2021–2023 inflation surge: Difference between revisions

See "Monetary Policy Edits" on talk page. Again, this line is simply lifted from the Inflation Wikipedia page. |

|||

| Line 48: | Line 48: | ||

[[File:M2, CPI, PCE.webp|thumb|300px|right|(Percent change from a year earlier){{legend-line|#4572a7 solid 4px|[[Money supply|M2 money supply]]}} {{legend-line|#89A54E solid 4px|[[Consumer price index|CPI]]}} {{legend-line|#80699B solid 4px|Core CPI}} ]] |

[[File:M2, CPI, PCE.webp|thumb|300px|right|(Percent change from a year earlier){{legend-line|#4572a7 solid 4px|[[Money supply|M2 money supply]]}} {{legend-line|#89A54E solid 4px|[[Consumer price index|CPI]]}} {{legend-line|#80699B solid 4px|Core CPI}} ]] |

||

One theory, voiced by Stanford economist [[John B. Taylor]]<ref name="cnbc 2022">{{cite news|url=https://www.cnbc.com/video/2022/02/25/economy-is-strong-but-inflation-is-too-high-says-stanford-professor-john-taylor.html|publisher=cnbc|title=Economy is strong but inflation is too high, says Stanford professor John Taylor}}</ref> is that the uptick in inflation in the US was due to the large increase in the money supply, when M2 grew at a monthly rate of between 22% and 31% in the early months of the pandemic in 2020. Many governments adopted similar stimulatory actions around the world to support the wellbeing of their populations early in the COVID-19 pandemic,<ref name="nasdaq 2021">{{cite news|url=https://www.nasdaq.com/articles/money-printing-and-inflation:-covid-cryptocurrencies-and-more|title=Money Printing and Inflation: COVID, Cryptocurrencies and More|publisher=Nasdaq|author=Ron Surz}}</ref> caused by loose monetary policy on the part of central banks.<ref name="reuters 2021">{{cite news|publisher=Reuters|url=https://www. |

One theory, voiced by Stanford economist [[John B. Taylor]]<ref name="cnbc 2022">{{cite news|url=https://www.cnbc.com/video/2022/02/25/economy-is-strong-but-inflation-is-too-high-says-stanford-professor-john-taylor.html|publisher=cnbc|title=Economy is strong but inflation is too high, says Stanford professor John Taylor}}</ref> is that the uptick in inflation in the US was due to the large increase in the money supply, when M2 grew at a monthly rate of between 22% and 31% in the early months of the pandemic in 2020. Many governments adopted similar stimulatory actions around the world to support the wellbeing of their populations early in the COVID-19 pandemic,<ref name="nasdaq 2021">{{cite news|url=https://www.nasdaq.com/articles/money-printing-and-inflation:-covid-cryptocurrencies-and-more|title=Money Printing and Inflation: COVID, Cryptocurrencies and More|publisher=Nasdaq|author=Ron Surz}}</ref> caused by loose monetary policy on the part of central banks.<ref name="reuters 2021">{{cite news|publisher=Reuters|url=https://www.reuters.com/business/economists-eye-surging-money-supply-inflation-fears-mount-2021-06-17/|author=Karen Bretell|title=ANALYSIS-Economists eye surging money supply as inflation fears mount}}</ref> This theory is a central reason for the reliance on [[monetary policy]] as a means of [[Inflation#Controlling_inflation|controlling inflation]].<ref>{{Cite journal |last1=Sysoyeva |first1=Larysa |last2=Bielova |first2=Inna |last3=Ryabushka |first3=Luidmila |last4=Demikhov |first4=Oleksii |date=2021-05-29 |title=Determinants of Management of Central Bank to Provide the Economic Growth: an Application of Structural Equation Modeling |url=https://ojs.ual.es/ojs/index.php/eea/article/view/4803 |journal=Studies of Applied Economics |language=en |volume=39 |issue=5 |doi=10.25115/eea.v39i5.4803 |s2cid=236417850 |issn=1697-5731}}</ref><ref>[[Milton Friedman]] (1987). "quantity theory of money", ''[[The New Palgrave: A Dictionary of Economics]]'', v. 4, pp. 15–19.</ref><ref name = "iwdef">{{cite web |url=http://www.investorwords.com/3110/money_supply.html|title= money supply Definition |access-date=July 20, 2008 }}</ref><ref>{{cite journal |last1=Humphrey |first1=Thomas |title=A Monetary Model of the Inflationary Process |journal=Economic Review |date=1975 |volume=25 |issue=November/December 1975 |pages=13–23 |url=https://www.richmondfed.org/~/media/richmondfedorg/publications/research/economic_review/1975/pdf/er610602.pdf |access-date=23 December 2021}}</ref><ref name="econjournalwatch.org">Hummel, Jeffrey Rogers. "Death and Taxes, Including Inflation: the Public versus Economists" (January 2007).[http://econjwatch.org/articles/death-and-taxes-including-inflation-the-public-versus-economists] p. 56</ref> |

