Euro: Difference between revisions

→Optimal Currency Areas: chop chop,you choped choped this section :) |

|||

| Line 265: | Line 265: | ||

==Economics of the euro== |

==Economics of the euro== |

||

===Optimal Currency |

===Optimal Currency Area=== |

||

{{Refimprovesect|date=February 2008}} |

|||

{{main|Optimum currency area}} |

{{main|Optimum currency area}} |

||

In economics, an optimum currency area(or region) (OCA,or OCR) is a geographical region in which it would maximize economic efficiency to have the entire region share a single currency.There are two models ,both proposed by [[Robert A. Mundell].Most economists cite preferentially the [[Optimum currency area#OCA with stationary expectations|stationary expectations model]] and conclude against the euro, yet Mundell advocates the [[Optimum currency area#OCA with international risk sharing|international risk sharing model]] and concludes in favour of the euro.<ref>A Plan for a European Currency,1973 by Mundell</ref> |

|||

===Transaction costs and risks=== |

===Transaction costs and risks=== |

||

Revision as of 16:25, 10 February 2008

The euro (currency sign: €; banking code: EUR) is the official currency of the European Union (EU), and is implemented in the Eurozone which currently consists of 15 states (Austria, Belgium, Cyprus, Finland, France, Germany, Greece, Ireland, Italy, Luxembourg, Malta, the Netherlands, Portugal, Slovenia, Spain). It is the single currency for more than 320 million Europeans. Including areas using currencies pegged to the euro, the euro directly affects close to 500 million people worldwide.[1] With more than €610 billion in circulation as of December 2006 (equivalent to US$802 billion at the exchange rates at the time), the euro is the currency with the highest combined value of cash in circulation in the world, having surpassed the U.S. dollar.[2]

The euro was introduced to world financial markets as an accounting currency in 1999 and launched as physical coins and banknotes on 1 January 2002. It replaced the former European Currency Unit (ECU) at a ratio of 1:1.

The euro is managed and administered by the Frankfurt-based European Central Bank (ECB) and the Eurosystem (composed of the central banks of the euro zone countries). As an independent central bank, the ECB has sole authority to set monetary policy. The Eurosystem participates in the printing, minting and distribution of notes and coins in all member states, and the operation of the Eurozone payment systems.

While all European Union (EU) member states are eligible to join if they comply with certain monetary requirements, not all EU members have chosen to adopt the currency. All nations that have joined the EU since the 1993 implementation of the Maastricht Treaty have pledged to adopt the euro in due course. Maastricht obliged current members to join the euro; however, the United Kingdom and Denmark negotiated exemptions from that requirement for themselves.[3] Sweden turned down the euro in a 2003 referendum, and has circumvented the requirement to join the euro area by not meeting the membership criteria. In addition, three European microstates (Vatican City, Monaco, and San Marino), although not EU members, have adopted the euro due to currency unions with member states. Andorra, Montenegro, and Kosovo have adopted the euro unilaterally, while not being EU members either. (cf. #Eurozone.)

Characteristics

Coins and banknotes

The euro is divided into 100 cent (sometimes referred to as eurocent, especially when distinguishing it from the U.S. cent or the former currency in a particular country). All circulating euro coins (including the €2 commemorative coins) have a common side showing the denomination (value) with the old 15 EU-countries in the background. From 2007 or 2008 on (depending on the country where the coin is issued) that "old" map is replaced by a map of Europe, thus also showing non-EU-members like Norway. The coins also have a national side showing an image specifically chosen by the country that issued the coin. Euro coins from any country may be freely used in any nation which has adopted the euro.

The euro coins are €2, €1, €0.50, €0.20, €0.10, €0.05, €0.02, and €0.01. In the Netherlands some, and in Finland by the law all cash transactions are rounded to the nearest five cent, to avoid the use of €0.02, and €0.01. (See also Linguistic issues concerning the euro.)

Commemorative coins with €2 face value have been issued with changes to the design of the national side of the coin — as Greece did for the 2004 Summer Olympics. These two-euro coins are legal tender throughout the Eurozone. Coins with various other denominations have been issued as well, but these are not intended for general circulation. These later coins are only legal tender in the nation which issued them.

All euro banknotes have a common design for each denomination on both sides. Notes are issued in €500, €200, €100, €50, €20, €10, €5. The design for each of them has a common theme of European architecture in various artistic periods. The front (or recto) of the note features windows or gateways while the back (or verso) has bridges. Care has been taken so that the architectural examples do not represent any actual existing monument, so as not to induce jealousy and controversy in the choice of which monument should be depicted. Some of the highest denominations such as the €500 are not issued in a few countries, though they remain legal tender throughout the Eurozone.

Payments clearing, electronic funds transfer

All intra-Eurozone transfers shall cost the same as a domestic one. This is true for retail payments, although several ECB payment methods can be used. Credit/debit card charging and ATM withdrawals within the Eurozone are also charged as if they were domestic. The ECB has not standardised paper-based payment orders, such as cheques; these are still domestic-based.

The ECB has set up a clearing system, TARGET, for large euro transactions.[4]

Currency sign

A special euro currency sign (€) was designed after a public survey had narrowed the original ten proposals down to two. The European Commission then chose the final design. The eventual winner was a design created by the Belgian Alain Billiet. The official story of the design history of the euro sign is disputed by Arthur Eisenmenger, a former chief graphic designer for the EEC, who claims to have created it as a generic symbol of Europe.[5]

The glyph is according to the European Commission "a combination of the Greek epsilon, as a sign of the weight of European civilization; an E for Europe; and the parallel lines crossing through standing for the stability of the euro".

