Laissez-faire

| Part of a series on |

| Economic systems |

|---|

|

Major types

|

Laissez-faire (pronunciation: French, ; English, ) is a French phrase literally meaning "Let do." From the French diction first used by the eighteenth century physiocrats as an injunction against government interference with trade, it became used as a synonym for 19th-century capitalism. Laissez-faire capitalism was the economic system before the Progressive Era[2] and the Keynesian revolution.[3] It is generally understood to be a doctrine that maintains that private initiative and production are best allowed a minimal of economic interventionism and taxation by the state beyond what is necessary to maintain individual liberty, peace, security, and property rights.[4]

Laissez-faire capitalism is supported by proponents of libertarianism, classical liberalism, neoliberalism, minarchism, Conservativism and Objectivism. Libertarians argue that the free market produces greater prosperity and personal freedom than other economic systems. The Austrian School of economics and the Chicago School of economics are important figures supporting of laissez-faire economics. Market anarchists take the idea of laissez-faire to its extreme by opposing all compulsory state intervention including taxation, preferring that law and order be privately funded.

Origins of the term

The exact origins of the term "laissez-faire" as a slogan of economic liberalism are uncertain. According to historical folklore, the phrase stems from a meeting c. 1680 between the powerful French finance minister Jean-Baptiste Colbert and a group of French businessmen led by a certain M. Le Gendre. When the eager mercantilist minister asked how the French state could be of service to the merchants, Le Gendre replied simply "Laissez-nous faire" ('Leave us be', lit. 'Let us do').[5]

The laissez faire slogan became closely associated with Vincent de Gournay, a French intendant of commerce in the 1750s and ardent proponent of the removal of restrictions on trade and the deregulation of industry in France, and a mentor of the later Physiocrats. Gournay was delighted by the LeGendre anecdote, and forged it into a larger maxim all his own: "Laissez faire et laissez passer, le monde va de lui même!" ('Let do and let pass, the world goes on by itself!'). Although Gournay left no written tracts on his economic policy ideas, his immense personal influence on the thinking of his contemporaries, notably the Physiocrats, is generously acknowledged in their testimonies. Among others, Jacques Turgot,Tyler Caron, the Marquis de Mirabeau, the Comte d'Albon and, most insistently, DuPont de Nemours credit both the 'laissez-faire' slogan and doctrine to Gournay. [6]

The honour of the first recorded use of the 'laissez faire' maxim goes to the contemporary French minister Rene de Voyer, Marquis d'Argenson, another champion of free trade. [7] However, there is little dispute that it was Gournay who gave the maxim its vogue - or at least it was persistently ascribed to him by the Physiocrats, particularly DuPont de Nemours. D'Argenson, during this time, was better known for the similar but less-celebrated motto "Pas trop gouverner" ("Govern not too much").[8]

In English, a variety of "free trade" and "non-interference" slogans had been coined already in the seventeenth century. The first known appearance of the French motto laissez faire in an English text is in the writings of the London merchant Charles Bosanquet in 1808.[9]. It was originally introduced in the English-language world in 1774, by George Whatley, in the book Principles of Trade, which was co-authored with Benjamin Franklin. Classical economists, such as Thomas Malthus, Adam Smith and David Ricardo did not use the term. Bentham employed it, but only with the advent of the Anti-Corn Law League did the term receive much of its (English) meaning.[10] Nonetheless, it was probably James Mill's reference to the 'laissez-faire' maxim (together with 'pas trop gouverner') in an 1824 entry for Encyclopedia Britannica that really brought the term into wider English usage.

