International Monetary Fund: Difference between revisions

Apartheid South Africa was NOT a military dictatorship, but it did perpetrate human rights abuses (obviously) |

No edit summary Tag: nonsense characters |

||

| Line 280: | Line 280: | ||

The Debt of Dictators<ref>{{cite web|url=http://www.newsreel.org/nav/title.asp?tc=CN0193 |title=NewsReel.org |publisher=NewsReel.org |date= |accessdate=2010-05-30}}</ref> explores the lending of billions of dollars by the IMF, World Bank multinational banks and other international financial institutions to brutal [[dictators]] throughout the [[world]]. ''(see [[International Monetary Fund#IMF/World Bank support of military dictatorships|IMF/World Bank support of military dictatorships]])'' |

The Debt of Dictators<ref>{{cite web|url=http://www.newsreel.org/nav/title.asp?tc=CN0193 |title=NewsReel.org |publisher=NewsReel.org |date= |accessdate=2010-05-30}}</ref> explores the lending of billions of dollars by the IMF, World Bank multinational banks and other international financial institutions to brutal [[dictators]] throughout the [[world]]. ''(see [[International Monetary Fund#IMF/World Bank support of military dictatorships|IMF/World Bank support of military dictatorships]])'' |

||

==References== i will cum in your mouth and u will call me daddy and your mom will make me a sandwhich which i will eat half and then shove it up your moms pussyyyyyyyyyyyyyyyyyyyyyyyy and you will see these acts cuz my name is mrs.koch and i love big husky dickssssssssssssssssssssssssssssssssssssssssssssssssssssssssssssssssssssssssssssssssssssssssssssssssssssssssssssssssssssssssssssssssssssssssssssssssssssssssssssssssss |

|||

==References== |

|||

{{Reflist|colwidth=30em}} |

{{Reflist|colwidth=30em}} |

||

Revision as of 15:17, 17 March 2011

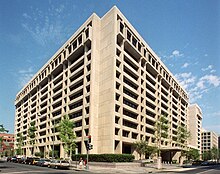

The International Monetary Fund (IMF) is the intergovernmental organization that oversees the global financial system by following the macroeconomic policies of its member countries, in particular those with an impact on exchange rate and the balance of payments. It is an organization formed with a stated objective of stabilizing international exchange rates and facilitating development through the enforcement of liberalising economic policies[1][2] on other countries as a condition for loans, restructuring or aid.[3] It also offers loans with varying levels of conditionality, mainly to poorer countries. Its headquarters are in Washington, D.C., United States. The IMF's relatively high influence in world affairs and development has drawn heavy criticism from some sources.[4][5]

Organization and purpose

The International Monetary Fund was conceived in July 1944 originally with 45 members and came into existence in December 1945 when 29 countries signed the agreement,[6] with a goal to stabilize exchange rates and assist the reconstruction of the world's international payment system. Countries contributed to a pool which could be borrowed from, on a temporary basis, by countries with payment imbalances (Condon, 2007). The IMF was important when it was first created because it helped the world stabilize the economic system. The IMF works to improve the economies of its member countries.[7] The IMF describes itself as "an organization of 187 countries (as of July 2010), working to foster global monetary cooperation, secure financial stability, facilitate international trade, promote high employment and sustainable economic growth, and reduce poverty".

Membership

Members of the IMF are 192 of the UN members and Kosovo.[9][10].

Former members are: Cuba (left in 1964),[11], Taiwan (expelled in 1980 due to political reasons),[12]

The other non-members are: North Korea, Andorra, Monaco, Liechtenstein, Nauru, Cook Islands, Niue, Vatican City and the rest of the states with limited recognition.

All member states participate directly in the IMF. Member states are represented on a 24-member Executive Board (five Executive Directors are appointed by the five members with the largest quotas, nineteen Executive Directors are elected by the remaining members), and all members appoint a Governor to the IMF's Board of Governors.[13]

All members of the IMF are also IBRD members, and vice versa.

History

The International Monetary Fund was conceived in July 1944 during the United Nations Monetary and Financial Conference. The representatives of 45 governments met in the Mount Washington Hotel in the area of Bretton Woods, New Hampshire, United States, with the delegates to the conference agreeing on a framework for international economic cooperation.[14] The IMF was formally organized on December 27, 1945, when the first 29 countries signed its Articles of Agreement. The statutory purposes of the IMF today are the same as when they were formulated in 1943 (see #Assistance and reforms).

The IMF's influence in the global economy steadily increased as it accumulated more members. The number of IMF member countries has more than quadrupled from the 44 states involved in its establishment, reflecting in particular the attainment of political independence by many developing countries and more recently the collapse of the Soviet bloc. The expansion of the IMF's membership, together with the changes in the world economy, have required the IMF to adapt in a variety of ways to continue serving its purposes effectively.