The European Commission also specified a euro logo with exact proportions and foreground/background colour tones.[6] While the Commission intended the logo to be a prescribed glyph shape, font designers made it clear that they intended to design their own variants instead.[7]

Placement of the currency sign varies from nation to nation. There are no official standards on where to place the euro sign.[8]

Another advantage to the final chosen symbol is that it is easily created on a typewriter lacking the euro sign, by typing a capital 'C', backspacing and overstriking it with the equal ('=') sign.

Economic and Monetary Union

History (1990–present)

The euro was established by the provisions in the 1992 Maastricht Treaty on European Union that was used to establish an economic and monetary union. In order to participate in the new currency, member states had to meet strict criteria such as a budget deficit of less than three per cent of their GDP, a debt ratio of less than sixty per cent of GDP, low inflation, and interest rates close to the EU average. In the Maastricht Treaty, the United Kingdom and Denmark were granted exemptions from moving to the stage of monetary union which would result in the introduction of the euro.

Economists that helped create or contributed to the euro include Robert Mundell, Wim Duisenberg, Robert Tollison, Neil Dowling, Fred Arditti and Tommaso Padoa-Schioppa. (For macro-economic theory, see below.)

| Currency | Code | Rate[9] | Fixed on | Yielded |

|---|---|---|---|---|

| Austrian schilling | ATS | 13.7603 | 31 December 1998 | 1 January 1999 |

| Belgian franc | BEF | 40.3399 | 31 December 1998 | 1 January 1999 |

| Dutch guilder | NLG | 2.20371 | 31 December 1998 | 1 January 1999 |

| Finnish markka | FIM | 5.94573 | 31 December 1998 | 1 January 1999 |

| French franc | FRF | 6.55957 | 31 December 1998 | 1 January 1999 |

| German mark | DEM | 1.95583 | 31 December 1998 | 1 January 1999 |

| Irish pound | IEP | 0.787564 | 31 December 1998 | 1 January 1999 |

| Italian lira | ITL | 1,936.27 | 31 December 1998 | 1 January 1999 |

| Luxembourg franc | LUF | 40.3399 | 31 December 1998 | 1 January 1999 |

| Portuguese escudo | PTE | 200.482 | 31 December 1998 | 1 January 1999 |

| Spanish peseta | ESP | 166.386 | 31 December 1998 | 1 January 1999 |

| Greek drachma | GRD | 340.750 | 19 June 2000 | 1 January 2001 |

| Slovenian tolar | SIT | 239.640 | 11 July 2006 | 1 January 2007 |

| Cypriot pound | CYP | 0.585274 | 10 July 2007 | 1 January 2008 |

| Maltese lira | MTL | 0.429300 | 10 July 2007 | 1 January 2008 |

| Slovak koruna | SKK | 30.1260 | 8 July 2008 | 1 January 2009 |

| Estonian kroon | EEK | 15.6466 | 13 July 2010 | 1 January 2011 |

| Latvian lats | LVL | 0.702804 | 9 July 2013 | 1 January 2014 |

| Lithuanian litas | LTL | 3.45280 | 23 July 2014 | 1 January 2015 |

| Croatian kuna | HRK | 7.53450 | 12 July 2022 | 1 January 2023 |

Due to differences in national conventions for rounding and significant digits, all conversion between the national currencies had to be carried out using the process of triangulation via the euro. The definitive values in euro of these subdivisions (which represent the exchange rates at which the currency entered the euro) are shown at right.

The rates were determined by the Council of the European Union, based on a recommendation from the European Commission based on the market rates on 31 December 1998, so that one ECU (European Currency Unit) would equal one euro. (The European Currency Unit was an accounting unit used by the EU, based on the currencies of the member states; it was not a currency in its own right.) Council Regulation 2866/98 (EC), of 31 December 1998, set these rates. They could not be set earlier, because the ECU depended on the closing exchange rate of the non-euro currencies (principally the pound sterling) that day.

The procedure used to fix the irrevocable conversion rate between the drachma and the euro was different, since the euro by then was already two years old. While the conversion rates for the initial eleven currencies were determined only hours before the euro was introduced, the conversion rate for the Greek drachma was fixed several months beforehand, in Council Regulation 1478/2000 (EC), of 19 June 2000.

The currency was introduced in non-physical form (travellers' cheques, electronic transfers, banking, etc.) at midnight on 1 January 1999, when the national currencies of participating countries (the Eurozone) ceased to exist independently in that their exchange rates were locked at fixed rates against each other, effectively making them mere non-decimal subdivisions of the euro. The euro thus became the successor to the European Currency Unit (ECU). The notes and coins for the old currencies, however, continued to be used as legal tender until new notes and coins were introduced on 1 January 2002.

The changeover period during which the former currencies' notes and coins were exchanged for those of the euro lasted about two months, until 28 February 2002. The official date on which the national currencies ceased to be legal tender varied from member state to member state. The earliest date was in Germany; the Mark officially ceased to be legal tender on 31 December 2001, though the exchange period lasted two months. The final date was 28 February 2002, by which all national currencies ceased to be legal tender in their respective member states. However, even after the official date, they continued to be accepted by national central banks for periods ranging from several years to forever in Austria, Germany, Ireland, and Spain. The earliest coins to become non-convertible were the Portuguese escudos, which ceased to have monetary value after 31 December 2002, although banknotes remain exchangeable until 2022.

