Double Irish arrangement: Difference between revisions

| Line 209: | Line 209: | ||

===Distortion of Irish GDP/GNP=== |

===Distortion of Irish GDP/GNP=== |

||

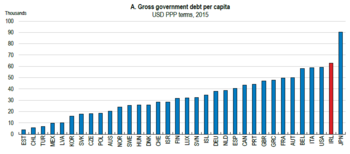

[[File:OECD Public Debt per Capita (2015).png|thumb|upright=1.6|OECD Public Debt-per-Capita table for 2015.<ref name="oecd"/>]] |

[[File:OECD Public Debt per Capita (2015).png|thumb|upright=1.6|OECD Public Debt-per-Capita table for 2015.<ref name="oecd">{{cite web|url=http://www.finance.gov.ie/wp-content/uploads/2018/03/OECD-survey.pdf|title=OECD Ireland Survey 2018|publisher=[[OECD]]|page=34|date=March 2018|isbn= 978-92-64-29177-5}}</ref>]] |

||

{{Main|Modified gross national income|Leprechaun economics}} |

{{Main|Modified gross national income|Leprechaun economics}} |

||

An "[[Tax haven#Inflated GDP-per-capita|artificially inflated GDP-per-capita statistic]]", is a feature of tax havens, due to the BEPS flows.<ref name="be"/><ref name="ber"/> In February 2017, Ireland's national accounts became so distorted by BEPS flows that the [[Central Bank of Ireland]] replaced Irish GDP and Irish GNP with a new economic measure, Irish [[Modified gross national income|Modified GNI*]].<ref name="gni3">{{cite web|url=https://www.ft.com/content/dd3a6f1c-6aea-11e7-bfeb-33fe0c5b7eaa|title=Ireland's deglobalised data to calculate a smaller economy|publisher=Financial Times|date=17 July 2017}}</ref> However, in December 2017, [[Eurostat]] reported that Modified GNI* did not remove all of the distortions from Irish economic date.<ref name="eurostat1">{{cite web|url= https://ec.europa.eu/eurostat/cros/system/files/euronaissue2-2016-art2.pdf|title=Globalisation at work in statistics — Questions arising from the ‘Irish case’|publisher=[[EuroStat]]|author1=SILKE STAPEL-WEBER|author2=JOHN VERRINDER|quote=Nevertheless the rise in [Irish] GNI is still very substantial because the additional income flows of the companies (interest and dividends) concerned are considerably smaller than the value added of their activities|page=31| date=December 2017}}</ref> By September 2018, the Irish [[Central Statistics Office (Ireland)|Central Statistics Office]] ("CSO") reported that [[Modified gross national income#Irish GDP versus Modified GNI (2009-2017)|Irish GDP was 162% of Irish GNI*]] (e.g. BEPS tools had artificially inflated Ireland's economic statistics by 62%). In contrast EU–28 2017 GDP was 100% of GNI.<ref name="eurostat2">{{cite web|url=https://ec.europa.eu/eurostat/web/products-datasets/-/sdg_08_10|title=Real GDP per capita|publisher=[[Eurostat]]|access-date=26 November 2018}}</ref> Irish public indebtedness changes dramatically depending on whether Debt-to-GDP, Debt-to-GNI* or Debt-per-Capita is used (''Per-Capita'' removes all BEPS tool distortion).<ref>{{cite web|url=https://www.irishtimes.com/business/economy/who-owes-more-money-the-irish-or-the-greeks-1.2236034|title=Who owes more money - the Irish or the Greeks?|publisher=Irish Times|date=4 June 2015}}</ref><ref>{{cite web|url=https://www.irishtimes.com/business/economy/why-do-the-irish-still-owe-more-than-the-greeks-1.3001026|title=Why do the Irish still owe more than the Greeks?|publisher=Irish Times|date=7 March 2017|quote=Why, then, when we look at debt on a per-capita basis, is it still so high? Per person, the Irish are right up the top of the leaderboard, with government debt per person of $45,941 (€43,230) as of March 1st, behind only Japan ($80,465) and the US ($48,203).}}</ref><ref>{{cite web|url=https://www.irishtimes.com/business/economy/budget-2019-who-still-owes-more-the-irish-or-the-greeks-1.3625800|title=Who still owes more, Ireland or the Greeks|date=12 September 2018|publisher=[[Irish Times]]|author=Fiona Reddan}}</ref> |

An "[[Tax haven#Inflated GDP-per-capita|artificially inflated GDP-per-capita statistic]]", is a feature of tax havens, due to the BEPS flows.<ref name="be"/><ref name="ber"/> In February 2017, Ireland's national accounts became so distorted by BEPS flows that the [[Central Bank of Ireland]] replaced Irish GDP and Irish GNP with a new economic measure, Irish [[Modified gross national income|Modified GNI*]].<ref name="gni3">{{cite web|url=https://www.ft.com/content/dd3a6f1c-6aea-11e7-bfeb-33fe0c5b7eaa|title=Ireland's deglobalised data to calculate a smaller economy|publisher=Financial Times|date=17 July 2017}}</ref> However, in December 2017, [[Eurostat]] reported that Modified GNI* did not remove all of the distortions from Irish economic date.<ref name="eurostat1">{{cite web|url= https://ec.europa.eu/eurostat/cros/system/files/euronaissue2-2016-art2.pdf|title=Globalisation at work in statistics — Questions arising from the ‘Irish case’|publisher=[[EuroStat]]|author1=SILKE STAPEL-WEBER|author2=JOHN VERRINDER|quote=Nevertheless the rise in [Irish] GNI is still very substantial because the additional income flows of the companies (interest and dividends) concerned are considerably smaller than the value added of their activities|page=31| date=December 2017}}</ref> By September 2018, the Irish [[Central Statistics Office (Ireland)|Central Statistics Office]] ("CSO") reported that [[Modified gross national income#Irish GDP versus Modified GNI (2009-2017)|Irish GDP was 162% of Irish GNI*]] (e.g. BEPS tools had artificially inflated Ireland's economic statistics by 62%). In contrast EU–28 2017 GDP was 100% of GNI.<ref name="eurostat2">{{cite web|url=https://ec.europa.eu/eurostat/web/products-datasets/-/sdg_08_10|title=Real GDP per capita|publisher=[[Eurostat]]|access-date=26 November 2018}}</ref> Irish public indebtedness changes dramatically depending on whether Debt-to-GDP, Debt-to-GNI* or Debt-per-Capita is used (''Per-Capita'' removes all BEPS tool distortion).<ref>{{cite web|url=https://www.irishtimes.com/business/economy/who-owes-more-money-the-irish-or-the-greeks-1.2236034|title=Who owes more money - the Irish or the Greeks?|publisher=Irish Times|date=4 June 2015}}</ref><ref>{{cite web|url=https://www.irishtimes.com/business/economy/why-do-the-irish-still-owe-more-than-the-greeks-1.3001026|title=Why do the Irish still owe more than the Greeks?|publisher=Irish Times|date=7 March 2017|quote=Why, then, when we look at debt on a per-capita basis, is it still so high? Per person, the Irish are right up the top of the leaderboard, with government debt per person of $45,941 (€43,230) as of March 1st, behind only Japan ($80,465) and the US ($48,203).}}</ref><ref>{{cite web|url=https://www.irishtimes.com/business/economy/budget-2019-who-still-owes-more-the-irish-or-the-greeks-1.3625800|title=Who still owes more, Ireland or the Greeks|date=12 September 2018|publisher=[[Irish Times]]|author=Fiona Reddan}}</ref> |

||

Revision as of 16:43, 26 November 2018

| Part of a series on |

| Taxation |

|---|

|

| An aspect of fiscal policy |

The Double Irish is a base erosion and profit shifting ("BEPS") corporate tax tool, used mostly by U.S. multinationals since the late 1980s, to avoid corporate taxation on most non–U.S. profits.[a] It is the largest tax avoidance tool in history and by 2010, was shielding USD 100 billion annually in U.S. multinational foreign profits from taxation,[b] and was the main tool by which U.S. multinationals built up untaxed offshore reserves of USD 1 trillion from 2004 to 2018.[c][d] Traditionally, it was also used with the Dutch Sandwich BEPS tool, however, changes to Irish tax law in 2010 dispensed with this requirement for most users.

Despite U.S. knowledge about the Double Irish for a decade, it was the EU who forced Ireland to close the scheme in October 2014, starting January 2015. However, users of existing schemes, such as Apple, Google, Facebook, and Pfizer, were given until January 2020 to close them. At the announcement of the closure it was known that Ireland had replacement BEPS tools, the Single Malt (2014), and the Capital Allowances for Intangible Assets (CAIA) (2009):

- Single malt, is almost identical to the Double Irish, and was identified with Microsoft and Allergan in 2017;

- CAIA, can provide up to twice the tax shield of Single Malt, or Double Irish, and was identified with Apple in the 2015 leprechaun economics affair.

