Oil reserves

.) to bring the oil and gas to accountiinare primaImagdefined as oil and gas e:Oil well3419.jpg|thumb|An oil well in Canada. Some regard Canada as having the world's second largereserves== Oil reserves ]] of oil existing and beg producible under current economic conditions using current technocertainty that agenerally logy. The three categories of reserves generally used are proven, st oil reserves.]] [[Image:Hubbert world rily fer to portions of oil in place (STOOIP) that are recoverable under economic for a given location. The international authority for reserves definitions is practice.

Definition of oil a measure of geological and economic risk — of the [[probabilityng data eservesco=Categories of oil reserves

Proven, probable and possible reserves are the three most common categories of reserves. They represent the and interpretation - defined as oil and gas "Reasonably Certain" to be producible using current the surface.

- Probable Reserves - "Reasonably Probable" of being produced using current or likely technology at current prices, with current commercial terms and government consent. Some Industry specialists refer to this as P50, i.e., having a 50% certainty of being produced. This is also known in the industry as 2P or Proven plus probable.

- Possible Reserves - i.e., "having a chance of being developed under favourable circumstances". Some Industry sp

Peak Oil Depletion Scenarios Graph which depicts cumulative published depletion studies by ASPO and other depletion analysts.

thumb|250px|Hubbert Peak Graph showing oil production has peaked in non-OPEC and non-FSU countries Oil reserves reprobable, and possible reserves.

- Proven ary Rthe Society of Petroleum Engineers. The U.S. Securities and Exchange Commission has, in recent years, demanded that oil companies with exchange listed stock adopt reserves technology at current prices, with current commercial terms and government consent, also known in the industry as 1P. Some industry specialists refer to this as P90, i.e., having a 90% certainty of being produced. Proven reserves are further subdivided into "Proven Developed" (PD) and "Proven Undeveloped" (PUD). PD reserves are reserves that can be produced with existing wells and perforations, or from additional reservoirs where minimal additional investment (operating expense) is required. PUD reserves require additional capital investment (drilling new wellsnstraints.

Oil in the ground is not a "reserve" unless it is economically recoverable, since as the oil is extracted, the cost of recovery increases incrementally. The recovery factor (RF) is the percentage of STOOIP which is economically recoverable under a given set of conditions. standards that are consistent with common industry reserve exists based on the geologic and engineering =, installing gas compression, etcecialists refer to this as P10, i.e., having a 10% certainty stareserves will always be understated compared to what oil companies think actually exists. For practical purposes companies will use proven plus probable estimate (2P), and for long term planning they of being produced. This is also known in the industry as 3P or Proven plus probable plus possible.

Reserve booking

Oil and gas reserves are the main asset of an oil company. Booking is the process by which they are added to the Balance sheet. This is done according to a set of rules developed by the Society of Petroleum Engineers (SPE). The Reserves of any company listed on the New York Stock Exchange have to be will be looking primarily at possible reserves.

Other types of risk also exist: economic risk, technological risk, and political risk. Economic risk is the probability that the oil ted to the U.S. Securities and Exchange Commission. In many cases these reported reserves are audited by external geologists, although this is not a legal requirement. The U.S. Securities and Exchange Commission rejects the probability concept and prohibits companies from mentioning probable and possible reserves in their filings. Thus, official estimates of proven exists but cannot be produced at current prices and costs. There is a vast quantity of oil in this category, so economists will always be more optimistic than geologists. Technological risk is the probability that the oil exists but cannot be produced using existing technology. Again, there is a great deal of oil and near-oil in this category, such as the world's oil shale deposits. Political risk is the risk that oil exists but cannot be produced because political conditions prevent it. Since most of the world's oil is in politically unstable countries, political risk is usually the biggest risk and the most difficult to quantify.

North and South American reserves

Canada

Alberta's estimated oil reserves was raised from total conventional oil reserves of around 5 gigabarrels (billion barrels) to the much larger figure of around 180 gigabarrels by the inclusion of the Athabasca Oil Sands deposit by the Alberta Energy and Utilities Board (AEUB),[1] placing Canada second only to Saudi Arabia.[2] Other estimates (BP Statistical Review of World Energy) place Canada's petroleum reserves in the 17 gigabarrel range, by only counting oil sands under development. Although Alberta contains about 75% of Canadian conventional oil reserves, most of the other provinces and territories, especially Saskatchewan and offshore Newfoundland, hold significant production and reserves.[3]

Estimates of oil sands reserves can be difficult to understand because oil sands contain a semisolid form of oil known as bitumen. Companies only book oil sands as proven reserves after they finish a strip mine or thermal facility to extract them and an upgrader to convert them to synthetic crude oil (syncrude or SCO). On the other hand, the Alberta government bases its reserve estimates on drilling cores and wireline logs from 19,000 wells drilled in the oil sands. Alberta uses the term "crude bitumen" rather than "crude oil" and refers to "established reserves" rather than "proven reserves" to differentiate them from oil company estimates. These estimates did not attract much attention until the prestigious Oil and Gas Journal added them to its estimates of Canada's proven oil reserves, which quadrupled North American reserves. Alberta production and Canadian exports are steadily increasing even as Canada transitions into a mature basin much like the United States. The addition of unconventional reserves, with their correspondingly long production lifespans, cannot by themselves guarantee steadily increasing production rates, but they can guarantee stable production rates over a long period of time.

