Tehran Stock Exchange

| بورس اوراق بهادار تهران | |

| |

| Type | Stock Exchange |

|---|---|

| Location | Tehran, Iran |

| Founded | 1967[1] |

| Owner | Public Joint Stock Company,[2] demutualized (not-listed and for-profit)[3] |

| Key people | Dr. Ali SalehAbadi, President of the Securities and Exchange Organization (SEO); Hassan Ghalibaf Asl, CEO[3] |

| Currency | Iranian rial |

| Commodities | Shares & rights, corporate participation certificates, futures[4][5] |

| No. of listings | 339 companies (May 2012)[6] |

| Market cap | $104.21 billion (May 2012)[6] |

| Volume | 82,479 million (2009)[4] |

| Indices | TEPIX and TEDPIX (main) |

| Website | www.tse.ir |

| Note: TSE is self-regulated under SEO supervision. As of July 2010, no margin/lending is offered, except for futures.[4][5] | |

The Tehran Stock Exchange (TSE) (Persian: بورس اوراق بهادار تهران) is Iran's largest stock exchange, which first opened in 1967.[1] The TSE is based in Tehran. As of May 2012, 339 companies with a combined market capitalization of US$104.21 billion were listed on TSE.[6] TSE, which is a founding member of the Federation of Euro-Asian Stock Exchanges, has been one of the world's best performing stock exchanges in the years 2002 through 2011.[5][7][8][9] TSE is an emerging or "frontier" market.[10]

The most important advantage that Iran's capital market has in comparison with other regional markets is that there are 37 industries[6] directly involved in it. Industries such as the automotive, telecommunications, agriculture, petrochemical, mining, steel iron, copper, banking and insurance, financial mediation and others trade shares at the stock market, which makes it unique in the Middle East.[11]

The second advantage is that most of the state-owned firms are being privatized under the general policies of article 44 in the Iranian constitution. Under the circumstances, people are allowed to buy the shares of newly-privatized firms.

History

The concept of stock industrialization dates to 1936, when Bank Melli, together with Belgian experts, issued a report detailing a plan for an operational stock exchange in Iran. However, the plan was not implemented prior to the outbreak of World War II, and did not gain traction until 1967, when the Government revisited the issue and ratified the "Stock Exchange Act". Initially limited in size and scope, the Tehran Stock Exchange (the "TSE") began operations in 1967, trading only in corporate and government bonds. Iran's rapid economic expansion in the 1970s, coupled with a popular desire to participate in the country's economic growth through the financial markets, led to a demand for equity. The Government became actively engaged in the process, by granting shares to employees of large state-owned and family-owned enterprises. Market activity increased substantially, as both companies and high net worth individuals participated in the new-found wealth associated with the TSE.[1]

Everything came to a standstill after the Islamic Revolution leading in a prohibition against interest-based activities and nationalization of major banks and industrial giants. Mobilization of all resources towards the war effort during the 8-year Iran-Iraq war did not help matters. However, the Government fully embraced economic reforms and a privatization initiative in 1989 with a surge of activity in share activity of many state-owned companies through the defined targets in the first "Five-Year Economic Reform" where the Government together with the Parliament defined the economic prospects of the country for the coming five years. Attention to promotion of the private sector and new interest in the TSE brought life back to the market. However, lack of regulation and out-of-date legal framework led to crisis in the market leading to certain "meltdowns" until today. The market has experienced its share of highs and lows in the past years including topping the World Federation of Exchanges' list in terms of performance in 2004 to tumbling down to last place in 2007 due to political uncertainties in the region.[1]

| 2006 | 2007 | 2008 | 2009 | |

|---|---|---|---|---|

| Number of Listed Companies | 417 | 415 | 346 | 337 |

| Market Capitalization (USD Millions) | 43,794 | 45,574 | 49,040 | 58,698 |

| Total Value of Share Trading (USD Millions) | 6,230 | 7,872 | 15,252 | 16,875 |

| Daily Average Trading Value (USD Millions) | 26.1 | 32.5 | 63.8 | 65.4 |

| Total Number of Trade in Share (Millions) | 15,839 | 23,401 | 37,975 | 82,479 |

| No. of Transactions (in thousands) | 1866 | 2107 | 1978 | 2646 |

| No. of Trading Days | 239 | 242 | 239 | 258 |

| Share Turnover Velocity (%) | 15.6 | 16.37 | 26.5 | 28.74 |

| P/E ratio | 5.4 | 5.2 | 4.1 | 5.5 |

| Dividend yield (%) | 10.44 | 14.5 | 12.3 | 15.8 |

| Market Capitalization/GDP (%) | 17.9 | 15.4 | 14.1 | 15.2 |

*Exchange rate: 1 US $=10,004 IRR (2009)

Industry affiliations

Since 1995, TSE has been a full member of the World Federation of Exchanges (the former Fédération Internationale des Bourses de Valeurs or FIBV), and is a founding member of Federation of Euro-Asian Stock Exchanges (FEAS).[3] Since July 2010 the TSE is a member of the International Options Market Association.

