Petroleum industry: Difference between revisions

| Line 89: | Line 89: | ||

|| 3 |

|| 3 |

||

|| [[Qatar Petroleum]] |

|| [[Qatar Petroleum]] |

||

|| |

|| 15 |

||

|| 905 |

|| 905 |

||

|| 170 |

|| 170 |

||

Revision as of 10:08, 30 May 2013

The petroleum industry includes the global processes of exploration, extraction, refining, transporting (often by oil tankers and pipelines), and marketing petroleum products. The largest volume products of the industry are fuel oil and gasoline (petrol). Petroleum (oil) is also the raw material for many chemical products, including pharmaceuticals, solvents, fertilizers, pesticides, and plastics. The industry is usually divided into three major components: upstream, midstream and downstream. Midstream operations are usually included in the downstream category.

Petroleum is vital to many industries, and is of importance to the maintenance of industrial civilization in its current configuration, and thus is a critical concern for many nations. Oil accounts for a large percentage of the world’s energy consumption, ranging from as low of 32% for Europe and Asia, up to a high of 53% for the Middle East.

Other geographic regions’ consumption patterns are as follows: South and Central America (44%), Africa (41%), and North America (40%). The world consumes 30 billion barrels (4.8 km³) of oil per year, with developed nations being the largest consumers. The United States consumed 25% of the oil produced in 2007.[1] The production, distribution, refining, and retailing of petroleum taken as a whole represents the world's largest industry in terms of dollar value.

Governments such as the United States government provide a heavy public subsidy to petroleum companies, with major tax breaks at virtually every stage of oil exploration and extraction, including for the costs of oil field leases and drilling equipment.[2]

History

Natural history

Petroleum is a naturally occurring liquid found in rock formations. It consists of a complex mixture of hydrocarbons of various molecular weights, plus other organic compounds. It is generally accepted that oil is formed mostly from the carbon rich remains of ancient plankton after exposure to heat and pressure in the Earth's crust over hundreds of millions of years. Over time, the decayed residue was covered by layers of mud and silt, sinking further down into the Earth’s crust and preserved there between hot and pressured layers, gradually transforming into oil reservoirs.[citation needed]

Early history

Petroleum in an unrefined state has been utilized by humans for over 5000 years. Oil in general has been used since early human history to keep fires ablaze, and also for warfare.

Its importance in the world economy evolved slowly, with whale oil used for lighting into the 19th century and wood and coal used for heating and cooking well into the 20th Century. The Industrial Revolution generated an increasing need for energy which was fueled mainly by coal, with other sources including whale oil. However, it was discovered that kerosene could be extracted from crude oil and used as a light and heating fuel. Petroleum was in great demand, and by the twentieth century had become the most valuable commodity traded on the world markets.[3]

Modern history

Imperial Russia produced 3,500 tons of oil in 1825 and doubled its output by mid-century.[4] After oil drilling began in what is now Azerbaijan in 1848, two large pipelines were built in the Russian Empire: the 833 km long pipeline to transport oil from the Caspian to the Black Sea port of Batumi (Baku-Batumi pipeline), completed in 1906, and the 162 km long pipeline to carry oil from Chechnya to the Caspian.

At the turn of the 20th century, Imperial Russia's output of oil, almost entirely from the Apsheron Peninsula, accounted for half of the world's production and dominated international markets.[5] Nearly 200 small refineries operated in the suburbs of Baku by 1884.[6] As a side effect of these early developments, the Apsheron Peninsula emerged as the world's "oldest legacy of oil pollution and environmental negligence."[7] In 1878, Ludvig Nobel and his Branobel company "revolutionized oil transport" by commissioning the first oil tanker and launching it on the Caspian Sea.[5]

The first modern oil refineries were built by Ignacy Łukasiewicz near Jasło (then in the dependent Kingdom of Galicia and Lodomeria in Central European Galicia), Poland from 1854–56.[8] These were initially small as demand for refined fuel was limited. The refined products were used in artificial asphalt, machine oil and lubricants, in addition to Łukasiewicz's kerosene lamp. As kerosene lamps gained popularity, the refining industry grew in the area.