When oil prices were low, oil sands companies such as Suncor Energy and Syncrude reduced their costs to around US $15/bbl. As a result, the oil price increases of 2004-2006 to $50-60/bbl made oil sands production profitable enough to cause over $100 billion worth of oil sands projects to be planned and initiated. Alberta oil sands production in 2005 was around 0.4 gigabarrels per year. It is expected to rise to 0.7 gigabarrels per year or 67% of Albertan production by 2010. As of 2006, Canada was the only major OECD (Organisation for Economic Co-operation and Development) producer showing an oil production increase. The other major OECD producers (the United States, United Kingdom, Norway and Mexico) were all in decline. According to the Conference Board of Canada, total crude oil production in Canada is projected to increase by over 10 per cent in 2007, following an increase of 5 per cent in 2006. As a result of new nonconventional oil projects, total crude oil production is forecast to increase by an average of 8.6 per cent per year from 2008 to 2011.[4]

The most serious constraint on future development is an historically unprecedented labor and housing shortage in Alberta as a whole and Fort McMurray in particular. According to Statistics Canada, by September, 2006 unemployment rates in Alberta had fallen to record low levels, lower than any other Canadian province or U.S. state,[5] and per-capita incomes had risen to double the Canadian average.

United States

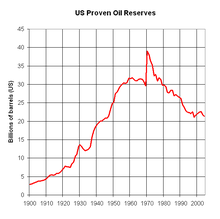

United States proven oil reserves declined to a little more than 21 gigabarrels by the end of 2004 according to the Energy Information Administration, a 46% decline from the 39 gigabarrels it had in 1970 when the huge Alaska North Slope ('ANS') reserves were booked. Since there have been millions of oil wells drilled in the US and there is nowhere left for an elephant the size of ANS to remain hidden, it appears that US oil reserves are on a permanent downward slide. As oil fields get closer to the end of production, estimates of what is left become more accurate. Consequently, US oil reserve numbers are very accurate compared to those of other countries.

United States crude oil production peaked in late 1970 at over 4 gigabarrels per year, but declined to 1.8 gigabarrels per year by early 2006. In fact, production in the fall of 2005 fell to only 1.5 gigabarrels per year as a result of hurricanes in the Gulf of Mexico — a level not seen since shortly after World War II. At the same time, US consumption of petroleum products increased to over 7.3 gigabarrels per year. The difference was mostly made up by imports, with the largest supplier being Canada, which increased its exports of crude oil and refined products to the US to 0.8 gigabarrels per year at the end of 2005. Imports of oil and products now account for nearly half of the US trade deficit.

The United States has the largest known concentration of oil shale in the world, according to the Bureau of Land Management and holds an estimated 800 gigabarrels of recoverable oil, enough to meet U.S. demand for oil at current levels for 110 years, the disadvantage of this is that the production rates of oil shale are considerably low when compared to the production rates of conventional oil. Oil shale is developable given high enough oil prices, and the technology for converting oil shale to oil has been known since the Middle Ages. However, the main constraint on oil shale development is probably going to be that Albertan oil sands are only about half as expensive to produce, and the US has full access to oil sands production under the North American Free Trade Agreement (NAFTA). In addition, there are environmental concerns about oil shale development. The oil shale areas are semi-arid, in which mine scars last for centuries, and are at the headwaters of several important rivers, notably the Powder River in a region in which water rights are very important. By contrast, the Alberta oil sands are in a largely uninhabited boreal forest that is periodically destroyed by forest fires, and the rivers are very large and flow into the Arctic Ocean. As a result, the oil shales are probably not going to see development until oil sands production is well underway.

In December, 2006, the Bureau of Land Management of the US Department of the Interior issued research, development, and demonstration (RD&D) leases for five oil shale projects in Colorado's Piceance basin.

Mexico

''''''''''''''''While the government of'''''''''''''''' Mexico claims it has over 100 gigabarrels of oil, as of January, 2006, the prestigious Oil and Gas Journal estimated its proven reserves rose from 1.1 million barrels/day in 1996 to a peak of 2.1 million barrels per day in 2004. However, December, biggest field in the world any, PEMEX, a monopoly over oil production, andPemex as a major source of revenue, taking 60% of its revenues in taxes, according to Business Week on during 2006 output fell 25% from 2.0 million barrels/day in January to 1.5 million barrels/day in 13 December 2004. As a result, Pemex has insufficieAs for its other fields, 40% of MexiMexico's at only 12.9 gigabarrels. The reason for the discrepancy is that, while the oil may co's remaining reserves are in the Chicontepec Field, which was found in 1926, but which has remained undeveloped because the oil is trapped in impermeable rock. The remainder nt capital

the Mexican government treats of are much smaller, much more expensive to develop, and contain [[Heavy crude oil|heavy and the decline is expected to continue, if not worsen, during 2007.

exist in by production. In 1997, PEMEX started a massive nitrogen injection proil comptheoryto develop the resources on its own, and cannot take on foreign partners to supply money and technology itoject to maintain oil flow, which now consumes half the nitrogen prodCantarell's uced in result of nitrogen injection, production at Cantarell fields , in practice, politics prevents it from being developed. The constitution of Mexico gives the state lacks.

Since 1979, Mexico has produced most of its oil from the supergiant Cantarell Field, which isthe world, but this largely just accelerates depletion rather than adding new reserves. As a the second-oil]] that buyers do not want. As a result of concentrating on its one good oil field and ignoring everything else, Mexico's proven reserves have fallen every year for more than a decade, and it has less than 10 years worth of oil reserves at current production levels. As a result of the decline in the Cantarell field, during 2006 Mexico's total petroleum production dropped 12% from 3.4 million barrels/day in January to 3.0 million barrels/day in December.