Logo

The symbol of the TSE is a highly stylized representation of an Achaemedian dynasty (550-330 BC) gun-metal relief artifact, which was found in Lorestan province. The artifact features four men, hand in hand, indicating unity and cooperation. They are shown standing inside circles of the globe, which is in turn, according to ancient Iranian myth, supported on the backs of two cows, symbols of intelligence and prosperity.[12]

Structure

- The Securities & Exchange Council is the highest authority and is responsible for all related policies, market strategies, and supervision of the market in Iran. The Chairman of the Council will be the Minister of Economics; other members are: Minister of Trades, Governor of the Central Bank of Iran, Managing Director of the Chamber of Commerce, Attorney General, Chairman of the Securities and Exchange Organization, representatives of the active market associations, three financial experts requested by the Economics Minister and approved by the Council of Ministers, and one representative for each commodity exchange.[13]

- The Securities and Exchange Organization (SEO) is responsible for administration and supervisory duties, governed by the Board of Directors. The SEO’s Board of Directors are elected by the Securities and Exchange Council. SEO also actively promotes innovation in Islamic products and has formed a specific "Sharia committee" to assess the compatibility of new products with Islamic law. SEO is the sole regulatory entity for the regulation and development of the capital market in Iran.[14]

Operations

The TSE is open for trading five days a week from Saturday to Wednesday, excluding public holidays. Trading takes place through the Automated Trade Execution System from 9am to 12 noon, which is integrated with a clearing, settlement, depository and registry system[dead link]. Settlement is T+3.[3] The TSE is solely an order-driven market and all transactions are executed in the manner and under the principles of open auction.[4]

Trading platform

The Tehran Stock Exchange (TSE) has started an ambitious modernization program aimed at increasing market transparency and attracting more domestic and foreign investors. Concrete measures that have been taken in the planning and operations of the stock exchange such as the settlement system, geographical expansion, new exchange laws in order to attract local and foreign capital. The TSE has installed the new trading system which has been purchased from Atos Euronext Market Solutions (AEMS) in 2007.[15]

The new system makes it possible to purchase and sell stocks on the same day. The system has also made it possible for 2,000 brokerage stations to work simultaneously, while the number was just about 480 in the past. The rise in electronic dealing, non-stop input and updated data on orders, transactions and indices are among other features of the new system. The new system has made it possible to link the stock market to the international bourses. The bourse can now handle 700 transactions per second and 150,000 transactions per day.[16]

The trading system is an order driven system, which matches buying and selling orders of the investors. Investors can place their orders with TSE accredited brokers, who enter these orders into the trading system.[17] Then, the system automatically matches buy and sell orders of a particular security based on the price and quantity requirements. The mechanism for which the price of equities is determined is as follows:[3]

- The best price (price priority)

- Time of order priority

Under the price priority rule, a selling (buying) order with the lowest (highest) price takes precedence. Under the time priority rule, an earlier order takes precedence over others at the same price. Thus, when the lowest sell and the highest buy orders match in price, the transaction is executed at the price. In short, the TSE market is a pure order-driven Market.[3]

The trading system also generates and displays details of current and historical trading activity, including prices, volumes traded and outstanding buy and sell orders. This ensures that investors have the required information to be able to take informed investment decisions.

The range of price movements is typically restricted to 3% daily either way from last closing. Restriction on Rights is 6%.[4] This can be changed in specific situation by the Board of the TSE in case of unusual price movements resulting in an extremely high or low P/E ratio. Short selling is not permitted. There are no minimum trading lots.[3][4] According to the Iranian Commercial Law, companies are prohibited from share repurchases.[18] TSE Services Company (TSESC), who is in charge of the site, supplies computer services. TSESC is a member of Association of National Numbering Agencies (ANNA).[17]

Market segmentation

Besides the Main and Secondary Market, there is a Corporate participation certificates Market (corporate bonds). Secondary Market is an exchange facility where the listed securities of small and mid-size companies can be traded efficiently and competitively.[4] Any company, domestic or foreign, can list their products on the exchange for as long as they meet the listing criteria. The value of three markets of Securities and Stock Exchange, Over-the-Counter (OTC) stock exchange and commodity exchange hit $100 billion in December 2010.[19] In 2010, the Kish Stock Exchange was launched to facilitate foreign investment and monetary activities in Kish Island free trade zone.[20]

| Description | Main Board | Secondary Board | Secondary Market |

|---|---|---|---|

| Minimum Capital (billion IRR) | 200,000 | 100,000 | 30,000 |

| Minimum Shareholders | 1000 | 750 | 250 |

| Free Float (%) | 20 | 10 | 15 |

| Minimum Term of Operation (Years) | 3 | – | – |

| Profitability (Years) | 3 | 2 | 1 |

| Equity to Asset Ratio (%) | 30 | 20 | 15 |

| Market Makers | Selective | Selective | Mandatory |

TSE rate

Since 1998 importers and exporters have also been permitted to trade foreign-exchange certificates on the TSE, creating a floating value for the rial known as the "TSE rate". In 2002 the "official rate" was abolished, and the TSE rate became the basis for the new unified foreign exchange regime.[22]

OTC market

Since 2009, Iran has been developing an over-the-counter (OTC) market for bonds and equities (aka Farabourse). Its shareholders include the Tehran Stock Exchange Corporation (20%), several banks, insurance companies and other financial institutions (60%), and private and institutional shareholders (20%).[23] As of July 2011, Farabourse has a total market capitalization of $20 billion and a monthly volume of $2 billion.[24]

Brokers

Trading takes place through licensed private brokers registered with the Securities and Exchange Organization of Iran. Thirty-one of the 88 brokerages active in the TSE are licensed to trade the futures contracts. The leverage for futures contracts is set at 1-to-10. TSE will only deal in the derivatives through electronic trading.[5]

Electronic trading

Starting March 2011, investors will be able to trade in the Iranian stock market through the Internet from anywhere in the world (on a trial basis since July 2010), or get all the necessary information before traveling to Iran.[25] There are 87 online service providers which offer round-the-clock information and services about Iran and its stock market.[11] As of September 2011, 40,000 shareholders are registered and conducting transactions online.[26]

Trading fees

As of July 2010, trading fees include:

- Equities and rights: 0.55% payable by the sellers and 0.5% the buyers.[4]

