Digital currency: Difference between revisions

No edit summary Tags: references removed Visual edit |

ClueBot NG (talk | contribs) m Reverting possible vandalism by Flora Cox to version by KolbertBot. Report False Positive? Thanks, ClueBot NG. (3412026) (Bot) |

||

| Line 1: | Line 1: | ||

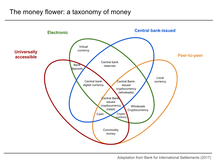

[[File:Money flower.png|thumb|Taxonomy of money, |

[[File:Money flower.png|thumb|Taxonomy of money, based on "Central bank cryptocurrencies" by Morten Linnemann Bech and Rodney Garratt]] |

||

| ⚫ | |||

| ⚫ | |||

{{redirect|E-cash|the 20th century brand|ecash}} |

{{redirect|E-cash|the 20th century brand|ecash}} |

||

'''Digital currency''' ('''digital money''' |

'''Digital currency''' ('''digital money''' or '''electronic money''' or '''electronic currency''') is a type of [[currency]] available only in digital form, not in physical (such as [[banknote]]s and [[coin]]s). It exhibits properties similar to physical currencies, but allows for instantaneous transactions and borderless transfer-of-ownership. Examples include [[Virtual currency|virtual currencies]] and [[Cryptocurrency|cryptocurrencies]]<ref>{{cite web|title=Digital vs. Virtual Currencies|url=http://bitcoinmagazine.com/15862/digital-vs-virtual-currencies/|publisher=Andrew Wagner|accessdate=1 December 2014}}</ref> or even [[central bank]] issued "[[digital base money]]". Like traditional [[money]], these currencies may be used to buy physical [[goods]] and [[Service (economics)|services]], but may also be restricted to certain communities such as for use inside an online game or social network.<ref>{{cite web|title=What is bitcoin?|url=http://www.coindesk.com/information/what-is-bitcoin/|publisher=CoinDesk|accessdate=24 January 2014}}</ref> |

||

Digital currency is a money balance recorded electronically on a [[stored-value card]] or other device. Another form of electronic money is network money, allowing the transfer of value on [[computer networks]], particularly the [[Internet]]. Electronic money is also a claim on a private [[bank]] or other financial institution such as [[bank deposits]].<ref>{{Cite journal|last=Al-Laham, Al-Tarawneh, Abdallat|first=|date=2009|title=Development of Electronic Money and Its Impact on the Central Bank Role and Monetary Policy|url=http://iisit.org/Vol6/IISITv6p339-349Al-Laham589.pdf|journal=|doi=|pmid=|access-date=}}</ref> |

|||

La moneta digitale e' un bilancio monetario registrato elettronicamente in una carta digitale o altri supporti. Un'altra forma di denaro elettronico e' il network money che permette il trasferimento di valuta su reti di computers particolarmente via internet. |

|||

Digital money can either be centralized, where there is a central point of control over the money supply, or [[Decentralization|decentralized]], where the control over the money supply can come from various sources. |

|||

La moneta digitale puo' anche essere centralizzata, quando vi e' un punto centrale di controllo sulla produzione del denaro, oppure decentralizzata, quando il controllo sulla produzione della criptovaluta proviene da varie fonti. |

|||

== |

==History== |

||

In 1983, a research paper by [[David Chaum]] introduced the idea of digital cash.<ref>{{Cite web|url=http://blog.koehntopp.de/uploads/Chaum.BlindSigForPayment.1982.PDF|title=Blind signatures for untraceable payments|last=Chaum|first=David|date=1982|website=|publisher=Department of Computer Science, University of California, Santa Barbara, CA}}</ref> In 1990, he founded [[DigiCash]], an electronic cash company, in Amsterdam to commercialize the ideas in his research.<ref name=":0">{{Cite news|url=https://bitcoinmagazine.com/12241/quick-history-cryptocurrencies-bbtc-bitcoin/|title=A Quick History of Cryptocurrencies BBTC — Before Bitcoin|last=Griffith|first=Ken|date=April 16, 2014|work=[[Bitcoin Magazine]]|via=|accessdate=18 April 2015}}</ref> It filed for bankruptcy in 1998.<ref>{{Cite news|url=http://news.cnet.com/2100-1001-217527.html|title=Digicash files Chapter 11|last=|first=|date=|work=|access-date=|via=}}</ref><ref>{{Cite web|url=https://www.forbes.com/forbes/1999/1101/6411390a.html|title=Requiem for a Bright Idea|last=|first=|date=|website=|publisher=|accessdate=}}</ref> In 1999, Chaum left the company. |