||

===Supply chain crisis=== |

===Supply chain crisis=== |

||

Revision as of 00:39, 7 September 2022

This article needs additional citations for verification. (August 2022) |

| Country/Region | 2020 | 2021 |

|---|---|---|

| World | 1.9% | 3.4% |

| Europe/Central Asia | 1.2% | 3.1% |

| Latin America/Caribbean | 1.4% | 4.3% |

| Brazil | 3.2% | 8.3% |

| South Asia | 5.7% | 5.5% |

| Australia | 0.8% | 2.9% |

| South Korea | 0.5% | 2.5% |

| Japan | 0.0% | -0.2% |

| China | 2.4% | 1.0% |

| Canada | 0.7% | 3.4% |

| United Kingdom | 1.0% | 2.5% |

| United States | 1.2% | 4.7% |

In early 2021, a worldwide increase in inflation began. It has been attributed to various causes, including pandemic-related fiscal and monetary stimulus,[2] supply shortages (including chip shortages and energy shortages), price gouging and, as of 2022, the Russian invasion of Ukraine.[3] Debate arose over whether inflationary pressures were transitory or persistent, however central banks started to raise policy rates in 2022. Many countries have seen their highest inflation in decades and their central banks have responded by increasing interest rates.[4][5][6]

Background and causes

Economists at Deloitte noted that consumer spending on goods moved in tandem with spending on services prior to the COVID-19 recession, but upon emerging from the recession consumers significantly shifted spending to goods, particularly in the United States. This shift placed stress on supply chains such that the supply of goods could not meet demand, resulting in price increases. They observed that in November 2021 inflation for durable goods was 14.9%, compared to 10.7% for consumable goods and just 3.8% for services in the United States; they noted similar results in several other major economies. They also noted that supply chain stresses increased prices for commodities and transportation, which are cost inputs for finished goods.[7]

In countries where food represents a larger part of the inflation basket, rising prices force low-income consumers to tighten their belts – crimping spending on other goods and slowing economic growth. "It looks like in those countries with high inflation, consumer spending has weakened because household spending power has taken a hit from rising prices," said William Jackson, chief emerging markets economist at Capital Economics consultancy. "And you've generally seen much more aggressive moves to tighten monetary policy."[8]

As of mid-2022, there was no consensus among economists as to the cause of the inflation surge. Several factors have been identified and discussed.

Monetary policy

One theory, voiced by Stanford economist John B. Taylor[9] is that the uptick in inflation in the US was due to the large increase in the money supply, when M2 grew at a monthly rate of between 22% and 31% in the early months of the pandemic in 2020. Many governments adopted similar stimulatory actions around the world to support the wellbeing of their populations early in the COVID-19 pandemic,[10] caused by loose monetary policy on the part of central banks.[11] This theory is a central reason for the reliance on monetary policy as a means of controlling inflation.[12][13][14][15][16]

Supply chain crisis

Some economists[17] attribute the inflation surge to product shortages resulting from the global supply-chain problems, largely caused by the COVID-19 pandemic.[18] Another cause cited include strong consumer demand driven by historically robust job and nominal wage growth;[19] and the fact that 2021 prices are being compared to 2020 prices, which were depressed due to pandemic-related shutdowns.[20] In the United States, Republicans and some economists cite spending from the passage of COVID-19 relief programs by the United States Congress as a factor for the inflation surge.[21][22]