In 2008, faced with a shortfall in revenue, the International Monetary Fund's executive board agreed to sell part of the IMF's gold reserves. On April 27, 2008, IMF Managing Director Dominique Strauss-Kahn welcomed the board's decision of April 7, 2008 to propose a new framework for the fund, designed to close a projected $400 million budget deficit over the next few years. The budget proposal includes sharp spending cuts of $100 million until 2011 that will include up to 380 staff dismissals.[15]

At the 2009 G-20 London summit, it was decided that the IMF would require additional financial resources to meet prospective needs of its member countries during the ongoing global financial crisis. As part of that decision, the G-20 leaders pledged to increase the IMF's supplemental cash tenfold to $500 billion, and to allocate to member countries another $250 billion via Special Drawing Rights.[16][17]

On October 23, 2010, the Ministers of Finance of G-20, governing most of the IMF member quotas, agreed to reform IMF and shift about 6% of the voting shares to major developing nations and countries with emerging markets.[18] As of August 2010 Romania ($13.9 billion), Ukraine ($12.66 billion), Hungary ($11.7 billion) and Greece ($30 billion) are the largest borrowers of the fund.[19]

Data dissemination systems

In 1995, the International Monetary Fund began work on data dissemination standards with the view of guiding IMF member countries to disseminate their economic and financial data to the public. The International Monetary and Financial Committee (IMFC) endorsed the guidelines for the dissemination standards and they were split into two tiers: The General Data Dissemination System (GDDS) and the Special Data Dissemination Standard (SDDS).

The International Monetary Fund executive board approved the SDDS and GDDS in 1996 and 1997 respectively and subsequent amendments were published in a revised "Guide to the General Data Dissemination System". The system is aimed primarily at statisticians and aims to improve many aspects of statistical systems in a country. It is also part of the World Bank Millennium Development Goals and Poverty Reduction Strategic Papers.

The IMF established a system and standard to guide members in the dissemination to the public of their economic and financial data. Currently there are two such systems: General Data Dissemination System (GDDS) and its superset Special Data Dissemination System (SDDS), for those member countries having or seeking access to international capital markets.

The primary objective of the GDDS is to encourage IMF member countries to build a framework to improve data quality and increase statistical capacity building. This will involve the preparation of meta data describing current statistical collection practices and setting improvement plans. Upon building a framework, a country can evaluate statistical needs, set priorities in improving the timeliness, transparency, reliability and accessibility of financial and economic data.

Some countries initially used the GDDS, but lately upgraded to SDDS.

Some entities that are not themselves IMF members also contribute statistical data to the systems:

Palestinian Authority – GDDS

Palestinian Authority – GDDS Hong Kong – SDDS

Hong Kong – SDDS European Union institutions:

European Union institutions:

- the European Central Bank for the Eurozone – SDDS

- Eurostat for the whole EU – SDDS, thus providing data from

Cyprus (not using any DDSystem on its own) and

Cyprus (not using any DDSystem on its own) and  Malta (using only GDDS on its own)

Malta (using only GDDS on its own)

Member states

Membership qualifications

The application will be considered first by the IMF's Executive Board. After its consideration, the Executive Board will submit a report to the Board of Governors of the IMF with recommendations in the form of a "Membership Resolution". These recommendations cover the amount of quota in the IMF, the form of payment of the subscription, and other customary terms and conditions of membership.[20] After the Board of Governors has adopted the "Membership Resolution," the applicant state needs to take the legal steps required under its own law to enable it to sign the IMF's Articles of Agreement and to fulfill the obligations of IMF membership.

Similarly, any member country can withdraw from the Fund, although that is rare. For example, in April 2007, the president of Ecuador, Rafael Correa announced the expulsion of the World Bank representative in the country. A few days later, at the end of April, Venezuelan president Hugo Chavez announced that the country would withdraw from the IMF and the World Bank. Chavez dubbed both organizations as "the tools of the empire" that "serve the interests of the North".[21] As of June 2009, both countries remain as members of both organizations. Venezuela was forced to back down because a withdrawal would have triggered default clauses in the country's sovereign bonds[citation needed].

