Chevron Corporation

| |

| Company type | Public |

|---|---|

| NYSE: CVX Dow Jones Industrial Average Component S&P 500 Component | |

| Industry | Oil and gas |

| Predecessor | Standard Oil of California Gulf Oil[1] |

| Founded | 1984 |

| Headquarters | San Ramon, California, U.S. |

Area served | Worldwide |

Key people | John S. Watson (Chairman & CEO) |

| Products | Petroleum, natural gas and other petrochemicals, See Chevron products |

| Revenue | |

| Total assets | |

| Total equity | |

Number of employees | 62,000 (Dec 2012)[2] |

| Website | Chevron.com |

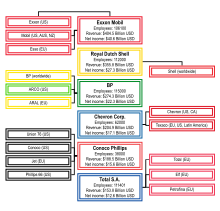

Chevron Corporation (commonly known as Chevron) is an American multinational energy corporation headquartered in San Ramon, California, United States. It operates in more than 180 countries. Chevron is engaged in the oil, gas, and geothermal sectors, including exploration and production; refining, marketing and transport; chemicals manufacturing and sales; and power generation. Chevron is one of the world's six "supermajor" oil companies. For the past five years (through 2012) Chevron has been ranked as America's third largest corporation in the Fortune 500[3][4] In 2011 it was named the 16th largest public company in the world by Forbes Global 2000.[5][6] Chevron is one of the largest corporations in the world by revenue.

History

Chevron traces its roots to an oil discovery in Pico Canyon (now the Pico Canyon Oilfield) north of Los Angeles. The discovery led to the formation, in 1879, of the Pacific Coast Oil Company (also known as "Coast Oil"), the oldest predecessor of Chevron Corporation.[citation needed]

In 1895, Coast Oil initiated its enduring marine history when it launched California's first steel tanker, the George Loomis, which could ship 6,500 barrels of crude between Ventura and San Francisco.[7] Coast Oil was acquired in 1900 by the Standard Oil Co. (Iowa), a subsidiary of John D. Rockefeller's Standard Oil company. In 1906, Coast Oil was reincorporated as Standard Oil Co. (California).[citation needed]

Another side of the genealogical chart points to the founding of The Texas Fuel Company in 1901, a modest enterprise that started out in three rooms of a corrugated iron building in Beaumont, Texas, United States. This company was known as the Texas Company and later Texaco.[citation needed]

In 1911, Standard Oil Co. (California) was severed from its parent corporation, Standard Oil, as a result of the federal government's successful lawsuit against Standard Oil under the Sherman Antitrust Act. It went on to become part of the "Seven Sisters", which dominated the world oil industry in the early 20th century.[8] In 1926, the company shed its parenthetical name by changing to Standard Oil Co. of California, or SoCal. As a former subsidiary of Standard Oil, SoCal had traditionally used the brand name "Standard", but in the 1930s, it began using "Chevron" on some of its retail products, which would eventually become its dominant brand name, although the brand name Calso was used from 1946 to 1955 in states outside its native West Coast territory.[9][10][11]

Standard Oil Company of California ranked 75th among United States corporations in the value of World War II military production contracts.[12]

In 1933, Saudi Arabia granted SoCal a concession to find oil, which led to the discovery of oil in 1938. In 1948, SoCal discovered the world's largest oil field (Ghawar) in Saudi Arabia.[13] SoCal's subsidiary, California-Arabian Standard Oil Company, grew over the years and became the Arabian American Oil Company (ARAMCO) in 1944. In 1973, the Saudi government began buying into ARAMCO. By 1980, the company was entirely owned by the Saudis, and in 1988, its name was changed to Saudi Arabian Oil Company (Saudi Aramco).[citation needed]

Standard Oil of California and Gulf Oil merged in 1984, which was the largest merger in history at that time. To comply with U.S. antitrust law, SoCal divested many of Gulf's operating subsidiaries, and sold some Gulf stations and a refinery in the eastern United States. (The refinery is currently owned by Sunoco.) Among the assets sold off were Gulf's retail outlets in Gulf's home market of Pittsburgh, where Chevron lacks a retail presence but does retain a regional headquarters there as of 2013, partially for Marcellus Shale-related drilling.[14] The same year, SoCal also took the opportunity to change its legal name to Chevron Corporation, since it had already been using the well-known "Chevron" retail brand name for decades.[1] Chevron would sell the Gulf Oil trademarks for the entire U.S. to Cumberland Farms, the parent company of Gulf Oil LP, in 2010 after Cumberland Farms had a license to the Gulf trademark in the Northeastern United States since 1986.[15]

In 1996 Chevron transferred its natural gas gathering, operating and marketing operation to NGC Corporation (later Dynegy) in exchange for a roughly 25% equity stake in NGC.[16] In a merger completed February 1, 2000, Illinova Corp. became a wholly owned subsidiary of Dynegy Inc. and Chevron's stake increased up to 28%.[17] However, in May 2007 Chevron sold its stake in the company for approximately $985 million, resulting in a gain of $680 million.[18][19]

On October 15, 2000, Chevron announced acquisition of Texaco in a deal valued at $45 billion, creating the second-largest oil company in the United States and the world's fourth-largest publicly traded oil company with a combined market value of approximately $95 billion.[20][21][22][23] The merged company was named ChevronTexaco. On May 9, 2005, ChevronTexaco announced it would drop the Texaco moniker and return to the Chevron name. Texaco remained as a brand under the Chevron Corporation.[24]

On October 10, 2001, Texaco purchased General Motors' share in GM Ovonics, which in 2003, was restructured into Cobasys, a 50/50 joint venture between Chevron and Energy Conversion Devices Ovonics. In 2009, both Chevron and Energy Conservation Devices sold their stakes in Cobasys to SB LiMotive Co.[citation needed]

In 2005, Chevron purchased Unocal Corporation for $18.4 billion, increasing the company's petroleum and natural gas reserves by about 15%.[25][26][27][28] Because of Unocal's large South East Asian geothermal operations, Chevron became the world's largest producer of geothermal energy.[29]

Chevron and the Los Alamos National Laboratory started a cooperation in 2006 to improve the recovery of hydrocarbons from oil shale by developing a shale oil extraction process named Chevron CRUSH.[30] In 2006, the United States Department of the Interior issued a research, development and demonstration lease for Chevron's demonstration oil shale project on public lands in Colorado's Piceance Basin.[31] In February 2012, Chevron notified the Bureau of Land Management and the Department of Reclamation, Mining and Safety that it intends to divest this lease.[32]

In July 2010, Chevron ended retail operations in the Mid-Atlantic United States, removing the Chevron and Texaco names from 1,100 stations.[33] In 2011, Chevron acquired Pennsylvania based Atlas Energy Inc. for $3.2 billion in cash and an additional $1.1 billion in existing debt owed by Atlas.[34][35][36]

Overview

Chevron employs approximately 62,000 people worldwide (of which approximately 31,000 are employed in U.S. operations). As of December 31, 2010, Chevron had 10.545 billion barrels (1.6765×109 cubic metres) of oil-equivalent net proved reserves. Daily production in 2010 was 2.763 million barrels per day (439.3×103 m3/d) of net oil equivalent. The company has a worldwide marketing network in 84 countries with approximately 19,550 retail sites, including those of affiliate companies. The company also has interests in 13 power generating assets in the United States and Asia. Chevron also has gas stations in Western Canada[37] and operates the Burnaby Refinery.

Chevron was headquartered in San Francisco for nearly a century before it relocated across the bay to San Ramon, California.

