Economy of India

Template:Economy of India infobox

The economy of India is one of the largest in the world with a GDP of 568 billion USD ($3.319 trillion USD adjusted at PPP). With a GDP growth rate of 6.2%, India has the world's twelfth largest economy and the fourth largest when adjusted for PPP. However, the large population means that per capita income at 3,100 USD is quite low.

India's economy is diverse and encompasses agriculture, handicrafts, industries, and a multitude of services. Services are the major source of economic growth in India today, though two-thirds of Indian workforce earn their livelihood directly or indirectly through agriculture. In recent times, India has also capitalised on its large number of highly-educated populace fluent in the English language to become a major exporter of software services and software engineers.

For most of India's independent history, a socialist approach was adhered to with strict government controls in many sectors such as telecommunications, banking and foreign direct investment. Since the early 1990s, India has gradually opened up its markets through economic reforms by reducing government controls on foreign trade and investment. Privatisation of public-owned industries and opening up of certain sectors to private and foreign players has proceeded slowly amid political debate.

The socio-economic problems India faces are the burgeoning population, poverty, lack of infrastructure and growing unemployment. Although poverty has seen a decrease of 10% since the 1980's, a quarter of India's citizens cannot still afford an adequate meal.

History

India's economic history can be compartmentalised into three eras, beginning with the pre-colonial period up to the 17th century. With the advent of British colonization of the Indian subcontinent started the colonial period in the 17th century, ending with the Indian independence in 1947. The third period is the post-independence period after 1947.

Pre-colonial

The citizens of the Indus valley civilisation, a permanent and predominantly urban settlement that flourished between 2800 BC to 1800 BC practised agriculture, domesticated animals, made tools and weapons and traded with other cities. Evidence of well planned streets, drainage system and water supply reveals their knowledge of urban planning and the existence of some form of municipal government. (Ch.4, pg.63-67 Template:Mn)

Much of the population of the region constituting present-day India resided in villagesTemplate:Mn, whose economy was largely isolated and self-sustaining. Agriculture was the predominant occupation of the populace. It satisfied the food requirements of a village and provided raw materials for hand-based industries like textile, food processing and crafts. While the many kingdoms and rulers issued coins, barter was still prevalent. Villages paid a portion of their agricultural produce as revenue while its craftsmen received a stipend out of the crops at harvest time for their services. (Ch.2, pg.15-16 Template:Mn)

Religion, especially Hinduism, the caste and the joint family systems, played an influential role in shaping economic activities (Ch.3, pg.50 Template:Mn). The caste system, despite its social fallbacks, functioned much like medieval European guilds, ensuring the division of labour, providing for the training of apprentices and in some cases led certain manufacturers to practice super specialisation. For instance, in certain regions, each variety of cloth produced was the speciality of a particular sub-caste. Superstitions about foreign travel among Hindus meant a greater part of India's foreign trade was carried out by foreigners and Muslims. (Ch.1, pg.24-26 Template:Mn)

Indian textiles like muslin, Calicos, shawls, agricultural products like pepper, cinnamon, opium and indigo were exported to Europe, Middle East and South East Asia in return for gold and silver. (Ch.2, pg.16 Template:Mn)

Owing to the lack of sufficient quantitative information on India's pre-colonial economy, much of its assessment is qualitative in nature. India, by the arrival of the British, was a traditional agrarian economy with a dominant subsistence sector dependent on primitive technology. It existed alongside a competitively developed network of commerce, manufacturing and credit. After the fall of the Mughals and the rise of Maratha imperialism, the Indian ecomomy was plunged into a state of political instability due to internecine wars and conflicts. (Ch.1, pg.32-35 Template:Mn)

Colonial

Akbar's Mughal empire in 1600 had a revenue of £ 17.5 million. In contrast, the entire treasury of Great Britain in 1800 totalled to £ 16 million. The broader macroeconomic view of India during this period reveals that there were segments of both growth and decline, resulting from changes bought about by colonialism and a world that was moving towards industrialisation and economic integration. (Ch.10, pg.304 Template:Mn)

The colonial rule also brought along a favourable institutional environment that guaranteed property rights, ensured free trade, had fixed exchange rates, uniform currency system, uniform weights and measures, open capital markets, well developed system of railways and telegraphs, a bureaucracy free from political interferences and a modern legal system. Template:Mn

However, at the end of the colonial rule and World War II, India inherited an economy which was one of the poorest in the world and stagnant (Ch.1, pg.1 Template:Mn), with industrial development stalled, agriculture unable to feed a rapidly accelerating population, who were subject to frequent famines, had one of the world’s lowest life expectancy, suffered from pervasive malnutrition and was largely illiterate.