U.S. tax academics showed as far back as 1994, that U.S. multinational use of tax havens and BEPS tools had maximised long-term U.S. exchequer receipts. They showed that multinationals from "territorial" tax systems, which all but a handful of countries follow,[e] did not use BEPS tools, or tax havens, including those that had recently switched, such as Japan (2009), and the U.K. (2009–12). By 2018, non–U.S. tax academics showed U.S. multinationals were the largest users of BEPS tools and Ireland was the largest global BEPS hub or tax haven. They showed Ireland was almost exclusively a U.S. corporate tax haven, and that U.S. multinationals represented the largest component of the Irish economy, and that Ireland had failed to attract multinationals from "territorial" tax systems.[f]

U.S. tax academics advocated the U.S. switch to a "territorial" tax system in the December 2017 Tax Cuts and Jobs Act ("TCJA"), and as a result, forecast the demise of Irish BEPS tools, and Ireland as a U.S. corporate tax haven. However, by mid–2018, other tax academics, including the IMF, noted technical flaws in the TCJA had increased the attractiveness of Ireland's BEPS tools, and the CAIA BEPS tool in particular, which post-TCJA, delivered a total effective tax rate ("ETR") of 0–3% on profits that can be fully repatriated to the U.S. without incurring any additional U.S. taxation. In July 2018, one of Ireland's leading tax economists forecasted a "boom" in the use of the Irish CAIA BEPS tool, as U.S. multinationals close existing Double Irish BEPS schemes before the 2020 deadline.

Explanation of Double Irish

Concept and origin (1991)

Under OECD rules, corporations with intellectual property ("IP"), which are mostly technology and life sciences firms, can turn this into an intangible asset ("IA") on their balance sheet, and charge it out as a tax-deductible royalty payment to end-customers.[7] Without such IP, if Microsoft charged a German end-customer, say $100, for Microsoft Office, a profit of circa $95 (as the cost of Microsoft selling copies of Microsoft Office is small) would be realised in Germany, and German tax payable. With such IP, Microsoft can additionally charge Microsoft Germany $95 in IP royalty payments on each copy of Microsoft Office, ensuring that its German profits are zero. The $95 is paid to the location in which the IP is legally housed. Microsoft would prefer to house this IP in a tax haven, however, higher-tax locations like Germany do not sign full tax treaties with tax havens, and would not accept the IP charged from a tax haven as deductible against German taxation. The Double Irish fixes this problem.[8][9]

The Double Irish enables the IP to be charged-out from Ireland, which has a large global network of full bilateral tax treaties.[g] The Double Irish enables the hypothetical $95 which was sent from Germany to Ireland, to be sent-on to a tax haven like Bermuda, without incurring any Irish taxation. The techniques of using IP to relocate profits from higher-tax locations to low-tax locations are called base erosion and profit shifting ("BEPS") tools.[7] There are many types of BEPS tools (e.g. Debt–based BEPS tools), however, IP-based BEPS tools are the largest group.[11] The Double Irish is an IP–based BEPS tool.[7]

As with all Irish BEPS tools, the Irish subsidiary must conduct a "relevant trade" on the IP in Ireland.[h] A "business plan" must be produced with Irish employment and salary levels that are acceptable to the Irish State during the period the BEPS tool is in operation.[i] Despite these requirements, the effective tax rate ("ETR") of the Double Irish is almost 0%, as the EU Commission discovered in 2016.[12]

Most major U.S. technology and life sciences multinationals have been identified as using the Double Irish. By 2010, USD 95 billion of U.S. profits were being shifted annually to Ireland,[13] which by 2015, was USD 106 billion.[14] As the BEPS tool with which U.S. multinationals built up untaxed offshore reserves of circa USD 1 trillion from 2004 to 2017,[c][d][16][17] the Double Irish is the largest tax avoidance tool in history. In 2016, when the EU levied a €13 billion fine on Apple, the largest tax fine in history,[18] it only covered the period 2004–14, during which Apple shielded €111 billion in profits from U.S (and Irish) tax.

The earliest recorded versions of the Double Irish BEPS tool is by Apple in the late 1980s,[19] and the EU discovered Irish Revenue tax rulings on the Double Irish for Apple in 1991.[12] However, Feargal O'Rourke, PwC tax partner in the IFSC (and son of Minister Mary O'Rourke, cousin of the 2008–2011 Irish Finance Minister Brian Lenihan Jnr) is regarded as its "grand architect".[20][21][22][23]

Basic structure (no Dutch Sandwich)

From the Corporation:

1. CORP (X) creates the software.

2. CORP (X) sells IP to BER1 (H).

3. BER1 (H) revalues IP higher.

4. BER1 (H) licenses IP to IRL2 (A).

5. IRL2 (A) licenses IP to DUT1 (S).

6. DUT1 licenses IP to IRL1 (B).

7. IRL1 sells software to customer.

From the Customer:

A. Customer pays $100 to IRL1 (B).

B. IRL1 pays $100 to DUT1 (S) as royalty.

C. DUT1 pays $100 to IRL2 (A) as royalty.

D. IRL2 pays $100 to BER1 (H) as royalty.

E. BER1 accumulates the cash.

F. BER1 can lend cash to CORP.

While there have been variations (e.g. Apple), the standard Double Irish arrangement, in simplified form, takes the following structure (note that the steps below initially exclude the Dutch sandwich component for simplicity, which is explained in the next section; Chart 1 includes the Dutch sandwich):[j][25][26][27]

- A U.S. corporate (CORP, or X) develops new software in the U.S. costing $1 to build;

- CORP sells it to its wholly owned Bermuda company (BER1, or H) for $1 (at cost, ideally);

- BER1 revalues it to $100 (as an intangible asset under GAAP), and books gain in Bermuda (tax free);

- BER1 licenses it to its wholly owned Irish subsidiary (IRL1, or B) for $100;

- IRL1 then sells it in Germany to a customer for $100;

- IRL1 uses the $100 from Germany to pay the $100 royalty to BER1 (no profit in Ireland);

- BER1 holds the $100 cash in perpetuity, thus avoiding U.S. 35% tax;

- BER1 lends the $100 cash back to CORP (and other subsidiaries).

This structure has a problem. The pre–TCJA U.S. tax code allows foreign income to be left in foreign subsidiaries (deferring U.S. taxes), but it will consider BER1 to be a controlled foreign corporation (or "CFC"), sheltering income from a related party transaction (i.e. IRL1). It will apply full U.S. taxes to BER1 at 35%.[27]

To get around this, the U.S. corporation needs to create a second Irish company (IRL2, or A), legally incorporated in Ireland (so under the U.S. tax code it is Irish), but which is "managed and controlled" from Bermuda (so under the Irish tax code it is from Bermuda). IRL2 will be placed between BER1 and IRL1 (i.e. owned by BER1, and owning IRL1). Up until the 2015 shut-down of the Double Irish, the Irish tax code was one of the few that allowed a company be legally incorporated in its jurisdiction, but not be subject to its taxes (if managed and controlled elsewhere).[27]

The U.S. corporation will "check-the-box" for IRL1 as it is clearly a foreign subsidiary selling to non–U.S. locations. The U.S. tax code will rightly ignore IRL1 from U.S. tax calculations. However, because the U.S. tax code also views IRL2 as foreign (i.e. Irish), it also ignores the transactions between IRL1 and IRL2 (even though they are related parties). This is the essence of the Double Irish arrangement.[28]

Note that in some explanations and diagrams BER1 is omitted (the Bermuda black hole), however, it is rare for a U.S. corporation to "own" IRL2 directly.

Elimination of Dutch sandwich (2010)

The Irish tax code historically levied a 20% withholding tax on transfers from an Irish company like IRL1, to companies in tax havens like BER1.[29] However, if IRL1 sends the money to a new Dutch company DUT1 (or S), via another royalty payment scheme, no Irish withholding tax is payable as Ireland does not levy withholding tax on transfers within EU states. In addition, under the Dutch tax code DUT1 can send money to IRL2 under another royalty scheme without incurring Dutch withholding tax, as the Dutch do not charge withholding tax on royalty payment schemes.[27] This is called the dutch sandwich and DUT1 is described as the "dutch slice" (sitting between IRL1 and IRL2).[28][30] Thus, with the addition of IRL2 and DUT1, we have the "Double Irish dutch sandwich" tax structure.[31]

In 2010, the Irish State, on lobbying from PwC Ireland's IFSC tax partner, Feargal O'Rourke,[22] relaxed the rules for sending royalty payments to non–EU countries without incurring Irish withholding tax (thus ending the dutch sandwich), but they are subject to conditions that will not suit all Double Irish arrangements.[32][33][34]

O'Rourke set out to simplify those structures, eliminating the need for a Dutch intermediary. In October 2007, he met at Google's Dublin headquarters on Barrow Street with Tadhg O'Connell, the head of the Revenue division that audits tech companies. O'Connell is understood to have rejected O'Rourke's request that royalties like Google's should be able to flow directly to units in Bermuda and Cayman without being taxed. In 2008, O'Rourke's cousin Brian Lenihan became finance minister, setting much of the Revenue's policy. Two years later, after continued entreaties by O'Rourke, the Revenue's office announced that it would no longer impose withholding taxes on such transactions.

Controversial closure (2015)

The 2014–16 EU investigation into Apple in Ireland (see below), showed that the Double Irish existed as far back as 1991. Early U.S. academic research in 1994 into U.S. multinational use of tax havens identified profit shifting accounting techniques.[37][7] U.S. congressional investigations into the tax practices of U.S. multinationals were aware of such BEPS tools for many years.[38] However, the U.S. did not try to force the closure of the Double Irish BEPS tool, instead it was the EU which forced Ireland to close the Double Irish to new schemes in October 2014.[39] Even still, existing users of the Double Irish BEPS tool (e.g. Apple, Google, Facebook, Microsoft, amongst many others), were given five more years until January 2020, before the tool would be fully shut-down to all users.[28]

This approach by successive U.S. administrations is explained by an early insight that one of the most cited U.S. academic researchers into tax havens, and corporate taxation, James R. Hines Jr., had in 1994. Hines realised in 1994, that: "low foreign tax rates [from tax havens] ultimately enhance U.S. tax collections".[37] Hines would revisit this concept several times,[40] as would others,[41] and it would guide U.S. policy in this area for decades, including introducing the "check-the-box"[k] rules in 1996, curtailing the 2000–10 OECD initiative on tax havens,[43] and not signing the 2016 OCED anti-BEPS initiative.[44][45]

Lower foreign tax rates entail smaller credits for foreign taxes and greater ultimate U.S. tax collections (Hines and Rice, 1994).[37] Dyreng and Lindsey (2009),[41] offer evidence that U.S. firms with foreign affiliates in certain tax havens pay lower pay lower foreign taxes and higher U.S. taxes than do otherwise-similar large U.S. companies.