On 1 January 2007, Slovenia joined the Eurozone.

On 1 January 2008, Malta and Cyprus joined the Eurozone.[10]

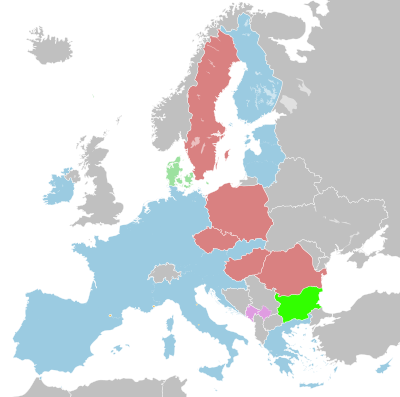

Eurozone

- The euro is the sole currency in Austria, Belgium, Cyprus, Finland, France, Germany, Greece, Ireland, Italy, Luxembourg, Malta, the Netherlands, Portugal, Slovenia and Spain. These 15 countries together are frequently referred to as the Eurozone or the euro area, or more informally "euroland" or the "eurogroup". Outside of the area covered by the map, the euro is the legal currency of the French overseas possessions of French Guiana, Réunion, Saint-Pierre et Miquelon, Guadeloupe, Martinique, Saint-Barthélemy, Saint Martin, Mayotte, and the uninhabited Clipperton Island and the French Southern and Antarctic Lands; the Portuguese autonomous regions of the Azores and Madeira; and the Spanish Canary Islands.

- By virtue of some bilateral agreements,[11] the European microstates of Monaco, San Marino, and Vatican City mint their own euro coins on behalf of the European Central Bank. They are, however, severely limited in the total value of coins they may issue.

- Andorra, Montenegro, Kosovo, and Akrotiri and Dhekelia adopted the foreign euro as their legal currency for movement of capital and payments without participation in the ESCB or the right to mint coins. Andorra is in the process of entering a monetary agreement similar to that of the microstates above.

- Several possessions and former colonies of EU states have currencies pegged to the euro. These are French Polynesia, New Caledonia, Wallis and Futuna (the CFP franc); Cape Verde; the Comoros; and fourteen nations of Central and West Africa (the CFA franc). See Currencies related to the euro.

- Although not legal tender in Denmark and the United Kingdom, the euro is accepted in some stores throughout both countries, particularly international stores in large cities, and shops in Northern Ireland near the border with the Republic of Ireland, where the euro is the official currency. Similarly, the euro is widely accepted in Switzerland, even by official boards, such as the Swiss Railways.[12]

Future prospects (2008–)

Pre-2004 EU members

From Greece's participation in 2001 until the EU enlargement in 2004, Denmark, Sweden and the United Kingdom were the only EU member states outside the monetary union. The situation for the three older member states also looks different from that of the newer EU members; the three countries have no clear roadmap for adopting the euro:

- Denmark negotiated a number of opt-out clauses from the Maastricht treaty after it had been rejected in a first referendum. On 28 September 2000, another referendum was held in Denmark regarding the euro resulting in a 53.2% vote against joining. However, Danish politicians have suggested that debate on abolishing the four opt-out clauses may possibly be re-opened. In addition, Denmark has pegged its krone to the euro (€1 = DKr 7.46038 ± 2.25%) as the krone remains in the ERM. Although not part of the European Union, both Greenland and the Faroe Islands use the Danish krone (the Faroes in the form of the Faroese króna), and so also fall within the ERM.

- Sweden: Sweden is obliged to join the euro by the 1994 Act of Accession, when they meet the economic conditions. However, the krona has never been part of ERM II, rendering Sweden ineligible. In 2003, a public referendum rejected euro membership, and Sweden has no plans to adopt the euro. The EU has made it clear that it will tolerate this with respect to Sweden, thereby giving Sweden a de facto opt-out, but not those member states that joined in 2004 or 2007.[citation needed]

- The United Kingdom has an opt-out from eurozone membership under the Maastricht treaty and is not obliged to join the euro. While the government is in favour of membership provided the economic conditions are right (requiring that "five economic tests" be met), opposition among the general population has reached as high as 71 percent [13] and the question has never been put to referendum.[14] The United Kingdom was forced to withdraw the pound sterling from the ERM (the precursor to ERM II) on Black Wednesday (16 September, 1992) following pressure from currency speculators, and the pound is not part of ERM II.

Post-2004 EU members

As of 2008, nine new EU member states have a currency other than the euro; however, all of these countries are required by their Accession Treaties to join the euro. Some of the following countries have already joined the European Exchange Rate Mechanism, ERM II. They and the others have set themselves the goal of joining the euro (EMU III) as follows:

| Non-eurozone member state | Currency (Code) |

Central rate per €1[15] | EU join date | ERM II join date[15] | Government policy on euro adoption | Convergence criteria compliance[16] (as of June 2024) |