Post-Independence

Indian economic policy after independence, influenced by the colonial experience, which their leaders saw as exploitative in nature and their exposure to Fabian socialism became protectionist in nature, implementing a policy of import substitution, industrialization, state intervention in labour and financial markets, a large public sector, overt regulation of business and central planning. Template:Mn Jawaharlal Nehru, the first prime minister of India, who along with statistician Prasanta Chandra Mahalanobis formulated and oversaw the economic policy of independent India. They expected favourable outcomes from this strategy since it involved both the public and private sectors, and was based on direct and indirect state intervention instead of Soviet-style central command system Template:Mn. The policy of concentrating simultaneously on capital and technology intensive heavy industry and subsidising hand based and low-skilled cottage industries was criticised by economist Milton Friedman, who thought it would not only waste both capital and labour, but also retard the development of smaller manufacturers Template:Mn.

India's low average growth rate upto 1980 was snubbed as the Hindu rate of growth because of the contrasting high growth rates in other Asian countries, especially the East Asian Tigers Template:Mn. The economic reforms that surged economic growth in India after 1980 can be attributed to two stages of reforms. The pro-business reform of 1980 initiated by Indira Gandhi and carried on by Rajiv Gandhi, eased restrictions on capacity expansion for incumbents, removed price controls and reduced corporate taxes. The economic liberalisation of 1991, initiated by then Indian prime minister P. V. Narasimha Rao and his finance minister Manmohan Singh in response to a macroeconomic crisis did away with the license raj (investment, industrial and import licensing),and ending public sector monopoly in many sectors, thereby allowing automatic approval of foreign direct investment in many sectors Template:Mn Template:Mn. Since then, the overall direction of liberalisation has remained the same, irrespective of the ruling party at the centre, although no party has tried to take on powerful lobbies like the trade unions and farmers, or contentious issues like labour reforms and cutting down agricultural subsidies. Template:Mn

Government Intervention

State Planning

After independence, India opted to have a centrally planned economy to ensure an effective and equitable allocation of national resources for the purpose of balanced economic development. After liberalisation, because of the emergence of a market economy with a fast growing private sector and with the public sector becoming less dominant, planning has become indicative, rather than prescriptive in nature. The process of formulation and direction of her Five-Year Plans is carried out by the Planning Commission, headed by the Prime Minister of India as its chairperson. Template:Mn

Mixed economy

India is a mixed economy and combines features of both capitalist market economies and socialist command economies. Thus, there is a private sector with regulation (which has decreased since liberalisation) being the only government intervention and a public sector controlled almost entirely by the government. The public sector generally covers areas which are deemed too important or not profitable enough to leave to the instability of capitalistic markets. Thus such services as railways and postal system are carried out by the government.

Since independence, the various phases have seen nationalisation of such areas as banking, thus bringing them into the public sector, on the one hand, and privatisation of some of the Public Sector Undertakings during the liberalisation period on the other. Template:Mn

Public expenditure

India's public expenditure is classified as development expenditure, comprising of central plan expenditure and central assistance and non-development expenditures, comprising of capital expenditure and revenue expenditure. Central plan expenditure is money spent on development schemes outlined in the plans of the central government and public sector undertakings, while central assistance refers to financial assistance and developmental loans given for plans of the state governments and union territories. Non-development capital expenditure comprises of capital defence expenditure, loans to public enterprises, states and union territories and foreign governments, while non-development revenue expenditure comprises revenue defence expenditure, administrative expenditure, subsidies, debt relief to farmers, postal deficit, pensions, social and economic services (education, health, agriculture, science and technology), grants to states and union territories and foreign governments, etc., Template:Mn

