Economy of India: Difference between revisions

Ravikiran r (talk | contribs) rv. The whole section is disproportionate |

undoing page deletion |

||

| Line 56: | Line 56: | ||

While the credit rating of India was hit by its nuclear tests in 1998, it has been raised to investment level in 2007 by S&P and Moody's.<ref name="S&P raises India's credit rating">{{cite web|url=http://in.today.reuters.com/news/newsArticle.aspx?type=businessNews&storyID=2007-01-30T184448Z_01_NOOTR_RTRJONC_0_India-285588-3.xml|title="S&P raises India's credit rating}}</ref><ref name="Moody's raises India to Investment level">{{cite web|url=http://www.ft.com/cms/s/714d6a02-b0b0-11db-8a62-0000779e2340,dwp_uuid=a6dfcf08-9c79-11da-8762-0000779e2340.html|title="India's sovereign credit upgraded"}}</ref> |

While the credit rating of India was hit by its nuclear tests in 1998, it has been raised to investment level in 2007 by S&P and Moody's.<ref name="S&P raises India's credit rating">{{cite web|url=http://in.today.reuters.com/news/newsArticle.aspx?type=businessNews&storyID=2007-01-30T184448Z_01_NOOTR_RTRJONC_0_India-285588-3.xml|title="S&P raises India's credit rating}}</ref><ref name="Moody's raises India to Investment level">{{cite web|url=http://www.ft.com/cms/s/714d6a02-b0b0-11db-8a62-0000779e2340,dwp_uuid=a6dfcf08-9c79-11da-8762-0000779e2340.html|title="India's sovereign credit upgraded"}}</ref> |

||

==Future predictions: "conventional wisdom" from Goldman Sachs== |

|||

==Future== |

|||

[[Image:IndianEconomicForecast.SVG|thumb|450px|Goldman Sachs has predicted that India will become 3rd largest economy of the world by 2035 based on predicted growth rate of 5.3 to 6.1%. Currently It is cruising at 9.4% growth rate.]] |

[[Image:IndianEconomicForecast.SVG|thumb|450px|Goldman Sachs has predicted that India will become 3rd largest economy of the world by 2035 based on predicted growth rate of 5.3 to 6.1%. Currently It is cruising at 9.4% growth rate.]] |

||

In 1999, [[Goldman Sachs]] predicted that India's GDP in current prices will overtake France and Italy by 2020, Germany, UK and Russia by 2025 and Japan by 2035. By 2035 it is expected to reach as 3rd largest economy of the world behind US and [[People's Republic of China|China]][http://www2.goldmansachs.com/insight/research/reports/99.pdf]. |

|||

India's GDP growth is expected to continue at 8-8.5% for the next couple of years.<ref name ="FinExpress">{{cite news |

|||

| title = ADB ups growth projection for India |

|||

[[Image:Time cove june 26 2006 1101060626 400 1.jpg|thumb|Rise of indian economy featured on the cover of ''TIME.'']] |

|||

| publisher = Financial Expxress |

|||

Goldman Sachs has made these predictions based on India's expected growth rate of 5.3 to 6.1% in various periods, whereas India is registering more than 9% growth rate. However the same report also shows there were large variation in its predicted gauging growth between 1960–2000, 7.5% predicted India's annual growth rate compared to the real average value of only 4.5% during that period. |

|||

| date = [[2007-09-17]] |

|||

| url = http://www.financialexpress.com/news/ADB-ups-growth-projection-for-India/217826/ |

|||

A Goldman Sachs report recently cited by BBC News stated that 'India could overtake Britain and have the world's fifth largest economy within a decade as the country's growth accelerates'<ref name="Indian economy 'to overtake UK'">{{cite web|url=http://news.bbc.co.uk/1/hi/world/south_asia/6294409.stm|title="Indian economy 'to overtake UK'"|publisher=[[BBC News]]|accessdate=2007-01-26}}</ref> Jim O'Neal, head of the Global Economics Team at Goldman Sachs, said on the BBC, "In thirty years, India's workforce could be as big as that of the United States and China combined"<ref name="India Rising">{{cite web | url=http://www.bbc.co.uk/mediaselector/check/worldservice/meta/dps/2007/02/070205_india_rising_debate_1?size=au&bgc=003399&lang=&nbram=1&nbwm=1|title="India Rising; Economy; Special Debate|publisher=[[BBC News]]|accessdate=2007-03-08}}</ref> |

|||

| accessdate = 2007-10-02 }}</ref> |

|||

In 2003, [[Goldman Sachs]] grouped India with other the other emerging economis of Brazil, Russia and China under the acronym [[BRIC]].<ref name ="Goldman">{{cite conference |

|||

==Future predictions taking purchasing power parity shifts into account== |

|||

| first =Dominic |

|||

[[Image:Econpro2007.jpg|thumb|300px|GDP sizes for US, China and India over the next few decades (at 2006 US dollars), taking purchasing power parity, growth trends and demographics into account.]] |

|||

| last =Wilson |

|||

[[Image:Percappro2007.jpg|thumb|300px|Per capita income projections for US, China and India (at 2006 US dollars) over the next few decades, taking purchasing power parity, growth trends and demographics into account.]] |

|||

| coauthors =Roopa Purushothaman |

|||

| title =DreamingWith BRICs: The Path to 2050. Global Economics Paper No: 99 |

|||

'''GDP growth at exchange rates''' |

|||

| publisher =[[Goldman Sachs]] |

|||

| date =2003-10-01 |

|||

The Goldman Sachs report makes predictions about relative sizes of economies in 2025 or 2050 based on current exchange rate economy sizes, and ignores the effect of rapid decline in purchasing power parity ratios of economies as they approach maturity. |

|||

| url =http://www2.goldmansachs.com/insight/research/reports/99.pdf |

|||

The PPP ratio measures approxiamately how many times the cost of living is less in a given country as compared to in the US, and results in an artificial deflation of a GDP when measured at current exchange rates. However, the PPP ratio has historically ''always'' declined rapidly towards 1.0 (recent examples include Ireland, Japan, S. Korea, Taiwan, Singapore) when a rapidly industrializing country has caught up to even half of the level of US per-capita income in PPP terms. India and China's PPP ratios in 2005 were close to 5.0, and are now rapidly declining even as their undervalued currencies appreciate against the US dollar. This decline happens because of two reasons- (1) inflation, and (2) appreciation of the local currency. The two factors can happen simultaneously leading to ''exchange-rate'' level GDP growth rates that are much higher than the ''real GDP growth''. This phenomena has resulted in recent doubling of India's GDP as measured in exchange rate dollars, every 3.5 years or so. ''It is important to note that we are not talking about real GDP growth at this point but are looking at economic growth in exchange-rate terms- which is important if we are comparing the sizes of two economies in exchange rate dollars, as the Goldman Sach's report does.'' Later parts of this section discusses real GDP growth in PPP (which is inflation, price, and exchange rate adjusted by definition) terms. |

|||

| accessdate =2007-10-02 }}</ref>. The thesis was that these four countries would rapidly grow and soon displace the current dominant superpowers. It predicted that India would become the third largest economy in the world by [[2035]], behind only he US and [[China]]. |

|||

There is some controversy about these predictions because while the model used by the report accurately predicts the past GDP growth for other countries, it overestimates India's growth for 1960-2000 at 7.5, while the actual growth rate was 4.5%. The counterargument is that structural changes in India's economy make the model's projections accurate for the future, even though it failed to predict the past.<ref name = "rediff">{{cite news |

|||

Let us take an example from 2006-2007 GDP growth for India. Note that the real GDP growth (which is hard to measure directly) is calculated using the nominal gdp growth (which is easy to measure) minus the inflation (which is also measured directly). |

|||

| last =Jain |

|||

The real 2006-07 GDP growth for India was 9.4 percent, and the annual inflation was around 5%. The nominal GDP growth in Rupees was 9.4+5=14.5 percent. On top of that, Indian Rupees appreciated by 10% between 2006-2007 against the US dollar, resulting in a total economic output as measured in nominal (2007 exchange rate) US dollars in 2007 as = (1+ 14.5%) x (1+10%) times of exchange rate economy of 2006 = 1.2595 times of 2006. In other words, the size of the Indian economy grew by 25.95 percent in 2006-07 in nominal dollar terms. If we adjust for the 3% loss of value of the real US dollar in 2006-2007 due to inflation in US, these numbers for the Indian economy still add up to 22.3% GDP growth in constant 2006 dollar terms. |