A member's quota in the IMF determines the amount of its subscription, its voting weight, its access to IMF financing, and its allocation of Special Drawing Rights (SDRs). A member state cannot unilaterally increase its quota—increases must be approved by the Executive Board of IMF and are linked to formulas that include many variables such as the size of a country in the world economy. For example, in 2001, the People's Republic of China was prevented from increasing its quota as high as it wished, ensuring it remained at the level of the smallest G7 economy (Canada).[22]

In September 2005, the IMF's member countries agreed to the first round of ad hoc quota increases for four countries, including China[citation needed]. On March 28, 2008, the IMF's Executive Board ended a period of extensive discussion and negotiation over a major package of reforms to enhance the institution's governance that would shift quota and voting shares from advanced to emerging markets and developing countries[citation needed]. Under existing arrangements, the industrialised countries(including Mexico) hold 57 per cent of the IMF votes[citation needed]. But the financial crisis has tilted control away from heavily indebted mature economies, such as the United States and the United Kingdom, in favour of the fast-growing, cash-rich, so-called “BRIC” economies of Brazil, Russia, India and China.[1]

Since the United States has by far the largest share of votes (approx. 17%) amongst IMF members (see table below), it has little to lose relative to European nations. At the 2009 G-20 Pittsburgh summit, the US raised the possibility that some European countries would reduce their votes in favour of increasing the votes for emerging economies. However, both France and Britain were particularly reluctant as an increase in China's votes would mean China now has more votes than the UK and France. At a subsequent IMF meeting in Istanbul, the same month as the Pittsburgh Summit, IMF managing director Dominique Strauss-Kahn then highlighted that "If we don't correct them, we'll have the recipe for the next major crisis."[23] Citing the seriousness of the issue to be tackled.

Members' quotas and voting power, and board of governors

Major decisions require an 85% supermajority.[24] The United States has always been the only country able to block a supermajority on its own. The following table shows the top 20 member states in terms of voting power (2,220,817 votes in total). The 27 member states of the European Union have a combined vote of 710,786 (32.07%).[25]

On October 23, 2010, the Ministers of Finance of G-20, governing most of the IMF member quotas, agreed to reform IMF and shift about 6% of the voting shares to major developing nations and countries with emerging markets.[18]

| Members' quotas and voting power, and board of governors | ||||||

|---|---|---|---|---|---|---|

| IMF member country | Quota: millions of SDRs | Quota: percentage of total | Governor | Alternate Governor | Votes: number | Votes: percentage of total |

| 37,149.3 | 15.82 | Timothy F. Geithner | Ben Bernanke | 371,743 | 16.74 | |

| 13,312.8 | 6.12 | Yoshihiko Noda | Masaaki Shirakawa | 133,378 | 6.01 | |

| 13,008.2 | 5.98 | Axel A. Weber | Wolfgang Schäuble | 130,332 | 5.87 | |

| 10,738.5 | 4.94 | George Osborne | Mervyn King | 107,635 | 4.85 | |

| 10,738.5 | 4.94 | Christine Lagarde | Christian Noyer | 107,635 | 4.85 | |

| 8,090.1 | 4.42 | Zhou Xiaochuan | Yi Gang | 81,151 | 3.65 | |

| 7,055.5 | 3.24 | Giulio Tremonti | Mario Draghi | 70,805 | 3.19 | |

| 6,985.5 | 3.21 | Ibrahim A. Al-Assaf | Hamad Al-Sayari | 70,105 | 3.16 | |

| 6,369.2 | 2.93 | Jim Flaherty | Mark Carney | 63,942 | 2.88 | |

| 5,945.4 | 2.73 | Aleksei Kudrin | Sergey Ignatyev | 59,704 | 2.69 | |

| 5,162.4 | 2.37 | Nout Wellink | L.B.J. van Geest | 51,874 | 2.34 | |

| 4,605.2 | 2.12 | Guy Quaden | Jean-Pierre Arnoldi | 46,302 | 2.08 | |

| 4,158.2 | 2.91 | Pranab Mukherjee | Duvvuri Subbarao | 41,832 | 1.88 | |

| 3,458.5 | 1.59 | Jean-Pierre Roth | Eveline Widmer-Schlumpf | 34,835 | 1.57 | |

| 3,236.4 | 1.49 | Wayne Swan | Ken Henry | 32,614 | 1.47 | |

| 3,152.8 | 1.45 | Agustín Carstens | Guillermo Ortiz | 31,778 | 1.43 | |

| 3,048.9 | 1.40 | Elena Salgado | Miguel Fernández Ordóñez | 30,739 | 1.38 | |

| 3,036.1 | 1.40 | Guido Mantega | Henrique Meirelles | 30,611 | 1.38 | |

| 2,927.3 | 1.35 | Okyu Kwon | Seong Tae Lee | 29,523 | 1.33 | |

| 2,659.1 | 1.22 | Gastón Parra Luzardo | Rodrigo Cabeza Morales | 26,841 | 1.21 | |

| remaining 166 countries | 62,593.8 | 28.79 | respective | respective | 667,438 | 30.05 |