- Participation bonds: 0.1% of transaction value payable by both the buyer and seller with a maximum of 100 million IRR.[4]

New products and services

Presently, TSE trades mainly in securities offered by listed companies. Equities and Corporate Bonds are being traded at TSE at the moment. The plan is to introduce other financial instruments in the near future. The introduction of project-based participation certificates that bear a fixed annual return during the period of the project and promise the final settlement of the profit at the date of its completion, has diversified the market.[3]

Futures

In 2008, commodity Futures came onto the Iran Mercantile Exchange (IME).[27] In July 2010, TSE introduced six single-stock futures contracts based on Parsian Bank and Karafarin Bank, which will expire in two, four and six months.[5] Thirty-one of the 88 brokerages active in the TSE are licensed to trade the futures contracts. The leverage for futures contracts is set at 1-to-10. TSE will only deal in the derivatives through electronic trading.[5] In the TSE’s derivatives market, over 13,200 single stock futures contracts were traded in 2011 with a value of over 510 billion Rials.[28]

Outlook

| TSE projects (as of 2009) | Status (as of July 2010) |

|---|---|

| Continuation of privatization plan and IPOs of state-owned companies. | Iran has privatized $63 billion worth of equity since 2005. Government's ownership in GDP down to 40% as of November 2009 (from 80% in 2005).[29] More information: Privatization in Iran. |

| Increasing liquidity in securities market with a review on trading regulations. | New bylaw to facilitate foreign portfolio investment was ratified by the Council of Ministers in April 2010. Since then, as an incentive to investment in Iran, foreign investors in TSE are tax-exempt.[11] |

| Launching derivatives market and introducing stock futures and options. | In July 2010, TSE introduced six single-stock futures contracts, based on 2 companies which will expire in two, four and six months. Plan to increase coverage to 10 companies by March 2011.[5] No update on exchange-traded funds, Gold ETF and options trading but their offering is planned.[4] Futures on indices: Expected by 2011.[13] |

| Establishing Islamic bonds and products such as Sukuk and Islamic Mortgage-Backed Securities (MBS), based on market development act and tax exemption. | Sukuk and options are the next instruments to be available.[13] Profit and awards accrued on participation papers are tax exempt.[30] See also: (OTC) Bond market in Iran. |

| Enactment of anti-money laundering laws. | See: Anti-money laundering laws in Iran. |

| Setting up required mechanisms for tracking frauds and claiming against breach of market law. | TSE has an electronic system for tracing market abuse and insider trading.[13] See also: Iran Securities and Exchange Commission. |

| Creating efficient corporate governance and investor relations frameworks. | In 2006, the TSE introduced more stringent reporting and disclosure requirements for listed companies and enforcement measures for non-compliance.[31] Six-month corporate earnings announcements are mandatorily audited prior to publishing and seen as being a reliable source of information by investors.[32] KPMG and PriceWaterhouseCoopers have suspended their operations in Iran because of international sanctions.[33] See also: Accounting standards in Iran |

| Facilitating and expanding market access by means of developing brokerage network, electronic trading and direct market access. | E-trading is possible since July 2010 on trial basis and will be offered to the general public starting March 2011.[25][34] Mobile Phone-Based Trading planned later in 2011.[25] There are 87 online service providers which offer round-the-clock information and services about Iran and its stock market.[11] See also: Tehran Stock Exchange Services Company (TSESC). |

| Economic calendar and market data. | Real-time data available: Bid/Ask Prices, Indices, Companies Announcements, Trading Volume and Value through the TSE website and a system named "CODAL" (free of charge).[4] |

| Promoting the shareholding culture in Iran. | The Government is running financial literacy training programs in the society.[4] See also: "Justice Shares" in Iran. |

Economic sectors

2007: There were 324 companies listed on the TSE with a total market capitalization (MC) of US$42,452 million. Close to 60% of the MC relates to listed companies from the following sectors:[35]

- Basic Metals,

- Motor Vehicles and Trailers,

- Chemicals and By-Products,

- Non-Metallic Minerals Products.

A total of 161 companies from these sectors are listed on the TSE, which translates to 49.7% of total companies listed. Largest stocks include:

- Mobarakeh Steel Co. with MC of US$3,218 million, which translates to 7.6% of MC,

- National Iranian Copper Industries Company (Persian: Sanaye Mese Iran) at 6.8% of MC,

- SAIPA at 5.3% of MC.

2008: other companies in the top spots included:[36]

- Gol Gohar Iron Ore Company ($2.1 billion MC),

- Chadormalu Mining and Industrial Company ($2 billion),

- Kharg Petrochemical Company (over $1 billion),

- Ghadir petrochemical companies (over $1 billion),

- Khouzestan Steel Company (over $1 billion),

- Power Plant Projects Management Company (MAPNA) (over $1 billion),

- Retirement Investment Firm (over $1 billion),

- Iran Khodro (over $1 billion),

- Metal and Mine Investment Companies (over $1 billion).

