Wall Street: Difference between revisions

Undid revision 453589332 by 82.11.213.153 (talk); unsourced |

|||

| Line 731: | Line 731: | ||

==See also== |

==See also== |

||

{{Portal|New York City}} |

{{Portal|New York City}} |

||

| ⚫ | |||

*[[Wall Street Historic District (New York, New York)]] |

*[[Wall Street Historic District (New York, New York)]] |

||

* [[Global settlement]] (2002) |

* [[Global settlement]] (2002) |

||

| Line 739: | Line 738: | ||

* [[City of London]] |

* [[City of London]] |

||

* [[List of financial districts]] |

* [[List of financial districts]] |

||

| ⚫ | |||

==References== |

==References== |

||

Revision as of 00:48, 3 October 2011

| |

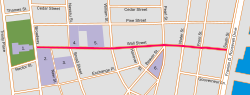

| West end | Broadway in Manhattan |

|---|---|

| East end | South Street in Manhattan |

| New Netherland series |

|---|

| Exploration |

| Fortifications: |

| Settlements: |

| The Patroon System |

|

| People of New Netherland |

| Flushing Remonstrance |

|

Wall Street refers to the financial district of New York City,[1] named after and centered on the eight-block-long street running from Broadway to South Street on the East River in lower Manhattan. Over time, the term has become a metonym for the financial markets of the United States as a whole, or signifying New York-based financial interests.[2] It is the home of the New York Stock Exchange, the world's largest stock exchange by market capitalization of its listed companies.[3] Several other major exchanges have or had headquarters in the Wall Street area, including NASDAQ, the New York Mercantile Exchange, the New York Board of Trade, and the former American Stock Exchange. Anchored by Wall Street, New York City is one of the world's principal financial centers.[4][5][6][7][8][9][10]

History

Early years

There are varying accounts about how the Dutch-named "de Waal Straat"[11] got its name. A generally accepted version is that the name of the street name was derived from an earthen wall on the northern boundary of the New Amsterdam settlement, perhaps to protect against English colonial encroachment or incursions by native Americans. A conflicting explanation is that Wall Street was named after Walloons -- possibly a Dutch abbreviation for Walloon being Waal.[12] Among the first settlers that embarked on the ship "Nieu Nederlandt" in 1624 were 30 Walloon families.

In the 1640s, basic picket and plank fences denoted plots and residences in the colony.[13] Later, on behalf of the Dutch West India Company, Peter Stuyvesant, using both African slaves[14] and white colonists, collaborated with the city government in the construction of a more substantial fortification, a strengthened 12-foot (4 m) wall.[15] In 1685 surveyors laid out Wall Street along the lines of the original stockade.[15] The wall started at Pearl Street, which was the shoreline at that time, crossing the Indian path Broadway and ending at the other shoreline (today's Trinity Place), where it took a turn south and ran along the shore until it ended at the old fort. In these early days, local merchants and traders would gather at disparate spots to buy and sell shares and bonds, and over time divided themselves into two classes—auctioneers and dealers.[16] The rampart was removed in 1699.[12]

In the late 18th century, there was a buttonwood tree at the foot of Wall Street under which traders and speculators would gather to trade securities.[17] The benefit was being in close proximity to each other.[17] In 1792, traders formalized their association with the Buttonwood Agreement which was the origin of the New York Stock Exchange.[18] The idea of the agreement was to make the market more "structured" and "without the manipulative auctions", with a commission structure.[16] Persons signing the agreement agreed to charge each other a standard commission rate; persons not signing could still participate but would be charged a higher commission for dealing.[16]

In 1789, Wall Street was the scene of the United States' first presidential inauguration when George Washington took the oath of office on the balcony of Federal Hall on April 30, 1789. This was also the location of the passing of the Bill Of Rights. In the cemetery of Trinity Church, Alexander Hamilton, who was the first Treasury secretary and "architect of the early United States financial system," is buried.[19]

Nineteenth century

In the first few decades, both residences and businesses occupied the area, but increasingly business predominated. "There are old stories of people's houses being surrounded by the clamor of business and trade and the owners complaining that they can't get anything done," according to a historian named Burrows.[20] The opening of the Erie Canal in the early 19th century meant a huge boom in business for New York City, since it was the only major eastern seaport which had direct access by inland waterways to ports on the Great Lakes. Wall Street became the "money capital of America".[17]

Historian Charles R. Geisst suggested that there has constantly been a "tug-of-war" between business interests on Wall Street and authorities in Washington, D.C..[16] Generally during the 19th century Wall Street developed its own "unique personality and institutions" with little outside interference.[16]

In the 1840s and 1850s, most residents moved north to midtown because of the increased business use at the lower tip of the island.[20] The Civil War had the effect of causing the northern economy to boom, bringing greater prosperity to cities like New York which "came into its own as the nation's banking center" connecting "Old World capital and New World ambition", according to one account.[19] J. P. Morgan created giant trusts; John D. Rockefeller’s Standard Oil moved to New York.[19] Between 1860 and 1920, the economy changed from "agricultural to industrial to financial" and New York maintained its leadership position despite these changes, according to historian Thomas Kessner.[19] New York was second only to London as the world's financial capital.[19]

In 1884, Charles H. Dow began tracking stocks, initially beginning with 11 stocks, mostly railroads, and looked at average prices for these eleven.[21] When the average "peaks and troughs" went up consistently, he deemed it a bull market condition; if averages dropped, it was a bear market.[21] He added up prices, and divided by the number of stocks to get his Dow Jones average. Dow's numbers were a "convenient benchmark" for analyzing the market and became an accepted way to look at the entire stock market.[21]

In 1889, the original stock report, Customers' Afternoon Letter, became The Wall Street Journal. Named in reference to the actual street, it became an influential international daily business newspaper published in New York City.[22] After October 7, 1896, it began publishing Dow's expanded list of stocks.[21] A century later, there were 30 stocks in the average.

Twentieth century

Historian John Brooks in his book Once in Golconda considered the turn of the 20th century period to have been Wall Street's heyday.[19] The address of 23 Wall Street where the headquarters of J. P. Morgan & Company, known as The Corner, was "the precise center, geographical as well as metaphorical, of financial America and even of the financial world."[19]

Wall Street has had changing relationships with government authorities. In 1913, for example, when authorities proposed a $4 tax on stock transfers, stock clerks protested.[23] At other times, city and state officials have taken steps through tax incentives to encourage financial firms to continue to do business in the city.

In the late 19th and early 20th centuries, the corporate culture of New York was a primary center for the construction of skyscrapers, and was rivaled only by Chicago on the American continent. There were also residential sections, such as the Bowling Green section between Broadway and the Hudson river, and between Vesey Street and the Battery. The Bowling Green area was described as "Wall Street's back yard" with poor people, high infant mortality rates, and the "worst housing conditions in the city."[24] As a result of the construction, looking at New York City from the east, one can see two distinct clumps of tall buildings—the financial district on the left, and the taller midtown district on the right. The geology of Manhattan is well-suited for tall buildings, with a solid mass of bedrock underneath Manhattan providing a firm foundation for tall buildings. Skyscrapers are expensive to build, but when there is a "short supply of land" in a "desirable location", then building upwards makes sound financial sense.[25] A post office was built at 60 Wall Street in 1905.[26] During the World War I years, occasionally there were fund-raising efforts for projects such as the National Guard.[27]

On September 16, 1920, close to the corner of Wall and Broad Street, the busiest corner of the financial district and across the offices of the Morgan Bank, a powerful bomb exploded. It killed 38 and seriously injured 143 people.[28] The perpetrators were never identified or apprehended. The explosion did, however, help fuel the Red Scare that was underway at the time. A report from the New York Times:

The tomb-like silence that settles over Wall Street and lower Broadway with the coming of night and the suspension of business was entirely changed last night as hundreds of men worked under the glare of searchlights to repair the damage to skyscrapers that were lighted up from top to bottom. ... The Assay Office, nearest the point of explosion, naturally suffered the most. The front was pierced in fifty places where the cast iron slugs, which were of the material used for window weights, were thrown against it. Each slug penetrated the stone an inch or two and chipped off pieces ranging from three inches to a foot in diameter. The ornamental iron grill work protecting each window was broken or shattered. ... the Assay Office was a wreck. ... It was as though some gigantic force had overturned the building and then placed it upright again, leaving the framework uninjured but scrambling everything inside. -- 1920[29]

