Portal:Economics

Introduction

Economics (/ˌɛkəˈnɒmɪks, ˌiːkə-/) is a social science that studies the production, distribution, and consumption of goods and services.

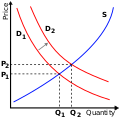

Economics focuses on the behaviour and interactions of economic agents and how economies work. Microeconomics analyses what is viewed as basic elements within economies, including individual agents and markets, their interactions, and the outcomes of interactions. Individual agents may include, for example, households, firms, buyers, and sellers. Macroeconomics analyses economies as systems where production, distribution, consumption, savings, and investment expenditure interact, and factors affecting it: factors of production, such as labour, capital, land, and enterprise, inflation, economic growth, and public policies that have impact on these elements. It also seeks to analyse and describe the global economy. (Full article...)

Selected general articles

In 1995, his 1973 book Small Is Beautiful: A Study of Economics As If People Mattered was ranked by The Times Literary Supplement as one of the 100 most influential books published since World War II. In 1977 he published A Guide for the Perplexed as a critique of materialistic scientism and as an exploration of the nature and organisation of knowledge. (Full article...)

Marie-Esprit-Léon Walras (French: [valʁas]; 16 December 1834 – 5 January 1910) was a French mathematical economist and Georgist. He formulated the marginal theory of value (independently of William Stanley Jevons and Carl Menger) and pioneered the development of general equilibrium theory. Walras is best known for his book Éléments d'économie politique pure, a work that has contributed greatly to the mathematization of economics through the concept of general equilibrium. The definition of the role of the entrepreneur found in it was also taken up and amplified by Joseph Schumpeter.

For Walras, exchanges only take place after a Walrasian tâtonnement (French for "trial and error"), guided by the auctioneer, has made it possible to reach market equilibrium. It was the general equilibrium obtained from a single hypothesis, rarity, that led Joseph Schumpeter to consider him "the greatest of all economists". The notion of general equilibrium was very quickly adopted by major economists such as Vilfredo Pareto, Knut Wicksell and Gustav Cassel. John Hicks and Paul Samuelson used the Walrasian contribution in the elaboration of the neoclassical synthesis. For their part, Kenneth Arrow and Gérard Debreu, from the perspective of a logician and a mathematician, determined the conditions necessary for equilibrium. (Full article...)

Arthur Cecil Pigou (/ˈpiːɡuː/; 18 November 1877 – 7 March 1959) was an English economist. As a teacher and builder of the School of Economics at the University of Cambridge, he trained and influenced many Cambridge economists who went on to take chairs of economics around the world. His work covered various fields of economics, particularly welfare economics, but also included business cycle theory, unemployment, public finance, index numbers, and measurement of national output. His reputation was affected adversely by influential economic writers who used his work as the basis on which to define their own opposing views. He reluctantly served on several public committees, including the Cunliffe Committee and the 1919 Royal Commission on income tax. (Full article...)

Thorstein Bunde Veblen (July 30, 1857 – August 3, 1929) was an American economist and sociologist who, during his lifetime, emerged as a well-known critic of capitalism.

In his best-known book, The Theory of the Leisure Class (1899), Veblen coined the concepts of conspicuous consumption and conspicuous leisure. Veblen laid the foundation for the perspective of the institutional economics. Contemporary economists still theorize Veblen's distinction between "institutions" and "technology", known as the Veblenian dichotomy. (Full article...)

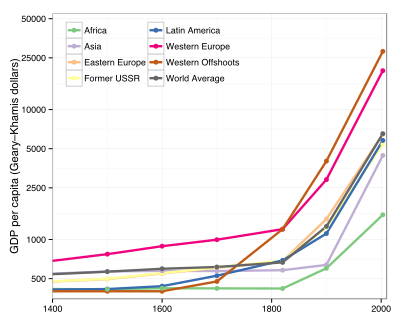

Malthusianism is a theory that population growth is potentially exponential, according to the Malthusian growth model, while the growth of the food supply or other resources is linear, which eventually reduces living standards to the point of triggering a population decline. This event, called a Malthusian catastrophe (also known as a Malthusian trap, population trap, Malthusian check, Malthusian crisis, Point of Crisis, or Malthusian crunch) has been predicted to occur if population growth outpaces agricultural production, thereby causing famine or war. According to this theory, poverty and inequality will increase as the price of assets and scarce commodities goes up due to fierce competition for these dwindling resources. This increased level of poverty eventually causes depopulation by decreasing birth rates. If asset prices keep increasing, social unrest would occur, which would likely cause a major war, revolution, or a famine. Societal collapse is an extreme but possible outcome from this process. The theory posits that such a catastrophe would force the population to "correct" back to a lower, more easily sustainable level (quite rapidly, due to the potential severity and unpredictable results of the mitigating factors involved, as compared to the relatively slow time scales and well-understood processes governing unchecked growth or growth affected by preventive checks). Malthusianism has been linked to a variety of political and social movements, but almost always refers to advocates of population control.