|||

| first =Sunil |

|||

| title =Will India's economy be bigger than US by 2050? |

|||

This is the reason why India's GDP went from less than 800 billion US$ in 2006 to over a trillion US$ in 2007<ref name="Welcome To The Trillion Dollar Club">{{cite web | url=http://www.forbes.com/home/2007/04/26/india-trillion-mark-markets-econ-cx_rd_0426markets24.html|title="Welcome To The Trillion Dollar Club|publisher=[[Forbes.com]]|accessdate=2007-09-27}}</ref>. At this point the question arises- what is the root cause of this apparent dichotomy between real GDP growth and exchange rate GDP growth? The heart of the difference stems from the [[purchasing power parity]] ratio. The PPP ratio for India for 2006 was 4.5, i.e. the cost of living in India was estimated to be over 4.5 times cheaper than in US in 2006. The PPP ratio would remain unchanged if the Indian Rupee did not appreciate and if the inflation rate in Indian and US were to remain the same. However, as can be see from the data above, despite India having a higher inflation rate in 2006-07 of around 5% (as compared to 3% in US), the Rupee still appreciated by around 10% against the US dollar. This is what resulted in the purchasing power parity to actually decline in 2007 as compared to 2006. And it can be shown that this decline would be = (2006 PPP ratio) x (2006-07 real GDP growth)/(2006-07 exchange rate GDP growth)= 4.5 x 1.094/1.223 = 4.03. |

|||

| publisher =[[Rediff.com]] |

|||

| date =2007-01-29 |

|||

The usually large PPP ratios for underdeveloped economies is linked to the fact that they are underdeveloped- to varying degrees both in terms physical infrastructure and human capital. On top of that, political and social factors often prevent them from developing rapidly, despite the obvious need for better infrastructure, human development etc. However, when many such economies (e.g Ireland, Japan, S. Korea, Taiwan, Singapore and others in the recent past) transition and reach a certain critical level of social and economic development, the bottlenecks to their growth get removed, and the human and physical resource utilization goes up suddenly and is often self-reinforcing. This results in increasing demand, productivity, and wealth in that order, resulting in the price of human capital going up. This causes the PPP ratio to then rapidly decline towards 1.0. |

|||

| url =http://www.rediff.com/money/2007/jan/29guest2.htm |

|||

| accessdate = 2007-10-02 }} |

|||

[Comment: There is strong evidence that India and China are now experiencing this phenomena, and most experts agree that they have crossed such a threshold in human development, and their high growth phase (now in the third decade for China and second decade for India) is not temporary. Also, both Chinese and Indian currencies are now under strong pressure to appreciate.] |

|||

</ref> |

|||

This decline in PPP ratio year over year is what causes observed exchange rate GDP growth numbers that are substantially larger than those described by reports such as Goldman Sachs above. ''Note that there is no actual acceleration in economic growth because of the decline in the PPP ratio, which only causes the exchange-rate GDP numbers to ramp up at a faster pace, causing such economies to rapidly overtake smaller developed economies in GDP rankings when measured at exchange-rates.'' |

|||

Ignoring the effect just described above, many conventional predictions use two incompatible quantities in their computations: (1) the real GDP growth of a country corresponding to the PPP is used as a basis for growth rate estimates, and (2) the current exchange-rate GDP is used as the base economy size. Such a simulation then "grows" the economy every year by increasing the exchange rate GDP base by the real GDP growth rate. For example, such a simulation, starting from the 800 billion Indian economy of early 2006- would predict an 875 billion economy in early 2007 using the 9.4% real GDP growth, as opposed to the over US $1 trillion Indian economy actually observed in early 2007<ref name="Welcome To The Trillion Dollar Club">{{cite web | url=http://www.forbes.com/home/2007/04/26/india-trillion-mark-markets-econ-cx_rd_0426markets24.html|title="Welcome To The Trillion Dollar Club|publisher=[[Forbes.com]]|accessdate=2007-09-27}}</ref>. Thus, such an extrapolation of GDP growth based on past "local" growth does not take into account the decline in PPP ratios as an economy develops, hugely underestimating the GDP growth at exchange rates that actually occurs. Because of the exponential nature of economic growth, the error accumulates very quickly as the predictions are stretched further into the future, resulting in quixotic numbers such as "India's GDP to overtake UK's by 2025"- that are conservative compared to the reality by decades. |

|||

'''Real GDP growth projections in PPP terms''' |

|||

A more realistic projection of future per-capita could simply be based on two compatible quantities- the current economy size as measured in PPP, and the real growth-rate. Based on PPP growth, the Chinese GDP is set to cross the US economy to become the largest in the World between 2009 and 2010, in merely 2 to 3 years from now. Similarly India's GDP has already crossed Japan's to become the third largest. Making projections into the future, India is set to cross US economy at PPP around 2024 (at 10 percent annual growth for India, 3 percent for US. There is substantial evidence looking at Chinese, Taiwanese, S. Korean and Japanese history that India's economy has just crossed a growth bottleneck, and that the actual growth rates for India might be even higher and would sustain for decades, making this crossing even earlier and even more dramatic"<ref name="The Future of Space Exploration in the Age of New Giants">{{cite web | url=http://www.sandgun.com/pages/share/other/marssociety/newGiants.ppt|title="The Future of Space Exploration in the Age of New Giants|publisher=[[Gunjan Gupta]]|accessdate=2007-07-24}}</ref>). When India becomes larger than the US economy, India's per capita income would still be ~1/4 of US income at that time; for the reasons mentioned above, it is likely that it would still be growing close to its current pace when it crosses US to become the second largest economy in the World, 16-17 years from now. |

|||

==Government intervention== |

==Government intervention== |

||

Revision as of 17:40, 3 October 2007

Template:Economy of India infobox The economy of India is the fourth largest in the world as measured by purchasing power parity (PPP). When measured in USD exchange-rate terms, it is the twelfth largest in the world, with a GDP of US $1.0 trillion (2007).[1] India is the second fastest growing major economy in the world, with a GDP growth rate of 9.4% for the fiscal year 2006–2007.[2] However, India's huge population results in a per capita income of $3,800 at PPP and $735 at nominal (2006 estimate).[3] The World Bank classifies India as a low-income economy.[4][5]

India's economy is diverse and encompasses agriculture, handicrafts, textile, manufacturing, and a multitude of services. Although two-thirds of the Indian workforce still earn their livelihood directly or indirectly through agriculture, services are a growing sector and are playing an increasingly important role of India's economy. The advent of the digital age, and the large number of young and educated populace fluent in English, is gradually transforming India as an important 'back office' destination for global companies for the outsourcing of their customer services and technical support. India is a major exporter of highly-skilled workers in software and financial services, and software engineering. Other sectors like manufacturing, pharmaceuticals, biotechnology, nanotechnology, telecommunication, shipbuilding, aviation and tourism are showing strong potentials with higher growth rates.

India followed a socialist-inspired approach for most of its independent history, with strict government control over private sector participation, foreign trade, and foreign direct investment. However, since the early 1990s, India has gradually opened up its markets through economic reforms by reducing government controls on foreign trade and investment. The privatisation of publicly owned industries and the opening up of certain sectors to private and foreign interests has proceeded slowly amid political debate.

India faces a burgeoning population and the challenge of reducing economic and social inequality. Poverty remains a serious problem, although it has declined significantly since independence, mainly due to the green revolution and economic reforms.

History

India's economic history can be broadly divided into three eras, beginning with the pre-colonial period lasting up to the 17th century. The advent of British colonisation started the colonial period in the 17th century, which ended with the independence in 1947. The third period stretches from independence in 1947 until the present.

Pre-colonial

The citizens of the Indus Valley civilisation, a permanent and predominantly urban settlement that flourished between 2800 BC and 1800 BC, practised agriculture, domesticated animals, used uniform weights and measures, made tools and weapons, and traded with other cities. Evidence of well planned streets, a drainage system and water supply reveals their knowledge of urban planning, which included the world's first urban sanitation systems and the existence of a form of municipal government.[6]

The 1872 census revealed that 99.3% of the population of the region constituting present-day India resided in villages,[7] whose economies were largely isolated and self-sustaining, with agriculture the predominant occupation. This satisfied the food requirements of the village and provided raw materials for hand-based industries, such as textiles, food processing and crafts. Although many kingdoms and rulers issued coins, barter was prevalent. Villages paid a portion of their agricultural produce as revenue to the rulers, while its craftsmen received a part of the crops at harvest time for their services.[8]

Religion, especially Hinduism, and the caste and the joint family systems, played an influential role in shaping economic activities.[9] The caste system functioned much like medieval European guilds, ensuring the division of labour, providing for the training of apprentices and, in some cases, allowing manufacturers to achieve narrow specialization. For instance, in certain regions, producing each variety of cloth was the speciality of a particular sub-caste.