This indicates that the capital market in Tehran is heavily concentrated on four economic sectors with companies that make up nearly half of the total listed companies on the exchange. While 163 companies listed are spread out amongst 26 sectors, with the "Food and Beverages Sector" alone accounts to 32 companies at a market capitalization of US$897.5 million. Studies show that in 2008 about 30 firms, involved in 11 industries, hold close to 75% of shares in Tehran Stock Exchange.[37]

2009: A comparison of the top 100 Iranian companies and the Fortune 500 in 2009 indicated that the gross profit margins of the top 100 Iranian companies were almost double those of the Fortune 500. For Fortune 500 companies, the average gross profit margin was 6.9% and for the Iranian companies, it was 13%.[38] The sector with the highest profit margin among the top 100 Iranian companies in 2009 is mining, with a margin of 58%. The mining companies in the Fortune 500 had a gross profit margin of 11%. After mining, other industries with highest margins are base metals, and telecommunications.[38]

2011: The best performing industries in 2011, in terms of total sales, were the banking and automotive sectors. The worst performers were home appliances and electronics. In terms of gross profit margin, mining, telecommunications, and oil and gas exploration & production were the best performing industries. Sales totals of the top 100 Iranian companies on the list ranged from $12.8 billion or the top ranking company, Iran Khodro, to $318 million for the 100th company.[38]

2012: Companies showing the most profit, are mostly in pharmaceutical, petrochemical and steel businesses. The sharp decline of the Rial in 2012 has made exports more competitive.[39] Other favoured companies are state-owned industrial companies that rely on a mostly domestic supply chain, turning locally-produced raw materials into products targeting Iranian consumers.[40]

| Name | Market Cap. (million $) |

% of Total MC | |

|---|---|---|---|

| 1. | Telecommunication Company of Iran | 9,702 | 9.31 |

| 2. | National Iranian Copper Industries Company | 6,572 | 6.31 |

| 3. | Mobarakeh Steel Company | 6,164 | 5.91 |

| 4. | Ghadir Investment Company | 3,942 | 3.78 |

| 5. | Bank Pasargad | 3,573 | 3.43 |

| 6. | Gol Gohar Iron Ore Company | 3,194 | 3.06 |

| 7. | Khouzestan Steel Company | 3,064 | 2.94 |

| 8. | Omid Investment Corporation | 2,908 | 2.79 |

| 9. | Pardis Petrochemical Company | 2,773 | 2.66 |

| 10. | Bank Mellat | 2,737 | 2.63 |

| Total | 44,629 | 42.82 |

Market participants

The Government of Iran directly holds 35 percent of the TSE, while securing another 40 percent through pension funds and investment companies such as the Social Security Investment Company, one of the largest institutional investors on the TSE. Bonyads also play a leading role in TSE trading.[22] In 2005 fewer than 5 percent of Iranians owned stock.[42]

The Government is promoting the shareholding culture in Iran. By March 2010, 3.219 million shareholders had registered in the TSE, with investment firms having 562,375 shareholders, which makes it the "favorite industry" in the stock market.[43] By September 2011, the number of registered shareholders in the TSE had increased to 4.5 million.[26]

Funds management

As of 2009, 21 mutual funds managed by permitted brokerage firms and investment banks are investing in the TSE according to the investment funds regulation. Mutual funds are open ended and their operation permission is issued by the Iran Securities and Exchange Organization (SEO).[4] Since then, 41 funds have been established, four of which are fixed income funds and the remainder of which are equity funds. As of August 2010, total assets under management within the Iranian fund management industry amount to approximately $230 million with great potential for development.[27]

Indices

• TSE All-Share Price Index (TEPIX)

• TSE Dividend & Price "total return" Index (TEDPIX)

• TSE All-Share FF adjusted (TEFIX)

• TSE TEFIX-30 - Blue chip index

• TSE Cash Dividend Index (TEDIX)

• TSE-50

• Each industry (sector) Index

• Industrial Index

• Financial Index

• Each Company Index (based on Price & Volume)

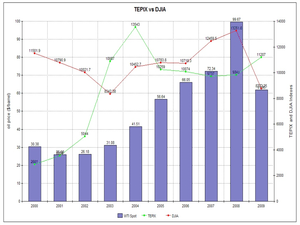

In 1990, the All-Shares Price Index (TEPIX) was introduced to the market as the main indicator of share price movements.TEPIX is a weighted market value of all share prices appearing on the TSE Board and is measured every two minutes. In addition to the TEPIX, daily price indices of shares of each company, each sector, and the "Top Fifty" most active companies (TSE-50) are computed.

| No. Shares Traded (million) |

Daily Average Turnover (million $) | |

|---|---|---|

| July-09 | 20,256 | 100.7 |

| Aug-09 | 5,747 | 53.9 |

| Sep-09 | 3,202 | 35.8 |

| Oct-09 | 4,669 | 56.7 |

| Nov-09 | 26,675 | 436.3 |

| Dec-09 | 1,547 | 19.8 |

| Jan-10 | 3,228 | 30.5 |

| Feb-10 | 4,315 | 57.6 |

| Mar-10 | 2,229 | 28.9 |

| Apr-10 | 5,294 | 67.1 |

| May-10 | 21,563 | 125.9 |

| June-10 | 17,837 | 112.7 |

| 116,562 (total) | 93.83 (average) |

Performance

2000–2004: The performance of the TSE has had no correlation with major exchanges or emerging stock markets over the past few years and not even with the oil price.[47] While the overall indices of the world’s five major exchanges – New York, London, Paris, Frankfurt and Tokyo plunged by 40 to 70% between March 2001 and April 2003, the TSE index (Tepix) bucked the trend by going up nearly 80%.[7]

2005–2006: In December, 2005, 419 companies with a market capitalization of IRR 32,741.7 million were listed in TSE. The TSE has had an exceptional performance over the past 5 years. In general, the stock market in 2005/06 shed value as it is manifested by the decline of its major stock price indices. The TSE price index (TSPIX) at the end of 2005/06, declined by 21.9%, while the Financial Sector Index, and the Industrial Index, declined by, 38.8%, 19.4% respectively, and the Dividend Index gained 11.8%, mostly due to a reported 100 billion USD capital flight from the country because of the international dispute surrounding the Iranian nuclear programme.[35]

2007: The market bottomed in June 2007 mainly because of the renewed privatization drive in the Iranian economy.[48][49][50]