The area was subjected to numerous threats; one bomb threat in 1921 led to detectives sealing off the area to "prevent a repetition of the Wall Street bomb explosion."[30]

Regulation

In October 1929, a celebrated Yale economist named Irving Fisher reassured worried investors that their "money was safe" on Wall Street.[31] A few days later, stock values plummeted. The stock market crash of 1929 ushered in the Great Depression in which a quarter of working people were unemployed, with soup kitchens, mass foreclosures of farms, and falling prices.[31] During this era, development of the financial district stagnated, and Wall Street "paid a heavy price" and "became something of a backwater in American life."[31] During the New Deal years as well as the forties, there was much less focus on Wall Street and finance. The government clamped down on the practice of buying equities based only on credit, but these policies began to ease. From 1946-1947, stocks could not be purchased "on margin", meaning that an investor had to pay 100% of a stock's cost without taking on any loans.[32] But this margin requirement was reduced four times before 1960, each time stimulating a mini-rally and boosting volume, and when the Federal Reserve reduced the margin requirements from 90% to 70%.[32] These changes made it somewhat easier for investors to buy stocks on credit.[32] The growing national economy and prosperity led to a recovery during the sixties, with some down years during the early seventies in the aftermath of the Vietnam War. Trading volumes climbed; in 1967, according to Time Magazine, volume hit 7.5 million shares a day which caused a "traffic jam" of paper with "batteries of clerks" working overtime to "clear transactions and update customer accounts."[33]

In 1973, the financial community posted a collective loss of $245 million and needed help, and got it with the form of temporary help from the goverrnment.[34] Reforms happened; the SEC eliminated fixed commissions which forced "brokers to compete freely with one another for investors' business."[34] In 1975, the Securities & Exchange Commission threw out the NYSE's "Rule 394" which had required that "most stock transactions take place on the Big Board's floor", in effect freeing up trading for electronic methods.[35] In 1976, banks were allowed to buy and sell stocks, which provided more competition for stockbrokers.[35] Reforms had the effect of lowering prices overall, making it easier for more people to participate in the stock market.[35] Broker commissions for each stock sale lessened, but volume increased.[34]

The Reagan years were marked by a renewed push for capitalism, business, with national efforts to de-regulate industries such as telecommunications and aviation. The economy resumed upward growth after a period in the early eighties of languishing. A report in the New York Times described that the flushness of money and growth during these years had spawned a drug culture of sorts, with a rampant acceptance of cocaine use although the overall percent of actual users was most likely small. A reporter wrote:

The Wall Street drug dealer looked like many other successful young female executives. Stylishly dressed and wearing designer sunglasses, she sat in her 1983 Chevrolet Camaro in a no-parking zone across the street from the Marine Midland Bank branch on lower Broadway. The customer in the passenger seat looked like a successful young businessman. But as the dealer slipped him a heat-sealed plastic envelope of cocaine and he passed her cash, the transaction was being watched through the sunroof of her car by Federal drug agents in a nearby building. And the customer - an undercover agent himself -was learning the ways, the wiles and the conventions of Wall Street's drug subculture. -- Peter Kerr in the New York Times, 1987.[36]

In 1987, the stock market plunged[17] and, in the relatively brief recession following, lower Manhattan lost 100,000 jobs according to one estimate.[37] Since telecommunications costs were coming down, banks and brokerage firms could move away from Wall Street to more affordable locations.[37] The recession of 1990–1991 were marked by office vacancy rates downtown which were "persistently high" and with some buildings "standing empty."[20] The day of the drop, October 20, was marked by "stony-faced traders whose sense of humor had abandoned them and in the exhaustion of stock exchange employees struggling to maintain orderly trading."[38] Ironically, it was the same year that Oliver Stone's movie Wall Street appeared. In 1995, city authorities offered the Lower Manhattan Revitalization Plan which offered incentives to convert commercial properties to residential use.[20]

Construction of the World Trade Center began in 1966 but had trouble attracting tenants when completed. Nonetheless, some substantial firms purchased space there. It's impressive height helped make it a visual landmark for drivers and pedestrians. In some respects, the nexus of the financial district moved from the street of Wall Street to Trade Center complex. Real estate growth during the latter part of the 1990s was significant, with deals and new projects happening in the financial district and elsewhere in Manhattan; one firm invested more than $24 billion in various projects, many in the Wall Street area.[39] In 1998, the NYSE and the city struck a $900 million deal which kept the NYSE from moving across the river to Jersey City; the deal was described as the "largest in city history to prevent a corporation from leaving town".[40] A competitor to the NYSE, NASDAQ, moved its headquarters from Washington to New York.[41]

Twenty-first century

In the first year of the new century, the Big Board, as some termed the NYSE, was described as the world's "largest and most prestigious stock market."[42] But when the World Trade Center was destroyed on September 11th, it left an architectural void as new developments since the 1970s had played off the complex aesthetically. The attacks "crippled" the communications network.[42] One estimate was that 45% of Wall Street's "best office space" had been lost.[17] The physical destruction was immense:

Debris littered some streets of the financial district. National Guard members in camouflage uniforms manned checkpoints. Abandoned coffee carts, glazed with dust from the collapse of the World Trade Center, lay on their sides across sidewalks. Most subway stations were closed, most lights were still off, most telephones did not work, and only a handful of people walked in the narrow canyons of Wall Street yesterday morning. -- Leslie Eaton and Kirk Johnson of the New York Times, September 16, 2001.[43]

Still, the NYSE was determined to re-open on September 17, almost a week after the attack.[43] The attack hastened a trend towards financial firms moving to midtown and contributed to the loss of business on Wall Street, due to temporary-to-permanent relocation to New Jersey and further decentralization with establishments transferred to cities like Chicago, Denver, and Boston.

After September 11, the financial services industry went through a downturn with a sizable drop in year-end bonuses of $6.5 billion, according to one estimate from a state comptroller's office.[44] Many brokers are paid mostly through commission, and get a token annual salary which is dwarfed by the year-end bonus.

To guard against a vehicular bombing in the area, authorities built concrete barriers, and found ways over time to make them more aesthetically appealing by spending $5000 to $8000 apiece on bollards:

To prevent a vehicle-delivered bomb from entering the area, Rogers Marvel designed a new kind of bollard, a faceted piece of sculpture whose broad, slanting surfaces offer people a place to sit in contrast to the typical bollard, which is supremely unsittable. The bollard, which is called the Nogo, looks a bit like one of Frank Gehry's unorthodox culture palaces, but it is hardly insensitive to its surroundings. Its bronze surfaces actually echo the grand doorways of Wall Street's temples of commerce. Pedestrians easily slip through groups of them as they make their way onto Wall Street from the area around historic Trinity Church. Cars, however, cannot pass. -- Blair Kamin in the Chicago Tribune, 2006[45]

Wall Street itself and the Financial District as a whole are crowded with highrises. Further, the loss of the World Trade Center has spurred development on a scale that hadn't been seen in decades. In 2006, Goldman Sachs began building a tower near the former Trade Center site.[25] Tax incentives provided by federal, state and local governments encouraged development. A new World Trade Center complex, centered on Daniel Liebeskind's Memory Foundations plan, is in the early stages of development and one building has already been replaced. The centerpiece to this plan is the 1,776-foot (541 m) tall 1 World Trade Center (formerly known as the Freedom Tower). New residential buildings are sprouting up, and buildings that were previously office space are being converted to residential units, also benefiting from tax incentives. A new Fulton Street Transit Center is planned to improve access. In 2007, the Maharishi Global Financial Capital of New York opened headquarters at 70 Broad Street near the NYSE, in an effort to seek investors.[46]

The Guardian reporter Andrew Clark described the years of 2006 to 2010 as "tumultous" in which the heartland of America is "mired in gloom" with high unemployment around 9.6%, with average house prices falling from $230,000 in 2006 to $183,000, and foreboding increases in the national debt to $13.4 trillion, but that despite the setbacks, the American economy was once more "bouncing back."[47] What had happened during these heady years? Clark wrote:

