European debt crisis

| Part of a series on the |

| Great Recession |

|---|

| Timeline |

The European sovereign debt crisis is an ongoing financial crisis that has made it difficult or impossible for some countries in the euro area to re-finance their government debt without the assistance of third parties.[3]

From late 2009, fears of a sovereign debt crisis developed among investors as a result of the rising private and government debt levels around the world together with a wave of downgrading of government debt in some European states. Causes of the crisis varied by country. In several countries, private debts arising from a property bubble were transferred to sovereign debt as a result of banking system bailouts and government responses to slowing economies post-bubble. In Greece, unsustainable public sector wage and pension commitments drove the debt increase. The structure of the Eurozone as a monetary union (i.e., one currency) without fiscal union (e.g., different tax and public pension rules) contributed to the crisis and impacted the ability of European leaders to respond.[4][5] European banks own a significant amount of sovereign debt, such that concerns regarding the solvency of banking systems or sovereigns are negatively reinforcing.[6]

Concerns intensified in early 2010 and thereafter,[7][8] leading Europe's finance ministers on 9 May 2010 to approve a rescue package worth €750 billion aimed at ensuring financial stability across Europe by creating the European Financial Stability Facility (EFSF).[9]

In October 2011 and February 2012, the eurozone leaders agreed on more measures designed to prevent the collapse of member economies. This included an agreement whereby banks would accept a 53.5% write-off of Greek debt owed to private creditors,[10] increasing the EFSF to about €1 trillion, and requiring European banks to achieve 9% capitalisation.[11] To restore confidence in Europe, EU leaders also agreed to create a European Fiscal Compact including the commitment of each participating country to introduce a balanced budget amendment.[12][13]

While sovereign debt has risen substantially in only a few eurozone countries, it has become a perceived problem for the area as a whole.[14] Prior to May, 2012, the European currency remained stable.[15] As of mid-November 2011, the euro was even trading slightly higher against the bloc's major trading partners than at the beginning of the crisis.[16][17] Three countries significantly affected, Greece, Ireland and Portugal, collectively accounted for 6% of the eurozone's gross domestic product (GDP).[18]

During June 2012, the Spanish debt crisis became a prime concern for the Euro-zone.[19] Interest rates on Spain’s debt rose significantly and its ability to access capital markets was affected, leading to a bailout of its banks and other measures.[20]

Causes

The European sovereign debt crisis resulted from a combination of complex factors, including the globalization of finance; easy credit conditions during the 2002–2008 period that encouraged high-risk lending and borrowing practices; the 2007–2012 global financial crisis; international trade imbalances; real-estate bubbles that have since burst; the 2008–2012 global recession; fiscal policy choices related to government revenues and expenses; and approaches used by nations to bail out troubled banking industries and private bondholders, assuming private debt burdens or socializing losses. [21][22]

One narrative describing the causes of the crisis begins with the significant increase in savings available for investment during the 2000–2007 period when the global pool of fixed-income securities increased from approximately $36 trillion in 2000 to $70 trillion by 2007. This "Giant Pool of Money" increased as savings from high-growth developing nations entered global capital markets. Investors searching for higher yields than those offered by U.S. Treasury bonds sought alternatives globally.[23]

The temptation offered by such readily available savings overwhelmed the policy and regulatory control mechanisms in country after country as global fixed-income investors searched for yield, generating bubble after bubble across the globe. While these bubbles have burst, causing asset prices (e.g., housing and commercial property) to decline, the liabilities owed to global investors remain at full price, generating questions regarding the solvency of governments and their banking systems.[22]

How each European country involved in this crisis borrowed and invested the money varies. For example, Ireland's banks lent the money to property developers, generating a massive property bubble. When the bubble burst, Ireland's government and taxpayers assumed private debts. In Greece, the government increased its commitments to public workers in the form of extremely generous wage and pension benefits, with the former doubling in real terms over 10 years.[4] Iceland's banking system grew enormously, creating debts to global investors ("external debts") several times GDP.[22]

The interconnection in the global financial system means that if one nation defaults on its sovereign debt or enters into recession putting some of the external private debt at risk, the banking systems of creditor nations face losses. For example, in October 2011, Italian borrowers owed French banks $366 billion (net). Should Italy be unable to finance itself, the French banking system and economy could come under significant pressure, which in turn would affect France's creditors and so on. This is referred to as financial contagion.[6][24] Another factor contributing to interconnection is the concept of debt protection. Institutions entered into contracts called credit default swaps (CDS) that result in payment should default occur on a particular debt instrument (including government issued bonds). But, since multiple CDSs can be purchased on the same security, it is unclear what exposure each country's banking system now has to CDS.[25]

Greece hid its growing debt and deceived EU officials with the help of derivatives designed by major banks.[26][27][28][29][30][31] Although some financial institutions clearly profited from the growing Greek government debt in the short run,[26] there was a long lead-up to the crisis.

Rising government debt levels

In 1992, members of the European Union signed the Maastricht Treaty, under which they pledged to limit their deficit spending and debt levels. However, a number of EU member states, including Greece and Italy, were able to circumvent these rules and mask their deficit and debt levels through the use of complex currency and credit derivatives structures.[32][33] The structures were designed by prominent U.S. investment banks, who received substantial fees in return for their services.[26]

The adoption of the Euro led to many Eurozone countries of different credit worthiness receiving similar and very low interest rates for their bonds during years preceding the crisis, which author Michael Lewis referred to as "a sort of implicit Germany guarantee."[4]

A number of economists have suggested that the debt crisis was caused by excessive government spending. According to their analysis, increased debt levels were also due to the large bailout packages provided to the financial sector during the late-2000s financial crisis, and the global economic slowdown thereafter. The average fiscal deficit in the euro area in 2007 was only 0.6% before it grew to 7% during the financial crisis. In the same period, the average government debt rose from 66% to 84% of GDP. The authors also stressed that fiscal deficits in the euro area were stable or even shrinking since the early 1990s.[34] US economist Paul Krugman named Greece as the only country where fiscal irresponsibility is at the heart of the crisis.[35]

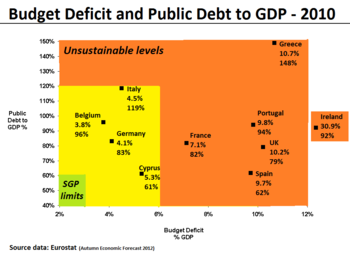

Either way, high debt levels alone may not explain the crisis. According to The Economist Intelligence Unit, the position of the euro area looked "no worse and in some respects, rather better than that of the US or the UK." The budget deficit for the euro area as a whole (see graph) is much lower and the euro area's government debt/GDP ratio of 86% in 2010 was about the same level as that of the US. Moreover, private-sector indebtedness across the euro area is markedly lower than in the highly leveraged Anglo-Saxon economies.[36]

Trade imbalances

Commentator and Financial Times journalist Martin Wolf has asserted that the root of the crisis was growing trade imbalances. He notes in the run-up to the crisis, from 1999 to 2007, Germany had a considerably better public debt and fiscal deficit relative to GDP than the most affected eurozone members. In the same period, these countries (Portugal, Ireland, Italy and Spain) had far worse balance of payments positions.[37][38] Whereas German trade surpluses increased as a percentage of GDP after 1999, the deficits of Italy, France and Spain all worsened.