India's non-development revenue expenditure have increased nearly five-fold in 2003-04 since 1990-91 and more than ten-fold since 1985-86. Defence expenditure increased four-fold during the same period and has been increasing due to growing tensions in the region, high cost dispute with Pakistan over Jammu and Kashmir and an effort to modernise the military. Administrative expenses are compounded by a large salary and pension bill, which rises periodically due to revisions in wages, dearness allowance etc. Interest payments are now the single largest item of expenditure and accounted for more than 40% of the total non development expenditure in the 2003-04 budget. Subsidies on food, fertilisers, education and petroleum and other merit and non-merit subsidies account are not only continuously rising, especially because of rising crude oil and food prices, but are also harder to rein in, because of political compulsions. (Ch.55, pg.943-945, Template:Mn) Template:Mn

Public receipts

India has a three-tier tax structure, wherein the constitution empowers the union government to levy Income tax, tax on capital transactions (wealth tax, inheritance tax, gift tax), sales tax, service tax, customs and excise duties and the state governments to levy sales tax on intra-state sale of goods, tax on entertainment and professions, excise duties on manufacture of alcohol, stamp duties on transfer of property and collect land revenue (levy on land owned). The local governments are empowered by the state government to levy property tax, octroi and charge users for public utilities like water supply, sewage, etc. Template:Mn Template:Mn More than half of the revenues of union and state governments come from taxes, half of which come from Indirect taxes and more than a quarter of the union government's tax revenues is shared with the state governments. Template:Mn

The tax reforms initiated in 1991, have sought to rationalise the tax structure and increase compliance by taking steps in the following directions:

- Reducing the rates of individual and corporate income taxes, excises, customs and making it more progressive

- Reducing exemptions and concessions

- Simplification of laws and procedures

- Introduction of Permanent account number to track monetary transactions

- Despite protests from traders, 21 of the 29 states introduced Value added tax (VAT) on April 1, 2005 to replace the complex and multiple sales tax system Template:Mn Template:Mn

The non-tax revenues of the central government comes from fiscal services, interest receipts, public sector dividends, etc., while the non-tax revenues of the states are grants from the central government, interest receipts, dividends, income from general, social and services. (Ch.55, pg.942,946 Template:Mn)

Determinants

Geography and natural resources

India's geography ranges from snow-capped mountain ranges to deserts, plains, hills and plateaus, while its climate varies from tropical in the south to a more temperate climate in the north. 56.78% of India's total land area of 2,973,190 km² (1,269,219 mi²) is cultivable land, the area of which is decreasing due to constant pressure from an ever growing population and increased urbanisation.

India has a total water surface area of 314,400 km² and receives an average annual rainfall of 1,100 mm. Irrigation accounts for 92% of the water utilisation, was 380 km² in 1974 and is expected to rise to 1,050 km² by 2025, with the balance accounted for by industrial and domestic consumers. India's inland water resources comprising rivers, canals, ponds and lakes and marine resources comprising the east and west coasts of the Indian ocean and other gulfs and bays provide employment to nearly 6 million people in the fisheries sector, making India the sixth largest producer of fish in the world and second largest in inland fish production.

India's major mineral resources include Coal (fourth-largest reserves in the world), Iron ore, Manganese, Mica, Bauxite, Titanium ore, Chromite, Natural gas, Diamonds, Petroleum, Limestone and Thorium (world's largest along Kerala's shores). Petroleum, found off the coast of Maharashtra, Gujarat and in Assam meet 40% of India's demand. (Ch.7, pg.90,97,98,100, Template:Mn) Template:Mn

Politics

India, a federal republic, has had a stable democratic government since independence. Politics is dominated by the centre-left Indian National Congress (INC), the right-wing Bharatiya Janata Party (BJP), the left-wing Communist Party of India (CPI) and CPI (Marxist) and various regional parties, which are either centre-right or centre-left. Despite the varied political spectrums they occupy, the necessity of forming coalitions to form governments, the growing middle class that generally favours liberalisation and tightening fiscal deficits, especially at the state levels, has meant that all political parties adopt a moderate view towards economic reforms. Template:Mn Template:Mn Template:Mn

Financial instititutions

At the time of Independence, India inherited institutions like the civil services, central bank, railways, etc., from her British rulers. Mumbai serves as the nation's commercial capital. The city is the location of the Reserve Bank of India (RBI), Bombay Stock Exchange (BSE) and the National Stock Exchange (NSE). The headquarters of many financial institutions are also located within the city.

