Affordable Care Act

| |

| Long title | The Patient Protection and Affordable Care Act |

|---|---|

| Acronyms (colloquial) | PPACA, ACA |

| Nicknames | Affordable Care Act, Health Insurance Reform, Healthcare Reform, Obamacare |

| Enacted by | the 111th United States Congress |

| Effective | March 23, 2010 Most major provisions phased in by January 2014; remaining provisions phased in by 2020 |

| Citations | |

| Public law | 111–148 |

| Statutes at Large | 124 Stat. 119 through 124 Stat. 1025 (906 pages) |

| Legislative history | |

| |

| Major amendments | |

| Health Care and Education Reconciliation Act of 2010 Comprehensive 1099 Taxpayer Protection and Repayment of Exchange Subsidy Overpayments Act of 2011 | |

| United States Supreme Court cases | |

| National Federation of Independent Business v. Sebelius | |

The Patient Protection and Affordable Care Act (PPACA),[1] commonly called the Affordable Care Act (ACA) or Obamacare,[2][3] is a United States federal statute signed into law by President Barack Obama on March 23, 2010. Together with the Health Care and Education Reconciliation Act,[4] it represents the most significant regulatory overhaul of the country's healthcare system since the passage of Medicare and Medicaid in 1965.[5]

The ACA aims to increase the quality and affordability of health insurance, lower the uninsured rate by expanding public and private insurance coverage, and reduce the costs of healthcare for individuals and the government. It provides a number of mechanisms—including mandates, subsidies, and insurance exchanges—to increase coverage and affordability.[6][7] The law also requires insurance companies to cover all applicants within new minimum standards and offer the same rates regardless of pre-existing conditions or sex.[8][9] Additional reforms aim to reduce costs and improve healthcare outcomes by shifting the system towards quality over quantity through increased competition, regulation, and incentives to streamline the delivery of healthcare. The Congressional Budget Office projected that the ACA will lower both future deficits[10] and Medicare spending.[11]

On June 28, 2012, the United States Supreme Court upheld the constitutionality of most of the ACA in the case National Federation of Independent Business v. Sebelius. However, the Court held that states cannot be forced to participate in the ACA's Medicaid expansion under penalty of losing their current Medicaid funding.[12][13][14] Since the ruling, the law and its implementation have continued to face challenges in Congress, in federal courts, and from some state governments. Efforts to oppose, undermine, and repeal the legislation have drawn support from prominent conservative advocacy groups, Congressional and many state Republicans, certain small business organizations, and the Tea Party movement.[15]

Overview of provisions

The ACA includes numerous provisions that take effect between 2010 and 2020. Policies issued before 2010 are exempted by a grandfather clause from many of the changes to insurance standards, but they are affected by other provisions.[17][18] Significant reforms are listed below, most of which take effect by January 1, 2014:

- Guaranteed issue prohibits insurers from denying coverage to individuals due to pre-existing conditions, and a partial community rating requires insurers to offer the same premium price to all applicants of the same age and geographical location without regard to gender or most pre-existing conditions (excluding tobacco use).[19][20][21]

- Minimum standards for health insurance policies are established.[22][23][24][25][26]

- An individual mandate[27][28] requires all individuals not covered by an employer sponsored health plan, Medicaid, Medicare or other public insurance programs (such as Tricare) to secure an approved private-insurance policy or pay a penalty, unless the applicable individual has a financial hardship or is a member of a recognized religious sect exempted by the Internal Revenue Service.[29] The law includes subsidies to help people with low incomes comply with the mandate.[30]

- Health insurance exchanges will commence operation in every state. Each exchange will serve as an online marketplace where individuals and small businesses can compare policies and buy insurance (with a government subsidy if eligible).[31] In the first year of operation, open enrollment on the exchanges runs from October 1, 2013 to March 31, 2014, and insurance plans purchased by December 15, 2013 will begin coverage on January 1, 2014.[32][33][34][35] In subsequent years, open enrollment will start on October 15 and end on December 7.[36][37][38]

- Low-income individuals and families whose incomes are between 100% and 400% of the federal poverty level will receive federal subsidies on a sliding scale if they purchase insurance via an exchange.[39] Those from 133% to 150% of the poverty level will be subsidized such that their premium costs will be 3% to 4% of income.[40] In 2013, the subsidy would apply for incomes up to $45,960 for an individual or $94,200 for a family of four; consumers can choose to receive their tax credits in advance, and the exchange will send the money directly to the insurer every month.[41] Small businesses will also be eligible for subsidies.[42]

- Medicaid eligibility is expanded to include individuals and families with incomes up to 133% of the federal poverty level, including adults without disabilities and without dependent children.[43] The law also provides for a 5% "income disregard", making the effective income eligibility limit for Medicaid 138% of the poverty level.[44] Furthermore, the State Children's Health Insurance Program (CHIP) enrollment process is simplified.[43] However, in National Federation of Independent Business v. Sebelius, the Supreme Court ruled that states may opt out of the Medicaid expansion, and several have done so.

- Reforms to the Medicare payment system are meant to promote greater efficiency in the healthcare delivery system by restructuring Medicare reimbursements from fee-for-service to bundled payments.[45][46] Under the new payment system, a single payment is paid to a hospital and a physician group for a defined episode of care (such as a hip replacement) rather than individual payments to individual service providers. In addition, the Medicare Part D coverage gap (commonly called the "donut hole") will shrink and be completely closed by January 1, 2020.[47]

- Businesses who employ 50 or more people but do not offer health insurance to their full-time employees will pay a tax penalty if the government has subsidized a full-time employee's healthcare through tax deductions or other means. This is commonly known as the employer mandate.[48][49]

Legislative history

Background

The Patient Protection and Affordable Care Act consists of a combination of measures to control healthcare costs, and an expansion of coverage through public and private insurance: broader Medicaid eligibility and Medicare coverage, and subsidized, regulated private insurance. An individual mandate coupled with subsidies for private insurance as a means for universal healthcare was considered the best way to win the support of the Senate because it had been included in prior bipartisan reform proposals. The idea goes back as far as 1989, when it was initially proposed by the conservative Heritage Foundation as an alternative to single-payer health care.[50] It was championed by many Republican politicians as a market-based approach to healthcare reform on the basis of individual responsibility. Specifically, because the 1986 Emergency Medical Treatment and Active Labor Act (EMTALA) requires any hospital participating in Medicare (which nearly all do) to provide emergency care to anyone who needs it, the government often indirectly bore the cost of those without the ability to pay.[51][52][53]

When, in 1993, President Bill Clinton proposed a healthcare reform bill that included a mandate for employers to provide health insurance to all employees through a regulated marketplace of health maintenance organizations, Republican Senators proposed an alternative that would have required individuals, but not employers, to buy insurance.[52] Ultimately the Clinton plan failed due to concerns that it was overly complex, amid an unprecedented barrage of negative advertising funded by politically conservative groups and the health insurance industry.[54] After failing to obtain a comprehensive reform of the healthcare system, Clinton negotiated a compromise with the 105th Congress to instead enact the State Children's Health Insurance Program (SCHIP) in 1997.[55]

The 1993 Republican alternative, introduced by Senator John Chafee as the Health Equity and Access Reform Today Act, contained a "universal coverage" requirement with a penalty for noncompliance—an individual mandate—as well as subsidies to be used in state-based 'purchasing groups.'[56] Advocates for the 1993 bill included prominent Republicans who today oppose a mandate, such as Senators Orrin Hatch, Chuck Grassley, Bob Bennett, and Kit Bond.[57][58] Of the 43 Republicans Senators from 1993, almost half—20 out of 43—supported the HEART Act.[50][59] Another Republican proposal, introduced in 1994 by Senator Don Nickles, the Consumer Choice Health Security Act, also contained an individual mandate with a penalty provision;[60] however, Nickles subsequently removed the mandate from the bill, stating he had decided "that government should not compel people to buy health insurance."[61] At the time of these proposals, Republicans did not raise constitutional issues with the mandate; Mark Pauly, who helped develop a proposal that included an individual mandate for George H.W. Bush, remarked, "I don’t remember that being raised at all. The way it was viewed by the Congressional Budget Office in 1994 was, effectively, as a tax."[50]