But the picture is too nuanced simply to dump all the responsibility on financiers. Most Wall Street banks didn't actually go around the US hawking dodgy mortgages; they bought and packaged loans from on-the-ground firms such as Countrywide Financial and New Century Financial, both of which hit a financial wall in the crisis. Foolishly and recklessly, the banks didn't look at these loans adequately, relying on flawed credit-rating agencies such as Standard & Poor's and Moody's, which blithely certified toxic mortgage-backed securities as solid... A few of those on Wall Street, including maverick hedge fund manager John Paulson and the top brass at Goldman Sachs, spotted what was going on and ruthlessly gambled on a crash. They made a fortune but turned into the crisis's pantomime villains. Most, though, got burned – the banks are still gradually running down portfolios of non-core loans worth $800bn. -- The Guardian reporter Andrew Clark, 2010.[47]

The first months of 2008 was a particularly troublesome period which caused Federal Reserve chairman Benjamin Bernanke to "work holidays and weekends" and which did an "extraordinary series of moves."[48] It bolstered U.S. banks and allowed Wall Street firms to borrow "directly from the Fed."[48] These efforts were highly controversial at the time, but from the perspective of 2010, it appeared the Federal exertions had been the right decisions. By 2010, Wall Street firms, in Clark's view, were "getting back to their old selves as engine rooms of wealth, prosperity and excess."[47] A report by Michael Stoler in The New York Sun described a "phoenix-like resurrection" of the area, with residential, commercial, retail and hotels booming in the "third largest business district in the country."[49] At the same time, the investment community was worried about proposed legal reforms, including the Wall Street Reform and Consumer Protection Act which dealt with matters such as credit card rates and lending requirements.[50] The NYSE closed two of its trading floors in a move towards transforming itself into an electronic exchange.[19] In September 2011, protesters disenchanted with the financial system protested in parks and plazas in lower Manhattan.[51]

Buildings: Physical layout

Wall Street's architecture is generally rooted in the Gilded Age, though there are also some art deco influences in the neighborhood. The layout of streets doesn't have the rectangular grid pattern typical of midtown Manhattan, but small streets "barely wide enough for a single lane of traffic are bordered on both sides by some of the tallest buildings in the city", according to one description, which creates "breathtaking artificial canyons" offering spectacular views in some instances.[20] Construction in such narrow steep areas has resulted in occasional accidents such as a crane collapse.[52] One report divided lower Manhattan into three basic districts:[20]

- The financial district proper—particularly along John Street

- South of the World Trade Center area—the handful of blocks south of the World Trade Center along Greenwich, Washington and West Streets

- Seaport district—characterized by century-old low-rise buildings and South Street Seaport; the seaport is "quiet, residential, and has an old world charm" according to one description.[20]

Landmark buildings on Wall Street include Federal Hall, 14 Wall Street (Bankers Trust Company Building), 40 Wall Street (The Trump Building) the New York Stock Exchange at the corner of Broad Street and the US headquarters of Deutsche Bank at 60 Wall Street. The Deutsche Bank building (formerly the J.P Morgan headquarters) is the last remaining major investment bank to still have its headquarters on Wall Street.

The older skyscrapers often were built with elaborate facades; such elaborate aesthetics haven't been common in corporate architecture for decades. The World Trade Center, built in the 1970s, was very plain and utilitarian in comparison (the Twin Towers were often criticized as looking like two big boxes, despite their impressive height). Excavation from the World Trade Center was later used by Battery Park City residential development as landfill.[17] 23 Wall Street was built in 1914 and was known as the "House of Morgan" and served for decades as the bank's headquarters and, by some accounts, was viewed as an important address in American finance.

A key anchor for the area is, of course, the New York Stock Exchange. City authorities realize its importance, and believed that it has "outgrown its neoclassical temple at the corner of Wall and Broad streets", and in 1998 offered substantial tax incentives to try to keep it in the financial district.[17] Plans to rebuild it were delayed by the events of 2001.[17] In 2011, the exchange still occupies the same site. The exchange is the locus for an impressive amount of technology and data. For example, to accommodate the three thousand persons who work directly on the Exchange floor requires 3,500 kilowatts of electricity, along with 8,000 phone circuits on the trading floor alone, and 200 miles of fiber-optic cable below ground.[43]

Personalities: players and deal-makers

Persons associated with Wall Street have become famous. Although their reputations are usually limited to members of the stock brokerage and banking communities, several have gained national and international fame. Some earned their fame for their investment strategies, financing, reporting, legal or regulatory skills, while others are remembered for their greed.[53] One of the most iconic representations of the market prosperity is the Charging Bull sculpture, by Arturo Di Modica. Representing the bull market economy, the sculpture was originally placed in front of the New York Stock Exchange, and subsequently moved to its current location in Bowling Green.

Wall Street's culture is often criticized as being rigid. This is a decades-old stereotype stemming from the Wall Street establishment's protection of its interests, and the link to the WASP establishment. More recent criticism has centered on structural problems and lack of a desire to change well-established habits. Wall Street's establishment resists government oversight and regulation. At the same time, New York City has a reputation as a very bureaucratic city, which makes entry into the neighborhood difficult or even impossible for middle class entrepreneurs. The ethnic background of Wall Streeters remains largely unchanged since the days of the railway barons of the early 20th century, as documented by their portraits in the Wall+Broad chapter of The Corners Project[53]

Several well known Wall Street individuals include John Meriwether, John Briggs, Michael Bloomberg, and Warren Buffett (All affiliated at one time or another with the firm Salomon Brothers), as well as Bernie Madoff, and numerous others.

Many talented financiers and bankers worked for Wasserstein Perella & Co. during the 1980s.

The now defunct investment bank of Donaldson, Lufkin & Jenrette had numerous talented people working there including people such as William Donaldson who served in the Nixon administration, as well as Ken Moelis, Bennett Goodman, Herald "Hal" Ritch, Joel Cohen, Safra A. Catz who became president of Oracle Corporation, Tom Dean, Larry Schloss, Michael Connelly, and others.[54]

Wall Street as a financial center

Wall Street in the New York economy

Finance professor Charles R. Geisst wrote that the exchange has become "inextricably intertwined into New York's economy".[42] Wall Street pay, in terms of salaries and bonuses and taxes, is an important part of the economy of New York City, the tri-state metropolitan area, and the United States. In 2008, after a downturn in the stock market, the decline meant $18 billion less in taxable income, with less money available for "apartments, furniture, cars, clothing and services".[44] A falloff in Wall Street's economy could have "wrenching effects on the local and regional economies".[44]

Estimates vary about the number and quality of financial jobs in the city. One estimate was that Wall Street firms employed close to 200,000 persons in 2008.[44] Another estimate was that in 2007, the financial services industry which had a $70 billion profit became 22 percent of the city's revenue.[55] Another estimate (in 2006) was that the financial services industry makes up 9% of the city's work force and 31% of the tax base.[56] An additional estimate (2007) from Steve Malanga of the Manhattan Institute was that the securities industry accounts for 4.7 percent of the jobs in New York City but 20.7 percent of its wages, and he estimated there were 175,000 securities-industries jobs in New York (both Wall Street area and midtown) paying an average of $350,000 annually.[19] Between 1995 and 2005, the sector grew at an annual rate of about 6.6% annually, a respectable rate, but that other financial centers were growing faster.[19] Another estimate (2008) was that Wall Street provided a fourth of all personal income earned in the city, and 10% of New York City's tax revenue.[57]

The seven largest Wall Street firms in the first decade of the 21st century were Bear Stearns, JPMorgan Chase, Citigroup Incorporated, Goldman Sachs, Morgan Stanley, Merrill Lynch and Lehman Brothers.[44] During the recession of 2008–2010, many of these firms went out of business or were bought up at firesale prices by other financial firms. In 2008, Lehman filed for bankruptcy,[47] Bear Stearns was bought up by JP Morgan Chase[47] with blessing by the U.S. government,[48] and Merrill Lynch was bought up by Bank of America. These failures marked a catastrophic downsizing of Wall Street as the financial industry goes through restructuring and change. Since New York's financial industry provides almost one-fourth of all income produced in the city, and accounts for 10% of the city's tax revenues and 20% of the state's, the downturn has had huge repercussions for government treasuries.[44] New York's mayor Michael Bloomberg reportedly over a four year period dangled over $100 million in tax incentives to persuade Goldman Sachs to build a 43-story headquarters in the financial district near the destroyed World Trade Center site.[55] In 2009, things looked somewhat gloomy, with one analysis by the Boston Consulting Group suggesting that 65,000 jobs had been permanently lost because of the downturn.[58] But there were signs that Manhattan property prices were rebounding with price rises of 9% annually in 2010, and bonuses were being paid once more, with average bonuses over $124,000 in 2010.[47] The U.S. banking industry employes 1.86 million people and earned profits of $22 billion in the second quarter of 2010, up substantially from previous quarters.[47]