Paul Krugman wrote in 2009 that a trade deficit by definition requires a corresponding inflow of capital to fund it, which can drive down interest rates and stimulate the creation of bubbles: "For a while, the inrush of capital created the illusion of wealth in these countries, just as it did for American homeowners: asset prices were rising, currencies were strong, and everything looked fine. But bubbles always burst sooner or later, and yesterday’s miracle economies have become today’s basket cases, nations whose assets have evaporated but whose debts remain all too real."[39]

A trade deficit can also be affected by changes in relative labor costs, which made southern nations less competitive and increased trade imbalances. Since 2001, Italy's unit labor costs rose 32% relative to Germany's.[40][41] Greek unit labor costs rose much faster than Germany's during the last decade.[42] However, most EU nations had increases in labor costs greater than Germany's.[43] Those nations that allowed "wages to grow faster than productivity" lost competitiveness.[38] Germany's restrained labor costs, while a debatable factor in trade imbalances,[43] are an important factor for its low unemployment rate.[44] More recently, Greece's trading position has improved;[45] in the period 2011 to 2012, imports dropped 20.9% while exports grew 16.9%, reducing the trade deficit by 42.8%.[45]

Simon Johnson explains the hope for convergence in the Euro-zone and what went wrong. The Euro locks countries into an exchange rate amounting to “very big bet that their economies would converge in productivity.” If not, workers would move to countries with greater productivity. Instead the opposite happened: the gap between German and Greek productivity increased resulting in a large current account surplus financed by capital flows. The capital flows could have been invested to increase productivity in the peripheral nations. Instead capital flows were squandered in consumption and consumptive investments.[46]

Further, Eurozone countries with sustained trade surpluses (i.e., Germany) do not see their currency appreciate relative to the other Eurozone nations due to a common currency, keeping their exports artificially cheap. Germany's trade surplus within the Eurozone declined in 2011 as its trading partners were less able to find financing necessary to fund their trade deficits, but Germany's trade surplus outside the Eurozone has soared as the Euro declined in value relative to the dollar and other currencies.[47]

Structural problem of Eurozone system

There is a structural contradiction within the euro system, namely that there is a monetary union (common currency) without a fiscal union (e.g., common taxation, pension, and treasury functions).[48] In the Eurozone system, the countries are offered to follow a similar fiscal path, but they do not have common treasury to enforce it. That is, countries with same monetary system have freedom in fiscal policies in taxation and expenditure. So, even though there are some agreements on monetary policy and through European Central Bank, countries may not be able to or would simply choose not to follow it. This feature brought fiscal free riding of peripheral economies, especially represented by Greece, as it is hard to control and regulate national financial institutions. Furthermore, there is also a problem that the euro zone system has a difficult structure for quick response. Eurozone, having 17 nations as its members, require unanimous agreement for a decision making process. This would lead to failure in complete prevention of contagion of other areas, as it would be hard for the Euro zone to respond quickly to the problem.[49]

In addition, as of June 2012 there was no "banking union" meaning that there was no Europe-wide approach to bank deposit insurance, bank oversight, or a joint means of recapitalization or resolution (wind-down) of failing banks.[50] Bank deposit insurance helps avoid bank runs. Recapitalization refers to injecting money into banks so that they can meet their immediate obligations and resume lending, as was done in 2008 in the U.S. via the TARP program.[51]

Columnist Thomas L. Friedman wrote in June 2012: "In Europe, hyperconnectedness both exposed just how uncompetitive some of their economies were, but also how interdependent they had become. It was a deadly combination. When countries with such different cultures become this interconnected and interdependent — when they share the same currency but not the same work ethics, retirement ages or budget discipline — you end up with German savers seething at Greek workers, and vice versa."[52]

Monetary policy inflexibility

Since membership of the Eurozone establishes a single monetary policy, individual member states can no longer act independently, preventing them from printing money in order to pay creditors and ease their risk of default. By "printing money", a country's currency is devalued relative to its (eurozone) trading partners, making its exports cheaper, in principle leading to an improved balance of trade, increased GDP and higher tax revenues in nominal terms.[53]

In the reverse direction moreover, assets held in a currency which has devalued suffer losses on the part of those holding them. For example, by the end of 2011, following a 25 percent fall in the rate of exchange and 5 percent rise in inflation, eurozone investors in Pound Sterling, locked in to euro exchange rates, had suffered an approximate 30 percent cut in the repayment value of this debt.[54]

Loss of confidence

Prior to development of the crisis it was assumed by both regulators and banks that sovereign debt from the eurozone was safe. Banks had substantial holdings of bonds from weaker economies such as Greece which offered a small premium and seemingly were equally sound. As the crisis developed it became obvious that Greek, and possibly other countries', bonds offered substantially more risk. Contributing to lack of information about the risk of European sovereign debt was conflict of interest by banks that were earning substantial sums underwriting the bonds.[55] The loss of confidence is marked by rising sovereign CDS prices, indicating market expectations about countries' creditworthiness (see graph).

Furthermore, investors have doubts about the possibilities of policy makers to quickly contain the crisis. Since countries that use the euro as their currency have fewer monetary policy choices (e.g., they cannot print money in their own currencies to pay debt holders), certain solutions require multi-national cooperation. Further, the European Central Bank has an inflation control mandate but not an employment mandate, as opposed to the U.S. Federal Reserve, which has a dual mandate.

According to The Economist, the crisis "is as much political as economic" and the result of the fact that the euro area is not supported by the institutional paraphernalia (and mutual bonds of solidarity) of a state.[36] Heavy bank withdrawals have occurred in weaker Eurozone states such as Greece and Spain.[56] Bank deposits in the Eurozone are insured, but by agencies of each member government. If banks fail, it is unlikely the government will be able to fully and promptly honor their commitment, at least not in euros, and there is the possibility that they might abandon the euro and revert to a national currency; thus, euro deposits are safer in Dutch, German, or Austrian banks than they are in Greece or Spain.[57]

As of June, 2012, many European banking systems were under significant stress, particularly Spain. A series of "capital calls" or notices that banks required capital contributed to a freeze in funding markets and interbank lending, as investors worried that banks might be hiding losses or were losing trust in one-another.[58][59]

In June, 2012, as the Euro hit new lows with no bottom in sight, there were reports that the wealthy were moving assets out of the Eurozone.[60] Mario Draghi, president of the European Central Bank, has called for an integrated European system of deposit insurance which would require European political institutions craft effective solutions for problems beyond the limits of the power of the European Central Bank.[61] As of June 6, 2012, closer integration of European banking appeared to be under consideration by political leaders.[62]

- Interest on long term sovereign debt

In June, 2012, following negotiation of the Spanish bailout line of credit interest on long-term Spanish and Italian debt continued to rise rapidly, casting doubt on the efficacy of bailout packages as anything more than a stopgap measure. The Spanish rate, over 6% before the line of credit was approved, approached 7%, a rough rule of thumb indicator of serious trouble.[63]

- Rating agency views

On 5 December 2011, S&P placed its long-term sovereign ratings on 15 members of the eurozone on "CreditWatch" with negative implications; S&P wrote this was due to "systemic stresses from five interrelated factors: 1) Tightening credit conditions across the eurozone; 2) Markedly higher risk premiums on a growing number of eurozone sovereigns including some that are currently rated 'AAA'; 3) Continuing disagreements among European policy makers on how to tackle the immediate market confidence crisis and, longer term, how to ensure greater economic, financial, and fiscal convergence among eurozone members; 4) High levels of government and household indebtedness across a large area of the eurozone; and 5) The rising risk of economic recession in the eurozone as a whole in 2012. Currently, we expect output to decline next year in countries such as Spain, Portugal and Greece, but we now assign a 40% probability of a fall in output for the eurozone as a whole."[64]

Evolution of the crisis

In the first few weeks of 2010, there was renewed anxiety about excessive national debt, with lenders demanding ever higher interest rates from several countries with higher debt levels, deficits and current account deficits. This in turn made it difficult for some governments to finance further budget deficits and service existing debt, particularly when economic growth rates were low, and when a high percentage of debt was in the hands of foreign creditors, as in the case of Greece and Portugal.[65]

Some governments have focused on austerity measures (e.g., higher taxes and lower expenses) which has contributing to social unrest and significant debate among economists, many of whom advocate greater deficits when economies are struggling. Especially in countries where budget deficits and sovereign debts have increased sharply, a crisis of confidence has emerged with the widening of bond yield spreads and risk insurance on CDS between these countries and other EU member states, most importantly Germany.[66] By the end of 2011, Germany was estimated to have made more than €9 billion out of the crisis as investors flocked to safer but near zero interest rate German federal government bonds (bunds).[67]

While Switzerland equally benefited from lower interest rates, the crisis also harmed its export sector due to a substantial influx of foreign capital and the resulting rise of the Swiss franc. In September 2011 the Swiss National Bank surprised currency traders by pledging that "it will no longer tolerate a euro-franc exchange rate below the minimum rate of 1.20 francs", effectively weakening the Swiss franc. This is the biggest Swiss intervention since 1978.[68]

Greece

In the early mid-2000s, Greece's economy was one of the fastest growing in the eurozone and was associated with a large structural deficit.[69] As the world economy was hit by the global financial crisis in the late 2000s, Greece was hit especially hard because its main industries — shipping and tourism — were especially sensitive to changes in the business cycle. The government spent heavily to keep the economy functioning and the country's debt increased accordingly.