An individual health insurance mandate and an insurance exchange was also enacted at the state level in Massachusetts: In 2006, Republican Governor Mitt Romney signed an insurance expansion bill with strong bipartisan support, including that of Senator Ted Kennedy. Romney's successful implementation of the 'Health Connector' exchange and individual mandate in Massachusetts was at first lauded by Republicans. During Romney's 2008 presidential campaign, Senator Jim DeMint praised Romney's ability to "take some good conservative ideas, like private health insurance, and apply them to the need to have everyone insured." Romney himself said of the individual mandate: "I'm proud of what we've done. If Massachusetts succeeds in implementing it, then that will be the model for the nation."[62]

In 2007, a year after the Massachusetts reform, Republican Senator Bob Bennett and Democratic Senator Ron Wyden introduced the Healthy Americans Act, which also featured an individual mandate and state-based regulated insurance markets called "State Health Help Agencies".[53][62] The bill attracted bipartisan support but died in committee; however, many of the sponsors and co-sponsors remained in Congress during the 2008 healthcare debate.[63]

Given the history of bipartisan support for an individual mandate and regulated insurance markets with subsidies as well as their perceived success in Massachusetts, by 2008 Democrats were considering using this approach as the basis for comprehensive, national healthcare reform. Experts have pointed out that the legislation that eventually emerged from Congress in 2009 and 2010 bears many similarities to the 2007 bill[56] and that it was deliberately patterned after Romney's state healthcare plan.[64] Jonathan Gruber, a key architect of the Massachusetts reform who advised the Clinton and Obama presidential campaigns on their healthcare proposals, served as a technical consultant to the Obama administration and helped Congress draft the ACA.[65]

Healthcare debate, 2008–10

Healthcare reform was a major topic of discussion during the 2008 Democratic presidential primaries. As the race narrowed, attention focused on the plans presented by the two leading candidates, Hillary Clinton and eventual nominee Barack Obama. Each candidate proposed a plan to cover the approximately 45 million Americans estimated to not have health insurance at some point each year. Clinton's plan would have required all Americans obtain coverage (in effect, an individual mandate), while Obama provided a subsidy but opposed the use of a mandate.[66][67] During the general election, Obama said that fixing healthcare would be one of his top four priorities if he won the presidency.[68]

After his inauguration, Obama announced to a joint session of Congress in February 2009 his intent to work with Congress to construct a plan for healthcare reform.[69][70] By July, a series of bills were approved by committees within the House of Representatives.[71] On the Senate side, from June to September, the Senate Finance Committee held a series of 31 meetings to develop a healthcare reform bill. This group—in particular, Democrats Max Baucus, Jeff Bingaman, and Kent Conrad, and Republicans Mike Enzi, Chuck Grassley, and Olympia Snowe—met for more than 60 hours, and the principles that they discussed, in conjunction with the other committees, became the foundation of the Senate's healthcare reform bill.[72][73][74]

With universal healthcare as one of the stated goals of the Obama administration, congressional Democrats and health policy experts like Jonathan Gruber and David Cutler argued that guaranteed issue would require both a community rating and an individual mandate to prevent either adverse selection and/or free riding from creating an insurance death spiral;[75] they convinced Obama that this was necessary, persuading him to accept congressional proposals including a mandate.[76] This approach was preferred because the President and congressional leaders concluded that more liberal plans such as Medicare for All, could not win filibuster-proof support in the Senate. By deliberately drawing on bipartisan ideas—the same basic outline was supported by former Senate majority leaders Howard Baker, Bob Dole, Tom Daschle and George J. Mitchell—the bill's drafters hoped to increase the chances of getting the necessary votes for passage.[77][78]

However, following the adoption of an individual mandate as a central component of the proposed reforms by Democrats, Republicans began to oppose the mandate and threaten to filibuster any bills that contained it.[50] Senate minority leader Mitch McConnell, who lead the Republican congressional strategy in responding to the bill, calculated that Republicans should not support the bill, and worked to keep party discipline and prevent defections:[79]

It was absolutely critical that everybody be together because if the proponents of the bill were able to say it was bipartisan, it tended to convey to the public that this is O.K., they must have figured it out.[80]

Republican Senators, including those who had supported previous bills with a similar mandate, began to describe the mandate as "unconstitutional". Writing in The New Yorker, Ezra Klein stated that "the end result was... a policy that once enjoyed broad support within the Republican Party suddenly faced unified opposition."[53] The New York Times subsequently noted: "It can be difficult to remember now, given the ferocity with which many Republicans assail it as an attack on freedom, but the provision in President Obama's healthcare law requiring all Americans to buy health insurance has its roots in conservative thinking."[52][59]

The reform negotiations also attracted a great deal of attention from lobbyists,[81] including deals among certain lobbies and the advocates of the law to win the support of groups who had opposed past reform efforts, such as in 1993.[82][83] The Sunlight Foundation documented many of the reported ties between "the healthcare lobbyist complex" and politicians in both major parties.[84]

During the August 2009 summer congressional recess, many members went back to their districts and entertained town hall meetings to solicit public opinion on the proposals. Over the recess, the Tea Party movement organized protests and many conservative groups and individuals targeted congressional town hall meetings to voice their opposition to the proposed reform bills.[70] There were also many threats made against members of Congress over the course of the Congressional debate, and many were assigned extra protection.[85]

To maintain the progress of the legislative process, when Congress returned from recess, in September 2009 President Obama delivered a speech to a joint session of Congress supporting the ongoing Congressional negotiations, to re-emphasize his commitment to reform and again outline his proposals.[86] In it he acknowledged the polarization of the debate, and quoted a letter from the late Senator Ted Kennedy urging on reform: "what we face is above all a moral issue; that at stake are not just the details of policy, but fundamental principles of social justice and the character of our country."[87] On November 7, the House of Representatives passed the Affordable Health Care for America Act on a 220–215 vote and forwarded it to the Senate for passage.[70]

Senate

The Senate began work on its own proposals while the House was still working on the Affordable Health Care for America Act. Instead, the Senate took up H.R. 3590, a bill regarding housing tax breaks for service members.[88] As the United States Constitution requires all revenue-related bills to originate in the House,[89] the Senate took up this bill since it was first passed by the House as a revenue-related modification to the Internal Revenue Code. The bill was then used as the Senate's vehicle for their healthcare reform proposal, completely revising the content of the bill.[90] The bill as amended would ultimately incorporate elements of proposals that were reported favorably by the Senate Health and Finance committees.

With the Republican minority in the Senate vowing to filibuster any bill that they did not support, requiring a cloture vote to end debate, 60 votes would be necessary to get passage in the Senate.[91] At the start of the 111th Congress, Democrats had only 58 votes; the Senate seat in Minnesota that would be won by Al Franken was still undergoing a recount, and Arlen Specter was still a Republican.

To reach 60 votes, negotiations were undertaken to satisfy the demands of moderate Democrats, and to try to bring aboard several Republican senators; particular attention was given to Bob Bennett, Mike Enzi, Chuck Grassley, and Olympia Snowe. Negotiations continued even after July 7—when Franken was sworn into office, and by which time Specter had switched parties—because of disagreements over the substance of the bill, which was still being drafted in committee, and because moderate Democrats hoped to win bipartisan support. However, on August 25, before the bill could come up for a vote, Ted Kennedy—a long-time advocate for healthcare reform—died, depriving Democrats of their 60th vote. Before the seat was filled, attention was drawn to Senator Snowe because of her vote in favor of the draft bill in the Finance Committee on October 15, however she explicitly stated that this did not mean she would support the final bill.[75] Paul Kirk was appointed as Senator Kennedy's temporary replacement on September 24.