2008: The TSE was not directly affected by the international financial turmoil in 2008, but following the global reduction in prices of copper and steel, the bourse index dropped by 12.5 percent, as most of the companies listed on the exchange are producers of such commodities.[37][51] TSE experienced an 11% growth at the end of 2008 and ranked second in the world in terms of increase in the volume of trade after Luxembourg’s Bourse.[52]

2009: The TSE sank about 40% in value between August 2008 and March 2009, influenced by falling oil prices and declining markets in other parts of the world. As of August 1, 2009 it has recovered by more than 10%.[46] During Iranian year 2009/10, the value of capital market was around $20 billion. Some 3 million trade exchanges were made, pushing up the index to 12,500 units from the previous 8,000 units.[11]

2010: In the first month of Iranian 2010 (March 20 – April 21, 2010), the index hit the 14,000 unit mark, up from the previous 12,500, showing 12 percent growth. The value of one month's trading transactions exceeded $1 billion against the previous year's corresponding period of $95 million.[11] Tehran Stock Exchange bourse index from June 2009 to 2010 grew 55 percent and the value of TSE's total market capitalization went up about 33 percent, to over $71 billion.[53]

On August 2, 2010, the TSE main index (TEPIX) reached a record level of 16,056 points, despite US-sponsored sanctions against Iran.[54] Thus, TEDPIX became the world’s second-best performing equity index.[5] Factors such as the global spike in oil and metal prices, government support for industries and oil sectors as well as the growth of stock market liquidity flow contributed to the boom.[55] Experts commented that the growth was also partly due to a government decision to sell off 20 percent of its equity in two major automakers. Given the relative low market valuation of TSE stocks in 2010, the upward trend was expected to continue over the long run, rather than being a bubble.[54] TEPIX reached a new record on September 18, 2010, when it hit 18,658, up from 11,295 at the start of the year.[56] As of December 2010, the TSE index rose about 64 percent since the start of 2010.[57] The Tehran Stock Exchange has been ranked as the best bourse index in Europe, Africa and Middle East in 2010 in terms of performance of the main index.[58]

2011: On February 1, 2011, TEPIX and total market value reached an all-time high of 21,349 and USD 100 billion respectively.[58][59] An alleged $200 million investments by Iranian expats also contributed to this increase.[60]

On April 9, 2011, TSE's main index (TEPIX) hit a new all-time record high at 26,222 over a boost from the stocks of metal and shipping industries.[45][61] According to the World Federation of Exchanges (WFE), TSE had the best performance among WFE member exchanges from May 2010 to May 2011. With a staggering 79% growth rate in its main index, the TSE ranked 1st in WFE’s “Broad Stock Index Performance” category followed by the Colombo and Lima Stock Exchanges with 75.1% and 48.9% rates respectively.[26]

Overall, Tehran stock exchange posted the second highest gains in global markets in 2011 (TEPIX up 29.6%). Meanwhile the German's DAX (DAX INDEX) lost 16.5% due and the FTSE 100(UKX INDEX) performed poorly, down 6.7%. Stock markets of emerging economies, like Brazil's Brazil Bovespa Index (IBOV INDEX), shed 18.4%.[62] Equally, MENA stock markets had a poor year in 2011, reflecting both the political turbulence across the region and the battering suffered by most global markets as a result of the euro zone crisis and the increasingly bearish outlook for the global economy.[63]

2012: TSE’s overall index hit a new record high in October 2012 surpassing 31,000 points. Export-oriented companies have been favoured because of a sharp decline in the value of the Iranian rial over 2012.[39][40]

Growth potential

According to experts, the economy of Iran has many investment opportunities, particularly on its stock exchange.[64] The Central Bank of Iran indicate that 70 percent of the Iranians own homes with huge amounts of idle money entering the housing market.[65] However, if the stock market grows stronger, it will undoubtedly attract idle capital.[66] In terms of investment, the domestic rival markets of the bourse are the Iranian real estate market, cars and gold (with gold being used as a store of value, a hedging tool against hyperinflation and the devaluation of the Rial). According to Goldman Sachs, Iran is forecast to reach the highest economic growth between 2015 and 2025 and join the world's largest economies (world's 12th economy by 2025).[67]

Market valuation

In 2007, the market, with a capitalization of $37 billion was trading at a fraction of the earnings multiples enjoyed by Iran's neighbours, while average earnings continued to grow at about 25 per cent a year.[68] As of 2010, the price-to-earnings rate in Iran's market stands at around six while it is 15 in regional markets.[11] With the removal of obstacles to foreign investment Iran could potentially have a 2,000–3,000 billion US dollar stock exchange market.[69] Due to the price gains the average dividend yield has fallen from 16 per cent in 2009 to 13 per cent in 2010.[70]

Privatization

In recent years, the role of the private sector has been further on the increase. Furthermore, an amendment of the article 44 of the Iranian Constitution in 2004 has allowed 80% of state assets to be privatized, 40% of which will be conducted through the "Justice Shares" scheme and the rest through the Bourse Organization. The government will keep the title of the remaining 20%.[71][72]

Under the privatization plan, 47 oil and gas companies (including PetroIran and North Drilling Company) worth an estimated $90 billion are to be privatized on the Tehran Stock Exchange by 2014.[73]

Foreign investors can bid in Iranian privatization tenders, but need permission from the Economy Ministry on a case-by-case basis.[74] The government has reduced the bureaucratic channels and issues investment permits for foreign nationals in less than seven days.[11] Iran has announced it will begin to allow foreign firms to purchase Iranian state-run companies, with the possibility of obtaining full ownership.[75]

