Global energy crisis (2021–2023)

This article needs to be updated. (March 2022) |

The 2021–present global energy crisis is the most recent in a series of circular energy shortages experienced over the last fifty years. It is more acutely affecting countries such as the United Kingdom[1][2] and China,[3] among others.[4]

Background

Slow supply recover after pandemic

The COVID-19 pandemic in 2019-2020 caused a rapid drop in energy demand and a corresponding cut in oil production, and despite the 2020 Russia–Saudi Arabia oil price war, OPEC responded slowly to the demand recovery under new normal, causing a supply-demand imbalance, and the 2021–2022 global supply chain crisis that further stressed the delivery of extracted petroleum.

Coal trade dispute

In December 2020, after months of restrictions, China fully blocked coal imports from Australia, which was China's largest source of imported coal.[5]

Climate abnormality impact on renewable energy

Brazil's worst drought in almost a century is threatening its electricity supply.[6][7] Brazil relies on hydropower for two-thirds of its electricity.[8] In the West Pacific, El Nino's impact on typhoon path have resulted in lowered waterfall throughout Southern China and Taiwan region in year 2020–2021, which also affected hydroelectric power supply in the area.

Euractiv reported that European Commissioner for Climate Action Frans Timmermans told the European Parliament in Strasbourg that "about one fifth" of the energy price increase "can be attributed to rising CO2 pricing on the EU's carbon market".[9]

Russo-Ukrainian war

The Russian military buildup outside Ukraine and subsequent invasion have also threatened the energy supply from Russia to Europe, causing European countries to diversify their source of energy import.[10][11] Western sanctions targeting Russia's energy sector have been in place since the Russian annexation of the Crimea in 2014, and were subsequently tightened after the 2022 Russian invasion of the Ukraine and the new Nord Stream 2 pipeline's certification was suspended. Russia reacted in late July 2022 and reduced gas deliveries to Germany through the strategic Nord Stream 1 pipeline.[12][13]

Global effects

This section needs expansion. You can help by adding to it. (August 2022) |

2022 food crises

Natural gas is a significant key component in producing fertilisers.[14] The development of synthetic nitrogen fertilizer has significantly supported global population growth — it has been estimated that almost half of the world's population is currently fed as a result of synthetic nitrogen fertiliser use.[15]

Rising energy prices are pushing agricultural costs higher, contributing to increasing food prices globally.[16] The agriculture and food industries use energy for various purposes. Direct energy use includes electricity for automated water irrigation, fuel consumption for farm machinery and energy required at various stages of food processing, packaging, transportation and distribution. The use of pesticides and mineral fertilisers results in large quantities of indirect energy consumption, with these inputs being highly energy intensive to manufacture.[16][17] While the share varies considerably between regions – depending on factors such as weather conditions and crop types – direct and non-direct energy costs can account for 40% to 50% of total variable costs of cropping in advanced economies such as the United States. Higher energy and fertiliser prices therefore inevitably translate into higher production costs, and ultimately into higher food prices.[17]

Energy transition

Aside of inflationary pressures, the 2021/22 energy crisis has also increased the use of coal in energy production worldwide. Coal use in Europe already increased by 14% in 2021, and is expected to rise another 7% in 2022. Soaring natural gas prices have made coal more competitive in many markets, and some nations have resorted to coal as a substitute for potential energy rationing in winter 2022/23. With demand for coal increasing in Asia and elsewhere, global coal consumption is forecast to rise again by 0.7% in 2022 to 8 billion tonnes. Burning coal or petroleum products emits significantly higher amounts of carbon dioxide and air pollutants compared to natural gas. The return to coal slows the transition to greener and more sustainable energy sources. Both the United States and Russia are top exporters of natural gas and coal.[18][19]

Europe has been historically leading with regard to global climate policy, pledging to cut emissions to at least 55% below 1990 levels in the next 8 years. But sanctions on Russia are crushing global supplies of fossil fuel with drastic price increases. Russia’s invasion of Ukraine in 2022 risks unravelling decades of hard work to reduce emissions on the European continent. After a long period of optimistic projections on reducing Europe's carbon footprint, governments there aren't keep anything off the table, including reopening coal-fired power plants or upping oil imports, as well as prolonging the phase-out for nuclear energy.[20]

Effects by location

Africa

Cameroon

Cameroon has been hit by fuel shortages in July as most fuel stations run out of diesel and have to start rationing. Fuel subsidies cost the Cameroonian government over $1.2 billion a year and Yaounde has come under pressure from the IMF to stop them.[21]

Central African Republic

Fuel shortage and rising food prices exacerbated humanitarian assistance in the country, with some humanitarian flights have been either suspended or postponed due to high fuel price.[22]

Ethiopia

In Ethiopia, the government removed fuel subsidies in July, causing diesel price to increase by 38%. Motorists in the capital Addis Ababa were seen waiting in long queues for up to eight hours to refill.[23]

Kenya

In Kenya, a row between oil companies and the government over subsidy payments has resulted in reduced import and a fuel crunch. Hours-long queues and strict rationing at petrol stations are reported.[24]

Nigeria

Fuel crisis exacerbated by the Russian-Ukraine conflict has caused prices for importing fuel to go up by more than 100%. Despite being an oil exporting country, Nigeria imports almost all of its fuel since its refineries fail to cover the country's needs. Long lines up to eight hours are reported in the capital Lagos.[25] The lack of A1 jet fuel has caused flights to be cancelled with passengers stranded in Abuja.[26]

Asia

China

China is facing its worst energy crisis in decades, due in part to a record heatwave, with droughts drying up water reservoirs and impacting hydropower stations.[27][28] The Guardian reported that "Companies in the industrial heartlands have been told to limit consumption, residents have been subjected to rolling blackouts, and annual light shows have been cancelled."[29]

Prices for industrial metals such as copper, zinc and aluminum have soared to record levels as energy shortages in China drive up costs for electricity and natural gas.[30][31] The price of aluminum has reached a 13-year high.[32][33]