On 23 April 2010, the Greek government requested an initial loan of €45 billion from the EU and International Monetary Fund (IMF), to cover its financial needs for the remaining part of 2010.[70][71] A few days later Standard & Poor's slashed Greece's sovereign debt rating to BB+ or "junk" status amid fears of default,[72] in which case investors were liable to lose 30–50% of their money.[72] Stock markets worldwide and the Euro currency declined in response to the downgrade.[73]

On 1 May 2010, the Greek government announced a series of austerity measures[74] to secure a three year €110 billion loan.[75] This was met with great anger by the Greek public, leading to massive protests, riots and social unrest throughout Greece.[76] The Troika (EU, ECB and IMF), offered Greece a second bailout loan worth €130 billion in October 2011, but with the activation being conditional on implementation of further austerity measures and a debt restructure agreement. A bit surprisingly, the Greek prime minister George Papandreou first answered that call, by announcing a December 2011 referendum on the new bailout plan,[77][78] but had to back down amidst strong pressure from EU partners, who threatened to withhold an overdue €6 billion loan payment that Greece needed by mid-December.[77][79] On 10 November 2011 Papandreou instead opted to resign, following an agreement with the New Democracy party and the Popular Orthodox Rally, to appoint non-MP technocrat Lucas Papademos as new prime minister of an interim national union government, with responsibility for implementing the needed austerity measures to pave the way for the second bailout loan.[80][81]

All the implemented austerity measures, have so far helped Greece bring down its primary deficit before interest payments, from €24.7bn (10.6% of GDP) in 2009 to just €5.2bn (2.4% of GDP) in 2011,[82][83] but as a side-effect they also contributed to a worsening of the Greek recession, which began in October 2008 and only became worse in 2010 and 2011.[84] The austerity relies primarily on tax increases which harms the private sector and economy.[85] Overall the Greek GDP had its worst decline in 2011 with −6.9%,[86] a year where the seasonal adjusted industrial output ended 28.4% lower than in 2005,[87][88] and with 111,000 Greek companies going bankrupt (27% higher than in 2010).[89][90] As a result, the seasonal adjusted unemployment rate also grew from 7.5% in September 2008 to a record high of 19.9% in November 2011, while the Youth unemployment rate during the same time rose from 22.0% to as high as 48.1%.[91][92]

Overall the share of the population living at "risk of poverty or social exclusion" did not increase noteworthy during the first 2 years of the crisis. The figure was measured to 27.6% in 2009 and 27.7% in 2010 (only being slightly worse than the EU27-average at 23.4%),[93] but for 2011 the figure was now estimated to have risen sharply above 33%.[94] In February 2012, an IMF official negotiating Greek austerity measures admitted that excessive spending cuts were harming Greece.[82]

Some economic experts argue that the best option for Greece and the rest of the EU, would be to engineer an “orderly default”, allowing Athens to withdraw simultaneously from the eurozone and reintroduce its national currency the drachma at a debased rate.[95][96] However, if Greece were to leave the euro, the economic and political impact would be devastating. According to Japanese financial company Nomura an exit would lead to a 60% devaluation of the new drachma. Analysts at French bank BNP Paribas added that the fallout from a Greek exit would wipe 20% off Greece's GDP, increase Greece's debt-to-GDP ratio to over 200%, and send inflation soaring to 40%-50%.[97] Also UBS warned of hyperinflation, a bank run and even "military coups and possible civil war that could afflict a departing country".[98][99]

To prevent this from happening, the troika (EU, IMF and ECB) eventually agreed in February 2012 to provide a second bailout package worth €130 billion,[100] conditional on the implementation of another harsh austerity package, reducing the Greek spendings with €3.3bn in 2012 and another €10bn in 2013 and 2014.[83] For the first time, the bailout deal also included a debt restructure agreement with the private holders of Greek government bonds (banks, insurers and investment funds), to "voluntarily" accept a bond swap with a 53.5% nominal write-off, partly in short-term EFSF notes, partly in new Greek bonds with lower interest rates and the maturity prolonged to 11–30 years (independently of the previous maturity).[10]

It is the world's biggest debt restructuring deal ever done, affecting some €206 billion of Greek government bonds.[101] The debt write-off had a size of €107 billion, and caused the Greek debt level to fall from roughly €350bn to €240bn in March 2012, with the predicted debt burden now showing a more sustainable size equal to 117% of GDP,[102] somewhat lower than the originally expected 120.5%.[83][103][104]

On 9 March 2012 the International Swaps and Derivatives Association (ISDA) issued a communique calling the debt restructuring deal with its private sector involvement (PSI) a "Restructuring Credit Event" which will trigger payment of credit default swaps. According to Forbes magazine Greece’s restructuring represents a default.[105][106]

This credit event implies that previous Greek bond holders are being given, for 1000€ of previous notional, 150€ in “PSI payment notes” issued by the EFSF and 315€ in “New Greek Bonds” issued by the Hellenic Republic, including a “GDP-linked security”. The latter represents a marginal coupon enhancement in case the Greek growth meets certain conditions. While the market price of the portfolio proposed in the exchange is of the order of 21% of the original face value (15% for the two EFSF PSI notes – 1 and 2 years – and 6% for the New Greek Bonds – 11 to 30 years), the duration of the set of New Greek Bonds is slightly below 10 years.[107]

Mid May 2012 the crisis and impossibility to form a new government after elections led to strong speculations Greece would have to leave the Eurozone shortly due. This phenomenon became known as "Grexit" and started to govern international market behaviour.[108][109] The center-right's narrow victory in the June 17th election gives hope that a coalition will enable Greece to stay in the Euro-zone.[110] A victory by the anti-austerity axis could have been "an excuse to cut Greece out of the euro zone" according to the Wall Street Journal.[111]

Ireland

The Irish sovereign debt crisis was not based on government over-spending, but from the state guaranteeing the six main Irish-based banks who had financed a property bubble. On 29 September 2008, Finance Minister Brian Lenihan, Jnr issued a one-year guarantee to the banks' depositors and bond-holders.[112] He renewed it for another year in September 2009 soon after the launch of the National Asset Management Agency (NAMA), a body designed to remove bad loans from the six banks.