Wall Street versus Midtown Manhattan

A requirement of the New York Stock Exchange was that brokerage firms had to have offices "clustered around Wall Street" so clerks could deliver physical paper copies of stock certificates each week.[17] There were some indications that midtown had been becoming the locus of financial services dealings even by 1911.[59] But as technology progressed, in the middle and later decades of the 20th century, computers and telecommunications replaced paper notifications, meaning that the close proximity requirement could be bypassed in more situations.[17] Many financial firms found that they could move to midtown Manhattan four miles away[20] or elsewhere and still operate effectively. For example, the former investment firm of Donaldson, Lufkin & Jenrette was described as a Wall Street firm but had its headquarters on Park Avenue in midtown.[54] A report described the migration from Wall Street:

The financial industry has been slowly migrating from its historic home in the warren of streets around Wall Street to the more spacious and glamorous office towers of Midtown Manhattan. Morgan Stanley, J.P. Morgan Chase, Citigroup, and Bear Stearns have all moved north. -- USA Today, October 2001.[17]

Nevertheless, a key magnet for the Wall Street remains the New York Stock Exchange. Some "old guard" firms such as Goldman Sachs and Merrill Lynch (bought by Bank of America in 2009), have remained "fiercely loyal to the financial district" location, and new ones such as Deutsche Bank have chosen office space in the district.[17] So-called "face–to–face" trading between buyers and sellers remains a "cornerstone" of the NYSE, with a benefit of having all of a deal's players close at hand, including investment bankers, lawyers, and accountants.[17]

In 2011, the Manhattan Financial District is one of the largest business districts in the United States, and second in New York City only to Midtown in terms of dollar volume of business transacted.

Wall Street as a neighborhood

During most of the 20th century, Wall Street was a business community with practically only offices which emptied out at night. A report in the New York Times in 1961 described a "deathlike stillness that settles on the district after 5:30 and all day Saturday and Sunday."[20] But there has been a change towards greater residential use of the area, pushed forwards by technological changes and shifting market conditions. The general pattern is for several hundred thousand workers to commute into the area during the day, sometimes by sharing a taxicab[60] from other parts of the city as well as from New Jersey and Long Island, and then leave at night. In 1970, only 833 people lived "south of Chambers Street"; by 1990; 13,782 people were residents with the addition of areas such as Battery Park City[17] and Southbridge Towers.[37] Battery Park City was built on 92 acres of landfill, and 3,000 people moved there beginning about 1982, but by 1986 there was evidence of more shops and stores and a park, along with plans for more residential development.[61]

According to one description in 1996, "The area dies at night ... It needs a neighborhood, a community."[37] During the past two decades there has been a shift towards greater residential living areas in the Wall Street area, with incentives from city authorities in some instances.[17] Many empty office buildings have been converted to lofts and apartments; for example, the office building where Harry Sinclair, the oil magnate involved with the Teapot Dome scandal, was converted to a co-op in 1979.[37] In 1996, a fifth of buildings and warehouses were empty, and many were converted to living areas.[37] Some conversions met with problems, such as aging gargoyles on building exteriors having to be expensively restored to meet with current building codes.[37] Residents in the area have sought to have a supermarket, a movie theater, a pharmacy, more schools, and a "good diner".[37] The discount retailer named Job Lot used to be located at the World Trade Center but moved to Church Street; merchants bought extra unsold items at steep prices and sold them as a discount to consumers and shoppers included "thrifty homemakers and browsing retirees" who "rubbed elbows with City Hall workers and Wall Street executives"; but the firm went bust in 1993.[44] There were reports that the number of residents increased by 60% during the 1990s to about 25,000[17] although a second estimate (based on the 2000 census based on a different map) places the residential (nighttime and weekend) population in 2000 at 12,042.[20] By 2001, there were several grocery stores, dry cleaners, and two grade schools and a top high school.[17] There is a barber shop across from the New York Stock Exchange which has been there a long time.[62] By 2001, there were more signs of dogwalkers at night and a 24-hour neighborhood, although the general pattern of crowds during the working hours and emptiness at night was still apparent.[20] There were ten hotels and thirteen museums by 2001.[20] Stuyvesant High School moved to its present location near Battery Park City in 1992 and has been described as one of the nation's premier high schools with emphasis on science and mathematics.[20] In 2007, the French fashion retailer Hermès opened a store in the financial district to sell items such as a "$4,700 custom-made leather dressage saddle or a $47,000 limited edition alligator briefcase."[63] Some streets have been designated as pedestrian–only with vehicular traffic prohibited at some times.[63] There are reports of panhandlers like elsewhere in the city.[64] By 2010, the residential population had increased to 24,400 residents[65] with crime statistics showing no murders in 2010.[65] The area is growing with luxury high-end apartments and upscale retailers.[49]

Wall Street as a tourist destination

Wall Street is a major location of tourism in New York City. One report described lower Manhattan as "swarming with camera-carrying tourists".[66] Tour guides highlight places such as Trinity Church, the Federal Reserve gold vaults 80 feet below street level (worth $100 billion), and the NYSE.[67] A Scoundrels of Wall Street Tour is a walking historical tour which includes a museum visit and discussion of various financiers "who were adept at finding ways around finance laws or loopholes through them".[68] Occasionally artists make impromptu performances; for example, in 2010, a troupe of 22 dancers "contort their bodies and cram themselves into the nooks and crannies of the Financial District in Bodies in Urban Spaces" choreographed by Willi Donner.[69] One chief attraction, the Federal Reserve Building in lower Manhattan, paid $750,000 to open a visitors' gallery in 1997.[70] The New York Stock Exchange and the American Stock Exchange also spent money in the late 1990s to upgrade facilities for visitors.[70] Attractions include the gold vault beneath the Federal Reserve and that "staring down at the trading floor was as exciting as going to the Statue of Liberty."[70]

Wall Street versus Main Street

As a figure of speech contrasted to "Main Street", the term "Wall Street" can refer to big business interests against those of small business and the working of middle class. It is sometimes used more specifically to refer to research analysts, shareholders, and financial institutions such as investment banks. Whereas "Main Street" conjures up images of locally owned businesses and banks, the phrase "Wall Street" is commonly used interchangeably with the phrase "Corporate America". It is also sometimes used in contrast to distinguish between the interests, culture, and lifestyles of investment banks and those of Fortune 500 industrial or service corporations.

Wall Street in the public imagination

Wall Street in a conceptual sense represents financial and economic power. To Americans, it can sometimes represent elitism and power politics, and its role has been a source of controversy throughout the nation's history, particularly beginning around the Gilded Age period in the late 19th century. Wall Street became the symbol of a country and economic system that many Americans see as having developed through trade, capitalism, and innovation.[71]

