Economy of Japan: Difference between revisions

No edit summary |

Polylepsis (talk | contribs) No edit summary |

||

| Line 10: | Line 10: | ||

$4.141 trillion (2009) (PPP; [[List of countries by GDP (PPP)|3rd]]) |

$4.141 trillion (2009) (PPP; [[List of countries by GDP (PPP)|3rd]]) |

||

|growth = -5.7% (2009 est.) |

|growth = -5.7% (2009 est.) |

||

|per capita = $39,573 (2009) (nominal; [[List of countries by GDP (nominal) per capita|23th]]) |

|per capita = $39,573 (2009) (nominal; [[List of countries by GDP (nominal) per capita|23th]])<br /> |

||

$32,817 (2009) (PPP; [[List of countries by GDP (PPP) per capita|24th]]) |

$32,817 (2009) (PPP; [[List of countries by GDP (PPP) per capita|24th]]) |

||

|sectors = agriculture: 1.6%, industry: 23.1%, services: 75.4% (2009 est.) |

|sectors = agriculture: 1.6%, industry: 23.1%, services: 75.4% (2009 est.) |

||

Revision as of 15:19, 7 February 2010

| |

| Currency | Japanese Yen (JPY) |

|---|---|

| 1 April – 31 March | |

Trade organisations | APEC, WTO, OECD, G-20, G8 and others |

| Statistics | |

| GDP | $5.048 trillion (2009) (nominal; 2nd) $4.141 trillion (2009) (PPP; 3rd) |

GDP growth | -5.7% (2009 est.) |

GDP per capita | $39,573 (2009) (nominal; 23th) $32,817 (2009) (PPP; 24th) |

GDP by sector | agriculture: 1.6%, industry: 23.1%, services: 75.4% (2009 est.) |

| -1.3% (2009 est.) | |

Population below poverty line | 13.5% (after taxes and transfers) |

Labour force | 65.97 million (2009 est.) |

Labour force by occupation | agriculture: 4.4%, industry: 27.9%, services: 66.4% (2005) |

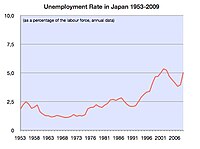

| Unemployment | 5.6% (2009 est.) |

Main industries | motor vehicles, industrial and transportation equipment, electronics, chemicals, steel, machine tools, processed foods, nonferrous metals |

| External | |

| Exports | $516.3 billion f.o.b. (2009 est.) |

Main export partners | US 17.8%, PRC 16%, South Korea 7.6%, Hong Kong 5.1% (2008) |

| Imports | $490.6 billion f.o.b. (2009 est.) |

Main import partners | PRC 18.9%, US 10.4%, Saudi Arabia 6.7%, Australia 6.2%, UAE 6.1%, Indonesia 4.3% (2008) |

Gross external debt | 204.5 trillion yen ($2.13 trillion, Jun 09) |

| Public finances | |

| 192.1% of GDP (2009) | |

| Revenues | $1.411 trillion (2006) |

| Expenses | $1.639 trillion, including capital expenditures (public works only) of about $71 billion (2006 est.) |

| Economic aid | $9.7 billion ODA (February 2007) |

All values, unless otherwise stated, are in US dollars. | |

The economy of Japan is the second largest in the world,[1] after the United States at around $5 trillion USD in terms of nominal GDP[1] and third after the United States and China when adjusted for purchasing power parity.[2] The workers of Japan rank 18th in the world in GDP per hour worked as of 2006.[3] The Big Mac Index shows that the wages in Tokyo are the highest among principal cities in the world.

For three decades, Japan experienced rapid economic growth, which was referred to as the Japanese post-war economic miracle. With average growth rates of 10% in the 1960s, 5% in the 1970s, and 4% in the 1980s Japan was able to establish itself as the world's second largest economy.[4] However, in the second half of the 1980’s sliding stock and real estate prices caused the Japanese economy to overheat in what was later to be known as the Japanese asset price bubble. The ‘’bubble economy’’ came to an abrupt end as the Tokyo Stock Exchange crashed in 1989. Growth in Japan throughout the 1990s was slower than growth in other major industrial nations, and the same as in France and Germany. The problems of the 1990’s may have been exacerbated by domestic policies intended to wring speculative excesses from the stock and real estate markets. Government efforts to revive economic growth throughout the 1990’s was not very successful and when the global economic outlook was downgraded in 2000-2001 the Japanese economy was in a serious economic situation. Despite this, the economy began to recover under the policies of Junichiro Koizumi. GDP growth for 2003 was 2.8%, with an annualized fourth quarter expansion of 5.5%, surpassing the growth rates of the US and European Union during the same period. In 2008, due to the global financial crisis, the export dependent economy of Japan was strongly hit and shrank 0.7%, and is expected to shrink some 5% in 2009. Nonetheless, the economy is recovering and is expected to grow significantly by 2010.