The energy crisis has intensified pressures on China ahead of the 2022 Winter Olympics.[34][35] Al-Jazeera reported that "China's energy crisis is partially of its own making as CCP general secretary Xi Jinping tries to ensure blue skies at the Winter Olympics in Beijing next February and show the international community he's serious about de-carbonizing the economy."[36]

The energy crunch in Europe and Asia has allowed the Kremlin to forge its energy connections with China as Gazprom announced another gas pipeline with China, Power of Siberia 2, after the finalisation of the existing Power of Siberia in 2019. The second project between Moscow and Beijing, planned to deliver gas from the Yamal Peninsula, will be signed off in late 2022.[37] According to ship-tracking data, China spent almost $19 billion on Russian oil, gas and coal in the first half of 2022, almost twice the amount than a year earlier. China is already buying essentially everything that Russia can export via pipelines and Pacific ports.[38]

India

India experienced power outages in Uttar Pradesh, Rajasthan, Punjab, Jharkhand, Maharashtra, and Kerala as the country's coal stockpiles at power plants were dangerously low.[39][40] In order to mitigate the outage, coal supplies were re-routed from industries to power plants.

In October 2021, the crisis reached its peak, with 1/3 of coal power plants having less than three days of supply.[41] A complete power failure was averted as Coal India, which supplies 80% of coal output, ramped up coal production.

In 2022, India was in a similar situation as China. The country increased its energy reliance with Russia in the aftermath of the 2022 Russian invasion of Ukraine, as imports for Russian liquid gas, crude oil and coal tripled to almost $5 billion.[38]

Laos

In 2022, Laos was hit by an economic crisis caused by rising debt, fuel shortage and rising inflation. Long queues have formed at gas stations in Vientiane as motorists scramble for fuel.[42]

South Korea

Diesel vehicle drivers had difficulties buying diesel exhaust fluid in South Korea.[43][44]

Sri Lanka

High fuel prices and the Sri Lankan economic crisis haves resulted in declines in electricity, fuel and cooking gas shortages in the country. Long queues formed in front of gas stations [45] as government suspended fuel sales to non-essential vehicles.[46] Discontent lead to protests which ousted president Gotabaya Rajapaksa.

Oceania

Australia

Australia's east coast faced very high gas and electricity prices and low reserve capacity in mid-2022, due to a combination of factors, including high prices for gas (which is exported via LNG terminals in Queensland and thus local prices depend on the global LNG market) and thermal coal, constrained production and transportation due to flooding in coal producing regions,[47] and a series of outages in coal-fired power plants. This led the Australian energy market operator AEMO to temporarily suspend operation of the east coast electricity market for the first time since its inception, and take direct control of generation and dispatch.[48] AEMO also intervened in the local gas market after a large gas storage facility in Victoria became increasingly depleted due to the "unprecedented demand".[49]

Europe

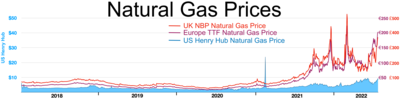

Due to a combination of unfavourable conditions, which involved soaring demand of natural gas, its diminished supply from U.S., Norway and Russia to the European markets, less power generation by renewable energy sources such as wind, water and solar energy, and cold winter that left European gas reservoirs depleted, Europe faced steep increases in gas prices in 2021.[51][52][53][54] Russia has fully supplied on all long-term contracts, but has not supplied extra gas on the spot market;[55] in the first half of 2021, Russia supplied over 3 billion m³/week (almost half of EU's imports), and around 2.3 billion m³/week in the second half of 2021.[56] In October 2021, the Economist Intelligence Unit reported that Russia had limited extra gas export capacity because of its own high domestic demands with production near its peak.[55][57] On 27 October 2021, Russian President Vladimir Putin authorised state-controlled energy giant Gazprom to start pumping extra natural gas into European gas storage sites once Russia finishes filling its own gas inventories, which may happen by November 8.[58][59] This caused the sharp drop in global prices on energy resources and temporarily alleviated the energy crisis in Europe.

The Groningen gas field in the Netherlands, Europe's largest natural gas field, will stop production by mid-2022. Reuters reported that "extraction quickly became problematic in recent years, as a series of tremors caused by gas production damaged houses and buildings in the region."[60][61]

Some critics blamed the European Union Emissions Trading System (EU ETS) and closure of nuclear plants for contributing to the energy crisis.[62][63] The Merkel government in Germany decided in 2011 to phase out both nuclear power and coal plants.[64]

U.S. exports of liquefied natural gas (LNG) to China and other Asian countries surged in 2021, with Asian buyers willing to pay higher prices than European importers.[65] In late 2021 and early 2022, half or more of US LNG exports went to Europe.[66]

In late 2021, European energy prices continued to increase, while an unprecedented energy crunch, particularly for natural gas, weighed heavily on economic growth indicators. Norway increased its export to EU to 2.9 billion m³/week.[56] Liquified natural gas markets were tight for the entire 2021. The Kremlin has been accused to tout the necessity of Nord Stream 2, but some energy analysts view energy shortages in Europe as self-inflicted, and blame European Union sanctions of Russian entities, among other reasons.[67]

Europe's energy crisis was spreading to the fertilizer and food industries.[68][69] According to Julia Meehan, the head of fertilizers for the commodity price agency ICIS, "We are seeing record prices for every fertiliser type, which are all way above the previous highs in 2008. It's very, very serious. People don't realise that 50% of the world's food relies on fertilisers."[70]

On 16 November 2021, European natural gas prices rose by 17% after Germany's energy regulator temporarily suspended approval of the Nord Stream 2 natural gas pipeline from Russia to Germany.[71][72]