Assistance and reforms

The primary mission of the IMF is to provide financial assistance to countries that experience serious financial and economic difficulties using funds deposited with the IMF from the institution's 187 member countries. Member states with balance of payments problems, which often arise from these difficulties, may request loans to help fill gaps between what countries earn and/or are able to borrow from other official lenders and what countries must spend to operate, including to cover the cost of importing basic goods and services. In return, countries are usually required to launch certain reforms, which have often been dubbed the "Washington Consensus". These reforms are thought to be beneficial to countries with fixed exchange rate policies that may engage in fiscal, monetary, and political practices which may lead to the crisis itself. For example, nations with severe budget deficits, rampant inflation, strict price controls, or significantly over-valued or under-valued currencies run the risk of facing balance of payment crises. Thus, the structural adjustment programs are at least ostensibly intended to ensure that the IMF is actually helping to prevent financial crises rather than merely funding financial recklessness.

Support of military dictatorships and governments perpetrating human rights abuses

The role of the Bretton Woods institutions has been controversial since the late Cold War period, due to claims that the IMF policy makers supported military dictatorships friendly to American and European corporations and other anti-communist regimes. Critics also claim that the IMF is generally apathetic or hostile to their views of human rights, and labor rights. The controversy has helped spark the Anti-globalization movement. Arguments in favor of the IMF say that economic stability is a precursor to democracy; however, critics highlight various examples in which democratized countries fell after receiving IMF loans.[26]

In the 1960s, the IMF and the World Bank supported the government of Brazil’s military dictator Castello Branco with tens of millions of dollars of loans and credit that were denied to previous democratically elected governments.[27]

Countries that were or are under a military dictatorship or whose governments were perpetrating human rights abuses whilst being members of the IMF/World Bank (support from various sources in $Billion):[28]

| Support of military dictatorships | ||||||||

|---|---|---|---|---|---|---|---|---|

| Country indebted to IMF/World Bank | Dictator | In power | Debt %[clarification needed] at start of dictatorship | Debt % at end of dictatorship | Country debts in 1996 | Dictator debts generated $ billion | Dictator generated debt % of total debt | |

| Military dictatorship | 1976 - 1983 | 9.3 | 48.9 | 93.8 | 39.6 | 42% | ||

| Military dictatorship | 1962 - 1980 | 0 | 2.7 | 5.2 | 2.7 | 52% | ||

| Military dictatorship | 1964 - 1985 | 5.1 | 105.1 | 179 | 100 | 56% | ||

| Augusto Pinochet | 1973 - 1989 | 5.2 | 18 | 27.4 | 12.8 | 47% | ||

| Military dictatorship | 1979 - 1994 | 0.9 | 2.2 | 2.2 | 1.3 | 59% | ||

| Mengistu Haile Mariam | 1977 - 1991 | 0.5 | 4.2 | 10 | 3.7 | 37% | ||

| Jean-Claude Duvalier | 1971 - 1986 | 0 | 0.7 | 0.9 | 0.7 | 78% | ||

| Suharto | 1967 - 1998 | 3 | 129 | 129 | 126 | 98% | ||

| Daniel arap Moi | 1979 - 2002 | 2.7 | 6.9 | 6.9 | 4.2 | 61% | ||

| Doe | 1979 - 1990 | 0.6 | 1.9 | 2.1 | 1.3 | 62% | ||

| Banda | 1964 - 1994 | 0.1 | 2 | 2.3 | 1.9 | 83% | ||

| Buhari/Babangida/Abacha | 1984 - 1998 | 17.8 | 31.4 | 31.4 | 13.6 | 43% | ||

| Zia-ul Haq | 1977 - 1988 | 7.6 | 17 | |||||

| Pervez Musharraf | 1999 - 2008 | 20 | 26 | |||||

| Stroessner | 1954 - 1989 | 0.1 | 2.4 | 2.1 | 2.3 | 96% | ||

| Marcos | 1965 - 1986 | 1.5 | 28.3 | 41.2 | 26.8 | 65% | ||

| Siad Barre | 1969 - 1991 | 0 | 2.4 | 2.6 | 2.4 | 92% | ||

| Apartheid | 1948 - 1992 | 18.7 | 23.6 | 18.7 | 79% | |||

| Nimeiry/al-Mahdi | 1969 - present | 0.3 | 17 | 17 | 16.7 | 98% | ||

| Military dictatorship | 1950 - 1983 | 0 | 13.9 | 90.8 | 13.9 | 15% | ||

| Mobutu | 1965 - 1997 | 0.3 | 12.8 | 12.8 | 12.5 | 98% | ||

Notes: Debt at takeover by dictatorship; earliest data published by the World Bank is for 1970. Debt at end of dictatorship (or 1996, most recent date for World Bank data).