|||

In 1997, Coca-Cola offered buying from vending machines using mobile payments.<ref>{{Cite web|url=http://www.nearfieldcommunication.org/payment-systems.html|title=History of Mobile & Contactless Payment Systems|last=|first=|date=|website=|publisher=|accessdate=}}</ref> After that [[PayPal]] emerged in 1998.<ref>{{Cite news|url=https://bitcoinmagazine.com/15862/digital-vs-virtual-currencies/|title=Digital vs Virtual currencies|last=|first=|date=|work=|access-date=|via=}}</ref> Other system such as [[e-gold]] followed suit, but faced issues because it was used by criminals and was closed by U.S Department of Justice in 2005.<ref name="FT11282013">{{cite news|last1=Foley|first1=Stephen|title=E-gold founder backs new Bitcoin rival|url=https://www.ft.com/content/f7488616-561a-11e3-96f5-00144feabdc0|accessdate=May 11, 2018|publisher=Financial Times|date=November 28, 2013}}</ref><ref name=":0" /> In 2008, [[bitcoin]] was introduced, which marked the start of digital currencies.<ref name=":0" /> |

|||

Origins of digital currencies date back to the 1990s [[Dot-com bubble]]. One of the first was [[E-gold]], founded in 1996 and backed by gold. Another known digital currency service was [[Liberty Reserve]], founded in 2006; it let users convert dollars or euros to Liberty Reserve Dollars or Euros, and exchange them freely with one another at a 1% fee. Both services were centralized, reputed to be used for money laundering, and inevitably shut down by the U.S. government.<ref>{{cite news |title='Black Market Bank' Accused of Laundering $6B in Criminal Proceeds|author=Jack Cloherty |date=28 May 2013 |work=[[ABC News]] |url=http://abcnews.go.com/US/black-market-bank-accused-laundering-6b-criminal-proceeds/story?id=19275887 |accessdate=28 May 2013}}</ref> Q coins or QQ coins, were used as a type of commodity-based digital currency on [[Tencent QQ]]'s messaging platform and emerged in early 2005. Q coins were so effective in China that they were said to have had a destabilizing effect on the Chinese Yuan currency due to speculation.<ref>{{cite news|title='China's virtual currency threatens the Yuan' |date=5 December 2006 |work=Asia Times Online |url=http://www.atimes.com/atimes/China_Business/HL05Cb01.html |accessdate=14 May 2016}}</ref> Recent interest in [[Cryptocurrency|cryptocurrencies]] has prompted renewed interest in digital currencies, with [[bitcoin]], introduced in 2008, becoming the most widely used and accepted digital currency. |

|||

== |

==Comparisons== |

||

===Digital versus virtual currency=== |

|||

===Moneta digitale e Moneta Virtuale=== |

|||

According to the [[European Central Bank]]'s 2015 "Virtual currency schemes – a further analysis" report, virtual currency is a digital representation of value, not issued by a central bank, credit institution or e-money institution, which, in some circumstances, can be used as an alternative to money.<ref>{{Cite web|url=https://www.ecb.europa.eu/pub/pdf/other/virtualcurrencyschemesen.pdf|title=Virtual currency schemes - a further analysis|last=|first=|date=February 2015|website=ecb.europa.eu|archive-url=|archive-date=|dead-url=|access-date=1 February 2018}}</ref> In the previous report of October 2012, the virtual currency was defined as a type of unregulated, digital money, which is issued and usually controlled by its developers, and used and accepted among the members of a specific virtual community.<ref name=":2" /> |

|||

According to the [[Bank for International Settlements]]' November 2015 "Digital currencies" report, it is an asset represented in digital form and having some monetary characteristics.<ref>{{Cite web|url=https://www.bis.org/cpmi/publ/d137.pdf|title=Digital Currencies|last=|first=|date=November 2015|website=bis.org|archive-url=|archive-date=|dead-url=|access-date=1 February 2018}}</ref> Digital currency can be denominated to a sovereign currency and issued by the issuer responsible to redeem digital money for cash. In that case, digital currency represents electronic money (e-money). Digital currency denominated in its own units of value or with decentralized or automatic issuance will be considered as a virtual currency. |

|||

As such, bitcoin is a digital currency but also a type of virtual currency. Bitcoin and its alternatives are based on cryptographic algorithms, so these kinds of virtual currencies are also called cryptocurrencies. |

|||

In questo modo il bitcoin e' una moneta elettronica ma anche una moneta virtuale. Bitcoin e i suoi simili sono basati su algoritmi criptografici cosi' questo tipo di valute virtuali sono anche chiamate criptovalute. |

|||

===Digital versus traditional currency=== |

|||

===Moneta digitale e moneta tradizionale=== |

|||

Most of the traditional [[money supply]] is [[Demand deposit|bank money]] held on computers. This is also considered digital currency. One could argue that our increasingly cashless society means that all currencies are becoming digital (sometimes referred to as "[[electronic money]]"), but they are not presented to us as such.<ref name="ECB">{{cite book |title=Virtual Currency Schemes |date=October 2012 |publisher=European Central Bank |location=Frankfurt am Main |isbn=978-92-899-0862-7 |page=5 |url=http://www.ecb.europa.eu/pub/pdf/other/virtualcurrencyschemes201210en.pdf |format=PDF |author= |chapter=1 |archiveurl=https://web.archive.org/web/20121106053452/http://www.ecb.europa.eu/pub/pdf/other/virtualcurrencyschemes201210en.pdf |archivedate=6 November 2012 |deadurl=no}}</ref> |