Irish banks had lost an estimated 100 billion euros, much of it related to defaulted loans to property developers and homeowners made in the midst of the property bubble, which burst around 2007. The economy collapsed during 2008. Unemployment rose from 4% in 2006 to 14% by 2010, while the federal budget went from a surplus in 2007 to a deficit of 32% GDP in 2010, the highest in the history of the eurozone, despite austerity measures.[22][113]

Ireland could have guaranteed bank deposits and let private bondholders who had invested in the banks face losses, but instead borrowed money from the ECB to pay these bondholders, shifting the losses and debt to its taxpayers, with severe negative impact on Ireland's creditworthiness. As a result, the government started negotiations with the EU, the IMF and three nations: the United Kingdom, Denmark and Sweden, resulting in a €67.5 billion "bailout" agreement of 29 November 2010[114][115] Together with additional €17.5 billion coming from Ireland's own reserves and pensions, the government received €85 billion,[116] of which €34 billion were used to support the country's ailing financial sector.[117] In return the government agreed to reduce its budget deficit to below three percent by 2015.[117] In April 2011, despite all the measures taken, Moody's downgraded the banks' debt to junk status.[118]

In July 2011 European leaders agreed to cut the interest rate that Ireland was paying on its EU/IMF bailout loan from around 6% to between 3.5% and 4% and to double the loan time to 15 years. The move was expected to save the country between 600–700 million euros per year.[119] On 14 September 2011, in a move to further ease Ireland's difficult financial situation, the European Commission announced it would cut the interest rate on its €22.5 billion loan coming from the European Financial Stability Mechanism, down to 2.59 per cent – which is the interest rate the EU itself pays to borrow from financial markets.[120]

The Euro Plus Monitor report from November 2011 attests to Ireland's vast progress in dealing with its financial crisis, expecting the country to stand on its own feet again and finance itself without any external support from the second half of 2012 onwards.[121] According to the Centre for Economics and Business Research Ireland's export-led recovery "will gradually pull its economy out of its trough". As a result of the improved economic outlook, the cost of 10-year government bonds, which has already fallen substantially since mid July 2011 (see the graph "Long-term Interest Rates"), is expected to fall further to 4 per cent by 2015.[122]

Portugal

In the first half of 2011, Portugal requested a €78 billion IMF-EU bailout package in a bid to stabilise its public finances. These measures were put in place as a direct result of decades-long governmental overspending and an over bureaucratised civil service. After the bailout was announced, the Portuguese government headed by Pedro Passos Coelho managed to implement measures to improve the State's financial situation and the country started to be seen as moving on the right track. However, the unemployment level rose to over 14.8 percent, taxes were increased, and civil service-related lower-wages were frozen and higher-wages were cut by 14.3%, on top of the government's spending cuts.

A report released in January 2011 by the Diário de Notícias[123] and published in Portugal by Gradiva, had demonstrated that in the period between the Carnation Revolution in 1974 and 2010, the democratic Portuguese Republic governments encouraged over-expenditure and investment bubbles through unclear Public–private partnerships and funding of numerous ineffective and unnecessary external consultancy and advisory of committees and firms. This allowed considerable slippage in state-managed public works and inflated top management and head officer bonuses and wages. Persistent and lasting recruitment policies boosted the number of redundant public servants. Risky credit, public debt creation, and European structural and cohesion funds were mismanaged across almost four decades. Prime Minister Sócrates's cabinet was not able to forecast or prevent this in 2005, and later it was incapable of doing anything to improve the situation when the country was on the verge of bankruptcy by 2011.[124]

Robert Fishman, in the New York Times article "Portugal's Unnecessary Bailout", points out that Portugal fell victim to successive waves of speculation by pressure from bond traders, rating agencies and speculators.[125] In the first quarter of 2010, before pressure from the markets, Portugal had one of the best rates of economic recovery in the EU. From the perspective of Portugal's industrial orders, exports, entrepreneurial innovation and high-school achievement, the country matched or even surpassed its neighbors in Western Europe.[125]

On 16 May 2011, the eurozone leaders officially approved a €78 billion bailout package for Portugal, which became the third eurozone country, after Ireland and Greece, to receive emergency funds. The bailout loan was equally split between the European Financial Stabilisation Mechanism, the European Financial Stability Facility, and the International Monetary Fund.[126] According to the Portuguese finance minister, the average interest rate on the bailout loan is expected to be 5.1 percent.[127] As part of the deal, the country agreed to cut its budget deficit from 9.8 percent of GDP in 2010 to 5.9 percent in 2011, 4.5 percent in 2012 and 3 percent in 2013.[128]

The Portuguese government also agreed to eliminate its golden share in Portugal Telecom to pave the way for privatization.[129][130] In 2012, all public servants had already seen an average wage cut of 20% relative to their 2010 baseline, with cuts reaching 25% for those earning more than 1,500 euro per month. This led to a flood of specialized technicians and top officials leaving the public service, many looking for better positions in the private sector or in other European countries.[131]

On 6 July 2011, the ratings agency Moody's had cut Portugal's credit rating to junk status, Moody's also launched speculation that Portugal could follow Greece in requesting a second bailout.[132]

In December 2011, it was reported that Portugal's estimated budget deficit of 4.5 percent in 2011 would be substantially lower than expected, due to a one-off transfer of pension funds. The country would therefore meet its 2012 target a year earlier than expected.[128] Despite the fact that the economy is expected to contract by 3 percent in 2011 the IMF expects the country to be able to return to medium and long-term debt sovereign markets by late 2013.[133] Any deficit means increasing the nation's debt. To bring down the debt to sustainable levels will require a 10% budget surplus for several years according to some estimates.[134]

Spain

Spain has a comparatively low debt among advanced economies.[135] The country's public debt relative to GDP in 2010 was only 60%, more than 20 points less than Germany, France or the US, and more than 60 points less than Italy, Ireland or Greece.[136][137] Debt was largely avoided by the ballooning tax revenue from the housing bubble, which helped accommodate a decade of increase government spending without debt accumulation.[138] Like Italy, Spain has most of its debt controlled internally, and both countries were in a better fiscal situation than Greece and Portugal at the outset of the financial crisis.[139]

As one of the largest eurozone economies, the condition of Spain's economy is of particular concern to international observers, and has faced pressure from the United States, the IMF, other European countries and the European Commission to cut its deficit more aggressively.[140][141] Spain's public debt was approximately U.S. $820 billion in 2010, roughly the level of Greece, Portugal, and Ireland combined.[142]

Rumors raised by speculators about a Spanish bail-out were dismissed by then Spanish Prime Minister José Luis Rodríguez Zapatero as "complete insanity" and "intolerable".[143] Nevertheless, shortly after the announcement of the EU's new "emergency fund" for eurozone countries in early May 2010, Spain had to announce new austerity measures designed to further reduce the country's budget deficit, in order to signal financial markets that it was safe to invest in the country.[144] The Spanish government had hoped to avoid such deep cuts, but weak economic growth as well as domestic and international pressure forced the government to expand on cuts already announced in January.

Spain succeeded in trimming its deficit from 11.2% of GDP in 2009 to 9.2% in 2010[145] and 8.5% in 2011.[146] Due to the European crisis and over spending by regional governments the latest figure is higher than the original target of 6%.[147][148] To build up additional trust in the financial markets, the government amended the Spanish Constitution in 2011 to require a balanced budget at both the national and regional level by 2020. The amendment states that public debt can not exceed 60% of GDP, though exceptions would be made in case of a natural catastrophe, economic recession or other emergencies.[149][150] Under pressure from the EU the new conservative Spanish government led by Mariano Rajoy aims to cut the deficit further to 5.3 percent in 2012 and 3 percent in 2013.[151]

While public debt was restrained prior to the crisis, private mortgage debt fueled a housing bubble.[38][152] The subsequent burst weakened private banks leading to government bailouts. In May 2012, Bankia received a 19 billion euro bailout,[153] on top of the previous 4.5 billion euros to prop up Bankia.[154] Questionable accounting methods disguised bank losses.[155]

As of June 6, 2012 a bailout package for Spain of between €40 and 100 billion was reported to be under consideration. The package was described as available if requested which it was on June 9, 2012 and granted for an amount up to €100 billion. The exact amount will depend on audits of the condition of Spanish banks which are in progress. The loan will be to the Spanish government but earmarked for relief of troubled banks.[156][152] A larger economy than other countries which have received bailout packages, Spain had considerable bargaining power regarding the terms of a bailout.[157] Due to reforms already instituted by Spain's conservative government less stringent austerity requirements are included then was the case with earlier bailout packages for Ireland, Portugal, and Greece.[158][159]