— James R. Hines Jr., "Treasure Islands" p. 107 (2010)[40]

By September 2018, tax academics proved U.S. multinationals were the largest users of BEPS tools,[42][46] and that Ireland was the largest global BEPS hub.[14][47][48]

Apple's €13 billion EU fine (2016)

By 2016, Apple was Ireland's largest company, and post leprechaun economics, was over one quarter of Irish GDP.[49][50] Apple's use of the Double Irish BEPS tool to achieve tax rates <1%, dates back to the late 1980s,[19] and was investigated by the U.S. Senate in May 2013,[51][52] and covered in the main financial media.[53][54]

On 29 August 2016 the European Commissioner for Competition concluded Apple had received illegal State aid from Ireland.[12] The Commission ordered Apple to pay €13 billion, plus interest, in unpaid Irish taxes on circa €111 billion of profits, for the ten-year period, 2004–2014.[55] It was the largest corporate tax fine in history.[18]

Apple was not using the standard Double Irish arrangement of two Irish companies (IRL1 in Ireland, and IRL2 in Bermuda). Instead, Apple combined the functions of the two companies inside one Irish company (namely, Apple Sales International, or ASI), which was split into two internal "branches".[56] The Irish Revenue issued private rulings to Apple in 1991 and 2007 regarding this hybrid-double Irish structure, which the EU Commission considered as illegal State aid.[57]

This selective treatment allowed Apple to pay an effective corporate tax rate of 1 per cent on its European profits in 2003 down to 0.005 per cent in 2014.

Replacement by Single Malt

Concept and origin (2014)

In an October 2013 interview, the noted "grand architect" of the Double Irish BEPS tool, Irish International Financial Services Centre ("IFSC") PWC tax partner Feargal O'Rourke (see above),[20] said that: "the days of the Double Irish tax scheme are numbered".[58]

In October 2014, as the EU forced the Irish State to close the Double Irish BEPS tool,[39] the influential U.S. National Tax Journal published an article by Jeffrey L Rubinger and Summer Lepree, showing that Irish based subsidiaries of U.S. corporations could replace the Double Irish arrangement with a new structure (now known as Single Malt).[59] If the Bermuda–controlled Irish company (IRL2) was relocated to a country with whom (a) Ireland had a tax treaty, (b) with wording on "management and control" tax residency, and (c) had a zero corporate tax rate, then the Double Irish effect could be replicated. They highlighted Malta as a candidate.[59] The Irish media picked up the article,[60] but when an Irish MEP notified the then Finance Minister, Michael Noonan, he was told to "Put on the green jersey".[5]

Basic structure

The Single Malt is also an IP–based BEPS tool, and as a small variation of the Double Irish, required little additional development, except choosing specific locations with the necessary specific wording in their Irish bilateral tax treaties (e.g. Malta and the UAE); thus the basic structure is almost identical to the Double Irish with often a Maltese company replaced as BER1 (from earlier).[61]

Discovery (2017)

A November 2017 report by Christian Aid, titled Impossible Structures, showed how quickly the Single Malt BEPS tool was replacing the Double Irish.[62][63][64] The report detailed Microsoft's and Allergen's schemes and extracts from advisers to their clients.[62] The report also showed that Ireland was behaving like a "Captured State", and for example, had opted out of Article 12 of the November 2016 OECD anti-BEPS initiative to protect the Single Malt BEPS tool (it was also later pointed out in September 2018, that Malta had similarly opted out of Article 4 of the initiative to enable it to be the recipient of the Single Malt[61]).[65] The then Irish Finance Minister Paschal Donohoe said that it would be investigated,[66] however, questions were raised regarding the Irish State's policy of addressing corporate tax avoidance.[67]

Figures released in April 2017 show that since 2015 there has been a dramatic increase in companies using Ireland as a low-tax or no-tax jurisdiction for intellectual property (IP) and the income accruing to it, via a nearly 1000% increase in the uptake of a tax break expanded between 2014 and 2017.

— Christian Aid. Impossible Structures, November 2017 (p. 3)[62]

In September 2018, the Irish Times revealed that U.S. medical device manufacturer Teleflex, had created a new Single Malt scheme in July 2018, and had reduced their overall effective corporate tax rate to circa 3%.[61] The same article quoted a spokesman from the Department of Finance (Ireland) saying they had not as yet taken any action regarding the Single Malt BEPS tool, but they were keeping the matter, "under consideration".[61]

Backstop of Capital Allowances

Concept and origin (2009)

The Double Irish and Single Malt BEPS tools enable Ireland to act as a confidential "Conduit OFC" rerouting untaxed profits to places like Bermuda (e.g. it must be confidential as higher-tax locations would not sign full tax treaties with locations like Bermuda), the Capital Allowances for Intangible Assets ("CAIA") BEPS tool (also called the Green Jersey), enables Ireland to act as the terminus for the untaxed profits (e.g. Ireland becomes Bermuda, a "Sink OFC"). The CAIA uses the accepted tax concept of providing capital allowances for the purchase of assets.[l] However, Ireland turns it into a BEPS tool by providing the allowances for the purchase of intangible assets, and especially intellectual property assets, and critically, where the owner of the intangible assets is a "connected party" (e.g. a Group subsidiary).

A hypothetical multinational with an equity market capitalisation of €1,000 million, but tangible assets of €100 million, can argue that the gap of €900 million represents its intangible asset base, which can be legally created and appropriately located.[m] [..] Ireland's Capital Allowances for Intangible Assets program enables these intangible assets to be turned into tax deductible charges. [..] With appropriate structuring, the intergroup acquisition financing for the purchase of these intangible assets, can also be used to further amplify the quantum of tax deductible charges.

— KPMG, "Intellectual Property Tax" (4 December 2017)[68]

For example, in Q1 2015, Apple used the CAIA tool when its Irish subsidiary purchased USD 300 billion in intangible assets from an Apple subsidiary based in Jersey. The CAIA tool enabled Apple to write-off the USD 300 billion price as a capital allowance against future Irish profits (e.g. the next USD 300 billion of profits Apple books in Ireland are free of Irish tax). The CAIA capitalises the effect of the Double Irish or Single Malt BEPS tools, and behaves like a corporate tax inversion of a U.S. multinational's non–U.S. business. However, the CAIA is more powerful, as Apple demonstrated by effectively doubling the tax shield (e.g. to USD 600 billion in allowances), via Irish interest relief on the intergroup virtual loans used to purchase the IP.[n][69] While Apple's CAIA had an ETR of 0%, some have an ETR of 2.5%.[o][70][71][72]

I cannot see a justification for giving large amounts of Irish tax relief to the intragroup acquisition of a virtual group asset, except that it is for the purposes of facilitating corporate tax avoidance.

— Professor Jim Stewart, Trinity College Dublin, "MNE Tax Strategies in Ireland" (2016)[73]

In June 2009, the Irish State established the Commission on Taxation, to review Ireland's tax regime, and included Feargal O'Rourke, the "grand architect" of the Double Irish tool.[58] In September 2009, the Commission recommended that the Irish State provide capital allowances for the acquisition of intangible assets, creating the CAIA BEPS tool.[74][75] The 2009 Finance Act, materially expanded the range of intangible assets attracting Irish capital allowances[72] deductible against Irish taxable profits.[70][76][77][78] These "specified intangible assets"[79] cover more esoteric intangibles such as types of general rights, general know-how, general goodwill, and the right to use software.[72] It includes types of "internally developed" group intangible assets and intangible assets purchased from "conntected parties".[80][81] The control is that the intangible assets must be acceptable under GAAP (older 2004 Irish GAAP is used), and auditable by an Irish IFSC accounting firm, like PwC or Ernst & Young.[77][78][82]

In the 2010 Finance Act, on the recommendation of the Department of Finance's Tax Strategy Group, the CAIA BEPS tool was upgraded, reducing the amortisation and "clawback" period from 15 to 10 years, and expanding the range of intangible assets to include "a broader definition of know-how".[83] In the 2011 and 2012 Finance Acts, the Tax Strategy Group made additional amendments to the rules rearding the acquisition of intangible assets from "connected parties", and the "employment tax" users of the CAIA BEPS tool must pay.[h][84] The 2012 Finance Act removed the minimum amortisation period for the acquired intangible assets, and reduced the "clawback" to 5 years for CAIA schemes set up after February 2013.[72][85][86]

The first known user of the CAIA BEPS tool was by Accenture, the first U.S. corporate tax inversion to Ireland in 2009.[87][70]

By March 2017, Bloomberg would report that Ireland had become the most popular destination for U.S. corporate tax inversions in history,[88] and would have the largest Medtronic (2015), 3rd-largest Johnson Controls (2016), 4th-largest Eaton Corporation (2012) and 6th-largest Perrigo (2013) U.S. corporate tax inversions in history.[88][89]

Basic structure

The CAIA follows the first three steps of the Double Irish, and Single Malt, basic structure (see above, except in this case the example is not a per-unit example, but for the entire sales of a block of intellectual property), namely:[90][71][70][72]

- A U.S. corporate (CORP) develops new software in the U.S. costing $1 million to build;

- CORP sells it to its wholly owned Bermuda company (BER1) for $1 million (at cost, ideally);

- BER1 revalues it to $1 billion (as an intangible asset under GAAP), and books gain in Bermuda (tax-free);

- An Irish subsidiary, IRL1, purchases this intangible asset from BER1, for $1 billion;

- Under the CAIA rules, IRL1 can write-off the $1 billion paid for this group intangible asset against Irish tax;

- Additionally, BER1 gives IRL1 a $1 billion 10-year inter-group loan to buy the intangible asset, at an interest rate of circa 7%;

- Over the next 10 years IRL1 claims tax relief on both the $1 billion purchase (under CAIA), and the inter-group loan interest;

- During the 10 years, IRL1 charges out this asset to end-customers globally (as per step v. in the Double Irish), accumulating profits;

- During the 10 years, CORP in line with its product cycle, has created new software and repeated step i. to iii. above;

- At the end of the 10 years, IRL1 has shielded $1.7 billion of Irish profits against Irish tax;

- At the end of the 10 years, BER1, who received the $1 billion purchase price, and $0.7 billion in loan interest, has paid no tax;

- At the end of the 10 years, IRL1, repeats steps iv. to ix. above, and buys a new intangible asset from BER1 for $1 billion.