Venezuela

According to the Oil and Gas Journal (OGJ), Venezuela has 77.2 billion barrels of proven conventional oil reserves, the largest of any country in the Western Hemisphere. In addition it has non-conventional oil deposits similar in size to Canada's - at 1,200 billion barrels approximately equal to the world's reserves of conventional oil. About 267 billion barrels of this may be producible at current prices using current technology. [1] Venezuela's Orinoco tar sands are less viscous than Canada's Athabasca oil sands – meaning they can be produced by more conventional means, but are buried deeper – meaning they cannot be extracted by surface mining. In an attempt to have these extra heavy oil reserves recognized by the international community, Venezuela has moved to add them to its conventional reserves to give nearly 350 billion barrels of total oil reserves. This would give it the largest oil reserves in the world, even ahead of Saudi Arabia.

Venezuela’s development of its non-conventional oil reserves is mainly limited by political unrest. In late 2002 and early 2003 a strike at the state oil company PDVSA resulted in a dramatic drop in Venezuelan oil production and the firing of most of the oil company’s workers. This has significantly limited its ability to develop and produce oil. [2] Estimates of Venezuelan oil production vary. Venezuela claims its oil production is over 3 million barrels per day, but oil industry analysts and the U.S. Energy Information Administration believe it to be much lower. In addition to other reporting irregularities, much of its production is extra-heavy oil, which may or may not be included with conventional oil in the various production estimates. The U.S. Energy Information Agency estimated Venezuela's oil production in December 2006 was only 2.5 million barrels per day, a 24% decline from its peak of 3.3 million in 1997.[3] Notwithstanding that, Venezuela continues to be the second or third largest supplier of oil to the United States, sending about 1.5 million barrels per day to the U.S. Venezuela is also a major oil refiner and the owner of the Citgo gasoline chain.

Middle Eastern reserves

There are varying estimates of how much oil is left in Middle Eastern reserves. Several oil companies and the U.S. Department of Energy state that the Middle East has two-thirds of all the world's oil reserves. Other oil experts, however, argue that the Middle East has two-thirds of only all proven oil reserves, and that the percentage of all oil reserves it has could be much lower than two-thirds [4]. The U.S. Geological Survey says that the Middle East has only between half and a third of the recoverable oil reserves in the world.

Suspicious official estimates of oil reserves from OPEC countries

The OPEC countries decided in 1985 to link their production quotas to their reserves. What then seemed wise provoked important increases of the estimates; in order to increase their production rights. This also permits the ability to obtain bigger loans at lesser interest rates. This is a suspected reason for the reserves rise of Iraq in 1983, then at war with Iran.

In fact, Dr. Ali Samsam Bakhtiari, a former senior executive of the National Iranian Oil Company, has stated unequivocally that OPEC's oil reserves (notably Iran's) are grossly overstated. In a recent interview [5] he stated that world oil production is now at its peak and predicted that it will fall 32% by 2020.

| Declared reserves with suspicious increases (in billion of barrels) Colin Campbell, SunWorld, 80-95 | |||||||

| Year | Abu Dhabi | Dubai | Iran | Iraq | Kuwait | Saudi Arabia | Venezuela |

| 1980 | 28.00 | 1.40 | 58.00 | 31.00 | 65.40 | 163.35 | 17.87 |

| 1981 | 29.00 | 1.40 | 57.50 | 30.00 | 65.90 | 165.00 | 17.95 |

| 1982 | 30.60 | 1.27 | 57.00 | 29.70 | 64.48 | 164.60 | 20.30 |

| 1983 | 30.51 | 1.44 | 55.31 | 41.00 | 64.23 | 162.40 | 21.50 |

| 1984 | 30.40 | 1.44 | 51.00 | 43.00 | 63.90 | 166.00 | 24.85 |

| 1985 | 30.50 | 1.44 | 48.50 | 44.50 | 90.00 | 169.00 | 25.85 |

| 1986 | 31.00 | 1.40 | 47.88 | 44.11 | 89.77 | 168.80 | 25.59 |

| 1987 | 31.00 | 1.35 | 48.80 | 47.10 | 91.92 | 166.57 | 25.00 |

| 1988 | 92.21 | 4.00 | 92.85 | 100.00 | 91.92 | 166.98 | 56.30 |

| 1989 | 92.20 | 4.00 | 92.85 | 100.00 | 91.92 | 169.97 | 58.08 |

| 1990 | 92.20 | 4.00 | 93.00 | 100.00 | 95.00 | 258.00 | 59.00 |

| 1991 | 92.20 | 4.00 | 93.00 | 100.00 | 94.00 | 258.00 | 59.00 |

| 1992 | 92.20 | 4.00 | 93.00 | 100,00 | 94,00 | 258.00 | 62.70 |

| 2004 | 92.20 | 4.00 | 132.00 | 115.00 | 99.00 | 259.00 | 78.00 |

The total declared reserves are 701 billion barrels, from which 317.54 are suspicious (the year 2004 was added later).

The table suggests that, firstly, the OPEC countries declare that the discovery of new fields, year after year, replaces exactly or near exactly the quantities produced, because the declared reserves do not vary a lot from one year to the other. For example, Saudi Arabia extracts 3 billion barrels a year, which will diminish by this amount. However, Abu Dhabi, in the United Arab Emirates, declares exactly 92.3 billion barrels since 1988, but in 16 years, 14 billion barrels were extracted.

Also, there is much competition between states. For example, Kuwait gave to themselves 90 billion barrels of reserves in 1985, the year of the reserves link. Abu Dhabi and Iran responded with slightly higher numbers, to guarantee similar production quotas. Saddam Hussein, fearing to be left behind by nations he disliked, replied with around 100. Apparently, with all this amount of inflation, Saudi Arabia was forced to reply, two years later, with its own revision.