A mountainous, volcanic island country, Japan has inadequate natural resources to support its growing economy and large population. Although many kinds of minerals were extracted throughout the country, most mineral resources had to be imported in the postwar era. Local deposits of metal-bearing ores were difficult to process because they were low grade. The nation's large and varied forest resources, which covered 70 percent of the country in the late 1980s, were not utilized extensively. Because of political decisions on local, prefectural, and nation levels, Japan decided not to exploit its forest resources for economic gain. Domestic sources only supplied between 25 and 30 percent of the nation's timber needs. Agriculture and fishing were the best developed resources, but only through years of painstaking investment and toil. The nation therefore built up the manufacturing and processing industries to convert raw materials imported from abroad. This strategy of economic development necessitated the establishment of a strong economic infrastructure to provide the needed energy, transportation, communications, and technological know-how.

Deposits of gold, magnesium, and silver meet current industrial demands, but Japan is dependent on foreign sources for many of the minerals essential to modern industry. Iron ore, copper, and bauxite must be imported, as well as many forest products.

Economic history

The economic history of Japan is one of the most studied for its spectacular growth after the Meiji Revolution to be the first non European power and after World War II when the island nation rose to become the world's second largest economy.

First contacts with Europe (16th century)

Renaissance Europeans were quite admiring of Japan when they reached the country in the 16th century. Japan was considered as a country immensely rich in precious metals, mainly owing to Marco Polo's accounts of gilded temples and palaces, but also due to the relative abundance of surface ores characteristic of a volcanic country, before large-scale deep-mining became possible in Industrial times. Japan was to become a major exporter of copper and silver during the period.

Japan was also perceived as a sophisticated feudal society with a high culture and a strong pre-industrial technology. It was densely populated and urbanized. It had Buddhist “universities” larger than any learning institution in the West, such as Salamanca or Coimbra.[citation needed] Prominent European observers of the time seemed to agree that the Japanese "excel not only all the other Oriental peoples, they surpass the Europeans as well" (Alessandro Valignano, 1584, "Historia del Principo y Progresso de la Compania de Jesus en las Indias Orientales).

Early European visitors were amazed by the quality of Japanese craftsmanship and metalsmithing. This stems from the fact that Japan itself is rather poor in natural resources found commonly in Europe, especially iron. Thus, the Japanese were famously frugal with their consumable resources; what little they had they used with expert skill.

The cargo of the first Portuguese ships (usually about 4 smaller-sized ships every year) arriving in Japan almost entirely consisted of Chinese goods (silk, porcelain). The Japanese were very much looking forward to acquiring such goods, but had been prohibited from any contacts with the Emperor of China, as a punishment for Wakō pirate raids. The Portuguese (who were called Nanban, lit. Southern Barbarians) therefore found the opportunity to act as intermediaries in Asian trade.

Edo period

The beginning of the Edo period coincides with the last decades of the Nanban trade period, during which intense interaction with European powers, on the economic and religious plane, took place. It is at the beginning of the Edo period that Japan built her first ocean-going Western-style warships, such as the San Juan Bautista, a 500-ton galleon-type ship that transported a Japanese embassy headed by Hasekura Tsunenaga to the Americas, which then continued to Europe. Also during that period, the bakufu commissioned around 350 Red Seal Ships, three-masted and armed trade ships, for intra-Asian commerce. Japanese adventurers, such as Yamada Nagamasa, were active throughout Asia.

In order to eradicate the influence of Christianization, Japan entered in a period of isolation called sakoku, during which its economy enjoyed stability and mild progress.

Economic development during the Edo period included urbanization, increased shipping of commodities, a significant expansion of domestic and, initially, foreign commerce, and a diffusion of trade and handicraft industries. The construction trades flourished, along with banking facilities and merchant associations. Increasingly, han authorities oversaw the rising agricultural production and the spread of rural handicrafts.

By the mid-eighteenth century, Edo had a population of more than 1 million and Osaka and Kyoto each had more than 400,000 inhabitants. Many other castle towns grew as well. Osaka and Kyoto became busy trading and handicraft production centers, while Edo was the center for the supply of food and essential urban consumer goods.

Rice was the base of the economy, as the daimyo collected the taxes from the peasants in the form of rice. Taxes were high, about 40% of the harvest. The rice was sold at the fudasashi market in Edo. To raise money, the daimyo used forward contracts to sell rice that was not even harvested yet. These contracts were similar to modern futures trading.

During the period, Japan progressively studied Western sciences and techniques (called rangaku, literally "Dutch studies") through the information and books received through the Dutch traders in Dejima. The main areas that were studied included geography, medicine, natural sciences, astronomy, art, languages, physical sciences such as the study of electrical phenomena, and mechanical sciences as exemplified by the development of Japanese clockwatches, or wadokei, inspired from Western techniques.

