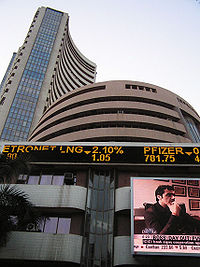

BSE SENSEX

The BSE SENSEX (Bombay Stock Exchange Sensitive Index), also-called the BSE 30 (BOMBAY STOCK EXCHANGE)or simply the SENSEX, is a free-float market capitalisation-weighted stock market index of 30 well-established and financially sound companies listed on Bombay Stock Exchange (BSE). The 30 component companies which are some of the largest and most actively traded stocks, are representative of various industrial sectors of the Indian economy. Published since 1 January 1986, the SENSEX is regarded as the pulse of the domestic stock markets in India. The base value of the SENSEX is taken as 100 on 1 April 1979, and its base year as 1978–79. On 25 July 2001 BSE launched DOLLEX-30, a dollar-linked version of SENSEX. As of 21 April 2011, the market capitalisation of SENSEX was about ₹29,733 billion (US$356 billion) (47.68% of market capitalisation of BSE), while its free-float market capitalisation was ₹15,690 billion (US$188 billion).

Components

Template:BSE Sensex Constituents

Calculation

The BSE constantly reviews and modifies its composition to be sure it reflects current market conditions. The index is calculated based on a free float capitalisation method, a variation of the market capitalisation method. Instead of using a company's outstanding shares it uses its float, or shares that are readily available for trading. As per free float capitalisation methodology, the level of index at any point of time reflects the free float market value of 30 component stocks relative to a base period. The market capitalisation of a company is determined by multiplying the price of its stock by the number of shares issued by the company. This market capitalisation is multiplied by a free float factor to determine the free float market capitalisation. Free float factor is also referred as adjustment factor. Free float factor represents the percentage of shares that are readily available for trading.

The calculation of SENSEX involves dividing the free float market capitalisation of 30 companies in the index by a number called index divisor.The divisor is the only link to original base period value of the SENSEX. It keeps the index comparable over time and is the adjustment point for all index adjustments arising out of corporate actions, replacement of scrips, etc.

The index has increased by over ten times from June 1990 to the present. Using information from April 1979 onwards, the long-run rate of return on the BSE SENSEX works out to be 18.6% per annum, which translates to roughly 9% per annum.

Milestones

Here is a timeline on the rise of the SENSEX through Indian stock market history

- 1000, 25 July 1990 – On 25 July 1990, the SENSEX touched the four-digit figure for the first time and closed at 1,001 in the wake of a good monsoon and excellent corporate results.

- 2000, 15 January 1992 – On 15 January 1992, the SENSEX crossed the 2,000-mark and closed at 2,020 followed by the liberal economic policy initiatives undertaken by the then finance minister and current Prime Minister Dr Manmohan Singh.

- 3000, 29 February 1992 – On 29 February 1992, the SENSEX surged past the 3000 mark in the wake of the market-friendly Budget announced by Manmohan Singh.

- 4000, 30 March 1992 – On 30 March 1992, the SENSEX crossed the 4,000-mark and closed at 4,091 on the expectations of a liberal export-import policy. It was then that the Harshad Mehta scam hit the markets and SENSEX witnessed unabated selling.

- 5000, 11 October 1999 – On 8 October 1999, the SENSEX crossed the 5,000-mark.

- 6000, 11 February 2000 – On 11 February 2000, the information technology boom helped the SENSEX to cross the 6,000-mark and hit an all-time high of 6,006.

- 7000, 21 June 2005 – On 20 June 2005, the news of the settlement between the Ambani brothers boosted investor sentiments and the scrips of RIL, Reliance Energy, Reliance Capital and IPCL made huge gains. This helped the SENSEX crossed 7,000 points for the first time.

- 8000, 8 September 2005 – On 8 September 2005, the Bombay Stock Exchange's benchmark 30-share index – the SENSEX – crossed the 8000 level following brisk buying by foreign and domestic funds in early trading.

