Keynesian economics

This article has multiple issues. Please help improve it or discuss these issues on the talk page. (Learn how and when to remove these template messages)

|

Keynesian economics (/ˈkeɪnziən/ KAYN-zee-ən; or Keynesianism) are the various theories about how in the short run – and especially during recessions – economic output is strongly influenced by aggregate demand (total spending in the economy). In the Keynesian view, aggregate demand does not necessarily equal the productive capacity of the economy; instead, it is influenced by a host of factors and sometimes behaves erratically, affecting production, employment, and inflation.[1]

The theories forming the basis of Keynesian economics were first presented by the British economist John Maynard Keynes during the Great Depression in his 1936 book, The General Theory of Employment, Interest and Money.[2] Keynes contrasted his approach to the aggregate supply-focused classical economics that preceded his book. The interpretations of Keynes that followed are contentious and several schools of economic thought claim his legacy.

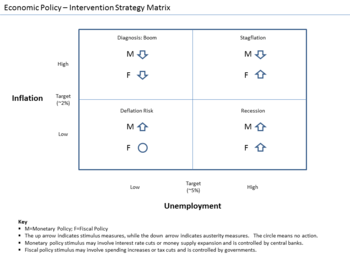

Keynesian economists generally argue that, as aggregate demand is volatile and unstable, a market economy will often experience inefficient macroeconomic outcomes in the form of economic recessions (when demand is low) and inflation (when demand is high). These can be mitigated by economic policy responses, in particular, monetary policy actions by the central bank and fiscal policy actions by the government, which can help stabilize output over the business cycle.[3] Keynesian economists generally advocate a managed market economy – predominantly private sector, but with an active role for government intervention during recessions and depressions.[4]

Keynesian economics served as the standard economic model in the developed nations during the later part of the Great Depression, World War II, and the post-war economic expansion (1945–1973), though it lost some influence following the oil shock and resulting stagflation of the 1970s.[5] The advent of the financial crisis of 2007–08 caused a resurgence in Keynesian thought,[6] which continues as new Keynesian economics.

Historical context

This section is written like a personal reflection, personal essay, or argumentative essay that states a Wikipedia editor's personal feelings or presents an original argument about a topic. (October 2015) |

At the time that Keynes's wrote the General Theory, it had been a tenet of mainstream economic thought that the economy would automatically revert to a state of general equilibrium: it had been assumed that, because the needs of consumers are always greater than the capacity of the producers to satisfy those needs, everything that is produced would eventually be consumed once the appropriate price was found for it. This perception is reflected in Say's law[7] and in the writing of David Ricardo,[8] which state that individuals produce so that they can either consume what they have manufactured or sell their output so that they can buy someone else's output. This argument rests upon the assumption that if a surplus of goods or services exists, they would naturally drop in price to the point where they would be consumed.

Keynes argued that because there was no guarantee that the goods that individuals produce would be met with demand, periodic unemployment could be expected from time to time, especially in the instance of an economy undergoing contraction.

He saw the economy as unable to maintain itself at full employment automatically, and believed that it was necessary for the government to step in and put purchasing power into the hands of the working population through government spending. Thus, according to Keynesian theory, some individually rational microeconomic-level actions such as not investing savings in the goods and services produced by the economy, if taken collectively by a large proportion of individuals and firms, can lead to outcomes wherein the economy operates below its potential output and growth rate.

Prior to Keynes, a situation in which aggregate demand for goods and services did not meet supply was referred to by classical economists as a general glut, although there was disagreement among them as to whether a general glut was possible. Keynes argued that when a glut occurred, it was the over-reaction of producers and the laying off of workers that led to a fall in demand and perpetuated the problem. Keynesians therefore advocate an active stabilization policy to reduce the amplitude of the business cycle, which they rank among the most serious of economic problems. According to the theory, government spending can be used to increase aggregate demand, thus increasing economic activity, reducing unemployment and deflation.

Theory

This section is written like a personal reflection, personal essay, or argumentative essay that states a Wikipedia editor's personal feelings or presents an original argument about a topic. (October 2015) |

Overview

Keynes argued that the solution to the Great Depression was to stimulate the country ("inducement to invest") through some combination of two approaches:

- A reduction in interest rates (monetary policy), and

- Government investment in infrastructure (fiscal policy).

If the interest rate at which businesses and consumers can borrow is decreased, investments which were previously uneconomic become profitable, and large consumer sales which are normally financed through debt (such as houses, automobiles, and, historically, even appliances like refrigerators) become more affordable. A principal function of central banks in countries which have them is to influence this interest rate through a variety of mechanisms which are collectively called monetary policy. This is how monetary policy which reduces interest rates is thought to stimulate economic activity, i.e. "grow the economy", and why it is called expansionary monetary policy.

Expansionary fiscal policy consists of increasing net public spending, which the government can effect by a) taxing less, b) spending more, or c) both. Investment and consumption by government raises demand for businesses' products and for employment, reversing the effects of the aforementioned imbalance. If desired spending exceeds revenue, the government finances the difference by borrowing from capital markets by issuing government bonds. This is called deficit spending. Two points are important to note at this point. First, deficits are not required for expansionary fiscal policy, and second, it is only change in net spending that can stimulate or depress the economy. For example, if a government ran a deficit of 10% both last year and this year, this would represent neutral fiscal policy. In fact, if it ran a deficit of 10% last year and 5% this year, this would actually be contractionary. On the other hand, if the government ran a surplus of 10% of GDP last year and 5% this year, that would be expansionary fiscal policy, despite never running a deficit at all.

In the price mechanism of neoclassical economics, it is predicted that, in a competitive market, if demand for a particular good or service falls, that would immediately cause the price for that good or service to fall, which in turn would decrease supply and increase demand, thereby bringing them back to equilibrium. A central conclusion of Keynesian economics, in strong contrast to the previously dominant models of neoclassical synthesis, is that there are some situations in which a depressed economy would not quickly self-correct towards full employment and potential output, but could remain trapped indefinitely with both high unemployment and mothballed factories. To the observation that these were, in fact, the prevailing conditions throughout the industrialized world for many years during the Great Depression, classical models could only conclude that it was a temporary aberration. The purpose of Keynes' theory was to show such conditions could, without intervention, persist in a stable, though dismal, equilibrium.

By the end of the Second World War, Keynesianism was the most popular school of economic theory in the non-Communist world. Beginning in the late 1960s, a new classical macroeconomics movement arose, critical of Keynesian assumptions (see sticky prices), and seemed, especially in the 1970s, to explain certain phenomena (e.g. the co-existence of high unemployment and high inflation, or "stagflation") better. It was characterized by explicit and rigorous adherence to microfoundations, as well as use of increasingly sophisticated mathematical modelling. However, by the late 1980s, certain failures of the new classical models, both theoretical (see Real business cycle theory) and empirical (see the "Volcker recession")[9] hastened the emergence of New Keynesian economics, a school which sought to unite the most realistic aspects of Keynesian and neo-classical assumptions and place them on more rigorous theoretical foundation than ever before.