From the Meiji Restoration to World War II

Since the mid-nineteenth century, when the Tokugawa government first opened the country to Western commerce and influence, Japan has gone through two periods of economic development. The first began in earnest in 1868 and extended through World War II; the second began in 1945 and continued into mid-1980s.

In the Meiji period (1868-1912), leaders inaugurated a new Western-based education system for all young people, sent thousands of students to the United States and Europe, and hired more than 3,000 Westerners to teach modern science, mathematics, technology, and foreign languages in Japan (Oyatoi gaikokujin). The government also built railroads, improved roads, and inaugurated a land reform program to prepare the country for further development.

To promote industrialization, the government decided that, while it should help private business to allocate resources and to plan, the private sector was best equipped to stimulate economic growth. The greatest role of government was to help provide the economic conditions in which business could flourish. In short, government was to be the guide and business the producer. In the early Meiji period, the government built factories and shipyards that were sold to entrepreneurs at a fraction of their value. Many of these businesses grew rapidly into the larger conglomerates. Government emerged as chief promoter of private enterprise, enacting a series of probusiness policies.

In the mid 1930s, the Japanese nominal wage rates were 10 times less than the one of the U.S (based on mid-1930s exchange rates), while the price level is estimated to have been about 44% the one of the U.S.[5]

Post-war economic history

From the 1960s to the 1980s, overall real economic growth has been called a "miracle": a 10% average in the 1960s, a 5% average in the 1970s and a 4% average in the 1980s.[6]

Growth slowed markedly in the late 1990s ("the Lost Decade"), largely due to the Bank of Japan's failure to cut interest rates quickly enough to counter after-effects of over-investment during the late 1980s. Some economists believe that because the Bank of Japan failed to cut rates quickly enough, Japan entered a liquidity trap. Therefore, to keep its economy afloat, Japan ran massive budget deficits (added trillions in Yen to Japanese financial system) to finance large public works programs.

By 1998, Japan's public works projects still could not stimulate demand enough to end the economy's stagnation. In desperation, the Japanese government undertook "structural reform" policies intended to wring speculative excesses from the stock and real estate markets. Unfortunately, these policies led Japan into deflation on numerous occasions between 1999 and 2004. In his 1998 paper, Japan's Trap, Princeton economics professor Paul Krugman argued that based on a number of models, Japan had a new option. Krugman's plan called for a rise in inflation expectations to, in effect, cut long-term interest rates and promote spending.[7]

Japan used another technique, somewhat based on Krugman's, called Quantitative easing. As opposed to flooding the money supply with newly printed money, the Bank of Japan expanded the money supply internally to raise expectations of inflation. Initially, the policy failed to induce any growth, but it eventually began to effect inflationary expectations. By late 2005, the economy finally began what seems to be a sustained recovery. GDP growth for that year was 2.8%, with an annualized fourth quarter expansion of 5.5%, surpassing the growth rates of the US and European Union during the same period.[8] Unlike previous recovery trends, domestic consumption has been the dominant factor of growth.

Despite having interest rates down near zero for a long period of time, the Quantitative easing strategy did not succeed in stopping price deflation.[9] This led some economists, such as Paul Krugman, and some Japanese politicians, to speak of deliberately causing hyperinflation.[10] In July 2006, the zero-rate policy was ended. In 2008, the Japanese Central Bank still has the lowest interest rates in the developed world, deflation has still not been eliminated[11] and the Nikkei 225 has fallen over approximately 50% (between June 2007 and December 2008).

The Economist has suggested that improvements to bankruptcy law, land transfer law, and tax laws will aid Japan's economy.

In recent years, Japan has been the top export market for almost 15 trading nations worldwide.

Infrastructure

As of 2005, one half of energy in Japan is produced from petroleum, a fifth from coal, and 14% from natural gas.[12] Nuclear power in Japan makes a quarter of electricity production and Japan would like to double it in the next decades.

Japan's road spending has been large.[13] The 1.2 million kilometers of paved road are the main means of transportation.[14] Japan has left-hand traffic. A single network of speed, divided, limited-access toll roads connects major cities and are operated by toll-collecting enterprises. New and used cars are inexpensive. Car ownership fees and fuel levies are used to promote energy-efficiency.

Dozens of Japanese railway companies compete in regional and local passenger transportation markets; for instance, 7 JR enterprises, Kintetsu Corporation, Seibu Railway, and Keio Corporation. Often, strategies of these enterprises contain real estate or department stores next to stations. Some 250 high-speed Shinkansen trains connect major cities. All trains are known for punctuality.

There are 176 airports and flying is a popular way to travel between cities. The largest domestic airport, Tokyo International Airport, is Asia's busiest airport. The largest international gateways are Narita International Airport (Tokyo area), Kansai International Airport (Osaka/Kobe/Kyoto area), and Chūbu Centrair International Airport (Nagoya area). The largest ports include Nagoya Port.