Chevron is the owner of the Standard Oil trademark in 16 states in the western and southeastern U.S. To maintain ownership of the mark, the company owns and operates one Standard-branded Chevron station in each state of the area.[38] Additionally, Chevron owns the trademark rights to Texaco and CalTex fuel and lubricant products.[39][40]

Chevron Shipping Company, a wholly owned subsidiary company, provides the maritime transport operations, marine consulting services and marine risk management services for Chevron Corporation. The CSC-operated fleet comprises crude oil and product tankers, crude lightering ships and liquefied natural gas (LNG) carriers. The fleet is divided into two sections: The U.S. fleet consists of four product tankers, which transport oil product between Chevron refineries and oil products from Chevron refineries to U.S. supply terminals. The ships are manned by U.S. citizens and are flagged in the United States. The International fleet vessels are primarily flagged in the Bahamas and have officers and crews from many different nations.[41] The largest ships are 320,000 tonne Very Large Crude Carriers VLCCs, which carry 2 million barrels (320,000 m3) of crude oil. The job of the international fleet is to transport crude oil from the oilfields to the refineries. The international fleet mans one LNG tanker.[citation needed]

Chevron ships historically had names beginning with "Chevron", such as the Chevron Washington and Chevron South America, or were named after former or serving directors of the company. Samuel Ginn, William E. Crain, Kenneth Derr, Richard Matzke and most notably Condoleezza Rice were among those honored, but the ship named after Rice was subsequently renamed as Altair Voyager.[42] All the ships were renamed in 2001 following the corporate merger with Texaco. Ships in the international fleet are all named after celestial bodies or constellations, such as Orion Voyager and Altair Voyager and Capricorn Voyager. The U.S.-flagged ships are named after the states in the country, as in Washington Voyager and Colorado Voyager, Mississippi Voyager, Oregon Voyager and the California Voyager.[43][44]

Chevron is a signatory participant of the Voluntary Principles on Security and Human Rights.[45]

Upstream

United States

Gulf of Mexico

Chevron is one of the leading producers in the deepwater Gulf of Mexico. Key producing assets include Tahiti and Blind Faith, the company's deepest operated offshore production facility. Two major capital projects, Jack/St. Malo and Big Foot, were authorized in 2010.

Blind Faith, which began production in 2008, is located in 6,500 feet of water and is capable of producing up to 65,000 barrels of oil and 55 million cubic feet of natural gas each day.[46] It is named after Eric Clapton's short-lived band of the same name.[47]

Chevron's Tahiti project began operations in 2009 after $4.7 billion development costs, following the discovery of the Tahiti field in 2002.[48] The Tahiti project has total estimated recoverables of 400–500 million barrels of oil and gas equivalent and can produce up to 125,000 barrels of oil and 70 million cubic feet of gas a day.[49] The field is located almost 200 miles from New Orleans, in 4,100 feet of water.

In 2010, Chevron approved development plans for Big Foot, located in approximately 5,200 feet of water about 225 miles south of New Orleans. The Big Foot project is expected to produce up to 75,000 barrels of oil and 25 million cubic feet of natural gas per day when it begins operations in 2014.[50][51]

Also in 2010, the company approved the Jack/St. Malo project, the company's first project in the Lower Tertiary trend in the deepwater U.S. Gulf of Mexico. The Jack and St. Malo fields are located within 25 miles of each other in the Gulf of Mexico, about 280 miles southwest of New Orleans in water depths of 7,000 feet. The initial development is expected to require an investment of approximately $7.5 billion. It will comprise three subsea centers tied back to a hub production facility with a capacity of 170,000 barrels of oil and 42.5 million cubic feet of natural gas per day.[52]

In 2009, the company announced an oil discovery at the Buckskin prospect in the deepwater Gulf of Mexico about 190 miles southeast of Houston. The well is located in approximately 6,920 feet of water and was drilled to a depth of 29,404 feet. In 2011, the company announced an oil discovery at the Moccasin prospect in the deepwater U.S. Gulf of Mexico.[53] The well is located approximately 216 miles off the Louisiana coast in 6,759 feet of water and was drilled to a depth of 31,545 feet. In addition to these deepwater Gulf of Mexico activities, Chevron produces oil and natural gas from the Gulf of Mexico shelf.[citation needed]

San Joaquin Valley

Since the late 19th century, Chevron and its predecessor companies have operated in San Joaquin Valley, which comprises the southern two-thirds of the Central Valley of California. Chevron currently operates eight fields, including Kern River, Coalinga, Cymric, Lost Hills, Kettleman North Dome, McKittrick and Midway-Sunset. The company also operates the San Ardo Oil Field in the nearby Salinas Valley.

The Kern River Oil Field, just outside of Bakersfield, California, is now recognized as the fifth largest in the United States. Spread along a lazy river outside Bakersfield, Calif., the 100-year-old oilfield is the size of Manhattan. The Kern River facility pumps about 80,000 barrels of crude a day from a dusty landscape studded with 13,000 wells. It has produced over 2 billion barrels of oil, qualifying it as a "supergiant" field. An estimated half a billion barrels of reserves remain, but with another generation of enhanced oil recovery (EOR) technology, the company believes it can extract considerably more. The Kern River field is one of the longest-lived in the nation, having been in production for over 100 years.[54] In this field, Chevron uses steam-flooding, a process by which high-temperature steam is injected into a reservoir, making the heavy oil less viscous and driving it to production wells.[55] Heat induced swelling of the oil also aids in releasing it from the reservoir rock.[56]

In Kern River, the company developed a work efficiency program called iField, a 3-D map of the surface, with oil wells, structures, vehicles, and people, all updated in real time. The program collects information from the San Joaquin Valley fields and allows workers to optimize operations, and make it easier to introduce new technologies.[57][58]

Permian Basin

The Permian Basin, located in West Texas and southeastern New Mexico, is approximately 250 miles wide and 300 miles long, with the second largest oil reserves in the United States, after Alaska.[59] Through its legacy companies like Texaco, Gulf, Getty, Skelly Unocal and Pure, Chevron has been a significant producer in the Permian Basin for more than 85 years.

The company currently operates approximately 11,000 oil and natural gas wells in hundreds of fields occupying four million acres across the region. Its net daily production from the Permian Basin is more than 115,000 barrels of oil equivalent, composed of 55 percent oil, 34 percent natural gas and 11 percent natural gas liquids, the fourth largest producer in the region. [60] Most of ther properties acquired through the purchase of Gulf Oil and Texaco. In February 2011, Chevron celebrated the production of its 5 billionth barrel of Permian Basin oil.[61]

Marcellus and Utica Shale

The Marcellus Shale is a rock formation underlying Ohio, West Virginia, Pennsylvania, and New York, as well as Maryland, Kentucky, Tennessee, and Virginia.[62]

In February 2011, Chevron purchased Atlas Energy Inc. for $3.2 billion, obtaining gas leases for 486,000 acres in the Marcellus Shale and 623,000 net acres of Utica Shale.[63] Three months later, Chevron acquired drilling and development rights for another 228,000 acres in the Marcellus Shale from Chief Oil & Gas LLC and Tug Hill, Inc.[64]

According to reports, the Marcellus shale region contains 410.3 trillion cubic feet (Tcf) of the 2,543 Tcf of technically recoverable shale gas in the United States.[65] In Pennsylvania, Marcellus natural gas development generated $11.2 billion in economic value, contributed $1.1 billion in state and local tax revenues, and supported nearly 140,000 jobs. Improvements in two drilling techniques – hydraulic fracturing and horizontal drilling have made shale gas more accessible and affordable to develop.[66]

Australia

Chevron is the largest holder of natural gas resources in Australia and is leading the development of the Gorgon Gas Project, the largest single-resource project in Australia. The $43 billion project was started in 2010 and is expected to be brought online in 2014.[67] The project includes construction of a 15 million tonne per annum Liquefied Natural Gas plant on Barrow Island, and a domestic gas plant with the capacity to provide 300 terajoules per day to supply gas to Western Australia. The project will be one of the most greenhouse gas efficient LNG developments in the world, due largely to its CO2 injection component that will sequester naturally occurring CO2 in the gas from the Gorgon and Jansz reservoirs.[68]

In September 2011, the company announced it would proceed with the Wheatstone liquefied natural gas development in West Australia. The foundation phase of the project is estimated to cost $29 billion; it will consist of two LNG processing trains with a combined capacity of 8.9 million tons per annum, a domestic gas plant and associated offshore infrastructure.[69]

Chevron is a long-time participant in Australia's North West Shelf Venture, which runs five offshore LNG facilities in the Pilbara region of Western Australia. The last section of the project to be completed began producing natural gas in 2008. The entire venture produces up to 16.3 million tons of liquefied natural gas a year.[70]

The company is also a joint venture participant in the Browse gas development, [71] operated by Australian energy company, Woodside Petroleum. The project is planned to tap three fields, Torosa, Brecknock and Calliance, estimated to have combined reserves of approximately 13 trillion cubic feet of natural gas and 280 million barrels of condensate. The project is expected to come online between 2013 and 2015.[72]