Notes |

|---|---|---|---|---|---|---|---|

| Lev (BGN) |

1.95583[18] | 2007-01-01 | 2020-07-10 | Euro adoption on 1 July 2025[19] | Compliant with 4 out of 5 criteria (all except inflation)[20] | The Bulgarian government expects to be in compliance with all criteria by the end of 2024[20] | |

| Koruna (CZK) |

Free floating | 2004-05-01 | None | Assessment of joining ERM-II to be completed by October 2024[21] | Compliant with 2 out of 5 criteria | ||

| Krone (DKK) |

7.46038 | 1973-01-01 | 1999-01-01 | Not on government's agenda[22][23] | Not assessed due to opt-out from eurozone membership | Rejected euro adoption by referendum in 2000 | |

| Forint (HUF) |

Free floating | 2004-05-01 | None | Not on government's agenda[24] | Not compliant with any of the 5 criteria | ||

| Złoty (PLN) |

Free floating | 2004-05-01 | None | Not on government's agenda[25] | Not compliant with any of the 5 criteria | ||

| Leu (RON) |

Free floating | 2007-01-01 | None | ERM-II by 2026 and euro by 1 January 2029[26][27][28] | Not compliant with any of the 5 criteria | ||

| Krona (SEK) |

Free floating | 1995-01-01 | None | Not on government's agenda[29] | Compliant with 2 out of 5 criteria | Rejected euro adoption by referendum in 2003. Still obliged to adopt the euro once compliant with all criteria.[30] |

- 1 January 2009 for Slovakia[31]

- 1 January 2010 for Lithuania[32]

- 1 January 2011 for Estonia,[33]

- 1 January 2012 or later for Bulgaria,[34] Hungary, Latvia,[35] Czech Republic, Poland, Romania and Sweden.

Too high an inflation rate postponed the entry of Lithuania and Estonia as planned on 1 January 2007. Some of these currencies do not float against the euro, and a subset of those were unilaterally pegged to the euro before joining ERM II. See European Exchange Rate Mechanism, currencies related to the euro, and individual currency articles for more details.

Originally, the Czech Republic aimed for entry into the ERM II in 2008 or 2009, but the current government has officially dropped the 2010 target date, saying it will clearly not meet the economic criteria. The new goal is 2012.[36]

Similarly Latvia had aimed to join the euro in 2008 but inflation of over 11% has resulted in a delay as the country does not meet the current criteria. The government's official target is now 1 January 2012 although the head of the Bank of Latvia has suggested that 2013 may be a more realistic date.[37]

The Fifth Report on the Practical Preparations for the Future Enlargement of the Euro Area[38] stated on 16 July 2007 that only Cyprus, Malta (both of which adopted the euro in January 2008), Slovakia (2009) and Romania (2014) had currently set official target dates for adopting the euro.

Estonia, Latvia, Lithuania and Slovakia have already finalised the design for their respective coins' obverse sides.

Economics of the euro

Optimal Currency Area

In economics, an optimum currency area(or region) (OCA,or OCR) is a geographical region in which it would maximize economic efficiency to have the entire region share a single currency.There are two models ,both proposed by [[Robert A. Mundell].Most economists cite preferentially the stationary expectations model and conclude against the euro, yet Mundell advocates the international risk sharing model and concludes in favour of the euro.[39]

Transaction costs and risks

This section needs additional citations for verification. (February 2008) |

The most obvious benefit of adopting a single currency is removing from trade the cost of exchanging currency, theoretically allowing businesses and individuals to consummate previously unprofitable trades. On the consumer side, banks in the Eurozone must charge the same for intra-member cross-border transactions as purely domestic transactions for electronic payments (e.g. credit cards, debit cards and cash machine withdrawals).

The absence of distinct currencies also removes exchange rate risks. The risk of unanticipated exchange rate movement has always added an additional risk or uncertainty for companies or individuals looking to invest or trade outside their own currency zones. Companies that hedge against this risk will no longer need to shoulder this additional cost. The reduction in risk is particularly important for countries whose currencies have traditionally fluctuated a great deal, particularly the Mediterranean nations.

Financial markets on the continent are expected to be far more liquid and flexible than they were in the past. The reduction in cross-border transaction costs will allow larger banking firms to provide a wider array of banking services that can compete across and beyond the Eurozone.

Price parity

This section needs additional citations for verification. (February 2008) |

Another effect of the common European currency is that differences in prices—in particular in price levels—should decrease because of the 'law of one price'. Differences in prices can trigger arbitrage, i.e. speculative trade in a commodity across borders purely to exploit the price differential. Therefore, prices on commonly traded goods are likely to converge, causing inflation in some regions and deflation in others during the transition. Some evidence of this has been observed in specific markets. [2]

Macroeconomic stability

This section needs additional citations for verification. (February 2008) |

Low levels of inflation are the hallmark of stable and modern economies. Because a high level of inflation acts as a highly regressive tax (seigniorage) and theoretically discourages investment, it is generally viewed as undesirable. In spite of the downside, many countries have been unable or unwilling to deal with serious inflationary pressures. Some countries have successfully contained them by establishing largely independent central banks. One such bank was the Bundesbank in Germany; as the European Central Bank is modelled on the Bundesbank, it is independent of the pressures of national governments and has a mandate to keep inflationary pressures low. Member countries join the bank to credibly commit to lower inflation, hoping to enjoy the macroeconomic stability associated with low levels of expected inflation. The ECB (unlike the Federal Reserve in the United States of America) does not have a second objective to sustain growth and employment.

National and corporate bonds denominated in euro are significantly more liquid and have lower interest rates than was historically the case when denominated in legacy currencies.[citation needed] While increased liquidity may lower the nominal interest rate on the bond, denominating the bond in a currency with low levels of inflation arguably plays a much larger role. A credible commitment to low levels of inflation and a stable debt reduces the risk that the value of the debt will be eroded by higher levels of inflation or default in the future, allowing debt to be issued at a lower nominal interest rate.