Given its heavy dependence on imported energy, Japan has aimed to diversify its sources. Since the oil shocks of the 1970s, Japan has reduced dependence on petroleum as a source of energy from more than 75% in 1973 to about 57% at present. Other important energy sources are coal, liquefied natural gas, nuclear power, and hydropower. Demand for oil is also dampened by higher government taxes on automobile engines over 2000 cc, as well as on gasoline itself, currently 54 yen per liter sold retail. Kerosene is also used extensively for home heating in portable heaters, especially farther north. Many taxi companies run their fleets on liquefied gas with tanks in the car trunks. A recent success towards greater fuel economy was the introduction of mass-produced Hybrid vehicles. Former Prime Minister Shinzo Abe, who was working on Japan's economic revival, signed a treaty with Saudi Arabia and UAE about the rising prices of oil.

Macro-economic trend

This is a chart of trend of gross domestic product of Japan at market prices estimated by the International Monetary Fund with figures in millions of Japanese Yen. See also[15][16]

| Year | Gross Domestic Product | US Dollar Exchange | Inflation Index (2000=100) |

Per Capita Income (as % of USA) |

| 1955 | 8,369,500 | ¥360.00 | 10.31 | |

| 1960 | 16,009,700 | ¥360.00 | 16.22 | |

| 1965 | 32,866,000 | ¥360.00 | 24.95 | |

| 1970 | 73,344,900 | ¥360.00 | 38.56 | |

| 1975 | 148,327,100 | ¥297.26 | 59.00 | |

| 1980 | 240,707,315 | ¥225.82 | 75 | 74.04 |

| 1985 | 323,541,300 | ¥236.79 | 86 | 63.44 |

| 1990 | 440,124,900 | ¥144.15 | 92 | 105.82 |

| 1995 | 493,271,700 | ¥122.78 | 98 | 151.55 |

| 2000 | 501,068,100 | ¥107.73 | 100 | 105.85 |

| 2005 | 502,905,400 | ¥110.01 | 97 | 85.04 |

For purchasing power parity comparisons, the US Dollar is exchanged at ¥93.59 (August 2009).

Services

Japan's service sector accounts for about three-quarters of its total economic output. Banking, insurance, real estate, retailing, transportation, and telecommunications are all major industries such as Mitsubishi UFJ, Mizuho, NTT, TEPCO, Nomura, Mitsubishi Estate, Tokio Marine, JR East, Seven & I, and Japan Airlines counting as one of the largest companies in the world. The Koizumi government set Japan Post, one of the country's largest providers of savings and insurance services for privatization by 2014. The six major keiretsus are the Mitsubishi, Sumitomo, Fuyo, Mitsui, Dai-Ichi Kangyo and Sanwa Groups. Japan is home to 326 companies from the Forbes Global 2000 or 16.3% (as of 2006).

Industry

Japanese manufacturing is very diversified, with a variety of advanced industries that are highly successful.

Industry is concentrated in several regions, in the following order of importance: the Kantō region surrounding Tokyo, especially the prefectures of Chiba, Kanagawa, Saitama and Tokyo (the Keihin industrial region); the Tōkai region, including Aichi, Gifu, Mie, and Shizuoka prefectures (the Chukyo-Tokai industrial region); Kinki (Kansai), including Osaka, Kyoto, Kobe, (the Hanshin industrial region); the southwestern part of Honshū and northern Shikoku around the Inland Sea (the Setouchi industrial region); and the northern part of Kyūshū (Kitakyūshū). In addition, a long narrow belt of industrial centers is found between Tokyo and Fukuoka, established by particular industries, that have developed as mill towns.

The fields in which Japan enjoys relatively high technological development include consumer electronics, automobile manufacturing, semiconductor manufacturing, optical fibers, optoelectronics, optical media, facsimile and copy machines, and fermentation processes in food and biochemistry.

Agriculture

Only 12% of Japan's land is suitable for cultivation. Due to this lack of arable land, a system of terraces is used to farm in small areas. This results in one of the world's highest levels of crop yields per unit area, with an overall agricultural self-sufficiency rate of about 50% on fewer than 56,000 km² (14 million acres) cultivated.

Japan's small agricultural sector, however, is also highly subsidized and protected, with government regulations that favor small-scale cultivation instead of large-scale agriculture as practiced in North America.