Nigeria

Chevron is the third-largest oil producer in Nigeria and one of the largest private investors operating in Nigeria.[73]

In the onshore and near-offshore regions of the Niger Delta, Chevron operates under a joint venture with the Nigerian National Petroleum Corporation, operating and holding a 40 percent interest in 13 concessions spread over approximately 2.2 million acres (8,900 km2) in the region. In addition, Chevron operates the Escravos Gas Plant and the Escravos Gas-To-Liquids Project.[37][74]

The company has extensive interests in deepwater Nigeria, where it holds interests ranging from about 20 percent, up to 100 percent, in 10 deepwater blocks. The most important are the Agbami development, which is based on one of Nigeria's largest deepwater discoveries and the company's non-operated interest in the Usan project.[75]

In 2010, Chevron created the multi-million-dollar Niger Delta Partnership Initiative Foundation to address the socioeconomic challenges facing the area.[76][77]

Angola

Chevron is one of Angola's top petroleum producers investing billions of dollars in major energy projects focused on oil production and gas commercialization for domestic and export markets. The company has interests in four concessions in Angola, two of which the company operates located offshore Cabinda province. Among its largest offshore assets are the Benguela Belize–Lobito Tomboco platform, the Tombua–Landana development, and the Mafumeira Norte project. In addition, Chevron is a partner in the multi-billion dollar 5.2 million-metric-ton-per-year liquefied natural gas plant located near the coastal city of Soyo, Zaire province.[78][79]

Chevron is Angola's largest foreign oil industry employer with over 3,000 Angolan employees – about 90 percent of the company's workforce in the country including many local professional and supervisory roles at Chevron in Angola.[79]

Kazakhstan

Chevron is the largest private oil producer in Kazakhstan and is involved in two of the largest projects in the country, Tengiz and Karachaganak, which together produce 831,000 barrels of oil and 1.7 billion cubic feet of natural gas a day.[80]

The Tengiz project was developed as part of a 40-year joint venture with ExxonMobil, KazMunayGas and LukArco: Chevron is the major stakeholder in project. The operation recently expanded its sour gas injection and second generation plant facilities to increase production and recovery levels.[81]

The Karachaganak Field in northwest Kazakhstan is one of the world's largest oil and gas condensate reserves. Chevron has a 20 percent nonoperated working interest in the field. In 2010, total daily production from the Karachaganak Field averaged 220,000 barrels of liquids (39,000 net) and 840 million cubic feet of natural gas (149 million net).[82]

Chevron has expanded its investment in Kazakhstan in recent years. In 2010, Chevron invested in a multi-billion dollar expansion of the Caspian Pipeline Consortium pipeline. The company is the largest private shareholder in the project. The pipeline connects in Kazakhstan with marine terminals in Russia.[83]

Downstream

Chevron's downstream operations manufacture and sell products such as fuels, lubricants, additives and petrochemicals. The company's most significant areas of operations are the west coast of North America, the U.S. Gulf Coast, Southeast Asia, South Korea, Australia and South Africa. Products are sold through a network of approximately 20,000 retail stations. Chevron's chemicals business includes 50% ownership in the Chevron Phillips Chemical Company, which manufactures petrochemicals, and the Chevron Oronite Company, which develops, manufactures and sells fuel and lubricant additives.

Refinery locations

Chevron owns and operates five active refineries in the United States, one in Cape Town, South Africa, and one in Burnaby, British Columbia. Chevron is the non-operating partner in seven joint venture refineries, located in Australia,[84] Pakistan,[85] Singapore, Thailand, South Korea, and New Zealand.[86] Chevron's United States refineries are located in Gulf and Western states. Chevron also owns an asphalt refinery in Perth Amboy, New Jersey; however, since early 2008 that refinery has primarily operated as a terminal.[87]

- Pascagoula, Mississippi

- Salt Lake City, Utah

- Kapolei, Hawaii

- El Segundo, California

- Richmond, California

- Burnaby, Canada

- Cape Town, South Africa

Processing and sales

In 2010, Chevron processed 1.9 million barrels of crude oil per day and averaged 3.1 million barrels per day in sales of refined products like gasoline, diesel and jet fuel.[88]

Alternative energy

The company is developing alternative energy sources, including geothermal, solar, wind, biofuel, fuel cells, photovoltaics, advanced and hydrogen fuel for transport and power technologies through Chevron Energy Solutions and Chevron Technology Ventures. The company plans to spend at least $2 billion on renewable power ventures and research between 2010 and 2013.[89][90][91][92]

In addition to developing its own technologies, Chevron has cut its energy use by a third since 1992 by utilizing hydrogen fuel cells and solar panels at its facilities.

Geothermal

Chevron has claimed to be the world's largest producer of geothermal energy.[29] The company's geothermal operations are primarily located in Southeast Asia, where steam from underground deposits of boiling water is tapped and piped to the surface to turn generators, producing 1,273 MW of electricity.[93][94][95]

Chevron operates numerous geothermal wells in Indonesia, helping to provide power to Jakarta and the surrounding area, and plans to potentially open a 200 MW geothermal facility in South Sumatra. In the Philippines, Chevron also operates geothermal wells at Tiwi field in Albay province, the Makiling-Banahaw field in Laguna and Quezon provinces.[96]

Biofuels

Chevron Technology Ventures (CTV) is investing between US$ 300 and $400 million a year into alternative fuel sources and environmentally sustainable technologies. CTV contains a biofuels business unit.[97]

In 2007, Chevron and the United States Department of Energy's National Renewable Energy Laboratory (NREL) announced that they had entered into a collaborative agreement to produce biofuels from algae. Chevron and NREL scientists would develop algae strains that can be economically harvested and processed into transportation fuels, such as jet fuel.[98]

In 2008 Chevron and Weyerhaeuser Company jointly created Catchlight Energy LLC, which researches the conversion of cellulose-based biomass into biofuels.[99]

Between 2006 and 2011 Chevron contributed up to $12 million to a strategic research alliance with the Georgia Institute of Technology to develop cellulosic biofuels and to create a process to convert biomass like wood or switchgrass into fuels. Additionally, Chevron holds a 22% ownership stake in Galveston Bay Biodiesel LP, which produces up to 110 million US gallons (420,000 m3) of renewable biodiesel fuel a year.[100][101]

Solar energy

In 2010, the Chevron announced a 740 kW photovoltaic demonstration project in Bakersfield, California, called Project Brightfield, for exploring possibilities to use solar power for powering Chevron's facilities. It consists of technologies from seven companies, which Chevron is evaluating for large-scale use.[102] In Fellows, California, Chevron has invested in the 500 kW Solarmine photovoltaic solar project, which supplies daytime power to the Midway-Sunset Oil Field.[103] In Questa, Chevron has built a 1 MW concentrated photovoltaic plant that comprises 173 solar arrays, which use Fresnel lenses.[104][105] In October 2011, Chevron launched a 29-MW thermal solar-to-steam facility in the Coalinga Field to produce the steam for enhanced oil recovery. The project is the largest of its kind in the world.[106]

Controversies

Great American streetcar scandal

In 1950 three companies, General Motors, Firestone and Chevron, then known as "Standard Oil", were charged and convicted of criminal conspiracy for their part in the General Motors streetcar conspiracy. The scandal involved purchasing streetcar systems throughout the United States and dismantling and replacing them with buses,[107] in order to increase their sales of petroleum, automobiles and tires.

Tax evasion

Chevron was found to have evaded $3.25 billion in federal and state taxes from 1970 to 2000 through a complex petroleum pricing scheme involving a project in Indonesia.[108][109][110] Chevron and Texaco, before they merged in 2001, each owned 50 percent of a joint venture called Caltex, which pulled crude oil from the ground in a project with the Indonesian state oil company, Pertamina. Chevron was accused of reducing its tax liabilities in the U.S. by buying oil from Caltex at inflated prices. One internal Chevron document set the price it paid Pertamina for oil at $4.55 a barrel higher than the prevailing market price. Chevron was then able to overstate deductions for costs on its U.S. income tax returns. Indonesia appeared to levy tax on this oil at 56%, a rate far higher than the corporate tax rate in the U.S. Because the United States gives companies a credit for taxes paid to foreign governments, tax paid to the Indonesian government reduces tax to the U.S. government.