Interpretations of Keynes have emphasized his stress on the international coordination of Keynesian policies, the need for international economic institutions, and the ways in which economic forces could lead to war or could promote peace.[10]

Keynes’s economic ideas are set forward in his main work, The General Theory of Employment, Interest and Money (1936), comprising more than 400 pages.

Book I: Introduction

The first Book of the General Theory is a repudiation of Say’s Law. Say held that the value of wages was equal to the value of the goods produced, and that the wages were inevitably put back into the economy sustaining demand at the level of current production. Hence, starting from full employment, there cannot be a glut of industrial output leading to a loss of jobs. As Keynes put it on p18, “supply creates its own demand”.

Stickiness of wages in money terms

Say’s Law depends on the operation of a market economy. If there is unemployment (and if there are no distortions preventing the employment market from adjusting to it) then there will be workers willing to offer their labour at less than the current wage levels, leading to downward pressure on wages and hence on prices.

The classics held that full employment was the equilibrium condition of an undistorted labour market, but they and Keynes agreed in the existence of distortions impeding transition to equilibrium.[11] The classical position had generally been to view the distortions as the culprit and to argue that their removal was the main tool for eliminating unemployment. Keynes on the other hand viewed the market distortions as part of the economic fabric and advocated different policy measures which (as a separate consideration) had social consequences which he personally found congenial and which he expected his readers to see in the same light.

The distortions which have prevented wage levels from adapting downwards have lain in employment contracts being expressed in monetary terms; in various forms of legislation such as the minimum wage and in state-supplied benefits; in the unwillingness of workers to accept reductions in their income; and in their ability through unionisation to resist the market forces exerting downward pressure on them.

Keynes accepted the classical relation between wages and the marginal productivity of labour, referring to it on p5[12] as the ‘first postulate of classical economics’ and summarising it as saying that ‘The wage is equal to the marginal product of labour’.

Outline of Keynes’s theory

Keynes’s economic theory is based on the interaction between demands for saving, investment, and liquidity (i.e. money). Saving and investment are necessarily equal, but different factors influence decisions concerning them. The desire to save, in Keynes’s analysis, is mostly a function of income: the richer people are, the more wealth they will seek to put aside. The profitability of investment, on the other hand, is determined by the relation between the return available to capital and the interest rate. The economy needs to find its way to an equilibrium in which no more money is being saved than will be invested, and this can be accomplished by contraction of income and a consequent reduction in the level of employment.

In the classical scheme it is the interest rate rather than income which adjusts to maintain equilibrium between saving and investment; but Keynes asserts that the rate of interest already performs another function in the economy, that of equating demand and supply of money, and that it cannot adjust to maintain two separate equilibria. In his view it is the monetary role which wins out. This is why Keynes’s theory is a theory of money as much as of employment: the monetary economy of interest and liquidity interacts with the real economy of production, investment and consumption.

Book II: Definitions and ideas

The choice of units

Keynes sought to allow for the lack of downwards flexibility of wages by constructing an economic model in which the money supply and wage rates were externally determined (the latter in money terms), and in which the main variables were fixed by the equilibrium conditions of various markets in the presence of these facts.

Many of the quantities of interest, such as income and consumption, are monetary. Keynes often expresses such quantities in wage units (Chapter 4): to be precise, a value in wage units is equal to its price in money terms divided by W, the wage (in money units) per man-hour of labour. Keynes generally writes a subscript w on quantities expressed in wage units, but in this account we use wage units consistently and omit the w.

As a result of Keynes’s choice of units, the assumption of sticky wages, though important to the argument, is largely invisible in the reasoning. If we want to know how a change in the wage rate would influence the economy, Keynes tells us on p266 that the effect is the same as that of an opposite change in the money supply.

The identity of saving and investment

The relationship between saving and investment, and the factors influencing their demands, play an important role in Keynes’s model. Saving and investment are considered to be necessarily equal for reasons set out in Chapter 6 which looks at economic aggregates from the viewpoint of manufacturers. The discussion is intricate, considering matters such as the depreciation of machinery, but is summarised on p63:

Provided it is agreed that income is equal to the value of current output, that current investment is equal to the value of that part of current output which is not consumed, and that saving is equal to the excess of income over consumption... the equality of saving and investment necessarily follows.

Book III: The propensity to consume

Book III of the General Theory is given over to the propensity to consume, which is introduced in Chapter 8 as the desired level of expenditure on consumption (for an individual or aggregated over an economy). The demand for consumer goods depends chiefly on the income Y and may be written functionally as C (Y ). Keynes discusses the possible influence of the interest rate r on the propensity to save, but regards it as ‘complex and uncertain’ and leaves it out as a parameter.

The demand for saving may be written as S (Y ) = Y – C (Y ).

This apparently anodyne discussion embodies an assumption whose consequences will be considered later. Since Y is measured in wage units, the proportion of income saved is considered to be unaffected by the change in real income resulting from a change in the price level while wages stay fixed. Keynes acknowledges that this is undesirable in Point (1) of Section II. It would be possible to correct it by giving the demand a form like C (Y,P /W ) where P is the price level, but Keynes does not do so.

In Chapter 9 he provides a homiletic enumeration of the motives to consume or not to do so, finding them to lie in social and psychological considerations which can be expected to be relatively stable, but which may be influenced by objective factors such as ‘changes in expectations of the relation between the present and the future level of income’ (p95).

The multiplier

Chapter 10 introduces the famous ‘multiplier’ through an example: if the marginal propensity to consume is 90%, then ‘the multiplier k is 10; and the total employment caused by (e.g.) increased public works will be ten times the employment caused by the public works themselves’ (pp116f).

Formally the multiplier can be written k = 1/(1–c ) where c is the marginal propensity to consume; i.e. c = C' (Y ), the gradient of the purple curve. Keynes states as a ‘fundamental psychological law’ (p96) that it will be positive and less than unity, from which it follows that k will be greater than 1.

Keynes’s account is not intelligible until his economic system has been fully set out (see below). In Chapter 10 he describes his multiplier as being related to the one introduced by R. F. Kahn in 1931,[13] but the two have little in common. The mechanism of Kahn’s mutliplier lies in an infinite series of transactions, each conceived of as creating employment: if you spend a certain amount of money, then the recipient will spend a proportion of what he or she receives, the second recipient will spend a further proportion again, and so forth. Enough meaning can be extracted from Keynes’s account of his own mechanism (in the second para of p117) to see that it makes no reference to infinite series.

Book IV: The inducement to invest

The rate of investment

Book IV discusses the inducement to invest, with the key ideas being presented in Chapter 11. The ‘marginal efficiency of capital’ is defined as the annual revenue which will be yielded by an extra increment of capital as a proportion of its cost. The ‘schedule of the marginal efficiency of capital’ is the function which, for any rate of interest r, gives us the level of investment which will take place if all opportunities are accepted whose return is at least r. By construction this depends on r alone and is a decreasing function of its argument; it is illustrated in the diagram, and we shall write it as Is (r ).