These concepts derive from the political and economic thought of the Reverend Thomas Robert Malthus, as laid out in his 1798 writings, An Essay on the Principle of Population. Malthus suggested that while technological advances could increase a society's supply of resources, such as food, and thereby improve the standard of living, the abundance of resources would enable population growth, which would eventually bring the supply of resources for each person back to its original level. Some economists contend that since the Industrial Revolution in the early 19th century, mankind has broken out of the trap. Others argue that the continuation of extreme poverty indicates that the Malthusian trap continues to operate. Others further argue that due to lack of food availability coupled with excessive pollution, developing countries show more evidence of the trap as compared to developed countries. A similar, more modern concept, is that of human overpopulation. (Full article...)

David Ricardo (18 April 1772 – 11 September 1823) was a British political economist, politician, and member of Parliament. He is recognized as one of the most influential classical economists, alongside figures such as Thomas Malthus, Adam Smith and James Mill.

Ricardo was born in London as the third surviving child of a successful stockbroker and his wife. He came from a Sephardic Jewish family of Portuguese origin. At 21, he eloped with a Quaker and converted to Unitarianism, causing estrangement from his family. He made his fortune financing government borrowing and later retired to an estate in Gloucestershire. Ricardo served as High Sheriff of Gloucestershire and bought a seat in Parliament as an earnest reformer. He was friends with prominent figures like James Mill, Jeremy Bentham, and Thomas Malthus, engaging in debates over various topics. Ricardo was also a member of The Geological Society, and his youngest sister was an author. (Full article...)

According to RBC theory, business cycles are therefore "real" in that they do not represent a failure of markets to clear but rather reflect the most efficient possible operation of the economy, given the structure of the economy. (Full article...)

Claude-Frédéric Bastiat (/bɑːstiˈɑː/; French: [klod fʁedeʁik bastja]; 30 June 1801 – 24 December 1850) was a French economist, writer and a prominent member of the French liberal school.

A member of the French National Assembly, Bastiat developed the economic concept of opportunity cost and introduced the parable of the broken window. He was described as "the most brilliant economic journalist who ever lived" by economic theorist Joseph Schumpeter. (Full article...)

Friedrich Freiherr von Wieser (German: [ˈviːzɐ]; 10 July 1851 – 22 July 1926) was an early (so-called "first generation") economist of the Austrian School of economics. Born in Vienna, the son of Privy Councillor Leopold von Wieser, a high official in the war ministry, he first trained in sociology and law. In 1872, the year he took his degree, he encountered Austrian-school founder Carl Menger's Grundsätze and switched his interest to economic theory. Wieser held posts at the universities of Vienna and Prague until succeeding Menger in Vienna in 1903, where along with his brother-in-law Eugen von Böhm-Bawerk he shaped the next generation of Austrian economists including Ludwig von Mises, Friedrich Hayek and Joseph Schumpeter in the late 1890s and early 20th century. He was the Austrian Minister of Commerce from August 30, 1917, to November 11, 1918.

Wieser is renowned for two main works, Natural Value, which carefully details the alternative-cost doctrine and the theory of imputation; and his Social Economics (1914), an ambitious attempt to apply it to the real world. His explanation of marginal utility theory was decisive, at least terminologically. It was his term Grenznutzen (building on von Thünen's Grenzkosten) that developed into the standard term "marginal utility", not William Stanley Jevons's "final degree of utility" or Menger's "value". His use of the modifier "natural" indicates that he regarded value as a "natural category" that would pertain to any society, no matter what institutions of property had been established. (Full article...)

John Kenneth Galbraith OC (October 15, 1908 – April 29, 2006), also known as Ken Galbraith, was a Canadian-American economist, diplomat, public official, and intellectual. His books on economic topics were bestsellers from the 1950s through the 2000s. As an economist, he leaned toward post-Keynesian economics from an institutionalist perspective.

Galbraith was a long-time Harvard faculty member and stayed with Harvard University for half a century as a professor of economics. He was a prolific author and wrote four dozen books, including several novels, and published more than a thousand articles and essays on various subjects. Among his works was a trilogy on economics, American Capitalism (1952), The Affluent Society (1958), and The New Industrial State (1967). (Full article...)

Economic history is the study of history using methodological tools from economics or with a special attention to economic phenomena. Research is conducted using a combination of historical methods, statistical methods and the application of economic theory to historical situations and institutions. The field can encompass a wide variety of topics, including equality, finance, technology, labour, and business. It emphasizes historicizing the economy itself, analyzing it as a dynamic entity and attempting to provide insights into the way it is structured and conceived.

Using both quantitative data and qualitative sources, economic historians emphasize understanding the historical context in which major economic events take place. They often focus on the institutional dynamics of systems of production, labor, and capital, as well as the economy's impact on society, culture, and language. Scholars of the discipline may approach their analysis from the perspective of different schools of economic thought, such as mainstream economics, Austrian economics, Marxian economics, the Chicago school of economics, and Keynesian economics. (Full article...)

