Competition between Airbus and Boeing: Difference between revisions

→Orders and deliveries: updated Boeing orders |

Undid revision 555514042 by 70.168.134.209 (talk) reverted incomplete edit |

||

| Line 122: | Line 122: | ||

|- |

|- |

||

||Boeing |

||Boeing |

||

| |

|255 |

||

|{{green|'''1203'''}} |

|{{green|'''1203'''}} |

||

|805 |

|805 |

||

Revision as of 15:49, 17 May 2013

Competition between Airbus and Boeing is a result of the two companies' duopoly in the market for large jet airliners since the 1990s,[1] a consequence of mergers within the global aerospace industry. Airbus began as a consortium from Europe, whereas the American Boeing took over its former arch-rival, McDonnell Douglas, when the latter became defunct and merged with the former in 1997. Other manufacturers, such as Lockheed Martin and Convair in the United States and British Aerospace, Dornier and Fokker in Europe, have pulled out of the civil aviation market after economic problems and declining sales.

In the last 10 years (2003–2012), Airbus has received 7,714 orders while delivering 4,503, and Boeing has received 7,312 orders while delivering 4,091. Competition is intense; each company regularly accuses the other of receiving unfair state aid from their respective governments.

Competing products

This section possibly contains original research. (April 2013) |

Range overlap

Though both manufacturers have a broad product range varying from single-aisle to wide-body, they do not always compete head-to-head. As listed below they respond with slightly different models.

- The Airbus A320 competes with the smaller Boeing 737-700 and the larger 737-800.

- The Airbus A321 competes with the smaller Boeing 737-900 and the larger Boeing 757-200.

- The Airbus A330 competes with the similar Boeing 767, the Boeing 777-200ER and the Boeing 787.

- The Airbus A340 competed with the Boeing 777 and Boeing 747, (the A340-300 with the Boeing 777-200 and the A340-600 with the Boeing 777-300 and Boeing 747-400).

- The Airbus A350 competes with the Boeing 787-9 and the Boeing 777.

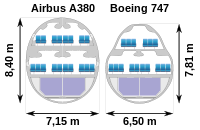

- The Airbus A380 competes with but has a greater capacity than the Boeing 747.

Airlines benefit from this competition as they get an array of diversified products ranging from 100-500 seats, which they would not get if both companies offered identical aircraft.

Passengers/range for all models

Airbus A380 vs Boeing 747

The wide-body Boeing 747-8, the latest modification of Boeing's largest airliner, is notably in direct competition on long-haul routes with the A380, a full-length double-deck aircraft now in service. For airlines seeking very large passenger airliners, the two have been pitched as competitors on various occasions. Following another delay to the A380 programme in October 2006, FedEx and the United Parcel Service cancelled their orders for the A380-800 freighter. Some A380 launch customers deferred delivery or considered switching to the 747-8 and 777F aircraft.[2][3]

Boeing's advertising claims the 747-8I to be over 10% lighter per seat and have 11% less fuel consumption per passenger, with a trip-cost reduction of 21% and a seat-mile cost reduction of more than 6%, compared to the A380. The 747-8F's empty weight is expected to be 80 tonnes (88 tons) lighter and 24% lower fuel burnt per ton with 21% lower trip costs and 23% lower ton-mile costs than the A380F.[4] On the other side, Airbus' advertising claims the A380 to have 8% less fuel consumption per passenger than the 747-8I and emphasises the longer range of the A380 while using up to 17% shorter runways.[5] In order to counter the perceived strength of the 747-8I, from 2012 Airbus will offer, as an option, improved maximum take-off weight allowing for better payload/range performance. The precise increase in maximum take-off weight is still unknown. British Airways and Emirates will be the first customers to take this offer.[6] As of April 2009 no airline has cancelled an order for the passenger version of the A380. Boeing currently has four commercial airline orders for the 747-8I: Lufthansa (20), Korean Airlines (5), Air China (5), and Arik Air (2).[7]

EADS/Northrop Grumman KC-45A vs Boeing KC-767

The announcement in March 2008 that Boeing had lost a US$40 billion refuelling aircraft contract to Northrop Grumman and Airbus for the EADS/Northrop Grumman KC-45 with the United States Air Force drew angry protests in the United States Congress.[8] Upon review of Boeing's protest, the Government Accountability Office ruled in favour of Boeing and ordered the USAF to recompete the contract. Later, the entire call for aircraft was rescheduled, then cancelled, with a new call decided upon in March 2010.