This schedule is a characteristic of the current industrial process which Irving Fischer described as representing the ‘investment opportunity side of interest theory’;[14] and in fact the condition that it should equal S (Y,r ) is the equation which determines the interest rate from income in classical theory. Keynes is seeking to reverse the direction of causality (and omitting r as an argument to S () ).

He interprets the schedule as expressing the demand for investment at any given value of r , giving it an alternative name: “We shall call this the investment demand-schedule...” (p136). He also refers to it as the ‘demand curve for capital’ (p178). However it has many of the properties of a supply curve (for instance not being constrained by income). It is analogous to the curve giving the amount of gold which can be extracted from the soil at a price less than p. It is a decreasing function of r while a supply curve is an increasing function of p because the purchase of an investment with return r is equivalent to the purchase of a perpetual annuity whose price is the reciprocal of r. Nonetheless Keynes was inclined to view it as a demand curve, and his followers did so without hesitation.

For fixed industrial conditions, we conclude that ‘the amount of investment... depends on the rate of interest’ (John Hicks, “Mr Keynes and the Classics”, p128[15]).

Animal spirits

Chapter 12 is a digression on the psychology of speculation and enterprise.

Most, probably, of our decisions to do something positive, the full consequences of which will be drawn out over days to come, can only be taken as a result of animal spirits – of a spontaneous urge to action rather than inaction, and not as the outcome of a weighted average of quantified benefits... Thus if the animal spirits are dimmed and spontaneous optimism falters, leaving us to depend on nothing but a mathematical expectation, enterprise will fade and die.[16]

And since the marginal efficiency of capital is governed by its anticipated yield, changes in expectation may lead to volubility in the demand for investment which in turn affects the rest of the economy.

Liquidity preference

Chapter 13 discusses liquidity preference (i.e. the demand for money), and makes the point that the rate of interest r influences people’s desire to hold cash.[17] Keynes initially considers the demand for money to depend solely on r, so we may write it as L (r ); L is in money units. A little later (in Chapter 15, p199) he revises his view and writes the liquidity preference as L (W ·Y, r ): it is the sum of two demands, one of which is chiefly influenced by income in money units (in an increasing direction) and the other of which is chiefly influenced by r in an uncertain manner.

The Keynesian economic system

Keynes’s economic model

In chapter 14 Keynes contrasts the classical theory of interest with his own, and in making the comparison he shows how his system can be applied to explain all the principal economic unknowns from the facts he takes as given. The two topics can be treated together because they are different ways of analysing the same equation.

Keynes’s presentation is informal. To make it more precise we will identify a set of 4 variables – saving, investment, the rate of interest, and the national income – and a parallel set of 4 equations which jointly determine them. The graph illustrates the reasoning. The red S lines are shown as increasing functions of r in obedience to classical theory; for Keynes they should be horizontal.

The first equation asserts that the reigning rate of interest r̂ is determined from the amount of money in circulation M̂ through the liquidity preference function and the assumption that L (r̂ ) = M̂.

The second equation fixes the level of investment Î given the rate of interest through the schedule of the marginal efficiency of capital as Is (r̂ ).

The third equation tells us that saving is equal to investment: S (Y ) = Î. The final equation tells us that the income Ŷ is the value of Y corresponding to the implied level of saving.

All this makes a satisfying theoretical system.

Three comments can be made concerning the argument. Firstly, no use is made of the ‘first postulate of classical economics’, which can be called on later to set the price level. Secondly, Hicks (in “Mr Keynes and the classics”) presents his version of Keynes’s system with a single variable representing both saving and investment; so his exposition has three equations in three unknowns.

And finally, since Keynes’s discussion takes place in Chapter 14, it precedes the modification which makes liquidity preference depend on income as well as on the rate of interest. Once this modification has been made the unknowns can no longer be recovered sequentially.

Keynesian economic intervention

The state of the economy, according to Keynes, is determined by four parameters: the money supply, the demand functions for consumption (or equivalently for saving) and for liquidity, and the schedule of the marginal efficiency of capital determined by ‘the existing quantity of equipment‘ and ‘the state of long-term expectation’ (p246).

Adjusting the money supply is the domain of monetary policy. The effect of a change in the quantity of money is considered at p298. The change is effected in the first place in money units. According to Keynes’s account on p295 (offered as an simplification), in a condition of full employment the wage unit and prices will increase in exact proportion to the money supply; hence there will be inflation but no change in the real economy. But ‘an increase in the quantity of money will have no effect whatever on prices, so long as there is any unemployment’, with the result that for as long as unemployment persists, a change in the money supply will carry through into wage units.

We can then analyse its effect from the diagram, in which we see that an increase in M̂ shifts r̂ to the left, pushing Î upwards and leading to an increase in total income (and employment) whose size depends on the gradients of all 3 demand functions. If we look at the change in income as a function of the upwards shift of the schedule of the marginal efficiency of capital (blue curve), we see that as the level of investment is increased by one unit, the income must adjust so that the level of saving (red curve) is one unit greater, and hence the increase in income must be 1 / S' (Y ) units, i.e. k units. This is the explanation of Keynes’s multiplier.

It does not necessarily follow that individual decisions to invest will have a similar effect, since decisions to invest above the level suggested by the schedule of the marginal efficiency of capital are not the same thing as an increase in the schedule.

The equations of classical economics

At this point it is useful to compare Keynes’s conclusions with those obtained by classical means. Each theory can be summed up in 3 equations:

| Classical | Keynesian | ||

|---|---|---|---|

| Y' (N ) = W / P | The first postulate | ∂Y / ∂N = 1 / P | |

| Is (r ) = S (Y (N ),r ) | Determination of the interest rate | Is (r ) = S (Y ) | Determination of income |

| M̂ = P ·Y (N ) / V (r ) | Quantity theory of money | M̂ = L (W ·Y ,r ) | Liquidity preference |

| Y, Is , S in real terms | Y, Is , S in wage units | ||

Here Y is written on the left as a function of N, the number of workers employed; P is the price (in money terms) of a unit of real output; V (r ) is the velocity of money; and W is the wage rate in money terms (assumed given). N, P and r are the 3 variables we need to recover. In the Keynesian system income is measured in wage units and will be a function of prices as well as of employment; the first postulate is written in a form which is only admissible if one allows prices to be represented by a single variable. Strictly it should be modified to take account of the distinction between marginal wage cost and marginal prime cost.[18]

The classics took the second equation as determining the rate of interest, the third as determining the price level, and the first as determining employment. Keynes believed that the last two equations could be solved together for Y and r (see wage unit), which is not possible in the classical system.