History of laissez-faire debate

Europe

In nineteenth century Britain, laissez-faire found a small but strong following by such Manchester Liberals as Richard Cobden and Richard Wright. In 1867, this resulted in a free trade treaty being signed between Britain and France, after which several of these treaties were signed among other European countries. The newspaper The Economist was founded, partly in opposition to the Corn Laws, in 1843, and free trade was discussed in such places as The Cobden Club, founded a year after the death of Richard Cobden, in 1866. [11] [12]

However, Austrian scholars consider that laissez-faire was never the main doctrine of any nation, and at the end of the eighteen-hundreds, European countries would find themselves taking up economic protectionism and interventionism again. France for example, started cancelling its free trade agreements with other European countries in 1890. Germany's protectionism started (again) with a December 1878 letter from Bismarck, resulting in the iron and rye tariff of 1879.

United States

Although the period before the American Civil War was notable for the limited extent of the federal government, the Austrian School suggest that there was a considerable degree of government intervention in the economy--particularly after the 1820s. Notable examples of government intervention in the period prior to the Civil War include the establishment of the First Bank of the United States and Second Bank of the United States as well as various protectionist measures (e.g., the tariff of 1828). Several of these proposals met with serious opposition, and required a great deal of horse trading to be enacted into law. For instance, the First National Bank would not have reached the desk of President George Washington in the absence of an agreement that was reached between Alexander Hamilton and several southern members of Congress to locate the capital in the District of Columbia. In contrast to Hamilton and the Federalists was the opposing political party the (Democratic)-Republicans. The early Republican party led by Jefferson was very pro-Laissez-Faire. In fact Jefferson wished to only have the government do three things: collect a census (every ten years), collect duties which were the government's only tax [citation needed], and run the postal service. Jefferson also had very few federal employees especially compared to today's American government.

Most of the early proponents of a mixed economy in the United States subscribed to the American School (economics). This school of thought was inspired by the ideas of Alexander Hamilton, who proposed the creation of a government sponsored bank and increased tariffs to favor northern industrial interests. Following Hamilton's death, the more abiding protectionist influence in the antebellum period came from Henry Clay and his American System.

In the mid-19th century, the Abraham Lincoln followed the Whig tradition of economic liberalism, which included increased state control such as the provision and regulation of railroads. The Pacific Railway Acts provided the development of the First Transcontinental Railroad.[13]

Following the Civil War, the movement towards a mixed economy accelerated with even more protectionism and government regulation. In the 1880s and 1890s, significant tariff increases were enacted (see the McKinley Tariff and Dingley Tariff). Moreover, with the enactment of the Interstate Commerce Act of 1887, the Sherman Anti-trust Act, the federal government began to assume an increasing role in regulating and directing the country's economy.

The Progressive Era saw the enactment of even more controls on the economy, as evidenced by the Wilson Administration's New Freedom program.

Following World War I and the Great Depression, Keynesian policies turned the state into a mixed economy. The United States, in the 1980s, for example, sought to protect its automobile industry by "voluntary" export restrictions from Japan.[14] One scholar wrote about the early 1980s that:

By and large, the comparative strength of the dollar against major foreign currencies has reflected high U.S. interest rates driven by huge federal budget deficits. Hence, the source of much of the current deterioration of trade is not the general state of the economy, but rather the government's mix of fiscal and monetary policies — that is, the problematic juxtaposition of bold tax reductions, relatively tight monetary targets, generous military outlays, and only modest cuts in major entitlement programs. Put simply, the roots of the trade problem and of the resurgent protectionism it has fomented are fundamentally political as well as economic.[15]

The Great Depression

There is much debate over the relationship between laissez-faire economics and the onset of the Great Depression. Some economists and historians (such as John Maynard Keynes) argue that laissez-faire economic policy fostered the conditions under which the Great Depression arose. Other scholars, such as Milton Friedman and Murray Rothbard, say that the Depression was not a result of laissez-faire economic policy but of government intervention on the monetary and credit system. Most scholars accept the Great Depression to be a monetary phenomenon.