Caltex transferred funds out of the U.S. to Indonesia, because the Indonesian government compensated Caltex for the excessively priced oil and the extra taxes paid by giving oil for free. Because Caltex had to pay taxes on that oil, too, the Indonesian government gave it even more oil to cover the taxes.

Blocking of NiMH battery technology for automobiles

Chevron was accused to be limiting access to large NiMH batteries through its stake in Cobasys and control of patent licenses in order to remove a competitor to gasoline. This culminated in a lawsuit against Panasonic and Toyota over production of the EV-95 battery used in the RAV4 EV.[111][112] Chevron's influence over Cobasys extends beyond a strict 50/50 joint venture as it held a 19.99% interest in ECD Ovonics.[113] In her book, Plug-in Hybrids: The Cars that Will Recharge America, published in February 2007, Sherry Boschert argues that large-format NiMH batteries are commercially viable but that Cobasys refuses to sell the batteries or license the technology to small companies or individuals. Boschert argues that Cobasys accepts only very large orders for the batteries. Major automakers showed little interest in placing large orders for large-format NiMH batteries. However, Toyota complained about the difficulty in getting smaller orders of large format NiMH batteries to service the existing 825 RAV-4EVs. Because no other companies were willing to place large orders, Cobasys was not manufacturing or licensing large format NiMH battery technology for automobiles. Boschert concludes that "it's possible that Cobasys (Chevron) is squelching all access to large NiMH batteries through its control of patent licenses in order to remove a competitor to gasoline. Or it's possible that Cobasys simply wants the market for itself and is waiting for a major automaker to start producing plug-in hybrids or electric vehicles."[114] In an interview with The Economist, the ECD Ovonics founder Stan Ovshinsky subscribed to the former view. "I think we at ECD we made a mistake of having a joint venture with an oil company, frankly speaking. And I think it's not a good idea to go into business with somebody whose strategies would put you out of business, rather than building the business."[115]

In addition, Chevron maintained the right to seize all of Cobasys' intellectual property rights if ECD Ovonics does not fulfill its contractual obligations.[116] On September 10, 2007, Chevron filed a legal claim that ECD Ovonics has not fulfilled its obligations. ECD Ovonics disputes this claim.[117]

In October 2007, International Acquisitions Services and Innovative Transportation Systems filed suit against Cobasys and its parents for refusing to fill an order for large-format NiMH batteries to be used in the electric Innovan.[118] In August 2008, Mercedes-Benz U.S. International filed suit against Cobasys, on the ground Cobasys did not tender the batteries it agreed to build for Mercedes-Benz's planned hybrid SUV.[119]

Environmental damage in Ecuador

From 1972 to 1993, Texaco operated development of the Lago Agrio oil field in Ecuador. Ecuadorian farmers and indigenous residents accused Texaco, now Chevron, of making residents ill and damaging forests and rivers by discharging 18 billion US gallons (68,000,000 m3) of formation water into the rainforest without any environmental remediation. They sued Chevron for extensive environmental damage caused by these operations, which have sickened thousands of Ecuadorians and polluted the Amazon rainforest.[120] The Ecuadorian court could have imposed a legal penalty of up to $28 billion in a class action lawsuit filed on behalf of Amazonian villagers in the region. Chevron claimed that agreements with the Ecuadorian Government exempted the company from any liabilities.[121][122][123] A documentary on the issue, Crude, premiered in September 2009.

From 1977 until 1992 Texaco (Texpet), a subsidiary of Texaco Inc., was a minority member of this consortium with Petroecuador, the Ecuadorian state-owned oil company, as the majority partner. Since 1990, the operations were conducted solely by Petroecuador. At the conclusion of the consortium and following an independent third-party environmental audit of the area, Texaco formally agreed with the Republic of Ecuador and Petroecuador to conduct a three-year remediation program at a cost of $40 million. The government subsequently granted Texpet and all related corporate entities a full release from any and all environmental liability arising from its operations.[121] Based on that release, Chevron contended that "this lawsuit lacks legal or factual merit." However, water and soil samples taken by an Ecuadorean scientific team after Texaco departed in 1998 found almost half still contained unsafe levels of petroleum hydrocarbons.[124]

On 15 February 2011, a court in Ecuador fined Chevron $8.6 billion for pollution to the country's Amazon region by Texaco between 1972 and 1992, with claimants claiming loss of crops and farm animals as well as increased local cancer rates.[124][125][126] The action was brought against Chevron by 30,000 Ecuadorean people; it is the first time that indigenous people have successfully sued a multinational corporation in the country where the pollution took place.[124][125] The trial began in 2003.[127] The total penalty imposed on Chevron was $9.5 billion as it was ruled that the oil company must pay an additional 10 per cent legally mandated reparations fee.[125] $27 billion was the sum total requested by plaintiffs, $18.4 billion more than was eventually granted by the court.[126] The Ecuadoreans expressed happiness that Chevron was declared guilty; they also expressed dismay that the award of $8.6 billion would not be enough to make up for the damage caused by the oil company.[128] Environmental activists believe that this case serves as a precedent for representing pollution-causing business being carried out by firms in developing countries.[125] The nonprofit organization Amazon Watch described the outcome of the case as "unprecedented".[128] Chevron described the lawsuit as an "extortion scheme" and refused to pay the fine.[124] Chevron has no international obligation to pay, and no assets in Ecuador for the government to seize.

Pollution in Richmond, California

Chevron's activities at its century-old Richmond refinery have been the subject of ongoing controversy. The project generated over 11 million pounds of toxic materials and caused more than 304 accidents.[129] The Richmond refinery paid $540,000 in 1998 for illegally bypassing waste water treatments and failing to notify the public about toxic releases.[130] Overall, Chevron is listed as potentially liable for 95 Superfund sites, with funds set aside by the EPA for clean-up.[131] In October 2003, the state of New Hampshire sued Chevron and other oil companies for using MTBE, a gasoline additive that the attorney general claimed polluted much of the state's water supply.[132] The pollution created by the refinery has also had adverse health effects on the residents of Richmond, including relatively high rates of respiratory diseases and cancer when compared to the state and national averages, and the health issues related to emergency spills.[133]

Violation of the Clean Air Act in the United States

On October 16, 2003, Chevron U.S.A. settled a charge under the Clean Air Act, which reduced harmful air emissions by about 10,000 tons a year.[134] In San Francisco, Chevron was filed by a consent decree to spend almost $275 million to install and utilize innovative technology to reduce nitrogen oxide (NOx) and sulfur dioxide emissions at its refineries.[135] After violating the Clean Air Act at an offline loading terminal in El Segundo, California, Chevron paid a $6 million penalty as well as $1 million for environmental improvement projects.[136] Chevron also had implemented programs that minimized production of hazardous gases, upgraded leak detection and repair procedure, reduced emissions from sulfur recovery plants, and adopted strategies to ensure the proper handling of harmful benzene wastes at refineries.[134] Chevron also spent about $500,000 to install leakless valves and double-sealed pumps at its El Segundo refinery, which could prevent significant emissions of air contaminants.[136]

Defenders of Chevron's environmental record point to recent changes in the corporation, particularly its pledge in 2004 to combat global warming.[137]

Destruction of natural forest in Bangladesh

On 26 June 2008, a fire in Lawachara National Park (a natural forest; a major national park, rare of its kind in the region, and crucial to maintain the biodiversity of Bangladesh's flora & fauna) had broken out as Chevron Corp. carried out a 3D seismic survey that was to be six-months long. The company had violated the conditions of the government's environment clearance certificate by not informing the ministry about the cracks that had occurred in nearby residents' properties due to explosions caused by their activities.[138]

Investment in Iran

One of the U.S. Embassy cables published by WikiLeaks concerns a conversation that took place on March 19, 2009, between the Iraqi Prime Minister, Nouri al-Maliki, and the U.S. chargé d'affaires.[139] One of the subjects discussed was the negotiation between the Iraqi Prime Minister and Chevron concerning a cross-border oilfield (Iran–Iraq), despite strict U.S. sanctions that state "US persons may not perform services, including financing services, or supply goods or technology that would benefit the Iranian oil industry." Chevron asserted that they had not engaged in any negotiations that would violate U.S. law.[140] This document was intended to have been kept secret until 2029.[139]