Following the Finance Committee vote, negotiations turned to the demands of moderate Democrats to finalize their support, whose votes would be necessary to break the Republican filibuster. Majority leader Harry Reid focused on satisfying the centrist members of the Democratic caucus until the holdouts narrowed down to Joe Lieberman of Connecticut, an independent who caucused with Democrats, and Ben Nelson of Nebraska. Lieberman, despite intense negotiations in search of a compromise by Reid, refused to support a public option; a concession granted only after Lieberman agreed to commit to voting for the bill if the provision was not included,[75][92] even though it had majority support in Congress.[93] There was debate among supporters of the bill about the importance of the public option,[94] although the vast majority of supporters concluded that it was a minor part of the reform overall,[92] and that congressional Democrats' fight for it won various concessions, including conditional waivers allowing states to set up state-based public options such as Vermont's Green Mountain Care.[93][95]

With every other Democrat now in favor and every other Republican now overtly opposed, the White House and Reid moved on to addressing Senator Nelson's concerns in order to win filibuster-proof support for the bill;[96] they had by this point concluded that "it was a waste of time dealing with [Snowe]"[97] because, after her vote for the draft bill in the Finance Committee, Snowe had come under intense pressure from the Republican Senate leadership who opposed reform.[98] After a final 13-hour negotiation, Nelson's support for the bill was won after two concessions: a compromise on abortion, modifying the language of the bill "to give states the right to prohibit coverage of abortion within their own insurance exchanges," which would require consumers to pay for the procedure out-of-pocket if the state so decided; and an amendment to offer a higher rate of Medicaid reimbursement for Nebraska.[70][99] The latter half of the compromise was derisively referred to as the "Cornhusker Kickback"[100] and was later repealed by the subsequent reconciliation amendment bill.

On December 23, the Senate voted 60–39 to end debate on the bill: a cloture vote to end the filibuster by opponents. The bill then passed by a vote of 60–39 on December 24, 2009, with all Democrats and two independents voting for, and all Republicans voting against (except for Jim Bunning, who did not vote).[101] The bill was endorsed by the AMA and AARP.[102]

Several weeks after the vote, on January 19, 2010, Massachusetts Republican Scott Brown was elected to the Senate in a special election to replace the late Ted Kennedy, having campaigned on giving the Republican minority the 41st vote needed to sustain filibusters, even signing autographs as "Scott 41."[70][103][104] The special election had become significant to the reform debate because of its effects on the legislative process. The first was a psychological one: the symbolic importance of losing the traditionally Democratic Massachusetts seat formerly held by Ted Kennedy, a staunch support of reform, made many congressional Democrats concerned about the political cost of passing a bill.[105][106] The second effect was more practical: the loss of the Democratic supermajority complicated the legislative strategy of reform proponents.[106]

House

The election of Scott Brown meant Democrats could no longer break a filibuster in the Senate. In response, White House Chief of Staff Rahm Emanuel argued the Democrats should scale back for a less ambitious bill; House Speaker Nancy Pelosi pushed back, dismissing Emanuel's scaled-down approach as "Kiddie Care."[107][108] Obama also remained insistent on comprehensive reform, and the news that Anthem Blue Cross in California intended to raise premium rates for its patients by as much as 39% gave him a new line of argument to reassure nervous Democrats after Scott Brown's win.[107][108] On February 22 Obama laid out a "Senate-leaning" proposal to consolidate the bills.[109] He also held a meeting, on February 25, with leaders of both parties urging passage of a reform bill.[70] The summit proved successful in shifting the political narrative away from the Massachusetts loss back to healthcare policy.[108]

With Democrats having lost a filibuster-proof supermajority in the Senate but having already passed the Senate bill with 60 votes on December 24, the most viable option for the proponents of comprehensive reform was for the House to abandon its own health reform bill, the Affordable Health Care for America Act, and pass the Senate's bill, the Patient Protection and Affordable Care Act, instead. Various health policy experts encouraged the House to pass the Senate version of the bill.[110] However, House Democrats were not happy with the content of the Senate bill and had expected to be able to negotiate changes in a House-Senate conference before passing a final bill.[106] With that option off the table, as any bill that emerged from conference that differed from the Senate bill would have to be passed in the Senate over another Republican filibuster, most House Democrats agreed to pass the Senate bill on condition that it be amended by a subsequent bill.[106] They drafted the Health Care and Education Reconciliation Act, which could be passed via the reconciliation process.[107][111][112] Unlike rules under regular order, as per the Congressional Budget Act of 1974, reconciliation cannot be subject to a filibuster. However, the process is limited to budget changes, which is why the procedure was never able to be used to pass a comprehensive reform bill like the ACA in the first place; such a bill would have inherently non-budgetary regulations.[113][114] Whereas the already passed Senate bill could not have been put through reconciliation, most of House Democrats' demands were budgetary: "these changes—higher subsidy levels, different kinds of taxes to pay for them, nixing the Nebraska Medicaid deal—mainly involve taxes and spending. In other words, they're exactly the kinds of policies that are well-suited for reconciliation."[111]

The remaining obstacle was a pivotal group of pro-life Democrats led by Bart Stupak who were initially reluctant to support the bill. The group found the possibility of federal funding for abortion substantive enough to warrant opposition. The Senate bill had not included language that satisfied their abortion concerns, but they could not include additional such language in the reconciliation bill as it would be outside the scope of the process with its budgetary limits. Instead, President Obama issued Executive Order 13535, reaffirming the principles in the Hyde Amendment.[115] This concession won the support of Stupak and members of his group and assured passage of the bill.[112][116] The House passed the Senate bill with a 219–212 vote on March 21, 2010, with 34 Democrats and all 178 Republicans voting against it.[117] The following day, Republicans introduced legislation to repeal the bill.[118] Obama signed the ACA into law on March 23, 2010.[119] The amendment bill, The Health Care and Education Reconciliation Act, was also passed by the House on March 21, by the Senate via reconciliation on March 25, and was signed by President Obama on March 30.

Impact

Public policy

Change in number of uninsured

The ACA has two primary mechanisms for increasing insurance coverage: expanding Medicaid eligibility to include individuals within 138% of the federal poverty level,[44] and creating state-based insurance exchanges where individuals and small business can buy health insurance plans—those individuals with incomes between 100% and 400% of the federal poverty level will be eligible for subsidies to do so.[39][31] The CBO originally estimated that the legislation will reduce the number of uninsured residents by 32 million, leaving 23 million uninsured residents in 2019 after the bill's provisions have all taken effect.[120][121] With the elderly covered by Medicare, the CBO estimate projected that the law would raise the proportion of insured non-elderly citizens from 83% to 94%.[120] A July 2012 CBO estimate raised the expected number of uninsured by 3 million, reflecting the successful legal challenge to the ACA's expansion of Medicaid.[122][123]

Among the people who will remain uninsured:

- Illegal immigrants, estimated at around 8 million—or roughly a third of the 23 million projection—will be ineligible for insurance subsidies and Medicaid.[120][124][125] They will also be exempt from the health insurance mandate but will remain eligible for emergency services under provisions in the 1986 Emergency Medical Treatment and Active Labor Act (EMTALA).