- 9000, 9 December 2005 – The SENSEX on 28 November 2005 crossed 9000 to touch 9000.32 points during mid-session at the Bombay Stock Exchange on the back of frantic buying spree by foreign institutional investors and well supported by local operators as well as retail investors.

- 10,000, 7 February 2006 – The SENSEX on 6 February 2006 touched 10,003 points during mid-session. The SENSEX finally closed above the 10,000-mark on 7 February 2006.

- 11,000, 27 March 2006 – The SENSEX on 21 March 2006 crossed 11,000 and touched a peak of 11,001 points during mid-session at the Bombay Stock Exchange for the first time. However, it was on 27 March 2006 that the SENSEX first closed at over 11,000 points.

- 12,000, 20 April 2006 – The SENSEX on 20 April 2006 crossed 12,000 and touched a peak of 12,004 points during mid-session at the Bombay Stock Exchange for the first time.

- 13,000, 30 October 2006 – The SENSEX on 30 October 2006 crossed 13,000 for the first time. It touched a peak of 13,039.36 and finally closed at 13,024.26.

- 14000, 5 December 2006 – The SENSEX on 5 December 2006 crossed 14,000.

- 15,000, 6 July 2007 – The SENSEX on 6 July 2007 crossed 15,000 mark.

- 16,000, 19 September 2007 – The SENSEX on 19 September 2007 crossed the 16,000 mark.

- 17,000, 26 September 2007 – The SENSEX on 26 September 2007 crossed the 17,000 mark for the first time.

- 18,000, 9 October 2007 – The SENSEX on 9 October 2007 crossed the 18,000 mark for the first time.

- 19,000, 15 October 2007 – The SENSEX on 15 October 2007 crossed the 19,000 mark for the first time.

- 20,000, 29 October 2007 – The SENSEX on 29 October 2007 crossed the 20,000 mark for the first time.

- 21,000, 8 Jan 2008 – The SENSEX on 8 January 2008 touched all time peak of 21078 before closing at 20873.[1]

- 5 November 2010 – The SENSEX on 5 November 2010 closes at 20,893.6 with highest peak in two years.

- 18 January 2013 – The SENSEX on 18 January 2013 closes at 20,039.04 with highest peak in two years.[2]

- 19 February 2013 – SENSEX becomes S&P SENSEX as BSE ties up with Standard and Poor's to use the S&P brand for Sensex and other indices.[3]

May 2006

On 22 May 2006, the SENSEX plunged by 1100 points during intra-day trading, leading to the suspension of trading for the first time since 17 May 2004. The volatility of the SENSEX had caused investors to lose Rs 6 lakh crore (US$131 billion) within seven trading sessions. The Finance Minister of India, P. Chidambaram, made an unscheduled press statement when trading was suspended to assure investors that nothing was wrong with the fundamentals of the economy, and advised retail investors to stay invested. When trading resumed after the reassurances of the Reserve Bank of India and the Securities and Exchange Board of India (SEBI), the SENSEX managed to move up 700 points, still 450 points in the red.

The SENSEX eventually recovered from the volatility, and on 16 October 2006, the SENSEX closed at an all-time high of 12,928.18 with an intra-day high of 12,953.76. This was a result of increased confidence in the economy and reports that India's manufacturing sector grew by 11.1% in August 2006.

- 13,000, 30 October 2006 – The SENSEX on 30 October 2006 crossed 13,000 and still riding high at the Bombay Stock Exchange for the first time. It took 135 days to reach 13,000 from 12,000. And 124 days to reach 13,000 from 12,500. On 30 October 2006 it touched a peak of 13,039.36 & closed at 13,024.26.

- 14,000, 5 December 2006 – The SENSEX on 5 December 2006 crossed 14,000 and touched a peak of 14028 at 9.58 am(IST) while opening for the day 5 December 2006.