Iranian expatriates

There are differing estimates of the total capital held by Iranian expatriates. One estimate places the number at $1.3 trillion US dollars.[76] Whatever the actual number, it is clear that these funds are sufficiently large enough to buy significant stakes in all state companies. In Dubai alone, Iranian expatriates are estimated to have invested up to $200 billion.[77] Even a 10 percent repatriation of capital would have a significant impact.[78] In 2000, the Iran Press Service reported that Iranian expatriates had invested between $200 and $400 billion in the United States, Europe, and China, but almost nothing in Iran.[79] FIPPA provisions apply to all foreign investors, and many Iranian expatriates based in the US continue to make substantial investments in Iran.[80]

Foreign portfolio investment

So far, the Tedpix index has been driven by domestic investors, including wealthy Iranians, public sector pension funds and the investment arms of state-owned banks. For the index to prosper in the long run, more foreign investors need to make significant share purchases.[81] As at 2009, foreign portfolio investment accounts for only about 2 percent of the stock market in Iran.[70][82]

The new by-law on foreign portfolio investment was approved by the government in June 2005, but ratified by the Council of Ministers in April, 2010. Under this new bylaw, foreign investors can participate in the TSE for the first time. Initially, however, some limitations had been imposed on foreign investors:

- Foreign investors may own a maximum of 10 percent of each listed company.

- Foreign investors may not withdraw their main capital and capital gain for the first three years of their investment. Repatriation is possible, after one year under the current regulations.

With the new law, Iran has increased the ceiling on foreign participation to 20% and foreign investors can now invest in the capital market, trade shares (including OTC) and:

- for small-scale (foreign) investors, take out their money at any time;[11][83]

- for large-scale investors which possess 10 percent of the agency's value or 10 percent of the management position, can take their capital out of the country after two years upon receiving permission from the government.[84]

Exchange currencies

Since April 2010, foreign investors have been able to open foreign-currency accounts at Iranian banks and exchange their currencies to rials and vice-versa. Foreigners who want to trade in Iran must get a license, which the exchange says will take seven days on its website.[5]

Non-commercial risks

The Central Bank of Iran is also in charge of providing the investors with the necessary foreign exchange, which is also transferrable.[11] Moreover, under the law, foreign investors are protected and insured against possible losses and damages caused by future political turmoil or regional conflicts.

Dual listing

Iran is to target foreign investment in its energy sector by creating an umbrella group of nearly 50 state-run firms and listing its shares on four international stock exchanges.[85]

Offshore funds

The "Turquoise Iran Equity Investments" from the London-based investment boutique Turquoise Partners is one of the few opportunities for foreign investors to participate on the Tehran Stock Exchange.[86] Turquoise Partners publishes one of the few English newsletters that covers developments of the Tehran Stock Exchange and the Iranian economy called "Iran Investment Monthly". Turquoise is a private company with offices in Tehran and London.[87]

U.S. sanctions

U.S. persons need a license from the U.S. Treasury Department's Office of Foreign Assets Control (OFAC) in order to invest in the TSE.[88]

Taxes

As of July 2010, taxes on TSE transactions are as follows:

- Cash dividend: no tax (22.5% at source from Company).[4]

- Share transfers: the Tax Amendment has changed the regulations regarding calculation of tax on transfer of shares and their rights in Iranian corporate entities.

- In the case of shares listed on the Tehran Stock Exchange (TSE) the tax on transfer of such shares and other rights is 0.5 per cent of the sales price.[22]

- In the case of transfer of the shares and their rights to other corporate entities (i.e. those not listed on the TSE) a flat rate of four per cent of value of the shares and rights transferred applies. No other taxes will be charged. The Amendment has removed the requirement to value the shares in this category.[22]

Exemptions

- Capital gain: no tax.[3]

- Interest income: no tax.[3]

- Participation papers: Profit and awards accrued are tax exempt.[30]

- Listed companies: 10% tax exemption, companies holding 20% free float shares are provided 20% tax exemption.[4]

- Foreign investors: Foreign investors in TSE are tax-exempt.[11]

See also

- Next eleven

- International Rankings of Iran in Economy

- Economy of Iran

- Petroleum industry in Iran

- Construction in Iran

- List of Iranian companies

- List of banks in Iran

- Iranian Oil Bourse

- Iranian labor law

- List of Mideast stock exchanges

References

- ^ a b c d TSE: History. Retrieved August 5, 2010. Cite error: The named reference "TSE3" was defined multiple times with different content (see the help page).

- ^ iranbourse.com: TSE Articles of Association Retrieved July 31, 2010 [dead link]

- ^ a b c d e f g h i j "Federation of Euro-Asian Stock Exchanges". FEAS. Retrieved 2010-07-29.

- ^ a b c d e f g h i j k l m n o p q Tehran Stock Exchange: FACT BOOK. Retrieved July 31, 2010.

- ^ a b c d e f g h i j "Tehran Exchange Trades Futures to Attract Investors". BusinessWeek. 2009-12-08. Retrieved 2010-07-29.

- ^ a b c d "Tehran Stock Exchange Monthly Report". TSE. Retrieved 2012-06-12.

- ^ a b The Tehran Stock Exchange: A Maverick Performer?, Middle East Economic Survey, May 23, 2005

- ^ BBC: http://news.bbc.co.uk/1/hi/business/3129995.stm

- ^ "Iran Daily – Domestic Economy – 07/02/09". Nitc.co.ir. Retrieved 2010-07-30.

- ^ "Iranian stock market in fast recovery – The National Newspaper". Thenational.ae. 2010-05-09. Retrieved 2010-07-29.

- ^ a b c d e f g h i j k "Iran offers incentives to draw investors". Press TV. 2010-04-26. Retrieved 2010-07-29.

- ^ "History". Iranbourse.com. 1967-02-04. Retrieved 2010-07-29.