Other examples suggest the inaccuracy of official reserve estimates:

- January 2006, the magazine Petroleum Intelligence Weekly declared that reserves of Kuwait were in fact only 48 billion barrels, of which only 24 billion were "completely proven", backing this statement on "leaks" of official confidential Kuwaiti documents. The value is half of the official estimate.[6]

- Shell company announced 9 January 2004 that 20% of its reserves had to pass from proven to possible (uncertain). This announcement led to a loss in the value of the stock; a lawsuit challenged that the value of the company was fraudulently overvalued. Shell later revised its reserves estimates three times, reducing them by 10,133 million barrels (against 14,500 million). Shell's president, Phil Watts, resigned.

- As can be seen on the table the reserves declared by Kuwait before and after the Gulf War 1990-1991 are the same, 94 billion barrels, despite the fact that immense oil-well fires ignited by the Iraqi forces had burned off approximately 6 billion barrels.

- In 1970, Algeria increased its "proven reserves" estimate (until then 7-8 billion barrels) to 30 billion. Two years later, the estimate was increased to 45 billion. After 1974, the country's estimate was less than 10 billion barrels (as reported by Jean Laherrère).

- Pemex (state company of Mexico) in September 2002 decreased its reserve estimate by 53%, from 26.8 to 12.6 billion barrels. Later the estimate was increased to 15.7 billion.

- Other examples exist of reserves being underestimated. In 1993, the reserves of Equatorial Guinea were limited to some insignificant fields; the Oil And Gas Journal estimated them at 12 million barrels. Two giant fields and several smaller ones were discovered, but the numbers announced stayed unchanged until 2003. In 2002, the country still had 12 million barrels of reserves according to the journal, while it was producing 85 million barrels in the same year. The reserves of Angola were at 5.421 billion barrels, (four significant numbers, it gives the impression of great precision) from 1994 to 2003, despite the discovery of 38 new fields of more than 100 million barrels each.

Note however that the definition of proven reserves varies from country to country. In the USA, the conservative rule is to classify as proven only the reserves that are being produced. On the other hand, Saudi Arabia classifies as proven reserves known fields not yet in production. Venezuela includes non-conventional oil (bitumens) of the Orinoco in its reserve base.

Saudi Arabia

With one-fourth of the world's proven oil reserves and some of its lowest production costs, Saudi Arabia produces over 4 gigabarrels of oil per year and is likely to remain the world's largest oil exporter for the foreseeable future. However, there are serious political risks involved in Saudi Arabian domination of the world oil market. In spite of recent increases in oil income, Saudi Arabia faces serious long-term challenges, including rates of unemployment of at least 13 percent, one of the world's fastest population growth rates (its population has tripled since 1980), and the need for political and economic reforms [7].

According to the Oil and Gas Journal, Saudi Arabia contains 262 gigabarrels of proven oil reserves, around one-fourth of proven, conventional world oil reserves. Although Saudi Arabia has around 80 oil and gas fields, more than half of its oil reserves are contained in only eight fields, and more than half its production comes from one field, the Ghawar field.

One challenge for the Saudis in maintaining or increasing production is that their existing fields sustain 5-12 percent annual decline rates, meaning that the country needs new capacity each year to compensate. The challenge is that the Ghawar field, found in 1948, has produced about half its total reserves, and is starting to run into production problems — notably, there are rumors that it is now producing more water than oil. Other Saudi fields are not only smaller, but more difficult to produce. Historically, when Saudi Arabia has run into production problems in other fields, it has simply shut them in and stepped up production in Ghawar, but if Ghawar runs into problems that no longer will be possible.

Since Saudi Arabia is the world's largest producer of oil, their reserves are analyzed very closely and estimates vary on the amount of economically recoverable oil in Saudia Arabia. The raw data are not available to outside scrutiny. The International Energy Agency has predicted that Saudi oil output will double during the next two decades, projecting production of 7 gigabarrels per year in 2020, although this seems unlikely, if only for political reasons.

A dissenting opinion regarding Saudi oil reserves came from Matthew Simmons who claimed in his 2004 book "Twilight in the Desert" that Saudi Arabia's oil production is declining, and that it will not be able to produce more than current levels — about 4 gigabarrels per year [8]. In addition to his belief that the Saudi fields have hit their peak, Simmons also argues that the Saudis may have irretrievably damaged their large oil fields by overpumping salt water into the fields in an effort to maintain the fields' pressure and thus make the oil easier to extract. Simmons interpretation of normal oilfield practice into a future crisis has been refuted by reservoir engineers at CERI.[9]

Since 1982 the Saudis have withheld their well data and any detailed data on their reserves, giving outside experts no way to verify the overall size of Saudi reserves and output. However, experts question the Saudi claim that recent declines in production are due to lack of demand (which no other producer has experienced), and pointed to the fact that the number of drilling rigs in Saudi Arabia has tripled with no comparable increase in production as similar to what happened in Texas when US production peaked and started to decline in the 1970s. This could mean that many Saudi oil wells have peaked and have begun the decline toward the end of their economic usefulness. Only with verifiable data can production and reserves increases or declines be demonstrated. According to the U.S. Energy Information Agency, Saudi oil production declined about 8% during 2006 to 8.75 million barrels per day in December.[10]

Iran

Iran has the world's second largest reserves of conventional crude oil at 133 gigabarrels, according to the CIA World Factbook, although it should be noted that both Canada and Venezuela have larger reserves if Non-conventional oil is included. Iran is the second largest oil holder globally with approximately 10% of the world's oil.

Iran averages about 1.5 gigabarrels per year, which is a significant decline from the 6 gigabarrels per year it produced when the Shah of Iran was in power. The United States prohibits imports of oil from Iran, which limits its exposure to an Iranian oil cutoff, but does not reduce the likelihood that an interruption of Iranian oil would cause a spike in world oil prices. American pressure on Iran to renounce Iran's nuclear program makes the possibility of military confrontation quite high, and the political risks of Iranian oil far outweigh any geological ones.