|||

== |

== Types of systems == |

||

=== |

=== Centralized systems === |

||

{{Main|Electronic funds transfer}} |

{{Main|Electronic funds transfer}} |

||

Currency can be exchanged electronically using [[Debit card|debit cards]] and [[Credit card|credit cards]] using [[electronic funds transfer at point of sale]]. |

|||

La valuta puo' essere scambiata elettronicamente usando le carte di credito collegate ad un conto bancario di riferimento o il bancomat oppure le carte di debito che sono collegate a un fondo garantito da una finanziaria. |

|||

==== Mobile digital wallets ==== |

==== Mobile digital wallets ==== |

||

Revision as of 11:38, 20 June 2018

Digital currency (digital money or electronic money or electronic currency) is a type of currency available only in digital form, not in physical (such as banknotes and coins). It exhibits properties similar to physical currencies, but allows for instantaneous transactions and borderless transfer-of-ownership. Examples include virtual currencies and cryptocurrencies[1] or even central bank issued "digital base money". Like traditional money, these currencies may be used to buy physical goods and services, but may also be restricted to certain communities such as for use inside an online game or social network.[2]

Digital currency is a money balance recorded electronically on a stored-value card or other device. Another form of electronic money is network money, allowing the transfer of value on computer networks, particularly the Internet. Electronic money is also a claim on a private bank or other financial institution such as bank deposits.[3]

Digital money can either be centralized, where there is a central point of control over the money supply, or decentralized, where the control over the money supply can come from various sources.

History

In 1983, a research paper by David Chaum introduced the idea of digital cash.[4] In 1990, he founded DigiCash, an electronic cash company, in Amsterdam to commercialize the ideas in his research.[5] It filed for bankruptcy in 1998.[6][7] In 1999, Chaum left the company.

In 1997, Coca-Cola offered buying from vending machines using mobile payments.[8] After that PayPal emerged in 1998.[9] Other system such as e-gold followed suit, but faced issues because it was used by criminals and was closed by U.S Department of Justice in 2005.[10][5] In 2008, bitcoin was introduced, which marked the start of digital currencies.[5]

Origins of digital currencies date back to the 1990s Dot-com bubble. One of the first was E-gold, founded in 1996 and backed by gold. Another known digital currency service was Liberty Reserve, founded in 2006; it let users convert dollars or euros to Liberty Reserve Dollars or Euros, and exchange them freely with one another at a 1% fee. Both services were centralized, reputed to be used for money laundering, and inevitably shut down by the U.S. government.[11] Q coins or QQ coins, were used as a type of commodity-based digital currency on Tencent QQ's messaging platform and emerged in early 2005. Q coins were so effective in China that they were said to have had a destabilizing effect on the Chinese Yuan currency due to speculation.[12] Recent interest in cryptocurrencies has prompted renewed interest in digital currencies, with bitcoin, introduced in 2008, becoming the most widely used and accepted digital currency.

Comparisons

Digital versus virtual currency

According to the European Central Bank's 2015 "Virtual currency schemes – a further analysis" report, virtual currency is a digital representation of value, not issued by a central bank, credit institution or e-money institution, which, in some circumstances, can be used as an alternative to money.[13] In the previous report of October 2012, the virtual currency was defined as a type of unregulated, digital money, which is issued and usually controlled by its developers, and used and accepted among the members of a specific virtual community.[14]

According to the Bank for International Settlements' November 2015 "Digital currencies" report, it is an asset represented in digital form and having some monetary characteristics.[15] Digital currency can be denominated to a sovereign currency and issued by the issuer responsible to redeem digital money for cash. In that case, digital currency represents electronic money (e-money). Digital currency denominated in its own units of value or with decentralized or automatic issuance will be considered as a virtual currency.

As such, bitcoin is a digital currency but also a type of virtual currency. Bitcoin and its alternatives are based on cryptographic algorithms, so these kinds of virtual currencies are also called cryptocurrencies.

Digital versus traditional currency

Most of the traditional money supply is bank money held on computers. This is also considered digital currency. One could argue that our increasingly cashless society means that all currencies are becoming digital (sometimes referred to as "electronic money"), but they are not presented to us as such.[16]

Types of systems

Centralized systems

Currency can be exchanged electronically using debit cards and credit cards using electronic funds transfer at point of sale.

Mobile digital wallets

A number of electronic money systems use contactless payment transfer in order to facilitate easy payment and give the payee more confidence in not letting go of their electronic wallet during the transaction.