- 15,000, 6 July 2007- The SENSEX on 6 July 2007 crossed another milestone and reached a magic figure of 15,000. it took almost 7-month and 1-day to touch such a historic miles

May 2009

On 18 May 2009, the SENSEX surged 2,110.79 points (from its previous closing of 12,174.42) up 17.33%. This sharp surge was a reaction to the resounding victory of the United Progressive Alliance (UPA) in the 15th General Elections. The historic rise also marked the first ever time an Indian benchmark index was locked up on an upper circuit. The first limit was hit within 25 seconds after the markets were opened for trade that day at 9:55 am. After remaining shut for 2 hours, the markets resumed for trading again at 11:55 am only to be locked up again at a higher limit 30 seconds later. The markets were open for trade for only 55 seconds on that day.

Effects of the subprime mortgage crisis in the U.S

On Monday 23 July 2007, the SENSEX touched a new height of 15,733 points. On 27 July 2007 the SENSEX witnessed a huge correction because of selling by foreign institutional investors (FIIs) and global cues to come back to 15,160 points by noon. Following global cues and heavy selling in the international markets, the BSE SENSEX fell by 615 points in a single day on Wednesday 1 August 2007.

- 16,000, 19 September 2007- The SENSEX on 19 September 2007 crossed the 16,000 mark and reached a historic peak of 16322 while closing. The bull hits because of the rate cut of 50 bit/s in the discount rate by the Fed chief Ben Bernanke on 26 September 2007 crossed the 17,000 mark for the first time, creating a record for the second fastest 1000 point gain in just 5 trading sessions. It failed however to sustain the momentum and closed below 17000. The SENSEX closed above 17000 for the first time on the following day. Reliance group has been the main contributor in this bull run, contributing 256 points. This also helped Mukesh Ambani's net worth to grow to over $50 billion or Rs.2 trillion. It was also during this record bull run that the SENSEX for the first time zoomed ahead of the Nikkei of Japan.

- 18,000, 9 October 2007- The SENSEX crossed the 18k mark for the first time on 9 October 2007. The journey from 17k to 18k took just 8 trading sessions which is the third fastest 1000 point rise in the history of the SENSEX. The SENSEX closed at 18,280 at the end of day. This 788-point gain on 9 October was the second biggest single day absolute gains.

- 19,000, 15 October 2007- The SENSEX crossed the 19k mark for the first time on 15 October 2007. It took just 4 days to reach from 18k to 19k. This is the fastest 1000 points rally ever and also the 640-point rally was the second highest single day rally in absolute terms. This made it a record 3000 point rally in 17 trading sessions overall.

Participatory notes issue

On 16 October 2007, SEBI (Securities & Exchange Board of India) proposed curbs on participatory notes which accounted for roughly 50% of FII investment in 2007. SEBI was not happy with P-notes because it was not possible to know who owned the underlying securities, and hedge funds acting through P-notes might therefore cause volatility in the Indian markets.

However the proposals of SEBI were not clear and this led to a knee-jerk crash when the markets opened on the following day (17 October 2007). Within a minute of opening trade, the SENSEX crashed by 1744 points or about 9% of its value – the biggest intra-day fall in Indian stock markets in absolute terms till then. This led to automatic suspension of trade for 1-hour. Finance Minister P. Chidambaram issued clarifications, in the meantime, that the government was not against FIIs and was not immediately banning PNs. After the market opened at 10:55 am, the index staged a comeback and ended the day at 18715.82, down 336.04 from the last day's close.

This was, however not the end of the volatility. The next day (18 October 2007), the SENSEX tumbled by 717.43 points – 3.83 per cent – to 17998.39. The slide continued the next day when the SENSEX fell 438.41 points to settle at 17559.98 at the end of the week, after touching the lowest level of that week at 17226.18 during the day.

After detailed clarifications from the SEBI chief M. Damodaran regarding the new rules, the market made a 879-point gain on 23 October, thus signalling the end of the PN crisis.