The CAIA and Double Irish (and Single Malt) share the same basic components and techniques (e.g. an intangible asset needs to be created and significantly re-valued in a tax haven). The key differences between the CAIA BEPS tool and the Double Irish (and Single Malt) BEPS tools are noted as follows:

- CAIA capitalises the effect of the Double Irish in the Irish national accounts, leading to even greater § Distortion of Irish GDP/GNP;

- While the ETR of the Double Irish is close to zero, the Irish State has from time-to-time capped the level of allowances under CAIA to 80%, giving an ETR of 2.5%;[o]

- By providing the inter-group finance to purchase the intangible asset (step vi. above), the tax avoided by CAIA is almost twice that of the Double Irish;

- While the loophole behind the Double Irish has been closed, CAIA is a more established tax concept internationally, although only for tangible assets.

As with all Irish BEPS tools, the Irish subsidiary must conduct a "relevant trade" on the acquired IP.[h][72] A "business plan" must be produced with Irish employment and salary levels that are acceptable to the Irish State during the period capital allowances are claimed.[i] If the Irish subsidiary is wound up within 5 years,[p] the CAIA intangible capital allowances are repayable, which is called "clawback".

Marketing of the CAIA BEPS tool

Irish BEPS tools are not overtly marketed as brochures showing near-zero effective tax rates ("ETR") would damage Ireland's ability to sign and operate bilateral tax treaties (i.e. higher-tax countries do not sign full treaties with known tax havens).[g] However, in the Irish financial crisis, some Irish tax law firms in the IFSC produced CAIA brochures openly marketing that its ETR was 2.5%.[o][90][71][72][70]

Intellectual Property: The effective corporation tax rate can be reduced to as low as 2.5% for Irish companies whose trade involves the exploitation of intellectual property. The Irish IP regime is broad and applies to all types of IP. A generous scheme of capital allowances .... in Ireland offer significant incentives to companies who locate their activities in Ireland. A well-known global company [Accenture in 2009] recently moved the ownership and exploitation of an IP portfolio worth approximately $7 billion to Ireland.

The tax deduction can be used to achieve an effective tax rate of 2.5% on profits from the exploitation of the IP purchased [via the CAIA scheme]. Provided the IP is held for five years, a subsequent disposal of the IP will not result in a clawback.

Structure 1: The profits of the Irish company will typically be subject to the corporation tax rate of 12.5% if the company has the requisite level of substance to be considered trading. The tax depreciation and interest expense can reduce the effective rate of tax to a minimum of 2.5%.

Apple's Leprechaun Economics (2015)

The EU Commission's 30 August 2016 findings against Apple's hybrid–Double Irish BEPS tool, Apple Sales International ("ASI"), covered the period from 2004 to end 2014 (see above). The EU's August 2016 report on Apple, notes that Apple had informed the Commission at the start of 2015 that they had closed their hybrid–Double Irish BEPS tool.[55] In January 2018, Irish economist Seamus Coffey, Chairman of the State's Irish Fiscal Advisory Council,[94] and author of the State's 2017 Review of Ireland's Corporation Tax Code,[95][96] showed Apple restructured ASI into the CAIA BEPS tool in Q1 2015.[97][98][99]

During Q1 2018, Coffey, and international economists,[98][99] proved Ireland's 2015 "leprechaun economics" GDP growth of 33.4%, was almost solely attributable to Apple's new CAIA BEPS tool. Coffey noted the significance of Apple's endorsement of the CAIA BEPS tool, given Apple's status as one of the longest users of the Double Irish BEPS tool,[19] and one of the largest users of BEPS tools worldwide.[53]

In January 2018, there was further controversy over Apple's CAIA BEPS tool when Coffey pointed out that it is prohibited under Ireland's tax code (Section 291A(c) of the Taxes and Consolation Act 1997), to use the CAIA BEPS tool for reasons that are not "commercial bona fide reasons", and in schemes where the main purpose is "... the avoidance of, or reduction in, liability to tax". In addition, it was realised in hindsight, that changes former Finance Minister Michael Noonan made in the Irish 2015 Finance Budget, was to ensure the ETR of Apple's CAIA tool was reduced to zero.[91]

In June 2018, Apple's post Q1 2015 BEPS tax structure in Ireland was labelled "the Green Jersey" by the EU Parliament's GUE–NGL body and described in detail.[100][69]

Microsoft's Green Jersey (2018)

In December 2017, the Irish Government accepted the recommendation of Coffey that the corporation tax relief for the Irish CAIA BEPS tool be capped at 80% for new arrangements, to restore the CAIA's effective Irish corporate tax rate ("ETR") back to 2.5%.[o][101][102] This was enacted in the 2017 Finance Budget, but only for new CAIA BEPS schemes (e.g. Apple's 2015 CAIA scheme would not be affected).[91] Given the dramatic take-up in the CAIA tool in 2015, when the cap lifted (e.g. the ETR was 0%), Irish commentators challenged Coffey's recommendation. He responded in a paper in late 2017.[103][104]

In 2015 there were a number of “balance-sheet relocations” with companies who had acquired IP while resident outside the country becoming Irish-resident. It is possible that companies holding IP for which capital allowances are currently being claimed could become non-resident and remove themselves from the charge to tax in Ireland. If they leave in this fashion there will be no transaction that triggers an exit tax liability.

— Seamus Coffey, "Intangibles, taxation and Ireland's contribution to the EU Budget", December 2017[103]

In July 2018, it was reported that Microsoft was preparing to execute another "Green Jersey" CAIA BEPS transaction.[105] which, due to technical issues with the TCJA, makes the CAIA BEPS tool attractive to U.S. multinationals. In July 2018, Coffey posted that Ireland could see a "boom" in the onshoring of U.S. IP, via the CAIA BEPS tool, between now and 2020, when the Double Irish is fully closed.[106]

Effect of BEPS tools on Ireland's economy

In June 2018, academic tax researcher Gabriel Zucman (et alia) estimated Ireland was the world's largest BEPS hub,[14] and also the world's largest tax haven.[47][48] In September 2018, Zucman and Wright showed that U.S. corporates were the largest users of BEPS tools, representing almost half of all BEPS activity.[42][107][46] The concentration of BEPS activity impacted Ireland's economy in a number of ways:

Distortion of Irish GDP/GNP

An "artificially inflated GDP-per-capita statistic", is a feature of tax havens, due to the BEPS flows.[7][109] In February 2017, Ireland's national accounts became so distorted by BEPS flows that the Central Bank of Ireland replaced Irish GDP and Irish GNP with a new economic measure, Irish Modified GNI*.[110] However, in December 2017, Eurostat reported that Modified GNI* did not remove all of the distortions from Irish economic date.[111] By September 2018, the Irish Central Statistics Office ("CSO") reported that Irish GDP was 162% of Irish GNI* (e.g. BEPS tools had artificially inflated Ireland's economic statistics by 62%). In contrast EU–28 2017 GDP was 100% of GNI.[112] Irish public indebtedness changes dramatically depending on whether Debt-to-GDP, Debt-to-GNI* or Debt-per-Capita is used (Per-Capita removes all BEPS tool distortion).[113][114][115]

Concentration of U.S. multinationals

Tax academics show multinationals from countries with "territorial" tax systems make little use of tax havens like Ireland.[116] Since the UK changed its tax regime to a "territorial" system in 2009–12, Ireland has failed to attract corporates from any other jurisdiction except the U.S., one of the last "worldwide" tax systems.[e][f] By September 2018, U.S.–controlled corporates were 25 of Ireland's 50 largest companies, paid 80% of Irish business taxes,[117] and directly employed 25% of the Irish labour force,[118] and created 57% of Irish value-add.[118][109] The past President of the Irish Tax Institute stated they pay 50% of all Irish salary taxes (due to higher paying jobs), 50% of all Irish VAT, and 92% of all Irish customs and excise duties.[119] The American-Ireland Chamber of Commerce estimated the value of U.S. investment in Ireland in 2018 was €334 billion, exceeding Irish GDP (€291 billion in 2016), and exceeding the combined investment of U.S. investment in the BRIC countries.[120] The U.S. multinational subsidiaries in Ireland, are not simply used for booking EU sales, in most cases, they handle the entire non–U.S. business of the Group.[a] Outside of U.S. corporates, and legacy UK corporates (pre 2009–12), there are no foreign corporates in Ireland's top 50 firms. Academics say Ireland is more accurately described as a "U.S. corporate tax haven", and a shield for non–U.S. profits from the historic U.S. "worldwide" tax system.[121]