Wall Street has become synonymous with financial interests, often used negatively.[72] During the mortgage mess from 2007–2010, Wall Street financing was blamed as one of the causes, although most commentators blame an interplay of factors. The U.S. government with the Troubled Asset Relief Program bailed out the banks and financial backers with billions of dollars, but the bailout was often criticized as politically motivated,[72] and was criticized by journalists as well as the public. Analyst Robert Kuttner in the Huffington Post criticized the bailout as helping large Wall Street firms such as Citigroup while neglecting to help smaller community development banks such as Chicago's ShoreBank.[72] One writer in the Huffington Post looked at FBI statistics on robbery, fraud, and crime and concluded that Wall Street was the "most dangerous neighborhood in the United States" if one factored in the $50 billion fraud perpetrated by Bernie Madoff.[23] When large firms such as Enron, WorldCom and Global Crossing were found guilty of fraud, Wall Street was often blamed,[31] even though these firms had headquarters around the nation and not in Wall Street. Many complained that the resulting Sarbanes-Oxley legislation dampened the business climate with regulations that were "overly burdensome."[73] Interest groups seeking favor with Washington lawmakers, such as car dealers, have often sought to portray their interests as allied with Main Street rather than Wall Street, although analyst Peter Overby on National Public Radio suggested that car dealers have written over $250 billion in consumer loans and have real ties with Wall Street.[74] When the United States Treasury bailed out large financial firms, to ostensibly halt a downward spiral in the nation's economy, there was tremendous negative political fallout, particularly when reports came out that monies supposed to be used to ease credit restrictions were being used to pay bonuses to highly-paid employees.[61] Analyst William D. Cohan argued that it was "obscene" how Wall Street reaped "massive profits and bonuses in 2009" after being saved by "trillions of dollars of American taxpayers' treasure" despite Wall Street's "greed and irresponsible risk-taking."[75] Washington Post reporter Suzanne McGee called for Wall Street to make a sort of public apology to the nation, and expressed dismay that people such as Goldman Sachs chief executive Lloyd Blankfein hadn't expressed contrition despite being sued by the SEC in 2009.[76] McGee wrote that "Bankers aren't the sole culprits, but their too-glib denials of responsibility and the occasional vague and waffling expression of regret don't go far enough to deflect anger."[76]

But chief banking analyst at Goldman Sachs, Richard Ramsden, is "unapologetic" and sees "banks as the dynamos that power the rest of the economy."[47] Ramsden believes "risk-taking is vital" and said in 2010:

You can construct a banking system in which no bank will ever fail, in which there's no leverage. But there would be a cost. There would be virtually no economic growth because there would be no credit creation. -- Richard Ramsden of Goldman Sachs, 2010.[47]

Others in the financial industry believe they've been unfairly castigated by the public and by politicians. For example, Anthony Scaramucci reportedly told President Barack Obama in 2010 that he felt like a piñata, "whacked with a stick" by "hostile politicians".[47]

The financial misdeeds of various figures throughout American history sometimes casts a dark shadow on financial investing as a whole, and include names such as William Duer, Jim Fisk and Jay Gould (the latter two believed to have been involved with an effort to collapse the U.S. gold market in 1869) as well as modern figures such as Bernard Madoff who "bilked billions from investors".[68]

In addition, images of Wall Street and its figures have loomed large. The 1987 Oliver Stone film Wall Street created the iconic figure of Gordon Gekko who used the phrase "greed is good", which caught on in the cultural parlance.[77] According to one account, the Gekko character was a "straight lift" from the real world junk-bond dealer Michael Milkin,[31] who later pled guilty to felony charges for violating securities laws. Stone commented in 2009 how the movie had had an unexpected cultural influence, not causing them to turn away from corporate greed, but causing many young people to choose Wall Street careers because of that movie.[77] A reporter repeated other lines from the film:

I’m talking about liquid. Rich enough to have your own jet. Rich enough not to waste time. Fifty, a hundred million dollars, Buddy. A player. -- lines from the script of Wall Street[77]

Wall Street firms have however also contributed to projects such as Habitat for Humanity as well as done food programs in Haiti and trauma centers in Sudan and rescue boats during floods in Bangladesh.[78]

Wall Street in popular culture

- Herman Melville's classic short story Bartleby, the Scrivener is subtitled A Story of Wall Street and provides an excellent portrayal of a kind and wealthy lawyer's struggle to reason with that which is unreasonable as he is pushed beyond his comfort zone to "feel" something real for humanity.

- In William Faulkner's novel The Sound and the Fury, Jason Compson hits on other perceptions of Wall Street: after finding some of his stocks are doing poorly, he blames "the Jews."

- The film Die Hard with a Vengeance has a plot involving thieves breaking into the Federal Reserve Bank of New York and stealing most of the gold bullion stored underground by driving dump trucks through a nearby Wall Street subway station.

- Many events of Tom Wolfe's Bonfire of the Vanities center on Wall Street and its culture.

- On January 26, 2000, the band Rage Against The Machine filmed the music video for "Sleep Now in the Fire" on Wall Street, which was directed by Michael Moore. The band at one point stormed the Stock Exchange, causing the doors of the Exchange to be closed early (2:52 P.M.). Trading on the Exchange floor, however, continued uninterrupted.[79][80]

- The 1987 film Wall Street and its 2010 sequel exemplify many popular conceptions of Wall Street, being a tale of shady corporate dealings and insider trading.[81]

- "Wallstreet Kingdom" is a controversial fashion brand promoting capitalism and bonuses on Wall Street.

- In the film National Treasure a clue to finding the Templar Treasure leads the main characters to Wall Street's Trinity Church.

- TNA Wrestler Robert Roode is billed from "Wall Street in Manhattan, New York."

- Bret Easton Ellis's novel American Psycho follows the day-to-day life of Wall Street investment banker and serial killer Patrick Bateman.

- In the video game Grand Theft Auto IV in the fictional Liberty City Wall Street is a district dubbed The Exchange.

- Battles 2011 album Gloss Drop contains a song titled "Wall Street."

Competitors to Wall Street

During much of the 20th century, the United States and its financial capital of New York City were the leaders. But over the past few decades, with the rise of a multipolar world with new regional powers and global capitalism, numerous financial centers have challenged Wall Street's predominance, particularly from Asia which some analysts believe will be the focus of new worldwide growth.[82] New York still has strengths in having a "concentration of finance professionals" -- prime brokers, large banks, traders, lawyers, accountants, and private bankers.[19] One analyst suggested the prime factors for success as a financial city were three:

- a pool of money to lend or invest

- a decent legal framework

- high-quality human resources[73]

- London. Reports suggest that the City of London has overtaken New York as a financial capital[83] with better regulation. London's merger volume was higher than New York's by $79 billion in 2005 and equity issuance was $130 billion versus $105 billion in the United States.[54] Companies seeking to list their stocks have started going to London before New York.[56] There is a perception that "regulatory scrutiny is more burdensome in the United States than in London"[19][56] and which has a "transparent and reliable legal system."[84] One report was that London's location between Asia and the U.S. meant that it was often suitable in terms of time zones.[84] With multinationals sending their employees there; one estimate was there were 224,000 Americans in Britain in 2008.[85]

- Shanghai. Official efforts have been directed to making Pudong a financial leader by 2010.[86] Efforts during the 1990s were mixed, but in the early 21st century, Shanghai gained ground. Factors such as a "protective banking sector" and a "highly restricted capital market" have held the city back, according to one analysis in 2009 in China Daily.[87] Shanghai has done well in terms of market capitalization but it needs to "attract an army of money managers, lawyers, accountants, actuaries, brokers and other professionals, Chinese and foreign," to enable it to compete with New York and London.[88] China is generating tremendous new capital, which makes it easier to stage initial public offerings of state-owned companies in places like Shanghai.[19]

- Hong Kong. In 2010, the Hong Kong Stock Exchange raised nearly $53 billion for initial public offerings, compared with only $42 billion for the U.S. and $16 billion (£10 billion) in London.[56][89] Hong Kong was the site of the world's largest I.P.O. in 2006 of the $19.1 billion Industrial and Commercial Bank of China.[19] Hedge funds are doing well in Hong Kong with increased growth from 2006 to 2010.[89] One estimate in 2009 was that the Hong Kong stock market was the world's seventh largest and noted that 70 percent of the world's 100 largest banks were based in the city.[90]

- Tokyo. One report suggests that Japanese authorities are working on plans to transform Tokyo but have met with mixed success, noting that "initial drafts suggest that Japan’s economic specialists are having trouble figuring out the secret of the Western financial centers’ success."[91] Efforts include more English-speaking restaurants and services and earthquake-resistant offices, but that have neglected more powerful stimuli such as lower taxes and a deep-seated aversion to finance.[91]

- Singapore. This city was mentioned as a competitor given its proximity to Asian markets.[84]

- Chicago. The Illinois city has the "world’s largest derivatives market" when the Chicago Mercantile Exchange and the Chicago Board of Trade merged in 2007.[56]

- Dubai. This city has been mentioned as a competitor as well.[19]

- Others. Cities such as São Paulo and Johannesburg and other "would-be hubs" lack liquidity and the "skills base," according to one source.[73] Financial industries in countries and regions such as the Indian subcontinent, Korea and Malaysia require not only well-trained people but the "whole institutional infrastructure of laws, regulations, contracts, trust and disclosure" which takes time to happen.[73]