- ^ a b c d Sheikholeslami, Ali (2010-07-24). "Tehran Exchange Begins Trading Futures to Attract Investors". Bloomberg. Retrieved 2010-07-29.

- ^ http://en.seo.ir/Portals/80db6c92-61a1-4abe-a487-e469fa03e00c/IICM-vol1.pdf

- ^ BUSINESS WIRE: ATOSEURONEXT TO PROVIDE SYSTEMS TO TEHRAN STOCK EXCHANGE. Retrieved August 2, 2010.

- ^ "Iran Daily – Domestic Economy – 12/10/08". Nitc.co.ir. 2008-12-10. Retrieved 2010-07-30.

- ^ a b Iranian Embassy in Oslo: Tehran stock exchange. Retrieved July 31, 2010.

- ^ Turquoise Partners: Iran Investment Monthly (February 2011) Retrieved April 30, 2011

- ^ "Capital Market Value To Hit $100b". Zawya.com. 2010-12-21. Retrieved 2011-01-04.

- ^ "Fars News Agency :: New Stock Exchange Kicks off Work in Southern Iran". English.farsnews.com. 2010-12-24. Retrieved 2011-01-04.

- ^ Taghavi, Roshanak (2009-08-06). "Tehran Struggles to Defend Currency". Wall Street Journal: A7.

{{cite journal}}:|access-date=requires|url=(help); Unknown parameter|coauthors=ignored (|author=suggested) (help) - ^ a b c d "Iran Profile – Doing business – For Australian Exporters – Export assistance, grants, and help. – Australian Trade Commission". Web.archive.org. Archived from the original on 2006-10-04. Retrieved 2010-07-29.

- ^ Turquoise Partners: Iran Investment Monthly. Retrieved October 5, 2010.

- ^ Iran Investment Monthly - August 2011. Turquoise Partners. Retrieved February 5, 2012.

- ^ a b c "No. 3817 | Domestic Economy | Page 4". Irandaily. Retrieved 2010-12-12.

- ^ a b c Iran Investment Monthly - September 2011. Turquoise Partners. Retrieved November 3, 2011

- ^ a b "Iran Investment Monthly Aug 2010.pdf" (PDF). Retrieved 2010-12-12.

- ^ Iran Investment Monthly. Turquoise Partners, January 2102. Retrieved February 16, 2012.

- ^ "Iran privatizes $63bn of state assets". Presstv.com. 2009-11-29. Retrieved 2010-07-29.

- ^ a b "Netfirms | This account has been suspended" (PDF). Irantradelaw.com. Retrieved 2012-12-20.

- ^ Turquoise Partners Retrieved May 2, 2011.

- ^ Iran Investment Monthly - November 2011. Turquoise Partners. Retrieved December 5, 2011.

- ^ "FACTBOX-Foreign companies step away from Iran | Reuters". In.reuters.com. 2010-07-23. Retrieved 2010-07-29.

- ^ "Tehran Stock Exchange". Iranbourse.com. Retrieved 2010-07-29.

- ^ a b "Iran – Ambitious modernization program for the Tehran Stock Exchange". Al Bawaba. 2007-06-22. Retrieved 2010-07-29.[dead link]

- ^ "Iran Daily – Domestic Economy – 11/11/07". Web.archive.org. Archived from the original on 2008-02-19. Retrieved 2011-01-04.

- ^ a b "Iran Daily – Domestic Economy – 12/15/08". Nitc.co.ir. 2008-12-15. Retrieved 2010-07-30.

- ^ a b c Turquoise Partners: Iran Investment Monthly (March 2011) Retrieved April 30, 2011

- ^ a b Tehran Stock Exchange Index hits unprecedented highs. PressTV October 23, 2012. Retrieved October 28, 2012

- ^ a b http://online.wsj.com/article/SB10001424052970204840504578088082176063380.html?mod=googlenews_wsj In Iran, Stocks Are a Haven As Economy Hits the Skids.] Wall Street Journal , 30 October 2012. Retrieved November 4, 2012.

- ^ "Tehran Stock Exchange Monthly Bulletin May 2012" (PDF). TSE. Retrieved 2012-06-12.

- ^ Kurtis, Glenn. Iran, a country study (PDF). Washington D.C.: Library of Congress. p. 196. ISBN 978-0-8444-1187-3. Retrieved November 21, 2010.

{{cite book}}: Unknown parameter|coauthors=ignored (|author=suggested) (help) - ^ "3.2 Million Shareholders in Iran". Payvand.com. 2006-11-22. Retrieved 2010-07-29.

- ^ Tehran Stock Exchange Retrieved May 2, 2011.

- ^ a b Mehr News Agency: Tehran capital market value hits $84B. Retrieved December 29, 2010.

- ^ a b "Iran stock market to see record $5B deal". Presstv.com. 2009-08-03. Retrieved 2010-07-29.

- ^ a b "Atieh Bahar". Web.archive.org. 2007-09-28. Archived from the original on 2007-09-28. Retrieved 2010-07-30.

- ^ "Iran – Ambitious modernization program for the Tehran Stock Exchange". Albawaba.com. 2007-06-22. Retrieved 2010-12-12.

- ^ "Iran Daily – Domestic Economy – 09/13/07". Nitc.co.ir. 2007-09-13. Retrieved 2010-12-12.

- ^ "Iran Daily – Domestic Economy – 09/17/07". Web.archive.org. Archived from the original on 2007-12-22. Retrieved 2011-01-04.

- ^ "Tehran Stock Exchange Falls to Five Year Low". Payvand.com. 2006-11-22. Retrieved 2010-07-29.

- ^ "Iran Daily – Front Page – 05/09/09". Nitc.co.ir. 2009-05-09. Retrieved 2010-07-30.