A new reserve currency

The euro is widely perceived to be a major global reserve currency, sharing that status with the U.S. dollar (USD), albeit to a lesser degree. The U.S. dollar still continues to enjoy its status as the primary reserve of most commercial and central banks worldwide.[citation needed]

Since its introduction, the euro has been the second most widely-held international reserve currency after the U.S. dollar. The euro inherited this status from the German mark, and since its introduction, has increased its standing somewhat, mostly at the expense of the dollar. The steep increase of 4.4% in 2002 is due to the introduction of euro banknotes and coins in January 2002.

The possibility for the euro to become the first international reserve currency in the near future is now widely debated among economists.[40] Former Federal Reserve Chairman Alan Greenspan gave his opinion in September 2007 by stating that the euro could indeed replace the U.S. dollar as the world's primary reserve currency. He said that it is "absolutely conceivable that the euro will replace the dollar as reserve currency, or will be traded as an equally important reserve currency."[41] Additionally, there has been some suggestion that the recent weakness of the US dollar might encourage various parties to increase their reserves in euro at the expense of the dollar.[42] In the second term of 2007, euro as a reserve currency has reached a record level of 25.6% (a +0.8% increase from the year before)- at the expense of US dollar which dropped to 64.8% (a drop of 1.3% from the year before).[43] By the end of 2007, shares of euro increased to 26.4% as the dollar slumped to its lowest level since records began in 1999, 63.8%.[44]

| 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | 2009 | 2008 | 2007 | 2006 | 2005 | 2004 | 2003 | 2002 | 2001 | 2000 | 1995 | 1990 | 1985 | 1980 | 1975 | 1970 | 1965 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| US dollar | 58.41% | 58.52% | 58.80% | 58.92% | 60.75% | 61.76% | 62.73% | 65.36% | 65.73% | 65.14% | 61.24% | 61.47% | 62.59% | 62.14% | 62.05% | 63.77% | 63.87% | 65.04% | 66.51% | 65.51% | 65.45% | 66.50% | 71.51% | 71.13% | 58.96% | 47.14% | 56.66% | 57.88% | 84.61% | 84.85% | 72.93% |

| Euro (until 1999—ECU) | 19.98% | 20.40% | 20.59% | 21.29% | 20.59% | 20.67% | 20.17% | 19.14% | 19.14% | 21.20% | 24.20% | 24.05% | 24.40% | 25.71% | 27.66% | 26.21% | 26.14% | 24.99% | 23.89% | 24.68% | 25.03% | 23.65% | 19.18% | 18.29% | 8.53% | 11.64% | 14.00% | 17.46% | |||

| Japanese yen | 5.70% | 5.51% | 5.52% | 6.03% | 5.87% | 5.19% | 4.90% | 3.95% | 3.75% | 3.54% | 3.82% | 4.09% | 3.61% | 3.66% | 2.90% | 3.47% | 3.18% | 3.46% | 3.96% | 4.28% | 4.42% | 4.94% | 5.04% | 6.06% | 6.77% | 9.40% | 8.69% | 3.93% | 0.61% | ||

| Pound sterling | 4.84% | 4.92% | 4.81% | 4.73% | 4.64% | 4.43% | 4.54% | 4.35% | 4.71% | 3.70% | 3.98% | 4.04% | 3.83% | 3.94% | 4.25% | 4.22% | 4.82% | 4.52% | 3.75% | 3.49% | 2.86% | 2.92% | 2.70% | 2.75% | 2.11% | 2.39% | 2.03% | 2.40% | 3.42% | 11.36% | 25.76% |

| Canadian dollar | 2.58% | 2.38% | 2.38% | 2.08% | 1.86% | 1.84% | 2.03% | 1.94% | 1.77% | 1.75% | 1.83% | 1.42% | |||||||||||||||||||

| Chinese renminbi | 2.29% | 2.61% | 2.80% | 2.29% | 1.94% | 1.89% | 1.23% | 1.08% | |||||||||||||||||||||||

| Australian dollar | 2.11% | 1.97% | 1.84% | 1.83% | 1.70% | 1.63% | 1.80% | 1.69% | 1.77% | 1.59% | 1.82% | 1.46% | |||||||||||||||||||

| Swiss franc | 0.23% | 0.23% | 0.17% | 0.17% | 0.15% | 0.14% | 0.18% | 0.16% | 0.27% | 0.24% | 0.27% | 0.21% | 0.08% | 0.13% | 0.12% | 0.14% | 0.16% | 0.17% | 0.15% | 0.17% | 0.23% | 0.41% | 0.25% | 0.27% | 0.33% | 0.84% | 1.40% | 2.25% | 1.34% | 0.61% | |

| Deutsche Mark | 15.75% | 19.83% | 13.74% | 12.92% | 6.62% | 1.94% | 0.17% | ||||||||||||||||||||||||

| French franc | 2.35% | 2.71% | 0.58% | 0.97% | 1.16% | 0.73% | 1.11% | ||||||||||||||||||||||||

| Dutch guilder | 0.32% | 1.15% | 0.78% | 0.89% | 0.66% | 0.08% | |||||||||||||||||||||||||

| Other currencies | 3.87% | 3.48% | 3.09% | 2.65% | 2.51% | 2.45% | 2.43% | 2.33% | 2.86% | 2.83% | 2.84% | 3.26% | 5.49% | 4.43% | 3.04% | 2.20% | 1.83% | 1.81% | 1.74% | 1.87% | 2.01% | 1.58% | 1.31% | 1.49% | 4.87% | 4.89% | 2.13% | 1.29% | 1.58% | 0.43% | 0.03% |

| Source: World Currency Composition of Official Foreign Exchange Reserves. International Monetary Fund. | |||||||||||||||||||||||||||||||