Since foreign travel and the ensuing ritual pollution resulted in loss of caste to Hindus a large part of India's foreign trade was conducted by foreigners and Muslims.[11] Textiles such as muslin, Calicos, shawls, and agricultural products such as pepper, cinnamon, opium and indigo were exported to Europe, the Middle East and South East Asia in return for gold and silver.[12]

Assessment of India's pre-colonial economy is mostly qualitative, owing to the lack of quantitative information. One estimate puts the revenue of Akbar's Mughal Empire in 1600 at £17.5 million, in contrast with the total revenue of Great Britain in 1800, which totalled £16 million.[13] India, by the time of the arrival of the British, was a largely traditional agrarian economy with a dominant subsistence sector dependent on primitive technology. It existed alongside a competitively developed network of commerce, manufacturing and credit. After the fall of the Mughals and the rise of Maratha Empire, the Indian economy was plunged into a state of political instability due to internecine wars and conflicts.[14]

Colonial

Colonial rule brought a major change in the taxation environment from revenue taxes to property taxes resulting in mass impoverishment and destitution of the great majority of farmers. It also created an institutional environment that, on paper, guaranteed property rights among the colonizers, encouraged free trade, and created a single currency with fixed exchange rates, standardized weights and measures, capital markets, a well developed system of railways and telegraphs, a civil service that aimed to be free from political interference, and a common-law, adversarial legal system.[15] India's colonisation by the British coincided with major changes in the world economy—industrialisation, and significant growth in production and trade. However, at the end of colonial rule, India inherited an economy that was one of the poorest in the developing world,[16] with industrial development stalled, agriculture unable to feed a rapidly growing population, one of the world's lowest life expectancies, and low rates of literacy.

An estimate by Cambridge University historian Angus Maddison reveals that India's share of the world income fell from 22.6% in 1700, comparable to Europe's share of 23.3%, to a low of 3.8% in 1952.[17] While Indian leaders during the Independence struggle, and left-nationalist economic historians have blamed colonial rule for the dismal state of India's economy in its aftermath, a broader macroeconomic view of India during this period reveals that there were sectors of growth and decline, resulting from changes brought about by colonialism and a world that was moving towards industrialisation and economic integration.[18][19]

Independence to 1991

Indian economic policy after independence was influenced by the colonial experience (which was seen by Indian leaders as exploitative in nature) and by those leaders' exposure to Fabian socialism. Policy tended towards protectionism, with a strong emphasis on import substitution, industrialisation, state intervention in labour and financial markets, a large public sector, business regulation, and central planning.[20] Jawaharlal Nehru, the first prime minister, along with the statistician Prasanta Chandra Mahalanobis, carried on by Indira Gandhi formulated and oversaw economic policy. They expected favourable outcomes from this strategy, because it involved both public and private sectors and was based on direct and indirect state intervention, rather than the more extreme Soviet-style central command system.[21] The policy of concentrating simultaneously on capital- and technology-intensive heavy industry and subsidising manual, low-skill cottage industries was criticized by economist Milton Friedman, who thought it would waste capital and labour, and retard the development of small manufacturers.[22]

India's low average growth rate from 1947–80 was derisively referred to as the Hindu rate of growth, because of the unfavourable comparison with growth rates in other Asian countries, especially the "East Asian Tigers".[15]

After 1991

In the late 80s, the government led by Rajiv Gandhi eased restrictions on capacity expansion for incumbents, removed price controls and reduced corporate taxes. While this increased the rate of growth, it also led to high fiscal deficits and a worsening current account. The collapse of the Soviet Union, which was India's major trading partner, and the first Gulf War, which caused a spike in oil prices, caused a major balance-of-payments crisis for India, which found itself facing the prospect of defaulting on its loans.[24] In response, Prime Minister Narasimha Rao along with his finance minister Manmohan Singh initiated the economic liberalisation of 1991. The reforms did away with the Licence Raj (investment, industrial and import licensing) and ended many public monopolies, allowing automatic approval of foreign direct investment in many sectors.[25] Since then, the overall direction of liberalisation has remained the same, irrespective of the ruling party, although no party has yet tried to take on powerful lobbies such as the trade unions and farmers, or contentious issues such as reforming labour laws and reducing agricultural subsidies.[26]

Since 1990 India has emerged as one of the wealthiest economies in the developing world; during this period, the economy has grown constantly, but with a few major setbacks. This has been accompanied by increases in life expectancy, literacy rates and food security.

While the credit rating of India was hit by its nuclear tests in 1998, it has been raised to investment level in 2007 by S&P and Moody's.[27][28]

Future predictions: "conventional wisdom" from Goldman Sachs

In 1999, Goldman Sachs predicted that India's GDP in current prices will overtake France and Italy by 2020, Germany, UK and Russia by 2025 and Japan by 2035. By 2035 it is expected to reach as 3rd largest economy of the world behind US and China[1].

Goldman Sachs has made these predictions based on India's expected growth rate of 5.3 to 6.1% in various periods, whereas India is registering more than 9% growth rate. However the same report also shows there were large variation in its predicted gauging growth between 1960–2000, 7.5% predicted India's annual growth rate compared to the real average value of only 4.5% during that period.

A Goldman Sachs report recently cited by BBC News stated that 'India could overtake Britain and have the world's fifth largest economy within a decade as the country's growth accelerates'[29] Jim O'Neal, head of the Global Economics Team at Goldman Sachs, said on the BBC, "In thirty years, India's workforce could be as big as that of the United States and China combined"[30]

Future predictions taking purchasing power parity shifts into account

GDP growth at exchange rates

The Goldman Sachs report makes predictions about relative sizes of economies in 2025 or 2050 based on current exchange rate economy sizes, and ignores the effect of rapid decline in purchasing power parity ratios of economies as they approach maturity. The PPP ratio measures approxiamately how many times the cost of living is less in a given country as compared to in the US, and results in an artificial deflation of a GDP when measured at current exchange rates. However, the PPP ratio has historically always declined rapidly towards 1.0 (recent examples include Ireland, Japan, S. Korea, Taiwan, Singapore) when a rapidly industrializing country has caught up to even half of the level of US per-capita income in PPP terms. India and China's PPP ratios in 2005 were close to 5.0, and are now rapidly declining even as their undervalued currencies appreciate against the US dollar. This decline happens because of two reasons- (1) inflation, and (2) appreciation of the local currency. The two factors can happen simultaneously leading to exchange-rate level GDP growth rates that are much higher than the real GDP growth. This phenomena has resulted in recent doubling of India's GDP as measured in exchange rate dollars, every 3.5 years or so. It is important to note that we are not talking about real GDP growth at this point but are looking at economic growth in exchange-rate terms- which is important if we are comparing the sizes of two economies in exchange rate dollars, as the Goldman Sach's report does. Later parts of this section discusses real GDP growth in PPP (which is inflation, price, and exchange rate adjusted by definition) terms.

Let us take an example from 2006-2007 GDP growth for India. Note that the real GDP growth (which is hard to measure directly) is calculated using the nominal gdp growth (which is easy to measure) minus the inflation (which is also measured directly). The real 2006-07 GDP growth for India was 9.4 percent, and the annual inflation was around 5%. The nominal GDP growth in Rupees was 9.4+5=14.5 percent. On top of that, Indian Rupees appreciated by 10% between 2006-2007 against the US dollar, resulting in a total economic output as measured in nominal (2007 exchange rate) US dollars in 2007 as = (1+ 14.5%) x (1+10%) times of exchange rate economy of 2006 = 1.2595 times of 2006. In other words, the size of the Indian economy grew by 25.95 percent in 2006-07 in nominal dollar terms. If we adjust for the 3% loss of value of the real US dollar in 2006-2007 due to inflation in US, these numbers for the Indian economy still add up to 22.3% GDP growth in constant 2006 dollar terms.

This is the reason why India's GDP went from less than 800 billion US$ in 2006 to over a trillion US$ in 2007[31]. At this point the question arises- what is the root cause of this apparent dichotomy between real GDP growth and exchange rate GDP growth? The heart of the difference stems from the purchasing power parity ratio. The PPP ratio for India for 2006 was 4.5, i.e. the cost of living in India was estimated to be over 4.5 times cheaper than in US in 2006. The PPP ratio would remain unchanged if the Indian Rupee did not appreciate and if the inflation rate in Indian and US were to remain the same. However, as can be see from the data above, despite India having a higher inflation rate in 2006-07 of around 5% (as compared to 3% in US), the Rupee still appreciated by around 10% against the US dollar. This is what resulted in the purchasing power parity to actually decline in 2007 as compared to 2006. And it can be shown that this decline would be = (2006 PPP ratio) x (2006-07 real GDP growth)/(2006-07 exchange rate GDP growth)= 4.5 x 1.094/1.223 = 4.03.