The RBI, the country's central bank was established on 1935-04-01. It serves as the nation's monetary authority, regulator and supervisor of the financial system, manager of exchange control and as an issuer of currency. The RBI is governed by a central board headed by a governor who is appointed by the Central government of India.

The BSE Sensex or BSE Sensitive Index is a value-weighted index composed of 30 companies with the base April 1979=100. It consists of the 30 largest and most actively traded stocks, representative of various sectors, on the Bombay Stock Exchange. These companies account for around one-fifth of the market capitalization of the BSE. The Sensex is generally regarded as the most popular and precise barometer of the Indian stock markets. Incorporated in 1992, the National Stock Exchange is one of the largest and most advanced stock markets in India. The NSE is the world's third largest stock exchange in terms of transactions. There are a total of 23 stock exchanges in India, but the BSE and NSE comprise of 83% of the volumes.Template:Mn

The Securities and Exchange Board of India (SEBI), established in 1992, regulates the stock markets and other securities markets of the country.

Sectors

Agriculture

Agriculture and allied sectors like forestry, logging and fishing contributed to 25% of the GDP, employed 57% of the total workforce in 1999-2000Template:Mn and despite a steady decline of its share in the GDP, is still the largest economic sector and plays a significant role in the overall socio-economic development of India. Yields per unit area of all crops have grown since 1950, due to the special emphasis placed on agriculture in the five-year plans and steady improvements in irrigation, technology, application of modern agricultural practices and provision of agricultural credit and subsidies since the green revolution. However, international comparisons reveal that the average yield in India is generally 30% to 50% of the highest average yield in the world. (Ch.28, pg.485-491, Template:Mn)

Low productivity in India is a result of the following factors:

- Illiteracy, general socio-economic backwardness, slow progress in implementing land reforms and inadequate or inefficient finance and marketing services for farm produce.

- The average size of land holdings is very low (less than 20,000 m²) and are subject to fragmentation, due to land ceiling acts and in some cases, family disputes. Such small holdings are often overmanned, resulting in disguised unemployment and low productivity of labour.

- Adoption of modern agricultural practices and use of technology is inadequate, hampered by ignorance of such practices, high costs and impracticality in the case of small land holdings

- Irrigation facilities are inadequate, as revealed by the fact that only 53.6% of the land was irrigated in 2000-01 Template:Mn, which result in farmers still being dependent on rainfall, specifically the Monsoon. (Ch.28, pg.492-493, Template:Mn)

Industry

| Rank | Company | MC (Crore Rs.) | |

|---|---|---|---|

| 1 | File:Hindusthan lever limited logo.png | Hindustan Lever | 50,511.9 |

| 2 | File:WiproLogo.jpg | Wipro | 46,240.6 |

| 3 | File:Infosys logo sml.gif | Infosys Technologies | 42,587.9 |

| 4 | File:Reliance group logo.png | Reliance Industires | 33,225.1 |

| 5 | File:Reliance group logo.png | Reliance Petroleum | 20,895.2 |

Concerted efforts at industrialisation by the government, aiming at self-sufficiency in production and protection from foreign competition, for nearly four decades have encouraged a broad industrial base, both in the public and private sectors, which together contribute to 28.4% of the GDP and employ 17% of the total workforce Template:Mn. Economic reforms bought foreign competition, led to privatisation of certain public sector firms, opened up sectors hitherto reserved for the public sector and the small scale sector and led to an expansion in the production of durable consumer goods Template:Mn.

Post-liberalisation, the Indian private sector, which was usually run by old family firms and required political connections to prosper, when faced with foreign competition and the threat of cheap Chinese imports, has handled the change by squeezing costs, revamping management, focusing on designing new products and relying on low labour costs and technology. Template:Mn

Services

The service sector, providing employment to 23% of the work force Template:Mn, is the fastest growing sector, with a growth rate of 7.5% in 1991-2000 up from 4.5% in 1951-80 and the largest, with a share of 48% of the GDP in 2000 up from 15% in 1950. Business services (including information technology (IT) and IT enabled services), communication services, financial services, hotels and restaurants, community services and trade (distribution) services were the fastest growing sectors contributing to one third of the total output of services in 2000. The growth in the service sector is attributed to increased specialisation, availability of a large population of highly-educated and fluent English-speaking workers on the supply side and on the demand side, increased demand from domestic consumers resulting from growth in personal incomes and from foreign consumers interested in India's service exports or those looking to outsource their operations. India's IT industry, despite contributing significantly to its balance of payments, was only about 1% of the total GDP or 1/50th of the total services. Template:Mn