The first commercial oil well in Canada became operational in 1858 at Oil Springs, Ontario (then Canada West).[9] Businessman James Miller Williams dug several wells between 1855 and 1858 before discovering a rich reserve of oil four metres below ground.[10][11] Williams extracted 1.5 million litres of crude oil by 1860, refining much of it into kerosene lamp oil.[9] Some historians challenge Canada’s claim to North America’s first oil field, arguing that Pennsylvania’s famous Drake well was the continent’s first. But there is evidence to support Williams, not least of which is that the Drake well did not come into production until August 28, 1859. The controversial point might be that Williams found oil above bedrock while Edwin Drake’s well located oil within a bedrock reservoir. The discovery at Oil Springs touched off an oil boom which brought hundreds of speculators and workers to the area. The first gusher erupted on January 16, 1862, when local oil man John Shaw struck oil at 158 feet (48 m).[12] For a week the oil gushed unchecked at levels reported as high as 3,000 barrels per day.

The first modern oil drilling in the United States began in West Virginia and Pennsylvania in the 1850s. Edwin Drake's 1859 well near Titusville, Pennsylvania, is typically considered the first true modern oil well, and touched off a major boom.[13][14] In the first quarter of the 20th century, the United States overtook Russia as the world's largest oil producer. By the 1920s, oil fields had been established in many countries including Canada, Poland, Sweden, the Ukraine, the United States, Peru and Venezuela.[14]

The first successful oil tanker, the Zoroaster, was built in 1878 in Sweden, designed by Ludvig Nobel. It operated from Baku to Astrakhan.[15] A number of new tanker designs were developed in the 1880s.

In the early 1930s the Texas Company developed the first mobile steel barges for drilling in the brackish coastal areas of the Persian Gulf. In 1937 Pure Oil Company (now part of Chevron Corporation) and its partner Superior Oil Company (now part of ExxonMobil Corporation) used a fixed platform to develop a field in 14 feet (4.3 m) of water, one mile (1.6 km) offshore of Calcasieu Parish, Louisiana. In early 1947 Superior Oil erected a drilling/production oil platform in 20 ft (6.1 m) of water some 18 miles[vague] off Vermilion Parish, Louisiana. It was Kerr-McGee Oil Industries (now Anadarko Petroleum Corporation), as operator for partners Phillips Petroleum (ConocoPhillips) and Stanolind Oil & Gas (BP), that completed its historic Ship Shoal Block 32 well in October 1947, months before Superior actually drilled a discovery from their Vermilion platform farther offshore. In any case, that made Kerr-McGee's well the first oil discovery drilled out of sight of land.[16][17]

After World War II ended, the countries of the Middle East took the lead in oil production from the United States. Important developments since World War II include deep-water drilling, the introduction of the Drillship, and the growth of a global shipping network for petroleum relying upon oil tankers and pipelines. In the 1960s and 1970s, multi-governmental organizations of oil–producing nations OPEC and OAPEC played a major role in setting petroleum prices and policy. Oil Spills and their cleanup have become an issue of increasing political, environmental, and economic importance.

Industry structure

The American Petroleum Institute divides the petroleum industry into five sectors:[18]

- upstream (exploration, development and production of crude oil or natural gas)

- downstream (oil tankers, refiners, retailers and consumers)