The usually large PPP ratios for underdeveloped economies is linked to the fact that they are underdeveloped- to varying degrees both in terms physical infrastructure and human capital. On top of that, political and social factors often prevent them from developing rapidly, despite the obvious need for better infrastructure, human development etc. However, when many such economies (e.g Ireland, Japan, S. Korea, Taiwan, Singapore and others in the recent past) transition and reach a certain critical level of social and economic development, the bottlenecks to their growth get removed, and the human and physical resource utilization goes up suddenly and is often self-reinforcing. This results in increasing demand, productivity, and wealth in that order, resulting in the price of human capital going up. This causes the PPP ratio to then rapidly decline towards 1.0.

[Comment: There is strong evidence that India and China are now experiencing this phenomena, and most experts agree that they have crossed such a threshold in human development, and their high growth phase (now in the third decade for China and second decade for India) is not temporary. Also, both Chinese and Indian currencies are now under strong pressure to appreciate.]

This decline in PPP ratio year over year is what causes observed exchange rate GDP growth numbers that are substantially larger than those described by reports such as Goldman Sachs above. Note that there is no actual acceleration in economic growth because of the decline in the PPP ratio, which only causes the exchange-rate GDP numbers to ramp up at a faster pace, causing such economies to rapidly overtake smaller developed economies in GDP rankings when measured at exchange-rates.

Ignoring the effect just described above, many conventional predictions use two incompatible quantities in their computations: (1) the real GDP growth of a country corresponding to the PPP is used as a basis for growth rate estimates, and (2) the current exchange-rate GDP is used as the base economy size. Such a simulation then "grows" the economy every year by increasing the exchange rate GDP base by the real GDP growth rate. For example, such a simulation, starting from the 800 billion Indian economy of early 2006- would predict an 875 billion economy in early 2007 using the 9.4% real GDP growth, as opposed to the over US $1 trillion Indian economy actually observed in early 2007[31]. Thus, such an extrapolation of GDP growth based on past "local" growth does not take into account the decline in PPP ratios as an economy develops, hugely underestimating the GDP growth at exchange rates that actually occurs. Because of the exponential nature of economic growth, the error accumulates very quickly as the predictions are stretched further into the future, resulting in quixotic numbers such as "India's GDP to overtake UK's by 2025"- that are conservative compared to the reality by decades.

Real GDP growth projections in PPP terms

A more realistic projection of future per-capita could simply be based on two compatible quantities- the current economy size as measured in PPP, and the real growth-rate. Based on PPP growth, the Chinese GDP is set to cross the US economy to become the largest in the World between 2009 and 2010, in merely 2 to 3 years from now. Similarly India's GDP has already crossed Japan's to become the third largest. Making projections into the future, India is set to cross US economy at PPP around 2024 (at 10 percent annual growth for India, 3 percent for US. There is substantial evidence looking at Chinese, Taiwanese, S. Korean and Japanese history that India's economy has just crossed a growth bottleneck, and that the actual growth rates for India might be even higher and would sustain for decades, making this crossing even earlier and even more dramatic"[32]). When India becomes larger than the US economy, India's per capita income would still be ~1/4 of US income at that time; for the reasons mentioned above, it is likely that it would still be growing close to its current pace when it crosses US to become the second largest economy in the World, 16-17 years from now.

Government intervention

State planning and the mixed economy

After independence, India opted for a centrally planned economy to try to achieve an effective and equitable allocation of national resources and balanced economic development. The process of formulation and direction of the Five-Year Plans is carried out by the Planning Commission, headed by the Prime Minister of India as its chairperson.[33]

India's mixed economy combines features of both capitalist market economy and the socialist command economy, but has shifted more towards the former over the past decade. The public sector generally covers areas which are deemed too important or not profitable enough to leave to the market, including such services as the railways and postal system.

Since independence, there have been phases of nationalizing such areas as banking and, more recently, of privatization.[34]

Public expenditure

India's public expenditure is classified as development expenditure, comprising central plan expenditure and central assistance and non-development expenditures; these categories can each be divided into capital expenditure and revenue expenditure. Central plan expenditure is allocated to development schemes outlined in the plans of the central government and public sector undertakings; central assistance refers to financial assistance and developmental loans given for plans of the state governments and union territories. Non-development capital expenditure comprises capital defense expenditure, loans to public enterprises, states and union territories and foreign governments, while non-development revenue expenditure comprises revenue defence expenditure, administrative expenditure, subsidies, debt relief to farmers, postal deficit, pensions, social and economic services (education, health, agriculture, science and technology), grants to states and union territories and foreign governments.[35][36][34]

India's non-development revenue expenditure has increased nearly fivefold in 2003–04 since 1990–91 and more than tenfold since 1985–1986. Interest payments are the single largest item of expenditure and accounted for more than 40% of the total non development expenditure in the 2003–04 budget. Defence expenditure increased fourfold during the same period and has been increasing due to growing tensions in the region, the expensive dispute with Pakistan over Jammu and Kashmir and an effort to modernise the military. Administrative expenses are compounded by a large salary and pension bill, which rises periodically due to revisions in wages, dearness allowance etc. subsidies on food, fertilizers, education and petroleum and other merit and non-merit subsidies account are not only continuously rising, especially because of rising crude oil and food prices, but are also harder to rein in, because of political compulsions.[37][34]

Public receipts

India has a three-tier tax structure, wherein the constitution empowers the union government to levy Income tax, tax on capital transactions (wealth tax, inheritance tax), sales tax, service tax, customs and excise duties and the state governments to levy sales tax on intra-state sale of goods, tax on entertainment and professions, excise duties on manufacture of alcohol, stamp duties on transfer of property and collect land revenue (levy on land owned). The local governments are empowered by the state government to levy property tax, Octroi and charge users for public utilities like water supply, sewage etc.[38][39] More than half of the revenues of the union and state governments come from taxes, of which half come from Indirect taxes. More than a quarter of the union government's tax revenues is shared with the state governments.[40]

The tax reforms, initiated in 1991, have sought to rationalise the tax structure and increase compliance by taking steps in the following directions:

- Reducing the rates of individual and corporate income taxes, excises, customs and making it more progressive

- Reducing exemptions and concessions

- Simplification of laws and procedures

- Introduction of Permanent account number to track monetary transactions

- 21 of the 29 states introduced Value added tax (VAT) on April 1, 2005 to replace the complex and multiple sales tax system[39][41]

The non-tax revenues of the central government come from fiscal services, interest receipts, public sector dividends, etc., while the non-tax revenues of the States are grants from the central government, interest receipts, dividends and income from general, economic and social services.[37]

Inter-State share in the federal tax pool is decided by the recommendations of the Finance Commission to the President.

General budget

The Finance minister of India presents the annual union budget in the Parliament on the last working day of February. The budget has to be passed by the Lok Sabha before it can come into effect on April 1, the start of India's fiscal year. The Union budget is preceded by an economic survey which outlines the broad direction of the budget and the economic performance of the country for the outgoing financial year. This economic survey involves all the various NGOs, women organizations, business people, old people associations etc.

India's union budget for 2005–06, had an estimated outlay of Rs.5,14,344 crores ($118 billion). Earnings from taxes amount to Rs. 2,73,466 crore ($63b). India's fiscal deficit amounts to 4.5% or 1,39,231 crore ($32b).[42] The fiscal deficit is expected to be 3.8% of GDP, by March 2007.[43]

Currency system

Rupee

The Rupee is the only legal tender accepted in India. The exchange rate as of September 21 2007 is about 39.84 to a US dollar,[44] 56.08 to a Euro, and 80.51 to a UK pound. The Indian rupee is accepted as legal tender in the neighboring Nepal and Bhutan, both of which peg their currency to that of the Indian rupee. The rupee is divided into 100 paise. The highest-denomination banknote is the 1,000 rupee note; the lowest-denomination coin in circulation is the 25 paise coin.[45]

Exchange rates

Under the fixed exchange rate system, the value of the rupee was linked to the British pound sterling until 1946, and after independence, 30% of India's foreign trade was determined in pound sterling. In 1975, as per the floating exchange rate system, the value of the rupee was pegged to a basket of currencies and was tightly controlled by the Reserve Bank of India. Since 2005, its value has been appreciating against the US dollar, Euro and British Pound Sterling. Since liberalisation reforms in early 1990s, the rupee is fully convertible on trade and current account.

Labour

The large population puts further pressure on infrastructure and social services. A positive factor has been the large working-age population, which forms 45.33%[46] of the population and is expected to increase substantially, because of the decreasing dependency ratio. The national labour market has been tightly regulated by successive governments ever since the Workmen's Compensation Act was passed in 1923.

Natural resources

India's total cultivable area is 1,269,219 km² (56.78% of total land area), which is decreasing due to constant pressure from an ever growing population and increased urbanisation.

