Reaganomics: Difference between revisions

Undid revision 291619734 by 86.14.234.63 (talk) uncited |

summarizing criticism |

||

| Line 9: | Line 9: | ||

In attempting to cut back on domestic spending while lowering taxes, Reagan's approach was a departure from his immediate predecessors. |

In attempting to cut back on domestic spending while lowering taxes, Reagan's approach was a departure from his immediate predecessors. |

||

Reagan became president during a period of high [[inflation]] and [[unemployment]] (commonly referred to as [[stagflation]]), which had largely abated by the time he left office eight years later. |

Reagan became president during a period of high [[inflation]] and [[unemployment]] (commonly referred to as [[stagflation]]), which had largely abated by the time he left office eight years later. However, this is often credited to the economic boom of the 1980s instead of the policies of Reagan. Indeed, critics have argued that the policies of Reagan contributed to the fall of the real income of the lower class, at a time when the real income of the upper class was increasingly rapidly. Thus, a "rising tide" did not "lift all boats", but rather contributed to a growing income disparity and class division. |

||

==Historical context== |

==Historical context== |

||

Revision as of 18:56, 26 May 2009

Reaganomics (a portmanteau of Reagan and economics attributed to Paul Harvey[1]) refers to the economic policies promoted by United States President Ronald Reagan during the 1980s. The four pillars of Reagan's economic policy were to:[2]

- reduce the growth of government spending,

- reduce income and capital gains marginal tax rates,

- reduce government regulation of the economy,

- control the money supply to reduce inflation.

In attempting to cut back on domestic spending while lowering taxes, Reagan's approach was a departure from his immediate predecessors.

Reagan became president during a period of high inflation and unemployment (commonly referred to as stagflation), which had largely abated by the time he left office eight years later. However, this is often credited to the economic boom of the 1980s instead of the policies of Reagan. Indeed, critics have argued that the policies of Reagan contributed to the fall of the real income of the lower class, at a time when the real income of the upper class was increasingly rapidly. Thus, a "rising tide" did not "lift all boats", but rather contributed to a growing income disparity and class division.

Historical context

Prior to the Reagan Administration was a roughly ten year period of economic stagnation and inflation, known as stagflation. Political pressure favored stimulus resulting in an expansion of the money supply. Nixon's wage and price controls were abandoned.[3] Under Ford the problems continued. The federal oil reserves were created to ease any future short term shocks. Carter started phasing out price controls on petroleum, but created the Department of Energy. Much of the credit for the resolution of the stagflation is given to two causes: a three year contraction of the money supply by the Federal Reserve under Paul Volcker, initiated in the last year of Carter's presidency,[4] and to long term easing of supply and pricing in oil during the 1980s oil glut. By the time Reagan took office, stagflation was near its end and for the remainder of his presidency the economy performed well. There was a renewed emphasis on prudent macroeconomic policy; Nixon's price controls and similar policies of government intervention had fallen out of favor, while subtler forms of monetary policy gained favor.

Policies

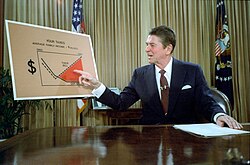

Reaganomics had its roots in two of Reagan's campaign promises: lower taxes and a smaller government. Reagan reduced income tax rates, with the largest rate reductions on the highest incomes; [1] [2] in a time of battling inflation,[citation needed] Reagan raised deficit spending to its highest level (relative to GDP) since World War II.[citation needed]

He lifted remaining domestic petroleum price and allocation controls on January 28, 1981[5] and lowered the Oil Windfall profits tax in August 1981, helping to end the 1979 energy crisis. He ended the Oil Windfall profits tax in 1988 during the 1980s oil glut.