- In 1994 Mondex and National Westminster Bank provided an "electronic purse" to residents of Swindon

- In about 2005 Telefónica and BBVA Bank launched a payment system in Spain called Mobipay[17] which used simple short message service facilities of feature phones intended for pay-as you go services including taxis and pre-pay phone recharges via a BBVA current bank account debit.

- In January 2010, Venmo launched as a mobile payment system through SMS, which transformed into a social app where friends can pay each other for minor expenses like a cup of coffee, rent and paying your share of the restaurant bill when you forget your wallet.[18] It is popular with college students, but has some security issues.[19] It can be linked to your bank account, credit/debit card or have a loaded value to limit the amount of loss in case of a security breach. Credit cards and non-major debit cards incur a 3% processing fee.[20]

- On September 19, 2011, Google Wallet released in the United States to make it easy to carry all your credit/debit cards on your phone.[21]

- In 2012 Ireland's O2 (owned by Telefónica) launched Easytrip to pay road tolls which were charged to the mobile phone account or prepay credit.[22]

- The UK's O2 invented O2 Wallet[23] at about the same time. The wallet can be charged with regular bank accounts or cards and discharged by participating retailers using a technique known as 'money messages'. The service closed in 2014.

- On September 9, 2014, Apple Pay was announced at the iPhone 6 event. In October 2014 it was released as an update to work on iPhone 6 and Apple Watch. It is very similar to Google Wallet, but for Apple devices only.[24]

Decentralized systems

A cryptocurrency is a type of digital asset that relies on cryptography for chaining together digital signatures of asset transfers, peer-to-peer networking and decentralization. In some cases a proof-of-work or proof-of-stake scheme is used to create and manage the currency.[25][26][27][28]

Cryptocurrencies allow electronic money systems to be decentralized. The first and most popular system is bitcoin, a peer-to-peer electronic monetary system based on cryptography.

Virtual currency

A virtual currency has been defined in 2012 by the European Central Bank as "a type of unregulated, digital money, which is issued and usually controlled by its developers, and used and accepted among the members of a specific virtual community".[14] The US Department of Treasury in 2013 defined it more tersely as "a medium of exchange that operates like a currency in some environments, but does not have all the attributes of real currency".[29] The key attribute a virtual currency does not have according to these definitions, is the status as legal tender. DigitalCash (DASH) uses a new chained hashing algorithm approach, with many new scientific hashing algorithms for the proof-of-work. DASH aims to be the first privacy-centric cryptographic currency with fully encrypted transactions and anonymous block transactions, this feature is called PrivateSend and can be found on the official Dashcore[30] wallet. DASH`s Market capitalization is about $ 2.070 B[31]

Law

Since 2001, the European Union has implemented the E-Money Directive "on the taking up, pursuit and prudential supervision of the business of electronic money institutions" last amended in 2009.[32] Doubts on the real nature of EU electronic money have arisen, since calls have been made in connection with the 2007 EU Payment Services Directive in favor of merging payment institutions and electronic money institutions. Such a merger could mean that electronic money is of the same nature as bank money or scriptural money.

In the United States, electronic money is governed by Article 4A of the Uniform Commercial Code for wholesale transactions and the Electronic Fund Transfer Act for consumer transactions. Provider's responsibility and consumer's liability are regulated under Regulation E.[33][34]

Regulation

Virtual currencies pose challenges for central banks, financial regulators, departments or ministries of finance, as well as fiscal authorities and statistical authorities.

U.S. Treasury guidance

On March 20, 2013, the Financial Crimes Enforcement Network issued a guidance to clarify how the U.S. Bank Secrecy Act applied to persons creating, exchanging, and transmitting virtual currencies.[35]

Securities and Exchange Commission guidance

In May 2014 the U.S. Securities and Exchange Commission (SEC) "warned about the hazards of bitcoin and other virtual currencies".[36]

New York state regulation

In July 2014, the New York State Department of Financial Services proposed the most comprehensive regulation of virtual currencies to date, commonly called BitLicense.[37] Unlike the US federal regulators it has gathered input from bitcoin supporters and the financial industry through public hearings and a comment period until 21 October 2014 to customize the rules. The proposal per NY DFS press release “sought to strike an appropriate balance that helps protect consumers and root out illegal activity".[38] It has been criticized by smaller companies to favor established institutions, and Chinese bitcoin exchanges have complained that the rules are "overly broad in its application outside the United States".[39]

Adoption by governments

As of 2016, over 24 countries are investing in distributed ledger technologies (DLT) with $1.4bn in investments. In addition, over 90 central banks are engaged in DLT discussions, including implications of a central bank issued digital currency.[40]

- Hong Kong’s Octopus card system: Launched in 1997 as an electronic purse for public transportation, is the most successful and mature implementation of contactless smart cards used for mass transit payments. After only 5 years, 25 percent of Octopus card transactions are unrelated to transit, and accepted by more than 160 merchants.[41]