India has a total water surface area of 314,400 km² and receives an average annual rainfall of 1,100 mm. Irrigation accounts for 92% of the water utilisation, and comprised 380 km² in 1974, and is expected to rise to 1,050 km² by 2025, with the balance accounted for by industrial and domestic consumers. India's inland water resources comprising rivers, canals, ponds and lakes and marine resources comprising the east and west coasts of the Indian ocean and other gulfs and bays provide employment to nearly 6 million people in the fisheries sector. India is the sixth largest producer of fish in the world and second largest in inland fish production.[citation needed]

India's major mineral resources include Coal (fourth-largest reserves in the world), Iron ore, Manganese, Mica, Bauxite, Titanium ore, Chromite, Natural gas, Diamonds, Petroleum, Limestone and Thorium (world's largest along Kerala's shores). India's oil reserves, found in Bombay High off the coast of Maharashtra, Gujarat, and in eastern Assam meet 25% of the country's demand.[47][3]

Rising energy demand concomitant with economic growth has created a perpetual state of energy crunch in India. India is poor in oil resources and is currently heavily dependent on dirty coal and foreign oil imports for its energy needs. Though India is rich in Thorium, but not in Uranium, which it might get access to if a nuclear deal with US comes to fruitition. India is rich in certain energy resources which promise significant future potential - clean / renewable energy resources like solar, wind, biofuels (jatropha, sugarcane).

Physical infrastructure

Since independence, India has allocated nearly half of the total outlay of the five-year plans for infrastructural development.[citation needed] Development of infrastructure was completely in the hands of the public sector and was plagued by corruption, bureaucratic inefficiencies, urban-bias and an inability to scale investment.[48]

India's low spending on power, construction, transportation, telecommunications and real estate, at $31 billion or 6% of GDP in 2002 had prevented India from sustaining higher growth rates. This had prompted the government to partially open up infrastructure to the private sector allowing foreign investment[49][50][34] which has helped in a sustained growth rate of close to 9% for the past six quarters.[51] India holds second position in the world in roadways' construction, more than twice that of China.[52]

As of 15 January 2007, there were 2.10 million broadband lines in India.[2] Low tele-density is the major hurdle for slow pickup in broadband services. Over 76% of the broadband lines were via DSL and the rest via cable modems.

Financial institutions

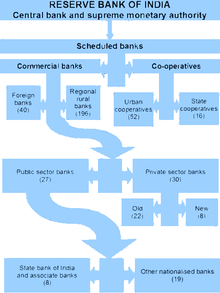

India inherited several institutions, such as the civil services, central bank, railways, etc., from her British rulers. Mumbai serves as the nation's commercial capital, with the Reserve Bank of India (RBI), Bombay Stock Exchange (BSE) and the National Stock Exchange (NSE) located here. The headquarters of many financial institutions are also located within the city.

The RBI, the country's central bank was established on 1 April 1935. It serves as the nation's monetary authority, regulator and supervisor of the financial system, manager of exchange control and as an issuer of currency. The RBI is governed by a central board, headed by a governor who is appointed by the Central government of India.

The BSE Sensex or the BSE Sensitive Index is a value-weighted index composed of 30 companies with April 1979 as the base year (100). These companies have the largest and most actively traded stocks and are representative of various sectors, on the Exchange. They account for around one-fifth of the market capitalisation of the BSE. The Sensex is generally regarded as the most popular and precise barometer of the Indian stock markets. Incorporated in 1992, the National Stock Exchange is one of the largest and most advanced stock markets in India. The NSE is the world's third largest stock exchange in terms of transactions. There are a total of 23 stock exchanges in India, but the BSE and NSE comprise 83% of the volumes.[53] The Securities and Exchange Board of India (SEBI), established in 1992, regulates the stock markets and other securities markets of the country.

Sectors

Agriculture

India ranks second worldwide in farm output. Agriculture and allied sectors like forestry, logging and fishing accounted for 18.6% of the GDP in 2005, employed 60% of the total workforce[3] and despite a steady decline of its share in the GDP, is still the largest economic sector and plays a significant role in the overall socio-economic development of India. Yields per unit area of all crops have grown since 1950, due to the special emphasis placed on agriculture in the five-year plans and steady improvements in irrigation, technology, application of modern agricultural practices and provision of agricultural credit and subsidies since the green revolution. However, international comparisons reveal that the average yield in India is generally 30% to 50% of the highest average yield in the world.[54]

The low productivity in India is a result of the following factors:

- Illiteracy, general socio-economic backwardness, slow progress in implementing land reforms and inadequate or inefficient finance and marketing services for farm produce.

- The average size of land holdings is very small (less than 20,000 m²) and is subject to fragmentation, due to land ceiling acts and in some cases, family disputes. Such small holdings are often over-manned, resulting in disguised unemployment and low productivity of labour.

- Adoption of modern agricultural practices and use of technology is inadequate, hampered by ignorance of such practices, high costs and impracticality in the case of small land holdings.

- Irrigation facilities are inadequate, as revealed by the fact that only 53.6% of the land was irrigated in 2000–01,[55] which result in farmers still being dependent on rainfall, specifically the Monsoon season. A good monsoon results in a robust growth for the economy as a whole, while a poor monsoon leads to a sluggish growth.[56] Farm credit is regulated by NABARD, which is the statutory apex agent for rural development in the subcontinent.

Industry

| Global ranking |

Company | |

|---|---|---|

| 265 | File:ONGC Logo.jpg | Oil and Natural Gas Corporation |

| 269 | State Bank of India Group | |

| 279 | File:Indian Oil logo.png | Indian Oil Corporation |

| 309 | File:Ril logo.jpg] | Reliance Industries Limited |

| 486 | File:NTPC logo.png | National Thermal Power Corporation |

India is fourteenth in the world in factory output. They together account for 27.6% of the GDP and employ 17% of the total workforce.[3] Economic reforms brought foreign competition, led to privatisation of certain public sector industries, opened up sectors hitherto reserved for the public sector and led to an expansion in the production of fast-moving consumer goods.[58]

Post-liberalisation, the Indian private sector, which was usually run by oligopolies of old family firms and required political connections to prosper was faced with foreign competition, including the threat of cheaper Chinese imports. It has since handled the change by squeezing costs, revamping management, focusing on designing new products and relying on low labour costs and technology.[59]

Six Indian companies have been listed in the Fortune Global 500 list for the year 2006.[60] They are:

- Rank 153 - Indian Oil Corporation Ltd. File:Indian Oil logo.png

- Rank 342 - Reliance Industries Ltd. File:Ril logo.jpg]

- Rank 368 - Bharat Petroleum Corporation Ltd.

- Rank 378 - Hindustan Petroleum Corporation Ltd. File:Logo hpcl.gif

- Rank 402 - Oil and Natural Gas Corporation Ltd. File:ONGC Logo.jpg

- Rank 498 - State Bank Of India Ltd.

India's 10 leading companies, as per Forbes Global 2000 ranking for 2007.[61]

| World Rank | Company | Logo | Industry | Revenue (billion $) |

Profits (billion $) |

Assets (billion $) |

Market Value (billion $) |

|---|---|---|---|---|---|---|---|

| 239 | Oil and Natural Gas Corporation | File:ONGC Logo.jpg | Oil & Gas Operations | 15.64 | 3.46 | 26.98 | 38.19 |

| 258 | Reliance Industries | File:Ril logo.jpg | Oil & Gas Operations | 18.05 | 2.11 | 21.75 | 42.62 |

| 326 | State Bank of India | Banking | 13.66 | 1.24 | 156.37 | 12.35 | |

| 399 | Indian Oil Corporation | File:Indian Oil logo.png | Oil & Gas Operations | 34.22 | 1.11 | 22.68 | 10.92 |

| 494 | NTPC | File:NTPC logo.png | Utilities | 6.06 | 1.31 | 17.25 | 26.06 |

| 536 | ICICI Bank | File:Icicibank.gif | Banking | 5.79 | 0.54 | 62.13 | 16.72 |

| 800 | Steel Authority of India Limited | File:Saillogo.JPG | Materials | 6.30 | 0.91 | 7.06 | 10.16 |

| 1047 | Tata Consultancy Svcs | File:TCS LOGO.JPG | Software & Services | 2.98 | 0.67 | 1.93 | 26.27 |

| 1128 | Tata Steel | File:In 01.gif | Materials | 4.54 | 0.84 | 4.61 | 5.80 |

| 1130 | Infosys Technologies | File:Infosys logo sml.gif | Software & Services | 2.14 | 0.55 | 2.09 | 26.19 |