In the first two months after Russia invaded Ukraine on 24 February 2022, Russia earned $66.5 billion from fossil fuel exports, and the EU accounted for 71% of that trade.[73] As a result of the invasion, Brent oil prices rose above $130 a barrel for the first time since 2008.[74] In April 2022, Russia supplied 45% of EU's natural gas imports, earning $900 million a day.[75] In May 2022, the European Commission proposed a ban on oil imports from Russia, part of the economic response to the 2022 Russian invasion of Ukraine.[76][77] In May 2022, Russia imposed sanctions on European subsidiaries of Gazprom.[78]

In response to the invasion of Ukraine, the European Commission and International Energy Agency presented joint plans to reduce reliance on Russian energy, reduce Russian gas imports by two thirds within a year, and completely by 2030.[79][80] On 18 May 2022, the European Union published plans to end its reliance on Russian oil, natural gas and coal by 2027.[81]

Responding to the crisis, Peru saw its export of LNG increase 74% in the first months of 2022 compared to the previous year, with LNG exports to Europe rising greatly, especially in Spain and the United Kingdom.[82]

In June 2022, the United States government agreed to allow Italian company Eni and Spanish company Repsol to import oil from Venezuela to Europe to replace oil imports from Russia.[83] French Finance Minister Bruno Le Maire said that France negotiated with the United Arab Emirates to replace some Russian oil imports.[83] On 15 June 2022, Israel, Egypt and the European Union signed a trilateral natural gas agreement.[84]

In March 2022, Bloomberg reported that China was reselling its US LNG shipments to a desperate Europe at a "hefty profit".[85] In August 2022, it was reported in Nikkei Asia that China was again reselling some of its surplus LNG cargoes to Europe due to having weak energy demands in its domestic market, suggesting that China was sufficiently stocked in LNG and was an unexpected "white knight" throwing an "energy lifeline" to help Europe with its winter gas shortage fears.[86]

Belgium

A study by the Commission for the Regulation of Electricity and Gas shows a 30% increase in the price of electricity and 50% in the price of natural gas in Belgium.[87]

France

Nuclear power in France usually provides up to 70% of electricity production. Corrosion in several French nuclear reactors, even the most modern type N4, led to long term shutdowns since October 2021.

Surging energy prices for natural gas and heating oil have caused higher living expenses, particularly for renters and rural land owners. Socio-economic measures were taken to counter-act inflationary pressures that disproportionally affect working families and immigrants. The 2021 energy crisis, complicated by political tensions in Eastern Europe and scarce natural gas supplies, have cost the French state an additional €580 million ($685 million) per year.[88]

On 6 July 2022, Paris announced that it will nationalise the Électricité de France (EDF) power utility as a result of the escalating energy crisis on the European continent.[89]

Germany

The country is a principal purchaser of Russian natural gas and was mostly affected by sanctions on Russian energy in the aftermath of its invasion of Ukraine in February 2022. Germany indefinitely suspended the regulatory approval for the Nord Stream 2 in March, but resisted pressures to shut down oil and natural gas trades with Russia altogether. In Germany, both employers and labour representatives feared that a further tightening of sanctions would threaten entire employment sectors. The recent energy crisis and encouragement by German governments to save Russian energy was also dubbed "freezing for Ukraine". Industry sectors not directly involved with natural gas or petroleum would also suffer as "firms would go bust" if prices for crucial raw materials like nickel and aluminium were to increase even more.[90] In March 2022, Germany's Minister for Economic Affairs Robert Habeck cautioned, "If we do not obtain more gas next winter and if deliveries from Russia were to be cut then we would not have enough gas to heat all our houses and keep all our industry going."[91]

German Chancellor Olaf Scholz announced plans to build two new LNG terminals.[92] Habeck said Germany reached a long-term energy partnership with Qatar,[93] one of the world's largest exporters of liquefied natural gas.[94]

In June 2022, Scholz said that his government remains committed to phasing out nuclear power despite rising energy prices and Germany's dependence on energy imports from Russia.[95] Former Chancellor Angela Merkel committed Germany to a nuclear power phase-out after the Fukushima nuclear disaster.[96]

On 25 July 2022, Gazprom announced it will reduce gas flows to Germany to 20% of the maximum capacity, or 50% of the current throughput, which further exacerbated the energy crisis in Europe.[12]

Greece

Due to the abrupt delignitisation and Limit Price, electricity prices hit record high €420 per MWh.[97] The Limit Price is a key parameter of the electricity tariff. It is transferred to the electricity bill as adjustment clause. By activating it, the providers pass on to the consumption the total increases of the supply costs in the wholesale market and the reductions respectively, although in the latter case they are not in a hurry or can be forgotten. The adjustment clause transfers to consumption the total cost of supply that is added to the Limit Price and corresponds to costs.

Due to the high taxation, including the Excise Tax, and the rise in price of crude oil, Unleaded Price was over 2€/l.[98]

Kosovo

The 2021/2022 energy crisis and the 2022 Russian invasion of the Ukraine made coal from Kosovo more attractive for European energy traders. Serbia as well is increasing coal production due to a lack of hydroelectric energy. Surging wholesale prices for natural gas increased the demand for coal in Western Europe. Environmentalists warned that coal is not the answer, as it roughly emits double the amount of carbon dioxide per kWh.[99]

Moldova

In 2021, Moldova had a gas crisis that lasted for several months until the signing of a new contract with the Russian state-controlled gas company Gazprom with a duration of 5 years. There were allegations that Russia used this crisis to its advantage as a consequence of Moldova having elected the pro-European now president Maia Sandu over the pro-Russian candidate Igor Dodon in 2020, although this was denied by Russia.[100]

Russia

In 2022, Russia achieved record amount of earnings through the export of fossil fuels. On 27 May 2022, Russian Finance Minister Anton Siluanov stated that extra revenues from the sale of natural gas in the amount of €13.7 billion will be used to increase pension funds for retired individuals and families with children, as well for "special operations" in Ukraine.[101] Russia has also increased energy exports to China and India to make up for decreased revenues in Europe. In the first half of 2022, Russia pocketed an extra $24 billion from selling fossil fuels to both nations.[38]