Banking and finance

The Indian money market is classified as the organised sector (comprising private, public and foreign owned commercial banks and cooperative banks, together known as scheduled banks) and the unorganised sector (comprising individual or family owned indigenous bankers or money lenders and non-banking financial companies (NBFCs)). (Ch.50, pg.847-850 Template:Mn)

Indira Gandhi nationalised 14 banks in 1969, followed by seven others in 1980 and made it mandatory for banks to provide 40% (since reduced to 10%) of their net credit to priority sectors like agriculture, small-scale industry, retail trade, small businesses, etc. to ensure that the banks fulfil the social and developmental goals. Since then, the number of branches have increased from 10,120 in 1969 to 98,910 in 2003 and the population covered by a branch decreased from 63,800 to 15,000 during the same period. The total deposits increased 32.6 times between 1971 to 1991 compared to 7 times between 1951 to 1971. Despite an increase of rural branches, from 1,860 or 22% of the total number of branches in 1969 to 32,270 or 48%, only 32,270 out of 5 lakh villages are covered by a scheduled bank. (Ch.50, pg.850,851 Template:Mn) Template:Mn

Since liberalisation, the government has approved significant banking reforms. While some of these relate to nationalised banks (like encouraging mergers, reducing government interference and increasing profitability and competitiveness), other reforms have opened up the banking and insurance sectors to private and foreign players. (Ch.50, pg.865-867 Template:Mn) Template:Mn

Socio-economic issues

Poverty

The National sample survey organisation (NSSO) estimated that 26.1% of the population was below the poverty line in 1999-2000, down from 51.3% in 1977-78. The criterion used was monthly consumption of goods below Rs.211.30 for rural areas and Rs.454.11 for urban areas. 75% of the poor are in rural areas (27.1% of the total rural population) with most of them coming from daily wagers, self-employed households and landless labourers. The major causes for poverty are unemployment or under-employment, low ownership of assets (especially productive assets like land, farm implements,etc.,), illiteracy, etc., (Ch.22, pg.367,369,370 Template:Mn) Template:Mn

Since the early 1950's, successive governments have implemented various schemes, under planning, to alleviate poverty, that have met with partial success. All programs have improved upon the strategies of the Food for work programme and National Rural Employment Programme of the 1980's, which attempted to use the unemployed to generate productive assets and build rural infrastructure.Template:Mn

The question of whether economic reforms has reduced or increased poverty has fuelled debates without generating any clear cut answers and has also put political pressure on further economic reforms, especially those involving downsizing of labour and agriculture subsidies. (Ch.22, pg.375,376 Template:Mn) Template:Mn

Corruption

Corruption has been one of the pervasive problems affecting India, which has taken the form of bribes, evasion of tax and exchange controls, embezzlement, etc. The economic reforms of 1991 reduced the red tape, bureaucracy and the License Raj that had strangled private enterprise and was blamed for the corruption and inefficiencies Template:Mn. Yet, a 2005 study by Transparency International India found that more than half of those surveyed had firsthand experience of paying bribe or peddling influence to get a job done in a public office Template:Mn.

The Right to Information Act (2005) and equivalent acts in the states, that require government officials to furnish information requested by citizens or face punitive action, computerisation of services and various central and state government acts that have established vigilance commissions have considerably reduced corruption or at least have opened up avenues to redress grievances. Template:Mn Template:Mn

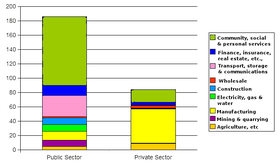

Occupational structure and unemployment

Agricultural and allied sectors accounted for about 57% of the total workforce in 1999-2000, down from 60% in 1993-94. While agriculture has faced stagnation in growth, services have seen steady growth. 8% of the workforce is in the organised sector, two-thirds of which are in the public sector. The NSSO survey estimated that in 1999-2000, 106 million, nearly 10% of the population were unemployed and the overall unemployment rate was 7.32%, with rural areas doing marginally better (7.21%) than urban areas (7.65%).