With the Tax Reform Act of 1986, Reagan and Congress sought to broaden the tax base and reduce perceived tax favoritism. In 1983, Democrats Bill Bradley and Dick Gephardt had offered a proposal to clean up/broaden the tax base; in 1984 Reagan had the Treasury Department produce its own plan. The eventual bipartisan 1986 act aimed to be revenue-neutral: while it reduced the top marginal rate, it also partially "cleaned up" the tax base by curbing tax loopholes, preferences, and exceptions, thus raising the effective tax on activities previously specially favored by the code. Economists of most affiliations favor cleaning up the tax code, since tax preferences and exceptions distort economic decisions.[citation needed]

Nobel Prize-winning economist Milton Friedman has pointed to the number of pages added to the Federal Register each year as evidence of Reagan's anti-regulation presidency (the Register records the rules and regulations that federal agencies issue per year). The number of pages added to the Register each year declined sharply at the start of the Ronald Reagan presidency breaking a steady and sharp increase since 1960. The increase in the number of pages added per year resumed an upward, though less steep, trend after Reagan left office. In contrast, the number of pages being added each year increased under Ford, Carter, George H.W. Bush, Clinton, and others.[6]

The question of how much of the overall trend of deregulation can be credited to Reagan remains contentious. The economists Raghuram Rajan and Luigi Zingales point out that many of the major deregulation efforts had either taken place or begun before Reagan (note the deregulation of airlines and trucking under Carter, and the beginning of deregulatory reform in railroads, telephones, natural gas, and banking). They argue for this and other reasons that "the move toward markets preceded the leader [Reagan] who is seen as one of their saviors."[7] Economist William Niskanen, a member of Reagan's Council of Economic Advisers and later chairman of the libertarian Cato Institute, writes that deregulation had the "lowest priority" of the items on the Reagan agenda[8] and that Reagan "failed to sustain the momentum for deregulation initiated in the 1970s." The apparent contradiction with Friedman's data may be resolved by seeing Niskanen as referring to statutory deregulation and Friedman to administrative deregulation. In sum, a large study by economists Paul Joskow and Roger Noll concludes that the changes in economic regulation

"simply do not reflect a sudden ideological change in federal executive branch views....many of the significant changes in economic regulation began during the Carter administration and were initiated by liberal Democrats.... it is not particularly productive to refer to a generic deregulation movement or to think of it as a consequence of the election of Ronald Reagan."[9]

Economic record

During Reagan's tenure, income tax rates of the top personal tax bracket dropped from 70% to 28% in 7 years,[10] while social security and medicare taxes increased.[11][12] Real Gross Domestic Product (GDP) growth recovered strongly after the 1982 recession and grew during Reagan's remaining years in office at an annual rate of 3.4% per year,[13] slightly lower than the post-World War II average of 3.6%.[14] Unemployment peaked at over 10.7% percent in 1982 then dropped during the rest of Reagan's terms, and inflation significantly decreased.[15] A net job increase of about 16 million also occurred (about the rate of population growth).

The policies were derided by some as "Trickle-down economics,"[16] due to the significant cuts in the upper tax brackets. There was a massive increase in Cold War related defense spending that caused large budget deficits,[17] the U.S. trade deficit expansion,[17] and contributed to the Savings and Loan crisis,[18] In order to cover new federal budget deficits, the United States borrowed heavily both domestically and abroad, raising the national debt from $700 billion to $3 trillion,[19] and the United States moved from being the world's largest international creditor to the world's largest debtor nation.[20] Reagan described the new debt as the "greatest disappointment" of his presidency.[19]

Donald Regan, the President's former Secretary of the Treasury, and later Chief of Staff, criticized Reagan for his supposed lack of understanding of economics[citation needed]: "In the four years that I served as Secretary of the Treasury, I never saw President Reagan alone and never discussed economic philosophy or fiscal and monetary policy with him one-on-one....The President never told me what he believed or what he wanted to accomplish in the field of economics.”[21] However, Reagan's chief economic adviser, Martin Feldstein, argues the opposite: "I briefed him on Third World debt; he didn't take notes, he asked very few questions....The subject came up in a cabinet meeting and he summarized what he had heard perfectly. He had a remarkably good memory for oral presentation and could fit information into his own philosophy and make decisions on it."[22]

Reagan himself claimed to be influenced by "classical economists" such as Frédéric Bastiat, Ludwig von Mises, Friedrich Hayek, and Henry Hazlitt.[23] Upon Reagan's death, a memo released by Jude Wanniski, economics advisor to Reagan during his 1980 campaign, highlights Reagan's firm grasp of economic concepts and his knack for conveying them so a layperson could understand.[24]