Boeing later won the contest, with a lower price, on February 24, 2011.[9] The price was so low some in the media believe Boeing would take a loss on the deal; they also speculated that the company could perhaps break even with maintenance and spare parts contracts.[10] In July 2011, it was revealed that projected development costs rose $1.4bn and will exceed the $4.9bn contract cap by $300m. For the first $1bn increase (from the award price to the cap), the U.S. government would be responsible for $600m under a 60/40 government/Boeing split. With Boeing being wholly responsible for the additional $300m ceiling breach, Boeing would be responsible for a total of $700m of the additional cost.[11][12][13][clarification needed]

Modes of competition

Outsourcing

Because many of the world's airlines are wholly or partially government owned, aircraft procurement decisions are often taken according to political criteria in addition to commercial ones. Boeing and Airbus seek to exploit this by subcontracting production of aircraft components or assemblies to manufacturers in countries of strategic importance in order to gain a competitive advantage.

For example, Boeing has maintained longstanding relationships with Japanese suppliers including Mitsubishi Heavy Industries and Kawasaki Heavy Industries by which these companies have had increasing involvement on successive Boeing jet programs, a process which has helped Boeing achieve almost total dominance of the Japanese market for commercial jets. Outsourcing was extended on the 787 to the extent that Boeing's own involvement was reduced to little more than project management, design, assembly and test operation, outsourcing most of the actual manufacturing all around the world. Boeing has since stated that it "outsourced too much" and that future airplane projects will depend far more on its own engineering and production personnel.[14]

Partly because of its origins as a consortium of European companies, Airbus has had fewer opportunities to outsource significant parts of its production beyond its own European plants. However, in 2009 Airbus opened an assembly plant in Tianjin, China for production of its A320 series airliners.[15]

Technology

Airbus sought to compete with the well-established Boeing in the 1970s through its introduction of advanced technology . For example, the A300 made the most extensive use of composite materials yet seen in an aircraft of that era, and by automating the flight engineer's functions, was the first large commercial jet to have a two-man flight crew. In the 1980s Airbus was the first to introduce digital fly-by-wire controls into an airliner (the A320).

With Airbus now an established competitor to Boeing, both companies use advanced technology to seek performance advantages in their products. For example, the Boeing 787 Dreamliner is the first large airliner to use composites for most of its construction.

Provision of engine choices

The competitive strength in the market of any airliner is considerably influenced by the choice of engine available. In general, airlines prefer to have a choice of at least two engines from the major manufacturers General Electric, Rolls-Royce and Pratt & Whitney. However, engine manufacturers prefer to be single source, and often succeed in striking commercial deals with Boeing and Airbus to achieve this. Several notable aircraft have only provided a single engine offering: the Boeing 737-300 series onwards (CFM56), the Airbus A340-500 & 600 (Rolls-Royce Trent 500), the Airbus A350 XWB (Rolls-Royce Trent XWB), the Boeing 747-8 (GEnx-2B67), and the Boeing 777-300ER/200LR/F (General Electric GE90).[16]

Currency

Boeing's production costs are mostly in United States dollars, whereas Airbus' production costs are mostly in Euro. When the dollar appreciates against the euro the cost of producing a Boeing aircraft rises relatively to the cost of producing an Airbus aircraft, and conversely when the dollar falls relative to the euro it is an advantage for Boeing. There are also possible currency risks and benefits involved in the way aircraft are sold. Boeing typically prices its aircraft only in dollars, while Airbus, although pricing most aircraft sales in dollars, has been known to be more flexible and has priced some aircraft sales in Asia and the Middle East in multiple currencies. Depending on currency fluctuations between the acceptance of the order and the delivery of the aircraft this can result in an extra profit or extra expense — or, if Airbus has purchased insurance against such fluctuations, an additional cost regardless.[17]

Safety

Both aircraft manufacturers have good safety records on recently manufactured aircraft. By convention, both companies tend to avoid safety comparisons when selling their aircraft to airlines. Most aircraft dominating the companies' current sales, the Boeing 737-NG and Airbus A320 families and both companies' wide-body offerings, have good safety records. Older model aircraft such as the Boeing 727, the original Boeing 737s and 747s, Airbus A300 and Airbus A310, which were respectively first flown during the 1960s, 1970s, and 1980s, have had higher rates of fatal accidents.[18] According to Airbus' John Leahy, the Boeing 787 Dreamliner battery problems will not cause customers to switch airplane supplier.[19]

Effect of competition on product plans

The A320 has been selected by 222 operators (Dec. 2008), among these several low-cost operators, gaining ground against the previously well established 737 in this sector; it has also been selected as a replacement for 727s and aging 737s by many full-service airlines such as Star Alliance members United Airlines and Lufthansa. After dominating the very large aircraft market for four decades, the Boeing 747 now faces a challenge from the A380. In response, Boeing now offer the stretched and updated 747-8, with greater capacity, fuel efficiency, and longer range. Frequent delays to the Airbus A380 program caused several customers to consider cancelling their orders in favour of the refreshed 747-8,[20] although none have done so and some have even placed repeat orders for the A380. However, all orders for the A380F freight variant have been cancelled. To date, Boeing has secured orders for 78 747-8F and 28 747-8I aircraft with first deliveries originally scheduled for 2011 and 2012 as the 747-8I is still (as of August 2011) being test-flown, while Airbus has orders for 262 A380s, the first of which entered service in 2007 and has delivered a total of 92 to customers (as of December 2012).