Disagreement on Irish ETRs

One of the most contested aspects of Ireland's economy is the aggregate "effective tax rate" (ETR) of Ireland's corporate tax regime. The Irish State refutes tax haven labels as unfair criticism of its low, but legitimate, 12.5% Irish corporate tax rate,[122][123] which it defends as being the effective tax rate ("ETR").[124] Independent studies show that Ireland's aggregate effective corporate tax rate is between 2.2% to 4.5% (depending on assumptions made).[125][126][127] This lower aggregate effective tax rate is consistent with the individual effective tax rates of U.S. multinationals in Ireland,[73][128][31][129][130] as well as the IP-based BEPS tools openly marketed by the main Irish tax-law firms, in the IFSC, with ETRs of 0–3% (see "effective tax rate").[90][85][70][71]

Effect of Tax Cuts and Jobs Act

U.S. corporate tax haven (to 2017)

In June 2018, tax academics showed that Ireland had become the world's largest global BEPS hub,[14] or corporate-focused tax haven.[47][48] In September 2018, tax academics showed that U.S. multinationals were the largest users of BEPS tools.[42][46] In 2016, leading tax academic James R. Hines Jr., showed that multinationals from "territorial" tax systems, the system used by almost all global economies bar a handful but which included the U.S.,[e] make little use of tax havens.[116] Hines, and others, had previously quoted the example of the U.K., who transitioned from a "worldwide" system to a "territorial" system in 2009-2012, which led to a reversal of many UK inversions to Ireland,[137][133][134] and turned the U.K. into one of the leading destinations for U.S. corporate tax inversions (although Ireland is still the most popular).[138][88] A similar case study was cited in the switch by Japan in 2009 from a full U.S. "worldwide" tax system (e.g. very high domestic tax rate, partially mitigated by a controlled foreign corporation regime), to a full "territorial" tax system, with positive results.[135][136]

As discussed in § Controversial closure (2015), Hines had shown as early as 1994, that under the U.S. "worldwide" tax system, U.S. multinational use of tax havens and BEPS tools, had increased long-term U.S. exchequer returns. Academics point to these facts as the explanation for the extraordinary § Concentration of U.S. multinationals in Ireland's economy, and the equal failure of Ireland to attract non-U.S. multinationals or any multinationals from "territorial" tax systems. While Ireland sometimes describes itself as a "global knowledge hub for selling into Europe", it is more accurately described as a U.S. corporate tax haven for shielding non-U.S. revenues from the historical U.S. "worldwide" tax system.[121][f]

U.S. change to a territorial system (post 2017)

In December 2017, the U.S. Tax Cuts and Jobs Act ("TCJA"), the U.S. changed from a "worldwide" tax system to a hybrid–"territorial" tax system,[r] to encourage U.S. multinationals to relocate functions back from tax havens.[e] In addition, the U.S., as the UK had done in 2009–12, aimed to become a favoured destination for foreign multinational to re-locate to. In their October 2017 report on the proposed TCJA legalisation, the U.S. Council of Economic Advisors, quoted Hines' work on tax havens, and used Hines' calculations, to estimate the quantum of U.S. investment that should return as a result of the TCJA.[36]

As well as switching to a hybrid–"territorial" tax system,[r] the TCJA contains a unique "carrot" and a "stick" aimed at U.S. multinationals in Ireland:[140][141][139]

- As a "carrot", the TCJA enables these firms to charge out their IP globally (just like with a Double Irish or Single Malt arrangement) but from a U.S. base, at a preferential FDII tax rate of 13.125% . In addition, the extra reliefs of 100% capital expensing, and 21% relief on U.S. costs, make the effective FDII rate 1–2% lower again (or 11–12%).

- As a "stick", the TCJA GILTI tax rate forces these firms to pay a minimum U.S. tax rate of 10.5% on their global IP, regardless of where their IP is located. In addition, only getting 80% relief (not 100%), against foreign taxes paid, means that the effective GILTI rate is 1–2% higher again (or 11–12%, similar to the net FDII rate).

In March–April 2018, major U.S. tax law firms showed that pre the TCJA, U.S. multinationals with the IP needed to use Irish BEPS tools, would achieve effective Irish tax rates ("ETR") of 0–3%[s] versus 35% under the historical U.S. system. However, post the TCJA, these multinationals can use their IP to achieve U.S. ETRs, which net of the TCJA's 100% capital relief provisions, are similar to the ETRs they would achieve in Ireland when the TCJA's new GILTI provisions are taken into account (e.g. ETR of circa 11–12%).[141][142] In Q1 2018, U.S. multinationals like Pfizer announced in Q1 2018, a post-TCJA global tax rate for 2019 of circa 17%, which is close to the circa 15–16% 2019 tax rate announced by past U.S. corporate tax inversions to Ireland, Eaton, Allergan, and Medtronic.[143]

Early implications for Ireland (2018)

As the TCJA was being passed in December 2017, the new corporate tax provisions were recognised by the Irish media, as a challenge.[144][145] Donald Trump had "singled out" Ireland in 2017 speeches promoting the TCJA,[146] and Trump administration economic advisor, Stephen Moore, predicted "a flood of companies" would leave Ireland due to the TCJA.[147] Leading U.S. tax academic, Mihir A. Desai[t] in a post–TCJA 26 December 2017 interview in the Harvard Business Review said that: "So, if you think about a lot of technology companies that are housed in Ireland and have massive operations there, they’re not going to maybe need those in the same way, and those can be relocated back to the U.S.[148]

In December 2017, U.S technology firm Vantiv, the world's largest payment processing company, confirmed that it had abandoned its plan to execute a corporate tax inversion to Ireland.[149] In March 2018, the Head of Life Sciences in Goldman Sachs, Jami Rubin, stated that: "Now that [U.S.] corporate tax reform has passed, the advantages of being an inverted company are less obvious".[143] In August 2018, U.S. multinational Afilias, who had been headquartered in Ireland since 2001, announced that as a result of the TCJA, it was moving back to the U.S.[150]

However, in contrast, it was reported in May–July 2018, that U.S. tax academics and tax economists were discovering material technical flaws in the TCJA that incentivise the U.S. use of tax havens like Ireland. Of particular note was the exclusion from the GILTI tax of the first 10% of profits on overseas tangible assets, which incentivises investment in tangible assets abroad.[151][152] However, a more serious concern, was the acceptance of capital allowances, both tangible and intangible, as deductible against GILTI taxation, which would enable U.S. users of the CAIA BEPS tool to convert their Irish ETR of 0–3%, into a final U.S. ETR of 0–3%.[153][154][155] In May–July 2018, Google and Facebook announced large expansions of their Dublin office campuses in Ireland.[156]

A June 2018 IMF country report on Ireland, while noting the significant exposure of Ireland's economy to U.S. corporates, concluded that the TCJA may not be as effective as Washington expects in addressing Ireland as a U.S. corporate tax haven. In writing its report, the IMF conducted confidential anonymous interviews with Irish corporate tax experts.[157] In July 2018, it was reported that Microsoft was preparing to execute Apple's "Green Jersey" CAIA BEPS transaction.[105] In July 2018, Seamus Coffey, Chairperson of the Irish Fiscal Advisory Council and author of the Irish State's 2016 review of the Irish corporate tax code,[158] posted that Ireland could see a "boom" in the onshoring of U.S. IP, via the CAIA BEPS tool, between now and 2020, when the Double Irish is fully closed.[106]

Multinationals who used Irish BEPS tools

This is not a comprehensive list as many U.S. multinationals in Ireland use "unlimited liability companies" (ULCs), which do not file public accounts with the Irish CRO.[159][160]

Double Irish

Major companies in Ireland known to employ the Double Irish BEPS tool, include:

- Apple Inc. original user, and known in operation since the late 1980s[161][19][52][53]

- Abbott Laboratories[162][163]

- Adobe Systems[164]

- Airbnb[165][166]

- Apple Inc.[19]

- Eli Lilly and Company[164]

- Facebook[167][168][169][129]

- Forest Laboratories[164]

- General Electric[167]

- Google[31][170][167]

- IBM[171]

- Johnson & Johnson[167]

- Medtronic Inc.[172]

- Microsoft[164][173][174]

- News Corp[164]

- Oracle Corp.[130][164]

- Pfizer Inc.[164]

- Starbucks[167]

- Yahoo![175]

Single Malt

Major companies in Ireland known to employ the single-malt BEPS tool, include:

- Microsoft (LinkedIn), using Malta[62]

- Allergan (Zeitiq), using Malta[62]

- Teleflex, using Malta[61]

Capital Allowances for Intangible Assets

Major companies in Ireland known to employ the capital-allowances for intangible assets ("CAIA") BEPS tool, include:

- Apple Inc., started in 2015[97] with the leprechaun economics affair

- Accenture, started in 2009[87]

See also

- Corporation tax in the Republic of Ireland

- EU illegal State aid case against Apple in Ireland

- Corporate tax haven

- Tax haven

- Leprechaun economics Apple BEPS tool in Ireland

- Modified gross national income replaced Irish GDP/GNP

- Green jersey agenda

- Feargal O'Rourke architect of Ireland's BEPS tools

- Matheson (law firm) Ireland's largest U.S. tax advisor

- Qualifying investor alternative investment fund (QIAIF) Irish tax-free vehicles