- pipeline

- marine

- service and supply

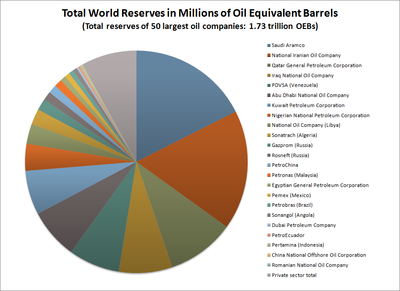

Oil companies used to be classified by sales as "supermajors" (BP, Chevron, ExxonMobil, ConocoPhillips, Shell, Eni and Total S.A.), "majors", and "independents" or "jobbers". In recent years however, National Oil Companies (NOC, as opposed to IOC, International Oil Companies) have come to control the rights over the largest oil reserves; by this measure the top ten companies all are NOC. The following table shows the ten largest national oil companies ranked by reserves[19] and by production.[20]

| Rank | Company | Worldwide Liquids Reserves (109 bbl) | Worldwide Natural Gas Reserves (1012 ft3) | Total Reserves in Oil Equivalent Barrels (109 bbl) | Company | Production (106 bbl/d) |

|---|---|---|---|---|---|---|

| 1 | Saudi Aramco | 260 | 254 | 303 | Saudi Aramco | 11.0 |

| 2 | National Iranian Oil Company | 138 | 948 | 300 | National Iranian Oil Company | 4.0 |

| 3 | Qatar Petroleum | 15 | 905 | 170 | Kuwait Petroleum Corporation | 3.7 |

| 4 | Iraq National Oil Company | 116 | 120 | 134 | Iraq National Oil Company | 2.7 |

| 5 | Petróleos de Venezuela | 99 | 171 | 129 | Petróleos de Venezuela | 2.6 |

| 6 | Abu Dhabi National Oil Company | 92 | 199 | 126 | Abu Dhabi National Oil Company | 2.6 |

| 7 | Petróleos Mexicanos | 102 | 56 | 111 | Petróleos Mexicanos | 2.5 |

| 8 | Nigerian National Petroleum Corporation | 36 | 184 | 68 | Nigerian National Petroleum Corporation | 2.3 |

| 9 | Libya NOC | 41 | 50 | 50 | Libya NOC | 2.1 |

| 10 | Sonatrach | 12 | 159 | 39 | Lukoil | 1.9 |

Most upstream work in the oil field or on an oil well is contracted out to drilling contractors and oil field service companies.[citation needed]

Midstream operations are sometimes classified within the upstream sector, but these operations compose a separate and discrete sector of the petroleum industry. Midstream operations and processes include the following:

- Gathering: The gathering process employs narrow, low-pressure pipelines to connect oil- and gas-producing wells to larger, long-haul pipelines or processing facilities.[21]

- Processing/refining: Processing and refining operations turn crude oil and gas into marketable products. In the case of crude oil, these products include heating oil, gasoline for use in vehicles, jet fuel, and diesel oil.[22] Oil refining processes include distillation, vacuum distillation, catalytic reforming, catalytic cracking, alkylation, isomerization and hydrotreating.[22] Natural gas processing includes compression; glycol dehydration; amine treating; separating the product into pipeline-quality natural gas and a stream of mixed natural gas liquids; and fractionation, which separates the stream of mixed natural gas liquids into its components. The fractionation process yields ethane, propane, butane, isobutane, and natural gasoline.

- Transportation: Oil and gas are transported to processing facilities, and from there to end users, by pipeline, tanker/barge, truck, and rail. Pipelines are the most economical transportation method and are most suited to movement across longer distances, for example, across continents.[23] Tankers and barges are also employed for long-distance, often international transport. Rail and truck can also be used for longer distances but are most cost-effective for shorter routes.

- Storage: Midstream service providers provide storage facilities at terminals throughout the oil and gas distribution systems. These facilities are most often located near refining and processing facilities and are connected to pipeline systems to facilitate shipment when product demand must be met. While petroleum products are held in storage tanks, natural gas tends to be stored in underground facilities, such as salt dome caverns and depleted reservoirs.

- Technological applications: Midstream service providers apply technological solutions to improve efficiency during midstream processes. Technology can be used during compression of fuels to ease flow through pipelines; to better detect leaks in pipelines; and to automate communications for better pipeline and equipment monitoring.