- ^ "Tehran Stock Exchange ranks 2nd in WFE rankings". Payvand.com. 2006-11-22. Retrieved 2010-07-29.

- ^ a b PressTV: Tehran stocks hit all-time record. Retrieved August 2, 2010.

- ^ "Tehran stock hits all-time high". Presstv.com. 2010-07-12. Retrieved 2010-07-29.

- ^ PressTV: Tehran Stock Exchange booming. Retrieved October 5, 2010.

- ^ "Tehran Stock Exchange index rises 64% in 2010". Payvand.com. 2006-11-22. Retrieved 2010-12-12.

- ^ a b PressTV: TSE ranked as best bourse index Retrieved February 1, 2011

- ^ Mehr News Agency: Tehran Stock Exchange's Index Hits Record High Retrieved January 30, 2011

- ^ Mehr News Agency: Expats invest $200m in Tehran Bourse Retrieved January 30, 2011

- ^ Mehr News Agency: Tehran Stock Exchange value hits $125B Retrieved April 9, 2011.

- ^ Tehran Times: Tehran exchange posted the second highest growth among global markets. Retrieved January 4, 2011.

- ^ Tehran Stock Exchange leads MENA financial markets in 2011: The Economist. Tehran Times. retrieved January 19, 2012.

- ^ "Iran Daily – Domestic Economy – 10/09/08". Nitc.co.ir. Retrieved 2010-07-30.

- ^ "Iran Daily – Domestic Economy – 04/09/07". Nitc.co.ir. 2007-04-09. Retrieved 2010-12-12.

- ^ "Iran Daily – Domestic Economy – 12/23/06". Nitc.co.ir. 2006-12-23. Retrieved 2010-12-12.

- ^ PressTV:'Iran to notch up highest growth in 2015' Retrieved April 2011.

- ^ Gulfnews.com: Bank Melli Iran will launch fund to invest in bourse. Retrieved July 31, 2010.

- ^ "Press TV – TSE foreign investment ceiling to rise". Previous.presstv.com. 2008-06-27. Retrieved 2010-12-12.

- ^ a b "/ Equities – Tehran exchange extends advance". Ft.com. 2010-08-25. Retrieved 2010-12-12.

- ^ Justice Shares Payment Soon. Retrieved December 25, 2008. [dead link]

- ^ "BBC Persian.com". BBC. 2006-07-16. Retrieved 2007-07-17.

- ^ "Iran Daily – Domestic Economy – 02/10/08". Nitc.co.ir. Retrieved 2010-12-12.

- ^ "/ In depth – Iran to privatise but cling to big oil companies". Ft.com. 2006-07-03. Retrieved 2010-07-29.

- ^ "Iran to allow 100% foreign ownership". Presstv.com. 2008-06-30. Retrieved 2010-07-29.

- ^ "Iran Daily – Domestic Economy – 02/14/07". Nitc.co.ir. 2007-02-14. Retrieved 2011-01-04.

- ^ "Iran Daily – Domestic Economy – 04/04/06". Nitc.co.ir. Retrieved 2011-01-04.

- ^ "Iran Daily – Domestic Economy – 09/02/06". Web.archive.org. Archived from the original on 2008-02-19. Retrieved 2011-01-04.

- ^ Migration Policy Institute – Iran: A Vast Diaspora Abroad and Millions of Refugees at Home. Retrieved December 28, 2010.

- ^ "Iran", Investment regulations, Economist Intelligence Unit, 19 March 2008

{{citation}}:|access-date=requires|url=(help); Cite has empty unknown parameters:|editors=and|coauthors=(help) - ^ "Iran Daily – Domestic Economy – 11/27/08". Nitc.co.ir. 2008-11-27. Retrieved 2010-07-30.

- ^ "Iran Daily – Domestic Economy – 12/16/08". Nitc.co.ir. Retrieved 2010-07-30.

- ^ "Iran keen to attract foreign investment". Presstv.com. 2010-07-23. Retrieved 2010-07-29.

- ^ "Iran to ease foreign investment regulations". Payvand.com. 2006-11-22. Retrieved 2010-07-29.

- ^ "Iran Daily – Domestic Economy – 06/18/08". Nitc.co.ir. Retrieved 2010-07-30.

- ^ Financial Times: Tehran exchange extends advance. Retrieved November 8, 2010.

- ^ Turquoise Partners website Retrieved January 8, 2011

- ^ Payvand.com: How U.S. Laws Can Affect Your Personal Affairs in Iran Retrieved January 4, 2010

External links

- Tehran Stock Exchange (TSE) Template:Fa iconTemplate:En icon

- Tehran Securities Exchange Technology Management Company (TSETMC) Template:Fa icon

- Iran Securities and Exchange Organization (SEO) – Offers Quarterly Bulletin of Iran Islamic Capital Market

- Federation of Euro-Asian Stock Exchanges – TSE statistics/regulations/operations/international comparisons/calendar and latest news

- Iran's Capital Markets – Comprehensive 2003-Study

- Turquoise Partners – Monthly report on the Tehran Stock Exchange and Iran's economy

- Iran Daily: "Iranian Bourse Prospects for Foreign Investment"

- Iran CSD Company[dead link] – Clearing and setllement of trading, central registry

- Videos

- Video on YouTube Iran's Stock Market – Part I Part II – PressTV

- 2010 Hike in Iran's Bourse – PressTV (2010)

- Investing in Iran – Part I Part II Part III Part IV Part V VI – CNBC (December 2010)

- Iran's flourishing economy - PressTV (2011)

- Iran's Bourse: Hallmark of Iranian economy - PressTV (2011)

- Hike in Tehran's bourse index - PressTV (2012)