- London Transport’s Oyster card system: Oyster is a plastic smartcard which can hold pay as you go credit, Travelcards and Bus & Tram season tickets. You can use an Oyster card to travel on bus, Tube, tram, DLR, London Overground and most National Rail services in London.[42]

- Japan’s FeliCa: A contactless RFID smart card, used in a variety of ways such as in ticketing systems for public transportation, e-money, and residence door keys.[43]

- The Netherlands' Chipknip: As an electronic cash system used in the Netherlands, all ATM cards issued by the Dutch banks had value that could be loaded via Chipknip loading stations. For people without a bank, pre-paid Chipknip cards could be purchased at various locations in the Netherlands. As of January 1, 2015, you can no longer pay with Chipknip.[44]

- Belgium's Proton: An electronic purse application for debit cards in Belgium. Introduced in February 1995, as a means to replace cash for small transactions. The system was retired in December 31, 2014.[45]

In March 2018, the Marshall Islands became the first country to issue their own cryptocurrency and certify it as legal tender; the currency is called the "sovereign".[46]

Canada

The Bank of Canada have explored the possibility of creating a version of its currency on the blockchain.[47]

The Bank of Canada teamed up with the nation’s five largest banks — and the blockchain consulting firm R3 — for what was known as Project Jasper. In a simulation run in 2016, the central bank issued CAD-Coins onto a blockchain similar Ethereum.[48] The banks used the CAD-Coins to exchange money the way they do at the end of each day to settle their master accounts.[48]

China

A deputy governor at the central bank of China, Fan Yifei, wrote that "the conditions are ripe for digital currencies, which can reduce operating costs, increase efficiency and enable a wide range of new applications".[48] According to Fan Yifei, the best way to take advantage of the situation is for central banks to take the lead, both in supervising private digital currencies and in developing digital legal tender of their own.[49]

Denmark

The Danish government proposed getting rid of the obligation for selected retailers to accept payment in cash, moving the country closer to a "cashless" economy.[50] The Danish Chamber of Commerce is backing the move.[51] Nearly a third of the Danish population uses MobilePay, a smartphone application for transferring money.[50]

Ecuador

A law passed by the National Assembly of Ecuador gives the government permission to make payments in electronic currency and proposes the creation of a national digital currency. "Electronic money will stimulate the economy; it will be possible to attract more Ecuadorian citizens, especially those who do not have checking or savings accounts and credit cards alone. The electronic currency will be backed by the assets of the Central Bank of Ecuador", the National Assembly said in a statement.[52] In December 2015, Sistema de Dinero Electrónico ("electronic money system") was launched, making Ecuador the first country with a state-run electronic payment system.[53]

Germany

The German central bank is testing a functional prototype for the blockchain technology-based settlement of securities and transfer of centrally-issued digital coins.[54][55]

Netherlands

The Dutch central bank is experimenting with a bitcoin-based virtual currency called “DNBCoin”.[48][56]

India

Unified Payments Interface (UPI) is an instant real-time payment system developed by National Payments Corporation of India facilitating inter-bank transactions. The interface is regulated by the Reserve Bank of India and works by instantly transferring funds between two bank accounts on a mobile platform. UPI is built over Immediate Payment Service(IMPS) for transferring funds. Being a digital payment system it is available 24*7 and across public holidays. Unlike traditional mobile wallets, which takes a specified amount of money from user and stores it in its own accounts, UPI withdraws and deposits funds directly from the bank account whenever a transaction is requested. It uses Virtual Payment Address (a unique ID provided by the bank), Account Number with IFS Code, Mobile Number with MMID (Mobile Money Identifier), Aadhaar Number, or a one-time use Virtual ID. An UPI-PIN (UPI Personal Identification number that one creates on the UPI app of the bank) is required to confirm each payment.

Russia

Government-controlled Sberbank of Russia owns Yandex.Money – electronic payment service and digital currency of the same name.[57] Russia’s President Vladimir Putin has signed off on regulation of ICOs and cryptocurrency mining by July 2018.[58]

South Korea

South Korea plans national digital currency using a Blockchain.[59] The chairman of South Korea’s Financial Services Commission (FSC), Yim Jong-yong, announced that his department will "Lay the systemic groundwork for the spread of digital currency."[59] South Korea has already announced plans to discontinue coins by the year 2020.[60]

Sweden

Sweden is in the process of replacing all of its physical banknotes, and most of its coins by mid 2017. However the new banknotes and coins of the Swedish krona will probably be circulating at about half the 2007 peak of 12,494 kronor per capita. The Riksbank is planning to begin discussions of an electronic currency issued by the central bank to which "is not to replace cash, but to act as complement to it".[61] Deputy Governor Cecilia Skingsley states that cash will continue to spiral out of use in Sweden, and while it is currently fairly easy to get cash in Sweden, it is often very difficult to deposit it into bank accounts, especially in rural areas. No decision has been currently made about the decision to create "e-krona". In her speech Skingsley states: "The first question is whether e-krona should be booked in accounts or whether the ekrona should be some form of digitally transferable unit that does not need an underlying account structure, roughly like cash." Skingsley also states: "Another important question is whether the Riksbank should issue e-krona directly to the general public or go via the banks, as we do now with banknotes and coins." Other questions will be addressed like interest rates, should they be positive, negative, or zero?