- Section 110 SPV Debt-based BEPS tool

- Conduit and Sink OFCs analysis of tax havens

- Ireland as a tax haven

- Panama as a tax haven

- United States as a tax haven

- James R. Hines Jr., leader in academic research on tax havens

- Dhammika Dharmapala, leader in academic research on tax havens

- Gabriel Zucman, leader in academic research on tax havens

Notes

- ^ a b The Double Irish is sometimes mis-understood as being only used for EU–sourced revenues and business. For example, in 2016, Facebook recorded global revenues of $27 billion, while Facebook in Ireland paid €30 million in Irish tax on Irish revenues of €13 billion (approximately half of all global revenues).[1] Similarly, when the EU introduced the GDPR regulations in 2018, Facebook disclosed that all of its non–U.S. accounts (circa 1.9 billion, of which 1.5 billion were non-E.U), were legally based in Dublin.[2] Similarly, Google is also believed to run most of its non–U.S. sales revenue and profits through its Dublin operation.[3][4]

- ^ Before the U.S. 2017 TCJA repatriation tax, the Double Irish shielded all non–U.S. profits of U.S. multinationals from: (a) taxation in the end-consumer market, (b) from taxation in Ireland, and (c) from U.S. taxation. The 2017 TCJA placed a 15.5% U.S. tax on these untaxed profits, and they were deemed to be automatically repatriated (regardless of whether the U.S. multinational wanted to repatriate the untaxed profits or not).

- ^ a b 2004 was the date of the last Bush Administration tax amnesty, when pre–2004 offshore untaxed cash was repatriated at a special U.S. tax rate of 5%; in 2018, the TCJA repatriation tax rate was 15.5%.

- ^ a b While various sources quote the amount of untaxed cash reserves as being closer to USD 2 trillion, a component of this figure represents cash flow that is awaiting reinvestment in the overseas markets, non-cash assets, and U.S. banking flows; the strong consensus is that the pure cash figure is at least over USD 1 trillion.[15]

- ^ a b c d Before the passing of the TCJA in December 2017, the U.S. was one of eight remaining jurisdictions to run a "worldwide" taxation system, which was the principal obstacle to U.S. corporate tax reform, as it was not possible to differentiate between the source of income. The seven other "worldwide" tax systems, are: Chile, Greece, Ireland, Israel, Korea, Mexico, and Poland.[132] The positive experience of the UK switch to a "territorial" system in 2009-12,[133][134] and the Japanese switch to a "territorial" system in 2009,[135] amongst others,[136] was continually highlighted by U.S. tax academics.

- ^ a b c It is believed that Ireland's extreme economic exposure to U.S. corporate BEPS activity, had led Ireland to expand into more traditional tax haven–type tools, such as the Qualifying investor alternative investment fund (QIAIF) (designed to compete with the Cayman Islands SPC), and the Irish Section 110 Special Purpose Vehicle (SPV) (designed to compete with the Luxembourg SPV).[6]

- ^ a b In September 2018, Ireland had a global network of 73 bilateral tax treaties, and a 74th with Ghana awaiting ratification.[10]

- ^ a b c Under Section 291A of the 1997 Irish Tax and Consolidated Acts, users of Irish BEPS tools must conduct a "relevant trade" and perform "relevant activities" in Ireland to give the BEPS tool a degree of credibility and substance.[92][77][78] In effect, it can equate to an "employment tax" on the Irish subsidiary, however, to the extent that the "relevant activities" are needed within the Group (e.g. they are performing real tasks), then the effect of this "employment tax" is mitigated. While the Irish State has never published the employment metrics for using Irish BEPS tools, the evidence is that even where the "relevant activities" were completely unnecessary, the "employment tax" equates to circa 2–3% of profits shifted through Ireland (see here).

- ^ a b In documents released under FOI from the Irish Department of Finance Tax Strategy Group, they describe the CAIA BEPS tool as a: "measure was introduced to support the development of the knowledge economy and the provision of high-quality employment.[83][84]

- ^ The most cited academic explanation of the Double Irish Dutch Sandwich, is Edward Kleinbard's 2011 Stateless Income, however it is not possible to reference a copy online.[24]

- ^ Before 1996, the United States, like other high-income countries, had anti-avoidance rules—known as “controlled foreign corporations” provisions—designed to immediately tax in the United States some foreign income (such as royalties and interest) conducive of profit shifting. In 1996, the IRS issued regulations that enabled U.S. multinationals to avoid some of these rules by electing to treat their foreign subsidiaries as if they were not corporations but disregarded entities for tax purposes. This move is called “checking the box” because that is all that needs to be done on IRS form 8832 to make it work and use Irish BEPS tools on non–U.S. revenues was a compromise to keep U.S. multinationals from leaving the U.S. (page 10.)[42]

- ^ Most tax codes in developed countries have capital allowance programs that give tax relief on capital expenditure that is amortised over the life of the capital asset on which the capital was invested in.

- ^ While not stating it explicitly, it is implied in the document, that the location is one where the rate of tax is zero, such as Bermuda or Jersey

- ^ In simple terms, Apple gave its Irish subsidiary a USD 300 billion intergroup loan to buy the intangible assets from the Apple subsidiary in Jersey. Apple in Ireland can charge the interest on this intergroup loan against Irish tax, while the Apple subsidiary in Jersey, who is receiving the loan interest, pays no tax. If a rate of circa 7% was used, and the loan runs for 15 years, the full amortisation period of the CAIA, that will add another USD 315 billion in Irish tax relief from loan interest charges paid to Jersey

- ^ a b c d When the Irish State applied a cap of 80% on the total amount of Irish intangible capital allowances that can be used against taxable profits in any year, it gave an Irish effective tax rate ("ETR") of 2.5%, being the Irish corporation tax rate of 12.5% multiplied by 20%. Therefore, the ETR of the CAIA is often described as being 0-2.5%, depending on the Irish State rules regarding caps. During Apple's creation of an Irish CAIA BEPS tool in 2015, the CAIA cap was temporarily lifted to 100% (e.g. the ETR was 0%).[91]

- ^ For CAIA plans after 13 February 2013; before 13 February 2013, it is 10 years

- ^ a b c Arthur Cox is Ireland's largest law firm,[93] Matheson describes itself as the Irish law firm with the largest tax practice group, and Maples and Calder is the world's largest offshore magic circle law firm

- ^ a b The TCJA's GILTI tax regime, which acts like an international alternative minimum tax for IP–heavy U.S. multinationals, has led some to qualify the new U.S. TCJA system as a hybrid–"territorial" system.[139]

- ^ Close to 0% for the Double Irish and Single Malt BEPS tools; 0–2.5% for the CAIA BEPS tool depending on whether the cap on capital allowances was 80% or 100% when the tool was started

- ^ Desai had written several major academic papers on tax havens with James R. Hines Jr., including the second most cited academic paper on tax havens, The demand for tax haven operations (2006).[121]

References

- ^ Adrian Weckler (29 November 2017). "Facebook paid just €30m tax in Ireland despite earning €12bn". Irish Independent.

- ^ David Ingram (18 April 2018). "Exclusive: Facebook to put 1.5 billion users out of reach of new EU privacy law". Reuters.

- ^ Simon Bowers (4 November 2016). "Google pays €47m in tax in Ireland on €22bn sales revenue". The Guardian.

- ^ "Google booked 41% of global revenues in Ireland in 2012; A leprechaun's gold?". Finfacts.ie. 30 September 2013.

- ^ a b "Dáil Éireann debate - Thursday, 23 Nov 2017". House of the Oireachtas. 23 November 2017.

Pearse Doherty: It was interesting that when [MEP] Matt Carthy put that to the Minister's predecessor (Michael Noonan), his response was that this was very unpatriotic and he should wear the green jersey. That was the former Minister's response to the fact there is a major loophole, whether intentional or unintentional, in our tax code that has allowed large companies to continue to use the Double Irish [called Single Malt].

- ^ Authur Beesley (31 January 2018). "Ireland enjoys tax boom but fears a reckoning: Dublin concerned about reliance on revenue from small group of multinational companies". Financial Times.

- ^ a b c d e Dhammika Dharmapala (2014). "What Do We Know About Base Erosion and Profit Shifting? A Review of the Empirical Literature". University of Chicago. p. 1.

It focuses particularly on the dominant approach within the economics literature on income shifting, which dates back to Hines and Rice (1994) and which we refer to as the "Hines–Rice" approach.

- ^ Clemens Fuest; Christoph Spengel; Katharina Finke; Jost Heckemeyer; Hannah Nusser (15 October 2013). "Profit Shifting and "Aggressive" Tax Planning by Multinational Firms" (PDF). Centre for European Economic Research, (ZEW).

- ^ "Intellectual Property Tax Planning in the light of Base Erosion and Profit Shifting". University of Tilburg. June 2017.

- ^ "Revenue: Double Taxation Treaties". Revenue Commissioners. 3 September 2018.

- ^ "Intellectual Property Law Solutions to Tax Avoidance" (PDF). UCLA Law Review. 2015. p. 4.

Intellectual property (IP) has become the leading tax avoidance vehicle

- ^ a b c d "European Commission - PRESS RELEASES - Press release - State aid: Ireland gave illegal tax benefits to Apple worth up to €13 billion". europa.eu. EU Commission. 30 August 2016. Retrieved 14 November 2016.

This selective treatment allowed Apple to pay an effective corporate tax rate of 1 per cent on its European profits in 2003 down to 0.005 per cent in 2014.