Imported rice, the most protected crop, is subject to tariffs of 490% and was restricted to a quota of only 7.2% of average rice consumption from 1968 to 1988. Imports beyond the quota are unrestricted in legal terms, but subject to a 341 yen per kilogram tariff. This tariff is now estimated at 490%, but the rate will soar to a massive 778% under new calculation rules to be introduced as part of the Doha Round.[17] :D

Although Japan is usually self-sufficient in rice (except for its use in making rice crackers and processed foods) and wheat, the country must import about 50% [18] of its requirements of other grain and fodder crops and relies on imports for most of its supply of meat. Japan imports large quantities of wheat, sorghum, and soybeans, primarily from the United States. Japan is the largest market for EU agricultural exports. Apples are also grown, mostly in Tohoku and Hokkaidō; Pears and Oranges are mainly grown in Shikoku and in Kyūshū. Pears and oranges were first introduced by Dutch traders, in Nagasaki in the late 18th century.

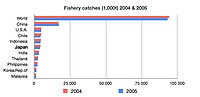

Fishery

Japan ranked second in the world behind the People's Republic of China in tonnage of fish caught—11.9 million tons in 1989, up slightly from 11.1 million tons in 1980. After the 1973 energy crisis, deep-sea fishing in Japan declined, with the annual catch in the 1980s averaging 2 million tons. Offshore fisheries accounted for an average of 50 % of the nation's total fish catches in the late 1980s although they experienced repeated ups and downs during that period

Coastal fishing by small boats, set nets, or breeding techniques accounts for about one third of the industry's total production, while offshore fishing by medium-sized boats makes up for more than half the total production. Deep-sea fishing from larger vessels makes up the rest. Among the many species of seafood caught are sardines, skipjack tuna, crab, shrimp, salmon, pollock, squid, clams, mackerel, sea bream, saury, tuna and Japanese amberjack. Freshwater fishing takes up about 30% of Japan's fishing industry. Among the species of fish caught in the rivers of Japan are many different types and some freshwater crustaceans.

Japan maintains one of the world's largest fishing fleets and accounts for nearly 15% of the global catch [19], prompting some claims that Japan's fishing is leading to depletion in fish stocks such as tuna.[20] Japan has also sparked controversy by supporting quasi-commercial whaling.[21]

Labor force

The claimed unemployment rate for June 2009 is 5.2% (5.4% male (up 0.1% from May 2009), 4.9% female (up 0.3% from May 2009)). [1] [2] This is regarded an under-estimate. Even part-time workers with extremely low hours are classified as employed.

In July 2006, the unemployment rate in Japan was 4.1%, according to the OECD. At the end of February 2009, it stood at 4.4% [3] This seemingly modest rate however understates the situation. According to The Economist, the ratio of job offers to number of applicants has declined to just 0.59, from almost 1 at the start of 2008, while average work hours also declined. Average wages also went down by 2.9% over the 12 months ending in February. In 2008, Japan's labour force consisted of some 66 million workers—40% of whom were women—and was rapidly shrinking. [4]

One major long-term concern for the Japanese labour force is a low birthrate. In the first half of 2005, the number of deaths in Japan exceeded the number of births, indicating that the decline in population, initially predicted to start in 2007, had already started. While one countermeasure for a declining birthrate would be to remove barriers to immigration, the Japanese government has been reluctant to do so.

In 1989, the predominantly public sector union confederation, SOHYO (General Council of Trade Unions of Japan), merged with RENGO (Japanese Private Sector Trade Union Confederation) to form the Japanese Trade Union Confederation. Labour union membership is about 12 million.

see also: Labor market of Japan

Law and government

Japan ranks 12th of 178 countries in the Ease of Doing Business Index 2008.

Japan has one of the smallest tax burdens in the developed world.[22] After deductions, the majority of workers are free from personal income taxes. Value-added tax rate is only 5%, while corporate tax rates are high.[22]

Shareholder activism is rare despite the fact that the corporate law gives shareholders strong powers over managers. Recently, more shareholders have stood up against managers.[23]

The government's liabilities include the third largest public debt of any nation.

Japan's central bank has the second largest foreign exchange reserves after People's Republic of China.

Culture

Overview

Nemawashi (根回し) in Japanese culture is an informal process of quietly laying the foundation for some proposed change or project, by talking to the people concerned, gathering support and feedback, and so forth. It is considered an important element in any major change, before any formal steps are taken, and successful nemawashi enables changes to be carried out with the consent of all sides.

Japanese companies are known for management methods such as "The Toyota Way". Kaizen (改善, Japanese for "improvement") is a Japanese philosophy that focuses on continuous improvement throughout all aspects of life. When applied to the workplace, Kaizen activities continually improve all functions of a business, from manufacturing to management and from the CEO to the assembly line workers.[24] By improving standardized activities and processes, Kaizen aims to eliminate waste (see Lean manufacturing). Kaizen was first implemented in several Japanese businesses during the country's recovery after World War II, including Toyota, and has since spread to businesses throughout the world.[25]

Some companies have powerful enterprise unions and shuntō.