Tax receipts

According to a United States Department of the Treasury economic study,[25] the major tax bills enacted under Reagan, as a whole, significantly reduced (~-1% of GDP) government tax receipts. Separated out, however, it is clear that the Economic Recovery Tax Act of 1981 was a massive (~-3% of GDP) decrease in revenues (the largest tax cuts ever enacted),[26] while other tax bills had neutral or, in the case of the Tax Equity and Fiscal Responsibility Act of 1982, significant (~+1% of GDP) government revenue-enhancing effects:

| Number of years after enactment | ||||||

| Tax bill | 1 | 2 | 3 | 4 | First 2-yr avg | 4-yr avg |

|---|---|---|---|---|---|---|

| Economic Recovery Tax Act of 1981 | -1.21 | -2.60 | -3.58 | -4.15 | -1.91 | -2.89 |

| Tax Equity and Fiscal Responsibility Act of 1982 | 0.53 | 1.07 | 1.08 | 1.23 | 0.80 | 0.98 |

| Highway Revenue Act of 1982 | 0.05 | 0.11 | 0.10 | 0.09 | 0.08 | 0.09 |

| Social Security Amendments of 1983 | 0.17 | 0.22 | 0.22 | 0.24 | 0.20 | 0.21 |

| Interest and Dividend Tax Compliance Act of 1983 | -0.07 | -0.06 | -0.05 | -0.04 | -0.07 | -0.05 |

| Deficit Reduction Act of 1984 | 0.24 | 0.37 | 0.47 | 0.49 | 0.30 | 0.39 |

| Omnibus Budget Reconciliation Act of 1985 | 0.02 | 0.06 | 0.06 | 0.06 | 0.04 | 0.05 |

| Tax Reform Act of 1986[27] | 0.41 | 0.02 | -0.23 | -0.16 | 0.22 | 0.01 |

| Omnibus Budget Reconciliation Act of 1987 | 0.19 | 0.28 | 0.30 | 0.27 | 0.24 | 0.26 |

| Total | 0.33 | -0.53 | -1.63 | -1.97 | -0.10 | -0.95 |

Theoretical justification

In his 1980 campaign speeches, Reagan presented his economic proposals as merely a return to the free-enterprise principles that had been in favor before the Great Depression. At the same time he attracted a following from the supply-side economics movement, formed in opposition to Keynesian demand-stimulus economics. This movement produced some of the strongest supporters for Reagan's policies during his term in office.

The belief by some proponents of Reaganomics that the tax rate cuts would more than pay for themselves was influenced by the Laffer curve, a theoretical taxation model that was particularly in vogue among some American conservatives during the 1970s. Arthur Laffer's model predicts that excessive tax rates actually reduce potential tax revenues, by lowering the incentive to produce.

Before Reagan's election, Reaganomics was considered extreme by the moderate wing of the Republican Party. While running against Reagan for the Presidential nomination in 1980, George Bush had derided Reaganomics as "voodoo economics".[28] Similarly, in 1976, Gerald Ford had severely criticized Reagan's proposal to turn back a large part of the Federal budget to the states. Since Reagan's presidency, however, Republican federal politicians have for the most part continued to support his program of low taxes and private sector growth.

Support

According to a 1996 study[29] from the libertarian think tank Cato Institute:

- On 8 of the 10 key economic variables examined, the American economy performed better during the Reagan years than during the pre- and post-Reagan years.

- Real median family income grew by $4,000 during the Reagan period after experiencing no growth in the pre-Reagan years; it experienced a loss of almost $1,500 in the post-Reagan years.

- Interest rates, inflation, and unemployment fell faster under Reagan than they did immediately before or after his presidency.

- The only economic variable that was worse in the Reagan period than in both the pre- and post-Reagan years was the savings rate, which fell rapidly in the 1980s.

- The productivity rate was higher in the pre-Reagan years but much lower in the post-Reagan years.