Services

India is fifteenth in services output. It provides employment to 23% of work force, and it is growing fast, growth rate 7.5% in 1991–2000 up from 4.5% in 1951–80. It has the largest share in the GDP, accounting for 53.8% in 2005 up from 15% in 1950.[3] Business services (information technology, information technology enabled services, business process outsourcing) are among the fastest growing sectors contributing to one third of the total output of services in 2000. The growth in the IT sector is attributed to increased specialisation, availability of a large pool of low cost, but highly skilled, educated and fluent English-speaking workers (a legacy of British Colonialism) on the supply side and on the demand side, increased demand from foreign consumers interested in India's service exports or those looking to outsource their operations. India's IT industry, despite contributing significantly to its balance of payments, accounted for only about 1% of the total GDP or 1/50th of the total services.[62]

Banking and finance

The Indian money market is classified into: the organised sector (comprising private, public and foreign owned commercial banks and cooperative banks, together known as scheduled banks); and the unorganised sector (comprising individual or family owned indigenous bankers or money lenders and non-banking financial companies (NBFCs)). The unorganised sector and microcredit are still preferred over traditional banks in rural and sub-urban areas, especially for non-productive purposes, like ceremonies and short duration loans.[64]

Prime Minister Indira Gandhi nationalised 14 banks in 1969, followed by six others in 1980, and made it mandatory for banks to provide 40% (since reduced to 10%) of their net credit to priority sectors like agriculture, small-scale industry, retail trade, small businesses, etc. to ensure that the banks fulfill their social and developmental goals. Since then, the number of bank branches has increased from 10,120 in 1969 to 98,910 in 2003 and the population covered by a branch decreased from 63,800 to 15,000 during the same period. The total deposits increased 32.6 times between 1971 to 1991 compared to 7 times between 1951 to 1971. Despite an increase of rural branches, from 1,860 or 22% of the total number of branches in 1969 to 32,270 or 48%, only 32,270 out of 5 lakh (500,000) villages are covered by a scheduled bank.[65][66]

Since liberalisation, the government has approved significant banking reforms. While some of these relate to nationalised banks (like encouraging mergers, reducing government interference and increasing profitability and competitiveness), other reforms have opened up the banking and insurance sectors to private and foreign players.[67][3]

Socio-economic characteristics

Poverty

Despite the economic gains, a vast population of India's people live in abject poverty. Wealth distribution in India, a developing country, is fairly uneven, with the top 10% of income groups earning 33% of the income.[68] While poverty in India has reduced significantly, 17.59% (over 230 million) of Indians still live below the national poverty line. A 2007 report by the state-run National Commission for Enterprises in the Unorganised Sector (NCEUS) found that 77% of Indians, or 836 million people, lived on less than 20 rupees per day (USD 0.50), with most working in "informal labour sector with no job or social security, living in abject poverty."[69]

Since the early 1950s, successive governments have implemented various schemes, under planning, to alleviate poverty, that have met with partial success. All these programmes have relied upon the strategies of the Food for work programme and National Rural Employment Programme of the 1980s, which attempted to use the unemployed to generate productive assets and build rural infrastructure.[34] In August 2005, the Indian parliament passed the Rural Employment Guarantee Bill, the largest programme of this type in terms of cost and coverage, which promises 100 days of minimum wage employment to every rural household in 200 of India's 600 districts. Template:Inote The question of whether economic reforms have reduced poverty or not has fuelled debates without generating any clear cut answers and has also put political pressure on further economic reforms, especially those involving the downsizing of labour and cutting agricultural subsidies.[70][71]

Corruption

Corruption has been one of the pervasive problems affecting India. It takes the form of bribes, evasion of tax and exchange controls, embezzlement, etc. The economic reforms of 1991 reduced the red tape, bureaucracy and the Licence Raj that had strangled private enterprise and was blamed for the corruption and inefficiencies.[73] Yet, a 2005 study by Transparency International (TI) India found that more than half of those surveyed had firsthand experience of paying bribe or peddling influence to get a job done in a public office.[72]

The chief economic consequences of corruption are the loss to the exchequer, an unhealthy climate for investment and an increase in the cost of government-subsidised services. The TI India study estimates the monetary value of petty corruption in 11 basic services provided by the government, like education, healthcare, judiciary, police, etc., to be around Rs.21,068 crores.[72] India still ranks in the bottom quartile of developing nations in terms of the ease of doing business, and compared to China, the average time taken to secure the clearances for a startup or to invoke bankruptcy is much greater.[34]

The Right to Information Act (2005) and equivalent acts in the states, that require government officials to furnish information requested by citizens or face punitive action, computerisation of services and various central and state government acts that established vigilance commissions have considerably reduced corruption or at least have opened up avenues to redress grievances.[72][74] The 2006 report by Transparency International puts India at 70th place and states that significant improvements were made by India in reducing corruption.[75] [76]

Occupations and unemployment

Agricultural and allied sectors accounted for about 57% of the total workforce in 1999–2000, down from 60% in 1993–94. While agriculture has faced stagnation in growth, services have seen a steady growth. Of the total workforce, 8% is in the organised sector, two-thirds of which are in the public sector. The NSSO survey estimated that in 1999–2000, 106 million, nearly 10% of the population were unemployed and the overall unemployment rate was 7.32%, with rural areas doing marginally better (7.21%) than urban areas (7.65%).

Unemployment in India is characterised by chronic underemployment or disguised unemployment. Government schemes that target eradication of both poverty and unemployment, (Which in recent decades has sent millions of poor and unskilled people into urban areas in search of livelihoods.) attempt to solve the problem, by providing financial assistance for setting up businesses, skill honing, setting up public sector enterprises, reservations in governments, etc. The decreased role of the public sector after liberalisation has further underlined the need for focusing on better education and has also put political pressure on further reforms.[77][34]

Regional imbalance

One of the critical problems facing India's economy is the sharp and growing regional variations among India's different states and territories in terms of per capita income, poverty, availability of infrastructure and socio-economic development.[78]

The five-year plans have attempted to reduce regional disparities by encouraging industrial development in the interior regions, but industries still tend to concentrate around urban areas and port cities[79] After liberalization, the more advanced states are better placed to benefit from them, with infrastructure like well developed ports, urbanisation and an educated and skilled workforce which attract manufacturing and service sectors. The union and state governments of backward regions are trying to reduce the disparities by offering tax holidays, cheap land, etc., and focusing more on sectors like tourism, which although being geographically and historically determined, can become a source of growth and is faster to develop than other sectors.[80][81]

External trade and investment

Global trade relations

| Rank | Country | Inflows (Million USD) |

Inflows (%) |

|---|---|---|---|

| 1 | 8,898 | 34.49%[83] | |

| 2 | 4,389 | 17.08% | |

| 3 | 1,891 | 7.33% | |

| 4 | 1,847 | 7.16% | |

| 5 | 1,692 | 6.56% |

Until the liberalisation of 1991, India was largely and intentionally isolated from the world markets, to protect its fledging economy and to achieve self-reliance. Foreign trade was subject to import tariffs, export taxes and quantitative restrictions, while foreign direct investment was restricted by upper-limit equity participation, restrictions on technology transfer, export obligations and government approvals; these approvals were needed for nearly 60% of new FDI in the industrial sector. The restrictions ensured that FDI averaged only around $200M annually between 1985 and 1991; a large percentage of the capital flows consisted of foreign aid, commercial borrowing and deposits of non-resident Indians.[84]

India's exports were stagnant for the first 15 years after independence, due to the predominance of tea, jute and cotton manufactures, demand for which was generally inelastic. Imports in the same period consisted predominantly of machinery, equipment and raw materials, due to nascent industrialisation. Since liberalisation, the value of India's international trade has become more broad-based and has risen to Rs. 63,080,109 crores in 2003–04 from Rs.1,250 crores in 1950–51.[citation needed] India's major trading partners are China, the US, the UAE, the UK, Japan and the EU.[85] The exports during August 2006 were $10.3 billion up by 41.14% and import were $13.87 billion with an increase of 32.16% over the previous year [3].

India is a founding-member of General Agreement on Tariffs and Trade (GATT) since 1947 and its successor, the World Trade Organization. While participating actively in its general council meetings, India has been crucial in voicing the concerns of the developing world. For instance, India has continued its opposition to the inclusion of such matters as labour and environment issues and other non-tariff barriers into the WTO policies.[86]

Balance of payments

Since independence, India's balance of payments on its current account has been negative. Since liberalisation in the 1990s (precipitated by a balance of payment crisis), India's exports have been consistently rising, covering 80.3% of its imports in 2002–03, up from 66.2% in 1990–91. Although India is still a net importer, since 1996–97, its overall balance of payments (i.e., including the capital account balance), has been positive, largely on account of increased foreign direct investment and deposits from non-resident Indians; until this time, the overall balance was only occasionally positive on account of external assistance and commercial borrowings. As a result, India's foreign currency reserves stood at $141bn in 2005–06.[87][88] Now however the reserves have been sitting at $200 billion which could be used in infrastructural development of the country if used effectively.