The Nenko System or Nenko Joretsu as it is called in Japan, is the Japanese system of promoting an employee in order of his or her proximity to retirement. The advantage of the system is that it allows older employees to achieve a higher salary level before retirement and that it usually brings more experience to the executive ranks. The disadvantage of the system is that it does not allow new talent to be merged with the experience and those with specialized skills cannot be promoted to the already crowded executive ranks. It also does not guarantee or even attempt to bring the "right person for the right job".

Relationships between government bureaucrats and companies are often cozy. Amakudari (天下り, amakudari, "descent from heaven") is the institutionalised practice where Japanese senior bureaucrats retire to high-profile positions in the private and public sectors. The practice is increasingly viewed as corrupt and a drag on unfastening the ties between private sector and state which prevent economic and political reforms.

Lifetime employment (shushin koyo) and seniority-based career advancement have been common in the Japanese work environment.[22][26]

Recently, Japan has begun to gradually move away from some of these norms.[27][28]

Salaryman (サラリーマン, Sararīman, salaried man) refers to someone whose income is salary based; particularly those working for corporations. Its frequent use by Japanese corporations, and its prevalence in Japanese manga and anime has gradually led to its acceptance in English-speaking countries as a noun for a Japanese white-collar businessman. The word can be found in many books and articles pertaining to Japanese culture. Immediately following World War II, becoming a salaryman was viewed as a gateway to a stable, middle-class lifestyle. In modern use, the term carries associations of long working hours, low prestige in the corporate hierarchy, absence of significant sources of income other than salary, wage slavery, and karōshi. The term salaryman refers almost exclusively to males.

An office lady, often abbreviated OL (Japanese: オーエル Ōeru), is a female office worker in Japan who performs generally pink collar tasks such as serving tea and secretarial or clerical work. Like many unmarried Japanese, OLs often live with their parents well into early adulthood. Office ladies are usually full-time permanent staff, although the jobs they do usually have little opportunity for promotion, and there is usually the tacit expectation that they leave their jobs once they get married.

Freeter (フリーター, furītā) (other spellings below) is a Japanese expression for people between the age of 15 and 34 who lack full time employment or are unemployed, excluding homemakers and students. They may also be described as underemployed or freelance workers. These people do not start a career after high school or university but instead usually live as parasite singles with their parents and earn some money with low skilled and low paid jobs. The low income makes it difficult for freeters to start a family, and the lack of qualifications makes it difficult to start a career at a later point in life.

Karōshi (過労死, karōshi), which can be translated quite literally from Japanese as "death from overwork", is occupational sudden death. The major medical causes of karōshi deaths are heart attack and stroke due to stress.

Sōkaiya (総会屋, sōkaiya), (sometimes also translated as corporate bouncers, meeting-men, or corporate blackmailers) are a form of specialized racketeer unique to Japan, and often associated with the yakuza that extort money from or blackmail companies by threatening to publicly humiliate companies and their management, usually in their annual meeting (総会, sōkai).

Sarakin (サラ金) is a Japanese term for moneylender, or loan shark. It is a contraction of the Japanese words for salaryman and cash. Around 14 million people, or 10% of the Japanese population, have borrowed from a sarakin. In total, there are about 10,000 firms (down from 30,000 a decade ago); however, the top seven firms make up 70% of the market. The value of outstanding loans totals $100 billion. The biggest sarakin are publicly traded and often allied with big banks.[29]

The first "Western-style" department store in Japan was Mitsukoshi, founded in 1904, which has its root as a kimono store called Echigoya from 1673. When the roots are considered, however, Matsuzakaya has an even longer history, dated from 1611. The kimono store changed to a department store in 1910. In 1924, Matsuzakaya store in Ginza allowed street shoes to be worn indoors, something innovative at the time. [5] These former kimono shop department stores dominated the market in its earlier history. They sold, or rather displayed, luxurious products, which contributed for their sophisticated atmospheres. Another origin of Japanese department store is that from railway company. There have been many private railway operators in the nation, and from 1920s, they started to build department stores directly linked to their lines' termini. Seibu and Hankyu are the typical examples of this type.

From the 1980s and onwards, Japanese department stores are facing the fierce competition from supermarkets and convenience stores, gradually losing their presences. Still, depāto are bastions of several aspects of cultural conservatism in the country. Gift certificates for prestigious department stores are frequently given as formal presents in Japan. Department stores in Japan generally offer a wide range of services and can include foreign exchange, travel reservations, ticket sales for local concerts and other events.