During June 2012, the Spanish debt crisis became a prime concern for the Euro-zone.[160] Interest on Spain’s 10-year bonds reached the 7% level and it faced difficulty in accessing bond markets. Spain accepted a €100 aid package for its banks. “Spanish banks have propped up the government, which is now forced to turn to Europe for help propping up the weaker banks. Stronger banks are shying away from buying government bonds.” The aid package (counted towards Spain’s gross debt but it is not considered a sovereign debt bailout) brings Spain’s debt close to the 90% level, the Euro-zone average. It is expected to increase given a negative growth rate of 1.7%, 25% unemployment, falling housing prices, and a deficit of 5.4%. Spain is the EU’s fourth-largest economy, larger than Greece, Portugal and Ireland combined.[20]

Cyprus

In September 2011, yields on Cyprus long-term bonds have risen above 12%, since the small island of 840,000 people was downgraded by all major credit ratings agencies following a devastating explosion at a power plant in July and slow progress with fiscal and structural reforms. Since January 2012, Cyprus is relying on a € 2.5bn emergency loan from Russia to cover its budget deficit and re-finance maturing debt. The loan has an interest rate of 4.5% and it is valid for 4.5 years[161] though it is expected that Cyprus will be able to fund itself again by the first quarter of 2013.[162] On June 12, 2012 financial media reported that a bailout request by Cyprus was imminent. Despite its low population and small economy Cyprus has an off-shore banking industry which is disproportional to its economy.[63] A request was made to the European Financial Stability Facility or the European Stability Mechanism on June 25, 2012. It is anticipated that a bailout package would include requirements for fiscal reforms. The request follows a downgrade of Cyprus bonds to BB+ by Fitch, also on June 25, 2012, which disqualified bonds issued by Cyprus from being accepted as collateral by the European Central Bank.[163]

On 13 March 2012 Moody's has slashed Cyprus's credit rating into Junk status, warning that the Cyprus government will have to inject fresh capital into its banks to cover losses incurred through Greece's debt swap. Cyprus's banks were highly exposed to Greek debt and so are disproportionately hit by the haircut taken by creditors.[151] It was reported on June 25, 2012 by The Financial Times that banks in Cyprus held €22 billion of Greek private sector debt.[163]

Possible spread to other countries

One of the central concerns prior to the bailout was that the crisis could spread to several other countries after reducing confidence in other European economies. According to the UK Financial Policy Committee "Market concerns remain over fiscal positions in a number of euro area countries and the potential for contagion to banking systems."[164] Besides Ireland, with a government deficit in 2010 of 32.4% of GDP, and Portugal at 9.1%, other countries such as Spain with 9.2% are also at risk.[165]

For 2010, the OECD forecast $16 trillion would be raised in government bonds among its 30 member countries. Financing needs for the eurozone come to a total of €1.6 trillion, while the U.S. is expected to issue US$1.7 trillion more Treasury securities in this period,[166] and Japan has ¥213 trillion of government bonds to roll over.[167] Greece has been the notable example of an industrialised country that has faced difficulties in the markets because of rising debt levels but even countries such as the U.S., Germany and the UK, have had fraught moments as investors shunned bond auctions due to concerns about public finances and the economy.[168]

Italy

Italy's deficit of 4.6 percent of GDP in 2010 was similar to Germany’s at 4.3 percent and less than that of the U.K. and France. Italy even has a surplus in its primary budget, which excludes debt interest payments. However, its debt has increased to almost 120 percent of GDP (U.S. $2.4 trillion in 2010) and economic growth was lower than the EU average for over a decade.[169] This has led investors to view Italian bonds more and more as a risky asset.[170]

On the other hand, the public debt of Italy has a longer maturity and a substantial share of it is held domestically. Overall this makes the country more resilient to financial shocks, ranking better than France and Belgium.[171] About 300 billion euros of Italy's 1.9 trillion euro debt matures in 2012. It will therefore have to go to the capital markets for significant refinancing in the near-term.[172]

On 15 July and 14 September 2011, Italy's government passed austerity measures meant to save €124 billion.[173][174] Nonetheless, by 8 November 2011 the Italian bond yield was 6.74 percent for 10-year bonds, climbing above the 7 percent level where the country is thought to lose access to financial markets.[175] On 11 November 2011, Italian 10-year borrowing costs fell sharply from 7.5 to 6.7 percent after Italian legislature approved further austerity measures and the formation of an emergency government to replace that of Prime Minister Silvio Berlusconi.[176]

The measures include a pledge to raise €15 billion from real-estate sales over the next three years, a two-year increase in the retirement age to 67 by 2026, opening up closed professions within 12 months and a gradual reduction in government ownership of local services.[170] The interim government expected to put the new laws into practice is led by former European Union Competition Commissioner Mario Monti.[170]

As in other countries, the social effects have been severe, with child labour even re-emerging in poorer areas.[177]

Belgium

In 2010, Belgium's public debt was 100% of its GDP—the third highest in the eurozone after Greece and Italy[178] and there were doubts about the financial stability of the banks,[179] following the country's major financial crisis in 2008–2009. After inconclusive elections in June 2010, by November 2011[180] the country still had only a caretaker government as parties from the two main language groups in the country (Flemish and Walloon) were unable to reach agreement on how to form a majority government.[178] In November 2010 financial analysts forecast that Belgium would be the next country to be hit by the financial crisis as Belgium's borrowing costs rose.[179]

However the government deficit of 5% was relatively modest and Belgian government 10-year bond yields in November 2010 of 3.7% were still below those of Ireland (9.2%), Portugal (7%) and Spain (5.2%).[179] Furthermore, thanks to Belgium's high personal savings rate, the Belgian Government financed the deficit from mainly domestic savings, making it less prone to fluctuations of international credit markets.[181] Nevertheless on 25 November 2011, Belgium's long-term sovereign credit rating was downgraded from AA+ to AA by Standard and Poor[182] and 10-year bond yields reached 5.66%.[180]

Shortly after, Belgian negotiating parties reached an agreement to form a new government. The deal includes spending cuts and tax rises worth about €11 billion, which should bring the budget deficit down to 2.8% of GDP by 2012, and to balance the books in 2015.[183] Following the announcement Belgium 10-year bond yields fell sharply to 4.6%.[184]

France

France's public debt in 2010 was approximately U.S. $2.1 trillion and 83% GDP, with a 2010 budget deficit of 7% GDP.[185] By 16 November 2011, France's bond yield spreads vs. Germany had widened 450% since July, 2011.[186] France's C.D.S. contract value rose 300% in the same period.[187]

On 1 December 2011, France's bond yield had retreated and the country auctioned €4.3 billion worth of 10 year bonds at an average yield of 3.18%, well below the perceived critical level of 7%.[188] By early February 2012, yields on French 10 year bonds had fallen to 2.84%.[189]

United Kingdom

According to the Financial Policy Committee "Any associated disruption to bank funding markets could spill over to UK banks."[164] The UK has the highest gross foreign debt of any European country (€7.3 trillion; €117,580 per person) due in large part to its highly leveraged financial industry, which is closely connected with both the United States and the eurozone.[190]

In 2012 the U.K. economy was in recession, being negatively impacted by reduced economic activity in Europe, and apprehensive regarding possible future impacts of the Eurozone crisis. The Bank of England made substantial funds available at reduced interest to U.K. banks for loans to domestic enterprises. The bank is also providing liquidity by purchase of large quantities of government bonds, a program which may be expanded.[191] Bank of England support of British banks with respect to the Eurozone crisis was backed by the British Treasury.[192]

Bank of England governor Mervyn King stated in May 2012 that the Euro zone is "tearing itself apart" and advised British banks to pay bonuses and dividends in stock to hoard cash. He acknowledged that the Bank of England, the Financial Services Authority, and the British government were preparing contingency plans for a Greek exit from the Euro or a collapse of the currency, but refused to discuss them to avoid adding to the panic.[193] Known contingency plans include emergency immigration controls to prevent millions of Greek and other EU residents from entering the country to seek work, and the evacuation of Britons from Greece during civil unrest.[194]

A Euro collapse would damage London's role as a major financial centre because of the increased risk to UK banks. The pound and gilts would likely benefit, however, as investors seek safer investments.[195] The London real estate market has similarly benefited from the crisis, with French, Greeks, and other Europeans buying property with capital moved out of their home countries,[196] and a Greek exit from the Euro would likely increase such transfer of capital.[195]