Price gouging

Some analysts argued that price gouging may have played a role. They noted that in recent decades major industries, notably retailing, had concentrated into oligopolies that dominated markets and consequently wielded higher pricing power. The analysts argued that in an inflationary environment, consumers know prices are increasing but do not have good knowledge of what reasonable prices should be, giving retailers an opportunity to raise consumer prices beyond the inflation they were seeing in their costs, thereby permanently locking in higher prices. There was anecdotal but inconclusive evidence this was happening, and most economists generally did not see gouging as a significant contributor to inflation at the time.[23][24][25]

Transitory vs persistent debate

A debate arose among economists early in 2021 as to whether inflation was a transitory effect of the world's emergence from the pandemic, or whether it would be persistent. Some economists, such as Larry Summers and Olivier Blanchard warned of persistent inflation, while others, such as Paul Krugman and US Treasury Secretary Janet Yellen, were on "Team Transitory."[26] As 2021 turned to 2022, inflation continued to accelerate. In response, the Federal Reserve increased the fed funds rate by 25 basis points in March 2022, the first increase in three years, followed by 50 basis points in May, then another 75 basis points in June, moves that some analysts considered late and dramatic, and which might induce a recession. The June rate increase was the largest since 1994 and was followed by another 75 basis point increase the next month.[27] After Eurozone inflation hit a record high 8.1% in May, the European Central Bank announced in June it would raise rates in July by 25 basis points, the first increase in eleven years, and again in September by as much as 50 basis points; the ECB raised rates by 50 basis points in July.[28] After the Fed's third rate increase, Summers said "We are still headed for a pretty hard landing."[29]

Impact of the 2022 Russian invasion of Ukraine

Mark Zandi, chief economist of Moody's Analytics, analyzed consumer price index components following the May 2022 report that showed an 8.6% inflation rate. He found that by then the 2022 Russian invasion of Ukraine was the principal cause of higher inflation, comprising 3.5% of the 8.6%. He said oil and commodities prices jumped in anticipation of and response to the invasion, leading to higher gasoline prices. Resulting higher diesel prices led to higher transportation costs for consumer goods, notably food. Zandi cited the pandemic and a housing shortage as the next largest contributors to inflation, attributing 0.1% of the 8.6% to effects of the American Rescue Plan legislation. Investment banker Steven Rattner and economist Larry Summers had previously cited the legislation as contributing to inflation.[30]

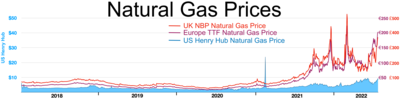

On 22 February 2022, before the Russian invasion, the German Government froze the Nord Stream 2 pipeline between Russia and Germany,[31] causing natural gas prices to rise significantly.[32] Its impact on energy supply extends globally. Especially in Europe, this translated to much higher electricity bills.[33]

On 24 February, Russian military forces invaded Ukraine[34] to overthrow the democratically elected government, and replace it with a Russian puppet government.[35] Before the invasion, Ukraine accounted for 11.5% of the world's wheat crop market, and contributed 17% of the world's corn crop export market, and the invasion caused wheat and corn from Ukraine unable to reach international market, causing shortage, and result in dramatic rise in prices,[36] that exacerbated to foodstuffs and biodiesel prices.[37][38] Additionally, the price of Brent Crude Oil per barrel rose from $97.93 on 25 February to a high of $127.98 on 8 March,[39] this caused petrochemicals and other goods reliant on crude oil to rise in price as well.[40][41]

The effect of sanctions on the Russian economy caused annual inflation in Russia to rise to 17.89%, its highest since 2002.[42] Weekly inflation hit a high of 0.99% in the week of 8 April, bringing YTD inflation in Russia to 10.83%, compared to 2.72% in the same period of 2021.[42]

Impact on countries

This section needs expansion. You can help by adding to it. (December 2021) |

While most countries saw a rise in their annual inflation rate during 2021 and 2022, some of the highest rates of increase have been in Europe, Brazil, Turkey, the United States, and Israel.[20][43][44] By June 2022, nearly half of Eurozone countries had double-digit inflation, and the region reached an average inflation rate of 8.6%, the highest since its formation in 1999.[45] In response, at least 75 central banks around the world have aggressively increased interest rates.[46]