- Citizens not enrolled in Medicaid despite being eligible.[126]

- Citizens not otherwise covered and opting to pay the annual penalty instead of purchasing insurance, mostly younger and single Americans.[126]

- Citizens whose insurance coverage would cost more than 8% of household income and are exempt from paying the annual penalty.[126]

- Citizens who live in states that opt out of the Medicaid expansion and who qualify for neither existing Medicaid coverage nor subsidized coverage through the states' new insurance exchanges.[123]

ACA drafters believed that increasing insurance coverage would not only improve quality of life but also help reduce medical bankruptcies (currently the leading cause of bankruptcy in America[127]) and job lock.[128] In addition, many believed that expanding coverage would help ensure that the cost controls successfully function; healthcare providers could more easily adapt to payment system reforms that incentivize value over quantity if their costs were partially offset—for example, hospitals having to do less charity care or insurers having larger and more stable risk pools to distribute costs over.[129]

Due to the new regulations of guaranteed issue, and allowing children to be included on their parents' plans until age 26, several insurance companies announced that they would stop issuing new child-only policies.[130][131][132] However, because children would now be covered by their parents' plans, the Census Bureau found that the number of uninsured 19- to 25-year-olds had declined by 1.6% or 393,000 people by 2011.[133] Starting January 1, 2014, state health insurance exchanges will be required to offer a child-only coverage option, and Medicaid eligibility will be made available to 16 million individuals with incomes below 133% of the federal poverty level.[134]

Under the law, those workers whose employers offer "affordable coverage" will not be eligible for subsidies in the exchanges. To be eligible, per the law's definition, the cost of employer-based health insurance must exceed 9.5% of the worker’s household income. In January 2013 the Internal Revenue Service ruled that only the cost of covering the individual employee would be considered in determining whether the cost of coverage exceeded 9.5% of income. However, the cost of a family plan is often higher, but the ruling means that those higher costs will not be considered even if the extra premiums push the cost of coverage above the 9.5% income threshold. The New York Times said this could leave 2–4 million Americans unable to afford family coverage under their employers’ plans and ineligible for subsidies to buy coverage elsewhere.[135][136]

Insurance exchanges and the individual mandate

The Act establishes state-based health insurance exchanges. The exchanges are regulated, online marketplaces, administered by either federal or state government, where individuals and small business can purchase private insurance plans starting October 1, 2013, with coverage beginning January 1, 2014.[31][137][138] Individuals with incomes between 100% and 400% of the federal poverty level who purchase insurance plans via an exchange will be eligible to receive federal subsidies to help pay premium costs.[39][30]

The exchanges will take the form of websites where the private plans allowed on sale within them will be regulated and comparable: Consumers will be able to visit these websites or ring a call center, compare the plans on offer, fill out a form to the government that will be used to determine their eligibility for subsidies, and then purchase the insurance of their choice from the options available during limited open enrollment periods.[139] The first open enrollment period will last from October 1, 2013 to March 31, 2014, after which time uninsured individuals generally may not purchase insurance through an exchange until the following open enrollment period. In subsequent years, the open enrollment period will start on October 15 and end on December 7.[37][38] Despite some controversy, Members of Congress and their staff will participate in this system: they are required to obtain health insurance through the exchanges or plans otherwise approved by the bill (such as Medicare) instead of the Federal Employees Health Benefits Program that they currently use.[140]

The insurance exchanges are a method designed to create a market for private insurance in a way that addresses market failures in the current system (such as the high number of uninsured, medical bankruptcies, coverage limits, unaffordability, and inflation)[141] through regulations:[142][92] Only approved plans that meet certain standards will be allowed to be sold on the exchanges, and insurers will be prohibited from denying insurance to consumers on the basis of pre-existing conditions.[19][20] Several methods will be employed to make these plans affordable: Subsidies will be provided to those eligible.[39][42] Regulations intended to reduce prices through competition will make plans and prices more transparent and price comparisons more accessible for consumers with online information;[143][144][145] and federally approved, multi-state plans will be phased-into state exchanges[146] to help guarantee enough options.[147] And price regulations will be implemented, including a minimum medical loss ratio,[148] and partial community rating that prevents price discrimination from pricing individuals out of the market through unaffordable plans or premium increases on the insured[149]—namely poor and sick individuals who are more expensive to cover for insurers motivated either by profit maximization and/or the economics of insurance; specifically, the risk of an insurance pool not providing enough net-premiums to offset net-pay-outs.[150]

These regulations are enabled to function due to the individual mandate[27]—the requirement to buy insurance or pay a penalty—and the limits on open enrollment,[151][38] without which healthy people might put-off insuring themselves until they got sick. In such a situation, insurers would have to raise their premiums to afford the remaining (relatively sicker and thus more expensive) population,[27][152][153] which could create a vicious cycle in which more and more people drop their coverage—a result known as an insurance death spiral.[154] Alternatively, the process could settle at a stable equilibrium relying on relatively high premiums for the insured and less coverage (and thus more illness and medical bankruptcy) for the uninsured.[152][155] Either way, the absence of the mandate would likely cause the exchanges as a whole to malfunction, and ultimately perform similarly to the current private insurance market,[156][157] as studies by the CBO, Jonathan Gruber, and Rand Health have concluded.[158][159][160] Conversely, the inclusion of the mandate increases the size and diversity of the insured population, broadening the risk pool to spread the cost of insurance in a sustainable manner.[161] Policy experience in New Jersey on the one hand and Massachusetts on the other offers evidence of such divergent outcomes.[159][162] In September 2012, the Congressional Budget Office estimated that nearly six million will pay the penalty in 2016.[163][164]

Under the law, setting up an exchange gives a state partial discretion on standards and prices of insurance, aside from those specifics set-out in the ACA.[166][167] For example, those administering the exchange will be able to determine which plans are sold on or excluded from the exchanges, and adjust (through limits on and negotiations with private insurers) the prices on offer. They will also be able to impose higher or state-specific coverage requirements—including whether plans offered in the state are prohibited from covering abortion (making the procedure an out-of-pocket expense) or mandated to cover abortions that a physician determines is medically necessary; in either case, federal subsidies are prohibited from being used to fund the procedure.[168] If a state does not set up an exchange itself, they lose that discretion, and the responsibility to set up exchanges for such states defaults to the federal government, whereby the Department of Health and Human Services assumes the authority and legal obligation to operate all functions in these federally facilitated exchanges.[166] As of May 2013, 23 states and the District of Columbia plan to operate state-based exchanges themselves, seven of which will do so in partnership with the federal government—an arrangement where they retain discretionary management but the federal government executes various functions. The remaining 27 states default to federally facilitated exchanges.[165]

The law is also designed to be flexible by allowing states, from 2017 onwards, to apply for a "waiver for state innovation" from the federal government that allows them to experiment with their own state-based system, on condition that it meets certain criteria.[169] To obtain a waiver, a state must pass legislation setting up an alternative health system that provides insurance at least as comprehensive and as affordable as that the ACA would, covers at least as many residents, and does not increase the federal deficit.[170] Provided a state meets these conditions; receiving a waiver can exempt states from some of the central requirements of the ACA, including the individual mandate, the provision of an insurance exchange, and the employer mandate.[171] The state would also receive compensation equal to the aggregate amount of any federal subsidies and tax credits for which its residents and employers would have been eligible under the ACA plan, if they cannot be paid out due to the structure of the state plan.[169] So far, only Vermont, in May 2011, has enacted an alternative plan—a state-based single-payer system for which they intend to pursue a waiver to implement.[172][173][174]

Change in insurance standards

The ACA includes regulations that set standards for insurance,[22] some specified in the law, others subsequently established by the Secretary of Health and Human Services. Among these new standards are a ban on the ability to drop policyholders if they become sick,[175] a ban on price discrimination on the basis of pre-existing conditions or sex through a partial community rating,[176] and allowing children and dependents to remain on their parents' insurance plan until their 26th birthday.[177][178]