Several Boeing projects were pursued and then cancelled, for example the Sonic Cruiser. Boeing's current platform for fleet rejuvenation is the Boeing 787 Dreamliner, which uses technology from the Sonic Cruiser concept. The 787's rapid sales success and pressure from potential customers forced Airbus to revise the design of its competing A350.[citation needed]

Boeing initially ruled out producing a re-engined version of its 737 to compete with the Airbus A320neo family launch planned for 2015, believing airlines would be looking towards the Boeing Y1 and a 30% fuel saving, instead of paying 10% more for fuel efficiency gains of only a few percent. Industry sources believe that the 737's design makes re-engining considerably more expensive for Boeing than it was for the Airbus A320. However, there did prove to be considerable demand. Southwest Airlines, who use the 737 for their entire fleet (680 in service or on order), said they were not prepared to wait 20 years or more for a new 737 model and threatening to convert to Airbus.[21] Boeing eventually bowed to airline pressure and in 2011 approved the 737 MAX project, scheduled for first delivery in 2017.

Orders and deliveries

| 2013 | 2012 | 2011 | 2010 | 2009 | 2008 | 2007 | 2006 | 2005 | 2004 | 2003 | 2002 | 2001 | 2000 | 1999 | 1998 | 1997 | 1996 | 1995 | 1994 | 1993 | 1992 | 1991 | 1990 | 1989 | |

| Airbus | 493 | 833 | 1419 | 574 | 271 | 777 | 1341 | 790 | 1055 | 370 | 284 | 300 | 375 | 520 | 476 | 556 | 460 | 326 | 106 | 125 | 38 | 136 | 101 | 404 | 421 |

| Boeing | 255 | 1203 | 805 | 530 | 142 | 662 | 1413 | 1044 | 1002 | 272 | 239 | 251 | 314 | 588 | 355 | 606 | 543 | 708 | 441 | 125 | 236 | 266 | 273 | 533 | 716 |

| Sources 2013: Airbus net orders until April 30, 2013 <http://www.airbus.com/company/market/orders-deliveries/>[22] Boeing net orders until April 30, 2013 <http://active.boeing.com/commercial/orders/index.cfm> | |||||||||||||||||||||||||

| 2013 | 2012 | 2011 | 2010 | 2009 | 2008 | 2007 | 2006 | 2005 | 2004 | 2003 | 2002 | 2001 | 2000 | 1999 | 1998 | 1997 | 1996 | 1995 | 1994 | 1993 | 1992 | 1991 | 1990 | 1989 | |

| Airbus | 202 | 588 | 534 | 510 | 498 | 483 | 453 | 434 | 378 | 320 | 305 | 303 | 325 | 311 | 294 | 229 | 182 | 126 | 124 | 123 | 138 | 157 | 163 | 95 | 105 |

| Boeing | 181 | 601 | 477 | 462 | 481 | 375 | 441 | 398 | 290 | 285 | 281 | 381 | 527 | 491 | 620 | 563 | 375 | 271 | 256 | 312 | 409 | 572 | 606 | 527 | 402 |

| Sources 2013: Airbus deliveries until April 30, 2013 <http://www.airbus.com/company/market/orders-deliveries/>[22] Boeing deliveries until April 30, 2013 <http://active.boeing.com/commercial/orders/index.cfm?content=displaystandardreport.cfm&optReportType=CurYrDelv> | |||||||||||||||||||||||||

-

Yearly orders.

-

Yearly deliveries.

-

Orders/Deliveries overlay.

Orders and deliveries, by product[23][citation needed]

| Civil airplanes | 2012 Deliveries | 2012 Orders | 2012 Backlog | Historical Deliveries * | ||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Airbus | Boeing | Airbus | Boeing | Airbus | Boeing | Airbus | Boeing | |||

| single aisle | 1010 707 | |||||||||

| single aisle | 155 717 | |||||||||

| single aisle | 1831 727 | |||||||||

| single aisle | 455 A320 | 415 737 | 739 A320 | 1124 737 | 3629 A320 family | 3074 737 | 5402 A320 | 7425 737 | ||