Criticism

Two criticisms from economists have been that financial aid is always bound to so-called "Conditionalities", including Structural Adjustment Programs (SAP). It is claimed that conditionalities (economic performance targets established as a precondition for IMF loans) retard social stability and hence inhibit the stated goals of the IMF, while Structural Adjustment Programs lead to an increase in poverty in recipient countries.[29]

The IMF sometimes advocates "austerity programmes," increasing taxes even when the economy is weak, in order to generate government revenue and bring budgets closer to a balance, thus reducing budget deficits. Countries are often advised to lower their corporate tax rate. These policies were criticized by Joseph E. Stiglitz, former chief economist and Senior Vice President at the World Bank, in his book Globalization and Its Discontents.[30] He argued that by converting to a more Monetarist approach, the fund no longer had a valid purpose, as it was designed to provide funds for countries to carry out Keynesian reflations, and that the IMF "was not participating in a conspiracy, but it was reflecting the interests and ideology of the Western financial community".[31]

Argentina, which had been considered by the IMF to be a model country in its compliance to policy proposals by the Bretton Woods institutions, experienced a catastrophic economic crisis in 2001,[32] which some believe to have been caused by IMF-induced budget restrictions — which undercut the government's ability to sustain national infrastructure even in crucial areas such as health, education, and security — and privatization of strategically vital national resources.[33] Others attribute the crisis to Argentina's misdesigned fiscal federalism, which caused subnational spending to increase rapidly.[34] The crisis added to widespread hatred of this institution in Argentina and other South American countries, with many blaming the IMF for the region's economic problems.[35] The current — as of early 2006 — trend towards moderate left-wing governments in the region and a growing concern with the development of a regional economic policy largely independent of big business pressures has been ascribed to this crisis.

Another example of where IMF Structural Adjustment Programmes aggravated the problem was in Kenya. Before the IMF got involved in the country, the Kenyan central bank oversaw all currency movements in and out of the country. The IMF mandated that the Kenyan central bank had to allow easier currency movement. However, the adjustment resulted in very little foreign investment, but allowed Kamlesh Manusuklal Damji Pattni, with the help of corrupt government officials, to siphon off billions of Kenyan shillings in what came to be known as the Goldenberg scandal, leaving the country worse off than it was before the IMF reforms were implemented.[citation needed] In an interview, the former Romanian Prime Minister Tăriceanu stated that "Since 2005, IMF is constantly making mistakes when it appreciates the country's economic performances".[36]

Overall, the IMF success record is perceived as limited.[citation needed] While it was created to help stabilize the global economy, since 1980 critics claim over 100 countries (or reputedly most of the Fund's membership) have experienced a banking collapse that they claim have reduced GDP by four percent or more, far more than at any time in Post-Depression history.[citation needed] The considerable delay in the IMF's response to any crisis, and the fact that it tends to only respond to them (or even create them)[37] rather than prevent them, has led many economists to argue for reform. In 2006, an IMF reform agenda called the Medium Term Strategy was widely endorsed by the institution's member countries. The agenda includes changes in IMF governance to enhance the role of developing countries in the institution's decision-making process and steps to deepen the effectiveness of its core mandate, which is known as economic surveillance or helping member countries adopt macroeconomic policies that will sustain global growth and reduce poverty. On June 15, 2007, the Executive Board of the IMF adopted the 2007 Decision on Bilateral Surveillance, a landmark measure that replaced a 30-year-old decision of the Fund's member countries on how the IMF should analyse economic outcomes at the country level.

Impact on access to food

A number of civil society organizations[38] have criticized the IMF's policies for their impact on people's access to food, particularly in developing countries. In October 2008, former US President Bill Clinton joined this chorus in a speech to the United Nations World Food Day, which criticized the World Bank and IMF for their policies on food and agriculture:

We need the World Bank, the IMF, all the big foundations, and all the governments to admit that, for 30 years, we all blew it, including me when I was President. We were wrong to believe that food was like some other product in international trade, and we all have to go back to a more responsible and sustainable form of agriculture.