Chapter 3: The principle of effective demand

The theoretical system we have described is developed over chapters 4–18, but is adumbrated by an introductory chapter written in a different terminology and notation which can only be understood in the light of what it seeks to explain.

The aggregate supply Z is employers’ outlay when they employ N workers, written functionally as φ(N ). The aggregate demand D is their expected proceeds, written as f (N ). In equilibrium Z = D. D can be decomposed as D1 + D2 where D1 is the propensity to consume, which may be written C (Y ) or χ(N ). D2 is explained as ‘the volume of investment’, and the equilibrium condition determining the level of employment is that D1 + D2 should equal Z as functions of N. Presumably we should identify D2 with Is (r ), and associate the fact that it is being added to something which is unmistakably a demand with Keynes’s calling it a ‘demand schedule’. If we assume that Z = Y we end up with the equation Is (r ) = S (Y ).

Samuelson’s Keynesian cross is a graphical representation of the Chapter 3 argument.[19]

Mr Keynes and the classics

The IS-LM model

For guidance in analysing Keynes’s system when liquidity preference is a function of income as well as of the rate of interest we turn to John Hicks’s essay “Mr. Keynes and the Classics”. Keynes’s readmission of income as an influence on the demand for money is a step back in the direction of classical theory, and Hicks takes a further step in the same direction by generalising the propensity to save (and also the schedule of the marginal efficiency of capital) to take both Y and r as arguments.

The equations are solved by setting up a relation between income and the rate of interest satisfied by those pairs (Y,r ) for which Is (Y,r ) = S (Y,r ); the set of pairs thus related can be plotted as the IS curve on a graph of r against Y. Meanwhile another curve on the same axes, the LM curve, connects the pairs for which L(W ·Y ,r ) = M̂. The point of intersection of the two curves tells us the national income Ŷ and the rate of interest r̂.

If we follow Keynes’s initial account under which liquidity preference depends only on the interest rate r, then the LM curve will be horizontal.

Joan Robinson commented that

modern teaching has been confused by J. R. Hicks’ attempt to reduce the General Theory to a version of static equilibrium with the formula IS/LM. Hicks has now repented and changed his name from J. R. to John, but it will take a long time for the effects of his teaching to wear off.

Hicks subsequently relapsed.[20]

The liquidity trap

It has generally been considered that the rate of interest would not fall below a certain limit, often seen as zero or a slightly negative number. Keynes suggested on p207 that the limit might be appreciably greater than zero but did not attach much practical significance to it.

The term ‘liquidity trap’ was coined by Dennis Robertson in his comments on the General Theory ,[21] but it was Hicks in “Mr. Keynes and the classics” who identified the liquidity trap as the cause of economic difficulties. He discussed it using IS-LM curves but the concept can be illustrated using simpler graphs.

If the economy is in a position such that the liquidity preference curve is almost vertical, as must happen as the lower limit on r is approached, then a change in the money supply M̂ will make almost no difference to the equilibrium rate of interest r̂ or, unless there is compensating steepness in the other curves, to the resulting income Ŷ. As Hicks put it, ‘monetary means will not force down the rate of interest any further’ (p138).

Paul Krugman has worked extensively on the liquidity trap, claiming that it was the problem confronting the Japanese economy around the turn of the millennium.[22] In his later words

Short-term interest rates were close to zero, long-term rates were at historical lows, yet private investment spending remained insufficient to bring the economy out of deflation. In that environment, monetary policy was just as ineffective as Keynes described. Attempts by the Bank of Japan to increase the money supply simply added to already ample bank reserves and public holdings of cash...[23]

Keynesian economic policies

Active fiscal policy

Classical economists have traditionally advocated balanced government budgets. Keynesians, on the other hand, believe that it is entirely legitimate and appropriate for governments to incur expenditure in excess of taxation revenues during periods of economic stagnation such as the Great Depression, which dominated economic life at the time he was developing and publicizing his theories.[24]

Contrary to some critical characterizations of it, Keynesianism does not consist solely of deficit spending. Keynesianism recommends counter-cyclical policies.[25] An example of a counter-cyclical policy is raising taxes to cool the economy and to prevent inflation when there is abundant demand-side growth, and engaging in deficit spending on labour-intensive infrastructure projects to stimulate employment and stabilize wages during economic downturns. Classical economics, on the other hand, argues that one should cut taxes when there are budget surpluses, and cut spending – or, less likely, increase taxes – during economic downturns.

Keynes's ideas influenced Franklin D. Roosevelt's view that insufficient buying-power caused the Depression. During his presidency, Roosevelt adopted some aspects of Keynesian economics, especially after 1937, when, in the depths of the Depression, the United States suffered from recession yet again following fiscal contraction. But to many the true success of Keynesian policy can be seen at the onset of World War II, which provided a kick to the world economy, removed uncertainty, and forced the rebuilding of destroyed capital. Keynesian ideas became almost official in social-democratic Europe after the war and in the U.S. in the 1960s.

Keynes developed a theory which suggested that active government policy could be effective in managing the economy. Rather than seeing unbalanced government budgets as wrong, Keynes advocated what has been called countercyclical fiscal policies, that is, policies that acted against the tide of the business cycle: deficit spending when a nation's economy suffers from recession or when recovery is long-delayed and unemployment is persistently high – and the suppression of inflation in boom times by either increasing taxes or cutting back on government outlays. He argued that governments should solve problems in the short run rather than waiting for market forces to do it in the long run, because, "in the long run, we are all dead."[26]

This contrasted with the classical and neoclassical economic analysis of fiscal policy. Fiscal stimulus could actuate production. But, to these schools, there was no reason to believe that this stimulation would outrun the side-effects that "crowd out" private investment: first, it would increase the demand for labour and raise wages, hurting profitability; Second, a government deficit increases the stock of government bonds, reducing their market price and encouraging high interest rates, making it more expensive for business to finance fixed investment. Thus, efforts to stimulate the economy would be self-defeating.

The Keynesian response is that such fiscal policy is appropriate only when unemployment is persistently high, above the non-accelerating inflation rate of unemployment (NAIRU). In that case, crowding out is minimal. Further, private investment can be "crowded in": Fiscal stimulus raises the market for business output, raising cash flow and profitability, spurring business optimism. To Keynes, this accelerator effect meant that government and business could be complements rather than substitutes in this situation.

Second, as the stimulus occurs, gross domestic product rises, raising the amount of saving, helping to finance the increase in fixed investment. Finally, government outlays need not always be wasteful: government investment in public goods that will not be provided by profit-seekers will encourage the private sector's growth. That is, government spending on such things as basic research, public health, education, and infrastructure could help the long-term growth of potential output.

In Keynes's theory, there must be significant slack in the labour market before fiscal expansion is justified.