Under the law's authorization, Secretary of Health Kathleen Sebelius issued a set of defined "essential health benefits"[23] that all new insurance plans have to include. Insurers will be prohibited from imposing annual or lifetime coverage caps on these essential benefits.[175][179] These cover: "ambulatory patient services; emergency services; hospitalization; maternity and newborn care; mental health and substance use disorder services, including behavioral health treatment; prescription drugs; rehabilitative and habilitative services and devices; laboratory services; preventive and wellness services and chronic disease management; and pediatric services, including oral and vision care."[180][181] In determining what qualified as an essential benefit, the law required that the scope of standard benefits should equal that of a "typical employer plan".[180] States have some discretion in determining what should be considered the benchmark plan within the requirements of the law, and may include services beyond those set out by the Secretary.[182]

Among the essential health benefits, preventive care, childhood immunizations and adult vaccinations, and medical screenings will be covered by an insurance plan's premiums, and have co-payments, co-insurance, and deductibles eliminated.[183][184] Specific examples of such services covered include: mammograms and colonoscopies, wellness visits, gestational diabetes screening, HPV testing, STI counseling, HIV screening and counseling, FDA-approved contraceptive methods, breastfeeding support and supplies, and domestic violence screening and counseling.[185]

In addition, the law establishes four tiers of coverage: bronze, silver, gold, and platinum. All categories offer the same set of essential health benefits. What the categories specify is the division of premiums and out-of-pocket costs: bronze plans will have the lowest monthly premiums and higher out-of-pocket costs, and vice versa for platinum plans.[180][186] The percentages of care that plans are expected to cover through premiums (as opposed to out-of-pocket costs) are, on average: 60% (bronze), 70% (silver), 80% (gold), and 90% (platinum).[187]

Insurers are required to implement an appeals process for coverage determination and claims on all new plans.[175] They are also required to spend at least 80–85% of premium dollars on health costs and claims instead of administrative costs and profits; rebates must be issued to policyholders if this is violated.[188][189]

Coverage for contraceptives

One provision in the law is the contraceptive coverage mandate that applies to all employers and educational institutions except for religious organizations.[190][191] These regulations were included on the recommendations of the Institute of Medicine, which concluded that access to contraception is medically necessary "to ensure women's health and well-being."[192][193]

The initial regulations proved controversial among Catholic hospitals, Catholic Charities, Catholic universities, and other enterprises owned or controlled by Catholic organizations that oppose contraception on doctrinal grounds.[194] To accommodate those concerns while still guaranteeing access to contraception, the regulations were adjusted to "allow religious organizations to opt out of the requirement to include birth control coverage in their employee insurance plans. In those instances, the insurers themselves will offer contraception coverage to enrollees directly, at no additional cost."[195]

Several studies on insurance premiums expect that with the subsidies offered under the ACA, more people will pay less (than they did prior to the reforms) than those who will pay more, and that those premiums will be more stable (even in changing health circumstances) and transparent, thanks to the regulations on insurance.[196][197][198] The Kaiser Family Foundation has calculated that about half the people who currently buy insurance on their own today will be eligible for subsidies. Among those receiving subsidies (which excludes those with incomes above four times the poverty line—about $46,000 for individuals or $94,000 for a family of four), the subsidies are projected to be worth an average of $5,548 per household, which would effectively discount the projected price of insurance by two-thirds, on average.[199] For individuals, NPR and the Kaiser Family Foundation collaborated to produce a quick online calculator for people to estimate their premiums and subsidy amount, based on where they live, income, and family size.[198]

For the effect on health insurance premiums, the CBO forecast that by 2016 the individual market would comprise 17% of the market, and that premiums per person would increase by 10% to 13% but that over half of these individuals would receive subsidies that would decrease the premium paid to "well below" premiums charged under current law.[200][201] It also forecast that for the small group market, 13% of the market, premiums would be impacted 1% to −3% and −8% to −11% for those receiving subsidies; for the large group market comprising 70% of the market, premiums would be impacted 0% to −3%, with those under high premium plans subject to excise taxes being charged −9% to −12% less. The analysis was affected by various factors, including increased benefits particularly for the individual market, more healthy policyholders due to the mandate, administrative efficiencies related to the health exchanges, and high-premium insurance plans reducing some benefits in response to the tax.[201] As of September 2013, the final projections of the average monthly premium scheduled to be offered in the exchanges came in below CBO expectations, reducing expected costs not only for consumers but also for the government by reducing the overall cost of the subsidies.[202][203][204][205]

The Associated Press reported that, as a result of ACA's provisions concerning the Medicare Part D coverage gap (between the "initial coverage limit" and the "catastrophic coverage threshold" in the prescription drug program), individuals falling in this "donut hole" would save about 40 percent.[206] Almost all of the savings came because, with regard to brand-name drugs, ACA secured a discount from pharmaceutical companies.[206] The change benefited more than two million people, most of them in the middle class.[206]

Larry Levitt, a health policy analyst from the Kaiser Family Foundation, noted that the individual market compromises a relatively small share of those under 65, and said, in contrast, "I don't think anyone expects significant [cost] increases in the employer market," where the majority of Americans get their health insurance. Secretary of Health and Human Services Kathleen Sebelius also indicated that some cost increase in the individual market was expected because the standard of insurance allowed in the insurance exchanges would be higher quality than that generally available currently (and thus more expensive), and that the government subsidies provided to make insurance affordable are intended to more than offset this effect.[207]

In June 2013, a study by the Kaiser Family Foundation focused on actual experience under the Act as it affected individual market consumers (those buying insurance on their own). The study found that the Medical Loss Ratio provision of the Act had saved this group of consumers $1.2 billion in 2011 and $2.1 billion in 2012, reducing their 2012 costs by 7.5%.[148] The bulk of the savings were in reduced premiums for individual insurance, but some came from premium rebates paid to consumers by insurance companies that had failed to meet the requirements of the Act.

Healthcare cost inflation

In a May 2010 presentation on "Health Costs and the Federal Budget", CBO stated:

Rising health costs will put tremendous pressure on the federal budget during the next few decades and beyond. In CBO's judgment, the health legislation enacted earlier this year does not substantially diminish that pressure.

CBO further observed that "a substantial share of current spending on health care contributes little if anything to people's health" and concluded, "Putting the federal budget on a sustainable path would almost certainly require a significant reduction in the growth of federal health spending relative to current law (including this year's health legislation)."[208]

Jonathan Cohn, a noted health policy analyst, commented that:

CBO doesn't produce estimates of how reform will affect overall health care spending—that is, the amount of money our society, as a whole, will devote to health care. But the official actuary for Medicare does. The actuary determined that... the long-term trend is towards less spending: Inflation after ten years would be lower than it is now. And it's the long-term trend that matters most... [The Affordable Care Act] will reduce the cost of care—not by a lot and not by as much as possible in theory, but as much as is possible in this political universe.[209]

He and fellow The New Republic editor Noam Scheiber further noted the CBO did not include in its estimate various cost-saving provisions intended to reduce health inflation.[210] They also noted the CBO has a history of consistently underestimating the impact of health legislation.[211]

Jonathan Gruber, an influential consultant who helped develop both the ACA and the Massachusetts healthcare reform that preceded it, acknowledges that the ACA is not guaranteed to significantly "bend the curve" of rising healthcare costs:[212]

The real question is how far the ACA will go in slowing cost growth. Here, there is great uncertainty—mostly because there is such uncertainty in general about how to control cost growth in health care. There is no shortage of good ideas for ways of doing so... There is, however, a shortage of evidence regarding which approaches will actually work—and therefore no consensus on which path is best to follow. In the face of such uncertainty, the ACA pursued the path of considering a range of different approaches to controlling health care costs... Whether these policies by themselves can fully solve the long run health care cost problem in the United States is doubtful. They may, however, provide a first step towards controlling costs—and understanding what does and does not work to do so more broadly.[213]