In the last year of the Carter Administration (1980) the US inflation rate climbed to a peak of 14.8%, the top individual tax payer rate was 78%, unemployment was 7.4%, federal outlay was 17% higher than the economy's growth rate, and the federal government grew while enacting loads of new spending programs. During this period, the US economy was the worst it had been since the Great Depression of the 1930s.[citation needed] The nation was in quite a deep hole of economic collapse when the new president Ronald Reagan took office in January 1981. Reagan had to devise a constructive, sound tax and monetary policy to pull the US out of its economic low point.

Stephen Moore of the Cato Institute stated that "no act in the last quarter century had a more profound impact on the US economy of the eighties and nineties than the Reagan tax cut of 1981." Reagan's tax cuts, combined with an emphasis on federal monetary policy, deregulation, and expansion of free trade created a sustained economic expansion creating America's greatest sustained wave of prosperity ever. The American economy grew by more than a third in size, producing a $15 trillion increase in American wealth. Every income group, from the richest, middle class and poorest in this country, grew its income (1981-1989). Consumer and investor confidence soared. Cutting federal income taxes, cutting the US government spending budget, cutting useless programs, scaling down the government work force, maintaining low interest rates, and keeping a watchful inflation hedge on the monetary supply was Ronald Reagan's formula for a successful economic turnaround. The economic principle that business expansion, jobs and wealth follow low tax rates is widely accepted. The last principle Ronald Reagan incorporated was the realization that immigrant workers are a key and vital component of the US economy.

Criticisms

Reagan's tax policies were accused of pushing both the international transactions current account and the federal budget into deficit and led to a significant increase in public debt. Debt exploded from 900 billion dollars before Reagan's tenure to 2.8 trillion dollars after his tenure, an increase of over 300%. This overspending would be continued in later presidents, with the result that debt 20 years later would jump to over 10 trillion. Advocates of the Laffer curve contend that the tax cuts did lead to a near doubling of tax receipts[citation needed] ($517 billion in 1980 to $1,032 billion in 1990), so that the deficits were actually caused by an increase in government spending. However, critics argue that the doubling of revenue is significantly smaller when looking at real inflation-adjusted figures ($1,077.4 billion in 1981 to $1,235.6 billion in 1988, measured in FY2000-dollars). Furthermore, an analysis from the Center on Budget and Policy Priorities argues that "history shows that the large reductions in income tax rates in 1981 were followed by abnormally slow growth in income tax receipts, while the increases in income-tax rates enacted in 1990 and 1993 were followed by sizeable growth in income-tax receipts." Specifically, the analysis calculated that the average annual growth rate of real income-tax receipts per working-age person was 0.2% from 1981 to 1990 and a much higher 3.1% from 1990 to 2001.

A recession occurred in 1982, his second year in office. This was central to Volcker's campaign against inflation: applying either the Phillips Curve or the NAIRU theory, high unemployment (more than 10 % of the labor force in both 1982 and 1983) undercuts inflation. Reagan benefited from the fact that Volcker relented (shifting to more expansionary monetary policy) after inflation had largely been beaten. Further, the sudden fall in oil prices around 1986 helped the economy attain demand growth without inflation in the late 1980s.

The job growth under the Reagan administration was an average of 2.1% per year, which is in the middle of the pack of twentieth-century Presidents. [citation needed] Comparing the recovery from the 1981-82 recession (1983-1990) with the years between 1971 (end of a recession) and 1980 shows that the rate of growth of real GDP per capita averaged 2.77 under Reagan and 2.50% under Nixon, Ford and Carter. However, the unemployment rate averaged higher under Reagan (6.75% vs. 6.35%), average productivity growth was slower under Reagan (1.38% vs. 1.92%) and private investment as a percentage of GDP also averaged lower under Reagan (16.08% vs. 16.86%). What makes this comparison so significant is that between 1971 and 1980 the economy suffered a severe recession in 1975 whereas during the Reagan recovery there was no such interruption.[30]