Switzerland

In 2016, a city government first accepted digital currency in payment of city fees. Zug, Switzerland, added bitcoin as a means of paying small amounts, up to SFr 200, in a test and an attempt to advance Zug as a region that is advancing future technologies. In order to reduce risk, Zug immediately converts any bitcoin received into the Swiss currency.[62]

Swiss Federal Railways, government-owned railway company of Switzerland, sells bitcoins at its ticket machines.[63][63]

UK

The Chief Scientific Adviser to the UK government advised his Prime Minister and Parliament to consider using a blockchain-based digital currency.[64]

The chief economist of Bank of England, the central bank of the United Kingdom, proposed abolition of paper currency. The Bank has also taken an interest in bitcoin.[48][65] In 2016 it has embarked on a multi-year research programme to explore the implications of a central bank issued digital currency.[40] The Bank of England has produced several research papers on the topic. One suggests that the economic benefits of issuing a digital currency on a distributed ledger could add as much as 3 percent to a country's economic output.[48] The Bank said that it wanted the next version of the bank’s basic software infrastructure to be compatible with distributed ledgers.[48]

Ukraine

The National Bank of Ukraine is considering a creation of its own issuance/turnover/servicing system for a blockchain-based national cryptocurrency.[66] The regulator also announced that blockchain could be a part of a national project called "Cashless Economy".[66]

Hard vs. soft digital currencies

Hard electronic currency does not have the ability to be disputed or reversed when used. It is nearly impossible to reverse a transaction, justified or not. It is very similar to cash. Advantages of this system include it being cheaper to operate, and transactions are instantaneous. Western Union, KlickEx and Bitcoin are examples of this type of currency.[67]

Soft electronic currencies are the opposite of hard electronic currencies. Payments can be reversed. Usually when a payment is reversed there is a "clearing time." This can take 72 hours or more. Examples of soft currencies are PayPal and any type of credit card. A hard currency can be "softened" with a third party service.[67]

Criticism

Many of existing digital currencies have not yet seen widespread usage, and may not be easily used or exchanged. Banks generally do not accept or offer services for them.[68] There are concerns that cryptocurrencies are extremely risky due to their very high volatility[69] and potential for pump and dump schemes.[70] Regulators in several countries have warned against their use and some have taken concrete regulatory measures to dissuade users.[71] The non-cryptocurrencies are all centralized. As such, they may be shut down or seized by a government at any time.[72] The more anonymous a currency is, the more attractive it is to criminals, regardless of the intentions of its creators.[72] Forbes writer Tim Worstall has written that the value of bitcoin is largely derived from speculative trading.[73] Bitcoin has also been criticised for its energy inefficient SHA-256-based proof of work.[74]

List

See also

- Central bank digital currency

- Alternative currency

- Local exchange trading system

- Cashless society

- Digital currency exchanger

- Private currency

- Automated Clearing House

- Cashless catering

- Community Exchange System

- Digital wallet

- Cryptocurrency wallet

- E-commerce payment system

- Electronic Money Association

- Electronic Payment System

- Payment system

References

- ^ "Digital vs. Virtual Currencies". Andrew Wagner. Retrieved 1 December 2014.

- ^ "What is bitcoin?". CoinDesk. Retrieved 24 January 2014.

- ^ Al-Laham, Al-Tarawneh, Abdallat (2009). "Development of Electronic Money and Its Impact on the Central Bank Role and Monetary Policy" (PDF).

{{cite journal}}: Cite journal requires|journal=(help)CS1 maint: multiple names: authors list (link) - ^ Chaum, David (1982). "Blind signatures for untraceable payments" (PDF). Department of Computer Science, University of California, Santa Barbara, CA.

- ^ a b c Griffith, Ken (16 April 2014). "A Quick History of Cryptocurrencies BBTC — Before Bitcoin". Bitcoin Magazine. Retrieved 18 April 2015.

- ^ "Digicash files Chapter 11".

- ^ "Requiem for a Bright Idea".

- ^ "History of Mobile & Contactless Payment Systems".

- ^ "Digital vs Virtual currencies".

- ^ Foley, Stephen (28 November 2013). "E-gold founder backs new Bitcoin rival". Financial Times. Retrieved 11 May 2018.

- ^ Jack Cloherty (28 May 2013). "'Black Market Bank' Accused of Laundering $6B in Criminal Proceeds". ABC News. Retrieved 28 May 2013.

- ^ "'China's virtual currency threatens the Yuan'". Asia Times Online. 5 December 2006. Retrieved 14 May 2016.