- ^ Jesse Drucker (23 October 2013). "Ireland: Where Profits Pile Up, Helping Multinationals Keep Taxes Low". Bloomberg.

- ^ a b c d Gabriel Zucman; Thomas Torslov; Ludvig Wier (June 2018). "The Missing Profits of Nations". National Bureau of Economic Research, Working Papers. p. 31.

Table 2: Shifted Profits: Country-by-Country Estimates (2015)

- ^ Eric Cederwall (15 March 2015). "Making Sense of Profit Shifting: Edward Kleinbard". Tax Foundation.

We also know that the cash component of that is about $1 trillion. Therefore, we know from this that we're not talking simply about foreign investment in real foreign assets because somewhere in the neighborhood of $1 trillion is in cash and cash equivalents

- ^ David Cogman; Tim Koller (June 2017). "The real story behind U.S. companies' offshore cash reserves". McKinsey & Company.

By our reckoning, the 500 largest U.S. nonfinancial companies have now accumulated around $1 trillion more than their businesses need. The majority of this is held offshore, in non-U.S. overseas subsidiaries, to avoid the incremental U.S. income taxes they would pay if they repatriated the money under current U.S. laws

- ^ Jill Treanor (20 May 2016). "U.S. corporate giants hoarding more than a trillion dollars". The Guardian.

Earlier this year, anti-poverty charity Oxfam had estimated U.S. companies had $1.4tn in subsidiaries based offshore, while the $1.68tn that Moody's estimates is being stashed by U.S. companies is a sum equivalent to the size of the Canadian economy

- ^ a b RANA FOROOHAR (30 August 2016). "Apple vs the EU is the biggest tax battle in history". Time Magazine.

Ever hear of a Double Irish? It's not a drink, but one of the dodgy tax strategies that help American companies keep their profits nearly tax free abroad. Such strategies are at the heart of what may well turn out to be the most important corporate tax case in history

- ^ a b c d e Duhigg, Charles; Kocieniewski, David (28 April 2012). "How Apple Sidesteps Billions in Global Taxes". New York Times. Retrieved 22 March 2018.

In the late 1980s, Apple was among the pioneers in creating a tax structure – known as the Double Irish – that allowed the company to move profits into tax havens around the world ...

{{cite news}}: Cite has empty unknown parameter:|coauthors=(help) - ^ a b c Jesse Drucker (28 October 2013). "Man Making Ireland Tax Avoidance Hub Proves Local Hero". Bloomberg News.

The grand architect of much of that success: Feargal O'Rourke, the scion of a political dynasty who heads the tax practice in PriceWaterhouseCoopers in Ireland

- ^ Fiona Reddan (8 May 2015). "Scion of a prominent political dynasty who gave his vote to accountancy". Irish Times.

- ^ a b c Jesse Drucker (3 November 2013). "Controversial tax strategies brainchild of O'Rourke's son". Irish Independent.

- ^ "Feargal O'Rourke Turning Ireland Into 'A Global Tax-Avoidance Hub'". Broadsheet Ireland. 29 October 2013.

- ^ Edward Kleinbard. "Stateless Income". Florida Tax Review. 11 (9): 699–744.

- ^ "FISCAL MONITOR: Taxing Times". International Monetary Fund. October 2013. p. 47.

Figure 5.1 The Double Irish

- ^ Vanessa Houlder (9 October 2014). "What is the Double Irish". The Financial Times.

- ^ a b c d Rodger Royse (1 November 2013). "Double Irish Tax Sandwich". Rose Law.

- ^ a b c Anthony Ting (October 2014). "Ireland's move to close the 'Double Irish' tax loophole unlikely to bother Apple, Google". The Guardian and University of Sydney.

- ^ "Taxation Guide to Investing in Ireland" (PDF). A&L Goodbody. June 2016.

- ^ "'Dutch Sandwich' saves Google and many other U.S. companies billions in taxes". MSNBC. 22 October 2010.

- ^ a b c "'Double Irish' and 'Dutch Sandwich' saved Google $3.7bn in tax in 2016". Irish Times. 2 January 2018.

- ^ "Treatment of Certain Patent Royalties Paid to Companies Resident Outside the State (e-brief 55/10)". Irish Revenue. June 2010.

- ^ "Ireland Expands Withholding Tax Exemption On Royalties". Mason Hayes Curran Law Firm. August 2010.

- ^ "Withhold No More - Outbound Patent Royalties Can Be Paid Gross". Matheson (law firm). June 2011.

- ^ a b "IDEAS/RePEc Database". Federal Reserve Bank of St. Louis.

Tax Havens by Most Cited

- ^ a b "TAX CUTS AND JOBS ACT OF 2017 Corporate Tax Reform and Wages: Theory and Evidence" (PDF). Council of Economic Advisors. 17 October 2017.

[In the Whitehouse advocating for the TCJA] Applying Hines and Rice's (1994) findings to a statutory corporate rate reduction of 15 percentage points (from 35 to 20 percent) suggests that reduced profit shifting would result in more than $140 billion of repatriated profit based on 2016 numbers.

- ^ a b c James R. Hines Jr.; Eric M. Rice (February 1994). "FISCAL PARADISE: FOREIGN TAX HAVENS AND AMERICAN BUSINESS" (PDF). Quarterly Journal of Economics (Harvard/MIT). 9 (1).

Together the seven tax havens with populations greater than one million (Hong Kong, Ireland, Liberia, Lebanon, Panama, Singapore, and Switzerland) account for 80 percent of total tax haven population and 89 percent of tax haven GDP

- ^ "INTERNATIONAL TAXATION: Large U.S. Corporations and Federal Contractors with Subsidiaries in Jurisdictions Listed as Tax Havens or Financial Privacy Jurisdictions" (PDF). U.S. GAO. 18 December 2008. p. 12.

Table 1: Jurisdictions Listed as Tax Havens or Financial Privacy Jurisdictions and the Sources of Those Jurisdictions

- ^ a b Alex Barker; Vincent Boland; Vanessa Houlder (October 2014). "Brussels in crackdown on 'Double Irish' tax loophole". The Financial Times.

Brussels is challenging the "Double Irish" tax avoidance measure prized by big U.S. tech and pharma groups, putting pressure on Dublin to close it down or face a full-blown investigation. [..] The initial enquiries have signalled that Brussels wants Dublin to call time on the tax gambit, which has helped Ireland become a hub for American tech and pharma giants operating in Europe.

- ^ a b James R. Hines Jr. (2010). "Treasure Islands". Journal of Economic Perspectives. 4 (24): 103–125.

Table 1: 52 Tax Havens

- ^ a b Scott Dyreng; Bradley P. Lindsey (12 October 2009). "Using Financial Accounting Data to Examine the Effect of Foreign Operations Located in Tax Havens and Other Countries on U.S. Multinational Firms' Tax Rates". Journal of Accounting Research.

Finally, we find that U.S. firms with operations in some tax haven countries have higher federal tax rates on foreign income than other firms. This result suggests that in some cases, tax haven operations may increase U.S. tax collections at the expense of foreign country tax collections.

- ^ a b c d Gabriel Zucman; Thomas Wright (September 2018). "THE EXORBITANT TAX PRIVILEGE" (PDF). National Bureau of Economic Research: 11.

U.S. multinationals use tax havens more than multinationals from other countries which have kept their controlled foreign corporations regulations. No other non-haven OECD country records as high a share of foreign profits booked in tax havens as the United States. [...] This suggests that half of all the global profits shifted to tax havens are shifted by U.S. multinationals

{{cite journal}}: Cite journal requires|journal=(help) - ^ James K. Jackson (11 March 2010). "The OECD Initiative on Tax Havens" (PDF). Congressional Research Service. p. 7.

As a result of the Bush Administration's efforts, the OECD backed away from its efforts to target "harmful tax practices" and shifted the scope of its efforts to improving exchanges of tax information between member countries.

- ^ "Treasury Official Explains Why U.S. Didn't Sign OECD Super-Treaty". Bloomberg BNA. 8 June 2017.

The U.S. didn't sign the groundbreaking tax treaty inked by 68 [later 70] countries in Paris June 7 [2017] because the U.S. tax treaty network has a low degree of exposure to base erosion and profit shifting issues", a U.S. Department of Treasury official said at a transfer pricing conference co-sponsored by Bloomberg BNA and Baker McKenzie in Washington

- ^ "International Tax Advisory: Impact of the Multilateral Instrument on U.S. Taxpayers: Why Didn't the United States Choose to Sign the MLI?". Alston & Bird. 14 July 2014.

- ^ a b c "Half of U.S. foreign profits booked in tax havens, especially Ireland: NBER paper". The Japan Times. 10 September 2018.

"Ireland solidifies its position as the #1 tax haven," Zucman said on Twitter. "U.S. firms book more profits in Ireland than in China, Japan, Germany, France & Mexico combined. Irish tax rate: 5.7%."

{{cite web}}: Italic or bold markup not allowed in:|publisher=(help) - ^ a b c "Ireland is the world's biggest corporate 'tax haven', say academics". Irish Times. 13 June 2018.

Study claims State shelters more multinational profits than the entire Caribbean

- ^ a b c "Zucman:Corporations Push Profits Into Corporate Tax Havens as Countries Struggle in Pursuit, Gabrial Zucman Study Says". Wall Street Journal. 10 June 2018.

Such profit shifting leads to a total annual revenue loss of $200 billion globally

- ^ "Quarter of Irish economic growth due to Apple's iPhone, says IMF". RTE News. 17 April 2018.