Keynesian economists believe that adding to profits and incomes during boom cycles through tax cuts, and removing income and profits from the economy through cuts in spending during downturns, tends to exacerbate the negative effects of the business cycle. This effect is especially pronounced when the government controls a large fraction of the economy, as increased tax revenue may aid investment in state enterprises in downturns, and decreased state revenue and investment harm those enterprises.

Views on trade imbalance

In the last few years of his life, John Maynard Keynes was much preoccupied with the question of balance in international trade. He was the leader of the British delegation to the United Nations Monetary and Financial Conference in 1944 that established the Bretton Woods system of international currency management. He was the principal author of a proposal – the so-called Keynes Plan – for an International Clearing Union. The two governing principles of the plan were that the problem of settling outstanding balances should be solved by 'creating' additional 'international money', and that debtor and creditor should be treated almost alike as disturbers of equilibrium. In the event, though, the plans were rejected, in part because "American opinion was naturally reluctant to accept the principle of equality of treatment so novel in debtor-creditor relationships".[27]

The new system is not founded on free-trade (liberalisation[28] of foreign trade[29]) but rather on the regulation of international trade, in order to eliminate trade imbalances: the nations with a surplus would have a powerful incentive to get rid of it, and in doing so they would automatically clear other nations deficits[30]. He proposed a global bank that would issue its own currency - the bancor - which was exchangeable with national currencies at fixed rates of exchange and would become the unit of account between nations, which means it would be used to measure a country's trade deficit or trade surplus. Every country would have an overdraft facility in its bancor account at the International Clearing Union. He pointed out that surpluses lead to weak global aggregate demand – countries running surpluses exert a "negative externality" on trading partners, and posed far more than those in deficit, a threat to global prosperity.[31] In "National Self-Sufficiency" The Yale Review, Vol. 22, no. 4 (June 1933) [32][33], he already highlighted the problems created by free trade.

His view, supported by many economists and commentators at the time, was that creditor nations may be just as responsible as debtor nations for disequilibrium in exchanges and that both should be under an obligation to bring trade back into a state of balance. Failure for them to do so could have serious consequences. In the words of Geoffrey Crowther, then editor of The Economist, "If the economic relationships between nations are not, by one means or another, brought fairly close to balance, then there is no set of financial arrangements that can rescue the world from the impoverishing results of chaos."[34]

These ideas were informed by events prior to the Great Depression when – in the opinion of Keynes and others – international lending, primarily by the U.S., exceeded the capacity of sound investment and so got diverted into non-productive and speculative uses, which in turn invited default and a sudden stop to the process of lending.[35]

Influenced by Keynes, economics texts in the immediate post-war period put a significant emphasis on balance in trade. For example, the second edition of the popular introductory textbook, An Outline of Money,[36] devoted the last three of its ten chapters to questions of foreign exchange management and in particular the 'problem of balance'. However, in more recent years, since the end of the Bretton Woods system in 1971, with the increasing influence of Monetarist schools of thought in the 1980s, and particularly in the face of large sustained trade imbalances, these concerns – and particularly concerns about the destabilising effects of large trade surpluses – have largely disappeared from mainstream economics discourse[37] and Keynes' insights have slipped from view.[38] They are receiving some attention again in the wake of the financial crisis of 2007–08.[39]

History

Precursors

Keynes's work was part of a long-running debate within economics over the existence and nature of general gluts. While a number of the policies Keynes advocated (the notable one being government deficit spending at times of low private investment or consumption) and the theoretical ideas he proposed (effective demand, the multiplier, the paradox of thrift) were advanced by various authors in the 19th and early 20th centuries, Keynes's unique contribution was to provide a general theory of these, which proved acceptable to the political and economic establishments.

Schools

An intellectual precursor of Keynesian economics was underconsumption theories associated with John Law, Thomas Malthus, the Birmingham School of Thomas Attwood,[40] and the American economists William Trufant Foster and Waddill Catchings, who were influential in the 1920s and 1930s. Underconsumptionists were, like Keynes after them, concerned with failure of aggregate demand to attain potential output, calling this "underconsumption" (focusing on the demand side), rather than "overproduction" (which would focus on the supply side), and advocating economic interventionism. Keynes specifically discussed underconsumption (which he wrote "under-consumption") in the General Theory, in Chapter 22, Section IV and Chapter 23, Section VII.

Numerous concepts were developed earlier and independently of Keynes by the Stockholm school during the 1930s; these accomplishments were described in a 1937 article, published in response to the 1936 General Theory, sharing the Swedish discoveries.[41]

Concepts

The multiplier dates to work in the 1890s by the Australian economist Alfred de Lissa, the Danish economist Julius Wulff, and the German-American economist Nicholas Johannsen,[42] the latter being cited in a footnote of Keynes.[43] Nicholas Johannsen also proposed a theory of effective demand in the 1890s.

The paradox of thrift was stated in 1892 by John M. Robertson in his The Fallacy of Saving, in earlier forms by mercantilist economists since the 16th century, and similar sentiments date to antiquity.[44][45]

Today these ideas, regardless of provenance, are referred to in academia under the rubric of "Keynesian economics", due to Keynes's role in consolidating, elaborating, and popularizing them.

Postwar Keynesianism

Keynes's ideas became widely accepted after World War II, and until the early 1970s, Keynesian economics provided the main inspiration for economic policy makers in Western industrialized countries.[5] Governments prepared high quality economic statistics on an ongoing basis and tried to base their policies on the Keynesian theory that had become the norm. In the early era of social liberalism and social democracy, most western capitalist countries enjoyed low, stable unemployment and modest inflation, an era called the Golden Age of Capitalism.

In terms of policy, the twin tools of post-war Keynesian economics were fiscal policy and monetary policy. While these are credited to Keynes, others, such as economic historian David Colander, argue that they are, rather, due to the interpretation of Keynes by Abba Lerner in his theory of functional finance, and should instead be called "Lernerian" rather than "Keynesian".[46]

Through the 1950s, moderate degrees of government demand leading industrial development, and use of fiscal and monetary counter-cyclical policies continued, and reached a peak in the "go go" 1960s, where it seemed to many Keynesians that prosperity was now permanent. In 1971, Republican US President Richard Nixon even proclaimed "I am now a Keynesian in economics."[47]

However, with the oil shock of 1973, and the economic problems of the 1970s, Keynesian economics began to fall out of favour. During this time, many economies experienced high and rising unemployment, coupled with high and rising inflation, contradicting the Phillips curve's prediction. This stagflation meant that the simultaneous application of expansionary (anti-recession) and contractionary (anti-inflation) policies appeared to be necessary. This dilemma led to the end of the Keynesian near-consensus of the 1960s, and the rise throughout the 1970s of ideas based upon more classical analysis, including monetarism, supply-side economics,[47] and new classical economics.