Unemployment in India, like most other developing countries, is characterised by chronic under-employment or disguised unemployment. Government schemes that target eradication of both poverty and unemployment, attempt to solve the problem, by providing financial assistance for setting up businesses, skill upgradation, setting up public sector enterprises, reservations in governments, etc., The decreased role of the public sector after liberalisation has further undermined the need for focusing on better education and has also put political pressure on further reforms. (Ch.24, pg.403-405 Template:Mn) Template:Mn

Demographics

India, with a population of 1.027 billion people, is the second most populous country in the world, accounting for nearly 17% of the world's population. Growth rate of population has shown signs of decrease, coming down from an compound annual growth rate of 2.15 between 1951-1981 to 1.93 between 1991-2001, despite the decrease in the death rates owing to improvements in healthcare.

The large population has put further pressure on infrastructure, social services like education and has further magnified socio-economic problems like unemployment, illiteracy, etc., A positive factor has been the large working age population, which forms 58.2% of the total population and is expected to substantially increase, because of the decrease in dependency ratio. Increased literacy, better healthcare and self-sufficiency in food production, since independence, have ensured that the large population has not caused any serious problems. (Ch.4, pg.42,43,50 Template:Mn) Template:Mn

Regional imbalance

One of the critical problems facing India's economy is the sharp and growing regional variations among India's different states and territories in terms of per capita income, poverty, availability of infrastructure and socio-economic development. For instance, the difference in growth rate between the forward and backward states was 0.3% (5.2% & 4.9%) during 1980-81 to 1990-91, but had grown to 3.3% (6.3% & 3.0%) during 1990-91 to 1997-98. (Ch.27, pg.471,472 Template:Mn)

The five-year plans attempted to reduce regional disparities by sanctioning industrial development in the interior regions, but industries still tended to concentrate around urban areas and port cities. Even the industrial townships in the interiors, Bhilai for instance, resulted in very little development in the surrounding areas.Template:Mn After liberalisation, the disparities have grown despite the efforts of the union government in reducing them. Part of the reason being, manufacturing and services and not agriculture are the engines of growth, which the forward states are better placed in with infrastructure like well developed ports, urbanisation and a educated and skilled workforce which attract manufacturing and service sectors. The union and state governments of backward regions are trying to reduce the disparities by offering tax holidays, cheap land, etc., and focussing more on sectors like tourism, which although geographically and historically determined, can be a source of growth and is faster to develop than other sectors. Template:Mn Template:Mn

See also: List of regions in India, States and territories of India

Rupee

The Rupee is the only legal tender accepted in the country. The value of the rupee is pegged to a basket of currencies and tightly controlled by the Reserve Bank of India. In recent years its value has depreciated with respect to most currencies with the exception of the US dollar. The inflation rate is a high 7%.

The rupee is divided into 100 paise. The highest currency note printed is the 1000 rupee note, and the lowest denomination in circulation is the 10 p coin.

India's foreign exchange reserves currently stands at 141 billion US dollars. Template:Mn. The rupee is also accepted as legal tender in neighbouring Nepal and Bhutan, the latter's currency value being pegged to the rupee.

External trade and investment

Global trade relations

Until the liberalisation of 1991, India was largely and intentionally isolated from the world markets, in order to protect its fledging economy and achieve self-reliance. Foreign trade was subject to import tariffs, export taxes and quantitative restrictions, while foreign direct investment was restricted by upper limit equity participation, requirements on technology transfer, export obligations and government approvals, which were needed for nearly 60% of new FDI in the industrial sector. These restrictions ensured that FDI averaged only around $200 million annually between 1985-1991 and a large percentage of the capital flows consisted of foreign aid, commercial borrowing and deposits of non-resident Indians. Template:Mn

| Rank | Country | Inflows (Million USD) |

Inflows(%) | |

|---|---|---|---|---|

| 1 | File:Mauritius flag large.png | Mauritius | 8,898 | 34.49% |

| 2 | USA | 4,389 | 17.08% | |

| 3 | Japan | 1,891 | 7.33% | |

| 4 | File:Netherlands flag large.png | Netherlands | 1,847 | 7.16% |

| 5 | File:Uk flag large.png | UK | 1,692 | 6.56% |

India's exports were stagnant for the first 15 years, due to the predominance of tea, jute and cotton manufactures, whose demand were generally inelastic. Imports in the same period consisted predominantly of machinery, equipment and raw materials due to the nascent industrialisation. Post-liberalisation, the value of India's international trade has become more broad based and gone up to Rs. 63,080,109 crores in 2003-04 from Rs.1,250 crores in 1950-51. India's major trading partners are China, United States, UAE, UK, Japan and the European Union.(Ch.46, pg.767,772-776 Template:Mn)