Oil spill off the coast of Rio de Janeiro

On November 8 2011, Chevron came under fire by Brazilian authorities for its role in the spill of crude oil off of the southeastern coast of Brazil.[141] The Brazilian regulators said 416,400 liters of oil leaked over the course of two weeks from undersea rock near the well in the Frade oil project 370 km off the Brazilian coast.[142] Prosecutors in Brazil are demanding $10.6bn in the subsequent lawsuit. The National Petroleum Agency (ANP) suspended Chevron's activities in Brazil until it has identified the cause of an oil spill off the coast of Rio de Janeiro.[143]

KS Endeavor explosion

The KS Endeavor jackup rig exploded on 16 January 2012 while drilling an exploration well for Chevron on the Funiwa field in Nigeria. Two of the 154 workers on the KS Endeavor and a nearby support barge are unaccounted for. The rig was contracted by Fode Drilling. The rig had been under contract to Chevron in Nigeria from January 2011 to January 2013. The rig, which has a crew capacity of 130, was delivered in 2010.[144]

Political contributions

Since January 2011 Chevron has contributed almost $15 million on Washington lobbying. On October 7, 2012 Chevron donated $2.5 million to the Republican Congressional Leadership Fund super PAC that is closely tied to House Speaker John Boehner.[145]

Niger Delta shootings

On May 25, 1998, over 100 activists staged a demonstration and occupied a barge servicing a company oil platform in the Niger Delta, Nigeria.[146] After demanding a meeting with the managing director of the company to express their grievances, they were eventually met by a Nigerian employee whose job was to liaise with the local communities. After speaking to the elders of the community on shore, the representative then informed the activists that Chevron would offer more jobs to local people on the project but would have to get back to them in a few days about their other demands. [146] Four days later, on May 28, 1998, activists saw Chevron helicopters flying in and, as one activist said, "We were looking at all these helicopters thinking that probably people inside these helicopters might have been Chevron reps who are actually coming to dialogue with us here."

In fact, the helicopters contained members of the Nigerian navy and police, who immediately began teargassing and shooting at the activists; two activists, Jola Ogungbeje and Aroleka Irowaninu, died from their wounds.[146] Chevron describes the situation as "a violent occupation of private property by aggressors seeking to extort cash payments from the company".[147] The Nigerian government is reportedly 80% dependent upon oil production and is condemned by many for its reported treatment of environmentalists.[148] The documentary Drilling and Killing covers these and other topics.

U.S. District Judge Susan Illston, in allowing a lawsuit brought by victims and their families against Chevron to proceed, said that there was evidence that Chevron had hired and provided transportation to Nigerian military forces known for their "general history of committing abuses".[149] In March 2008, the plaintiffs' lawyers, without explanation, "quietly moved to withdraw half of their claims" against Chevron.[150]

On December 1, 2008, a federal jury cleared Chevron of all charges brought against them in the case. The jury deliberated for almost two days. Chevron had claimed that the military intervention was necessary to protect the lives of its workers and considers the jury's decision vindication for the accusations of wrongdoing.[151]

Oil spills in Angola

Chevron's operations in Africa have also been criticized as environmentally unsound.[152] In 2002, Angola became the first country in Africa ever to levy a fine on a major multinational corporation operating within its borders, when it demanded $2 million in compensation for oil spills allegedly caused by Chevron.[153] An oil spill occurred in Cabinda Province in August 2010.[154]

New policy and development

Chevron has taken steps to reduce emissions of greenhouse gases and pursue cleaner forms of energy.[155] It has scored highest among U.S. oil companies for investing in alternative energy sources and setting targets for reducing its own emissions[155] and is the world's largest producer of geothermal energy, providing enough power for over 7 million homes.[156]

Chevron is currently considering a floating liquefied natural gas facility to develop offshore discoveries in the Exmouth Plateau of Western Australia.[157]

Organization overview

Organizational structure

Chevron is an integrated energy and technology company, publicly traded on the NYSE. Chevron is an example of a bureaucratic corporation because there exist positions of rank throughout the organization. This type of organizational structure establishes hierarchical power structured from the top all the way down to the lowest level employees, interns and first-years. According to Max Weber, in companies structured like Chevron, as employees gain more experience, they desire a "career within the hierarchical order" and expect to "move from the lower, less important and less well paid, to the higher positions".[158]

The company is led by a chief executive, who also serves on the board of directors, which is a group of people that have been elected by the stockholders to represent them in decision making. Corporate Officers make up the next rung of the ladder. These officers are in charge of different branches within the corporation, ranging from technology and services to health environment and safety.[1] The fact that the firm has multiple divisions, each led by different corporate officials, is an example of bureaucratic control in that many distinct positions exist in the company on different hierarchical levels. The benefit of bureaucratic control in this situation is that workers have unique and distinct positions making them feel more valued and important at the firm ultimately leading to higher moral and productivity.[159]

Division of labor

Chevron divides its responsibilities based on the corporations hierarchy structure and specialization of employees skills. At the top of Chevron's hierarchical ladder, as a result of being publicly traded, is a board of directors led by the chief executive officer. This board's responsibilities include, but are not limited to, approving the chief executive officer's compensation, evaluating the attractiveness of paying dividends to investors, approving the company's financial statements and overseeing any mergers or acquisitions. The corporate officers manage the specific branches of the corporation. These branches of the corporation deal with specific affairs and therefore the employees working within these branches have been trained to specialize in this particular field.

The different branches within Chevron's corporation portray theories brought up by Adam Smith. Smith believed that dividing labor into different branches, allowing workers to specialize in specific tasks and skill-sets, would lead to improved efficiency throughout the entire corporation.[160] Chevron implements different responsibilities to different people based on their rank and what branch they work for. According to the bureaucratic control theory, this delegation strategy will help keep workers motivated and in good spirits, both important traits within a corporation.[159]

Internal culture

The corporation strives to achieve and maintain productivity throughout all branches of the corporation, encouraging employees to develop the skills they need to succeed and to follow the career paths they desire. Chevron maintains a collaborative work experience, working with teams of people from all over the world. Employees come from a variety of backgrounds most of them with education and background from one or more of the following categories: Engineering, Earth Science, Operations and Maintenance, Information Technology, Chemistry, Human Resources, Finance and Accounting, Health, Environment and Safety, or Sales and Marketing.[161]

Chevron also requires its employees to be trained in their specific employment duties, which draws on Weber's idea of specialization. So in order for employees to be efficient they must get training to become skilled in their specific duties. Chevron's new employees go through a 5-year extensive training program (Horizon) that helps them develop a "technical experience and job skills".[161] Chevron encourages current employees to maintain and update their skills primarily through on-the-job education programs. Chevron, through its new and current employee training programs, is portraying, according to Laurie Graham, the important company function of building a cooperative team environment.[162]

Chevron incentivizes their employees to be efficient and productive through compensation and benefits. The incentive to receiving higher pay through a job promotion is obviously an employee's biggest motivation to work hard. However, Chevron offers a number of other compensation incentives to be efficient including annual incentive awards when the company meets its established goals, such as bonuses and salary raises. To decrease the risk of job turnover and to maintain a positive atmosphere the company offers a number of benefits including, but not limited to, retirement and savings plans, healthcare and dental plans, paid vacations and life insurance.[161]

External culture

Chevron maintains external culture deals primarily with its subsidiaries and its public investors. By merging with and acquiring other companies, Chevron is effectively expanding its enterprise, helping it grow rapidly into new locations and new fields of work. Chevron performs most of its expansion by merging with and acquiring new companies, allowing it to gain footholds in industries without creating new subsidiaries from scratch. This exemplifies theory proposed by Chandler, in that Chevron by acquiring footholds in these new companies they are effectively entering into new geographical areas and into similar markets.[163]

Chevron's biggest merger occurred between Chevron and Texaco, another large integrated energy and technology company. By merging with Texaco, Chevron gained access to all of Texaco's resources ranging from offshore acreage in the Gulf of Mexico to the numerous gas stations Texaco had throughout the country. This merger allowed Chevron to expand geographically as well as financially.

Board of directors

- John S. Watson (Chairman & CEO)

- George L. Kirkland (Vice Chairman)

- Linnet F. Deily

- Robert Denham

- Robert James Eaton

- Chuck Hagel

- Franklyn Jenifer

- Enrique Hernandez, Jr.