Russia pumps almost as much oil as before its 2022 invasion of the Ukraine. Sales to the Middle East and Asia have made up for declining exports to Europe, and due to the higher price, Moscow made $20 billion monthly compared to $14.6 billion a year before (2021). Despite International sanctions during the Russo-Ukrainian War, Russian energy sales have increased in value, and its exports have expanded with new financing options and payment methods for international buyers.[102]

Spain

In Spain, electricity prices rose more than 200%.[103]

On 1 November 2021, Algeria stopped natural gas exports to Spain through the Maghreb–Europe Gas Pipeline, opting instead to supply Spain through the Medgaz pipeline.[104][105] Algeria is Spain's largest gas supplier.[104][105]

Switzerland

In 2021, the Swiss confederation obtained 45% of its total natural gas consumption from Russian sources via Germany. Initially, Switzerland has sought to expand its use of natural gas for electricity generation, with three back-up power stations to prepare for any potential energy crunch in the coming years. But in the aftermath of the 2022 Russian invasion of the Ukraine, Switzerland imposed financial sanctions against Russian banks, and a ban on Russian crude and petroleum products in June 2022.[106]

In August 2022, the Swiss Federal Council presented an emergency plan for Switzerland's energy grid with the goal to supply more hydroelectric energy, and assure sufficient external storage for natural gas. Switzerland was also negatively affected by the 2022 European drought with minimal fill volumes of alpine dams.[107]

United Kingdom

From August 2021, high European wholesale natural gas prices caused 31 domestic suppliers in the United Kingdom to go out of business, out of a total of 70 that had been in operation at the beginning of the year.[108][109][110] In September 2021, panic buying of petrol and diesel fuel by consumers in the United Kingdom caused serious disruption to the supply of road fuel.[111]

North America

United States

Energy Secretary Jennifer Granholm blamed the OPEC oil cartel led by Saudi Arabia and the U.S. gas and petroleum industry for rising motor fuel prices in the United States.[112][113][114] As the Financial Times reported on November 4: "The White House has said OPEC+ risks imperiling the global economic recovery by refusing to speed up oil production increases and warned the U.S. was prepared to use 'all tools' necessary to lower fuel prices."[115]

According to the U.S. Energy Information Administration, American families heating with propane can expect to pay 54% more in winter 2021/22 than they did last year.[116]

On 23 November 2021, the Biden administration announced it would release 50 million barrels of oil from the Strategic Petroleum Reserve (SPR).[117]

Due to the 2022 Russian invasion of Ukraine and subsequent international sanctions during the Russo-Ukrainian War against Russia, oil prices worldwide soared. In the beginning of March 2022, the price of Brent Crude passed US$113 a barrel, the highest level since June 2014, while West Texas Intermediate was trading at just under US$110 a barrel.[118] On 8 March, President Joe Biden ordered a ban on imports of Russian oil, gas and coal to the US.[119] Biden ordered another 30 million barrels of oil released from the SPR in early March, which on 31 March was followed by a release of 1 million barrels on average per day for 180 days, the latter on which is the largest release from the SPR in its history.[120] The Biden administration was pressed on potential oil deals with Saudi Arabia, Venezuela, and Iran that would have them increase their oil production.[121] However, so far, Saudi Arabia and the United Arab Emirates have declined requests from the US.[122][123] In May 2022, the Biden Administration announced that it will allow European oil companies to acquire Venezuelan crude immediately but dismissed calls for the US to unilaterally lift all sanctions against Venezuela.[124]

On June 14, 2022, the American Petroleum Institute unveiled a ten-point policy plan advising how to reduce the price of fuel in the United States and globally. Some of those points include lifting development restrictions on federal lands and waters, ending permitting obstruction on natural gas projects, revising the National Environmental Policy Act process to reduce some of the "bureaucracy" placed on energy projects, among other suggestions.[125]

During Biden's visit in Saudi Arabia on 16 July 2022, the US president failed to secure commitments for an immediate OPEC output rise as intended. With economic sanctions in place against Iran and Venezuela, energy analysts expect a tight petroleum market well into 2023. In contrast to the United States, European countries would like to see a return of Iran and Venezuela to the global oil market to ease inflationary pressures worldwide.[126][127]

In late August 2022, Saudi Arabia and OPEC announced another possible cut in oil output, Brent crude futures rose again significantly. Meanwhile, Iran accused the United States of procrastinating in efforts to revive Tehran’s 2015 nuclear deal. At the same time, Europe continued to face disruptions in energy supplies due to damage to a pipeline system bringing oil from Kazakhstan through Russia.[128]

South America

Ecuador

In Ecuador, rising fuel prices led to protests by transportation union in Quito.[129] In June 2022, protests by students and workers against rising prices became widespread in what is known as the 2022 Ecuadorian protests.

Peru

In Peru, effects from the COVID-19 pandemic along with rising fertilizer and fuel prices as part of the economic impact of the Russian invasion of Ukraine sparked the 2022 Peruvian protests, which resulted with the death of eight individuals and dozens injured.

Responses

The UK government has turned to Qatar to seek a long-term gas deal to ensure a stable supply of liquefied natural gas (LNG) to the UK.[130] Prime Minister Boris Johnson asked Sheikh Tamim bin Hamad Al Thani, the Emir of Qatar, for help during a meeting at the UN General Assembly in September 2021.[131][132] EU suspended an antitrust investigation into QatarEnergy in February 2022.[133]

In October 2021, U.S. producer Venture Global LNG signed three long-term supply deals with China's state-owned Sinopec to supply liquefied natural gas. China's imports of U.S. natural gas will more than double.[134]

On 28 October 2021, natural gas prices in Europe dropped by at least 12% after Gazprom announced it would increase supplies to Europe after Russian domestic storage sites were filled on about 8 November. Norway had increased gas production and lower coal prices in China are also helping lower natural gas prices.[135][58]