India is a founder-member of General Agreement on Tariffs and Trade (GATT) since 1947 and its successor, the World Trade Organization since its inception. While participating actively in its general council meetings, India has been crucial in voicing the concerns of the developing world. For instance, India has continued its opposition to the inclusion of such matters as labour and environment issues and other non-tariff barriers into the WTO policies. Template:Mn

Balance of payments

Since independence, India's balance of payments on current account has been negative for most of the years, owing to a larger share of imports vis-a-vis exports. Since liberalisation, incidentally precipitated by a balance of payment crisis, India's exports has been consistently raising, covering 80.3% of India's imports in 2002-03, up from 66.2% in 1990-91. Although India is still a net importer, since 1996-97, India's overall balance of payments (current account balance + capital account balance) has been positive, largely on account of increased foreign direct investment and deposits from non-resident Indians, which until then, was occasionally positive on account of external assistance and commercial borrowings. As a result, India's foreign currency reserves stood at $69.1 billion as on 2003-04.(Ch.47, pg.789 Template:Mn)

India's reliance on external assistance and commercial borrowings has decreased since 1991-92 and since 2002-03, has been repaying them. Declining interest rates and reduced borrowings have decreased India's debt service ratio to 14.1% in 2001-02 from 35.3% in 1990-91. (Ch.47, pg.786,790 Template:Mn) Template:Mn

See also

External links

- OxusResearch Research publications, in particular about poverty in India.

References

Books

Template:Mnb . ISBN 0-14-303103-1. {{cite book}}: Missing or empty |title= (help); Unknown parameter |Author= ignored (|author= suggested) (help); Unknown parameter |Publisher= ignored (|publisher= suggested) (help); Unknown parameter |Title= ignored (|title= suggested) (help); Unknown parameter |Year= ignored (|year= suggested) (help)

Template:Mnb {{cite book}}: Empty citation (help)

Template:Mnb . ISBN 81-219-0298-3. {{cite book}}: Missing or empty |title= (help); Unknown parameter |Author= ignored (|author= suggested) (help); Unknown parameter |Publisher= ignored (|publisher= suggested) (help); Unknown parameter |Title= ignored (|title= suggested) (help); Unknown parameter |Year= ignored (|year= suggested) (help)

Template:Mnb {{cite book}}: Empty citation (help)

Template:Mnb . ISBN 019-565154-5. {{cite book}}: Missing or empty |title= (help); Unknown parameter |Author= ignored (|author= suggested) (help); Unknown parameter |Publisher= ignored (|publisher= suggested) (help); Unknown parameter |Title= ignored (|title= suggested) (help); Unknown parameter |Year= ignored (|year= suggested) (help)

Template:Mnb Template:Chapter reference

Research papers

Template:Mnb Template:Citepaper publisher version

Template:Mnb http://ksghome.harvard.edu/~drodrik/Growth%20volume/DeLong-India.pdf. {{cite journal}}: Cite journal requires |journal= (help); Missing or empty |title= (help); Unknown parameter |Author= ignored (|author= suggested) (help); Unknown parameter |PublishYear= ignored (help); Unknown parameter |Title= ignored (|title= suggested) (help)

Template:Mnb Template:Citepaper publisher

Template:Mnb Template:Citepaper version

Template:Mnb http://www.economicissues.org/archive/pdfs/5v6p2.PDF. {{cite journal}}: Cite journal requires |journal= (help); Missing or empty |title= (help); Unknown parameter |Author= ignored (|author= suggested) (help); Unknown parameter |PublishYear= ignored (help); Unknown parameter |Title= ignored (|title= suggested) (help)

Template:Mnb http://ideas.repec.org/p/wpa/wuwpit/0403005.html. {{cite journal}}: Cite journal requires |journal= (help); Missing or empty |title= (help); Unknown parameter |Author= ignored (|author= suggested) (help); Unknown parameter |PublishYear= ignored (help); Unknown parameter |Title= ignored (|title= suggested) (help)