The law created the Center for Medicare and Medicaid Innovation and requires numerous pilot programs and demonstrations that may affect healthcare costs.[214] Although these cost reductions have not been factored into CBO cost estimates, the experiments cover nearly every idea healthcare experts advocate except tort reform.[215]

The Business Roundtable, an association of CEOs, commissioned a report from the consulting company Hewitt Associates that found that the legislation "could potentially reduce that trend line by more than $3,000 per employee, to $25,435" with respect to insurance premiums. It also stated that the legislation "could potentially reduce the rate of future health care cost increases by 15% to 20% when fully phased in by 2019". The group cautioned that this is all assuming that the cost-saving government pilot programs both succeed and then are wholly copied by the private market, which is uncertain.[216]

The Centers for Medicare and Medicaid Services reported in 2013 that, while costs per capita continue to rise, the rate of increase in annual healthcare costs has fallen since 2002. Per capita cost increases have averaged 5.4% annually since 2000. Costs relative to GDP, which had been rising, have stagnated since 2009.[217] Several studies have attempted to explain the reduction in the rate of annual increase. Reasons include, among others:

- Higher unemployment due to the 2008-2010 recession, which has limited the ability of consumers to purchase healthcare;

- Out-of-pocket payments, and deductibles, which constitute the amount an individual pays for their health costs before insurance begins to cover claims, have risen. These rising costs generally cause less consumption of healthcare services.[218] The proportion of workers with employer-sponsored health insurance that requires a deductible has climbed to about three-quarters in 2012 from about half in 2006.[219][220]

- Structural changes[219] in the healthcare system made by the ACA that aim to shift the healthcare system from paying-for-quantity to paying-for-quality. Examples include incentives to reduce hospital infections and to use electronic medical records, accountable care organizations, and bundled payments to coordinate care and prioritize quality over quantity.[221] Some of these changes have occurred due to healthcare providers acting in anticipation of future implementation of reforms.[222]

Uncertainty exists about the extent to which each factor is responsible for the recent reduction in health inflation, and about the durability of the overall trend, including the accompanying reduction in long-term deficit projections due to reduced healthcare costs. However, several studies have found that the temporary effects of the recession cannot account for the entirety of the slowdown and that structural changes likely share at least partial credit.[219][223][224] One study estimated that the changes to the health system are responsible for about a quarter of the recent reduction in inflation.[225] Even if the cost controls succeed in reducing the amount spent on healthcare, such efforts on their own may be insufficient to outweigh the long-term burden placed by demographic changes, particularly the growth of the population on Medicare.[226]

Federal deficit

CBO estimates of impact on deficit

The 2011 comprehensive CBO estimate projected a net deficit reduction of more than $200 billion during the 2012–2021 period:[227][228] it calculated the law would result in $604 billion in total outlays (expenditure) offset by $813 billion in total receipts (revenue), resulting in a $210 billion net reduction in the deficit.[227] The CBO separately noted that while most of the spending provisions do not begin until 2014,[229][230] revenue will still exceed spending in those subsequent years.[231] CBO also stated that the bill would "substantially reduce the growth of Medicare's payment rates for most services; impose an excise tax on insurance plans with relatively high premiums; and make various other changes to the federal tax code, Medicare, Medicaid, and other programs"[200]—ultimately extending the solvency of the Medicare trust fund by 8 years.[232]

However, this estimate was made prior to the Supreme Court's ruling on the ACA, which enabled states to opt out of the Medicaid expansion, thereby forgoing the federal funding. The CBO and JCT subsequently updated the budget projection, estimating the impact of the ruling would reduce the cost estimate of the insurance coverage provisions by $84 billion.[121][233][234]

Major sources of deficit reduction include:[183] higher Medicare taxes on the wealthy; new annual fees on health insurance providers; similar fees on the healthcare industry such as manufacturers and importers of brand-name pharmaceutical drugs and certain medical devices; limits on tax deductions of medical expenses and flexible spending accounts; a new 40% excise tax on "Cadillac" insurance policies - plans with annual insurance premiums in excess of $10,200 for an individual or $27,500 for a family; revenue from mandate penalty payments; a 10% federal sales tax on indoor tanning services; and spending offsets such as a reduction in Medicare reimbursements to insurers and drug companies for private Medicare Advantage policies that the Government Accountability Office and Medicare Payment Advisory Commission found to be overpaid (relative to government Medicare); and reductions in Medicare reimbursements to hospitals that do not meet standards of efficiency and care.

Although the CBO generally does not provide cost estimates beyond the 10-year budget projection period (because of the degree of uncertainty involved in the projection) it decided to do so in this case at the request of lawmakers, and estimated a second decade deficit reduction of $1.2 trillion.[200][235] CBO predicted deficit reduction around a broad range of one-half percent of GDP over the 2020s while cautioning that "a wide range of changes could occur".[236]

A commonly heard criticism of the CBO cost estimates is that CBO was required to exclude from its initial estimates the effects of likely "doc fix" legislation that would increase Medicare payments by more than $200 billion from 2010 to 2019.[237][238][239] However, the doc fix remains a separate issue that would have existed whether or not the ACA became law - omitting its cost from the ACA is no different than omitting the cost of the Bush tax cuts.[240][241][242]

Opinions on CBO projections

There was mixed opinion about the CBO estimates. Uwe Reinhardt, a health economist at Princeton, wrote that "The rigid, artificial rules under which the Congressional Budget Office must score proposed legislation unfortunately cannot produce the best unbiased forecasts of the likely fiscal impact of any legislation", but went on to say "But even if the budget office errs significantly in its conclusion that the bill would actually help reduce the future federal deficit, I doubt that the financing of this bill will be anywhere near as fiscally irresponsible as was the financing of the Medicare Modernization Act of 2003."[243]

Douglas Holtz-Eakin, CBO director during the George W. Bush administration, who later served as the chief economic policy adviser to U.S. Senator John McCain's 2008 presidential campaign, alleged that the bill would increase the deficit by $562 billion because, he argued, it front-loaded revenue and back-loaded benefits.[244]

The New Republic editors Noam Scheiber (an economist) and Jonathan Cohn (a healthcare policy analyst), countered critical assessments of the law's deficit impact, arguing that it is as likely, if not more so, for predictions to have underestimated deficit reduction than to have overestimated it. They noted that it is easier, for example, to account for the cost of definite levels of subsidies to specified numbers of people than account for savings from preventive healthcare, and that the CBO has a track record of consistently overestimating the costs of, and underestimating the savings of health legislation;[210][211] "innovations in the delivery of medical care, like greater use of electronic medical records[245] and financial incentives for more coordination of care among doctors, would produce substantial savings while also slowing the relentless climb of medical expenses... But the CBO would not consider such savings in its calculations, because the innovations hadn't really been tried on such large scale or in concert with one another—and that meant there wasn't much hard data to prove the savings would materialize."[210]

David Walker, former U.S. Comptroller General now working for The Peter G. Peterson Foundation, has stated that the CBO estimates are not likely to be accurate, because they are based on the assumption that Congress is going to do everything they say they're going to do.[246] The Center on Budget and Policy Priorities objected: in its analysis, Congress has a good record of implementing Medicare savings. According to their study, Congress followed through on the implementation of the vast majority of provisions enacted in the past 20 years to produce Medicare savings.[247][248]

Employer mandate and part-time working hours

- Not to be confused with the individual mandate[249][250]

The employer mandate is a penalty that will be incurred by employers with more than 50 employees, if they do not offer health insurance to their full-time workers.[251] This provision was included as a disincentive for employers considering dropping their current insurance plans once the insurance exchanges begin operating as an alternative source of insurance.[252] Proponents of the reform law wanted to address the parts of the healthcare system they believed to not be working well, while causing minimal disruption to those happy with the coverage they have, and the employer mandate was a part of this attempt.[253][252] Lawmakers recognized that approximately 80% of Americans already have insurance, of whom 54% are covered directly or indirectly through an employer (44% of the total population) and 29% (or 23% of the total population) are covered by the government, mainly though Medicare and Medicaid.[254][255] And 73% of the total population reported themselves satisfied with their insurance situation; however significant minorities, even among those that reported favorably, had medically related financial troubles and/or dissatisfaction with aspects of their insurance coverage, especially among the poor and sick.[253] The intent of the employer mandate (along with a grandfather clause in the ACA) is to help ensure that existing employer-sponsored insurance plans that people like will stay in place.