Iraq

Iraq has the third largest reserves of conventional oil in the world at 112 gigabarrels. Despite its vast oil reserves and low costs, production has not recovered since the US-led 2003 invasion of Iraq. Constant looting, insurgent attacks, and sabotage in the oil fields has limited production to around 0.5 gigabarrels per year at best. Political risk is thus the main constraint on Iraqi oil production and likely to remain so in the near future.

United Arab Emirates and Kuwait

The United Arab Emirates and Kuwait are nearly tied for the fourth largest conventional oil reserves in the world at 98 and 97 gigabarrels, respectively. The UAE produces about 0.8 gigabarrels per year and has about 100 years of reserves at that rate while Kuwait produces about the same amount and also has about 100 years of reserves. Abu Dhabi has 94 percent of the UAE's oil reserves while most of Kuwait's oil reserves are in the Burgan Field, the world's second largest oil field after Saudi Arabia's Ghawar. Kuwait hopes to step up oil production to reach capacity of 4 million bbl/d by 2020, but since Burgan was found in 1938 and is getting very mature, this will be a challenge. Furthermore, according to data leaked from the Kuwait Oil Company (KOC), Kuwait's remaining proven and non-proven oil reserves are only about half the official figure - 48 gigabarrels.

2020 Vision

The US EIA (Energy Information Administration) reduced their forecast for Saudi oil production to 15.4 mb/day in 2020 and Middle East OPEC countries increasing to 35.2 mb/day by 2020 from 20.7 mb/day in 2002 [Internation Energy Outlook 2005 table E1 [11]. These estimates were further reduced in the 2006 Annual Energy Outlook, in which Middle East OPEC production was projected to be 29.4/27.0/18.5 mb/day in 2020 assuming $34/$51/$85 oil prices respectively [12].

Oil supplies

The term oil supplies is sometimes used to mean the same thing as oil reserves. However, Oil reserves refer mainly to oil in the ground that can be recovered economically. Oil supply also includes the oil production and processing facilities and the oil delivery systems that provide oil to the end user. When there is a 'shortage' of supply it is more often a problem of the delivery systems than a failure of reserves. While geologists are sure the world will eventually run out of oil, economists are sure there will always be a price at which supply will meet demand, albeit possibly at a higher price than people would like to pay.

Oil exploration

Arctic basins tend to be richer in natural gas than in oil. The abundance of gas in the Arctic so far from main markets will require moving gas long distances. Problems of ensuring that oil and gas keep flowing freely in arctic subsea pipelines are virtually identical to those experienced at a depth of 8,000 feet in the Gulf of Mexico, where temperatures are at or close to the freezing point (at that pressure) along the seafloor where hydrates can form. Technology for moving oil from the seafloor to the shore is similar to that employed in Norway, and may someday have application in Alaska.

Shell, one of the world's largest oil companies, believes Arctic waters, including those of northern Alaska, hold great potential as an oil and natural gas frontier. Shell sees the Arctic as a very tantalizing opportunity to develop new oil and gas resources and the last remaining frontier. The company's views tend to support studies by academics and agencies that Arctic basins contain 25% of the world's remaining undiscovered resources. Most of these basins are unexplored and undeveloped. Shell recognizes how "difficult and challenging" the social, environmental, and economic aspects will be. Shell believes that technology solutions developed for other areas, such as the deepwater, will have applications in the offshore Arctic.

However, in early 2006, Royal Dutch Shell made a bold move into non-conventional oil when it purchased $465 million worth of leases in northern Canada just outside the Athabasca Oil Sands. Mysteriously, Shell did not assign the property to Shell Canada, which already has a large oil sands operation in the area, but created a new, wholly-owned subsidiary called SURE Northern Energy Ltd. (SURE Northern) to develop the leases. While the area is known to contain large oil deposits, it is not included in current Canadian oil reserves because the geology is harder and more rocky than the sand which characterizes most oilsands projects.

Strategic oil reserves

Many countries maintain government-controlled oil reserves for both economic and national security reasons. Although there are global strategic petroleum reserves, the following highlights the strategic reserves of the top three oil consumers.

The United States maintains a Strategic Petroleum Reserve at four sites in the Gulf of Mexico, with a total capacity of 0.727 gigabarrels of crude oil. The sites are enormous salt caverns that have been converted to store crude oil. The US SPR has never been filled to capacity; the largest amount reached thus far was 0.7 gigabarrels on August 17, 2005, whereafter reserves were drawn down to meet demand in the aftermath of Hurricane Katrina. This reserve was created in 1975 following the 1973-1974 oil embargo, and as of 2005 it is the largest emergency petroleum supply in the world. At current US consumption rates (over 7 gigabarrels per year), the SPR would supply all normal US demand for approximately 37 days.

In 2004 China's National Development and Reform Commission (NDRC) began development on a 101.9 million barrel strategic reserve.[6] This strategic reserve plan calls for the construction of four storage facilities. An updated strategic reserve plan was announced in March 2007 for the construction of a second strategic reserve with an additional 209.44 million barrels.[7] Separately, Kong Linglong, director of the National Development and Reform Commission's Foreign Investment Department, said that the Chinese government would soon move to establish a government fund aimed at helping its state oil groups purchase offshore energy assets.