New York Times analyst Daniel Gross wrote:

In today’s burgeoning and increasingly integrated global financial markets — a vast, neural spaghetti of wires, Web sites and trading platforms — the N.Y.S.E. is clearly no longer the epicenter. Nor is New York. The largest mutual-fund complexes are in Valley Forge, Pa., Los Angeles and Boston, while trading and money management are spreading globally. Since the end of the cold war, vast pools of capital have been forming overseas, in the Swiss bank accounts of Russian oligarchs, in the Shanghai vaults of Chinese manufacturing magnates and in the coffers of funds controlled by governments in Singapore, Russia, Dubai, Qatar and Saudi Arabia that may amount to some $2.5 trillion. -- Daniel Gross in 2007[19]

An example is the alternative trading platform known as BATS based in Kansas City which came "out of nowhere to gain a 9 percent share in the market for trading United States stocks."[19] The firm has computers in New Jersey, two salespersons in New York City, but the remaining 33 employees work in a center in Missouri.[19]

Transportation

Wall Street being historically a commuter destination, much transportation infrastructure has been developed to serve it. Today, Pier 11 at the foot of the street is a busy terminal for New York Waterway and other ferries. The New York City Subway has three stations under Wall Street:

- Wall Street (IRT Broadway – Seventh Avenue Line) at William Street (2 and 3 trains)

- Wall Street (IRT Lexington Avenue Line) at Broadway (4 and 5 trains)

- Broad Street (BMT Nassau Street Line) at Broad Street (J and Z trains)

Motor traffic, particularly during working hours, is often congested but driving late at night and on weekends can be easier. The roads are not arranged according to midtown's distinctive rectangular grid pattern with staggered lights, but have small often one-lane roads with numerous stoplights and stop signs. A highway runs along the East River and the Downtown Manhattan Heliport serves Wall Street.

See also

- Wall Street Historic District (New York, New York)

- Global settlement (2002)

- Economy of New York City

- Hard Hat Riot

- Bay Street

- City of London

- List of financial districts

- Occupy Wall Street

References

- ^ Profile of Manhattan Community Board 1, retrieved July 17, 2007.

- ^ Merriam-Webster Online, retrieved July 17, 2007.

- ^ World-exchanges.org

- ^ "The World's Most Expensive Real Estate Markets". CNBC. Retrieved May 31, 2010.

- ^ The Best 301 Business Schools 2010 by Princeton Review, Nedda Gilbert. Retrieved May 31, 2010.

- ^ "New York Eclipses London as Financial Center in Bloomberg Poll". Bloomberg News. Retrieved March 30, 2011.

- ^ "The Tax Capital of the World". The Wall Street Journal. April 11, 2009. Retrieved May 31, 2010.

- ^ "JustOneMinute – Editorializing From The Financial Capital Of The World". Retrieved May 31, 2010.

- ^ "London may have the IPOs..." Marketwatch. Retrieved May 31, 2010.

- ^ "Fondos – Londres versus Nueva York" (PDF). Cinco Dias. Retrieved May 31, 2010.

- ^ The street on the map of Nieuw-Amsterdam

- ^ a b "Walloons and Wallets". the loc.gov. 2009-03. Retrieved 2010-09-24.

{{cite news}}: Check date values in:|date=(help) - ^ [The History of New York State, Book II, Chapter II, Part IV.] Editor, Dr. James Sullivan, Online Edition by Holice, Deb & Pam. Retrieved August 20, 2006.

- ^ White New Yorkers in Slave Times New-York Historical Society. Retrieved August 20, 2006. (PDF)

- ^ a b Timeline: A selected Wall Street chronology PBS Online. Retrieved 2011-08-08. Cite error: The named reference "timeline" was defined multiple times with different content (see the help page).

- ^ a b c d e Charles R. Geisst (1997). "Wall Street: a history : from its beginnings to the fall of Enron". Oxford University Press. ISBN 0-19-511512-0. Retrieved January 19, 2010.

{{cite news}}: Italic or bold markup not allowed in:|publisher=(help) - ^ a b c d e f g h i j k l m n o p q Noelle Knox and Martha T. Moor (October 24, 2001). "'Wall Street' migrates to Midtown". USA Today. Retrieved January 14, 2010.

{{cite news}}: Italic or bold markup not allowed in:|publisher=(help) - ^ Today in History: January 4 – The New York Stock Exchange The Library of Congress. Retrieved 2011-08-08.

- ^ a b c d e f g h i j k l m n o p q r Daniel Gross (October 14, 2007). "The Capital of Capital No More?". The New York Times: Magazine. Retrieved January 15, 2011.

{{cite news}}: Italic or bold markup not allowed in:|publisher=(help) - ^ a b c d e f g h i j k l m Aaron Donovan (September 9, 2001). "If You're Thinking of Living In/The Financial District; In Wall Street's Canyons, Cliff Dwellers". The New York Times: Real Estate. Retrieved January 14, 2010.

{{cite news}}: Italic or bold markup not allowed in:|publisher=(help) - ^ a b c d "Description - Dow Jones Industrial Average Index". MarketVolume. January 19, 2010. Retrieved January 19, 2010.

{{cite news}}: Italic or bold markup not allowed in:|publisher=(help) - ^ DOW JONES HISTORY – THE LATE 1800s 2006 Dow Jones & Company, Inc. Retrieved August 19, 2006.

- ^ a b "WALL STREET CLERKS FIGHT NEW STOCK TAX; Employes in Financial District, Including Waiters and Elevator Men, Enlisted in Movement". The New York Times. March 6, 1913. Retrieved January 14, 2010.

{{cite news}}: Italic or bold markup not allowed in:|publisher=(help) Cite error: The named reference "twsJanN213" was defined multiple times with different content (see the help page). - ^ "TO CLEAR BACK YARD OF WALL ST. DISTRICT; Bowling Green Neighborhood Association Reports Progress in Lower Manhattan. CITY OFFICIALS GIVE AID Work Said to be Experiment Offering Great Promise for a Community Plan". The New York Times. May 14, 1916. Retrieved January 14, 2010.

{{cite news}}: Italic or bold markup not allowed in:|publisher=(help) - ^ a b "Better than flying: Despite the attack on the twin towers, plenty of skyscrapers are rising. They are taller and more daring than ever, but still mostly monuments to magnificence". The Economist. Jun 1st 2006. Retrieved 2011-01-15.

{{cite news}}: Check date values in:|date=(help); Italic or bold markup not allowed in:|publisher=(help) - ^ "WALL STREET P.O. BRANCH.; Postmaster General Yields to Request of Financial District". The New York Times. March 14, 1905. Retrieved January 15, 2011.

{{cite news}}: Italic or bold markup not allowed in:|publisher=(help) - ^ "SHOW GIRLS MAKE WALL STREET RAID; They Invade Financial District and Sell Tickets for Soldiers' Relief. BROKERS HARD TO CATCH Party Welcomed at Morgan Offices, but No Sales Were Made There". The New York Times. July 27, 1916. Retrieved January 15, 2011.

{{cite news}}: Italic or bold markup not allowed in:|publisher=(help) - ^ Beverly Gage, The Day Wall Street Exploded: A Story of America in its First Age of Terror. New York: Oxford University Press, 2009; pp. 160-161.

- ^ "WALL STREET NIGHT TURNED INTO DAY". The New York Times. September 17, 1920. Retrieved January 14, 2010.

{{cite news}}: Italic or bold markup not allowed in:|publisher=(help) - ^ "DETECTIVES GUARD WALL ST. AGAINST NEW BOMB OUTRAGE; Entire Financial District Patrolled Following AnonymousWarning to a Broker". The New York Times. December 19, 1921. Retrieved January 15, 2011.

{{cite news}}: Italic or bold markup not allowed in:|publisher=(help) - ^ a b c d e Larry Elliott (reviewer) Steve Fraser (author) (book:) Wall Street: A cultural History (by Fraser) (May 21, 2005). "Going for brokers: Steve Fraser charts the highs and the lows of the world's financial capital in Wall Stree". The Guardian. Retrieved January 15, 2011.