At the same time, Keynesians began during the period to reorganize their thinking (some becoming associated with New Keynesian economics). One strategy, utilized also as a critique of the notably high unemployment and potentially disappointing GNP growth rates associated with the latter two theories by the mid-1980s, was to emphasize low unemployment and maximal economic growth at the cost of somewhat higher inflation (its consequences kept in check by indexing and other methods, and its overall rate kept lower and steadier by such potential policies as Martin Weitzman's share economy).[48]

Multiple schools of economic thought that trace their legacy to Keynes currently exist, the notable ones being Neo-Keynesian economics, New Keynesian economics, and Post-Keynesian economics. Keynes's biographer Robert Skidelsky writes that the post-Keynesian school has remained closest to the spirit of Keynes's work in following his monetary theory and rejecting the neutrality of money.[49][50]

In the postwar era, Keynesian analysis was combined with neoclassical economics to produce what is generally termed the "neoclassical synthesis", yielding Neo-Keynesian economics, which dominated mainstream macroeconomic thought. Though it was widely held that there was no strong automatic tendency to full employment, many believed that if government policy were used to ensure it, the economy would behave as neoclassical theory predicted. This post-war domination by Neo-Keynesian economics was broken during the stagflation of the 1970s. There was a lack of consensus among macroeconomists in the 1980s. However, the advent of New Keynesian economics in the 1990s, modified and provided microeconomic foundations for the neo-Keynesian theories. These modified models now dominate mainstream economics.

Post-Keynesian economists, on the other hand, reject the neoclassical synthesis and, in general, neoclassical economics applied to the macroeconomy. Post-Keynesian economics is a heterodox school that holds that both Neo-Keynesian economics and New Keynesian economics are incorrect, and a misinterpretation of Keynes's ideas. The Post-Keynesian school encompasses a variety of perspectives, but has been far less influential than the other more mainstream Keynesian schools.

Other schools of economics

The Keynesian schools of economics are situated alongside a number of other schools that have the same perspectives on what the economic issues are, but differ on what causes them and how to best resolve them:

Stockholm School

The Stockholm school rose to prominence at about the same time that Keynes published his General Theory and shared a common concern in business cycles and unemployment. The second generation of Swedish economists also advocated government intervention through spending during economic downturns[51] although opinions are divided over whether they conceived the essence of Keynes's theory before he did.[52]

Monetarism

There was debate between Monetarists and Keynesians in the 1960s over the role of government in stabilizing the economy. Both Monetarists and Keynesians agree that issues such as business cycles, unemployment, and deflation are caused by inadequate demand. However, they had fundamentally different perspectives on the capacity of the economy to find its own equilibrium, and the degree of government intervention that would be appropriate. Keynesians emphasized the use of discretionary fiscal policy and monetary policy, while monetarists argued the primacy of monetary policy, and that it should be rules-based.[53]

The debate was largely resolved in the 1980s. Since then, economists have largely agreed that central banks should bear the primary responsibility for stabilizing the economy, and that monetary policy should largely follow the Taylor rule – which many economists credit with the Great Moderation.[54][55] The financial crisis of 2007–08, however, has convinced many economists and governments of the need for fiscal interventions and highlighted the difficulty in stimulating economies through monetary policy alone during a liquidity trap.[56]

Public choice theory

Some Marxist economists criticized Keynesian economics.[57] For example, in his 1946 appraisal[58] Paul Sweezy, while admitting that there was much in the General Theory's analysis of effective demand which Marxists could draw upon, described Keynes as in the last resort a prisoner of his neoclassical upbringing. Sweezy argued Keynes had never been able to view the capitalist system as a totality. He argued Keynes had regarded the class struggle carelessly, and overlooked the class role of the capitalist state, which he treated as a deus ex machina, and some other points. While Michał Kalecki was generally enthusiastic about the Keynesian revolution, he predicted that it would not endure, in his article "Political Aspects of Full Employment". In the article Kalecki predicted that the full employment delivered by Keynesian policy would eventually lead to a more assertive working class and weakening of the social position of business leaders, causing the elite to use their political power to force the displacement of the Keynesian policy even though profits would be higher than under a laissez faire system: The erosion of social prestige and political power would be unacceptable to the elites despite higher profits.[59]

James M. Buchanan[60] criticized Keynesian economics on the grounds that governments would in practice be unlikely to implement theoretically optimal policies. The implicit assumption underlying the Keynesian fiscal revolution, according to Buchanan, was that economic policy would be made by wise men, acting without regard to political pressures or opportunities, and guided by disinterested economic technocrats. He argued that this was an unrealistic assumption about political, bureaucratic and electoral behaviour. Buchanan blamed Keynesian economics for what he considered a decline in America's fiscal discipline.[61] Buchanan argued that deficit spending would evolve into a permanent disconnect between spending and revenue, precisely because it brings short-term gains, so, ending up institutionalizing irresponsibility in the federal government, the largest and most central institution in our society.[62] Martin Feldstein argues that the legacy of Keynesian economics–the misdiagnosis of unemployment, the fear of saving, and the unjustified government intervention–affected the fundamental ideas of policy makers.[63] Milton Friedman thought that Keynes's political bequest was harmful for two reasons. First, he thought whatever the economic analysis, benevolent dictatorship is likely sooner or later to lead to a totalitarian society. Second, he thought Keynes's economic theories appealed to a group far broader than economists primarily because of their link to his political approach.[64] Alex Tabarrok argues that Keynesian politics–as distinct from Keynesian policies–has failed pretty much whenever it's been tried, at least in liberal democracies.[65]

In response to this argument, John Quiggin,[66] wrote about these theories' implication for a liberal democratic order. He thought if it is generally accepted that democratic politics is nothing more than a battleground for competing interest groups, then reality will come to resemble the model. Paul Krugman wrote "I don’t think we need to take that as an immutable fact of life; but still, what are the alternatives?" [67] Daniel Kuehn, criticized James M. Buchanan. He argued, "if you have a problem with politicians - criticize politicians," not Keynes.[68] He also argued that empirical evidence makes it pretty clear that Buchanan was wrong.[69][70] James Tobin argued, if advising government officials, politicians, voters, it's not for economists to play games with them.[71] Keynes implicitly rejected this argument, in "soon or late it is ideas not vested interests which are dangerous for good or evil."[72][73]

Brad DeLong has argued that politics is the main motivator behind objections to the view that government should try to serve a stabilizing macroeconomic role.[74] Paul Krugman argued that a regime that by and large lets markets work, but in which the government is ready both to rein in excesses and fight slumps is inherently unstable, due to intellectual instability, political instability, and financial instability.[75]

New classical

Another influential school of thought was based on the Lucas critique of Keynesian economics. This called for greater consistency with microeconomic theory and rationality, and in particular emphasized the idea of rational expectations. Lucas and others argued that Keynesian economics required remarkably foolish and short-sighted behaviour from people, which totally contradicted the economic understanding of their behaviour at a micro level. New classical economics introduced a set of macroeconomic theories that were based on optimizing microeconomic behaviour. These models have been developed into the real business-cycle theory, which argues that business cycle fluctuations can to a large extent be accounted for by real (in contrast to nominal) shocks.