North America

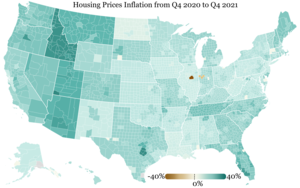

40%

20%

0%

-20%

-40%

In the US, the Consumer Price Index rose 6.8% between November 2020 and November 2021, spurred by price increases for gasoline, food, and housing.[47] Higher energy costs caused the inflation to rise further in 2022,[48] reaching 9.1%, a high not seen since 1981.[49] In July 2022 the Fed increased the interest rate for the third time in the year,[50] yet inflation remained high outpacing the growth in wages[51] and spending,[52] and according to the Economic Policy Institute the minimum wage was worth less than any time since 1956 due to inflation,[53][54] nevertheless the hikes were seen as faster and sooner than the response by European Central Bank so while the euro fell the dollar remained relatively stronger helping it to be the more valuable one for the first time in 20 years.[55][56] On July 27 the Fed announced a fourth rate rise by 0.75 points bringing the rate to a range between 2.25% and 2.5%, although an expected move to combat the inflation the rise has been seen more cautiously as there are signs that the economy is entering a recession which the rate rises could potentially aggravate.[57][58][59] On July 28 data from the BEA showed that the economy shrunk for the second quarter in a row, which is commonly used to define a recession.[60][61][62][63] BLS data showed that inflation eased on July to 8.5%[64][65] from the 40 year peak reached on June at 9.1%.[66]

Inflation is believed to have played a major role in a decline in the approval rating of President Joe Biden, who took office in January 2021, being net negative starting in October of that year.[67] Many Republicans have blamed the actions of Biden and fellow Democrats for fueling the surge.[68]

Canada also saw multi-decade highs in inflation, hitting 5.1% in February 2022[69] and further increasing to 6.7% two months later.[70] In April, inflation rose again to 6.8%,[71][72] before jumping to 7.7% in May, the highest ever since 1983.[73][74]

In July 2022, Mexico's INEGI reported a year-on-year increase in consumer prices of 8.15%, against a Central Bank target of 2%–4%.[75]

South America

In Brazil, inflation hit its highest rate since 2003—prices rose 10.74% in November 2021 compared to November 2020. Economists predicted that inflation has peaked and that in fact the economy may be headed for recession, in part due to aggressive interest rate increases by the central bank.[76]

In Argentina, a country with a chronic inflation problem, the interest rate was hiked to 69.5% in August as inflation has further deteriorated hitting a 20-year high at 70% and is forecasted to top 90% by the end of the year.[77]

Europe

In the Netherlands, the average 2021 inflation rate was the highest since 2003.[78] The inflation rate in November was the highest in nearly 40 years.[79] With energy prices having increased by 75%, December saw the highest inflation rate in decades.[78]

In the UK inflation reached a 40-year high of 10.1% in July driven by food prices and further increase is anticipated in October when higher energy bills are expected to hit.[80] The interest rate has been raised six times reaching 1.75% in August and the Bank of England has warned the UK will fall into recession by the end of the year.[81]

In June 2022, the European Central Bank (ECB) has decided to raise interest rates next month for the first time in more than 11 years due to the elevated inflation pressure,[82][83] and in July the euro has fallen below dollar for first time in 20 years mainly by fears of energy supply restrictions from Russia but also because it is seen that the ECB has lagged behind the US, UK and other central banks in raising rates against the inflation, further weakening the euro.[55][56] In July the Eurozone inflation hit 8.9%[84] in contrast to the US where it eased that month and which by June at 8.6% was already the highest ever since the creation of the euro in 1999.[85] In August inflation still didn't ease as it beat expectations reaching a record 9.1%.[86]

Asia

In Turkey, retail prices rose 9.65% in December compared to November, for an annual rate of 34%. Some of the largest increases were for electricity, natural gas, and gasoline. The economy was further strained by a currency crisis caused by a series of rate cuts by the central bank; the Turkish lira lost 44% of its value against the dollar during 2021.[87]

In June 2022, the Philippines recorded a 6.1% inflation, its highest since October 2018. The Philippine Statistics Authority forecasted that the number will most likely be higher in the following months. However, President Ferdinand Marcos Jr. claims that the record inflation rate was "not that high".[88]

Oceania

Inflation in New Zealand exceeded forecasts in 2022 July, reaching 7.3% which is the highest since 1990.[89] Economists at ANZ reportedly said they expected faster interest rate increases to counteract inflationary pressures.[90]

In Fiji, inflation rose to 4.7% in April 2022 compared to -2.4% in 2021.[91] Food prices rose by 6.9% in April 2022, fuel increased by 25.2%, kerosene by 28.5% and gas by 27.7%.[92] This has also resulted in the increase of bus fares.[93]

See also

- Economic impact of the COVID-19 pandemic

- COVID-19 recession

- 2021–2022 global energy crisis

- 2018–2022 Turkish currency and debt crisis

- 2021 United Kingdom natural gas supplier crisis

- 2022 stock market decline

References

- ^ "Inflation rates". International Monetary Fund via World Bank. Archived from the original on 2021-12-06.