Keiretsu

A keiretsu (系列, lit. system or series) is a set of companies with interlocking business relationships and shareholdings. It is a type of business group. The prototypical keiretsu are those which appeared in Japan during the "economic miracle" following World War II. Before Japan's surrender, Japanese industry was controlled by large family-controlled vertical monopolies called zaibatsu. The Allies dismantled the zaibatsu in the late 1940s, but the companies formed from the dismantling of the zaibatsu were reintegrated. The dispersed corporations were re-interlinked through share purchases to form horizontally-integrated alliances across many industries. Where possible, keiretsu companies would also supply one another, making the alliances vertically integrated as well. In this period, official government policy promoted the creation of robust trade corporations which could withstand heavy pressures from intensified world trade competition.[30]

The major keiretsu were each centered around one bank, which lent money to the keiretsu's member companies and held equity positions in the companies. Each central bank had great control over the companies in the keiretsu and acted as a monitoring entity and as an emergency bail-out entity. One effect of this structure was to minimize the presence of hostile takeovers in Japan, because no entities could challenge the power of the banks.

There are two types of keiretsu: vertical and horizontal. Vertical keiretsu illustrates the organization and relationships within a company (for example all factors of production of a certain product will be connected), while a horizontal keiretsu shows relationships between entities and industries, normally centered around a bank and trading company. Both are complexly woven together and self-sustain each other.

The Japanese recession in the 1990s had profound effects on the keiretsu. Many of the largest banks were hit hard by bad loan portfolios and forced to merge or go out of business. This had the effect of blurring the lines between the keiretsu: Sumitomo Bank and Mitsui Bank, for instance, became Sumitomo Mitsui Banking Corporation in 2001, while Sanwa Bank (the banker for the Hankyu-Toho Group) became part of Bank of Tokyo-Mitsubishi UFJ. Additionally, many companies from outside the keiretsu system, such as Sony, began outperforming their counterparts within the system.

Generally, these causes gave rise to a strong notion in the business community that the old keiretsu system was not an effective business model, and led to an overall loosening of keiretsu alliances. While the keiretsu still exist, they are not as centralized or integrated as they were before the 1990s. This, in turn, has led to a growing corporate acquisition industry in Japan, as companies are no longer able to be easily "bailed out" by their banks, as well as rising derivative litigation by more independent shareholders.

Current economic issues

The Koizumi administration, which held office until 2006, enacted or attempted to pass (sometimes with failure) major privatization and foreign-investment laws intended to help stimulate Japan's economy. Although the effectiveness of these laws is still ambiguous, the economy has begun to respond, but Japan's aging population is expected to place further strain on growth in the near future.[31]

Keynesians tend to claim that Japan's economy is far stronger than generally believed.[32] Some mainstream economists acknowledge that Japan, which unlike most developed countries has maintained its industrial base, and has vast capital reserves, currently has a strong economic outlook.

The privatization of Japan Post, the Japanese postal system which also runs insurance and deposit-taking businesses, is a major issue. A political battle over privatization caused a political stalemate in August, 2005, and ultimately led to the dissolution of the Japanese House of Representatives. The Postal Savings deposits, which have until now been used to fund public works projects, many of which have had questionable economic value, stands in excess of 1.9 trillion U.S. dollars, and could be a major force in energizing the private sector.

The Japanese monetary authorities' continued desire to depress the price of yen relative to other key specific currencies to protect domestic business from imports may no longer be feasible. The most recent record intervention in 2003 amounted to over 17 trillion yen, more than one third of one trillion US dollars at the time and nearly 3% of Japan's 2003 GDP, being sold in favor of other non-yen denominated assets. However, since 2005, Japan has not directly intervened to buy currency, as yen carry trade has effectively carried out the same task.

Interestingly, international trade has expanded by 60% from 91.4 trillion yen to 142.6 trillion yen from 2001 to 2006. Taking in account the economic participation rate, Japan's GDP per worker has increased steadily.

The Organization for Economic Cooperation and Development downgraded its economic forecasts on March 20, 2008 for the Japan for the first half of 2008. Japan does not have room to ease fiscal or monetary policy, the 30-nation group warned. For Japan, the OECD said the pace of underlying growth appears to be softening despite support from buoyant neighboring Asian economies. The organization expects first-quarter GDP to be up 0.3 percent and predicts a rise of 0.2 in the second quarter. [6]

On November 17, 2008, Japanese government officials announced that the economy was in a recession.[33] It was reported that Japan's economy contracted at an annual pace of 1.8% in the third quarter of 2008. It is forecasted to have shrunk 0.8% through the fiscal year that ends March 2009. In July 2009 unemployment reached a post-war high of 5.7 per cent, according to the Japan Times. Nonetheless, the economy has since recovered is expected to make a major comeback in 2010.

Other economic indicators

Industrial Production Growth Rate: 3.3% (2006 est.)

Investment (gross fixed): 100% of GDP (2006 est.)