Beginning in the late 1950s new classical macroeconomists began to disagree with the methodology employed by Keynes and his successors. Keynesians emphasized the dependence of consumption on disposable income and, also, of investment on current profits and current cash flow. In addition, Keynesians posited a Phillips curve that tied nominal wage inflation to unemployment rate. To support these theories, Keynesians typically traced the logical foundations of their model (using introspection) and supported their assumptions with statistical evidence.[76] New classical theorists demanded that macroeconomics be grounded on the same foundations as microeconomic theory, profit-maximizing firms and rational, utility-maximizing consumers.[76]

The result of this shift in methodology produced several important divergences from Keynesian macroeconomics:[76]

- Independence of consumption and current income (life-cycle permanent income hypothesis)

- Irrelevance of current profits to investment (Modigliani–Miller theorem)

- Long run independence of inflation and unemployment (natural rate of unemployment)

- The inability of monetary policy to stabilize output (rational expectations)

- Irrelevance of taxes and budget deficits to consumption (Ricardian equivalence)

See also

References

- ^ "What Is Keynesian Economics? - Back to Basics - Finance & Development, September 2014". www.imf.org.

- ^ Hunt, Michael H. (2004). The World Transformed: 1945 to the present. New York, New York: Oxford University Press. p. 80. ISBN 9780199371020.

- ^ O'Sullivan, Arthur; Sheffrin, Steven M. (2003). Economics: Principles in Action. Upper Saddle River: Pearson Prentice Hall. ISBN 0-13-063085-3.

- ^ Blinder, Alan S. "Keynesian Economics". Concise Encyclopedia of Economics. Library of Economics and Liberty. Retrieved 23 August 2017.

- ^ a b Fletcher, Gordon (1989). The Keynesian Revolution and Its Critics: Issues of Theory and Policy for the Monetary Production Economy. Palgrave MacMillan. pp. xix–xxi, 88, 189–91, 234–38, 256–61. ISBN 0-312-45260-8.

- ^ "Economic Crisis Mounts in Germany". Der Spiegel. 4 November 2008. Retrieved 13 August 2011.

- ^ Say, Jean-Baptiste (2001). A Treatise on Political Economy; or the Production Distribution and Consumption of Wealth. Kitchener: Batoche Books.

- ^ Ricardo, David (1871). On The Principles of Political Economy and Taxation.

- ^ Krugman, Paul. "Trash Talk and the Macroeconomic Divide". Retrieved 10 September 2015.

- ^ Markwell, Donald (2006). John Maynard Keynes and International Relations: Economic Paths to War and Peace. New York: Oxford University Press. ISBN 0-19-829236-8.

{{cite book}}: Invalid|ref=harv(help) - ^ See for instance Pigou’s evidence to the 1930 Macmillan Committee cited on p194 of Richard Kahn’s, “The Making of Keynes’ General Theory ”.

- ^ Page numbers refer to the edition published for the Royal Economic Society as Vol VII of the Collected Writings.

- ^ See Kahn’s “The Making of Keynes’ General Theory”, Fourth lecture, part 1.

- ^ ”The theory of interest...”, p155, quoted by Keynes, p141.

- ^ Conveniently reprinted in “Critical Essays in Monetary Theory”, to which page numbers here refer.

- ^ p161.

- ^ Hicks discusses the evolution of this view from the older outlook on pp131f of “Mr. Keynes and the Classics”.

- ^ See Appendix to Keynes’s Chapter 19.

- ^ P. A. Samuelson, “Economics: an introductory analysis”, 1948 and many subsequent editions.

- ^ Richard Kahn, The Making of Keynes’ General Theory, pp 160 and 248.

- ^ D. H. Robertson, “Some Notes on Mr. Keynes’ General Theory of Interest”, Quarterly Journal of Economics, 1936

- ^ P. R. Krugman, “It’s baaack: Japan’s slump and the return of the liquidity trap”, Brookings papers on economic activity, 1998.

- ^ P. R. Krugman, Introduction to the General Theory..., 2008.

- ^ Galbraith, John K. (2009) The Great Crash. Houghton Mifflin Harcourt, 137

- ^ "I Think Keynes Mistitled His Book". The Washington Post. 26 July 2011. Retrieved 13 August 2011.

- ^ Keynes, John Maynard (1924). "The Theory of Money and the Foreign Exchanges". A Tract on Monetary Reform.

- ^ Crowther, Geoffrey (1948). An Outline of Money. Second Edition. Thomas Nelson and Sons. pp. 326–29.

- ^ Staff, Investopedia (25 November 2003). "Deregulation".

- ^ Staff, Investopedia (3 April 2010). "Trade Liberalization".

- ^ http://scholarworks.umass.edu/cgi/viewcontent.cgi?article=1127&context=peri_workingpapers

- ^ Joseph Stiglitz (5 May 2010). "Reform the euro or bin it". www.theguardian.com.

- ^ http://www.uam.es/personal_pdi/economicas/jsanchez/documentos/1601%20KEYNES%20National%20Self-sufficiency%201933.pdf

- ^ "601 David Singh Grewal, What Keynes warned about globalization". www.india-seminar.com.

- ^ Crowther, Geoffrey (1948). An Outline of Money. Second Edition. Thomas Nelson and Sons. p. 336.

- ^ Crowther, Geoffrey (1948). An Outline of Money. Second Edition. Thomas Nelson and Sons. pp. 368–72.

- ^ Crowther, Geoffrey (1948). An Outline of Money. Second Edition. Thomas Nelson and Sons.

- ^ See for example, Krugman, P and Wells, R (2006). "Economics", Worth Publishers

- ^ although see Duncan, R (2005). "The Dollar Crisis: Causes, Consequences, Cures", Wiley

- ^ See for example,"Clearing Up This Mess". 18 November 2008. Archived from the original on 23 January 2009.

{{cite web}}: Unknown parameter|deadurl=ignored (|url-status=suggested) (help) - ^ Glasner, David (1997). "Attwood, Thomas (1783–1856)". In Glasner, David (ed.). Business Cycles and Depressions: An Encyclopedia. Taylor & Francis. p. 22. ISBN 0-8240-0944-4. Retrieved 15 June 2009.

{{cite book}}: Invalid|ref=harv(help) - ^ Ohlin, Bertil (1937). "Some Notes on the Stockholm Theory of Savings and Investment". Economic Journal.

{{cite journal}}: Invalid|ref=harv(help) - ^ Dimand, Robert William (1988). The origins of the Keynesian revolution. Stanford: Stanford University Press. p. 117. ISBN 0-8047-1525-4.

{{cite book}}: Invalid|ref=harv(help) - ^ Keynes, John Maynard (1930). "Treatise on Money". Nature. 127 (3216). London: Macmillan: 90. Bibcode:1931Natur.127..919M. doi:10.1038/127919a0.