Hungarian Prime Minister Viktor Orbán blamed a record-breaking surge in energy prices on the European Commission's Green Deal plans.[136] Politico reported that "Despite the impact of high energy prices, [EU Commissioner for Energy] Kadri Simson insisted that there are no plans to backtrack on the bloc's Green Deal, which aims to make the EU climate neutral by 2050."[137] Speaking at the COP26 climate summit in Glasgow, Czech Prime Minister Babiš denounced the European Green Deal,[138] saying that the European Commission "continues to propose dangerous policies such as the ban on combustible engines in 2035, or carbon allowances for transport and individual housing. Due to improper legislature and speculation, the price of emission allowances has gone out of control, resulting in the surging costs of electricity."[139]

U.S. President Joe Biden's national security adviser Jake Sullivan released a statement calling on OPEC+ to boost oil production to "offset previous production cuts that OPEC+ imposed during the pandemic until well into 2022."[140] On 28 September 2021, Sullivan met in Saudi Arabia with Saudi Crown Prince Mohammed bin Salman to discuss the high oil prices.[141] The price of oil was about US$80 by October 2021, the highest since 2014.[142][143] USA delivered 16 billion cubic meters of LNG to Europe in January 2022, and 6 billion in February.[144]

Iranian oil minister Javad Owji said if U.S.-led sanctions on Iran's oil and gas industry are lifted, Iran will have every capability to tackle the global energy crisis.[145][146]

Qatar's energy minister Saad Sherida al-Kaabi stated that there "is a huge demand from all our customers, and unfortunately we cannot cater for everybody. Unfortunately, in my view, this is due to the market not investing enough in the [gas] industry."[147]

European Commission President Ursula von der Leyen said that "Europe today is too reliant on gas and too dependent on gas imports. The answer has to do with diversifying our suppliers ... and, crucially, with speeding up the transition to clean energy."[148][149]

European Commissioner for Climate Action Frans Timmermans suggested "the best answer to this problem today is to reduce our reliance on fossil fuels."[150]

In late October 2021, Russian ambassador Andrei Kelin denied that Russia is withholding gas supplies for political reasons. According to the ambassador, delivery of natural gas through Ukraine has been increased by up to 15% for November 2021, but it was unclear whether this increase would have an immediate effect on the natural gas supply in Europe. Furthermore, such increase in gas delivery was hindered by a lack of modernization of the Ukrainian gas pipelines, according to the source.[151]

On 13 July 2022, the Kremlin expressed hope that a visit by President Biden in Saudi Arabia to boost OPEC oil production would not foster anti-Russian sentiments there. Russia is the largest oil and gas exporter after Saudi Arabia and enjoys a highly valued cooperation with the Arab country in the framework of the OPEC group. But at current levels, major Gulf producers have little to spare, and Russia blames international sanctions for higher energy prices around the world.[152]

See also

- 9-Euro-Ticket

- 1970s energy crisis

- Economic impact of the COVID-19 pandemic

- Energy crisis

- Fossil fuel phase-out

- 2022 food crises

- 2021–2022 inflation surge

- US Trade Data

References

- ^ "Global Energy Crisis Shows Fragility of Clean-Power Era". Bloomberg.com. 2021-10-05. Retrieved 2021-10-09.

- ^ "Warning UK energy bills may soar 30% in 2022 – as it happened". The Independent. 2021-10-07. Archived from the original on 2021-10-07. Retrieved 2021-10-09.

- ^ "China's Energy Crisis Is Hitting Everything From iPhones to Milk". Bloomberg.com. 2021-10-07. Retrieved 2021-10-09.

- ^ "The Electricity Crisis Was Not Caused By A 'Perfect Storm'". finance.yahoo.com. Retrieved 2021-10-09.

- ^ "China needs more coal to avert a power crisis — but it's not likely to turn to Australia for supply". CNBC. 26 October 2021.

- ^ "Brazil warns of energy crisis with record drought". Al-Jazeera. 1 September 2021.

- ^ "Brazil's Drought Pressures Power Grid, Boosting Case for Renewables—and Fossil Fuels". The Wall Street Journal. 11 October 2021.

- ^ "Drought squeezes Brazil's electricity supply". France 24. 3 September 2021.

- ^ "The Green Brief: Europe's energy price crunch dilemna [sic]". Euractiv. 29 September 2021.

- ^ "Business EU moves to speed up energy investments amid Ukraine war, rising gas prices". Deutsche Welle. 1 March 2022. Archived from the original on 1 March 2022.

- ^ Davies, Rob (4 March 2022). "Gas prices hit record high again as Ukraine invasion disrupts markets". The Guardian.

- ^ a b “Seeking Leverage Over Europe, Putin Says Russian Gas Flow Will Resume“ NYT. Retrieved 26 July 2022.

- ^ Chambers, Madeline; Marsh, Sarah (22 February 2022). "Germany freezes Nord Stream 2 gas project as Ukraine crisis deepens". Reuters. Reuters. Retrieved 24 February 2022.

- ^ Mulvaney, Dustin (2011). Green Energy: An A-to-Z Guide. SAGE. p. 301. ISBN 978-1-4129-9677-8.

- ^ Erisman, Jan Willem; MA Sutton, J Galloway, Z Klimont, W Winiwarter (October 2008). "How a century of ammonia synthesis changed the world". Nature Geoscience. 1 (10): 636–639. Bibcode:2008NatGe...1..636E. doi:10.1038/ngeo325. S2CID 94880859. Archived from the original on 23 July 2010.

{{cite journal}}: CS1 maint: multiple names: authors list (link) - ^ a b "Russia-Ukraine war worsens fertilizer crunch, risking food supplies". NPR. 12 April 2022.

- ^ a b Levi, Peter; Molnar, Gergely (14 June 2022). "How the energy crisis is exacerbating the food crisis". Paris: International Energy Agency. Retrieved 16 June 2022.

- ^ "Global coal demand is set to return to its all-time high in 2022". iea.org. Retrieved 31 July 2022.

- ^ "Russia is squeezing Europe’s gas supplies, sparking a bitter and reluctant return to coal" cnbc.com. Retrieved 31 July 2022.