- 20,000, 29 October 2007- The SENSEX crossed the 20k mark for the first time with a massive 734.5-point gain but closed below the 20k mark. It took 11 days to reach from 19k to 20k. The journey of the last 10,000 points was covered in just 869 sessions as against 7,297 sessions taken to touch the 10,000 mark from 1,000 levels. In 2007 alone, there were six 1,000-point rallies for the SENSEX.

- 21,000, 8 January 2008 Business Standard

January 2008

In the third week of January 2008, the SENSEX experienced huge falls along with other markets around the world. On 21 January 2008, the SENSEX saw its highest ever loss of 1,408 points at the end of the session. The SENSEX recovered to close at 17,605.40 after it tumbled to the day's low of 16,963.96, on high volatility as investors panicked following weak global cues amid fears of a recession in the US.

The next day, the BSE SENSEX index went into a free fall. The index hit the lower circuit breaker in barely a minute after the markets opened at 10 am. Trading was suspended for an hour. On reopening at 10.55 am IST, the market saw its biggest intra-day fall when it hit a low of 15,332, down 2,273 points. However, after reassurance from the Finance Minister of India, the market bounced back to close at 16,730 with a loss of 875 points.[4]

Over the course of two days, the BSE SENSEX in India dropped from 19,013 on Monday morning to 16,730 by Tuesday evening or a two-day fall of 13.9%.[4]

- 9,975, 17 October 2008 – SENSEX crashes below the psychological 5 figure mark of 10K, following extremely negative global financial indications in US and other countries. Exactly one year back in October 2007, SENSEX had gone past the 20K mark.

- 8701.07, 24 October 2008 lost 10.96% of its value on the intra day trade, the 3rd highest loss for a one day period in its history

Major crashes since 2000

On 22 May 2006, the SENSEX plunged by 1100 points during intra-day trading, leading to the suspension of trading for the first time since 17 May 2004. The volatility of the SENSEX had caused investors to lose Indian rupees 6 trillion (short scale) ($131 billion) within seven trading sessions. The Finance Minister of India, P. Chidambaram, made an unscheduled press statement when trading was suspended to assure investors that nothing was wrong with the fundamentals of the economy, and advised retail investors to stay invested. When trading resumed after the reassurances of the Reserve Bank of India and the Sed of India (SEBI), the SENSEX managed to move up 700 points, still 450 points in the red.

The SENSEX eventually recovered from the volatility, and on 16 October 2006, the SENSEX closed at an all-time high of 12,928.18 with an intra-day high of 12,953.76. This was a result of increased confidence in the economy and reports that India's manufacturing sector grew by 11.1% in August 2006.

Effects of the subprime crisis in the U.S.

On 23 July 2007, the SENSEX touched a new high of 15,733 points. On 27 July 2007 the SENSEX witnessed a huge correction because of selling by Foreign Institutional Investors and global cues to come back to 15,160 points by noon. Following global cues and heavy selling in the international markets, the BSE SENSEX fell by 615 points in a single day on 1 August 2007.

Participatory notes issue

On 16 October 2007, SEBI (Securities & Exchange Board of India) proposed curbs on participatory notes which accounted for roughly 50% of FII investment in 2007. SEBI was not happy with P-notes because it was not possible to know who owned the underlying securities,[5] and hedge funds acting through P-notes might therefore cause volatility in the Indian markets.[6]

However the proposals of SEBI were not clear and this led to a knee-jerk crash when the markets opened on the following day (17 October 2007). Within a minute of opening trade, the SENSEX crashed by 1744 points or about 9% of its value – the biggest intra-day fall in Indian stock markets in absolute terms till then. This led to automatic suspension of trade for 1-hour. Finance Minister P. Chidambaram issued clarifications, in the meantime, that the government was not against FIIs and was not immediately banning PNs. After the market opened at 10:55 am, the index staged a comeback and ended the day at 18715.82, down 336.04 from the last day's close.

This was, however not the end of the volatility. The next day (18 October 2007), the SENSEX tumbled by 717.43 points – 3.83 per cent – to 17998.39. The slide continued the next day when the SENSEX fell 438.41 points to settle at 17559.98 at the end of the week, after touching the lowest level of that week at 17226.18 during the day.

