Stimulus.."

- ^ a b Sullivan, Andy (February 23, 2010). "UPDATE 2-US stimulus added up to 2.1 mln jobs in Q4 2009-CBO". Reuters. Retrieved 2010-02-28.

- ^ Estimated Impact of the American Recovery and Reinvestment Act on Employment and Economic Output

- ^ Sullivan, Andy (May 25, 2010). "CORRECTED - UPDATE 2-Stimulus raised GDP by up to 4.2 pct in Q1 2010 -CBO". Reuters. Retrieved 2010-05-27.

- ^ CBO letter to Sen. Judd Gregg. February 11, 2010. http://www.cbo.gov/ftpdocs/99xx/doc9987/Gregg_Year-by-Year_Stimulus.pdf

- ^ http://www.nabe.com/publib/indsum.html

- ^ "Hypocrisy Alert: 91 House Republicans Take Credit for the Economic Bills They Opposed". Democratic Congressional Campaign Committee. Retrieved 2010-02-28.

- ^ "Reboot America—Manifesto Support Surges". The Daily Beast. July 19, 2010. Retrieved 2010-07-28.

{{cite web}}: Italic or bold markup not allowed in:|publisher=(help) - ^ Council of Economic Advisers, "The Economic Impact of the American Recovery and Reinvestment Act of 2009", July 14, 2010, page 1.

- ^ Council of Economic Advisers, "The Economic Impact of the American Recovery and Reinvestment Act of 2009", July 14, 2010, page 4.

- ^ "GOP slams stimulus plan with list of 100 worst projects". CNN. August 3, 2010.

External links

- Complete text of enacted statute at Wikisource

- American Recovery and Reinvestment Act Fully Searchable Conference Version

- Recovery.gov - A website of the Executive for transparency of actions taken under the American Recovery and Reinvestment Act of 2009

- Full Video of The American Recovery and Reinvestment Act of 2009 signing ceremony on February 17, 2009 (from C-SPAN)

- Vice President Biden and President Obama speeches on the 1 year anniversary of the ARRA (from C-SPAN)

- New Tax Guide Features Recovery Tax Breaks

Analysis

- Stimulus.org Tracking the Stimulus, Financial Bailout, and Recovery Spending

- Stimulus Analysis - An economic and fiscal analysis of the Act, from the Committee for a Responsible Federal Budget

- Onvia Tracking Recovery project database

- Stimulus Watch.org - built to help the new administration keep its pledge to invest stimulus money smartly

- [1] - A report of estimated ARRA funds for students with disabilities in public schools by state

- Stimulus Spending Programs from The Hive Group

- American Recovery and Reinvestment Act of 2009 from Discourse DB

- EERE Network News, from Energy.gov

- 111th United States Congress

- Late 2000s global economic crisis

- Presidency of Barack Obama

- United States housing bubble

- United States federal financial legislation

- United States federal healthcare legislation

- United States federal housing legislation

- United States federal taxation legislation

- 2009 in American politics

- Canada – United States relations