Impact on public health

In 2008, a study by analysts from Cambridge and Yale universities published on the open-access Public Library of Science concluded that strict conditions on the international loans by the IMF resulted in thousands of deaths in Eastern Europe by tuberculosis as public health care had to be weakened. In the 21 countries to which the IMF had given loans, tuberculosis deaths rose by 16.6%.[40]

In 2009, a book by Rick Rowden titled, The Deadly Ideas of Neoliberalism: How the IMF has Undermined Public Health and the Fight Against Aids, claimed that the IMF's monetarist approach towards prioritizing price stability (low inflation) and fiscal restraint (low budget deficits) was unnecessarily restrictive and has prevented developing countries from being able to scale up long-term public investment as a percent of GDP in the underlying public health infrastructure. The book claimed the consequences have been chronically underfunded public health systems, leading to dilapidated health infrastructure, inadequate numbers of health personnel, and demoralizing working conditions that have fueled the "push factors" driving the brain drain of nurses migrating from poor countries to rich ones, all of which has undermined public health systems and the fight against HIV/AIDS in developing countries.[41]

Impact on environment

IMF policies have been repeatedly criticized for making it difficult for indebted countries to avoid ecosystem-damaging projects that generate cash flow, in particular oil, coal and forest-destroying lumber and agriculture projects. Ecuador for example had to defy IMF advice repeatedly in order to pursue the protection of its rain forests, though paradoxically this need was cited in IMF argument to support that country. The IMF acknowledged this paradox in a March 2010 staff position report [42] which proposed the IMF Green Fund, a mechanism to issue Special Drawing Rights directly to pay for climate harm prevention and potentially other ecological protection as pursued generally by other environmental finance.

While the response to these moves was generally positive [43] possibly because ecological protection and energy and infrastructure transformation are more politically neutral than pressures to change social policy. Some experts voiced concern that the IMF was not representative, and that the IMF proposals to generate only 200 billion dollars/year by 2020 with the SDRs as seed funds, did not go far enough to undo the general incentive to pursue destructive projects inherent in the world commodity trading and banking systems - criticisms often levelled at the WTO and large global banking institutions.

In the context of the May 2010 European banking crisis, some observers also noted that Spain and California, two troubled economies within Europe and the United States respectively, and also Germany, the primary and politically most fragile supporter of a Euro currency bailout would benefit from IMF recognition of their leadership in green technology, and directly from Green-Fund generated demand for their exports, which might also improve their credit standing with international bankers.

Criticism from free-market advocates

Typically the IMF and its supporters advocate a monetarist approach. As such, adherents of supply-side economics generally find themselves in open disagreement with the IMF. The IMF frequently advocates currency devaluation, criticized by proponents of supply-side economics as inflationary. Secondly they link higher taxes under "austerity programmes" with economic contraction.

Currency devaluation is recommended by the IMF to the governments of poor nations with struggling economies. Some economists claim these IMF policies are destructive to economic prosperity.[44]

Complaints have also been directed toward the International Monetary Fund gold reserve being undervalued. At its inception in 1945, the IMF pegged gold at US$35 per Troy ounce of gold. In 1973, the administration of US President Richard Nixon lifted the fixed asset value of gold in favor of a world market price. This need to lift the fixed asset value of gold had largely come about because Petrodollars outside the United States were worth more than could be backed by the gold at Fort Knox under the fixed exchange rate system.[citation needed] Following this, the fixed exchange rates of currencies tied to gold were switched to a floating rate, also based on market price and exchange. The fixed rate system had only served to limit the nominal amount of assistance the organization could provide to debt-ridden countries.

Managing director

Historically the IMF's managing director has been European and the president of the World Bank has been from the United States. However, this standard is increasingly being questioned and competition for these two posts may soon open up to include other qualified candidates from any part of the world. Executive Directors, who confirm the managing director, are voted in by Finance Ministers from countries they represent. The First Deputy Managing Director of the IMF, the second-in-command, has traditionally been (and is today) an American.

The IMF is for the most part controlled by the major Western Powers, with voting rights on the Executive board based on a quota derived from the relative size of a country in the global economy. Critics claim that the board rarely votes and passes issues contradicting the will of the US or Europeans, which combined represent the largest bloc of shareholders in the Fund. On the other hand, Executive Directors that represent emerging and developing countries have many times strongly defended the group of nations in their constituency. Alexandre Kafka, who represented several Latin American countries for 32 years as Executive Director (including 21 as the dean of the Board), is a prime example.

Rodrigo Rato became the ninth Managing Director of the IMF on June 7, 2004 and resigned his post at the end of October 2007.