Household income or consumption by percentage share:

- Lowest 10%: 4.8%

- Highest 10%: 21.7% (1993)

Agriculture - Products: rice, sugar beets, vegetables, fruit, pork, poultry, dairy products, eggs, fish

Exports - Commodities: machinery and equipment, motor vehicles, semiconductors, chemicals

Imports - Commodities: machinery and equipment, fuels, foodstuffs, chemicals, textiles, raw materials (2001)

Exchange rates:

Japanese Yen per US$1 - 100.320 (2008) 109.690016 (2005), 115.933 (2003), 125.388 (2002), 121.529 (2001), 105.16 (January 2000), 113.91 (1999), 130.91 (1998), 120.99 (1997), 108.78 (1996), 94.06 (1995)

Electricity:

- Electricity - consumption: 946.3 billion kWh (2005)

- Electricity - production: 996 billion kWh (2005)

- Electricity - exports: 0 kWh (2003)

- Electricity - imports: 0 kWh (2003)

Electricity - Production by source:

- Fossil Fuel: 56.68%

- Hydro: 8.99%

- Nuclear: 31.93%

- Other: 2.4% (1998)

Electricity - Standards:

Oil:

- production: 125,000 bbl/day (2006)

- consumption: 5.578 million bbl/day (2005)

- exports: 93,360 barrel/day (2001)

- imports: 5.449 million barrel/day (2001)

- net imports: 5.3 million barrel/day (2004 est.)

- proved reserves: 59 million bbl (1 January 2006)

See also

- Economic history of Japan

- Tokugawa coinage

- Japanese post-war economic miracle

- Japanese asset price bubble

- Quantitative easing

Notes

- ^ a b "World Economic Outlook Database; country comparisons". IMF. 2006-09-01. Retrieved 2007-03-14.

- ^ "NationMaster; Economy Statistics". NationMaster. Retrieved 2007-03-26.

- ^ Groningen Growth and Development Centre (GGDC)

- ^ Japan - Patterns Of Development

- ^ Fukao, Kyoji (2007). Real GDP in Pre-War East Asia: A 1934-36 Benchmark Purchasing Power Parity Comparison with the US (PDF).

- ^ "Japan: Patterns of Development". country-data.com. 1994. Retrieved 2006-12-28.

{{cite web}}: Unknown parameter|month=ignored (help) - ^ "Japan's Trap". MIT. 1999-05-19. Retrieved 2007-06-06.

- ^ Masake, Hisane. A farewell to zero. Asia Times Online (2006-03-02). Retrieved on 2006-12-28.

- ^ Template:Cite article

- ^ See, as one example, Paul Krugman's website, http://web.mit.edu/krugman/www/jpage.html

- ^ Template:Cite article

- ^ Chapter 7 Energy, Statistical Handbook of Japan 2007

- ^ Japan's Road to Deep Deficit Is Paved With Public Works, New York Times in 1997

- ^ Chapter 9 Transport, Statistical Handbook of Japan

- ^ Statistics Bureau Home Page

- ^ What Were Japanese GDP, CPI, Wage, or Population Then?

- ^ "http://www.bilaterals.org/article.php3?id_article=2378"

- ^ "http://www.skillclear.co.uk/japan/default.asp"

- ^ "https://www.cia.gov/library/publications/the-world-factbook/geos/ja.html#Econ"

- ^ "http://www.atimes.com/oceania/AH31Ah01.html"

- ^ "http://news.bbc.co.uk/1/hi/sci/tech/4118990.stm"

- ^ a b c OECD: Economic survey of Japan 2008

- ^ Activist shareholders swarm in Japan, The Economist

- ^ Imai, Masaaki (1986). Kaizen: The Key to Japan's Competitive Success. New York, NY, USA: Random House.

- ^ Europe Japan Centre, Kaizen Strategies for Improving Team Performance, Ed. Michael Colenso, London: Pearson Education Limited, 2000

- ^ "Japan's Economy: Free at last". The Economist. 2006-07-20. Retrieved 2007-03-29.

- ^ moneyweek.com/file/26181/why-germanys-economy-will-outshine-japan.html "Why Germany's economy will outshine Japan". MoneyWeek. 2007-02-28. Retrieved 2007-03-28.

{{cite web}}: Check|url=value (help) - ^ The Economist: Going hybrid

- ^ Lenders of first resort, The Economist, May 22, 2008

- ^ "Japan Again Plans Huge Corporations," New York Times. July 17, 1954.

- ^ "Japan, Refutation of Neoliberalism", Post-Autistic Economics Network, 5 January 2004. Retrieved 14 May 2006.

- ^ Issue no. 23 of the Post-Autistic Economics Review

- ^ Ogura, Junko (16 November 2008). "Japan - world's No. 2 economy - in recession". CNN. CNN Money. Retrieved 17 November 2008.

{{cite news}}: Unknown parameter|coauthors=ignored (|author=suggested) (help); Unknown parameter|curly=ignored (help) - ^ Current account balance, U.S. dollars, Billions from IMF World Economic Outlook Database, April 2008