- ^ Were The Stimulus Checks A Mistake?

- ^ Van Dam, Andrew (January 13, 2022). "2021 shattered job market records, but it's not as good as it looks". The Washington Post. Archived from the original on April 15, 2022.[better source needed]

- ^ Weber, Alexander (2 February 2022). "Euro-Zone Inflation Unexpectedly Hits Record, Boosting Rate Bets". Bloomberg. Archived from the original on 12 February 2022.

- ^ "India's Dec WPI inflation at 13.56% as firms fight rising costs". Reuters. 14 January 2022. Archived from the original on 12 February 2022.

- ^ Kihara, Leika (14 January 2022). "Japan's wholesale inflation at near record high on broad price gains". Reuters. Archived from the original on 12 February 2022.

- ^ Ira Kalish; Michael Wolf (February 18, 2022). "Global surge in inflation". Deloitte. Archived from the original on June 20, 2022.

- ^ "Rising costs: How emerging economies are being affected by inflation". World Economic Forum. Archived from the original on 2022-06-16.

- ^ "Economy is strong but inflation is too high, says Stanford professor John Taylor". cnbc.

- ^ Ron Surz. "Money Printing and Inflation: COVID, Cryptocurrencies and More". Nasdaq.

- ^ Karen Bretell. "ANALYSIS-Economists eye surging money supply as inflation fears mount". Reuters.

- ^ Sysoyeva, Larysa; Bielova, Inna; Ryabushka, Luidmila; Demikhov, Oleksii (2021-05-29). "Determinants of Management of Central Bank to Provide the Economic Growth: an Application of Structural Equation Modeling". Studies of Applied Economics. 39 (5). doi:10.25115/eea.v39i5.4803. ISSN 1697-5731. S2CID 236417850.

- ^ Milton Friedman (1987). "quantity theory of money", The New Palgrave: A Dictionary of Economics, v. 4, pp. 15–19.

- ^ "money supply Definition". Retrieved July 20, 2008.

- ^ Humphrey, Thomas (1975). "A Monetary Model of the Inflationary Process" (PDF). Economic Review. 25 (November/December 1975): 13–23. Retrieved 23 December 2021.

- ^ Hummel, Jeffrey Rogers. "Death and Taxes, Including Inflation: the Public versus Economists" (January 2007).[1] p. 56

- ^ "How the supply chain caused current inflation, and why it might be here to stay". PBS NewsHour. 2021-11-10. Retrieved 2022-08-26.

- ^ Austin, Craig (November 10, 2021). "How the supply chain caused current inflation, and why it might be here to stay". PBS. Archived from the original on January 3, 2022.

- ^ * Van Dam, Andrew (January 13, 2022). "2021 shattered job market records, but it's not as good as it looks". The Washington Post. Archived from the original on April 15, 2022.

- Jason Furman; Wilson Powell III (January 28, 2022). "US wages grew at fastest pace in decades in 2021, but prices grew even more". Petersen Institute for International Economics. Archived from the original on June 6, 2022.

- ^ a b DeSilver, Drew (November 24, 2021). "Inflation has risen around the world, but the U.S. has seen one of the biggest increases". Pew Research Center. Archived from the original on December 29, 2021.

- ^ Morgan, David (2021-11-01). "Explainer: Republicans blame Biden for inflation, but are they right?". Reuters. Archived from the original on 2022-03-24.

- ^ Smith, Jillian (March 31, 2022). "Economists say American Rescue Plan contributed to inflation". The National Desk. Archived from the original on 2022-06-16.

- ^ Lopez, German (June 14, 2022). "Inflation and Price Gouging". The New York Times. Archived from the original on June 25, 2022.