- ^ "Europe must not backslide on climate action despite war in Ukraine" (05 July 2022) NATURE (Editorial). Retrieved 21 August 2022.

- ^ "Cameroonians queue for fuel as shortages hit the capital". 22 July 2022.

- ^ "Central African Republic: Alarming fuel shortage exacerbates worst levels of humanitarian needs since 2015 - Central African Republic | ReliefWeb".

- ^ Tadesse, Fasika (6 July 2022) [5 July 2022]. "Drivers Wait Eight Hours to Refill in Ethiopia's Fuel Crisis". Bloomberg News.

- ^ "Drivers queue for hours as Kenya reels from fuel shortage". 5 April 2022.

- ^ "Nigeria continues to grapple with fuel shortages, price surges". 25 June 2022.

- ^ "Hundreds of Passengers Stranded in Abuja Airport as Scarcity of Jet A1 Fuel Bites Harder". 24 July 2022.

- ^ "Will China's Energy Crisis Make It More Reluctant to Fight Climate Change?". Time. 30 September 2021.

- ^ CNN, Analysis by Nectar Gan. "Analysis: China's worst heat wave on record is crippling power supplies. How it reacts will impact us all". CNN. Retrieved 2022-08-26.

{{cite web}}:|last=has generic name (help) - ^ "Global energy crisis: how key countries are responding". The Guardian. 12 October 2021.

- ^ "METALS-Copper heads for best week since 2016, zinc rockets". Reuters. 15 October 2021.

- ^ "Base Metals Surge as Energy Crisis Knocks Out More Supply". Bloomberg. 15 October 2021.

- ^ "Aluminum prices hit 13-year high amid power shortage in China". Nikkei Asia. 22 September 2021.

- ^ "Global Energy Crisis Piles Pressure on Aluminum Supply". Bloomberg. 11 October 2021.

- ^ "Analysis: China's green Winter Olympics 2022 to boost natural gas demand". S&P Global. 15 September 2021.

- ^ "How China's energy crisis has sent commodity markets reeling". Nikkei Asia. 18 October 2021.

- ^ "The next shock in the pipeline for China's economy: energy crunch". Al Jazeera. 27 September 2021.

- ^ "Russia's energy deals with China..." FT. 17. November 2021.

- ^ a b c "Russia pockets $24bn from selling energy to China, India" aljazeera.com. Retrieved 7 July 2022.

- ^ "India States Hit by Power Outages as Coal Supply Still Tight". Bloomberg. 11 October 2021.

- ^ "China isn't the only huge Asian economy with a coal shortage now". CNBC. 12 October 2021.

- ^ "India's Oct power demand rises 4.1%, coal-fired output up 1.8%". Reuters. 1 November 2021.

- ^ "A fuel shortage is driving Laos — which is on the brink of a debt default — to seek out cheap Russian oil". Business Insider. 7 July 2022.

- ^ "Urea shortage threatens South Korea's transport, energy industries". Reuters. 9 November 2021.

- ^ "ANALYSIS: Shortage of diesel exhaust fluid could halt South Korea's automotive fuel demand recovery". S&P Global. 10 November 2021.

- ^ Ellis-Petersen, Hannah (2022-03-02). "Milk sachets, chicken, fuel: basics slip out of reach for Sri Lankans as economic crisis bites". The Guardian. Retrieved 2022-04-03.

- ^ "Non-essential petrol sales halted for two weeks in Sri Lanka". BBC News. 28 June 2022.

- ^ Leitch, David (2022-06-03). "La Niña's big hit on coal is forgotten factor behind Australia's energy crisis". RenewEconomy. Retrieved 2022-07-23.

- ^ Packham, Colin (2022-06-17). "How the energy market broke and forced AEMO's hand". Australian Financial Review. Archived from the original on 2022-07-23. Retrieved 2022-07-23.

- ^ "Energy market operator intervenes to prevent gas shortage as Victoria's reserves fall". ABC News. 2022-07-19. Retrieved 2022-07-23.

- ^ Sullivan, Becky (9 February 2022). "Explaining why natural gas plays such a big role in the Russia-Ukraine crisis". NPR.

- ^ "Energy crisis: The blame game has begun - but are some of the claims just hot air?". Sky News. 22 September 2021.

- ^ "Europe's Power Crisis Moves North as Water Shortage Persists". Bloomberg. 3 October 2021.

- ^ "Russia says it could boost supplies to ease Europe gas costs". Associated Press. 7 October 2021.

- ^ "It is tempting to blame foreigners for Europe's gas crisis: The main culprit is closer to home". The Economist. 16 October 2021.

- ^ a b Horton, Jake (14 October 2021). "Europe gas prices: How far is Russia responsible?". BBC News.

- ^ a b "Can Norwegian Natural Gas Solve Europe's Energy Crisis?". OilPrice.com. 17 February 2022. Archived from the original on 20 February 2022.

- ^ Mazneva, Elena (3 September 2021). "Russia Has a Gas Problem Nearly the Size of Exports to Europe". Bloomberg.

- ^ a b "Russia seen starting to fill Europe's gas storage after Nov. 8". Euronews. 27 October 2021.

- ^ "Putin Orders More Gas for Europe Next Month, Sending Down Price". Bloomberg. 27 October 2021.

- ^ "Dutch confirm plan to end gas production at Groningen next year". Reuters. 24 September 2021.

- ^ "Europe's energy crisis: Why are natural gas prices soaring and how will it affect Europeans?". Euronews. 6 October 2021.

- ^ "European Energy Crisis Fuels Carbon Trading Expansion Concerns". Bloomberg. 6 October 2021.

- ^ "In Global Energy Crisis, Anti-Nuclear Chickens Come Home to Roost". Foreign Policy. 8 October 2021.

- ^ "Germany Flirts With Power Crunch in Nuclear and Coal Exit". Bloomberg. 22 August 2021.

- ^ "Asian buyers outbid Europe for spot supplies of US natural gas". Financial Times. 21 September 2021.