After detailed clarifications from the SEBI chief M. Damodaran regarding the new rules, the market made a 879-point gain on 23 October, thus signalling the end of the PN crisis.

January 2008

In the third week of January 2008, the SENSEX experienced huge falls along with other markets around the world. On 21 January 2008, the SENSEX saw its highest ever loss of 1,408 points at the end of the session. The SENSEX recovered to close at 17,605.40 after it tumbled to the day's low of 16,963.96, on high volatility as investors panicked following weak global cues amid fears of a recession in the US.

2012

The BSE Sensex rose above the 19,000 for the first time since 15 July 2011 while the broader Nifty headed to the 5,800 mark Thursday. The rupee, too, hit a five-and-half-month high against the dollar.

The next day, the BSE SENSEX index went into a free fall. The index hit the lower circuit breaker in barely a minute after the markets opened at 10 am. Trading was suspended for an hour. On reopening at 10.55 am IST, the market saw its biggest intra-day fall when it hit a low of 15,332, down 2,273 points. However, after reassurance from the Finance Minister of India, the market bounced back to close at 16,730 with a loss of 875 points.[4]

Over the course of two days, the BSE SENSEX in India dropped from 19,013 on Monday morning to 16,730 by Tuesday evening or a two-day fall of 13.9%.[4]

Major falls

Some major single-day falls of the SENSEX have occurred on the following dates:[7]

- 21 January 2008 --- 1,408.35 points

- 24 Oct 2008—1070.63 points

- 17 March 2008 --- 951.03 points

- 6 July 2009 --- 870 points

- 22 January 2008 --- 857 points

- 11 February 2008 --- 833.98 points

- 18 May 2006 --- 826 points

- 10 October 2008 --- 800.10 points

- 13 March 2008 --- 770.63 points

- 17 December 2007 --- 769.48 points

- 7 January 2009 --- 749.05 points

- 31 March 2007 --- 726.85 points

- 6 October 2008 --- 724.62 points

- 17 October 2007 --- 717.43 points

- 15 September 2008 --- 710.00 points

- 22 September 2011 --- 704.00 points

- 18 January 2007 --- 687.82 points

- 21 November 2007 --- 678.18 points

- 16 August 2007 --- 642.70 points

- 17 August 2009 --- 626.71 points

- 27 June 2008 --- 600.00 points

- 24 February 2011 --- 545.92 points

- 27 February 2012 --- 477.82 points

- 16 November 2010 --- 444.55 Points

- 4 February 2011 --- 441.92 Points

- 12 November 2010 --- 432 Points

References

- ^ "Sensex hits 21,000; ends up 61 points – Rediff.com Business". In.rediff.com. 8 January 2008. Retrieved 19 September 2011.

- ^ http://timesofindia.indiatimes.com/business/india-business/Sensex-closes-above-20k-first-time-in-two-years/articleshow/18078078.cms?utm_source=twitter&utm_medium=tweets

- ^ http://www.livemint.com/Money/3IL0OG1aYmaHAKYfrFS6bO/BSE-in-a-joint-venture-with-SP-Dow-Jones.html

- ^ a b c d rediff Business Bureau (21 January 2008). "The 10 biggest falls in SENSEX history". MarketWatch. Archived from the original on 27 January 2008. Retrieved 23 January 2008.

{{cite web}}:|author=has generic name (help); Unknown parameter|deadurl=ignored (|url-status=suggested) (help) - ^ "What are P-Notes?". 17 October 2007. Retrieved 21 February 2011.

{{cite web}}: Unknown parameter|source=ignored (help) - ^ Vaidyanathan, R. (24 October 2007). "Why Participatory Notes are dangerous". The Hindu. Retrieved 22 February 2011.

{{cite news}}: Cite has empty unknown parameter:|source=(help) - ^ "The Hindu News Update Service". Hindu.com. Retrieved 19 September 2011.