{{cite journal}}: Invalid|ref=harv(help) - ^ Nash, Robert T.; Gramm, William P. (1969). "A Neglected Early Statement the Paradox of Thrift". History of Political Economy. 1 (2): 395–400. doi:10.1215/00182702-1-2-395.

{{cite journal}}: Invalid|ref=harv(help) - ^ Robertson, John M. (1892). The Fallacy of Saving.

- ^ "What eventually became known as textbook Keynesian policies were in many ways Lerner's interpretations of Keynes's policies, especially those expounded in The Economics of Control (1944) and later in The Economics of Employment (1951). ... Textbook expositions of Keynesian policy naturally gravitated to the black and white 'Lernerian' policy of Functional Finance rather than the grayer Keynesian policies. Thus, the vision that monetary and fiscal policy should be used as a balance wheel, which forms a key element in the textbook policy revolution, deserves to be called Lernerian rather than Keynesian." (Colander 1984, p. 1573)

- ^ a b Lewis, Paul (15 August 1976). "Nixon's Economic Policies Return to Haunt the G.O.P." New York Times.

{{cite news}}: Invalid|ref=harv(help) - ^ Blinder, Alan S. (1987). Hard Heads, Soft Hearts: Tough Minded Economics for a Just Society. New York: Perseus Books. pp. 65–66. ISBN 0-201-14519-7.

- ^ Skidelsky 2009

- ^ Financial markets, money and the real world, by Paul Davidson, pp. 88–89

- ^ Jonung, Lars (1991). The Stockholm School of Economics Revisited. Cambridge University Press. p. 5.

- ^ Jonung, Lars (1991). The Stockholm School of Economics Revisited. Cambridge University Press. p. 18.

- ^ Abel, Andrew; Ben Bernanke (2005). "14.3". Macroeconomics (5th ed.). Pearson Addison Wesley. pp. 543–57. ISBN 0-321-22333-0.

- ^ Bernanke, Ben (20 February 2004). "The Great Moderation". federalreserve.gov. Retrieved 15 April 2011.

- ^ Federal Reserve Bank of Chicago, Monetary Policy, Output Composition and the Great Moderation, June 2007

- ^ Henry Farrell and John Quiggin (March 2012). "Consensus, Dissensus and Economic Ideas: The Rise and Fall of Keynesianism During the Economic Crisis" (PDF). The Center for the Study of Development Strategies. Archived from the original (pdf) on 25 August 2013. Retrieved 29 May 2012.

{{cite web}}: Unknown parameter|deadurl=ignored (|url-status=suggested) (help) - ^ Michael Charles Howard, John Edward King. A History of Marxian Economics, Volume II: 1929-1990. Princeton Legacy library. pp. 91–108.

- ^ Sweezy, P. M. (1946). "John Maynard Keynes". Science and Society: 398–405.

- ^ Kalecki (1943). "Political Aspects of Full Employment". Monthly Review. The Political Quarterly. Retrieved 2 May 2012.

- ^ James M. Buchanan and Richard E. Wagner, Democracy in Deficit: The Political Legacy of Lord Keynes (1977)

- ^ Robert D. McFadden, James M. Buchanan, Economic Scholar and Nobel Laureate, Dies at 93, New York Times, January 9, 2013

- ^ Tyler Cowen, It's Time to Face the Fiscal Illusion, New York Times, March 5, 2011

- ^ Feldstein, Martin (Summer 1981). "The retreat from Keynesian economics". The Public Interest: 92–105.

- ^ Friedman, Milton (1997). "John Maynard Keynes". FRB Richmond Economic Quarterly. 83: 1–23.

- ^ "The Failure of Keynesian Politics" (2011)

- ^ John Quiggin, Public choice = Marxism

- ^ Paul Krugman, "Living Without Discretionary Fiscal Policy" (2011)

- ^ Daniel Kuehn, Democracy in Deficit: Hayek Edition,

- ^ Daniel Kuehn, Yes, a lot of people have a very odd view of the 1970s

- ^ Daniel Kuehn, The Significance of James Buchanan

- ^ Snowdon, Brian, Howard R. Vane (2005). Modern Macroeconomics: Its Origin, Development and Current State. p. 155.

{{cite book}}: CS1 maint: multiple names: authors list (link) - ^ Keynes, John Maynard (1936). The General Theory Of Employment, Interest And Money.

- ^ Peacock, Alan (1992). Public Choice Analysis in Historical Perspective. Cambridge University Press. p. 60.

- ^ J. Bradford DeLong, "The Retreat of Macroeconomic Policy", Project Syndicate, November 25, 2010

- ^ Paul Krugman, "The Instability of Moderation" (November 26, 2010)

- ^ a b c Akerlof, George A. (2007). "The Missing Motivation in Macroeconomics". American Economic Review. 97 (1): 5–36. doi:10.1257/aer.97.1.5.

{{cite journal}}: Invalid|ref=harv(help)

Further reading

- Keynes, John Maynard (2007) [1936]. The General Theory of Employment, Interest and Money. Basingstoke, Hampshire: Palgrave Macmillan. ISBN 0-230-00476-8.

- The collected writings of John Maynard Keynes. London and Basingstoke: Macmillan for the Royal Economic Society. 1973. Edited by Sir Austin Robinson and Donald Moggridge. Vol VII is the General Theory ; Vols XIII and XIV contain writings on its preparation, defence and development.

- Lerner, Abba (1946). The economics of control. New York: Macmillan.

- Hansen, Alvin (1953). A guide to Keynes. New York: McGraw Hill. A thorough and thoughtful reader’s guide.

- Hazlitt, Henry (1995) [1960]. The critics of Keynesian economics. Van Nostrand. ISBN 1-57246-013-X. A useful collection of critical reviews.

- Hicks, John (1967). Critical essays in monetary theory. Oxford: OUP. ISBN 0-19-828423-3. Contains “Mr Keynes and the classics” and other essays relating to Keynes.

- Stein, Jerome L. (1982). Monetarist, Keynesian & New classical economics. Oxford: Blackwell. ISBN 0-631-12908-1.

- Kahn, Richard (1984). The making of Keynes’ General Theory. Cambridge: CUP. ISBN 0-521-25373-X. Lectures and discussion from a colloquium in 1978.

- Gordon, Robert J. (1990). "What Is New-Keynesian Economics?". Journal of Economic Literature. 28 (3): 1115–71. JSTOR 2727103.

{{cite journal}}: Invalid|ref=harv(help) - McCann Jr., Charles R. (1998). John Maynard Keynes: critical responses. Routledge. Not easily obtainable. Vol 3 contains reviews of the General Theory.

- Markwell, Donald, John Maynard Keynes and International Relations: Economic Paths to War and Peace, Oxford University Press, 2006. ISBN 9780198292364

External links

- Works by John Maynard Keynes at Project Gutenberg

- "We are all Keynesians now" – Historic article from Time magazine, 1965