- ^ "Virtual currency schemes - a further analysis" (PDF). ecb.europa.eu. February 2015. Retrieved 1 February 2018.

{{cite web}}: Cite has empty unknown parameter:|dead-url=(help) - ^ a b "Virtual Currency Schemes" (PDF). ecb.europa.eu. October 2012. Retrieved 1 February 2018.

{{cite web}}: Cite has empty unknown parameter:|dead-url=(help) - ^ "Digital Currencies" (PDF). bis.org. November 2015. Retrieved 1 February 2018.

{{cite web}}: Cite has empty unknown parameter:|dead-url=(help) - ^ "1". Virtual Currency Schemes (PDF). Frankfurt am Main: European Central Bank. October 2012. p. 5. ISBN 978-92-899-0862-7. Archived from the original (PDF) on 6 November 2012.

{{cite book}}: Unknown parameter|deadurl=ignored (|url-status=suggested) (help) - ^ "Mobipay - Fujitsu Spain".

- ^ "Origins of Venmo". Retrieved 23 April 2015.

- ^ "Venmo Money, Venmo Problems".

- ^ "Venmo pricing".

- ^ "This Day in Tech: Google Wallet launches". 19 September 2011.

- ^ "Easytrip, O2 launch mobile toll payments service in the Republic of Ireland".

- ^ "O2 - O2 money - The O2 Wallet service closed on 31st March 2014".

- ^ "Apple Watch works with Apple Pay to replace your credit cards". 9 September 2014.

- ^ Wary of Bitcoin? A guide to some other cryptocurrencies, ars technica, 26-05-2013

- ^ What does Cryptocurrency mean?, technopedia, 01-07-2013

- ^ From your wallet to Google Wallet: your digital payment options, The Conversation, 26-05-2013

- ^ Liu, Alec. "Beyond Bitcoin: A Guide to the Most Promising Cryptocurrencies". Vice Motherboard. Retrieved 7 January 2014.

- ^ "Audit Report" (PDF). Treasury.gov. 10 November 2015. Retrieved 1 February 2018.

{{cite web}}: Cite has empty unknown parameter:|dead-url=(help) - ^ "Official Dash Core Wallet".

{{cite web}}: Cite has empty unknown parameter:|dead-url=(help) - ^ "Mkt. Cap of DigitalCash". CoinMarket.to. 18 June 2018.

{{cite web}}: Cite has empty unknown parameter:|dead-url=(help) - ^ "Directive 2009/110/EC of the European Parliament and of the Council of 16 September 2009 on the taking up, pursuit and prudential supervision of the business of electronic money institutions amending Directives 2005/60/EC and 2006/48/EC and repealing Directive 2000/46/EC, Official Journal L 267, 10/10/2009 P. 0007 - 0017". Retrieved 30 December 2013.

- ^ "ELECTRONIC FUND TRANSFER ACT (REGULATION E)" (PDF). Federal Deposit Insurance Corporation.

- ^ "In Introduction to Electronic Money Issues - Appendixes" (PDF).

- ^ "FIN-2013-G001: Application of FinCEN's Regulations to Persons Administering, Exchanging, or Using Virtual Currencies". Financial Crimes Enforcement Network. 18 March 2013. p. 6. Archived from the original on 19 March 2013.

{{cite web}}: Unknown parameter|deadurl=ignored (|url-status=suggested) (help) - ^ Bobelian, Michael (9 May 2014). "SEC Warns Investors To Beware Of Bitcoin". Forbes. Retrieved 2 October 2014.

- ^ Bobelian, Michael (25 July 2014). "New York's Financial Regulator, Benjamin Lawsky, Maintains Lead On Bitcoin Regulation". Forbes. Retrieved 3 October 2014.

- ^ "NY DFS RELEASES PROPOSED BITLICENSE REGULATORY FRAMEWORK FOR VIRTUAL CURRENCY FIRMS". New York State Department of Financial Services. 17 July 2014. Retrieved 8 October 2014.

- ^ SydneyEmber (21 August 2014). "More Comments Invited for Proposed Bitcoin Rule". DealBook. NY Times. Retrieved 3 October 2014.

- ^ a b "BoE explores implications of blockchain and central bank-issued digital currency". EconoTimes.com. 9 September 2016. Retrieved 5 January 2017.

- ^ "Hong Kong Octopus Card" (PDF). 2005.

- ^ "What is Oyster?".

- ^ ""Contactless" convenience with Sony's FeliCa".

- ^ "Home - Chipknip".

- ^ "Proton".[permanent dead link]

- ^ "Marshall Islands to issue own sovereign cryptocurrency". Reuters. Retrieved 5 March 2018.

- ^ "Celent calls on central banks to issue their own digital currencies /Euromoney magazine". Euromoney.com. 20 October 2016. Retrieved 5 January 2017.