- ^ "iPhone exports accounted for quarter of Irish economic growth in 2017 - IMF". Irish Times. 17 April 2018.

- ^ Levin, Carl; McCain, John (May 2013), Memorandum: Offshore profit shifting and the U.S. tax code - Part 2 (Apple Inc.) (memorandum of the Permanent Subcommittee on Investigations), archived from the original (PDF) on 29 June 2013, retrieved 27 June 2013

{{citation}}: Unknown parameter|deadurl=ignored (|url-status=suggested) (help) - ^ a b "Senate Probe Finds Apple Used Unusual Tax Structure to Avoid Taxes". Reuters. Retrieved 20 May 2013.

- ^ a b c Jesse Drucker; Simon Bowers (6 November 2017). "After a Tax Crackdown, Apple Found a New Shelter for Its Profits". New York Times.

- ^ "Apple's cash mountain, how it avoids tax, and the Irish link". Irish Times. 6 November 2017.

Explanatory video from the International Consortium of Investigative Journalists

- ^ a b "COMMISSION DECISION of 30.8.2016 on STATE AID SA. 38373 (2014/C) (ex 2014/NN) (ex 2014/CP) implemented by Ireland to Apple" (PDF). EU Commission. 30 August 2016.

Brussels. 30.8.2016 C(2016) 5605 final. Total Pages (130)

- ^ Cliff Taylor. "Apple's Irish company structure key to EU tax finding". Irish Times. Retrieved 2 September 2016.

- ^ Rita Barrera; Jessica Bustamante (2 August 2017). "The Rotten Apple: Tax Avoidance in Ireland". The International Trade Journal.

- ^ a b Colm Kelpie (30 October 2013). "Days of 'Double Irish' tax scheme are numbered, says PwC's O'Rourke". The Irish Times.

However, Mr O'Rourke, who is also a cousin of the late Finance Minister Brian Lenihan, told Bloomberg that changes in Ireland and across the globe on tax was inevitable. Mr O'Rourke was also a member of the Government's Commission on Taxation, which sat in 2008 and 2009.

- ^ a b JEFFREY L. RUBINGER; SUMMER AYERS LEPREE (23 October 2014). "Death of the "Double Irish Dutch Sandwich"? Not so Fast". Taxes Without Borders.

- ^ Sarah McCabe (9 November 2014). "Multinationals replacing 'Double Irish' with new tax avoidance scheme". Irish Independent.

Another sophisticated loophole in the tax system means the removal of the "Double Irish" tax-avoidance strategy won't actually have any real impact for U.S. firms in Ireland seeking to lower their tax bills. An influential U.S. tax journal has found that the Irish subsidiaries of U.S. companies can easily opt to use another loophole, known as the "check the box" rule, to enjoy the same tax benefits created by the Double Irish.

- ^ a b c d e Peter Hamilton (26 September 2018). "Ireland's 'Single Malt' still aiding tax avoidance". The Irish Times.

Prior to opening a Single Malt structure, Teleflex operated a Double Irish tax structure, according to Christian Aid. "Since Teleflex set up its Double Irish structure, through this and [presumably] other tax strategies its global effective tax rate has dropped to just over 3 per cent," the NGO flagged.

- ^ a b c d e Mike Lewis (November 2017). "'Impossible' structures: tax outcomes overlooked by the 2015 tax Spillover analysis" (PDF). Christian Aid.

- ^ "Multinationals replacing 'Double Irish' with new tax avoidance scheme". RTE News. 14 November 2017.

- ^ "How often is the 'Single Malt' tax loophole used? The government is finding out". TheJournal.ie. 15 November 2017.

- ^ Jack Power (10 November 2017). "Ireland resists closing corporation tax 'loophole'". The Irish Times.

Global legal firm Baker McKenzie representing a coalition of 24 multinational U.S. software firms, including Microsoft, lobbied Michael Noonan, as [Irish] minister for finance, to resist the [OECD MLI] proposals in January 2017. In a letter to him, the group recommended Ireland not adopt article 12, as the changes "will have effects lasting decades" and could "hamper global investment and growth due to uncertainty around taxation". The letter said that "keeping the current standard will make Ireland a more attractive location for a regional headquarters by reducing the level of uncertainty in the tax relationship with Ireland's trading partners".

- ^ Suzanne Lynch (14 November 2017). "Paschal Donohoe says Government will examine 'Single Malt' loophole". The Irish Times.

- ^ Cantillion (16 November 2017). "Three years of silence on 'Single Malt' tax loophole raises questions". Irish Times.

- ^ "Intellectual Property Tax". KPMG. 4 December 2017.

- ^ a b Martin Brehm Christensen; Emma Clancy (21 June 2018). "Apple's Irish Tax Deals". European United Left–Nordic Green Left EU Parliament.

- ^ a b c d e f g "Uses of Ireland for German Companies: Irish "Intellectual Property" Tax of 2.5% ETR" (PDF). Arthur Cox Law Firm. January 2012. p. 3.

Intellectual Property: The effective corporation tax rate can be reduced to as low as 2.5% for Irish companies whose trade involves the exploitation of intellectual property. The Irish IP regime is broad and applies to all types of IP. A generous scheme of capital allowances in Ireland offers significant incentives to companies who locate their activities in Ireland. A well-known global company [Accenture in 2009] recently moved the ownership and exploitation of an IP portfolio worth approximately $7 billion to Ireland

- ^ a b c d "World IP Day: IRELAND'S 2.5% IP Tax Rate (Section 4.1.1)". Mason Hayes and Curran (Law Firm). April 2013.

When combined with other features of Ireland's IP tax regime, an effective rate as low as 2.5% can be achieved on IP related income

- ^ a b c d e f g "Ireland as a Location for Your Intellectual Property Trading Company" (PDF). Arthur Cox Law. April 2015.

- ^ a b Adjunct Professor Jim Stewart (2016). "MNE Tax Strategies in Ireland" (PDF). Trinity College Dublin.

- ^ "Commission on Taxation report 2009". UCD Archives. September 2009.

- ^ "Commission on Taxation Report Ireland 2009: Proposed property tax, a carbon tax, and domestic water charges as part of overhaul of Irish tax system". FinFacts. 7 September 2009.

- ^ "Corporate Taxation in Ireland 2016" (PDF). Industrial Development Authority (IDA). 2018.

- ^ a b c "Intangible Assets Scheme under Section 291A Taxes Consolidation Act 1997" (PDF). Irish Revenue. 2010.

- ^ a b c "Capital Allowances for Intangible Assets under section 291A of the Taxes Consolidation Act 1997 (Part 9 / Chapter2)" (PDF). Irish Revenue. February 2018.

- ^ "Capital Allowances for Intangible Assets "Specified Assets"". Irish Revenue. September 2017.

- ^ "Ireland's Tax Regime for Investing in Intellectual Property" (PDF). FGS Partnership. June 2011.

- ^ "Ireland's Intellectual Property Regime". BDO Ireland. October 2016.

- ^ "Base Erosion and Profit Shifting (BEPS) tax diagnostic toolkit". PriceWaterhouseCoopers. 2016.

- ^ a b "Department of Finance Tax Strategy Group: Irish Corporate Taxation" (PDF). 10 June 2011. p. 5.

(23-26) Tax relief for acquisition of intangible assets: A number of amendments to the scheme were made in Finance Act 2010 on foot, among other reasons, of the recommendations of the Innovation Taskforce Report. (1) The period in which a specified intangible asset must be used in the trade to avoid a clawback of allowances was reduced from 15 years to 10 years. (2) The list of specified intangible assets covered by the scheme was augmented by the inclusion of applications for the grant or registration of patents, copyright etc. and a broader definition of "know-how". (3) Relief will now be available for capital expenditure incurred prior to the commencement of a trade on the provision of specified intangible assets for the purposes of the trade.

- ^ a b "Department of Finance Tax Strategy Group: Irish Corporate Taxation" (PDF). 19 November 2012. p. 7.

2.2 Tax Relief for Acquisition of Intangible Assets: A scheme of tax relief for the acquisition of specified intangible assets was announced in the 2009 Supplementary Budget and introduced in Finance Act 2009. This measure was introduced to support the development of the knowledge economy and the provision of high-quality employment

- ^ a b c John Ryan; Alan Connell (March 2013). "Ireland as a European gateway jurisdiction for China – outbound and inbound investments" (PDF). Matheson (law firm).

The tax deduction can be used to achieve an effective tax rate of 2.5% on profits from the exploitation of the IP purchased. Provided the IP is held for five years, a subsequent disposal of the IP will not result in a clawback.

- ^ "Irish Revenue Note for Guidance on Intangible Assets". Chartered Accountants of Ireland. 2016.

- ^ a b c Vincent Ryan (24 January 2012). "Firm gets tax relief on $7bn rights: Accenture". Irish Examiner.

Multinational management consultancy Accenture is receiving tax relief on the $7bn (€5.4bn) it spent building up a portfolio of intellectual property rights. [...] The Arthur Cox document, 'Uses of Ireland for German Companies', states: "A well-known global company recently moved the ownership and exploitation of an intellectual property portfolio worth approximately $7bn to Ireland."

- ^ a b c "Tracking Tax Runaways". Bloomberg News. 1 March 2017.

Bloomberg Special Reports: Corporate Tax Inversions

- ^ Emily Stewart (22 July 2017). "As Treasury Moves to Bring Back Inversions, Here are 7 of the Biggest Recent Deals". TheStreet.

- ^ a b c d "Maples and Calder Irish Intellectual Property Tax Regime - 2.5% Effective Tax". Maples and Calder Law Firm. February 2018.