- ^ Luna, Marcy de (15 February 2022). "Europe remains top destination for U.S. LNG for the third month". Reuters. Archived from the original on 20 February 2022.

- ^ Cohen, Ariel (Oct 14, 2021). "Europe's Self-Inflicted Energy Crisis". Forbes. Retrieved 8 November 2021.

- ^ "Energy crisis today – fertiliser and food crisis tomorrow?". Euractiv. 19 October 2021.

- ^ "'I'm afraid we're going to have a food crisis': The energy crunch has made fertilizer too expensive to produce, says Yara CEO". Fortune. 4 November 2021.

- ^ "Fears global energy crisis could lead to famine in vulnerable countries". The Guardian. 20 October 2021.

- ^ "Natural-Gas Prices Jump as Germany Pauses Certification of Russian Pipeline". The Wall Street Journal. 16 November 2021.

- ^ "European Natural Gas Prices Surge on Nord Stream 2 Delay — LNG Recap". Natural Gas Intelligence. 16 November 2021.

- ^ "Russia has made $66 billion from fuel exports since it invaded Ukraine - and the EU is still its biggest buyer, study finds". Business Insider. 28 April 2022.

- ^ Disavino, Scott (7 March 2022). "Oil price surges to highest since 2008 on delays in Iranian talks". Reuters.

- ^ "Missiles fly, but Ukraine's pipeline network keeps Russian gas flowing to Europe". CBC News. 12 April 2022.

- ^ Bill Chappell (4 May 2022). "The EU just proposed a ban on oil from Russia, its main energy supplier". NPR.

- ^ "EU oil ban adds pressure on Russia but obstacles remain: Analysts". Al Jazeera. 12 May 2022.

- ^ "Europe faces gas supply disruption after Russia imposes sanctions". Al Jazeera. 12 May 2022.

- ^ Weise, Zia (8 March 2022). "Commission plans to get EU off Russian gas before 2030". POLITICO.

- ^ International Energy Agency (March 2022). "A 10-Point Plan to Reduce the European Union's Reliance on Russian Natural Gas". IEA.

- ^ "EU unveils 210 bln euro plan to ditch Russian fossil fuels". Reuters. 18 May 2022.

- ^ Aquino, Marco; Parraga, Marianna (2022-05-31). "In Latam, Peru streaks ahead in LNG race to Europe as Trinidad stumbles". Reuters. Retrieved 2022-06-06.

- ^ a b "Oil from sanctioned Venezuela to help Europe replace Russian crude as soon as next month: report". Business Insider. 5 June 2022.

- ^ "EU signs gas deal with Israel, Egypt in bid to ditch Russia". Al Jazeera. 15 June 2022.

- ^ "China Sells U.S. LNG to Europe at a Hefty Profit". Bloomberg.com. 2022-03-15. Retrieved 2022-08-26.

- ^ "China throws Europe an energy lifeline with LNG resales". Nikkei Asia. Retrieved 2022-08-26.

- ^ "Les prix du gaz et de l'électricité explosent". RTBF Info (in French). 2021-09-06. Retrieved 2021-10-18.

- ^ "France to Give Families 580 Million Euros to Pay Energy Bills". Bloomberg News. Retrieved 8 November 2021.

- ^ "France plans full nationalisation of power utility EDF" Reuters. Retrieved 7 July 2022.

- ^ 'Firms will go bust': Germany prepares for a future without Russian gas. theguardian.com. Retrieved 10 April 2022.

- ^ "Reliant on Russian gas, Germany concerned over winter fuel supplies". France 24. 20 March 2022. Archived from the original on 22 March 2022.

- ^ "German minister heads to Qatar to seek gas alternatives". Deutsche Welle. 19 March 2022.

- ^ "Germany Signs Energy Deal With Qatar As It Seeks To reduce Reliance On Russian Supplies". Radio Free Europe/Radio Liberty. 20 March 2022.

- ^ "Germany goes on a mission to secure supplies of Qatari gas". Euractiv. 21 March 2022.

- ^ "Scholz and liberal finance minister clash over nuclear phase-out". Euractiv. 9 June 2022.

- ^ "Germany Confronts Its Nuclear Demons". Foreign Policy. 20 June 2022.

- ^ "Νέο ρεκόρ η τιμή ρεύματος στην Ελλάδα: 426,90 ευρώ η μεγαβατώρα". Retrieved 17 April 2022.

- ^ "ΘΕΜΑ: ΚΑΘΗΜΕΡΙΝΟ ΔΕΛΤΙΟ ΕΠΙΣΚΟΠΗΣΗΣ ΤΙΜΩΝ ΥΓΡΩΝ ΚΑΥΣΙΜΩΝ" (PDF). Retrieved 17 April 2022.

- ^ "Balkans turns to coal as energy crisis trumps climate commitments". Reuters. Retrieved 30 July 2022.

- ^ "Moldova says gas crisis over after deal with Russia's Gazprom". Radio Free Europe/Radio Liberty. 1 November 2021.

- ^ "13,7 Milliarden Euro Russland: Rekordeinnahmen aus Gas-Exporten" (in German). blick.ch. Retrieved 29 May 2022.

- ^ "Russia Confounds the West by Recapturing Its Oil Riches" WSJ. Retrieved 29 August 2022.

- ^ "Spain's Plan to Curb Soaring Energy Prices a Sign of Growing State Intervention". VOA News. 20 September 2021.

- ^ a b "Europe's energy crisis: Spain presses Algeria to guarantee natural gas supply". Euronews. 28 October 2021.

- ^ a b "Algeria to halt gas exports to Spain via Morocco". Africanews. 1 November 2021.

- ^ "Swiss adopt Russian oil ban and other sanctions over Ukraine war" swissinfo.ch. Retrieved 20 August 2022.

- ^ "Sommarugas Notfallplan ist unrealistisch" (in German). Tages Anzeiger. Retrieved 20 August 2022.