Baumol wrote extensively about labor market and other economic factors that affect the economy. He also made significant contributions to the theory of entrepreneurship and the history of economic thought. He is among the most influential economists in the world according to IDEAS/RePEc. He was elected a Fellow of the American Academy of Arts and Sciences in 1971, the American Philosophical Society in 1977, and the United States National Academy of Sciences in 1987. (Full article...)

Modern game theory began with the idea of mixed-strategy equilibria in two-person zero-sum games and its proof by John von Neumann. Von Neumann's original proof used the Brouwer fixed-point theorem on continuous mappings into compact convex sets, which became a standard method in game theory and mathematical economics. His paper was followed by Theory of Games and Economic Behavior (1944), co-written with Oskar Morgenstern, which considered cooperative games of several players. The second edition provided an axiomatic theory of expected utility, which allowed mathematical statisticians and economists to treat decision-making under uncertainty. (Full article...)

Nobel laureates Milton Friedman, George Stigler and James M. Buchanan were all students of Knight at Chicago. Ronald Coase said that Knight, without teaching him, was a major influence on his thinking. F.A. Hayek considered Knight to be one of the major figures in preserving and promoting classical liberal thought in the twentieth century. (Full article...)

It is the study of the ways and means by which human societies procure and use energy and other biological and physical resources to produce, distribute, consume and exchange goods and services, while generating various types of waste and environmental impacts. Biophysical economics builds on both social sciences and natural sciences to overcome some of the most fundamental limitations and blind spots of conventional economics. It makes it possible to understand some key requirements and framework conditions for economic growth, as well as related constraints and boundaries. (Full article...)

This is in contrast to a laissez faire capitalist economy which seeks to abolish or privatize most government services while wanting to deregulate the economy, and a fully centrally planned economy that seeks to nationalize most services like under the early Soviet Union. Examples of political philosophies that support mixed economies include Keynesianism, social liberalism, state capitalism, fascism, social democracy, the Nordic model, and China's socialist market economy, Vietnam's socialist-oriented market economy. (Full article...)

Did you know...

- ... that anti-Korean sentiment, due to South Korea's economic growth, motivated Djuna to write the sci-fi novel Counterweight?

- ... that Elizabeth Wilkins chose to work at the Federal Trade Commission on the hope that the agency is now positioned to address economic injustice?

- ... that Francois Massaquoi, who studied economics at New York University, later led the Lofa Defense Force during the First Liberian Civil War?

- ... that the petunia carnage of 2017 led to worldwide economic losses?

- ... that the selection of Palu as capital of Palu Regency led to protests from the nearby town of Donggala, concerned they would lose out on economic development?

- ... that Michael Kremer's O-ring theory of economic development was inspired by his forgetting to purchase toilet paper for a training session?

Need help?

Do you have a question about Economics that you can't find the answer to?

Consider asking it at the Wikipedia reference desk.

Get involved

For editor resources and to collaborate with other editors on improving Wikipedia's Economics-related articles, see WikiProject Economics.

Selected images

In the news

- 29 October 2024 – German economic crisis

- German metalworkers union IG Metall begins a labor strike over the working conditions and wages of 3.9 million workers in the country. (DW)

- 23 October 2024 – Russian invasion of Ukraine

- The U.S. Defense Department finalizes a US$20 billion loan to Ukraine for military and economic support as part of a collective US$50 billion loan between G7 members. (Reuters)

- 23 October 2024 – Demographics of Germany, German economic crisis

- The Ifo Institute for Economic Research reports that Germany experienced a 13% birth rate decline nationally and up to a 17.5% birth rate decline in eastern Germany between 2021 and 2023, with the institute attributing the decline to several reasons including the COVID-19 pandemic, the Russo-Ukrainian war, and high inflation. (DW)

- 14 October 2024 – Nobel Memorial Prize in Economic Sciences

- This year's Nobel Prize in economics is awarded to Turkish-American economist Daron Acemoglu, British-American economist Simon Johnson, and British economist James A. Robinson for their studies "of how institutions are formed and affect prosperity". (The New York Times) (Nobel Prize)

- 1 October 2024 –

- Three people are killed and fifteen others are injured in a mass stabbing at a supermarket in Songjiang district, Shanghai, China. Police arrest a 37-year-old man at the scene, adding that the man had come to Shanghai in order to "vent his anger due to a personal economic dispute". (Reuters) (BBC News)

- 25 September 2024 – Pakistani economic crisis

- The International Monetary Fund approves a $7 billion loan for Pakistan to help its economy, with $1 billion being disbursed immediately and the rest in instalments over 37 months. (AP)

Subcategories

Subtopics

Associated Wikimedia

The following Wikimedia Foundation sister projects provide more on this subject:

-

Commons

Free media repository -

Wikibooks

Free textbooks and manuals -

Wikidata

Free knowledge base -

Wikinews

Free-content news -

Wikiquote

Collection of quotations -

Wikisource

Free-content library -

Wikiversity

Free learning tools -

Wiktionary

Dictionary and thesaurus