As of 2003 Japan has a SPR composed of the following three types of stockpiles; state controlled reserves of petroleum composed of 320 million barrels, privately held reserves of petroleum held "in accordance with the Petroleum Stockpiling Law" of 129 million barrels, privately held reserves of petroleum products for another 130 million barrels.[8] The state stockpile equals about 92 days of consumption and the privately held stockpiles equal another 77 days of consumption for a total of 169 days or 579 million barrels.[9][10] These reserves are particularly important for Japan since they have practically no domestic petroleum production and import 99.7% of their oil.

OPEC countries

Many countries with extensive oil reserves are members of the Organization of the Petroleum Exporting Countries, or OPEC. The members of the OPEC cartel hold about two-thirds of the world's oil reserves, allowing them to significantly influence the international price of crude oil.

Oil reserves by country

As the amount of oil left is an estimate, not a known amount, there are many differing estimates for the amount of oil remaining in different regions of the world. The following table lists the highest and lowest estimates for regions, and countries, with significant oil reserves in gigabarrels (109 barrels), as listed here [13]. The large range of some country's estimates, Canada in particular, stems from factors such as the potential future development of non-conventional oil from tar sands, oil shale, etc.

Country/Region Lowest estimate Highest estimate North America 50.7 222.9 Canada 16.5 178.8 United States 21.3 29.3 Mexico 12.9 14.8 Central & South America 76 401.1 Venezuela 52.4 361.2 Brazil 10.6 11.2 Western Europe 16.2 17.3 United Kingdom 4.1 4.5 Norway 7.7 8.0 Eastern Europe & Former USSR 79.2 121.9 Russia 60 72.4 Kazakhstan 9 39.6 Middle East 708.3 733.9 Iran 125.8 132.7 Iraq 115 115 Kuwait 99 101.5 Qatar 15.2 15.2 Saudi Arabia1 261.9 264.3 UAE 69.9 97.8 Africa 100.8 113.8 Algeria 11.4 11.8 Libya 33.6 39.1 Nigeria 35.3 35.9 Asia and Oceania 36.2 39.8 China 15.4 16.0 Australia 1.5 4 India 4.9 5.6 Indonesia 4.3 4.3 World total 1082 1650.7

1This reserve number cannot be verified.

Countries that have already passed their production peak

The neutrality of this section is disputed. |

Note: this table is a work in progress, and not all classifications of countries are correct.

Note: this chart lists when, as a historical matter, oil production peaked. Peaking can occur for many reasons, related or unrelated to technical extraction difficulties, such as discovery of more accessible oil elsewhere, or changes in regulations. Inclusion on this list does not necessarily mean oil extraction cannot exceed the previous peak in that country.

| Regular Oil (light, heavy, deepwater, polar) | Other hydrocarbon reserves | Total Recoverable Hydrocarbons Depletion (projected) | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| State | Oil Discovery peak | Oil Production peak | Oil Depletion midpoint | Natural Gas peak | Coal peak | Tar sand, oil shale peak | Recoverable Oil Depletion | Recoverable Natural Gas depletion | Recoverable Coal depletion | ||