| single aisle | 1049 757 | |||||||||

| widebody | 26 767 | 22 767 | 68 767 | 561 A300 255 A310 |

1040 767 | |||||

| widebody | 101 A330 2 A340 |

83 777 | 58 A330 | 68 777 | 306 A330 | 365 777 | 938 A330 377 A340 |

1066 777 | ||

| widebody | 0 A350 | 46 787 | 27 A350 | -12 787 | 582 A350 | 799 787 | 0 A350 | 49 787 | ||

| widebody | 30 A380 | 31 747 | 9 A380 | 1 747 | 165 A380 | 67 747 | 97 A380 | 1458 747 | ||

| Total | 588 | 601 | 833 | 1203 | 4628 | 4373 | 7630 | 15083 | ||

| *Historical deliveries are all jet airliners from Boeing since 1958 and Airbus since 1974 until 31 December 2012 | ||||||||||

| Boeing [24] | Airbus [25] | |||||||||

| 707 | 717 | 727 | 737 | 747 | 757 | 767 | 777 | 787 | Boeing[26] | A300 | A310 | A320 | A330 | A340 | A350 | A380 | Airbus | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 1974 | 21 | 91 | 55 | 22 | 189 | 4 | 4 | |||||||||||

| 1975 | 7 | 91 | 51 | 21 | 170 | 8 | 8 | |||||||||||

| 1976 | 9 | 61 | 41 | 27 | 138 | 13 | 13 | |||||||||||

| 1977 | 8 | 67 | 25 | 20 | 120 | 15 | 15 | |||||||||||

| 1978 | 13 | 118 | 40 | 32 | 203 | 15 | 15 | |||||||||||

| 1979 | 6 | 136 | 77 | 67 | 286 | 26 | 26 | |||||||||||

| 1980 | 3 | 131 | 92 | 73 | 299 | 39 | 39 | |||||||||||

| 1981 | 2 | 94 | 108 | 53 | 257 | 38 | 38 | |||||||||||

| 1982 | 8 | 26 | 95 | 26 | 2 | 20 | 177 | 46 | 46 | |||||||||

| 1983 | 8 | 11 | 82 | 22 | 25 | 55 | 203 | 19 | 17 | 36 | ||||||||

| 1984 | 8 | 8 | 67 | 16 | 18 | 29 | 146 | 19 | 29 | 48 | ||||||||

| 1985 | 3 | 115 | 24 | 36 | 25 | 203 | 16 | 26 | 42 | |||||||||

| 1986 | 4 | 141 | 35 | 35 | 27 | 242 | 10 | 19 | 29 | |||||||||

| 1987 | 9 | 161 | 23 | 40 | 37 | 270 | 11 | 21 | 32 | |||||||||

| 1988 | 165 | 24 | 48 | 53 | 290 | 17 | 28 | 16 | 61 | |||||||||

| 1989 | 5 | 146 | 45 | 51 | 37 | 284 | 24 | 23 | 58 | 105 | ||||||||

| 1990 | 4 | 174 | 70 | 77 | 60 | 385 | 19 | 18 | 58 | 95 | ||||||||

| 1991 | 14 | 215 | 64 | 80 | 62 | 435 | 25 | 19 | 119 | 163 | ||||||||

| 1992 | 5 | 218 | 61 | 99 | 63 | 446 | 22 | 24 | 111 | 157 | ||||||||

| 1993 | 152 | 56 | 71 | 51 | 330 | 22 | 22 | 71 | 1 | 22 | 138 | |||||||

| 1994 | 1 | 121 | 40 | 69 | 41 | 272 | 23 | 2 | 64 | 9 | 25 | 123 | ||||||

| 1995 | 89 | 25 | 43 | 37 | 13 | 207 | 17 | 2 | 56 | 30 | 19 | 124 | ||||||

| 1996 | 76 | 26 | 42 | 43 | 32 | 219 | 14 | 2 | 72 | 10 | 28 | 126 | ||||||

| 1997 | 135 | 39 | 46 | 42 | 59 | 321 | 6 | 2 | 127 | 14 | 33 | 182 | ||||||

| 1998 | 282 | 53 | 54 | 47 | 74 | 510 | 13 | 1 | 168 | 23 | 24 | 229 | ||||||

| 1999 | 12 | 320 | 47 | 67 | 44 | 83 | 573 | 8 | 222 | 44 | 20 | 294 | ||||||

| 2000 | 32 | 282 | 25 | 45 | 44 | 55 | 483 | 8 | 241 | 43 | 19 | 311 | ||||||

| 2001 | 49 | 299 | 31 | 45 | 40 | 61 | 525 | 11 | 257 | 35 | 22 | 325 | ||||||

| 2002 | 20 | 223 | 27 | 29 | 35 | 47 | 381 | 9 | 236 | 42 | 16 | 303 | ||||||

| 2003 | 12 | 173 | 19 | 14 | 24 | 39 | 281 | 8 | 233 | 31 | 33 | 305 | ||||||

| 2004 | 12 | 202 | 15 | 11 | 9 | 36 | 285 | 12 | 233 | 47 | 28 | 320 | ||||||

| 2005 | 13 | 212 | 13 | 2 | 10 | 40 | 290 | 9 | 289 | 56 | 24 | 378 | ||||||

| 2006 | 5 | 302 | 14 | 12 | 65 | 398 | 9 | 339 | 62 | 24 | 434 | |||||||