- Donald Rice

- Kevin W. Sharer

- Charles Shoemate

- John G. Stumpf

- Ronald Sugar

- Carl Ware

Condoleezza Rice is a former member of the board of directors, and also headed Chevron's committee on public policy until she resigned on January 15, 2001, to become National Security Advisor to President George W. Bush.

On September 30, 2009, John Watson, age 52, was elected Chairman of the Board and CEO, effective at the December 31, 2009 retirement of David J. O'Reilly.

Marketing brands

Fuel

- Chevron

- Standard Oil (in limited circumstances to hold trademark on the name)

- Texaco

- Caltex

- Unocal (Upstream Business Only—Fuel stations are owned by Phillips 66[165])

Convenience stores

- Star Mart

- Extra Mile

- Redwood Market

- Town Pantry

Lubricants

- Delo (sold by Caltex and Chevron)

- Havoline (sold by Caltex and Texaco)

- Revtex (sold by Caltex)

- Ursa (sold by Texaco)

Fuel additives

- Techron—Chevron, Texaco (phased in during 2005), Caltex (phased in during 2006 and later)

- Clean System 3—Texaco (phased out during 2005 in favor of Techron)

See also

- RAV4 EV

- Patent encumbrance of large automotive NiMH batteries

- Texaco

- Chevron U.S.A., Inc. v. Natural Resources Defense Council, Inc.

- Gordon L. Park

- Jack 2

- Trans-Caribbean pipeline

- Pico Canyon Oilfield

References

- ^ a b c "Company Profile". Chevron.com. Retrieved August 9, 2011.

- ^ a b c d e f "Chevron Corp, Form 10-K, Annual Report, Filing Date Feb 22, 2013" (PDF). secdatabase.com. Retrieved Mar 24, 2013.

- ^ Fortune 500, 2010 "America's Largest Corporations". CNNmoney.com.

- ^ CNN Money. "FORTUNE 500 Our annual ranking of America's largest corporations". Retrieved 24 February 2013.

{{cite web}}:|last=has generic name (help) - ^ "The World's Biggest Public Companies". Forbes. Retrieved June 6, 2011.

- ^ "Chevron". Forbes. Retrieved June 6, 2011.

- ^ "Leading the Way". chevron.com. Retrieved 2010-12-18.[dead link]

- ^ Baker, David R. (2005-05-10). "Chevron drops the Texaco from its name". San Francisco Chronicle. Retrieved 2 May 2011.

- ^ Chevron and Calso

- ^ Whatever happened to Standard Oil?

- ^ Vintage Calso Gasoline / Standard Oil of California pump

- ^ Peck, Merton J. & Scherer, Frederic M. The Weapons Acquisition Process: An Economic Analysis (1962) Harvard Business School p.619

- ^ "The King of Giant Fields". Retrieved 5 june 2013.

{{cite web}}: Check date values in:|accessdate=(help) - ^ http://www.post-gazette.com/stories/business/news/chevron-acquires-kmart-property-in-moon-for-possible-regional-headquarters-685784/

- ^ "Gulf Oil acquires brand rights for entire US". Vermont Business Magazine. 2010-01-13. Retrieved 2010-05-05.

- ^ "Chevron Corp, Form 10-Q, Quarterly Report, Filing Date Nov 8, 1996". secdatabase.com. Retrieved Mar 24, 2013.

- ^ "Chevron Corp, Form 8-K, Current Report, Filing Date Mar 6, 2000". secdatabase.com. Retrieved Mar 24, 2013.

- ^ "Chevron Corp, Form 8-K, Current Report, Filing Date May 25, 2007" (PDF). secdatabase.com. Retrieved Mar 24, 2013.

- ^ "Chevron's Profit Rises 24%, With Help From Its Refineries". The New York Times. Reuters. 2007-07-28. Retrieved 2 May 2011.

- ^ "Chevron Corp, Form 8-K, Current Report, Filing Date Oct 16, 2000". secdatabase.com. Retrieved Mar 24, 2013.

- ^ "Oil giant Chevron buys rival Texaco". BBC News. 2000-10-16. Retrieved 2 May 2011.

- ^ "Chevron to Acquire Texaco". The Street.com. Retrieved 2 May 2011.

- ^ Raine, George (2001-10-10). "The Chevron - Texaco Merger / An oil giant emergers / Shareholders approval of Chevron-Texaco deal creates industy's lates behemoth". San Francisco Chronicle. Retrieved 2 May 2011.

- ^ "Chevron Corp, Form 8-K, Current Report, Filing Date May 10, 2005" (PDF). secdatabase.com. Retrieved Mar 24, 2013.

- ^ "Chevron Corp, Form 8-K, Current Report, Filing Date Apr 7, 2005". secdatabase.com. Retrieved Mar 24, 2013.

- ^ "Chevron Corp, Form 8-K, Current Report, Filing Date Aug 10, 2005" (PDF). secdatabase.com. Retrieved Mar 24, 2013.

- ^ Baker, David R. (2005-04-05). "Chevron plans to buy Unocal for $18.4 billion / Deal would bolster East Bay oil giant's strategically located sources of gas, crude". San Francisco Chronicle. Retrieved 2 May 2011.

- ^ Blum, Justin (2005-08-11). "Shareholders Vote in Favor Of Unocal Acquisition". The Washington Post. Retrieved 2 May 2011.

- ^ a b "Chevron claims energy debate". BBC News. 2006-02-19. Retrieved 2009-12-31.

- ^ "Chevron and Los Alamos Jointly Research Oil Shale Hydrocarbon Recovery". Green Car Congress. 2006-09-25. Retrieved 2009-04-12.

- ^ "Interior Department Issues Oil Shale Research, Development and Demonstration Leases for Public Lands in Colorado" (Press release). Bureau of Land Management. 2006-12-15. Retrieved 2009-04-12.

- ^ "Chevron leaving Western Slope oil shale project". Denver Business Journal. 2012-02-28. Retrieved 2012-03-12.

- ^ "Eastern Withdrawal for Chevron | CSP Daily News / Magazine | Petroleum - CSP Information Group, Inc. - news for convenience & petroleum retailing". Cspnet.com. 2009-12-07. Retrieved 2011-02-16.

- ^ "Chevron Corp, Form DFAN14A, Filing Date Nov 9, 2010". secdatabase.com. Retrieved Mar 24, 2013.

- ^ Kaplan, Thomas (2010-11-09). "Chevron to Buy Atlas Energy for $4.3 Billion". The New York Times. Retrieved 2 May 2011.

- ^ "Chevron Corp, Form 10-K, Annual Report, Filing Date Feb 24, 2011". secdatabase.com. Retrieved Mar 24, 2013.

- ^ a b "e10vk". Sec.gov. Retrieved 2012-07-23.

- ^ Robert V. Droz. "Standard Oil Today". Us-highways.com. Retrieved 2011-02-16.

- ^ "Latest Status Info". Tarr.uspto.gov. Retrieved 2012-07-23.

- ^ "Latest Status Info". Tarr.uspto.gov. Retrieved 2012-07-23.

- ^ "Chevron: SEC Filings". Investor.chevron.com. Retrieved 2012-07-23.

- ^ Marinucci, Carla (2001-05-05). "Chevron redubs ship named for Bush aide". San Francisco Chronicle. Retrieved 2008-10-13.

- ^ "Gemini Voyager - IMO 9174218 - Vessel Details". Q88.com. Retrieved 2012-07-23.

- ^ "Oregon Voyager - IMO 9144914 - Vessel Details". Q88.com. Retrieved 2012-07-23.

- ^ "The Voluntary Principles on Security and Human Rights - Participants". Secretariat for the Voluntary Principles on Security and Human Rights.

- ^ "UPDATE 3-Chevron starts Blind Faith oil production". Reuters. 2008-11-12.

- ^ "On a Wing and a Prayer: Chevron's Deep Well". The New York Times. 2010-06-17.

- ^ "Chevron starts pumping from $4.7B Tahiti platform". Houston Chronicle. Bloomberg News. 2009-05-06. Retrieved 2012-07-23.

- ^ "Chevron Corp, Form 8-K, Current Report, Filing Date Jan 27, 2006" (PDF). secdatabase.com. Retrieved Mar 24, 2013.