EU ministers agreed on the candidacy of Dominique Strauss-Kahn as managing director of the IMF at the Economic and Financial Affairs Council meeting in Brussels on July 10, 2007. On September 28, 2007, the International Monetary Fund's 24 executive directors elected Mr. Strauss-Kahn as new managing director, with broad support including from the United States and the 27-nation European Union. Strauss-Kahn succeeded Spain's Rodrigo de Rato, who retired on October 31, 2007.[45] The only other nominee was Josef Tošovský, a late candidate proposed by Russia. Strauss-Kahn said: "I am determined to pursue without delay the reforms needed for the IMF to make financial stability serve the international community, while fostering growth and employment."[46]

| Dates | Name | Nationality |

|---|---|---|

| May 6, 1946 – May 5, 1951 | Camille Gutt | |

| August 3, 1951 – October 3, 1956 | Ivar Rooth | |

| November 21, 1956 – May 5, 1963 | Per Jacobsson | |

| September 1, 1963 – August 31, 1973 | Pierre-Paul Schweitzer | |

| September 1, 1973 – June 16, 1978 | Johannes Witteveen | |

| June 17, 1978 – January 15, 1987 | Jacques de Larosière | |

| January 16, 1987 – February 14, 2000 | Michel Camdessus | |

| May 1, 2000 – March 4, 2004 | Horst Köhler | |

| June 7, 2004 – October 31, 2007 | Rodrigo Rato | |

| November 1, 2007 – present | Dominique Strauss-Kahn |

In the media

Life and Debt, a documentary film, deals with the IMF's policies' influence on Jamaica and its economy from a critical point of view.

The Debt of Dictators[47] explores the lending of billions of dollars by the IMF, World Bank multinational banks and other international financial institutions to brutal dictators throughout the world. (see IMF/World Bank support of military dictatorships)

==References== i will cum in your mouth and u will call me daddy and your mom will make me a sandwhich which i will eat half and then shove it up your moms pussyyyyyyyyyyyyyyyyyyyyyyyy and you will see these acts cuz my name is mrs.koch and i love big husky dickssssssssssssssssssssssssssssssssssssssssssssssssssssssssssssssssssssssssssssssssssssssssssssssssssssssssssssssssssssssssssssssssssssssssssssssssssssssssssssssssss

- ^ "Neoliberalism: origins, theory, definition". Web.inter.nl.net. Retrieved 2010-05-30.

- ^ Davis, Bob (2010-05-03). "IMF's Sweeping Demands Signal Shift - WSJ.com". Online.wsj.com. Retrieved 2010-05-30.

- ^ Sullivan, Arthur (2003). Economics: Principles in action. Upper Saddle River, New Jersey 07458: Pearson Prentice Hall. p. 488. ISBN 0-13-063085-3.

{{cite book}}: Unknown parameter|coauthors=ignored (|author=suggested) (help)CS1 maint: location (link) - ^ http://www.brettonwoodsproject.org/item.shtml?x=320869

- ^ http://tech.mit.edu/V120/N46/46chomsky.46n.html

- ^ "Factsheet - The IMF at a Glance". IMF. 2009. Retrieved 2009-07-19.

{{cite web}}: Unknown parameter|month=ignored (help) - ^ Escobar, Arturo. 1988. Power and Visibility: Development and the Invention and Management of the Third World. Cultural Anthropology 3 (4): 428-443.

- ^ Articles of Agreement of the International Monetary Fund, Article VIII - General Obligations of Members

Section 2: Avoidance of restrictions on current payments;

Section 3: Avoidance of discriminatory currency practices;

Section 4: Convertibility of foreign-held balances. - ^ "Republic of Kosovo is now officially a member of the IMF and the World Bank". The Kosovo Times. 2009-06-29. Retrieved 2009-06-29.

Kosovo signed the Articles of Agreement of the International Monetary Fund (IMF) and the International Bank for Reconstruction and Development (the World Bank) on behalf of Kosovo at the State Department in Washington.

- ^ "Kosovo Becomes the International Monetary Fund's 186th Member" (Press release). International Monetary Fund. 2009-06-29. Retrieved 2009-06-29.

- ^ "Brazil calls for Cuba to be allowed into IMF". Caribbean Net News. 2009-04-27. Retrieved 2009-05-07.

Cuba was a member of the IMF until 1964, when it left under revolutionary leader Fidel Castro following his confrontation with the United States.

- ^ Andrews, Nick (2009-05-07). "Kosovo Wins Acceptance to IMF". The Wall Street Journal. Retrieved 2009-05-07.

Taiwan was booted out of the IMF in 1980 when China was admitted, and it hasn't applied to return since.

{{cite web}}: Unknown parameter|coauthors=ignored (|author=suggested) (help) - ^ IMF Articles of Agreement, Article XII Section 2(a) and Section 3(b).

- ^ Brief video of the Bretton Woods Conference is available at YouTube.com

- ^ "IMF.org". IMF.org. Retrieved 2010-05-30.

- ^ "G20 leaders seal $1tn global deal". BBC News. 2009-04-02. Retrieved 2010-05-30.

- ^ Patrick Wintour and Larry Elliott (2009-04-03). "G20: Gordon Brown brokers massive financial aid deal for global economy". London: Guardian. Retrieved 2010-05-30.