| 2007 | 330 | 16 | 12 | 83 | 441 | 6 | 367 | 68 | 11 | 1 | 453 | |||||||

| 2008 | 290 | 14 | 10 | 61 | 375 | 386 | 72 | 13 | 12 | 483 | ||||||||

| 2009 | 372 | 8 | 13 | 88 | 481 | 402 | 76 | 10 | 10 | 498 | ||||||||

| 2010 | 376 | 12 | 74 | 462 | 401 | 87 | 4 | 18 | 510 | |||||||||

| 2011 | 372 | 9 | 20 | 73 | 3 | 477 | 421 | 87 | 26 | 534 | ||||||||

| 2012 | 415 | 31 | 26 | 83 | 46 | 601 | 455 | 101 | 2 | 30 | 588 | |||||||

| 2013 | 139 | 6 | 5 | 30 | 1 | 181 | 159 | 39 | 4 | 202 | ||||||||

| Total | 1010 | 155 | 1831 | 7564 | 1464 | 1049 | 1045 | 1096 | 50 | 15264 | 561 | 255 | 5561 | 977 | 377 | 0 | 101 | 7832 |

| 707 | 717 | 727 | 737 | 747 | 757 | 767 | 777 | 787 | A300 | A310 | A320 | A330 | A340 | A350 | A380 |

| Narrow-body | Wide-body | Boeing[26] | Narrow-body | Wide-body | Airbus | |

|---|---|---|---|---|---|---|

| 1980s | 1747 | 624 | 2371 | 16 | 460 | 476 |

| 1990s | 2466 | 1232 | 3698 | 1068 | 563 | 1631 |

| 2000s | 2974 | 966 | 3940 | 2983 | 827 | 3810 |

| 2010s | 1163 | 377 | 1540 | 1277 | 355 | 1632 |

| Total | 11502 | 3620 | 15122 | 5432 | 2233 | 7665 |

In the 80s, Boeing surpassed Airbus in both markets with not much difficulty. Airbus was still new in the market with its first delivery in 1974. In the 90s Boeing was still ahead of Airbus. Part of this wider market share in the narrow-body segment was the fact that Boeing had a wider offer of airliner families like the 707, 727, 737 and 757. In contrast, Airbus only had the A320 family. In 2000s, even though Boeing still had a wider offer of airliner families (717, 737 and 757); the narrow-body market share changed in favor of Airbus who out-performed its rival with its A320 family, only. Boeing still remains to this day the clear winner in the wide-body market.

| 707 | 717 | 727 | 737 | 747 | 757 | 767 | 777 | 787 | Boeing[26] | A300 | A310 | A320 | A330 | A340 | A350 | A380 | Airbus | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 2006 | 68 | 155 | 620 | 4328 | 989 | 996 | 862 | 575 | 8593 | 408 | 199 | 2761 | 418 | 306 | 4092 | ||||

| 2007 | 63 | 155 | 561 | 4583 | 985 | 1000 | 880 | 640 | 8867 | 392 | 193 | 3095 | 481 | 330 | 4491 | ||||

| 2008 | 61 | 154 | 500 | 4761 | 955 | 980 | 873 | 714 | 8998 | 387 | 194 | 3395 | 533 | 330 | 4 | 4843 | |||

| 2009 | 58 | 142 | 442 | 4928 | 947 | 970 | 864 | 780 | 9131 | 376 | 188 | 3737 | 607 | 345 | 16 | 5269 | |||

| 2010 | 39 | 147 | 398 | 5153 | 915 | 945 | 863 | 858 | 9318 | 348 | 160 | 4092 | 675 | 342 | 30 | 5647 | |||

| 2011 | 10 | 130 | 250 | 5177 | 736 | 898 | 837 | 924 | 8962 | 296 | 121 | 4392 | 766 | 332 | 50 | 5957 | |||

| 2012 | 2 | 143 | 169 | 5357 | 690 | 860 | 838 | 1017 | 15 | 9091 | 262 | 102 | 4803 | 848 | 312 | 76 | 6403 | ||

| 707 | 717 | 727 | 737 | 747 | 757 | 767 | 777 | 787 | A300 | A310 | A320 | A330 | A340 | A350 | A380 | ||||

| World Airliner Census 2006 [27] | World Airliner Census 2007 [28] | World Airliner Census 2008 [29] | World Airliner Census 2009 [30] | ||||||||||||||||

| World Airliner Census 2010 [31] | World Airliner Census 2011 [32] | World Airliner Census 2012 [33] | World Airliner Census 2012 | ||||||||||||||||