Switzerland

Switzerland was impacted by the Eurozone crisis as money was moved into Swiss assets seeking safety from the Eurozone crisis as well as by apprehension of further worsening of the crisis. This resulted in appreciation of the Swiss Franc with respect to the Euro and other currencies which drove down internal prices and raised the price of exports. Credit Suisse was required to increase its capitalization by the Swiss National Bank which also declared its intention to continue to retard rise of Swiss franc by substantial purchases of other currencies; purchases of the Euro had the effect of maintaining the value of the Euro which before Swiss intervention had fallen below the Swiss comfort level. Real estate values in Switzerland are extremely high, thus posing a possible risk.[191][197]

Germany

In relationship to the total amounts involved in the Eurozone crisis, the economy of Germany is relatively small and would be unable, even if it were willing, to guarantee payment of the sovereign debts of the rest of the Eurozone as Spain and even Italy and France are added to potentially defaulting nations. Thus, according to Chancellor Angela Merkel, German participation in rescue efforts are conditioned on negotiation of Eurozone reforms which have the potential to resolve the underlying imbalances which are driving the crisis.[198][199]

Policy reactions

EU emergency measures

European Financial Stability Facility (EFSF)

On 9 May 2010, the 27 EU member states agreed to create the European Financial Stability Facility, a legal instrument[200] aiming at preserving financial stability in Europe by providing financial assistance to eurozone states in difficulty. The EFSF can issue bonds or other debt instruments on the market with the support of the German Debt Management Office to raise the funds needed to provide loans to eurozone countries in financial troubles, recapitalize banks or buy sovereign debt.[201]

Emissions of bonds are backed by guarantees given by the euro area member states in proportion to their share in the paid-up capital of the European Central Bank. The €440 billion lending capacity of the facility is jointly and severally guaranteed by the eurozone countries' governments and may be combined with loans up to €60 billion from the European Financial Stabilisation Mechanism (reliant on funds raised by the European Commission using the EU budget as collateral) and up to €250 billion from the International Monetary Fund (IMF) to obtain a financial safety net up to €750 billion.[202]

The EFSF issued €5 billion of five-year bonds in its inaugural benchmark issue 25 January 2011, attracting an order book of €44.5 billion. This amount is a record for any sovereign bond in Europe, and €24.5 billion more than the European Financial Stabilisation Mechanism(EFSM), a separate European Union funding vehicle, with a €5 billion issue in the first week of January 2011.[203]

On 29 November 2011, the member state finance ministers agreed to expand the EFSF by creating certificates that could guarantee up to 30% of new issues from troubled euro-area governments, and to create investment vehicles that would boost the EFSF’s firepower to intervene in primary and secondary bond markets.[204]

- Reception by financial markets

Stocks surged worldwide after the EU announced the EFSF's creation. The facility eased fears that the Greek debt crisis would spread,[205] and this led to some stocks rising to the highest level in a year or more.[206] The euro made its biggest gain in 18 months,[207] before falling to a new four-year low a week later.[208] Shortly after the euro rose again as hedge funds and other short-term traders unwound short positions and carry trades in the currency.[209] Commodity prices also rose following the announcement.[210]

The dollar Libor held at a nine-month high.[211] Default swaps also fell.[212] The VIX closed down a record almost 30%, after a record weekly rise the preceding week that prompted the bailout.[213] The agreement is interpreted as allowing the ECB to start buying government debt from the secondary market which is expected to reduce bond yields.[214] As a result Greek bond yields fell sharply from over 10% to just over 5%.[215] Asian bonds yields also fell with the EU bailout.[216])

- Usage of EFSF funds

The EFSF only raises funds after an aid request is made by a country.[217] As of the end of December 2011, it has been activated two times. In November 2010, it financed €17.7 billion of the total €67.5 billion rescue package for Ireland (the rest was loaned from individual European countries, the European Commission and the IMF). In May 2011 it contributed one third of the €78 billion package for Portugal. As part of the second bailout for Greece, the loan was shifted to the EFSF, amounting to €164 billion (130bn new package plus 34.4bn remaining from Greek Loan Facility) throughout 2014.[218] This leaves the EFSF with €250 billion or an equivalent of €750 billion in leveraged firepower.[219] According to German newspaper Sueddeutsche, this is more than enough to finance the debt rollovers of all flagging European countries until end of 2012, in case necessary.[219]

The EFSF is set to expire in 2013, running one year parallel to the permanent €500 billion rescue funding program called the European Stability Mechanism (ESM), which will start operating as soon as member states representing 90% of the capital commitments have ratified it. This is expected to be in July 2012.[220][221]

On 13 January 2012, Standard & Poor’s downgraded France and Austria from AAA rating, lowered Spain, Italy (and five other[222]) euro members further, and maintained the top credit rating for Finland, Germany, Luxembourg, and the Netherlands; shortly after, S&P also downgraded the EFSF from AAA to AA+.[222][223]

European Financial Stabilisation Mechanism (EFSM)

On 5 January 2011, the European Union created the European Financial Stabilisation Mechanism (EFSM), an emergency funding programme reliant upon funds raised on the financial markets and guaranteed by the European Commission using the budget of the European Union as collateral.[224] It runs under the supervision of the Commission[225] and aims at preserving financial stability in Europe by providing financial assistance to EU member states in economic difficulty.[226] The Commission fund, backed by all 27 European Union members, has the authority to raise up to €60 billion[227] and is rated AAA by Fitch, Moody's and Standard & Poor's.[228][229]

Under the EFSM, the EU successfully placed in the capital markets a €5 billion issue of bonds as part of the financial support package agreed for Ireland, at a borrowing cost for the EFSM of 2.59%.[230]

Like the EFSF, the EFSM will also be replaced by the permanent rescue funding programme ESM, which is due to be launched in July 2012.[220]

Brussels agreement and aftermath

On 26 October 2011, leaders of the 17 eurozone countries met in Brussels and agreed on a 50% write-off of Greek sovereign debt held by banks, a fourfold increase (to about €1 trillion) in bail-out funds held under the European Financial Stability Facility, an increased mandatory level of 9% for bank capitalisation within the EU and a set of commitments from Italy to take measures to reduce its national debt. Also pledged was €35 billion in "credit enhancement" to mitigate losses likely to be suffered by European banks. José Manuel Barroso characterised the package as a set of "exceptional measures for exceptional times".[11][231]

The package's acceptance was put into doubt on 31 October when Greek Prime Minister George Papandreou announced that a referendum would be held so that the Greek people would have the final say on the bailout, upsetting financial markets.[232] On 3 November 2011 the promised Greek referendum on the bailout package was withdrawn by Prime Minister Papandreou.

In late 2011, Landon Thomas in the New York Times noted that some, at least, European banks were maintaining high dividend payout rates and none were getting capital injections from their governments even while being required to improve capital ratios. Thomas quoted Richard Koo, an economist based in Japan, an expert on that country's banking crisis, and specialist in balance sheet recessions, as saying:

I do not think Europeans understand the implications of a systemic banking crisis.... When all banks are forced to raise capital at the same time, the result is going to be even weaker banks and an even longer recession – if not depression.... Government intervention should be the first resort, not the last resort.