- ^ McCann, Jaymi (24 September 2021). "Who are the 'Big 6' energy companies? The UK's biggest suppliers explained and why gas prices have gone up". i. Associated Newspapers. Archived from the original on 27 September 2021. Retrieved 27 September 2021.

- ^ "Failed UK Energy Suppliers Update". Forbes. 18 February 2022.

- ^ "Two more UK energy firms go bust as prices soar". BBC News. 14 October 2021.

- ^ "Fuel crisis: Business Secretary Kwasi Kwarteng 'not guaranteeing anything' over impact on Christmas". Sky News. 29 September 2021.

- ^ "US energy secretary blames Opec 'cartel' for high petrol prices". Financial Times. 31 October 2021.

- ^ "Energy secretary says she hopes gas prices won't reach $4". The Hill. 7 November 2021.

- ^ "Granholm Takes Gas Price Blame Shifting To New Heights In Sunday Interview". Forbes. 8 November 2021.

- ^ "Biden's other setback: OPEC+ ignores his plea for help". The Hill. 8 November 2021.

- ^ "EIA expects U.S. households to spend more on energy this winter". U.S. Energy Information Administration (EIA). 13 October 2021. Retrieved 26 November 2021.

- ^ "Why Is Biden Tapping the Strategic Oil Reserve, and Will That Lower Gas Prices?" WSJ. 23 November 2021.

- ^ Martin, Josh (2 March 2022). "Oil price rises again as buyers shun Russian crude". BBC News. Retrieved 11 March 2022.

- ^ Miller, Zeke; Balsamo, Mike; Boak, Josh (9 March 2022). "US strikes harder at Putin, banning all Russian oil imports". Associated Press. Retrieved 11 March 2022.

- ^ Geman, Ben; Doherty, Erin (1 April 2022). "Biden ordering massive release of oil in bid to curb gas prices". Axios. Retrieved 4 April 2022.

- ^ Knickmeyer, Ellen; Bussewitz, Cathy (10 March 2022). "Pariahs no more? US reaches out to oil states as prices rise". Associated Press. Retrieved 10 March 2022.

- ^ Lonas, Lexi (8 March 2022). "Saudi, UAE leaders declined calls with Biden amid Ukraine conflict: report". The Hill.

- ^ "Mohammed bin Salman Has Leverage on Biden—and Is Using It". Foreign Policy. 24 March 2022.

- ^ "U.S. to ease sanctions on Venezuela, enabling cargoes to Europe" worldoil.com. Retrieved 29 May 2022.

- ^ "API Unveils Ten-Point Policy Plan to Restore U.S. Energy Leadership, Fuel Economic Recovery". June 14, 2022.

- ^ "Biden fails to secure major security, oil commitments at Arab summit" Reuters. Retrieved 31 July 2022.

- ^ "France wants return of Iran, Venezuela to global oil market" AA Energy. Retrieved 31 July 2022.

- ^ "Oil prices rise after Saudi says OPEC could cut output" Reuters. Retrieved 22 August 2022.

- ^ "Ambato, más sectores se suman a la paralización – Diario la Hora".

- ^ "Why Boris Johnson's Qatar gas plan is a cop out". Evening Standard. 17 November 2021.

- ^ "UK asks Qatar to become gas 'supplier of last resort' amid energy crisis". Doha News. 7 November 2021.

- ^ "UK seeks long-term gas deal with Qatar, asks to become 'supplier of last resort' -FT". Reuters. 6 November 2021.

- ^ Chee, Foo Yun (11 February 2022). "Qatar Petroleum no longer in EU antitrust crosshairs - sources". Reuters. Archived from the original on 20 February 2022.

- ^ "Sinopec signs huge LNG deals with US producer Venture Global". Financial Times. 20 October 2021.

- ^ Millard, Rachel (28 October 2021). "Gas prices slump as Putin boosts supplies to Europe". The Daily Telegraph. Retrieved 28 October 2021.

- ^ "The Green Brief: East-West EU split again over climate". Euractiv. 20 October 2021.

- ^ "Putin promises gas to a Europe struggling with soaring prices". Politico. 13 October 2021.

- ^ "COP26: Babiš to focus on European energy crisis, EU Green Deal's economic impact". Czech Radio. 1 November 2021.

- ^ "Andrej Babiš: It is absolutely crucial for individual states to choose their own energy mix to achieve carbon neutrality". Government of the Czech Republic. 1 November 2021.

- ^ "Turning to foreign leaders to fix our energy crisis is a shameful solution". The Hill. 16 August 2021.

- ^ "Top White House aide discussed oil prices with Saudi Arabia". Reuters. 1 October 2021.

- ^ "U.S. crude oil price tops $80 a barrel, the highest since 2014". CNBC. 8 October 2021.

- ^ "Oil analysts predict a prolonged rally as OPEC resists calls to ramp up supply". CNBC. 5 October 2021.

- ^ "Europe Is Running Out Of Space For LNG". OilPrice.com. 18 February 2022. Archived from the original on 19 February 2022.

- ^ "Iran ready to resolve global energy crisis if sanctions lifted: minister". Tehran Times. 5 October 2021.

- ^ "Iran Rises Above Russia On The Oil Market Radar". OilPrice.com.

- ^ "Soaring gas prices not a crisis, reflect lack of investment -Qatar minister". Reuters. 21 September 2021.

- ^ "EU chief says key to energy crisis is pushing Green Deal". Associated Press. 20 October 2021.

- ^ "Europe's energy crisis: Continent 'too reliant on gas,' says von der Leyen". Euronews. 20 October 2021.

- ^ "EU countries look to Brussels for help with 'unprecedented' energy crisis". Politico. 6 October 2021.

- ^ "Ambassador Andrei Kelin denies Russia is withholding gas supplies for political reasons". the national.scot. Retrieved 8 November 2021.

- ^ "Kremlin hopes Biden will not seek to turn Saudi Arabia against Russia" Reuters -Middle East-. Retrieved 14 July 2022.