A currency is attractive for international transactions when it demonstrates a proven track record of stability, a well-developed financial market to trade the currency, and proven acceptability to others. While the euro has made substantial progress toward achieving these features, there are a few challenges that undermine the ascension of the euro as a major reserve currency. Persistent excessive budget deficits of some member nations, economically weak new members, conservatism of financial markets, and inertia or path dependence are all important factors keeping the euro as a junior international currency to the U.S. dollar. However, at the same time, the USD has increasingly suffered from a double deficit and consequently has its own concerns.

As the euro becomes a new reserve currency, Eurozone governments will enjoy substantial benefits. Since money is effectively an interest-free loan to the issuing government by the holder of the currency—foreign reserves act as a subsidy to the country minting the currency (see Seigniorage). However, reserve status also holds risks, as the currency may become overvalued, hurting European exporters, and potentially exposing the European economy to influence by external factors who hold large quantities of euro.

Criticism

This section needs additional citations for verification. (September 2007) |

Some European nationalist parties oppose the euro as part of a more general opposition to the European Union. A significant group of these include the members of the Independence and Democracy bloc in the European Parliament. Additionally the Green Party of England and Wales is opposed for anti-globalisation reasons but the rest of the European Green Party bloc in the European Parliament do not share their stances.

In their view, the countries that participate in the EMU have surrendered their sovereign abilities to conduct monetary policy. The European Central Bank is required to pursue a policy that might be at odds with national interests and there is no guarantee of extra-national assistance from their more fortunate neighbours should local conditions necessitate some sort of economic stimulus package. Many critics of the EMU believe the benefits to joining the organisation are outweighed by the loss of sovereignty over local policy that accompanies membership.

The euro is underpinned by the Stability and Growth Pact, which is designed to ensure even fiscal policy across the Eurozone. The SGP has been criticised for removing the ability of national governments to stimulate their own economies to a certain extent, in the only way left to them now that monetary policy is determined supranationally. The failure of some member states to observe the SGP, and its inherent problems have led to minor reforms, and further reforms are likely.[citation needed]

Exchange rate

Flexible exchange rates

| Year | Lowest ↓ | Highest ↑ | ||||

|---|---|---|---|---|---|---|

| Date | Rate | Date | Rate | |||

| 1999 | 03 Dec | $1.0015 | 05 Jan | $1.1790 | ||

| 2000 | 26 Oct | $0.8252 | 06 Jan | $1.0388 | ||

| 2001 | 06 Jul | $0.8384 | 05 Jan | $0.9545 | ||

| 2002 | 28 Jan | $0.8578 | 31 Dec | $1.0487 | ||

| 2003 | 08 Jan | $1.0377 | 31 Dec | $1.2630 | ||

| 2004 | 14 May | $1.1802 | 28 Dec | $1.3633 | ||

| 2005 | 15 Nov | $1.1667 | 03 Jan | $1.3507 | ||

| 2006 | 02 Jan | $1.1826 | 05 Dec | $1.3331 | ||

| 2007 | 12 Jan | $1.2893 | 27 Nov | $1.4874 | ||

| 2008 | 21 Jan | $1.4482 | 14 Jan | $1.4895 | ||

| Source: Euro exchange rates in USD, ECB | ||||||

The ECB targets interest rates rather than exchange rates and in general does not intervene on the foreign exchange rate markets, because of the implications of the Mundell-Fleming Model which suggest that a central bank cannot maintain interest rate and exchange rate targets simultaneously because increasing the money supply results in a depreciation of the currency. In the years following the Single European Act, the EU has liberalised its capital markets, and as the ECB has chosen monetary autonomy, the exchange rate regime of the euro is flexible, or floating. This explains why the exchange rate of the euro vis-à-vis other currencies is characterised by strong fluctuations. Most notable are the fluctuations of the euro versus the U.S. dollar, another free-floating currency. However this focus on the dollar-euro parity is partly subjective. It is taken as a reference because the euro competes with the dollars role as reserve currency. The effect of this selective reference is misleading, as it gives observers the impression that a rise in the value of the euro versus the dollar is the effect of increased global strength of the euro, while it may be the effect of an intrinsic weakening of the dollar itself.

Against other major currencies

Green: in Jan-1999: €1 = $1.18 ; in Nov-2007: €1 = $1.47

Red: in Jan-1999: €1 = ¥133 ; in Nov-2007: €1 = ¥166

Blue: in Jan-1999: €1 = £0.71 ; in Nov-2007: €1 = £0.70

After the introduction of the euro, its exchange rate against other currencies fell heavily, especially against the U.S. dollar. At its introduction in 1999, the euro was traded at US$1.18/€, but by October 26, 2000, it had fallen to an all-time low of $0.8228/€. After the appearance of the coins and notes in 2002 and the replacement of all national currencies, the euro then began steadily appreciating, and reached parity with the U.S. dollar on July 15, 2002. Since December 2002, the euro has not fallen below parity with the U.S. dollar.