Template:Mnb http://ksghome.harvard.edu/~drodrik/IndiapaperdraftMarch2.pdf. {{cite journal}}: Cite journal requires |journal= (help); Missing or empty |title= (help); Unknown parameter |Author= ignored (|author= suggested) (help); Unknown parameter |PublishYear= ignored (help); Unknown parameter |Title= ignored (|title= suggested) (help)

Template:Mnb Template:Citepaper version

Template:Mnb Template:Citepaper version

Template:Mnb Template:Web reference author

Template:Mnb Template:Citepaper version

Template:Mnb Template:Citepaper version

Government publications

Template:Mnb Template:Web reference simple

Template:Mnb Template:Web reference simple

Template:Mnb Template:Web reference simple

Template:Mnb Template:Web reference simple

Template:Mnb http://agricoop.nic.in/statatglance2004/AtGlance.pdf. {{cite journal}}: Cite journal requires |journal= (help); Missing or empty |title= (help); Unknown parameter |Author= ignored (|author= suggested) (help); Unknown parameter |PublishYear= ignored (help); Unknown parameter |Title= ignored (|title= suggested) (help)

Template:Mnb Template:Web reference author

Articles

Template:Mnb Template:Web reference simple

Template:Mnb "That old Gandhi magic". November 27th, 1997. {{cite news}}: Check date values in: |date= (help); Unknown parameter |org= ignored (help)

Template:Mnb "India says 21 of 29 states to launch new tax". March 25th, 2005. {{cite news}}: Check date values in: |date= (help); Unknown parameter |org= ignored (help)

Template:Mnb Template:Web reference simple

Template:Mnb "Economic structure". October 6th, 2003. {{cite news}}: Check date values in: |date= (help); Unknown parameter |org= ignored (help)

Template:Mnb "Indian manufacturers learn to compete". February 12th, 2004. {{cite news}}: Check date values in: |date= (help); Unknown parameter |org= ignored (help)

Template:Mnb "India's next 50 years". August 14th, 1997. {{cite news}}: Check date values in: |date= (help); Unknown parameter |org= ignored (help)

Template:Mnb "The plot thickens". May 31st, 2001. {{cite news}}: Check date values in: |date= (help); Unknown parameter |org= ignored (help)

Template:Mnb "The voters' big surprise". May 13th, 2004. {{cite news}}: Check date values in: |date= (help); Unknown parameter |org= ignored (help)

Template:Mnb Template:Web reference simple

Template:Mnb Template:Web reference simple

Template:Mnb Template:Web reference simple

Template:Mnb Template:Web reference simple

Template:Mnb Template:Web reference simple

Footnotes

Template:Mnb The 1872 census puts the non-urban population at 91.3% (Ch.5, pg.519, Template:Mn)

Template:Mnb Data for Bangladesh is not available for 1950.

Template:Mnb Totals are rounded off. Private sector data relates to non-agriculture establishments employing 10 or more persons. Coverage in construction, especially in the private sector is known to be inadequate.

Template:Mnb Example of a central government department's implementation of the Right to Information Act.

Template:Mnb Old private banks are private banks existing prior to opening up of the banking sector.

Template:Mnb Service tax and expenditure tax are not levied in Jammu and Kashmir; Intra-state sale happens when goods or the title of goods move from one state to another.

Template:Mnb Tax revenue was 88% of total union government revenue in 1950-51 and has come down to 73% in 2003-04, as a result of increase in non-tax revenue. Tax revenues were 70% of total state government revenues in 2002 to 2003. Indirect taxes were 84% of the union governments total tax revenue and have come down to 62% in 2003-04, mostly due to cuts in import duties and rationalisation. The states share in union governments tax revenue is 28.0% for the period 2000 to 2005 as per the recommendations of the eleventh finance commission. In addition, states that do not levy sales tax on sugar, textiles and tobacco are entitled to 1.5 % of the proceeds; (Ch.55, pg.938,942,946, Template:Mn)

Template:Mnb Public expenditure was classified as plan and non-plan expenditure in the 1987-88 union budget. It is now referred to as development and non-development expenditure, but the definition remains the same. Development expenditure is a capital expenditure. (Ch.55, pg.943, Template:Mn), Template:Mn