In Keynes's 1936 work, The General Theory of Employment Interest and Money, Keynes introduced concepts and terms that were intended to help explain the Great Depression. One argument for a laissez-faire economic policy during a recession was that if consumption fell, then the rate of interest would fall. Lower interest rates would lead to increased investment spending and demand would remain constant. However, Keynes believed that there are reasons why investment does not necessarily automatically increase as a response to a fall in consumption. Businesses make investments based on expectations of profit. According to Keynes, if a fall in consumption appears to be long-term, businesses analyzing trends will lower expectations of futures sales and will not invest in increasing future production even if lower interest rates make capital inexpensive. In that case, according to Keynes and contrary to Say's law, the economy can be thrown into a general slump. (Keen 2000:198) Keynesian economists and historians argue that this self-reinforcing dynamic is what happened to an extreme degree during the Depression, where bankruptcies were common and investment, which requires a degree of optimism, was very unlikely to occur. As a solution to this Keynes proposed to alleviate market instability through government intervention. In his view, since private actors cannot be counted on to create aggregate demand during a recession, the government has the responsibility to create demand.[16] Keynes saw his macroeconomic theory much better suited for totalitarian systems than those governed by the principles of laissez-faire. He highlighted this in the foreword to the German edition of 'The General Theory of Employment Interest and Money: "The theory of aggregate production, which is the point of the following book, nevertheless can be much easier adapted to the conditions of a totalitarian state than the theory of production and distribution of a given production put forth under conditions of free competition and a large degree of laissez-faire."[17]

Friedrich August von Hayek and Milton Friedman argued that the Great Depression was not a result of laissez-faire economic policy but a result of too much government intervention and regulation upon the market. They note that the Great Depression was the longest depression in U.S. history and the only depression in which the government heavily intervened. In Friedman's work, Capitalism and Freedom he argues: "A governmentally established agency--The Federal Reserve System--had been assigned responsibility for monetary policy. In 1930 and 1931, it exercised this responsibility so ineptly as to convert what otherwise would have been a moderate contraction into a major catastrophe."[18]

Furthermore, the U.S. Federal government had created a fixed currency pegged to the value of gold. At one point the pegged value was considerably higher than the world price, which created a massive surplus of gold. World wide demand for gold surged, but the pegged value was too low in the U.S. This created a massive migration of gold from the U.S. Milton Friedman and Hayek both argued that this inability to react to currency demand created a run on the banks that they were not able to handle. The banks inability to handle such a run, and the fixed exchange rates between the dollar and gold; both worked to cause the Great Depression by creating, and then not fixing, deflationary pressures.[19] He further argued in this thesis, that the government inflicted more pain upon the American public by first raising taxes, then by printing money to pay debts (thus causing inflation), the combination of which helped to wipe out the savings of the middle class. Friedman concludes that the effects of the Great Depression were not mitigated until after World War II when the economy saw a return to normalcy with the elimination of many price controls. This opinion specifically blames a combination of Federal Reserve policies and economic regulation by the U.S. government as causes of the Great Depression, and that the depression was exacerbated by raising income taxes on the highest incomes from 25% to 63%, a "check tax", and the Smoot-Hawley tariff. Friedman believed that Herbert Hoover's interventionist policies and Franklin Roosevelt's New Deal further lengthened and worsened the depression. Friedman concludes, "The Great Depression in the United States, far from being a sign of the inherent instability of the private enterprise system, is a testament to how much harm can be done by mistakes on the part of a few men when they wield vast power over the monetary system of a country."[20] Despite criticism of government intervention by those of the Chicago school, they still prefer central banks to control the money supply. Rothbard criticizes Milton Friedman's assertion that the central bank failed to inflate the supply of money. Rothbard asserts that the Federal Reserve purchased $1.1 billion of government securities from February to July 1932 which raised its total holding to $1.8 billion. Total bank reserves only rose by $212 million, but Rothbard argues that this was because the American populace lost faith in the banking system and began hoarding more cash, a factor very much beyond the control of the Central Bank. The potential for a run on the banks caused local bankers to be more conservative in lending out their reserves, and, Rothbard argues, was the cause of the Federal Reserve's inability to inflate.[21]

The Austrian school, however, has a different point of view than the Chicago scholars. They are opposed to central banks and fiat money--things thay are supported by Chicago scholars. In their view, the key cause of the Depression was the expansion of the money supply in the 1920s that lead to an unsustainable credit driven boom. In their view, the Federal Reserve, which was created in 1913, shoulders much of the blame. In fact, Hayek, writing for the Austrian Institute of Economic Research Report in February 1929[22] predicted the economic downturn, stating that "the boom will collapse within the next few months." Ludwig von Mises also expected this financial catastrophe, and is quoted as stating "A great crash is coming, and I don't want my name in any way connected with it,"[23] when he turned down an important job at the Kreditanstalt Bank in early 1929.

One reason for the monetary inflation was to help Great Britain, which, in the 1920s, was struggling with its plans to return to the gold standard at pre-war (World War I) parity. Returning to the gold standard at this rate meant that the British economy was facing deflationary pressure.[24] According to Rothbard, the lack of price flexibility in Britain meant that unemployment shot up, and the American government was asked to help. The United States was receiving a net inflow of gold and inflated further in order to help Britain return to the gold standard. Montagu Norman, head of the Bank of England, had an especially good relationship with Benjamin Strong, the de facto head of the Federal Reserve. Norman pressured the heads of the central banks of France and Germany to inflate as well, but unlike Strong, they refused.[24] Rothbard says American inflation was meant to allow Britain to inflate as well, because under the gold standard, Britain could not inflate on its own.

In the Austrian view it was this inflation of the money supply that led to an unsustainable boom in both asset prices (stocks and bonds) and in capital goods. By the time the Fed belatedly tightened in 1928, it was far too late and, in the Austrian view, a depression was inevitable.

The artificial interference in the economy was a disaster prior to the Depression, and government efforts to prop up the economy after the crash of 1929 only made things worse. According to Rothbard, government intervention delayed the market’s adjustment and made the road to complete recovery more difficult.[26] It was President Herbert Hoover's interventionist policies during the Depression that prolonged it. He criticized Hoover's policies such as tarrifs, wage controls and government spending that worsened the Depression. Wage controls and labor union regulations at that time, he argued, kept the unemployment rate high. Artificially high wage controls during a time of monetary contraction kept the real incomes of the workers much higher than the real value, which forced business owners to fire workers. Finally, he refuted the common misconception that World War II spending ended the war--the Great Depression ended a few years after the war, and argued that military spending kept down the artificially high unemployment rate because the unemployed volunteered in the war. A Depression that should have lasted only a few months is worsened by Hoover's interventionist policies, and Rothbard refuted the popular misconception that Hoover was non-interventionist: Hoover was only a bit less interventionist than President Franklin D. Roosevelt, and stated that the New Deal was started by Hoover.

Laissez-faire today

The Austrian School consider that many modern nations today are not representative of laissez-faire principles or policies, as they usually involve significant amounts of government intervention in the economy. This intervention includes minimum wages, corporate welfare, anti-trust regulation, nationalized industries, intellectual property, licenses and welfare programs among other forms of government intervention. Subsidy programs for businesses and agricultural products; government ownership of some industry (usually in natural resources); regulation of market competition; economic trade barriers in the form of protective tariffs - quotas on imports -, "fair trade" or internal regulation favoring domestic industry; and other forms of government favoritism. The now-ubiquitous worldwide money regulating agencies such as the U.S. Federal Reserve System (although it is technically privately owned) and other government owned-and-operated central banking systems as criticised by mainly Austrian School scholars, are seen as artificial at best and damaging at worst. The Austrian School consider the now-ubiquitous agencies such as the Food and Drug Administrations, environmental regulations, and the War in Iraq, illegitimate interventions of the state.[27]

The Austrian School is against our current neoliberal version of globalization. They argue that the free-trade agreements and intellectual property laws are only protecting the multi-national corporations in expense of the people. For example, the intellectual property laws represent corporate welfare policies, as they may restrict some technology in undeveloped countries, such as the patented AIDSs medication prevented in Africa. Many of them are also against global organizations such as the United Nations, associating them as a world government which undermines the independence of the state. They may also oppose international organization such as the International Monetary Fund, which uses a Keynesian inflationary approach that contradicts their support of private currencies by Austrians. [28]

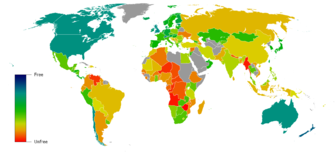

According to the 2008 Index of Economic Freedom and The Economic Freedom of the World, issued by the Heritage Foundation and the Fraser Institute respectively, seven countries with the most free economies in the former index are currently the following: Hong Kong, Singapore, Ireland, Australia, United States, New Zealand and Canada (all of them former constituents of the British Empire). Hong Kong is ranked number one for 14 consecutive years in the Index which attempts to measure "the absence of government coercion or constraint on the production, distribution, or consumption of goods and services beyond the extent necessary for citizens to protect and maintain liberty itself." Because of this, Milton Friedman described Hong Kong as laissez-faire state and he credits that policy for the rapid move from poverty to prosperity in 50 years.[29] Much of this growth came under British colonial control prior to the 1997 resumption of sovereignty by the People's Republic of China. Note that the economic freedom scales are relative, and Hong Kong may not be considered "laissez-faire", especially those who identify with the Austrian school. Central banks, school regulations, environmental regulations and government ownership of housing are some examples of economic intervention in Hong Kong.

However at a press conference on 11 September 2006, Donald Tsang, the Chief Executive of Hong Kong said that "Positive non-interventionism was a policy suggested by a previous Financial Secretary many years ago, but we have never said that we would still use it as our current policy.... We prefer the so-called 'big market, small government' policy." Responses in Hong Kong were widely divided, some see it as an announcement to abandon the positive non-interventionism, others see it as a more realistic response to the government policies in the past few years, such as the intervention of the stock market to prevent brokering.[30].

Controversy

Private defense agencies[31] and intellectual property[32] are a source of controversy amongst laissez-faire advocates. This is what usually divides the minarchists who advocate government police and military, and anarcho-capitalists who want full privatization of goods. For many of the latter, the principle of liberty must overcome the goal of wealth. The public good of police, for instance, could be seen as immoral coercion no matter how efficient over private security.

Murray Rothbard was a prominent critic of laissez-faire minarchism. As an anarcho-capitalist, he argued that government defence is inefficient. He criticized laissez-faire activists for supporting geographically large, minarchist states. In his book Power and Market, he argued that geographically large minarchist states are indifferent from a unified minarchist world monopoly government.[33]

Some libertarians argue that anarcho-capitalism is the only logically consistent form of libertarian belief. It is also contradictory to state that violence is immoral, yet still maintain violence in the form of a government. Such views are often voiced by "rights libertarians", though consequentialist libertarians may argue that laissez-faire is more compatible with utilitarian values (in the manner of von Mises or Milton Friedman)

But laissez-faireists counter that a government could survive on private donations and the creation of trust funds without any form of taxation whatsoever. Even if a government could be voluntarily funded, then it still amounts to an authority with a monopoly of force over a given area, and as such would dictate and control. Additionally, some argue that voluntary donations are not enough to support a government to prevent a foreign invasion. The mere existence of government, irrespective of how it is funded, undermines one's self-ownership, since to govern is to control. Laissez-faireists, however, depart here from anarcho-capitalists in philosophical beliefs, believing that the government should indeed be the sole arbiter of force in law and military matters, on the premise that competing law systems would inevitably lead to chaos, where no libertarian principles could possibly reign. However, market anarchists had argued that the sole arbitrator can just be the society itself, instead of a government that is separate from the society.[34]

Also, some libertarians believe that the concept of "constitutionally limited government" is a fallacy. They argue that the American Founding Fathers' approach of limiting the inherent force linked with government (in respect to the United States Constitution) has not worked. They claimed that states would inevitably become corrupt.

A number of laissez-faireists state that human beings naturally gravitate towards leaders, hence making anarchism untenable and not viable.[citation needed] As such, they believe that the existence of government is inevitable, and people should only be concerned with limiting the size and scope of the state, rather than opposing its existence. Murray Rothbard denouced this claim by citing that it often took hundreds years for aristocrats to set up a state out of anarchy.[35]

More to the point, even if anarchy were in some way commensurate with individual liberties, laissez-faireists often argue that anarchy would be highly inefficient at providing for a stable means of repelling organized aggression from foreign armies. As such anarchies would quickly be replaced by whatever government happened to assert its will via military means. However, Murray Rothbard argued that in anarchy, it would be much harder for foreign invasion to set up a government because there would not be an existing central entity to take control over.[35]

Some laissez-faireists believe their approach to be more pragmatic. However, Hans Hermann Hoppe has argued that the only form of state that can pragmatically be restrained from expanding is a monarchical (privately owned) state.[36]

References

- ^ As well as being used in economic management, the term has also been applied more broadly to a style of management and leadership, where it typically describes any form of control where the controlled are given most or all of the decision-making power. In this limited usage, laissez-faire (imperative) has come to be distinct from laisser faire (infinitive), which refers to a careless attitude in the application of a policy, implying a lack of consideration or thought.

- ^ Charlene Gannage (1980). "E.S. Varga and the Theory of State Monopoly Capitalism". Review of Radical Political Economics. 12 (3): 36–49. doi:10.1177/048661348001200304.

- ^ Trevithick, J. (1979). "Keynes and Laissez-Faire". The Economic Journal. 9 (354). JSTOR: 476--478.

- ^ Oscar Handlin (1943). "Laissez-Faire thought in Massachusetts, 1790-1880". Journal of Economic History. 3: 55–65.

- ^ The anecdote on Le Gendre is briefly referenced in J. Turgot's "Eloge de Vincent de Gournay", Mercure, August, 1759).

- ^ J. Turgot, op cit. V.R. Marquis Mirabeau, in Philosophie rurale 1763 and Ephémérides du Citoyen, 1767. C.C. Comte d'Albon,"Éloge Historique de M. Quesnay", Nouvelles Ephémérides Économiques, May, 1775, p.136-7. P.S.DuPont de Nemours, in Ouevres de Jacques Turgot, 1808-11, Vol. I, p.257 and p.259 (Daire ed.)

- ^ A. Oncken (Die Maxime Laissez faire et laissez passer, ihr Ursprung, ihr Werden, 1866) indicates d'Argenson used the 'laissez-faire' term firstly in his 1736 Memoires and then in an article in the 1751 Journal Oeconomique (the term's first known appearance in print).

- ^ DuPont de Nemours, op cit, p.258.

- ^ "if trade could be left free and unfettered, it would in most cases take very good of itself; but alas! laissez nous faire, though an excellent maxim, is grown quite obsolete." From C. Bosanquet, 1808, Thoughts on the Values to Great Britain of Commerce in General and the Value and Importance of the Colonial Trade in Particular, London, p.48-49. The identification of this as its first use in English is due to E.R. Kittrell (1966) "Laissez Faire in English Classical Economics", Journal of the History of Ideas, Vol. 27 (4), p.610-620.

- ^ Abbott P. Usher; et al. (1931). "Economic History--The Decline of Laissez Faire". American Economic Review. 22 (1, Supplement): 3–10.

{{cite journal}}: Explicit use of et al. in:|author=(help) - ^ Scott Gordon (1955). "The London Economist and the High Tide of Laissez Faire". Journal of Political Economy. 63 (6): 461–488. doi:10.1086/257722.

- ^ Antonia Taddei (1999). "London Clubs in the Late Nineteenth Century" (PDF).

- ^ Guelzo, Allen C. (1999), Abraham Lincoln: Redeemer President, ISBN 0-8028-3872-3

- ^ Robert W. Crandall (1987). "The Effects of U.S. Trade Protection for Autos and Steel". Brookings Papers on Economic Activity. 1987 (1): 271–288. doi:10.2307/2534518.

- ^ Pietro S. Nivola (1986). "The New Protectionism: U.S. Trade Policy in Historical Perspective". Political Science Quarterly. 101 (4): 577–600. doi:10.2307/2150795.

- ^ Yergin, Daniel., and Joseph Stanislaw. 1998. The Commanding Heights. Touchstone Book. p 21-22

- ^ John V. Denson (ed). (2001). Reassessing the Presidency: The Rise of the Executive State and the Decline of Freedom. Ludwig von Mises Institute. ISBN 0945466293 p.597

- ^ Friedman, Milton. 1962. Capitalism and Freedom. University of Chicago Press. p 38.

- ^ Milton, Capitalism and Freedom, p 45-50.

- ^ Milton, Capitalism and Freedom, p 50.

- ^ Rothbard 2002, pp. 293–294

- ^ "Austrian Institute of Economic Research Report". February 1929.

{{cite journal}}: Cite journal requires|journal=(help) - ^ Mises, Margit von (1976). My Years with Ludwig von Mises. Arlington House. p. 31.

- ^ a b Rothbard 2002, p. 141

- ^ http://www.measuringworth.com/ppowerus/ Purchasing Power of Money in the United States from 1774 to 2007 from measuringworth.com

- ^ Rothbard 2002, p. 25

- ^ Ron Paul. "Challenge to America: A Current Assessment of Our Republic".

- ^ Llewellyn H. Rockwell. [mises.org/fullstory.asp?control=1334 "Does World Trade Need World Government?"]. Mises Institute.

{{cite web}}: Check|url=value (help) - ^ The Hong Kong Experiment by Milton Friedman on Hoover Digest accessed at March 29 2007

- ^ (Ref: 2006-Sept-12: Mingpao Daily)

- ^ Hans-Hermann Hoppe (2003), The Myth of National Defense: Essays on the Theory and History of Security Protection

- ^ N. Stephan Kinsella (Spring 2001), "Against Intellectual Property", Journal of Libertarian Studies, 15, no. 2: 1–53

- ^ Murray Rothbard, Power and Market: Government and the Economy

- ^ http://www.veritasnoctis.net/docs/persistentanarchyapsa2006.pdf

- ^ a b Murray Rothbard. Power and Market: Government and the Economy.

- ^ Hoppe, Hans-Hermann. Democracy: The God that Failed: Studies in the Economics and Politics of Monarchy, Democracy, and Natural Order New Brunswick, NJ: Transaction Publishers, 2001

Bibliography

- Brebner, John Bartlet (1948). "Laissez Faire and State Intervention in Nineteenth-Century Britain". Journal of Economic History. 8: 59–73.

- Fisher, Irving (1907). "Why has the Doctrine of Laissez Faire been Abandoned?". Science. 25 (627): 18–27. doi:10.1126/science.25.627.18. PMID 17739703.

{{cite journal}}: Unknown parameter|month=ignored (help) - Taussig, Frank W. (1904). "The Present Position of the Doctrine of Free Trade". Publications of the American Economic Association. 6 (1): 29–65.

Further reading

- August Oncken (1886). Die Maxime Laissez faire et laissez passer : ihr Ursprung, ihr Werden. Ein Beitrag zur Geschichte der Freihandelslehre. Bern: K.J. Wyss.

- Template:PDFlink by Christian Gerlach, London School of Economics – March 2005

- John Maynard Keynes, The end of laissez-faire (1926)