- ^ Brooks, Khristopher J. (May 27, 2022). "Companies use inflation to hike prices and generate huge profits, report says". CBS News. Archived from the original on June 25, 2022.

- ^ DePillis, Lydia (June 3, 2022). "Is 'Greedflation' Rewriting Economics, or Do Old Rules Still Apply?". The New York Times. Archived from the original on June 25, 2022.

- ^ Paul Krugman. "The Year of Inflation Infamy". New York Times.

- ^ Smialek, Jeanna (July 27, 2022). "The Fed raises rates by three-quarters of a percentage point". The New York TImes.

- ^ Amaro, Silvia (July 21, 2022). "European Central Bank surprises markets with larger-than-expected rate hike, its first in 11 years". CNBC.

- ^ Multiple sources:

- Cox, Jeff (March 16, 2022). "Federal Reserve approves first interest rate hike in more than three years, sees six more ahead". CNBC. Archived from the original on June 16, 2022.

- Cox, Jeff (May 4, 2022). "Fed raises rates by half a percentage point — the biggest hike in two decades — to fight inflation". CNBC. Archived from the original on June 19, 2022.

- Cox, Jeff (June 15, 2022). "Fed hikes its benchmark interest rate by 0.75 percentage point, the biggest increase since 1994". CNBC. Archived from the original on June 19, 2022.

- Megan Greene (January 7, 2022). "Betting on transitory US inflation is still valid". Financial Times. Archived from the original on June 19, 2022.

- Beilfuss, Lisa (June 17, 2022). "'We Are Still Headed for a Pretty Hard Landing,' Ex-Treasury Secretary Larry Summers Says". Barron's. Archived from the original on June 19, 2022.

- Ben White (June 17, 2022). "Inflation's main culprit? CEOs zero in on Powell's Fed". Politico. Archived from the original on June 19, 2022.

- "Europe's central bank to hike rates in July, 1st in 11 years". Associated Press. June 9, 2022. Archived from the original on June 19, 2022.

- Collinson, Stephen (June 1, 2022). "Yellen's words on inflation won't end America's price hikes". CNN. Archived from the original on June 19, 2022.

- ^ Mui, Christine (June 13, 2022). "Top economist Mark Zandi says forget Biden's stimulus—Putin's war in Ukraine is by far the biggest driver of inflation". Fortune. Archived from the original on June 15, 2022.

- ^ Marsh, Sarah; Chambers, Madeline (2022-02-22). "Germany freezes Nord Stream 2 gas project as Ukraine crisis deepens". Reuters. Archived from the original on 2022-04-29.

- ^ "Natural Gas PRICE Today | Natural Gas Spot Price Chart | Live Price of Natural Gas per Ounce | Markets Insider". markets.businessinsider.com. Archived from the original on 2022-05-02.

- ^ "Energy inflation rate continues upward hike, hits 27%". ec.europa.eu. Archived from the original on 2022-04-29.

- ^ "Ukraine crisis: Russia orders troops into rebel-held regions". BBC News. 2022-02-22. Archived from the original on 2022-02-24.

- ^ Kudlenko, Anastasiia. "Ukraine: Putin's desire to install a puppet government draws from the Bolshevik playbook". The Conversation. Archived from the original on 2022-04-08.

- ^ Welle (www.dw.com), Deutsche. "Ukraine war increases global food insecurity | DW | 21.03.2022". DW.COM. Archived from the original on 2022-05-02.

- ^ Reuters (2022-03-05). "Food prices jump 20.7% yr/yr to hit record high in Feb, U.N. agency says". Reuters. Archived from the original on 2022-06-01.

{{cite news}}:|last=has generic name (help) - ^ "Biodiesel prices (SME & FAME)". Neste worldwide. 2015-02-19. Archived from the original on 2022-04-01.

- ^ "Crude Oil Price Today | BRENT OIL PRICE CHART | OIL PRICE PER BARREL | Markets Insider". markets.businessinsider.com. Archived from the original on 2022-05-02.

- ^ Dolar, Veronika. "Soaring crude prices make the cost of pretty much everything else go up too because we almost literally eat oil". The Conversation. Archived from the original on 2022-05-02.

- ^ "Petrochemical prices expected to keep rising". Globuc. Archived from the original on 2022-07-16.