| North America | |||||||||||

| Canada3

|

1958 | 1973 | 1988 | 2002 | |||||||

| USA | 1930 | 1971 | 2003 | 1974 | |||||||

| Mexico | 1977 | 2002 | 1999 | ||||||||

| South America | |||||||||||

| Argentina | 1960 | 1998 | 1994 | 2004 | |||||||

| Colombia | 1992 | 1999 | 1999 | ||||||||

| Venezuela 1 | 1941 | 1970 | 2003 | ||||||||

| Chile | 1960 | 1982 | 1979 | 1980 | |||||||

| Ecuador 2 | 1969 | 2004 | 2007 | ||||||||

| Peru | 1861 | 1983 | 1988 | ||||||||

| Trinidad and Tobago | 1969 | 1978 | 1983 | ||||||||

| Europe | |||||||||||

| Albania | 1928 | 1983 | 1986 | ||||||||

| Austria | 1947 | 1955 | 1970 | ||||||||

| Croatia | 1950 | 1988 | 1987 | ||||||||

| Denmark | 1971 | 2002 | 2004 | ||||||||

| France | 1958 | 1988 | 1987 | 1978 | |||||||

| Germany | 1952 | 1966 | 1977 | 1979 | |||||||

| Hungary | 1964 | 1987 | 1987 | ||||||||

| Italy | 1981 | 1997 | 2005 | 1994 | |||||||

| Netherlands | 1980 | 1987 | 1991 | 1976 | |||||||

| Norway | 1979 | 2003 | 2003 | ||||||||

| Romania | 1857 | 1976 | 1970 | 1982 | |||||||

| Ukraine | 1962 | 1970 | 1984 | ||||||||

| United Kingdom | 1974 | 1999 | 1998 | 2000 | 1913 | ||||||

| Africa | |||||||||||

| Cameroon | 1977 | 1986 | 1994 | ||||||||

| Congo | 1984 | 2001 | 2000 | ||||||||

| Egypt | 1965 | 1995 | 2007 | ||||||||

| Gabon 2 | 1985 | 1996 | 1997 | ||||||||

| Libya 1 | 1961 | 1970 | 2011 | ||||||||

| Sudan | 1980 | 2005 | 2009 | ||||||||

| Tunisia | 1971 | 1981 | 1998 | ||||||||

| Middle East | |||||||||||

| Bahrain | 1932 | 1970 | 1977 | ||||||||

| Oman | 1962 | 2001 | 2003 | ||||||||

| Qatar 1 | 1940 | 2004 | 1998 | ||||||||

| Syria | 1966 | 1995 | 1998 | ||||||||

| Saudi Arabia | 1946 | 2006 | 2010 | ||||||||

| Yemen | 1978 | 1999 | 2003 | ||||||||

| Eurasia and Central Asia | |||||||||||

| Turkey | 1969 | 1991 | 1992 | ||||||||

| Uzbekistan | 1992 | 1998 | 2008 | ||||||||

| Turkmenistan | 1973 | ||||||||||

| Rest of Asia | |||||||||||

| Brunei | 1929 | 1978 | 1989 | 2003 | |||||||

| China | 1953 | 2005 | 2003 | ||||||||

| India | 1974 | 2004 | 2003 | ||||||||

| Indonesia 1 | 1955 | 1977 | 1992 | ||||||||

| Malaysia | 1973 | 2004 | 2002 | ||||||||

| Pakistan | 1983 | 1992 | 2001 | ||||||||

| Thailand | 1981 | 2005 | 2008 | ||||||||

| Oceania | |||||||||||

| Papua New Guinea | 1987 | 1993 | 2007 | ||||||||

| Australia | 1967 | 2000 | 2001 | ||||||||

Data from [14] and the annual British Petroleum Energy Report[15].

1 OPEC member

2 former OPEC member

3 This peak date refers to conventional oil only. The total production have been higher than in 1973 since 1993 because of increased output from Alberta oil sands .

Countries where production can be increased

| Regular Oil (light, heavy, deepwater, polar) | Other hydrocarbon reserves | Total Recoverable Hydrocarbons Depletion (projected) | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| State | Oil Discovery peak | Oil Production peak (projection) | Oil Depletion midpoint | Natural Gas peak | Coal peak | tar sand, oil shale peak | Recoverable Oil Depletion | Recoverable Natural Gas depletion | Recoverable Coal depletion | ||

| North America | |||||||||||

| Canada | |||||||||||

| South America | |||||||||||

| Bolivia | 1966 | 2010 | 2016 | ||||||||

| Brazil | 1996 | 2012 | 2012 | ||||||||

| Europe - no such states (but some are still unclassified) | |||||||||||

| Africa | |||||||||||

| Algeria 1 | 1956 | 2006 | 2010 | ||||||||

| Angola | 1998 | 2019 | 2011 | ||||||||

| Chad | 1977 | 2008 | 2014 | ||||||||

| Nigeria 1 | 2001 | 2009 | 2009 | ||||||||

| Middle East | |||||||||||

| Iran 1 | 1961 | 1974 2 | 2009 | ||||||||

| Iraq 1 | 1948 | 2015 | 2021 | ||||||||

| Kuwait 1 | 1938 | 1971 2 | 2018 3 | ||||||||

| United Arab Emirates 1 | 1964 | 2011 | 2026 | ||||||||

| Eurasia and Central Asia | |||||||||||

| Azerbaijan | 1871 | 2015 | 2014 | ||||||||

| Kazakhstan | 2000 | 2020 | 2036 | ||||||||

| Russia | 1960 | 1987 2 | 1992 | ||||||||

| Rest of Asia | |||||||||||

| Vietnam | 1975 | 2009 | |||||||||

| Oceania - no such states (but some are still unclassified) | |||||||||||

| Antarctica - still unclassified | |||||||||||

Data from [16] and the annual British Petroleum Energy Report.

1 OPEC member

2 Because of various historical events, production has dropped, and so there are still possibilities for further increases in output even though the main peak has passed.

3 The Burgan field, the largest oil field in Kuwait, peaked in November 2005, years earlier than expected. This estimate thus requires revision.

Countries to be classified

The vast majority of these countries have tiny oil reserves, making classification difficult: a single new field, even very small by world standards, could change everything for one of them.

| Regular Oil (light, heavy, deepwater, polar) | Other hydrocarbon reserves | Total Recoverable Hydrocarbons Depletion (projected) | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| State | Oil Discovery peak | Oil Production peak | Oil Depletion midpoint | Natural Gas peak | Coal peak | Oil peak (tar sand, shale) | Recoverable Oil Depletion | Recoverable Natural Gas depletion | Recoverable Coal depletion | ||

| North America | |||||||||||

| Costa Rica | |||||||||||

| Panama | |||||||||||

| Jamaica | |||||||||||

| Bahamas | |||||||||||

| multiple additional countries | |||||||||||

| South America | |||||||||||

| Suriname | |||||||||||

| Guyana | |||||||||||

| Paraguay | |||||||||||

| Uruguay | |||||||||||

| Europe | |||||||||||

| Estonia | |||||||||||

| Serbia | |||||||||||

| Latvia | |||||||||||

| multiple additional countries | |||||||||||

| Africa | |||||||||||

| Equatorial Guinea | |||||||||||

| Sahrawi Republic Western Sahara |

|||||||||||

| Somali Republic Somalia |

|||||||||||

| multiple additional countries | |||||||||||

| Middle East | |||||||||||

| Lebanon | |||||||||||

| Jordan | |||||||||||

| Israel | |||||||||||

| Palestine (West Bank and Gaza Strip) |

|||||||||||

| Eurasia and Central Asia | |||||||||||

| Armenia | |||||||||||

| Cyprus | |||||||||||

| Georgia | |||||||||||

| Kyrgyz Republic | |||||||||||

| Tajikistan | |||||||||||

| Rest of Asia | |||||||||||

| Japan | |||||||||||

| Taiwan | |||||||||||

| multiple additional countries | |||||||||||

| Oceania | |||||||||||

| Tonga | |||||||||||

| multiple additional countries | |||||||||||

| Antarctica 1 | |||||||||||

1 Substantial oil, natural gas and coal reserves may exist, but because of an international treaty, no extraction is allowed.

Alternative fuels

Several types of fuels exist that offer alternatives to petroleum. The United States Department of Energy officially recognizes the following alternative fuels:

- Alcohols - such as ethanol and methanol are extracted from grains, wood and biomass.

- Electricity - stores energy in batteries.