Controversies

Subsidies

Boeing has continually protested over launch aid in the form of credits to Airbus, while Airbus has argued that Boeing receives illegal subsidies through military and research contracts and tax breaks.[34]

In July 2004 Harry Stonecipher (then CEO of Boeing) accused Airbus of abusing a 1992 bilateral EU-US agreement regarding large civil aircraft support from governments. Airbus is given reimbursable launch investment (RLI, called "launch aid" by the US) from European governments with the money being paid back with interest, plus indefinite royalties if the aircraft is a commercial success.[35] Airbus contends that this system is fully compliant with the 1992 agreement and WTO rules. The agreement allows up to 33 per cent of the programme cost to be met through government loans which are to be fully repaid within 17 years with interest and royalties. These loans are held at a minimum interest rate equal to the cost of government borrowing plus 0.25%, which would be below market rates available to Airbus without government support.[36] Airbus claims that since the signing of the EU-U.S. agreement in 1992, it has repaid European governments more than U.S.$6.7 billion and that this is 40% more than it has received.

Airbus argues that pork barrel military contracts awarded to Boeing (the second largest U.S. defence contractor) are in effect a form of subsidy (see the Boeing KC-767 vs EADS (Airbus) KC-45 military contracting controversy). The significant U.S. government support of technology development via NASA also provides significant support to Boeing, as do the large tax breaks offered to Boeing, which some claim are in violation of the 1992 agreement and WTO rules. In its recent products such as the 787, Boeing has also been received substantial support from local and state governments.[37] However, Airbus' parent, EADS, itself is a military contractor, and is paid to develop and build projects such as the Airbus A400M transport and various other military aircraft.[38]

In January 2005, European Union and United States trade representatives Peter Mandelson and Robert Zoellick agreed to talks aimed at resolving the increasing tensions. These talks were not successful, with the dispute becoming more acrimonious rather than approaching a settlement.

World Trade Organization litigation

"We remain united in our determination that this dispute shall not affect our cooperation on wider bilateral and multilateral trade issues. We have worked together well so far, and intend to continue to do so."

Joint EU-US statement[39]

On 31 May 2005 the United States filed a case against the European Union for providing allegedly illegal subsidies to Airbus. Twenty-four hours later the European Union filed a complaint against the United States protesting support for Boeing.[40]

Increased tensions, due to the support for the Airbus A380, escalated toward a potential trade war as the launch of the Airbus A350 neared. Airbus preferred the A350 programme to be launched with the help of state loans covering a third of the development costs, although it stated it will launch without these loans if required. The A350 will compete with Boeing's most successful project in recent years, the 787 Dreamliner. EU trade officials questioned the nature of the funding provided by NASA, the Department of Defense, and in particular the form of R&D contracts that benefit Boeing; as well as funding from US states such as Washington, Kansas, and Illinois, for the development and launch of Boeing aircraft, in particular the 787.[41] An interim report of the WTO investigation into the claims made by both sides was made in September 2009.[42]

In September 2009, the New York Times and Wall Street Journal reported that the World Trade Organization would likely rule against Airbus on most, but not all, of Boeing's complaints; the practical effect of this ruling would likely be blunted by the large number of international partners engaged by both plane makers, as well as the expected delay of several years of appeals. For example, 35% of the Boeing 787 Dreamliner is manufactured in Japan. Thus, some experts are advocating a negotiated settlement.[43] In addition, the heavy government subsidies offered to automobile manufacturers in the United States have changed the political environment; the subsidies offered to Chrysler and General Motors dwarf the amounts involved in the Airbus-Boeing dispute.[44]

In March 2010, the WTO ruled that European governments unfairly financed Airbus.[45] In September 2010, a preliminary report of the WTO found unfair Boeing payments broke WTO rules and should be withdrawn.[46] In two separate findings issued in May 2011, the WTO found, firstly, that the US defence budget and NASA research grants could not be used as vehicles to subsidise the civilian aerospace industry and that Boeing must repay $5.3 billion of illegal subsidies.[47] Secondly, the WTO Appellate Body partly overturned an earlier ruling that European Government launch aid constituted unfair subsidy, agreeing with the point of principle that the support was not aimed at boosting exports and some forms of public-private partnership could continue. Part of the $18bn in low interest loans received would have to be repaid eventually; however, there was no immediate need for it to be repaid and the exact value to be repaid would be set at a future date.[48] Both parties claimed victory in what was the world's largest trade dispute.[49][50][51]