Another recent critique of Reagan's policies stem from Tax Reform Act of 1986 and its impact on the Alternative Minimum Tax (AMT). The tax reform was ostensibly to reduce or eliminate tax deductions. This legislation expanded the AMT from a law for untaxed rich investors to one refocused on middle class Americans who had children, owned a home, or lived in high tax states.[31] This parallel tax system hits middle class Americans the hardest by reducing their deductions and effectively raising their taxes. Meanwhile, the highest income earners (with incomes exceeding $1,000,000) are proportionately less affected thereby shifting the tax burden away from the richest 0.5%.[32] In 2006, the IRS's National Taxpayer Advocate's report highlighted the AMT as the single most serious problem with the tax code.[33] As of 2007, the AMT brought in more tax revenue than the regular tax which has made it difficult for Congress to reform.[32]

Humor

Reagan himself made light of the term "Reaganomics." In a July 10, 1987 White House Briefing for Members of the Deficit Reduction Coalition, he said, "America astonished the world. Chicago school economics, supply-side economics, call it what you will — I noticed that it was even known as Reaganomics at one point until it started working — all of it is fast becoming orthodoxy. It’s not just that Milton Friedman or Friedrich von Hayek or George Stigler have won Nobel Prizes; other younger names, unheard of a few years ago, are now also celebrated."

See also

Footnotes

- ^ "Broadcaster Delivered 'The Rest of the Story'". washingtonpost.com. March 1, 2009. Retrieved March 1, 2009.

- ^ William A. Niskanen. "Reaganomics". The Concise Encyclopedia of Economics. Retrieved 2007-05-22.

- ^ Alan Greenspan (2007), The Age of Turbulence, Penguin Press

{{citation}}:|access-date=requires|url=(help); Check date values in:|accessdate=(help) - ^ alan greenspan (2007), age of turbulence, Penguin Press

{{citation}}:|access-date=requires|url=(help); Check date values in:|accessdate=(help) - ^ "Executive Order 12287 -- Decontrol of Crude Oil and Refined Petroleum Products". January 28, 1981.

- ^ Friedman, Milton (2004-06-11). "Freedom's Friend". Wall Street Journal. Retrieved 2006-12-30.

- ^ Saving Capitalism from the Capitalists p. 268.

- ^ Reaganomics by William A. Niskanen

- ^ American Economic Policy in the 1980s, ed. Martin Feldstein, NBER 1994, pp. 371-72.

- ^ Daniel J. Mitchell, Ph.D. (July 19, 1996). "The Historical Lessons of Lower Tax Rates". The Heritage Foundation. Retrieved 2007-05-22.

- ^ "Social Security and Medicare Tax Rates". Social Security Administration. July 10, 2007.

- ^ "Effective Federal Tax Rates: 1979-2001". Bureau of Economic Analysis. July 10, 2007.

- ^ "Gross Domestic Product". Bureau of Economic Analysis. May 31, 2007.

- ^ John Miller (July/August 2004). "Ronald Reagan's Legacy". Dollars and Sense. Retrieved 2007-06-26.

{{cite web}}: Check date values in:|date=(help) - ^ "Ronald Reagan". Microsoft Corporation. 2007. Retrieved 2007-07-27.

- ^ Danziger, S.H. (1994). "The Historical Record: Trends in Family Income, Inequality, and Poverty" in Confronting Poverty: Prescriptions for Change.

{{cite book}}: Unknown parameter|coauthors=ignored (|author=suggested) (help) - ^ a b Page not found 2008-05-24 Etebari, Mehrun (July 17, 2003). "Trickle-Down Economics: Four Reasons why it Just Doesn't Work". faireconomy.org. Retrieved 2007-03-31.

- ^ "The S&L Crisis: A Chrono-Bibliography". Federal Deposit Insurance Corporation. Retrieved 2007-04-08..

- ^ a b Cannon, Lou (2001) p. 128

- ^ "Reagan Policies Gave Green Light to Red Ink". The Washington Post. Retrieved 2007-05-25.

- ^ Regan, Donald T. (1988), p. 142

- ^ Lee, Susan. 1996. Hands Off: Why the Government is a Menace to Economic Health. Simon & Schuster. p. 223

- ^ "Inside Ronald Reagan". Reason Magazine. July 1975. Retrieved 2009-03-08.