- ^ a b Reuters (2022-04-13). "Inflation in Russia hits highest in more than 20 years". Reuters. Archived from the original on 2022-05-02.

{{cite news}}:|last=has generic name (help) - ^ DeSilver, Drew (15 June 2022). "In the U.S. and around the world, inflation is high and getting higher". Pew Research Center. Archived from the original on 9 July 2022.

- ^ "Eurozone inflation hits record 8.1% amid rising energy costs". Associated Press. 31 May 2022. Archived from the original on 19 June 2022.

- ^ Eddy, Melissa (July 1, 2022). "Eurozone inflation rises to 8.6 percent, the highest ever, driven by high energy prices". The New York Times. Archived from the original on July 1, 2022.

- ^ Smialek, Jeanna; Nelson, Eshe (17 July 2022). "Global Central Banks Ramp Up Inflation Fight". The New York Times. Retrieved 18 July 2022.

- ^ Aratani, Lauren (December 10, 2021). "US inflation rate rose to 6.8% in 2021, its highest since 1982". The Guardian. Archived from the original on 3 January 2022.

- ^ Tan, Su-Lin (14 July 2022). "Yellen warns inflation in the U.S. is 'unacceptably high'". CNBC. Archived from the original on 15 July 2022.

Almost half of the increase in prices in the latest inflation numbers came from high energy costs, Yellen added.

- ^ Cox, Jeff (13 July 2022). "Inflation rose 9.1% in June, even more than expected, as consumer pressures intensify". CNBC. Archived from the original on 15 July 2022.

- ^ "US makes biggest interest rate rise in almost 30 years". BBC News. 2022-06-15. Retrieved 2022-07-22.

- ^ Harrison, David (2022-05-06). "Pay Raises Are Historically High. Inflation Is Still Eclipsing Those Gains". Wall Street Journal. ISSN 0099-9660. Retrieved 2022-07-22.

- ^ Dougherty, Danny (2022-07-17). "Inflation Has Outpaced Wage Growth. Now It's Cutting Into Spending". Wall Street Journal. ISSN 0099-9660. Retrieved 2022-07-22.

- ^ Konish, Lorie (2022-07-15). "High inflation leads federal minimum wage to reach lowest value since 1956, report finds". CNBC. Retrieved 2022-07-22.

- ^ "The value of the federal minimum wage is at its lowest point in 66 years". Economic Policy Institute. Retrieved 2022-07-22.

- ^ a b "Euro falls below dollar for first time in 20 years". BBC News. 2022-07-13. Retrieved 2022-07-22.

- ^ a b "Eurozone raises interest rates for first time in 11 years". BBC News. 2022-07-21. Retrieved 2022-07-22.

- ^ "Federal Reserve issues FOMC statement". Board of Governors of the Federal Reserve System. Retrieved 2022-08-03.

- ^ "US makes huge interest rate rise to tame soaring prices". BBC News. 2022-07-27. Retrieved 2022-08-03.

- ^ "Fed to Inflict More Pain on Economy as It Readies Big Rate Hike". www.bloomberg.com. Retrieved 2022-08-03.

- ^ "Gross Domestic Product, Second Quarter 2022 (Advance Estimate) | U.S. Bureau of Economic Analysis (BEA)". www.bea.gov. Retrieved 2022-08-03.

- ^ "US economy shrinks again sparking recession fears". BBC News. 2022-07-28. Retrieved 2022-08-03.

- ^ Rodeck, David (2021-08-04). "What Is A Recession?". Forbes Advisor. Retrieved 2022-08-03.

- ^ "The risk of redefining recession". 2008-05-05. Retrieved 2022-08-03.

- ^ "US inflation eases in July as petrol prices drop". BBC News. 2022-08-10. Retrieved 2022-08-14.

- ^ "US Inflation Runs Cooler Than Forecast, Easing Pressure on Fed". Bloomberg.com. 2022-08-10. Retrieved 2022-08-14.

- ^ "US prices rising at fastest rate for 40 years". BBC News. 2022-07-13. Retrieved 2022-08-14.

- ^ Enten, Harry (December 21, 2021). "Biden's economic ratings are worse than Carter's". CNN. Archived from the original on December 25, 2021.

- ^ Guida, Victoria (December 9, 2021). "Another eye-popping inflation reading is ahead. Next year could look very different". Politico. Archived from the original on 26 December 2021.