On 23 May 2003, the euro surpassed its initial ($1.18) trading value for the first time. At the end of 2004, it reached a 2004 peak of $1.3668 (€0.7316/$) as the U.S. dollar fell against all major currencies, fuelled by the so-called double deficit in the US accounts. But the dollar recovered in 2005, rising to $1.18 (€0.85/$) in July 2005, and was stable throughout the second half of 2005. The steep increase in U.S. interest rates during 2005 had much to do with this trend. By early December 2006, the dollar had fallen below €0.75, hitting a low of €0.7495/$ ($1.3340/€), slightly more than 3c above its record low, set in late 2004. On January 14, 2008, the dollar and British pound fell to all-time lows at $1.4895 and £0.7600, respectively against the euro (€0.6723/$).[45][46]

- Current and historical exchange rates against 29 other currencies (European Central Bank)

- Current dollar/euro exchange rates (BBC)

- Historical exchange rate from 1971 until now

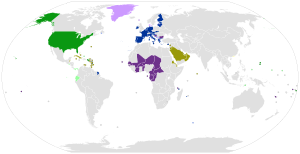

Currencies pegged to the euro

There are a number of non-EU currencies that were pegged to a European currency and are now currencies related to the euro: the Cape Verdean escudo, the Bosnia and Herzegovina convertible mark, the CFP franc, the CFA franc and the Comorian franc.

In total, the euro is the official currency in 15 states inside the European Union, and 5 states/territories outside the European Union. In addition, 23 states and territories have currencies that are directly pegged to the euro including 14 countries in mainland Africa, 3 EU members that will ultimately join the euro, 3 French Pacific territories, 2 African island countries and another Balkan country, Bosnia and Herzegovina.

| From Google Finance: | AUD CAD CHF CNY GBP HKD JPY USD SEK RUB |

| From Yahoo! Finance: | AUD CAD CHF CNY GBP HKD JPY USD SEK RUB |

| From XE.com: | AUD CAD CHF CNY GBP HKD JPY USD SEK RUB |

| From OANDA: | AUD CAD CHF CNY GBP HKD JPY USD SEK RUB |

In the United Kingdom, although not a member of the Eurozone, many high-street banks report that as much as 90% of their international trade is conducted in euro. It is common therefore for them to use the euro as their 'core' currency on international business systems, only converting to Sterling for local accountancy purposes.[47]

Linguistic issues

The formal titles of the currency are "euro" for the major unit and "cent" for the minor (one hundreth) unit and for official use in most Eurozone languages, these names are invariant in the plural.[48] These styles are often in conflict with the structures of the national languages. However, it is the policy of the EU that these national norms should continue in local documents intended for the general public.[49]

See also

Previous currency unions

- Latin Monetary Union (1865–1927)

- Scandinavian Monetary Union (1873–1914)

Other existing common currencies

- Central African CFA franc, a currency used by six independent states.

- East Caribbean dollar, a currency used by eight of the nine members of the Organisation of Eastern Caribbean States.

- West African CFA franc, a currency used by eight independent states.

Future planned and potential common currencies

- Amero, one of the possible names of the currency for a potential North American currency union.

- Eco, a planned West African currency to be used by 5 or 6 nations by 2009.

- Khaleeji, a planned common currency of the 6 nations of the Cooperation Council for the Arab States of the Persian Gulf to be produced by 2010.

References

- ^ Number is a sum of estimated populations (as stated in their respective articles) of: all Eurozone members; all users of euro not part of Eurozone (whether officially agreed upon or not); all areas which use a currency pegged to the euro, and only the euro. - Please see detailed summation in article Eurozone

- ^ Atkins, Ralph (2006-12-27). "Euro notes cash in to overtake dollar". Financial Times. Retrieved 2007-05-04.

- ^ "The €uro: Our Currency". Economic and Financial Affairs. Retrieved 2007-05-04.

- ^ "TARGET". European Central Bank. Retrieved 2007-10-25.

- ^ Connolly, Kate (2001-12-23). "Inventor who coined euro sign fights for recognition". The Observer. Berlin: Guardian Unlimited.

- ^ "The €uro: Our Currency". europa.eu. Retrieved 2007-10-25.

- ^ Siebert, Jürgen (2002). "The Euro: From Logo to Letter". Font Magazine (2).

- ^ "Frequently Asked Questions". europa.eu. Retrieved 2007-10-25.

- ^ "Use of the euro". European Central Bank. Retrieved 2020-08-15.

- ^ CNNMoney.com

- ^ "Agreements on monetary relations (Monaco, San Marino, the Vatican and Andorra)". Retrieved 2007-05-11.

- ^ SBB - More at the station - Automatic ticket machine

- ^ "Cook plays down anti-euro poll". BBC News. The British Broadcasting Corporation. 2001-02-01. Retrieved 2008-02-07.

- ^ "Sluggish Europe proves Brown's case on currency". The Guardian. Guardian News and Media Limited. 2004-12-20. Retrieved 2008-02-07.

- ^ a b "Foreign exchange operations". European Central Bank. Retrieved 12 July 2020.

- ^ "Convergence Report June 2024" (PDF). European Central Bank. 2024-06-26. Retrieved 2024-06-27.

- ^ "EUROPEAN ECONOMY 4/2014: Convergence Report 2014" (PDF). European Commission. 4 June 2014.