However, because a company will not face the penalty if it has less than 50 full-time employees, many are concerned that the employer mandate creates a perverse incentive for business to employ people part-time instead of full-time.[256][257] Several businesses and the State of Virginia have clarified the contracts of their part-time employees by adding a 29-hour a week cap,[258][259] to reflect the 30-hour threshold for full-time hours, as defined by the law.[251] As of yet, however, only a small percent of companies have shifted their workforce towards more part-time hours (4% in a survey from the Federal Reserve Bank of Minneapolis).[257] And labor market experts note that such shifts are not clearly attributable to the implementation of the ACA: pre-existing, long-term trends in working hours,[260] and the effects of the Great Recession correlate with part-time working hour patterns.[261][262] The impact of this provision on employer’s decision-making is partially offset by other factors: offering healthcare helps attract and retain employees, while increasing productivity and reducing absenteeism; and to trade a smaller full-time workforce for a larger part-time work force carries costs of training and administration for a business.[257][260][263] In addition, the amount of employers with over 50 employees is relatively small,[257] and over 90% of them already offer insurance,[264] so changes in employer plans from this provision are expected to be small.[256] Workers who do not receive insurance from an employer plan will still be able to purchase insurance on the exchanges.

Regardless of the political rationale of maintaining existing insurance arrangements for those happy with them, most policy analysts (on both the right and left) are critical of the employer mandate provision on the policy merits.[256][264] They argue that the perverse incentives regarding part-time hours, even if they do not change many existing insurance plans, are real and harmful; that the raised marginal cost of the 50th worker for businesses could limit companies’ growth; that the costs of reporting and administration—the paperwork for businesses and the state enforcement—are not worth the trade-off of incentivizing the maintenance of current employer plans; and note that the employer mandate, unlike the individual mandate, is a non-essential part of the law.[265][266][267][268][250] (At the same time, though, some analysts have noted that it is possible to design an employer mandate that partially avoids these problems, by instead taxing business that do not offer insurance by a percentage of their payroll, known as "pay-or-play", rather than using the 50-employee and 30-hour cut-offs).[256][265] Furthermore, many healthcare policy analysts think it would be better to transition away from the employer-based system to systems (whether state- or market-based) where insurance is more portable and stable, and hence think that it is a bad idea to even try to maintain existing employer insurance systems.[269] The effects of the provision have also generated vocal opposition from several business and unions.[266][270]

On July 2, 2013, the Obama Administration announced on the Treasury Department’s website that it would delay the implementation of the employer mandate for one year, until 2015.[264][271]

Political

Public opinion

Polls indicate support of healthcare reform in general, but became more negative in regards to specific plans during the legislative debate over 2009 and 2010, and the Act that was ultimately signed in 2010 remains controversial with opinions falling along party lines: Democrats favor the law, while Republicans and most Independents do not. Polling averages show a plurality with negative opinions of the law, with those in favor trailing by single digits.[272][273] USA Today found opinions were starkly divided by age, with a solid majority of seniors opposing the bill and a solid majority of those younger than 40 in favor.[274]

Specific elements are very popular across the political spectrum, with the notable exception of the mandate to purchase insurance. FiveThirtyEight, describing public opinion of the law, said, "while surveys have consistently found that a plurality of Americans have an overall negative view of the Affordable Care Act, they have just as consistently shown that large majorities of Americans favor individual elements of the law."[275][276] For example, a Reuters-Ipsos poll during June 2012 indicated the following:

- 44% of Americans supported the law, with 56% against. By party affiliation, 75% of Democrats, 27% of Independents, and 14% of Republicans favored the law overall.

- 82% favored banning insurance companies from denying coverage to people with pre-existing conditions.

- 61% favored allowing children to stay on their parents' insurance until age 26.

- 72% supported requiring companies with more than 50 employees to provide insurance for their employees.

- 39% supported the individual mandate to own insurance or pay a penalty. By party affiliation, 19% of Republicans, 27% of Independents, and 59% of Democrats favored the mandate.[277]

- Other polls showed additional provisions receiving majority support include: the creation of insurance exchanges, pooling small businesses and the uninsured with other consumers, so all can take advantage of large group pricing benefits (the community rating); and providing subsidies to individuals and families to make health insurance more affordable.[278][279]

- Other specific ideas that were not enacted but which showed majority support included importing prescription drugs from Canada (with its lower, government-controlled prices),[280] limiting malpractice awards, reducing the age to qualify for Medicare, and the Public health insurance option.[281]

Pollsters probed the reasons for opposition.[282] In a CNN poll, 62% of respondents said they thought the ACA would "increase the amount of money they personally spend on health care," 56% said the bill "gives the government too much involvement in health care," and only 19% said they thought they and their families would be better off with the legislation.[283] Other polls found that people were concerned that the law would cost more than projected, and would not do enough to control the cost of health care affecting their families.[284]

However, part of the opposition to the law is because some Americans believe the reform did not go far enough: A Reuters-Ipsos poll indicated that, for those opposed to the bill, 71% of Republican opponents reject it overall while 29% believed it did not go far enough; independent opponents were divided 67% to 33%; and among the relatively much smaller group of Democratic opponents, 49% reject it overall, and 51% wanted the measure to go further.[277]

Many Democrats believe that the ACA will grow more popular over time, like Medicare did after its implementation,[285] as the benefits of the law take effect and close the information gap about the contents of the bill.[275][276][286]

A majority of the public (52%–34%) indicate that they want "Congress to implement or tinker with the law rather than repeal it."[287] Following the Supreme Court decision upholding the Act, a poll released in July 2012 showed that "most Americans (56%) want to see critics of President Obama's health care law drop efforts to block it and move on to other national issues."[288]

Term "Obamacare"

The term "Obamacare" was originally coined by opponents, notably Mitt Romney in 2007, as a pejorative term. According to The New York Times, the term was first put in print in March 2007, when healthcare lobbyist Jeanne Schulte Scott penned it in a health industry journal. "We will soon see a 'Giuliani-care' and 'Obama-care' to go along with 'McCain-care,' 'Edwards-care,' and a totally revamped and remodeled 'Hillary-care' from the 1990s", Schulte Scott wrote.[2][289] The expression Obamacare first was used in early 2007 generally by writers describing the candidate’s proposal for expanding coverage for the uninsured according to research by Elspeth Reeve at The Atlantic magazine.[290] The word was first uttered in a political campaign by Mitt Romney in May 2007 in Des Moines, Iowa. Romney said: "In my state, I worked on healthcare for some time. We had half a million people without insurance, and I said, 'How can we get those people insured without raising taxes and without having government take over healthcare'. And let me tell you, if we don't do it, the Democrats will. If the Democrats do it, it will be socialized medicine; it'll be government-managed care. It'll be what's known as Hillarycare or Barack Obamacare, or whatever you want to call it."[2]