Beyond equity issuance and debt-to-equity conversion, then, one analyst "said that as banks find it more difficult to raise funds, they will move faster to cut down on loans and unload lagging assets" as they work to improve capital ratios. This latter contraction of balance sheets "could lead to a depression”, the analyst said.[233] Reduced lending was a circumstance already at the time being seen in a "deepen[ing] crisis" in commodities trade finance in western Europe.[234]

- Final agreement on the second bailout package

In a marathon meeting on 20/21 February 2012 the Eurogroup agreed with the IMF and the Institute of International Finance on the final conditions of the second bailout package worth €130 billion. The lenders agreed to increase the nominal haircut from 50% to 53.5%. EU Member States agreed to an additional retroactive lowering of the interest rates of the Greek Loan Facility to a level of just 150 basis points above the Euribor. Furthermore, governments of Member States where central banks currently hold Greek government bonds in their investment portfolio commit to pass on to Greece an amount equal to any future income until 2020. Altogether this should bring down Greece's debt to between 117%[102] and 120.5% of GDP by 2020.[103]

European Central Bank

The European Central Bank (ECB) has taken a series of measures aimed at reducing volatility in the financial markets and at improving liquidity.[235]

In May 2010 it took the following actions:

- It began open market operations buying government and private debt securities,[236] reaching €219.5 billion by February 2012,[237] though it simultaneously absorbed the same amount of liquidity to prevent a rise in inflation.[238] According to Rabobank economist Elwin de Groot, there is a “natural limit” of €300 billion the ECB can sterilize.[239]

- It reactivated the dollar swap lines[240] with Federal Reserve support.[241]

- It changed its policy regarding the necessary credit rating for loan deposits, accepting as collateral all outstanding and new debt instruments issued or guaranteed by the Greek government, regardless of the nation's credit rating.

The move took some pressure off Greek government bonds, which had just been downgraded to junk status, making it difficult for the government to raise money on capital markets.[242]

On 30 November 2011, the ECB, the U.S. Federal Reserve, the central banks of Canada, Japan, Britain and the Swiss National Bank provided global financial markets with additional liquidity to ward off the debt crisis and to support the real economy. The central banks agreed to lower the cost of dollar currency swaps by 50 basis points to come into effect on 5 December 2011. They also agreed to provide each other with abundant liquidity to make sure that commercial banks stay liquid in other currencies.[243]

- Long Term Refinancing Operation (LTRO)

On 22 December 2011, the ECB[244] started the biggest infusion of credit into the European banking system in the euro's 13 year history. Under its Long Term Refinancing Operations (LTROs) it loaned €489 billion to 523 banks for an exceptionally long period of three years at a rate of just one percent.[245] Previous refinancing operations matured after three, six and twelve months.[246] The by far biggest amount of €325 billion was tapped by banks in Greece, Ireland, Italy and Spain.[247]

This way the ECB tried to make sure that banks have enough cash to pay off €200 billion of their own maturing debts in the first three months of 2012, and at the same time keep operating and loaning to businesses so that a credit crunch does not choke off economic growth. It also hoped that banks would use some of the money to buy government bonds, effectively easing the debt crisis.[248] On 29 February 2012, the ECB held a second auction, LTRO2, providing 800 Eurozone banks with further €529.5 billion in cheap loans.[249] Net new borrowing under the €529.5 billion February auction was around €313 billion; out of a total of €256 billion existing ECB lending (MRO + 3m&6m LTROs), €215 billion was rolled into LTRO2.[250]

- Resignations

In September 2011, Jürgen Stark became the second German after Axel A. Weber to resign from the ECB Governing Council in 2011. Weber, the former Deutsche Bundesbank president, was once thought to be a likely successor to Jean-Claude Trichet as bank president. He and Stark were both thought to have resigned due to "unhappiness with the ECB’s bond purchases, which critics say erode the bank’s independence". Stark was "probably the most hawkish" member of the council when he resigned. Weber was replaced by his Bundesbank successor Jens Weidmann, while Belgium's Peter Praet took Stark's original position, heading the ECB's economics department.[251]

- Money supply growth

In April, 2012, statistics showed a growth trend in the M1 "core" money supply. Having fallen from an over 9% growth rate in mid-2008 to negative 1% +/- for several months in 2011, M1 core has built to a 2-3% range in early 2012. "'It is still early days but a further recovery in peripheral real M1 would suggest an end to recessions by late 2012,' said Simon Ward from Henderson Global Investors who collects the data." While attributing the money supply growth to ECB's LTRO policies, an analysis in The Telegraph said lending "continued to fall across the eurozone in March [and] ... [t]he jury is out on the ... three-year lending adventure (LTRO)".[252]

- Reorganization of the European banking system

On June 16, 2012 the European Central Bank together with other European leaders hammered out plans for the ECB to become a bank regulator and to form a deposit insurance program to augment national programs. Other economic reforms promoting European growth and employment were also proposed.[253]

European Stability Mechanism (ESM)

The European Stability Mechanism (ESM) is a permanent rescue funding programme to succeed the temporary European Financial Stability Facility and European Financial Stabilisation Mechanism in July 2012.[220]

On 16 December 2010 the European Council agreed a two line amendment to the EU Lisbon Treaty to allow for a permanent bail-out mechanism to be established[254] including stronger sanctions. In March 2011, the European Parliament approved the treaty amendment after receiving assurances that the European Commission, rather than EU states, would play 'a central role' in running the ESM.[255][256] According to this treaty, the ESM will be an intergovernmental organisation under public international law and will be located in Luxembourg.[257][258]

Such a mechanism serves as a "financial firewall." Instead of a default by one country rippling through the entire interconnected financial system, the firewall mechanism can ensure that downstream nations and banking systems are protected by guaranteeing some or all of their obligations. Then the single default can be managed while limiting financial contagion.

European Fiscal Compact

In March 2011 a new reform of the Stability and Growth Pact was initiated, aiming at straightening the rules by adopting an automatic procedure for imposing of penalties in case of breaches of either the deficit or the debt rules.[259][260] By the end of the year, Germany, France and some other smaller EU countries went a step further and vowed to create a fiscal union across the eurozone with strict and enforceable fiscal rules and automatic penalties embedded in the EU treaties.[12][13] On 9 December 2011 at the European Council meeting, all 17 members of the eurozone and six countries that aspire to join agreed on a new intergovernmental treaty to put strict caps on government spending and borrowing, with penalties for those countries who violate the limits.[261] All other non-eurozone countries apart from the UK are also prepared to join in, subject to parliamentary vote.[220] The treaty will enter into force on 1 January 2013, if by that time 12 members of the euro area have ratified it.[262]

Originally EU leaders planned to change existing EU treaties but this was blocked by British prime minister David Cameron, who demanded that the City of London be excluded from future financial regulations, including the proposed EU financial transaction tax.[263][264] By the end of the day, 26 countries had agreed to the plan, leaving the United Kingdom as the only country not willing to join.[265] Cameron subsequently conceded that his action had failed to secure any safeguards for the UK.[266] Britain's refusal to be part of the Franco-German fiscal compact to safeguard the eurozone constituted a de facto refusal (PM David Cameron vetoed the project) to engage in any radical revision of the Lisbon Treaty at the expense of British sovereignty: centrist analysts such as John Rentoul of The Independent concluded that "Any Prime Minister would have done as Cameron did".[267]

Economic reforms and recovery proposals

Increase investment

There has been substantial criticism over the austerity measures implemented by most European nations to counter this debt crisis. Some argue that an abrupt return to "non-Keynesian" financial policies is not a viable solution[268] and predict that deflationary policies now being imposed on countries such as Greece and Spain might prolong and deepen their recessions.[269] In a 2003 study that analyzed 133 IMF austerity programmes, the IMF's independent evaluation office found that policy makers consistently underestimated the disastrous effects of rigid spending cuts on economic growth.[270][271] Current austerity "cuts have been relatively small compared to the size of the problem and meaningful structural reforms were seldom implemented."[272] Most austerity cuts came with even larger tax increases.[273][274]

In early 2012 an IMF official, who negotiated Greek austerity measures, admitted that spending cuts were harming Greece.[82][82] Nouriel Roubini adds that the new credit available to the heavily indebted countries did not equate to an immediate revival of economic fortunes: "While money is available now on the table, all this money is conditional on all these countries doing fiscal adjustment and structural reform."[275]