{{cite news}}:|author=has generic name (help); Italic or bold markup not allowed in:|publisher=(help) - ^ a b c "STOCK MARKET MARGINS: The Federal Reserve v. Wall Street". Time Magazine. Aug. 08, 1960. Retrieved 2011-01-15.

{{cite news}}: Check date values in:|date=(help); Italic or bold markup not allowed in:|publisher=(help) - ^ "Wall Street: Bob Cratchit Hours". Time Magazine. Aug. 18, 1967. Retrieved 2011-01-15.

{{cite news}}: Check date values in:|date=(help); Italic or bold markup not allowed in:|publisher=(help) - ^ a b c "WALL STREET: Help for Broke Brokers". Time Magazine. Sep. 24, 1973. Retrieved 2011-01-15.

{{cite news}}: Check date values in:|date=(help); Italic or bold markup not allowed in:|publisher=(help) - ^ a b c "WALL STREET: Banks As Brokers". Time Magazine. Aug. 30, 1976. Retrieved 2011-01-15.

{{cite news}}: Check date values in:|date=(help); Italic or bold markup not allowed in:|publisher=(help) - ^ Peter Kerr (April 18, 1987). "AGENTS TELL OF DRUG'S GRIP ON WALL STREET". The New York Times. Retrieved January 15, 2011.

{{cite news}}: Italic or bold markup not allowed in:|publisher=(help) - ^ a b c d e f g h Michael Cooper (January 28, 1996). "NEW YORKERS & CO.: The Ghosts of Teapot Dome;Fabled Wall Street Offices Are Now Apartments, but Do Not Yet a Neighborhood Make". The New York Times. Retrieved January 14, 2010.

{{cite news}}: Italic or bold markup not allowed in:|publisher=(help) - ^ Alison Leigh Cowan (October 20, 1987). "THE MARKET PLUNGE; Day to Remember In Financial District". The New York Times. Retrieved January 14, 2010.

{{cite news}}: Italic or bold markup not allowed in:|publisher=(help) - ^ Laura M. Holson and Charles V. Bagli (November 1, 1998). "Lending Without a Net; With Wall Street as Its Banker, Real Estate Feels the World's Woes". The New York Times. Retrieved January 15, 2011.

{{cite news}}: Italic or bold markup not allowed in:|publisher=(help) - ^ Charles V. Bagli (December 23, 1998). "City and State Agree to $900 Million Deal to Keep New York Stock Exchange". The New York Times. Retrieved January 15, 2011.

{{cite news}}: Italic or bold markup not allowed in:|publisher=(help) - ^ Charles V. Bagli (May 7, 1998). "N.A.S.D. Ponders Move to New York City". The New York Times. Retrieved January 15, 2011.

{{cite news}}: Italic or bold markup not allowed in:|publisher=(help) - ^ a b c Alex Berenson (October 12, 2001). "A NATION CHALLENGED: THE EXCHANGE; Feeling Vulnerable At Heart of Wall St". The New York Times: Business Day. Retrieved January 15, 2011.

{{cite news}}: Italic or bold markup not allowed in:|publisher=(help) - ^ a b c Leslie Eaton and Kirk Johnson (September 16, 2001). "AFTER THE ATTACKS: WALL STREET; STRAINING TO RING THE OPENING BELL -- AFTER THE ATTACKS: WALL STREET". The New York Times. Retrieved January 15, 2011.

{{cite news}}: Italic or bold markup not allowed in:|publisher=(help) - ^ a b c d e f g Patrick McGeehan (July 26, 2008). "City and State Brace for Drop in Wall Street Pay". The New York Times. Retrieved January 14, 2010.

{{cite news}}: Italic or bold markup not allowed in:|publisher=(help) Cite error: The named reference "twsJanN214" was defined multiple times with different content (see the help page). - ^ Blair Kamin (September 9, 2006). "How Wall Street became secure, and welcoming". Chicago Tribune. Retrieved January 14, 2010.

{{cite news}}: Italic or bold markup not allowed in:|publisher=(help) - ^ MARIA ASPAN (July 2, 2007). "Maharishi's Minions Come to Wall Street". The New York Times. Retrieved January 15, 2011.

{{cite news}}: Italic or bold markup not allowed in:|publisher=(help) - ^ a b c d e f g h i j Andrew Clark (October 7, 2010). "Farewell to Wall Street: After four years as US business correspondent, Andrew Clark is heading home. He recalls the extraordinary events that nearly bankrupted America – and how it's bouncing back". The Guardian. Retrieved January 15, 2011.

{{cite news}}: Italic or bold markup not allowed in:|publisher=(help) - ^ a b c Steve Inskeep and Jim Zarroli (March 17, 2008). "Federal Reserve Bolsters Wall Street Banks". NPR. Retrieved January 15, 2011.

{{cite news}}: Italic or bold markup not allowed in:|publisher=(help) - ^ a b Michael Stoler (June 28, 2007). "Refashioned: Financial District Is Booming With Business". New York Sun. Retrieved January 15, 2011.

{{cite news}}: Italic or bold markup not allowed in:|publisher=(help) - ^ Jill Jackson (June 25, 2010). "Wall Street Reform: A Summary of What's In the Bill". CBS News. Retrieved January 15, 2011.

{{cite news}}: Italic or bold markup not allowed in:|publisher=(help) - ^ COLIN MOYNIHAN (September 17, 2011). "Wall Street Protest Begins, With Demonstrators Blocked". The New York Times. Retrieved September 16, 2011.

Throughout the afternoon hundreds of demonstrators gathered in parks and plazas in Lower Manhattan. They held teach-ins, engaged in discussion and debate and waved signs with messages like "Democracy Not Corporatization" or "Revoke Corporate Personhood."

{{cite news}}: Italic or bold markup not allowed in:|publisher=(help) - ^ Sarah Wheaton and Ravi Somaiya (March 27, 2010). "Crane Falls Against Financial District Building". The New York Times. Retrieved January 14, 2010.

{{cite news}}: Italic or bold markup not allowed in:|publisher=(help) - ^ a b John Steele Gordon "Wall Street's 10 Most Notorious Stock Traders," American Heritage, Spring 2009. Cite error: The named reference "test" was defined multiple times with different content (see the help page).

- ^ a b c Heidi N. Moore (March 10, 2008). "DLJ: Wall Street's Incubator". The Wall Street Journal. Retrieved January 14, 2010.

{{cite news}}: Italic or bold markup not allowed in:|publisher=(help) - ^ a b Patrick McGeehan (February 22, 2009). "After Reversal of Fortunes, City Takes a New Look at Wall Street". The New York Times. Retrieved January 15, 2011.

{{cite news}}: Italic or bold markup not allowed in:|publisher=(help) - ^ a b c d e Heather Timmons (October 27, 2006). "New York Isn't the World's Undisputed Financial Capital". The New York Times. Retrieved January 15, 2011.

{{cite news}}: Italic or bold markup not allowed in:|publisher=(help) - ^ Patrick McGeehan (September 12, 2008). "As Financial Empires Shake, City Feels No. 2 on Its Heels". The New York Times. Retrieved January 15, 2011.

{{cite news}}: Italic or bold markup not allowed in:|publisher=(help) - ^ Patrick McGeehan (February 22, 2009). "After Reversal of Fortunes, City Takes a New Look at Wall Street". The New York Times. Retrieved January 15, 2011.

{{cite news}}: Italic or bold markup not allowed in:|publisher=(help) - ^ "WALL STREET BANKS CONNECTING UPTOWN; Financial District Notes This as American Exchange National Buys Into the Pacific". The New York Times. May 27, 1911. Retrieved January 14, 2010.

{{cite news}}: Italic or bold markup not allowed in:|publisher=(help) - ^ Michael M. Grynbaum (June 18, 2009). "Stand That Blazed Cab-Sharing Path Has Etiquette All Its Own". The New York Times. Retrieved January 14, 2010.

{{cite news}}: Italic or bold markup not allowed in:|publisher=(help) - ^ a b Michael deCourcy Hinds (March 23, 1986). "SHAPING A LANDFILL INTO A NEIGHBORHOOD". The New York Times: Real Estate. Retrieved January 14, 2010.

{{cite news}}: Italic or bold markup not allowed in:|publisher=(help) Cite error: The named reference "twsJanN313" was defined multiple times with different content (see the help page). - ^ Simon Doolittle (February 27, 2009). "A Beer and a Haircut on Wall Street". The New York Times. Retrieved January 14, 2010.