By mid-2012, Obamacare had become the most common colloquial term to refer to the law by both supporters and opponents, in contrast to the use of "Patient Protection and Affordable Care Act" or "Affordable Care Act" in more formal and official use.[290] Use of the term in a positive sense was suggested by Democratic politicians such as John Conyers.[291] President Obama endorsed the nickname, saying, "I have no problem with people saying Obama cares. I do care."[292] Because of the number of "Obamacare" search engine queries, the Department of Health and Human Services purchased Google advertisements, triggered by the term, to direct people to the official HHS site.[293] In March 2012, the Obama reelection campaign embraced the term "Obamacare", urging Obama's supporters to post Twitter messages that begin, "I like #Obamacare because...".[294] After its debut as a phrase on Capitol Hill, according to an analysis by the Sunlight Foundation, from July 2009 to June 2012 the term "Obamacare" was used nearly 3,000 times in congressional speeches.[2]

Myths

On August 7, 2009, Sarah Palin falsely claimed that the proposed legislation would create "death panels" that would decide if sick and elderly Americans were "worthy" of medical care.[295] By 2010, the Pew Research Center reported that 85% of Americans were familiar with the claim, and that 30% of Americans believed it was true, with three contemporaneous polls finding similar results.[296] The allegation was named PolitiFact's "Lie of the Year",[295][297] one of FactCheck's "whoppers",[298][299] and the most outrageous term by the American Dialect Society.[300] The AARP described such rumors as "rife with gross—and even cruel—distortions."[301] A poll in August 2012 found that 39% of Americans still believed the "death panels" claim.[302]

The "death panel" rumors and comparable myths distort two issues related to the ACA to claim that seniors can either be denied care due to their age under the law,[303] and/or that the government will advise them to end their own lives instead of receiving due care.[301] Such rumors first allude to the Independent Payment Advisory Board (IPAB), which has the authority to make cost-saving changes to the Medicare program by implementing the adoption of cost-effective treatments, and finding savings in administration of the program. However, the IPAB is also prohibited from limiting Medicare eligibility or coverage, or raising the costs on beneficiaries.[304] The other related issue concerns advance care planning consultation: a section of the House reform proposal would have reimbursed physicians for providing voluntary consultations of Medicare recipients on end-of-life health planning (which is also covered by many private plans), enabling patients to specify, on request, the kind of care they wish to receive in their old age.[305] As described by the site Snopes.com, "This provision would allow patients (if they so choose) to prepare for the day when they might be seriously ill and unable to make medical decisions for themselves by engaging in consultations with doctors to discuss the full range of end-of-life care options available to them, and to have the cost of such consultations covered by Medicare... [including] directives to accept or refuse extreme life-saving measures, selection of hospice care programs, appointment of relatives" to act on the patient's behalf, etc.[301] However, due to the public concern, this provision was not included in the final draft of the bill that was enacted into law.[306]

Two other prominent myths about the ACA are that Congress is "exempt" from the reforms, and that illegal immigrants will receive free healthcare under the law. Both claims are false. The ACA requires that members of Congress and their staffs obtain health insurance either through an exchange or some other program approved by the law (such as Medicare), instead of using the current government program (the Federal Employees Health Benefits Program); and the federal government will, like large private employers, maintain its contributions to the new health insurance plans of federal employees.[140][307][308][309][310] The other rumor, regarding illegal immigrants, most notably circulated by Rep. Joe Wilson, is also untrue, as the law explicitly denies insurance subsidies to "unauthorized (illegal) aliens".[311][124]

In 2010, more false rumors spread on the Internet, claiming that the bill would require all Americans or those covered by public insurance to have a microchip implanted.[312] These were sometimes associated with the number of the beast in Christian eschatology.[313] These rumors echo similar "Big Brother" conspiracy myths, and in this case were based on language in draft bills of the law "which would allow the Department of Health and Human Services to collect data about medical devices 'used in or on a patient' (such as pacemakers or hip replacements) for purposes that included tracking the effectiveness of such devices and facilitating the distribution of manufacturer recall notices".[312] These provisions did not mandate or authorize the government to implant devices in patients, and were not included in the final bill that became law.[312]

Opposition and resistance

Efforts to oppose, undermine, and repeal the legislation have drawn support from prominent conservative advocacy groups, Congressional and many State Republicans, certain small business organizations, and the Tea Party movement.[314] These groups believe the law will lead to disruption of existing health plans, increased costs from new insurance standards, and that it will increase the deficit.[315] Some also are against the idea of universal healthcare, viewing insurance as similar to other commodities to which people are not entitled.[316][317]

Legal challenges

Opponents of the Patient Protection and Affordable Care Act turned to the federal courts to challenge the constitutionality of the legislation.[318][319] In National Federation of Independent Business v. Sebelius, decided on June 28, 2012, the Supreme Court upheld most of the law: It ruled on a 5–4 vote that the individual mandate is constitutional on the basis that it is a tax rather than being authorized by the Commerce Clause but determined that states could not be forced to participate in the Medicaid expansion, effectively allowing states to opt out of this provision. As written, the ACA withheld all Medicaid funding from states declining to participate in the expansion. However, the Supreme Court ruled that this withdrawal of funding was unconstitutionally coercive and that individual states had the right to opt out of the Medicaid expansion without losing pre-existing Medicaid funding from the federal government. All provisions of ACA will continue in effect or will take effect as scheduled subject to the states' determination on Medicaid expansion.[320]

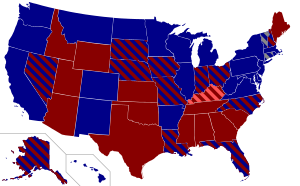

State rejections of Medicaid expansion

Following the Supreme Court ruling in NFIB v. Sebelius, several states with legislatures or governorships controlled by Republicans have opted to reject the expanded Medicaid coverage provided for by the Act. Over half of the national uninsured population lives in those states.[322] As of September 2013, with the addition of Michigan,[323] 25 states and the District of Columbia have adopted the Medicaid expansion; a few states remain undecided.[321][324][325] States that decline to expand Medicaid before 2014 may choose to opt in at a later time.[326]

The drafters of the ACA had intended for Medicaid to cover individuals and families with incomes up to 133% (138% under effective definitions of income[327]) of the poverty level by expanding Medicaid eligibility and simplifying the CHIP enrollment process. Low-income individuals and families above 100% and up to 400% of the federal poverty level will receive federal subsidies[39] on a sliding scale if they choose to purchase insurance via an exchange. For example, individuals with incomes between 133% and 150% of the poverty level would be subsidized such that their premium cost would be 3% to 4% of their income.[40]

However, the Supreme Court ruling created the potential for a coverage gap. States that choose to reject the Medicaid expansion can maintain the pre-existing Medicaid eligibility thresholds they have set, which in many states are significantly below 133% of the poverty line for most individuals. Furthermore, many states do not make Medicaid available to childless adults at any income level. Because subsidies on insurance plans purchased through exchanges are not available to those below 100% of the poverty line, this will create a coverage gap in those states between the state Medicaid threshold and the subsidy eligibility threshold.[328][329][330][331] For example, in Kansas, where only those able-bodied adults with children and with an income below 32% of the poverty line are eligible for Medicaid, those with incomes from 32% to 100% of the poverty level ($6,250 to $19,530 for a family of three) would be ineligible for both Medicaid and federal subsidies to buy insurance. If they have no children, able-bodied adults are not eligible for Medicaid in Kansas.[322] Studies of the impact of state decisions to reject the Medicaid expansion, as of July 2013, calculate that up to 6.4 million Americans could fall into this coverage gap.[332]

For states that do expand Medicaid, the law provides that the federal government will pay for 100% of the expansion for the first three years and then gradually reduce its subsidy to 90% by 2020.[326] Several opposing states argue that the 10% of the funding of the expansion that they will be responsible for will be too much for their states' budgets.[326][333] However, studies suggest that rejecting the expansion will cost states more than expanding Medicaid due to increased spending on uncompensated emergency care that otherwise would have been partially paid for by Medicaid coverage.[334]

Noncooperation