- ^ Perin, Monica (2006-01-04). "Chevron, Anadarko outline Big Foot oil discovery".

- ^ http://www.stockmarketsreview.com/news/72896.

{{cite news}}: Missing or empty|title=(help) - ^ Brett Clanton (2010-10-20). "Chevron plans floating city of deep-water wells in Gulf". Houston Chronicle. Retrieved 2012-07-23.

- ^ http://online.wsj.com/article/BT-CO-20110906-716568.html.

{{cite news}}: Missing or empty|title=(help); Unknown parameter|deadurl=ignored (|url-status=suggested) (help)[dead link] - ^ "Heavy Oil of the Kern River Oil Field". GetRealList. 2011-06-24. Retrieved 2012-07-23.

- ^ Mouawad, Jad (2007-03-05). "Oil Innovations Pump New Life Into Old Wells". The New York Times.

- ^ "Chevron leveraging information technology to optimize thermal production of heavy oil with increased recovery and reduced costs". Green Car Congress. 2011-06-23. Retrieved 2012-07-23.

- ^ SPE Digital Energy, 2007

- ^ Copeland, Michael V. (2009-03-20). "3-D gets down to business". CNN.

- ^ "PERMIAN BASIN | The Handbook of Texas Online| Texas State Historical Association (TSHA)". Tshaonline.org. Retrieved 2012-07-23.

- ^ Ordonez, Isabel (2011-04-08). "Chevron Rekindles Old Texas Flame". The Wall Street Journal.

- ^ "Chevron celebrates 5 billion barrels of Permian Basin crude - Mywesttexas.com: Local Newsroom". Mywesttexas.com. 2011-02-16. Retrieved 2012-07-23.

- ^ Marcellus Shale Gas: New Research Results Surprise Geologists!

- ^ "Chevron bets on shale gas with $3.2 billion Atlas buy". Reuters. 2010-11-09.

- ^ "Chevron Continues Aggressive Expansion into Marcellus Shale in PA – Buys Leases for Additional 228K Acres from Chief Oil & Gas | Marcellus Drilling News". Marcellusdrilling.com. Retrieved 2012-07-23.

- ^ "Analysis & Projections - U.S. Energy Information Administration (EIA) - U.S. Energy Information Administration (EIA)". Eia.gov. Retrieved 2012-07-23.

- ^ http://marcelluscoalition.org/wp-content/uploads/2011/07/Final-2011-PA-Marcellus-Economic-Impacts.pdf

- ^ Garrett, Geoffrey (2011-08-13). "Why this love triangle works". The Australian.

- ^ "Chevron's Gorgon project taking shape | Latest Business & Australian Stock market News". Perth Now. 2011-02-02. Retrieved 2012-07-23.

- ^ Burrell, Andrew (2011-06-15). "Chevron's Wheatstone LNG project to generate 6,500 jobs, says Roy Krzywosinski". The Australian.

- ^ "Chevron Announces First Gas from Australian North West Shelf Train 5 Facility - LNG Carriers". Gulfoilandgas.com. 2008-01-09. Retrieved 2012-07-23.

- ^ "No reason for doubt on Browse: Coleman - The West Australian". Au.news.yahoo.com. 2011-10-27. Retrieved 2012-07-23.

- ^ "Browse LNG Project, Kimberley". Hydrocarbons Technology. 2011-06-15. Retrieved 2012-07-23.

- ^ http://conference2011.gbcimpact.org/awards/Case%20Studies/workplace/chevron_commended_casestudy.pdf

- ^ "Escravos Gas-to-Liquids Project, Niger Delta". Hydrocarbons Technology. 2011-06-15. Retrieved 2012-07-23.

- ^ "Chevron, Total et al Prepare to Dive into Usan Project Offshore Nigeria". Rigzone. 2008-02-28. Retrieved 2012-07-23.

- ^ Gray, Sherry (2009-05-26). "Chevron, USAID Pledge $50 Million to Improve Living Standards in Nigeria - Global Notes". Blog.lib.umn.edu. Retrieved 2012-07-23.

- ^ "Chevron Foundation Gives Millions in Niger Delta". Petroleumafrica.com. 2011-02-18. Retrieved 2012-07-23.

- ^ "Chevron Corporation (CVX) Stock Description". Seeking Alpha. 2009-12-31. Retrieved 2012-07-23.

- ^ a b "Angola LNG". Angola Today. Retrieved 2012-07-23.

- ^ "Chevron Rises To $104 As Kazakhstan Kicks Up Production". Forbes. 2011-10-13. Retrieved 2013-06-23.

- ^ "TengizChevrOil (TCO) Sour Gas Injection and Second". Hydrocarbons Technology. 2011-06-15. Retrieved 2012-07-23.

- ^ Gizitdinov, Nariman (2010-07-21). "Oil in Kazakhstan May Be Too Rich for Tax to Deter Chevron: Energy Markets". Bloomberg L.P.

- ^ "Caspian Pipeline Consortium: Private Company Information - Businessweek". Investing.businessweek.com. 2011-09-20. Retrieved 2012-07-23.

- ^ Paton, James (2011-08-22). "Caltex Australia Starts Review of Refineries as Margins Drop". Bloomberg L.P.

- ^ Tanveer Ahmed (2010-07-01). "PSO willing to raise stakes in PRL". 'Daily Times. Retrieved 2012-07-23.

{{cite news}}: Italic or bold markup not allowed in:|newspaper=(help) - ^ "N.Z. Refining Jumps After Valero Said to Plan Bid (Update2)". Bloomberg L.P. 2009-07-24.

- ^ "Refining Crude Oil - Energy Explained, Your Guide To Understanding Energy". Eia.gov. Retrieved 2012-07-23.

- ^ "e10vk". Sec.gov. Retrieved 2012-07-23.

- ^ Swartz, Jon (2011-05-26). "Big companies aggressively jump into clean tech". USA Today.

- ^ Francisco, San (2011-07-05). "South San Francisco Unified starts work on solar project".

- ^ Hsu, Tiffany (2010-03-22). "Chevron is putting solar technologies to the test". Los Angeles Times.

- ^ "Chevron Sells Hybrid Battery Stake to Bosch, Samsung (Update1)". Bloomberg L.P. 2009-07-13.

- ^ "Harnessing the Heat of Indonesia's Volcanoes". Businessweek. 2011-07-07. Retrieved 2012-07-23.

- ^ "Chevron bets on $30B volcanoes beneath rainforest | Investing | Financial Post". Business.financialpost.com. 2011-06-15. Retrieved 2012-07-23.

- ^ "Chevron to expand its geothermal sites in the Philippines | Think GeoEnergy - Geothermal Energy News". Think GeoEnergy. 2010-06-21. Retrieved 2012-07-23.

- ^ Aboitiz, Chevron eye more drillings at Tiwi-Makban geothermal fields

- ^ Scanlon, Mavis (2006-05-31). "Chevron forms biofuels unit".

- ^ "Chevron backs green and slimy answer to biofuel problems - 02 Nov 2007 - News from". BusinessGreen. Retrieved 2012-07-23.

- ^ "Chevron investigates wood-fired cars - 04 Mar 2008 - News from". BusinessGreen. Retrieved 2012-07-23.

- ^ "Chevron forms $12M biofuel research alliance". 2006-06-15.

- ^ "BioSelect, Chevron unveil Galveston biodiesel plant". 2007-05-29.

- ^ Woody, Todd (2010-05-22). "Chevron Testing Solar Technologies". The New York Times. Retrieved 2013-06-23.

- ^ "Solar energy powers production of heavy oil in California". Oil & Gas Journal. 2007-05-02. (subscription required). Retrieved 2013-06-23.

- ^ "Chevron adds solar power to area mine". UPI. 2010-02-24. Retrieved 2012-07-23.

- ^ "Solar farm a sign of things to come". U-T San Diego. 2011-04-20. Retrieved 2013-06-23.

- ^ Korosec, Kirsten (2011-10-03). "Chevron uses solar power to produce more oil". SmartPlanet. Retrieved 2012-07-23.

- ^ Chomsky, Noam (1999). Year 501: the Conquest Continues. South End Press. ISBN 0-89608-444-2.

- ^ [1][dead link]

- ^ Johnston, David C. (2003). Perfectly Legal. New York: Penguin Group. pp. 253–255. ISBN 1-59184-069-4.