- ^ a b c d e f g "Central Banks Consider Bitcoin's Technology, if Not Bitcoin". The New York Times. Retrieved 5 January 2017.

- ^ "On Digital Currencies, Central Banks Should Lead - Bloomberg View". Bloomberg. Retrieved 5 January 2017.

- ^ a b "Denmark proposes cash-free shops to cut retail costs". Reuters. 6 May 2015. Retrieved 5 January 2017.

- ^ "Cashless society: Denmark to allow shops to ban paper money". Fortune.com. Retrieved 5 January 2017.

- ^ "Ecuador to Create Government-Run Digital Currency as It Bans Bitcoin". Ibtimes.co.uk. 25 July 2014. Retrieved 5 January 2017.

- ^ Everett Rosenfeld (9 February 2015). "Ecuador becomes the first country to roll out its own digital durrency". Cnbc.com. Retrieved 5 January 2017.

- ^ "German Central Bank testing blockchain technology". Brave New Coin. 1 December 2016. Retrieved 5 January 2017.

- ^ "Deutsche Börse Group - Joint Deutsche Bundesbank and Deutsche Börse blockchain prototype". Deutsche-boerse.com. 28 November 2016. Retrieved 5 January 2017.

- ^ Antony Peyton. "Blockchain goes Dutch » Banking Technology". Bankingtech.com. Retrieved 5 January 2017.

- ^ Andrii Degeler (19 December 2012). "Yandex Sells 75% Of Yandex.Money To Sberbank For $60M". Thenextweb.com. Retrieved 5 January 2017.

- ^ "Putin Confirms Russia Will Regulate ICOs, Mining By July 2018". Cointelegraph. 24 October 2017. Retrieved 20 December 2017.

- ^ a b "South Korea plans national digital currency using a Blockchain". Brave New Coin. 26 October 2016. Retrieved 5 January 2017.

- ^ CNBC. "Currencies". CNBC. Retrieved 19 November 2017.

- ^ Riksbanken. "Skingsley: Should the Riksbank issue e-krona?". www.riksbank.se. Retrieved 19 November 2017.

- ^ Uhlig/jse, Christian (1 July 2016). "Alpine 'Crypto Valley' pays with Bitcoins". DW Finance. Archived from the original on 20 September 2016. Retrieved 20 September 2016.

{{cite news}}: Unknown parameter|deadurl=ignored (|url-status=suggested) (help) - ^ a b "SBB: Make quick and easy purchases with Bitcoin". Sbb.ch. Retrieved 5 January 2017.

- ^ "Government urged to use Bitcoin-style digital ledgers". Bbc.co.uk. Retrieved 5 January 2017.

- ^ Szu Ping Chan (13 September 2016). "Inside the Bank of England's vaults: can cash survive?". Telegraph.co.uk. Retrieved 5 January 2017.

- ^ a b "Cashless Ukraine: The National Bank Considers Blockchain Technology". ForkLog.net. 19 October 2016. Retrieved 5 January 2017.

- ^ a b Wikoff, Shawn (13 September 2016). "The expert Shawn Wikoff talks about Electronic money". Medium. Retrieved 28 January 2018.

- ^ Sidel, Robin (22 December 2013). "Banks Mostly Avoid Providing Bitcoin Services". Retrieved 19 November 2017 – via www.wsj.com.

- ^ Tucker, Toph. "Bitcoin's Volatility Problem: Why Today's Selloff Won't Be the Last". Bloomberg BusinessWeek. Bloomberg. Retrieved 6 April 2014.

- ^ O'Grady, Jason D. "A crypto-currency primer: Bitcoin vs. Litecoin". ZDNet. Retrieved 6 April 2014.

- ^ Frances Schwartzkopff; Peter Levring (18 December 2013). Bitcoins Spark Regulatory Crackdown as Denmark Drafts Rules. Bloomberg. Retrieved 6 April 2014.

- ^ a b Zetter, Kim (9 June 2009). "Bullion and Bandits: The Improbable Rise and Fall of E-Gold". Wired. Retrieved 6 April 2014.

- ^ Worstall, Tim. "Bitcoin Is More Like A Speculative Investment Than A Currency". Forbes. Retrieved 24 January 2014.

- ^ Lee, David; Kuo Chuen (2015). Handbook of Digital Currency: Bitcoin, Innovation, Financial Instruments, and Big Data. Academic Press. p. 211. ISBN 9780128023518. Retrieved 19 January 2017.

External links

- "What is Bitcoin?". CoinDesk. A generalized introduction and Q&A regarding the most widely used digital currency: bitcoin.

- UK Digital Currency Association Non-profit organisation to inform public debate and promote growth-friendly policy and regulation for digital currencies in the United Kingdom

- Chamber of Digital Commerce The Digital Chamber is an authoritative representative for the digital commerce industry in Washington, promoting the acceptance and use of digital assets.

- Digital Currency Council Training, certification & support for lawyers, accountants, and financial professionals in the digital currency economy.