- ^ a b G20 summit agrees to reform IMF BBC.

- ^ Ukraine is now second largest International Monetary Fund debtor, Kyiv Post (August 10, 2010)

- ^ Section 1. Quotas and payment of subscriptions

- ^ "BrettonWoodsProject.org". BrettonWoodsProject.org. Retrieved 2010-05-30.

- ^ Barnett, Michael; Finnemore, Martha (2004). Rules for the World: International Organisations in Global Politics. Ithaca: Cornell University Press. ISBN 9780801488238.

- ^ Arnott, Sarah (2009-09-28). "Emerging economies battle for more voting rights at IMF". London: independent.co.uk. Retrieved 2010-06-08.

- ^ CounterPunch, 2 September, Multilateral Money

- ^ Source for the figures is the International Monetary Fund. "Members". Retrieved 2007-09-24.

- ^ "World Bank - IMF support to dictatorships". Committee for the Abolition of the Third World Debt. Retrieved 2007-09-21.

- ^ BRAZIL Toward Stability, TIME Magazine, December 31, 1965.

- ^ "Dictators and debt". Jubilee 2000. Retrieved 2007-09-21.

- ^ Hertz, Noreena. The Debt Threat. New York: Harper Collins Publishers, 2004.

- ^ Stiglitz, Joseph. Globalization and its Discontents. New York: WW Norton & Company, 2002.

- ^ More by Benjamin M. Friedman (2002-08-15). "Globalization: Stiglitz's Case". Nybooks.com. Retrieved 2010-05-30.

- ^ Memoria del Saqueo, Fernando Ezequiel Solanas, documentary film, 2003 (Language: spanish; Subtitles: english) YouTube.com

- ^ "Economic debacle in Argentina: The IMF strikes again". Twnside.org.sg. Retrieved 2010-05-30.

- ^ Stephen Webb, "Argentina: Hardening the Provincial Budget Constraint," in Rodden, Eskeland, and Litvack (eds.), Fiscal Decentralization and the Challenge of Hard Budget Constraints (Cambridge, Mass.: MIT Press, 2003).

- ^ How the IMF Props Up the Bankrupt Dollar System, by F. William Engdahl, US/Germany

- ^ "Tăriceanu: FMI a făcut constant greşeli de apreciere a economiei româneşti - Mediafax". Mediafax.ro. Retrieved 2010-05-30.

- ^ Budhoo, Davison L. (1990). Enough is Enough: Dear Mr. Camdessus--Open Letter of Resignation to the Managing Director of the International Monetary Fund (pdf). New York: New Horizons Press. ISBN 0-945257-28-7.

- ^ Oxfam, Death on the Doorstep of the Summit, August 2002.

- ^ Bill Clinton, "Speech: United Nations World Food Day", October 13, 2008

- ^ International Monetary Fund Programs and Tuberculosis Outcomes in Post-Communist Countries PLoS Medicine. The study has not been independently verified, nor have the authors published parts of their supporting data. Retrieved 29-7-2008.

- ^ Rowden, Rick (2009). The Deadly Ideas of Neoliberalismh: How the IMF has Undermined Public Health and the Fight Against AIDS. Zed Books. ISBN 9781848132849.

- ^ "Financing the Response to Climate Change, Staff Position Note 10/06, March 25, 2010" (PDF). Retrieved 2010-05-30.

- ^ Robert, Adam (2010-03-25). "Finance: IMF Proposes 100-Billion-Dollar Climate Fund — Global Issues". Globalissues.org. Retrieved 2010-05-30.

- ^ "Paying More Blood Money to the IMF". 1998-03-08. Retrieved 2011-01-12.

- ^ Yahoo.com, IMF to choose new director[dead link]

- ^ "BBC NEWS, [[Frenchman]] is named new [[IMF chief]]". BBC News. 2007-09-28. Retrieved 2010-05-30.

{{cite news}}: URL–wikilink conflict (help) - ^ "NewsReel.org". NewsReel.org. Retrieved 2010-05-30.

Further reading

- Md. Azim Ferdous. History of International Monetary System. www.scribd.com

- Manuela Moschella. Governing Risk: The IMF and Global Financial Crises (Palgrave Macmillan; 2010) 212 pages; contrasts the policies followed in the aftermath of the Mexican, Asian, and subprime crises.

External links

- Official website

- IFIWatchNet (Web resource for analysis and commentary critical of the IMF and similar institutions)

- IMF-Supported Macroeconomic Policies and the World Recession: A Look at Forty-One Borrowing Countries, from the Center for Economic and Policy Research, October 2009