- ^ "Memo To: American Historians". Jude Wanniski. 2004-06-04. Retrieved 2009-03-08.

- ^ a b Office of Tax Analysis (2003, rev. September 2006). "Revenue Effects of Major Tax Bills" (PDF). United States Department of the Treasury. Working Paper 81, Table 2. Retrieved 2007-11-28.

{{cite journal}}:|author=has generic name (help); Check date values in:|date=(help); Cite journal requires|journal=(help); External link in|author= - ^ Thorndike, Joseph J (14 June 2004). "Historical Perspective: The Reagan Legacy". Taxhistory.org. Retrieved 2007-11-28.

- ^ Note that this table does not include the impact of changes to the Alternative Minimum Tax from 1995 onward.

- ^ Reagonomics or 'voodoo economics'?

- ^ Supply-Side Tax Cuts and the Truth about the Reagan Economic Record, by William A. Niskanen and Stephen Moore

- ^ Meeropol, Michael (2000), p. 168

- ^ "Alternative Minimum Tax". New York Times. 2008. Retrieved 2008-07-29.

- ^ a b Leiserson, Greg (2008). "The Individual Alternative Minimum Tax: Historical Data and Projections" (PDF). Brookings Institution & Urban Institute. Retrieved 2008-07-29.

- ^ "National Taxpayer Advocate 2006 Annual Report to Congress-Executive Summary" (PDF). Internal Revenue Service. Retrieved 2008-07-29.

References

- Bienkowski Wojciech, Brada Josef, Radlo Mariusz-Jan eds. (2006) Reaganomics Goes Global. What Can the EU, Russia and Transition Countries Learn from the USA?, Palgrave Macmillan.

- Boskin Michael J. (1987) Reagan and the US Economy. The Successes, Failures, and Unfinished Agenda, ICEG.

- Niskanen, William A. (1988) Reaganomics: An Insider's Account of the Policies and the People, Oxford University Press, Oxford.

- Igor M. Sill, (2009) Reaganomics yet again.... Wikipedia "Support" additions

Further reading

- Lekachman, Robert (1982) Greed is not enough : Reaganomics, New York : Pantheon Books. ISBN 0394510232

- Meeropol, Michael (2000) "Surrender: How the Clinton Administration Completed the Reagan Revolution." (Ann Arbor: University of Michigan Press, 2000 pbk edition) ISBN 0-472-08676-6

- Sill, Igor (2009) "Looking at Reaganomics, Yet One More Time" (Topix)

External links

Online Debate between Proponent and Opponent:

Proponent Papers:

- The Historical Lessons of Lower Tax Rates by Heritage Foundation

- Great Myths of the Great Depression by Mackinac Center

- Supply Tax Cuts and the Truth About the Reagan Economic Record by Cato Institute

Opponent Papers:

- Do Tax Cuts Produce More Revenue? Dollars & Sense Magazine

- Ronald Reagan's Legacy by John Miller, Ph.D. Professor of Economics, Wheaton College

- Supply Side Economics: Do Tax Rate Cuts Increase Growth and Revenues and Reduce Budget Deficits ? Or Is It Voodoo Economics All Over Again? by Nouriel Roubini, Ph.D. Professor of Economics, New York University

- The Myths of Reaganomics by Murray N. Rothbard, Ph.D. Professor Emeritus of Economics

- The Tax-Cut Con by Paul Krugman, Ph.D. Professor of Economics, Princeton University

Mixed Assessment:

- Reaganomics: Why Ronald Reagan's 1981 Tax Cut Did Not Cause the 1983 Recovery or Boost Tax Revenues by Bernard Sherman. (Article argues against claims that the supply-side effects of the 1981 tax cut caused the 1983 expansion or were self-funding; praises 1986 tax reform.)

The President Reagan Information Page

- The President Reagan Information Page-featuring the economic history of the Reagan Presidency

PBS Commanding Heights: The Battle for the World Economy

Encyclopedia articles from the Concise Encyclopedia of Economics on Econlib: