Bitcoin

Prevailing bitcoin logo | |

| Denominations | |

|---|---|

| Plural | bitcoins |

| Symbol | ₿[a] |

| Code | BTC, XBT[b] |

| Subunits | |

| 1⁄1000 | millibitcoin[2] |

| 1⁄100000000 | satoshi[3] |

| Development | |

| Original author(s) | Satoshi Nakamoto |

| White paper | Bitcoin: A Peer-to-Peer Electronic Cash System[4] |

| Implementation(s) | Bitcoin Core |

| Initial release | 0.1.0 / 9 January 2009 |

| Latest release | 0.16.0 / 26 February 2018 |

| Ledger | |

| Ledger start | 3 January 2009 |

| Timestamping scheme | Proof-of-work (partial hash inversion) |

| Hash function | SHA-256 |

| Issuance schedule | Decentralized (block reward)[5][6] |

| Block reward | ₿12.5[c] |

| Block time | 10 minutes |

| Block explorer | blockchain |

| Circulating supply | ₿16,858,762 (as of 11 February 2018[update]) |

| Supply limit | ₿21,000,000 |

| Valuation | |

| Exchange rate | |

| Website | |

| Website | bitcoin |

Bitcoin (₿) is a cryptocurrency and worldwide payment system.[8]: 3 It is the first decentralized digital currency, as the system works without a central bank or single administrator.[8]: 1 [9] The network is peer-to-peer and transactions take place between users directly, without an intermediary.[8]: 4 These transactions are verified by network nodes through the use of cryptography and recorded in a public distributed ledger called a blockchain. Bitcoin was invented by an unknown person or group of people under the name Satoshi Nakamoto[10] and released as open-source software in 2009.[11]

Bitcoins are created as a reward for a process known as mining. They can be exchanged for other currencies,[12] products, and services. As of February 2015, over 100,000 merchants and vendors accepted bitcoin as payment.[13] Research produced by the University of Cambridge estimates that in 2017, there were 2.9 to 5.8 million unique users using a cryptocurrency wallet, most of them using bitcoin.[14]

Etymology

The word bitcoin first occurred and was defined in the white paper[4] that was published on 31 October 2008.[15] It is a compound of the words bit and coin.[16] The white paper frequently uses the shorter coin.[4]

There is no uniform convention for bitcoin capitalization. Some sources use Bitcoin, capitalized, to refer to the technology and network and bitcoin, lowercase, to refer to the unit of account.[17] The Wall Street Journal,[18] The Chronicle of Higher Education,[19] and the Oxford English Dictionary[16] advocate use of lowercase bitcoin in all cases, a convention followed throughout this article.

Units

The unit of account of the bitcoin system is a bitcoin. Ticker symbols used to represent bitcoin are BTC[a] and XBT.[b] Small amounts of bitcoin used as alternative units are millibitcoin (mBTC),[2] and satoshi (sat). Named in homage to bitcoin's creator, a satoshi is the smallest amount within bitcoin representing 0.00000001 bitcoins, one hundred millionth of a bitcoin.[3] A millibitcoin equals 0.001 bitcoins, one thousandth of a bitcoin or 100,000 satoshis.[24]

Symbol

The Unicode character for bitcoin is ₿.[25]: 2 This was standardized in version 10.0 in June 2017. As with most new symbols, font support is very limited. Typefaces supporting it include Horta.

History

On 18 August 2008, the domain name "bitcoin.org" was registered.[26] In November that year, a link to a paper authored by Satoshi Nakamoto titled Bitcoin: A Peer-to-Peer Electronic Cash System[4] was posted to a cryptography mailing list.[26] Nakamoto implemented the bitcoin software as open source code and released it in January 2009 on SourceForge.[27][28][11] The identity of Nakamoto remains unknown.[10]

In January 2009, the bitcoin network came into existence after Satoshi Nakamoto mined the first ever block on the chain, known as the genesis block.[29][30] Embedded in the coinbase of this block was the following text:

The Times 03/Jan/2009 Chancellor on brink of second bailout for banks.[11]

This note has been interpreted as both a timestamp of the genesis date and a derisive comment on the instability caused by fractional-reserve banking.[31]: 18

The receiver of the first bitcoin transaction was cypherpunk Hal Finney, who created the first reusable proof-of-work system (RPOW) in 2004.[32] Finney downloaded the bitcoin software the day it was released, and received 10 bitcoins from Nakamoto.[33][34] Other early cypherpunk supporters were Wei Dai, creator of bitcoin predecessor b-money, and Nick Szabo, creator of bitcoin predecessor bit gold.[35]

In the early days, Nakamoto is estimated to have mined 1 million bitcoins.[36] In 2010, Nakamoto handed the network alert key and control of the Bitcoin Core code repository over to Gavin Andresen, who later became lead developer at the Bitcoin Foundation.[37][38] Nakamoto subsequently disappeared from any involvement in bitcoin.[39] Andresen stated he then sought to decentralize control, saying: "As soon as Satoshi stepped back and threw the project onto my shoulders, one of the first things I did was try to decentralize that. So, if I get hit by a bus, it would be clear that the project would go on."[39] This left opportunity for controversy to develop over the future development path of bitcoin.[40]

Forks

Over the history of Bitcoin there have been several spins offs and deliberate hard forks that have lived on as separate blockchains. These have come to be known as "altcoins", short for alternative coins, since Bitcoin was the first blockchain and these are derivative of it. These spin offs occur so that new ideas can be tested, when the scope of that idea is outside that of Bitcoin, or when the community is split about merging such changes.

The first fork of Bitcoin was Namecoin, with discussions taking place on the Bitcointalk forum and IRC in December 2010.[41][42] Another early spin off was Litecoin, which began in October, 2011. Since then there have been numerous forks of Bitcoin. See list of bitcoin forks.

Design

Blockchain

The blockchain is a public ledger that records bitcoin transactions.[43] A novel solution accomplishes this without any trusted central authority: the maintenance of the blockchain is performed by a network of communicating nodes running bitcoin software.[8] Transactions of the form payer X sends Y bitcoins to payee Z are broadcast to this network using readily available software applications.[44] Network nodes can validate transactions, add them to their copy of the ledger, and then broadcast these ledger additions to other nodes. The blockchain is a distributed database – to achieve independent verification of the chain of ownership of any and every bitcoin amount, each network node stores its own copy of the blockchain.[45] Approximately six times per hour, a new group of accepted transactions, a block, is created, added to the blockchain, and quickly published to all nodes. This allows bitcoin software to determine when a particular bitcoin amount has been spent, which is necessary in order to prevent double-spending in an environment without central oversight. Whereas a conventional ledger records the transfers of actual bills or promissory notes that exist apart from it, the blockchain is the only place that bitcoins can be said to exist in the form of unspent outputs of transactions.[46]: ch. 5

Transactions

Transactions are defined using a Forth-like scripting language.[46]: ch. 5 Transactions consist of one or more inputs and one or more outputs. When a user sends bitcoins, the user designates each address and the amount of bitcoin being sent to that address in an output. To prevent double spending, each input must refer to a previous unspent output in the blockchain.[48] The use of multiple inputs corresponds to the use of multiple coins in a cash transaction. Since transactions can have multiple outputs, users can send bitcoins to multiple recipients in one transaction. As in a cash transaction, the sum of inputs (coins used to pay) can exceed the intended sum of payments. In such a case, an additional output is used, returning the change back to the payer.[48] Any input satoshis not accounted for in the transaction outputs become the transaction fee.[48]

Transaction fees

Paying a transaction fee is optional.[48] Miners can choose which transactions to process,[48] and they are incentivised to prioritize those that pay higher fees.

Because the size of mined blocks is capped by the network, miners choose transactions based on the fee paid relative to their storage size, not the absolute amount of money paid as a fee. Thus, fees are generally measured in satoshis per byte, or sat/b. The size of transactions is dependent on the number of inputs used to create the transaction, and the number of outputs.[46]: ch. 8

Ownership

In the blockchain, bitcoins are registered to bitcoin addresses. Creating a bitcoin address is nothing more than picking a random valid private key and computing the corresponding bitcoin address. This computation can be done in a split second. But the reverse (computing the private key of a given bitcoin address) is mathematically unfeasible and so users can tell others and make public a bitcoin address without compromising its corresponding private key. Moreover, the number of valid private keys is so vast that it is extremely unlikely someone will compute a key-pair that is already in use and has funds. The vast number of valid private keys makes it unfeasible that brute force could be used for that. To be able to spend the bitcoins, the owner must know the corresponding private key and digitally sign the transaction. The network verifies the signature using the public key.[46]: ch. 5

If the private key is lost, the bitcoin network will not recognize any other evidence of ownership;[8] the coins are then unusable, and effectively lost. For example, in 2013 one user claimed to have lost 7,500 bitcoins, worth $7.5 million at the time, when he accidentally discarded a hard drive containing his private key.[49] A backup of his key(s) would have prevented this.[50]

Mining

Mining is a record-keeping service done through the use of computer processing power.[d] Miners keep the blockchain consistent, complete, and unalterable by repeatedly grouping newly broadcast transactions into a block, which is then broadcast to the network and verified by recipient nodes.[43] Each block contains a SHA-256 cryptographic hash of the previous block,[43] thus linking it to the previous block and giving the blockchain its name.[46]: ch. 7 [43]

To be accepted by the rest of the network, a new block must contain a so-called proof-of-work.[43] The system used is based on Adam Back's 1997 anti-spam scheme, Hashcash.[4][52] The PoW requires miners to find a number called a nonce, such that when the block content is hashed along with the nonce, the result is numerically smaller than the network's difficulty target.[46]: ch. 8 This proof is easy for any node in the network to verify, but extremely time-consuming to generate, as for a secure cryptographic hash, miners must try many different nonce values (usually the sequence of tested values is the ascending natural numbers: 0, 1, 2, 3, ...[46]: ch. 8 ) before meeting the difficulty target.

Every 2,016 blocks (approximately 14 days at roughly 10 min per block), the difficulty target is adjusted based on the network's recent performance, with the aim of keeping the average time between new blocks at ten minutes. In this way the system automatically adapts to the total amount of mining power on the network.[46]: ch. 8 Between 1 March 2014 and 1 March 2015, the average number of nonces miners had to try before creating a new block increased from 16.4 quintillion to 200.5 quintillion.[53]

The proof-of-work system, alongside the chaining of blocks, makes modifications of the blockchain extremely hard, as an attacker must modify all subsequent blocks in order for the modifications of one block to be accepted.[54] As new blocks are mined all the time, the difficulty of modifying a block increases as time passes and the number of subsequent blocks (also called confirmations of the given block) increases.[43]

Pooled mining

Computing power is often bundled together or "pooled" to reduce variance in miner income. Individual mining rigs often have to wait for long periods to confirm a block of transactions and receive payment. In a pool, all participating miners get paid every time a participating server solves a block. This payment depends on the amount of work an individual miner contributed to help find that block.[55]

Supply

The successful miner finding the new block is rewarded with newly created bitcoins and transaction fees.[56] As of 9 July 2016[update],[57] the reward amounted to 12.5 newly created bitcoins per block added to the blockchain. To claim the reward, a special transaction called a coinbase is included with the processed payments.[46]: ch. 8 All bitcoins in existence have been created in such coinbase transactions. The bitcoin protocol specifies that the reward for adding a block will be halved every 210,000 blocks (approximately every four years). Eventually, the reward will decrease to zero, and the limit of 21 million bitcoins[e] will be reached c. 2140; the record keeping will then be rewarded by transaction fees solely.[58]

In other words, bitcoin's inventor Nakamoto set a monetary policy based on artificial scarcity at bitcoin's inception that there would only ever be 21 million bitcoins in total. Their numbers are being released roughly every ten minutes and the rate at which they are generated would drop by half every four years until all were in circulation.[59]

Wallets

A wallet stores the information necessary to transact bitcoins. While wallets are often described as a place to hold[60] or store bitcoins,[61] due to the nature of the system, bitcoins are inseparable from the blockchain transaction ledger. A better way to describe a wallet is something that "stores the digital credentials for your bitcoin holdings"[61] and allows one to access (and spend) them. Bitcoin uses public-key cryptography, in which two cryptographic keys, one public and one private, are generated.[62] At its most basic, a wallet is a collection of these keys.

There are three modes which wallets can operate in. They have an inverse relationship with regards to trustlessness and computational requirements.

- Full clients verify transactions directly on a local copy of the blockchain (over 150 GB As of January 2018[update]).[63] They are the most secure and reliable way of using the network, as trust in external parties is not required. Full clients check the validity of mined blocks, preventing them from transacting on a chain that breaks or alters network rules.[64] Because of its size and complexity, storing the entire blockchain is not suitable for all computing devices.

- Pruning clients store only the set of transactions that have not been spent (the "UTXO set"), thereby reducing the size of data they need to store, while simultaneously allowing them to validate new transactions.[65] However, if miners alter the blockchain at a point suitably far back in time (a "reorg"), the pruning client must re-validate the entire blockchain from its genesis.

- Lightweight clients consult full clients to send and receive transactions without requiring a local copy of the entire blockchain (see simplified payment verification – SPV). This makes lightweight clients much faster to set up and allows them to be used on low-power, low-bandwidth devices such as smartphones. When using a lightweight wallet, however, the user must trust the server to a certain degree, as it can report faulty values back to the user. Lightweight clients follow the longest blockchain and do not ensure it is valid, requiring trust in miners.[66]

Third-party internet services called online wallets offer similar functionality but may be easier to use. In this case, credentials to access funds are stored with the online wallet provider rather than on the user's hardware.[67][68] As a result, the user must have complete trust in the wallet provider. A malicious provider or a breach in server security may cause entrusted bitcoins to be stolen. An example of such a security breach occurred with Mt. Gox in 2011.[69] This has led to the often-repeated meme "Not your keys, not your bitcoin".[70]

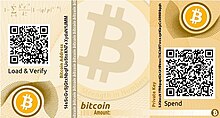

Physical wallets store offline the credentials necessary to spend bitcoins.[61] One notable example was a novelty coin with these credentials printed on the reverse side.[71] Paper wallets are simply paper printouts.

Another type of wallet called a hardware wallet keeps credentials offline while facilitating transactions.[72]

Implementations

The first wallet program – simply named "Bitcoin" – was released in 2009 by Satoshi Nakamoto as open-source code.[11] In version 0.5 the client moved from the wxWidgets user interface toolkit to Qt, and the whole bundle was referred to as "Bitcoin-Qt".[73] After the release of version 0.9, the software bundle was renamed "Bitcoin Core" to distinguish itself from the underlying network.[74][75] It is sometimes referred to as the "Satoshi client".

While a decentralized system cannot have an "official" implementation, Bitcoin Core is considered by some to be bitcoin's preferred implementation.[76] Today, other alternative clients (forks of Bitcoin Core) exist, such as Bitcoin XT, Bitcoin Unlimited,[40][77] and Parity Bitcoin.[78]

Decentralization

Bitcoin was designed not to need a central authority[4] and the bitcoin network is considered to be decentralized.[8][5][9][79][80][81] However, researchers have pointed out a visible "trend towards centralization" by the means of miners joining large mining pools to minimise the variance of their income.[82] According to researchers, other parts of the ecosystem are also "controlled by a small set of entities", notably online wallets and simplified payment verification (SPV) clients.[83]

Because transactions on the network are confirmed by miners, decentralization of the network requires that no single miner or mining pool obtains 51% of the hashing power, which would allow them to double-spend coins, prevent certain transactions from being verified and prevent other miners from earning income.[83] As of 2013 just six mining pools controlled 75% of overall bitcoin hashing power.[83]

In 2014 mining pool Ghash.io obtained 51% hashing power which raised significant controversies about the safety of the network. The pool has voluntarily capped their hashing power at 39.99% and requested other pools to act responsibly for the benefit of the whole network.[84]

Privacy

Bitcoin is pseudonymous, meaning that funds are not tied to real-world entities but rather bitcoin addresses. Owners of bitcoin addresses are not explicitly identified, but all transactions on the blockchain are public. In addition, transactions can be linked to individuals and companies through "idioms of use" (e.g., transactions that spend coins from multiple inputs indicate that the inputs may have a common owner) and corroborating public transaction data with known information on owners of certain addresses.[85] Additionally, bitcoin exchanges, where bitcoins are traded for traditional currencies, may be required by law to collect personal information.[86]

To heighten financial privacy, a new bitcoin address can be generated for each transaction.[87] For example, hierarchical deterministic wallets generate pseudorandom "rolling addresses" for every transaction from a single seed, while only requiring a single passphrase to be remembered to recover all corresponding private keys.[88] Researchers at Stanford University and Concordia University have also shown that bitcoin exchanges and other entities can prove assets, liabilities, and solvency without revealing their addresses using zero-knowledge proofs.[89] "Bulletproofs," a version of Confidential Transactions proposed by Greg Maxwell, have been tested by Professor Dan Boneh of Stanford.[90] Other solutions such Merkelized Abstract Syntax Trees (MAST), pay-to-script-hash (P2SH) with MERKLE-BRANCH-VERIFY, and "Tail Call Execution Semantics", have also been proposed to support private smart contracts.[91]

Fungibility

Wallets and similar software technically handle all bitcoins as equivalent, establishing the basic level of fungibility. Researchers have pointed out that the history of each bitcoin is registered and publicly available in the blockchain ledger, and that some users may refuse to accept bitcoins coming from controversial transactions, which would harm bitcoin's fungibility.[92] Projects such as CryptoNote, Zerocoin, and Dark Wallet aim to address these privacy and fungibility issues.[93][94]

Scalability

The blocks in the blockchain were not limited originally. The block size limit of one megabyte was introduced by Satoshi Nakamoto in 2010, as an anti-spam measure.[95] Eventually the block size limit of one megabyte created problems for transaction processing, such as increasing transaction fees and delayed processing of transactions that cannot be fit into a block.[96]

On 24 August 2017 (at block 481,824), Segregated Witness (SegWit) went live, introducing a new transaction format where signature data is separated and known as the witness. The upgrade replaced the block size limit with a limit on a new measure called block weight, which counts non-witness data four times as much as witness data, and allows a maximum weight of 4 megabytes.[95][97][98] Thus, per computer scientist Jochen Hoenicke, the actual block capacity depends on the ratio of SegWit transactions in the block, and on the ratio of signature data. Based on his estimate, if the ratio of SegWit transactions is 50%, the block capacity may be 1.25 megabytes.[95] According to Hoenicke, if native SegWit addresses from Bitcoin Core version 0.16.0 are used,[99] and SegWit adoption reaches 90 to 95%, a block size of up to 1.8 megabytes is possible.[95]

Economics

Classification

Bitcoin is a digital asset designed by its inventor, Satoshi Nakamoto, to work as a currency.[4][100] It is commonly referred to with terms like digital currency,[8]: 1 digital cash,[101] virtual currency,[3] electronic currency,[17] or cryptocurrency.[102]

The question whether bitcoin is a currency or not is still disputed.[102] Bitcoins have three useful qualities in a currency, according to The Economist in January 2015: they are "hard to earn, limited in supply and easy to verify".[103] Economists define money as a store of value, a medium of exchange, and a unit of account and agree that bitcoin has some way to go to meet all these criteria.[104] It does best as a medium of exchange; as of February 2015[update] the number of merchants accepting bitcoin had passed 100,000.[13] As of March 2014[update], the bitcoin market suffered from volatility, limiting the ability of bitcoin to act as a stable store of value, and retailers accepting bitcoin use other currencies as their principal unit of account.[104]

General use

According to research produced by Cambridge University, there were between 2.9 million and 5.8 million unique users using a cryptocurrency wallet, as of 2017, most of them using bitcoin. The number of users has grown significantly since 2013, when there were 300,000 to 1.3 million users.[14]

Acceptance by merchants

In 2015, the number of merchants accepting bitcoin exceeded 100,000.[13] Instead of 2–3% typically imposed by credit card processors, merchants accepting bitcoins often pay fees under 2%, down to 0%.[105] Firms that accepted payments in bitcoin as of December 2014 included PayPal,[106] Microsoft,[107] Dell,[108] and Newegg.[109] In 2017 bitcoin's acceptance among major online retailers included three out of the top 500 online merchants, down from five in 2016. Reasons for this fall include high transaction fees due to bitcoin's scalability issues, long transaction times and a rise in value making consumers unwilling to spend it.[110] In November 2017 PwC accepted bitcoin at its Hong Kong office in exchange for providing advisory services to local companies who are specialists in blockchain technology and cryptocurrencies, the first time any Big Four accounting firm accepted the cryptocurrency as payment.[111][112]

Payment service providers

Merchants accepting bitcoin ordinarily use the services of bitcoin payment service providers such as BitPay or Coinbase. When a customer pays in bitcoin, the payment service provider accepts the bitcoin on behalf of the merchant, converts it to the local currency, and sends the obtained amount to merchant's bank account, charging a fee for the service.[113]

Financial institutions

Bitcoins can be bought on digital currency exchanges. According to Tony Gallippi, a co-founder of BitPay, "banks are scared to deal with bitcoin companies, even if they really want to".[114] In 2014, the National Australia Bank closed accounts of businesses with ties to bitcoin,[115] and HSBC refused to serve a hedge fund with links to bitcoin.[116] Australian banks in general have been reported as closing down bank accounts of operators of businesses involving the currency;[117] this has become the subject of an investigation by the Australian Competition and Consumer Commission.[117] Nonetheless, Australian banks have trialled trading between each other using the blockchain technology on which bitcoin is based.[118]

In a 2013 report, Bank of America Merrill Lynch stated that "we believe bitcoin can become a major means of payment for e-commerce and may emerge as a serious competitor to traditional money-transfer providers."[119] In June 2014, the first bank that converts deposits in currencies instantly to bitcoin without any fees was opened in Boston.[120]

Plans were announced to include a bitcoin futures option on the Chicago Mercantile Exchange in 2017.[121] Trading in bitcoin futures was announced to begin on 10 December 2017.[122]

As an investment

Some Argentinians have bought bitcoins to protect their savings against high inflation or the possibility that governments could confiscate savings accounts.[86] During the 2012–2013 Cypriot financial crisis, bitcoin purchases in Cyprus rose due to fears that savings accounts would be confiscated or taxed.[123]

The Winklevoss twins have invested into bitcoins. In 2013 The Washington Post claimed that they owned 1% of all the bitcoins in existence at the time.[124]

Other methods of investment are bitcoin funds. The first regulated bitcoin fund was established in Jersey in July 2014 and approved by the Jersey Financial Services Commission.[125] Forbes started publishing arguments in favor of investing in December 2015.[126]

In 2013 and 2014, the European Banking Authority[127] and the Financial Industry Regulatory Authority (FINRA), a United States self-regulatory organization,[128] warned that investing in bitcoins carries significant risks. Forbes named bitcoin the best investment of 2013.[129] In 2014, Bloomberg named bitcoin one of its worst investments of the year.[130] In 2015, bitcoin topped Bloomberg's currency tables.[131]

According to bitinfocharts.com, in 2017 there are 9,272 bitcoin wallets with more than $1 million worth of bitcoins.[132] The exact number of bitcoin millionaires is uncertain as a single person can have more than one bitcoin wallet.

Venture capital

Venture capitalists, such as Peter Thiel's Founders Fund, which invested US$3 million in BitPay, do not purchase bitcoins themselves, instead funding bitcoin infrastructure like companies that provide payment systems to merchants, exchanges, wallet services, etc.[133] In 2012, an incubator for bitcoin-focused start-ups was founded by Adam Draper, with financing help from his father, venture capitalist Tim Draper, one of the largest bitcoin holders after winning an auction of 30,000 bitcoins,[134] at the time called 'mystery buyer'.[135] The company's goal is to fund 100 bitcoin businesses within 2–3 years with $10,000 to $20,000 for a 6% stake.[134] Investors also invest in bitcoin mining.[136] According to a 2015 study by Paolo Tasca, bitcoin startups raised almost $1 billion in three years (Q1 2012 – Q1 2015).[137]

Price and volatility

The price of bitcoins has gone through various cycles of appreciation and depreciation referred to by some as bubbles and busts.[138][139] In 2011, the value of one bitcoin rapidly rose from about US$0.30 to US$32 before returning to US$2.[140] In the latter half of 2012 and during the 2012–13 Cypriot financial crisis, the bitcoin price began to rise,[141] reaching a high of US$266 on 10 April 2013, before crashing to around US$50.[142] On 29 November 2013, the cost of one bitcoin rose to a peak of US$1,242.[143] In 2014, the price fell sharply, and as of April remained depressed at little more than half 2013 prices. As of August 2014[update] it was under US$600.[144]

According to Mark T. Williams, as of 2014[update], bitcoin has volatility seven times greater than gold, eight times greater than the S&P 500, and 18 times greater than the US dollar.[145] According to Forbes, there are uses where volatility does not matter, such as online gambling, tipping, and international remittances.[146]

According to an article in The Wall Street Journal, as of 19 April 2016[update], bitcoin had been more stable than gold for the preceding 24 days, and it was suggested that its value might be more stable in the future.[147] On 3 March 2017, the price of a bitcoin surpassed the market value of an ounce of gold for the first time as its price surged to an all-time high of $1,268.[148][149] A study in Electronic Commerce Research and Applications, going back through the network's historical data, showed the value of the bitcoin network as measured by the price of bitcoins, to be roughly proportional to the square of the number of daily unique users participating on the network, i.e. that the network is "fairly well modeled by the Metcalfe's law".[150]

Ponzi scheme and pyramid scheme concerns

Various journalists,[80][151] economists,[152][153] and the central bank of Estonia[154] have voiced concerns that bitcoin is a Ponzi scheme. In 2013, Eric Posner, a law professor at the University of Chicago, stated that "a real Ponzi scheme takes fraud; bitcoin, by contrast, seems more like a collective delusion."[155] A 2014 report by the World Bank concluded that bitcoin was not a deliberate Ponzi scheme.[156]: 7 The Swiss Federal Council[157]: 21 examined the concerns that bitcoin might be a pyramid scheme; it concluded that "Since in the case of bitcoin the typical promises of profits are lacking, it cannot be assumed that bitcoin is a pyramid scheme." In July 2017, billionaire Howard Marks referred to bitcoin as a pyramid scheme.[158]

On 12 September 2017, Jamie Dimon, CEO of JP Morgan Chase, called bitcoin a "fraud" and said he would fire anyone in his firm caught trading it. Zero Hedge claimed that the same day Dimon made his statement, JP Morgan also purchased a large amount of bitcoins for its clients.[159] In a January 2018 interview Dimon voiced regrets about his earlier remarks, and said "The blockchain is real. You can have cryptodollars in yen and stuff like that. ICOs ... you got to look at every one individually."[160]

Speculative bubble dispute

Bitcoin has been labelled a speculative bubble by many including former Fed Chairman Alan Greenspan[161] and economist John Quiggin.[162] Nobel Memorial Prize laureate Robert Shiller said that bitcoin "exhibited many of the characteristics of a speculative bubble".[163] Journalist Matthew Boesler in 2013 rejected the speculative bubble label and saw bitcoin's quick rise in price as nothing more than normal economic forces at work.[164] Timothy B. Lee, in a 2013 piece for The Washington Post pointed out that the observed cycles of appreciation and depreciation don't correspond to the definition of speculative bubble.[140] On 14 March 2014, the American business magnate Warren Buffett said, "Stay away from it. It's a mirage, basically."[165] During their time as bitcoin developers, Gavin Andresen[166] and Mike Hearn[167] warned that bubbles may occur.

Legal status, tax and regulation

Because of bitcoin's decentralized nature, nation-states cannot shut down the network or alter its technical rules.[168] However, the use of bitcoin can be criminalized, and shutting down exchanges and the peer-to-peer economy in a given country would constitute a "de facto ban".[169] The legal status of bitcoin varies substantially from country to country and is still undefined or changing in many of them. While some countries have explicitly allowed its use and trade, others have banned or restricted it. Regulations and bans that apply to bitcoin probably extend to similar cryptocurrency systems.[170]

Energy consumption

Bitcoin has been criticized for the amounts of electricity consumed by mining. As of 2015, The Economist estimated that even if all miners used modern facilities, the combined electricity consumption would be 166.7 megawatts (1.46 terawatt-hours per year).[103] At the end of 2017, the global bitcoin mining activity was estimated to consume between 1 and 4 gigawatts of electricity.[171] Politico noted that the banking sector today consumes about 6% of total global power, and even if bitcoin's consumption levels increased 100 fold from today's levels, bitcoin's consumption would still only amount to about 2% of global power consumption.[172]

To lower the costs, bitcoin miners have set up in places like Iceland where geothermal energy is cheap and cooling Arctic air is free.[80] Bitcoin miners are known to use hydroelectric power in Tibet, Quebec, Washington (state), and Austria to reduce electricity costs.[172][173][174][175] Miners are attracted to suppliers such as Hydro Quebec that have energy surpluses.[176] According to a University of Cambridge study, much of bitcoin mining is done in China, where electricity is subsidized by the government.[177][178]

Criminal activity

The use of bitcoin by criminals has attracted the attention of financial regulators, legislative bodies, law enforcement, and the media.[179] In the United States, the FBI prepared an intelligence assessment,[180] the SEC issued a pointed warning about investment schemes using virtual currencies,[179] and the U.S. Senate held a hearing on virtual currencies in November 2013.[79]

Several news outlets have asserted that the popularity of bitcoins hinges on the ability to use them to purchase illegal goods.[100][181] In 2014, researchers at the University of Kentucky found "robust evidence that computer programming enthusiasts and illegal activity drive interest in bitcoin, and find limited or no support for political and investment motives".[182]

The New York Post has published a news article based on a report by researchers at Germany’s RWTH Aachen University.[183] The researchers said "Our analysis shows that certain content, e.g., illegal pornography, can render the mere possession of a blockchain illegal".[184]

In popular culture

Academia

In September 2015, the establishment of the peer-reviewed academic journal Ledger (ISSN 2379-5980) was announced. It will cover studies of cryptocurrencies and related technologies, and is published by the University of Pittsburgh.[185][186] The journal encourages authors to digitally sign a file hash of submitted papers, which will then be timestamped into the bitcoin blockchain. Authors are also asked to include a personal bitcoin address in the first page of their papers.[187][188]

Film

The documentary film, The Rise and Rise of Bitcoin (late 2014), features interviews with people who use bitcoin, such as a computer programmer and a drug dealer.[189] The film Banking on Bitcoin is also a documentary about the beginnings of bitcoin and how it evolved to be what it is today.[190]

Literature

In Charles Stross' science fiction novel, Neptune's Brood, "bitcoin" (a modified version) is used as the universal interstellar payment system.[191][192]

Television

In November 2017, the American sitcom, The Big Bang Theory, dedicated an episode on bitcoins called "The Bitcoin Entanglement". In the episode, after hearing the price of a bitcoin had risen to $5,000, friends try to track down bitcoins they mined seven years earlier.[193]

See also

Notes

- ^ As of 2014[update], BTC is a commonly used code.[20] It does not conform to ISO 4217 as BT is the country code of Bhutan, and ISO 4217 requires the first letter used in global commodities to be 'X'.

- ^ As of 2014[update], XBT, a code that conforms to ISO 4217 though is not officially part of it, is used by Bloomberg L.P.,[21] CNNMoney,[22] and xe.com.[23]

- ^ Relative mining difficulty is defined as the ratio of the difficulty target on 9 January 2009 to the current difficulty target.

- ^ It is misleading to think that there is an analogy between gold mining and bitcoin mining. The fact is that gold miners are rewarded for producing gold, while bitcoin miners are not rewarded for producing bitcoins; they are rewarded for their record-keeping services.[51]

- ^ The exact number is 20,999,999.9769 bitcoins.[46]: ch. 8

- ^ The price of 1 bitcoin in US dollars.

- ^ Volatility is calculated on a yearly basis.

References

- ^ "Unicode 10.0.0". Unicode Consortium. 20 June 2017. Archived from the original on 20 June 2017. Retrieved 20 June 2017.

{{cite web}}: Unknown parameter|deadurl=ignored (|url-status=suggested) (help) - ^ a b Siluk, Shirley (2 June 2013). "June 2 "M Day" promotes millibitcoin as unit of choice". CoinDesk. Archived from the original on 7 August 2017. Retrieved 25 May 2017.

{{cite news}}: Unknown parameter|deadurl=ignored (|url-status=suggested) (help) - ^ a b c Jason Mick (12 June 2011). "Cracking the Bitcoin: Digging Into a $131M USD Virtual Currency". Daily Tech. Archived from the original on 20 January 2013. Retrieved 30 September 2012.

{{cite web}}: Unknown parameter|deadurl=ignored (|url-status=suggested) (help) - ^ a b c d e f g h Nakamoto, Satoshi (31 October 2008). "Bitcoin: A Peer-to-Peer Electronic Cash System" (PDF). bitcoin.org. Archived from the original (PDF) on 20 March 2014. Retrieved 28 April 2014.

{{cite web}}: Unknown parameter|deadurl=ignored (|url-status=suggested) (help) - ^ a b "Statement of Jennifer Shasky Calvery, Director Financial Crimes Enforcement Network United States Department of the Treasury Before the United States Senate Committee on Banking, Housing, and Urban Affairs Subcommittee on National Security and International Trade and Finance Subcommittee on Economic Policy" (PDF). fincen.gov. Financial Crimes Enforcement Network. 19 November 2013. Archived from the original (PDF) on 9 October 2016. Retrieved 1 June 2014.

{{cite web}}: Unknown parameter|deadurl=ignored (|url-status=suggested) (help) - ^ Empson, Rip (28 March 2013). "Bitcoin: How An Unregulated, Decentralized Virtual Currency Just Became A Billion Dollar Market". TechCrunch. AOL inc. Archived from the original on 9 October 2016. Retrieved 8 October 2016.

{{cite news}}: Unknown parameter|deadurl=ignored (|url-status=suggested) (help) - ^ "Bitcoin". LiveCoinWatch.

- ^ a b c d e f g Jerry Brito; Andrea Castillo (2013). "Bitcoin: A Primer for Policymakers" (PDF). Mercatus Center. George Mason University. Archived from the original (PDF) on 21 September 2013. Retrieved 22 October 2013.

{{cite web}}: Unknown parameter|deadurl=ignored (|url-status=suggested) (help); Unknown parameter|lastauthoramp=ignored (|name-list-style=suggested) (help) - ^ a b Tschorsch, Florian; Scheuermann, Björn (2016). "Bitcoin and Beyond: A Technical Survey on Decentralized Digital Currencies". IEEE Communications Surveys & Tutorials. 18 (3): 2084–2123. doi:10.1109/comst.2016.2535718. Archived from the original on 24 October 2017. Retrieved 24 October 2017.

{{cite journal}}: Unknown parameter|deadurl=ignored (|url-status=suggested) (help) - ^ a b S., L. (2 November 2015). "Who is Satoshi Nakamoto?". The Economist. The Economist Newspaper Limited. Archived from the original on 21 August 2016. Retrieved 23 September 2016.

{{cite news}}: Unknown parameter|deadurl=ignored (|url-status=suggested) (help) - ^ a b c d Davis, Joshua (10 October 2011). "The Crypto-Currency: Bitcoin and its mysterious inventor". The New Yorker. Archived from the original on 1 November 2014. Retrieved 31 October 2014.

{{cite web}}: Unknown parameter|deadurl=ignored (|url-status=suggested) (help) - ^ "What is Bitcoin?". CNN Money. Archived from the original on 31 October 2015. Retrieved 16 November 2015.

{{cite news}}: Unknown parameter|deadurl=ignored (|url-status=suggested) (help) - ^ a b c Cuthbertson, Anthony (4 February 2015). "Bitcoin now accepted by 100,000 merchants worldwide". International Business Times. IBTimes Co., Ltd. Archived from the original on 28 November 2015. Retrieved 20 November 2015.

{{cite news}}: Unknown parameter|deadurl=ignored (|url-status=suggested) (help) - ^ a b Hileman, Garrick; Rauchs, Michel. "Global Cryptocurrency Benchmarking Study" (PDF). Cambridge University. Archived from the original (PDF) on 10 April 2017. Retrieved 14 April 2017.

{{cite web}}: Unknown parameter|deadurl=ignored (|url-status=suggested) (help) - ^ Vigna, Paul; Casey, Michael J. (January 2015). The Age of Cryptocurrency: How Bitcoin and Digital Money Are Challenging the Global Economic Order (1 ed.). New York: St. Martin's Press. ISBN 978-1-250-06563-6.

- ^ a b "bitcoin". OxfordDictionaries.com. Archived from the original on 2 January 2015. Retrieved 28 December 2014.

{{cite web}}: Unknown parameter|deadurl=ignored (|url-status=suggested) (help) - ^ a b Bustillos, Maria (2 April 2013). "The Bitcoin Boom". The New Yorker. Condé Nast. Archived from the original on 27 July 2014. Retrieved 22 December 2013.

Standards vary, but there seems to be a consensus forming around Bitcoin, capitalized, for the system, the software, and the network it runs on, and bitcoin, lowercase, for the currency itself.

{{cite web}}: Unknown parameter|deadurl=ignored (|url-status=suggested) (help) - ^ Vigna, Paul (3 March 2014). "BitBeat: Is It Bitcoin, or bitcoin? The Orthography of the Cryptography". WSJ. Archived from the original on 19 April 2014. Retrieved 21 April 2014.

{{cite news}}: Unknown parameter|deadurl=ignored (|url-status=suggested) (help) - ^ Metcalf, Allan (14 April 2014). "The latest style". Lingua Franca blog. The Chronicle of Higher Education (chronicle.com). Archived from the original on 16 April 2014. Retrieved 19 April 2014.

{{cite web}}: Unknown parameter|deadurl=ignored (|url-status=suggested) (help) - ^ Nermin Hajdarbegovic (7 October 2014). "Bitcoin Foundation to Standardise Bitcoin Symbol and Code Next Year". CoinDesk. Archived from the original on 5 January 2015. Retrieved 28 January 2015.

{{cite web}}: Unknown parameter|deadurl=ignored (|url-status=suggested) (help) - ^ Romain Dillet (9 August 2013). "Bitcoin Ticker Available On Bloomberg Terminal For Employees". TechCrunch. Archived from the original on 1 November 2014. Retrieved 2 November 2014.

{{cite news}}: Unknown parameter|deadurl=ignored (|url-status=suggested) (help) - ^ "Bitcoin Composite Quote (XBT)". CNN Money. CNN. Archived from the original on 27 October 2014. Retrieved 2 November 2014.

{{cite news}}: Unknown parameter|deadurl=ignored (|url-status=suggested) (help) - ^ "XBT – Bitcoin". xe.com. Archived from the original on 2 November 2014. Retrieved 2 November 2014.

{{cite web}}: Unknown parameter|deadurl=ignored (|url-status=suggested) (help) - ^ Katie Pisa; Natasha Maguder (9 July 2014). "Bitcoin your way to a double espresso". cnn.com. CNN. Archived from the original on 18 June 2015. Retrieved 23 April 2015.

{{cite news}}: Unknown parameter|deadurl=ignored (|url-status=suggested) (help); Unknown parameter|lastauthoramp=ignored (|name-list-style=suggested) (help) - ^ "Regulation of Bitcoin in Selected Jurisdictions" (PDF). The Law Library of Congress, Global Legal Research Center. January 2014. Archived from the original (PDF) on 14 October 2014. Retrieved 26 August 2014.

{{cite web}}: Unknown parameter|deadurl=ignored (|url-status=suggested) (help) - ^ a b "What is 'Bitcoin'". Investopedia. Archived from the original on 11 October 2017. Retrieved 11 October 2017.

{{cite web}}: Unknown parameter|deadurl=ignored (|url-status=suggested) (help) - ^ Nakamoto, Satoshi (3 January 2009). "Bitcoin". Archived from the original on 21 July 2017.

{{cite web}}: Unknown parameter|deadurl=ignored (|url-status=suggested) (help) - ^ Nakamoto, Satoshi (9 January 2009). "Bitcoin v0.1 released". Archived from the original on 26 March 2014.

{{cite web}}: Unknown parameter|deadurl=ignored (|url-status=suggested) (help) - ^ Wallace, Benjamin (23 November 2011). "The Rise and Fall of Bitcoin". Wired. Archived from the original on 31 October 2013. Retrieved 13 October 2012.

{{cite news}}: Unknown parameter|deadurl=ignored (|url-status=suggested) (help) - ^ "Block 0 – Bitcoin Block Explorer". Archived from the original on 15 October 2013.

{{cite web}}: Unknown parameter|deadurl=ignored (|url-status=suggested) (help) - ^ Pagliery, Jose (2014). Bitcoin: And the Future of Money. Triumph Books. ISBN 9781629370361. Archived from the original on 21 January 2018. Retrieved 20 January 2018.

{{cite book}}: Unknown parameter|deadurl=ignored (|url-status=suggested) (help) - ^ "Here's The Problem with the New Theory That A Japanese Math Professor Is The Inventor of Bitcoin". San Francisco Chronicle. Archived from the original on 4 January 2015. Retrieved 24 February 2015.

{{cite web}}: Unknown parameter|deadurl=ignored (|url-status=suggested) (help) - ^ Peterson, Andrea (3 January 2014). "Hal Finney received the first Bitcoin transaction. Here's how he describes it". The Washington Post. Archived from the original on 27 February 2015.

{{cite news}}: Unknown parameter|deadurl=ignored (|url-status=suggested) (help) - ^ Popper, Nathaniel (30 August 2014). "Hal Finney, Cryptographer and Bitcoin Pioneer, Dies at 58". NYTimes. Archived from the original on 3 September 2014. Retrieved 2 September 2014.

{{cite news}}: Unknown parameter|deadurl=ignored (|url-status=suggested) (help) - ^ Wallace, Benjamin (23 November 2011). "The Rise and Fall of Bitcoin". Wired. Archived from the original on 4 November 2013. Retrieved 4 November 2013.

{{cite news}}: Unknown parameter|deadurl=ignored (|url-status=suggested) (help) - ^ McMillan, Robert. "Who Owns the World's Biggest Bitcoin Wallet? The FBI". Wired. Condé Nast. Archived from the original on 21 October 2016. Retrieved 7 October 2016.

{{cite news}}: Unknown parameter|deadurl=ignored (|url-status=suggested) (help) - ^ "Gavin Andresen Steps Down as Bitcoin's Lead Developer". CoinDesk. 8 April 2014. Archived from the original on 2 September 2017. Retrieved 6 December 2017.

{{cite web}}: Unknown parameter|deadurl=ignored (|url-status=suggested) (help) - ^ Simonite, Tom. "Meet Gavin Andresen, the most powerful person in the world of Bitcoin". MIT Technology Review. Retrieved 6 December 2017.

- ^ a b Odell, Matt (21 September 2015). "A Solution To Bitcoin's Governance Problem". TechCrunch. Archived from the original on 26 January 2016. Retrieved 24 January 2016.

{{cite news}}: Unknown parameter|deadurl=ignored (|url-status=suggested) (help) - ^ a b Vigna, Paul (17 January 2016). "Is Bitcoin Breaking Up?". The Wall Street Journal. Archived from the original on 20 August 2016. Retrieved 8 November 2016.

{{cite news}}: Unknown parameter|deadurl=ignored (|url-status=suggested) (help) - ^ IRC (14 October 2010). "IRC discussion about BitDNS 1/2". web.archive.org. web.archive.org. Archived from the original on 18 November 2010.

{{cite web}}: Unknown parameter|deadurl=ignored (|url-status=suggested) (help) - ^ IRC (15 October 2010). "IRC discussion about BitDNS 2/2". web.archive.org. web.archive.org. Archived from the original on 18 November 2010.

{{cite web}}: Unknown parameter|deadurl=ignored (|url-status=suggested) (help) - ^ a b c d e f "The great chain of being sure about things". The Economist. The Economist Newspaper Limited. 31 October 2015. Archived from the original on 3 July 2016. Retrieved 3 July 2016.

{{cite news}}: Unknown parameter|deadurl=ignored (|url-status=suggested) (help) - ^ "Bitcoin Wallet". Investopedia. Archived from the original on 19 August 2016. Retrieved 28 June 2016.

{{cite web}}: Unknown parameter|deadurl=ignored (|url-status=suggested) (help) - ^ Sparkes, Matthew (9 June 2014). "The coming digital anarchy". The Telegraph. London: Telegraph Media Group Limited. Archived from the original on 23 January 2015. Retrieved 7 January 2015.

{{cite news}}: Unknown parameter|deadurl=ignored (|url-status=suggested) (help) - ^ a b c d e f g h i j Andreas M. Antonopoulos (April 2014). Mastering Bitcoin. Unlocking Digital Crypto-Currencies. O'Reilly Media. ISBN 978-1-4493-7404-4.

- ^ a b c d e "Charts". Blockchain.info. Archived from the original on 3 November 2014. Retrieved 2 November 2014.

{{cite web}}: Unknown parameter|deadurl=ignored (|url-status=suggested) (help) - ^ a b c d e Joshua A. Kroll; Ian C. Davey; Edward W. Felten (11–12 June 2013). "The Economics of Bitcoin Mining, or Bitcoin in the Presence of Adversaries" (PDF). The Twelfth Workshop on the Economics of Information Security (WEIS 2013). Archived from the original (PDF) on 9 May 2016. Retrieved 26 April 2016.

A transaction fee is like a tip or gratuity left for the miner.

{{cite web}}: Unknown parameter|deadurl=ignored (|url-status=suggested) (help) - ^ "Man Throws Away 7,500 Bitcoins, Now Worth $7.5 Million". CBS DC. 29 November 2013. Archived from the original on 15 January 2014. Retrieved 23 January 2014.

{{cite news}}: Unknown parameter|deadurl=ignored (|url-status=suggested) (help) - ^ "How Not to Lose Your Bitcoin in 2017 – CoinDesk". 28 December 2016. Archived from the original on 8 September 2017.

{{cite web}}: Unknown parameter|deadurl=ignored (|url-status=suggested) (help) - ^ Andolfatto, David (31 March 2014). "Bitcoin and Beyond: The Possibilities and Pitfalls of Virtual Currencies" (PDF). Dialogue with the Fed. Federal Reserve Bank of St. Louis. Archived from the original (PDF) on 9 April 2014. Retrieved 16 April 2014.

{{cite web}}: Unknown parameter|deadurl=ignored (|url-status=suggested) (help) - ^ Blocki, Jeremiah; Zhou, Hong-Sheng (1 January 2016). "Designing Proof of Human-Work Puzzles for Cryptocurrency and Beyond". Theory of Cryptography. Lecture Notes in Computer Science. 9986. Springer Berlin Heidelberg: 517–546. doi:10.1007/978-3-662-53644-5_20. ISBN 978-3-662-53643-8. Retrieved 4 February 2018.

- ^ "Difficulty History" (The ratio of all hashes over valid hashes is D x 4,295,032,833, where D is the published "Difficulty" figure.). Blockchain.info. Archived from the original on 8 April 2015. Retrieved 26 March 2015.

{{cite web}}: Unknown parameter|deadurl=ignored (|url-status=suggested) (help) - ^ Hampton, Nikolai (5 September 2016). "Understanding the blockchain hype: Why much of it is nothing more than snake oil and spin". Computerworld. IDG. Archived from the original on 6 September 2016. Retrieved 5 September 2016.

{{cite news}}: Unknown parameter|deadurl=ignored (|url-status=suggested) (help) - ^ Biggs, John (8 April 2013). "How To Mine Bitcoins". Techcrunch. Archived from the original on 6 July 2017.

{{cite web}}: Unknown parameter|deadurl=ignored (|url-status=suggested) (help) - ^ Ashlee Vance (14 November 2013). "2014 Outlook: Bitcoin Mining Chips, a High-Tech Arms Race". Businessweek. Archived from the original on 21 November 2013. Retrieved 24 November 2013.

{{cite web}}: Unknown parameter|deadurl=ignored (|url-status=suggested) (help) - ^ "Block #420000". Blockchain.info. Archived from the original on 18 September 2016. Retrieved 11 September 2016.

{{cite web}}: Unknown parameter|deadurl=ignored (|url-status=suggested) (help) - ^ Ritchie S. King; Sam Williams; David Yanofsky (17 December 2013). "By reading this article, you're mining bitcoins". qz.com. Atlantic Media Co. Archived from the original on 17 December 2013. Retrieved 17 December 2013.

{{cite web}}: Unknown parameter|deadurl=ignored (|url-status=suggested) (help) - ^ Shin, Laura (24 May 2016). "Bitcoin Production Will Drop By Half In July, How Will That Affect The Price?". Forbes. Archived from the original on 24 May 2016. Retrieved 13 July 2016.

{{cite news}}: Unknown parameter|deadurl=ignored (|url-status=suggested) (help) - ^ Adam Serwer; Dana Liebelson (10 April 2013). "Bitcoin, Explained". motherjones.com. Mother Jones. Archived from the original on 27 April 2014. Retrieved 26 April 2014.

{{cite web}}: Unknown parameter|deadurl=ignored (|url-status=suggested) (help); Unknown parameter|lastauthoramp=ignored (|name-list-style=suggested) (help) - ^ a b c Villasenor, John (26 April 2014). "Secure Bitcoin Storage: A Q&A With Three Bitcoin Company CEOs". forbes.com. Forbes. Archived from the original on 27 April 2014. Retrieved 26 April 2014.

{{cite news}}: Unknown parameter|deadurl=ignored (|url-status=suggested) (help) - ^ "Bitcoin: Bitcoin under pressure". The Economist. 30 November 2013. Archived from the original on 30 November 2013. Retrieved 30 November 2013.

{{cite news}}: Unknown parameter|deadurl=ignored (|url-status=suggested) (help) - ^ "Blockchain Size". Blockchain.info. Archived from the original on 27 May 2017. Retrieved 16 January 2018.

{{cite web}}: Unknown parameter|deadurl=ignored (|url-status=suggested) (help) - ^ Torpey, Kyle. "You Really Should Run a Bitcoin Full Node: Here's Why". Bitcoin Magazine. Archived from the original on 3 July 2017. Retrieved 29 November 2017.

{{cite web}}: Unknown parameter|deadurl=ignored (|url-status=suggested) (help) - ^ "Masternode vs Pruning Node vs Full Node". The Merkle. Archived from the original on 16 January 2018. Retrieved 16 January 2018.

Rather than storing entire network blocks full of data, the pruning node stores the final link of every transaction. Moreover, they can still validate bitcoin transactions and relay them to the rest of the network.

{{cite web}}: Unknown parameter|deadurl=ignored (|url-status=suggested) (help) - ^ Gervais, Arthur; O. Karame, Ghassan; Gruber, Damian; Capkun, Srdjan. "On the Privacy Provisions of Bloom Filters in Lightweight Bitcoin Clients" (PDF). Archived from the original (PDF) on 5 October 2016. Retrieved 3 September 2016.

{{cite web}}: Unknown parameter|deadurl=ignored (|url-status=suggested) (help) - ^ Jon Matonis (26 April 2012). "Be Your Own Bank: Bitcoin Wallet for Apple". Forbes. Archived from the original on 12 October 2014. Retrieved 17 November 2014.

{{cite news}}: Unknown parameter|deadurl=ignored (|url-status=suggested) (help) - ^ Bill Barhydt (4 June 2014). "3 reasons Wall Street can't stay away from bitcoin". NBCUniversal. Archived from the original on 3 April 2015. Retrieved 2 April 2015.

{{cite news}}: Unknown parameter|deadurl=ignored (|url-status=suggested) (help) - ^ "MtGox gives bankruptcy details". bbc.com. BBC. 4 March 2014. Archived from the original on 12 March 2014. Retrieved 13 March 2014.

{{cite web}}: Unknown parameter|deadurl=ignored (|url-status=suggested) (help) - ^ "Antonopoulos: Your Keys, Your Bitcoin. Not Your Keys, Not Your Bitcoin". Cointelegraph. Retrieved 16 February 2018.

- ^ Staff, Verge (13 December 2013). "Casascius, maker of shiny physical bitcoins, shut down by Treasury Department". The Verge. Archived from the original on 10 January 2014. Retrieved 10 January 2014.

{{cite web}}: Unknown parameter|deadurl=ignored (|url-status=suggested) (help) - ^ Roberts, Daniel (15 December 2017). "How to send bitcoin to a hardware wallet". Yahoo Finance. Retrieved 17 February 2018.

- ^ Skudnov, Rostislav (2012). Bitcoin Clients (PDF) (Bachelor's Thesis). Turku University of Applied Sciences. Archived from the original (PDF) on 18 January 2014. Retrieved 16 January 2014.

{{cite thesis}}: Unknown parameter|deadurl=ignored (|url-status=suggested) (help) - ^ "Bitcoin Core version 0.9.0 released". bitcoin.org. Archived from the original on 27 February 2015. Retrieved 8 January 2015.

{{cite web}}: Unknown parameter|deadurl=ignored (|url-status=suggested) (help) - ^ Metz, Cade (19 August 2015). "The Bitcoin Schism Shows the Genius of Open Source". Wired. Condé Nast. Archived from the original on 30 June 2016. Retrieved 3 July 2016.

{{cite news}}: Unknown parameter|deadurl=ignored (|url-status=suggested) (help) - ^ "Who Funds Bitcoin Core Development? How the Industry Supports Bitcoin's 'Reference Client'". NASDAQ.com. 6 April 2016. Retrieved 16 February 2018.

- ^ Bajpai, Prableen (26 October 2016). "What Is Bitcoin Unlimited?". Investopedia, LLC. Archived from the original on 9 November 2016. Retrieved 8 November 2016.

{{cite news}}: Unknown parameter|deadurl=ignored (|url-status=suggested) (help) - ^ Allison, Ian (28 April 2017). "Ethereum co-founder Dr Gavin Wood and company release Parity Bitcoin". International Business Times. Archived from the original on 28 April 2017. Retrieved 28 April 2017.

{{cite news}}: Unknown parameter|deadurl=ignored (|url-status=suggested) (help) - ^ a b Lee, Timothy B. (21 November 2013). "Here's how Bitcoin charmed Washington". The Washington Post. Archived from the original on 1 January 2017. Retrieved 10 October 2016.

{{cite news}}: Unknown parameter|deadurl=ignored (|url-status=suggested) (help) - ^ a b c O'Brien, Matt (13 June 2015). "The scam called Bitcoin". Daily Herald. Archived from the original on 16 June 2015. Retrieved 20 September 2016.

{{cite news}}: Unknown parameter|deadurl=ignored (|url-status=suggested) (help) - ^ Janus Kopfstein (12 December 2013). "The Mission to Decentralize the Internet". The New Yorker. Archived from the original on 31 December 2014. Retrieved 30 December 2014.

The network's 'nodes' – users running the bitcoin software on their computers – collectively check the integrity of other nodes to ensure that no one spends the same coins twice. All transactions are published on a shared public ledger, called the 'blockchain'.

{{cite news}}: Unknown parameter|deadurl=ignored (|url-status=suggested) (help) - ^ Beikverdi, A.; Song, J. (June 2015). "Trend of centralization in Bitcoin's distributed network". 2015 IEEE/ACIS 16th International Conference on Software Engineering, Artificial Intelligence, Networking and Parallel/Distributed Computing (SNPD): 1–6. doi:10.1109/SNPD.2015.7176229. ISBN 978-1-4799-8676-7. Archived from the original on 26 January 2018.

{{cite journal}}: Unknown parameter|deadurl=ignored (|url-status=suggested) (help) - ^ a b c Gervais, Arthur; Karame, Ghassan O.; Capkun, Vedran; Capkun, Srdjan. "Is Bitcoin a Decentralized Currency?". InfoQ. InfoQ & IEEE Computer Society. Archived from the original on 10 October 2016. Retrieved 11 October 2016.

{{cite web}}: Unknown parameter|deadurl=ignored (|url-status=suggested) (help) - ^ Wilhelm, Alex. "Popular Bitcoin Mining Pool Promises To Restrict Its Compute Power To Prevent Feared '51%' Fiasco". TechCrunch. Archived from the original on 5 December 2017. Retrieved 25 January 2018.

{{cite news}}: Unknown parameter|deadurl=ignored (|url-status=suggested) (help) - ^ Simonite, Tom (5 September 2013). "Mapping the Bitcoin Economy Could Reveal Users' Identities". MIT Technology Review. Retrieved 2 April 2014.

- ^ a b Lee, Timothy (21 August 2013). "Five surprising facts about Bitcoin". The Washington Post. Archived from the original on 12 October 2013. Retrieved 2 April 2014.

{{cite news}}: Unknown parameter|deadurl=ignored (|url-status=suggested) (help) - ^ McMillan, Robert (6 June 2013). "How Bitcoin lets you spy on careless companies". wired.co.uk. Conde Nast. Archived from the original on 9 February 2014. Retrieved 2 April 2014.

{{cite web}}: Unknown parameter|deadurl=ignored (|url-status=suggested) (help) - ^ Potts, Jake (31 July 2015). "Mastering Bitcoin Privacy". Airbitz. Archived from the original on 10 August 2015. Retrieved 23 February 2016.

{{cite web}}: Unknown parameter|deadurl=ignored (|url-status=suggested) (help) - ^ Gaby G. Dagher; Benedikt Bünz; Joseph Bonneau; Jeremy Clark; Dan Boneh (26 October 2015). "Provisions: Privacy-preserving proofs of solvency for Bitcoin exchanges" (PDF). International Association for Cryptologic Research. Archived from the original (PDF) on 10 March 2016. Retrieved 23 February 2016.

{{cite web}}: Unknown parameter|deadurl=ignored (|url-status=suggested) (help) - ^ Michiel Mulders (20 December 2017). "How Bulletproofs Could Make Bitcoin Privacy Less Costly". bitcoin magazine. Retrieved 22 February 2018.

- ^ Nikhilesh De (9 January 2018). "Smart Contracts Proposal MAST Inches Closer to Bitcoin's Code". coindesk. Archived from the original on 9 February 2018. Retrieved 22 February 2018.

{{cite web}}: Unknown parameter|deadurl=ignored (|url-status=suggested) (help) - ^ Ben-Sasson, Eli; Chiesa, Alessandro; Garman, Christina; Green, Matthew; Miers, Ian; Tromer, Eran; Virza, Madars (2014). "Zerocash: Decentralized Anonymous Payments from Bitcoin" (PDF). 2014 IEEE Symposium on Security and Privacy. IEEE computer society. Archived from the original (PDF) on 14 October 2014. Retrieved 31 October 2014.

{{cite web}}: Unknown parameter|deadurl=ignored (|url-status=suggested) (help) - ^ Miers, Ian; Garman, Christina; Green, Matthew; Rubin, Aviel. "Zerocoin: Anonymous Distributed E-Cash from Bitcoin" (PDF). Johns Hopkins University. Archived from the original (PDF) on 15 February 2015. Retrieved 15 February 2015.

{{cite web}}: Unknown parameter|deadurl=ignored (|url-status=suggested) (help) - ^ Greenberg, Andy (29 April 2014). "'Dark Wallet' Is About to Make Bitcoin Money Laundering Easier Than Ever". Wired. Archived from the original on 13 February 2015. Retrieved 15 February 2015.

{{cite news}}: Unknown parameter|deadurl=ignored (|url-status=suggested) (help) - ^ a b c d "Understanding Block Weight: How much Capacity does SegWit really Give? by Christoph Bergmann". btcmanager.com. 26 June 2017. Retrieved 20 February 2018.

- ^ Orcutt, Mike (19 May 2015). "Leaderless Bitcoin Struggles to Make Its Most Crucial Decision". MIT Technology Review. Retrieved 22 June 2017.

- ^ "Segwit Activated: How it Works & What's Next for Bitcoin – Bitcoinist.com". bitcoinist.com. Archived from the original on 10 October 2017. Retrieved 10 October 2017.

{{cite web}}: Unknown parameter|deadurl=ignored (|url-status=suggested) (help) - ^ Momoh, Osi (3 May 2017). "SegWit (Segregated Witness)". Investopedia. Archived from the original on 6 October 2017. Retrieved 11 October 2017.

{{cite web}}: Unknown parameter|deadurl=ignored (|url-status=suggested) (help) - ^ "New Bitcoin Code Will Finally Boast Full SegWit Support". coindesk.com. Archived from the original on 20 February 2018. Retrieved 20 February 2018.

{{cite web}}: Unknown parameter|deadurl=ignored (|url-status=suggested) (help) - ^ a b "Monetarists Anonymous". The Economist. The Economist Newspaper Limited. 29 September 2012. Archived from the original on 20 October 2013. Retrieved 21 October 2013.

{{cite news}}: Unknown parameter|deadurl=ignored (|url-status=suggested) (help) - ^ Murphy, Kate (31 July 2013). "Virtual Currency Gains Ground in Actual World". The New York Times. Archived from the original on 14 October 2014. Retrieved 6 May 2014.

A type of digital cash, bitcoins were invented in 2009 and can be sent directly to anyone, anywhere in the world.

{{cite news}}: Unknown parameter|deadurl=ignored (|url-status=suggested) (help) - ^ a b Joyner, April (25 April 2014). "How bitcoin is moving money in Africa". usatoday.com. USA Today. Archived from the original on 1 May 2014. Retrieved 25 May 2014.

{{cite news}}: Unknown parameter|deadurl=ignored (|url-status=suggested) (help) - ^ a b "The magic of mining". The Economist. 13 January 2015. Archived from the original on 12 January 2015. Retrieved 13 January 2015.

{{cite news}}: Unknown parameter|deadurl=ignored (|url-status=suggested) (help) - ^ a b "Free Exchange. Money from nothing. Chronic deflation may keep Bitcoin from displacing its rivals". The Economist. 15 March 2014. Archived from the original on 25 March 2014. Retrieved 25 March 2014.

{{cite news}}: Unknown parameter|deadurl=ignored (|url-status=suggested) (help) - ^ Wingfield, Nick (30 October 2013). "Bitcoin Pursues the Mainstream". The New York Times. Archived from the original on 3 November 2013. Retrieved 4 November 2013.

{{cite news}}: Unknown parameter|deadurl=ignored (|url-status=suggested) (help) - ^ Williams, Sean (9 July 2017). "5 big companies that currently accept bitcoin". Business Insider. Archived from the original on 4 December 2017.

{{cite news}}: Unknown parameter|deadurl=ignored (|url-status=suggested) (help) - ^ Tom Warren (11 December 2014). "Microsoft now accepts Bitcoin to buy Xbox games and Windows apps". The Verge. Vox Media. Archived from the original on 11 December 2014. Retrieved 11 December 2014.

{{cite news}}: Unknown parameter|deadurl=ignored (|url-status=suggested) (help) - ^ Sydney Ember (18 July 2014). "Dell Begins Accepting Bitcoin". New York Times. Archived from the original on 18 July 2014. Retrieved 18 July 2014.

{{cite news}}: Unknown parameter|deadurl=ignored (|url-status=suggested) (help) - ^ "Newegg accepts bitcoins". newegg.com. 1 July 2014. Archived from the original on 6 July 2014. Retrieved 3 July 2014.

{{cite web}}: Unknown parameter|deadurl=ignored (|url-status=suggested) (help) - ^ Katz, Lily (12 July 2017). "Bitcoin Acceptance Among Retailers Is Low and Getting Lower". Bloomberg. Archived from the original on 25 January 2018. Retrieved 25 January 2018.

{{cite web}}: Unknown parameter|deadurl=ignored (|url-status=suggested) (help) - ^ Russolillo, Steven (30 November 2017). "Bitcoin Goes to the Big Four: PwC Accepts First Digital-Currency Payment". Wall Street Journal. ISSN 0099-9660. Archived from the original on 12 December 2017. Retrieved 12 December 2017.

{{cite news}}: Unknown parameter|deadurl=ignored (|url-status=suggested) (help) - ^ "PwC's Hong Kong Office Accepts Bitcoin Payment – CoinDesk". CoinDesk. 30 November 2017. Archived from the original on 12 December 2017. Retrieved 12 December 2017.

{{cite news}}: Unknown parameter|deadurl=ignored (|url-status=suggested) (help) - ^ Chavez-Dreyfuss, Gertrude; Connor, Michael (28 August 2014). "Bitcoin shows staying power as online merchants chase digital sparkle". Reuters. Archived from the original on 28 August 2014. Retrieved 28 August 2014.

{{cite news}}: Unknown parameter|deadurl=ignored (|url-status=suggested) (help) - ^ Dougherty, Carter (5 December 2013). "Bankers Balking at Bitcoin in US as Real-World Obstacles Mount". bloomberg.com. Bloomberg. Archived from the original on 17 April 2014. Retrieved 16 April 2014.

{{cite news}}: Unknown parameter|deadurl=ignored (|url-status=suggested) (help) - ^ "Bitcoin firms dumped by National Australia Bank as 'too risky'". Australian Associated Press. The Guardian. 10 April 2014. Archived from the original on 23 February 2015. Retrieved 23 February 2015.

{{cite web}}: Unknown parameter|deadurl=ignored (|url-status=suggested) (help) - ^ Weir, Mike (1 December 2014). "HSBC severs links with firm behind Bitcoin fund". bbc.com. BBC. Archived from the original on 3 February 2015. Retrieved 9 January 2015.

{{cite web}}: Unknown parameter|deadurl=ignored (|url-status=suggested) (help) - ^ a b "ACCC investigating why banks are closing bitcoin companies' accounts". Financial Review. Archived from the original on 11 February 2016. Retrieved 28 January 2016.

{{cite web}}: Unknown parameter|deadurl=ignored (|url-status=suggested) (help) - ^ "CBA tests blockchain trading with 10 global banks". The Sydney Morning Herald. Archived from the original on 24 January 2016. Retrieved 28 January 2016.

{{cite web}}: Unknown parameter|deadurl=ignored (|url-status=suggested) (help) - ^ Hill, Kashmir (5 December 2013). "Bitcoin Valued At $1300 By Bank of America Analysts". Forbes.com. Archived from the original on 7 December 2013. Retrieved 23 March 2014.

{{cite news}}: Unknown parameter|deadurl=ignored (|url-status=suggested) (help) - ^ "Bitcoin: is Circle the world's first crypto-currency bank?". The week.co.uk. 16 May 2014. Archived from the original on 27 June 2014. Retrieved 13 June 2014.

{{cite news}}: Unknown parameter|deadurl=ignored (|url-status=suggested) (help) - ^ "Bitcoin Shatters $7k Barrier After Futures Trading Announcement by CME Group". Archived from the original on 2 November 2017.

{{cite web}}: Unknown parameter|deadurl=ignored (|url-status=suggested) (help) - ^ "Archived copy". Archived from the original on 23 January 2018. Retrieved 16 December 2017.

{{cite web}}: Unknown parameter|deadurl=ignored (|url-status=suggested) (help)CS1 maint: archived copy as title (link) - ^ Salyer, Kirsten (20 March 2013). "Fleeing the Euro for Bitcoins". Bloomberg L.P. Archived from the original on 9 February 2014. Retrieved 31 October 2014.

{{cite news}}: Unknown parameter|deadurl=ignored (|url-status=suggested) (help) - ^ Lee, Timothy B. "The $11 million in bitcoins the Winklevoss brothers bought is now worth $32 million". The Switch. The Washington Post. Archived from the original on 6 July 2017. Retrieved 11 August 2017.

{{cite news}}: Unknown parameter|deadurl=ignored (|url-status=suggested) (help) - ^ "Jersey approve Bitcoin fund launch on island". BBC news. 10 July 2014. Archived from the original on 10 July 2014. Retrieved 10 July 2014.

{{cite news}}: Unknown parameter|deadurl=ignored (|url-status=suggested) (help) - ^ Shin, Laura (11 December 2015). "Should You Invest In Bitcoin? 10 Arguments In Favor As Of December 2015". Forbes. Archived from the original on 13 December 2015. Retrieved 12 December 2015.

{{cite news}}: Unknown parameter|deadurl=ignored (|url-status=suggested) (help) - ^ "Warning to consumers on virtual currencies" (PDF). European Banking Authority. 12 December 2013. Archived from the original (PDF) on 28 December 2013. Retrieved 23 December 2013.

{{cite web}}: Unknown parameter|deadurl=ignored (|url-status=suggested) (help) - ^ Jonathan Stempel (11 March 2014). "Beware Bitcoin: US brokerage regulator". reuters.com. Archived from the original on 15 March 2014. Retrieved 14 March 2014.

{{cite news}}: Unknown parameter|deadurl=ignored (|url-status=suggested) (help) - ^ Hill, Kashmir. "How You Should Have Spent $100 In 2013 (Hint: Bitcoin)". Forbes. Archived from the original on 19 February 2015. Retrieved 16 February 2015.

{{cite news}}: Unknown parameter|deadurl=ignored (|url-status=suggested) (help) - ^ Steverman, Ben (23 December 2014). "The Best and Worst Investments of 2014". bloomberg.com. Bloomberg LP. Archived from the original on 9 January 2015. Retrieved 9 January 2015.

{{cite news}}: Unknown parameter|deadurl=ignored (|url-status=suggested) (help) - ^ Gilbert, Mark (29 December 2015). "Bitcoin Won 2015. Apple ... Did Not". Bloomberg. Archived from the original on 29 December 2015. Retrieved 29 December 2015.

{{cite news}}: Unknown parameter|deadurl=ignored (|url-status=suggested) (help) - ^ "Top 100 Richest Bitcoin Addresses and Bitcoin distribution". bitinfocharts.com. Archived from the original on 15 October 2017. Retrieved 14 October 2017.

{{cite web}}: Unknown parameter|deadurl=ignored (|url-status=suggested) (help) - ^ Simonite, Tom (12 June 2013). "Bitcoin Millionaires Become Investing Angels". Computing News. MIT Technology Review. Retrieved 13 June 2013.

- ^ a b Robin Sidel (1 December 2014). "Ten-hut! Bitcoin Recruits Snap To". Wall Street Journal. Dow Jones & Company. Archived from the original on 27 February 2015. Retrieved 9 December 2014.

{{cite news}}: Unknown parameter|deadurl=ignored (|url-status=suggested) (help) - ^ Alex Hern (1 July 2014). "Silk Road's legacy 30,000 bitcoin sold at auction to mystery buyers". The Guardian. Archived from the original on 23 October 2014. Retrieved 31 October 2014.

{{cite news}}: Unknown parameter|deadurl=ignored (|url-status=suggested) (help) - ^ "CoinSeed raises $7.5m, invests $5m in Bitcoin mining hardware – Investment Round Up". Red Herring. 24 January 2014. Archived from the original on 9 March 2014. Retrieved 9 March 2014.

{{cite news}}: Unknown parameter|deadurl=ignored (|url-status=suggested) (help) - ^ Tasca, Paolo (7 September 2015). "Digital Currencies: Principles, Trends, Opportunities, and Risks". Social Science Research Network. SSRN 2657598.

{{cite journal}}: Cite journal requires|journal=(help) - ^ Colombo, Jesse (19 December 2013). "Bitcoin May Be Following This Classic Bubble Stages Chart". Forbes. Archived from the original on 20 December 2013. Retrieved 7 January 2014.

{{cite news}}: Unknown parameter|deadurl=ignored (|url-status=suggested) (help) - ^ Moore, Heidi (3 April 2013). "Confused about Bitcoin? It's 'the Harlem Shake of currency'". theguardian.com. The Guardian. Archived from the original on 1 March 2014. Retrieved 2 May 2014.

{{cite web}}: Unknown parameter|deadurl=ignored (|url-status=suggested) (help) - ^ a b Lee, Timothy (5 November 2013). "When will the people who called Bitcoin a bubble admit they were wrong". The Washington Post. Archived from the original on 11 January 2014. Retrieved 10 January 2014.

{{cite news}}: Unknown parameter|deadurl=ignored (|url-status=suggested) (help) - ^ Liu, Alec (19 March 2013). "When Governments Take Your Money, Bitcoin Looks Really Good". Motherboard. Archived from the original on 7 February 2014. Retrieved 7 January 2014.

{{cite web}}: Unknown parameter|deadurl=ignored (|url-status=suggested) (help) - ^ Lee, Timothy B. (11 April 2013). "An Illustrated History Of Bitcoin Crashes". Forbes. Archived from the original on 20 September 2015. Retrieved 7 January 2014.

{{cite news}}: Unknown parameter|deadurl=ignored (|url-status=suggested) (help) - ^ Ben Rooney (29 November 2013). "Bitcoin worth almost as much as gold". CNN. Archived from the original on 26 October 2014. Retrieved 31 October 2014.

{{cite news}}: Unknown parameter|deadurl=ignored (|url-status=suggested) (help) - ^ "Bitcoin prices remain below $600 amid bearish chart signals". nasdaq.com. August 2014. Archived from the original on 14 October 2014. Retrieved 31 October 2014.

{{cite web}}: Unknown parameter|deadurl=ignored (|url-status=suggested) (help) - ^ Williams, Mark T. (21 October 2014). "Virtual Currencies – Bitcoin Risk" (PDF). World Bank Conference Washington DC. Boston University. Archived from the original (PDF) on 11 November 2014. Retrieved 11 November 2014.

{{cite web}}: Unknown parameter|deadurl=ignored (|url-status=suggested) (help) - ^ Lee, Timothy B. (12 April 2013). "Bitcoin's Volatility Is A Disadvantage, But Not A Fatal One". Forbes. Archived from the original on 5 November 2014. Retrieved 15 November 2014.

{{cite news}}: Unknown parameter|deadurl=ignored (|url-status=suggested) (help) - ^ Yang, Stephanie (19 April 2016). "Is Bitcoin Becoming More Stable Than Gold?". The Wall Street Journal. Archived from the original on 20 April 2016. Retrieved 20 April 2016.

{{cite news}}: Unknown parameter|deadurl=ignored (|url-status=suggested) (help) - ^ "Bitcoin value tops gold for first time". BBC. 3 March 2017. Archived from the original on 23 April 2017. Retrieved 22 April 2017.

{{cite news}}: Unknown parameter|deadurl=ignored (|url-status=suggested) (help) - ^ Molloy, Mark (3 March 2017). "Bitcoin value surpasses gold for the first time". Telegraph. Archived from the original on 23 April 2017. Retrieved 22 April 2017.

{{cite news}}: Unknown parameter|deadurl=ignored (|url-status=suggested) (help) - ^ Alabi, Ken (2017). "Digital blockchain networks appear to be following Metcalfe's Law". Electronic Commerce Research and Applications. 24: 23. doi:10.1016/j.elerap.2017.06.003.

- ^ Braue, David (11 March 2014). "Bitcoin confidence game is a Ponzi scheme for the 21st century". ZDNet. Archived from the original on 6 October 2016. Retrieved 5 October 2016.

{{cite news}}: Unknown parameter|deadurl=ignored (|url-status=suggested) (help) - ^ Clinch, Matt (10 March 2014). "Roubini launches stinging attack on bitcoin". CNBC. Archived from the original on 6 October 2014. Retrieved 2 July 2014.

{{cite web}}: Unknown parameter|deadurl=ignored (|url-status=suggested) (help) - ^ North, Gary (3 December 2013). "Bitcoins: The second biggest Ponzi scheme in history". The Daily Dot. Archived from the original on 17 June 2016. Retrieved 23 May 2016.

{{cite web}}: Unknown parameter|deadurl=ignored (|url-status=suggested) (help) - ^ Ott Ummelas; Milda Seputyte (31 January 2014). "Bitcoin 'Ponzi' Concern Sparks Warning From Estonia Bank". bloomberg.com. Bloomberg. Archived from the original on 29 March 2014. Retrieved 1 April 2014.

{{cite news}}: Unknown parameter|deadurl=ignored (|url-status=suggested) (help); Unknown parameter|lastauthoramp=ignored (|name-list-style=suggested) (help) - ^ Posner, Eric (11 April 2013). "Bitcoin is a Ponzi scheme—the Internet's favorite currency will collapse". Slate. Archived from the original on 26 March 2014. Retrieved 1 April 2014.

{{cite web}}: Unknown parameter|deadurl=ignored (|url-status=suggested) (help) - ^ Kaushik Basu (July 2014). "Ponzis: The Science and Mystique of a Class of Financial Frauds" (PDF). World Bank Group. Archived from the original (PDF) on 31 October 2014. Retrieved 30 October 2014.

{{cite web}}: Unknown parameter|deadurl=ignored (|url-status=suggested) (help) - ^ "Federal Council report on virtual currencies in response to the Schwaab (13.3687) and Weibel (13.4070) postulates" (PDF). Federal Council (Switzerland). Swiss Confederation. 25 June 2014. Archived from the original (PDF) on 5 December 2014. Retrieved 28 November 2014.

{{cite web}}: Unknown parameter|deadurl=ignored (|url-status=suggested) (help) - ^ "This Billionaire Just Called Bitcoin a 'Pyramid Scheme'". Archived from the original on 24 September 2017. Retrieved 23 September 2017.

{{cite web}}: Unknown parameter|deadurl=ignored (|url-status=suggested) (help) - ^ "JPMorgan Helps Clients Buy Bitcoin Despite CEO Calling Bitcoin 'a Fraud'". Archived from the original on 23 September 2017. Retrieved 23 September 2017.