According to Keynesian economists "growth-friendly austerity" relies on the false argument that public cuts would be compensated for by more spending from consumers and businesses, a theoretical claim that has not materialized. The case of Greece shows that excessive levels of private indebtedness and a collapse of public confidence (over 90% of Greeks fear unemployment, poverty and the closure of businesses)[276] led the private sector to decrease spending in an attempt to save up for rainy days ahead. This led to even lower demand for both products and labor, which further deepened the recession and made it ever more difficult to generate tax revenues and fight public indebtedness.[277] According to New York Times chief economics commentator Martin Wolf, "structural tightening does deliver actual tightening. But its impact is much less than one to one. A 1 percentage point reduction in the structural deficit delivers a 0.67 percentage point improvement in the actual fiscal deficit." This means that Ireland e.g. would require structural fiscal tightening of more than 12% to eliminate its 2012 actual fiscal deficit. A task that is difficult to achieve without an exogenous eurozone-wide economic boom.[278] Austerity is bound to fail if it relies largely on tax increases[273] instead of cuts in government expenditures coupled with encouraging "private investment and risk-taking, labor mobility and flexibility, an end to price controls, tax rates that encouraged capital formation ..." as Germany has done in the decade before the crisis.[279]

Instead of austerity, Keynes suggested increasing investment and cutting income tax for low earners to kick-start the economy and boost growth and employment.[280] Since struggling European countries lack the funds to engage in deficit spending, German economist and member of the German Council of Economic Experts Peter Bofinger and Sony Kapoor of the global think tank Re-Define suggest financing additional public investments by growth-friendly taxes on "property, land, wealth, carbon emissions and the under-taxed financial sector". They also called on EU countries to renegotiate the EU savings tax directive and to sign an agreement to help each other crack down on tax evasion and avoidance. Currently authorities capture less than 1% in annual tax revenue on untaxed wealth transferred to other EU members. Furthermore the two suggest providing €40 billion in additional funds to the European Investment Bank (EIB), which could then lend ten times that amount to the employment-intensive smaller business sector.[277] The EU is currently discussing a possible €10 billion increase in the EIB's capital base.

Apart from arguments over whether or not austerity, rather than increased or frozen spending, is a macroeconomic solution,[281] union leaders have also argued that the working population is being unjustly held responsible for the economic mismanagement errors of economists, investors, and bankers. Over 23 million EU workers have become unemployed as a consequence of the global economic crisis of 2007–2010, and this has led many to call for additional regulation of the banking sector across not only Europe, but the entire world.[282]

In April, 2012, Olli Rehn, the European commissioner for economic and monetary affairs in Brussels, "enthusiastically announced to EU parliamentarians in mid-April that 'there was a breakthrough before Easter'. He said the European heads of state had given the green light to pilot projects worth billions, such as building highways in Greece." Other growth initiatives include "project bonds" wherein the EIB would "provide guarantees that safeguard private investors. In the pilot phase until 2013, EU funds amounting to €230 million are expected to mobilize investments of up to €4.6 billion." Der Spiegel also said: "According to sources inside the German government, instead of funding new highways, Berlin is interested in supporting innovation and programs to promote small and medium-sized businesses. To ensure that this is done as professionally as possible, the Germans would like to see the southern European countries receive their own state-owned development banks, modeled after Germany's [Marshall Plan-era-origin] Kreditanstalt für Wiederaufbau (KfW) banking group. It's hoped that this will get the economy moving in Greece and Portugal."[283]

Increase competitiveness

Slow GDP growth rates correspond to slower growth in tax revenues and higher safety net spending, increasing deficits and debt levels. Indian-American journalist Fareed Zakaria described the factors slowing growth in the eurozone, writing in November 2011: "Europe's core problem [is] a lack of growth... Italy's economy has not grown for an entire decade. No debt restructuring will work if it stays stagnant for another decade... The fact is that Western economies – with high wages, generous middle-class subsidies and complex regulations and taxes – have become sclerotic. Now they face pressures from three fronts: demography (an aging population), technology (which has allowed companies to do much more with fewer people) and globalization (which has allowed manufacturing and services to locate across the world)." He advocated lower wages and steps to bring in more foreign capital investment.[284]

British economic historian Robert Skidelsky disagreed saying it was excessive lending by banks, not deficit spending that created this crisis. Government's mounting debts are a response to the economic downturn as spending rises and tax revenues fall, not its cause.[285]

To improve the situation, crisis countries must significantly increase their international competitiveness. Typically this is done by depreciating the currency, as in the case of Iceland, which suffered the largest financial crisis in 2008–2011 in economic history but has since vastly improved its position. Since eurozone countries cannot devalue their currency, policy makers try to restore competitiveness through internal devaluation, a painful economic adjustment process, where a country aims to reduce its unit labour costs.[286]

German economist Hans-Werner Sinn noted in 2012 that Ireland was the only country that had implemented relative wage moderation in the last five years, which helped decrease its relative price/wage levels by 16%. Greece would need to bring this figure down by 31%, effectively reaching the level of Turkey.[287][288]

Other economists argue that no matter how much Greece and Portugal drive down their wages, they could never compete with low-cost developing countries such as China or India. Instead weak European countries must shift their economies to higher quality products and services, though this is a long-term process and may not bring immediate relief.[289]

Jeremy J. Siegel argues that the need to make labor competitive requires devaluation. This could be achieved by Greece leaving the Euro but that would lead to runs on the banks of Greece and other EU nations. This could be achieved by internal devaluation but this is difficult politically. Siegel argues that the only option left is for the devaluation of the Euro as a whole (parity with the dollar)--if it is to survive.[290]

- Progress

On 15 November 2011, the Lisbon Council published the Euro Plus Monitor 2011. According to the report most critical eurozone member countries are in the process of rapid reforms. The authors note that "Many of those countries most in need to adjust [...] are now making the greatest progress towards restoring their fiscal balance and external competitiveness". Greece, Ireland and Spain are among the top five reformers and Portugal is ranked seventh among 17 countries included in the report (see graph).[291]

Address current account imbalances

Regardless of the corrective measures chosen to solve the current predicament, as long as cross border capital flows remain unregulated in the euro area,[292] current account imbalances are likely to continue. A country that runs a large current account or trade deficit (i.e., importing more than it exports) must ultimately be a net importer of capital; this is a mathematical identity called the balance of payments. In other words, a country that imports more than it exports must either decrease its savings reserves or borrow to pay for those imports. Conversely, Germany's large trade surplus (net export position) means that it must either increase its savings reserves or be a net exporter of capital, lending money to other countries to allow them to buy German goods.[293]

The 2009 trade deficits for Italy, Spain, Greece, and Portugal were estimated to be $42.96 billion, $75.31bn and $35.97bn, and $25.6bn respectively, while Germany's trade surplus was $188.6bn.[294] A similar imbalance exists in the U.S., which runs a large trade deficit (net import position) and therefore is a net borrower of capital from abroad. Ben Bernanke warned of the risks of such imbalances in 2005, arguing that a "savings glut" in one country with a trade surplus can drive capital into other countries with trade deficits, artificially lowering interest rates and creating asset bubbles.[295][296][297]

A country with a large trade surplus would generally see the value of its currency appreciate relative to other currencies, which would reduce the imbalance as the relative price of its exports increases. This currency appreciation occurs as the importing country sells its currency to buy the exporting country's currency used to purchase the goods. Alternatively, trade imbalances can be reduced if a country encouraged domestic saving by restricting or penalizing the flow of capital across borders, or by raising interest rates, although this benefit is likely offset by slowing down the economy and increasing government interest payments.[298]

Either way, many of the countries involved in the crisis are on the euro, so devaluation, individual interest rates and capital controls are not available. The only solution left to raise a country's level of saving is to reduce budget deficits and to change consumption and savings habits. For example, if a country's citizens saved more instead of consuming imports, this would reduce its trade deficit.[298] It has therefore been suggested that countries with large trade deficits (e.g. Greece) consume less and improve their exporting industries. On the other hand, export driven countries with a large trade surplus, such as Germany, Austria and the Netherlands would need to shift their economies more towards domestic services and increase wages to support domestic consumption.[37][299] In May 2012 German finance minister Wolfgang Schäuble has signaled support for a significant increase in German wages to help decrease current account imbalances within the eurozone.[300]

Commentary