While some upstream companies carry out certain midstream operations, the midstream sector is dominated by a number of companies that specialize in these services. Midstream companies include:

- Aux Sable

- Bridger Group

- DCP Midstream

- Enbridge Energy Partners

- Enterprise Products Partners

- Genesis Energy

- Gibson Energy

- Inergy Midstream

- Kinder Morgan Energy Partners

- Oneok Partners

- Sunoco Logistics

- Targa Midstream Services

- TransCanada

- Williams Companies

Environmental impact and future shortages

Some petroleum industry operations have been responsible for water pollution through by-products of refining and oil spills.

The combustion of fossil fuels produces greenhouse gases and other air pollutants as by-products. Pollutants include nitrogen oxides, sulphur dioxide, volatile organic compounds and heavy metals.

As petroleum is a non-renewable natural resource the industry is faced with an inevitable eventual depletion of the world's oil supply. The BP Statistical Review of World Energy 2007 listed the reserve/production ratio for proven resources worldwide. The study placed the prospective life span of proven reserves in the Middle East at 79.5 years, Latin America at 41.2 years and North America at only 12 years.

The Hubbert peak theory, which introduced the concept of peak oil, questions the sustainability of oil production. It suggests that after a peak in oil production rates, a period of oil depletion will ensue. Since virtually all economic sectors rely heavily on petroleum, peak oil could lead to a partial or complete failure of markets.[24]

According to research by IBIS World, biofuels (primarily ethanol, but also biodiesel) will continue to supplement petroleum. However output levels are low, and these fuels will not displace local oil production. More than 90% of the ethanol used in the US is blended with gasoline to produce a 10% ethanol mix, lifting the oxygen content of the fuel.[25]

Petroleum industry in popular culture

The Petroleum industry is a favorite subject in contemporary fiction. Films with oil-industry themes include There Will Be Blood (2007) set around Southern California's oil boom of the late 19th and early 20th centuries, and Syriana (2005) set in present-day Middle-East.

See also

- Instrumentation in petrochemical industries

- List of crude oil products

- List of petroleum companies

- Oil depot

- Oil refinery

- Oil supplies

- Oil well

- Integrated operations

- Standardisation in oil industry

- Environmental issues

- Financial and political

- Chronology of world oil market events (1970-2005)

- Energy crisis: 1973 energy crisis, 1979 energy crisis

- Energy development

- Petroleum politics

- Oil imperialism

- Oil price increases since 2003

- Oil-storage trade

- OPEC

- Peak oil

- Oil and gas law in the United States

- Oil geology

- Oil-producing areas

- History of the petroleum industry in Canada

- History of the petroleum industry in the United States

- List of oil fields

- Oil Megaprojects

- List of oil-producing states

- Oil industry in Azerbaijan

- Industry Research Projects

References

- ^ "The World Factbook". Country Comparison - Oil Consumption. Found at https://www.cia.gov/library/publications/the-world-factbook/rankorder/2174rank.html

- ^ New York Times, 2010 July 3, "As Oil Industry Fights a Tax, It Reaps Subsidies," http://www.nytimes.com/2010/07/04/business/04bptax.html?_r=1

- ^ Halliday, Fred. The Middle East in International Relations: Power and Ideology. Cambridge University Pres: USA, 270

- ^ N.Y. Krylov, A.A. Bokserman, E.R.Stavrovsky. The Oil Industry of the Former Soviet Union. CRC Press, 1998. Page 187.

- ^ a b Shirin Akiner, Anne Aldis. The Caspian: Politics, Energy and Security. Routledge, 2004. Page 5.

- ^ United States Congress, Joint Economic Committee. The Former Soviet Union in Transition. M.E. Sharpe, 1993. Page 463.

- ^ Quoted from: Tatyana Saiko. Environmental Crises. Pearson Education, 2000. Page 223.