- Hydrogen - is produced by splitting water into oxygen and hydrogen by using electricity.

- Compressed Natural Gas - is natural gas under high pressure.

- Liquefied Natural Gas - refrigerates natural gas to very cold levels until it condenses into a liquid.

- Liquefied Petroleum Gas - consists of a mixture of propane and other similar types of hydrocarbon gasses under low pressure.

- Synthetic oil - using the Fischer-Tropsch process or Karrick process. Liquids made from Coal - are capable of producing gasoline, diesel fuel and methanol. During World War II Germany, which had limited access to crude oil supplies, manufactured 90 million tons of synthetic oil in 1944.

- Biodiesel - resembles the characteristics of diesel fuel but is made from plant oil (agriculture, Algaculture) or animal fat.

- Air engine an emission-free piston engine using compressed air as fuel.

Transportation Alternatives:

- Bicycles. Human powered vehicles are the cheapest and most efficient way to move people about. Many countries still move the majority of their people on human powered transport.

- Fuel cells. Vehicles-turn hydrogen fuel and oxygen into electricity. They are considered to be zero emission vehicles.

- Hybrid Vehicles derive their power from gasoline, but use an electric motor in combination with an internal combustion engine for better fuel economy and performance. Newer plug-in hybrid electric vehicles derive a substantial portion of their power from the power grid or solar energy.

- Coal. During the nineteenth century, trains, ships, machines and even some cars were run by steam engine, which requires the use of coal. Coal reserves were estimated in 1997 to be 1.04 trillion metric tons. [17]

- Solar power. Solar-powered cars have been built, including the Nuna which had an average speed of 103 km/h during the World solar challenge solar car race, and a top speed of 140 km/h. (However, this vehicle seated one occupant, had a weight less than one fifth that of a typical family-sized car and the performance figures quoted here are based on it having been run mostly in the arid Australian outback with the most expensive type of solar cells available.)

- Air car powered by an Air engine

- Electric vehicles such as trains, trams and trolley buses allow the power to be generated separately, removing the need for fuel on the vehicles themselves.

See also

- Non-conventional oil

- Oil exploration

- Peak Oil

- Strategic Petroleum Reserve

- Global strategic petroleum reserves

- Association for the Study of Peak Oil and Gas

- World energy resources and consumption

References

- Adams Neal, Terrorism & Oil (2002, pg.66), ISBN 0-87814-863-9

- Various, The Oil Industry of the Former Soviet Union: Reserves, Extraction, Transportation (1998, pg. 24-59), ISBN 90-5699-062-4

- Robert J Art, Grand Strategy for America (2003, pg.62), ISBN 0-8014-4139-0

- Paul Roberts, "The End of Oil", (2004 p47-p52), Bloomsbury, pbk, ISBN 0-7475-7081-7

External links

- Reserves and Fishing - World Energy Magazine Vol. 7 No. 2

- Whose Reserves Estimates Can I Trust? - World Energy Magazine Vol. 7 No. 1

- TrendLines' current Peak Oil Depletion Scenarios Graph A monthly compilation update of 16 recognized estimates of URR, Peak Year & Peak Rate

- U.S. Department of Energy Office of Fossil Energy information on managed reserves

- U.S. Department of Energy International Energy Outlook July 2005

- U.S. Department of Energy Annual Energy Outlook 2006

- Discusses Peak Oil implications

- Peak Oil and Permaculture - An interview with David Holmgren

- How Much Oil Does Iraq Have?, by Gal Luft, Co-Director, Institute for the Analysis of Global Security (IAGS), 12 May 2003

- New study raises doubts about Saudi oil reserves, by the Institute for the Analysis of Global Security, 31 March 2004

- Oil And The Future, by Richard Reese, 1997

- Kuwait oil reserves only half official estimate-PIW, Reuters, 20 January 2006

- Will The Proved Reserve Scandal Open The Door To Genuine Data Reform?, Reserve Reporting Conference, Matthew R. Simmons, 14 April 2004

Notes

- ^ AEUB (2006). "ST98: Alberta's Energy Reserves 2005 and Supply/Demand Outlook 2006-20015" (PDF). Alberta Energy and Utilities Board. Retrieved 2006-12-04.

{{cite journal}}: Cite journal requires|journal=(help) - ^ EIA (2006). "International Energy Outlook 2006". Energy Information Administration of the U.S. Department of Energy. Retrieved 2006-12-04.

- ^

USask (2006). "Canadian frontier petroleum" (DOC). University of Saskatchewan. Retrieved 2006-12-04.

{{cite journal}}: Cite journal requires|journal=(help) - ^ Clavet, Frederic (February 2007). "Canada's Oil Extraction Industry: Industrial Outlook, Winter 2007". The Conference Board of Canada. Retrieved 2007-04-01.

- ^

Cross, Philip (September 2006). "The Alberta economic juggernaut" (PDF). Canadian Economic Observer. Statistics Canada. Retrieved 2006-12-05.

{{cite web}}: Unknown parameter|coauthors=ignored (|author=suggested) (help) - ^ http://www.chinadaily.com.cn/english/doc/2005-06/10/content_450449.htm

- ^ "China to fill its 3rd strategic oil reserve". Times of India. 2007-03-08.

{{cite news}}: Check date values in:|date=(help) - ^ http://www.enecho.meti.go.jp/english/energy/japan/oilinfo.html

- ^ "Energy Security in East Asia". Institute for the Analysis of Global Security. 2004-08-13.

{{cite news}}: Check date values in:|date=(help) - ^ "Energy Security Initiative" (PDF). Asia Pacific Energy Research Center. 2002-01-01.

{{cite news}}: Check date values in:|date=(help)