India's reliance on external assistance and commercial borrowings has decreased since 1991–92, and since 2002–03, it has gradually been repaying these debts. Declining interest rates and reduced borrowings decreased India's debt service ratio to 14.1% in 2001–02, from 35.3% in 1990–91.[89] Template:Inote

Foreign direct investment in India

As the third-largest economy in the world, India is undoubtedly one of the most preferred destinations for foreign direct investments (FDI); India has strength in information technology and other significant areas such as auto components, chemicals, apparels, pharmaceuticals and jewellery. India has always held promise for global investors, but its rigid FDI policies were a significant hindrance in this regard. However, as a result of a series of ambitious and positive economic reforms aimed at deregulating the economy and stimulating foreign investment, India has positioned itself as one of the front-runners of the rapidly growing Asia Pacific Region. India has a large pool of skilled managerial and technical expertise. The size of the middle-class population at 300 million exceeds the population of both the US and the EU, and represents a powerful consumer market.[90]

India's recently liberalised FDI policy (2005) allows up to a 100% FDI stake in ventures. Industrial policy reforms have substantially reduced industrial licensing requirements, removed restrictions on expansion and facilitated easy access to foreign technology and foreign direct investment FDI. The upward moving growth curve of the real-estate sector owes some credit to a booming economy and liberalized FDI regime. In March 2005, the government amended the rules to allow 100 per cent FDI in the construction business.[91] This automatic route has been permitted in townships, housing, built-up infrastructure and construction development projects including housing, commercial premises, hotels, resorts, hospitals, educational institutions, recreational facilities, and city- and regional-level infrastructure.

See also

- International investment position

- Bilateral Investment Treaty

- Energy policy

- List of Cooperative Banks in India

Notes

- ^ Economic Times India

- ^ "India's GDP expanded at fastest pace in 18 years". MarketWatch. May 31 2007.

{{cite news}}: Check date values in:|date=(help) - ^ a b c d e f "CIA - The World Factbook - India". CIA. 2007-09-20. Retrieved 2007-10-02.

{{cite web}}: External link in|publisher= - ^ India climbs up the income ladder

- ^ World Bank Country Classification Groups, (July 2006 data)

- ^ Nehru, Jawaharlal (1946). Discovery of India. Penguin Books. ISBN 0-14-303103-1.

- ^ Kumar, Dharma (Ed.) (1982). The Cambridge Economic History of India (Volume 2) c. 1757 - c. 1970. Penguin Books. p. 519.

- ^ Datt, Ruddar & Sundharam, K.P.M. (2005). "2". Indian Economy. S.Chand. pp. 15–16. ISBN 81-219-0298-3.

{{cite book}}: CS1 maint: multiple names: authors list (link) - ^ Sankaran, S (1994). "3". Indian Economy: Problems, Policies and Development. Margham Publications. p. 50. ISBN.

- ^ Kumar, Dharma (Ed.). "4". The Cambridge Economic History of India (Volume 2). p. 422.

- ^ Kumar, Dharma (Ed.). "1". The Cambridge Economic History of India (Volume 2). pp. 24–26.

- ^ Datt, Ruddar & Sundharam, K.P.M. "2". Indian Economy. p. 16.

{{cite book}}: CS1 maint: multiple names: authors list (link) - ^ "Economy of Mughal Empire". Bombay Times. Times of India. 2004-08-17.

- ^ Kumar, Dharma (Ed.). "1". The Cambridge Economic History of India (Volume 2). pp. 32–35.

- ^ a b Williamson, John and Zagha, Roberto (2002). "From the Hindu Rate of Growth to the Hindu Rate of Reform" (PDF). Working Paper No. 144. Center for research on economic development and policy reform.

{{cite journal}}: Cite journal requires|journal=(help)CS1 maint: multiple names: authors list (link) - ^ Roy, Tirthankar (2000). "1". The Economic History of India. Oxford University Press. p. 1. ISBN 0-19-565154-5.

- ^ "Of Oxford, economics, empire, and freedom". The Hindu. October 2 2005.

{{cite news}}: Check date values in:|date=(help) - ^ Roy, Tirthankar (2000). "10". The Economic History of India. Oxford University Press. p. 304. ISBN 0-19-565154-5.

- ^ Roy, Tirthankar (2000). "preface". The Economic History of India. Oxford University Press. ISBN 0-19-565154-5.

- ^ a b Kelegama, Saman and Parikh, Kirit (2000). "Political Economy of Growth and Reforms in South Asia". Second Draft.

{{cite journal}}: Cite journal requires|journal=(help)CS1 maint: multiple names: authors list (link) - ^ Cameron, John and Ndhlovu, P Tidings (2001). "Cultural Influences on Economic Thought in India: Resistance to diffusion of neo-classical economics and the principles of Hinduism" (PDF).

{{cite journal}}: Cite journal requires|journal=(help)CS1 maint: multiple names: authors list (link) - ^ "Milton Friedman on the Nehru/Mahalanobis Plan".

{{cite web}}: Unknown parameter|accessmonthday=ignored (help); Unknown parameter|accessyear=ignored (|access-date=suggested) (help) - ^ Data for Bangladesh is not available for 1950.

- ^ Ghosh, Arunabha (2004-06-01). "India's pathway trough economic crisis" (PDF). Global Economic Governance Programme GEG Working Paper 2004/06. Retrieved 2007-10-02.

{{cite journal}}: Cite journal requires|journal=(help) - ^ Panagariya, Arvind (2004). "India in the 1980s and 1990s: A Triumph of Reforms".

{{cite journal}}: Cite journal requires|journal=(help) - ^ "That old Gandhi magic". The Economist. November 27 1997.

{{cite news}}: Check date values in:|date=(help) - ^ ""S&P raises India's credit rating".

- ^ ""India's sovereign credit upgraded"".

- ^ ""Indian economy 'to overtake UK'"". BBC News. Retrieved 2007-01-26.

- ^ ""India Rising; Economy; Special Debate". BBC News. Retrieved 2007-03-08.

- ^ a b ""Welcome To The Trillion Dollar Club". Forbes.com. Retrieved 2007-09-27.

- ^ ""The Future of Space Exploration in the Age of New Giants". Gunjan Gupta. Retrieved 2007-07-24.

- ^ "History of the Planning Commission".

{{cite web}}: Unknown parameter|accessmonthday=ignored (help); Unknown parameter|accessyear=ignored (|access-date=suggested) (help) - ^ a b c d e f g h "Economic Survey 2004–2005".

{{cite web}}: Unknown parameter|accessmonthday=ignored (help); Unknown parameter|accessyear=ignored (|access-date=suggested) (help) - ^ Public expenditure was classified as plan and non-plan expenditure in the 1987–1988 union budget. It is now referred to as development and non-development expenditure, but the definition remains the same. Development expenditure is a capital expenditure.

- ^ Datt, Ruddar & Sundharam, K.P.M. "55". Indian Economy. p. 943.

{{cite book}}: CS1 maint: multiple names: authors list (link) - ^ a b Datt, Ruddar & Sundharam, K.P.M. "55". Indian Economy. pp. 943–945.

{{cite book}}: CS1 maint: multiple names: authors list (link) - ^ Service tax and expenditure tax are not levied in Jammu and Kashmir; Intra-state sale happens when goods or the title of goods move from one state to another.

- ^ a b Bernardi, Luigi and Fraschini, Angela (2005). "Tax System And Tax Reforms In India". Working paper n. 51.

{{cite journal}}: Cite journal requires|journal=(help)CS1 maint: multiple names: authors list (link) - ^ Tax revenue was 88% of total union government revenue in 1950–51 and has come down to 73% in 2003–04, as a result of increase in non-tax revenue. Tax revenues were 70% of total state government revenues in 2002 to 2003. Indirect taxes were 84% of the union governments total tax revenue and have come down to 62% in 2003–04, mostly due to cuts in import duties and rationalisation. The states share in union government's tax revenue is 28.0% for the period 2000 to 2005 as per the recommendations of the eleventh finance commission. In addition, states that do not levy sales tax on sugar, textiles and tobacco, are entitled to 1.5% of the proceeds.Datt, Ruddar & Sundharam, K.P.M. (2005). Indian Economy. S.Chand. pp. 938, 942, 946. ISBN 81-219-0298-3.

{{cite book}}: CS1 maint: multiple names: authors list (link) - ^ "Indif_real_GDP_per_capitaa says 21 of 29 states to launch new tax". Daily Times. March 25 2005.

{{cite news}}: Check date values in:|date=(help) - ^ "Union Budget & Economic Survey".

{{cite web}}: Unknown parameter|accessmonthday=ignored (help); Unknown parameter|accessyear=ignored (|access-date=suggested) (help) - ^ "Revenue surge boosts fiscal health".

- ^ Historical Rupees-USD rates.