{{cite news}}: Italic or bold markup not allowed in:|publisher=(help) - ^ a b Claire Wilson (July 29, 2007). "Hermès Tempts the Men of Wall Street". The New York Times: Real Estate. Retrieved January 14, 2010.

{{cite news}}: Italic or bold markup not allowed in:|publisher=(help) - ^ Patty Stonesifer and Sandy Stonesifer (Jan. 23, 2009). "Sister, Can You Spare a Dime? I don't give to my neighborhood panhandlers. Should I?". Slate. Retrieved 2010-01-14.

{{cite news}}: Check date values in:|date=(help); Italic or bold markup not allowed in:|publisher=(help) - ^ a b Sushil Cheema (MAY 29, 2010). "Financial District Rallies as Residential Area". Wall Street Journal. Retrieved 2010-01-14.

{{cite news}}: Check date values in:|date=(help); Italic or bold markup not allowed in:|publisher=(help) - ^ David M. Halbfinger (August 27, 1997). "New York's Financial District Is a Must-See Tourist Destination". The New York Times. Retrieved January 15, 2011.

{{cite news}}: Italic or bold markup not allowed in:|publisher=(help) - ^ LIsa W. Foderaro (June 20, 1997). "A Financial District Tour". The New York Times. Retrieved January 15, 2011.

{{cite news}}: Italic or bold markup not allowed in:|publisher=(help) - ^ a b T.L. Chancellor (January 14, 2010). "Walking Tours of NYC". USA Today: Travel. Retrieved January 14, 2010.

{{cite news}}: Italic or bold markup not allowed in:|publisher=(help) - ^ Aaron Rutkoff (September 27, 2010). "'Bodies in Urban Spaces': Fitting In on Wall Street". Wall Street Journal. Retrieved January 14, 2010.

{{cite news}}: Italic or bold markup not allowed in:|publisher=(help) - ^ a b c David M. Halbfinger (August 27, 1997). "New York's Financial District Is a Must-See Tourist Destination". The New York Times. Retrieved January 15, 2011.

{{cite news}}: Italic or bold markup not allowed in:|publisher=(help) - ^ Fraser (2005).

- ^ a b c Robert Kuttner (August 22, 2010). "Zillions for Wall Street, Zippo for Barack's Old Neighborhood". Huffington Post. Retrieved January 14, 2010.

{{cite news}}: Italic or bold markup not allowed in:|publisher=(help) - ^ a b c d Daniel Altman (September 30, 2008). "Other financial centers could rise amid crisis". The New York Times: Business. Retrieved January 15, 2011.

{{cite news}}: Italic or bold markup not allowed in:|publisher=(help) - ^ Peter Overby (June 24, 2010). "Car Dealers May Escape Scrutiny Of Consumer Loans". NPR. Retrieved January 14, 2010.

{{cite news}}: Italic or bold markup not allowed in:|publisher=(help) - ^ William D. Cohan (April 19, 2010). "You're Welcome, Wall Street". The New York Times. Retrieved January 15, 2011.

{{cite news}}: Italic or bold markup not allowed in:|publisher=(help) - ^ a b Suzanne McGee (June 30, 2010). "Will Wall Street ever apologize?". Washington Post. Retrieved January 15, 2011.

{{cite news}}: Italic or bold markup not allowed in:|publisher=(help) - ^ a b c Tim Arango (September 7, 2009). "Greed Is Bad, Gekko. So Is a Meltdown". The New York Times: Movies. Retrieved January 14, 2010.

{{cite news}}: Italic or bold markup not allowed in:|publisher=(help) - ^ Emily Wax (October 11, 2008). "Wall Street Greed? Not in This Neighborhood". Washington Post. Retrieved January 14, 2010.

{{cite news}}: Italic or bold markup not allowed in:|publisher=(help) - ^ Basham, David (January 28, 2000). "Rage Against The Machine Shoots New Video With Michael Moore". MTV News. Retrieved September 24, 2007.

- ^ "NYSE special closings since 1885" (PDF). Retrieved September 24, 2007.

- ^ IMDb entry for Wall Street Retrieved August 19, 2006.

- ^ Nisha Gopalan (November 29, 2010). "Stock Brokers Flock to Asia in Search of Growth". Wall Street Journal. Retrieved January 15, 2011.

{{cite news}}: Italic or bold markup not allowed in:|publisher=(help) - ^ Patrick McGeehan (February 22, 2009). "After Reversal of Fortunes, City Takes a New Look at Wall Street". The New York Times. Retrieved January 15, 2011.

{{cite news}}: Italic or bold markup not allowed in:|publisher=(help) - ^ a b c Beth Gardiner (January 20, 2010). "The London Banking Center Is Beginning to Feel Like Itself Again". The New York Times: Global Business. Retrieved January 15, 2011.

{{cite news}}: Italic or bold markup not allowed in:|publisher=(help) - ^ Julia Werdigier (April 2, 2008). "Paychecks and Passports". The New York Times: Business. Retrieved January 15, 2011.

{{cite news}}: Italic or bold markup not allowed in:|publisher=(help) - ^ Seth Faison (December 13, 1996). "Hong Kong Continues to Eclipse An Economic Rebirth in Shanghai". The New York Times: Business Day. Retrieved January 15, 2011.

{{cite news}}: Italic or bold markup not allowed in:|publisher=(help) - ^ Hong Liang (May 4, 2009). "Software for a financial center here". China Daily. Retrieved January 15, 2011.

{{cite news}}: Italic or bold markup not allowed in:|publisher=(help) - ^ Dealbook (March 2, 2010). "Shanghai Opens Doors to Financial World". The New York Times. Retrieved January 15, 2011.

{{cite news}}: Italic or bold markup not allowed in:|publisher=(help) - ^ a b Cathy Holcombe (ANUARY 14, 2011). "Hong Kong and the Goldilocks Regulator". Wall Street Journal. Retrieved 2011-01-15.

{{cite news}}: Check date values in:|date=(help); Italic or bold markup not allowed in:|publisher=(help) - ^ (Xinhua) (June 2, 2009). "HK, Shenzhen promote financial industry in NY". China Daily. Retrieved January 15, 2011.

{{cite news}}: Italic or bold markup not allowed in:|publisher=(help) - ^ a b Martin Fackler (November 16, 2007). "Tokyo Seeking a Top Niche in Global Finance". The New York Times: World Business. Retrieved January 15, 2011.

{{cite news}}: Italic or bold markup not allowed in:|publisher=(help)

Further reading

- Atwood, Albert W. and Erickson, Erling A. "Morgan, John Pierpont, (Apr. 17, 1837 – March 31, 1913)," in Dictionary of American Biography, Volume 7 (1934)

- Carosso, Vincent P. The Morgans: Private International Bankers, 1854–1913. Harvard U. Press, 1987. 888 pp. ISBN 978-0-674-58729-8

- Carosso, Vincent P. Investment Banking in America: A History Harvard University Press (1970)

- Chernow, Ron. The House of Morgan: An American Banking Dynasty and the Rise of Modern Finance, (2001) ISBN 0-8021-3829-2

- Fraser, Steve. Every Man a Speculator: A History of Wall Street in American Life HarperCollins (2005)

- Geisst, Charles R. Wall Street: A History from Its Beginnings to the Fall of Enron. Oxford University Press. 2004. online edition

- Moody, John. The Masters of Capital: A Chronicle of Wall Street Yale University Press, (1921) online edition

- Morris, Charles R. The Tycoons: How Andrew Carnegie, John D. Rockefeller, Jay Gould, and J. P. Morgan Invented the American Supereconomy (2005) ISBN 978-0-8050-8134-3

- Perkins, Edwin J. Wall Street to Main Street: Charles Merrill and Middle-class Investors (1999)

- Sobel, Robert. The Big Board: A History of the New York Stock Market (1962)

- Sobel, Robert. The Great Bull Market: Wall Street in the 1920s (1968)

- Sobel, Robert. Inside Wall Street: Continuity & Change in the Financial District (1977)

- Strouse, Jean. Morgan: American Financier. Random House, 1999. 796 pp. ISBN 978-0-679-46275-0

External links

- New York Songlines: Wall Street, a virtual walking tour