On 1 December 2011 Airbus reported that it had fulfilled its obligations under the WTO findings and called upon Boeing to do likewise in the coming year.[52] The United States did not agree and had already begun complaint procedures prior to December, stating the EU had failed to comply with the DSB's recommendations and rulings, and requesting authorisation by the DSB to take countermeasures under Article 22 of the DSU and Article 7.9 of the SCM Agreement. The European Union requested the matter be referred to arbitration under Article 22.6 of the DSU. The DSB agreed that the matter raised by the European Union in its statement at that meeting be referred to arbitration as required by Article 22.6 of the DSU however on 19 January 2012 the US and EU jointly agreed to withdraw their request for arbitration.[53]

On 12 March 2012 the appellate body of the WTO released its findings confirming the illegality of subsidies to Boeing whilst confirming the legality of repayable loans made to Airbus. The WTO stated that Boeing had received at least $5.3 billion in illegal cash subsidies at an estimated cost to Airbus of $45 billion. A further $2 billion in state and local subsidies that Boeing is set to receive have also been declared illegal. Boeing and the US government were given six months to change the way government support for Boeing is handled.[54] At the DSB meeting on 13 April 2012, the United States informed the DSB that it intended to implement the DSB recommendations and rulings in a manner that respects its WTO obligations and within the time-frame established in Article 7.9 of the SCM Agreement. The European Union welcomed the US intention and noted that the 6-month period stipulated in Article 7.9 of the SCM Agreement would expire on 23 September 2012. On 24 April 2012, the European Union and the United States informed the DSB of Agreed Procedures under Articles 21 and 22 of the DSU and Article 7 of the SCM Agreement.[55]

On 25 September 2012 the EU requested discussions with the USA, because of the non compliance of the US and Boeing with the WTO ruling of 12 March 2012. On 27 September 2012 the EU requested the WTO to approve EU countermeasures against USA's subsidy of Boeing. If the WTO approves and the discussions between the EU and USA fail, the EU wants permission to place trade sanctions of up to 12 billion US$ annually against the USA. The EU believes this amount represents the damage the illegal subsidies of Boeing cause to the EU.[56][57]

See also

References

- ^ Airlines Industry Profile: United States, Datamonitor, November 2008, pp. 13–14

- ^ Robertson, David. "Airbus will lose €4.8bn because of A380 delays", Time, 3 October 2006.

- ^ Schwartz, Nelson D. "Big plane, big problems", CNN, 1 March 2007.

- ^ "Boeing 747-8 Family background". boeing.com. 2005-11-14. Retrieved 2011-05-21.

- ^ "A380 family presskit". 2012-01-01. Retrieved 2012-02-08.

- ^ "British Airways and Emirates will be first for new longer-range A380". flightglobal.com. Retrieved 2011-05-21.

- ^ "Korean 747-8I order snaps jumbo dry spell". flightglobal.com. 2006-12-06. Retrieved 2011-05-21.

- ^ "Air tanker deal provokes US row, BBC, 1 March 2008". BBC News. 2008-03-01. Retrieved 2011-05-21.

- ^ "The USAF's KC-X Aerial Tanker RFP: Canceled". Defense Industry Daily. 13 March 2011.

- ^ Leeham News and Comment: How will Boeing profit from tanker contract?, 12-7-2011, visited: 3-2-2012

- ^ Broken link: [1], missing 3-2-2012

- ^ A1 Blog: Mc Cain blasts Boeing overruns

- ^ Defensenews.com: Boeing Lowers KC-46 Cost Estimate, 27-7-2011, visited: 3-2-2012

- ^ Gates, Dominic (March 1, 2010). "Albaugh: Boeing's 'first preference' is to build planes in Puget Sound region". The Seattle Times. Retrieved 2010-06-16.

- ^ "Airbus' China gamble". Flight International. October 28, 2008. Retrieved 2008-11-15.

- ^ Thomas, Geoffrey (April 4, 2008). "Engines the thrust of the Boeing-Airbus battle". The Australian. Retrieved 2008-11-08.

- ^ Strong Euro Weighs on Airbus, Suppliers, Wall Street Journal, October 30, 2009, p.B3

- ^ "No Slide Title" (PDF). Retrieved 2011-05-21.

- ^ Robert Wall & Andrea Rothman (17 January 2013). "Airbus Says A350 Design Is 'Lower Risk' Than Troubled 787". Bloomberg. Retrieved 17 January 2013.

I don't believe that anyone's going to switch from one airplane type to another because there's a maintenance issue," Leahy said. "Boeing will get this sorted out.

- ^ Robertson, David (October 4, 2006). "Airbus will lose €4.8bn because of A380 delays". London: The Times Business News.

- ^ Associated, The (2011-01-20). "Southwest waiting to hear Boeing's plan for 737". BusinessWeek. Retrieved 2013-02-16.