- ^ ChevronTexaco evaded $3.25 billion in taxes - report. - Sep. 13, 2002

- ^ http://investor.shareholder.com/ovonics/secfiling.cfm?filingID=950123-10-82515 [dead link]

- ^ http://investor.shareholder.com/ovonics/secfiling.cfm?filingID=950123-09-38450 [dead link]

- ^ ECD Ovonics Definitive Proxy Statement[dead link] of January 15, 2003

- ^ Boschert, S. (2007) Plug-in Hybrids: The Cars that Will Recharge America (Gabriola Island, BC: New Society Publishers) ISBN 978-0-86571-571-4

- ^ Brigis, Alvis (2008-10-14). "The Edison of our Age: Stan Ovshinsky and the Future of Energy [Video Interview Part 1]". The Energy Roadmap. Retrieved 2011-02-16.

- ^ ECD Ovonics Amended General Statement of Beneficial Ownership[dead link] of December 2, 2004

- ^ ECD Ovonics 10-Q Quarterly Report[dead link] for the period ending September 30, 2007

- ^ ECD Ovonics 10-Q Quarterly Report[dead link] for the period ending March 31, 2008

- ^ "Mercedes sues Cobasys over battery deal" Automotive News Europe

- ^ Bogumil Terminski, Oil-Induced Displacement and Resettlement: Social Problem and Human Rights Issue,http://www.conflictrecovery.org/bin/Bogumil_Terminski-Oil-Induced_Displacement_and_Resettlement_Social_Problem_and_Human_Rights_Issue.pdf

- ^ Font size Print E-mail Share 130 Comments Page 2 of 4 (2009-05-03). "60 Minutes "Amazon Crude", May 3, 2009". CBS News. Retrieved 2011-02-16.

{{cite news}}: CS1 maint: numeric names: authors list (link) - ^ Chevron annual meeting heats up over Ecuador suit[dead link]

- ^ a b c d "Finally, the polluter is commanded to pay". The Independent. London. 16 February 2011. p. 2.

- ^ a b c d "Chevron fined for Amazon pollution by Ecuador court". BBC News. 15 February 2011. Retrieved 15 February 2011.

- ^ a b "Ecuador court orders Chevron to pay $8 bln -lawyer". Reuters. 15 February 2011. Retrieved 15 February 2011.

- ^ "Texaco faces $1bn lawsuit". BBC News. 22 October 2003. Retrieved 22 October 2003.

- ^ a b "Ecuador plaintiffs say Chevron ruling falls short". Reuters. 15 February 2011. Retrieved 15 February 2011.

- ^ "Environmental Justice Case Study: Richmond, CA". University of Michigan. 1994-06-02. Retrieved 2011-02-16.

- ^ "Chevron Richmond Refinery to Pay $540,000 Environmental Penalty | Newsroom | [[US EPA]]". Yosemite.epa.gov. 1998-10-15. Retrieved 2011-02-16.

{{cite web}}: URL–wikilink conflict (help) - ^ Responsible Shopper Profile: Chevron[dead link]

- ^ "Question Your Goods. Vote With Your Wallet". Knowmore.org. Retrieved 2011-02-16.

- ^ "Standing Up To Big Oil" [[Making Contact (radio program)|]], produced by National Radio Project. December 14, 2010.

- ^ a b "Environmental Protection Agency". 2003-10-16. Retrieved 2008-05-06.

- ^ "Department of Justice". 2003-10-16. Retrieved 2008-05-06.

- ^ a b "Chevron Agrees to Record $7 Million Environmental Settlement". 2000-08-11. Retrieved 2008-05-06.

- ^ Baker, David R. (2006-03-22). "Quest for clean energy / Chevron, PG&E cited for positive steps to combat global warming". San Francisco Chronicle. Retrieved 2011-02-16.[dead link]

- ^ "Chevron violated terms of environmental clearance from govt". BangladeshNews.com.bd. 2008-05-06. Retrieved 10 May 2011.

- ^ a b "US embassy cables: Iraqi PM claims US oil company in contact with Iran". London: Guardian.co.uk. 2010-12-15. Retrieved 2011-02-16.

- ^ Ewen MacAskill (2010-12-15). "WikiLeaks cables: Chevron discussed oil project with Tehran, claims Iraqi PM". The Guardian. London. Retrieved 2011-02-16.

- ^ Chevron Takes Responsibility for Brazil Oil Spill, May Face $51M Fine[dead link]

- ^ Chevron takes full responsibility for Brazil oil spill spill 20.11.2011

- ^ Chevron faces $10.6bn Brazil legal suit over oil spill. On March 16, 2012 the Brazilian Federal Justice prohibited 17 key people (including George Buck and other foreigners) connected to Chevron Brazil from leaving the country without judicial permission because of evident guilt on the 2011 oil spills. 14.12.2011

- ^ Schmidt, Kathrine (2012-01-17). "Chevron prepares to drill Nigeria relief well". Upstream Online. NHST Media Group. (subscription required). Retrieved 2012-01-24.

- ^ Chevron donates $2.5 million to GOP super PAC

- ^ a b c "Transcript of Drilling and Killing Documentary". Democracy Now!. Retrieved 2011-02-16.

- ^ "Nigerians pull half of claims in Chevron suit". Walter Olson, Manhattan Institute's Pointoflaw.com. Published April 7, 2008. Last accessed April 8, 2008.

- ^ "Human Rights by Country". Amnesty International. 2008-10-06. Retrieved 2011-02-16.

- ^ Egelko, Bob (August 15, 2007). "Chevron can be sued for attacks on Nigerians, U.S. judge rules". The San Francisco Chronicle.

- ^ Nigerians pull half of claims in Chevron suit, Bob Egelko, San Francisco Chronicle. March 12, 2008.

- ^ S.F. jury clears Chevron of protest shootings. Bob Egelko, San Francisco Chronicle. Published December 2, 2008. Accessed December 3, 2008.

- ^ AfricaResource.com - Chevron, Oil Pollution, and Human Rights[dead link]

- ^ "Business | Angola fines Chevron for pollution". BBC News. 2002-07-01. Retrieved 2011-02-16.

- ^ McClelland, Colin (2010-08-20). "Chevron Probes Spill in Angola's Cabinda Area After Oil Washes Up on Beach". Bloomberg L.P.

- ^ a b Baker, David R. (March 22, 2006). "Quest for clean energy / Chevron, PG&E cited for positive steps to combat global warming". The San Francisco Chronicle.

- ^ "Stories". Chevron. 2007-09-29. Retrieved 2011-02-16.

- ^ Chambers, Matt (2010-11-03). "Chevron considers floating LNG plant". The Australian.

- ^ Weber, Max. Economy and Society. University of California Press.

- ^ a b Edwards, Richard (1979). Contested Terrain. New York: Basic Books. pp. 4–36.

- ^ Smith, Adam (1776). The Wealth of Nations. Penguin Books.

- ^ a b c "Chevron United States". Chevron. Retrieved 2012-10-18.

- ^ Graham, Laurie (1993). "Inside a Japanese Transplant A Critical Perspective". Sage Journals. Work and Occupations. 20 (2): 147–173.

{{cite journal}}:|access-date=requires|url=(help); Unknown parameter|month=ignored (help) - ^ Chandler, Alfred (1991). "The Functions of the HQ Unit in the Multibusiness Firm". Strategic Management Journal. 12 (Special Issue): 31–50.

{{cite journal}}:|access-date=requires|url=(help); Unknown parameter|month=ignored (help) - ^ "As of May 2011". Chevron Corporation. Retrieved 30 June 2011.

- ^ "Conoco Phillips Products & Services". Products Site. Retrieved 3 August 2011.[dead link]

External links

- Wikipedia neutral point of view disputes from May 2011

- 1984 establishments in the United States

- Algal fuel producers

- Automotive companies of the United States

- Automotive fuel brands

- Chemical companies of the United States

- Chevron Corporation

- Companies based in Contra Costa County, California

- Companies established in 1984

- Companies in the Dow Jones Industrial Average

- Companies listed on the New York Stock Exchange

- Financial District, San Francisco

- Gas stations in Canada

- Multinational oil companies

- Multinational companies headquartered in the United States

- Oil companies of the United States

- Peabody Award winners

- Convenience stores of the United States

- Gas stations of the United States