- ^ The Bulgarian National Bank pursues its primary objective of price stability through an exchange rate anchor in the context of a Currency Board Arrangement (CBA), obliging them to exchange monetary liabilities and euro at the official exchange rate 1.95583 BGN/EUR without any limit. The CBA was introduced on 1 July 1997 as a 1:1 peg against German mark, and the peg subsequently changed to euro on 1 January 1999.[17]

- ^ "The National Assembly adopted at first reading a bill for the introduction of the euro in the Republic of Bulgaria". Parliament.bg. National Assembly of Bulgaria. 26 July 2024. Retrieved 7 August 2024.

- ^ a b "България покрива всички критерии, остава само инфлацията за членство в еврозоната, според редовните конвергентни доклади за 2024 г. на Европейската комисия и на Европейската централна банка" [Bulgaria meets all criteria, only inflation remains for eurozone membership, according to the regular convergence reports for 2024 of the European Commission and the European Central Bank]. Evroto.bg (in Bulgarian). Ministry of Finance (Bulgaria). 26 June 2024.

- ^ "Czech Government to Evaluate Merits of Joining 'Euro Waiting Room'". Reuters. 7 February 2024. Retrieved 7 February 2024.

- ^ "Denmark's Zeitenwende". European Council on Foreign Relations. 7 June 2022. Retrieved 25 February 2024.

- ^ "Regeringsgrundlag December 2022: Ansvar for Danmark (Government manifest December 2022: Responsibility for Denmark)" (PDF) (in Danish). Danish Ministry of Finance. 14 December 2022.

- ^ "Orbán: Hungary will not adopt the euro for many decades to come". Hungarian Free Press. 3 June 2015.

- ^ "Poland is still not ready to adopt the euro, its finance minister says". Ekathimerini.com. 30 April 2024.

- ^ Smarandache, Maria (20 March 2023). "Romania wants to push euro adoption by 2026". Euractiv.com. Retrieved 27 February 2024.

- ^ Smarandache, Maria (24 March 2023). "Iohannis: No 'realistic' deadline for Romania to join eurozone". Euractiv.com. Retrieved 29 February 2024.

- ^ Balázs Márton (20 March 2023). "Románia előrébb hozná az euró bevezetését" [Romania would advance the introduction of the euro]. Telex.hu (in Hungarian). Retrieved 29 February 2024.

- ^ "DN Debatt Repliker. 'Folkligt stöd saknas för att byta ut kronan mot euron'" [DN Debate Replicas. "There is no popular support for exchanging the krona for the euro"]. Dagens Nyheter (in Swedish). 3 January 2022. Retrieved 6 May 2022.

- ^ Sweden, while obliged to adopt the euro under its Treaty of Accession, has chosen to deliberately fail to meet the convergence criteria for euro adoption by not joining ERM II without prior approval by a referendum.

- ^ "Government approved the National Euro Changeover Plan". Bank of Slovakia. 2005-07-07.

- ^ "Adoption of the euro in Lithuania". Bank of Lithuania. Retrieved 2007-02-03.

- ^ "Alcohol and tobacco tax to rise in Estonia next year". Helsingin Sanomat. 2007-05-25. Retrieved 2007-07-30.

{{cite news}}: Check date values in:|date=(help) - ^ "Bulgaria's budget of reform". The Sofia Echo. 2007-11-30. Retrieved 2008-02-06.

{{cite news}}: Check date values in:|date=(help) - ^ "Latvia might adopt Euro between 2010 and 2012 - Minister". Forbes. 2006-12-04. Retrieved 2007-01-01.

- ^ "Finance Ministry sees 2012 as realistic for euro adoption". Prague Daily Monitor. 2007-02-22. Retrieved 2007-02-28.

- ^ Bank targets 2013 as Latvia’s ‘E-day’

- ^ "Fifth Report on the Practical Preparations for the Future Enlargement of the Euro Area" (PDF). Commission of the European Communities. 2007-07-16. Retrieved 2007-10-25.

- ^ A Plan for a European Currency,1973 by Mundell

- ^ http://www.wage.wisc.edu/uploads/Working%20Papers/chinnfrankel_NBER_eurotopcurrency.pdf

- ^ "Reuters". Euro could replace dollar as top currency - Greenspan. Retrieved September 17.

{{cite web}}: Check date values in:|accessdate=(help); Unknown parameter|accessyear=ignored (|access-date=suggested) (help) - ^ "American Gangster's Wad of Euros Signals U.S. Decline"

- ^ "Euro Rises on Speculation ECB's Trichet to Signal Higher Rates"

- ^ Dollar's Share of Currency Reserves Falls, IMF Says (Update1) Bloomberg

- ^ ECB official rates against the dollar from ecb.eu

- ^ ECB official rates against the British pound from ecb.eu

- ^

Nina, Koeppen (June 26, 2007). "Euro's Role Slips in World Markets". The Wall Street Journal. Retrieved 2007-08-08.

{{cite web}}: Check date values in:|date=(help) - ^ [http://www.ecb.eu/pub/pdf/conrep/cr200705en.pdf European Central Bank, CONVERGENCE REPORT MAY 2007]

- ^ For example, see European Commission, Directorate General for Translation: English Style Guide section 20.7 "However, in all other texts, especially documents intended for the general public, use the natural plurals 'euros' and 'cents'." [1]. It maybe assumed that the Style Guides for other languages make similar statements.

Further reading

- Baldwin, Richard and Charles Wyplosz, The Economics of European Integration, New York: McGraw Hill, 2004.

- European Commission, High Level Task Force on Skills and Mobility - Final Report, 14 December 2001.

External links

Official websites

Other

Template:Standard numismatics external links