- ^ Frank, Alison Fleig (2005). Oil Empire: Visions of Prosperity in Austrian Galicia (Harvard Historical Studies). Harvard University Press. ISBN 0-674-01887-7.

- ^ a b http://www.lclmg.org/lclmg/Museums/OilMuseumofCanada/BlackGold2/OilHeritage/OilSprings/tabid/208/Default.aspx Oil Museum of Canada, Black Gold: Canada's Oil Heritage, Oil Springs: Boom & Bust

- ^ Turnbull Elford, Jean. Canada West's Last Frontier. Lambton County Historical Society, 1982, p. 110

- ^ Sarnia Observer and Lambton Advertiser, "Important Discovery in the Township of Enniskillen," 5 August 1858, p 2.

- ^ Extraordinary Flowing Oil Well, Hamilton Times, Author Unknown, "Extraordinary Flowing Oil Well," 20 January 1862, p 2.

- ^ John Steele Gordon "10 Moments That Made American Business," American Heritage, February/March 2007.

- ^ a b Vassiliou, Marius (2009). Historical Dictionary of the Petroleum Industry. Lanham, MD: Scarecrow Press (Rowman and Littlefield), 700 pp.

- ^ Tolf, Robert W. (1976). "4: The World's First Oil Tankers". The Russian Rockefellers: The Saga of the Nobel Family and the Russian Oil Industry. Hoover Press. ISBN 0-8179-6581-5. p. 55.

- ^ Ref accessed 02-12-89 by technical aspects and coast mapping. Kerr-McGee

- ^ Project Redsand

- ^ American Petroleum Institute. "Industry Sectors." http://www.api.org/aboutoilgas/sectors/ Retrieved 12 May 2008

- ^ Ranked in order of 2007 worldwide oil equivalent reserves as reported in "OGJ 200/100", Oil & Gas Journal, September 15, 2008. http://www.petrostrategies.org/Links/Worlds_Largest_Oil_and_Gas_Companies_Sites.htm

- ^

"The Role of National Oil Companies in the International Oil Market" (PDF). Congressional Research Service. 2007. Retrieved 2009-09-17.

{{cite journal}}:|chapter=ignored (help); Cite journal requires|journal=(help); Unknown parameter|month=ignored (help) Ranking by oil reserves and production, 2006 values - ^ "The Transportation of Natural Gas," NaturalGas.org, Retrieved December 14, 2012.

- ^ a b "Refining and Product Specifications Module Overview," Petroleum Online, Retrieved December 14, 2012.

- ^ Trench, Cheryl J., "How Pipelines Make the Oil Market Work – Their Networks, Operation and Regulation," Allegro Energy Group, December 2001.

- ^ "German Military Braces for Scarcity After ‘Peak Oil’". The New York Times. September 9, 2010.

- ^ IBISWorld. "US Oil Drilling Industry Market Research Report." http://www.ibisworld.com/industry/retail.aspx?indid=103&chid=10 Retrieved 14 May 2008

Further reading

- Ordons Oil & Gas Information & News http://www.ordons.com

- Robert Sobel The Money Manias: The Eras of Great Speculation in America, 1770-1970 (1973) reprinted (2000).

- Daniel Yergin, The Prize: The Epic Quest for Oil, Money, and Power, (Simon and Schuster 1991; paperback, 1993), ISBN 0-671-79932-0.

- Matthew R. Simmons, Twilight in the Desert The Coming Saudi Oil Shock and the World Economy, John Wiley & Sons, 2005, ISBN 0-471-73876-X.

- Matthew Yeomans, Oil: Anatomy of an Industry (New Press, 2004), ISBN 1-56584-885-3.

- Smith, GO (1920): Where the World Gets Its Oil: National Geographic, February 1920, pp 181–202

- Marius Vassiliou, Historical Dictionary of the Petroleum Industry. Lanham, MD: Scarecrow Press (Rowman & Littlefield), 700pp. ISBN 0-8108-5993-9.