- ^ Evans, Pete (16 February 2022). "Canada's inflation rate rises to 5.1% — highest since 1991". Canadian Broadcasting Corporation. Archived from the original on 16 February 2022.

- ^ Evans, Pete (20 April 2022). "Canada's inflation rate jumps to new 31-year high of 6.7%". Canadian Broadcasting Corporation. Archived from the original on 14 May 2022.

- ^ "Consumer Price Index, April 2022". Statistics Canada. Government of Canada. 18 May 2022. Archived from the original on 6 June 2022.

- ^ Argitis, Theophilos (18 May 2022). "Canadian Inflation Hits New Three-Decade High of 6.8% on Housing". Bloomberg News. Bloomberg L.P. Archived from the original on May 18, 2022.

- ^ "Consumer Price Index, May 2022". Statistics Canada. Government of Canada. 22 June 2022. Archived from the original on 24 June 2022.

- ^ Evans, Pete (22 June 2022). "Canada's inflation rate now at 7.7% — its highest point since 1983". CBC News. Canadian Broadcasting Corporation. Archived from the original on 22 June 2022.

- ^ De Haldevang, Max (11 August 2022). "Mexico Raises Key Interest Rate to Highest Ever as Inflation Accelerates". Bloomberg.

- ^ Rosati, Andrew (December 10, 2021). "Brazil's Inflation Likely Peaked After Hitting 18-Year High". Bloomberg. Archived from the original on 2022-01-01.

- ^ "Argentina rate hiked to 69.5% as inflation hits 20-year high". BBC News. 2022-08-12. Retrieved 2022-08-19.

- ^ a b "Torenhoge inflatie in december, cijfer over heel 2021 naar 2,7 procent" (in Dutch). NOS. January 11, 2022. Archived from the original on 2022-01-11.

- ^ "Strongest inflation in almost 40 years". Statistics Netherlands. December 7, 2021. Archived from the original on 2021-12-07.

- ^ "UK inflation: Food costs push price rises to new 40-year high". BBC News. 2022-08-17. Retrieved 2022-08-19.

- ^ "Bank of England warns the UK will fall into recession this year". BBC News. 2022-08-05. Retrieved 2022-08-19.

- ^ Bank, European Central (2022-06-09). "Monetary policy decisions". European Central. Archived from the original on 2022-06-12.

- ^ "Eurozone interest rates set to rise for first time in 11 years". BBC News. 2022-06-09. Archived from the original on 2022-06-11.

- ^ Reuters (2022-07-29). "Euro zone inflation hits yet another record high after big jump". Reuters. Retrieved 2022-08-19.

{{cite news}}:|last=has generic name (help) - ^ Eddy, Melissa (2022-07-01). "Eurozone inflation rises to 8.6 percent, the highest ever, driven by energy prices". The New York Times. ISSN 0362-4331. Retrieved 2022-08-19.

- ^ Ward-Glenton, Hannah. "Euro zone inflation hits another record of 9.1% as food and energy prices soar". CNBC. Retrieved 2022-09-02.

- ^ "Turkey hikes energy prices; Istanbul monthly inflation highest in decade". WTVB. January 1, 2022. Archived from the original on 1 January 2022.

- ^ Cuyco, Jan (2022-07-06). "That high: What you need to know about inflation in the Philippines". Interaksyon. Archived from the original on 2022-07-13.

- ^ Brockett, Matthew (17 July 2022). "New Zealand Inflation Outpaces Forecasts at Fresh 32-Year High". Bloomberg. Retrieved 18 July 2022.

- ^ Janda, Michael (17 July 2022). "Federal Treasurer Jim Chalmers warns on budget outlook, New Zealand inflation surge hints at even bigger interest rate rises". ABC News. Retrieved 18 July 2022.

- ^ Fijivillage. "Annual headline inflation rises to 4.7% in April". www.fijivillage.com. Archived from the original on 2022-05-26.

- ^ Fijivillage. "Food prices rose by 6.9% in April". www.fijivillage.com. Archived from the original on 2022-06-11.

- ^ "Bus fare increase to come into effect from May 13". FijiTimes. Archived from the original on 2022-06-08.

External links

- Ross, Jenna (2022-06-24). "Interest Rate Hikes vs. Inflation Rate, by Country". Visual Capitalist.