- ^ RBI

- ^ Labor force=496.4 million(2005) according to CIA World factbook

- ^ Datt, Ruddar & Sundharam, K.P.M. "7". Indian Economy. pp. 90, 97, 98, 100.

{{cite book}}: CS1 maint: multiple names: authors list (link) - ^ Sankaran, S (1994). Indian Economy: Problems, Policies and Development. Margham Publications. ISBN.

- ^ "Infrastructure the missing link".

{{cite web}}: Unknown parameter|accessmonthday=ignored (help); Unknown parameter|accessyear=ignored (|access-date=suggested) (help) - ^ "Infrastructure in India: Requirements and favorable climate for foreign investment".

{{cite web}}: Unknown parameter|accessmonthday=ignored (help); Unknown parameter|accessyear=ignored (|access-date=suggested) (help) - ^ India's Economic Growth Unexpectedly Quickens to 9.2%

- ^ "Infrastructure Rankings".

- ^ "Regional stock exchanges—Bulldozed by the Big Two".

{{cite web}}: Unknown parameter|accessmonthday=ignored (help); Unknown parameter|accessyear=ignored (|access-date=suggested) (help) - ^ Datt, Ruddar & Sundharam, K.P.M. "28". Indian Economy. pp. 485–491.

{{cite book}}: CS1 maint: multiple names: authors list (link) - ^ Multiple authors (2004). "Agricultural Statistics at a Glance 2004" (PDF).

{{cite journal}}: Cite journal requires|journal=(help) - ^ Sankaran, S. "28". Indian Economy: Problems, Policies and Development. pp. 492–493.

- ^ "Forbes Global 2000 (Ger-Ind)".

{{cite web}}: Unknown parameter|accessmonthday=ignored (help); Unknown parameter|accessyear=ignored (|access-date=suggested) (help) - ^ "Economic structure". The Economist. October 6 2003.

{{cite news}}: Check date values in:|date=(help) - ^ "Indian manufacturers learn to compete". The Economist. 12 February 2004.

{{cite news}}: Check date values in:|date=(help) - ^ "Fortune Global 500 - India". Fortune Magazine. 2006.

- ^ "Forbes Global 2000 (Ger-Ind)". Retrieved september 18.

{{cite web}}: Check date values in:|accessdate=(help); Unknown parameter|accessyear=ignored (|access-date=suggested) (help) - ^ Gordon, Jim and Gupta, Poonam (2003). "Understanding India's Services Revolution" (PDF). November 12, 2003.

{{cite journal}}: Cite journal requires|journal=(help)CS1 maint: multiple names: authors list (link) - ^ Old private banks are private banks existing prior to opening up of the banking sector.

- ^ Datt, Ruddar & Sundharam, K.P.M. "50". Indian Economy. pp. 847–850.

{{cite book}}: CS1 maint: multiple names: authors list (link) - ^ Datt, Ruddar & Sundharam, K.P.M. "50". Indian Economy. pp. 850–851.

{{cite book}}: CS1 maint: multiple names: authors list (link) - ^ Ghosh, Jayati. "Bank Nationalisation: The Record". Macroscan.

{{cite web}}: Unknown parameter|accessmonthday=ignored (help); Unknown parameter|accessyear=ignored (|access-date=suggested) (help) - ^ Datt, Ruddar & Sundharam, K.P.M. "50". Indian Economy. pp. 865–867.

{{cite book}}: CS1 maint: multiple names: authors list (link) - ^ "In Pictures – Middle Class, or Upper Class? ". India Together. Civil Society Information Exchange. August 2003

- ^ "Nearly 80 Percent of India Lives On Half Dollar A Day". Reuters. August 10 2007.

{{cite news}}: Check date values in:|date=(help); Unknown parameter|accessed=ignored (help) - ^ Datt, Ruddar & Sundharam, K.P.M. "22". Indian Economy. pp. 367, 369, 370.

{{cite book}}: CS1 maint: multiple names: authors list (link) - ^ "Jawahar gram samriddhi yojana".

{{cite web}}: Unknown parameter|accessmonthday=ignored (help); Unknown parameter|accessyear=ignored (|access-date=suggested) (help) - ^ a b c d Centre for Media Studies (2005). "India Corruption Study 2005: To Improve Governance Volume – I: Key Highlights" (PDF). Transparency International India.

{{cite journal}}: Cite journal requires|journal=(help) - ^ DeLong, J. Bradford (2001). "India Since Independence: An Analytic Growth Narrative" (PDF).

{{cite journal}}: Cite journal requires|journal=(help) - ^ Example of a central government department's implementation of the Right to Information Act.

- ^ Transparency International Press release

- ^ Transparency International Press release

- ^ Datt, Ruddar & Sundharam, K.P.M. "24". Indian Economy. pp. 403–405.

{{cite book}}: CS1 maint: multiple names: authors list (link) - ^ Datt, Ruddar & Sundharam, K.P.M. "27". Indian Economy. pp. 471–472.

{{cite book}}: CS1 maint: multiple names: authors list (link) - ^ Bharadwaj, Krishna (1991). "Regional differentiation in India". In Sathyamurthy, T.V. (ed.) (ed.). Industry & agriculture in India since independence. Oxford University Press. pp. pp. 189–199. ISBN 0-19-564394-1.

{{cite book}}:|editor=has generic name (help);|pages=has extra text (help) - ^ Sachs, D. Jeffrey; Bajpai, Nirupam and Ramiah, Ananthi (2002). "Understanding Regional Economic Growth in India" (PDF). Working paper 88.

{{cite journal}}: Cite journal requires|journal=(help)CS1 maint: multiple names: authors list (link) - ^ Kurian, N.J. "Regional disparities in india".

{{cite web}}: Unknown parameter|accessmonthday=ignored (help); Unknown parameter|accessyear=ignored (|access-date=suggested) (help) - ^ "Share of Top Investing Countries in FDI Inflows".

{{cite web}}: Unknown parameter|accessmonthday=ignored (help); Unknown parameter|accessyear=ignored (|access-date=suggested) (help) - ^ Much of India's FDI is routed through Mauritius, because both countries have an agreement to avoid double taxation. "India to sign free trade agreement with Mauritius".

{{cite web}}: Unknown parameter|accessmonthday=ignored (help); Unknown parameter|accessyear=ignored (|access-date=suggested) (help) - ^ Srinivasan, T.N. (2002). "Economic Reforms and Global Integration" (PDF). 17 January 2002.

{{cite journal}}: Cite journal requires|journal=(help) - ^ Datt, Ruddar & Sundharam, K.P.M. "46". Indian Economy. pp. 767, 772–76.

{{cite book}}: CS1 maint: multiple names: authors list (link) - ^ "India & the World Trade Organization".

{{cite web}}: Unknown parameter|accessmonthday=ignored (help); Unknown parameter|accessyear=ignored (|access-date=suggested) (help) - ^ "Forex reserves up by $88mn".

{{cite web}}: Unknown parameter|accessmonthday=ignored (help); Unknown parameter|accessyear=ignored (|access-date=suggested) (help) - ^ Datt, Ruddar & Sundharam, K.P.M. "47". Indian Economy. p. 789.

{{cite book}}: CS1 maint: multiple names: authors list (link) - ^ Datt, Ruddar & Sundharam, K.P.M. "47". Indian Economy. pp. 786, 790.

{{cite book}}: CS1 maint: multiple names: authors list (link) - ^ Middle class in India has arrived

- ^ The Hinduonline

References

- Books

- Nehru, Jawaharlal (1946). Discovery of India. Penguin Books. ISBN 0-14-303103-1.

- Kumar, Dharma (Ed.) (1982). The Cambridge Economic History of India (Volume 2) c. 1757 - c. 1970. Penguin Books.

- Sankaran, S (1994). Indian Economy: Problems, Policies and Development. Margham Publications. ISBN.

- Roy, Tirthankar (2000). The Economic History of India. Oxford University Press. ISBN 0-19-565154-5.

- Bharadwaj, Krishna (1991). "Regional differentiation in India". In Sathyamurthy, T.V. (ed.) (ed.). Industry & agriculture in India since independence. Oxford University Press. pp. pp. 189–199. ISBN 0-19-564394-1.

{{cite book}}:|editor=has generic name (help);|pages=has extra text (help)

- Papers

- John Williamson: The Rise of the Indian Economy, March 2006

- Williamson, John and Zagha, Roberto (2002). "From the Hindu Rate of Growth to the Hindu Rate of Reform" (PDF). Working Paper No. 144. Center for research on economic development and policy reform.

{{cite journal}}: Cite journal requires|journal=(help)CS1 maint: multiple names: authors list (link) - DeLong, J. Bradford (2001). "India Since Independence: An Analytic Growth Narrative" (PDF).