- ^ a b "Airbus orders and deliveries" (Microsoft Excel). Airbus S.A.S. 2013-05-07. Retrieved 2013-05-07.

- ^ Analysis: Airbus's late push sees off Boeing — again

- ^ http://active.boeing.com/commercial/orders/index.cfm?content=displaystandardreport.cfm&pageid=m25065&RequestTimeout=20000

- ^ http://www.airbus.com/company/market/orders-deliveries/

- ^ a b c Time Period Reports. boeing.com

- ^ http://www.flightglobal.com/assets/getAsset.aspx?ItemID=14954

- ^ http://www.flightglobal.com/assets/getAsset.aspx?ItemID=18906

- ^ http://www.flightglobal.com/assets/getasset.aspx?ItemID=24736

- ^ http://www.flightglobal.com/airspace/media/airlinercensus/world-airliner-census-2009-34289.aspx

- ^ http://www.flightglobal.com/news/articles/airliner-census-2010-fleet-growth-marginal-and-idle-jets-at-record-high-346301/

- ^ http://www.flightglobal.com/features/census-2011/

- ^ http://www.flightglobal.com/airspace/media/reports_pdf/world-airliner-census-2012-97713.aspx

- ^ "Don't Let Boeing Close The Door On Competition" (PDF). Retrieved 2011-01-09.

- ^ Oconnell, Dominic; Porter, Andrew (2005-05-29). "Trade war threatened over £379m subsidy for Airbus". The Times. London. Retrieved Insert accessdate here.

{{cite news}}: Check date values in:|accessdate=(help) - ^ "Q&A: Boeing and Airbus". BBC News. 2004-10-07. Retrieved Insert accessdate here.

{{cite news}}: Check date values in:|accessdate=(help) - ^ "See you in court". The Economist. 23 March 2005.

- ^ "EADS Military Air Systems Website, retrieved September 3, 2009". eads.net. 2011-05-13. Retrieved 2011-05-21.

- ^ "EU, US face off at WTO in aircraft spat". Defense Aerospace. 31 May 2005.

- ^ "Flare-up in EU-US air trade row". BBC News. 31 May 2005. Retrieved 2010-01-02.

- ^ Milmo, Dan (14 August 2009). "US accuse Britain of stoking trade row with £340m Airbus loan". London: The Guardian.

- ^ "US refuses to disclose WTO ruling on Boeing-Airbus row". EU Business. 5 September 2009.

- ^ Clark, Nicola (2009-09-03). "W.T.O. to Weigh In on E.U. Subsidies for Airbus, New York Times, September 3, 2009, retrieved September 3, 2009". Europe;United States: nytimes.com. Retrieved 2011-05-21.

- ^ Boeing Set for Victory Over Airbus in Illegal Subsidy Case, Wall Street Journal, September 3, 2009, p.A1

- ^ "WTO says Europe subsidises Airbus, Boeing's rival, unfairly". USA Today. 3 March 2010. Retrieved 2010-06-16.

- ^ "EU claims victory in WTO case versus Boeing". Paris: Reuters. 15 September 2010.

- ^ Freedman, Jennifer M. "WTO Says U.S. Gave at Least $5.3 Billion Illegal Aid to Boeing". Bloomberg. Retrieved 2011-05-21.

- ^ "BBC News: WTO Airbus ruling leaves both sides claiming victory". bbc.co.uk. 2011-04-19. Retrieved 2011-05-21.

- ^ Lewis, Barbara (2011-05-19). "WTO gives mixed verdict on Airbus appeal". Reuters. Retrieved 2011-05-21.

- ^ "WTO final ruling: Decisive victory for Europe". LogisticsWeek. 2011-03-25. Retrieved 2011-05-21.

- ^ Khimm, Suzy (2011-05-17). "U.S. claims victory in Airbus-Boeing case". The Washington Post. Retrieved 2011-05-21.

- ^ "Airbus satisfy WTO obligations".

- ^ "European Communities — Measures Affecting Trade in Large Civil Aircraft".

- ^ http://www.airbus.com/presscentre/pressreleases/press-release-detail/detail/sweeping-loss-for-boeing-in-wto-appeal/

- ^ "United States — Measures Affecting Trade in Large Civil Aircraft — Second Complaint".

- ^ "WTO Boeing case: EU requests to impose countermeasures against the US". European Commission. 2012-09-27. Retrieved 2012-09-28.

- ^ "Next chapter in eight year old WTO conflict: Boeing's WTO Default Prompts $ 12 Bn in Annual Sanctions". Airbus. 2012-09-27. Retrieved 2012-09-28.

- Bibliography

- Newhouse, John (2007), Boeing versus Airbus, USA: Vintage Books, ISBN 978-1-4000-7872-1